Since the end of last century and the beginning of this century, agricultural insurance has been widely implemented as one of the tools of agricultural risk management. The impact of agricultural insurance on the crop planting structure of farmers has become a research hotspot in the theoretical and practical circles of agricultural insurance in the US and Europe. In recent years, along with the gradual piloting of agricultural weather index insurance around the world, some scholars, by using randomized intervention experiments, have studied the causal relationship between index insurance and farmers’ planting structure.

Scholars agree that insurance will reduce the risk of planting crops and encourage farmers to change their planting structure. Specifically, agricultural insurance will encourage farmers to reduce areas with lower insurance coverage of crops and increase areas with higher insurance coverage, which will lead to changes in the agricultural production structure and even household income structure. Turvey (1992) found that before government subsidies for crop insurance premiums, the proportion of acreage planted in corn and soybeans was 6% and 60%, respectively, and after financial subsidies, it was 60% for corn and 40% for soybeans; therefore, premium subsidization encouraged the production of high-risk crops [

3]. Young, Vandeveer, and Schnepf (2001) studied how insurance affects farm production in seven regions and eight major field crops in the US. Total planted acreage to major field crops would be about 0.4% higher with government-subsidized crop insurance than in the absence of any insurance program, or about 960,000 acres, with wheat and corn accounting for about 75% of the additional acreage [

4]. Barnett et al. (2002), using cotton production in the Mississippi River region of the US as an example, found that a 1% increase in expected returns is associated with a 0.036% increase in cotton acreage [

5]. Goodwin, Vandeveer, and Deal (2004) found that crop insurance significantly affects farmers’ crop acreage allocation, but the effect is small and varies by crop and region; for example, a 30% reduction in insurance premiums would result in a 1% increase in acreage for barley in the northern Great Plains and a 0.28% to 0.49% increase in corn in the heartland [

6]. Seo et al. (2005) found that these federal risk management programs increased optimal cotton acreage by 94% to 144% and decreased sorghum acres by up to 50% [

