Abstract

The main purpose of this study is to explore the carbon reduction environmental benefits that can be achieved if carbon benchmarking is applied when semiconductor manufacturers in Taiwan work to improve the technical efficiency of their carbon reduction efforts. The evaluation method used is as follows. First, a technical efficiency measurement method that is capable of considering both desirable outputs and undesirable outputs is used to measure the technical efficiency of the carbon reduction efforts and identify the benchmark firms with the best technical efficiency. Next, an attempt is made to estimate the greenhouse gas reduction that is realized by the sample if their carbon reduction efforts are accompanied by the implementation of a benchmarking system. Finally, the monetary value of the greenhouse gas reduction is estimated so as to develop a better understanding of the carbon reduction benefits for the adoption of the process outlined above. The empirical results show that using carbon benchmarking to raise the technical efficiency of carbon reduction management would, on average, boost the annual sales revenue of each decision-making unit by about US$486.6 million, while also bringing up the average annual CO2 reduction benefits per decision-making unit by US$11.11 million per year.

1. Introduction

In order to cope with the possible impacts and challenges of global climate change on human society, the design and implementation of various types of response measures to reduce greenhouse gas emissions (GHGs) is one of the key issues for decision makers [1]. In Taiwan, following the enactment of the Greenhouse Gas Emission Reduction and Management Act (the “Act” henceforth) in 2015, it is anticipated that the general trend in government policy is toward the implementation of a cap-and-trade system for GHG. Since the technology levels remain unchanged in the short term, the imposition of compulsory GHG reduction requirements on industry implies that GHG sources across many industries need to bear extra costs in their production processes in order to reduce GHGs. In other words, there will be a significant trade-off between production activity and GHG reduction measures. A key issue that needs to be addressed to reduce the magnitude of this trade-off between production activity and GHG reduction measures is the question of how to maintain the steady development of outputs from economic activity while still meeting GHG reduction targets. Among the various response measures to tackling this issue, the key focus of attention for GHG emission sources is the implementation of the carbon benchmarking management in production processes, so that improvements in technical efficiency (TE) can be used both to fulfill the GHG responsibility and achieve continuous economic growth.

Conceptually speaking, what the TE indicator measures is the extent of the impact of the management techniques used by the decision-making unit (DMU) on the efficiency of production activities. That is, the higher a given DMU’s TE is, the less factor inputs that the DMU will require to achieve a specified level of output (or the more output can be achieved with a fixed quantity of factor inputs). Thus, TE is concerned with the enhanced production efficiency that can be brought about by a DMU’s efforts in terms of improving its management. Therefore, the empirical measurement of TE is also the foundation of carbon benchmarking in different industries.

TE measurement is widely used in management studies to address a wide range of production management-related issues. So long as the inputs and outputs of production activity are defined, then it is possible to use TE measurement to evaluate whether or not a DMU has succeeded in improving its management. From a methodological perspective, of the many different TE empirical measurement techniques that have been developed, the distance function method has been particularly widely used, because it does not require input/output price data (which can be difficult to obtain); only quantitative data are needed to measure the TE of specific DMUs. As regards output-oriented TE measurement, this mainly involves setting a fixed level of DMU inputs, and then comparing the outputs of different DMUs; the DMU with the best performance is defined as the most efficient DMU. With this type of traditional measurement method, which assumes strong disposability, undesirable outputs such as CO2 emissions equivalents (CO2 henceforth) can be freely discarded without paying any price for them, and so they are usually left out of TE measurement with this method. As a consequence, TE values measured using the traditional distance function cannot reflect the impact of the cost of dealing with undesirable outputs on TE [2,3,4,5,6,7,8,9,10].

To remedy the weaknesses of the distance function when it comes to measuring TE with undesirable outputs, previous research has proposed three alternative methods [11,12]. All of these methods seek to measure the impact of undesirable outputs on TE. Of the three approaches, the directional distance function approach has emerged in recent years as the main method for measuring TE with undesirable outputs included, because it avoids the technical problems outlined above [13,14,15,16,17,18,19,20,21,22,23].

