Issue of Accumulation and Redistribution of Oil and Gas Rental Income in the Context of Exhaustible Natural Resources in Arctic Zone of Russian Federation

Abstract

1. Introduction

2. Materials and Methods

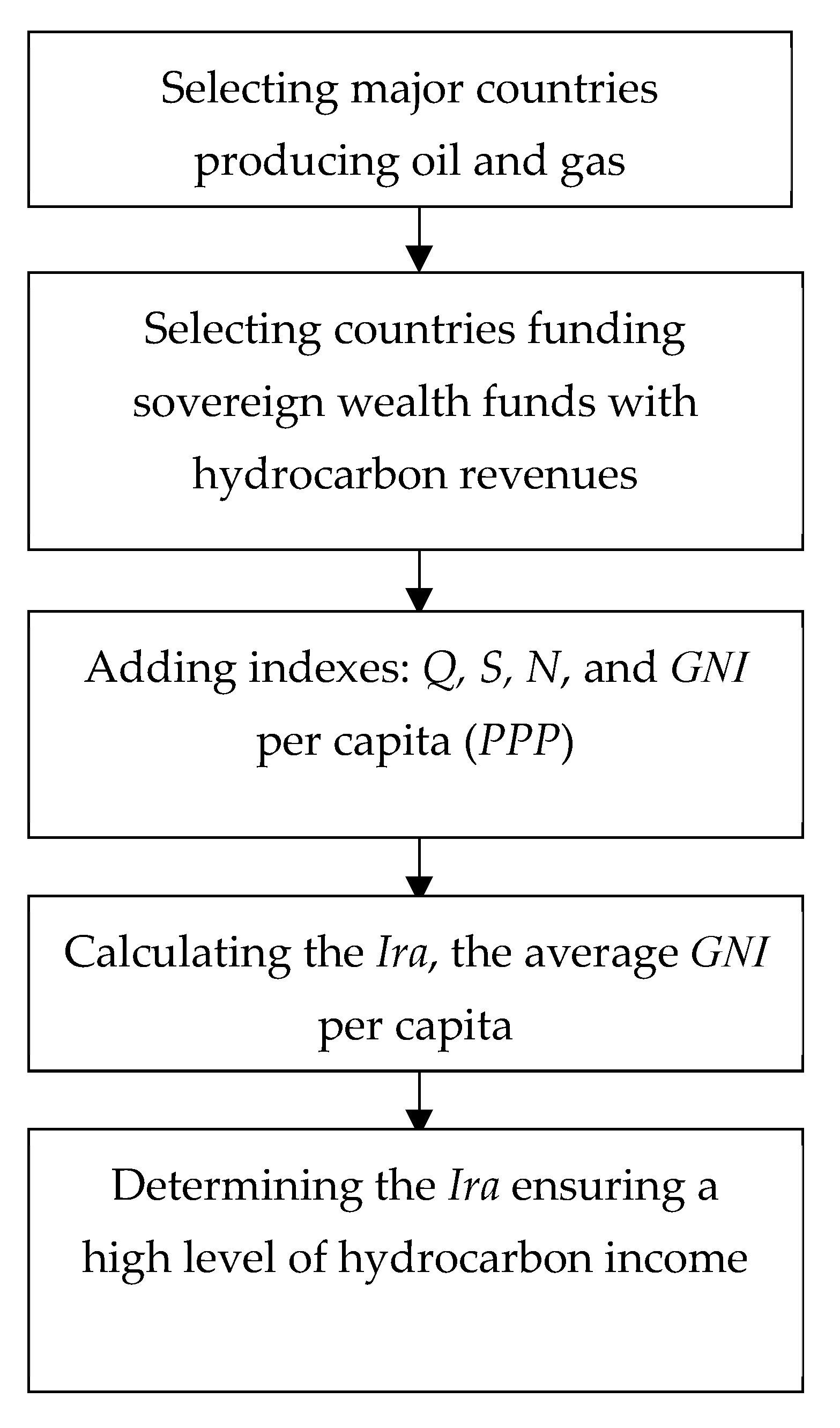

- Select ten major countries producing oil and gas. Recalculate their oil and gas production into tonnes of a standard fuel in order to compare the figures.

- Select countries funding sovereign wealth funds with hydrocarbon revenues from the list.

- The authors propose to assess the impact of the area and the population size using an n-fold multiplicative model:

- , where

- Ira is the resource availability index.

- Q is hydrocarbon production in tonnes of a standard fuel.

- S is the area of a country in thousands of km2.

- N is the population size in millions of people.

The authors suppose that not only the population size but also a country’s area should be taken into account while estimating a country’s provision with hydrocarbons. If the provision is estimated via the ratio of production to the population (Q/N), the result is misrepresented, because countries with large areas have to maintain a large and power-consuming transport infrastructure and have larger production facilities. It leads to increasing local demand and consumption of power resources. As a result, export opportunities and rent income decline. So, the authors propose to consider a country’s area for the correct estimation. Ira provides a generalized estimation of a country’s provision with hydrocarbons.The lack of standards leads to the use of comparative analysis by country. - Countries are ranked by the Gross National Income (GNI) per capita (the purchasing power parity, PPP, $). The average GNI per capita is calculated for the selected countries. The countries are divided into two groups: with the GNI per capita above the average level and below it.

- The performed calculations allow determining the Ira value required for the population to gain high incomes in countries possessing hydrocarbon reserves.

