EU Dairy after the Quota Abolition: Inelastic Asymmetric Price Responsiveness and Adverse Milk Supply during Crisis Time

Abstract

1. Introduction

2. Materials and Methods

2.1. Milk Production and Management Practices

2.2. Milk Pricing: Formation, Volatility and Asymmetry

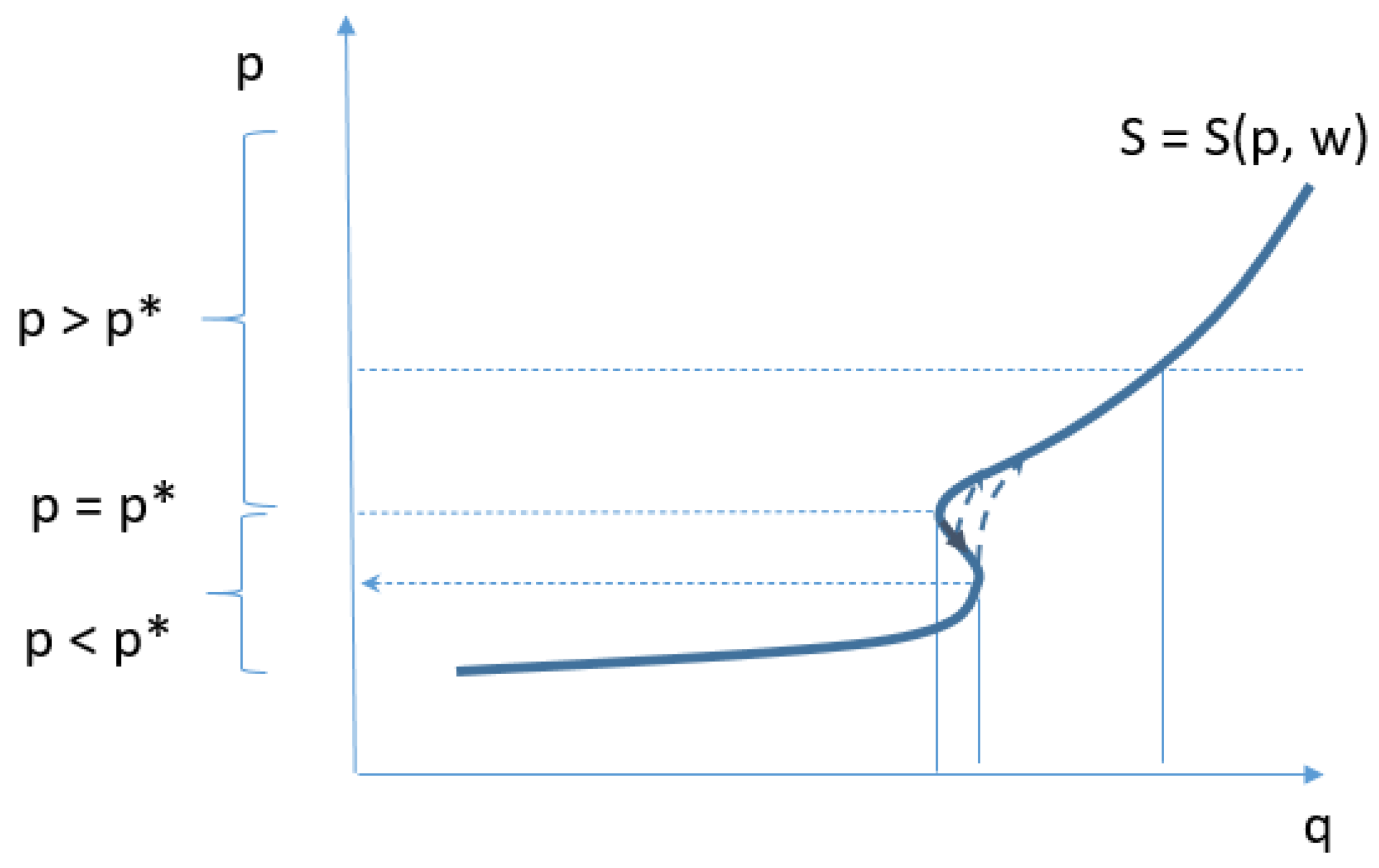

