The Determinants of Risk Transmission between Oil and Agricultural Prices: An IPVAR Approach

Abstract

1. Introduction

2. Materials and Methods

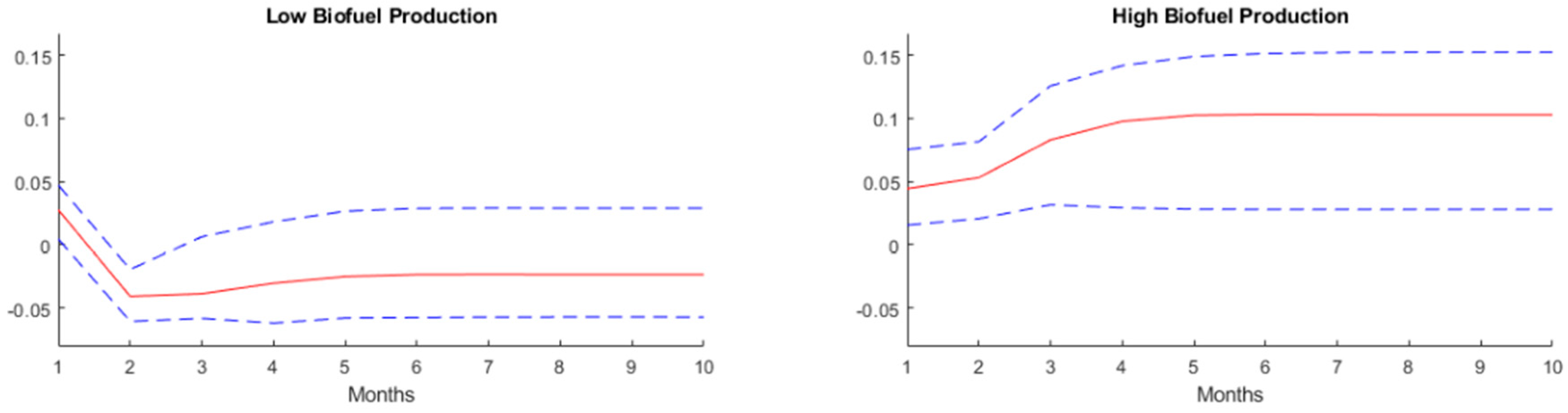

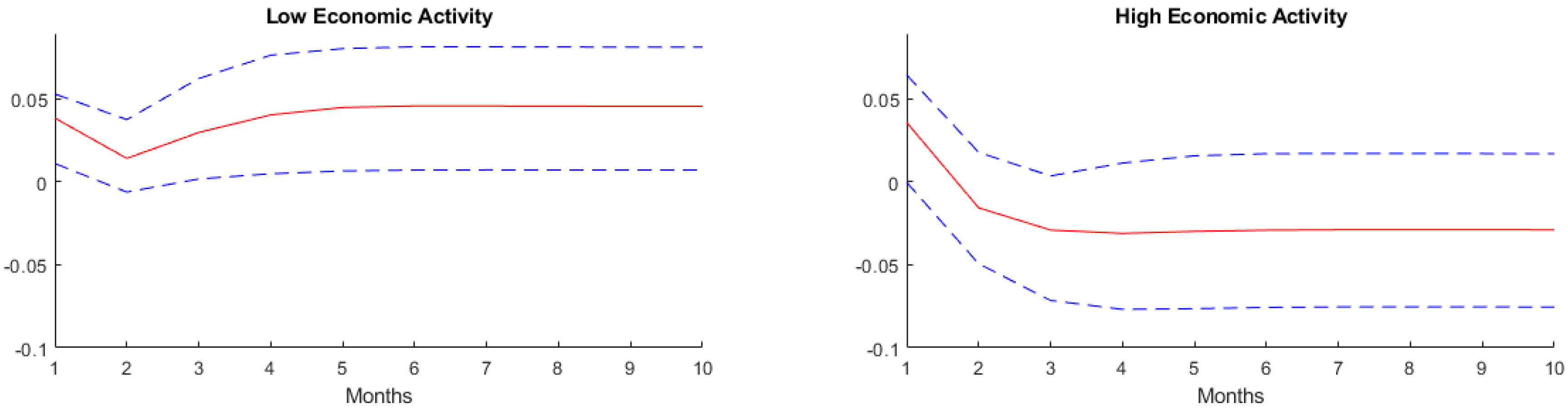

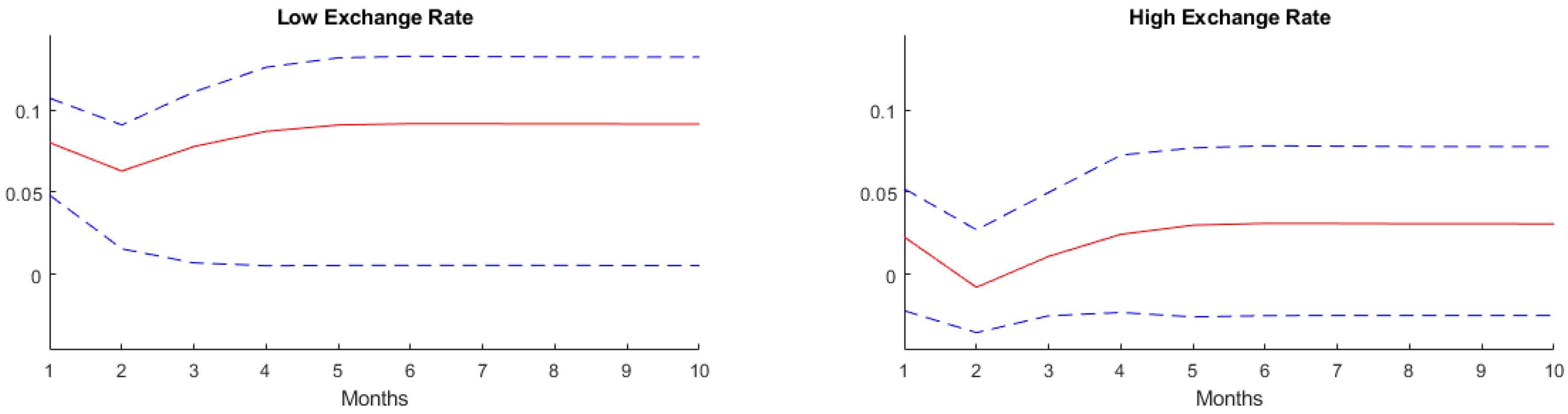

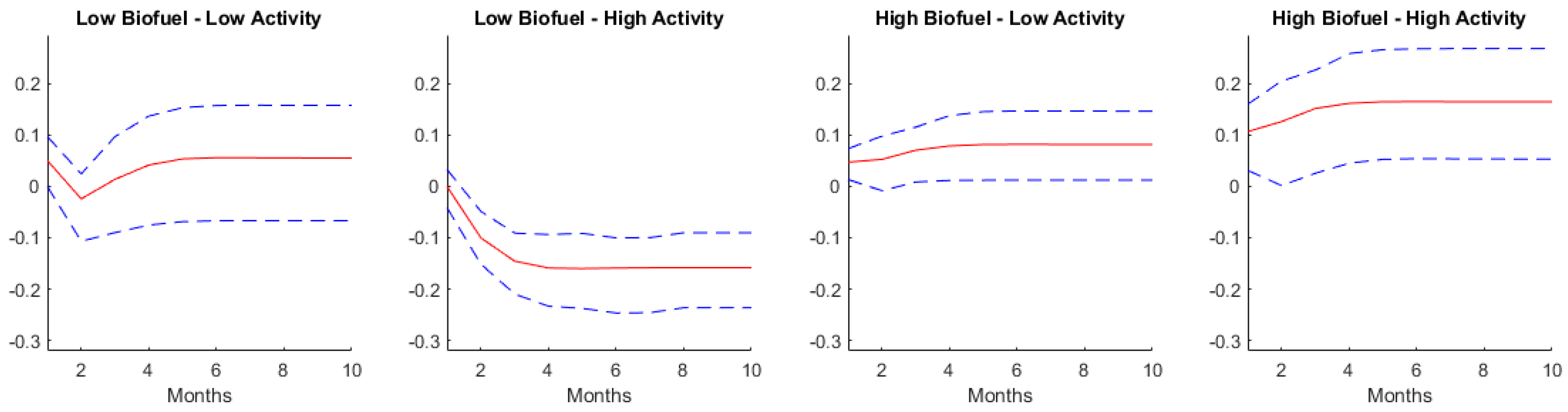

3. Results

4. Discussion

5. Concluding Remarks

Author Contributions

Funding

Conflicts of Interest

References

- Granco, G.; Caldas, M.; Featherstone, A.; Sant’Anna, A.C.; Bergtold, J. Farmers’ Acreage Responses to the Expansion of the Sugarcane Ethanol Industry: The Case of Goiás and Mato Grosso Do Sul, Brazil. In Land Allocation for Biomass Crops; Springer: Berlin, Germany, 2018; pp. 103–123. [Google Scholar]

- Kim, H.; Moschini, G. The dynamics of supply: US corn and soybeans in the biofuel era. Land Econ. 2018, 94, 593–613. [Google Scholar] [CrossRef]