3. Results

- −

- State budget stabilization (Reserve (stabilization) funds)

- −

- Compensation to the population for resource depletion (Future Generation Funds)

- −

- Supporting the economy in times of crisis (Budgetary Reserve Funds)

- The major countries producing hydrocarbons and establishing oil and gas sovereign wealth funds were selected for the comparative analysis: Russia, Saudi Arabia, Iraq, United Arab Emirates, Iran, Kuwait, Nigeria, Qatar, Norway, and Algeria (Table 5).

- Table 6 shows the results of the Ira calculation, data on GNI per capita (PPP) by country.

- Specific regional restrictions and risks for companies. It is difficult to imagine that businesses will choose the Arctic to deploy enterprises of light industry, agriculture, chemical industry, high-tech instrumentation, etc.We can find good examples of successful development of agriculture in the Arctic territories both in Russia and in other Northern states (Sweden, Finland, Norway, Iceland, Alaska (the USA)). Due to the climatic peculiarities of the Arctic countries, agriculture is mainly subsidized and is aimed at food self-production. Agriculture development is not considered as a backbone industry in AZRF because the country has Southern regions with more favorable climatic conditions.Launching production facilities in AZRF will lead to higher expenses compared to the average figures in industries. So, companies’ activities will be less efficient and their products will be less competitive in AZRF. The main reasons:

- -

- Production in extreme climatic conditions. Equipment, technologies, and materials are to be adjusted to the Arctic conditions.

- -

- The Arctic fragile ecosystem must be taken into consideration. Lack of natural light, low temperatures, strong winds, and drifting ice lead to low self-restoring and self-cleaning capacity of the ecosystem.

- -

- Complicated logistics: material and technical support to remote facilities and remote location from the main centers of the final product consumption.

- -

- Employee requirements and, as a result, provision of conditions attracting qualified personnel (with the number of employees required for the implementation of the AZRF development programs).

- The need to preserve the traditional way of life of the indigenous population, which is incompatible with a high level of industrialization. The problem of harmonization of socio-economic interest system in AZRF, the impact of the industrial development on the traditional way of life of indigenous peoples in the Arctic were considered by the authors in [7].

- −

- Risks connected with social and economic underdevelopment: shortage of manpower; decline in labor efficiency; migration of the population to more favorable regions, etc.

- −

- Risks of technical and scientific lagging behind: lack of technology in mineral resource exploration and production.

- −

- Environmental safety risks: subsoil users spill oil, emit hazardous air pollutants, violate waste disposal standards, and do not contribute to mined-land reclamation.

- −

- Risks of insufficient state funding: absence, or underdevelopment of infrastructure, housing construction, etc.

4. Discussion and Conclusions

- AZRF is and will remain the most important geopolitical and geo-economic macro-region of the country. However, the level of socio-economic development of AZRF’s territories threatens the country’s strategic plans for large-scale development of the Arctic. Possible extraction of the Arctic offshore oil and gas largely determines the level and quality of the region’s development.

- Principles of the state policy in the Arctic and strategic plans of the largest companies operating in the region consolidate the raw material nature of AZRF development, making rent the main form of income.

- The existing regional restrictions for launching production facilities not related to the mining industry, lead to increased attention to the rational use of raw materials. A colonial development model is observed in the Arctic zone: minerals are not developed in the region, but are exported. This fact reduces AZRF’s regional wealth and leads to resource depletion. At the same time, rental income is withdrawn to the federal budget, while the local population bears all the consequences of the industrial development of the territories.

- An improving level of AZRF’s socio-economic development and a reduction of territory depopulation will indicate the changing quality of economic growth and the transition from the colonial model of AZRF development to the sustainable development model.

- It seems reasonable to leave rental income in the region until the level of AZRF’s socio-economic development reaches at least the Russian average one. Development of the resource potential should not deteriorate the situation in the Arctic region.

Author Contributions

Funding

Conflicts of Interest

References

- Central Control Administration of the Fuel and Energy Complex. Arctic Oil and Gas Treasure Trove. Available online: https://www.cdu.ru/tek_russia/issue/2018/12/545/ (accessed on 26 August 2020).

- Varlamov, A.I.; Melnikov, P.N.; Kravchenko, M.N.; Afanasenkov, A.P. Neftegaz.ru Magazine. Available online: https://magazine.neftegaz.ru/articles/zapasy/454176-sostoyanie-mineralno-syrevoy-bazy-uglevodorodov-rossii/ (accessed on 26 August 2020).

- Executive Order of the Government of Russia. No. 1523-p on Energy Strategy of Russia for Period up to 2035. Available online: https://www.ifri.org/sites/default/files/atoms/files/mitrova_yermakov_russias_energy_strategy_2019.pdf (accessed on 8 December 2020).

- Decree, P. Basic Principles of Russian Federation State Policy in Arctic to 2035. Available online: http://pravo.gov.ru/proxy/ips/?docbody=&firstDoc=1&lastDoc=1&nd=102687377 (accessed on 26 August 2020).

- Article 9 of the Constitution of the Russian Federation; passed by nation-wide voting on 12 December 1993; with the amendments introduced by the Laws of the Russian Federation on amendments to the Constitution of the Russian Federation dated 30 December 2008 N 6-FKZ, dated 30 December 2008 N 7-FKZ, dated 5 February 2014 N 2-FKZ, dated 21 July 2014 N 11-FKZ, first published by Rossiyskaya Gazeta, Moscow. Available online: http://duma.gov.ru/en/news/28429/ (accessed on 8 December 2020).

- Law N 2395-1 of the Russian Federation; adopted on 21 February 1992; On Subsoil Resources. Available online: http://www.consultant.ru/document/cons_doc_LAW_343/ (accessed on 26 August 2020).

