How Does Technological and Financial Literacy Influence SME Performance: Mediating Role of ERM Practices

Abstract

1. Introduction

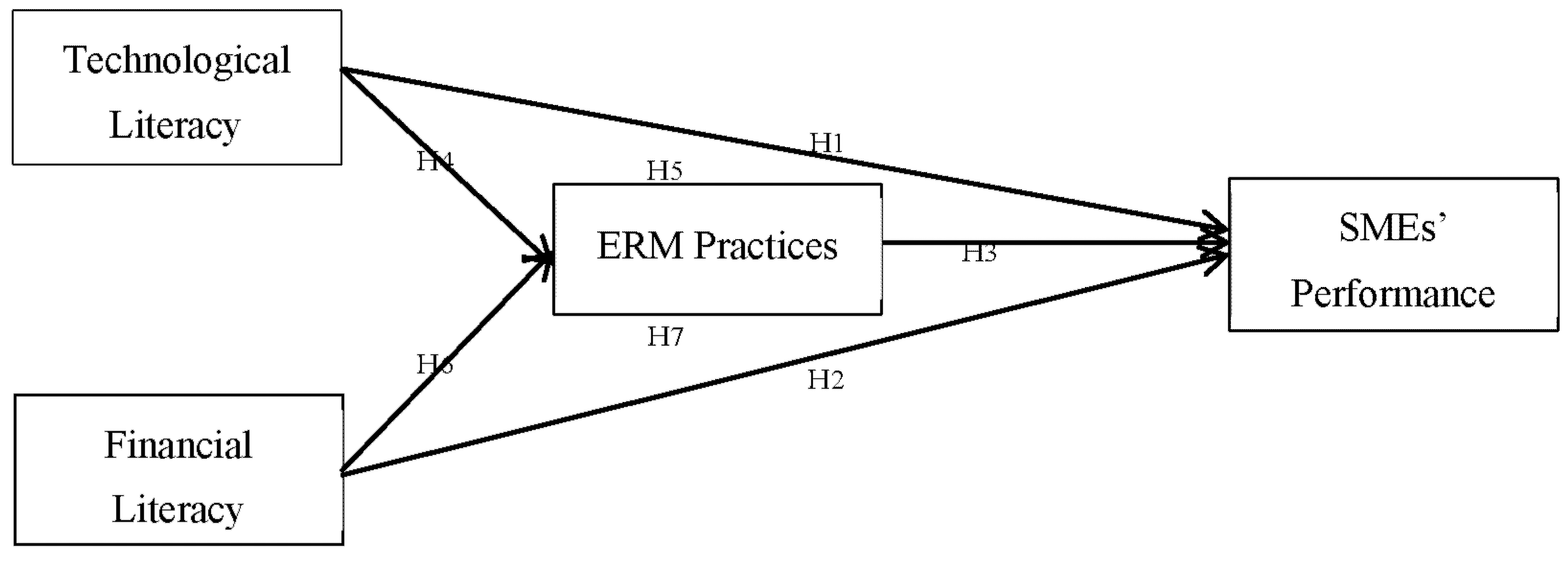

2. Literature Review and Hypothesis Development

2.1. Technological Literacy and SME Performance

2.2. Financial Literacy and SME Performance

2.3. Enterprise Risk Management Practices and SME Performance

2.4. The Links between Technological Literacy, ERM Practices, and SME Performance

2.5. The Links between Financial Literacy, ERM Practices, and SME Performance

3. Methodology

3.1. Sample Design and Data Collection

3.2. Measurement of Variables

4. Results

4.1. Measurement Model Assessment

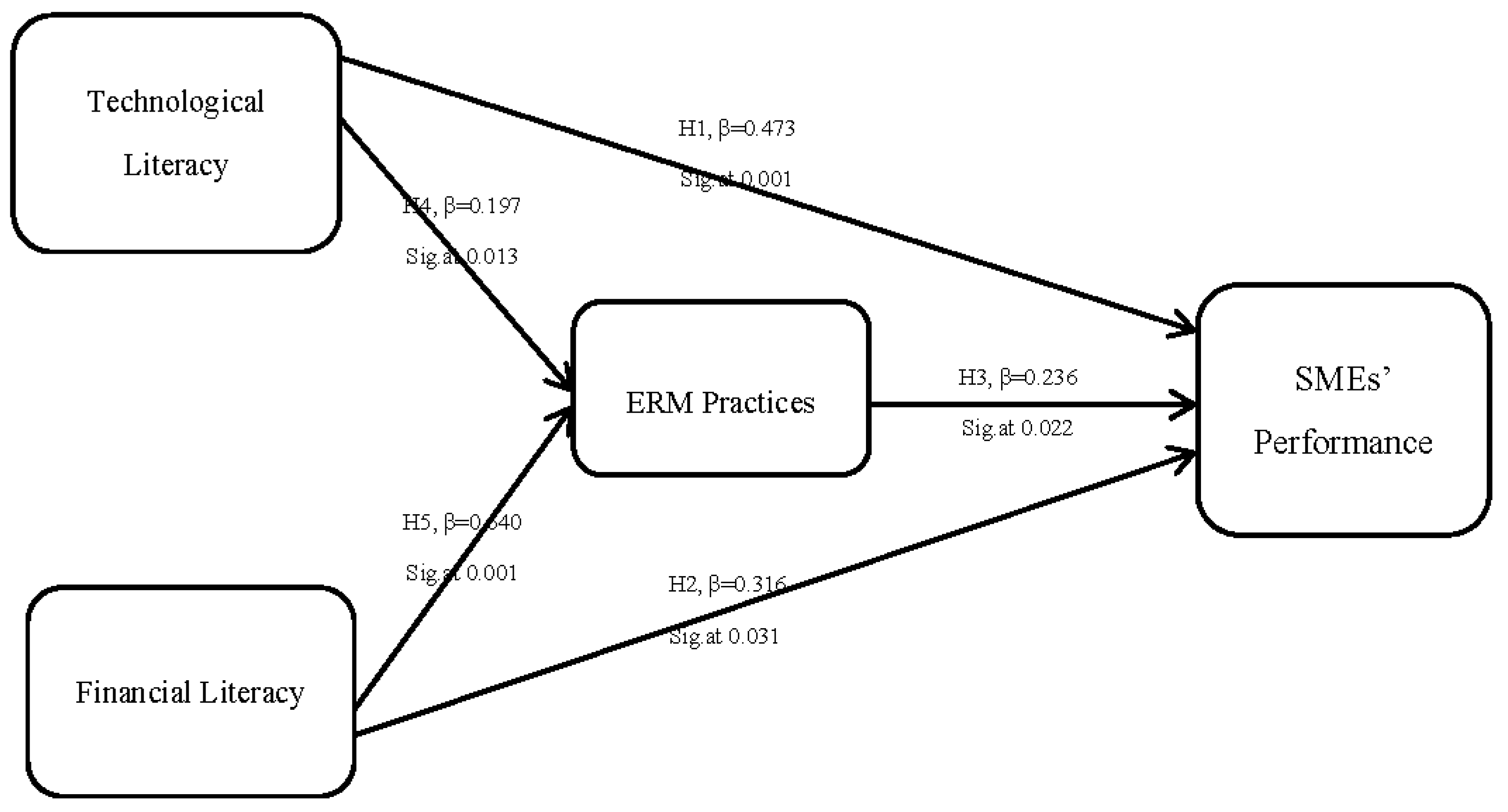

4.2. Structural Model Evaluation and Testing the Hypotheses

4.3. ERM as a Mediator between Technological Literacy and SME Performance

4.4. ERM as a Mediator between Financial Literacy and SME Performance

5. Discussion

5.1. Discussion of the Findings

5.2. Theoretical Implications

5.3. Implications for Managers

5.4. Limitations and Future Research Directions

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Agyei, S.K.; Nsiah, C. Culture, financial literacy, and SME performance in Ghana. Cogent Econ. Financ. 2018, 6, 1463813. [Google Scholar] [CrossRef]

- Aremu, M.A.; Adeyemi, S.L. Small and medium scale enterprises as a survival strategy for employment generation in Nigeria. J. Sustain. Dev. 2011, 4, 200. [Google Scholar]

- Smallbone, D. Government and entrepreneurship in transition economies: The case of small firms in business services in Ukraine. Strat. Dir. 2010, 26, 655–670. [Google Scholar] [CrossRef]

- Jianmu, Y.; Kulathunga, K. How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective. Sustainability 2019, 11, 2990. [Google Scholar] [CrossRef]

- Omiunu, O.G. E-literacy-adoption model and performance of women-owned SMEs in Southwestern Nigeria. J. Glob. Entrep. Res. 2019, 9, 26. [Google Scholar] [CrossRef]

- Oláh, J.; Kovács, S.; Virglerova, Z.; Lakner, Z.; Kovacova, M.; Popp, J. Analysis and Comparison of Economic and Financial Risk Sources in SMEs of the Visegrad Group and Serbia. Sustainability 2019, 11, 1853. [Google Scholar] [CrossRef]

