Feasibility Study of Harnessing Low Wind Speed Turbine as Hybrid Power Source for Offshore Platforms

Abstract

:1. Introduction

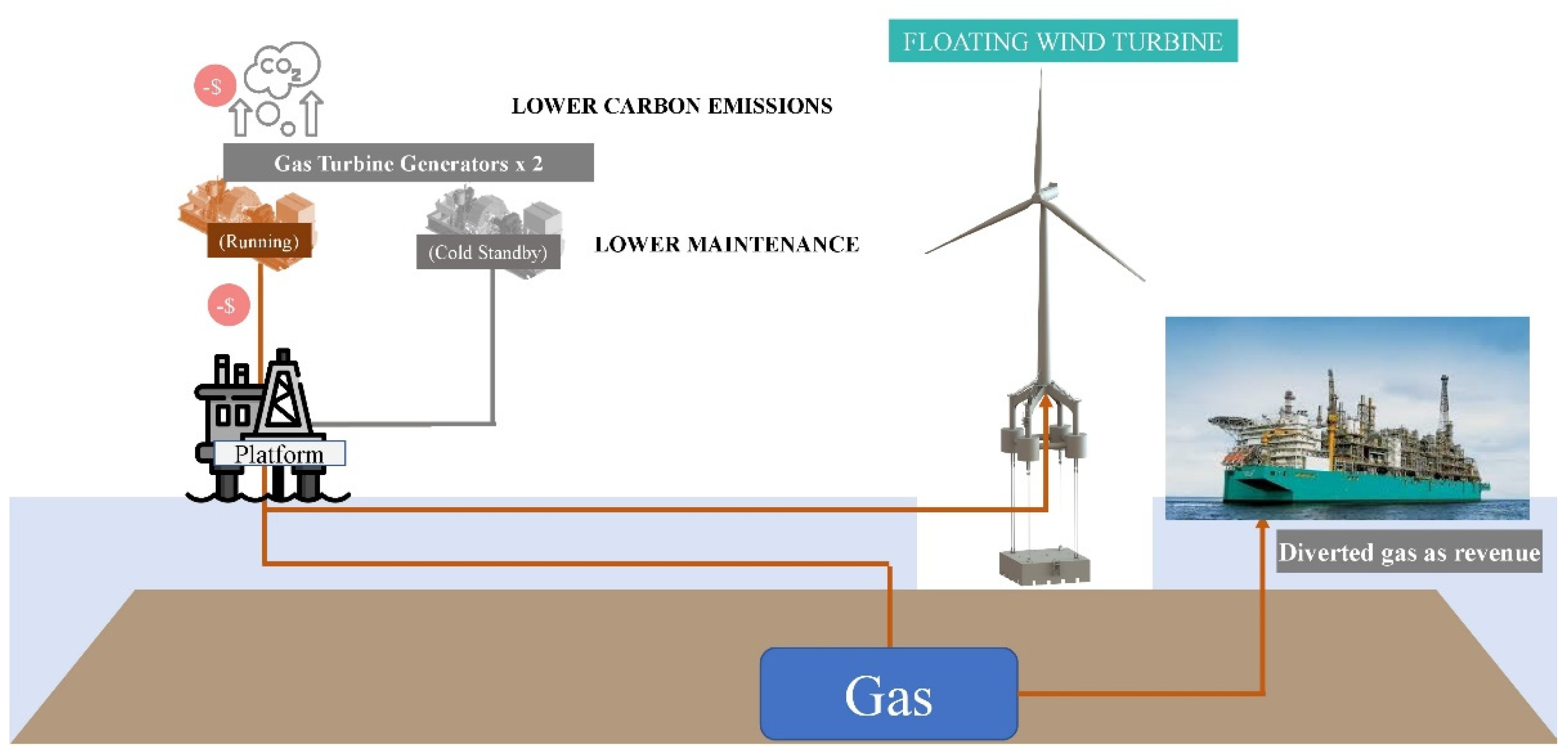

1.1. Background and Motivation

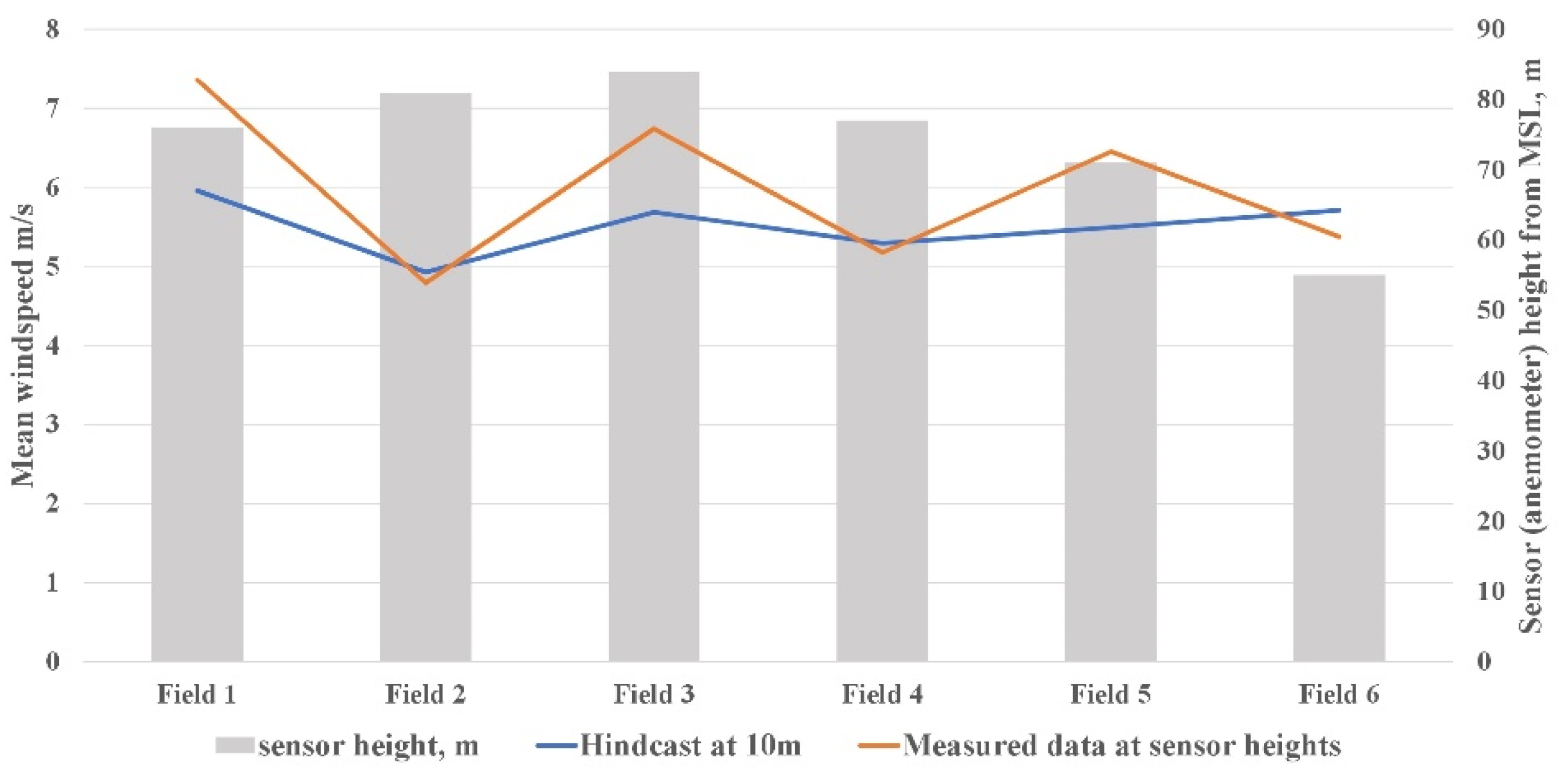

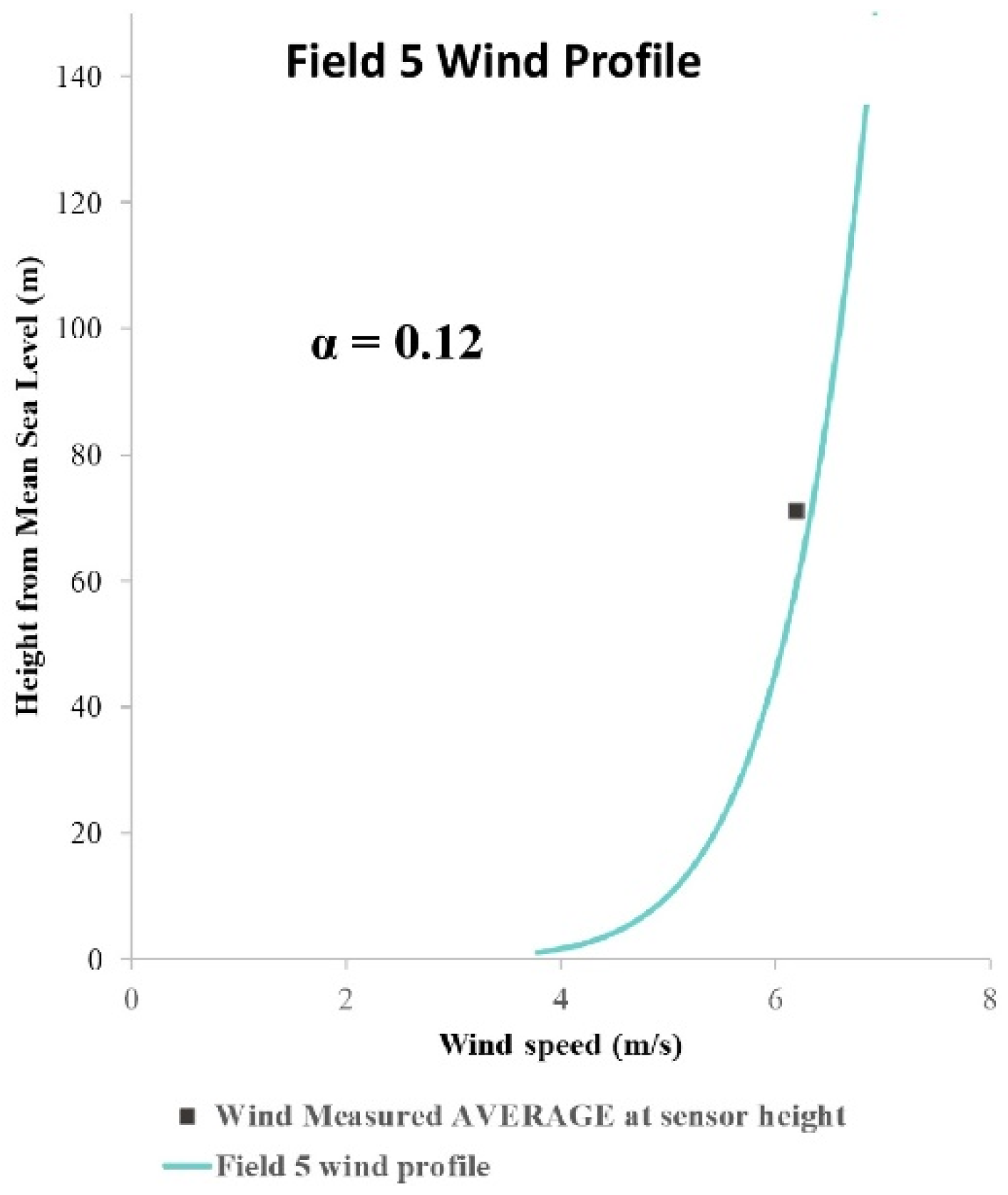

1.2. Wind Assessment

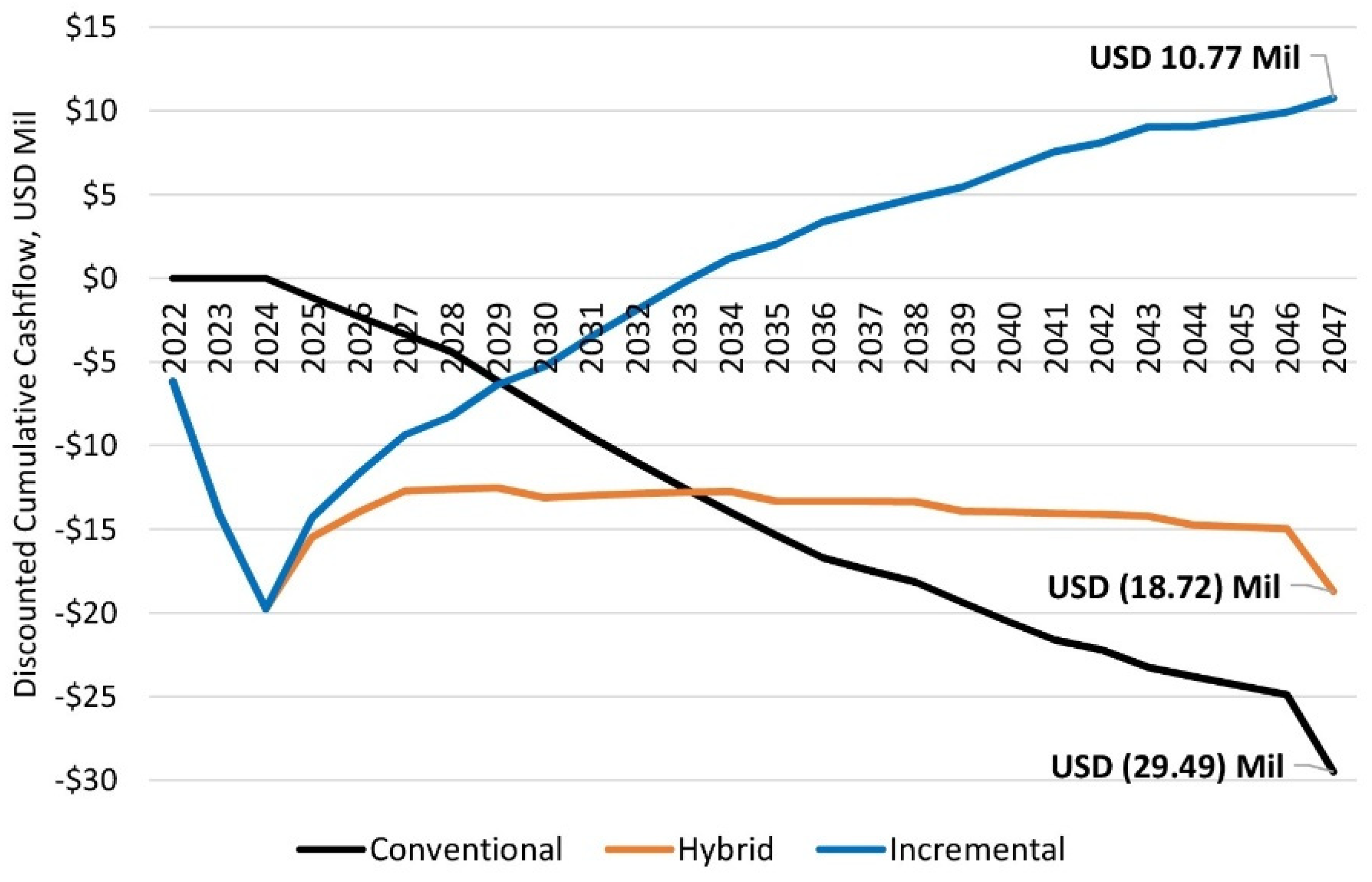

1.3. Economical Aspect

- A feasible techno-economic framework is established as a decision-making tool to optimize the economic and technical elements for offshore hybrid power generation in Malaysia.