- Kirsanova, N.Y. Role of State Regulation in Harmonization of Socio-Economic Interest System in Arctic Zone of Russian Federation (AZRF) in Current Institutional Environment. Rev. Espac. 2020, 41, 14. Available online: https://www.revistaespacios.com/a20v41n14/20411414.html (accessed on 26 August 2020).

- Leksin, V.N.; Porfiriev, B.N. The Russian Arctic: The Logic and Paradoxes of Change. Stud. Russ. Econ. Dev. 2019, 30, 594–605. [Google Scholar] [CrossRef]

- Akimov, A.K.; Afanasiev, Y.I.; Begun, V.I.; Beznogikh, S.V.; Belokon, S.P.; Bogoyavlensky, V.I.; Vazhenin, Y.I.; Volkov, V.V.; Volozhinsky, A.O.; Vylegzhanin, A.N.; et al. On Status and Issues of Legislative Support for Implementation of Basic Principles of State Policy of Russian Federation in Arctic for Period up to 2035. On Status and Issues of Legislative Support for Scientific Activities of the RF in the Antarctic. In Annual Report 2019 and Analytical Survey 2000–2019; Federation Council of the Federal Assembly of the Russian Federation: Moscow, Russia, 2020. [Google Scholar]

- Ivanter, V.V.; Leksin, V.N.; Porfiryev, B.N. Arctic Megaproject in the System of National Interests and State Administration. Probl. Anal. Public Manag. Plan. 2014, 7, 6–24. [Google Scholar]

- Bourgain, A.; Zanaj, S. A Tax Competition Approach to Resource Taxation in Developing Countries. Resour. Policy 2020, 65, 101519. [Google Scholar] [CrossRef]

- Canh, N.P.; Schinckus, C.; Thanh, S.D. The Natural Resources Rents: Is Economic Complexity a Solution for Resource Curse? Resour. Policy 2020, 69, 101800. [Google Scholar] [CrossRef]

- Strumilin, S.G. History of Iron and Steel Industry in USSR; The USSR Academy of Sciences Publishing House: Moscow, Russia, 1967. [Google Scholar]

- Volodomonov, N.V. Mining Rent and Principles of Deposit Assessment; Melallurgizdat: Moscow, Russia, 1959. [Google Scholar]

- Astakhov, A.S. Time Factor Assessment and Its Calculation in Mining Industry Economy; IGD: Moscow, Russia, 1966. [Google Scholar]

- Pakhomov, V.P. Assessment of Mineral Resources in Areas of New Development (Economic, Environmental, and Social Aspects); Nauka: Moscow, Russia, 1989. [Google Scholar]

- Khazanov, L.G. Mining Rent Evolution. Min. Inf. Anal. Bull. 2005, 12, 75–85. [Google Scholar]

- Razovskiy, Y.V.; Bulat, S.A.; Savelyeva, Y.Y. Mining Rent Assessment; Publishing House SGU: Moscow, Russia, 2009. [Google Scholar]

- Lvov, D.S. On Establishment of National Dividend System. Vestn. Univ. 2001, 1, 5–19. [Google Scholar]

- Volkonsky, V.A.; Kuzovkin, A.I.; Mudretsov, A.F.; Prokopyev, M.G.; Glazyev, S.Y. Assessment of Natural Resource Rent and Its Role in Economy of Russia; Glazyev, H.O., Ed.; Institute for Economic Strategies: Moscow, Russia, 2003. [Google Scholar]

- Nemchinov, V.S. Agricultural Statistics and Outlines of a General Theory; Livshitc, F., Ed.; Nauka: Moscow, Russia, 1967; Volume 2. [Google Scholar]

- Lukyanchikov, N.N. Economic and Organizational Mechanism of Environmental and Natural Resource Management; NIA-Priroda: Moscow, Russia, 1998. [Google Scholar]

- Meshcherov, V.A. Methodological Principles for Market Value and Land Rent Analysis; Dorogobytsky, I.N., Ed.; MESI: Moscow, Russia, 2006. [Google Scholar]

- Razovskiy, Y.V.; Vishnyakov, Y.D.; Saveleva, E.Y.; Kiseleva, S.P.; Makolova, L.V. The Arctic Way, 4th ed.; Ugol: Moscow, Russia, 2019. [Google Scholar]

- Kimmelman, S.A. Promyshlennye Vedomosti. Where Does Oil Rent Go in Russia? 2006. Available online: http://www.promved.ru/articles/article.phtml?id=768&nomer=28 (accessed on 22 July 2020).

- Shkatov, V.K. Differential Land Rent in Mining Industry and Sustainable Use of Natural Resources. 1964. Available online: https://search.rsl.ru/ru/record/01006280261 (accessed on 8 December 2020).

