1.1. Background

The international cruise industry is at a rapid developing time, marked by a strong interest in tourism and significant investments by cruise companies in numerous sophisticated ships [

1]. Such ships are characterized by a large number of passengers, large dimensions, long sailing time, and high commercial value [

2]. However, compared to conventional ships (i.e., cargo and container ships) and inland vehicles, cruise accidents are more likely to cause significant accidents. For this reason, the International Maritime Organization (IMO), Cruise Lines International Association (CLIA), Lloyd’s Register of Shipping (LR), and other organizations have issued strict specifications related to passenger ship design and construction.

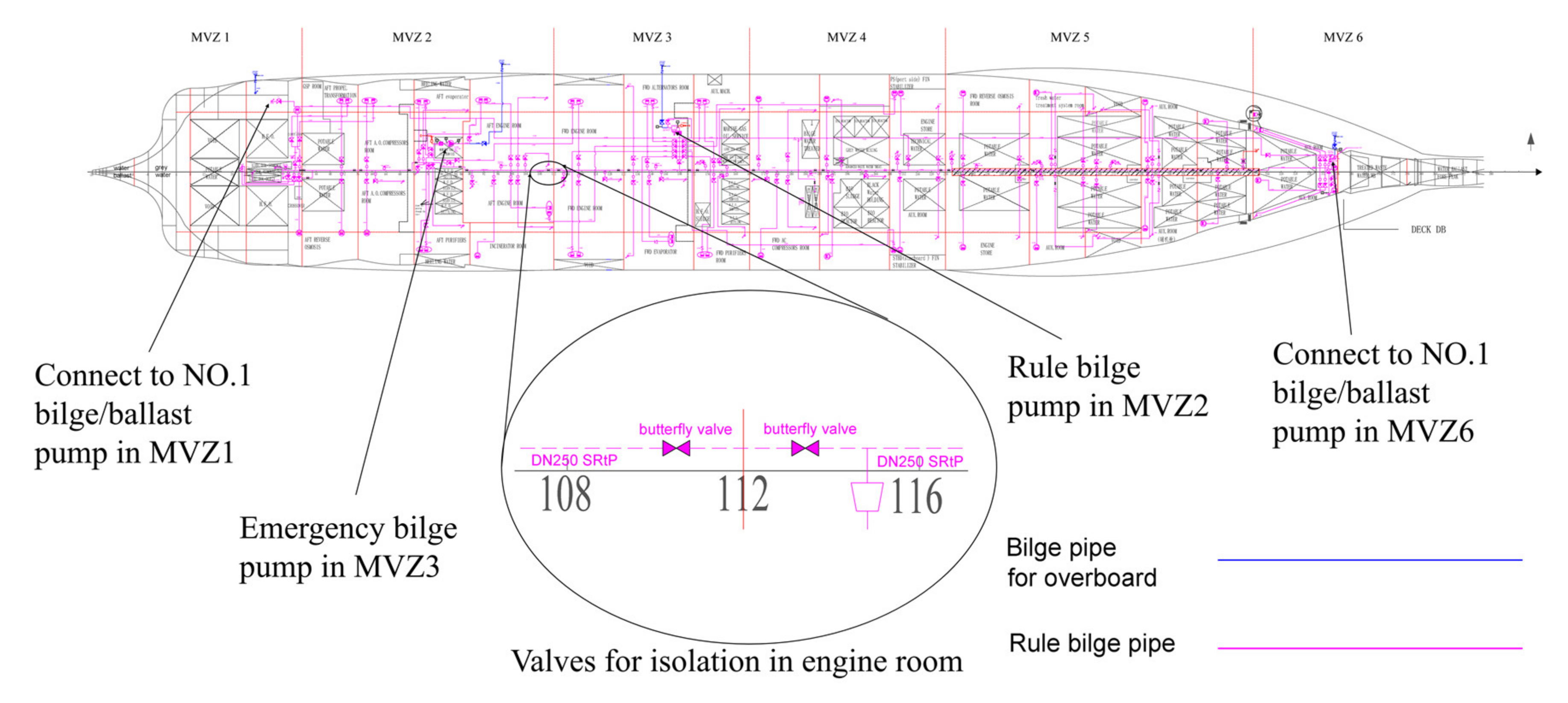

Cruise ship bilge systems are one of the most important auxiliary systems for cruise ship safety and typically consist of an oily bilge system and a rule bilge system. The oily bilge system is responsible for collecting and treating oily bilge water, whereas the rule bilge water system serves to timely discharge floodwater and firewater in case of emergency. Similar to a cargo ship, the large luxury cruise ship’s bilge system consists of elements such as a bilge pump, main bilge pipe, and valves. Several bilge-system components are adjacent to high-risk areas or high-temperature heat sources (e.g., engine room, generator, and fuel tank), creating a potential hazard [

3]. Since these components could be seriously affected by a fire accident, they are viewed as parts of the high-risk factors in a bilge system. However, qualitative analyses may not accurately identify predominant risk factors. Therefore, the main aspect of failure risk assessment is to determine the predominant risk factors. With regards to the ship piping system [

4], the bilge-system risk factors can be categorized into four categories (i.e., power machinery, facility, pipeline, measuring instrument), as further discussed in

Section 4, that serve as attributes in decision-making.

The International Convention for Safety of Life at Sea (SOLAS) has put forward requirements for the reliability of the bilge system in the event of a ship fire [

5]. These Safe Return to Port (SRtP) regulations apply to passenger ships 120 or more meters long, having three or more Main Vertical Zones (MVZs), or special purpose ships carrying more than 240 passengers. Thus, risk control measures for the bilge systems in large luxury cruise ships should also be designed to meet the SRtP regulations.