- Wu, J.; Si, S. Poverty reduction through entrepreneurship: Incentives, social networks, and sustainability. Asian Bus. Manag. 2018, 17, 243–259. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strat. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Hussain, J.; Salia, S.; Karimu, A. Is knowledge that powerful? Financial literacy and access to finance. J. Small Bus. Enterp. Dev. 2018, 25, 985–1003. [Google Scholar] [CrossRef]

- FFlorio, C.; Leoni, G. Enterprise risk management and firm performance: The Italian case. Br. Account. Rev. 2017, 49, 56–74. [Google Scholar] [CrossRef]

- Yang, Y.; Chen, X.; Gu, J.; Fujita, H. Alleviating Financing Constraints of SMEs through Supply Chain. Sustainability 2019, 11, 673. [Google Scholar] [CrossRef]

- Ying, Q.; Hassan, H.; Ahmad, H. The Role of a Manager’s Intangible Capabilities in Resource Acquisition and Sustainable Competitive Performance. Sustainability 2019, 11, 527. [Google Scholar] [CrossRef]

- Songling, Y.; Ishtiaq, M.; Ahmad, H.; Yang, S. Enterprise Risk Management Practices and Firm Performance, the Mediating Role of Competitive Advantage and the Moderating Role of Financial Literacy. J. Risk Financ. Manag. 2018, 11, 35. [Google Scholar] [CrossRef]

- Hobijn, B.; Jovanovic, B. The Information-Technology Revolution and the Stock Market: Evidence. Am. Econ. Rev. 2001, 91, 1203–1220. [Google Scholar] [CrossRef]

- Mabula, J.B.; Dong, H. Use of Technology and Financial Literacy on SMEs Practices and Performance in Developing Economies. Int. J. Adv. Comput. Sci. Appl. 2018, 9, 74–82. [Google Scholar] [CrossRef]

- Mehrtens, J.; Cragg, P.B.; Mills, A.M. A model of Internet adoption by SMEs. Inf. Manag. 2001, 39, 165–176. [Google Scholar] [CrossRef]

- Van Akkeren, J.; Harker, D. Mobile data technologies and small business adoption and diffusion: An empirical study of barriers and facilitators. In Mobile Commerce: Technology, Theory and Applications; IGI Global: Hershey, PA, USA, 2003; pp. 218–244. [Google Scholar]

- Hashim, J. Information communication technology (ICT) adoption among SME owners in Malaysia. Int. J. Bus. Inf. 2007, 2, 221–240. [Google Scholar]

- Osano, H.M. Factors Influencing Global Expansion/Scalability of Small and Medium Enterprises: A Kenyan Case. World Technopolis Rev. 2019, 8, 21–42. [Google Scholar]

- Glavas, C.; Mathews, S.; Russell-Bennett, R. Knowledge acquisition via internet-enabled platforms. Int. Mark. Rev. 2019, 36, 74–107. [Google Scholar] [CrossRef]

- Bowen, M.M.; Johnson, K.R. Entrepreneurial Skills for the 21st Century Workplace: The SME Sector. In Handbook of Research on Promoting Higher-Order Skills and Global Competencies in Life and Work; IGI Global: Hershey, PA, USA, 2019; pp. 56–69. [Google Scholar]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strat. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Kor, Y.Y.; Mahoney, J.T.; Michael, S.C. Resources, Capabilities and Entrepreneurial Perceptions. J. Manag. Stud. 2007, 44, 1187–1212. [Google Scholar] [CrossRef]

- Lei, D.; Hitt, M.A.; Bettis, R. Dynamic core competences through meta-learning and strategic context. J. Manag. 1996, 22, 549–569. [Google Scholar] [CrossRef]

- Theriou, N.; Aggelidis, V.; Theriou, G. The Mediating Effect of the Knowledge Management Process to the Firm’s Performance: A Resource-Based View. Int. J. Econ. Bus. Adm. 2014, 2, 87–114. [Google Scholar] [CrossRef]

- Hedlund, G. A model of knowledge management and the N-form corporation. Strat. Manag. J. 2007, 15, 73–90. [Google Scholar] [CrossRef]

- Zack, M.H. Developing a Knowledge Strategy. Calif. Manag. Rev. 1999, 41, 125–145. [Google Scholar] [CrossRef]

- Curado, C.; Henriques, P.L.; Bontis, N. Intellectual capital disclosure payback. Manag. Decis. 2011, 49, 1080–1098. [Google Scholar] [CrossRef]

- Kubr, M. Management Consulting: A Guide to the Profession; International Labour Organization: Geneva, Switzerland, 2002. [Google Scholar]