- Ryazanov, V.T. From Rent Economy to New Industrialization of Russia. Ekonomist 2011, 8, 3–17. [Google Scholar]

- Kontorovich, A.E.; Burshtein, L.M.; Livshitc, V.R.; Ryzhkova, S.V. Main Directions in the Development of Russia’s Oil Sector in the First Half of the XXI Century. Vestn. Ross. Akad. Nauk 2019, 89, 1095–1104. [Google Scholar] [CrossRef]

- Nazarov, V.I.; Medvedeva, L.V. Quantitative Evaluation of Factors Defining Effectiveness Geological Exploration for Oil and Gas. Neftegazov. Geol. Teor. I Prakt. 2018, 13. [Google Scholar] [CrossRef]

- Belonin, M.D.; Podolsky, Y.V. The State of the Resource Base and Forecast of Possible Oil Production Levels in Russia until the Year 2030. Miner. Resour. Russ. Econ. Manag. 2006, 5, 3–11. [Google Scholar]

- Aleshin, A.N. State Regulation of Relationship in the Sphere of Resource Usage, Legal Aspect of the Direction of Perfection. Vestn. OSU 2004, 4, 57–60. [Google Scholar]

- Ramírez-Cendrero, J.M.; Eszter, W. Is the Norwegian model exportable to combat Dutch disease? Resour. Policy 2016, 48, 85–96. [Google Scholar] [CrossRef]

- Poole, G.R.; Pretes, M.; Sinding, K. Managing Greenland’s Mineral Revenues. A Trust Fund Approach. Resour. Policy 1992, 18, 191–204. [Google Scholar] [CrossRef]

- Berman, M.; Loeffler, R.; Schmidt, J.I. Long-Term Benefits to Indigenous Communities of Extractive Industry Partnerships: Evaluating the Red Dog Mine. Resour. Policy 2020, 66, 101609. [Google Scholar] [CrossRef]

- Tysiachniouk, M.S.; Petrov, A.N.; Gassiy, V. Towards Understanding Benefit Sharing Between Extractive Industries and Indigenous/Local Communities in the Arctic. Resources 2020, 9, 48. [Google Scholar] [CrossRef]

- Tulaeva, S.; Nysten-Haarala, S. Resource Allocation in Oil-Dependent Communities: Oil Rent and Benefit Sharing Arrangements. Resources 2019, 8, 86. [Google Scholar] [CrossRef]

- Redmond, T.; Nasir, M.A. Role of Natural Resource Abundance, International Trade and Financial Development in the Economic Development of Selected Countries. Resour. Policy 2020, 66, 101591. [Google Scholar] [CrossRef]

- Portal Korabel.ru. Over 10 Million Tonnes of Cargoes Transported by Northern Sea Route Since Early 2020. Available online: https://www.korabel.ru/news/comments/bolee_10_mln_tonn_gruzov_bylo_perevezeno_po_sevmorputi_s_nachala_2020_goda.html (accessed on 26 August 2020).

- Salova, I. Difficult Northern Sea Route. Kommersant Newspaper. Available online: https://www.kommersant.ru/doc/3937692 (accessed on 28 August 2020).

- Vasilev, Y.; Vasileva, P. Effects of coal preparation and processing in the Russian coal value chain. In Proceedings of the 18th International Multidisciplinary Scientific GeoConference SGEM, Albena, Bulgaria, 2–8 July 2018; Volume 18, pp. 319–326. [Google Scholar]

- Nikulin, A.; Ikonnikov, D.; Dolzhikov, I. Increasing labour safety on coal mines. Int. J. Emerg. Trends Eng. Res. 2019, 7, 842–848. [Google Scholar] [CrossRef]

- Boyko, N.A.; Chvileva, T.A.; Romasheva, N.V. The impact of coal companies on the socio-economic development of coal mining regions and its assessment. Ugol 2019, 48–53. [Google Scholar] [CrossRef]

- Vasilev, Y.; Vasileva, P.; Tsvetkova, A. International review of public perception of CCS technologies. Int. Multidiscip. Sci. GeoConference SGEM 2019, 19, 415–422. [Google Scholar] [CrossRef]

- Ilyushin, Y.; Golovina, E. Stability of temperature field of the distributed control system. ARPN J. Eng. Appl. Sci. 2020, 15, 664–668. [Google Scholar]

- Romasheva, N.V.; Kruk, M.N.; Cherepovitsyn, A.E. Propagation perspectives of CO2 sequestration in the world. Int. J. Mech. Eng. Technol. 2018, 9, 1877–1885. [Google Scholar]

- Meeting Transcript. Meeting with Rosneft CEO Igor Sechin. President’s Website. Available online: http://en.kremlin.ru/catalog/persons/61/events/63904 (accessed on 28 August 2020).

- Meeting Transcript. Russia’s National Association of Oil and Gas Service. Meeting of President of Russia with Rosneft CEO Igor Sechin on April 1, 2019. Available online: https://nangs.org/news/business/vstrecha-prezidenta-rossii-s-glavoj-kompanii-rosneft-igorem-sechinym-01-04-2019-g (accessed on 28 August 2020).

- Official Website of PJSC Rosneft Oil Company. (n.d.). Offshore Projects. Available online: https://www.rosneft.com/business/Upstream/Offshoreprojects/ (accessed on 29 August 2020).

- Federal State Statistics Service (Rosstat). (n.d.). Calendar of Official Statistical Information Publication on Socio-Economic Development of Arctic Zone of Russian Federation in 2020. Available online: https://rosstat.gov.ru/free_doc/new_site/region_stat/arc_zona/2020_2/pok4.xlsx (accessed on 29 August 2020).

- Goman, I.V.; Oblova, I.S. Analysis of companies’ corporate social responsibility as a way to develop environmental ethics for students specialising in oil and gas activity. In Proceedings of the 18th International Multidisciplinary Scientific GeoConference SGEM, Albena, Bulgaria, 2–8 July 2018; Volume 18, pp. 11–18. [Google Scholar]

- Reschiwati, R.; Indrasari, A. Managing services, resources and activities in product companies: Does supply chain management moderates? Int. J. Supply Chain Manag. 2020, 9, 454–461. Available online: https://ojs.excelingtech.co.uk/index.php/IJSCM/article/view/5277/2606 (accessed on 22 September 2020).