- Li, Y.; Miao, R.; Khanna, M. Effects of Ethanol Plant Proximity and Crop Prices on Land-Use Change in the United States. Am. J. Agric. Econ. 2018, 101, 467–491. [Google Scholar] [CrossRef]

- Ogundari, K. Maize supply response to price and nonprice determinants in Nigeria: Bounds testing approach. Int. Trans. Oper. Res. 2018, 25, 1537–1551. [Google Scholar] [CrossRef]

- Shahzad, M.; Jan, A.U.; Ali, S.; Ullah, R. Supply response analysis of tobacco growers in Khyber Pakhtunkhwa: An ARDL approach. Field Crops Res. 2018, 218, 195–200. [Google Scholar] [CrossRef]

- Shevchuk, V.; Kopych, R. Modelling of agricultural commodity price effects on the fiscal performance and economic growth in Ukraine. Inf. Syst. Manag. 2019, 8, 47–56. [Google Scholar]

- Van Campenhout, B.; Pauw, K.; Minot, N. The impact of food price shocks in Uganda: First-order effects versus general-equilibrium consequences. Eur. Rev. Agric. Econ. 2018, 45, 783–807. [Google Scholar] [CrossRef]

- Yamauchi, F.; Larson, D.F. Long-term impacts of an unanticipated spike in food prices on child growth in Indonesia. World Dev. 2019, 113, 330–343. [Google Scholar] [CrossRef]

- Bhattacharya, R.; Gupta, A. Sen Food inflation in India: Causes and consequences. Natl. Inst. Public Financ. Policy Work. Pap. 2015. [Google Scholar]

- Gaetano, S.F.; Emilia, L.; Francesco, C.; Gianluca, N.; Antonio, S. Drivers of grain price volatility: A cursory critical review. Agric. Econ. 2018, 64, 347–356. [Google Scholar]

- Santeramo, F.G.; Lamonaca, E. On the drivers of global grain price volatility: An empirical investigation. Agric. Econ. 2019, 65, 31–42. [Google Scholar] [CrossRef]

- Luo, J.; Ji, Q. High-frequency volatility connectedness between the US crude oil market and China’s agricultural commodity markets. Energy Econ. 2018, 76, 424–438. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Rasoulinezhad, E.; Yoshino, N. Energy and food security: Linkages through price volatility. Energy Policy 2019, 128, 796–806. [Google Scholar] [CrossRef]

