Investment Incentives in Competitive Electricity Markets

Abstract

1. Introduction

- In our study, for the first time, the investment problem is uniquely proposed on a bi-level, being critical to include factors like the transmission constraints, which have not focused thorough in previous attempts [30,31,32,33,34]. In addition, the proposed model has been considered between one strategic GENCO, compared with non-strategic GENCOs, being unique for a multi-vendor strategic framework development for global strategy implementation planning while the proposed models in [30,31,32,33,34,35] have no strategic GENCO.

- The firm contract policy is also incorporated into the central design of investment incentive which focuses uniquely on the co-existence of an inter-relating investment incentive for the firm contract for a given capacity payment schedule while the firm contract has not been considered in [16,30,31,32,33,34,35,36,37,38,39,40].

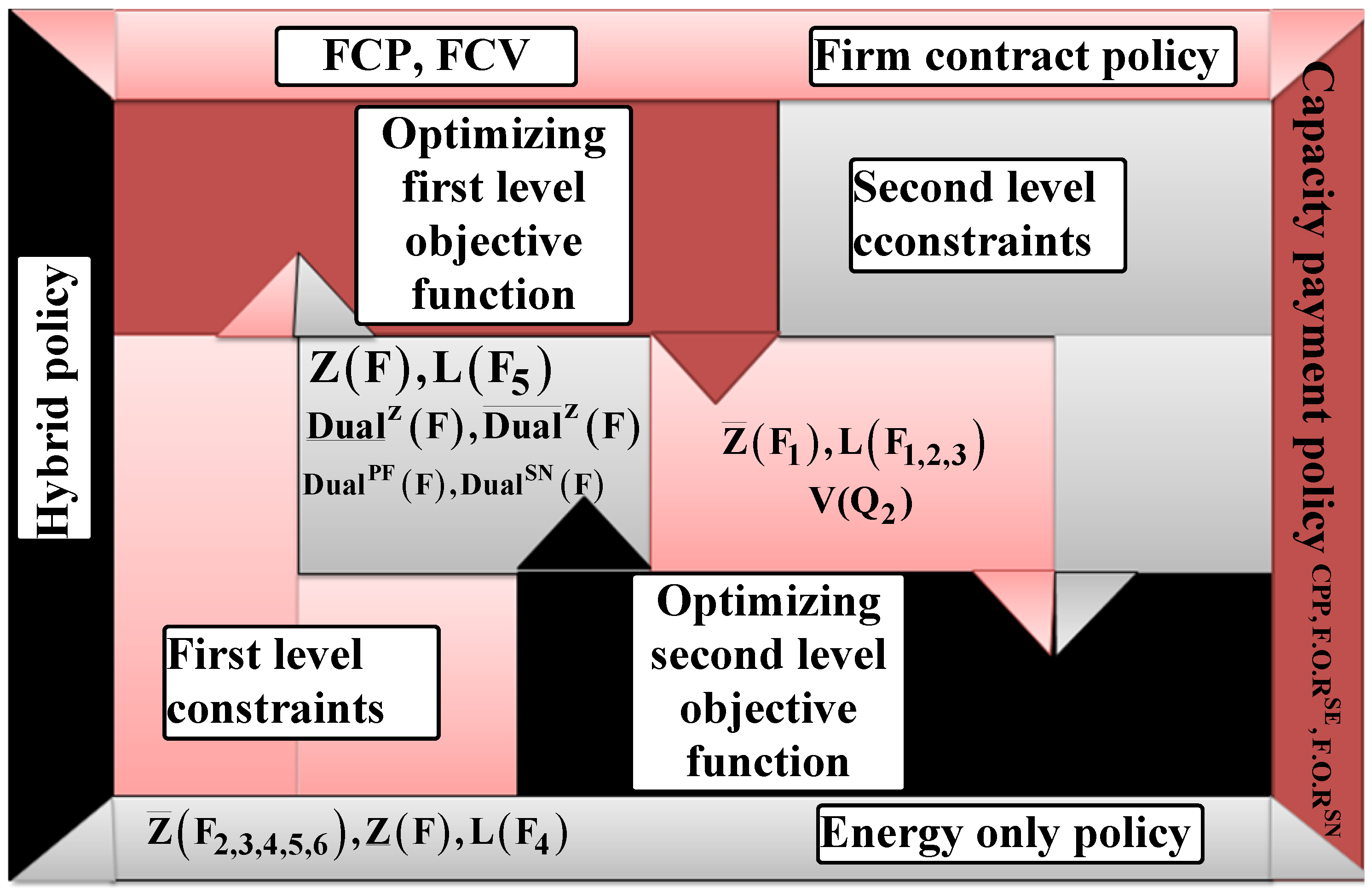

- In this paper specifically, a unique pre-requisite for a new emerging concept of smart hybrid energy markets being central to smart energy generation and distribution, including both capacity payment and firm contract, is also encompassed in the proposed model under the simultaneous scenario existence of two independent investment incentives, being considered simultaneously. A conventional practice [16,18,30,31,32,33,34,37,41,42] to implement mathematical programming with equilibrium constraint (MPEC) framework model to evaluate power generation investment incentives exists.

- In our case, we utilize and co-optimize the MPEC model for inter-relating the impact of both the firm contract and capacity payment on the global investment behaviour of electricity market structure.

- Furthermore, in this context, the reliability indicators for different markets can also be monitored and compared concurrently with each other, as this approach offers a unique adaptability to apply this method to a range of power networks.

- All demands in this paper are considered in two cases: elastic and inelastic, so that the price cap can be considered for strategic GENCO offers in market with inelastic demand. Some insight on the nature of market demands, such as elastic in [36,37,40,41,42], or as inelastic as in [18,30,31,32,33,34,37,41] have also been compared.

