Evolution of the Global Forage Products Trade Network and Implications for China’s Import Security

Abstract

1. Introduction

2. Materials and Methods

2.1. Research Methods

- (1)

- Network Matrix ConstructionBased on complex network theory, each country or region involved in the trade of forage products is represented as a node within the forage products trade network. A network matrix is then constructed, as shown in Equation (1).In Equation (1), represents an undirected, unweighted trade network for year t. represents the number of nodes in the network, and the element in matrix represents whether a trade relationship exists between country and country in year . Specifically, = 1 if there is a trade relationship between country and country , and = 0 if no such relationship exists. When , .Trade networks are classified as directed or undirected based on their directionality, and as weighted or unweighted networks based on the presence of weights. The global forage products trade network is a directed, weighted network, as represented in Equation (2).In the equation, represents a directed weighted network for year t. represents the number of nodes in the network. The element in the matrix represents the trade volume between country and country in year , where , when . Using the total import and export trade volumes between any two countries as edge weights, an undirected weighted network is constructed. The symmetric adjacency matrix is shown in Equation (3).In the equation, represents the undirected weighted network for year t. represents the number of nodes in the network. The element in the matrix represents the trade volume between country and country in year , where , when . ==+.

- (2)

- Trade Network Analysis IndicatorsBased on the construction of the network matrix and the directed weighted network, this study employs the following indicators to analyze the global forage products trade network. First, metrics such as node degree, node strength, degree distribution, and cumulative degree distribution are used to examine trade connections between countries and their positions within the network. Then, global characteristic indicators—including network density, average path length, and average clustering coefficient—are applied to assess the overall properties of the global forage products trade network.

- ①

- Node degreeThis study uses the node degree indicator to quantify the closeness of direct trade connections between countries for forage products, aligning with the research objective of analyzing trade relationships between nations. This indicator has been applied in studies of global food trade networks [10] and effectively represents the strength of trade associations between countries.Node degree refers to the number of trading partners directly connected to a node within the trade network and serves as a key indicator for measuring the scale of that node’s trade connections [28]. In a directed network, node degree is divided into out-degree and in-degree based on the direction of flow. The sum of these two is called the degree, as expressed in Equations (4)–(6).Among them, represents the out-degree and represents whether there is an export trade relationship from country to country . represents the in-degree and represents whether there is an import trade relationship from country to country . represents the degree. represents the total number of nodes in the network.

- ②

- Node strengthThis study uses the node strength indicator to measure the actual trade volume and influence of countries within the global trade network of forage products. This indicator has been employed in a previous study [29] to identify key countries and analyze their impact.Node strength reflects the magnitude of forage trade flow. Directed networks are subdivided into export strength and import strength [30]. See Equations (7)–(9).In this context, represents export intensity, represents whether there is an export trade relationship from country to country , and represents the trade volume of forage products exported from country to country . represents import intensity, represents whether there is an import trade relationship from country to country , and represents the trade volume of forage products imported by country to country . represents node intensity.

- ③

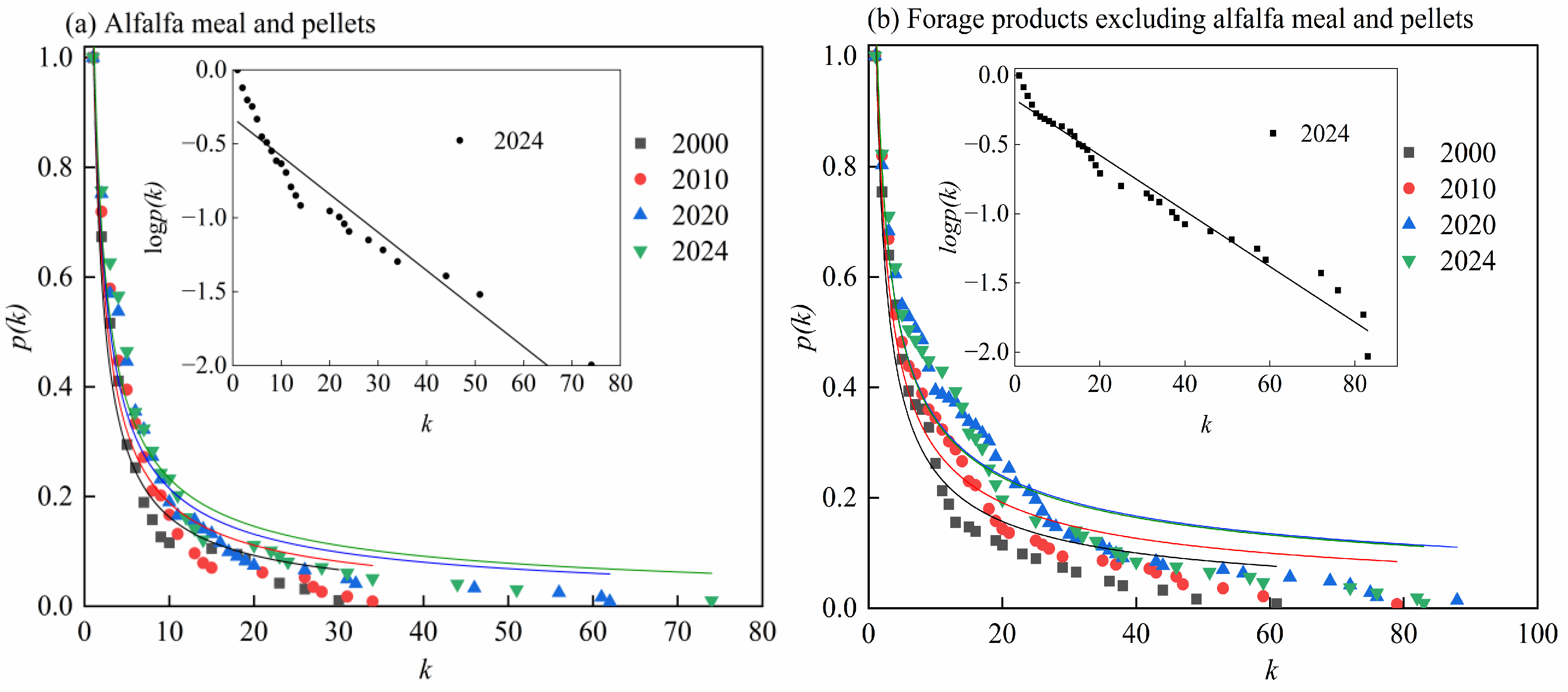

- Degree Distribution and Cumulative Degree DistributionThis study utilizes degree distribution and cumulative degree distribution metrics to identify core nodes and peripheral structures within the trade network, aligning with the research objective of determining core nodes and their roles. These metrics have been validated in the analysis of the global food trade network, effectively revealing the uneven distribution of node degrees and the dominant position of core nodes [10].Degree distribution illustrates the probability distribution of the number of trading partners for nodes within the trade network. This relationship is expressed in Equation (10).Among them, represents the degree distribution, represents a node in the network, k represents the degree, and represents the number of nodes.If the degree distribution follows a power–law relationship, the network is said to exhibit scale-free characteristics. This is characterized by the coexistence of a large number of low-degree nodes and a very small number of high-degree hub nodes [31], resulting in a highly uneven distribution of node degrees. In such networks, the few nodes with high degrees are called “hubs”, which play a crucial role in scale-free networks [32]. This relationship is shown in Equation (11).Here, represents the probability of node degree in the network, represents the node degree, and represents the power–law relationship exponent.Cumulative degree distribution. The cumulative degree distribution represents the sum of all degree distribution probabilities in the network for degree values greater than , and its expression is shown in Equation (12).wherein represents the segment where the cumulative distribution is greater than or equal to , represents the probability of node degree in the network, represents an artificially set critical value of degree, and represents the maximum value of node degree in the trade network.

