1. Introduction

The world is currently grappling with an escalating energy crisis and the urgent impacts of climate change. Greenhouse gas (GHG) emissions continue to have widespread and unpredictable impacts across most countries [

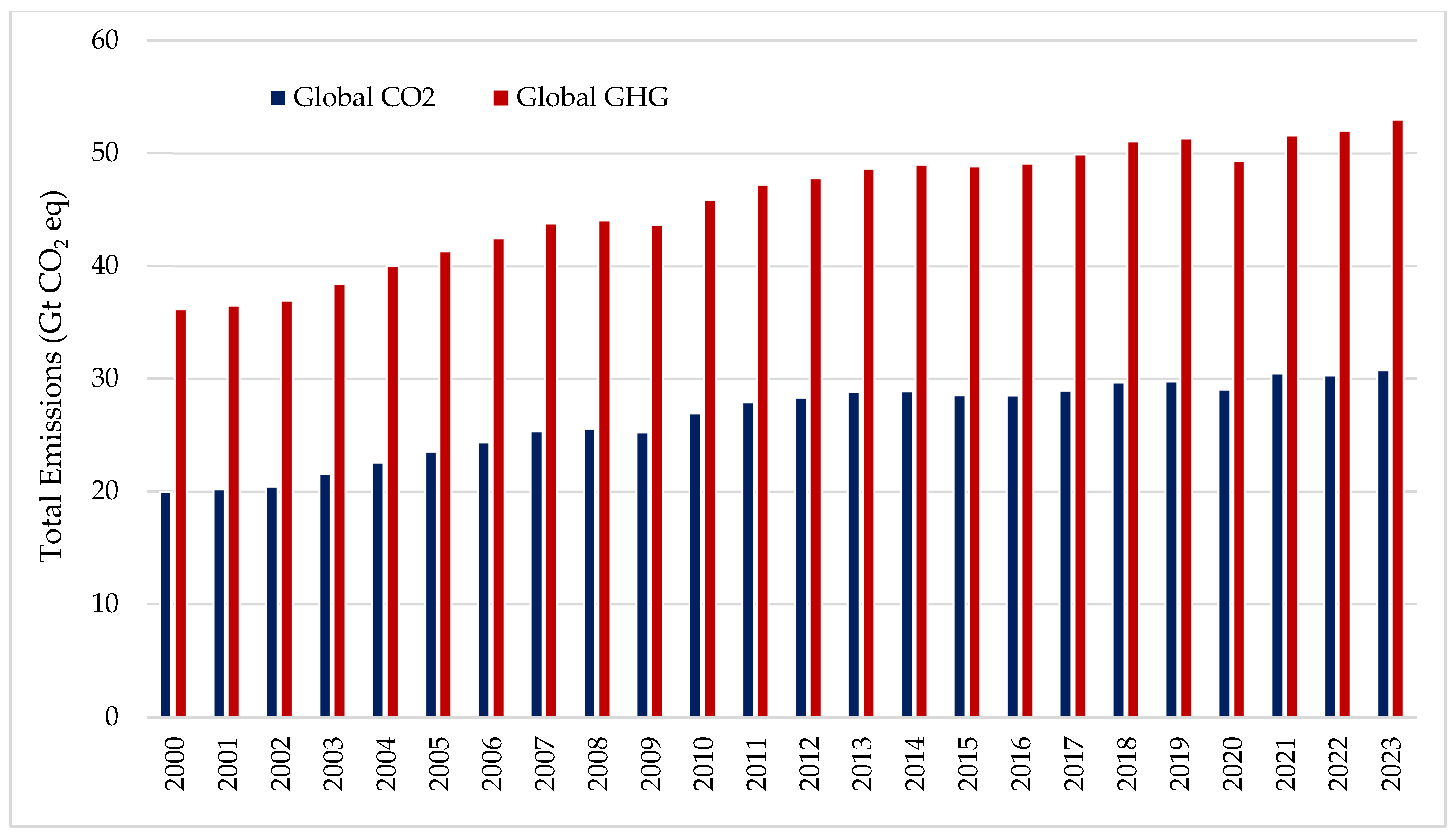

1]. In 2023, global GHG emissions reached approximately 53 gigatonnes (Gt) of CO

2 equivalent, an increase of 1.9% compared to 2022, as seen in

Figure 1. The world’s largest emitters—China, the United States (US), India, the EU27, Russia, and Brazil—were responsible for 62.7% of total emissions and 64.2% of global fossil fuel consumption. Carbon dioxide (CO

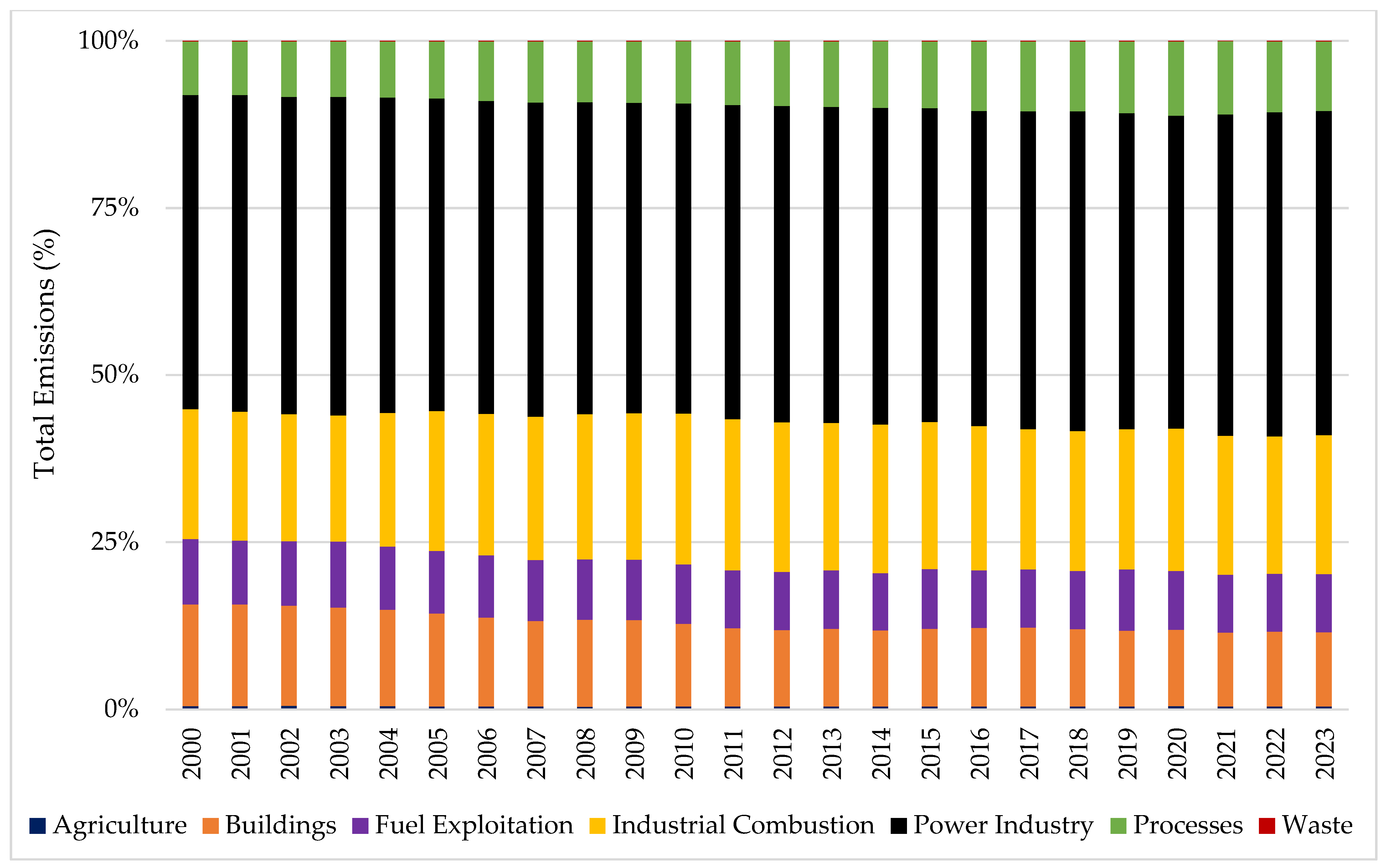

2) emissions from fossil fuels remain the dominant source of global GHG emissions, with the power industry playing a significant role in overall CO

2 output, as seen in

Figure 2. The heavy reliance on fossil fuels is considered a key driver of global warming and environmental degradation.