- Meng, X. Does Agricultural Commodity Price Co-move with Oil Price in the Time-Frequency Space ? Evidence from the Republic of Korea. Int. J. Energy Ecconomics Policy 2018, 8, 125–133. [Google Scholar]

- Baumeister, C.; Kilian, L. Do oil price increases cause higher food prices? Econ. Policy 2014, 29, 691–747. [Google Scholar] [CrossRef]

- Paris, A. On the link between oil and agricultural commodity prices: Do biofuels matter? Int. Econ. 2018, 155, 48–60. [Google Scholar] [CrossRef]

- Towbin, P.; Weber, S. Limits of floating exchange rates: The role of foreign currency debt and import structure. J. Dev. Econ. 2013, 101, 179–194. [Google Scholar] [CrossRef]

- Vo, D.H.; Vu, T.N.; McAleer, M. Modeling the Relationship between Crude Oil and Agricultural Commodity Prices. Energies 2019, 12, 1344. [Google Scholar] [CrossRef]

- Vu, T.N.; Vo, D.H.; Ho, C.M.; Van, L.T.-H. Modeling the Impact of Agricultural Shocks on Oil Price in the US: A New Approach. J. Risk Financ. Manag. 2019, 12, 147. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C.; Yang, L. Oil price shocks and agricultural commodity prices. Energy Econ. 2014, 44, 22–35. [Google Scholar] [CrossRef]

- Du, X.; Cindy, L.Y.; Hayes, D.J. Speculation and volatility spillover in the crude oil and agricultural commodity markets: A Bayesian analysis. Energy Econ. 2011, 33, 497–503. [Google Scholar] [CrossRef]

- Wei Su, C.; Wang, X.Q.; Tao, R.; Oana-Ramona, L. Do oil prices drive agricultural commodity prices? Further evidence in a global bio-energy context. Energy 2019, 172, 691–701. [Google Scholar] [CrossRef]

- Coronado, S.; Rojas, O.; Romero-Meza, R.; Serletis, A.; Chiu, L.V. Crude oil and biofuel agricultural commodity prices. In Uncertainty, Expectations and Asset Price Dynamics; Springer: Berlin, Germany, 2018; pp. 107–123. [Google Scholar]

- Diks, C.; Panchenko, V. A new statistic and practical guidelines for nonparametric Granger causality testing. J. Econ. Dyn. Control 2006, 30, 1647–1669. [Google Scholar] [CrossRef]

- Brooks, C.; Hinich, M.J. Cross-correlations and cross-bicorrelations in Sterling exchange rates. J. Empir. Financ. 1999, 6, 385–404. [Google Scholar] [CrossRef][Green Version]

- Pal, D.; Mitra, S.K. Time-frequency contained co-movement of crude oil and world food prices: A wavelet-based analysis. Energy Econ. 2017, 62, 230–239. [Google Scholar] [CrossRef]

- Natanelov, V.; Alam, M.J.; McKenzie, A.M.; Van Huylenbroeck, G. Is there co-movement of agricultural commodities futures prices and crude oil? Energy Policy 2011, 39, 4971–4984. [Google Scholar] [CrossRef]

- Zafeiriou, E.; Arabatzis, G.; Karanikola, P.; Tampakis, S.; Tsiantikoudis, S. Agricultural Commodity and Crude Oil Prices: An Empirical Investigation of Their Relationship. Sustainability 2018, 10, 1199. [Google Scholar] [CrossRef]

- Saghaian, S.; Nemati, M.; Walters, C.; Chen, B. Asymmetric price volatility transmission between US biofuel, corn, and oil markets. J. Agric. Resour. Econ. 2018, 43, 46. [Google Scholar]

- Engle, R.F.; Kroner, K.F. Multivariate simultaneous generalized arch. Econom. Theory 1995, 11, 122–150. [Google Scholar] [CrossRef]

- Yahya, M.; Oglend, A.; Dahl, R.E. Temporal and spectral dependence between crude oil and agricultural commodities: A wavelet-based copula approach. Energy Econ. 2019, 80, 277–296. [Google Scholar] [CrossRef]