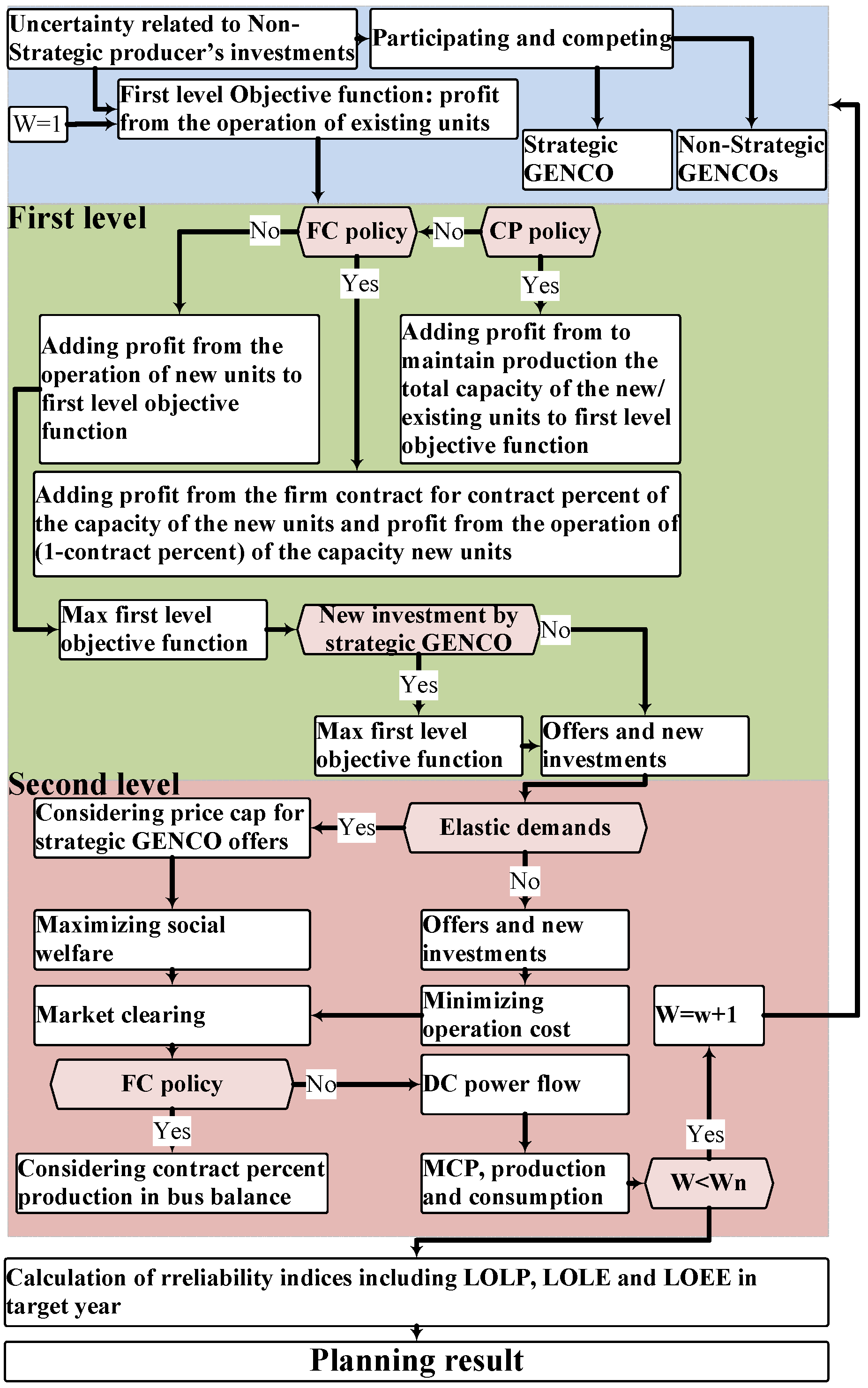

2. Proposal Algorithm for Optimizing GEP in Different Markets

| Algorithm 1 The proposed algorithm for investment incentives in the GEP problem. |

| Require: IDEA |

|

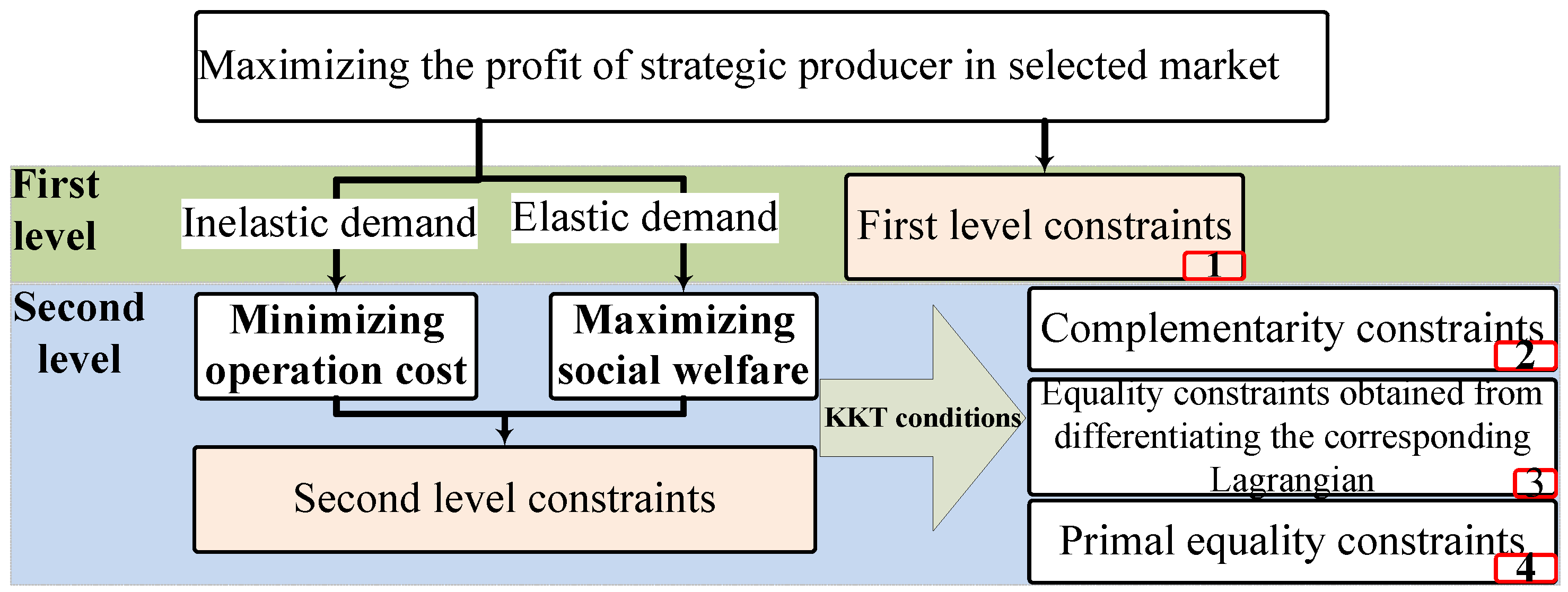

3. Converting Bi-Level to Single-Level

4. Considering Uncertainty

5. Relationship between the Different Levels and Variables Related to Each Level

6. Mathematical Formulation

Bi-Level Model Formulation of Markets

- To complete the conversion of bi-level solution to a single-level optimization structure, a linear expression for the term , which is the expression for strategic incoming in the operation market, is obtained by using a strong duality theorem and dedicated KKT equalities under pre-defined KKT conditions [16]. So far, all mathematical manipulation assumes the compliance by equilibrium constraints of MPEC and linearization by MILP.The strong duality theorem is preferred here because it is specifically required for optimization integration of a mathematical algorithm that is convex in nature; the objective functions of this type of primal and dual solutions have the same output value at the optimum limits, which is the feature in our case. The strong duality theorem is presented as follows:where rearranging and summating just for the term DUAL,

