1. Introduction

Following the rapid development of the Chinese economy, consumer consumption levels are improving and the demands of consumers for high-quality, fresh products are gradually increasing [

1]. However, food fraud may occur for financial gain [

2,

3], which leads to a series of foodstuff security incidents, and this has seriously dampened consumers’ confidence in high-quality, fresh products [

4,

5,

6]. This will damage the brand reputation, and even damage the performance, of the supply chain. According to statistics, food fraud would bring the loss hundreds of millions of pounds of food business and consumers in the UK [

7]. In China, during the 8 years period from 2004 to 2012, a total of 2489 food safety incidents were exposed, and the loss cause was difficult to estimate [

8].

To solve food safety and fraud problems, anti-counterfeiting traceability technology was adopted by some enterprises (for instance, the Olive Oil Tracking of Ambrosus and the Wine Blockchain of EZ Labs had also used blockchain-based traceability systems to trace their products [

9]). In the traditional environment, anti-counterfeiting traceability systems (based on the Internet of Things, radio frequency identification, barcode recognition, and so on) have played a very good role in solving information asymmetry and accelerating product circulation. However, in the traditional environment, the data storage model of an anti-counterfeiting traceability system was usually a centralized data storage model [

10]. At the same time, the data are stored by the stakeholders of the supply chain. When the data is unfavorable to the stakeholders, there is a risk of data tampering.

Therefore, to meet consumers’ demands for information transparency and inquiry convenience about fresh products, stakeholders need a real, reliable, and credible traceability system to provide this related information. Moreover, to ensure the accuracy of the market feedback data and prevent some sellers from fleecing goods, producers also need a reliable and credible traceability system. Blockchain, as a shared database, has the nature of being unforgeable, able to conduct all traces, traceable, open, and transparent. A blockchain-based anti-counterfeiting traceability system (hereafter, blockchain-based ACTS) could effectively improve the data credibility and trust between organizations [

11] and consumers, and solve the aforementioned problems. Meanwhile, it could reinforce consumers’ confidence in food goods [

12].

Some fresh producers and retailers have begun to use blockchain-based ACTS, including Heilongjiang Agriculture Company Limited (Heilongjiang, China) (producer), Walmart (Bentonville, AR, USA) (retailer), and Tyson Food (Springdale, AR, USA) [

13]. In addition, blockchain-based ACTS applications in the JD Zhizhen chain and Alibaba Ant chain have proven that they can help to improve the repeat purchase rate and product circulation rate [

14]; but whether stakeholders invest in a blockchain-based ACTS depends on the unreliability of the important information. Therefore, for many fresh producers and retailers, before they adopt a blockchain-based ACTS, they want to know the investment conditions about the blockchain-based ACTS and how to coordinate the supply chain after adopting a blockchain-based ACTS, and in this process, the unreliability of the freshness information is an important factor because the freshness information is important for consumers’ purchasing decisions.

The related documents focus on: (1) appliances of the blockchain-based traceability system in a fresh supply chain; and (2) investment decisions and the coordination of a fresh food supply chain considering blockchain-based ACTS inputs.

- ①

Appliances of the blockchain-based traceability system in a fresh supply chain.

The term blockchain first appeared in 2008 [

15,

16]. Discussions about blockchain-based traceability systems mainly concentrate on technical aspects, adoption factors, and so on. Effects of the applications of a blockchain-based traceability system on a chain member’s decision strategies are of little concern.

Studies about blockchain-based traceability have mainly focused on technical aspects, for instance, some studies have combined blockchain and RFID (NFC) to design a traceability system [

17,

18,

19]. However, this system cannot solve the expandability problem of blockchain. Therefore, Salah et al. [

20] put forward a new traceability framework based on Ethereum blockchain and smart contracts in a soybean supply chain. To solve food safety and contamination issues, Rejeb et al. [

21] discussed a blockchain-based traceability system based on IoT, Blockchain, and HACCP. This blockchain-based traceability system could solve the deficiencies of the centralized traceability system; however, it had some storage issues. In order to improve the anti-counterfeiting and quality assurance level of agricultural products and improve the reliability, scalability, and accuracy of the information from the traceability system in their study, Tsang et al. [

22] added the fuzzy logic method in their traceability system, which was composed of blockchain and IoT. In addition, to resolve the storage problems of the traceability system, cloud technology and storage rules were discussed [

23,

24]. However, most of these traceability systems couldn’t meet the demands of management and traceability in an agri-food/fresh supply chain, and then Chen et al. [

25] proposed a blockchain-based traceability framework and used a deep reinforcement learning method to optimize the production and storage decisions of a fresh supply chain.

In addition, some documents have assessed the application challenges of a blockchain-based traceability system in a food supply chain [

26,

27]. Some documents have focused on the adoption behaviors of blockchain technology in a food supply chain, such as, Kamble et al. [

28] and Kamble et al. [

29], which used a technology acceptance model to do analyses. Based on a new method called TISM and MICMAC analysis, Tayal et al. [

30] obtained the key success factors of a food supply chain by using blockchain technology (including transparency, fraud, etc.). However, in a wine supply chain, Saurabh et al. [

31] found that the important factors influencing blockchain adoption were dis-intermediation, traceability, and so on. Kamble et al. [

28] also proved that traceability was the important factor for a food supply chain to decide to use blockchain technology. In addition, there have been other efforts to study this subject, such as Kristoffer et al. [

32] and Kamble et al. [

29].