However, to correct the possible potential estimated bias of TE under the directional distance function, a bootstrap algorithm was proposed by Simar et al. [24]. This algorithm can not only capture the possible bias of TE estimates, it can also calculate the confidence intervals. For these reasons, studies that have used the directional distance function to measure TE in recent years have innovatively combined it with the bootstrap procedure to overcome the limitations mentioned above and improve the robustness of TE estimates [25,26,27].

Specifically, the main focus of this study is the use of a TE method based on the bootstrapped directional distance function approach to measure the TE of carbon reduction management in one of Taiwan’s key industries: the semiconductor industry. In addition, the study estimates the monetary benefit potential of the carbon reduction efforts, so that the results of carbon reduction can be presented in the form of a benefit indicator to support the implementation of carbon benchmarking management in the semiconductor industry. This paper is structured as follows: following this introduction, Section 2 explains the evaluation method, Section 3 discusses the sources of empirical data and the data-processing procedures, Section 4 presents the empirical results and the analysis of these results, and Section 5 concludes this study.

2. Evaluation Method

2.1. Directional Distance Function

Within the traditional scope of the production economics field, the discussion of output sets was initially focused on presenting possible relationships between factor inputs and desirable outputs. However, within a given production process, besides desirable outputs that create profits for the DMU, there may at the same time be undesirable outputs, i.e., various types of pollution that may be generated by production processes.

For production decision-making analysis, it is necessary for undesirable outputs to be incorporated into the analytical framework. The earliest attempt to improve the research method in this regard was the environmental production technology method proposed in Färe et al. [28] to bring undesirable outputs into the output sets for analysis. The core concept here is the idea that the desirable outputs and undesirable outputs within the production process represent a kind of conjoint production; i.e., any increase in desirable outputs within the production process will inevitably be accompanied by undesirable outputs. The cost that must be borne in order to reduce these undesirable outputs may take one of two forms, depending on the actual circumstances. If the undesirable outputs are readily disposable, then reducing these undesirable outputs will not impose any significant costs. Taking the pollution generated during the production process as an example, if the producer is located in a jurisdiction where environmental regulation is weak, then the producer can freely emit pollutants into the natural environment without paying any significant cost for this; in production theory, this is referred to as “strong disposability”. The other possibility is that reducing the undesirable outputs does impose significant costs. For example, it may be necessary to reduce the desirable outputs in order to control the increase in undesirable outputs, or reallocate some of the resources that would otherwise have gone toward generating desirable outputs for use in the reduction of undesirable outputs; this is referred to as “weak dispensability”.

In order to transform the above concepts into a usable analytical framework, Chung et al. [2] proposed the concept of the “directional distance function” to describe the simultaneous impact of desirable outputs and undesirable outputs on the technical efficiency of production. As defined in Chung et al. [2], the directional distance function for the output set P(X) can be expressed as follows:

where is the direction vector, denoting the movement of the DMU’s desirable outputs and undesirable outputs in such a way to achieve enhanced technical efficiency. The represents the rate at which the efficiency of the DMU is improved through the movement of desirable outputs and undesirable outputs in the direction vector , where has a value 0. If, for example, DMU has a value of 0.4 by comparison with the production boundary, then this indicates that the output set for this DMU must change to in order for it to be an efficient producer. This means that the larger the value of , the further the DMU is from the efficient production boundary, and the closer is to 0, the nearer that the DMU is to the efficient production boundary.

Later studies that make use of the directional distance function generally assumed that = (1, −1), following Chung et al. [2]. In terms of production decision-making behavior, this implies seeking to maximize desirable outputs from the production process, rather than seeking to minimize undesirable outputs, with desirable outputs increasing at the same rate that undesirable outputs decrease, i.e., . If management behavior is consistent with this analytical framework, it can be seen that the setting of the direction vectors and is used to delineate the impact of different types of management behavior on the output sets.