- The life cycle model and the levelized cost energy was developed, where the CAPEX and OPEX, which included not only the maintenance cost, but also the carbon tax, decommissioning costs, and sales gas offsets, are analyzed. This model is validated to ensure the simulation results are correct.

- The sensitivity analysis compares the impact of key parameters such as CAPEX, OPEX, and AEP to define the economic threshold for a viable hybrid power generation concept.

2. Methodology

- PV = present value,

- CF = future cash flow,

- r = discount rate,

- t = number of years.

- EPNet = AEP over the total project lifetime,

- WACC = weighted average cost of capital.

3. Results

- It is a gas-producing platform as the fuel gas savings will result in additional sales gas revenue.

- An oil producing platform is only possible if it has gas evacuation pipelines.

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- COP26 Keeps 1.5C Alive and Finalises Paris Agreement. Available online: https://ukcop26.org/cop26-keeps-1-5c-alive-and-finalises-paris-agreement/ (accessed on 9 July 2022).

- Ho, L.W. Wind energy in Malaysia: Past, present and future. Renew. Sustain. Energy Rev. 2016, 53, 279–295. [Google Scholar] [CrossRef]

- Samo, K. Wind Characterization for Renewable Energy Applications. In Proceedings of the 4th IASME/WSEAS International Conference on Energy and Environment, Cambridge, UK, 24–26 February 2016. [Google Scholar]

- Onshore vs. Offshore Wind: What Are the Differences and Facts? Available online: https://greencoast.org/onshore-vs-offshore-wind/ (accessed on 9 July 2022).

- Chokhawala, R. Powering Platforms Connecting Oil and Gas Platforms to Mainland Power Grids. ABB Rev. 2008. Available online: https://library.e.abb.com/public/aab4c01eb564adf3c1257427002e53a5/52-56%201M811_ENG72dpi.pdf (accessed on 9 July 2022).