2.3. A Framework to Understand “Irregular” Supply Behaviour

3. Results and Discussion

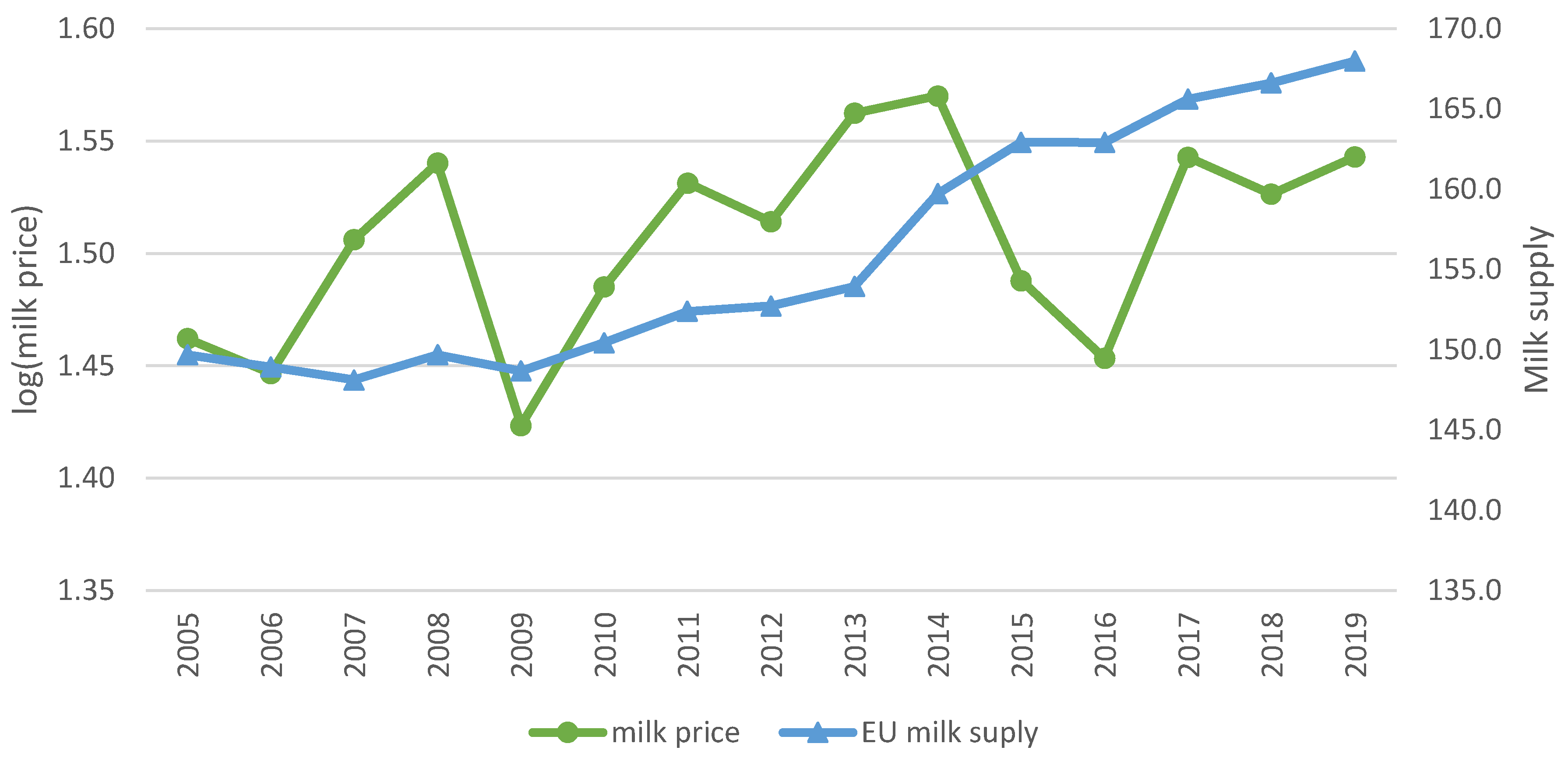

3.1. Milk Supply Responses within the EU

3.2. Milk Price Decomposition

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| MS | R-Squared (%) | Root MSE |