In fact, some practical application cases have also been explored, such as when Bumble Bee Foods adopted a blockchain-based traceability system to track their fresh fish. Consumers could gain a fish’s information from ocean to table [

33]. Maersk, as a logistics service provider, also adopted blockchain to help its chain members to track their products [

34]. JD, as a large e-commerce retailer from China, not only developed and used a blockchain-based traceability system for its self-operated goods, but also provided a blockchain-based ACTS for other retailers and producers in their platform. A report about the application survey of the blockchain-based ACTS from JD showed that, compared with the traditional traceability system, the blockchain-based traceability system could help to improve the repeat purchase rate and product circulation rate [

14]. A survey about the Alibaba Ant chain gained similar results.

- ②

Investment decisions and the coordination of a fresh food supply chain considering blockchain-based ACTS inputs.

Our job is also related to the investment decisions and coordination of a fresh food supply chain in a traditional environment and in a blockchain environment.

In a traditional environment, based on game theory, efforts about the effects of product traceability on the operating decisions of a fresh supply chain are relatively abundant. For instance, Pouliot et al. [

35] thought that traceability had an important impact on market demand. Considering the relationships between traceability and product recall, some studies have discussed the benefits and coordination strategies of a fresh supply chain [

36,

37]. Saak et al. [

38] discussed why and when decision makers invested in a traceability system and whether they should save the product origin information or not. If there was no proper management mechanism, the adoption of a traceable product labelling system might not achieve the desired effects [

39]. In addition, Aiello et al. [

40] evaluated the expected values and profits of a fresh supply chain after implementing an RFID-based traceability system. Hongyan et al. [

41] proposed a revenue-sharing contract to coordinate the supply chain after using a traceability system. They thought that the strict tracking regulation would be more effective than subsidies in improving the supply chain’s tracking ability [

42].

In a blockchain environment, based on game theory, the research achievements are few. Some related studies are as follows: Pedersen et al. [

43] proposed a ten-step decision method to decide when to adopt blockchain for an organization. Considering a supply chain with one producer and one retailer, Hayrutdinov et al. [

44] studied decision makers’ investment decision problems considering the lifecycle information-sharing effort, and then a cost-sharing contract, a revenue-sharing contract, and a cost- and revenue-sharing contract were put forward to coordinate the supply chain. They thought that the cost- and revenue-sharing contract could help chain members gain more benefits. In addition, based on a three-stage supply chain with one retailer, one supplier, and one manufacturer, Fan et al. [

45] discussed the investment decision problems of blockchain considering consumers’ traceability awareness and the costs spent on the blockchain technology, and then used a revenue-sharing contract to coordinate the supply chain. However, they did not focus on a fresh supply chain. Almost at the same time, focusing on a fresh supply chain and considering the changes of consumer perceptions on the quality and safety of products before and after adopting blockchain, Pan et al. [

6] discussed decision makers’ investment decision issues about the information service based on blockchain and big data, and then adopted a cost-sharing and revenue-sharing contract to achieve supply chain coordination. In the blockchain environment, based on a three-stage supply chain with one high-quality fresh product supplier, one e-retailer, and one logistics provider, Wu et al. [

46] discussed pricing rules considering the consumer preference for traceability information and traceability cost, and then a two-part tariff contract was proposed to coordinate the supply chain. They thought that using a blockchain-based traceability system was not always the best choice for decision makers.

Based on the above discussions, it can easily be understood that: (1) Applications of product traceability will help chain members reduce the unreliability of the freshness information; however, previous studies overlooked these in the blockchain environment. (2) Although some investigators discussed the investment decisions of a blockchain-based system, they overlooked the purchase situation of the ACTS. (3) Based on game theory, previous efforts did not consider the unreliability coefficient of the freshness information in discussing the investment rules of a fresh supply chain about an ACTS. (4) In addition, previous efforts did not use a price discount and revenue-sharing contract to achieve the supply chain coordination. Thus, in this paper, considering the unreliability of the freshness information after adopting a blockchain-based ACTS, four investment situations will be proposed, and then the investment conditions of chain members in different investment situations will be discussed. Finally, a price discount and revenue-sharing contract will be used to achieve supply chain coordination after using a blockchain-based ACTS.

Therefore, the aims of this study are to understand the investment thresholds of a blockchain-based ACTS in different investment situations and the suitable contract to coordinate the supply chain, considering the unreliability of the freshness information. To achieve these goals, a supply chain with one fresh producer and one retailer was chosen as the study subject. Afterwards, considering the unreliability of the freshness information in the new technology environment, the demand function was revised. Then, based on the Stackelberg game and considering the unreliability coefficient of the freshness information, the profit functions before and after adopting the blockchain-based ACTS were constructed. Then, a price discount and revenue-sharing contract was put forward to coordinate the supply chain. Finally, the investment thresholds of the blockchain-based ACTS in different investment situations and coordination conditions were analyzed.