- ④

- Network DensityThis study selects the network density indicator because it quantifies the overall cohesion of the global forage products trade network, aligning with the research objective of analyzing the network’s characteristics. This indicator effectively reflects the global characteristics of trade associations [12], confirming its suitability for similar studies.Network density refers to the ratio of actual trade connections to all possible trade connections. It serves as an indicator for measuring the closeness of connections between various nodes in the network [33], as expressed in Equation (13).Here, represents the trade network density and represents the actual number of existing links within the trade network, with a value range of [0, 1]. A higher network density represents a more tightly interconnected trade network.

- ⑤

- Average Clustering CoefficientThis study uses the average clustering coefficient to assess the regional agglomeration and grouping characteristics of the global forage products trade network, aligning with the research objectives. This metric has also been applied in analyzing the overall characteristics of trade networks in studies of the global palm oil trade [12].The average clustering coefficient is the mean value of the clustering coefficients of all nodes, which characterizes the agglomeration level of the trade network [34]. Its representation is presented in Equation (14).where represents the average clustering coefficient, represents the total number of nodes in the network, represents the number of edges actually existing between the neighbors of node , and represents the degree of node . Its value range is [0, 1], and a larger value implies stronger network cohesion.

- ⑥

- Average Path LengthThis study uses the average path length indicator to measure the average shortest path distance between nodes, reflecting the overall accessibility of the global forage products trade network [35] and aligning with the research objectives. This indicator effectively characterizes the global structural properties of trade networks [12]. Its formula is presented in Equation (15).where represents the average path length, represents the total number of nodes in the network, and represents the shortest path between node and node in the forage trade network.

- (3)

- Import Risk IndicatorsIn the analysis of import risks for pasture products, this article uses the Herfindahl–Hirschman Index (HHI) to represent the import concentration of the importing country or region [36], as shown in Equation (16).represents the import volume of the -th country among the source countries of forage products imports. represents the total import volume of forage products. The magnitude of the Herfindahl–Hirschman Index (HHI) reflects the degree of product concentration, typically ranging from 0 to 1. A higher index indicates greater import concentration for a country or region. The classification criteria are as follows: an HHI between 0.1 and 0.4 indicates a low level of concentration, while an HHI of 0.4 or higher indicates a high level of concentration.

2.2. Data Sources

3. Empirical Tests and Analysis of Results

3.1. Evolution of the Global Forage Products Trade Network

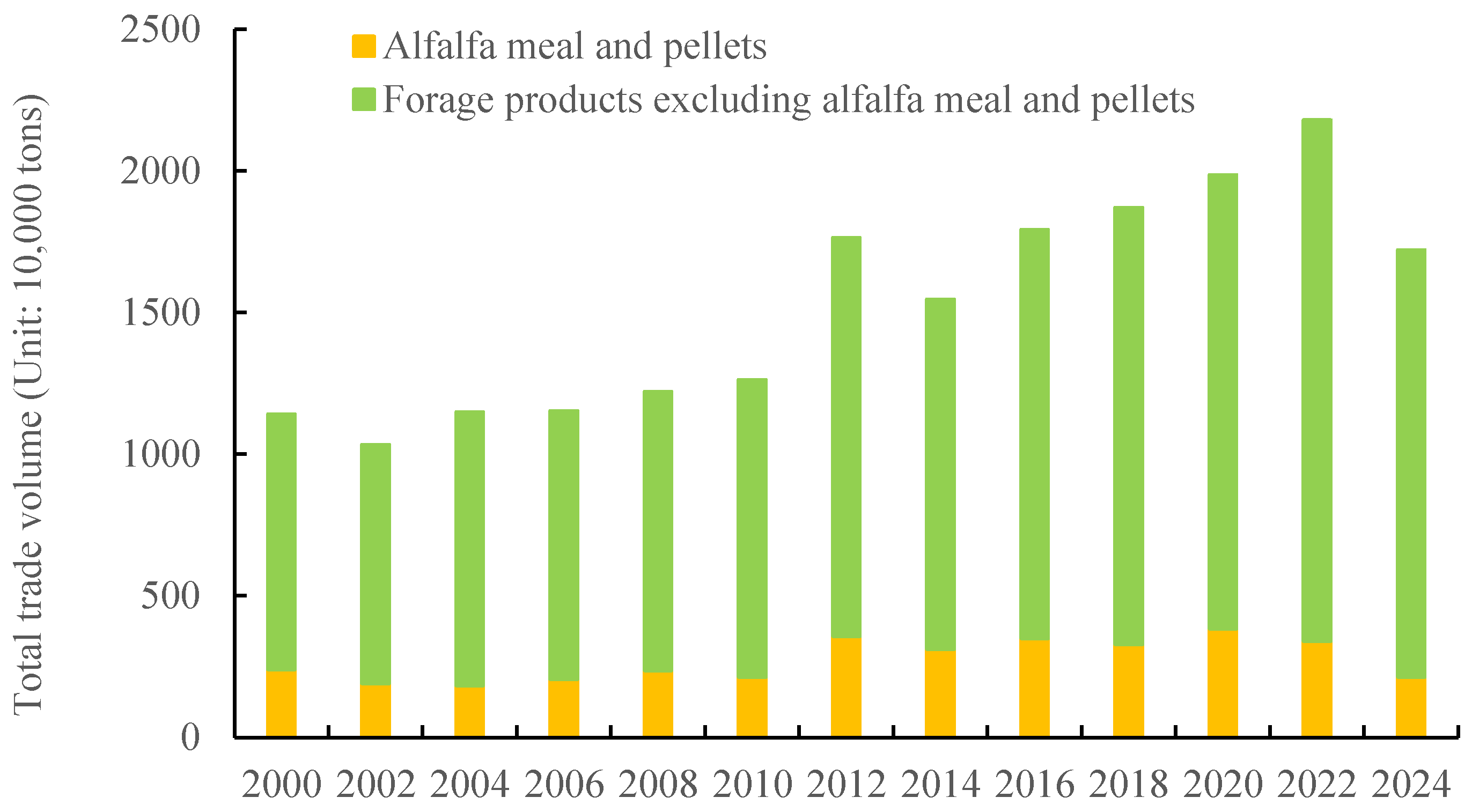

Analysis on Changes in Global Forage Products Trade Volume and Number of Trading Countries