|---|---|---|

| EU | 88.26 | 4,000,000.00 |

| Austria | 98.97 | 0.04 |

| Belgium | 98.38 | 0.09 |

| Bulgaria | 97.19 | 39,731.00 |

| Croatia | 86.96 | 33,735.00 |

| Czech Republic | 94.56 | 40,801.00 |

| Denmark | 99.08 | 63,548.00 |

| Estonia | 93.94 | 22,661.00 |

| Finland | 92.98 | 20,078.00 |

| France | 52.13 | 540,000.00 |

| Germany | 95.96 | 640,000.00 |

| Greece | 79.69 | 22,684.00 |

| Hungary | 89.75 | 41,217.00 |

| Ireland | 97.56 | 220,000.00 |

| Italy | 94.29 | 190,000.00 |

| Latvia | 98.01 | 18,878.00 |

| Lithuania | 92.92 | 46,960.00 |

| Netherlands | 98.96 | 230,000.00 |

| Poland | 97.20 | 190,000.00 |

| Portugal | 88.88 | 40,229.00 |

| Romania | 91.54 | 250,000.00 |

| Slovenia | 81.89 | 10,651.00 |

| Slovakia | 94.83 | 34,443.00 |

| Spain | 78.88 | 190,000.00 |

| Sweden | 97.58 | 52,697.00 |

| United Kingdom | 65.06 | 450,000.00 |

References

- Boots, M.; Oude Lansink, A.; Peerlings, J. Efficiency Loss due to Distortions in Dutch Milk Quota Trade. Eur. Rev. Agric. Econ. 1997, 24, 31–46. [Google Scholar] [CrossRef]

- De Frahan, B.H.; Baudry, A.; De Blander, R.; Polomé, P.; Howitt, R. Dairy Farms without Quotas in Belgium: Estimation and Simulation with a flexible cost function. Eur. Rev. Agric. Econ. 2011, 38, 469–495. [Google Scholar] [CrossRef]

- Jongeneel, R.; Van Berkum, S. What Will Happen after the EU Milk Quota System Expires? An Assessment of the Dutch Dairy Sector; LEI 2015-041; LEI Wageningen UR: The Hague, The Netherlands, 2015. [Google Scholar]

- Requilllart, V.; Boamra-Mechemache, Z.; Jongeneel, R. Economic Analysis of the Effects of the Expiry of the EU Milk Quota System; Final Report; Institut d’Economie Industrielle: Toulouse, France, 2008. [Google Scholar]

- Wieck, C.; Heckelei, T. Determinants, Differentiation, and Development of Short-term Marginal Costs in Dairy Production: An Empirical Analysis for Selected Regions of the EU. Agric. Econ. 2007, 36, 203–220. [Google Scholar] [CrossRef]

- Bouamra-Mechemache, Z.; Jongeneel, R.; Requillart, V. Impact of a Gradual Increase in Milk Quotas on the EU Dairy Sector. Eur. Rev. Agric. Econ. 2008, 35, 461–491. [Google Scholar] [CrossRef]

- Sutherland, L.A.; Burton, R.J.F.; Ingram, J.; Blackstock, K.; Slee, B.; Gotts, N. Triggering change: Towards a Conceptualisation of Major Change Processes in Farm Decision-Making. J. Environ. Manag. 2012, 104, 142–151. [Google Scholar] [CrossRef]

- Darnhofer, I. Resilience and Why It Matters for Farm Management. Eur. Rev. Agric. Econ. 2014, 41, 461–484. [Google Scholar] [CrossRef]

- Peerlings, J.H.M.; Ooms, D.L. Farm Growth and Exit: Consequences of EU Dairy Policy Reform for Dutch Dairy Farming. In Proceedings of the 12th EAAE Congress ‘People, Food and Environments: Global Trends and European Strategies’, Gent, Belgium, 26–29 August 2008. [Google Scholar]

- Samsom, S.; Gardebroek, G.C.; Jongeneel, R. Analysing Trade-offs between Milk, Feed and Manure Production on Dutch Dairy Farms. Eur. Rev. Agric. Econ. 2017, 44, 475–498. [Google Scholar] [CrossRef]

- Willock, J.; Deary, I.J.; Edwards-Jones, G.; Gibson, G.J.; McGregor, M.J.; Sutherland, A.; Dent, J.B.; Morgan, O.; Grieve, R. The Role of Attitudes and Objectives in Farmer Decision Making: Business and Environmentally-Oriented Behaviour in Scotland. J. Agric. Econ. 1999, 50, 286–303. [Google Scholar] [CrossRef]