- Jappelli, T.; Padula, M. Investment in financial literacy and saving decisions. J. Bank. Financ. 2013, 37, 2779–2792. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. Financial literacy around the world: An overview. J. Pension Econ. Financ. 2011, 10, 497–508. [Google Scholar] [CrossRef]

- Bontis, N.; Keow, W.C.C.; Richardson, S. Intellectual capital and business performance in Malaysian industries. J. Intellect. Cap. 2000, 1, 85–100. [Google Scholar] [CrossRef]

- Omiunu, O.G. Deploying ICT to Enhance Small Businesses and Achieving Sustainable Development: A Paradigm to Reducing Poverty and Unemployment and Enhancing a Sustainable National Development in Nigeria. In Handbook of Research on Small and Medium Enterprises in Developing Countries; IGI Global: Hershey, PA, USA, 2017; pp. 208–232. [Google Scholar]

- Ajiferuke, I.; Olatokun, W. Sectoral analysis of ICT use in Nigeria. In Encyclopedia of Information Science and Technology, 2nd ed.; IGI Global: Hershey, PA, USA, 2009; pp. 3364–3368. [Google Scholar]

- Ifijeh, G.; Iwu-James, J.; Adebayo, O. Digital Inclusion and Sustainable Development in Nigeria: The Role of Libraries. In Proceedings of the 3rd International Conference on African Development Issues, Ota, Nigeria, 9–11 May 2016. [Google Scholar]

- Zhang, X.; Majid, S.; Foo, S. The Role of Information Literacy in Environmental Scanning as a Strategic Information System-A Study of Singapore SMEs. In International Symposium on Information Management in a Changing World; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Rhodes, J. Can E-commerce enable marketing in an African rural women’s community based development organisation? Inf. Sci. 2003, 6, 157–172. [Google Scholar]

- Ladokun, I.; Osunwole, O.; Olaoye, B. Information and Communication Technology in Small and Medium Enterprises: Factors affecting the Adoption and use of ICT in Nigeria. Int. J. Acad. Res. Econ. Manag. Sci. 2013, 2, 74. [Google Scholar] [CrossRef]

- Sajuyigbe, A.; Alabi, E. Impact of information and communication technology in selected small and medium enterprises in Osogbo metropolis, Nigeria. J. Sch. Commun. Inf. Technol. 2012, 3, 24–35. [Google Scholar]

- Ashrafi, R.; Murtaza, M. Use and impact of ICT on SMEs in Oman. Electron. J. Inf. Syst. Eval. 2008, 11, 125–138. [Google Scholar]

- Iansiti, M.; Lakhani, K.R. Digital Ubiquity: How Connections, Sensors, and Data Are Revolutionizing Business. Harv. Bus. Rev. 2014, 92, 91–99. [Google Scholar]

- Windrum, P.; de Berranger, P. The Adoption of e-Business Technology by SMEs; Jones, O., Tilley, F., Eds.; John Wiley & Sons: Cheltenham, UK, 2002; pp. 177–201. [Google Scholar]

- Simpson, M.; Docherty, A.J. E-commerce adoption support and advice for UK SMEs. J. Small Bus. Enterp. Dev. 2004, 11, 315–328. [Google Scholar] [CrossRef]

- Fink, D. Guidelines for the Successful Adoption of Information Technology in Small and Medium Enterprises. Int. J. Inf. Manag. 1998, 18, 243–253. [Google Scholar] [CrossRef]

- Zaied, A.N.H. Barriers to E-Commerce Adoption in Egyptian SMEs. Int. J. Inf. Eng. Electron. Bus. 2012, 4, 9–18. [Google Scholar] [CrossRef]

- Estrin, L.; Foreman, J.T.; Garcia, S. Overcoming Barriers to Technology Adoption in Small Manufacturing Enterprises (SMEs); Carnegie-Mellon Software Engineering Inst: Pittsburgh, PA, USA, 2003. [Google Scholar]

- Irjayanti, M.; Azis, A.M. Barrier Factors and Potential Solutions for Indonesian SMEs. Procedia Econ. Financ. 2012, 4, 3–12. [Google Scholar] [CrossRef]

- Eniola, A.A.; Entebang, H. SME Firm Performance-Financial Innovation and Challenges. Procedia Soc. Behav. Sci. 2015, 195, 334–342. [Google Scholar] [CrossRef]

- Ong, J.-W.; Ismail, H.B. Sustainable competitive advantage through information technology competence: Resource-based view on small and medium enterprises. Commun. IBIMA 2008, 1, 62–70. [Google Scholar]