3.2. Analysis on the Characteristics of the Global Forage Products Trade Network

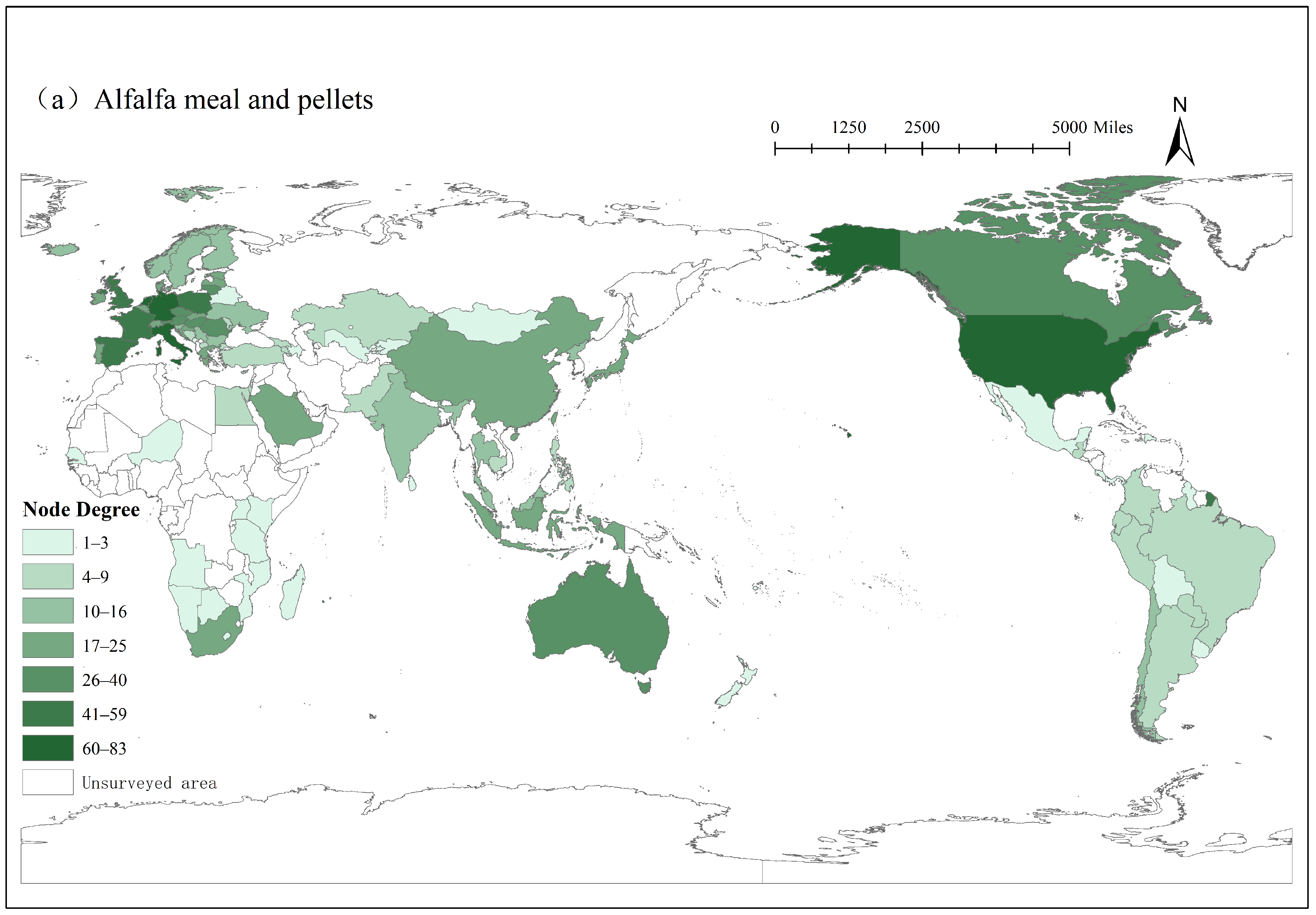

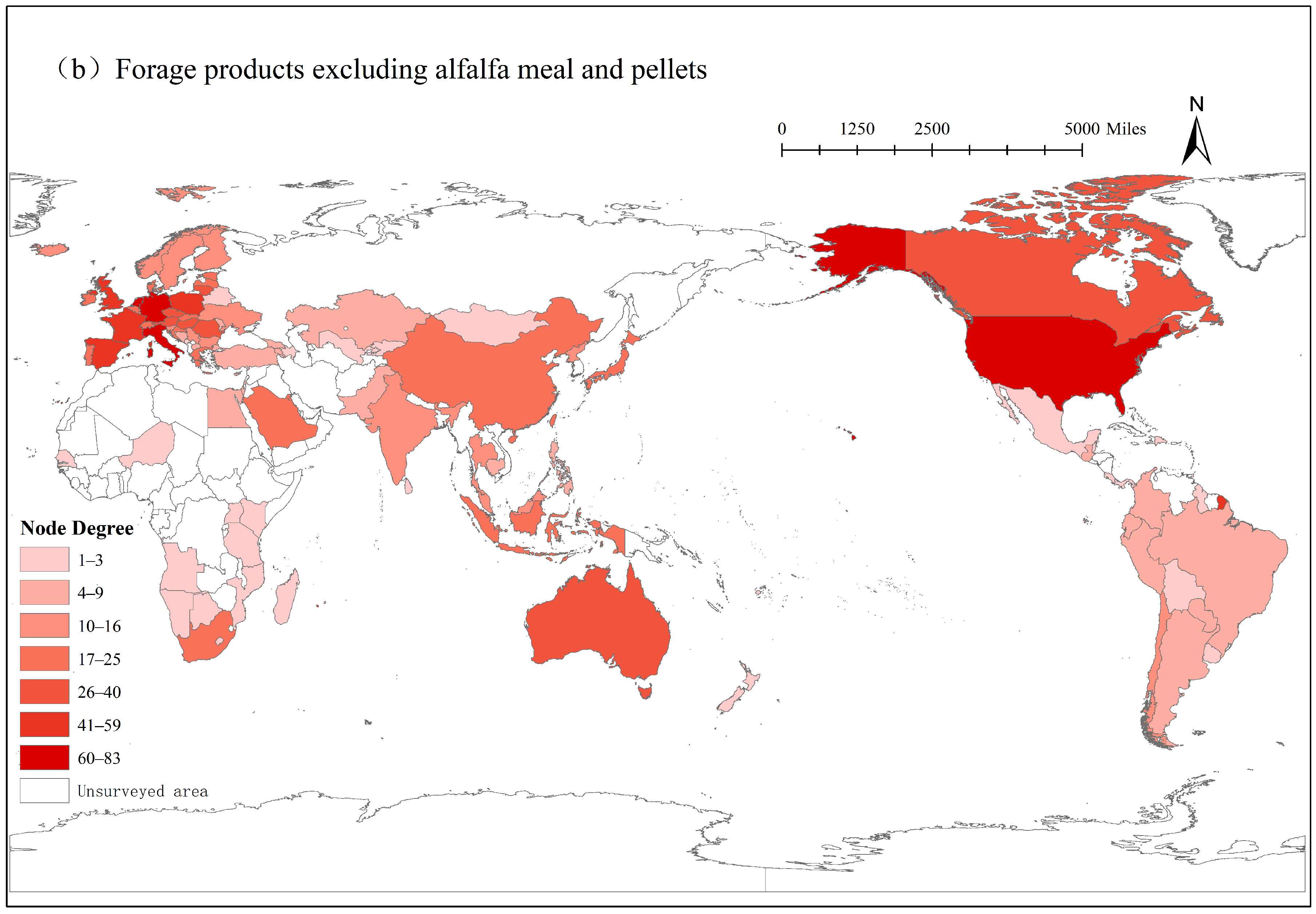

Node Degree Characteristics

3.3. Analysis of Influencing Factors for Changes in Node Degree

Degree Distribution and Cumulative Degree Distribution Characteristics

3.4. Evolution Trend of the Global Forage Products Trade Network

3.4.1. Temporal Evolutionary Trend

- (1)

- Increased Network Density. From 2000 to 2024, the global trade network density of various forage products has shown an upward trend (Figure 4). The integration of trade networks has improved, resulting in closer trade relations among nations and the formation of a more cohesive network structure. Notably, the density of the forage products excl. AM&P trade network has continuously increased, with an 88.74% rise in 2024 compared to 2000, driven by accumulated trade relationships that expand network coverage and connectivity. The trade network density of the AM&P (Main Supply and Market Partners) fluctuated but trended upward, increasing by 75% in 2024 compared to 2000. This growth reflects a rising market demand for high-quality forage and deepening trade cooperation, which continuously strengthens the network’s cohesion.