- Willock, J.; Deary, I.J.; McGregor, M.J.; Sutherland, A.; Dent, J.B.; Edwards Jones, G.; Grieve, R.; Morgan, O.; Gibson, G.; Austin, E. The Edinburgh Study of Decision Making on Farms: Farmer’s Attitudes, Goals and Behaviours. J. Vocat. Behav. 1999, 54, 5–36. [Google Scholar] [CrossRef]

- Mosheim, R. A Quarterly Econometric Model for Short-Term Forecasting of the U.S. Dairy Industry; Technical Bulletin 1932; USDA, ERS: Washington, DC, USA, 2012. [Google Scholar]

- Munshi, K.D.; Parikh, K.S. Milk Supply Behaviour in India: Data Integration, Estimation and Implications for Dairy Development. J. Dev. Econ. 1994, 45, 201–223. [Google Scholar] [CrossRef]

- Schmit, T.M.; Kaiser, H.M. Forecasting Fluid Milk and Cheese Demands for the Next Decade. Am. Dairy Sci. Assoc. 2006, 89, 4924–4936. [Google Scholar] [CrossRef] [PubMed]

- Lien, G. Assisting Whole-farm Decision-Making through Stochastic Budgeting. Agric. Syst. 2001, 76, 399–413. [Google Scholar] [CrossRef]

- Solano, C.; Leon, H.; Perez, E.; Perez, E.; Tole, L.; Fawcett, R.H.; Herrero, M. Using Farmer Decision-making Profiles and Managerial Capacity as Predictors of Farm Management and Performance in Costa Rican Dairy Farms. Agric. Syst. 2006, 88, 395–428. [Google Scholar] [CrossRef]

- Barry, P.J.; Baker, C.B.; Sanint, L.R. Farmers’ Credit Risks and Liquidity Management. Am. J. Agric. Econ. 1981, 63, 216–227. [Google Scholar] [CrossRef]

- Albuquerque, R.A.; Araujo, B.; Brandao-Marques, L.; Mosse, G.; Vletter, P.; Zavale, H. Market Timing, Farmer Expectations, and Liquidity Constraints. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3886662 (accessed on 11 September 2022).

- Langemeier, M.R.; Patrick, G.F. Farm Consumption and Liquidity Constraints. Am. J. Agric. Econ. 1993, 75, 479–484. [Google Scholar] [CrossRef]

- Nicholson, C.F.; Stephenson, M.W. Milk Price Cycles in the U.S. Dairy Supply Chain and Their Management Implications. Agribusiness 2015, 31, 507–520. [Google Scholar] [CrossRef]

- Frick, F.; Sauer, J. Deregulation and Productivity: Empirical Evidence on Dairy Production. Am. J. Agric. Econ. 2017, 100, 354–378. [Google Scholar] [CrossRef]

- Zimmerman, A.; Heckelei, T. Structural Change of European Dairy Farms–A Cross-Regional Analysis. J. Agric. Econ. 2012, 63, 576–603. [Google Scholar] [CrossRef]

- Weber, S.A.; Salamon, P.; Hansen, H. Volatile World Market Prices for Dairy Products-How Do They Affect Domestic Price Formation: The German Cheese Market. In Proceedings of the 123rd EAAE Seminar ‘Price Volatility and Farm Income Stabilisation. Modelling Outcomes and Assessing Market and Policy Based Responses’, Dublin, Ireland, 23–24 February 2012. [Google Scholar]

- Poczta, W.; Sredzinska, J.; Chenczke, M. Economic Situation of Dairy Farms in Identified Clusters of European Union Countries. Agriculture 2020, 10, 92. [Google Scholar] [CrossRef]

- Polman, N.B.P.; Krol, N.; Peerlings, J.H.M. Governance Structures in EU Milk Supply Chains. In Supply Chain Management: Concepts, Methodologies, Tools, and Applications; Khosrow-Pou, M., Clarke, S., Jennex, M.E., Beckerand, A., Anttiroiko, A., Eds.; IGI-Global: Hershey, PA, USA, 2013. [Google Scholar]

- Van Asseldonk, M.; van der Meer, R. Coping with Price Risks on Dutch Farms; LEI 2016-054; LEI Wageningen UR: The Hague, The Netherlands, 2016. [Google Scholar]

