Different Paths to Achieve High Technological Innovation in Clustered Firms: An Analysis of the Spanish Ceramic Tile Industry †

Abstract

1. Introduction

2. Theoretical Framework and Propositions: New Technology Adoption and Absorptive Capacity in Clusters

2.1. Equifinality of the Combinations of Conditions Leading to Technological Innovation

2.2. Role of Early Adoption of Disruptive Technologies in Clustered Firms

2.3. Role of Different Internal Attributes Related to Absorptive Capacity on Innovation Performance of the Clustered Firms

3. Empirical Setting: Context of the Research and Methods

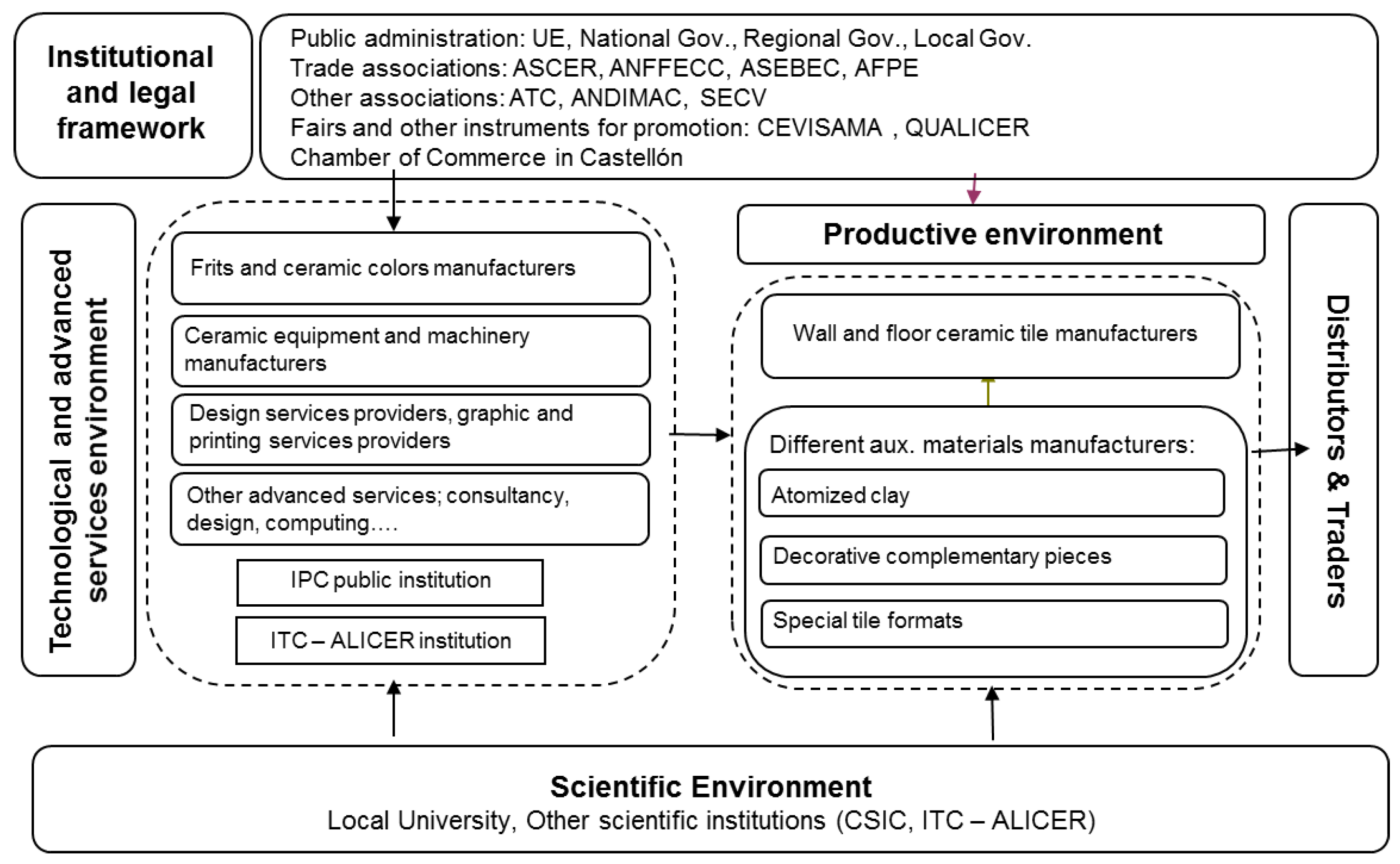

3.1. Context of the Research: The Spanish Ceramic Tile Cluster and the Digital Printing Technology Innovation

3.2. Sample and Data

3.3. Methodology: Qualitative Comparative Analysis

4. Results

4.1. Analysis of Necessary Conditions

4.2. Sufficiency Analysis

5. Discussion of Results and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix A.1. Technological Innovativeness

- During the last three years the company has introduced or improved new products/services based on those previously introduced by competitors.

- During the last three years the company has introduced or improved new products/services before competitors.

- During the last three years the company has introduced or improved new manufacturing methods.

- During the last three years the company has introduced or improved new delivery or logistical methods.

- During the last three years the company has introduced or improved new auxiliary processes.

Appendix A.2. Early Adoption

Appendix A.3. Absorptive Capacity

Appendix A.4. Experience in R&D Activities

Appendix A.5. Size

Appendix A.6. Intensity in R&D Activities

References

- Giuliani, E.; Bell, M. The micro-determinants of meso-level learning and innovation: Evidence from a Chilean wine cluster. Res. Policy 2005, 34, 47–68. [Google Scholar] [CrossRef]

- Pouder, R.; St. John, C.H. Hot spots and blind spots: Geographical clusters of firms and innovation. Acad. Manag. Rev. 1996, 21, 1192–1225. [Google Scholar] [CrossRef]

- Sammarra, A. Relocation and the international fragmentation of industrial districts value chain: Matching local and global perspectives. In Industrial Districts, Relocation, and the Governance of the Global Value Chain; CLEUP: Padua, Italy, 2005; pp. 61–70. [Google Scholar]