In addition, conflicts in the Middle East and the ongoing crisis in Ukraine have highlighted critical vulnerabilities in the global energy system [

2,

3]. Energy infrastructure is increasingly at risk, not only from geopolitical instability but also from extreme weather events, placing pressure on oil and natural gas supplies. These challenges underscore the urgent need to improve energy access and enhance the resilience of energy systems against unexpected disruptions.

In that context, one of the most effective strategies to address these issues is the deployment of clean energy technologies, which enables reducing emissions and limiting dependence on fossil fuel-based energy sources.

In response, many countries are accelerating efforts to transition to cleaner energy sources as part of their broader goal to achieve climate neutrality by 2050 [

4,

5]. This global shift is reflected in the declining share of fossil fuels in the energy mix, which dropped by 2% between 2013 and 2023 [

2,

3]. Over the same period, global energy demand increased by 15%, with 40% of this growth met by renewables, nuclear energy, and low-emission fuels. This transition is essential not only for reducing dependence on fossil fuels but also for fostering a cleaner and more sustainable energy future, one in which renewable energy plays a central role in powering the world responsibly.

However, the variable and unpredictable nature of renewable energy sources can limit their appeal and accessibility in certain regions [

6]. While wind and solar power are entirely weather-dependent, hydropower can only be developed in regions with abundant water resources and appropriate terrain. Bioenergy, derived from agricultural materials, is also limited in its scalability due to competition for land needed to grow food crops such as cereals and vegetables. As a result, the search for more reliable and flexible clean energy has become one of the defining challenges of the 21st century.

Among the most promising solutions, hydrogen has emerged as a potential energy vector well-suited to support the global transition toward more sustainable energy systems [

7,

8]. The appeal lies in its flexibility across production methods, storage options, and end-use applications. Though not found in its elemental form in nature, hydrogen can be produced through various chemical conversion processes, including steam methane reforming, biomass conversion through gasification or pyrolysis, and renewable-powered water electrolysis. However, steam methane reforming (gray hydrogen), which currently dominates global hydrogen production, relies on fossil fuels and results in significant CO

2 emissions. Meanwhile, biomass gasification or pyrolysis raises concerns about land use, feedstock availability, and other emissions. Therefore, hydrogen produced from renewable energy sources via electrolysis, referred to as green hydrogen, represents one of the most significant current solutions. This solution offers a zero-emissions fuel that can play a critical role in decarbonizing hard-to-abate sectors such as heavy industry, long-distance transportation, and power generation.

Across the globe, demand for hydrogen is rapidly increasing, prompting countries to ramp up investments in hydrogen infrastructure, technology, and supportive policy frameworks. Many countries have introduced national strategies to promote the development of green hydrogen technologies.

In the European Union (EU), the European Green Deal sets ambitious goals for hydrogen production from renewables by 2030 [

9,

10]. The Netherlands committed to producing green hydrogen using offshore wind energy by 2040 [

11], while Portugal and Spain have launched Renewable Energy Strategies to convert surplus renewable electricity into hydrogen, aiming to reduce renewable energy curtailment and dependency on other energy sources [

10]. Germany is leading several high-impact projects, including the transformation of the Heide Refinery into a green hydrogen facility powered by wind energy from the North Sea [

12,

13,

14]. This country’s National Hydrogen Strategy, introduced in 2020 and updated in 2022, targets an expansion of green hydrogen production capacity from 5 GW to 10 GW by 2030. Norway is also advancing its green hydrogen capabilities, with plans to develop large-scale electrolyzer technology powered by renewable energy by 2035 [

10].

In Australia, numerous large-scale projects are underway to supply both domestic and export markets [

15]. Given its abundant renewable resources, Australia is well-positioned to become a global leader in green hydrogen exports.

In Asia, China, Japan, and South Korea are spearheading efforts to scale up hydrogen infrastructure and promote hydrogen-powered applications in both industry and transport sectors [

16,

17]. These nations are also actively investing in research, development, and regional cooperation to accelerate hydrogen deployment.

As such, countries around the world are increasing their investments in hydrogen infrastructure, technology, and supportive policy frameworks to accelerate the green hydrogen transition. Developed regions such as Europe and North America are advancing large-scale projects, while leading Asian economies, including Japan, South Korea, and China, have made notable strides in research, pilot initiatives, and international cooperation.

Nevertheless, despite this global progress, the widespread adoption of green hydrogen still faces considerable challenges. Technical, financial, and regulatory barriers remain particularly pronounced in developing countries, where inadequate infrastructure, limited access to capital, and weak policy support continue to slow momentum toward a green hydrogen economy.

In Vietnam, the government is actively pursuing the decarbonization of its industrial and energy sectors as part of a broader commitment to reduce greenhouse gas emissions and transition toward a more sustainable economy [

18]. Within the framework of national development plans, Vietnam is making significant investments in the renewable energy market and aims to increase the share of renewables in the energy mix [

19]. As part of this trajectory, the government has outlined strategic commitments to support renewable energy expansion and emissions reduction in the energy sector. As a result, green hydrogen is increasingly recognized as a promising pathway for clean energy development in Vietnam.

However, green hydrogen remains a relatively new concept to the broader public, industry stakeholders, and even parts of the policymaking community in Vietnam [

18,

20]. The institutional support required for green hydrogen deployment remain at a nascent stage. While Vietnam has made significant strides in renewable energy like solar and wind, there is still a critical gap in awareness, capacity, and infrastructure related to green hydrogen.

So far, several initial studies have explored the potential of green hydrogen in Vietnam. Hoang et al. [

21] evaluated the capacity for green hydrogen production utilizing solar and wind energy in Vietnam. Nevertheless, this work is limited to conducting policy and technology assessments and analyses of the green hydrogen economies for other countries. Nam et al. [

22] investigated the feasibility of green hydrogen production using agricultural by-products through pyrolysis, gasification, and fermentation processes in Vietnam. However, the results of this study remained preliminary, were based largely on hypothetical data, and were still incomplete.

It is a fact that research on hydrogen energy in Vietnam remains limited, with relatively few academic publications directly addressing green hydrogen. Moreover, existing studies tend to overlook the strategic role that green hydrogen could play in enhancing national energy security, thereby promoting economic development in the face of future growth in energy demand.

For the reasons outlined above, this study provides a comprehensive, data-driven view on the technical, economic, and policy dimensions of green hydrogen in Vietnam. The study summarizes the energy landscape of Vietnam in

Section 2 and addresses the role of green hydrogen in Vietnam’s energy transition in

Section 3. The work focuses on evaluating localized production potential, identifying barriers to infrastructure development, and exploring opportunities for green hydrogen in

Section 4, and then provides some recommendations for Vietnam’s green hydrogen in

Section 5.