- Hemme, T.; Uddin, M.M.; Ndambi, O.A. Benchmarking Cost of Milk Production in 46 Countries. J. Rev. Glob. Econ. 2014, 3, 254–270. [Google Scholar]

- Serra, T.; Goodwind, B.K. Price transmission and asymmetric adjustment in the Spanish dairy sector. Appl. Econ. 2003, 35, 1889–1899. [Google Scholar] [CrossRef]

- Fernandez-Amador, O.; Baumgartner, J.; Crespo-Cuaresma, J. Milking the Prices: The Role of Asymmetries in the Price Transmission Mechanism for Milk Products in Austria; WIFO Working Papers, No. 378; WIFO: Viena, Austria, 2010. [Google Scholar]

- Galety, D. The Imperfect Price-Reversibility of World Oil Demand. Energy J. 1993, 14, 163–182. Available online: https://www.jstor.org/stable/41322534 (accessed on 8 September 2022).

- Galety, D.; Huntington, H. The Asymmetric Effects of Changes in Income on Energy and Oil Demand. Energy J. 2002, 23, 19–55. [Google Scholar] [CrossRef]

- Rezitis, A.N.; Tsionas, M. Modelling Asymmetric Price Transmission in the European Food Market. Econ. Model. 2019, 76, 216–230. [Google Scholar] [CrossRef]

- Phimister, E. Farm Household Production in the Presence of Restriction on Debt: Theory and Policy Implications. J. Agric. Econ. 1995, 46, 371–380. [Google Scholar] [CrossRef]

- Paarlberg, D. The Backward-Bending Supply Curve: A Myth That Persists. Choices Mag. Food Farm Resour. Issues 1988, 3, 1–2. [Google Scholar]

- Guttman, P.M. Intertemporal Profit maximization. Econ. Inq. 1967, 5, 271–275. [Google Scholar] [CrossRef]

- Just, R.E.; Zilberman, D. In defence of fence to fence: Can the backward bending supply curve exist? J. Agric. Resour. Econ. 1992, 17, 277–285. Available online: https://www.jstor.org/stable/pdf/40986758.pdf (accessed on 11 September 2022).

- Nakajima, C. Subjective Equilibrium Theory of the Farm Household; Developments in Agricultural Economics Series; Elsevier: Amsterdam, The Netherlands; New York, NY, USA, 1986; Volume III. [Google Scholar]

- Lovo, S. Liquidity Constraints and Farm Household Technical Efficiency. Evidence from South Africa. 2010. Available online: https://conference.iza.org/conference_files/worldb2010/lovo_s6000.pdf (accessed on 11 September 2022).

- Kaiser, L.W.; Tauer, H.M. Negative milk supply response under constrained profit maximizing behavior. Northeast. J. Agric. Resour. Econ. 1988, 17, 111–117. [Google Scholar] [CrossRef][Green Version]

- Fousekis, P.; Stefanou, S.E. Capacity Utilization Under Dynamic Profit Maximization. Empir. Econ. 1996, 21, 335–359. [Google Scholar] [CrossRef]

- Krichene, N. World Crude Oil and Natural Gas: A Demand and Supply Model. Energy Econ. 2002, 24, 557–576. [Google Scholar] [CrossRef]

- Emmanouilides, C.J.; Fousekis, P. Vertical Price Dependence Structures: Copula-Based Evidence from the Beef Supply Chain in the USA. Eur. Rev. Agric. Econ. 2014, 42, 77–97. [Google Scholar] [CrossRef]

- Qiu, F.; Goodwin, B.K. Asymmetric price transmission: A copula approach. In Proceedings of the 2012 Annual Meeting, Seattle, WA, USA, 12–14 August 2012; Agricultural and Applied Economics Association: Milwaukee, WI, USA, 2012. [Google Scholar]

- Wolffram, R. Positivistic Measures of Aggregate Supply Elasticities: Some New Approaches: Some Critical Notes. Am. J. Agric. Econ. 1971, 53, 356–359. [Google Scholar] [CrossRef]

- Tweeten, L.; Quance, L. Techniques for Segmenting Independent Variables in Regression Analysis: Reply. Am. J. Agric. Econ. 1969, 53, 359–360. [Google Scholar] [CrossRef]

- Houck, J.P. An Approach to Specifying and Estimating Non-reversible Functions. Am. J. Agric. Econ. 1977, 59, 570–572. [Google Scholar] [CrossRef]

- Griffin, J.M.; Schulman, C.T. Price Asymmetry in Energy Demand Models: A Proxy for Energy-Saving Technical Change? Energy J. 2005, 26, 1–21. Available online: https://www.jstor.org/stable/41323059 (accessed on 11 September 2022). [CrossRef]

- European Commission. Improving Crisis Prevention and Management Criteria and Strategies in the Agricultural Sector. Final Report. 2020. Available online: https://data.europa.eu/doi/10.2762/650110 (accessed on 8 September 2022).