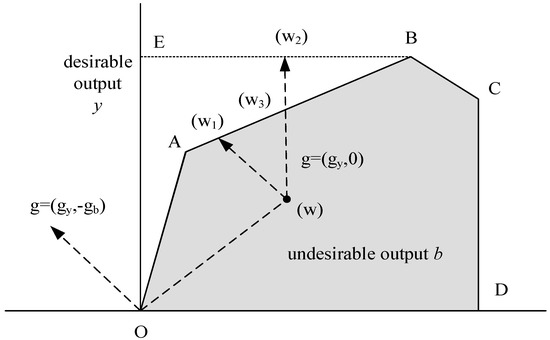

This idea can be explained by Figure 1 below. Assume an output set that incorporates both desirable output y and undesirable output b for a certain DMU, the current output set is . If further assuming strong dispensability, then the output set should fall within the area outlined by points OEBCD. Regarding the potential room for increase in production efficiency, the DMU can move up from output set to output set using the direction vector . If, on the other hand, controlling undesirable outputs incurs a cost, i.e., assuming weak dispensability, then the output set should fall within the area outlined by points OABCD, and improving TE will only move the output set from to .

Figure 1.

Environmental production technology output sets and the directional distance function.

To obtain the TE of a DMU, the directional distance value needs to be converted into a function that can differentiate between b and y. We therefore adopt the method employed in Färe et al. [17], using the quadratic approximation function for the directional distance function, and utilizing a parametric estimation method to obtain a solution. We further use an approximation function that includes a desirable output (the output value indicator for the semiconductor industry), an undesirable output CO2, and three factor inputs, as shown in Equation (2) below:

To ensure that the translation properties of the directional distance function remain unchanged after conversion, Equation (2) must conform to all of the constraints listed in Equation (3) below:

where are all unknown coefficients.

In the calculation, if we assume that there are K DMUs, then Equation (2) can be solved using the (4) to (10) program shown below:

2.2. Bootstrap for Directional Distance Function

The application of the bootstrap procedure to the directional distance function allows correcting the bias of TE estimates to improve the robustness of point estimates under the conventional directional distance function. A comprehensive algorithm of bootstrapping the directional distance function was proposed by Simar et al. [24], which expands the idea put forth in Simar & Wilson [29] to validate the directional distance function in the input–output space. The further practical application studies, such as Falavigna et al. [25] and Duan et al. [26], give a clear description of how the bootstrap procedure is applied to the directional distance function. According to Simar et al. [24], the possible bias of TE can be corrected. Consider a TE estimate without correcting bias and its corresponding bootstrap estimates , b = 1, …, B based on bootstrap samples of size m < n obtained by drawing m times, independently, uniformly, and without replacement, the bias-corrected TE estimates (TEbc) can be computed using Equation (11):

where m is the subsample size; n is the full sample size; and p and q are the numbers of the output variables and input variables, respectively.

Furthermore, the results of Simar & Wilson [29] ensure that:

with the replications of bootstrap B tends to . Given and the B bootstp , and can be estimated by the and percentiles for the set of values . These estimates are denoted as and , respectively. Based on this information, the -percent confidence intervals for can be obtained from Equation (13):

Finally, the subsample size m can be chosen using the method suggested by Simar & Wilson [29].

2.3. Social Cost of Carbon

An examination of the methods used in this field shows that, currently, the most widely used environment/cost benefit indicator for measuring reductions in greenhouse gas emissions is the social cost of carbon (SCC). In methodological terms, the SCC mainly employs a climate module integrated assessment model (IAM) to implement assessment. The IAM model makes various assumptions with respect to the impact of climate change on the economy, e.g., assumptions regarding trends in greenhouse gas emissions, changes in global temperatures, and other possible effects of climate change, such as rising sea levels, changes in the intensity of precipitation, increased incidence of extreme weather events, etc. The IAM model can be used to gauge the losses that climate change from greenhouse gas emissions causes to society; this in turn can be used to provide a quantitative measurement of the costs incurred from every ton of CO2 emissions, and the environmental benefits arising from every ton by which CO2 emissions are reduced.

As regards the practical implementation of the SCC concept in relation to government policy, the United States (U.S.) government established an Interagency Working Group on the Social Cost of Carbon in 2009. The purpose of this working group was to calculate the monetary benefits for every ton by which CO2 emissions are reduced; the working group published its first SCC Assessment Report in 2010 [30], followed by a second report in 2013, and a revised third report in July 2015 [31]. The working group’s reports mainly utilize the world’s three mostly widely used IAM models—the Policy Analysis of the Greenhouse Effect (PAGE) model [32], the Dynamic Integrated model of Climate and the Economy (DICE) model [33], and the Climate Framework for Uncertainty, Negotiation, and Distribution (FUND) model [34]—to calculate the amount of harm caused globally by every ton of CO2 emissions on the basis of a “global yardstick.”