2. Vietnam’s Energy Landscape

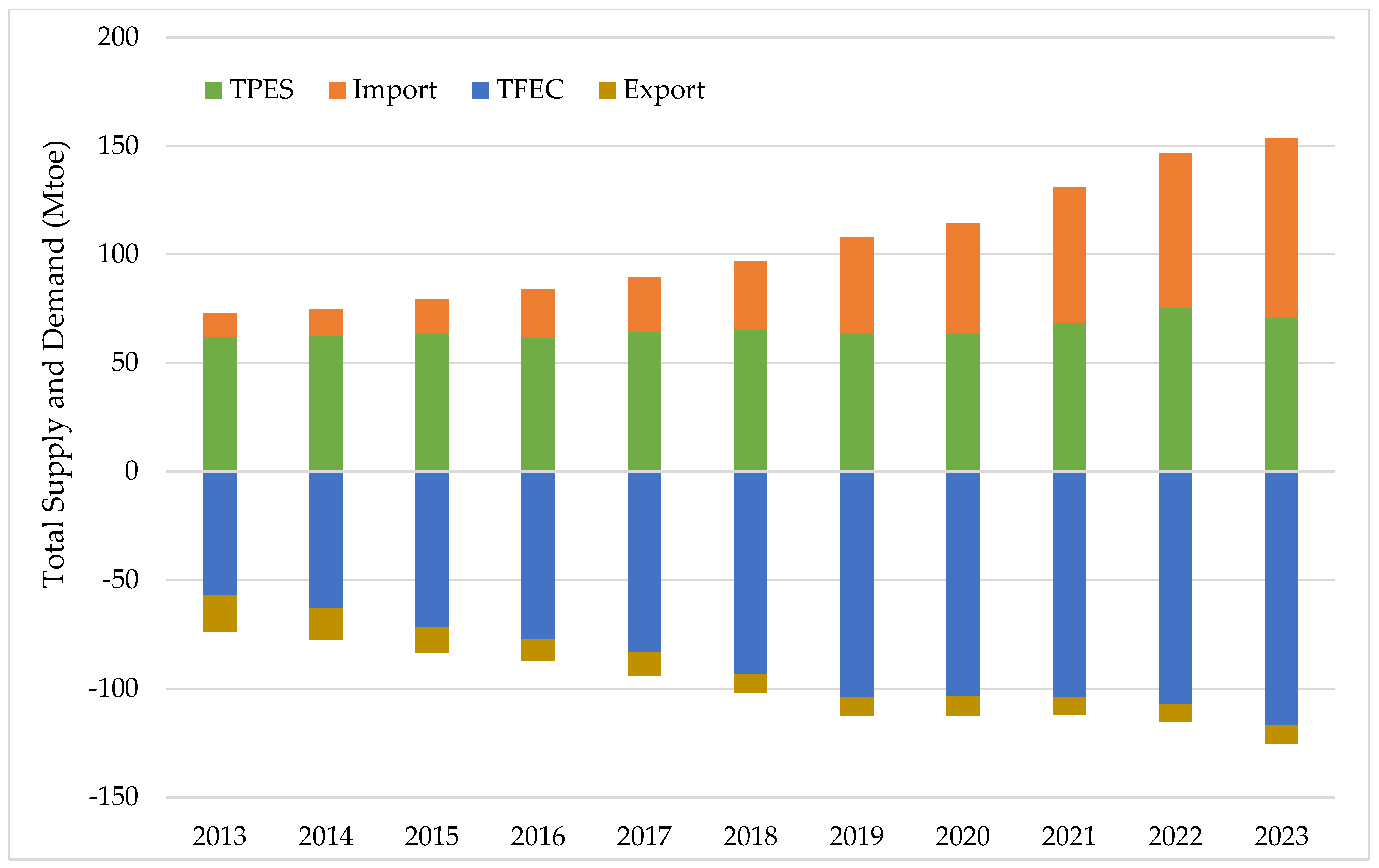

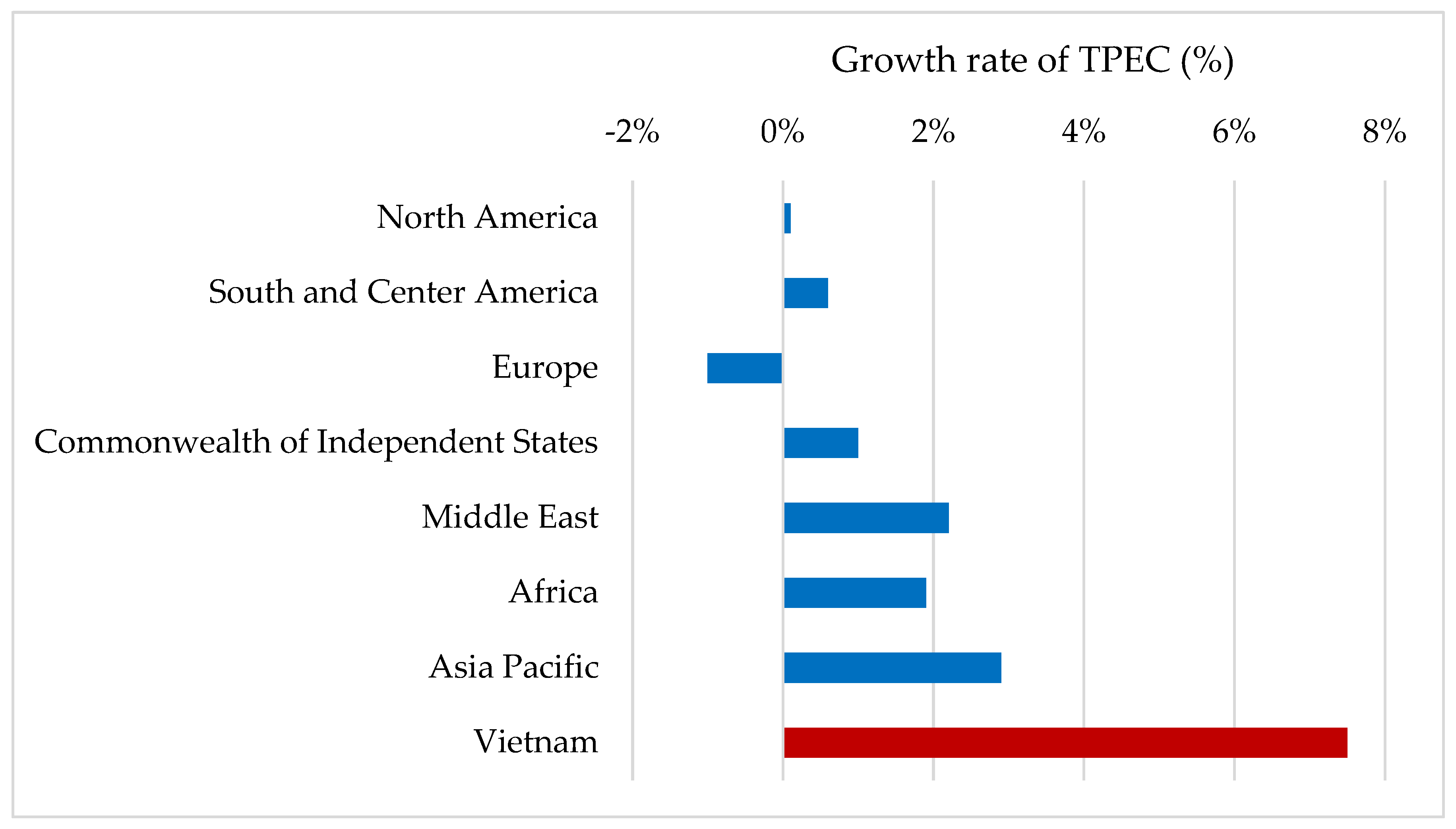

In 2023, Vietnam ranked as the 24th largest energy consumer in the world, a reflection of the country’s rapid industrialization and economic development [

20,

23,

24]. Over the period from 2013 to 2023, the country’s Total Primary Energy Consumption (TPEC) recorded one of the highest global growth rates, as shown in

Figure 3. This surge is primarily driven by the energy-intensive industrial sector, contributing more than 50% of the total economic output. The transportation sector, accounting for approximately 25%, also plays a significant role in energy demand.

Vietnam’s energy structure remains heavily reliant on fossil fuels [

20,

23]. The industrial sector predominantly consumes coal and electricity, while the transportation sector is largely dependent on petroleum-based fuels, including gasoline, diesel, and jet fuel [

20,

23]. This reliance not only contributes to the high energy demand but also increases the country’s exposure to global energy price volatility and supply chain risks.