- (2)

- Growth in Clustering Coefficient. From 2000 to 2024, the average clustering coefficient of the global forage products trade network initially decreased and then increased overall. From 2000 to 2008, it fluctuated and declined, followed by an upward trend from 2009 to 2024 (Figure 4). Specifically, the clustering coefficient for forage products excl. AM&P exhibited a fluctuating decline from 2000 to 2008, which disrupted the stability of small clusters and weakened local clustering. However, from 2009 to 2024, it increased from 0.38 to 0.4, indicating tighter connections among neighboring countries and the formation of more small-scale trade clusters, thereby enhancing local clustering. The clustering coefficient for AM&P fluctuated sharply between 0.2 and 0.3 from 2000 to 2014, reflecting a high dependence on core hub countries; these hubs significantly influenced “small-circle trade”. From 2015 to 2024, it showed a fluctuating upward trend, with the emergence of new trade clusters and the restoration of local agglomeration.

- (3)

- Decrease in Average Path Length. As the number of participating countries and regions in the global forage products trade network increased, the average path length exhibited a declining trend, indicating an overall improvement in transmission efficiency and a deepening of network globalization (Figure 4). Different categories of forage products showed variations in average path length. The AM&P network, characterized by a lower node degree and sparser connections, often requires traversing more intermediary nodes for indirect links, resulting in a longer average path length ranging from 2.7 to 3.2. In contrast, the average path length for forage products excl. AM&P is shorter, between 2.5 and 3.0, primarily due to a higher number of participating economies and denser connections among nodes, which naturally shorten the paths.

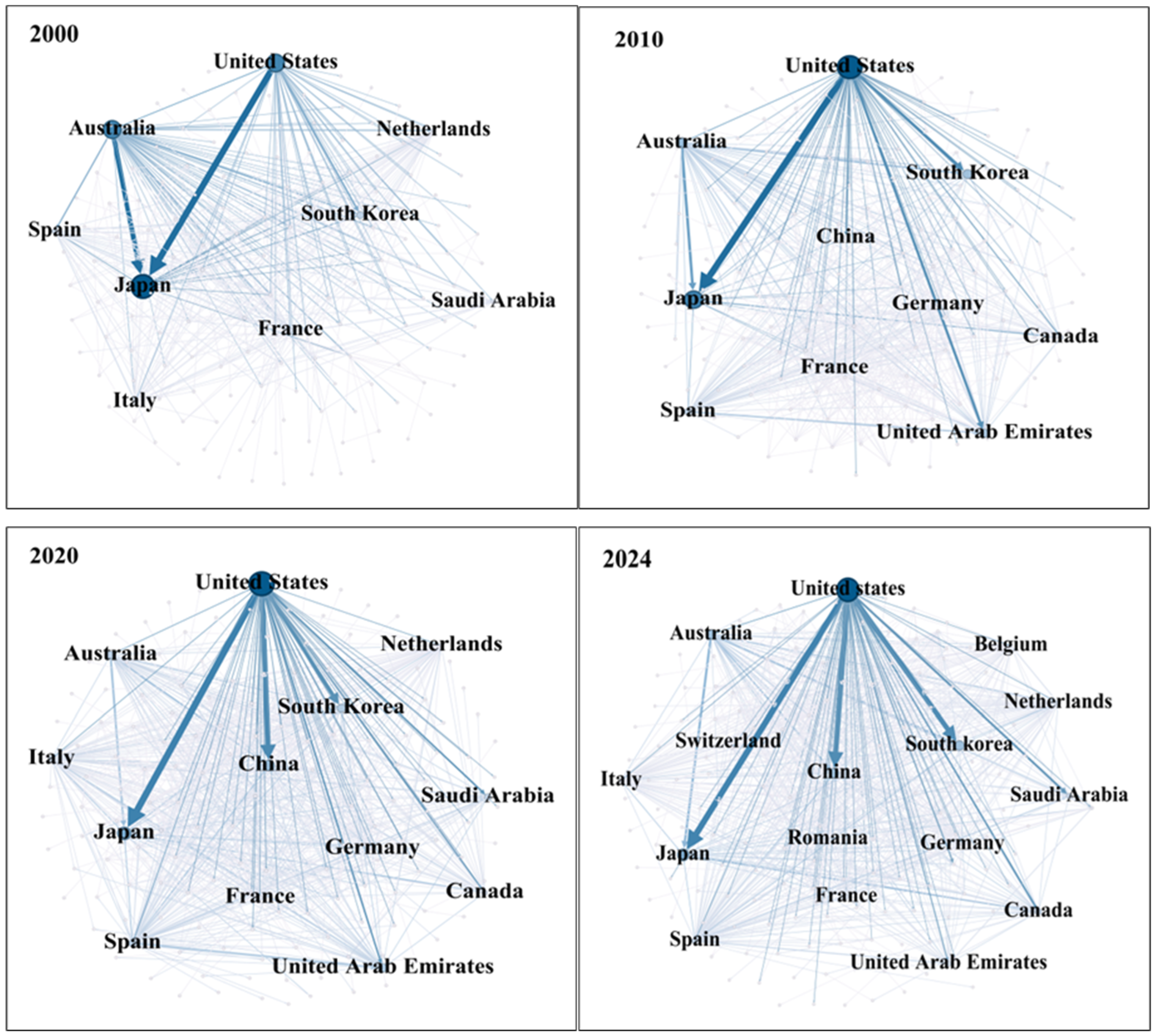

3.4.2. Spatial Evolutionary Trend

3.5. Evolution of China’s Forage Products Trade Network and Import Security Risks

3.5.1. Evolution of China’s Forage Products Trade Network

- (1)