- Foss, N.J. Higher-order industrial capabilities and competitive advantage. J. Ind. Stud. 1996, 3, 1–20. [Google Scholar] [CrossRef]

- Hervás-Oliver, J.L.; Albors-Garrigós, J.; Estelles-Miguel, S.; Boronat-Moll, C. Radical innovation in Marshallian industrial districts. Reg. Stud. 2018, 52, 1388–1397. [Google Scholar] [CrossRef]

- Molina-Morales, F.; Expósito-Langa, M. Overcoming undesirable knowledge redundancy in territorial clusters. Ind. Innov. 2013, 20, 739–758. [Google Scholar] [CrossRef]

- Markides, C. Disruptive innovation: In need of better theory. J. Prod. Innov. Manag. 2006, 23, 19–25. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and learning: The two faces of R & D. Econ. J. 1989, 99, 569–596. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Escribano, A.; Fosfuri, A.; Tribó, J.A. Managing external knowledge flows: The moderating role of absorptive capacity. Res. Policy 2009, 38, 96–105. [Google Scholar] [CrossRef]

- Kim, L. Crisis construction and organizational learning: Capability building in catching-up at Hyundai Motor. Organ. Sci. 1998, 9, 506–521. [Google Scholar] [CrossRef]

- Mowery, D.C.; Oxley, J.E. Inward technology transfer and competitiveness: The role of national innovation systems. Camb. J. Econ. 1995, 19, 67–93. [Google Scholar]

- Tripsas, M. Surviving radical technological change through dynamic capability: Evidence from the typesetter industry. Ind. Corp. Chang. 1997, 6, 341–377. [Google Scholar] [CrossRef]

- Leonard-Barton, D. Wellsprings of Knowledge Building and Sustaining the Sources of Innovation; Harvard Business School: Boston, MA, USA, 1995. [Google Scholar]

- Adner, R.; Zemsky, P. A demand-based perspective on sustainable competitive advantage. Strateg. Manag. J. 2006, 27, 215–239. [Google Scholar] [CrossRef]

- Burgelman, R.A. A process model of strategic business exit: Implications for an evolutionary perspective on strategy. Strateg. Manag. J. 1996, 17, 193–214. [Google Scholar] [CrossRef]

- Christensen, C.M.; Bower, J.L. Customer power, strategic investment, and the failure of leading firms. Strateg. Manag. J. 1996, 17, 197–218. [Google Scholar] [CrossRef]