The main innovations of this study are: (1) considering the unreliability coefficient of the freshness information in the new background, the demand function model was refactored. (2) Four benefits models were built considering the blockchain-based ACTS costs and the unreliability coefficient of the freshness information. (3) A price discount and revenue-sharing contract was proposed to coordinate the supply chain.

This research has some value: (1) The proposed demand function model will enrich the demand function research in the new environment and can provide a theoretical support for retailers and fresh producers to forecast market demand. (2) The proposed investment conditions about the blockchain-based ACTS will enrich the investment decision theory of the fresh supply chain and can help the fresh producers and retailers to make a decision when they want to invest in a blockchain-based ACTS. (3) The proposed contract (price discount and revenue-sharing contract) will enrich the coordination theory of the fresh supply chain and will be a strong support for coordinating the supply chain after adopting the blockchain-based ACTS.

This study was organized as shown in

Figure 1.

3. Results

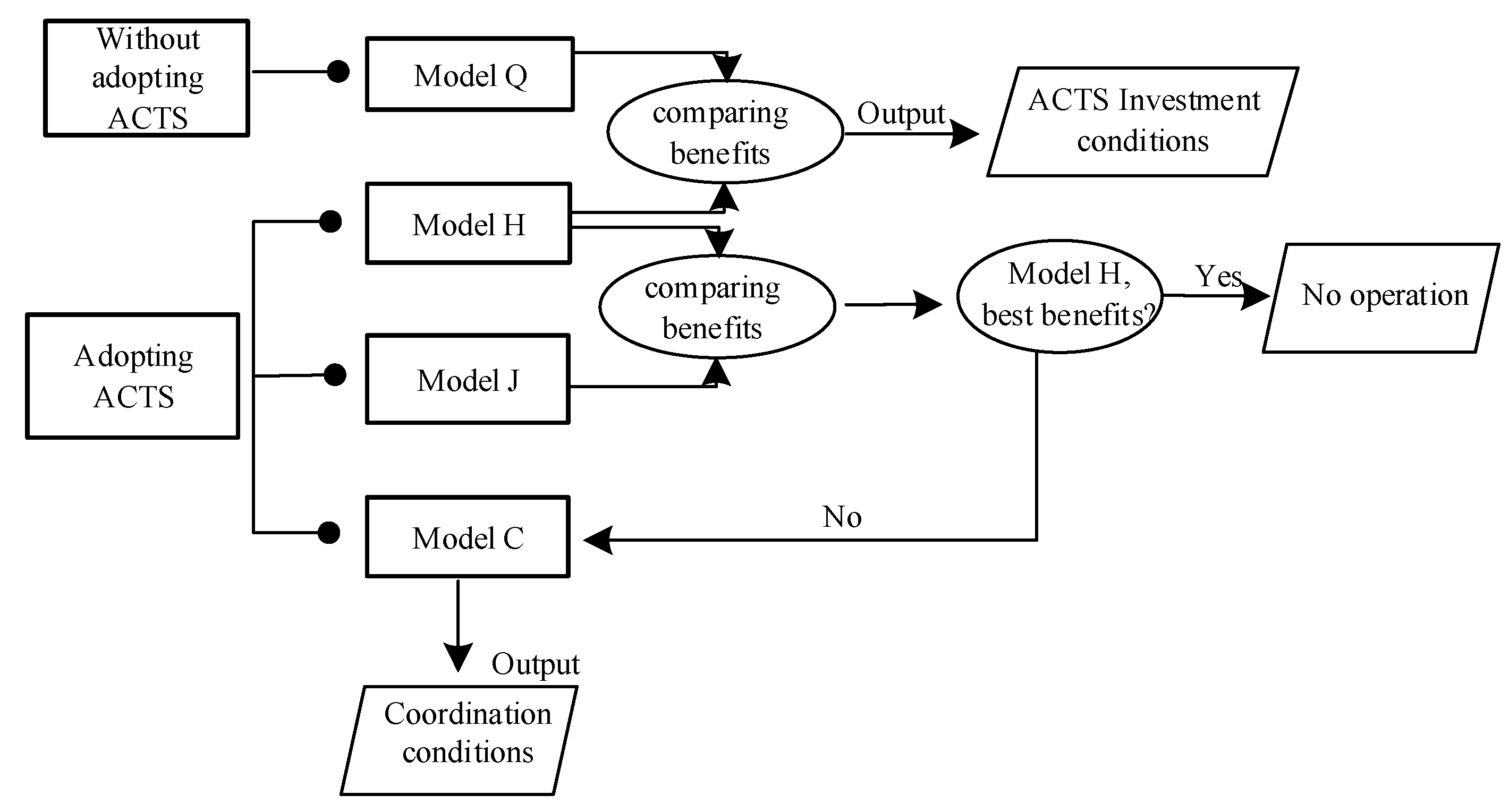

The aims of our research were to gain the investment threshold of an ACTS and design a contract to coordinate the supply chain. To achieve this goal, four investment situations were put forward, and the research idea structure is as seen in

Figure 5. Firstly, the benefit models in the Q and H situations were built, and then, through comparing the revenues of the two situations, the investment threshold was determined. Afterwards, the revenue model of the J situation was constructed, and then, through comparing the revenues of the situations of J and H, it was known whether the revenues of chain members in the H situation were the best. If they were not, a contract would be proposed to coordinate the supply chain.

