Economic Feasibility and Decarbonization Incentives of Sugarcane Biogas Production Pathways

Abstract

1. Introduction

2. Materials and Methods

2.1. Variables for the Stochastic Model

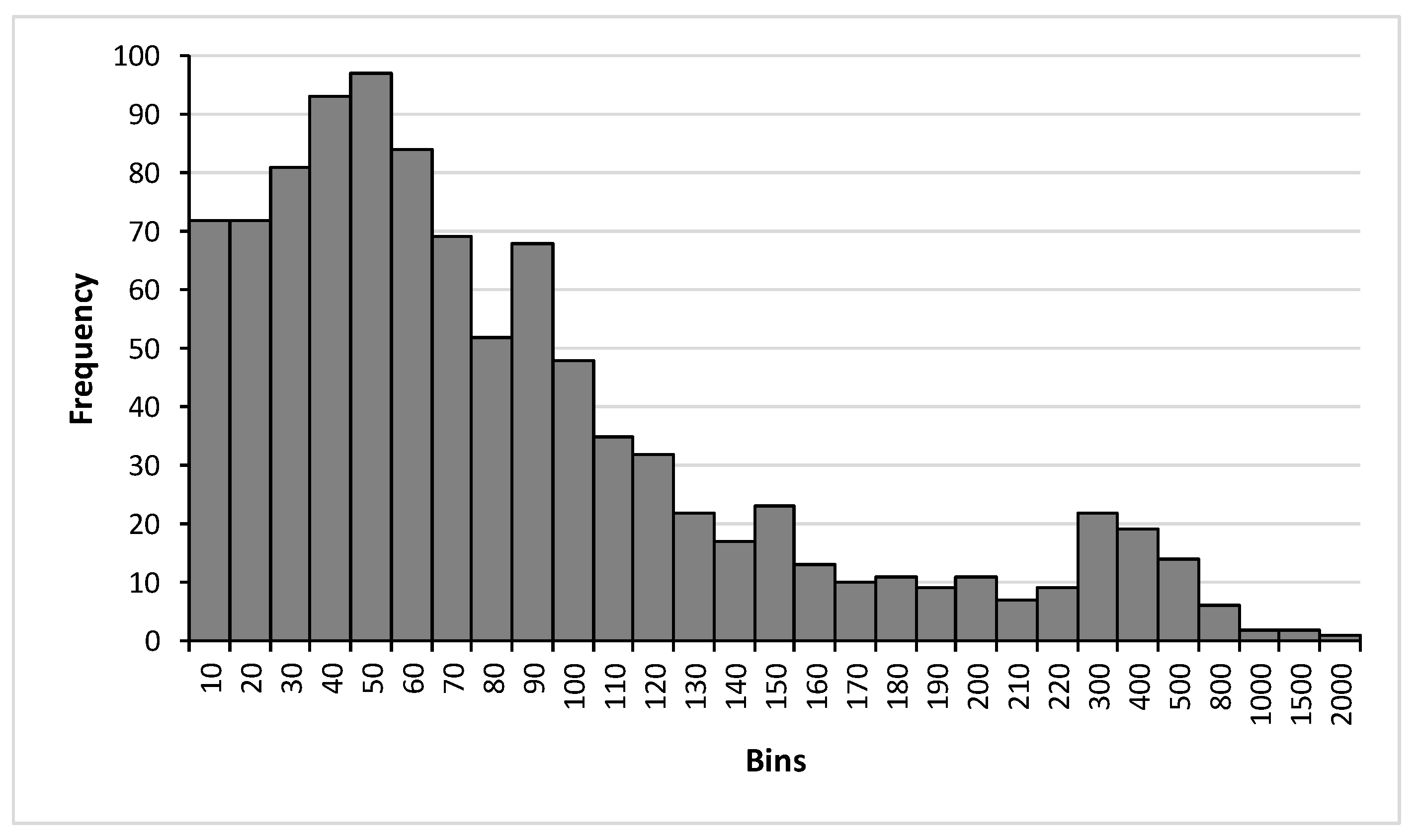

2.2. Stochastic Analysis

2.3. Investment Viability and Structure Attached to the Biorefinery

3. Results

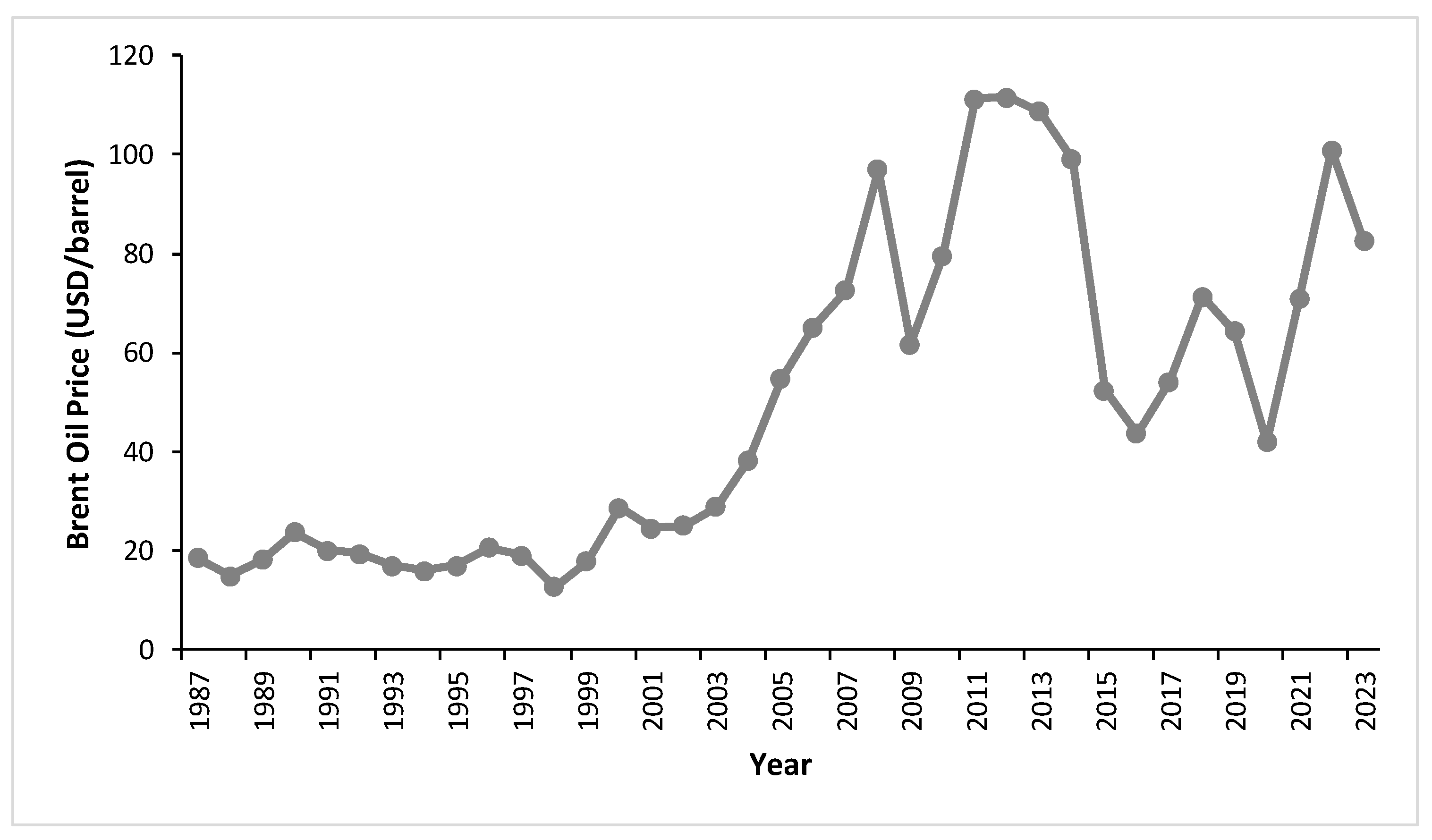