- Das, T.K.; Teng, B.-S. A resource-based theory of strategic alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Conner, K.R.; Prahalad, C.K. A Resource-Based Theory of the Firm: Knowledge Versus Opportunism. Organ. Sci. 1996, 7, 477–501. [Google Scholar] [CrossRef]

- Carmeli, A.; Tishler, A. The relationships between intangible organizational elements and organizational performance. Strateg. Manag. J. 2004, 25, 1257–1278. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The Economic Importance of Financial Literacy: Theory and Evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef]

- Huston, S. Measuring Financial Literacy. J. Consum. Aff. 2010, 44, 296–316. [Google Scholar] [CrossRef]

- Wise, S. The Impact of Financial Literacy on New Venture Survival. Int. J. Bus. Manag. 2013, 8, 30. [Google Scholar] [CrossRef]

- Widdowson, D.; Hailwood, K. Financial literacy and its role in promoting a sound financial system. Reserve Bank New Zealand Bull. 2007, 70, 37–49. [Google Scholar]

- Davidson, W.N.; Xie, B.; Xu, W. Market reaction to voluntary announcements of audit committee appointments: The effect of financial expertise. J. Account. Public Policy 2004, 23, 279–293. [Google Scholar] [CrossRef]

- Behrman, J.R.; Mitchell, O.S.; Soo, C.K.; Bravo, D. How Financial Literacy Affects Household Wealth Accumulation. Am. Econ. Rev. 2012, 102, 300–304. [Google Scholar] [CrossRef]

- Allgood, S.; Walstad, W.B. The effects of perceived and actual financial literacy on financial behaviors. Econ. Inq. 2016, 54, 675–697. [Google Scholar] [CrossRef]

- Yilmaz, A.K.; Flouris, T. Enterprise risk management in terms of organizational culture and its leadership and strategic management. In Corporate Risk Management for International Business; Springer: Berlin/Heidelberg, Germany, 2017; pp. 65–112. [Google Scholar]

- Ittner, C.D.; Oyon, D. Risk Ownership, ERM Practices, and the Role of the Finance Function. J. Manag. Account. Res. 2019. [Google Scholar] [CrossRef]

- Soin, K.; Collier, P. Risk and risk management in management accounting and control. Manag. Account. Res. 2013, 24, 82–87. [Google Scholar] [CrossRef]

- Lechner, P.; Gatzert, N. Determinants and value of enterprise risk management: Empirical evidence from Germany. Eur. J. Financ. 2018, 24, 867–887. [Google Scholar] [CrossRef]

- Elahi, E. Risk management: The next source of competitive advantage. Foresight 2013, 15, 117–131. [Google Scholar] [CrossRef]

- Callahan, C.; Soileau, J. Does enterprise risk management enhance operating performance? Adv. Account. 2017, 37, 122–139. [Google Scholar] [CrossRef]

- Zou, X.; Hassan, C.H. Enterprise risk management in China: The impacts on organisational performance. Int. J. Econ. Policy Emerg. Econ. 2017, 10, 226. [Google Scholar] [CrossRef]

- Lajili, K. Corporate Risk Disclosure and Corporate Governance. J. Risk Financ. Manag. 2009, 2, 94–117. [Google Scholar] [CrossRef]

- Agrawal, R. ’Enterprise risk management’ essential for survival and sustainable development of micro, small and medium enterprises. Int. Rev. 2016, 2016, 117–124. [Google Scholar] [CrossRef]

- Nelson, R.R. An Evolutionary Theory of Economic Change; Harvard University Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Limsarun, T. The Sustainability of Small and Medium-sized Enterprises (SMEs) in A Digital Economy Era. J. Bus. Adm. 2015, 4, 113–124. [Google Scholar]

- Gutiérrez, R.T.; Zuñiga, X.; Tomé, E.; Magaña, X.; Ostolaza, I. The benefits of Digital Best Practices Program: Improving digital literacy in SMEs of Basque tourism industry. Improv. Sustain. Tour. XXIst Century 2016, 57, 99. [Google Scholar]

- Ramsey, E.; Ibbotson, P.; McCole, P. Factors that impact technology innovation adoption among irish professional service sector smes. Int. J. Innov. Manag. 2008, 12, 629–654. [Google Scholar] [CrossRef]

- Kapurubandara, M.; Lawson, R. SMEs in developing countries need support to address the challenges of adopting e-commerce technologies. In Proceedings of the Bled eConference, Bled, Slovenia, 3–6 June 2007; p. 24. [Google Scholar]