3.1. Decision Model in the Q Situation

In this model, the unreliability coefficient of the freshness information and product circulation rate may have been lower than in other situations. Therefore, the revenues of the producer and retailer can be expressed as Functions (3) and (4), respectively:

Because the producer occupies a dominant position, the game relationship between chain members conforms to the master–slave game. Firstly, the producer sets the wholesale price based on the market sensitivity and the shipments. Then, the retailer sets the retail price based on the market sensitivity and the wholesale price. Due to the insufficiency of the effective supply of high-quality fresh products, there is no surplus of the supplied commodities. Therefore, using the reverse order solution method and according to Functions (2) and (4), the optimal retail price and the optimal wholesale price were obtained.

Putting

and

into Functions (5) and (6), we can obtain Functions (7) and (8). Meanwhile, the optimal sales volume

can be achieved.

Without a loss of generality, should be greater than 0, and thus was achieved. Meanwhile, when , .

3.2. Decision Model in the H Situation

When the producer and the retailer of the high-quality fresh products have adopted an ACTS, there is a positive influence on the unreliability coefficient of the freshness information , and the product circulation rate will be higher in this situation.

After adopting an ACTS, the circulation time of the high-quality fresh products will be reduced, and the main reasons are as follows: (1) Through the automatic identification of the goods and automatic data collection, the operation process can be simplified, with a reduced circulation time. (2) Consumers can quickly verify the authenticity of the high-quality fresh products, and this will reduce consumers’ time in choosing high-quality fresh products. (3) The increase of the unreliability coefficient of the freshness information will add to the product circulation rate in the warehouse. The reduction of the circulation time will reduce the loss of high-quality fresh products. Therefore,

. The revenues of the producer and the retailer can be expressed as Functions (10) and (11), respectively:

Using the reverse order solution method, and according to Functions (2) and (11), the optimal retail price and the optimal wholesale price can be obtained:

Putting

and

into Functions (10) and (11), Functions (14) and (15) can be obtained. Meanwhile, the optimal sales volume

can be achieved:

Without a loss of generality, should be greater than 0, and thus was achieved. Meanwhile, when , .

Based on Functions (14) and (15), we can determine the revenues of the total supply chain as follows: .

3.3. Decision Model in the J Situation

In the centralized decision model, chain members have adopted an ACTS, and to maximize their benefits, they will set the retail price together. In this situation, the profits from the high-quality fresh product supply chain can be expressed as Function (17):

Based on Function (17), we can solve

and let it equal zero, then the optimal retail price

can be obtained. Putting

into Functions (17) and (1), the optimal revenues

and the market demand

can be achieved in the J situation:

Through comparing the total revenues of the supply chain in the situations of H and J, we can determine that the total profits of the supply chain in the J situation are higher than in the H situation. Namely, after adopting an ACTS, the supply chain has not achieved coordination. In the next example, a contract will be used to coordinate the supply chain.

3.4. Supply Chain Coordination

According to Functions (20) and (12), we can determine that . Furthermore, . The above results show that in the J model, the optimal retail price is lower than in the H model. Meanwhile, the total profits in the J model are higher than in the H model. Therefore, after adopting an ACTS, the supply chain has not achieved coordination. To achieve supply chain coordination, a contract is needed. To stimulate the retailer to adopt a blockchain-based ACTS and order more products, the producer, as the game leader, may offer a discount of the wholesale price; meanwhile, to equalize revenue and estimate the behavior of producers, retailers may return a portion of their revenues. Thus, a price discount and revenue-sharing contract are proposed.

In this price discount and revenue-sharing contract, the revenues of the producer and the retailer can be expressed as Functions (21) and (22), respectively:

Using the reverse order solution method, and according to Functions (2) and (22),

is obtained. If the total benefits of the supply chain in the C situation are to reach the level of the J situation, the retail price in the C situation (

) should be equal to

. Then,

can be obtained. Based on

and

, the optimal revenues

and

can be achieved:

Meanwhile,

can be achieved. As

should be greater than 0,

can be achieved. When

and

, the price discount and revenue-sharing contract will coordinate the supply chain. Based on these, the Conclusion 1 can be obtained:

Conclusion 1. When, adopting the price discount and revenue-sharing contract can achieve high-quality fresh supply chain coordination.