- Reinganum, J.F. Technology adoption under imperfect information. Bell J. Econ. 1983, 14, 57–69. [Google Scholar] [CrossRef]

- Molina-Morales, F.X. Industrial districts and innovation: The case of the Spanish ceramic tiles industry. Entrep. Reg. Dev. 2002, 14, 317–335. [Google Scholar] [CrossRef]

- Cassiman, B.; Veugelers, R. In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar]

- Leal-Rodríguez, A.L.; Ariza-Montes, J.A.; Roldán, J.L.; Leal-Millán, A.G. Absorptive capacity, innovation and cultural barriers: A conditional mediation model. J. Bus. Res. 2014, 67, 763–768. [Google Scholar] [CrossRef]

- Vega-Jurado, J.; Gutiérrez-Gracia, A.; Fernández-de-Lucio, I.; Manjarrés-Henríquez, L. The effect of external and internal factors on firms’ product innovation. Res. Policy 2008, 37, 616–632. [Google Scholar] [CrossRef]

- Meyer, A.D.; Tsui, A.S.; Hinings, C.R. Configural approaches to organizational analysis. Acad. Manag. J. 1993, 36, 1175–1195. [Google Scholar]

- Ragin, C.C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2008; ISBN 0226702790. [Google Scholar]

- Ragin, C.; Davey, S. Fuzzy-Set/Qualitative Comparative Analysis 3.0; Department of Sociology, University of California: Irvine, CA, USA, 2016. [Google Scholar]

- Woodside, A.G. The good practices manifesto: Overcoming bad practices pervasive in current research in business. J. Bus. Res. 2016, 69, 365–381. [Google Scholar] [CrossRef]

- McCann, B.T.; Folta, T.B. Performance differentials within geographic clusters. J. Bus. Ventur. 2011, 26, 104–123. [Google Scholar] [CrossRef]

- Adner, R. When are technologies disruptive? A demand-based view of the emergence of competition. Strateg. Manag. J. 2002, 23, 667–688. [Google Scholar] [CrossRef]

- Ansari, S.; Garud, R.; Kumaraswamy, A. The disruptor’s dilemma: TiVo and the US television ecosystem. Strateg. Manag. J. 2016, 37, 1829–1853. [Google Scholar] [CrossRef]

- Bergek, A.; Berggren, C.; Magnusson, T.; Hobday, M. Technological discontinuities and the challenge for incumbent firms: Destruction, disruption or creative accumulation? Res. Policy 2013, 42, 1210–1224. [Google Scholar] [CrossRef]

- Bower, J.L.; Christensen, C.M. Disruptive technologies: Catching the wave. J. Prod. Innov. Manag. 1996, 1, 75–76. [Google Scholar]

- Charitou, C.D.; Markides, C.C. Responses to disruptive strategic innovation. MIT Sloan Manag. Rev. 2002, 44, 55–64. [Google Scholar]

- Christensen, C.M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business School Press: Boston, MA, USA, 1997; ISBN 0875845851. [Google Scholar]

- O’Reilly, C.A., III; Tushman, M.L. Lead and Disrupt: How to Solve the Innovator’s Dilemma; Stanford University Press: Palo Otto, CA, USA, 2016; ISBN 0804799490. [Google Scholar]

- Govindarajan, V.; Kopalle, P.K. Disruptiveness of innovations: Measurement and an assessment of reliability and validity. Strateg. Manag. J. 2006, 27, 189–199. [Google Scholar] [CrossRef]

- Slater, S.F.; Narver, J.C. Customer-led and market-oriented: let’s not confuse the two. Strateg. Manag. J. 1998, 19, 1001–1006. [Google Scholar] [CrossRef]

- Nadvi, K.; Halder, G. Local clusters in global value chains: Exploring dynamic linkages between Germany and Pakistan. Entrep. Reg. Dev. 2005, 17, 339–363. [Google Scholar] [CrossRef]

- Humphrey, J.; Schmitz, H. Governance and Upgrading: Linking Industrial Cluster and Global Value Chain Research; Institute of Development Studies Brighton: Brighton, UK, 2000; Volume 120, ISBN 1858643341. [Google Scholar]

- Lagendijk, A. Beyond the regional lifeworld against the global systemworld: Towards a relational–scalar perspective on spatial–economic development. Geogr. Ann.: Ser. B Hum. Geogr. 2002, 84, 77–92. [Google Scholar] [CrossRef]

