To validate the effectiveness and practicality of the proposed evaluation methodology, a case study is conducted using actual data from the 220 kV substations within the QZ power grid. The dataset comprises multi-period operational records for the years 2024 and 2025, including active power (MW), reactive power (MVar), and the total rated apparent power (MVA) for each substation, with a time resolution of 15 min. The data preprocessing procedure is as follows:

5.1. Results of Energy Storage Demand Assessment for Substations

Following data preprocessing, an assessment of the 15 220 kV substations within the QZ power grid was performed. The comprehensive evaluation results, including the final rankings, normalized indicator values, and composite scores for all substations, are presented in

Table 2.

As shown in the table, the QZ, TZ, and GT substations are ranked as the top three candidates, with high composite scores of 86.0, 72.8, and 72.2, respectively. A high-priority demand for ESS deployment is thereby indicated for these sites. A detailed analysis of the individual demand drivers, based on the specific indicators in

Table 2, is provided below.

In terms of high load concentration, the highest values are exhibited by the TZ, HB, and QZ substations. These sites are distinguished by maximum load rates exceeding 70% and sustained high-load durations of over 22 h, from which significant loading stress is indicated. Consequently, they are positioned as primary candidates for peak-shaving via ESS. Conversely, a high load concentration of zero was recorded for the substations ranked 11–15, signifying that these sites are currently operated under low-load conditions and are not affected by significant high-load issues.

Regarding the peak-to-valley difference in load rate, the YX, DY, and GT substations were ranked as the top three. Notably, the maximum difference of 0.688 was observed at the YX substation on 28 May 2024, characterized by significant reverse power flow (−24.5%) during off-peak hours. It is noteworthy that at most of the top-ranked sites, the load minimums were observed during midday, a pattern highly consistent with the temporal characteristics of PV generation. This indicates that the integration of renewable energy sources is a primary driver for the widening peak-valley difference. These sites are therefore well-suited for the deployment of ESS to enhance system flexibility.

In terms of power factor deviation, the largest deviations were recorded for the QZ, YX, and SK substations, all occurring during midday hours where the power factor was extremely low (approaching zero). This finding suggests the presence of severe reactive power issues, likely attributable to near-zero active power from PV generation coexisting with significant reactive power demand. The deployment of ESS with reactive power compensation capabilities can effectively address these issues.

With respect to the reactive power fluctuation range, the widest was observed at the GT substation, where a rapid drop in reactive power from a peak of 26.5% to 0.5% was recorded within a single day—a fluctuation corresponding to a magnitude of 0.259—which signifies severe reactive power volatility at the site. The QZ and TZ substations followed, with ranges also exceeding 0.180. It is noteworthy that the maximum reactive power fluctuations for multiple substations were recorded on the same date, i.e., 2 February 2024, suggesting the occurrence of a potential system-wide reactive power event.

In terms of reverse power flow, the highest concentration was recorded at the QZ substation, where a continuous duration of 17.75 h of reverse flow was observed on 9 June 2024, reaching a maximum reverse load rate of −20.7%. The YX and DY substations were ranked second and third, with both sites experiencing maximum reverse load rates exceeding −30%. The majority of these reverse flow incidents were concentrated during midday hours (11:30–14:15), a pattern highly consistent with peak PV generation periods. Simultaneous reverse flows were also observed across multiple substations in February (particularly on 11–12 February), which can likely be attributed to a specific combination of meteorological conditions and electricity demand patterns at the time. These sites are therefore identified as primary targets for the deployment of ESS to enhance renewable energy accommodation.

Based on the evaluation results, the comprehensive subjective-objective weights were obtained using AHP and the entropy method, as presented in

Table 3. The subjective weights from AHP assign the highest importance to high load concentration and reverse power flow concentration (both at 0.270), reflecting the expert view that mitigating grid congestion and facilitating renewable energy accommodation are the most critical applications. Conversely, in the objective weights, a value of 0.436 was assigned to high load concentration, indicating it has the highest distinguishing power in the dataset. The final comprehensive weights thus preserve the expert-driven rationale while incorporating objective data characteristics, providing a more balanced reflection of each indicator’s relative importance.