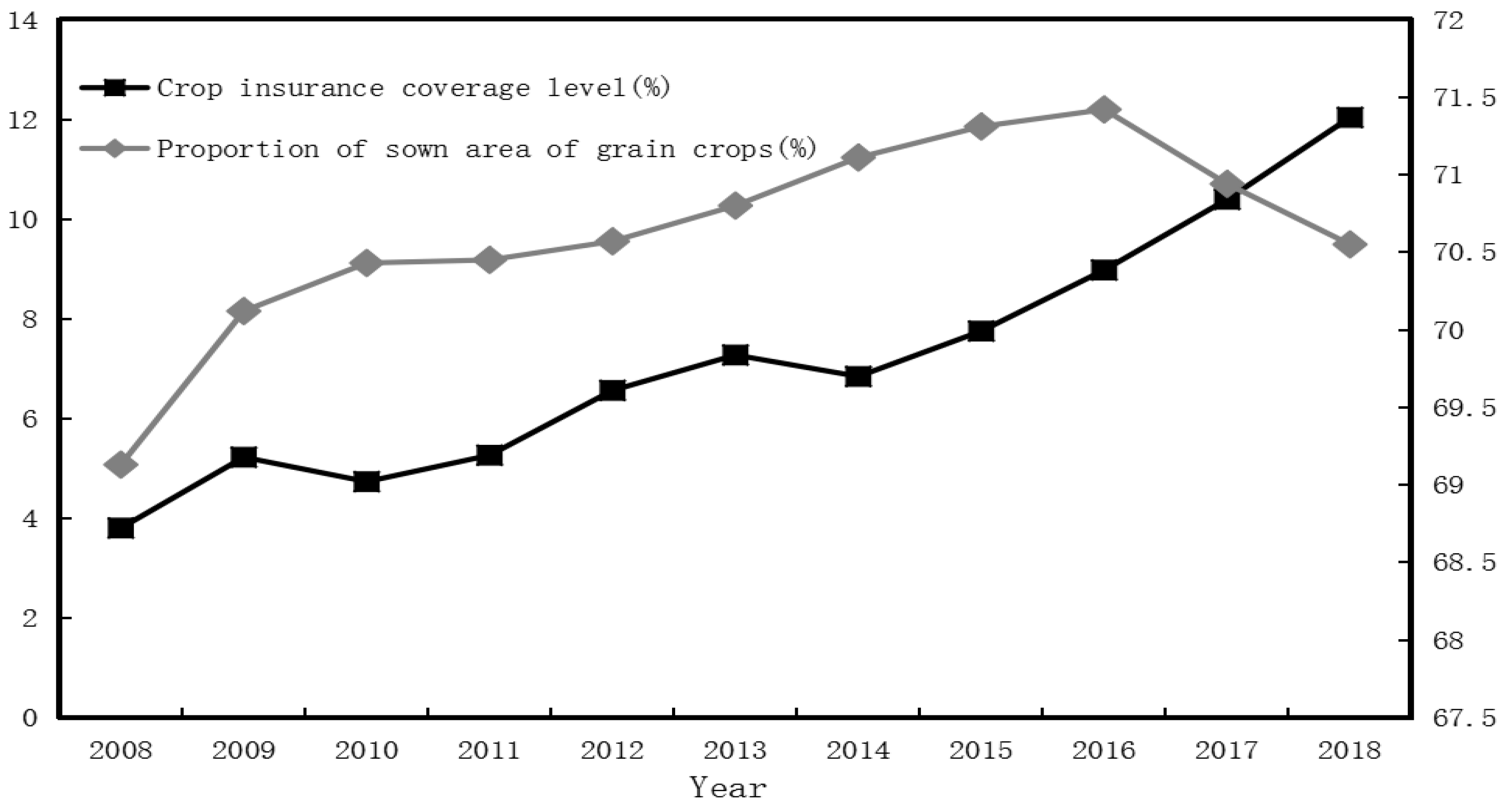

7]. Zhang et al. (2006) found that only 2.3% of farmers increased their grain area after participating in rice insurance in China (Shanghai) due to the low level of coverage [

8]. O’Donoghue, Roberts, and Key (2009) found that Federal Crop Insurance significantly affects farmers’ diversification [

9] and that it leads to more specialization, although to a lesser extent [

10]. Mobarak and Rosenzweig (2012), using India as an example, found that in an experimental setting, rice farmers who were offered the index insurance product were more likely to subsequently plant a portfolio of rice varieties [

11]. Capitanio et al. (2014) used a wheat and tomato farm in Puglia, Italy, as an example, and the results showed that under the current crop insurance programs, tomato production was expected to expand, whereas the opposite was true for wheat production. However, as farmer risk aversion increased, the optimal tomato acreage decreased, and optimal wheat acreage increased [

12]. In terms of theoretical analysis, Zong and Zhou (2014) point out that agricultural insurance affects farmers’ production behavior through the level of income substitution and the degree of insurance compensation within the same production behavior and between different production behaviors and that the current level of agricultural insurance income compensation satisfies the income risk diversification expectations of most farmers, thus having a solidifying effect on farmers’ production behavior of major crops [

13]. Elabed and Carter (2015) randomly distributed the possibility of being insured and feeling insured to a group of cotton cooperatives in Mali by giving them access to a microinsurance contract and found that offering insurance resulted in a 15% increase in the area in cotton [

14]. Cai (2016), through a natural experiment, studied the impact of tobacco insurance on farmers’ production in Jiangxi Province, China, and found that households tend to increase tobacco production by approximately 16% once they are insured [

15]. Xu and Sun (2016) concluded that the current agricultural insurance in China has a role in encouraging farmers to expand their sown area to increase agricultural income, and the change in area is significant. However, the lack of coverage leads to the participation in insurance and has little effect on enhancing farmers’ willingness to grow grain crops [