- Glasmeier, A. Technological discontinuities and flexible production networks: The case of Switzerland and the world watch industry. Res. Policy 1991, 20, 469–485. [Google Scholar] [CrossRef]

- Lazerson, M.H.; Lorenzoni, G. The firms that feed industrial districts: A return to the italian source. Ind. Corp. Chang. 1999, 8, 235–266. [Google Scholar] [CrossRef]

- Saxenian, A. The origin and dynamics of production networks in Silicon Valley. Res. Policy 1991, 20, 423–437. [Google Scholar] [CrossRef]

- Hervás-Oliver, J.L.; Albors-Garrigós, J. Are technology gatekeepers renewing clusters? Understanding gatekeepers and their dynamics across cluster life cycles. Entrep. Reg. Dev. 2014, 26, 431–452. [Google Scholar] [CrossRef]

- Molina-Morales, F.X.; Martínez-Cháfer, L.; Valiente-Bordanova, D. Disruptive Technological Innovations as New Opportunities for Mature Industrial Clusters. The Case of Digital Printing Innovation in the Spanish Ceramic Tile Cluster. Investig. Reg. 2017, 39, 39–57. [Google Scholar]

- Reig-Otero, Y.; Edwards-Schachter, M.; Feliú-Mingarro, C.; Fernández-de-Lucio, I. Generation and diffusion of innovations in a district innovation system: The case of ink-jet printing. J. Technol. Manag. Innov. 2014, 9, 56–76. [Google Scholar] [CrossRef]

- Sull, D.N.; Tedlow, R.S.; Rosenbloom, R.S. Managerial commitments and technological change in the US tire industry. Ind. Corp. Chang. 1997, 6, 461–500. [Google Scholar] [CrossRef]

- Coccia, M. Radical innovations as drivers of breakthroughs: Characteristics and properties of the management of technology leading to superior organisational performance in the discovery process of R&D labs. Technol. Anal. Strateg. Manag. 2016, 28, 381–395. [Google Scholar]

- Coccia, M. The source and nature of general purpose technologies for supporting next K-waves: Global leadership and the case study of the US Navy’s Mobile User Objective System. Technol. Forecast. Soc. Chang. 2017, 116, 331–339. [Google Scholar] [CrossRef]

- Cavallo, E.; Ferrari, E.; Coccia, M. Likely technological trajectories in agricultural tractors by analysing innovative attitudes of farmers. Int. J. Technol. Policy Manag. 2015, 15, 158–177. [Google Scholar] [CrossRef]

- Ambartsoumian, V.; Dhaliwal, J.; Lee, E.; Meservy, T.; Zhang, C. Implementing quality gates throughout the enterprise it production process. J. Inf. Technol. Manag. 2011, 22, 28–38. [Google Scholar]

- Coccia, M. Sources of technological innovation: Radical and incremental innovation problem-driven to support competitive advantage of firms. Technol. Anal. Strateg. Manag. 2017, 29, 1048–1061. [Google Scholar] [CrossRef]

- Durisin, B.; Todorova, G. A study of the performativity of the “ambidextrous organizations” theory: Neither lost in nor lost before translation. J. Prod. Innov. Manag. 2012, 29, 53–75. [Google Scholar] [CrossRef]

- Lin, H.; McDonough, E.F., III. Cognitive frames, learning mechanisms, and innovation ambidexterity. J. Prod. Innov. Manag. 2014, 31, 170–188. [Google Scholar] [CrossRef]

- O’Connor, G.C. Market learning and radical innovation: A cross case comparison of eight radical innovation projects. J. Prod. Innov. Manag. Int. Publ. Prod. Dev. Manag. Assoc. 1998, 15, 151–166. [Google Scholar] [CrossRef]

- Stock, G.N.; Greis, N.P.; Fischer, W.A. Absorptive capacity and new product development. J. High Technol. Manag. Res. 2001, 12, 77–91. [Google Scholar] [CrossRef]

- Kamien, M.; Schwartz, N. Lou Market Structure and Innovation; Cambridge University Press: Cambridge, NY, USA, 1982; ISBN 05212219000521293855. [Google Scholar]