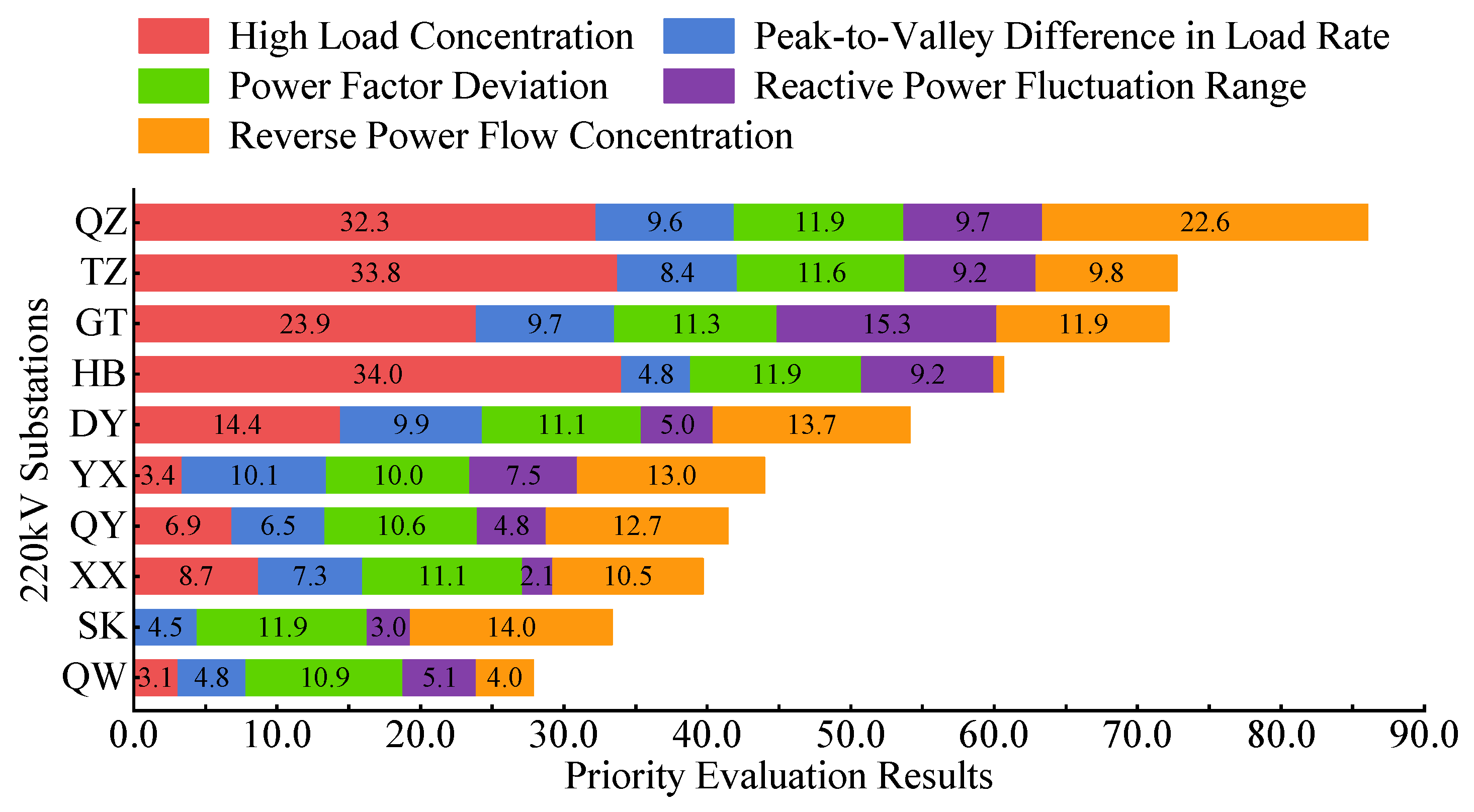

Based on the aforementioned evaluation results and the comprehensive weights, the indicator values and final rankings for the 10 220 kV substations are presented in

Figure 1. The QZ substation is ranked first with a comprehensive score of 86.0, with its ESS demand being primarily driven by high-load mitigation (37.5% contribution) and renewable energy accommodation (26.3% contribution). The TZ and GT substations are ranked second and third, respectively, and are both predominantly driven by high load concentration. A clear dominant demand driver was identified for each of the top five substations, which facilitates the determination of the primary functional role for the corresponding ESS.

From the perspective of application scenarios, the 15 substations can be categorized into three types:

- (1)

Dominated by grid congestion mitigation: QZ, TZ, GT, HB, and DY.

- (2)

Dominated by renewable energy accommodation: QZ, DY, YX, QY, and XX.

- (3)

Dominated by voltage quality improvement: GT, DY, YX, QY, and XX.

This classification highlights that, to achieve an optimal return on investment, the functionalities of the configured ESS should be specifically tailored to the dominant needs of each substation type.