- Meidell, A.; Kaarbøe, K. How the enterprise risk management function influences decision-making in the organization – A field study of a large, global oil and gas company. Br. Account. Rev. 2017, 49, 39–55. [Google Scholar] [CrossRef]

- Smit, Y. A literature review of small and medium enterprises (SME) risk management practices in South Africa. Afr. J. Bus. Manag. 2012, 6, 6324. [Google Scholar] [CrossRef]

- Beheshti, H.M. What managers should know about ERP/ERP II. Manag. Res. News 2006, 29, 184–193. [Google Scholar] [CrossRef]

- Shanahan, P.; McParlane, J. Serendipity or strategy? An investigation into entrepreneurial transnational higher education and risk management. Horizon 2005, 13, 220–228. [Google Scholar] [CrossRef]

- Dionne, G.; Triki, T. Risk Management and Corporate Governance: The Importance of Independence and Financial Knowledge for the Board and the Audit Committee; HEC Montreal: Montréal, QC, Canada, 2005. [Google Scholar]

- Hommel, U.; King, R. The emergence of risk-based regulation in higher education. J. Manag. Dev. 2013, 32, 537–547. [Google Scholar] [CrossRef]

- Robson, C.; McCartan, K. Real World Research; John Wiley & Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Burns, A.; Bush, R. Marketing Research, 5th ed.; John Wiley & Sons: Hoboken, NJ, USA, 2006. [Google Scholar]

- Pham, Q.T. Measuring the ICT maturity of SMEs. J. Knowl. Manag. Pract. 2010, 11, 1–14. [Google Scholar]

- Bongomin, G.O.C.; Munene, J.C.; Ntayi, J.M.; Malinga, C.A.; Okello, G.C.B. Exploring the mediating role of social capital in the relationship between financial intermediation and financial inclusion in rural Uganda. Int. J. Soc. Econ. 2018, 45, 829–847. [Google Scholar] [CrossRef]

- Sax, J.; Torp, S. Speak up! Enhancing risk performance with enterprise risk management, leadership style and employee voice. Manag. Decis. 2015, 53, 1452–1468. [Google Scholar] [CrossRef]

- Anwar, M. business model innovation and smes performance—does competitive advantage mediate? Int. J. Innov. Manag. 2018, 22, 1850057. [Google Scholar] [CrossRef]

- Runyan, R.C.; Dröge, C.; Swinney, J. Entrepreneurial Orientation versus Small Business Orientation: What Are Their Relationships to Firm Performance? J. Small Bus. Manag. 2008, 46, 567–588. [Google Scholar] [CrossRef]

- Haber, S.; Reichel, A. Identifying Performance Measures of Small Ventures-The Case of the Tourism Industry. J. Small Bus. Manag. 2005, 43, 257–286. [Google Scholar] [CrossRef]

- Ma, D.; Ullah, F.; Khattak, M.S.; Ahmad, H. Do International Capabilities and Resources Configure Firm’s Sustainable Competitive Performance? Research within Pakistani SMEs. Sustainability 2018, 10, 4298. [Google Scholar] [CrossRef]

- Leguina, A. A primer on partial least squares structural equation modeling (PLS-SEM). Int. J. Res. Method Educ. 2015, 38, 220–221. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2014, 43, 115–135. [Google Scholar] [CrossRef]

- Wong, K.Y.; Aspinwall, E. An empirical study of the important factors for knowledge-management adoption in the SME sector. J. Knowl. Manag. 2005, 9, 64–82. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Babin, B.J.; Black, W.C. Multivariate Data Analysis: A Global Perspective; Pearson: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Bharadwaj, A.S. A Resource-Based Perspective on Information Technology Capability and Firm Performance: An Empirical Investigation. MIS Q. 2000, 24, 169. [Google Scholar] [CrossRef]

- Liang, T.; You, J.; Liu, C. A resource-based perspective on information technology and firm performance: A meta analysis. Ind. Manag. Data Syst. 2010, 110, 1138–1158. [Google Scholar] [CrossRef]

- Fatoki, O. The Financial Literacy of Micro Entrepreneurs in South Africa. J. Soc. Sci. 2014, 40, 151–158. [Google Scholar] [CrossRef]

- Eniola, A.A.; Entebang, H.; Sakariyau, O.B. Small and medium scale business performance in Nigeria: Challenges faced from an intellectual capital perspective. Int. J. Res. Stud. Manag. 2015, 4, 59–71. [Google Scholar] [CrossRef]

- Carbo-Valverde, S.; Fernandez, F.R.; Udell, G.F. Trade Credit, the Financial Crisis, and SME Access to Finance. J. Money, Crédit. Bank. 2016, 48, 113–143. [Google Scholar] [CrossRef]