- Baffes, J.; Haniotis, T. What explains agricultural price movements? J. Agric. Econ. 2016, 67, 706–721. [Google Scholar] [CrossRef]

- Gözgör, G.; Kablamacı, B. The Linkage between Oil and Agricultural Commodity Prices in the Light of the Perceived Global Risk. Agric. Econ. (AGRICECON) 2014, 60, 332–342. [Google Scholar]

- Kohler, A.; Ferjani, A. Exchange rate effects: A case study of the export performance of the Swiss Agriculture and Food Sector. World Econ. 2018, 41, 494–518. [Google Scholar] [CrossRef]

- Hatzenbuehler, P.L.; Abbott, P.C.; Foster, K.A. Agricultural commodity prices and exchange rates under structural change. J. Agric. Resour. Econ. 2016, 41, 204–224. [Google Scholar]

- Gilbert, C.L. How to understand high food prices. J. Agric. Econ. 2010, 61, 398–425. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Soytas, U. Oil price, agricultural commodity prices, and the dollar: A panel cointegration and causality analysis. Energy Econ. 2012, 34, 1098–1104. [Google Scholar] [CrossRef]

- Adam, P.; Rosnawintang, R.; Tondi, L. The causal relationship between crude oil price, exchange rate and rice price. Int. J. Energy Econ. Policy 2018, 8, 90–94. [Google Scholar]

- Burakov, D. Oil prices, exchange rate and prices for agricultural commodities: Empirical evidence from Russia. AGRIS on-line Pap. Econ. Inform. 2016, 8, 33–47. [Google Scholar] [CrossRef]

- Rezitis, A.N. The relationship between agricultural commodity prices, crude oil prices and US dollar exchange rates: A panel VAR approach and causality analysis. Int. Rev. Appl. Econ. 2015, 29, 403–434. [Google Scholar] [CrossRef]

- Rezitis, A. Empirical analysis of agricultural commodity prices, crude oil prices and US dollar exchange rates using panel data econometric methods. Int. J. Energy Econ. Policy 2015, 5, 851–868. [Google Scholar]

- Bouri, E.; Azzi, G. Dynamic interactions between the markets of crude oil and fine wine in light of the global economic growth. Energy Stud. Rev. 2013, 20, 80–91. [Google Scholar] [CrossRef][Green Version]

- Joëts, M.; Mignon, V.; Razafindrabe, T. Does the volatility of commodity prices reflect macroeconomic uncertainty? Energy Econ. 2017, 68, 313–326. [Google Scholar] [CrossRef]

- Sedik, T.S.; Cevik, M.S. A Barrel of Oil or a Bottle of Wine: How Do Global Growth Dynamics Affect Commodity Prices? International Monetary Fund: Washington, DC, USA, 2011. [Google Scholar]

- Jadidzadeh, A.; Serletis, A. The Journal of Economic Asymmetries The global crude oil market and biofuel agricultural commodity prices. J. Econ. Asymmetries 2018, e00094. [Google Scholar] [CrossRef]

- Vo, A.T.; Le, Q.T.T.; Nguyen, P.V.; Ho, C.M.; Vo, D.H. Exchange rate pass-through in ASEAN countries: An application of the SVAR model. Emerg. Mark. Financ. Trade 2018. [Google Scholar] [CrossRef]

- Vo, A.T.; Ho, C.M.; Vo, D.H. Understanding the exchange rate pass-through to consumer prices in Vietnam: The SVAR approach. Int. J. Emerg. Mark. 2019. [Google Scholar] [CrossRef]

- Bergmann, P. Oil price shocks and GDP growth: Do energy shares amplify causal effects? Energy Econ. 2019, 80, 1010–1040. [Google Scholar] [CrossRef]

- Huidrom, R.; Kose, A.; Lim, J.J.; Ohnsorge, F.L. Why Do Fiscal Multipliers Depend on Fiscal Positions? The World Bank: Washington, DC, USA, 2019; ISBN 1813-9450. [Google Scholar]