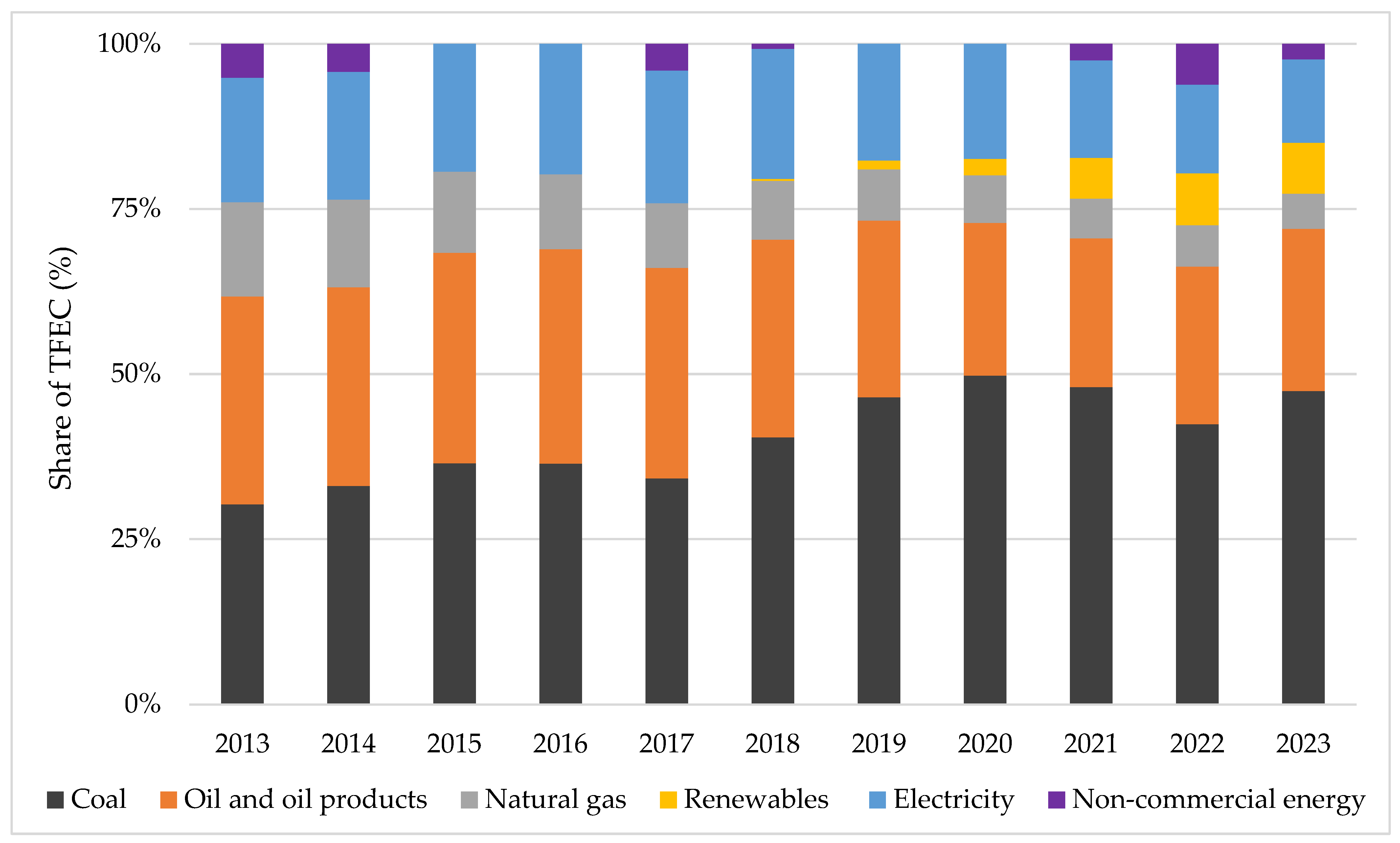

From 2013 to 2023, the Total Final Energy Consumption (TFEC) grew at an average annual rate of 7.6% [

20,

23,

24]. Importantly, the share of renewable energy in the TFEC increased significantly, from 1.4% in 2019 to 7.8% in 2023, as depicted in

Figure 4. This indicates Vietnam’s progress in diversifying the energy mix and fulfilling commitments to global climate goals under the Paris Agreement [

25,

26].

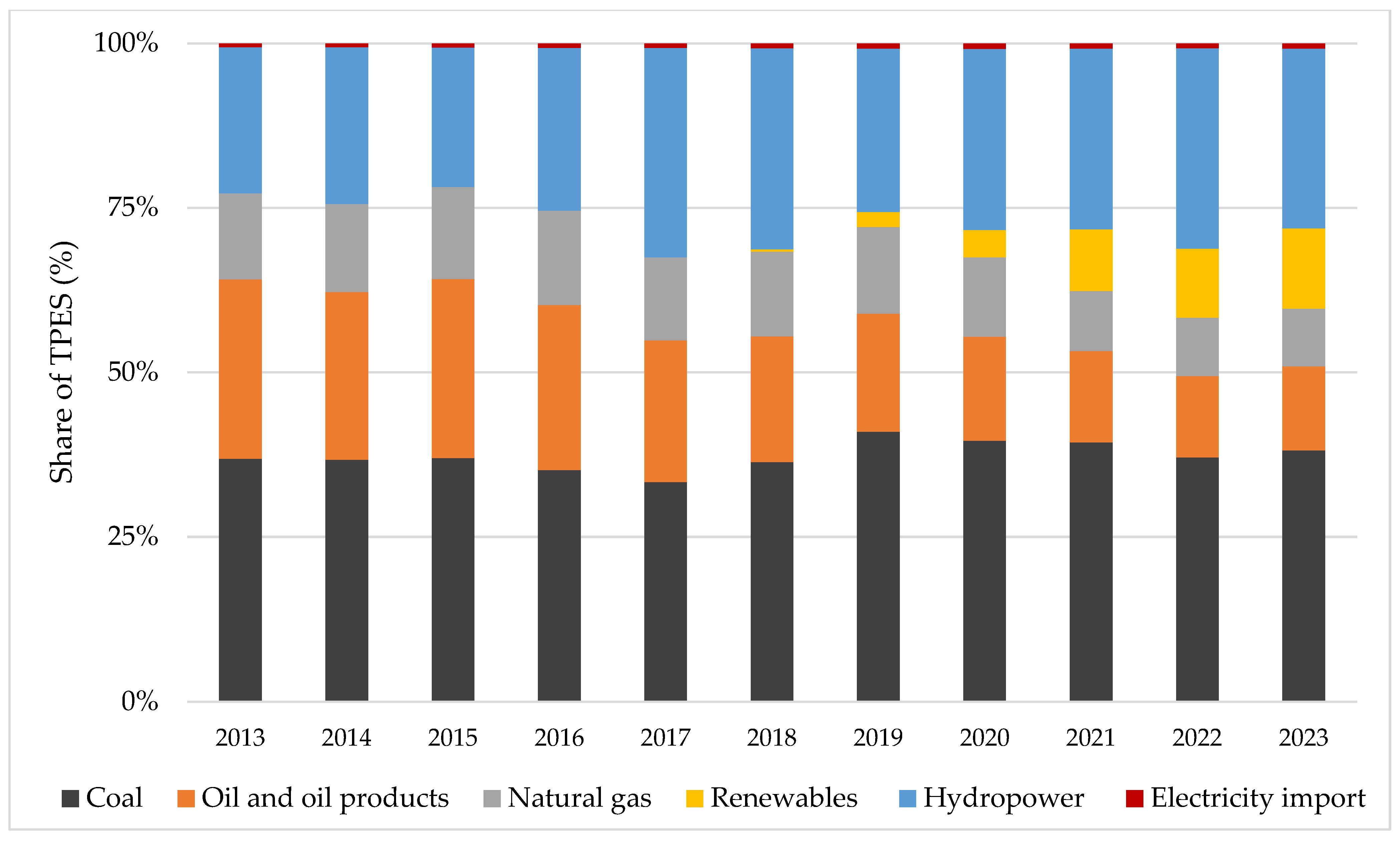

In contrast, the transition in the Total Primary Energy Supply (TPES) has been more gradual, with an annual growth rate of less than 2% over the same period [

20,

23,

24]. Notably, renewables accounted for 8.6% of the TPES in 2023, as shown in

Figure 5. This shift is largely driven by the rapid deployment of solar and wind energy, supported by government incentives and foreign investment.

In addition, Vietnam’s energy profile has shifted from being a net exporter in the early 2010s to a net importer in recent years [

20,

23,

24]. By 2023, the TPES was estimated at approximately 70 million tonnes of oil equivalent (Mtoe), supplying only 60% of the TFEC, as illustrated in

Figure 6. The widening gap between domestic supply and demand has led to a substantial increase in energy imports, particularly coal and crude oil. Imported coal alone accounted for nearly 50% of the TFEC, while crude oil and petroleum products made up approximately 30%.

While energy imports can serve as a measure for diversifying supply sources, they also expose Vietnam to external geopolitical risks, such as global supply disruptions, regional conflicts, and trade tensions. This dependence increases vulnerability to fluctuations in global coal and oil prices, which can negatively affect energy security and economic stability. Additionally, continued reliance on fossil fuels could pose significant environmental risks, including rising GHG emissions and worsening air and water pollution.

In this context, the accelerated development of renewable energy and the adoption of clean energy technologies, like green hydrogen, have become critical to Vietnam’s strategy for ensuring long-term energy security and achieving environmental sustainability. These solutions offer dual benefits: reducing dependence on imported fossil fuels and enhancing resilience to global market volatility, and simultaneously advancing Vietnam’s climate mitigation objectives, particularly the commitments to reach net-zero emissions by 2050 under the Paris Agreement.