7. Case Studies

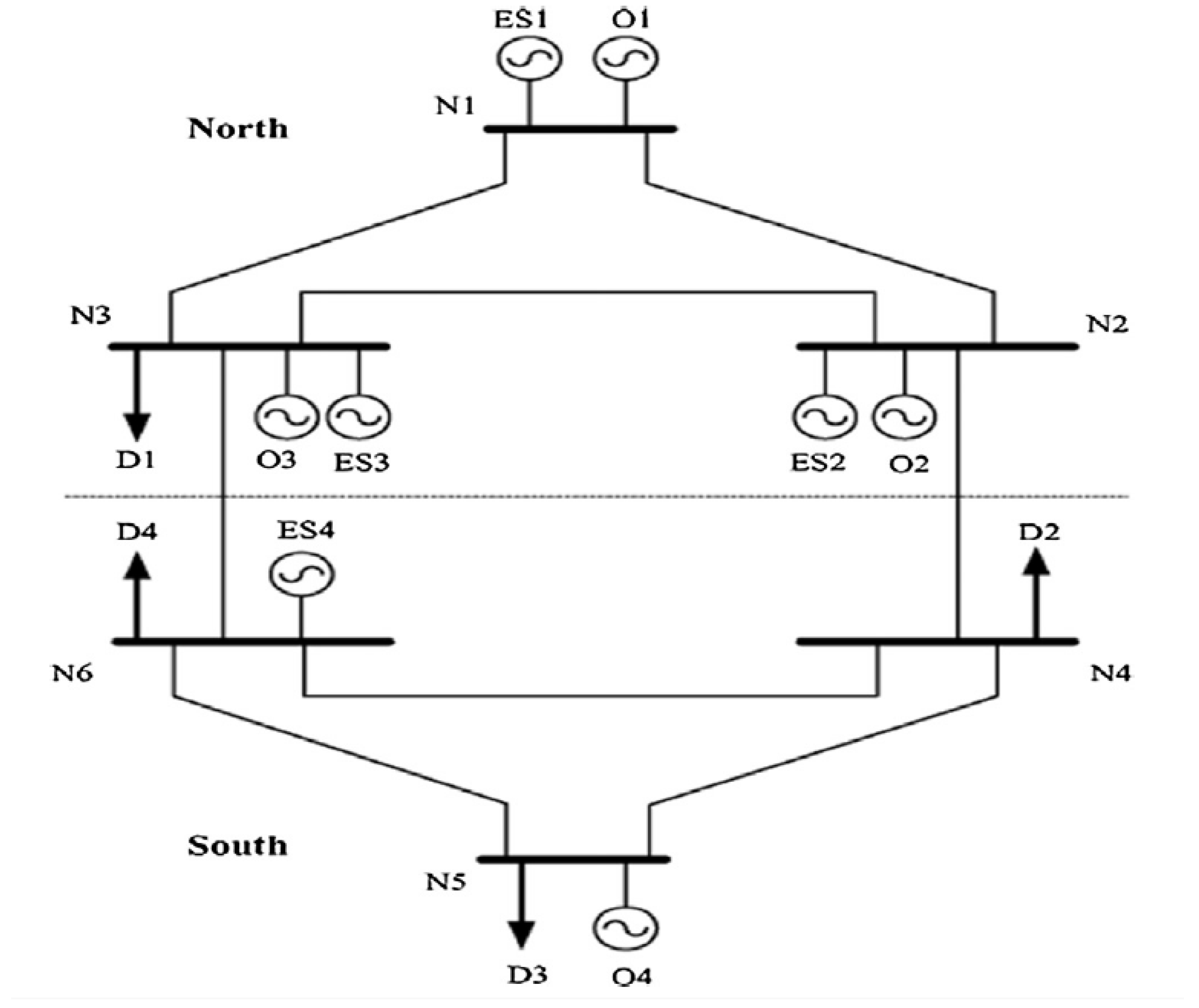

7.1. Six-Bus Power Transmission Network

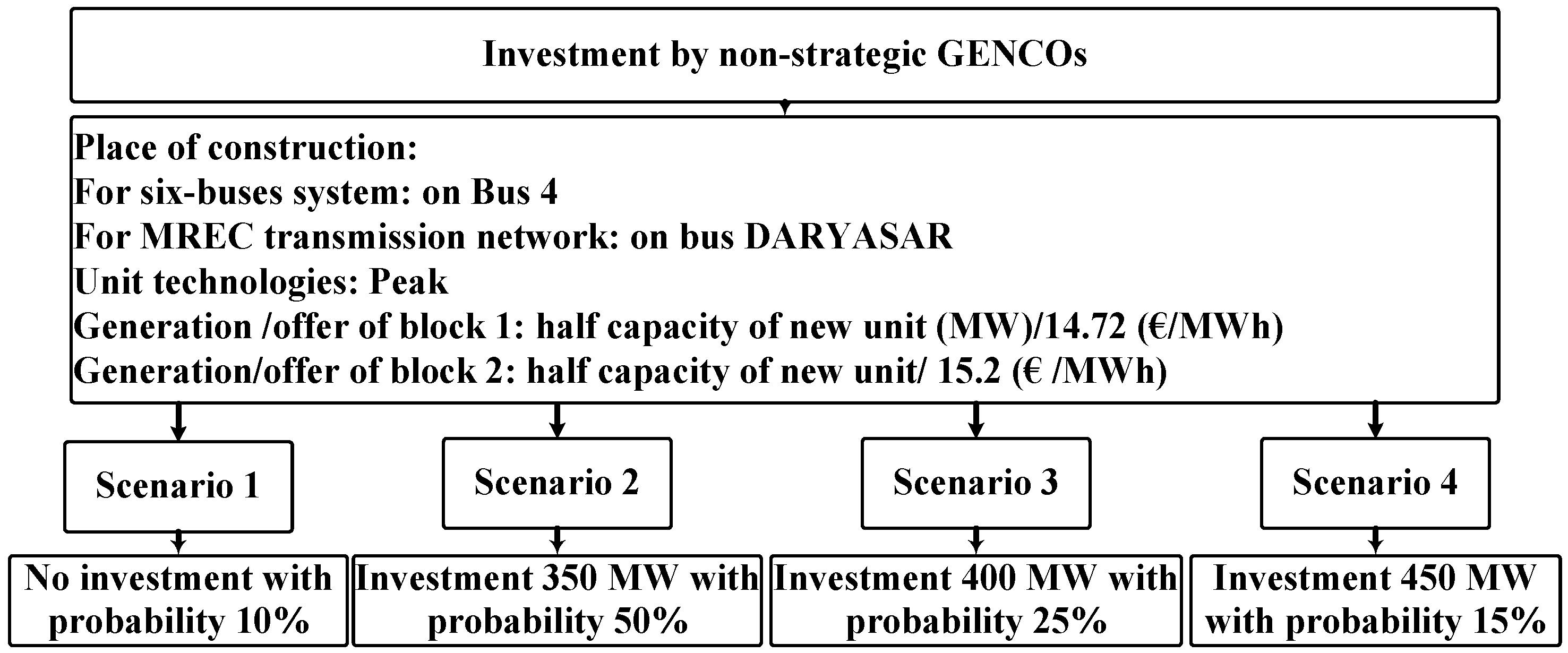

- Scenario-1:

- No investment over the planning period with the probability of 10%.

- Scenario-2:

- Investing 350 MW on the bus 4, with the probability of 50%.

- Scenario-3:

- Investing 400 MW on the bus 4, with the probability of 25%.

- Scenario-4:

- Investing 450 MW on the bus 4, with the probability of 15%.