- Kim, Y.; Lim, H. Transmission of Monetary Policy in Times of High Household Debt. J. Macroecon. 2019, 103168. [Google Scholar]

- Leroy, A.; Lucotte, Y. Competition and credit procyclicality in European banking. J. Bank. Financ. 2019, 99, 237–251. [Google Scholar] [CrossRef]

- Towbin, P.; Weber, S. A Guide to the Matlab Toolbox for Interacted Panel VAR Estimations (IPVAR) 2011. Available online: http://sebastianweber.weebly.com/codes.html (accessed on 16 December 2019).

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Zivot, E.; Andrews, D.W.K. Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J. Bus. Econ. Stat. 1992, 10, 251–270. [Google Scholar]

- Gregory, A.W.; Hansen, B.E. Residual-based tests for cointegration in models with regime shifts. J. Econom. 1996, 70, 99–126. [Google Scholar] [CrossRef]

- Balcombe, K. The nature and determinants of volatility in agricultural prices: An empirical study. Safeguarding Food Secur. Volatile Glob. Mark. 2011, 89–110. [Google Scholar]

- Kaltalioglu, M.; Soytas, U. Volatility Spillover from Oil to Food and Agricultural Raw Material Markets. Mod. Econ. 2011, 02, 71–76. [Google Scholar] [CrossRef]