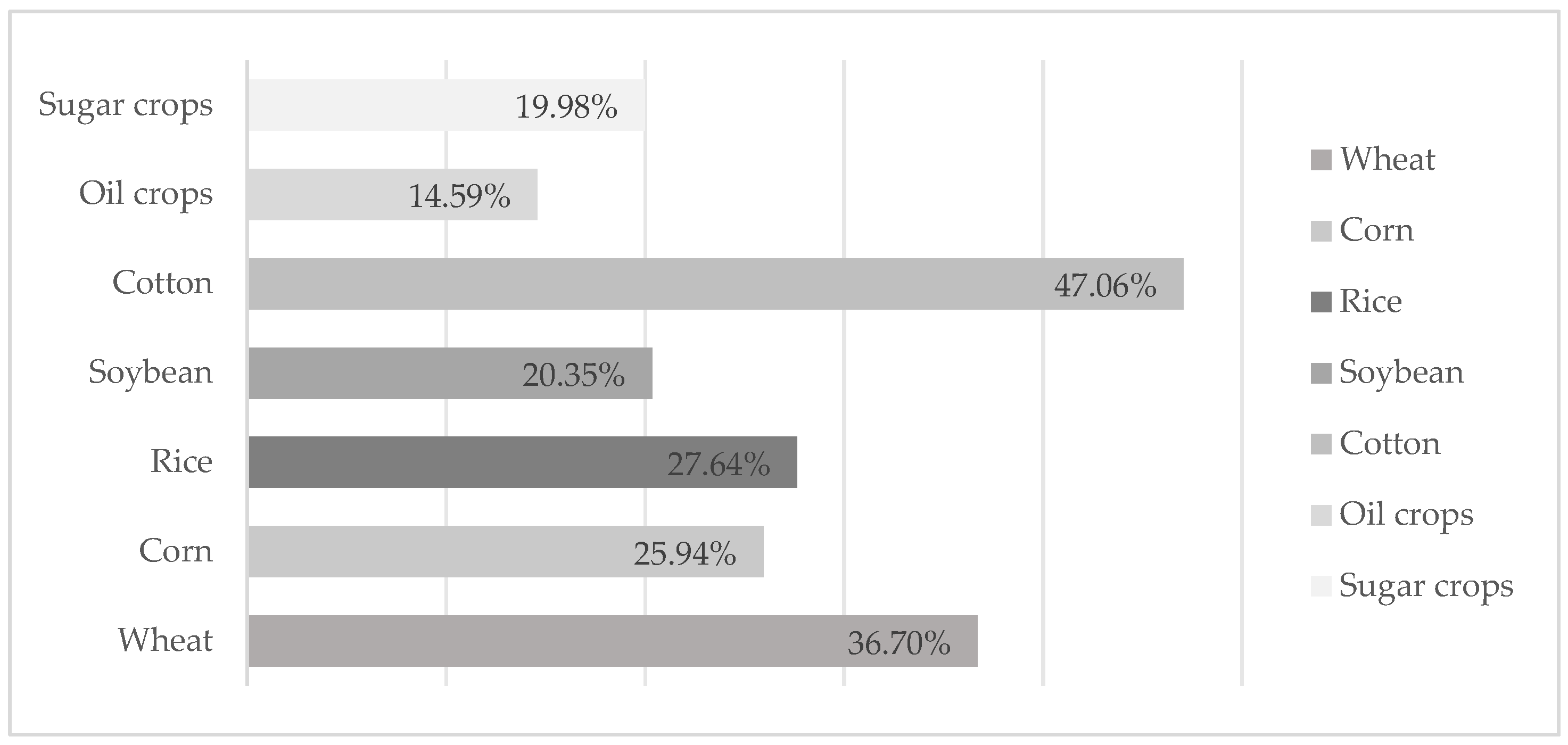

16]. Liu et al. (2016) found that agricultural insurance can solidify farmers’ production behavior and planting structure to a certain extent and trigger a shift in planting structure from low to high insurance items; especially, the adjustment trend of soybean and corn is significant [

17]. Claassen et al. (2017) concluded that crop income insurance increased the acreage of cropland devoted to continuous corn and continuous soybeans by 4.07% and 3.29%, whereas less land was planted with continuous wheat, which decreased by 14.4% [