As the basis of the calculation is global, and as the effects of CO2 emissions are non-segmented, the figures given in the working group reports for the harm caused by CO2 emissions are applicable globally (i.e., the impact on the Earth of one ton of emissions originating in Taiwan is the same as one ton of emissions originating in the U.S.). This means that “harm” in this case should not be taken to mean harm caused to any specific locality; rather, it represents the harm caused to the planet as a whole by excessively high emissions. Similarly, the social benefits deriving from efforts to reduce emissions are also global in scope, rather than being limited to a specific country. In calculating SCC, the working group first determines the values for SCC obtained with each of the three IAM models listed above, i.e., DICE, PAGE, and FUND, and then calculates the average of these values.

Calculation of the environmental benefits from the total amount of emission reduction is the multiplication of emissions reduction and its corresponding SCC value. SCC is not only widely used by the U.S. government when calculating the environmental benefits from emissions reduction policies, it is also used by many government agencies such as in the United Kingdom (U.K.) for assessing the effectiveness of government policies [35] (according to this report, British government agencies that use SCC for policy evaluation include the Department for Environment, Food and Rural Affairs (DEFRA), the Department for Transport (DFT), the Department for Trade and Industry (DTI), the Office of Gas and Electricity markets (OFGEM), the Office of the Deputy Prime Minister (OPDM), and the Environment Agency (EA)). On the basis of the method outlined above, this study uses the SCC method to evaluate the environmental benefits from carbon reduction from the implementation of benchmarking in the semiconductor industry in Taiwan.

3. Empirical Data Sources and Data Processing

The empirical analysis undertaken here requires data for input and output variables in the production processes of the Taiwanese semiconductor industry. There are two types of output variables to be considered. The first is desirable outputs, i.e., an indicator measuring the value of the products created during the production process that can provide economic benefits for the producer. This study uses the product sales revenue of individual semiconductor manufacturers for this indicator. The second type of output variable is undesirable output, which is defined as the volume of greenhouse gas emissions generated during the production process by the semiconductor industry. Past studies have generally used indicators such as capital stock, labor utilization, and the cost of goods sold for input variables. Based on the available empirical data, this study then used labor factor costs, net capital, and the cost of goods sold as the input variables.

As a result of policy planning requirements, the Environmental Protection Administration (EPA) in Taiwan used a survey to collect variable data for firms in five targeted industries (including the semiconductor industry focused on here) in 2010; the data that firms were required to provide included their energy usage data for different years, CO2 emission volume calculated using the carbon emissions coefficient method, product output (calculated within the production boundary), etc. However, it is readily apparent from the data included in this EPA database that the specifications of the products manufactured by individual semiconductor firms vary significantly. For example, in the case of integrated circuit (IC) wafer products, the database records the output of six-inch, eight-inch, and 12-inch wafers, etc. Some firms may produce only one product type, while others may produce several. Given the difficulty in implementing assessment on the basis of a breakdown of product types, it was decided to sum together the CO2 emissions totals for different product types to provide a single indicator for undesirable outputs.