| January 2000–April 2006 | ||||||

| Variable | Mean | SD | Max | Min | Skewness | Kurtosis |

| Oil | 44.662 | 13.546 | 79.849 | 23.087 | 0.934 | 3.064 |

| Barley | 3.140 | 0.354 | 3.870 | 2.471 | 0.441 | 1.999 |

| Beans | 25.273 | 5.266 | 38.075 | 18.939 | 0.982 | 2.618 |

| Corn | 2.702 | 0.341 | 3.655 | 2.086 | 0.748 | 3.352 |

| Cotton | 0.585 | 0.123 | 0.869 | 0.353 | 0.160 | 2.480 |

| Oats | 2.020 | 0.353 | 2.724 | 1.276 | 0.336 | 2.344 |

| Rice | 7.861 | 1.823 | 11.744 | 5.017 | 0.231 | 2.230 |

| Sorghum | 4.632 | 0.716 | 6.438 | 3.374 | 0.388 | 2.452 |

| Soybean | 7.221 | 1.498 | 12.167 | 5.458 | 1.790 | 6.012 |

| Sunflower | 14.220 | 2.819 | 18.854 | 7.851 | −0.389 | 2.237 |

| Wheat | 4.147 | 0.525 | 5.729 | 3.184 | 0.865 | 3.725 |

| Biofuel | 32.359 | 11.292 | 56.829 | 17.661 | 0.363 | 1.849 |

| Kilian’s index | 29.495 | 54.650 | 126 | −58 | 0.232 | 1.928 |

| Broad index | 118.871 | 6.431 | 129.640 | 108.974 | 0.016 | 1.600 |

| May 2006–May 2019 | ||||||

| Variable | Mean | SD | Max | Min | Skewness | Kurtosis |

| Oil | 81.782 | 28.008 | 149.801 | 28.828 | 0.126 | 1.992 |

| Barley | 5.021 | 0.892 | 6.742 | 2.957 | −0.042 | 2.333 |

| Beans | 32.403 | 6.336 | 48.790 | 21.972 | 0.428 | 2.497 |

| Corn | 4.431 | 1.345 | 7.866 | 2.431 | 0.900 | 2.570 |

| Cotton | 0.692 | 0.121 | 0.992 | 0.451 | 0.520 | 2.766 |

| Oats | 2.964 | 0.699 | 4.548 | 1.813 | 0.293 | 1.886 |

| Rice | 13.786 | 2.541 | 22.017 | 9.455 | 0.486 | 2.954 |

| Sorghum | 7.585 | 2.312 | 12.709 | 4.495 | 0.748 | 2.327 |

| Soybean | 10.838 | 2.457 | 16.700 | 6.082 | 0.285 | 2.088 |

| Sunflower | 21.552 | 5.188 | 33.995 | 13.557 | 0.531 | 2.146 |

| Wheat | 6.118 | 1.628 | 11.659 | 3.422 | 0.751 | 3.370 |

| Biofuel | 155.755 | 40.326 | 211.884 | 56.266 | −0.971 | 2.943 |

| Kilian’s index | 1.509 | 78.972 | 189 | −162 | 0.681 | 2.709 |

| Broad index | 108.686 | 10.197 | 128.734 | 94.548 | 0.548 | 1.868 |

| Level | |||

| Variable | ADF | ZA | |

| T-Stat | Break In | ||

| Oil | −2.535 | −5.629 ***; −4.565 **; −5.446 ** | Intercept (2014m8); Trend (2011m5); Intercept and Trend (2014m8) |

| Barley | −1.635 | −3.367; −3.266; −3.924 | Intercept (2007m6); Trend (2012m9); Intercept and Trend (2011m6) |

| Beans | −2.275 | −3.677; −3.856; −4.363 | Intercept (2015m6); Trend (2012m3); Intercept and Trend (2011m2) |

| Corn | −1.879 | −4.312; −3.178; −4.036 | Intercept (2013m8); Trend (2012m2); Intercept and Trend (2013m8) |

| Cotton | −2.323 | −3.553; −2.836; −3.851 | Intercept (2009m8); Trend (2011m9); Intercept and Trend (2009m8) |

| Oats | −2.084 | −4.033; −2.792; −3.476 | Intercept (2014m6); Trend (2012m1); Intercept and Trend (2014m6) |

| Rice | −1.841 | −3.031; −3.398; −4.176 | Intercept (2015m2); Trend (2008m9); Intercept and Trend (2007m10) |

| Sorghum | −2.245 | −3.839; −3.773; −4.818 | Intercept (2013m7); Trend (2012m4); Intercept and Trend (2010m7) |

| Soybean | −2.125 | −4.46; −4.244 *; −4.739 | Intercept (2014m7); Trend (2012m8); Intercept and Trend (2014m7) |

| Sunflower | −1.892 | −3.362; −3.468; −4.296 | Intercept (2015m8); Trend (2011m8); Intercept and Trend (2010m9) |

| Wheat | −2.24 | −3.982; −3.757; −4.304 | Intercept (2014m6); Trend (2011m9); Intercept and Trend (2007m6) |

| First Difference | |||

| Variable | ADF | ZA | |

| T-Stat | Break In | ||

| Oil | −8.08 *** | −9.065 ***; −8.757 ***; −9.088 *** | Intercept (2008m7); Trend (2015m1); Intercept and Trend (2008m7) |

| Barley | −17.131 *** | −17.414 ***; −17.189 ***; −17.523 *** | Intercept (2008m10); Trend (2007m10); Intercept and Trend (2008m10) |

| Beans | −16.576 *** | −16.81 ***; −16.582 ***; −16.779 *** | Intercept (2012m4); Trend (2008m3); Intercept and Trend (2012m4) |

| Corn | −8.354 *** | −11.683 ***; −11.092 ***; −11.781 *** | Intercept (2012m9); Trend (2006m12); Intercept and Trend (2012m9) |

| Cotton | −14.823 *** | −15.052 ***; −14.822 ***; −15.189 *** | Intercept (2011m3); Trend (2003m1); Intercept and Trend (2003m11) |

| Oats | −14.891 *** | −15.108 ***; −14.918 ***; −15.295 *** | Intercept (2013m6); Trend (2015m9); Intercept and Trend (2013m6) |

| Rice | −8.522 *** | −13.709 ***; −12.972 ***; −13.863 *** | Intercept (2008m12); Trend (2003m9); Intercept and Trend (2008m12) |