18]. Deryugina and Konar (2017) found that farmer participation in insurance led to an expansion in the acreage of the more water-consuming cotton crop, with a 1% increase in insured crop acreage leading to a 0.624% increase in cotton acreage, or 95,602 acres [

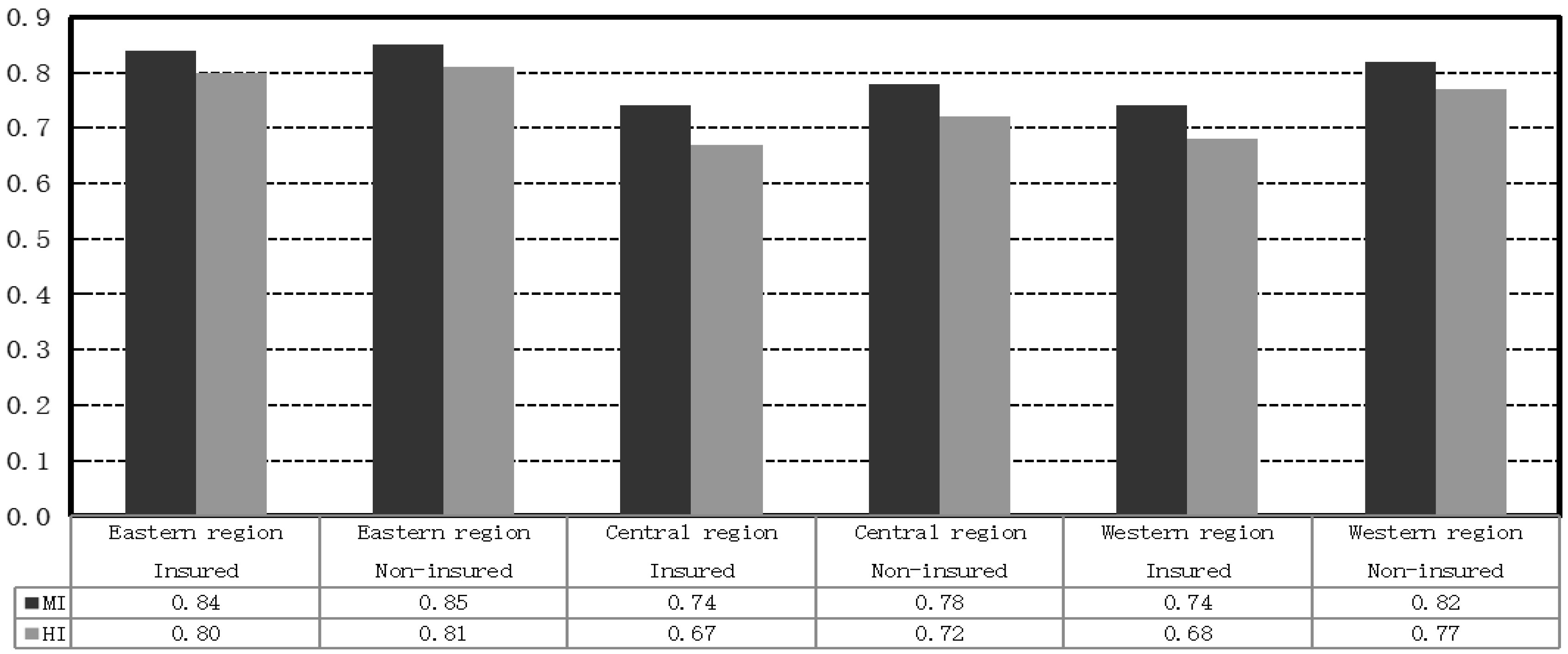

19]. Fu and Liang (2017) show that agricultural insurance significantly enhances farmers’ tendency to specialize and weakens diversification, and this effect is obviously characterized by lag and regional heterogeneity [