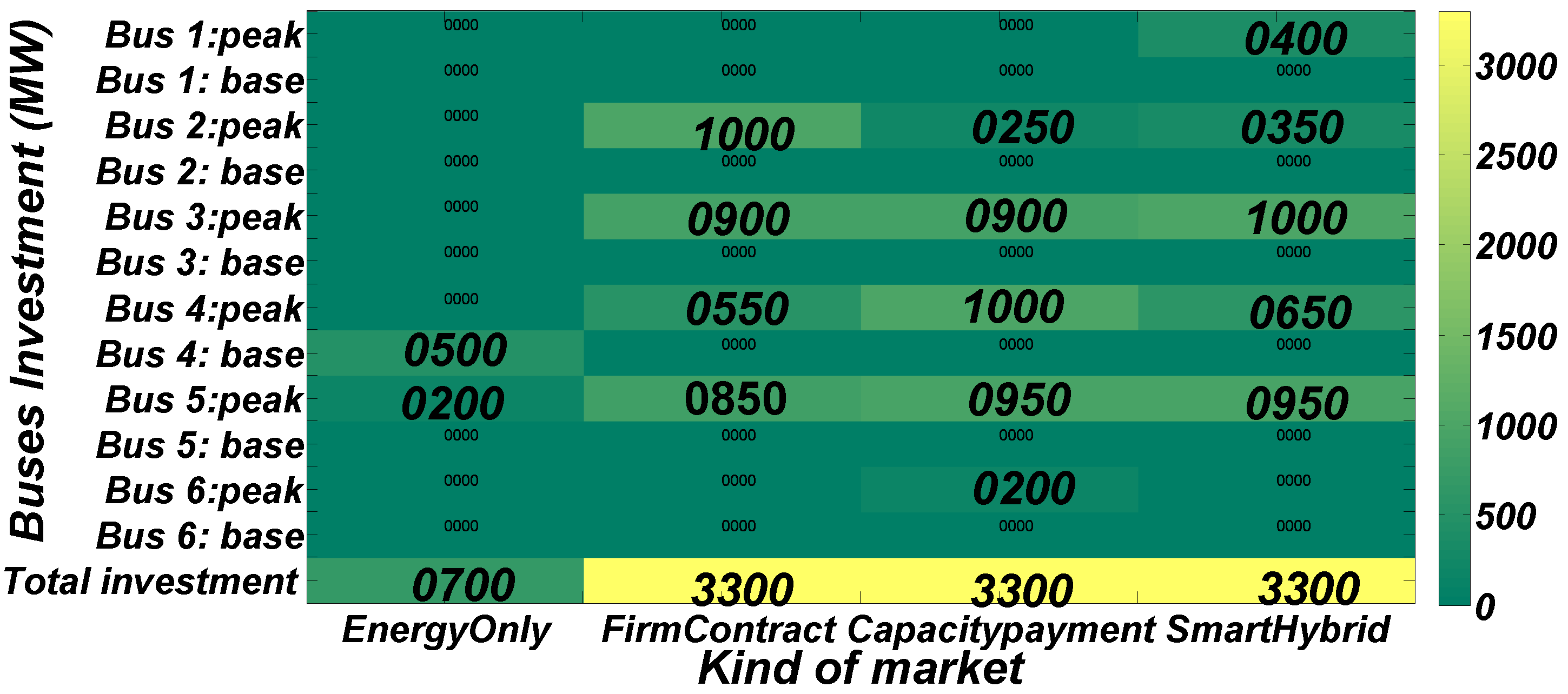

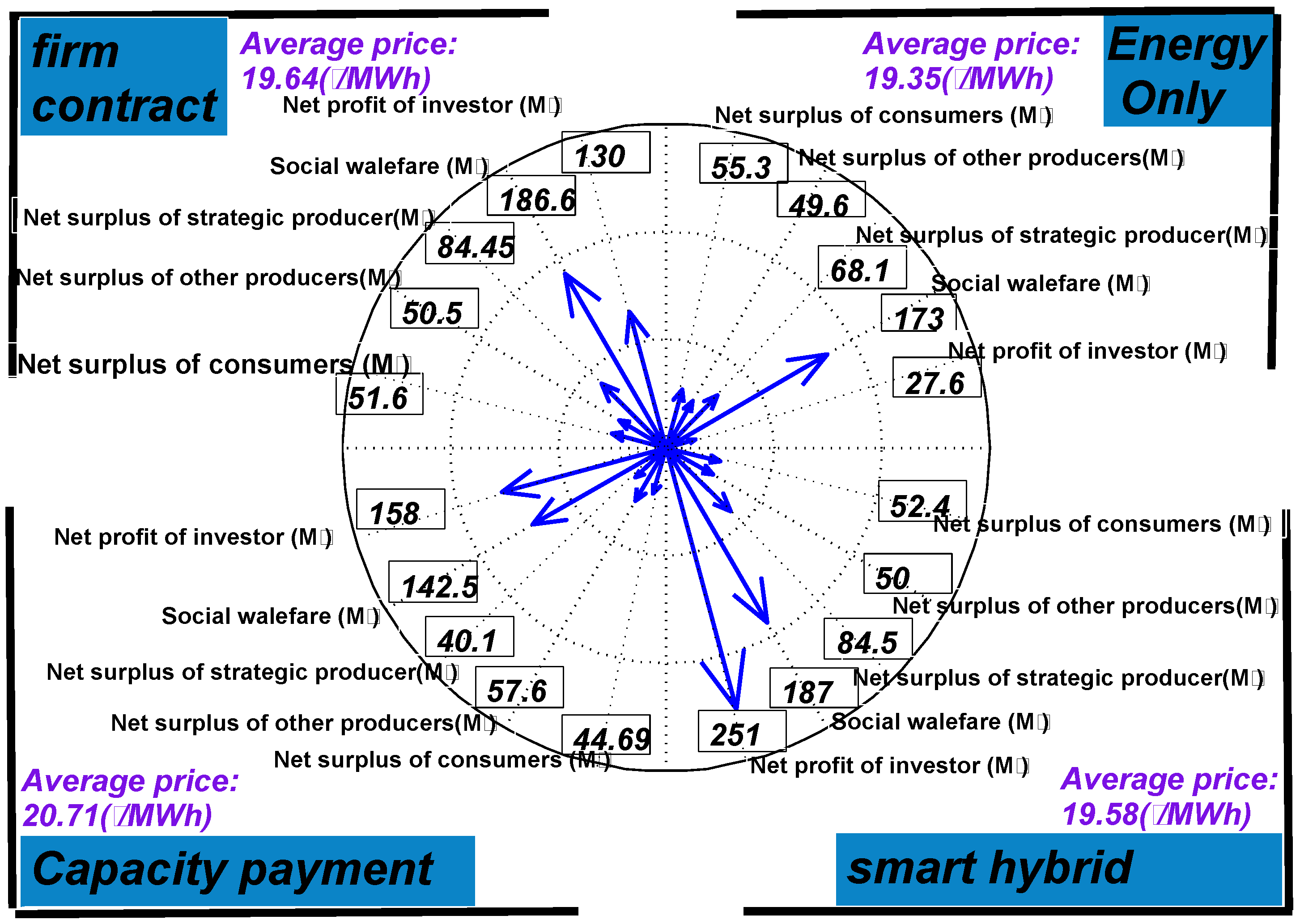

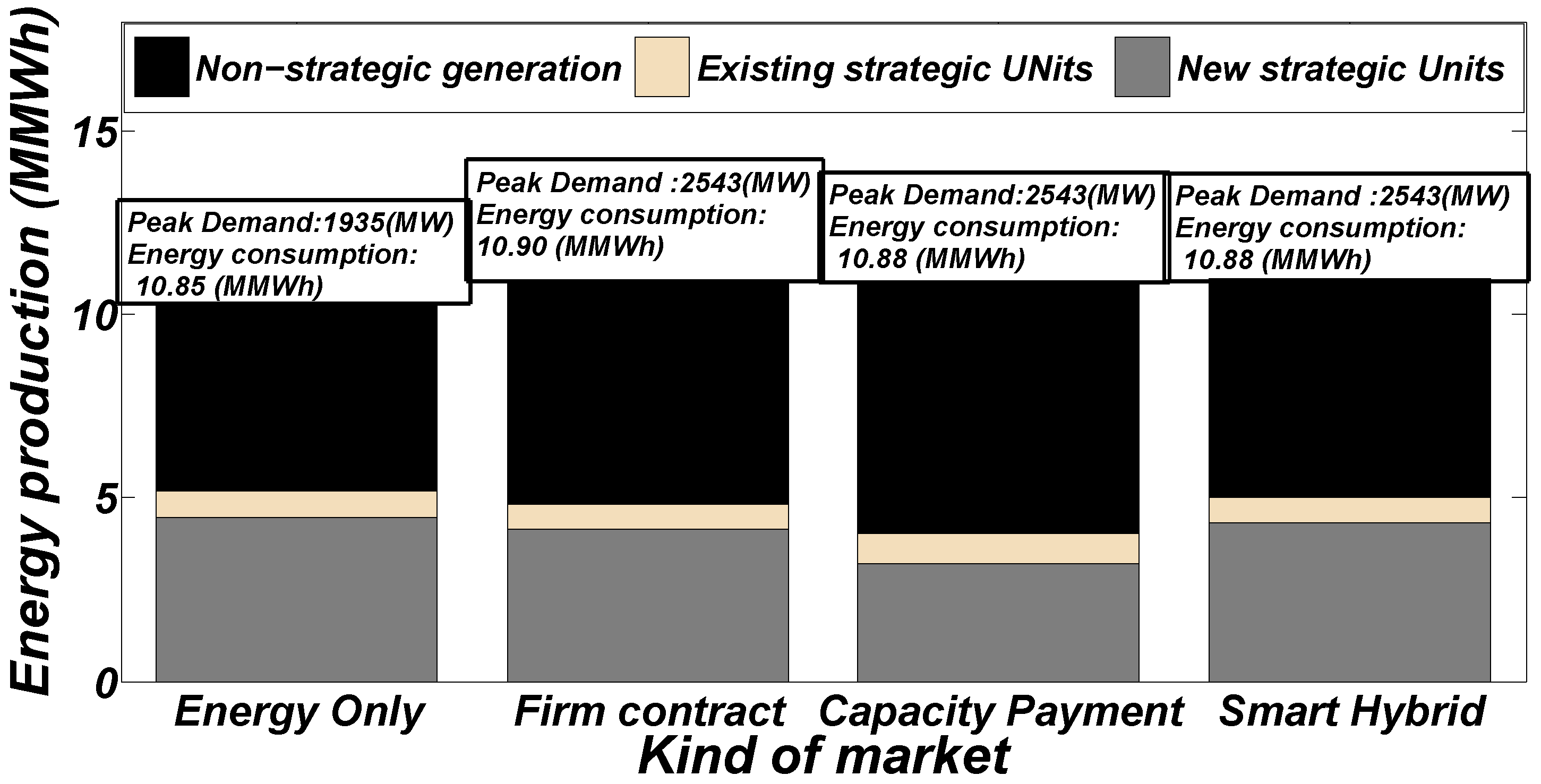

7.1.1. Energy Only Policy

7.1.2. Firm Contract Policy

7.1.3. Capacity Payment Policy

7.1.4. Smart Hybrid Market

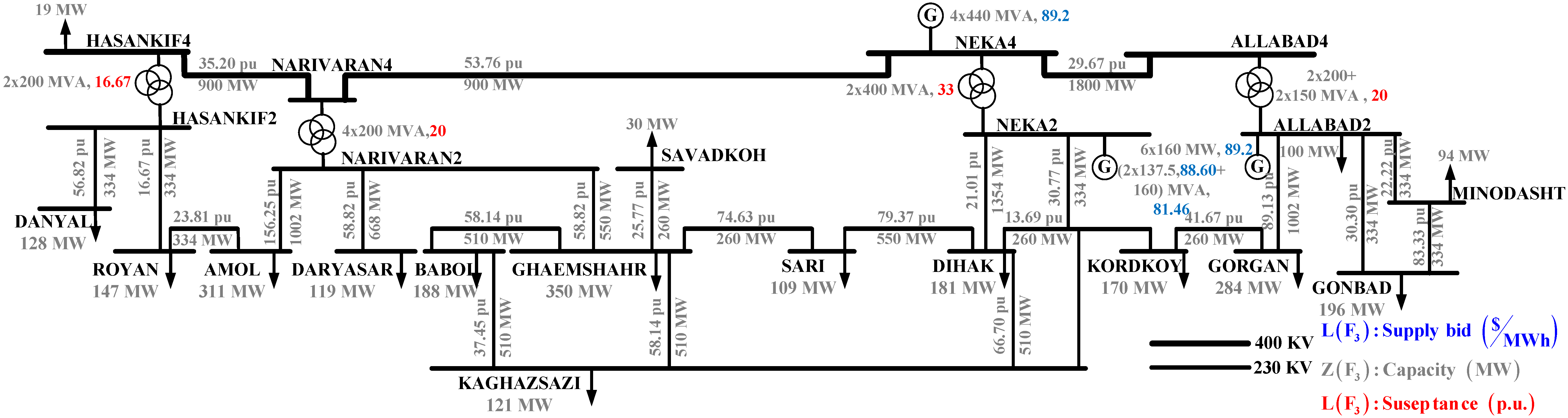

7.2. MREC Transmission Network

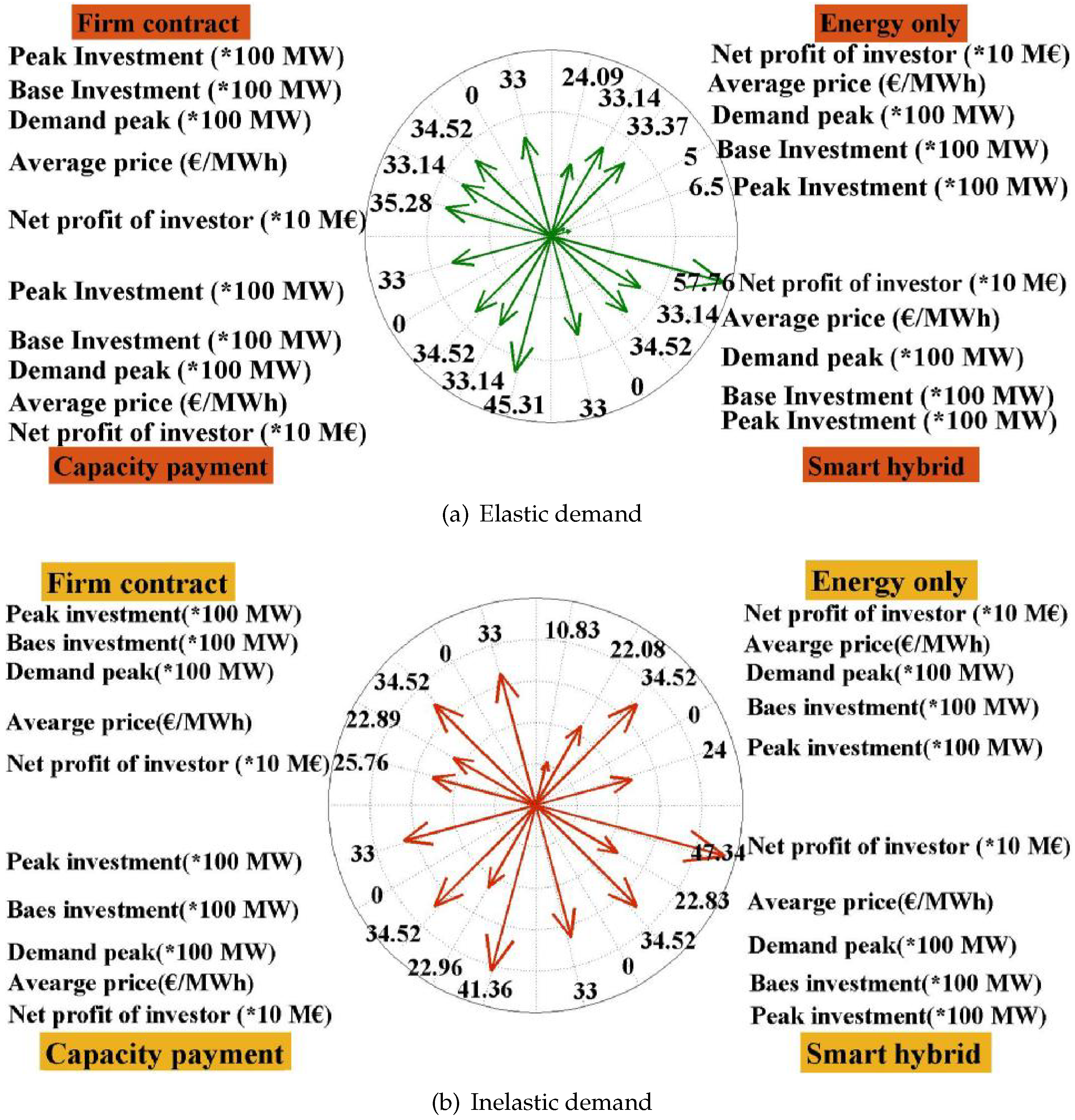

7.3. Analysis of Elastic Demands

7.3.1. Energy Only Policy

7.3.2. Firm Contract Policy

7.3.3. Capacity Payment Policy

7.3.4. Hybrid Policy

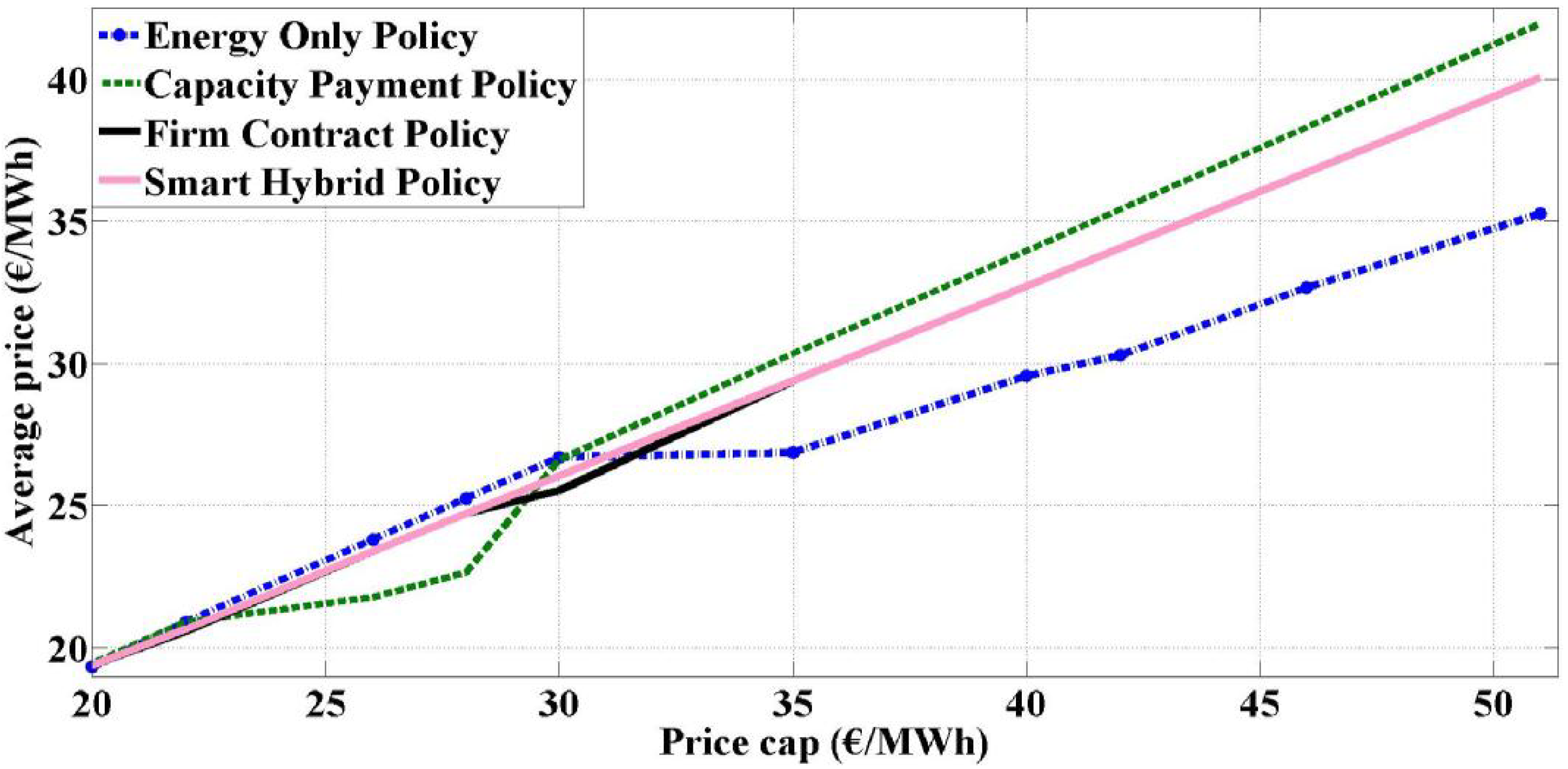

7.3.5. Analysis of Inelastic Demands

8. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| w/w | index for scenario |

| t | index for demand blocks |

| a/e//o | index for new/existing//generation unit of strategic GENCO/other GENCOs |

| j | index for demand |

| h | index for size of investment option |