- Leal-Rodríguez, A.L.; Roldán, J.L.; Ariza-Montes, J.A.; Leal-Millán, A. From potential absorptive capacity to innovation outcomes in project teams: The conditional mediating role of the realized absorptive capacity in a relational learning context. Int. J. Proj. Manag. 2014, 32, 894–907. [Google Scholar] [CrossRef]

- Molina-Morales, F.X.; Martínez-Fernández, M.T. Too much love in the neighborhood can hurt: How an excess of intensity and trust in relationships may produce negative effects on firms. Strateg. Manag. J. 2009, 30, 1013–1023. [Google Scholar] [CrossRef]

- Morrison, A.; Rabellotti, R. Knowledge and information networks in an Italian wine cluster. Eur. Plan. Stud. 2009, 17, 983–1006. [Google Scholar] [CrossRef]

- Rowley, T.; Behrens, D.; Krackhardt, D. Redundant governance structures: An analysis of structural and relational embeddedness in the steel and semiconductor industries. Strateg. Manag. J. 2000, 21, 369–386. [Google Scholar] [CrossRef]

- Gutierrez, A.; Boukrami, E.; Lumsden, R. Technological, organisational and environmental factors influencing managers’ decision to adopt cloud computing in the UK. J. Enterp. Inf. Manag. 2015, 28, 788–807. [Google Scholar] [CrossRef]

- Hervás-Oliver, J.L.; Lleo, M.; Cervello, R. The dynamics of cluster entrepreneurship: Knowledge legacy from parents or agglomeration effects? The case of the Castellon ceramic tile district. Res. Policy 2017, 46, 73–92. [Google Scholar] [CrossRef]

- Markman, G.D.; Waldron, T.L. Small entrants and large incumbents: A framework of micro entry. Acad. Manag. Perspect. 2014, 28, 179–197. [Google Scholar] [CrossRef]

- Park, K.H.; Lee, K. Linking the technological regime to the technological catch-up: Analyzing Korea and Taiwan using the US patent data. Ind. Corp. Chang. 2006, 15, 715–753. [Google Scholar] [CrossRef]

- Molina-Morales, F.X.; López-Navarro, M.A.; Guia-Julve, J. The role of local institutions as intermediary agents in the industrial district. Eur. Urban Reg. Stud. 2002, 9, 315–329. [Google Scholar] [CrossRef]

- Giuliani, E. Cluster absorptive capacity: Why do some clusters forge ahead and others lag behind? Eur. Urban Reg. Stud. 2005, 12, 269–288. [Google Scholar] [CrossRef]

- Belso-Martinez, J.A.; Molina-Morales, F.X.; Mas-Verdú, F. Combining effects of internal resources, entrepreneur characteristics and KIS on new firms. J. Bus. Res. 2013, 66, 2079–2089. [Google Scholar] [CrossRef]

- Expósito-Langa, M.; Molina-Morales, F.X.; Capo-Vicedo, J. New product development and absorptive capacity in industrial districts: A multidimensional approach. Reg. Stud. 2011, 45, 319–331. [Google Scholar] [CrossRef]

- Albors-Garrigós, J.; Hervás-Oliver, J.L. Disruptive technology in mature industries: Its contribution to industry sustainability. In 2013 Proceedings of PICMET 2013: Technology Management in the IT-Driven Services; IEEE: San Jose, CA, USA, 2013; pp. 585–596. [Google Scholar]

- Molina-Morales, F.X.; Martínez-Cháfer, L. Cluster Firms: You’ll Never Walk Alone. Reg. Stud. 2016, 50, 877–893. [Google Scholar] [CrossRef]

- Molina-Morales, F.X.; Martínez-Fernández, M.T. Does homogeneity exist within industrial districts? A social capital-based approach. Pap. Reg. Sci. 2009, 88, 209–229. [Google Scholar] [CrossRef]

- Pavitt, K. Sectoral patterns of technical change: Towards a taxonomy and a theory. Res. Policy 1984, 13, 343–373. [Google Scholar] [CrossRef]

- Gabaldón-Estevan, D.; Manjarrés-Henríquez, L.; Molina-Morales, F.X. An analysis of the Spanish ceramic tile industry research contracts and patents. Eur. Plan. Stud. 2018, 26, 895–914. [Google Scholar] [CrossRef]