- Wood Mackenzie. Why Powering Oil and Gas Platforms with Renewables Makes Sense; Wood Mackenzie: Edinburgh, UK, 2019. [Google Scholar]

- PETRONAS. Activity Oulook 2018–2020. Available online: https://www.petronas.com/sites/default/files/2018-12/petronas-activity-outlook-2018-2020.pdf (accessed on 9 July 2022).

- Floating Offshore Wind Energy; A Policy Blueprint for Europe. Available online: https://windeurope.org/wp-content/uploads/files/policy/position-papers/Floating-offshore-wind-energy-a-policy-blueprint-for-Europe.pdf (accessed on 9 July 2022).

- ABB. Electrification of petroleum installations, Commercially justifiable and necessary for the climate. Available online: https://library.e.abb.com/public/1239733f013ac1c485257ddc004d0246/PT0147%20BR%20ABB%20og%20elektrifisering_A4_engelsk_3mm.pdf (accessed on 9 July 2022).

- Power Management Options for Offshore Oil and Gas Rigs. Available online: https://www.wpowerproducts.com/new-s/how-to-power-offshore-oil-rigs/#:~:text=The%2-0most%20common%20way%20to,use%20of%20diesel%2Dpowered%20generators.&text=As%20such%2C%20the%20generators%20that,wind%20that%20are%20present%20offshore (accessed on 9 July 2022).

- Kausche, M.; Adam, F.; Dalhaus, F.; Grosmann, J. Floating offshore wind—Economic and ecological challenges of a TLP solution. Renew. Energy 2018, 128, 270–280. [Google Scholar] [CrossRef]

- Butterfield, S.; Musial, W.; Jonkman, J.; Sclavounos, P. Engineering Challenges for Floating Offshore Wind Turbines. In Proceedings of the 2005 Copenhagen Offshore Wind Conference, Copenhagen, Denmark, 26–28 October 2005. [Google Scholar]

- Musial, W.; Butterfield, S.; Boone, A. Feasibility of Floating Platform Systems for Wind Turbines. In Proceedings of the ASME Wind Energy Symposium, Reno, NV, USA, 5–8 January 2004. [Google Scholar]

- Paul, D.S. Dynamic Simulations of Deep Water Floating Offshore Wind Turbine Concepts. In Proceedings of the IEA Workshop on Deepwater Offshore Turbine Modeling Needs Riso National Laboratories, MA, USA, 13–14 January 2005. [Google Scholar]

- Adam, F.; Myland, T.; Schuldt, B.; Großmann, J.; Dahlhaus, F. Evaluation of internal force superposition on a TLP for wind turbines. Renew. Energy 2014, 71, 271–275. [Google Scholar] [CrossRef]

- Oceanweather. Available online: https://www.oceanweather-.com/metocean/seafine/index.html (accessed on 9 July 2022).

- Albani, A.; Ibrahim, M.Z. Wind Energy Potential and Power Law Indexes Assessment for Selected Near-Coastal Sites in Malaysia. Energies 2017, 10, 307. [Google Scholar] [CrossRef] [Green Version]

- IEC 61400-1; Wind Turbines—Design Requirements. IEC: Geneva, Switzerland, 2014.

- Wind Shear Exponent Value. Available online: https://en.wikipedia.-org/wiki/Wind_profile_power_law (accessed on 9 July 2022).

- Chang, T.P. Estimation of wind energy potential using different probability density functions. Appl. Energy 2011, 88, 1848–1856. [Google Scholar] [CrossRef]

- IEC 61400-12-1; Wind Turbines—Part 12-1: Power Performance Measurements of Electricity Producing wind Turbines. IEC: Geneva, Switzerland, 2017.

- Capacity Factor. Available online: https://en.wikipedia.org/wiki/Capacity_factor (accessed on 9 July 2022).

- McNamara, B. Challenges for Hybrid Renewable Energy Systems. 2012. Available online: http://ecolo.org/documents/documents_in_english/Renewable-Challenges-EFN-UK-I.pdf (accessed on 9 July 2022).

- DOE Office of Indian Energy. Levelised Cost of Energy. Available online: https://www.energy.gov/sites/prod/files/2015/08/f25/LCOE.pdf (accessed on 9 July 2022).

