The Effect of a Renewable Energy Certificate Incentive on Mitigating Wind Power Fluctuations: A Case Study of Jeju Island

Abstract

1. Introduction

- A coordinated model of a wind farm with an ESS is constructed to model actual behaviors of wind farm operators;

- A revenue optimization problem is modeled as a mixed integer linear programming (MILP) problem based on the settlement rules of wind power generation;

- An objective function is modified to consider additional revenue obtained by discharging in off-peak periods; and

- The effect of imposing an additional incentive in off-peak periods is analyzed according to the REC multiplier magnitude.

2. An Optimization Model for Wind Farms with an ESS

2.1. Coordinated Model of Wind Farms with an ESS

2.2. Objective Function

2.3. Operational Constraints of an ESS

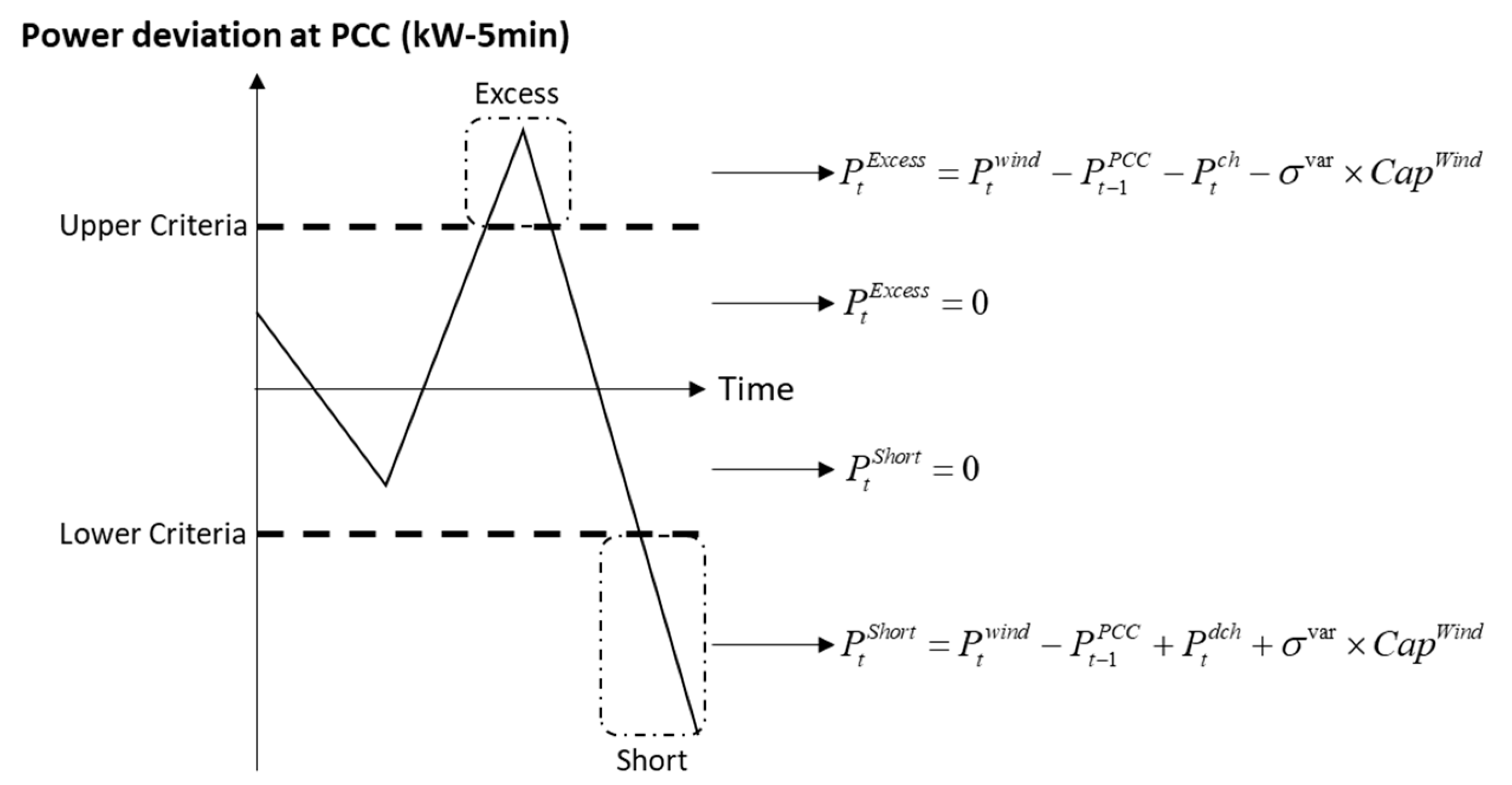

2.4. Variability Criteria for Wind Power Generation

3. A Modified Optimization Model to Induce the Discharge of an ESS in Off-Peak Periods

3.1. Modified Objective Function

3.2. Conditions for Determining REC Multiplier for Discharging Power in Off-Peak Periods

- Condition 1: The REC multiplier value is more than 1; and

- Condition 2: The REC multiplier value is more than the product reciprocal of the parameters related to ESS operations.

