Procurement of Category 2 Vaccines in China

Abstract

1. Introduction

2. Materials and Methods

2.1. Data Sources

2.2. Analytical Methods and Comparisons

- (a)

- Provincial-level GPO purchasing vs. CDC-tiered purchasing;

- (b)

- Provincial-level GPO purchasing vs. Independent purchasing;Between-province GPO purchasing differences: vaccine prices from six provinces or provincial-level municipalities in China (Guangdong, Shanghai, Tianjin, Jiangxi, Chongqing, and Xinjiang) were compared.

- (c)

- Provincial-level GPO purchasing vs. International collective purchasing: vaccine pricing from UNICEF and other organizations was compared to Chinese provincial-level GPO vaccine prices.

2.3. Ethical Approval

3. Results

3.1. Provincial-Level GPO Scheme vs. CDC-Tiered Purchasing

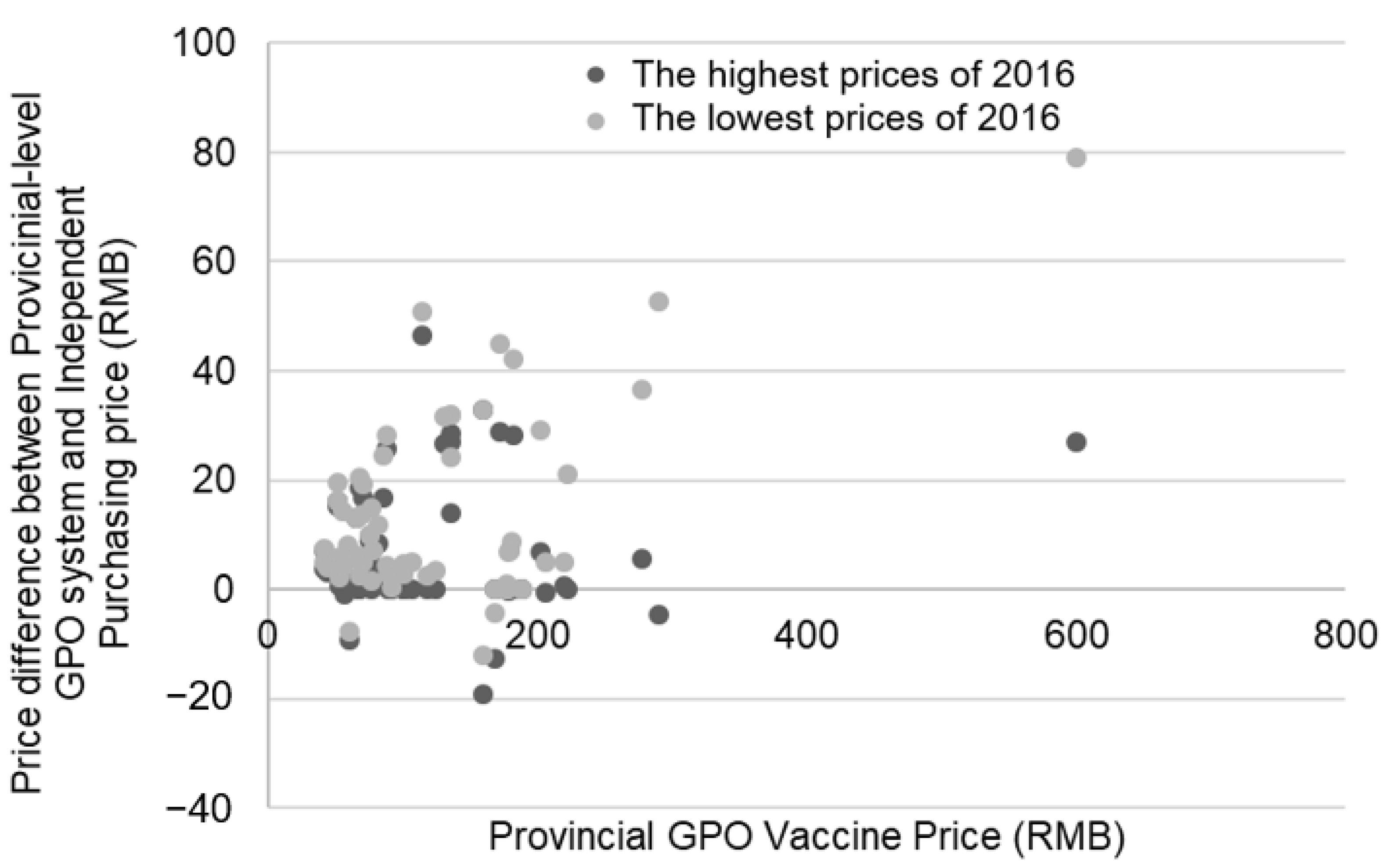

3.2. Provincial-Level GPO Purchasing vs. Independent Purchasing

3.3. Between-Province GPO Purchasing Differences

3.4. Provincial-Level GPO Purchasing vs. International Collective Purchasing

4. Discussion

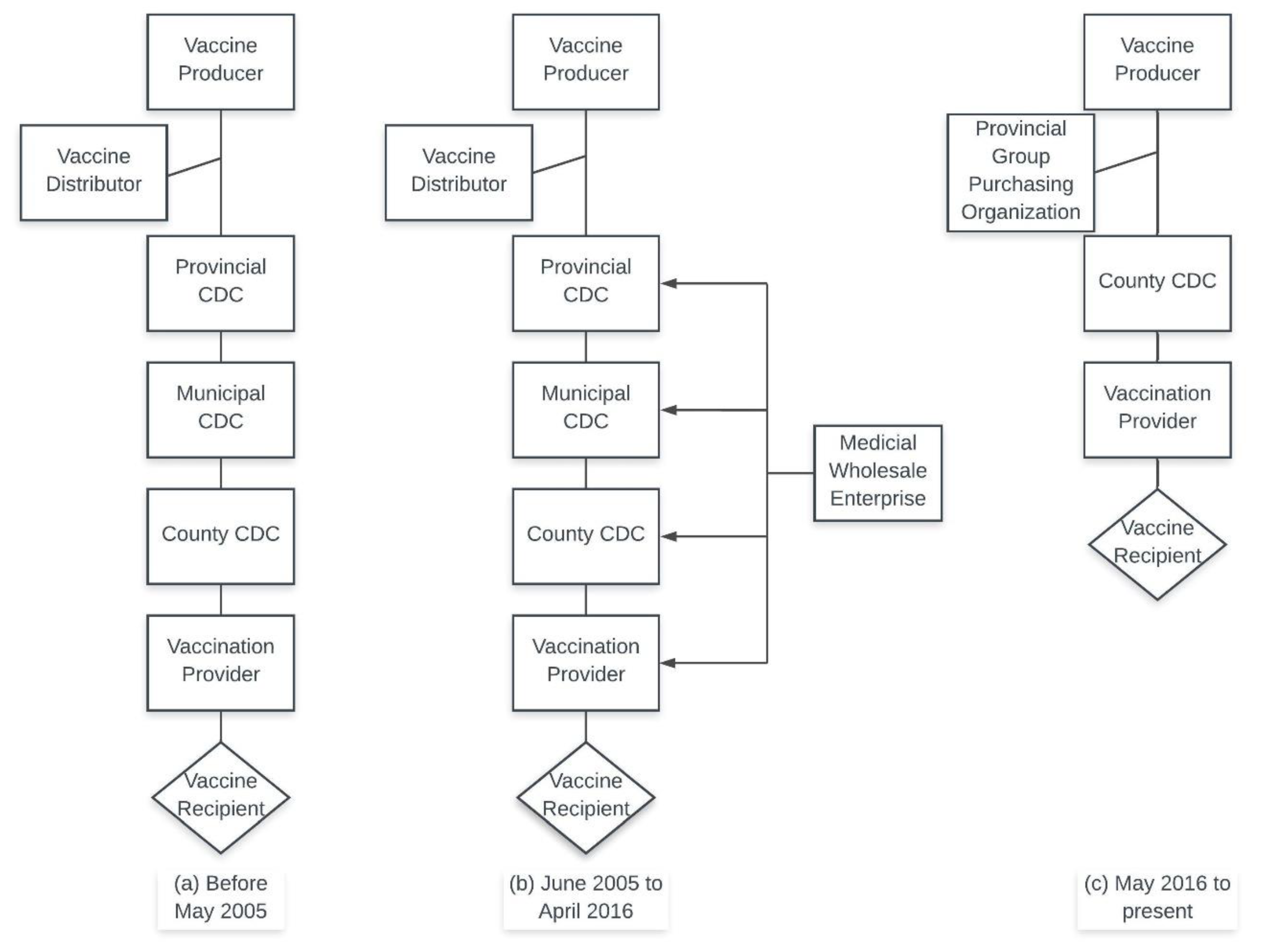

4.1. Changes in Category 2 Vaccine Procurement in China

4.2. Global Comparisons of Vaccine Prices