| n/m | index for bus |

| FCV/FCP | firm contract volume/price |

| CPP | capacity payment price |

| WDB | weight of demand block t |

| WSW | weight of scenario w in demand block t |

| IB | total budget of strategic GENCO for investment |

| ICth | annual investment cost of new generating unit (€/MW) |

| OIth | option h for investment capacity of new unit a (MW) |

| / | Capacity of existing /generation unit e/j |

| of strategic GENCO/non-strategic GENCOs (MW) | |

| MC/MC//MC | marginal cost of new/existing//generation unit |

| of strategic GENCO//non-strategic GENCOs (€/MWh) | |

| maximum load of demand j in block t (MW) | |

| UD | price bid of demand k in demand block t and scenario w (€/MW) |

| SL | susceptance of line n-m (p.u.) |

| Transmission capacity of line n-m (MW) | |

| / | forced outage rate of new/existing unit |

| D | Power consumed by demand d in demand block t and scenario w (MW) |

| AON | Voltage angle of bus n in demand block t and scenario w |

| capacity investment of new unit a (MW) | |

| G/G// G | Power produced of new/existing//generation unit a/e//o strategic GENCO//by |

| non-strategic GENCOs, in demand block t and scenario w (MW) | |

| binary variable that is equal to 1 if the hth | |

| investment option of technology a is selected, otherwise it is equal to 0 | |

| /// | price offer of new/existing//generation unit of strategic GENCO//non-strategic |

| GENCOs (€/MWh), in demand block t and scenario w |

References

- Meneguzzo, F.; Rosaria, C.; Lorenzo, A.; Mario, P. The remarkable impact of renewable energy generation in Sicily onto electricity price formation in Italy. Energy Sci. Eng. 2016, 4, 194–204. [Google Scholar] [CrossRef]