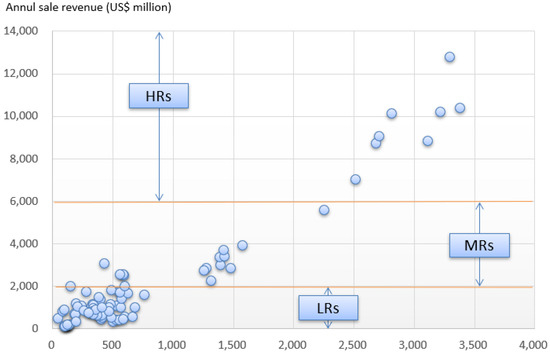

Obtaining the data required for desirable outputs (i.e., product sales revenue) and for inputs was much more challenging, because there is a lack of existing databases. To overcome this problem, a search of relevant data for stock market and Over-the-Counter (OTC) listed companies available from Taiwan’s Market Observation Post System [36] was taken as the starting point; in addition, financial data for individual firms were collected for consecutive years, so as to provide the data needed for the desirable output and input variables. The main problem for firms’ financial data is that the data included in the EPA database are structured by factory, not by company; to ensure consistency with the company-based financial data, the data for different factories belonging to the same company were added together. Following this data processing, the empirical data comprised data for nine semiconductor firms, with a total of 81 observations covering the period 2002–2010. To remove the impact of price fluctuations, data expressed in monetary terms were deflated using 2010 as the base year. Three groups were categorized according to the net sales revenue level. These groups are divided into high-revenue DMUs (HRs), middle-revenue DMUs (MRs), and low-revenue DMUs (LRs), according to the annual net sale revenue of US$6001 million and above, US$2001~6000 million, and US$2000 million and below, respectively. A summary of the basic statistical results obtained is shown in Table 1 below and the scatter diagram shown as Figure 2.

Table 1.

Descriptive Statistics for Empirical Variables. DMUs: decision-making units, HR: high revenue, MR: middle revenue, LR: low revenue.

Figure 2.

Annual sale revenue and CO2 emissions of all of the DMUs.

To evaluate the effectiveness of carbon reduction efforts, the SCC method was used. SCC data were derived mainly from a report prepared by the United States Environmental Protection Agency [31]. The SCC in the report covers the period 2015–2050. The results given for later years in this period have a high degree of uncertainty. This study then uses the SCC results for 2015 as the basis for calculation. On the basis of the SCC data shown in United States Environmental Protection Agency [31], at discount rates of 5%, 3%, and 2.5%, the SCC for 2015 is calculated to be US$11, US$36, and US$56, respectively. Regarding the choice of discount rate, the interest rate on government bonds in Taiwan in 2015 was 2.98%, which is closest to the 2.5% discount rate in the SCC data, so it was decided to use the 2.5% discount rate for SCC data. That is, an SCC that is equivalent to US$56 per ton was used as the basis for evaluation.

4. Discussions of Empirical Results

The General Algebraic Modeling Systems (GAMS) software was used in combination with a non-linear algorithm method to estimate the results of Equations (4) to (10); the coefficient estimation results are then transposed into Equation (2) to estimate the uncorrected TE value of each DMU. The directional distance function estimation results are shown in Table 2. Besides, in this study, we follow the bootstrap algorithm of Simar et al. [24] with 1000 replications to correct the possible bias so as to gain the biased-corrected TEbc. The bootstrapping results are shown in Table 3. Finally, the TEbc value was used to calculate the carbon reduction results and increase in revenue that could be achieved if a given firm learned from the management techniques used by a benchmark firm; a summary of the results is shown in Table 4.

Table 2.

Coefficient Estimation of Directional Distance Function.

Table 3.

Bias-corrected Technical Efficiency (TE) with Estimated 95% Confidence Intervals by Bootstrapping.

Table 4.

Summary of Adjusted TE Simulation Results.

Regarding the interpretation of the calculation results, the TEbc value represents the efficiency of the carbon reduction techniques used calculated by the bootstrapped directional distance function method. The closer the TEbc value is to zero, the more efficient the production techniques that are used; the further away the TEbc value is from zero, the greater the gap between the performance of the DMU and that of the benchmark firm. This phenomenon indicates that there is considerable room for improvement.

For instance, if a given DMU is calculated to have a TEbc value of 0.02, then this indicates that by comparison with the benchmark DMUs, this DMU has room to achieve a 2% increase in revenue and a 2% decrease in CO2 emissions. In managerial terms, if the DMU learns emissions management techniques from a benchmark DMU of similar size, then it can boost its overall revenue by 2%, while at the same time adjusting its production processes to realize a 2% reduction in CO2 emissions. Based upon the empirical results obtained in this study, the mean TEbc value for the sample can be calculated to be 0.3397. This indicates that on average, the 81 DMUs that constitute the sample could achieve an average reduction in emissions of 33.97% and an average increase in revenue of 33.97%. In absolute terms, each DMU can boost its sales revenue by about US$486.6 million per year through benchmarking, on average, and at the same time reducing annual emissions (per DMU) by 198.41 thousand tons of CO2.