Proof. because and were obtained. In addition, , was obtained. Conclusion 1 is thus confirmed. □

3.5. ACTS Investment Analysis

In China, the JD blockchain Open Platform and Ant chain from Ant Group have confirmed the positive effects of a blockchain-based ACTS on high-quality fresh products. Meanwhile, a blockchain-based ACTS can increase the product circulation rate. Based on these advantages, many brand owners and retailers want to adopt a blockchain-based ACTS. However, if chain members want to gain more benefits, the following condition should be met (i.e., the revenues of chain members, after using a blockchain-based ACTS, should be greater than those of the Q situation): immediately, and ; then, Conclusion 2 can be obtained.

Conclusion 2. Whencan be met in the H situation, adopting a blockchain-based ACTS is feasible. Whencan be satisfied in the C situation, adopting a blockchain-based ACTS is feasible.

Proof. According to Functions (7), (8), (14), and (15), can be obtained when and , and is identified as . Moreover, when and . This condition is similar to condition .

According to Functions (7), (8), (23), and (24), can be obtained when and , and is identified as . Moreover, when and . This condition is similar to condition . □

4. Discussions

To verify the effectiveness of the proposed conclusions, a numerical simulation case will be implemented. Based on the research of [

49], a company producing cherries that come from Shandong, China was chosen. After collating the related information, the unit production cost of the cherries

is RMB 0.8(10,000)/ton. The shipping fee

is equal to RMB 1.4(10,000)/ton. Assuming the market demand

tons, the transportation time is

days. The lifecycle of cherries is

days. Assuming that

, here,

, where

is a constant and stands for the quantity loss. We can set

and

. Based on the research of [

49],

can be obtained. According to the report about JD’s blockchain Open Platform in [

14],

was obtained. According to Functions (7), (8), (14), (15), (23) and (24),

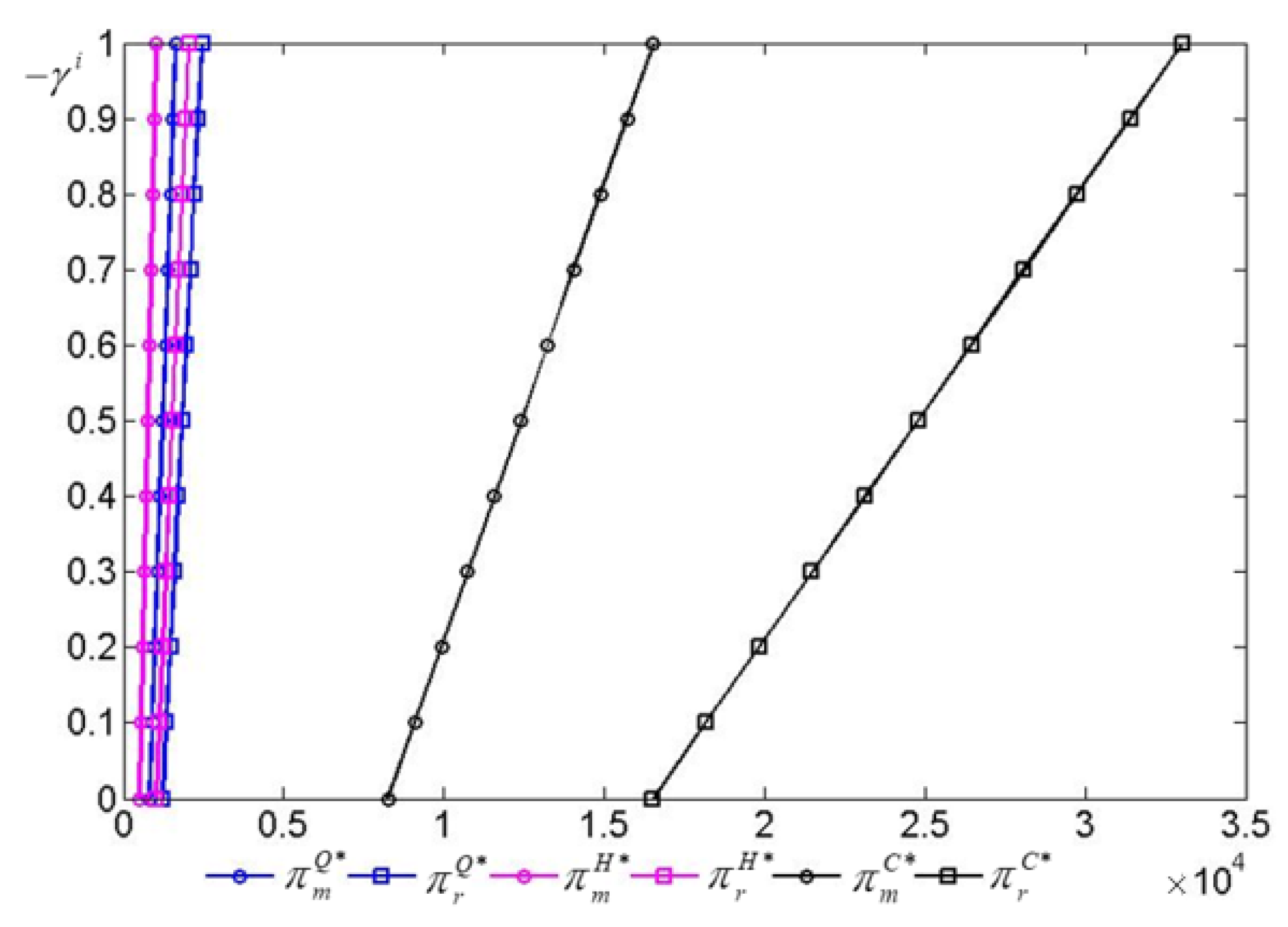

Figure 6 can be obtained:

In the

Figure 6, the abscissa represents the revenues of chain members in different situations, and the ordinate shows the unreliability coefficient of the freshness information in different situations. From

Figure 6, we can determine that with the growth of the unreliability coefficient of the freshness information, the benefits to the chain members in the proposed three situations will decrease. Meanwhile, we can determine that after adopting a blockchain-based ACTS, the profits of the chain members will be greater than before adopting a blockchain-based ACTS. These indicate that using a blockchain-based ACTS can help a supply chain gain greater revenues. In addition, we can find that the revenues of the chain members in the C situation are greater compared with those of the H situation. This demonstrates that a price discount and revenue-sharing contract can achieve supply chain coordination. Thus, we can conclude that after using a blockchain-based ACTS, if chain members want to gain more benefits, they should attempt to excavate the value of their blockchain-based ACTS and reduce the unreliability coefficient of the freshness information.

According to Functions (7), (8), (14), (15), (23) and (24), through analyzing the effects of the effective output factor function

on the revenues of the producer and the retailer in the proposed three situations, we can obtain the information shown in

Table 2. Based on

Table 2, we can conclude that following the rise of the effective output factor function, the profits of the producer and the retailer in different situations will decrease. However, after adopting a blockchain-based ACTS, the revenues of chain members are higher than before using a blockchain-based ACTS. In addition, we can also determine that in the C situation, the effects of the effective output factor function

on the supply chain benefits are relatively smaller compared with those of the H situation. These results tell us that using a blockchain-based ACTS can help supply chain members increase their revenues; moreover, supply chain coordination can help chain members obtain more benefits.