4.3. Strenghts and Limitations

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Drolet, M.; Bénard, É.; Jit, M.; Hutubessy, R.; Brisson, M. Model Comparisons of the Effectiveness and Cost-Effectiveness of Vaccination: A Systematic Review of the Literature. Value Health 2018, 21, 1250–1258. [Google Scholar] [CrossRef] [PubMed]

- World Health Organization. Summary of WHO Position Papers—Recommendations for Routine Immunization. Available online: http://www.who.int/immunization/policy/Immunization_routine_table1.pdf (accessed on 7 September 2017).

- Rosenthal, E. The Price of Prevention: Vaccine Costs Are Soaring. Available online: http://www.nytimes.com/2014/07/03/health/Vaccine-Costs-Soaring-Paying-Till-It-Hurts.html (accessed on 11 May 2016).

- Yu, H.; Yang, W.; Varma, J.K. To save children’s lives, China should adopt an initiative to speed introduction of pneumonia vaccines. Health Aff. 2012, 31, 2545–2553. [Google Scholar] [CrossRef] [PubMed]

- Zheng, Y.; Rodewald, L.; Yang, J.; Qin, Y.; Pang, M.; Feng, L.; Yu, H. The landscape of vaccines in China: History, classification, supply, and price. BMC Infect. Dis. 2018, 18, 502. [Google Scholar] [CrossRef] [PubMed]