3. Green Hydrogen in Vietnam’s Energy Security

Green hydrogen offers significant environmental and socio-economic advantages that support the global transition toward a more sustainable, low-carbon future [

27,

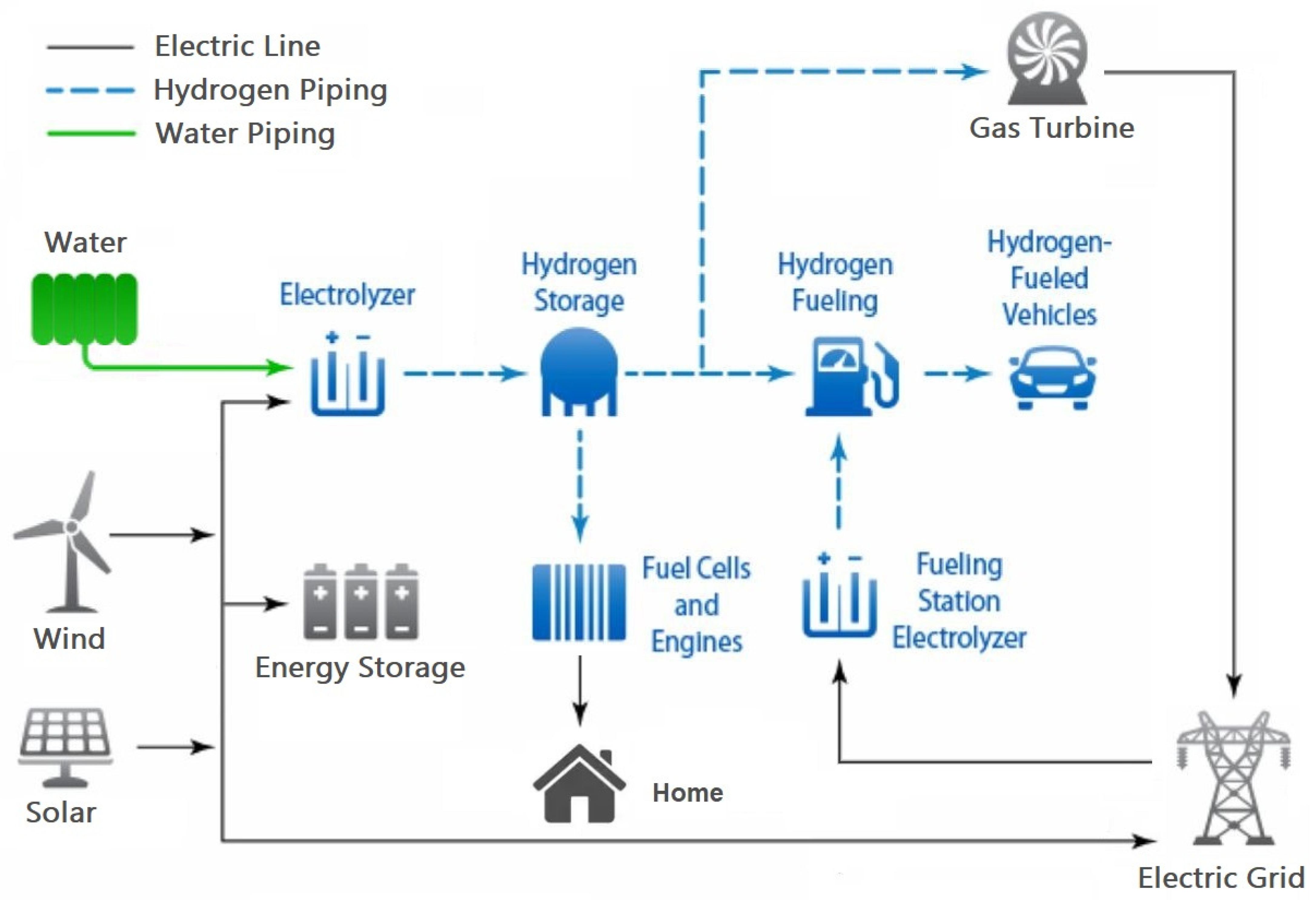

28]. This energy source is produced through electrolysis and powered by renewable energy sources such as wind and solar, as seen in

Figure 7. Unlike fossil fuels, the production and use of green hydrogen result in only water vapor as a by-product, emitting no greenhouse gases. This contributes to improved air quality and mitigates the harmful impacts of pollution.

Moreover, green hydrogen can be produced domestically, thus reducing reliance on imported fossil fuels. This contributes to enhancing energy independence, strengthening national energy security, and promoting sustainable economic growth.

Hydrogen holds potential for applications across the industrial, energy, and transportation sectors [

27,

28]. By 2023, global hydrogen demand reached nearly 100 million tonnes (Mt), driven by ongoing economic expansion worldwide, including in Vietnam [

17]. Recognizing hydrogen’s transformative potential, many countries are integrating it into their long-term energy strategies. China, for instance, views hydrogen as a key technology to bolster energy security, curb emissions, and reduce pollution in the transport sector [

16]. Similarly, Japan has made hydrogen a key element of its decarbonization strategy, targeting net-zero emissions by the mid-century [

29]. National policies are focused on boosting energy self-sufficiency, decarbonizing the economy, and enhancing industrial competitiveness. The EU is actively implementing measures to ensure that hydrogen accounts for 24% of the total energy demand by 2050, encompassing applications in power generation, transportation, buildings, and industry [

30].

Currently, hydrogen use is concentrated primarily in industrial applications, with the energy sector accounting for less than 1% of global hydrogen demand [

17]. However, this is expected to change as research and development continue to advance hydrogen-based technologies. In particular, hydrogen-fired gas turbines and combined-cycle gas turbines offer increased flexibility for power systems that integrate a high share of renewable energy [

27]. Many countries around the world are actively developing turbines capable of handling a wide range of hydrogen blends, up to 100% [

4,

16,

31].

Given its demonstrated potential in leading countries, hydrogen is also expected to play a critical role in Vietnam’s power sector. Specifically, hydrogen can partially substitute natural gas and liquefied natural gas (LNG) in co-firing applications, or potentially completely replace natural gas and liquefied petroleum gas (LPG) in gas turbine power plants [

27]. As indicated by data from the latest National Power Development Plan (PDP8), if hydrogen can fully replace these fossil fuels in power generation, Vietnam could achieve a 100% renewable and clean energy power system by 2050, as seen in

Figure 8. Furthermore, producing green hydrogen can help optimize the use of surplus renewable electricity generated domestically. This not only improves the efficiency of renewable energy utilization but also increases the share of renewables in Vietnam’s overall energy mix.

Besides applications in the energy sector, hydrogen presents significant opportunities for decarbonizing various transportation sectors, including road, maritime, rail, and aviation [

16,

17,

29,

30]. In road transportation, hydrogen is primarily used in fuel cell vehicles (FCVs), such as light-duty electric vehicles, fuel cell buses, and heavy-duty trucks. These vehicles offer zero-emission alternatives to traditional internal combustion engines, particularly in segments where battery-electric options may be less feasible due to range and refueling constraints. The maritime sector, which accounts for approximately 5% of global oil demand and contributes around 3% of global energy-related CO

2 emissions, is a major consumer of petroleum-based fuels [

32]. Its reliance on heavy fuel oils also negatively impacts air quality in port areas. In this context, hydrogen-based fuels—such as pure hydrogen, ammonia, and liquid hydrogen—are emerging as promising solutions in helping the shipping industry achieve its emission reduction targets: at least 40% by 2030 and 80% by 2040, relative to 2008 levels. In addition, hydrogen also shows promise in rail transport [

33]. The integration of fuel cells and batteries in train systems can yield performance comparable to hybrid electric–diesel locomotives, offering a cleaner alternative in non-electrified rail corridors. In aviation, hydrogen-based fuels, particularly liquid hydrogen, can be integrated into existing fueling infrastructure without significant modifications. This opens up possibilities for decarbonizing an industry that is otherwise difficult to electrify due to stringent energy density requirements.

Contrary to the global trend of decarbonizing the transportation sector, Vietnam’s transport system remains heavily reliant on oil and petroleum products, accounting for approximately 25% of the TFEC [

20,

23,

24]. While the introduction of compressed natural gas (CNG) and bio-gasoline (E5-A92) has contributed to lowering fossil fuel usage, Vietnam continues to be a net importer of petroleum products. With the domestic supply meeting only about 70% of the national fuel demand, Vietnam is facing external market fluctuations and supply chain risks.

Drawing on the experiences of developed countries, hydrogen fuel presents a strategic opportunity to address Vietnam’s energy security challenges. By reducing reliance on imported oil, hydrogen can significantly improve energy self-sufficiency in the transport sector. Based on projections from Vietnam’s most recent National Energy Master Plan (EMP) [

20], a complete transition from petroleum to hydrogen-based fuels in transportation could enable the country to achieve a fully renewable and clean energy system by 2050, as seen in

Figure 9.

Clearly, hydrogen holds immense potential as a future energy vector for Vietnam—not only for industrial applications, but also for electricity generation and transportation. Among the various forms of hydrogen, green hydrogen is particularly crucial, as it is expected to play a key role in enabling Vietnam to achieve its net-zero emissions target in the shortest possible timeframe.