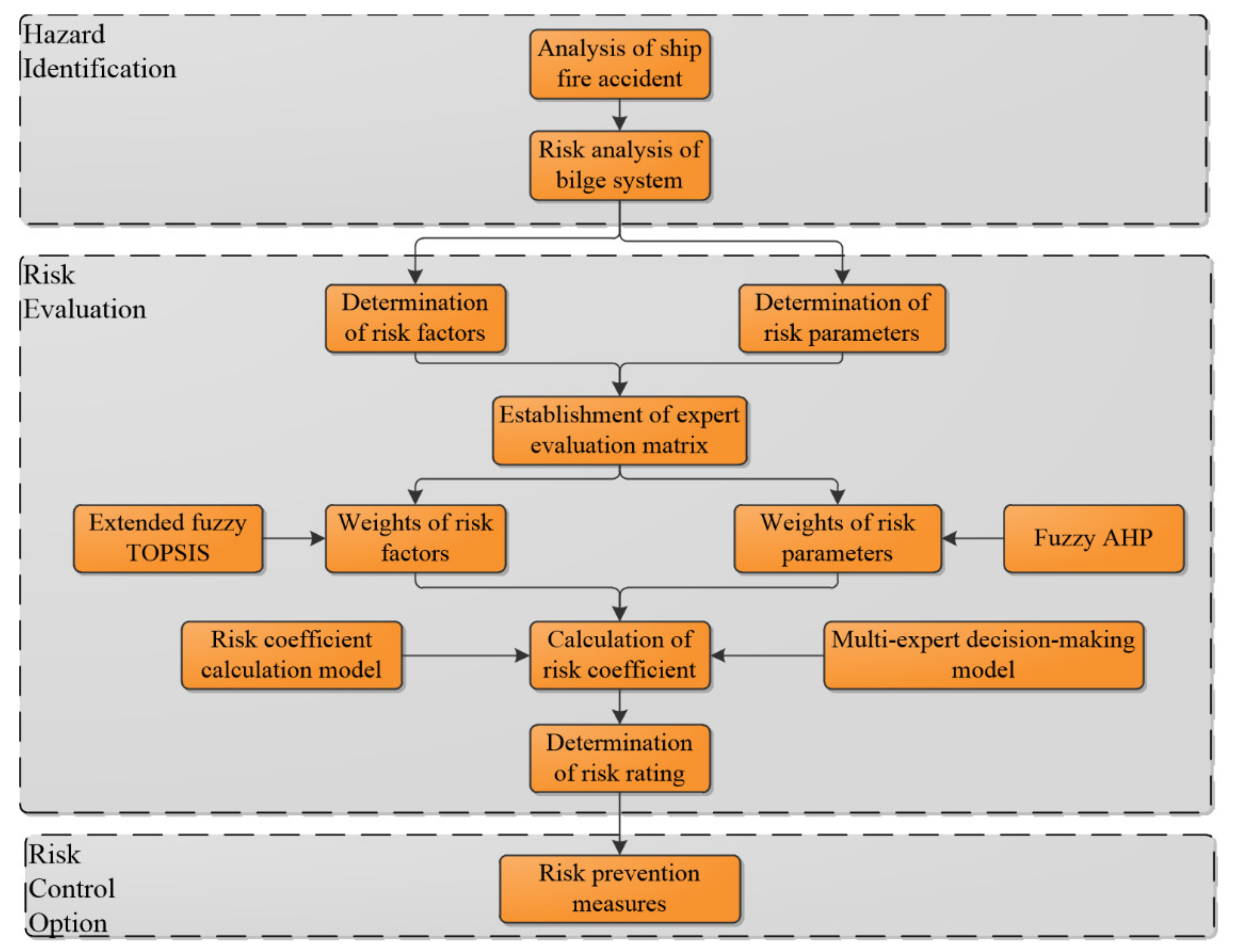

In 2002, IMO proposed the Formal Safety Assessment (FSA) process that comprises, for example, identification of hazards, risk evaluation, and risk control options [

6]. Nevertheless, although FSA outlines the required steps, it does not offer a specific risk analysis tool for maritime stakeholders [

7]. Such a lack of tools makes it necessary to rely on the knowledge and experience of experts when proposing an applicable failure risk assessment method.

1.2. Literature Review

Commonly used qualitative and quantitative evaluation methods are roughly divided into methods based on expert judgment (qualitative/quantitative), such as the Delphi method [

8], bibliometric analysis methods such as bibliometric assessment [

9], and mathematical analysis methods (quantitative), such as the Analytic Hierarchy Process (AHP) [

10]. AHP is a method put forward by Saaty [

11] that divides evaluation objectives into multiple levels and establishes mathematical models for their analysis. As a quantitative mathematical analysis method and a multi-criteria decision-making (MCDM) tool, AHP is practical, simple, and systematic and is widely applied in various disciplines, including engineering, economy, and management [

12,

13]. For example, Buckley [

14] extended the hierarchical analysis to the case where experts can replace exact weights with fuzzy weights to rank the alternatives (i.e., criteria).

In the marine sector, Celik et al. [

15] employed fuzzy AHP to select a suitable shipping registry for Turkish ship owners. Karahalios [

16] combined AHP with fuzzy set theory to calculate and analyze the risk coefficients of three different ship types. To mitigate the shortcomings stemming from the process subjectivity and approximations of the results, AHP is frequently combined with the TOPSIS method [

17]. TOPSIS is a commonly used method for MCDM problems that build on the idea that the best alternative should be the farthest from the negative ideal solution and the closest to the positive ideal solution [

18,

19]. Relating to fuzzy TOPSIS, Alarcin et al. [

20] combined FST with TOPSIS to mitigate the TOPSIS’s deficiencies in dealing with fuzzy problems. Chen [

21] extended TOPSIS to the fuzzy environment, calculating the distance between two triangular fuzzy numbers.