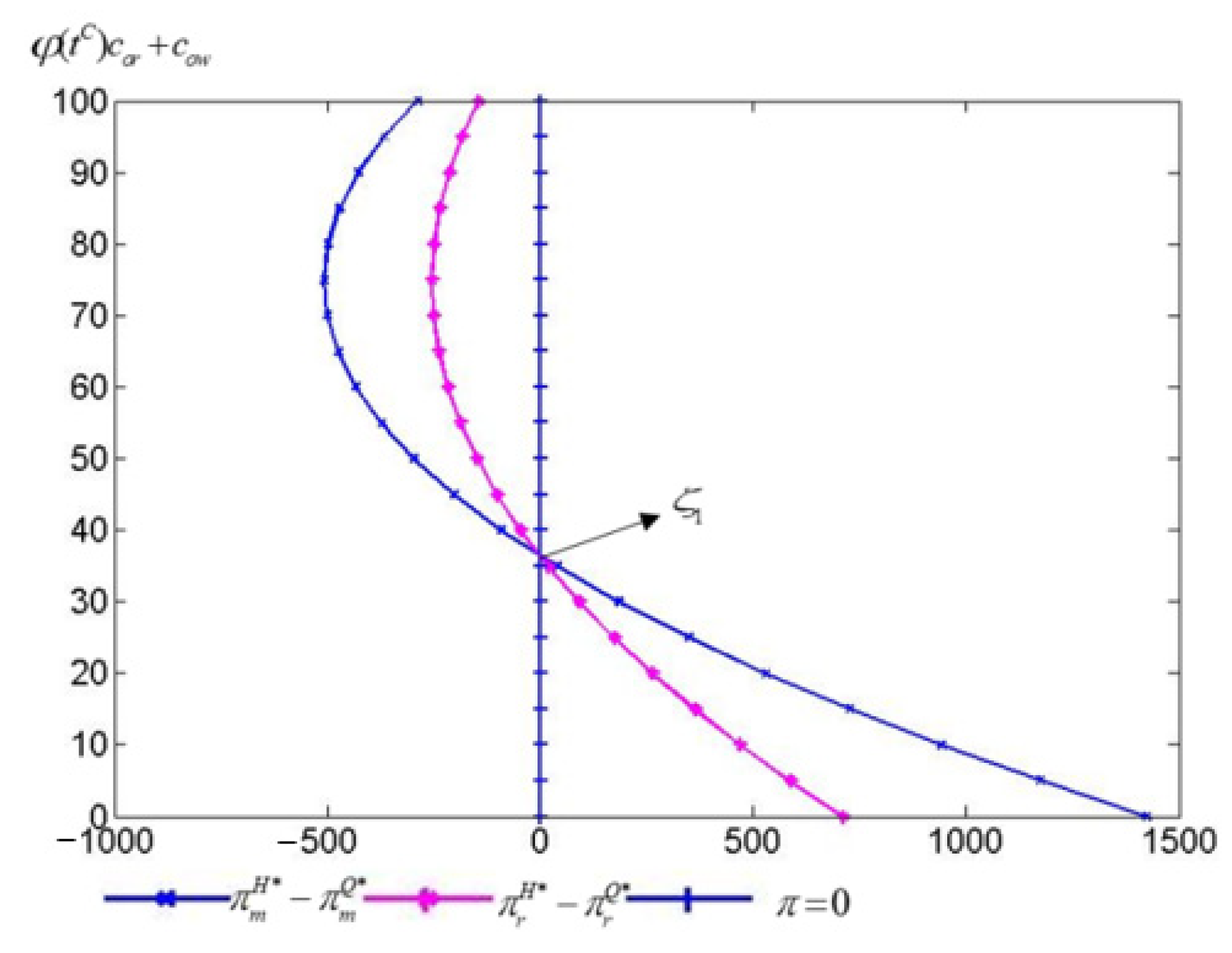

According to Conclusion 2,

Figure 7 and

Figure 8 can be obtained. In

Figure 7, the abscissa represents the revenue difference values of chain members before and after adopting a blockchain-based ACTS, and the ordinate demonstrates the investment costs of chain members for a blockchain-based ACTS. From

Figure 7, we can determine that with the growth of the investment costs for a blockchain-based ACTS, the benefit difference values for chain members before and after adopting a blockchain-based ACTS will decrease. Meanwhile, we can determine that when the investment costs for a blockchain-based ACTS are lower than a certain value

, investing in a blockchain-based ACTS can help chain members gain more benefits; otherwise, members of the supply chain will spend more than they earn.

In

Figure 8, the abscissa represents the revenue difference values of chain members before adopting a blockchain-based ACTS and after the coordination situation, and the ordinate demonstrates the investment costs of chain members for a blockchain-based ACTS. From

Figure 8, we can determine that with the growth of the investment costs for a blockchain-based ACTS, the benefit difference values of chain members before adopting a blockchain-based ACTS and after the coordination situation will decrease. Meanwhile, we can determine that when the investment costs for a blockchain-based ACTS are lower than a certain value

(in this figure, it is

), investing in a blockchain-based ACTS can help chain members gain more benefits; otherwise, members of the supply chain will spend more than they earn.