However, despite its considerable potential, green hydrogen remains a relatively nascent concept in Vietnam. Awareness and understanding of its applications and benefits are still limited among the general public, industry stakeholders, and policymakers. Furthermore, institutional support for hydrogen deployment is in the early stages, with significant gaps in infrastructure, technical expertise, and regulatory frameworks that must be addressed to enable large-scale adoption.

4. Opportunities and Challenges in Developing Green Hydrogen in Vietnam

4.1. Demand for Green Hydrogen

The global hydrogen demand is projected to reach approximately 100 million tonnes by 2024, driven primarily by conventional industrial applications such as petroleum refining, ammonia production, methanol synthesis, and other chemical processes [

2,

17]. The refining and transportation sectors continue to be the dominant consumers of hydrogen, while emerging interest in hydrogen-based fuels is growing within the shipping and aviation industries. This shift is especially noticeable in regions where supportive policy frameworks have been implemented. Beyond conventional uses, sectors such as steel production, power generation, and aviation collectively represent an estimated 20–30% of global hydrogen demand, although this demand remains geographically concentrated. In particular, European firms lead the applications of steel and aviation, whereas Japan and South Korea have taken pioneering roles in hydrogen-fueled power generation. Both countries have launched auctions for hydrogen- and ammonia-based electricity supplies and have demonstrated large-scale projects using these fuels.

Despite this progress, the adoption of hydrogen in heavy industry, long-haul transportation, and energy storage remains limited, collectively accounting for less than 1% of total global hydrogen use [

2,

17].

However, momentum is increasing. In recent years, many governments have introduced regulatory measures, financial incentives, and strategic mandates to stimulate the development of low-carbon hydrogen markets [

2,

17].

In response, industries such as chemical manufacturing, oil refining, and shipping are increasingly participating in offtake agreements, public tenders, and joint ventures involving low-emission hydrogen and hydrogen-derived fuels [

2,

17]. Several large-scale low-emission projects have reached final investment decisions (FIDs), notably in Canada and India, with applications in oil refining, chemicals, and steel production. One of the most prominent developments is the NEOM project in Saudi Arabia, which would host the world’s largest electrolyzer and has already secured an offtake agreement with Air Products, signaling growing commercial interest in green hydrogen. If all announced and committed projects proceed as planned, global demand for low-emission hydrogen could triple by 2030.

In contrast to global trends, hydrogen demand in Vietnam is quite limited, with an estimated annual consumption of approximately 500,000 tonnes [

34,

35,

36]. Current use is concentrated in fertilizer production and petroleum refining, with minimal deployment in other sectors. Specifically, around 63% of Vietnam’s hydrogen is used in refineries, while 35% supports ammonia production for fertilizers. The remaining 0.5% is distributed across the steel manufacturing, float glass production, electronics, and food processing industries.

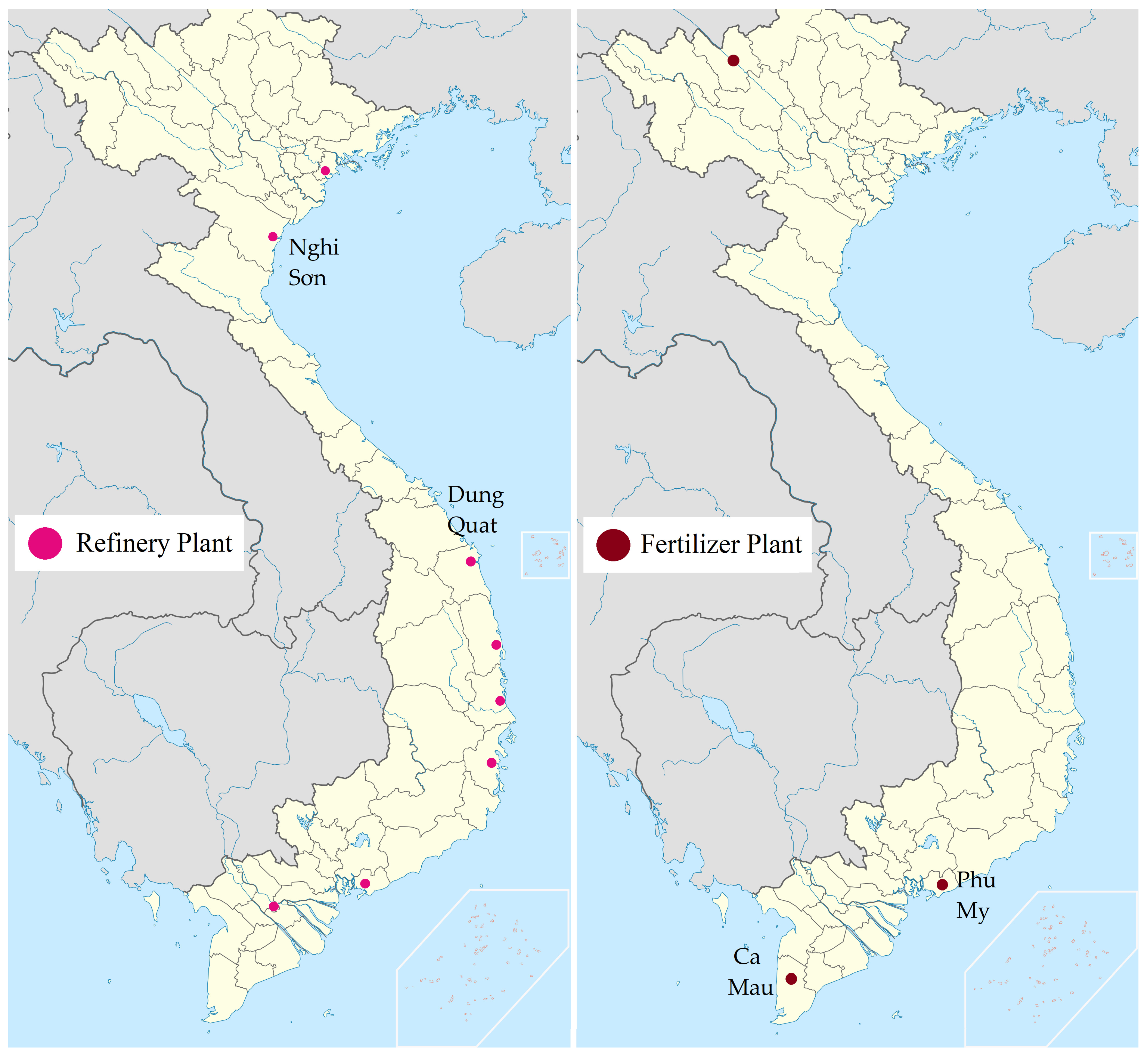

Vietnam’s two major oil refineries, Dung Quat and Nghi Son (see

Figure 10), consume approximately 39,000 tonnes and 139,000 tonnes of hydrogen per year [

35,

36]. Hydrogen is integral to the desulfurization of crude oil and intermediate streams through processes such as hydrotreating and hydrogenation. These processes are essential for producing high-quality fuels and meeting increasingly stringent environmental regulations. Currently, hydrogen at these facilities is primarily obtained as a by-product from Continuous Catalytic Reforming (CCR) units and via steam reforming of liquefied petroleum gas (LPG) and refinery off-gas. However, with rising demand and the limitations of the current production capacity, Vietnam faces the risk of hydrogen supply shortfalls, which could hinder refinery operations and environmental compliance.

The Phu My and Ca Mau fertilizer plants, as seen in

Figure 10, are the largest consumers of hydrogen in Vietnam’s chemical sector, using approximately 140,000 tons and 130,000 tons of hydrogen per year, respectively [

35,

36]. In these facilities, hydrogen is used for ammonia synthesis, and then processed into urea, a key nitrogen-based fertilizer. Hydrogen for ammonia production is primarily generated via steam methane reforming (SMR) of natural gas—a process that is both energy-intensive and carbon-intensive, contributing significantly to CO

2 emissions. While alternative feedstocks such as LPG, naphtha, coal gasification, and biomass are technically feasible, they vary in terms of cost, availability, and environmental impact. In addition, the decline in domestic natural gas reserves, both in terms of quantity and quality, raises serious concerns about the security and sustainability of the hydrogen supply for Vietnam’s fertilizer and chemical sectors.

This fact shows that hydrogen already plays a vital role in the economy, but Vietnam remains heavily dependent on fossil fuel-based sources, particularly gray and brown hydrogen.

Given these circumstances, it is crucial to diversify hydrogen production pathways to secure a consistent supply for economic activities. Green hydrogen, produced by electrolysis using renewable energy, offers a promising solution to decarbonize industrial processes, enhance resource security, and support sustainable economic development.