It is significant to aggregate opinions of several weighted decision-makers into group opinions in the group decision-making [

22]. Expert competence (i.e., qualification level and decision-making capacity) and decision-making preferences (individual vs. group decision-making preference) impact the evaluation results. Thus, rather than weighting the experts equally when integrating their judgments, differences between them should be considered [

23]. Nevertheless, the research on this aspect is relatively scarce. Chiclana et al. [

24] discussed the Consistency-Induced Ordered Weighted Averaging operator for weighting the decision-making capacity of experts in group decision-making problems based on the consistency of their information sources. Aly and Vrana [

25] regarded the experts’ knowledge, relevance, and experience as scoring indexes to determine the expert’s qualification level. However, the scoring index information is ambiguous and prone to overlap. Pythagorean fuzzy numbers [

26] are incorporated with the individual decision-making preferences to represent experts’ evaluation accurately, capturing the fuzzy information in the decision-making process. Considering the group decision-making preference, Büyüközkan et al. [

27] utilize each expert’s consensus degree coefficient to determine the expert weights. However, the proposed mathematical model omits the influence of experts’ individual decision-making preferences. Therefore, there is still a need for a comprehensive expert weight calculation model.

Another problem in risk evaluation is risk representation [

28,

29]. IMO defines risk as a combination of two risk parameters [

30], as shown in Equation (1):

where the risk coefficient (denoted

RC) is the quantitative risk representation,

O is the risk likelihood rating, and

S denotes the risk severity rating for the particular risk factor (i.e., criteria like the marine engines and pumps under fire accident conditions). Akyuz et al. [

31] extended this notation by incorporating the capacity of detectability to risk (denoted

D), and the RC can be calculated by taking the product of these three levels utilizing a numerical scale from 1 to 10, as shown in Equation (2):

where

O,

S, and

D denote the level of risk factor’s likelihood, risk factor’s severity and the capacity of detectability to the risk, respectively. Additionally,

O and

S are benefit-type risk parameters and RC increases with a higher level of

O and

S.

D is a cost-type risk parameter, which means a good capacity of detectability to risk may result in low level of

D. Thus, RC decreases with a lower level of

D (i.e., better capacity of detectability to the risk).

Anthony [

32] and Montewka et al. [

33] offered an improved risk coefficient calculation model, which transforms absolute risk coefficients into relative ones following Equation (3).

where

denotes the risk factor’s likelihood weight, and

is the risk factor’s severity weight.