- Nor, S.M. Petroleum Fiscal Regime—Malaysia’s Experience. In Proceedings of the Natural Resource Taxation in the Asia-Pacific Region. A Forum on the Design, Implementation and Evaluation of Fiscal Regimes for Extractive Industries, Jakarta, Indonesia, 11–13 August 2015. [Google Scholar]

| Parameters | Unit | Value |

|---|---|---|

| Rotor diameter | m | 155 |

| Turbine height | m | 187.5 |

| Hub height | m | 110 |

| Tower height | m | 90 |

| Swept area | m2 | 18,877 |

| Rated power | MW | 5 |

| Design lifetime | a | 25 |

| Cut in speed | m/s | 2.5 |

| Cut off speed | m/s | 21 |

| Rated speed | m/s | 11 |

| Windspeed | Power Curve | Weibull Cumulative Distribution Function (CDF) | Weibull Power Distribution Frequency | Power Generated |

|---|---|---|---|---|

| [m/s] | [kW] | [%] | [%] | [MWh/a] |

| 1 | 0 | 1.68% | 1.68% | - |

| 2.5 | 57 | 10.07% | 8.39% | - |

| 3 | 109 | 14.18% | 4.10% | 30 |

| 4 | 293 | 23.80% | 9.62% | 169 |

| 5 | 594 | 34.60% | 10.80% | 420 |

| 6 | 1038 | 45.74% | 11.15% | 797 |

| 7 | 1647 | 56.49% | 10.75% | 1264 |

| 8 | 2413 | 66.28% | 9.78% | 1740 |

| 9 | 3234 | 74.74% | 8.46% | 2092 |

| 10 | 4072 | 81.70% | 6.97% | 2230 |

| 11 | 5000 | 87.19% | 5.49% | 2181 |

| 12 | 5000 | 91.33% | 4.14% | 1814 |

| 13 | 5000 | 94.33% | 3.00% | 1313 |