20]. Yu, Smith, and Sumner (2018) argued that crop insurance premium subsidies affect patterns of crop acreage for two reasons. First, the direct profit effect. By holding insurance coverage constant, premium subsidies directly increase expected profit, which encourages more acreage of insured crops. Second, the indirect coverage effect. Premium subsidies encourage farms to increase crop insurance coverage. With more insurance coverage, farms obtain more subsidies, and farm revenue becomes less variable as indemnities offset revenue shortfalls, so the acreage of insured crops likely increases. A 10% increase in the premium subsidy causes a 0.43% increase in the acreage of a crop in a county [

21]. Zhang et al. (2019) point out that different agricultural insurance premium subsidy standards can be provided for grain crops and economic crops, so as to guide farmers to adjust their crop structure [

22]. Fang et al. (2019) found that the pilot of “Insurance + Futures” can effectively improve farmers’ motivation to grow grain [

23]. Based on the microdata of 10,270 households in the Third China Agricultural Census, Ren and Yang (2020) found that, after participating in insurance, farmers with an operating area of fewer than 10 acres mostly chose to adjust the area, while those with 10–50 acres chose to adjust the structure. Farmers show “adventurous” production decisions for economic crops and relatively “conservative” decisions for grain crops; agricultural insurance participation will make small farmers’ planting structure tend to be “non-grain production” and promote the specialization of economic crops [

24]. In addition, some scholars have analyzed climate change as an influencing factor and found that farmers will adjust their planting behavior in response to climate change. Cole, Giné, and Vickery (2013) found that the provision of rainfall insurance induces farmers to shift production towards higher-return but higher-risk cash crops by 15%, particularly among more educated farmers [

25]. Karlan et al. (2014) found that participation in rainfall index insurance in Ghana led to expanding the sown area of farm crops; insured farmers shifted the mix of their crops to highly rainfall-sensitive maize and increased the share of their land planted with maize by 9 percentage points [

26]. Hill et al. (2019) conducted a randomized controlled trial in Bangladesh and found that during the aman rice growing season (monsoon season, June to mid-November each year), farmers’ participation in index insurance increased by 20% in the total rice area under cultivation [

27]. Que et al. (2022) used Mann–Kendall and Sen slope tests to find how rice farmers adapt production to climate change. Three adaptation strategies are frequently employed in the Nong Cong district: adjusting the seasonal calendar to alter transplanting and harvesting timing, increasing fertilizer and pesticide application, and changing to fast-growing varieties [

28]. Therefore, in the future climate change scenario, farmers’ planting specialization behavior would be affected by changes in meteorological patterns.