- Maurer, K.A.; Chen, H.-F.; Wagner, A.L.; Hegde, S.T.; Patel, T.; Boulton, M.L.; Hutton, D.W. Cost-effectiveness analysis of pneumococcal vaccination for infants in China. Vaccine 2016, 34, 6343–6349. [Google Scholar] [CrossRef] [PubMed]

- Pan, X.-F.; Griffiths, U.K.; Pennington, M.; Yu, H.; Jit, M. Systematic review of economic evaluations of vaccination programs in mainland China: Are they sufficient to inform decision making? Vaccine 2015, 33, 6164–6172. [Google Scholar] [CrossRef] [PubMed]

- Yin, Y. HPV vaccination in China needs to be more cost-effective. Lancet 2017, 390, 1735–1736. [Google Scholar] [CrossRef]

- World Health Organization Regional Office for Europe. Review of Vaccine Price Data: Submitted by WHO European Region Member States through the WHO/UNICEF Joint Reporting Form for 2013; WHO Regional Office for Europe Publications: Copenhagen, Denmark, 2015. [Google Scholar]

- World Health Organization. Immunization, Vaccines and Biologicals: Vaccine Product, Price and Procurement (V3P). Available online: https://www.sabin.org/sites/sabin.org/files/case_study_-_vaccine_procurement_legislation_0.pdf (accessed on 20 June 2019).