- Laitinen, E.K. Prediction of failure of a newly founded firm. J. Bus. Ventur. 1992, 7, 323–340. [Google Scholar] [CrossRef]

- Jalal-Karim, A. Leveraging enterprise risk management (ERM) for boosting competitive business advantages in Bahrain. World J. Entrep. Manag. Sustain. Dev. 2013, 9, 65–75. [Google Scholar] [CrossRef]

- Venkatraman, S.; Fahd, K. Challenges and Success Factors of ERP Systems in Australian SMEs. Systems 2016, 4, 20. [Google Scholar] [CrossRef]

- Arena, M.; Arnaboldi, M.; Azzone, G. Is enterprise risk management real? J. Risk Res. 2011, 14, 779–797. [Google Scholar] [CrossRef]

- Pierrakis, Y.; Collins, L. Crowdfunding: A New Innovative Model of Providing Funding to Projects and Businesses. SSRN Electron. J. 2013. [Google Scholar] [CrossRef]

- Eniola, A.A.; Entebang, H. SME Managers and Financial Literacy. Glob. Bus. Rev. 2017, 18, 559–576. [Google Scholar] [CrossRef]

- Bansal, S. Perspective of Technology in Achieving Financial Inclusion in Rural India. Procedia Econ. Financ. 2014, 11, 472–480. [Google Scholar] [CrossRef]

| Frequency | Percentage | |

|---|---|---|

| Industrial sector | ||

| Manufacturing | 131 | 41.1% |

| Service | 93 | 29.2% |

| Trade | 95 | 29.7% |

| Size | ||

| 5–20 employees | 53 | 16.6% |

| 21–40 employees | 92 | 28.8% |

| 41–60 employees | 86 | 27.0% |

| 61–80 employees | 55 | 17.2% |

| 81–99 employees | 33 | 10.4% |

| Age | ||

| ≤5 years | 73 | 22.9% |

| 6–15 years | 97 | 30.4% |

| 16–25 years | 92 | 28.9% |

| ≥26 years | 57 | 17.8% |

| Construct | Items | Loading | Mean | SD | Skewness | Kurtosis | VIF |

|---|---|---|---|---|---|---|---|

| Technological Literacy | TL1 | 0.870 | 4.7000 | 1.65450 | −0.572 | −0.344 | 2.127 |