- Fauzer, V.V.; Smirnov, A.V. The Russian Arctic: From Prison to Urban Agglomeration. ECO 2018, 7, 112–130. [Google Scholar]

- Federal State Statistics Service (Rosstat). (n.d.). Estimation of Number of Permanent Population on Overland Territories of Arctic Region of RF as of January 1, 2019. Available online: https://rosstat.gov.ru/free_doc/new_site/region_stat/arc_zona/2019_1/pok_83.xls (accessed on 29 August 2020).

- RIA Novosti. Ranking of Regions by Incomes of Population—2020. Available online: https://ria.ru/20200706/1573773182.html (accessed on 8 August 2020).

- Stetsyunich, Y.; Busheneva, Y.; Zaytsev, A. Framing Public Financial Policy: Transforming the Classic Concept in the Time of Digitalization. In ACM International Conference Proceeding Series, Proceedings of the International Scientific Conference on Innovations in Digital Economy, St. Petersburg, Russia, 24–25 October 2019; SPBPU IDE: St. Petersburg, Russia, 2019. [Google Scholar]

- The Ministry of Finance of the Russian Federation. Main Directions of Budget, Tax, and Customs Tariff Policy for 2020 and for Planning Period of 2021 and 2022. Available online: https://www.minfin.ru/ru/document/?id_4=128344- (accessed on 8 August 2020).

- Sovereign Wealth Fund Institute. (n.d.). Top 89 Largest Sovereign Wealth Fund Rankings by Total Assets. Available online: https://www.swfinstitute.org/fund- (accessed on 10 August 2020).

- United Nations Development Programme. Human Development Report 2019. Available online: http://hdr.undp.org/sites/default/files/hdr2019.pdf (accessed on 8 August 2020).

- Alaska Department of Labor and Workforce Development, Research and Analysis Section. (n.d.). 2019 Population Estimates by Borough, Census Area, and Economic Region. Official Alaska State Website. Available online: https://live.laborstats.alaska.gov/pop/index.cfm (accessed on 15 August 2020).

- Milov, V. Can Russia Become an Energy Superpower? Vopr. Ekon. 2006, 9, 21–30. [Google Scholar] [CrossRef]

- Ponomarenko, T.V.; Nevskaya, M.A.; Marinina, O.A. An assessment of the applicability of sustainability measurement tools to resource-based economies of the commonwealth of independent states. Sustainability 2020, 12, 5582. [Google Scholar] [CrossRef]

- Ponomarenko, T.V.; Nevskaya, M.A.; Marinina, O.A. Complex use of mineral resources as a factor of the competitiveness of mining companies under the conditions of the global economy. Int. J. Mech. Eng. Technol. 2018, 9, 1215–1223. [Google Scholar]

- Tsvetkova, A.; Katysheva, E. Present problems of mineral and raw materials resources replenishment in Russia. In Proceedings of the 19th International Multidisciplinary Scientific GeoConference SGEM, Vienna, Austria, 9–12 December 2019; Volume 19, pp. 573–578. [Google Scholar]

- Katysheva, E.; Tsvetkova, A. Institutional problems of domestic technologies creation for exploitation of hard-to-recover oil reserves in Russia. In Proceedings of the 18th International Multidisciplinary Scientific GeoConference SGEM, Albena, Bulgaria, 2–8 July 2018; Volume 18, pp. 523–530. [Google Scholar]

- Rosprirodnadzor Press-Service. Rosprirodnadzor Calculates Environmental Damage Caused by Accident in Norilsk. The Official Website of the Russian Federal Service for Supervision of Natural Resources (Rosprirodnadzor). Available online: https://rpn.gov.ru/news/rosprirodnadzor_proizvel_raschet_ushcherba_ekologii_nanesennyy_avariey_v_norilske/ (accessed on 15 August 2020).

- Website of RIA Novosti. Greenpeace Estimates Time Needed to Clean up Consequences of Fuel Spill at CHPP-3. Available online: https://ria.ru/20200604/1572435031.html (accessed on 22 August 2020).

- Yurak, V.V.; Dushin, A.V.; Mochalova, L.A. Vs sustainable development: Scenarios for the future. J. Min. Inst. 2020, 242, 242–247. [Google Scholar] [CrossRef]

- Berezikov, S.A. Structural changes and innovation economic development of the Arctic regions of Russia. J. Min. Inst. 2019, 240, 716–723. [Google Scholar] [CrossRef]

- The UN General Assembly. Resolution Adopted by the General Assembly on 25 September 2015. The UN Official Website. Available online: https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_70_1_E.pdf (accessed on 22 September 2020).

- Kryuchkova, Y. Arctic to Share Money. Ministry for Development of Russian Far East and Arctic Simplifies State Program for Arctic Development. Kommersant Newspaper. Available online: https://www.kommersant.ru/doc/4269792 (accessed on 22 August 2020).

- Bondarenko, M. Government Approves Benefits of Almost RUB 15tn for Projects in Arctic. RBC Newspaper. Available online: https://www.rbc.ru/economics/30/01/2020/5e32df149a794752dc12eaa8 (accessed on 24 August 2020).

- Milov, V. Can Russia Become an Oil Paradise? Polit.ru Portal. Available online: https://polit.ru/article/2006/07/24/oilparadise/ (accessed on 8 August 2020).

- The Russian Government. Meeting with Deputy Prime Ministers. Available online: http://government.ru/en/news/40921/ (accessed on 23 November 2020).