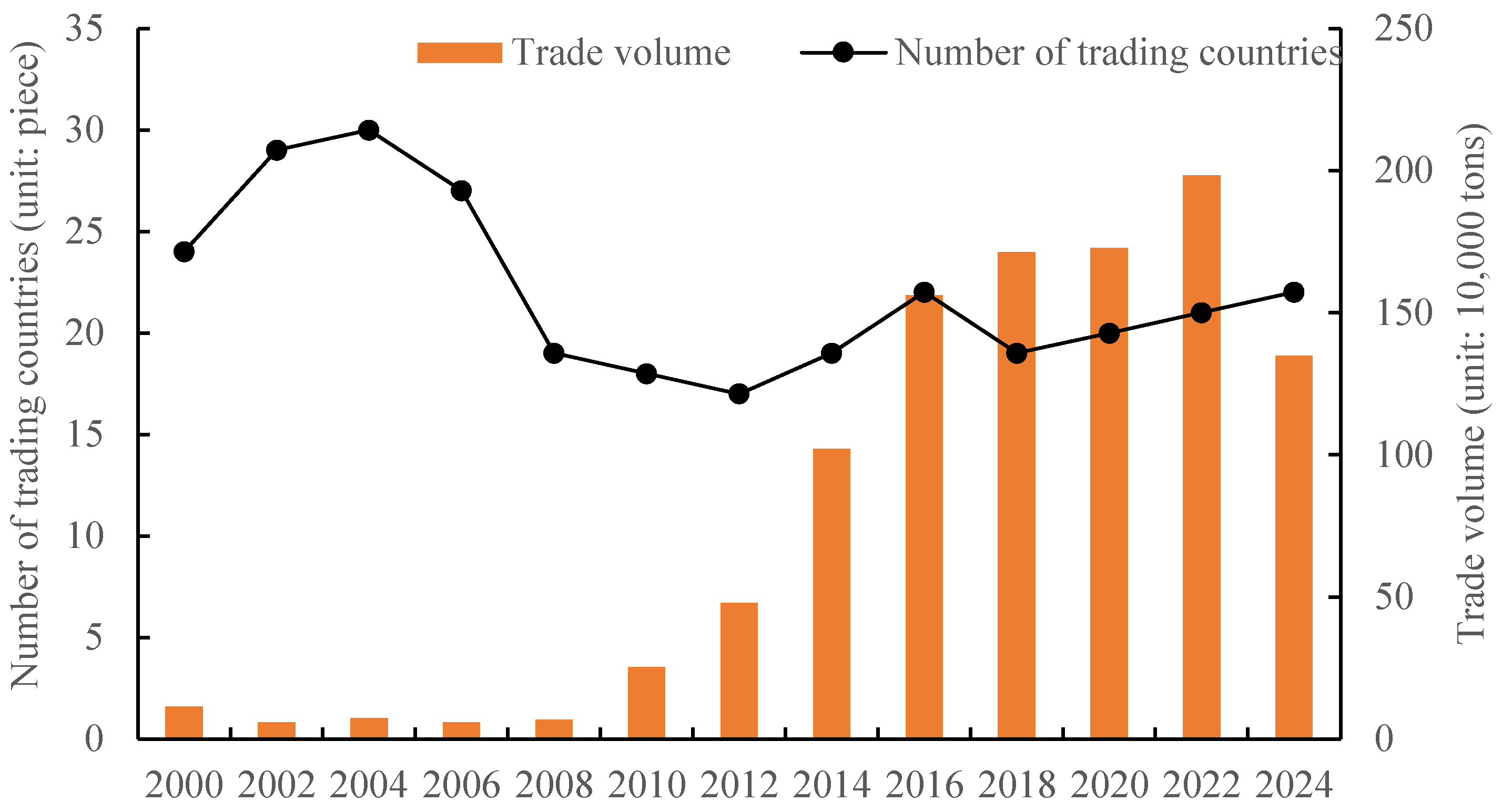

- Analysis of Changes in Trade Volume and Number of Trading Countries for China’s Forage Products

- (2)

- Characteristics of China’s Forage Products Trade Network

- (3)

- Evolutionary Characteristics of China’s Forage Products Trade Network

3.5.2. Security Risks of Forage Products Imports in China

- (1)

- Risks associated with China’s forage products trade supply chain dependence. Firstly, import sources remain highly concentrated. China’s 2024 HHI of 0.51 indicates a significant degree of market concentration and reveals potential dependency risks within its supply chain. China’s forage products import primarily rely on a limited number of countries, notably the United States and Australia, with the United States maintaining a dominant position over an extended period. Since China transitioned to a net forage importer in 2009, the U.S. share decreased significantly from 96.74% to 62.42% by 2019, yet it continued to serve as a core supplier. The 2018 China–U.S. trade friction primarily drove this shift, as the imposition of a 25% tariff directly reduced U.S. market share and prompted China to diversify its import channels. Between 2020 and 2024, the U.S. share rebounded slightly from 68.84% to 69.16%, indicating that China’s high dependency on U.S. high-quality forage persists. Secondly, supply chain disruption risks pose significant threats. Internationally, the Red Sea crisis has heightened transit risks in the Suez Canal [3], declining schedule reliability on China–U.S. shipping routes, and the Pacific hurricane season may easily cause supply delays or interruptions [44]. Domestically, the combination of limited port storage capacity for forage—sufficient for only 10 days of turnover—and heavy reliance on road transport increases vulnerability to supply chain breakdowns during frequent extreme weather events.

- (2)

- Risks related to international market price transmission. As the world’s second-largest forage importer, China imported 1,086,400 tons of alfalfa hay in 2024, with an external dependency exceeding 36.62%. Fluctuations in international market prices directly affect the domestic industry. China’s forage import price fluctuations [14] primarily result from weather-related reductions in forage production in key exporting countries such as the United States [45], which led to a record FOB (Free On Board) price exceeding $450 per ton in 2023. Additionally, tariffs between China and the U.S. [19], along with fluctuations in the RMB exchange rate, have directly contributed to rising domestic alfalfa prices, thereby compressing profit margins for livestock producers.

4. Discussion

4.1. Analysis on the Evolution of the Global Forage Products Trade Network

4.2. Analysis on China’s Forage Products Trade Network and Import Security Issues

4.3. Analysis of the Study’s Innovations and Contributions

4.4. Limitations of the Study

5. Conclusions and Implications

5.1. Conclusions

- (1)

- The global forage products trade network has shown an upward trend in total trade volume, the number of participating countries, and network connectivity. The total volume of global forage products trade increased by 48.17%, primarily driven by growth in the trade of forage products excl. AM&P. The number of countries involved in forage products trade rose by 14.79%. Network connectivity improved significantly, with the node degrees of AM&P and forage products excl. AM&P increasing by 61.34% and 67.16%, respectively. Europe, North America, and Oceania maintained central roles in trade volume, while Africa’s participation remained consistently minimal.

- (2)

- The global forage products trade network exhibited characteristic power–law distribution features. From 2000 to 2024, participation in AM&P and forage products excl. AM&P trade showed periods of both expansion and contraction. The node degree distribution among forage products trading countries revealed a “core-periphery” structure. Core hub countries demonstrated a significant upward trend in node degree, with an average increase of approximately 35.1.

- (3)

- Between 2000 and 2024, the global forage products trade network experienced several key changes. Network density increased, while the average path length decreased. The clustering coefficient, after an initial decline, subsequently rose. Spatially, the network expanded from North America, Oceania, and Asia to include multiple core nodes across North America, Oceania, Europe, Africa, and Asia.

- (4)

- China’s forage products trade volume and the composition of its trading partners exhibited distinct phased characteristics. The trade volume and number of trading partners followed a pattern of “low before high” and “high before low” pattern. China faced significant risks related to supply chain dependency and the transmission of international forage prices.

5.2. Implications for China’s Forage Import Security

- (1)

- To enhance China’s risk resilience, it is essential to identify high-quality foreign forage sources as substitutes. China’s forage imports followed a pattern of more in the early stage and less in the later stage. Concurrently, the number of trading partners decreased, leading to a greater concentration of import sources over time. Although origins of China’s forage imports are diversifying, the United States remains the predominant supplier. These observations yield several implications. First, China should prioritize expanding potential production regions along the Belt and Road Initiative, focusing on developing high-quality alfalfa resources in Central Asian countries such as Kazakhstan and Uzbekistan. Second, strengthening trade relations with African nations that have significant forage potential, such as South Africa and Egypt, is crucial. Additionally, establishing long-term procurement agreements with Argentina and Brazil can leverage their off-season production advantages to offset for domestic seasonal shortages.