- Corma-Canós, P.; Corma-Buforn, P. ¿Cuál será la siguiente innovación disruptiva en el cluster cerámico? In Proceedings of the Qualicer 2018, Castellón, Spain, 12–13 February 2018; pp. 1–16. [Google Scholar]

- Ordanini, A.; Parasuraman, A.; Rubera, G. When the Recipe Is More Important Than the Ingredients: A Qualitative Comparative Analysis (QCA) of Service Innovation Configurations. J. Serv. Res. 2014, 17, 134–149. [Google Scholar] [CrossRef]

- Ragin, C.C. The Comparative Method: Moving Beyond Qualitative and Quantitative Strategies; University of California Press: Oakland, CA, USA, 2014; ISBN 0520957350. [Google Scholar]

- Sager, F.; Andereggen, C. Dealing with complex causality in realist synthesis: The promise of Qualitative Comparative Analysis. Am. J. Eval. 2012, 33, 60–78. [Google Scholar] [CrossRef]

- Fan, D.; Li, Y.; Chen, L. Configuring innovative societies: The crossvergent role of cultural and institutional varieties. Technovation 2017, 66–67, 43–56. [Google Scholar] [CrossRef]

- Fiss, P.C. A set-theoretic approach to organizational configurations. Acad. Manag. Rev. 2007, 32, 1190–1198. [Google Scholar] [CrossRef]

- Greckhamer, T.; Misangyi, V.F.; Elms, H.; Lacey, R. Using qualitative comparative analysis in strategic management research: An examination of combinations of industry, corporate, and business-unit effects. Organ. Res. Methods 2008, 11, 695–726. [Google Scholar] [CrossRef]

- Ordanini, A.; Maglio, P.P. Market orientation, internal process, and external network: A qualitative comparative analysis of key decisional alternatives in the new service development. Decis. Sci. 2009, 40, 601–625. [Google Scholar] [CrossRef]

- Roig-Tierno, N.; Gonzalez-Cruz, T.F.; Llopis-Martinez, J. An overview of qualitative comparative analysis: A bibliometric analysis. J. Innov. Knowl. 2017, 2, 15–23. [Google Scholar] [CrossRef]

- Woodside, A.G.; Baxter, R. Achieving accuracy, generalization-to-contexts, and complexity in theories of business-to-business decision processes. Ind. Mark. Manag. 2013, 42, 382–393. [Google Scholar] [CrossRef]

- Crilly, D.; Zollo, M.; Hansen, M.T. Faking it or muddling through? Understanding decoupling in response to stakeholder pressures. Acad. Manag. J. 2012, 55, 1429–1448. [Google Scholar] [CrossRef]

- Fiss, P.C. Building better causal theories: A fuzzy set approach to typologies in organization research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef]

- Duşa, A.; Thiem, A. QCA: A package for Qualitative Comparative Analysis, R package version 1.1-4. 2014. Available online: http://cran. r-project. org/package= QCA (accessed on 25 June 2018).

- Schneider, C.Q.; Wagemann, C. Standards of good practice in qualitative comparative analysis (QCA) and fuzzy-sets. Comp. Soc. 2010, 9, 397–418. [Google Scholar] [CrossRef]

- Mas-Verdú, F.; Ribeiro-Soriano, D.; Roig-Tierno, N. Firm survival: The role of incubators and business characteristics. J. Bus. Res. 2015, 68, 793–796. [Google Scholar] [CrossRef]

- Schneider, M.R.; Schulze-Bentrop, C.; Paunescu, M. Mapping the institutional capital of high-tech firms: A fuzzy-set analysis of capitalist variety and export performance. J. Int. Bus. Stud. 2010, 41, 246–266. [Google Scholar] [CrossRef]

- Legewie, N. An introduction to applied data analysis with qualitative comparative analysis. Forum Qual. Sozialforschung Forum Qual. Soc. Res. 2013, 14, 1–45. [Google Scholar]

- Eng, S.; Woodside, A.G. Configural analysis of the drinking man: Fuzzy-set qualitative comparative analyses. Addict. Behav. 2012, 37, 541–543. [Google Scholar] [CrossRef]

- Henriques, P.L.; Matos, P.V.; Jerónimo, H.M.; Mosquera, P.; da Silva, F.P.; Bacalhau, J. University or polytechnic? A fuzzy-set approach of prospective students’ choice and its implications for higher education institutions’ managers. J. Bus. Res. 2018, 89, 435–441. [Google Scholar] [CrossRef]