For the groups of different revenue scale, the correlation coefficient of revenue scale and CO2 emissions is about 0.96, showing that there is a strong positive relation between them. This indicates that the larger the economic scale, the higher the CO2 emissions generated from the production process. From the perspective of efficiency, the TEbc performance has a positive relation with the revenue scale (i.e., the TEbc of HRs = 0.1146 < MRs = 0.3262 < LRs = 0.3734). This means that the company with the larger economic scale is the most likely to be the benchmark DMU. If we focus on the absolute value of the environmental improvement potential, the story will be different. On average, each DMU in the MRs group can increase its annual sales revenue by about US$1004.12 million through carbon benchmarking, which is only slightly less than the $1051.28 million of the DMU in HRs. However, on average, the DMU in the MRs group has a better CO2 reduction potential than the HRs. According to the results of Table 4, each DMU in the MRs can increase by 409.03 thousand tons of CO2 reduction per year by applying carbon benchmarking. However, each DMU in the HRs group can increase the annual CO2 reduction by about 333.04 thousand tons, which is significantly lower than that in the MRs group.

Having completed the calculations outlined above, it is now possible to determine the reduction in annual CO2 emissions that semiconductor firms can obtain through benchmarking. Using an estimated value of the benefits from carbon reduction per unit of SCC under the baseline year 2015, the benefits from carbon reduction (in monetary terms) resulting from the raising of the TE of each DMU can thus be estimated. Since the SCC per ton of CO2 is US$56, using this magnitude together with the reduction in CO2 emissions deriving from the improvement in TE achieved through benchmarking, it is possible to calculate the benefits from carbon reduction.

On the basis of the estimation results shown in Table 4 above, if each DMU uses carbon benchmarking to learn superior emission management techniques from the benchmark DMUs, then on average, the resulting improvement in the efficiency of carbon reduction techniques will provide each DMU with carbon reduction benefits that, in monetary terms, equate to about US$11.11 million per year. Among all three revenue groups, the MRs group has the biggest potential for carbon reduction benefits. There will be about US$22.91 million benefits per year through carbon benchmarking.

5. Concluding Remark

Utilizing the bootstrapped directional distance function method to measure the TE of carbon reduction, this study seeks to measure carbon reduction TE in the Taiwanese semiconductor industry. With the measurement of TE, the study goes on to integrate the SCC methodology in calculating the monetary terms of carbon reduction benefits from the improvement in carbon reduction TE.

By performing an estimation of the bootstrapped directional distance function, it is possible to calculate the bias-corrected TE and the efficiency gap between inefficient DMUs and the benchmark DMUs. From a policy-making perspective, the significance of this is that there is significant room for these inefficient DMUs to improve their management techniques and methods (as opposed to their level of production technology) by bringing them up to the level of the benchmark DMUs. Assuming that there is no significant disparity between the DMUs in terms of the achievable level of production technology, then if benchmarking is performed for the inefficient DMUs with lower TE, once the TE of their carbon reduction management has been raised to a level comparable to that of the benchmark DMUs, it should be possible to realize both a significant increase in revenue and a significant reduction in CO2 emissions.

In terms of policy implication, based on the empirical estimation results obtained in this study, it can be seen that using carbon benchmarking (asking every DMU to improve its TE to the benchmark one) to raise the TE of carbon reduction management would, on average, boost the annual sales revenue of each DMU by about US$486.60 million, while also reducing the average annual CO2 emissions per DMU by 198.41 thousand tons. Overall, the combined increase in revenue for all of the semiconductor firms included in the study would total US$39,415 million per year, and the combined reduction in CO2 emissions would total 16,071.48 thousand tons. As regards the benefits from carbon reduction, the average carbon reduction benefits for each DMU would amount to approximately US$11.11 million per year; overall, the combined carbon reduction benefits for all of the DMUs included in the sample would be about US$900 million per year. Aside from that, among the three groups of different revenue scales, MRs has the highest benefit potential in CO2 reduction. This gives us an insight into the policy implications. If the carbon benchmarking control is carried out for the industry in the future, the DMUs in the MRs group can be the primary target.

Lastly, since this study only focuses on the analysis of the benefit dimension, there is still a lack of discussion on the possible cost of implementing the carbon benchmarking. A comprehensive cost–benefit analysis of response measures requires both benefit and cost information, thus exploring the cost of carbon benchmarking in the semiconductor industry so as to design the optimal carbon benchmarking system for the semiconductor industry in Taiwan can be one of the further research streams.