| Sorghum | −8.062 *** | −12.049 ***; −11.74 ***; −12.088 *** | Intercept (2012m11); Trend (2006m11); Intercept and Trend (2013m4) |

| Soybean | −8.599 *** | −10.573 ***; −10.337 ***; −10.559 *** | Intercept (2012m9); Trend (2007m12); Intercept and Trend (2012m9) |

| Sunflower | −17.255 *** | −17.653 ***; −17.267 ***; −17.629 *** | Intercept (2011m10); Trend (2007m7); Intercept and Trend (2011m10) |

| Wheat | −9.613 *** | −10.554 ***; −9.963 ***; −10.645 *** | Intercept (2008m4); Trend (2007m5); Intercept and Trend (2008m3) |

| ADF*Test | Zt*Test | *Test | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Model | C | C/T | C/S | C | C/T | C/S | C | C/T | C/S |

| Barley | −3.474 | −3.530 | −3.510 | −3.485 | −3.445 | −3.646 | −22.120 | −22.349 | −22.267 |

| Beans | −3.520 | −3.890 | −3.836 | −3.537 | −3.899 | −4.000 | −24.997 | −29.127 | −29.174 |

| Corn | −3.962 | −4.426 | −4.672 | −4.604 * | −4.967 * | −5.146 ** | −24.106 | −29.366 | −31.733 |

| Cotton | −3.423 | −4.059 | −3.988 | −3.572 | −4.481 | −4.183 | −22.788 | −33.765 | −30.449 |

| Oats | −4.365 * | −5.390 ** | −5.140 ** | −5.071 ** | −5.742 *** | −5.511 *** | −35.916 | −43.022 | −41.312 |

| Rice | −4.059 | −3.999 | −4.547 | −4.694 ** | −4.811 * | −5.037 ** | −26.571 | −28.327 | −29.388 |

| Sorghum | −3.835 | −4.356 | −4.490 | −4.428 * | −4.922 * | −5.095 ** | −25.413 | −32.123 | −33.324 |

| Soybean | −4.278 | −4.660 | −4.856 * | −4.348 * | −4.707 | −4.748 * | −26.856 | −30.518 | −33.262 |

| Sunflower | −3.416 | −3.542 | −3.569 | −3.299 | −3.405 | −3.524 | −21.099 | −22.384 | −23.563 |

| Wheat | −5.830 *** | −6.045 *** | −6.191 *** | −4.948 ** | −5.452 *** | −5.409 ** | −34.145 | −39.686 | −40.231 |

| Lag | MBIC | MAIC |

|---|---|---|

| 1 | 90.1325 | 181.7731 |

| 2 | −64.8366 | 3.8939 |

| 3 | −44.6476 | 1.1727 |

| 4 | −22.3003 | 0.6098 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vu, T.N.; Ho, C.M.; Nguyen, T.C.; Vo, D.H. The Determinants of Risk Transmission between Oil and Agricultural Prices: An IPVAR Approach. Agriculture 2020, 10, 120. https://doi.org/10.3390/agriculture10040120

Vu TN, Ho CM, Nguyen TC, Vo DH. The Determinants of Risk Transmission between Oil and Agricultural Prices: An IPVAR Approach. Agriculture. 2020; 10(4):120. https://doi.org/10.3390/agriculture10040120

Chicago/Turabian StyleVu, Tan Ngoc, Chi Minh Ho, Thang Cong Nguyen, and Duc Hong Vo. 2020. "The Determinants of Risk Transmission between Oil and Agricultural Prices: An IPVAR Approach" Agriculture 10, no. 4: 120. https://doi.org/10.3390/agriculture10040120

APA StyleVu, T. N., Ho, C. M., Nguyen, T. C., & Vo, D. H. (2020). The Determinants of Risk Transmission between Oil and Agricultural Prices: An IPVAR Approach. Agriculture, 10(4), 120. https://doi.org/10.3390/agriculture10040120