- Santos, J.N.; Mota, J.; Baptista, C.S. Understanding configurations of value creation functions in business relationships using a fuzzy-set QCA. J. Bus. Res. 2018, 89, 429–434. [Google Scholar] [CrossRef]

- Rihoux, B.; Ragin, C.C. Configurational Comparative Methods; Applied Social Research Methods Series; SAGE Publications Inc.: Shawzend Oaks, CA, USA, 2009. [Google Scholar]

- Ragin, C.C. Set relations in social research: Evaluating their consistency and coverage. Political Anal. 2006, 14, 291–310. [Google Scholar] [CrossRef]

- Tomás-Miquel, J.; Molina-Morales, F.X.; Expósito-Langa, M. Loving Outside the Neighborhood: The Conflicting Effects of External Linkages on Incremental Innovation in Clusters. J. Small Bus. Manag. 2018, 1–19. [Google Scholar] [CrossRef]

- Bristow, G.; Healy, A. Innovation and regional economic resilience: An exploratory analysis. Ann. Reg. Sci. 2018, 60, 265–284. [Google Scholar] [CrossRef]

- Østergaard, C.; Park, E.K. Cluster decline and resilience-The case of the wireless communication cluster in North Jutland, Denmark. Denmark 2013, 1–24. [Google Scholar] [CrossRef]

- Crespo, J.; Suire, R.; Vicente, J. Lock-in or lock-out? How structural properties of knowledge networks affect regional resilience. J. Econ. Geogr. 2013, 14, 199–219. [Google Scholar] [CrossRef]

- Eisingerich, A.B.; Bell, S.J.; Tracey, P. How can clusters sustain performance? The role of network strength, network openness, and environmental uncertainty. Res. Policy 2010, 39, 239–253. [Google Scholar] [CrossRef]

- Rogers, E. Diffusion of Innovations; The Free Press: New York, NY, USA, 1983. [Google Scholar]

- Flatten, T.C.; Engelen, A.; Zahra, S.A.; Brettel, M. A measure of absorptive capacity: Scale development and validation. Eur. Manag. J. 2011, 29, 98–116. [Google Scholar] [CrossRef]

| Outcome Scope | Variables for Explaining the Outcome | Associated Condition to the Variables |

|---|---|---|

| Technological Innovativeness | Early adoption | Early adopter |

| Absorptive capacity | Strong absorptive capacity | |

| Experience in research and development activities | Experienced company in research and development | |

| Size | Large company | |

| Intensity in R&D activities | High intensity in R&D activities |

| Type | Name and Code | Description |

|---|---|---|

| Outcome | Strong Technological Innovator (INN_TEC) | Being a strong technological innovator means to introduce, intensely, product, and process innovations into the company. |

| Condition | Early adopter (EARLY) | Being an early adopter means adopting the technology before its massive adoption in the cluster. |

| Strong absorptive capacity (ACAP) | To have a strong absorptive capacity means to have a high capacity of acquiring, assimilating, transforming and exploiting new knowledge coming from outside. | |

| Experienced R&D Firm (ARD) | Being an experienced R&D firm means to have an experienced R&D department in terms of years of activity. | |

| Big firm (SIZE) | Being a big firm means to have a big size in terms of employees, assets y revenues (average values from 2007 to 2013.). | |

| High intensity in R&D activities (PID) | High intensity in R&D activities is defined by having a high number of employees in R&D departments (% over total employees of the company). |