4. Case Study and Discussion

4.1. Simulation Setup

4.1.1. Parameters of a Wind Farm and an ESS

4.1.2. Wind Farm Generation Profiles

- The yearly data were sorted by month;

- Power exceeding the upper and lower variation criteria for daily wind power generation in the monthly profiles was calculated;

- The day with the highest number of occurrences beyond the variation criteria was chosen as a typical day in the monthly profile; and

- The above procedures were repeated for all months.

4.1.3. SMP and REC Price

4.2. Case Study

4.2.1. Case Setup

4.2.2. Case Results

4.3. Discussions

5. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

Nomenclature

| Indices and Sets | |

| 5-min time step in . | |

| Set of time steps. | |

| Subset of off-peak period. | |

| Subset of peak period. | |

| Parameters | |

| System marginal price at time, , (Won/kW-5 min). | |

| Price of renewable energy certificate at time, (Won/kW-5 min). | |

| Wind farm power generation at time, (kW-5 min). | |

| Capacity of the wind farm (kW). | |

| Variation criteria of the point of common coupling (PCC). | |

| Capacity of the energy storage system (kWh). | |

| Variable O&M cost of energy storage system (Won/kW-5 min). | |

| / | Minimum/maximum state of charge level of the energy storage system (kWh). |

| Turnaround efficiency of the energy storage system. | |

| / | Charging/discharging efficiency of the energy storage system |

| Renewable energy certificate multiplier | |

| Renewable energy certificate multiplier in the off-peak period | |

| Positive infinity | |

| Variables | |

| Revenue in the off-peak period at time, . | |

| Revenue in the peak period at time, . | |

| Operational cost of the energy storage system at time, . | |

| Power of the point of common coupling (PCC) at time, . | |

| / | Charging/discharging power of the energy storage system at time, . |

| State of charge of the energy storage system at time, . | |

| / | Surplus variable for the power exceeding the upper/lower variation criteria of the point of common coupling (PCC) at time, . |

| Binary Variables | |

| / | Status of the charging/discharging operation of energy storage system at time, . |

| / | Status of exceeding the upper/lower variation criteria of the point of common coupling (PCC) at time, . |

Appendix A. The Linearization Process of Nonlinear Constraints for Determining the Surplus Variable for Power Exceeding Upper–Lower PCC Variation Criteria

References

- Jung, T.Y.; Kim, H.J. A critical review of the renewable portfolio standard in Korea. Int. J. Energy Res. 2016, 40, 572–578. [Google Scholar] [CrossRef]

- Energy & Environment News. Renewable Energy Supplying Half Of Total Electricity Consumption in Jeju Island. Available online: http://www.e2news.com/news/articleView.html?idxno=204758 (accessed on 16 January 2019).

- Jeju Energy Corporation. Q3 2018 Renewable Energy Plant Status. Available online: http://www.jejuenergy.or.kr/index.php/contents/open/development/development01?act=view&seq=1351&bd_bcid=development&page=1 (accessed on 17 January 2019).

- Nguyen, N.; Mitra, J. Reliability of Power System with High Wind Penetration Under Frequency Stability Constraint. IEEE Trans.Power Syst. 2018, 33, 985–994. [Google Scholar] [CrossRef]

- Yoon, M.; Yoon, Y.-T.; Jang, G. A Study on Maximum Wind Power Penetration Limit in Island Power System Considering High-Voltage Direct Current Interconnections. Energies 2015, 8, 14244–14259. [Google Scholar] [CrossRef]

- Chang, B.; Ha, Y.; Jeon, W. Jeju Island System Planning Considering Wind Power Penetration with HVDC Links. J. Int. Counc. Electr. Eng. 2011, 1, 287–291. [Google Scholar] [CrossRef]

- IRENA. Available online: https://www.irena.org/publications/2016/May/Scaling-up-Variable-Renewable-Power-The-Role-of-Grid-Codes (accessed on 22 January 2019).