Author Contributions

Conceptualization, J.-L.L. and P.-I.W.; Methodology, J.-L.L. and C.-R.C.; Software operation, J.-L.L.; Formal Analysis, J.-L.L., P.-I.W. and C.-R.C.; Writing-Original Draft Preparation, J.-L.L.; Writing-Review & Editing, P.-I.W. and C.-R.C.

Funding

This research was funded by (Ministry of Science and Technology, Taiwan] grant number (MOST 104-2410-H-170-002].

Conflicts of Interest

The authors declare no conflict of interest.

References

- United Nations. Guidance to Assist Developing Country Parties to Assess the Impact of the Implementation of Response Measures, Including Guidance on Modelling Tools. 2016. Available online: https://unfccc.int/sites/default/files/resource/docs/2016/tp/04.pdf (accessed on 15 July 2018).

- Chung, Y.H.; Färe, R.; Grosskopf, S. Productivity and undesirable outputs: A directional distance function approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Pasurka, C.A. Accounting for air pollution emissions in measures of state manufacturing productivity growth. J. Reg. Sci. 2001, 41, 381–409. [Google Scholar] [CrossRef]

- Dyckhoff, H.; Allen, K. Measuring ecological efficiency with data envelopment analysis (DEA). Eur. J. Oper. Res. 2001, 132, 312–325. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Modeling undesirable factors in efficiency evaluation. Eur. J. Oper. Res. 2002, 142, 16–20. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Noh, D.W.; Webber, W. Characteristics of a polluting technology theory and practice. J. Econom. 2005, 126, 469–492. [Google Scholar] [CrossRef]

- Yang, H.; Pollitt, M. Distinguishing Weak and Strong Disposability among Undesirable Outputs in DEA: The Example of the Environmental Efficiency of Chinese Coal-Fired Power Plants; Cambridge Working Papers in Economics No. 0741; Electricity Policy Research Group, University of Cambridge: Cambridge, UK, 2007. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Poh, K.L. A survey of data envelopment analysis in energy and environmental studies. Eur. J. Oper. Res. 2008, 189, 1–18. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Margaritis, D. Directional distance functions revisited: Selective overview and update. Data Envel. Anal. J. 2015, 1, 57–79. [Google Scholar] [CrossRef]

- Hampf, B.; Krüger, J.J. Optimal directions for directional distance functions: An exploration of potential reductions of greenhouse gases. Am. J. Agric. Econ. 2015, 97, 920–938. [Google Scholar] [CrossRef]

- Murty, S.; Russell, R.R.; Levkoff, S.B. On modeling pollution-generating technologies. J. Environ. Econ. Manag. 2012, 64, 117–135. [Google Scholar] [CrossRef]

- Atkinson, S.E.; Dorfman, R.H. Bayesian measurement of productivity and efficiency in the presence of undesirable outputs: Crediting electric utilities for reducing air pollution. J. Econom. 2005, 126, 445–468. [Google Scholar] [CrossRef]

- Boyd, G.A.; Tolley, G.; Pang, J. Plant level productivity, efficiency, and environmental performance of the container glass industry. Environ. Resour. Econ. 2002, 23, 29–43. [Google Scholar] [CrossRef]

- Lee, J.D.; Park, J.B.; Kim, T.Y. Estimation of the shadow prices of pollutants with production-environment inefficiency taken into account a nonparametric directional distance function approach. J. Environ. Manag. 2002, 64, 365–375. [Google Scholar] [CrossRef]

- Arcelus, F.J.; Arocena, P. Productivity differences across OECD countries in the presence of environmental constraints. J. Oper. Res. Soc. 2005, 56, 1352–1362. [Google Scholar] [CrossRef]

- Picazo-Tadeo, A.J.; Reig-Martinez, E.; Heranadez-Sancho, F. Directional distance functions and environmental regulation. Resour. Energy Econ. 2005, 27, 131–142. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Weber, W.L. Shadow prices and pollution costs in U.S. agriculture. Ecol. Econ. 2006, 56, 89–103. [Google Scholar] [CrossRef]