- (2)

- Encouraging capable enterprises to expand internationally is vital. The global forage trade network exhibits a stable “core-periphery” structure, with core countries such as the United States and Australia dominating trade flows. As a major importing country, China has experienced sustained growth in forage demand, while long-term contradictions with domestic resource constraints persist. These conclusions support the following implications. Countries like South Africa possess abundant forage resources and high export potential. Therefore, Chinese government agencies should implement policies to support enterprises in establishing forage cultivation and processing facilities in these resource-rich regions of Africa and South America. Such policies could include providing long-term, low-interest loans and tax incentives, along with duty exemptions for domestically produced forage that enterprises re-export. Furthermore, we recommend a three-pronged approach. First, foster overseas industrial alliances to develop integrated planting and processing projects. Second, enhance overseas investment insurance mechanisms to cover political risks and natural disasters. Third, strengthen international cooperation through bilateral agreements to secure long-term land lease rights.

- (3)

- To ensure supply chain security, China must develop a comprehensive “Maritime + Land Transport + Storage” system. The total volume of global forage trade has continued to grow amid increasingly frequent geopolitical conflicts and market price fluctuations. A single maritime logistics chain faces vulnerability to disruption. China’s imports confront the risk of “international forage price transmission,” and the global forage trade heavily relies on maritime transportation. These factors lead us to several important implications. To establish a safer and more efficient forage products trade supply chain, China should construct a tripartite “Maritime + Land Transport + Storage” framework. The maritime corridor should prioritize dedicated express routes from the United States, South America, and South Africa to China, with specialized port infrastructure providing support. The China–Europe Railway Express can enhance the land transport network through dedicated forage shipments (from Spain to Zhengzhou) and Central Asian rail corridors (from Kazakhstan to Urumqi). Simultaneously, it can contribute to developing cross-border road and rail transportation systems. China should implement a strategic reserve system with a three-tier architecture encompassing national, regional, and enterprise levels. Additionally, developing futures products for risk hedging can help mitigate the transmission of international price fluctuations.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Yahdjian, L.; Sala, O.E.; Havstad, K.M. Rangeland ecosystem services: Shifting focus from supply to reconciling supply and demand. Front. Ecol. Environ. 2015, 13, 44–51. [Google Scholar] [CrossRef]

- Bruinsma, J. World Agriculture: Towards 2015/2030: An FAO Study, 1st ed.; Routledge: London, UK, 2017; p. 444. [Google Scholar]

- Joyce, C.B.; Simpson, M.; Casanova, M. Future wet grasslands: Ecological implications of climate change. Ecosyst. Health Sustain. 2016, 2, e01240. [Google Scholar] [CrossRef]

- He, X.; Carriquiry, M.; Elobeid, A.; Hayes, D.; Zhang, W. Impacts of the Russian-Ukraine conflict on global agriculture commodity prices, trade, and cropland reallocation. Choices 2023, 38, 1–8. [Google Scholar]

- Taube, F.; Gierus, M.; Hermann, A.; Loges, R.; Schönbach, P. Grassland and globalization–challenges for north-west European grass and forage research. Grass Forage Sci. 2014, 69, 2–16. [Google Scholar] [CrossRef]

- Kotykova, O.; Babych, M.; Pohorielova, O.; Nadvynychnyy, S. Livestock production losses in Ukraine: Economic damages caused by the war. Agric. Resour. Econ. 2024, 10, 74–100. [Google Scholar] [CrossRef]

- Yang, T.; Dong, J.; Huang, L.; Li, Y.; Yan, H.; Zhai, J.; Zhang, G. A large forage gap in forage availability in traditional pastoral regions in China. Fundam. Res. 2023, 3, 188–200. [Google Scholar] [CrossRef]

- Ministry of Agriculture and Rural Affairs of the People’s Republic of China. Notice on Issuing the “14th Five-Year Plan” National Forage Industry Development Plan. Available online: https://www.moa.gov.cn/govpublic/xmsyj/202202/t20220225_6389705.htm (accessed on 22 September 2025).

- Ministry of Agriculture and Rural Affairs of the People’s Republic of China. Opinions on Implementing the Grain-Saving Action in the Livestock Industry. Available online: https://www.gov.cn/zhengce/zhengceku/202501/content_6996448.htm (accessed on 22 September 2025).

- Wang, J.Y.; Dai, C.; Zhou, M.Z.; Liu, Z.J. Pattern of the global grain trade network and its influencing factors. J. Nat. Resour. 2021, 36, 1545–1556. (In Chinese) [Google Scholar] [CrossRef]

- Li, T.X.; Liu, X.Y.; Wang, R.B.; Zhu, J. Evolution of the global pork trade pattern from 2000 to 2019 and its implications for China: From the perspective of complex trade network analysis. J. Nat. Resour. 2021, 36, 1557–1572. (In Chinese) [Google Scholar]

- Jiang, Z.L.; Wang, J.; Li, J.; Wang, Q. Evolution of the global palm oil trade network and its multi-dimensional driving mechanisms. Econ. Geogr. 2025, 45, 97–108. (In Chinese) [Google Scholar]

- Liu, Y.Z.; Wang, M.L. Analysis of Current Situation and Development Trends of the Global Forage Product Trade Pattern. Pratac. Sci. 2018, 35, 2031–2038. (In Chinese) [Google Scholar]

- Wang, W.; Liang, Y.; Ru, Z.; Guo, H.; Zhao, B. World forage import market: Competitive structure and market forces. Agric. 2023, 13, 1695. [Google Scholar] [CrossRef]

- Li, T.X.; Li, S.J.; Jiang, X.Z. Analysis on the Feasibility of Diversifying China’s Alfalfa Imports from the Perspective of Trade Networks. World Agric. 2023, 1, 66–76. (In Chinese) [Google Scholar]

- Wang, W.J.; Wang, M.L.; Lü, G.W.; Liu, Y.F.; Shi, Z.Z. Alfalfa Trade in the United States: Trends, Experiences, and Insights. Pratac. Sci. 2016, 33, 527–534. (In Chinese) [Google Scholar]

- Wang, W.X.; Ru, Z.; Guo, H.J.; Bai, Y. Analysis of U.S. Market Power in China’s Forage Import Market. Agric. Econ. Manag. 2022, 13, 78–87. (In Chinese) [Google Scholar]

- Wang, W.J.; Wang, M.L.; Jin, B.Y.L.; Liu, Y.F. Research on the International Trade Pattern of China’s Forage Product and Its Insights. Chin. Agric. Sci. 2015, 31, 1–6. (In Chinese) [Google Scholar]

- Wang, Q.B.; Zou, Y. China’s alfalfa market and imports: Development, trends, and potential impacts of the US–China trade dispute and retaliations. J. Integr. Agric. 2020, 19, 1149–1158. [Google Scholar] [CrossRef]

- Long, X.F.; Sun, Y.M.; Zhang, H.; Zhao, X.R.; Yang, C. Analysis of China’s Alfalfa Import Dependence and Outlook for Sino-Western Alfalfa Trade. Chin. Feed. 2025, 36, 138–148. (In Chinese) [Google Scholar]

- Hou, P.; Shen, B.; Kong, X.; Sawadgo, W.; Li, W. 2024 Q1 Agricultural Trade Series: US-China Trade Trends and Opportunities for Alfalfa Exports. Plains Press 2024, 10, 1–13. [Google Scholar]