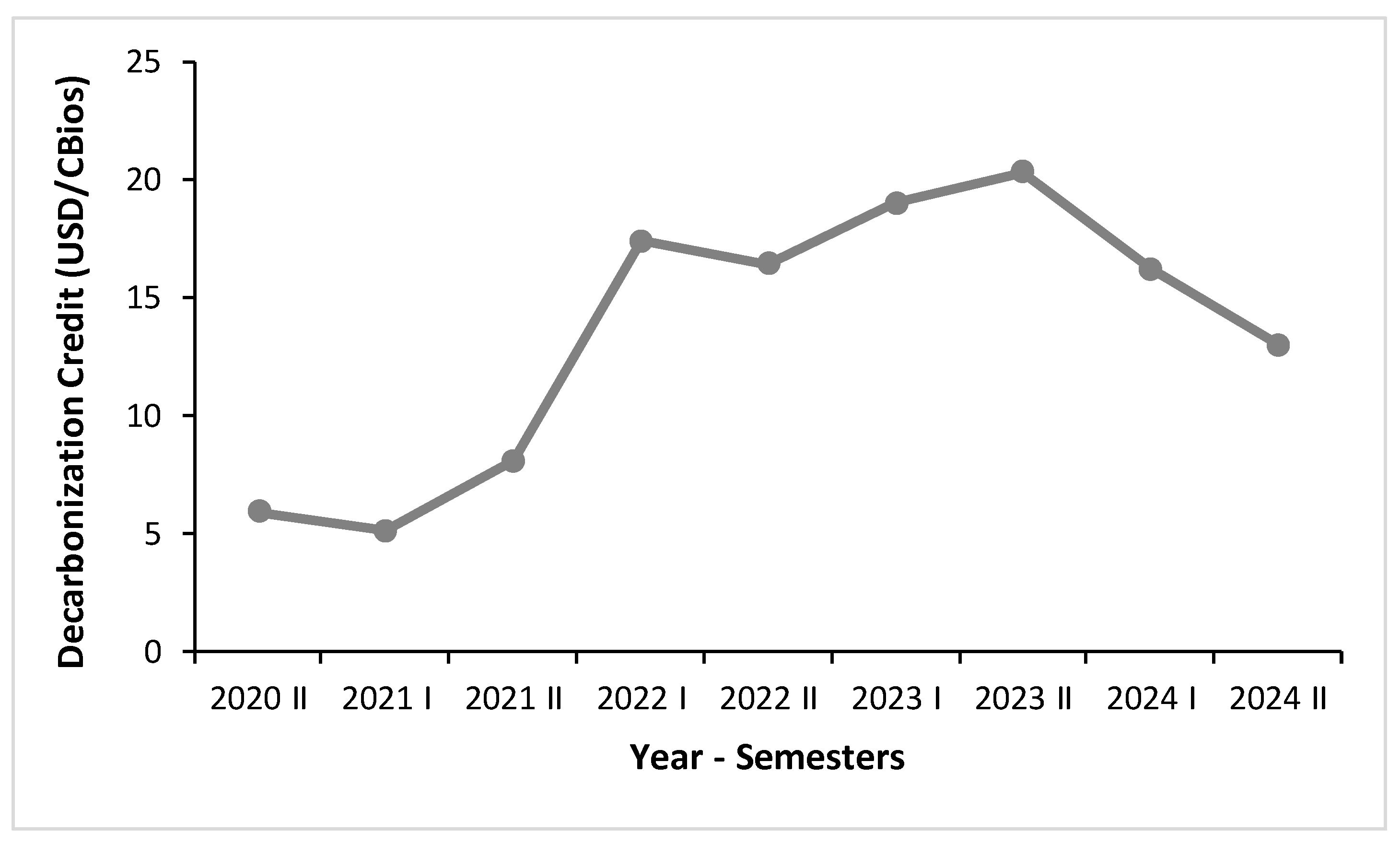

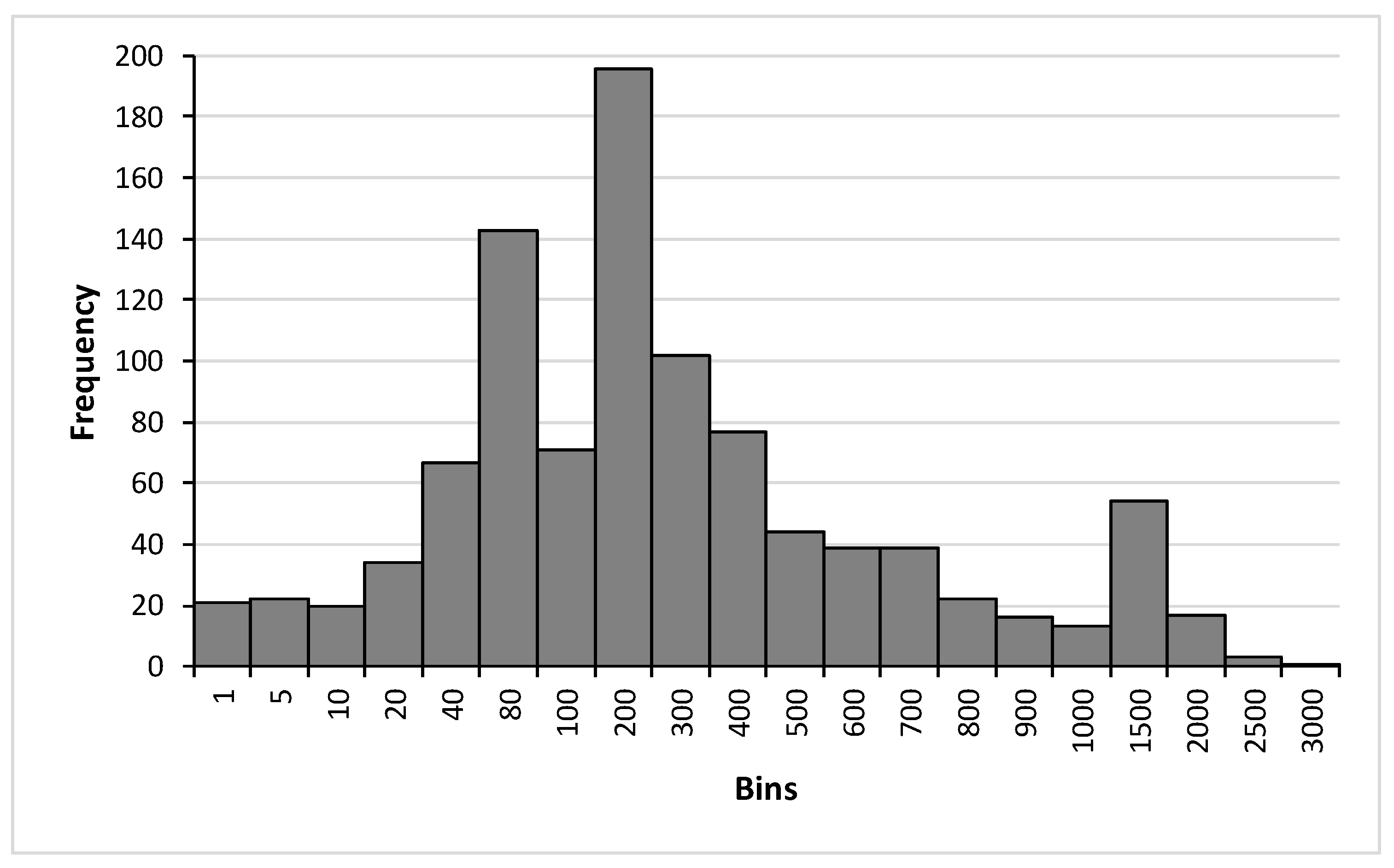

3.1. Data Surveyed for the Stochastic Model

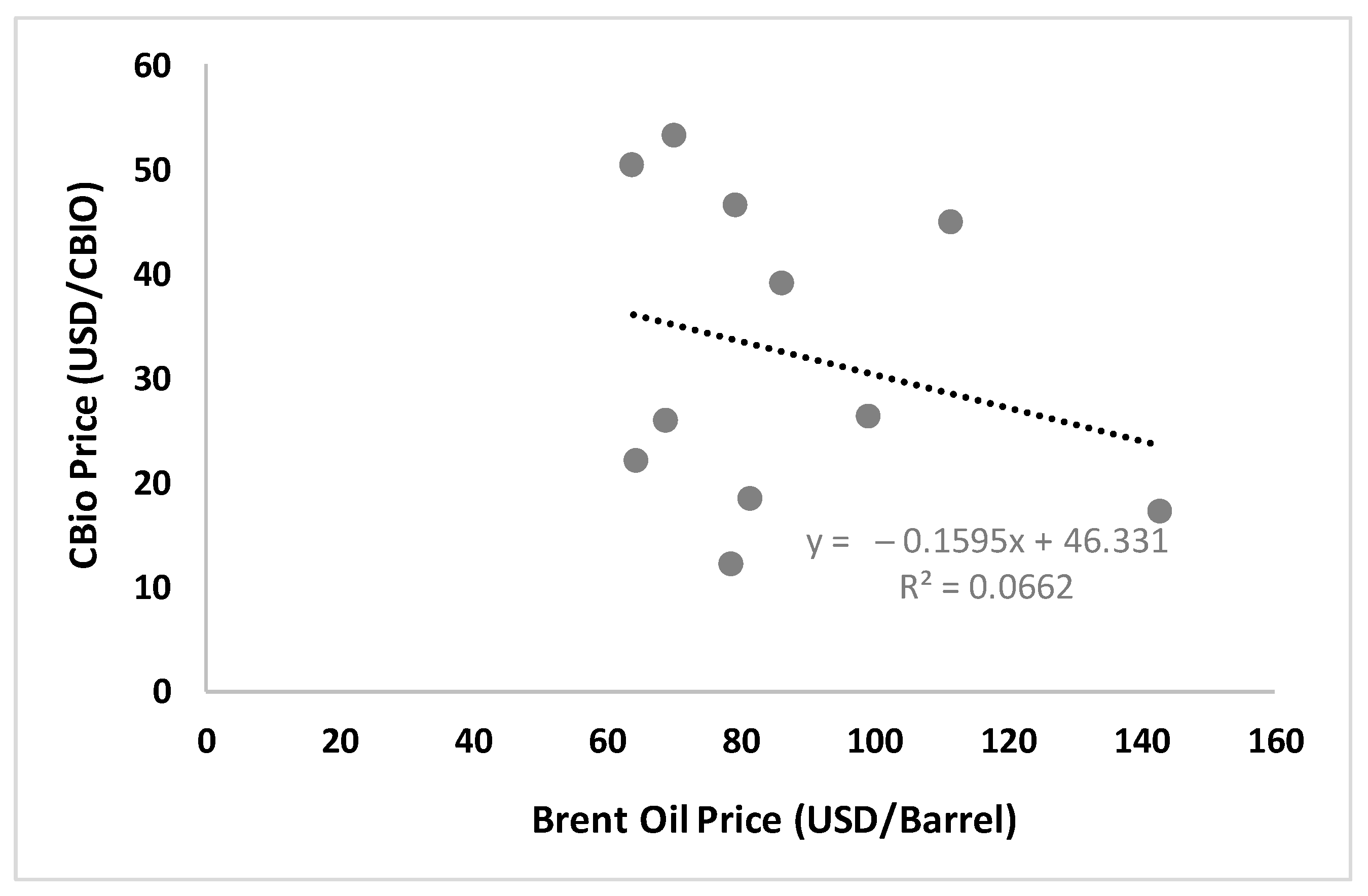

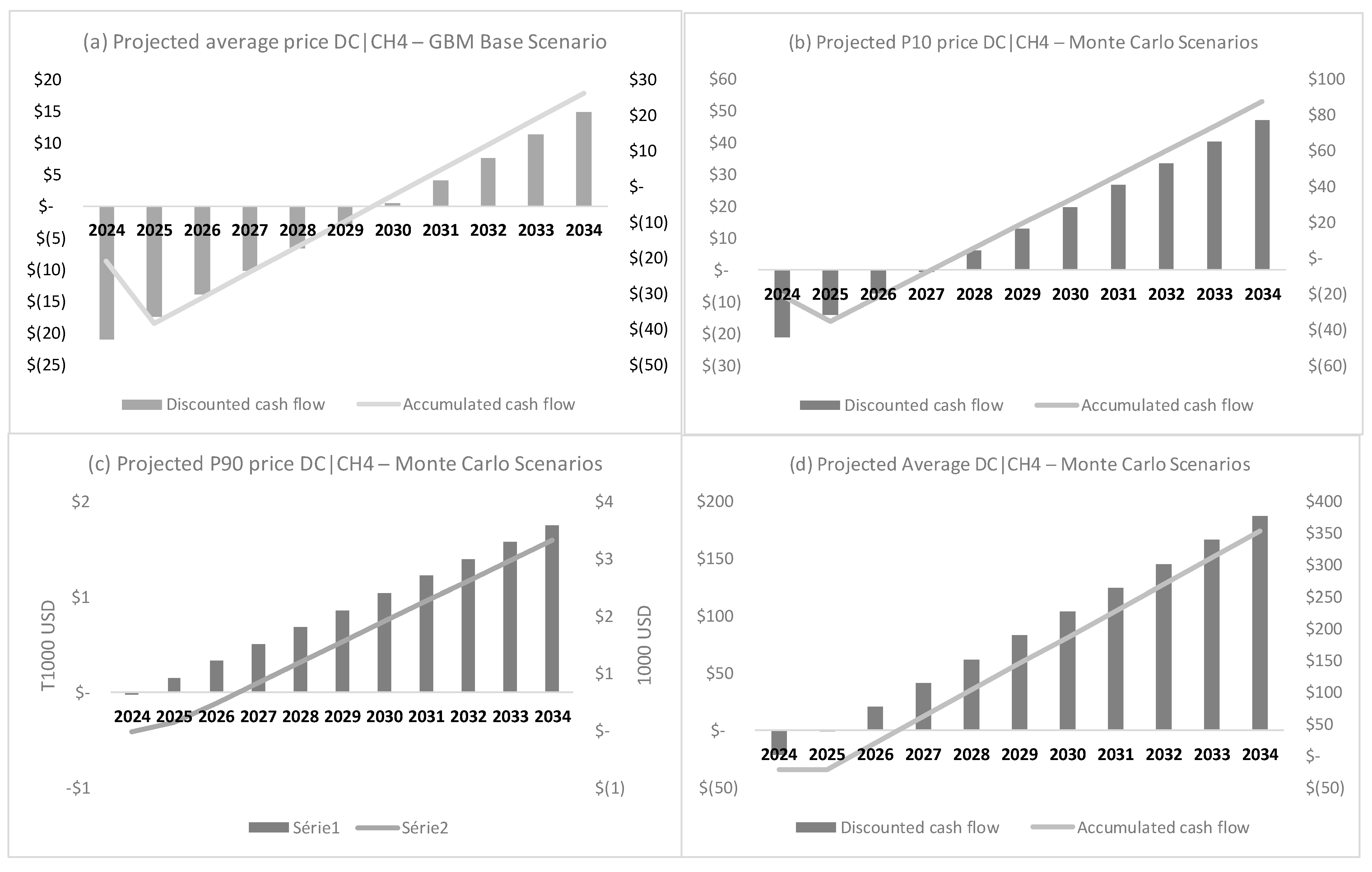

3.2. Decarbonization Credits Price Projection

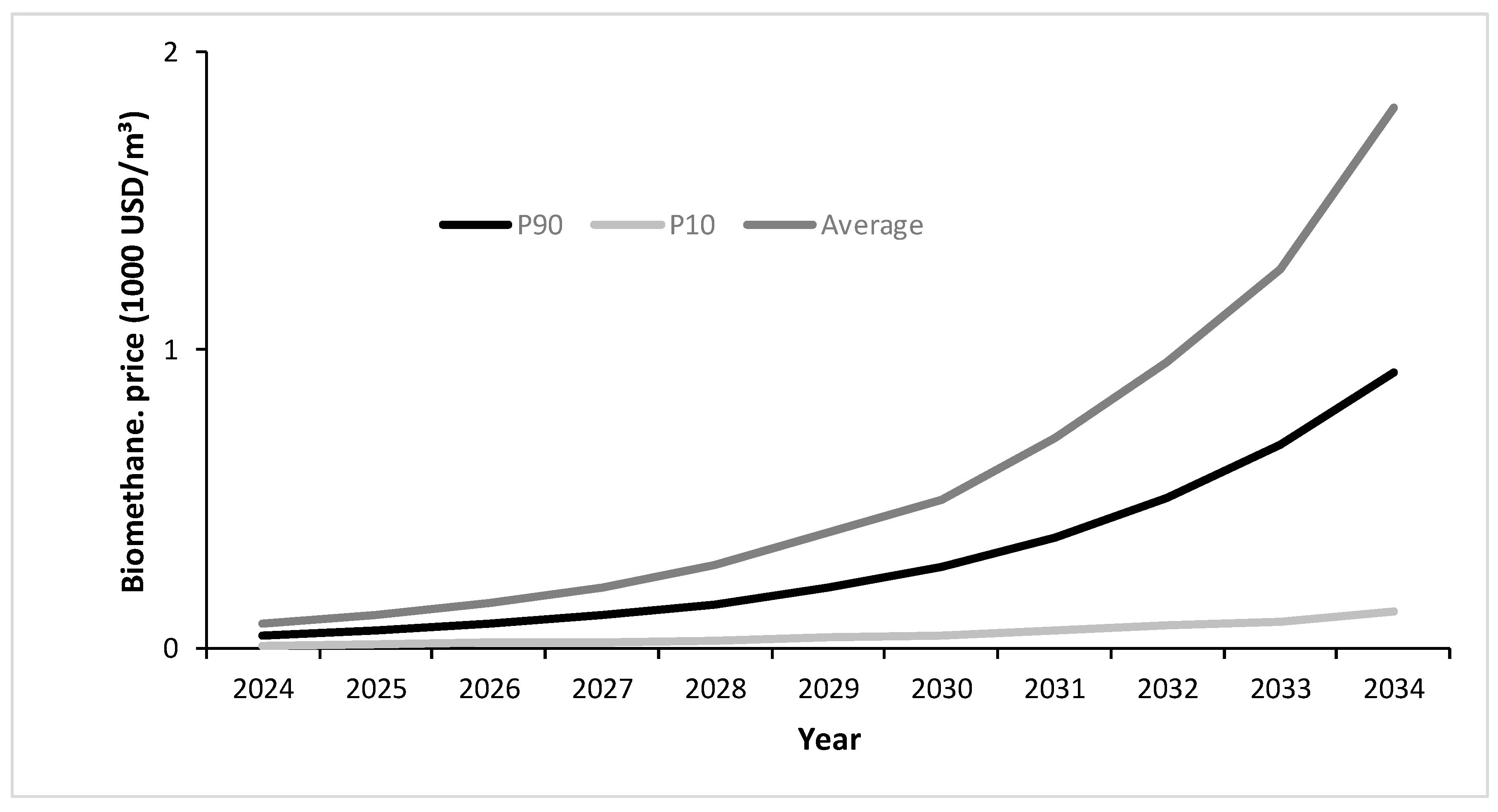

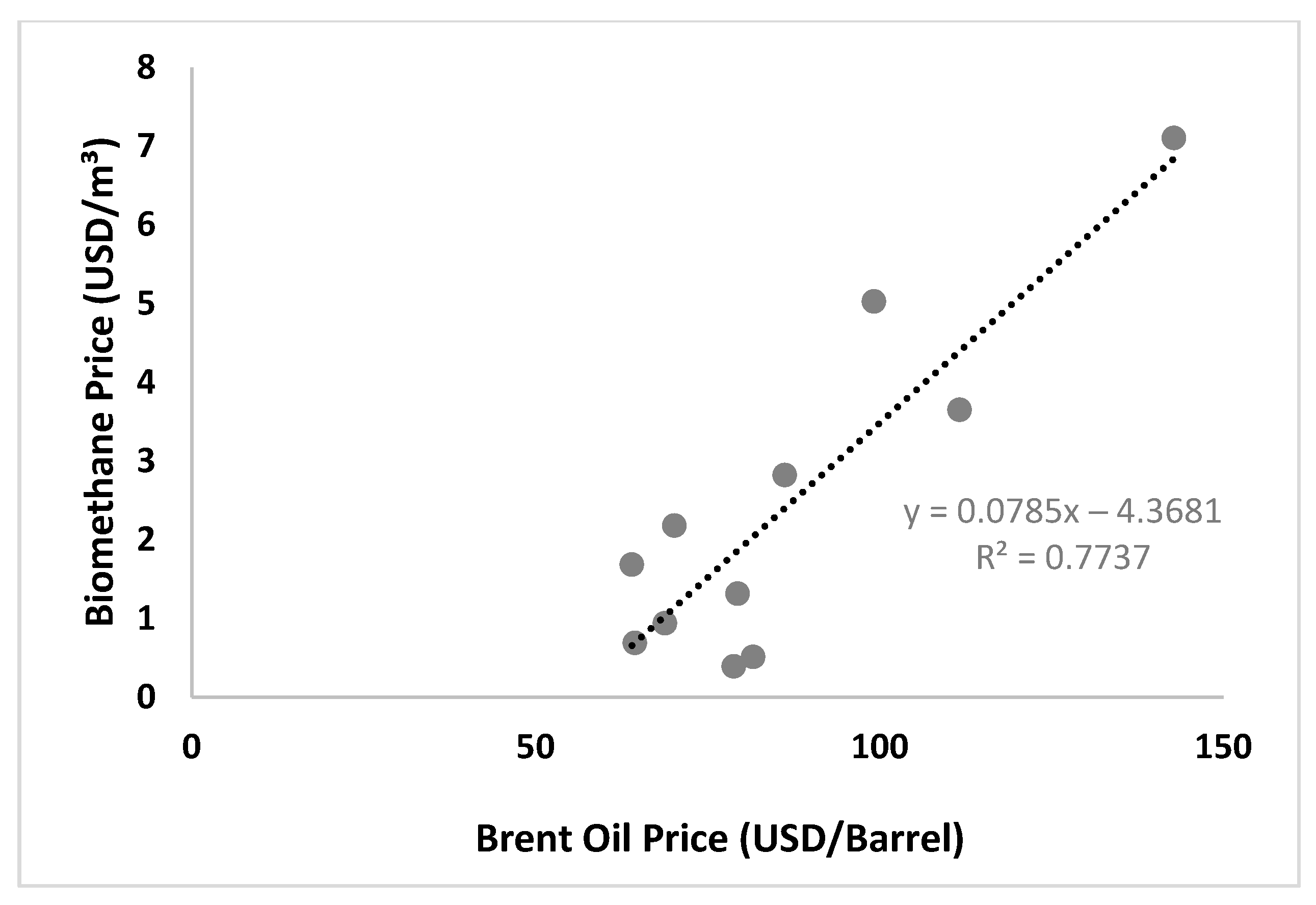

3.3. Biomethane Price Projection

3.4. Price Correlation with Brent Crude Oil