- Ikni, D.; Bagre, A.O.; Camara, M.B.; Dakyo, B. An offshore wind farm energy injection mastering using aerodynamic and kinetic control strategies. E3S Web Conf. 2018, 61, 00002. [Google Scholar] [CrossRef]

- Collins, S.; Deane, P.; Ó Gallachóir, B.; Pfenninger, S.; Staffell, I. Impacts of Inter-annual Wind and Solar Variations on the European Power System. Joule 2018, 2, 2076–2090. [Google Scholar] [CrossRef] [PubMed]

- California ISO. Flexible Ramping Product Uncertainty Calculation and Implementation Issues. Available online: https://www.caiso.com/Documents/FlexibleRampingProductUncertaintyCalculationImplementationIssues.pdf (accessed on 22 January 2019).

- Zhao, H.; Wu, Q.; Hu, S.; Xu, H.; Rasmussen, C.N. Review of energy storage system for wind power integration support. Appl. Energy 2015, 137, 545–553. [Google Scholar] [CrossRef]

- Mahto, T.; Mukherjee, V. Energy storage systms for mitigating the variability of isolated hybrid power system. Renew. Sustain. Energy Rev. 2015, 51, 1564–1577. [Google Scholar] [CrossRef]

- Wang, X.; Li, L.; Palazoglu, A.; El-Farra, N.H.; Shah, N. Optimization and control of offshore wind systems with energy storage. Energy Conv. Manag. 2018, 173, 426–437. [Google Scholar] [CrossRef]

- Kim, C.; Muljadi, E.; Chung, C.C. Coordinated Control of Wind Turbine and Energy Storage System for Reducing Wind Power Fluctuation. Energies 2018, 11, 52. [Google Scholar] [CrossRef]

- Meghni, B.; Dib, D.; Azar, A.T.; Saadoun, A. Effective supervisory controller to extend optimal energy management in hybrid wind turbine under energy and reliability constraints. Int. J. Dyn. Control 2018, 6, 369–383. [Google Scholar] [CrossRef]

- Damiano, A.; Gatto, G.; Marongiu, I.; Porru, M.; Serpi, A. Real-Time Control Strategy of Energy Storage Systems for Renewable Energy Sources Exploitation. IEEE Trans. Sustain. Energy 2014, 5, 567–576. [Google Scholar] [CrossRef]

- Choi, S.; Min, S. Optimal Scheduling and Operation of the ESS for Prosumer Market Environment in Grid-Connected Industrial Complex. IEEE Trans. Ind. Appl. 2018, 54, 1949–1957. [Google Scholar] [CrossRef]

- Hartmann, B.; Dán, A. Methodologies for Storage Size Determination for the Integration of Wind Power. IEEE Trans. Sust. Energy 2014, 5, 182–189. [Google Scholar] [CrossRef]

- Nick, M.; Cherkaoui, R.; Paolone, M. Optimal siting and sizing of distributed energy storage systems via alternating direction method of multipliers. Int. J. Electr. Power Energy Syst. 2015, 72, 33–39. [Google Scholar] [CrossRef]

- Delgado-Antillón, C.P.; Domínguez-Navarro, J.A. Probabilistic siting and sizing of energy storage systems in distribution power systems based on the islanding feature. Electr. Power Syst. Res. 2018, 155, 225–235. [Google Scholar] [CrossRef]

- Choi, D.G.; Min, D.; Ryu, J.-H. Economic Value Assessment and Optimal Sizing of an Energy Storage System in a Grid-Connected Wind Farm. Energies 2018, 11, 591. [Google Scholar] [CrossRef]

- Korea Energy Agency. Renewable Portfolio Standards(RPS). Available online: http://www.energy.or.kr (accessed on 13 December 2018).

- Energy & Environmental News. Dilemma on Integrating the ESS with the Wind Farm in Jeju Island. Available online: http://www.e2news.com/news/articleView.html?idxno=94724 (accessed on 22 January 2019).

- Samsung SDI. ENERGY STORAGE SYSTEM for Utility, Commercial. Available online: http://www.samsungsdi.co.kr/upload/ess_brochure/ESS%20for%20Utility%20Commercial.pdf (accessed on 14 December 2018).

- Jeju Energy Corporation. Wind Facilities. Available online: http://www.jejuenergy.or.kr/index.php/contents/energy/facilities (accessed on 14 December 2018).

- Kang, M.-S.; Jin, K.-M.; Kim, E.-H.; Oh, S.-B.; Lee, J.-M. A Study on the Determining ESS Capacity for Stabilizing Power Output of Haeng-won Wind Farm in Jeju. J. Korean Solar Energy Soc. 2012, 32, 25–31. [Google Scholar] [CrossRef][Green Version]

- Platte River Power Authority. Battery Energy Storage Technology Assessment. Available online: https://www.prpa.org/wp-content/uploads/2017/10/HDR-Battery-Energy-Storage-Assessment.pdf (accessed on 14 December 2018).