| Descriptive Statistics | Calibration Anchors | |||||

|---|---|---|---|---|---|---|

| Max | Min | Mean (S.D) | Fully-In | Crossover | Fully-Out | |

| INN_TEC | 5 | 0 | 3.52 (1.76) | 5 | 4 | 1 |

| EARLY | 17 | 0 | 8.05 (3.88) | 9 | 6 | 4 |

| ACAP | 2.0 | −3.4 | 0.00 (0.99) | 1.3 | −0.6 | −1.5 |

| ARD | 100 | 0 | 11.97 (12.34) | 20 | 13 | 5 |

| SIZE | 7.7 | −0.50 | 0.00 (0.99) | 0.3 | 0 | −0.4 |

| PID | 40 | 0 | 6.23 (7.88) | 10 | 5 | 0 |

| Outcome: Strong Technological Innovator | ||

| Conditions | Consistency | Coverage |

| Early adopter (EARLY) | 0.762 | 0.635 |

| ~ Early adopter (EARLY) | 0.331 | 0.597 |

| High intensity in R&D activities (PID) | 0.581 | 0.729 |

| ~ High intensity in R&D activities (PID) | 0.580 | 0.606 |

| Experienced R&D Firm (ARD) | 0.512 | 0.750 |

| ~ Experienced R&D Firm (ARD) | 0.623 | 0.580 |

| Strong absorptive capacity (ACAP) | 0.814 | 0.698 |

| ~ Strong absorptive capacity (ACAP) | 0.335 | 0.569 |

| Big firm (SIZE) | 0.442 | 0.826 |

| ~ Big firm (SIZE) | 0.684 | 0.560 |

| EARLY and ACAP | 0.663 | 0.727 |

| EARLY or ACAP | 0.913 | 0.627 |

| Outcome: ~ Strong Technological Innovator | ||

| Conditions | Consistency | Coverage |

| Early adopter (EARLY) | 0.704 | 0.443 |

| ~ Early adopter (EARLY) | 0.419 | 0.571 |

| High intensity in R&D activities (PID) | 0.500 | 0.474 |

| ~ High intensity in R&D activities (PID) | 0.714 | 0.563 |

| Experienced R&D Firm (ARD) | 0.403 | 0.447 |

| ~ Experienced R&D Firm (ARD) | 0.775 | 0.545 |

| Strong absorptive capacity (ACAP) | 0.664 | 0.430 |

| ~ Strong absorptive capacity (ACAP) | 0.534 | 0.685 |

| Big firm (SIZE) | 0.291 | 0.410 |

| ~ Big firm (SIZE) | 0.877 | 0.543 |

| EARLY and ACAP | 0.516 | 0.428 |

| EARLY or ACAP | 0.851 | 0.442 |

| Outcome: Strong Technological Innovator 1 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Consistency cut-Off: 0.82 | ||||||||

| Frequency Threshold = 1 | ||||||||

| Path Number | Antecedent Conditions | Coverage Raw Unique | Consistency | |||||

| Early Adopter | Strong ACAP | High Intensity in R&D Activities | Experienced R&D Firm | Big Firm | ||||

| 1 | ● | ● | ⚫ | ⚫ | 0.356 | 0.157 | 0.845 | |

| 2 | ● | ● | ⚫ | 0.347 | 0.042 | 0.867 | ||

| 3 | ● | ⚬ | ⚫ | 0.241 | 0.013 | 0.893 | ||

| 4 | ● | ⚬ | ⚫ | 0.237 | 0.009 | 0.870 | ||

| 5 | ⚫ | ⚬ | ⚫ | 0.157 | 0.011 | 0.887 | ||

| Solution coverage: 0.56 | ||||||||

| Solution consistency: 0.84 | ||||||||

| Overlapping coverage score: 0.33 | ||||||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Molina-Morales, F.X.; Martínez-Cháfer, L.; Valiente-Bordanova, D. Different Paths to Achieve High Technological Innovation in Clustered Firms: An Analysis of the Spanish Ceramic Tile Industry. Appl. Sci. 2019, 9, 3710. https://doi.org/10.3390/app9183710

Molina-Morales FX, Martínez-Cháfer L, Valiente-Bordanova D. Different Paths to Achieve High Technological Innovation in Clustered Firms: An Analysis of the Spanish Ceramic Tile Industry. Applied Sciences. 2019; 9(18):3710. https://doi.org/10.3390/app9183710

Chicago/Turabian StyleMolina-Morales, Francesc Xavier, Luis Martínez-Cháfer, and David Valiente-Bordanova. 2019. "Different Paths to Achieve High Technological Innovation in Clustered Firms: An Analysis of the Spanish Ceramic Tile Industry" Applied Sciences 9, no. 18: 3710. https://doi.org/10.3390/app9183710

APA StyleMolina-Morales, F. X., Martínez-Cháfer, L., & Valiente-Bordanova, D. (2019). Different Paths to Achieve High Technological Innovation in Clustered Firms: An Analysis of the Spanish Ceramic Tile Industry. Applied Sciences, 9(18), 3710. https://doi.org/10.3390/app9183710