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Klein, B.C.; Chagas, M.F.; Watanabe, M.D.B.; Bonomi, A.; Maciel Filho, R. Low carbon biofuels and the New Brazilian National Biofuel Policy (RenovaBio): A case study for sugarcane mills and integrated sugarcane-microalgae biorefineries. Renew. Sustain. Energy Rev. 2019, 115, 109365. [Google Scholar] [CrossRef]

- Milão, R.D.F.D.; Carminati, H.B.; Ofélia de Queiroz, F.A.; de Medeiros, J.L. Thermodynamic, financial and resource assessments of a large-scale sugarcane-biorefinery: Prelude of full bioenergy carbon capture and storage scenario. Renew. Sustain. Energy Rev. 2019, 113, 109251. [Google Scholar] [CrossRef]

- EPE, Empresa de Pesquisa Energética (Brasil). Balanço Energético Nacional 2024. Rio de Janeiro. 2024. Available online: https://www.epe.gov.br/pt/publicacoes-dados-abertos/publicacoes/balanco-energetico-nacional-2024 (accessed on 24 August 2024).

- Vandenberghe, L.P.S.; Valladares-Diestra, K.K.; Bittencourt, G.A.; Torres, L.Z.; Vieira, S.; Karp, S.G.; Sydney, E.B.; de Carvalho, J.C.; Soccol, V.T.; Soccol, C.R. Beyond sugar and ethanol: The future of sugarcane biorefineries in Brazil. Renew. Sustain. Energy Rev. 2022, 167, 112721. [Google Scholar] [CrossRef]

- CNI, Confederação Nacional das Industrias (Brasil). O Setor Sucroenergético em 2030 Dimensões, Investimentos e uma Agenda Estratégica. 2017. Available online: http://www.portaldaindustria.com.br/publicacoes/2017/8/o-setor-sucroenergetico-em-2030-dimensoes-investimentos-e-uma-agenda-estrategica/ (accessed on 10 December 2024).