| 14 | 5000 | 96.42% | 2.08% | 913 |

| 15 | 5000 | 97.81% | 1.39% | 610 |

| 16 | 5000 | 98.71% | 0.90% | 393 |

| 17 | 5000 | 99.26% | 0.55% | 243 |

| 18 | 5000 | 99.59% | 0.33% | 145 |

| 19 | 5000 | 99.78% | 0.19% | 83 |

| 20 | 5000 | 99.89% | 0.11% | 46 |

| 21 | 5000 | 99.94% | 0.06% | 25 |

| Total | 99.94% | 16,507 | ||

| Probability | AEP, MWh/a |

|---|---|

| P50 | 16,507 |

| P70 | 15,209 |

| P75 | 14,837 |

| P80 | 14,423 |

| P90 | 13,334 |

| Capital Allowance | GTG | WT |

|---|---|---|

| Initial Allowance | 20% | 40% |

| Annual Allowance | 8% | 20% |

| Cost Breakdown | GTG Only | Hybrid | WT Only | |

|---|---|---|---|---|

| Description | 3 GTG | 2 GTG | 1 WT | 1 WT |

| AEP, MWh | 41,400 | 39,793 | 16,507 | 16,507 |

| Discounted CAPEX, USD Mil | 74,445,700 | 83,192,348 | 19,761,500 | |

| Discounted OPEX, USD Mil | 36,943,022 | 26,799,707 | 7,139,706 | |

| Discounted Revenue, USD Mil | (22,932,536) | |||

| Discounted AEP, USD Mil | 407,606 | 407,606 | 162,524 | |

| LCOE, USD/Mwh | 273.28 | 213.59 | 165.52 | |

| Percentage improvement | Base | 22% | 39% | |

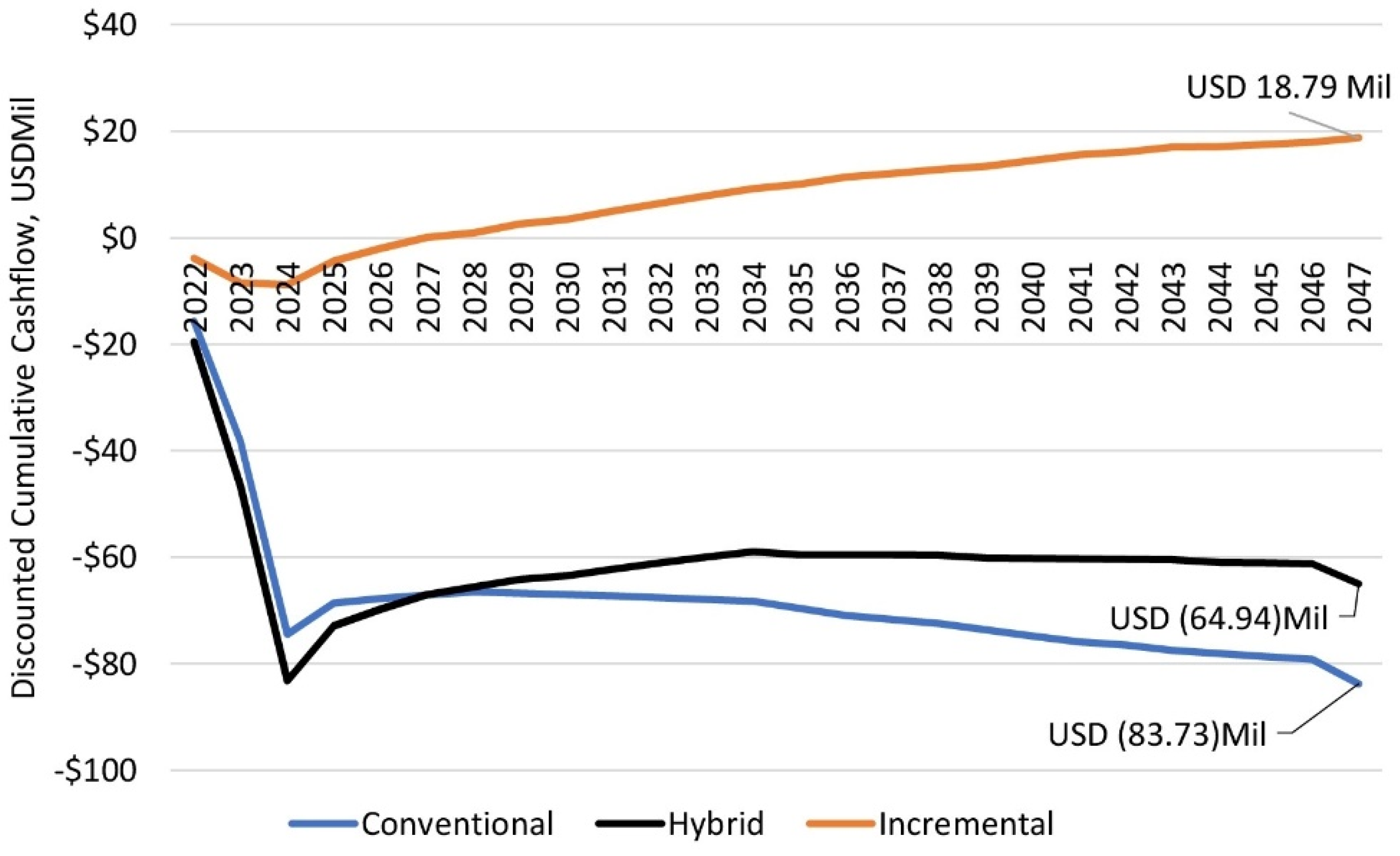

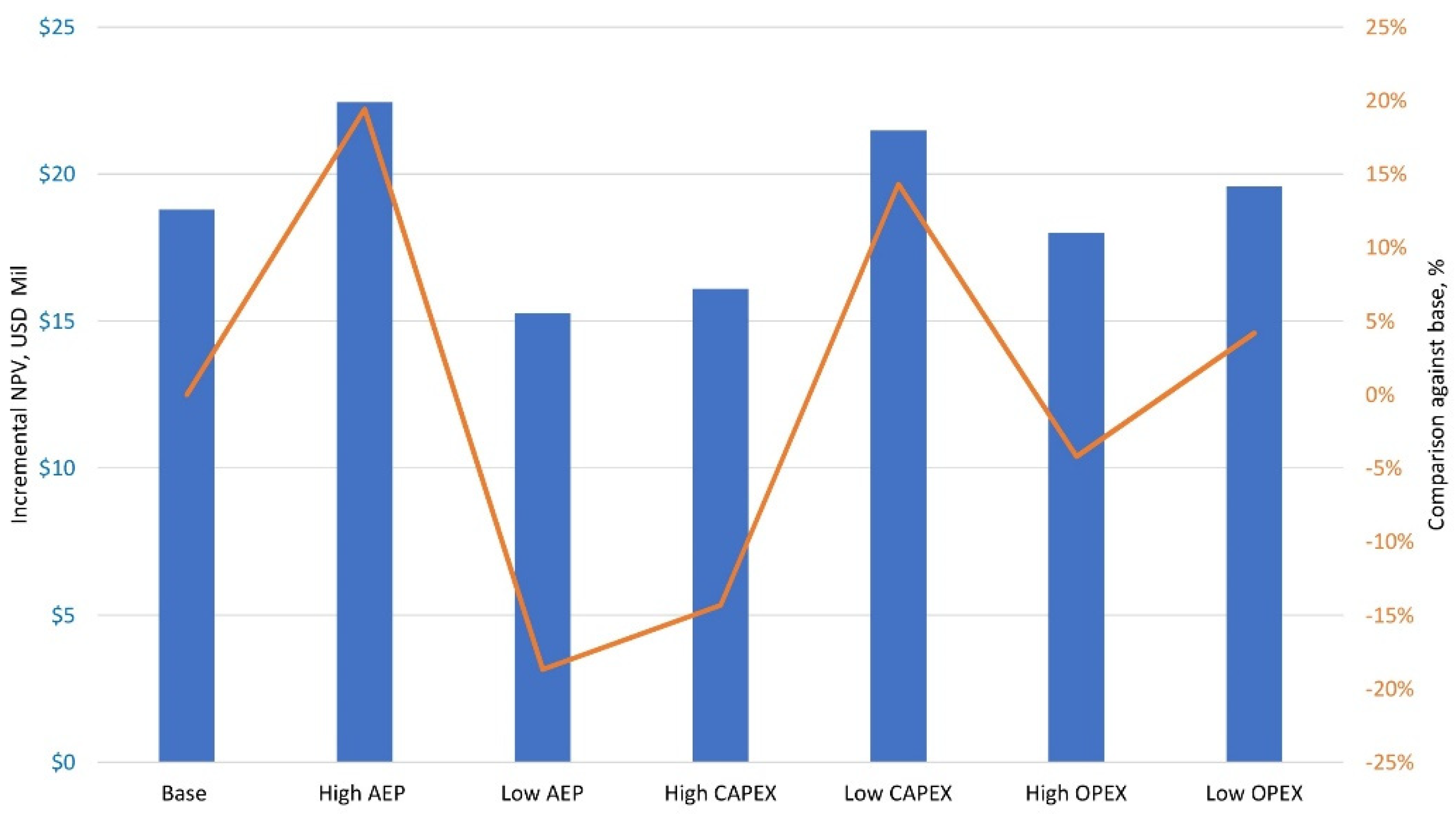

| No | Cases | Incremental NPV7, USD Mil | Comparison Incremental NPV7, % | Payback Period, Years |

|---|---|---|---|---|

| 1 | Base | 18.79 | Base | 5 |