- Korea Power Exchange. REC Price. Available online: http://onerec.kmos.kr/portal/rec/selectRecReport_tradePerformanceList.do?key=1971 (accessed on 14 December 2018).

- Korea Power Exchange. SMP for Jeju. Available online: http://www.kpx.or.kr/www/contents.do?key=226 (accessed on 14 December 2018).

| Parameter | Value |

|---|---|

| Wind Farm Capacity [kW] | 10,790 |

| ESS Capacity [kWh] | 2450 |

| / [%] | 20/80 |

| Turnaround efficiency [%] | 90 |

| Charging/Discharging efficiency [%] | 90/90 |

| Variable O&M cost of ESS [Won/kW-5 min] | 0.0275 |

| REC multiplier for discharging power in the peak period | 4.5 |

| Season | Month | Date | Number of Violating Variation Criteria | Peak Period for REC Multiplier |

|---|---|---|---|---|

| Winter | 1 | 01.20 | 34 | 18:00~21:00 |

| Winter | 2 | 02.10 | 26 | |

| Winter | 3 | 03.08 | 18 | |

| Spring | 4 | 04.17 | 15 | 19:00~22:00 |

| Spring | 5 | 05.09 | 10 | |

| Spring | 6 | 06.06 | 10 | |

| Summer | 7 | 07.02 | 6 | 13:00~15:00, 19:00~21:00 |

| Summer | 8 | 08.20 | 10 | |

| Summer | 9 | 09.07 | 9 | |

| Autumn | 10 | 10.01 | 18 | 18:00~21:00 |

| Winter | 11 | 11.24 | 17 | 18:00~21:00 |

| Winter | 12 | 12.05 | 32 |

| Month | Average System Marginal Price [Won/kW-5 min] | Average REC Price [Won/kW-5 min] |

|---|---|---|

| 1 | 8.85 | 20.51 |

| 2 | 10.6 | 17.72 |

| 3 | 11.06 | 17.49 |

| 4 | 10.11 | 17.28 |

| 5 | 10 | 19.07 |

| 6 | 10.39 | 17.38 |

| 7 | 10.12 | 17.92 |

| 8 | 9.39 | 17.88 |

| 9 | 9 | 19 |

| 10 | 8.87 | 16.44 |

| 11 | 10.79 | 18.05 |

| 12 | 10.77 | 14.59 |

| Case Number | Status of REC Multiplier in Off-Peak Period | Magnitude of REC Multiplier |

|---|---|---|

| 1 | X | - |

| 2 | O | 1 |

| 2-1 | O | 1.4 |

| 2-2 | O | 3 |

| 2-3 | O | 4.5 |

| Month | Average Discharging Power during Off-Peak Periods | Average Discharging Power during Peak Periods | ||||||

|---|---|---|---|---|---|---|---|---|

| Case 1 & Case 2 | Case 2-1 | Case 2-2 | Case 2-3 | Case 1 & Case 2 | Case 2-1 | Case 2-2 | Case 2-3 | |

| 1 | 0 | 163.8 | 158.5 | 160.5 | 182.4 | 182.9 | 172.8 | 130.2 |

| 2 | 0 | 156.7 | 157.4 | 129.4 | 184.5 | 187.2 | 137.2 | 71.5 |

| 3 | 0 | 160.6 | 161.1 | 161.3 | 182 | 179.9 | 155.5 | 161.7 |

| 4 | 0 | 110.4 | 153.3 | 151.1 | 181.3 | 181.3 | 172.5 | 152.5 |

| 5 | 0 | 155.6 | 162.2 | 166.8 | 179.1 | 179.3 | 179.3 | 146.4 |

| 6 | 0 | 138.7 | 155.8 | 155.8 | 183.1 | 183.9 | 178.7 | 152.6 |

| 7 | 0 | 158 | 152 | 147 | 183.5 | 198.9 | 175.2 | 169.2 |

| 8 | 0 | 154.4 | 157.5 | 157.7 | 186.7 | 190.3 | 186.3 | 180.6 |

| 9 | 0 | 151.9 | 152.6 | 149.9 | 192.1 | 191.3 | 192.1 | 183.1 |

| 10 | 0 | 147.8 | 148.5 | 151.8 | 178.4 | 180.4 | 178.2 | 153.6 |

| 11 | 0 | 121.7 | 158.7 | 161.4 | 181 | 182.6 | 163.5 | 148 |

| 12 | 0 | 163.8 | 155.1 | 163.2 | 177.3 | 178.8 | 164.8 | 142.3 |

| Total Average | 0 | 147.2 | 156.1 | 154.7 | 182.6 | 184.7 | 171.3 | 149.3 |

| Month | Average Value of Power Exceeding the Lower Variation Criteria of PCC in the Off-Peak Period | Average Value of Power Exceeding the Lower Variation Criteria of PCC in the Peak Period | ||||||