- Coelho, S.T.; Garcilasso, V.P.; Ferraz, A.D.N., Jr.; Santos, M.M.; Joppert, C.L. Tecnologias de Produção e uso de Biogás e Biometano. Parte I: Biogás, Parte II: Biometano; IEE-USP: São Paulo, Brazil, 2018. [Google Scholar]

- Hull, S. Guidebook to Gas Interchangeability and Gas Quality; BP in Association with the IGU: Brussels, Belgium, 2011. [Google Scholar]

- Silva, C.A.B.V. Limpeza e Purificação de Biogás. 91f. Dissertação de Mestrado, Universidade de Trás-os-Montes e Alto Douro, Vila Real, Portugal, 2009. [Google Scholar]

- de Souza Moraes, B.; Palacios-Bereche, R.; Martins, G.; Nebra, S.A.; Fuess, L.T.; Silva, A.J.; da Silva Clementino, W.; Bajay, S.V.; Manduca, P.C.; Lamparelli, R.A.; et al. Biogas production: Technologies and applications. In Biofuels and Biorefining; Elsevier: Amsterdam, The Netherlands, 2022; pp. 215–282. [Google Scholar]

- Souza, J.D.; Lima, H.Q.D.; Schaeffer, L. Desenvolvimento de tecnologia para utilização de biogás e biodiesel em motor de ciclo diesel. In Proceedings of the 2013 9º Congresso sobre Geração Distribuída e Energia no Meio Rural, Itajubá, Brazil, 15–17 May 2013. [Google Scholar] [CrossRef]

- COGEN, Associação da Indústria de Cogeração de Energia (Brasil). Cogen—Geo Energética. 2015. Available online: http://www.cogen.com.br/content/upload/1/documentos/workshop/2015/Apresentacao_GEO_COGEN_12032015.pdf (accessed on 4 November 2024).

- MME, Ministério de Minas e Energia. Comitê Renovabio. 2017. Available online: http://antigo.mme.gov.br/documents/20182/1164584/RO4/2192be7f-195d-b291-4926-2116723d252b (accessed on 25 September 2024).

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resour. Conserv. Recycl. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- Pretty, J.; Benton, T.G.; Bharucha, Z.P.; Dicks, L.V.; Flora, C.B. Global assessment of agricultural system redesign for sustainable intensification. Nat. Sustain. 2018, 1, 441–446. [Google Scholar] [CrossRef]

- Milanez, A.Y.; Maia, G.B.D.S.; Guimarães, D.D. Biogás: Evolução Recente e Potencial de uma nova Fronteira de Energia Renovável para o Brasil; BNDES: Rio de Janeiro, Brazil, 2021. [Google Scholar]

- Lux, T. Stochastic behavioral asset-pricing models and the stylized facts. In Handbook of Financial Markets: Dynamics and Evolution; North-Holland: Amsterdam, The Netherlands, 2009; pp. 161–215. [Google Scholar]

- Gopikrishnan, P.; Meyer, M.; Amaral, L.N.; Stanley, H.E. Inverse cubic law for the distribution of stock price variations. Eur. Phys. J. B-Condens. Matter Complex Syst. 1998, 3, 139–140. [Google Scholar] [CrossRef]

- Nadaleti, W.C.; Lourenço, V.A. A mathematical, economic and energetic appraisal of biomethane and biohydrogen production from Brazilian ethanol plants’ waste: Towards a circular and renewable energy development. Int. J. Hydrogen Energy 2021, 46, 27268–27281. [Google Scholar] [CrossRef]

- de Araujo, G.J.F.; de Oliveira, S.V.W.B.; de Oliveira, M.M.B. Economic analysis of internal circulation biodigesters and vinasse concentrators for the generation of electricity, fertilizers, and carbon credits in various Brazilian economic scenarios. Bioenergy Res. 2019, 12, 1164–1186. [Google Scholar] [CrossRef]

- Brandão, C.M.; Stradiotto, N.R. Comparative Economic Analysis of the Utilization of Biogas from Sugarcane Vinasse in Electricity Generation, Transport Fuel and Natural Gas Substitution: A Brazilian case Study. Waste Biomass Valorization 2024, 1–24. [Google Scholar] [CrossRef]

- Demirbas, A. Biofuels sources, biofuel policy, biofuel economy and global biofuel projections. Energy Convers. Manag. 2008, 49, 2106–2116. [Google Scholar] [CrossRef]

- Perin, G.; Jones, P.R. Economic feasibility and long-term sustainability criteria on the path to enable a transition from fossil fuels to biofuels. Curr. Opin. Biotechnol. 2019, 57, 175–182. [Google Scholar] [CrossRef] [PubMed]

- Volpi, M.P.C.; Fuess, L.T.; Moraes, B.S. Economic performance of biogas production and use from residues co-digestion in integrated 1G2G sugarcane biorefineries: Better electricity or biomethane? Energy Convers. Manag. 2023, 277, 116673. [Google Scholar] [CrossRef]

- Nadaleti, W.C.; Lourenco, V.A.; Belli Filho, P.; dos Santos, G.B.; Przybyla, G. National potential production of methane and electrical energy from sugarcane vinasse in Brazil: A thermo-economic analysis. J. Environ. Chem. Eng. 2020, 8, 103422. [Google Scholar] [CrossRef]

- Fava, F.E.; Romanelli, T.L. Biogas and biomethane production routes in the sugar-energy sector: Economic efficiency and carbon footprint. Bioresour. Technol. Rep. 2023, 22, 101388. [Google Scholar] [CrossRef]

- B3. CBIO—Consultas. 2024. Available online: https://www.b3.com.br/pt_br/b3/sustentabilidade/produtos-e-servicos-esg/credito-de-descarbonizacao-cbio/cbio-consultas/ (accessed on 30 October 2024).

- EIA, U.S. Energy Information Administration. Europe Brent Spot Price FOB. 2024. Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RBRTE&f=A (accessed on 24 December 2024).

- MME, Ministério de Minas e Energia (Brasil). Boletim Mensal de Acompanhamento da Indústria de Gás Natural. 2024. Available online: https://www.gov.br/mme/pt-br/assuntos/secretarias/petroleo-gas-natural-e-biocombustiveis/publicacoes-1/boletim-mensal-de-acompanhamento-da-industria-de-gas-natural (accessed on 6 December 2024).