- Kim, J.D.; Seo, M.; Lee, S.C.; Han, K.J. Review of the current forage production, supply, and quality measure standard in South Korea. J. Korean Soc. Grassl. Forage Sci. 2020, 40, 149–155. [Google Scholar] [CrossRef]

- Gotoh, T.; Nishimura, T.; Kuchida, K.; Mannen, M. The Japanese Wagyu beef industry: Current situation and future prospects—A review. Asian-Australas. J. Anim. Sci. 2018, 31, 933–950. [Google Scholar] [CrossRef]

- Liu, Y.Z.; Wang, M.L.; Jiang, N.H. Analysis of the Trade Pattern and Development Trends of China’s Forage Product. Pratac. Sci. 2018, 35, 2765–2772. (In Chinese) [Google Scholar]

- Diao, C.; Wang, W.X. Import Trade Pattern of China’s Alfalfa and Its Influencing Factors. Pratac. Sci. 2023, 40, 2424–2434. (In Chinese) [Google Scholar]

- Xu, R.; Pu, Z.P.; Han, S.X.; Yu, H.Q.; Guo, C.; Huang, Q.S.; Zhang, Y.J. Managing forage for grain: Strategies and mechanisms for enhancing forage production to ensure feed grain security. J. Integr. Agric. 2025, 24, 2025–2034. [Google Scholar] [CrossRef]

- Zhou, Q.P.; Hu, X.W.; Wang, H.; Chen, Y.J. The important role of oats in safeguarding national food security. Acta Pratacult. Sin. 2024, 33, 171–182. (In Chinese) [Google Scholar]

- Dalin, C.; Konar, M.; Hanasaki, N.; Rodriguez-Iturbe, I. Evolution of the global virtual water trade network. Proc. Natl. Acad. Sci. USA 2012, 109, 5989–5994. [Google Scholar] [CrossRef]

- Li, W.L.; Han, M.Y. Evolution of the trade pattern in the global wind power industry chain and simulation of risk transmission. Res. Sci. 2024, 46, 1822–1835. (In Chinese) [Google Scholar]

- Yang, K.; Guo, Q.; Liu, J.G. Community detection via measuring the strength between nodes for dynamic networks. Phys. A Stat. Mech. Appl. 2018, 509, 256–264. [Google Scholar] [CrossRef]

- Geng, J.B.; Ji, Q.; Fan, Y. A dynamic analysis on global natural gas trade network. Appl. Energy 2014, 132, 23–33. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, H.Y.; Fan, Y. Identification of global oil trade patterns: An empirical research based on complex network theory. Energy Convers. Manag. 2014, 85, 856–865. [Google Scholar] [CrossRef]

- Fischer, C.S.; Shavit, Y. National differences in network density: Israel and the United States. Soc. Netw. 1995, 17, 129–145. [Google Scholar] [CrossRef]

- Watts, D.J.; Strogatz, S.H. Collective dynamics of ‘small-world’ networks. Nature 1998, 393, 440–442. [Google Scholar] [CrossRef]

- Abbas, K.; Han, M.; Xu, D.; Butt, K.M.; Baz, K.; Cheng, J.; Zhu, Y.; Hussain, S. Exploring synergistic and individual causal effects of rare earth elements and renewable energy on multidimensional economic complexity for sustainable economic development. Appl. Energy 2024, 364, 123192. [Google Scholar] [CrossRef]

- Kim, J.; Jaumotte, F.; Panton, A.J.; Schwerhoff, G. Energy security and the green transition. Energy Policy. 2025, 198, 114409. [Google Scholar] [CrossRef]

- Kotowski, M.; Kotowska, D.; Biró, M.; Babai, D.; Sharifian, A.; Szentes, S.; Luczaj, L.; Molnár, Z. Change in European forage and fodder plant indicator sets over the past 250 years. Rangel. Ecol. Manag. 2023, 88, 159–173. [Google Scholar] [CrossRef]

- Baath, G.S.; Northup, B.K.; Rocateli, A.C.; Gowda, P.H.; Neel, J.P. Forage potential of summer annual grain legumes in the southern great plains. Agron. J. 2018, 110, 2198–2210. [Google Scholar] [CrossRef]

- Inwood, S.E.E.; Bates, G.E.; Butler, D.M. Forage performance and soil quality in forage systems under organic management in the southeastern United States. Agron. J. 2015, 107, 1641–1652. [Google Scholar] [CrossRef]

- Daniel, J.L.P.; Bernardes, T.F.; Jobim, C.C.; Schmidt, P.; Nussio, L.G. Production and utilization of silages in tropical areas with focus on Brazil. Grass Forage Sci. 2019, 74, 188–200. [Google Scholar] [CrossRef]

- Balehegn, M.; Ayantunde, A.; Amole, T.; Njarui, D.; Nkosi, B.D.; Müller, F.L.; Meeske, R.; Tjelele, T.J.; Malebana, I.M.; Madibela, O. Forage conservation in sub-Saharan Africa: Review of experiences, challenges, and opportunities. Agron. J. 2022, 114, 75–99. [Google Scholar] [CrossRef]

- Sharma, N.; Farooq, F.; Srivastava, H.; Saini, H.; Nanda, D.; Mehta, S.; MeCarty, J.S.; Attri, M.; Kumar, N. Perennial Grass-Legume Integration: A Sustainable Approach to Fodder Production. Grass Forage Sci. 2025, 80, e12727. [Google Scholar] [CrossRef]

- van Niekerk, H.N. The dynamics of the South African lucerne hay industry. Agrekon 2024, 63, 257–276. [Google Scholar] [CrossRef]

- Li, L.; Xiong, X.; Yuan, H. Ships’ response strategies to port disruptions caused by hurricane. Ocean Coast. Manage. 2022, 227, 106275. [Google Scholar] [CrossRef]

- Poděbradská, M.; Wylie, B.K.; Hayes, M.J.; Bathke, D.J.; Bayissa, Y.A.; Boyte, S.P.; Brown, J.F.; Wardlowet, B.D. Using seasonal climate scenarios in the ForageAhead annual forage production model for early drought impact assessment. Ecosphere. 2023, 14, e4496. [Google Scholar] [CrossRef]

- Hansen, P. Hokkaido Dairy Farm: Cosmopolitics of Otherness and Security on the Frontiers of Japan; State University of New York Press: Albany, NY, USA, 2024. [Google Scholar]

- Charmley, E.; Gardiner, C.; Watson, I.; O’Reagain, J. Reimagining the northern Australian beef industry; review of feedbase opportunities for growth. Rangeland J. 2025, 47, RJ25009. [Google Scholar] [CrossRef]