|---|---|---|---|---|---|---|---|---|

| Case 1 & Case 2 | Case 2-1 | Case 2-2 | Case 2-3 | Case 1 & Case 2 | Case 2-1 | Case 2-2 | Case 2-3 | |

| 1 | 45.16 | 18.01 | 17.85 | 16.53 | 14.81 | 0 | 0 | 0 |

| 2 | 27.37 | 6.07 | 10.31 | 3.02 | 0 | 0 | 0 | 0 |

| 3 | 7.96 | 0 | 0 | 2.48 | 16.3 | 25.3 | 16.3 | 0 |

| 4 | 17.9 | 14.38 | 20.7 | 7.74 | 19.35 | 19.35 | 0 | 0 |

| 5 | 16.02 | 10.17 | 7.25 | 2.68 | 15.5 | 15.5 | 15.5 | 0 |

| 6 | 8.72 | 8.08 | 0 | 12.02 | 19.48 | 18.58 | 18.85 | 41.12 |

| 7 | 8.8 | 9.73 | 3.98 | 7.29 | 12.11 | 0 | 12.1 | 13.93 |

| 8 | 8.47 | 11.02 | 8.24 | 7.89 | 61.67 | 61.29 | 33.62 | 18.43 |

| 9 | 5 | 3.99 | 2.77 | 4.91 | 49.15 | 49.15 | 49.15 | 25.58 |

| 10 | 12.88 | 5.6 | 12.45 | 10.73 | 29.58 | 24.18 | 31.01 | 0 |

| 11 | 11.03 | 13.03 | 2.47 | 5.78 | 38.86 | 19.04 | 0 | 0 |

| 12 | 31.57 | 21.95 | 21.53 | 16.96 | 17.87 | 34.51 | 19.88 | 0 |

| Total Average | 16.74 | 10.17 (↓39.3%) | 8.96 (↓46.5%) | 8.17 (↓51.2%) | 24.56 | 22.24 (↓9.4%) | 16.37 (↓33.3%) | 8.26 (↓66.4%) |

| Month | Case 1 & Case 2 [103 Won] | Case 2-1 [103 Won] | Case 2-2 [103 Won] | Case 2-3 [103 Won] |

|---|---|---|---|---|

| 1 | 56,027 | 56,080 | 57,360 | 58,513 |

| 2 | 62,766 | 62,787 | 63,804 | 64,331 |

| 3 | 57,057 | 57,068 | 58,164 | 59,255 |

| 4 | 36,255 | 36,262 | 37,324 | 38,263 |

| 5 | 21,344 | 21,354 | 22,494 | 23,558 |

| 6 | 32,043 | 32,060 | 33,132 | 34,094 |

| 7 | 42,325 | 42,589 | 43,782 | 44,851 |

| 8 | 29,355 | 29,642 | 31,059 | 32,360 |

| 9 | 27,149 | 27,430 | 28,834 | 30,055 |

| 10 | 39,275 | 39,293 | 40,318 | 41,292 |

| 11 | 35,039 | 35,054 | 36,126 | 37,171 |

| 12 | 38,463 | 38,488 | 39,574 | 40,688 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ko, W.; Lee, J.; Kim, J. The Effect of a Renewable Energy Certificate Incentive on Mitigating Wind Power Fluctuations: A Case Study of Jeju Island. Appl. Sci. 2019, 9, 1647. https://doi.org/10.3390/app9081647

Ko W, Lee J, Kim J. The Effect of a Renewable Energy Certificate Incentive on Mitigating Wind Power Fluctuations: A Case Study of Jeju Island. Applied Sciences. 2019; 9(8):1647. https://doi.org/10.3390/app9081647

Chicago/Turabian StyleKo, Woong, Jaeho Lee, and Jinho Kim. 2019. "The Effect of a Renewable Energy Certificate Incentive on Mitigating Wind Power Fluctuations: A Case Study of Jeju Island" Applied Sciences 9, no. 8: 1647. https://doi.org/10.3390/app9081647

APA StyleKo, W., Lee, J., & Kim, J. (2019). The Effect of a Renewable Energy Certificate Incentive on Mitigating Wind Power Fluctuations: A Case Study of Jeju Island. Applied Sciences, 9(8), 1647. https://doi.org/10.3390/app9081647