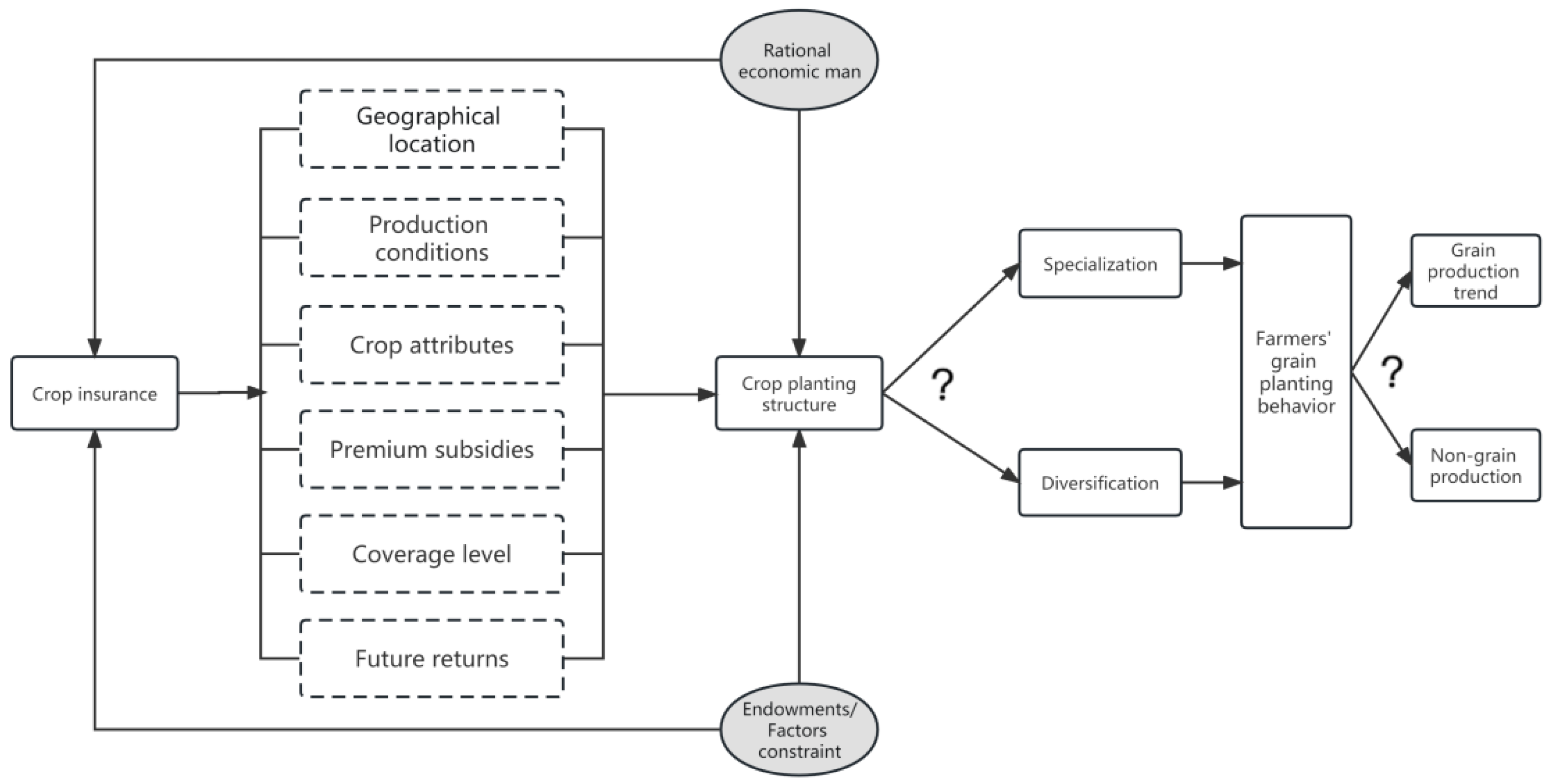

Based on the above incomplete literature review, scholars are more concerned about how agricultural insurance participation affects planting structure and generally believe that agricultural insurance will induce farmers to adjust their crop planting structure, especially to expand the planting area of insurable or high subsidy rate crops, i.e., farmers tend to specialize their agricultural production. The research methods mostly combine theoretical analysis and empirical tests, and most of the research subjects chose the US because it has more than 80 years of agricultural insurance history and has abundant micro farm or plot and county-level time series or panel data, which can allow academics and industry to conduct in-depth and detailed research. Although Chinese scholars’ research has theoretical analysis and empirical tests, they mostly use macro-provincial time series or panel data, and there are few analyses based on micro-household surveys in China.