- Wang, R.G.; Xu, W.P. Analysis on the development characteristics and trends of China’s alfalfa industry. J. Agric. Sci. Technol. 2021, 23, 7–12. (In Chinese) [Google Scholar]

| HS Code | Categories of Forage Products |

|---|---|

| 121410 | Alfalfa meal and pellets |

| 121490 | Swedes, mangolds, fodder roots, hay, lucerne “alfalfa”, clover, sainfoin, forage kale, lupines, vetches and similar forage products, whether or not in the form of pellets (excl. lucerne “alfalfa” meal and pellets) |

| Network Type | Global Metrics | 2000 | 2004 | 2008 | 2012 | 2016 | 2020 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|

| Forage products excl. AM&P | Directed weighted network | Network density | 0.03 | 0.04 | 0.03 | 0.04 | 0.04 | 0.05 | 0.06 |

| Average clustering coefficient | 0.30 | 0.33 | 0.30 | 0.36 | 0.38 | 0.37 | 0.40 | ||

| Average path length | 2.96 | 3.03 | 3.02 | 2.88 | 2.78 | 2.69 | 2.57 | ||

| Undirected weighted network | Network density | 0.05 | 0.06 | 0.06 | 0.07 | 0.06 | 0.08 | 0.09 | |

| Average clustering coefficient | 0.43 | 0.49 | 0.46 | 0.56 | 0.54 | 0.52 | 0.52 | ||

| Average path length | 2.78 | 2.60 | 2.62 | 2.49 | 2.56 | 2.41 | 2.39 | ||

| AM&P | Directed weighted network | Network density | 0.02 | 0.02 | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 |

| Average clustering coefficient | 0.28 | 0.29 | 0.28 | 0.31 | 0.34 | 0.32 | 0.35 | ||

| Average path length | 3.10 | 3.09 | 2.99 | 2.99 | 2.89 | 2.91 | 3.01 | ||

| Undirected weighted network | Network density | 0.04 | 0.04 | 0.05 | 0.06 | 0.05 | 0.05 | 0.07 | |

| Average clustering coefficient | 0.43 | 0.42 | 0.44 | 0.50 | 0.44 | 0.42 | 0.49 | ||

| Average path length | 3.15 | 3.00 | 2.84 | 2.75 | 2.79 | 2.72 | 2.65 |

| Comparison of Centrality Metrics | 2000 | 2010 | 2020 | 2024 |

|---|---|---|---|---|

| Directed out-strength vs. undirected strength | 0.72 ** | 0.738 ** | 0.649 ** | 0.511 ** |

| Directed out-degree vs. undirected degree | 0.825 ** | 0.914 ** | 0.86 ** | 0.866 ** |

| Product Categories | Year | 2000 | 2004 | 2008 | 2012 | 2016 | 2020 | 2024 |

|---|---|---|---|---|---|---|---|---|

| Forage product | The number of actual trading partners | 123 | 133 | 137 | 137 | 148 | 141 | 150 |

| The total number of potential trading countries | 189 | 191 | 192 | 193 | 193 | 193 | 193 | |

| The proportion of the number of trading partners | 65% | 70% | 71% | 71% | 77% | 73% | 78% | |

| AM&P | Importing countries/regions | 92 | 101 | 105 | 102 | 116 | 114 | 110 |

| Exporting countries/regions | 39 | 52 | 56 | 53 | 54 | 56 | 50 | |

| Forage products excl. AM&P | Importing countries/regions | 113 | 116 | 131 | 136 | 140 | 137 | 138 |

| Exporting countries/regions | 79 | 80 | 86 | 79 | 83 | 83 | 77 |

| Year | Node Degree | AM&P | Forage Products Excl. AM&P |

|---|---|---|---|

| 2000 | Average value | 4.94 | 8.19 |

| Top three countries | Australia 30 | Australia 61 | |

| U.S. 26 | Germany 49 | ||

| Italy 26 | Italy 45 | ||

| 2024 | Average value | 7.97 | 13.69 |

| Top three countries | The Netherlands 74 | The Netherlands 83 | |

| Italy 51 | Germany 82 | ||

| Spain 44 | USA 76 |

| Product Categories | 2000 | 2010 | 2020 | 2024 | ||||

|---|---|---|---|---|---|---|---|---|

| −r *** | R2 | −r *** | R2 | −r *** | R2 | −r *** | R2 | |

| AM&P | −8.129 | 0.969 | −0.762 | 0.946 | −0.711 | 0.948 | −0.667 | 0.945 |

| Forage products excl. AM&P | −0.652 | 0.940 | −0.593 | 0.938 | −0.522 | 0.907 | −0.528 | 0.912 |

| 2000 | 2010 | 2020 | 2024 | ||||

|---|---|---|---|---|---|---|---|

| Node degree | Node strength | Node degree | Node strength | Node degree | Node strength | Node degree | Node strength |

| Australia | Japan | Germany | USA | Italy | USA | Italy | USA |

| USA | Australia | USA | Japan | Spain | Japan | Spain | Japan |

| Germany | USA | Italy | Australia | Germany | China | USA | South Korea |

| France | South Korea | Australia | South Korea | Belgium | UAE | The Netherlands | China |

| Italy | Spain | Belgium | UAE | USA | South Korea | Germany | Australia |

| The Netherlands | France | France | Spain | The Netherlands | Australia | Belgium | Canada |

| Canada | Saudi Arabia | Spain | Canada | France | Spain | France | Spain |

| Spain | Italy | The Netherlands | France | Poland | Saudi Arabia | Poland | Saudi Arabia |

| UK | The Netherlands | Poland | China | UK | Italy | UK | UAE |

| Belgium | UAE | Canada | Germany | Australia | Canada | Canada | The Netherlands |

| 2024 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Countries | USA | Australia | Spain | Canada | France | Italy | The Netherlands | Romania | Saudi Arabia | Egypt |

| Node out strength | 4,090,787 | 1,434,881 | 739,404 | 661,159 | 383,630 | 284,391 | 220,391 | 191,175 | 157,773 | 103,720 |

| Countries | Japan | China | South Korea | Saudi Arabia | UAE | USA | The Netherlands | Switzerland | Canada | Germany |

| Node out strength | 1,855,832 | 1,343,952 | 1,195,665 | 863,816 | 529,292 | 353,610 | 276,991 | 192,375 | 139,106 | 111,352 |

| Year | Node Degree | AM&P | Forage Products Excl. AM&P |

|---|---|---|---|

| 2000 | Global average | 4.94 | 8.19 |

| China | 5 | 26 | |

| 2024 | Global average | 7.97 | 13.69 |

| China | 9 | 19 |

| 2000 | 2006 | 2012 | 2018 | 2024 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Ranking | country/region | Share/% | country/region | Share/% | country/region | Share/% | country/region | Share/% | country/region | Share/% |

| 1 | Canada | 44.84 | U.S. | 48.74 | U.S. | 84.26 | U.S. | 67.95 | U.S. | 69.16 |

| 2 | U.S. | 37.09 | Australia | 29.32 | Australia | 11.98 | Australia | 17.17 | Australia | 16.79 |

| 3 | Australia | 16.03 | Canada | 2.44 | Spain | 2.29 | Spain | 11.76 | Spain | 7.82 |

| Total | 97.96 | 80.5 | 98.53 | 96.88 | 93.77 | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, S.; Wei, Z.; Cui, C.; Wang, M. Evolution of the Global Forage Products Trade Network and Implications for China’s Import Security. Agriculture 2025, 15, 2073. https://doi.org/10.3390/agriculture15192073

Zhang S, Wei Z, Cui C, Wang M. Evolution of the Global Forage Products Trade Network and Implications for China’s Import Security. Agriculture. 2025; 15(19):2073. https://doi.org/10.3390/agriculture15192073

Chicago/Turabian StyleZhang, Shuxia, Zihao Wei, Cha Cui, and Mingli Wang. 2025. "Evolution of the Global Forage Products Trade Network and Implications for China’s Import Security" Agriculture 15, no. 19: 2073. https://doi.org/10.3390/agriculture15192073

APA StyleZhang, S., Wei, Z., Cui, C., & Wang, M. (2025). Evolution of the Global Forage Products Trade Network and Implications for China’s Import Security. Agriculture, 15(19), 2073. https://doi.org/10.3390/agriculture15192073