5.2. Results of Optimal ESS Planning

To validate the effectiveness of the proposed optimal capacity planning model, the top-ranked substations from the demand assessment are selected. For these sites, the economically optimal planning that satisfies the multi-dimensional operational security constraints is determined. The planning horizon is set to one year with a single planning stage. Based on historical data from 2024, the most severe daily operating scenarios for each indicator are screened. The corresponding load for these scenarios in 2025 is then forecasted by applying an annual load growth rate, and these forecasted scenarios are utilized for the operational security verification. Based on the official statistical yearbooks, an average annual load growth rate of 8.5% was calculated and adopted for this study. In accordance with the local dispatch requirements, the peak-load hours are defined as 08:00–11:00 and 13:00–24:00, while the off-peak hours are 00:00–08:00 and 11:00–13:00. The key parameters for the planning model are set as detailed in

Table 4.

It is noteworthy that, although the energy-to-power ratio was not strictly constrained to 2:1 within the optimization model—a ratio commonly observed in practice—the final results presented are adjusted to reflect this standard. Specifically, the greater of the two optimized values (energy capacity or power rating) is taken as the baseline, and the other quantity is subsequently adjusted to maintain the 2:1 ratio.

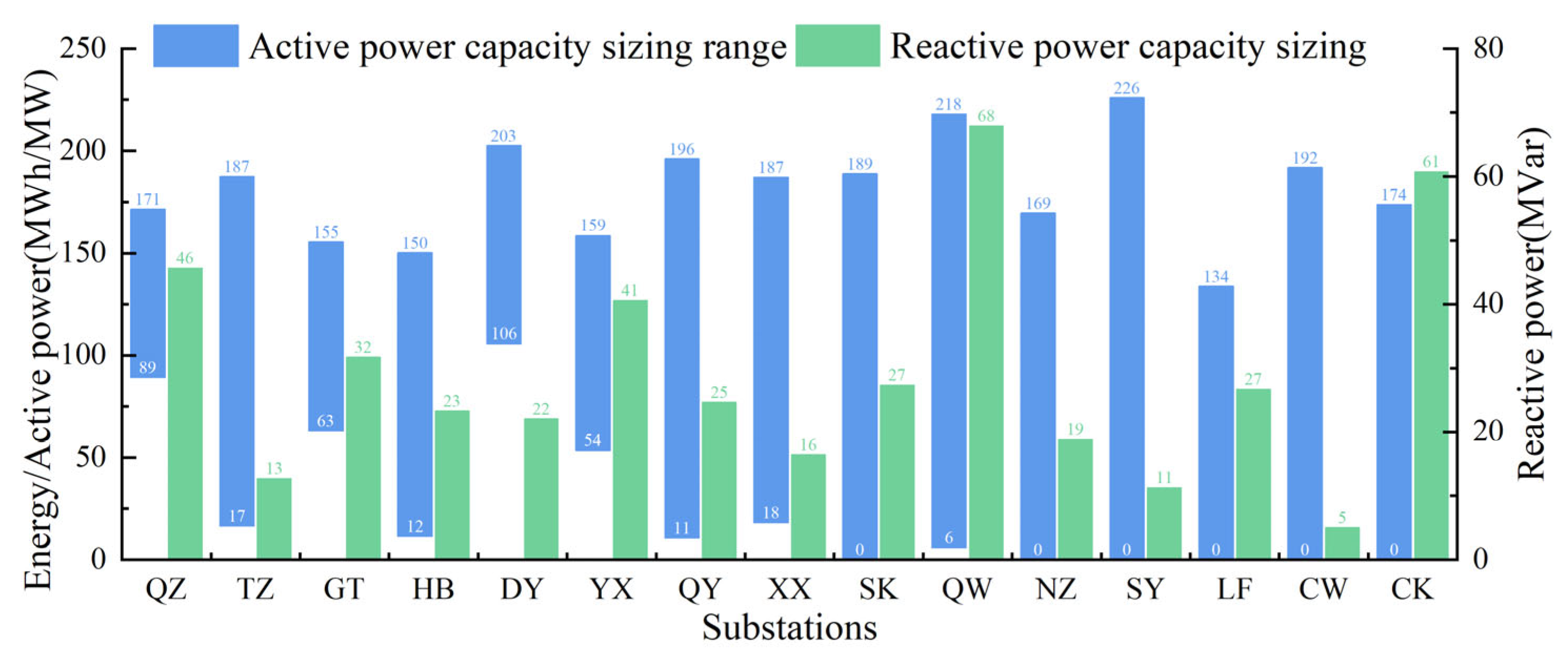

Using the Gurobi commercial solver, the optimal capacity planning model was solved for the screened severe scenario sets. The resulting planning for the 220 kV substations, as illustrated in

Figure 2, exhibits significant differentiation, which reflects the model’s ability to tailor allocations to the specific characteristics of each site. A strong correlation between the demand ranking and the allocated capacity was observed: the top 40% of substations account for 90.17% of the total minimum configured active power, whereas the lowest-ranked sites were assigned a minimum capacity of zero. This disparity validates the effectiveness of the proposed priority assessment method in accurately distinguishing site-specific needs. Notably, the largest minimum active power capacity (106 MW) was assigned to the DY substation.