- Kumar, S. Environmental sensitive productivity growth: A global analysis using Malmquist-Luenberger index. Ecol. Econ. 2006, 56, 280–293. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Wang, H. Energy and CO2 emission performance in electricity generation: A non-radial directional distance function approach. Eur. J. Oper. Res. 2012, 221, 625–635. [Google Scholar] [CrossRef]

- Lin, Y.-Y.; Chen, P.-Y.; Chen, C.-C. Measuring the environmental efficiency of countries: A directional distance function metafrontier approach. J. Environ. Manag. 2013, 119, 134–142. [Google Scholar] [CrossRef]

- Wang, Q.; Su, B.; Zhou, P.; Chiu, C.-R. Measuring total-factor CO2 emission performance and technology gaps using a non-radial directional distance function: A modified approach. Energy Econ. 2016, 56, 475–482. [Google Scholar] [CrossRef]

- Wang, K.; Xian, Y.; Lee, C.-Y.; Wei, Y.-M.; Huang, Z. On selecting directions for directional distance functions in a non-parametric framework: A review. Ann. Oper. Res. 2017, 1–34. [Google Scholar] [CrossRef]

- Xing, Z.; Wang, J.; Zhang, J. CO2 Emission performance, mitigation potential, and marginal abatement cost of industries covered in China’s nationwide emission trading scheme: A meta-frontier analysis. Sustainability 2017, 9, 932. [Google Scholar] [CrossRef]

- Simar, L.; Vanhems, A.; Wilson, P.W. Statistical inference for DEA estimators of directional distances. Eur. J. Oper. Res. 2012, 220, 853–864. [Google Scholar] [CrossRef]

- Falavigna, G.; Ippoliti, R.; Manello, A.; Ramello, G.B. Judicial productivity, delay and efficiency: A directional distance function (DDF) approach. Eur. J. Oper. Res. 2015, 240, 592–601. [Google Scholar] [CrossRef]

- Duan, N.; Guo, J.-P.; Xie, B.-C. Is there a difference between the energy and CO2 emission performance for China’s thermal power industry? A bootstrapped directional distance function approach. Appl. Energy 2016, 162, 1552–1563. [Google Scholar] [CrossRef]

- Almanza, C.; Rodríguze, J.J.M. Profit efficiency of banks in Colombia with undesirable output: A directional distance function approach. Economics 2018, 12, 1–18. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lovell, C.A.K.; Pasurka, C. Multilateral productivity comparisons when some outputs are undesirable: A nonparametric approach. Rev. Econ. Stat. 1989, 71, 90–98. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Inference by the m out of n bootstrap in nonparametric frontier models. J. Product. Anal. 2011, 36, 33–53. [Google Scholar] [CrossRef]

- Interagency Working Group on Social Cost of Carbon, United States Government. Technical Support Document: Social Cost of Carbon for Regulatory Impact Analysis—Under Executive Order 12866. 2010. Available online: https://www.epa.gov/sites/production/files/2016-12/documents/scc_tsd_2010.pdf (accessed on 15 July 2018).

- United States Environmental Protection Agency. EPA Fact Sheet: Social Cost of Carbon. 2015. Available online: https://www.arb.ca.gov/regact/2016/capandtrade16/attach11.pdf (accessed on 15 July 2018).

- Hope, C. Critical issues for the calculation of the social cost of CO2: Why the estimates from PAGE09 are higher than those from PAGE2002. Clim. Chang. 2013, 117, 531–543. [Google Scholar] [CrossRef]

- Nordhaus, W.; Sztorc, P. DICE 2013R: Introduction and User’s Manual. 2013. Available online: http://www.econ.yale.edu/~nordhaus/homepage/homepage/documents/DICE_Manual_100413r1.pdf (accessed on 15 July 2018).

- Anthoff, D.; Tol, D.S.J. FUND—Climate Framework for Uncertainty, Negotiation and Distribution. 2010. Available online: http://www.fund-model.org/publications (accessed on 15 July 2018).

- Paul, W. The Social Cost of Carbon. 2013. Available online: http://www.oecd.org/env/cc/37321411.pdf (accessed on 15 July 2018).

- Market Observation Post System (MOPS). 2016. Available online: http://emops.twse.com.tw/server-java/t58query (accessed on 15 July 2018).

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).