- Albanese, L.; Rosaria, R.; Ciriminna, F.; Meneguzzo, P.; Pagliaro, M. The impact of electric vehicles on the power market. Energy Sci. Eng. 2015, 4, 300–309. [Google Scholar] [CrossRef]

- Nowak, J.W.; Sarkani, S.; Mazzuchi, T.A. Risk Assessment for a National Renewable Energy Target Part I: Developing the Model. IEEE Syst. J. 2015, 9, 1045–1056. [Google Scholar] [CrossRef]

- Wu, J.; Wu, Z.; Wu, F.; Mao, X. A power balancing method of distributed generation and electric vehicle charging for minimizing operation cost of distribution systems with uncertainties. Energy Sci. Eng. 2017, 5, 167–179. [Google Scholar] [CrossRef]

- Shivaie, M.; Ameli, M.T. Risk-constrained multi-level framework for coordination of generation and transmission expansion planning in liberalised environments- part I: Theory and formulation. IET Gener. Transm. Distrib. 2016, 10, 3183–3197. [Google Scholar] [CrossRef]

- Wang, J.; Yang, S.; Jiang, C.; Zhang, Y.; Lund, P.D. Status and future strategies for Concentrating Solar Power in China. Energy Sci. Eng. 2017, 5, 100–109. [Google Scholar] [CrossRef]

- Valinejad, J.; Oladi, Z.; Barforoushi, T.; Parvania, M. Stochastic unit commitment in the presence of demand response program under uncertainties. IJE Trans. B Appl. 2017, 30, 1134–1143. [Google Scholar]

- Luo, F.; Zhang, T.; Wei, W.; Li, F.; Bai, L.; Tan, C.W.; Liu, Y.; Liu, G. Models and methods for low-carbon footprint analysis of Models and methods for low-carbon footprint analysis of grid-connected photovoltaic generation from a distribution network planning perspective. Energy Sci. Eng. 2017, 5, 290–301. [Google Scholar] [CrossRef]

- Zhou, L.; Xu, C.; Xu, G.; Bai, P.Y. Exergy analysis and economic evaluation of the steam superheat utilization using regenerative turbine in ultra-supercritical power plants under design/off-design conditions. Energy Sci. Eng. 2017, 5, 156–166. [Google Scholar]

- Marzband, M.; Fouladfar, M.H.; Akorede, M.F.; Lightbody, G.; Pouresmaeil, E. Framework for smart transactive energy in home-microgrids considering coalition formation and demand side management. Sustain. Cities Soc. 2018, 40, 136–154. [Google Scholar] [CrossRef]

- Najafi Ravadanegh, S.; Jahanyari, N.; Amini, A.; Taghizadeghan, N. Smart distribution grid multistage expansion planning under load forecasting uncertainty. IET Gener. Transm. Distrib. 2016, 10, 1136–1144. [Google Scholar] [CrossRef]

- Gouin, V.; Alvarez-Hérault, M.-C.; Raison, B. Innovative planning method for the construction of electrical distribution network master plans. Sustain. Energy Grids Netw. 2016, 10, 84–91. [Google Scholar] [CrossRef]

- Warmann, E.C.; Atwater, H.A. Energy production advantage of independent subcell connection for multijunction photovoltaics. Energy Sci. Eng. 2016, 4, 235–244. [Google Scholar] [CrossRef]

- Kagiannas, A.G.; Askounis, D.T.; Psarras, J. Power generation planning: a survey from monopoly to competition. Int. J. Electr. Power Energy Syst. 2004, 26, 413–421. [Google Scholar] [CrossRef]

- Vivadinar, Y.; Purwanto, W.W.; Saputra, A.H. Tracing the energy footprints of Indonesian manufacturing industry. Energy Sci. Eng. 2016, 4, 394–405. [Google Scholar] [CrossRef]

- Valinejad, J.; Marzband, M.; Akorede, M.F.; Barforoshi, T.; Jovanović, M. Generation expansion planning in electricity market considering uncertainty in load demand and presence of strategic GENCOs. Energy Sci. Eng. 2017, 152, 92–104. [Google Scholar] [CrossRef]

- Tavakoli, M.; Shokridehaki, F.; Akorede, M.F.; Marzband, M.; Vechiu, I.; Pouresmaeil, E. CVaR-based energy management scheme for optimal resilience and operational cost in commercial building microgrids. Int. J. Electr. Power Energy Syst. 2018, 100, 1–9. [Google Scholar] [CrossRef]

- Wilson, A.L.; Dent, C.J.; Goldstein, M. Quantifying uncertainty in wholesale electricity price projections using Bayesian emulation of a generation investment model. Sustain. Energy Grids Netw. 2017, 13, 42–55. [Google Scholar] [CrossRef]

- Káberger, T. Energy science during industrial transformation. Energy Sci. Eng. 2015, 3, 1–10. [Google Scholar] [CrossRef]

- Mavalizadeh, H.; Ahmadi, A.; Heidari, A. Probabilistic multi-objective generation and transmission expansion planning problem using normal boundary intersection. IET Gener. Transm. Distrib. 2015, 9, 560–570. [Google Scholar] [CrossRef]

- Guerra, G.; Martinez-Velasco, J.A. Optimum allocation of distributed generation in multi-feeder systems using long term evaluation and assuming voltage-dependent loads. Sustain. Energy Grids Netw. 2016, 5, 13–26. [Google Scholar] [CrossRef]

- Xing, H.; Cheng, H.; Zhang, Y.; Zeng, P. Active distribution network expansion planning integrating dispersed energy storage systems. IET Gener. Transm. Distrib. 2016, 10, 638–644. [Google Scholar] [CrossRef]

- Tavakoli, M.; Shokridehaki, F.; Marzband, M.; Godina, R.; Pouresmaeil, E. A two stage hierarchical control approach for the optimal energy management in commercial building microgrids based on local wind power and PEVs. Sustain. Cities Soc. 2018, 41, 332–340. [Google Scholar] [CrossRef]

- Thomsen, J.; Hussein, N.S.; Senkpiel, C.; Hartmann, A.; Schlegl, T. An optimized energy system planning and operation on distribution grid level—The Decentralized Market Agent as a novel approach. Sustain. Energy Grids Netw. 2016, 12, 40–56. [Google Scholar] [CrossRef]