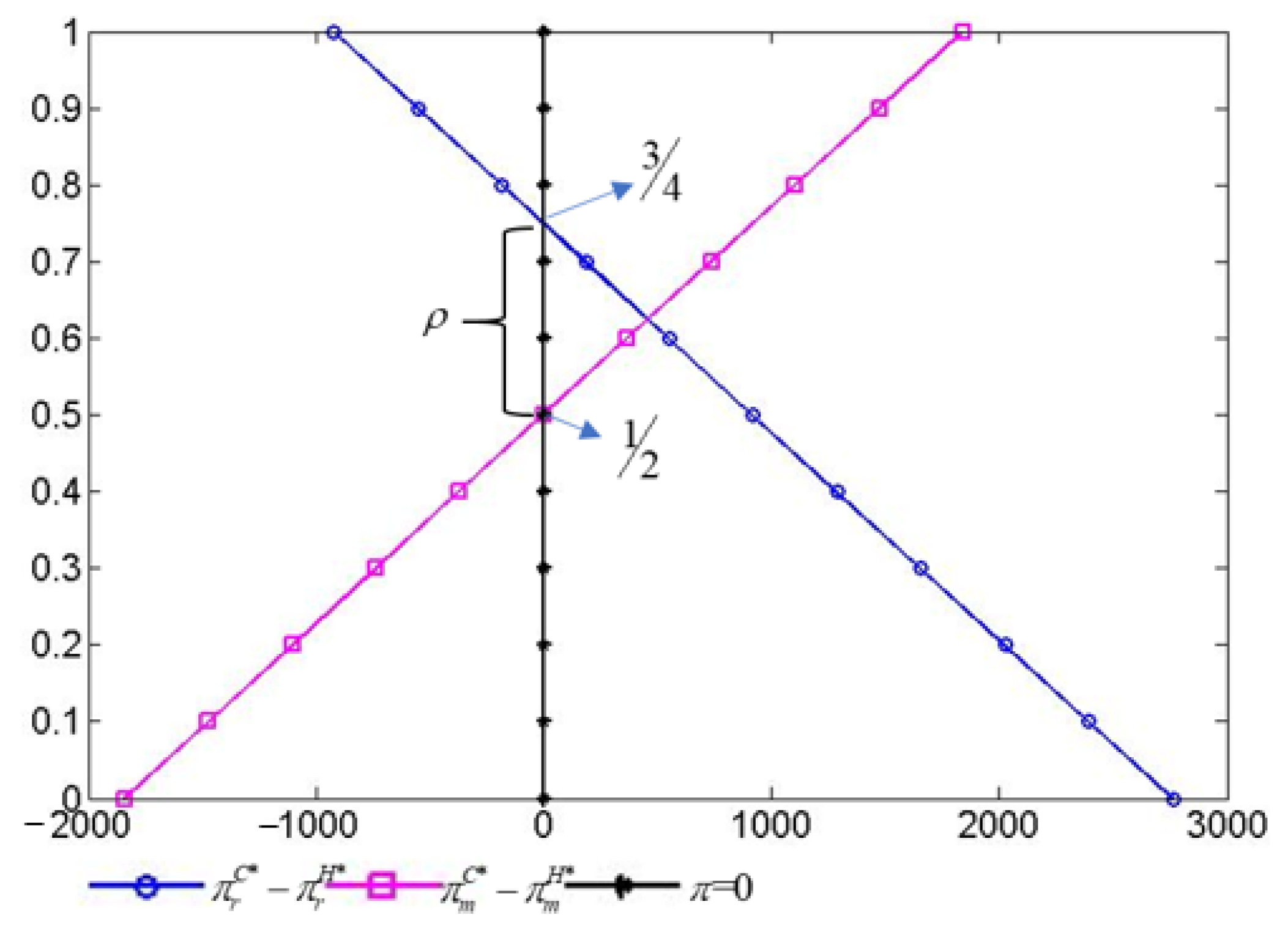

According to Conclusion 1,

Figure 9 can be obtained. In

Figure 9, the abscissa represents the revenue difference values of chain members before and after coordination, and the ordinate demonstrates the revenue sharing coefficient of the retailer. From

Figure 8, we can determine that when the revenue sharing coefficient of the retailer is in a certain range (

), adopting a price discount and revenue-sharing contract will achieve high-quality fresh supply chain coordination. Conclusion 1 is thus confirmed.

5. Conclusions

5.1. Conclusions

For consumers, in following a consumption level improvement, they have a higher requirement for the safety, information transparency, and inquiry convenience of high-quality fresh products. However, when facing these mixed goods, consumers need a real, reliable, and credible mechanism to provide a strong basis for their purchasing decision. In addition, for enterprises, how to ensure the accuracy of the market feedback data and prevent some sellers from losing goods are urgent problems. The data of the traditional traceability system are stored by the stakeholders of the supply chain. When the data are unfavorable to the stakeholders, there is a risk of tampering. A blockchain-based ACTS can effectively solve these problems.

Therefore, some fresh producers and retailers have begun to use a blockchain-based ACTS. However, for many fresh producers and retailers, using a blockchain-based ACTS necessitates additional expenditures. Therefore, they want to understand the investment conditions for a blockchain-based ACTS and how to coordinate their supply chain after adopting a blockchain-based ACTS.

To solve these problems, a fresh supply chain with a producer and a retailer was chosen. Then, considering the unreliability of the freshness information in the new background, the demand function model was refactored. Afterwards, four benefit models and a price discount and revenue-sharing contract were built to coordinate the supply chains after adopting a blockchain-based ACTS. Finally, some interesting findings were obtained:

① With the growth of the unreliability coefficient of the freshness information, the benefits to the chain members in the proposed three situations will decrease, namely, after using a blockchain-based ACTS, if chain members want to gain more benefits, they should attempt to excavate the value of their blockchain-based ACTS and reduce the unreliability coefficient of the freshness information.

② Following the rise of the effective output factor function, the profits of the producers and the retailers in the different situations will decrease. In other words, using a blockchain-based ACTS can help supply chain members increase their revenues; moreover, supply chain coordination can help chain members obtain more benefits.

③ In the H model, when the investment costs for a blockchain-based ACTS are lower than a certain value , investing in a blockchain-based ACTS can help chain members gain more benefits. In the coordination situation, when the investment costs for a blockchain-based ACTS are lower than a certain value , investing in a blockchain-based ACTS can help chain members gain more benefits. In other words, investing in a blockchain-based ACTS may not help chain members gain more benefits. When the investment costs can reach a certain range, chain members can adopt a blockchain-based ACTS.

④ When the revenue sharing coefficient of the retailer is in a certain range (), adopting a price discount and revenue-sharing contract can achieve high-quality fresh supply chain coordination. Meanwhile, discounts to the wholesale price have a negative relationship with the revenue sharing coefficient. In other words, adopting a revenue-sharing and price discount contract may achieve supply chain coordination, but the revenue-sharing coefficient should be higher than 0.5 and lower than 0.75.

5.2. Research Significance

This research has some academic value: (1) Considering the unreliability coefficient of the freshness information in the new background, the demand function model was refactored. This enriched the demand function research in the new environment. (2) Four benefits models were built considering blockchain-based ACTS costs and the unreliability coefficient of the freshness information. Then, the investment conditions for a blockchain-based ACTS were determined. This enriched the investment decision theory about fresh supply chains in the new technology environment. (3) A price discount and revenue-sharing contract was proposed to coordinate the supply chain. This enriched the coordination theory of fresh supply chains and expanded the usage situation of the price discount and revenue-sharing contract.

This research has some application values: (1) The proposed demand function can provide theoretical support for retailers and fresh producers to forecast market demand. (2) The gained investment conditions can help fresh producers and retailers make the decision to invest in a blockchain-based ACTS. (3) The proposed coordination contract will be a strong support for coordinating the supply chain after adopting a blockchain-based ACTS.