It is also noteworthy that reactive power allocations vary significantly among the sites. The two substations receiving the largest reactive power capacities, QW (68 MVar) and CK (61 MVar), were ranked lower in the overall demand assessment. This is attributed to two factors: firstly, the indicators correlated with reactive power were assigned lower weights in the comprehensive ranking; secondly, the unit cost of reactive power is substantially lower, causing the model to preferentially deploy it when operational security can be met without active power. The allocation of reactive power capacity to all substations indicates that such issues are prevalent system-wide and that, in addition to active power regulation, many sites face significant voltage stability challenges.

In terms of the active power configuration range, the largest interval (226 MW) was identified for the SY substation, while the smallest (only 82 MW) was attributed to the QZ substation. This narrow range signifies a severe configuration bottleneck at the QZ site, highlighting the urgent need for alternative solutions to be explored. Overall, these planning results embody the principle of a site-specific and precisely targeted allocation strategy, thereby providing a scientific basis for the efficient utilization of the grid’s ESS resources.

To visually demonstrate the technical benefits of the proposed method, the DY substation, which has the highest requirement for active power configuration (i.e., the largest lower bound), is selected as a case study. A comparative analysis of the improvement in key security indicators before and after the deployment of an ESS is conducted.

The indicator values before and after deployment, along with their respective improvement rates under different typical severe scenarios, are presented in

Table 5 and

Table 6. Specifically: Regarding the

dLD: The most significant improvement for this indicator is observed in ‘Scenario 2’ of the corresponding severe scenario set. After ESS deployment, the indicator value for this scenario is optimized from 0.579 (which exceeded the safety threshold) to 0.4, corresponding to an improvement rate of 30.91%. The issue of an excessive peak-to-valley difference is thereby effectively mitigated. Regarding the

dPF: For this indicator, an improvement rate exceeding 90% is achieved in most of the severe scenarios. It is thereby strongly confirmed that a low power factor is a prevalent and critical bottleneck issue at the DY substation, for which an extremely effective solution is provided by the deployment of ESS, particularly through its reactive power compensation capabilities.

5.3. Analysis of Investment Return on ESS

Based on the preceding evaluation results, an investment return analysis was conducted for the QZ substation, which was identified as the highest-priority site. In accordance with the capacity configuration results, a 100 MW/200 MWh Lithium Iron Phosphate (LFP) ESS was modeled for the site; the associated cost and operational parameters are detailed in

Appendix A.5.

The life-cycle cost and benefit composition for this project is presented in

Table 7. It is observed that the total cost is dominated by the initial investment of 179 million CNY, which constitutes 66% of the life-cycle expenditure. On the revenue side, TOU price arbitrage is the primary income source, generating 492 million CNY (86.7%), while frequency regulation services provide a significant secondary revenue stream (13.3%). It is noteworthy that revenue from dedicated peak regulation was found to be negligible, as the marginal returns from TOU arbitrage far exceed the compensation offered in the peak regulation market. Ultimately, a total net revenue of 299 million CNY is realized over the project’s lifetime.

The economic evaluation metrics for the QZ ESS project are presented in

Table 8. The project’s robust profitability is demonstrated by an achieved IRR of 32.28%, a value substantially exceeding the 5% benchmark rate. Concurrently, a DPP of only 3.24 years and a static payback period (SPP) of 2.92 years were determined; a duration significantly shorter than the 10-year design lifetime, indicating that the initial investment can be rapidly recouped before the project enters its long-term profitability phase. Furthermore, the calculated LCOS of 0.3236 CNY/kWh is markedly lower than the local peak and critical-peak tariffs, which constitutes the core competitive advantage of the business model.

To investigate the project’s sensitivity to key techno-economic parameters, a sensitivity analysis was conducted on the impact of fluctuations in the initial investment cost and the peak-to-valley price differential on the IRR, LCOS, and DPP. These two core variables were independently varied by ±10% and ±20% from their baseline values, with the results presented in

Table 9. It was found that for every 10% decrease in initial investment cost, the IRR is increased by more than four percentage points, and the DPP is shortened by approximately 0.4 years. A similar effect was observed for the price differential, where a 10% increase improves the IRR by nearly four percentage points and reduces the DPP by a comparable duration. The LCOS was observed to be sensitive only to investment cost and is unaffected by the market price spread. Notably, even under a 20% adverse fluctuation in either variable, the project’s IRR is maintained above 20%, which demonstrates that the project possesses both high return potential and significant robustness against financial risks.