- Wagner, A.L.; Sun, X.; Montgomery, J.P.; Huang, Z.; Boulton, M.L. The Impact of Residency and Urbanicity on Haemophilus influenzae Type b and Pneumococcal Immunization in Shanghai Children: A Retrospective Cohort Study. PLoS ONE 2014, 9, e97800. [Google Scholar] [CrossRef] [PubMed]

- Zheng, J.-S.; Cao, L.; Guo, S.-C.; A, K.-Z.; Wang, L.; Yu, W.-Z.; Yuan, P.; Jiang, K.-Y.; Zhang, G.-M.; Cao, L.-S.; et al. Survey on the Immunization Status of Category B Vaccine among Children Aged 1 to 2 Years in China. Chin. J. Vaccine Immun. 2012, 18, 233–237. (In Chinese) [Google Scholar]

- Lee, L. The current state of public health in China. Annu. Rev. Public Health 2004, 25, 327–339. [Google Scholar] [CrossRef] [PubMed]

- PRC State Council Regulations on the Administration of Vaccines and Vaccination. Available online: http://www.nhfpc.gov.cn/mohzcfgs/pfg/200804/18981.shtml (accessed on 13 February 2019).

- PRC State Council Regulations on the Administration of Vaccines and Vaccination. Available online: http://www.gov.cn/zhengce/content/2016-04/25/content_5067597.htm (accessed on 13 February 2019).

- Gavi. Gavi’s Business Model. Available online: https://www.gavi.org/about/gavis-business-model/ (accessed on 26 June 2019).

- Chen, J. Guangdong Province: 2016 Announcement of the Publication of Relevant Price Information of Category 2 Vaccines Which Can Participate in Price Negotiations in 2017. Available online: http://www.pharmadl.com/read/articles/126605/m/article/126605/info.html (accessed on 20 September 2018).

- Shanghai Health Affairs Service Center. Announcement of Year 2017 Shanghai Category 2 Vaccine Procurement Catalog (Supplement). Available online: http://www.shgpo.com:33/jggb/768.jhtml (accessed on 13 June 2019).

- Tianjin Center of Disease Control. Public announcement of Tianjin Category 2 Vaccine Procurement Project. Available online: https://toutiao.258.com/info/15732.html (accessed on 13 June 2019).

- Jiangxi Province Center for Disease Control and Prevention. Announcement of Jiangxi Province Year 2017 Category 2 Vaccine Procurement. Available online: http://www.jxcdc.cn/news/show.php?contentid=23516 (accessed on 13 June 2019).

- Government Procurement of Chongqing. Chongqing Municipality Year 2017 Category 2 Vaccine Supply and Procurement Publication (17A2467). Available online: https://www.cqgp.gov.cn/notices/detail/494158021228982272?title=2017%2525E5%2525B9%2525B4%2525E9%252587%25258D%2525E5%2525BA%252586%2525E5%2525B8%252582%2525E7%2525AC%2525AC%2525E4%2525BA%25258C%2525E7%2525B1%2525BB%2525E7%252596%2525AB%2525E8%25258B%252597%2525E4%2525BE%25259B%2525E5%2525BA%252594%2525E5%252595%252586%2525E5%252 (accessed on 20 September 2018).

- Health and Family Planning Commission of Xinjiang Uygar Autonomous Region. Notice on the Publication of the Category 2 Vaccine Procurement Catalog in the Autonomous Region. Available online: http://www.xjhfpc.gov.cn/info/1635/6441.htm (accessed on 20 September 2018).

- UNICEF Supply Division. Total Value (Millions USD) of Each Vaccine Procured by Year for 1996–2016. 2017. Available online: https://www.unicef.org/supply/files/Table_of_Vaccine_Procurement_1996_-2015_Value.pdf (accessed on 22 August 2019).