- Naim, M. If Geology Is Destiny, Then Russia Is in Trouble. The New York Times. Available online: www.nytimes.com/2003/12/04/opinion/04NAIM.html?ex=1071547802&ei=1&en=ecf60aed7ef58a9a (accessed on 26 August 2020).

- Polterovich, V.; Popov, V.; Tonis, A. Economic Policy, Quality of Institutions, and Mechanisms of Resource Curse. In Modernization of Economy and Public Development; A report for the 8th International Scientific Conference; HSE University: Moscow, Russia, 2007; 98p. [Google Scholar]

- Ryazanov, V.T. The Economy of Rental Relations in Modern Russia. Christ. Read. Mag. 2011, 4, 149–176. [Google Scholar]

- Danilenko, L.N. Rental-Resources Model of the Russian Economy and the Problems of its Transformation. Ph.D. Thesis, Pskov State University, Pskov, Russia, 2014. [Google Scholar]

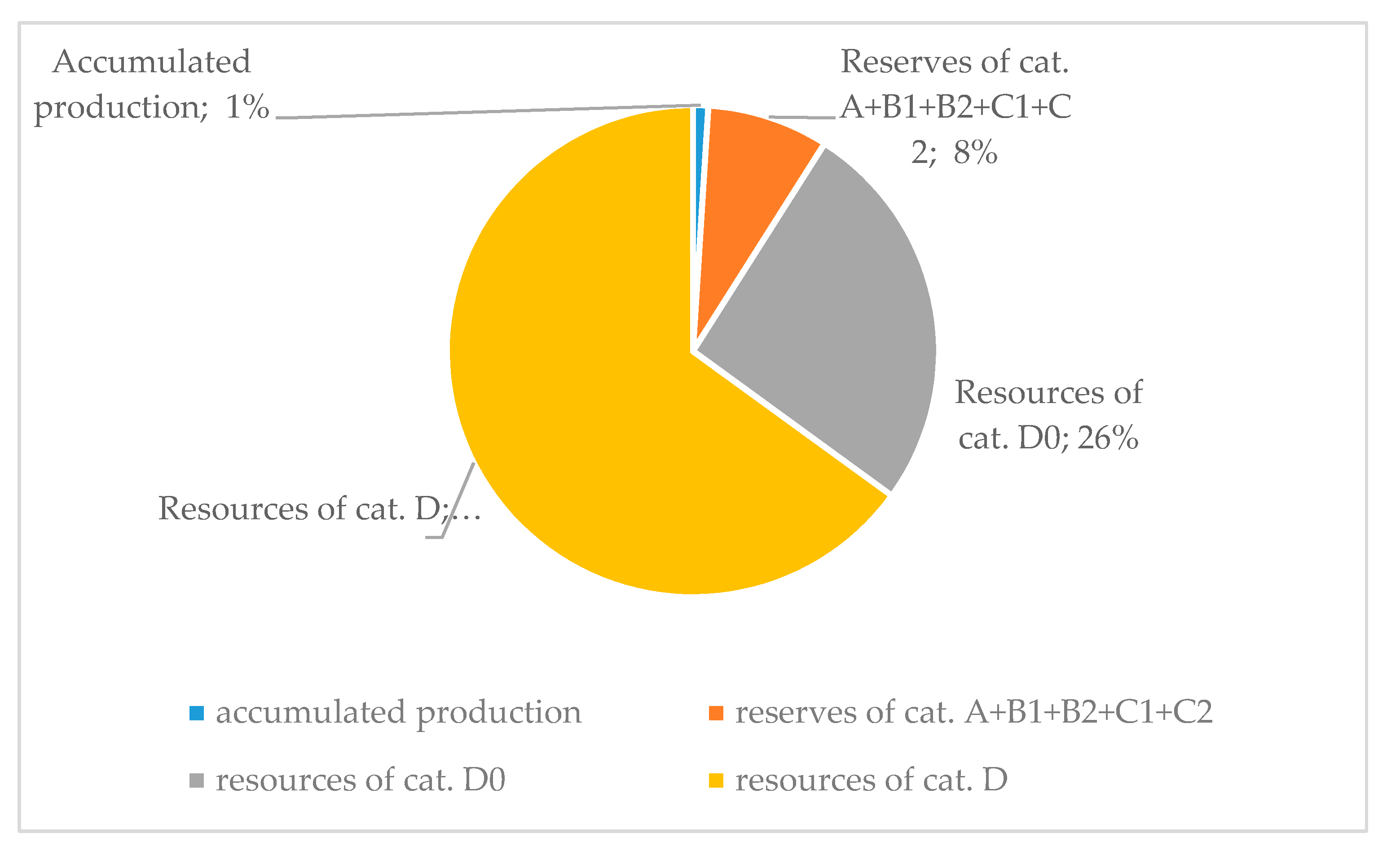

| 1 | According to the Order of the Ministry of Natural Resources and Environment of the Russian Federation as of 1 November 2013, No. 477 “On Approval of the Classification of Reserves of Oil and Combustible Gases”, oil and gas reserves are subdivided by the extent of commercial development and by the degree of geological knowledge into the following categories: A (developing, drilled), B1 (developing, not drilled, known), B2 (developing, not drilled, estimated), C1 (known), and C2 (estimated). Oil, gas, and condensate reserves are subdivided by geological knowledge into the categories D0 (prepared) and D (localized, prospective, and expected). |