- Severini, S.; Zinnanti, C.; Borsellino, V.; Schimmenti, E. EU income stabilization tool: Potential impacts, financial sustainability and farmer’s risk aversion. Agric. Food Econ. 2021, 9, 1–21. Available online: https://agrifoodecon.springeropen.com/articles/10.1186/s40100-021-00205-4 (accessed on 14 November 2022). [CrossRef]

- Farm Europe. France: CAP Strategic Plan 2023-27. Farm Europe Blog. 2022. Available online: https://www.farm-europe.eu/blog-en/france-cap-strategic-plan-2023-27/ (accessed on 11 September 2022).

| Period from 2007m11 to 2009m05 | Period from 2013m11 to 2016m07 | |||||

|---|---|---|---|---|---|---|

| % Change in Price | % Change in Quantity | Ratio (% Change Quantity/% Change Price) | % Change in Price | % Change in Quantity | Ratio (% Change Quantity/% Change Price) | |

| Austria | −39.73 | 24.03 | −0.60 | −35.28 | 11.42 | −0.32 |

| Belgium | −69.54 | 20.50 | −0.29 | −61.69 | 17.63 | −0.29 |

| Bulgaria | −27.71 | 3.93 | −0.14 | −34.70 | 13.65 | −0.39 |

| Croatia | NA | 19.58 | NA | −28.18 | 3.86 | −0.14 |

| Cyprus | 15.95 | 7.75 | 0.49 | −5.67 | 22.22 | −3.92 |

| Czech Republic | −49.53 | 9.89 | −0.20 | −41.82 | 24.49 | −0.59 |

| Denmark | −43.33 | 17.61 | −0.41 | −50.07 | 15.31 | −0.31 |

| Estonia | −46.02 | 15.38 | −0.33 | −55.41 | 10.11 | −0.18 |

| Finland | −17.40 | 15.42 | −0.89 | −30.01 | 10.79 | −0.36 |

| France | −31.73 | 10.74 | −0.34 | −27.00 | 1.16 | −0.04 |

| Germany | −58.68 | 17.60 | −0.30 | −57.80 | 14.09 | −0.24 |

| Greece | −20.44 | 15.82 | −0.77 | −18.02 | 4.64 | −0.26 |

| Hungary | −46.06 | 17.23 | −0.37 | −50.29 | 12.16 | −0.24 |

| Ireland | −68.88 | 83.07 | −1.21 | −58.84 | 95.58 | −1.62 |

| Italy | −20.60 | 16.12 | −0.78 | −26.68 | 4.10 | −0.15 |

| Latvia | −69.36 | 17.05 | −0.25 | −60.80 | 32.62 | −0.54 |

| Lithuania | −72.00 | 19.67 | −0.27 | −72.85 | 35.20 | −0.48 |

| Luxembourg | −60.06 | 25.66 | −0.43 | −49.52 | 31.58 | −0.64 |

| Malta | NA | NA | NA | −8.04 | NA | NA |

| Netherlands | −59.91 | 14.41 | −0.24 | −55.07 | 22.73 | −0.41 |

| Poland | −51.74 | 29.22 | −0.56 | −44.32 | 22.75 | −0.51 |

| Portugal | −32.45 | 24.34 | −0.75 | −29.89 | 14.13 | −0.47 |

| Romania | NA | 20.46 | NA | −35.68 | 27.24 | −0.76 |

| Slovenia | −24.41 | 12.76 | −0.52 | −40.60 | 19.43 | −0.48 |

| Slovakia | −59.62 | 4.93 | −0.08 | −40.96 | 10.21 | −0.25 |

| Spain | −47.59 | 12.22 | −0.26 | −30.26 | 12.87 | −0.43 |

| Sweden | −45.15 | 14.87 | −0.33 | −43.47 | 5.03 | −0.12 |

| United Kingdom | −48.48 | 17.04 | −0.35 | −49.91 | 8.78 | −0.18 |

| MS | T | (β1) R* | R*·P/Q | (β2) D* | D*·P/Q |

|---|---|---|---|---|---|

| EU | −821,148.300 | 45,337.280 | 0.093 | −76,777.880 | −0.157 |

| Austria | 0.007 | 0.001 ** | 0.122 | −0.001 ** | −0.110 |