- UNICEF. Supplies and Logistics: Historical Vaccine Procurement. Available online: https://www.unicef.org/supply/index_38554.html (accessed on 26 June 2019).

- Centers for Disease Control and Prevention (CDC). Archived CDC Vaccine Price List as of 1 December 2017. Available online: https://www.cdc.gov/vaccines/programs/vfc/awardees/vaccine-management/price-list/2017/2017-12-01.html (accessed on 2 July 2019).

- Li, Y.; Zhang, D.; Fang, X.; Ye, B.; Ye, X.; Sun, H.; Zhang, L. Analysis and Thoughts on the Effectiveness of Category 2 Vaccine Disparity Policies. Health Econ. Res. 2014, 321, 29–31. [Google Scholar] [CrossRef]

- Zhang, S. Strengthening Investigations into Guangdong Province’s Vaccine Price Management Guangdong Province. Chin. J. Vaccines Immun. 2012, 28, 779–780. [Google Scholar]

- Yao, Y.P.; Wu, J.Y.; Gu, L.H.; Yu, F.Y.; Wu, W.X. Analysis of Category 2 Vaccine Management Policies. Zhejiang Prev. Med. 2012, 24, 83–85. [Google Scholar] [CrossRef]

- Qiu, J.; Hu, H.; Zhou, S.; Liu, Q. Vaccine scandal and crisis in public confidence in China. Lancet 2016, 387, 2382. [Google Scholar] [CrossRef][Green Version]

- Zhejiang Price Information. Zhejiang Province Commodities and Finances Office Announcement of Standard Vaccine Prices. Available online: http://www.zjpi.gov.cn/art/2017/12/15/art_1402951_19588754.html (accessed on 13 June 2019).

- Su, J. Notice of the Jiangsu Provincial Price Bureau and the Jiangsu Provincial Department of Finance on Standard Prices and Related Issues of Category 2 Vaccine Services. Available online: http://www.pkulaw.cn/fulltext_form.aspx?Db=lar&Gid=6c5bd6313e645970e6a552cc298d6961bdfb (accessed on 20 September 2018).

- Hangzhou Price Website. Hangzhou City Year 2015 Vaccine and Preventable Disease Prevention and Control Center Category 2 Vaccine Prices. Available online: https://wenku.baidu.com/view/1d43e429bb4cf7ec4bfed05b.html (accessed on 20 September 2018).

- Ma, T. China’s Vaccine Prices and Management Research: Vaccine Price, Problems, and Related Research. Price Theory Pract. 2009, 12, 24–25. [Google Scholar]

- Li, C. Microeconomics; Beijing Normal University Publishing Group: Beijing, China, 2008. [Google Scholar]

- Cui, J.; Cao, L.; Zheng, J.; Cao, L.; Yuan, P.; Wang, M.; Xiao, Q.; Wang, H. Analysis of Reported Coverage Rates of Vaccines in National Immunization Program in China, 2014. Chin. J. Vaccines Immun. 2016, 22, 34–40. (In Chinese) [Google Scholar]

- Xu, M.; Liang, Z.; Xu, Y.; Wang, J. Chinese vaccine products go global: Vaccine development and quality control. Expert Rev. Vaccines 2015, 14, 763–773. [Google Scholar] [CrossRef] [PubMed]

- Xinhua China Adopts Tough Law to Ensure Vaccine Safety. Available online: http://en.people.cn/n3/2019/0630/c90000-9593019.html (accessed on 2 July 2019).

- GVAP Secretariat Global Vaccine Action Plan. Secretariat Annual Report 2017: Subchapter 4 Vaccine Pricing & Procurement Report. Available online: https://www.who.int/immunization/global_vaccine_action_plan/gvap_2017_secretariat_report_vaccine_prices.pdf (accessed on 6 August 2019).