| TL2 | 0.852 | 4.3200 | 1.85254 | −0.463 | −0.817 | 1.684 | |

| TL3 | 0.810 | 4.5900 | 1.86458 | −0.306 | −0.931 | 2.451 | |

| TL4 | 0.794 | 3.8000 | 1.28708 | −0.748 | −0.588 | 2.583 | |

| TL5 | 0.847 | 4.4200 | 1.80448 | −0.526 | −0.742 | 2.043 | |

| Financial Literacy | FL1 | 0.732 | 4.0700 | 1.45821 | 0.295 | −0.416 | 1.841 |

| FL2 | 0.757 | 4.8800 | 1.47901 | −0.114 | −0.951 | 2.582 | |

| FL3 | 0.652 | 4.4500 | 1.51341 | −0.054 | −0.441 | 2.947 | |

| FL4 | 0.757 | 4.0900 | 1.54459 | 0.165 | −0.513 | 2.164 | |

| FL5 | 0.787 | 4.2300 | 1.58181 | −0.029 | −0.576 | 1.973 | |

| FL6 | 0.765 | 5.0200 | 1.50407 | −0.507 | −0.583 | 1.473 | |

| FL7 | 0.707 | 4.6500 | 1.56589 | −0.365 | −0.557 | 1.639 | |

| FL8 | 0.771 | 4.8300 | 1.57669 | −0.171 | −0.882 | 2.078 | |

| FL9 | 0.769 | 4.4100 | 1.62739 | −0.202 | −0.660 | 2.665 | |

| FL10 | 0.804 | 4.9800 | 1.53070 | −0.518 | −0.464 | 1.943 | |

| ERM | ERM1 | 0.832 | 4.8500 | 1.43108 | −0.385 | −0.442 | 2.845 |

| ERM2 | 0.735 | 5.5100 | 1.32188 | −0.531 | −0.658 | 1.869 | |

| ERM3 | 0.738 | 5.2000 | 1.50420 | −0.894 | 0.433 | 2.537 | |

| ERM4 | 0.807 | 4.9500 | 1.55294 | −0.724 | 0.322 | 2.664 | |

| ERM5 | 0.740 | 4.5900 | 1.45710 | −0.172 | −0.866 | 2.476 | |

| ERM6 | 0.812 | 4.9900 | 1.54066 | −0.693 | −0.013 | 1.872 | |

| SME Performance | FP1 | 0.817 | 4.5900 | 1.29564 | −0.870 | 0.912 | 2.493 |

| FP2 | 0.845 | 4.9100 | 1.44875 | −0.684 | 0.343 | 2.055 | |

| FP3 | 0.854 | 5.0500 | 1.50000 | −0.756 | 0.255 | 1.846 | |

| FP5 | 0.755 | 3.1100 | 1.17975 | −0.330 | −0.854 | 2.460 | |

| FP6 | 0.782 | 4.6400 | 1.22697 | −0.984 | 0.858 | 2.573 | |

| FP7 | 0.796 | 4.5365 | 1.26953 | −0.921 | 0.898 | 2.417 | |

| FP8 | 0.784 | 3.9700 | 1.15168 | −0.469 | −0.866 | 2.835 |

| Latent Variable | Cronbach’s Alpha | CR | AVE |

|---|---|---|---|

| Technological Literacy | 0.893 | 0.870 | 0.697 |

| Financial Literacy | 0.914 | 0.891 | 0.564 |

| ERM Practices | 0.870 | 0.863 | 0.606 |

| SME Performance | 0.911 | 0.890 | 0.649 |

| Variable | TL | FL | ERM | FP |

|---|---|---|---|---|

| Technological Literacy (TL) | 0.834 | |||

| Financial Literacy (FL) | 0.527 | 0.751 | ||

| ERM Practices (ERM) | 0.495 | 0.474 | 0.778 | |

| SME Performance (FP) | 0.416 | 0.504 | 0.613 | 0.805 |

| Variable | TL | FL | ERM | FP |

|---|---|---|---|---|

| Technological Literacy | - | |||

| Financial Literacy | 0.803 | - | ||

| ERM Practices | 0.793 | 0.784 | - | |

| SME Performance | 0.779 | 0.813 | 0.726 | - |

| Path | Hypothesis | Path Coefficient | t-Value >1.96 | p-Value <0.05 | f2 | Significance |

|---|---|---|---|---|---|---|

| TL→FP | 1 | 0.473 | 4.270 | 0.000 | 0.312 | Yes |

| FL→FP | 2 | 0.316 | 2.160 | 0.031 | 0.264 | Yes |

| ERM→FP | 3 | 0.236 | 2.966 | 0.022 | 0.212 | Yes |

| TL→ERM | 4 | 0.197 | 2.698 | 0.013 | 0.198 | Yes |

| FL→ERM | 6 | 0.640 | 5.270 | 0.000 | 0.473 | Yes |

| Endogenous Latent Variable | R2 Value | Q2 Value |

|---|---|---|

| ERM Practices | 0.654 | 0.361 |

| SME Performance | 0.670 | 0.376 |

| Hypotheses | Decision |

|---|---|

| H1: Technological literacy is positively related to SME performance | Accepted |

| H2: Financial literacy is positively related to SME performance | Accepted |

| H3: ERM practices has a positive effect on SME performance | Accepted |

| H4: Technological literacy is positively related to ERM practices | Accepted |

| H5: ERM practices mediates the relationship between technological literacy and SME performance | Rejected |

| H6: Financial literacy has a positive effect on ERM practices | Accepted |

| H7: ERM practices mediates the relationship between financial literacy and SME performance | Partially accepted |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kulathunga, K.M.M.C.B.; Ye, J.; Sharma, S.; Weerathunga, P.R. How Does Technological and Financial Literacy Influence SME Performance: Mediating Role of ERM Practices. Information 2020, 11, 297. https://doi.org/10.3390/info11060297

Kulathunga KMMCB, Ye J, Sharma S, Weerathunga PR. How Does Technological and Financial Literacy Influence SME Performance: Mediating Role of ERM Practices. Information. 2020; 11(6):297. https://doi.org/10.3390/info11060297

Chicago/Turabian StyleKulathunga, K.M.M.C.B., Jianmu Ye, Saurabh Sharma, and P.R. Weerathunga. 2020. "How Does Technological and Financial Literacy Influence SME Performance: Mediating Role of ERM Practices" Information 11, no. 6: 297. https://doi.org/10.3390/info11060297

APA StyleKulathunga, K. M. M. C. B., Ye, J., Sharma, S., & Weerathunga, P. R. (2020). How Does Technological and Financial Literacy Influence SME Performance: Mediating Role of ERM Practices. Information, 11(6), 297. https://doi.org/10.3390/info11060297