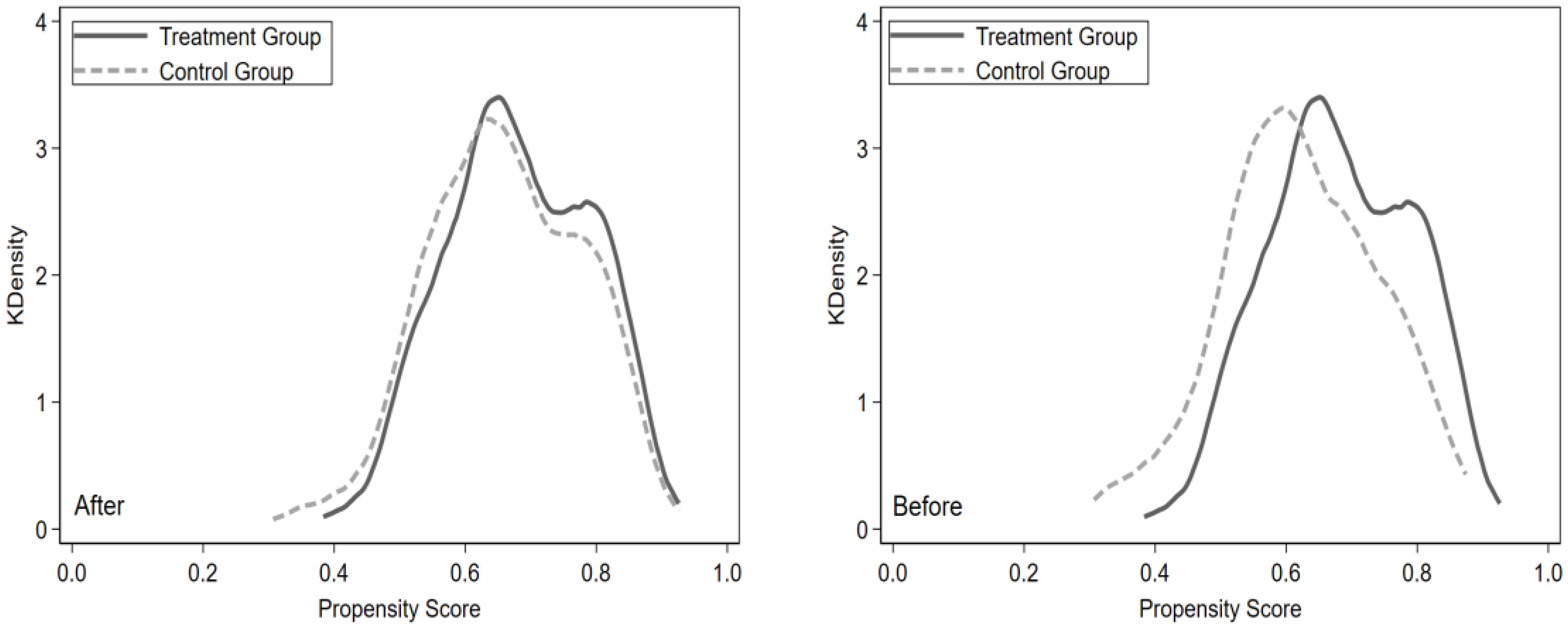

This paper is dedicated to supplementing the above aspects: first, to analyze theoretically the influence mechanism of agricultural insurance participation on farmers’ planting behavior and provide an explanation for the influence of agricultural insurance policy on farmers’ production behavior. Second, to distinguish the influence of agricultural insurance on farmers’ planting behavior as diversification or specialization and further analyze whether it is grain production trend or non-grain production. This discussion is of great significance because planting specialization is the main feature of modern agricultural production, and grain-oriented planting is conducive to ensuring national food security. Third, the empirical evidence is collected through field survey data, and the possible endogeneity of the model is fully considered to ensure the reliability of the research findings. Therefore, the research results of this paper can further expand the current analysis of the micro role of agricultural insurance in China’s theoretical and practical circles and integrate agricultural insurance policy and agricultural structural adjustment, especially farmers’ grain growing behavior. It can enrich research on the impact of China’s agricultural insurance policies on farmers’ production behavior. Fourth, the existing literature mostly demonstrates the effect of yield insurance or income insurance on farmers’ production behavior. We analyze the impact of materialized cost insurance on farmers’ production behavior. In terms of application value, in the context of the in-depth promotion of China’s agricultural supply-side structural reform and the increasing importance of comprehensively improving the ability to guarantee national food security, after more than 10 years of exploration and accumulation, China’s agricultural insurance is transforming into high-quality development. This study investigates whether materialized cost insurance at low coverage levels can lead farmers to change their planting behavior. It is different from existing scholars’ research based on output or income insurance; this insurance policy has Chinese characteristics. The results can provide convincing theoretical and empirical evidence for further optimization of the agricultural insurance system, as well as decision support for the government to formulate policies to strengthen agricultural insurance to help the development of agricultural modernization.