| 2 | High AEP | 22.45 | 19% | 5 |

| 3 | Low AEP | 15.28 | −19% | 7 |

| 4 | High CAPEX | 16.10 | −14% | 8 |

| 5 | Low CAPEX | 21.48 | 14% | 4 |

| 6 | High OPEX | 18.00 | −4% | 6 |

| 7 | Low OPEX | 19.58 | 4% | 5 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Iqbar, I.M.; Muhammad, M.; Gilani, S.I.U.-H.; Adam, F. Feasibility Study of Harnessing Low Wind Speed Turbine as Hybrid Power Source for Offshore Platforms. J. Mar. Sci. Eng. 2022, 10, 963. https://doi.org/10.3390/jmse10070963

Iqbar IM, Muhammad M, Gilani SIU-H, Adam F. Feasibility Study of Harnessing Low Wind Speed Turbine as Hybrid Power Source for Offshore Platforms. Journal of Marine Science and Engineering. 2022; 10(7):963. https://doi.org/10.3390/jmse10070963

Chicago/Turabian StyleIqbar, Izleena Md, Masdi Muhammad, Syed Ihtsham Ul-Haq Gilani, and Frank Adam. 2022. "Feasibility Study of Harnessing Low Wind Speed Turbine as Hybrid Power Source for Offshore Platforms" Journal of Marine Science and Engineering 10, no. 7: 963. https://doi.org/10.3390/jmse10070963

APA StyleIqbar, I. M., Muhammad, M., Gilani, S. I. U.-H., & Adam, F. (2022). Feasibility Study of Harnessing Low Wind Speed Turbine as Hybrid Power Source for Offshore Platforms. Journal of Marine Science and Engineering, 10(7), 963. https://doi.org/10.3390/jmse10070963