| Belgium | 0.027 ** | 0.0004 | 0.030 | −0.002 ** | −0.211 |

| Bulgaria | −34,656.130 *** | 991.116 ** | 0.293 | 781.157 | 0.231 |

| Croatia | 5443.494 | −466.048 | −0.166 | 2738.792 *** | 0.975 |

| Czech Republic | −38,285.390 *** | 2001.187 *** | 0.197 | −1640.161 *** | −0.161 |

| Denmark | 27,007.820 *** | 1558.472 ** | 0.093 | −1883.726 ** | −0.113 |

| Estonia | 6828.033 | −205.322 | −0.075 | −662.951 ** | −0.243 |

| Finland | −24,444.110 *** | 976.614 *** | 0.174 | −2700.322 *** | −0.481 |

| France | −48,439.440 | −8328.050 | −0.100 | −26,492.890 ** | −0.319 |

| Germany | 154,831.400 * | 665.522 | 0.007 | −12,543.980 | −0.123 |

| Greece | 4789.926 | −905.786 *** | −0.525 | −263.422 | −0.153 |

| Hungary | −66,375.020 *** | 2347.511 *** | 0.361 | −1403.257 *** | −0.216 |

| Ireland | −29,197.970 | 7229.128 *** | 0.311 | −5379.740 * | −0.231 |

| Italy | 28,276.840 | 4305.363 * | 0.132 | −131.482 | −0.004 |

| Latvia | 869.964 | 270.688 | 0.082 | −439.082 *** | −0.133 |

| Lithuania | 13,680.230 | −1565.929 *** | −0.246 | −58.891 | −0.009 |

| Netherlands | 80,547.800 *** | 4704.578 *** | 0.109 | −7567.050 *** | −0.176 |

| Poland | 77,878.470 ** | −194.288 | −0.004 | −2431.263 * | −0.053 |

| Portugal | −23,327.640 *** | 226.561 | 0.040 | −1016.918 ** | −0.178 |

| Romania | −75,298.480 * | −2756.438 | −0.177 | −10,447.790 | −0.670 |

| Slovenia | −6101.555 *** | 422.986 *** | 0.201 | −550.132 ** | −0.261 |

| Slovakia | −25,494.210 *** | 508.802 | 0.157 | −394.832 | −0.122 |

| Spain | −98,947.470 ** | 5116.289 | 0.225 | −7506.397 *** | −0.330 |

| Sweden | −68,699.820 *** | 980.665 *** | 0.122 | −1250.942 ** | −0.156 |

| United Kingdom | −432,274.400 *** | 23,687.210 *** | 0.461 | −20,162.130 ** | −0.392 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jongeneel, R.; Gonzalez-Martinez, A. EU Dairy after the Quota Abolition: Inelastic Asymmetric Price Responsiveness and Adverse Milk Supply during Crisis Time. Agriculture 2022, 12, 1985. https://doi.org/10.3390/agriculture12121985

Jongeneel R, Gonzalez-Martinez A. EU Dairy after the Quota Abolition: Inelastic Asymmetric Price Responsiveness and Adverse Milk Supply during Crisis Time. Agriculture. 2022; 12(12):1985. https://doi.org/10.3390/agriculture12121985

Chicago/Turabian StyleJongeneel, Roel, and Ana Gonzalez-Martinez. 2022. "EU Dairy after the Quota Abolition: Inelastic Asymmetric Price Responsiveness and Adverse Milk Supply during Crisis Time" Agriculture 12, no. 12: 1985. https://doi.org/10.3390/agriculture12121985

APA StyleJongeneel, R., & Gonzalez-Martinez, A. (2022). EU Dairy after the Quota Abolition: Inelastic Asymmetric Price Responsiveness and Adverse Milk Supply during Crisis Time. Agriculture, 12(12), 1985. https://doi.org/10.3390/agriculture12121985