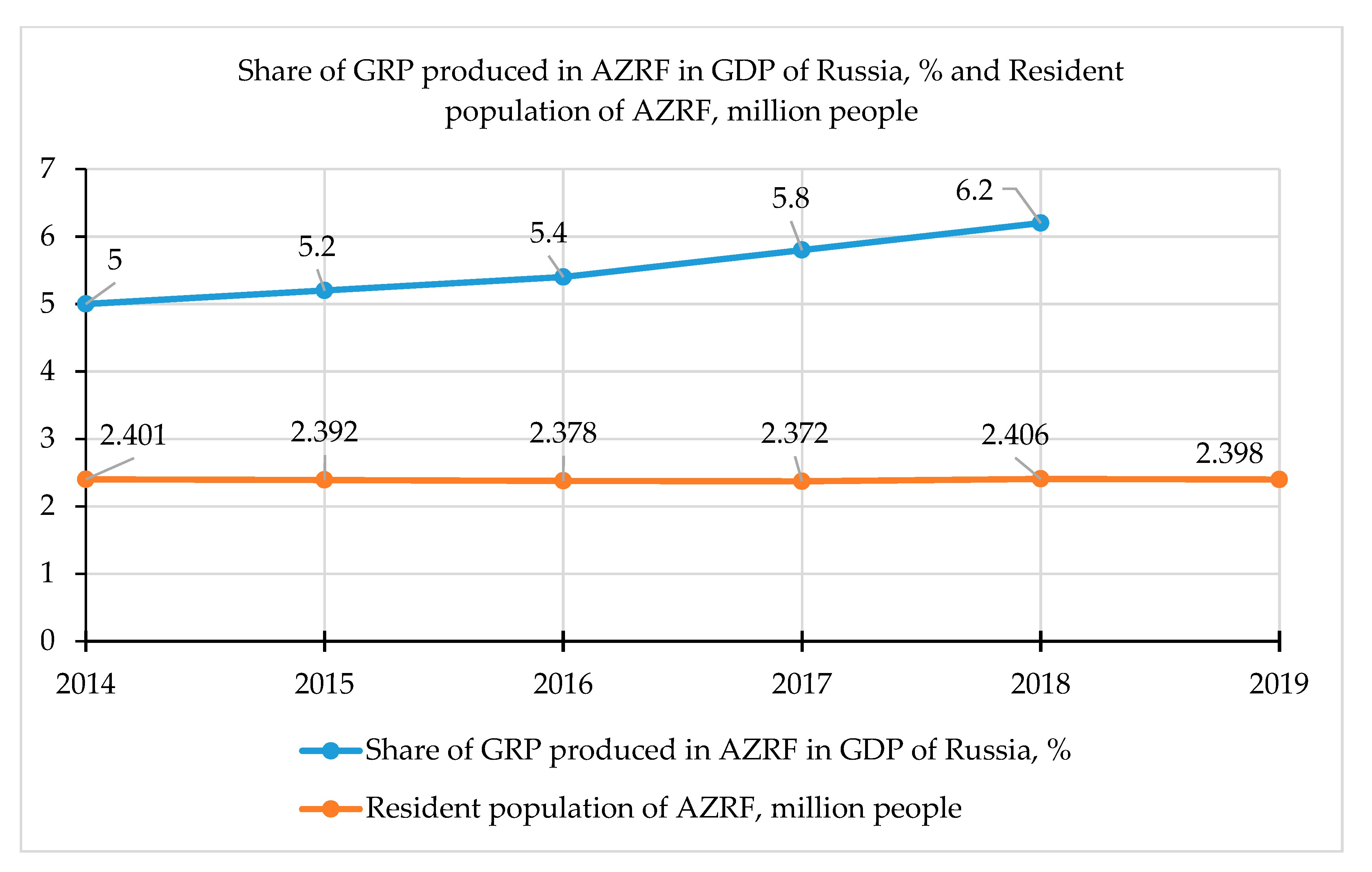

| 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|

| Total for the Arctic zone of the Russian Federation | 5.0 | 5.2 | 5.4 | 5.8 | 6.2 |

| AZRF’s Constituent Region | 1989 | 2019 | Total Population Decline (1989–2019), People | Total Population Decline (1989–2019), % |

|---|---|---|---|---|

| Arctic zone of the Russian Federation | 3,471,581 | 2,397,509 | −1,074,072 | −30.9 |

| Including: European part: | 2,349,490 | 1,551,461 | −798,029 | −34.0 |

| Murmansk region | 1,164,586 | 748,056 | −416,530 | −35.8 |

| Karelia Republic | 82,141 | 41,605 | −40,536 | −49.3 |

| Arkhangelsk region, excluding Nenets Autonomous Okrug | 830,384 | 643,215 | −187,169 | −22.5 |

| Nenets Autonomous Okrug | 53,912 | 43,829 | −10,083 | −18.7 |

| Komi Republic | 218,467 | 74,756 | −143,711 | −65.8 |

| Asian part: | 1,122,091 | 846,048 | −276,043 | −24.6 |

| Yamalo-Nenets Autonomous Okrug | 494,844 | 541,479 | 46,635 | +9.4 |

| Krasnoyarsk region | 379,430 | 228,943 | −150,487 | −39.7 |

| Sakha Republic (Yakutia) | 83,883 | 25,963 | −57,920 | −69.0 |

| Chukotka Autonomous Okrug | 163,934 | 49,663 | −114,271 | −69.7 |

| Place in the Ranking of Russia’s Regions | Region | Ratio of Median Income to the Cost of a Fixed Set of Goods and Services | Share of Population below the Poverty Line in 2019, % | Share of Population below the Extreme Poverty Line in 2019, % |