- Macedo, L.H.; Montes, C.V.; Franco, J.F.; Rider, M.J.; Romero, R. MILP branch flow model for concurrent AC multistage transmission expansion and reactive power planning with security constraints. IET Gener. Transm. Distrib. 2016, 10, 3023–3032. [Google Scholar] [CrossRef]

- Marzband, M.; Javadi, M.; Pourmousavi, S.A.; Lightbody, G. An advanced retail electricity market for active distribution systems and home microgrid interoperability based on game theory. Electr. Power Syst. Res. 2018, 157, 187–199. [Google Scholar] [CrossRef]

- Höschle, H.; Le Cadre, H.; Belmans, R. Inefficiencies caused by non-harmonized capacity mechanisms in an interconnected electricity market. Sustain. Energy Grids Netw. 2018, 13, 29–41. [Google Scholar] [CrossRef]

- Cui, H.; Li, F.; Fang, X.; Chen, H.; Wang, H. Bilevel Arbitrage Potential Evaluation for Grid-Scale Energy Storage Considering Wind Power and LMP Smoothing Effect. IEEE Trans. Sustain. Energy 2018, 9, 707–718. [Google Scholar] [CrossRef]

- Cui, H.; Li, F.; Fang, X.; Hu, Q.; Bai, L.; Fang, X. Day-ahead coordinated operation of utility-scale electricity and natural gas networks considering demand response based virtual power plants. Appl. Energy 2016, 176, 183–195. [Google Scholar] [CrossRef]

- Murphy, F.H.; Smeers, Y. Generation capacity expansion in imperfectly competitive restructured electricity markets. Oper. Res. 2005, 53, 646–661. [Google Scholar] [CrossRef]

- Botterud, A.; Ilic, M.D.; Wangensteen, I. Optimal investments in power generation under centralized and decentralized decision making. IEEE Trans. Power Syst. 2005, 20, 254–263. [Google Scholar] [CrossRef]

- Barforoushi, T.; Moghaddam, M.P.; Javidi, M.H.; Sheikh-El-Eslami, M.K. Evaluation of Regulatory Impacts on Dynamic Behavior of Investments in Electricity Markets: A New Hybrid DP/GAME Framework. IEEE Trans. Power Syst. 2010, 25, 1978–1986. [Google Scholar] [CrossRef]

- Wogrin, S.; Barquin, J.; Centeno, E. Capacity Expansion Equilibria in Liberalized Electricity Markets: An EPEC Approach. IEEE Trans. Power Syst. 2013, 28, 1531–1539. [Google Scholar] [CrossRef]

- Kaymaz, P.; Valenzuela, J.; Park, C.S. Transmission Congestion and Competition on Power Generation Expansion. IEEE Trans. Power Syst. 2007, 22, 156–163. [Google Scholar] [CrossRef]

- Valinejad, J.; Marzband, M.; Busawona, K.; Kyyrä, J.; Pouresmaeil, E. Investigating Wind Generation Investment Indices in Multi-Stage Planning. In Proceedings of the 5th International Symposium on Environment Friendly Energies and Applications (EFEA), Rome, Italy, 24–26 September 2018. [Google Scholar]

- Jalal Kazempour, S.; Conejo, A.J.; Ruiz, C. Strategic Generation Investment Using a Complementarity Approach. IEEE Trans. Power Syst. 2010, 26, 940–948. [Google Scholar] [CrossRef]

- Valinejad, J.; Barforoushi, T. Generation expansion planning in electricity markets: A novel framework based on dynamic stochastic MPEC. Int. J. Electr. Power Energy Syst. 2015, 70, 108–117. [Google Scholar] [CrossRef]

- Xu, M.; Wilson, A.; Dent, C.J. Calibration and sensitivity analysis of long-term generation investment models using Bayesian emulation. Sustain. Energy Grids Netw. 2015, 5, 58–69. [Google Scholar] [CrossRef]

- Valinejad, J.; Marzband, M.; Barforoushi, T.; Kyyrä, J.; Pouresmaeil, E. Dynamic stochastic EPEC model for Competition of Dominant Producers in Generation Expansion Planning. In Proceedings of the 5th International Symposium on Environment Friendly Energies and Applications (EFEA), Rome, Italy, 24–26 September 2018. [Google Scholar]

- Jalal Kazempour, S.; Conejo, A.J. Strategic Generation Investment Under Uncertainty via Benders Decomposition. IEEE Trans. Power Syst. 2015, 27, 424–432. [Google Scholar] [CrossRef]

- Wogrin, S.; Centeno, E.; Barquán, J. Generation Capacity Expansion Analysis: Open Loop Approximation of Closed Loop Equilibria. IEEE Trans. Power Syst. 2013, 28, 3362–3371. [Google Scholar] [CrossRef]

- Facchinei, F.; Pang, J.-S. Finite-Dimensional Variational Inequalities and Complementarity Problems. IEEE Trans. Power Syst. 2003, 28, 3362–3371. [Google Scholar]

- Brooke, D.; Kendrick, A.; Meeraus, R.; Raman, R. GAMS: A User’s Guide; GAMS Development Corporation: Washington, DC, USA, 1998. [Google Scholar]

- Facchinei, F.; Pang, J.-S. A bi-level robust optimization model to determine retail electricity price in presence of a significant number of invisible solar sites. Sustain. Energy Grids Netw. 2017, 28, 3362–3371. [Google Scholar]

- Hobbs, B.F.; Metzler, C.B.; Pang, J.S. Strategic gaming analysis for electric power systems: An MPEC approach. IEEE Trans. Power Syst. 2000, 15, 638–645. [Google Scholar] [CrossRef]

- Fortuny-Amat, J.; McCarl, B. A Representation and Economic Interpretation of a Two-Level Programming Problem. J. Oper. Res. Soc. 1981, 32, 783–792. [Google Scholar] [CrossRef]

| Kind of Market | LOLP% | LOLE (day/year) | LOEE (MMWh) |

|---|---|---|---|

| Energy only | 4.24 | 15.49 | 0.066643 |

| Firm contract | 0.00286 | 0.0105 | 0.0000420 |

| Capacity payment | 0.00169 | 0.0062 | 0.0000316 |

| Hybrid | 0.0021 | 0.0077 | 0.0000796 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Valinejad, J.; Barforoshi, T.; Marzband, M.; Pouresmaeil, E.; Godina, R.; P. S. Catalão, J. Investment Incentives in Competitive Electricity Markets. Appl. Sci. 2018, 8, 1978. https://doi.org/10.3390/app8101978

Valinejad J, Barforoshi T, Marzband M, Pouresmaeil E, Godina R, P. S. Catalão J. Investment Incentives in Competitive Electricity Markets. Applied Sciences. 2018; 8(10):1978. https://doi.org/10.3390/app8101978

Chicago/Turabian StyleValinejad, Jaber, Taghi Barforoshi, Mousa Marzband, Edris Pouresmaeil, Radu Godina, and João P. S. Catalão. 2018. "Investment Incentives in Competitive Electricity Markets" Applied Sciences 8, no. 10: 1978. https://doi.org/10.3390/app8101978

APA StyleValinejad, J., Barforoshi, T., Marzband, M., Pouresmaeil, E., Godina, R., & P. S. Catalão, J. (2018). Investment Incentives in Competitive Electricity Markets. Applied Sciences, 8(10), 1978. https://doi.org/10.3390/app8101978