The transition to low-emission or green hydrogen is still in the early stages, posing a dual challenge: overcoming technological, financial, and infrastructure-related barriers while also leveraging the strategic opportunity to accelerate industrial decarbonization and meet long-term sustainability objectives.

In the long term, green hydrogen is expected to become a key enabler of emissions reduction, particularly in carbon-intensive sectors such as heavy industry and transportation [

18]. As the global energy system transitions toward cleaner and more renewable alternatives, hydrogen is increasingly recognized as a critical energy vector. For Vietnam, this shift presents a unique opportunity to not only meet domestic decarbonization goals but also to establish itself as a regional hub for green hydrogen production and export.

4.2. Potential for Producing Green Hydrogen

Green hydrogen can be produced from water and renewable energy through the process of electrolysis [

17,

37]. Among renewable sources, wind and solar power are the most widely used for this process, and water electrolysis technology is also considered a mature and well-established method for green hydrogen.

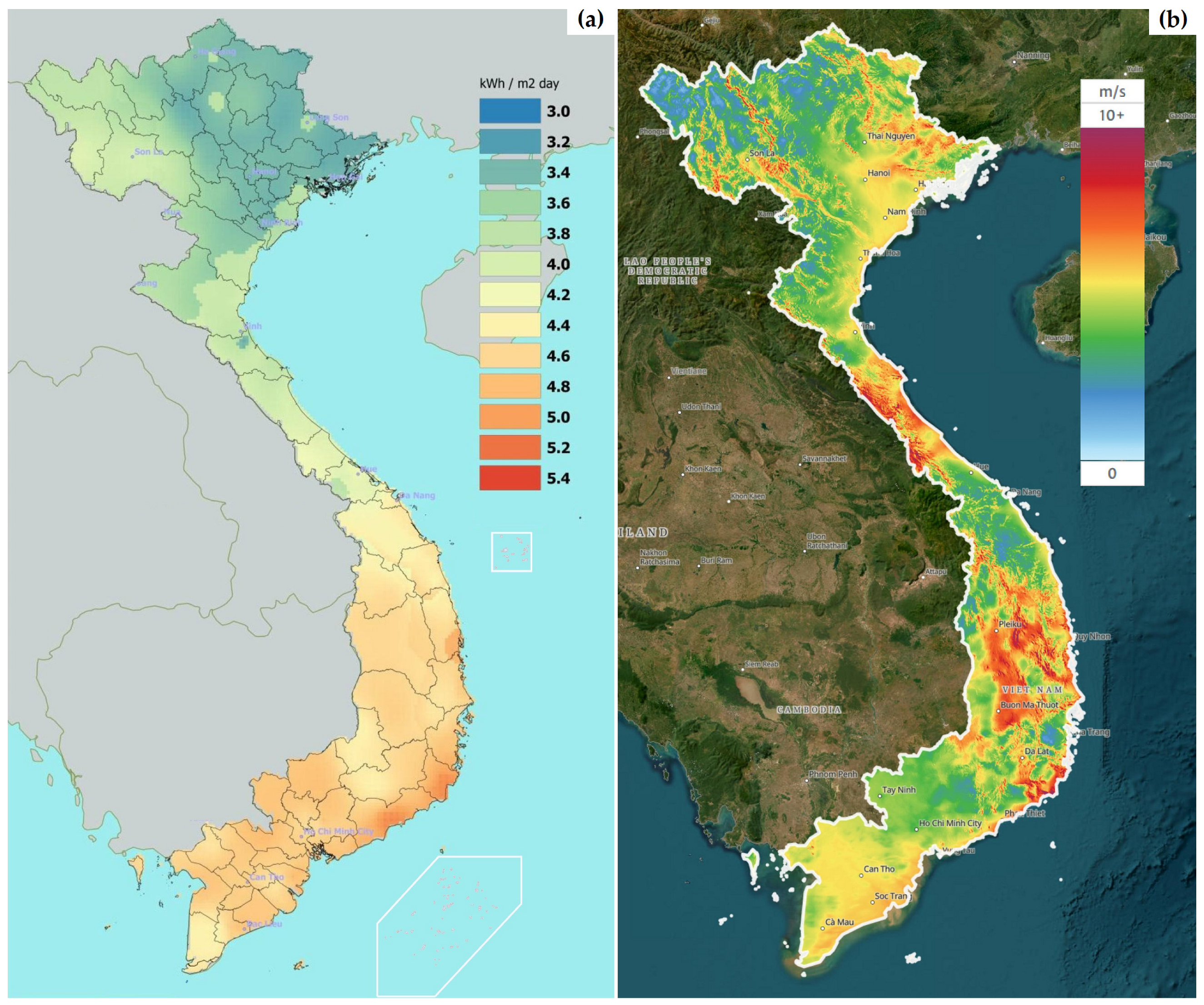

Vietnam is considered to possess a diverse range of renewable energy resources, including biomass, solar, wind, hydropower, and geothermal resources [

23]. Among these, solar and wind energy have garnered significant attention and experienced substantial growth in recent years [

38,

39]. Together, solar and wind represent the vast majority of Vietnam’s renewable energy potential, approximately 960 GW and 820 GW, accounting for more than 90% of the total potential, as illustrated in

Figure 11 [

23,

40]. Notably, Vietnam’s solar potential exceeds that of regional peers such as Malaysia, Thailand, and the Philippines [

41]. At the same time, its wind potential is also significantly higher than that of Cambodia, Thailand, Taiwan, and Pakistan [

42]. These abundant solar and wind resources present considerable opportunities for green hydrogen production in Vietnam.

However, the distribution of solar and wind energy potential across Vietnam is geographically uneven [

38,

43], as seen in

Figure 12. Solar potential is highly favorable in the Central and Southern regions, with irradiation levels ranging from 4 to 5 kWh/m

2, particularly in the South Central and Southern areas. In contrast, the Northern region has the lowest solar potential, below 4 kWh/m

2, due to the Northeast monsoon during the winter months. A similar pattern is observed for wind energy. The average annual wind speed in the South Central and Southern regions is significantly higher than that in other areas of the country. Specifically, regions such as Binh Thuan, Ninh Thuan, and Ba Ria–Vung Tau record wind speeds of 8–10 m/s, compared to just 3–4 m/s in the Northern regions.

As a result, the deployment of solar and wind power applications is heavily concentrated in the Central and Southern regions, while the Northern region has a relatively low presence of such installations [

23,

38,

42]. Most large-scale solar and wind power projects are currently located in the South Central provinces, particularly Ninh Thuan and Binh Thuan.

Geographic disparities in solar and wind energy potential could significantly impact the widespread development and deployment of green hydrogen infrastructure in Vietnam. Given that green hydrogen production is highly dependent on access to stable and abundant renewable energy sources, production facilities are likely to be concentrated in regions with the highest solar irradiance and wind speeds.

While this co-location strategy is logical from a technical and economic perspective, it also presents several challenges. The simultaneous and concentrated development of solar, wind, and hydrogen infrastructure in these regions could place increasing pressure on local infrastructure. Moreover, such regional concentration could limit the equitable distribution of green hydrogen benefits for other areas, particularly the industrial hubs in the North.

Therefore, while the South Central and Southern regions offer favorable conditions for renewable-based hydrogen production, the geographic imbalance highlights the need for strategic, cross-regional planning, including investment in national infrastructure and the development of region-specific supporting policies in Vietnam.

4.3. Regulatory and Policy Framework

Support policies are crucial for advancing the deployment and utilization of green hydrogen as a clean and sustainable energy source. These policies typically include strategic national roadmaps with ambitious decarbonization targets, financial incentives, investments in research and development, and efforts to promote infrastructure construction.

In Vietnam, hydrogen is recognized as a promising solution to support the country’s carbon emission reduction commitments and was formally incorporated into the National Energy Master Plan (EMP) in 2023 [

20]. This has paved the way for the introduction of more detailed hydrogen support policies by relevant national authorities.

In 2024, the Vietnamese Government published the Hydrogen Energy Development Strategy (HEDS) until 2030, with a vision to 2050 [

18]. This strategy provides a structured roadmap aligned with the country’s broader energy transition objectives. It places strong emphasis on using renewable energy (RE) sources, primarily solar and wind, to produce green hydrogen, and also supports hydrogen production from carbon capture technologies. Specifically, hydrogen production from RE and carbon capture processes is projected to reach approximately 100,000 to 500,000 tons per year by 2030, and between 10 million and 20 million tons per year by 2050. The strategy also encourages the adoption of hydrogen energy across all economic sectors as a means to reduce GHG emissions. To support this, hydrogen consumption is targeted to account for approximately 10% of the country’s TFEC, equivalent to a minimum production of 11 million tonnes of oil equivalent (Mtoe) by 2030 and 17 Mtoe by 2050.