|---|---|---|---|---|

| 1 | Yamalo-Nenets Autonomous Okrug | 3.11 | 5.6 | 0.8 |

| 2 | Nenets Autonomous Okrug | 2.92 | 9.5 | 1.5 |

| 4 | Chukotka Autonomous Okrug | 2.27 | 8.7 | 1.1 |

| 12 | Murmansk region | 1.92 | 10.8 | 0.9 |

| 15 | Sakha Republic (Yakutia) | 1.71 | 17.9 | 3.3 |

| 22 | Komi Republic | 1.62 | 15.5 | 2.2 |

| 29 | Arkhangelsk region | 1.56 | 12.7 | 1.4 |

| 41 | Krasnoyarsk region | 1.51 | 17.5 | 2.8 |

| 45 | Karelia Republic | 1.50 | 15.7 | 1.7 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|

| Tax revenues and payments | 31.86 | 30.80 | 31.29 | 28.97 | 28.51 | 30.27 | 32.72 |

| Budget revenues from taxes and duties related to taxation of oil, gas and petroleum products, which includes: | 10.18 | 9.65 | 10.01 | 7.42 | 6.12 | 6.84 | 9.03 |

| MET on oil | 3.13 | 2.99 | 3.11 | 3.25 | 2.72 | 3.64 | 5.04 |

| MET on gas | 0.39 | 0.44 | 0.47 | 0.51 | 0.57 | 0.73 | 0.75 |

| Export customs duties on oil | 3.65 | 3.19 | 3.31 | 1.72 | 1.20 | 1.06 | 1.49 |

| Export customs duties on gas | 0.64 | 0.66 | 0.62 | 0.66 | 0.62 | 0.63 | 0.78 |

| Export customs duties on petroleum products | 1.66 | 1.65 | 1.88 | 0.90 | 0.52 | 0.43 | 0.62 |

| Customs duty (when crude oil and certain categories of petroleum products were exported from Belarus outside the Customs Union) | 0.17 | 0.14 | 0.14 | 0.0 | 0.0 | 0.0 | 0.0 |

| Country | Oil Production in Millions of Tonnes in 2019 | Natural Gas Production in Billions of m3 per Year in 2019 | Hydrocarbons Were the Source for Funding Sovereign Wealth Funds |

|---|---|---|---|

| USA | 747.7 | 955.1 | |

| Russia | 568.1 | 703.8 | Yes |

| Saudi Arabia | 556.6 | 117 | Yes |

| Canada | 274.9 | 190.5 | |

| Iraq | 234.2 | 11.6 | Yes |

| China | 191 | 170.2 | |

| United Arab Emirates | 180.2 | 55.1 | Yes |

| Iran | 160.8 | 253.8 | Yes |

| Brazil | 150.8 | 23.8 | |

| Kuwait | 144 | 14 | Yes |

| Nigeria | 101.4 | 47.8 | Yes |

| Qatar | 78.5 | 183.6 | Yes |

| Norway | 78.4 | 119 | Yes |

| Australia | 64.3 | 151.9 | |

| Algeria | 20.6 | 89.6 | Yes |

| Country | Gross National Income (GNI) Per Capita, PPP, $ * | Territory of a Country in Thousands of km2 | Population Size in Millions of People | Ira |

|---|---|---|---|---|

| Countries with GNI per Capita above the Average Value | ||||

| Qatar | 110,489 | 11.59 | 2.64 | 59.15 |

| Kuwait | 71,164 | 17.82 | 4.59 | 24.58 |

| Norway | 68,059 | 385.21 | 5.37 | 5.53 |

| United Arab Emirates | 66,912 | 83.60 | 10.21 | 11.03 |

| Saudi Arabia | 49,338 | 2149.69 | 34.22 | 3.44 |

| Countries with GNI per Capita below the Average Value | ||||

| Russia | 25,036 | 17,125.19 | 146.75 | 1.03 |

| Iraq | 15,365 | 435.05 | 37.06 | 2.74 |

| Iran | 18,166 | 1648.20 | 84.20 | 1.41 |

| Algeria | 13,639 | 2381.74 | 38.09 | 0.45 |

| Nigeria | 5086 | 923.77 | 203.01 | 0.46 |

| Average GNI per Capita, PPP, $ | 40,259 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kirsanova, N.; Lenkovets, O.; Hafeez, M. Issue of Accumulation and Redistribution of Oil and Gas Rental Income in the Context of Exhaustible Natural Resources in Arctic Zone of Russian Federation. J. Mar. Sci. Eng. 2020, 8, 1006. https://doi.org/10.3390/jmse8121006

Kirsanova N, Lenkovets O, Hafeez M. Issue of Accumulation and Redistribution of Oil and Gas Rental Income in the Context of Exhaustible Natural Resources in Arctic Zone of Russian Federation. Journal of Marine Science and Engineering. 2020; 8(12):1006. https://doi.org/10.3390/jmse8121006

Chicago/Turabian StyleKirsanova, Natalia, Olga Lenkovets, and Muhammad Hafeez. 2020. "Issue of Accumulation and Redistribution of Oil and Gas Rental Income in the Context of Exhaustible Natural Resources in Arctic Zone of Russian Federation" Journal of Marine Science and Engineering 8, no. 12: 1006. https://doi.org/10.3390/jmse8121006

APA StyleKirsanova, N., Lenkovets, O., & Hafeez, M. (2020). Issue of Accumulation and Redistribution of Oil and Gas Rental Income in the Context of Exhaustible Natural Resources in Arctic Zone of Russian Federation. Journal of Marine Science and Engineering, 8(12), 1006. https://doi.org/10.3390/jmse8121006