- Clendinen, C.; Zhang, Y.; Warburton, R.N.; Light, D.W. Manufacturing costs of HPV vaccines for developing countries. Vaccine 2016, 34, 5984–5989. [Google Scholar] [CrossRef] [PubMed][Green Version]

| Vaccine | Guangdong | Shanghai | Tianjin | Jiangxi | Chongqing | Xinjiang | Highest/Lowest Price |

|---|---|---|---|---|---|---|---|

| DTaP-Hib | 278.00 | 285.50 | 274.53 | 275.00 | - | 308.00 | 1.12 |

| DTaP-IPV-Hib | 600.00 | 604.50 | - | 599.00 | 599.00 | - | 1.01 |

| MenAC-Hib | 222.90 | 221.50 | 216.00 | - | - | 226.00 | 1.05 |

| Rotavirus | 172.00 | 173.5 | - | 172.00 | - | 172.00 | 1.01 |

| PCV13 | - | 703.50 | 698.00 | 698.00 | - | 698.00 | 1.01 |

| HepE | 160.00 | 165.50 | - | 160.00 | - | - | 1.03 |

| Hib | 84.98 | 91.46 | 91.71 | 80.66 | 95.27 | 85.86 | 1.18 |

| Varicella | 134.75 | 144.95 | 138.93 | 136.54 | 136.00 | 140.63 | 1.08 |

| PPSV23 | 192.25 | 197.50 | 189.61 | 191.00 | 200.00 | - | 1.05 |

| EV71 | 178.00 | 193.50 | 184.26 | 174.67 | 168.00 | 184.67 | 1.15 |

| HepA | 116.31 | 118.88 | 118.78 | 130.50 | 151.00 | 105.37 | 1.43 |

| MenACYW135 | 60.88 | 64.83 | 64.00 | 56.45 | 56.00 | 64.71 | 1.16 |

| Vaccine | UNICEF (2017) | Europe MICs (2013) | US CDC Public Sector Cost (December 2017) | Shanghai GPO (2018) 3 |

|---|---|---|---|---|

| Hib | 23 RMB $3.40 1 | $4.03 | $9.46–$12.79 | 71–107 RMB $10.20–15.40 |

| Rotavirus | 14–22 RMB $2.00–3.20 | $2.46–2.96 | $69.12–91.05 | 174 RMB $25.10 |

| PCV13 | 23 RMB $3.30 | $3.53–41.28 | $126.97 | 704 RMB $102.00 |

| HPV 2 | 31–32 RMB $4.50–4.60 | $53.97–93.40 | $154.28 | 587–804 RMB $84.90–116.40 |

| Influenza | - | $2.73–14.29 | $13.55–15.68 | 26–56 RMB $3.70–8.00 |

| Varicella | - | $17.35 | $92.72 | 142–155 RMB $20.50–22.50 |

| DTaP-HepB-Hib | 6–10 RMB $0.80–1.40 | - | - | - |

| DTaP-IPV-Hib | - | $7.98–16.56 | $56.74 | 600 RMB $87.00 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhuang, J.-L.; Wagner, A.L.; Laffoon, M.; Lu, Y.-H.; Jiang, Q.-W. Procurement of Category 2 Vaccines in China. Vaccines 2019, 7, 97. https://doi.org/10.3390/vaccines7030097

Zhuang J-L, Wagner AL, Laffoon M, Lu Y-H, Jiang Q-W. Procurement of Category 2 Vaccines in China. Vaccines. 2019; 7(3):97. https://doi.org/10.3390/vaccines7030097

Chicago/Turabian StyleZhuang, Jian-Lin, Abram L. Wagner, Megan Laffoon, Yi-Han Lu, and Qing-Wu Jiang. 2019. "Procurement of Category 2 Vaccines in China" Vaccines 7, no. 3: 97. https://doi.org/10.3390/vaccines7030097

APA StyleZhuang, J.-L., Wagner, A. L., Laffoon, M., Lu, Y.-H., & Jiang, Q.-W. (2019). Procurement of Category 2 Vaccines in China. Vaccines, 7(3), 97. https://doi.org/10.3390/vaccines7030097