- IBGE, Instituto Brasileiro de Geografia e Estatística (Brasil). IPCA—Índice Nacional de Preços ao Consumidor Amplo, Séries Históricas. 2024. Available online: https://www.ibge.gov.br/estatisticas/economicas/precos-e-custos/9256-indice-nacional-de-precos-ao-consumidor-amplo.html?=&t=series-historicas (accessed on 29 November 2024).

- Glasserman, P. Monte Carlo Methods in Financial Engineering; Springer: Berlin/Heidelberg, Germany, 2004. [Google Scholar]

- Björk, T. Arbitrage Theory in Continuous Time; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- BCB, Banco Centro do Brasil. Boletim Focus. 2024. Available online: https://www.bcb.gov.br/content/focus/focus/R20241220.pdf (accessed on 21 December 2024).

- B3. Indicadores e Taxas de Câmbio. 2024. Available online: https://www.b3.com.br/pt_br/market-data-e-indices/servicos-de-dados/market-data/consultas/clearing-de-cambio/indicadores/taxas-de-cambio-praticadas/ (accessed on 1 December 2024).

- UNICA—União da Agroindústria Canavieira do Estado de São Paulo (Brasil). Observatório da Cana. Mix de Produção. 2024. Available online: https://observatoriodacana.com.br/ (accessed on 18 October 2024).

- Kreibich, N. Toward global net zero: The voluntary carbon market on its quest to find its place in the post-Paris climate regime. Wiley Interdiscip. Rev. Clim. Change 2024, 15, e892. [Google Scholar] [CrossRef]

- Stavins, R.N. The relative merits of carbon pricing instruments: Taxes versus trading. Rev. Environ. Econ. Policy 2022, 16, 62–82. [Google Scholar] [CrossRef]

- Dragicevic, A. Internalizing CO2-Equivalent Emissions Issued from Agricultural Activities. Front. Clim. 2021, 3, 714334. [Google Scholar] [CrossRef]

- Keogh, N.; Corr, D.; O’Shea, R.; Monaghan, R.F.D. The gas grid as a vector for regional decarbonisation-a techno economic case study for biomethane injection and natural gas heavy goods vehicles. Appl. Energy 2022, 323, 119590. [Google Scholar] [CrossRef]

- EPE, Empresa de Pesquisa Energética (Brasil). Investimentos e Custos Operacionais e de Manutenção no Setor de Biocombustíveis: 2020–2030. Rio de Janeiro. 2019. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-343/topico-506/Investimentos_Custos_O_e_M_Bios_2020-2030.pdf (accessed on 4 November 2024).

- Mata-Alvarez, J.; Macé, S.; Llabrés, P. Anaerobic digestion of organic solid wastes. An overview of research achievements and perspectives. Bioresour. Technol. 2014, 74, 3–16. [Google Scholar] [CrossRef]

- Monforti, F.; Lugato, E.; Motola, V.; Bodis, K.; Scarlat, N.; Dallemand, J.F. Optimal energy use of agricultural crop 40residues preserving soil organic carbon stocks in Europe. Renew. Energy 2016, 96, 460–469. [Google Scholar]

- Persson, M.; Jönsson, O.; Wellinger, A. Biogas upgrading to vehicle fuel standards and grid injection. In IEA Bioenergy Task; IEA Bioenergy: Paris, France, 2006; Volume 37, pp. 1–34. [Google Scholar]

- Dragicevic, A.; Pereau, J.-C. Comparing Climate Pledges and EcoTaxation in a Networked Agricultural Supply Chain Organization. Eur. Rev. 2024, 51, 354–398. [Google Scholar]

| Structure | Quantity | Investments—USD 1 Million | |

|---|---|---|---|

| Initial Capex | Annual Opex | ||

| Buffer Lagoon | 2 | 0.5 | 0.1 |

| Horizontal Digesters | 4 | 2.5 | 0.1 |

| Desulfurization Plant | 1 | 5.8 | 0.2 |

| Purification Plant | 1 | 6.7 | 0.1 |

| Gasometer | 1 | 1.7 | 0.1 |

| Flare | 1 | 0.3 | 0.1 |

| Compression Station | 1 | 5.8 | 0.1 |

| Buffer Lagoon | 2 | 0.5 | 0.1 |

| Parameter | Unit | Value |

|---|---|---|

| Sugarcane mill | Gg | 5000 |

| ETOH production | m3 | 243,310 |

| Vinasse | m3 | 2,919,720 |

| Biomethane | m3 | 208,800 |

| Biomethane CBio | # | 620 |

| Ethanol CBio | # | 355,197 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fava, F.E.; Alves, L.R.A.; Romanelli, T.L. Economic Feasibility and Decarbonization Incentives of Sugarcane Biogas Production Pathways. Agriculture 2025, 15, 380. https://doi.org/10.3390/agriculture15040380

Fava FE, Alves LRA, Romanelli TL. Economic Feasibility and Decarbonization Incentives of Sugarcane Biogas Production Pathways. Agriculture. 2025; 15(4):380. https://doi.org/10.3390/agriculture15040380

Chicago/Turabian StyleFava, Flavio Eduardo, Lucílio Rogério Aparecido Alves, and Thiago Libório Romanelli. 2025. "Economic Feasibility and Decarbonization Incentives of Sugarcane Biogas Production Pathways" Agriculture 15, no. 4: 380. https://doi.org/10.3390/agriculture15040380

APA StyleFava, F. E., Alves, L. R. A., & Romanelli, T. L. (2025). Economic Feasibility and Decarbonization Incentives of Sugarcane Biogas Production Pathways. Agriculture, 15(4), 380. https://doi.org/10.3390/agriculture15040380