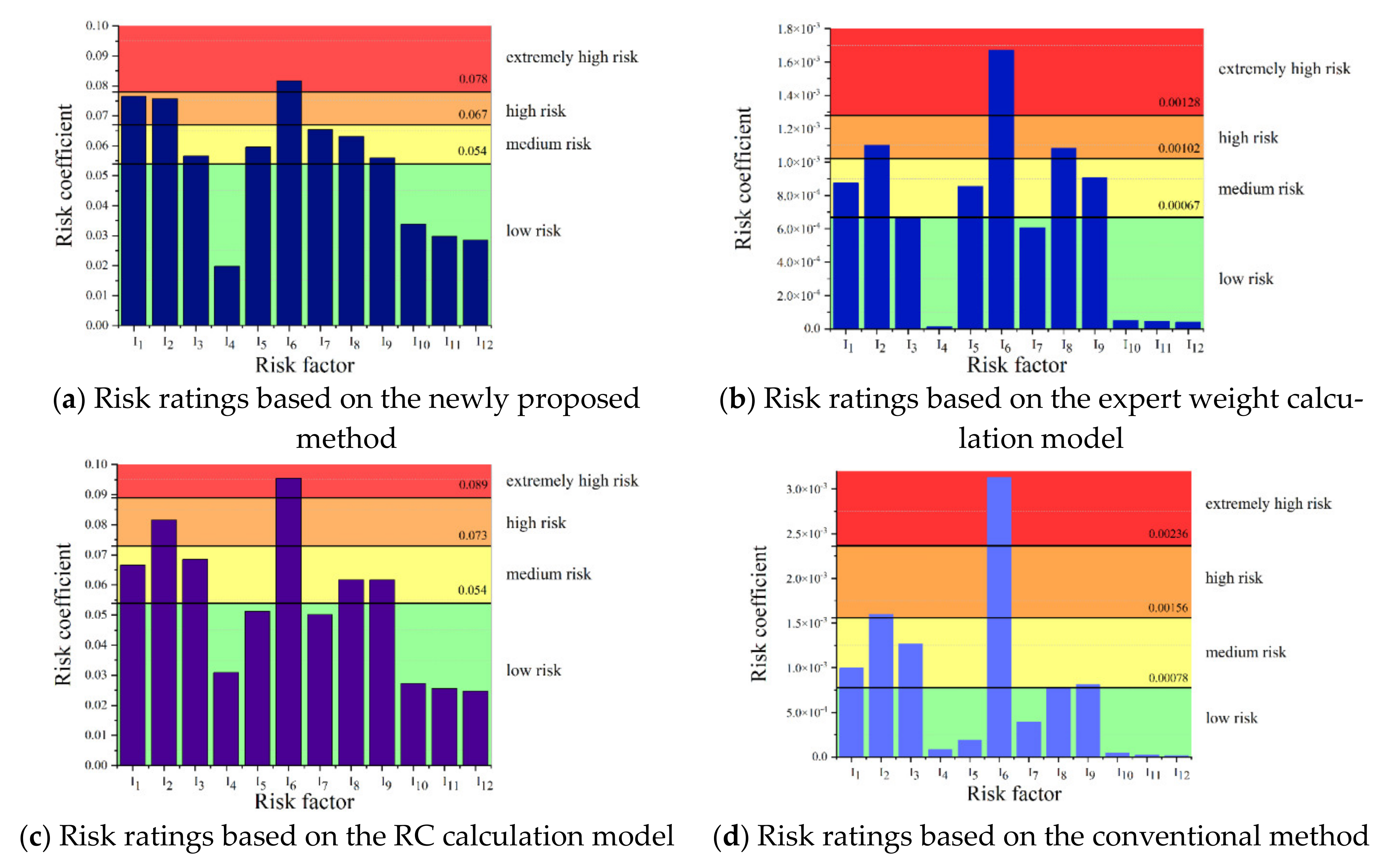

Risk coefficients determine the risk ratings. A review of risk matrices presented in [

34] proposed a risk classification method based on a two-dimensional discrete risk matrix. Similarly, Hsu et al. [

35] built on Equation (3) to propose a risk classification method based on a two-dimensional continuous risk matrix. However, there is little research related to a three-dimensional continuous risk matrix. Moreover, although a typical risk matrix provides a practical risk identification method, two problems arise when using the traditional

RC calculation model that relies on multiplication.

The same RC value implies that the risk factors’ actual ratings are identical. For example, consider a case where O, S, and D all equal two, and one where O = 4, S = 2, and D = 1. Following Equation (2), the two cases’ RCs are similar, and the risk ratings of the cases cannot be distinguished.

Each risk parameter’s sensitivity to

RC is the same. For example, let

O,

S, and

D be 2, 2, 2, respectively in Equation (2). If

O or

S changes to 3,

RC becomes 12. However, the influence of

O,

S, and

D on risk rating should be different [

7].

Resolving the listed problems requires a nonlinear aggregation of the risk parameters, with different weights assigned to distinct risk parameters. Thus, the risk coefficient calculation model is proposed.

In summary, the novelties and motivations of the proposed two methods for calculating the expert weight and risk coefficient can be summarized as follows:

The expert weight calculation model comprehensively considers the differences in experts’ expertise levels (i.e., qualification level, decision-making capacity, and decision-making preference). Furthermore, there are shortcomings in some of existing expert weight calculation methods. Therefore, the weighted expert weight calculation model is proposed.

A new RC calculation method is proposed to solve the list of two problems. The RC calculation model incorporates a nonlinear aggregation of the risk parameters, utilizing a three-dimensional continuous matrix that serves to determine the risk factors’ ratings. Additionally, the weights of different risk parameters are also considered.

The remainder of this paper is organized as follows.

Section 2 introduces the preliminaries on the failure risk assessment for large luxury cruise ships’ bilge system.

Section 3 describes the improved method for calculating the risk coefficients and determining the risk ratings. The application and discussion of the bilge system’s failure assessment on a Carnival Vista cruise ship example are presented in

Section 4. Finally,

Section 5 concludes the paper.