This underscores the need for a substantial expansion of RE infrastructure—specifically solar and wind—dedicated to hydrogen production, with a minimum installed capacity of 20 GW by 2030 and 40 GW by 2050 [

37].

However, despite these ambitious goals, significant challenges remain, particularly regarding the alignment between hydrogen strategy targets and Vietnam’s broader energy planning documents.

The latest National Power Development Plan (PDP8) [

23] projects the total power generation capacity to reach approximately 150 GW by 2030 and 500 GW by 2050, primarily to serve domestic electricity demand. Notably, this plan does not account for additional electricity demand to green hydrogen production, such as electrolysis for green hydrogen or green ammonia synthesis. Similarly, under the EMP, the installed capacity of wind and solar energy is projected to reach only 6 GW by 2030 and 30 GW by 2050 [

20]. These figures fall significantly short of the renewable energy capacity needed to meet the hydrogen goals outlined in the HEDS [

18].

In addition, the Vietnamese Government recognizes hydrogen as a promising alternative fuel for the transportation sector through the HEDS [

18]. Key initiatives outlined in the strategy include pilot projects for public transportation and long-distance travel by 2030, as well as a broader transition to hydrogen-based fuels by 2050. However, the strategy lacks comprehensive policy support for this energy adoption in the transport sector. It currently provides formal backing only for E5 biofuels and electric vehicle (EV) charging infrastructure as green transportation solutions [

44]. In addition, there is no clear mechanism to support the integration of green electricity into this fuel transition [

23].

It can be seen that Vietnam’s current energy support policies lack synchronization across sectors. The mechanisms supporting renewable electricity development are not fully aligned with policies promoting green hydrogen, and there is also no clear framework for integrating hydrogen energy into the transportation sector. This misalignment may cause instability in the hydrogen fuel supply chain and undermine the long-term viability of hydrogen within Vietnam’s broader energy transition.

Therefore, this highlights the urgent need for cross-sectoral coordination in developing clear and specific policy goals and implementation measures for the energy sector as a whole, and for hydrogen in particular.

In fact, several countries have successfully established comprehensive, long-term hydrogen development strategies. The EU has implemented a Hydrogen Strategy aimed at achieving a climate-neutral economy by 2050 [

9]. The strategy promotes the production and utilization of green hydrogen across multiple sectors, including industry, transportation, power generation, and buildings, in EU member states. It also outlines clearly specific targets and policy measures to support the widespread adoption of hydrogen technologies. Australia released its National Hydrogen Strategy in 2019 [

15], focusing on leveraging solar and wind energy to develop a clean, safe, and competitive hydrogen industry. This strategy supports both domestic use and international export opportunities. Japan introduced the Basic Hydrogen Strategy in 2017 [

29], providing a detailed roadmap for integrating hydrogen into electricity generation, transport, and residential applications. The strategy is designed to fulfill climate commitments, reduce energy import dependence, and stimulate economic growth through the hydrogen industry.

4.4. Infrastructure Network

A robust and well-integrated hydrogen infrastructure is essential for the widespread deployment of green hydrogen in regional and global energy systems [

27,

28]. Establishing a comprehensive production and distribution network can significantly improve hydrogen accessibility and availability, thereby stimulating demand and fostering market growth. Key components of such infrastructure often include hydrogen production facilities, storage units, transportation systems, and end-use consumption sites, as shown in

Figure 13.

The EU is actively developing a cohesive hydrogen infrastructure strategy to link production centers with areas of high demand, thereby facilitating intra-European trade [

9,

10,

30]. This strategy includes repurposing existing natural gas pipelines and constructing new hydrogen-specific pipelines and storage facilities. One of the flagship initiatives in this context is the European Hydrogen Backbone (EHB), launched by a coalition of 33 European Natural Gas Transmission System Operators (TSOs) [

13,

14]. The EHB aims to connect low-cost renewable energy generation sites, such as PV solar in Southern Europe and offshore wind in the North Sea, with major hydrogen consumption centers across Central Europe. Specifically, Germany has positioned hydrogen as a cornerstone of its energy transition through the implementation of its National Hydrogen Strategy, initially published in 2020 and revised in 2022. The strategy outlines a plan to expand the domestic green hydrogen production capacity from 5 GW to 10 GW by 2030. Supporting this ambition, German TSOs released a national hydrogen grid map in 2021, outlining infrastructure development plans through 2030 and 2050. The proposed hydrogen backbone would connect key industrial hubs in the Ruhr Area, Rhine-Main, East and Central Germany, and Bavaria, with domestic production sites and international import routes. Planned cross-border pipelines are to connect Germany to neighboring countries, including the Netherlands, Denmark, Poland, Austria, the Czech Republic, Belgium, and France. In the United Kingdom (UK), efforts are underway to establish a national hydrogen transmission network by repurposing existing natural gas infrastructure. This network is designed to interlink prominent industrial clusters, including Grangemouth, Teesside, Humberside, Merseyside, and South Wales. By 2030, four of these five clusters are expected to be interconnected. Further expansion plans include the construction of international hydrogen pipelines to Belgium and the Netherlands by 2035, with a UK–Ireland link by 2040. In Italy, the hydrogen infrastructure strategy focuses on enabling the flow of green hydrogen from production sites in central and southern regions, such as Sicily and Puglia, to industrial demand hubs in the north, particularly in Pianura Padana. The national hydrogen backbone is expected to facilitate these connections while also fostering the development of regional hydrogen valleys in the south. Strategically, Italy is well-positioned to serve as a critical transit corridor for competitively priced green hydrogen imports from North Africa to the broader European market.

The Australian government has identified infrastructure development as a strategic priority for enabling the domestic green hydrogen industry [

45]. National efforts include investments in hydrogen production facilities, distribution networks, and storage systems. In parallel, Australia is actively exploring export opportunities and forming bilateral partnerships to ensure long-term market stability and competitiveness in global hydrogen supply chains [

46].

The Canadian Government has built a national hydrogen strategy to establish the country as one of the world’s leading hydrogen producers and exporters [

47]. This strategy emphasizes the development of a robust domestic infrastructure network, including hydrogen production plants, distribution pipelines, and refueling stations. Additionally, Canada is promoting hydrogen adoption across various sectors while seeking to expand its participation in the global hydrogen economy through targeted investments and international collaborations.

The Japanese Government has formulated a comprehensive hydrogen infrastructure roadmap to support the deployment of hydrogen technologies across the transport, industrial, and power sectors [

29]. Key elements of this roadmap include the development of hydrogen refueling stations for fuel cell electric vehicles (FCEVs), the construction of hydrogen pipelines, and the establishment of import terminals for hydrogen supply. Japan is also investing in international partnerships to diversify and secure its hydrogen supply chains.

Vietnam is poised to benefit from the global transition toward clean energy, particularly the rising international interest in green hydrogen as a key vector for decarbonization. This global shift is expected to attract foreign investment and drive the development of necessary infrastructure and supply chains for green hydrogen in Vietnam.

Presently, the country operates three major natural gas transportation and distribution systems, all located in the southern region [

20]. These systems include the following:

Cuu Long Gas Transportation and Distribution System: This consists of an offshore compression platform and pipeline transporting gas from the Cuu Long Basin to Long Hai. The gas is then processed at the Dinh Co plant before being delivered to nearby gas-fired power plants and industrial zones in Ba Ria and Phu My.

Nam Con Son Gas Transportation and Distribution System: This transports offshore gas to the Dinh Co processing facility, followed by distribution to industrial consumers in the Phu My area.

PM3—Ca Mau Gas Transportation and Distribution System: This features a 300 km offshore and 30 km onshore pipeline transporting gas from the Cai Nuoc wells to the Ca Mau Gas Distribution Center, supplying local power and fertilizer plants.

Despite the existing systems, Vietnam’s gas infrastructure remains underdeveloped and regionally limited. The concentration of gas pipelines in the south, along with insufficient seaport capacity, storage facilities, and pipeline networks, hinders the large-scale development of green hydrogen [

20]. In addition, unlike areas such as the EU, Canada, Australia, and Japan, Vietnam lacks an established natural gas pipeline system to be rehabilitated or repurposed for green hydrogen transport.

Therefore, the investment in a new hydrogen transport network should be fundamental to the implementation of Vietnam’s hydrogen strategy [

18]. Such a network typically comprises transmission pipelines, transfer stations, and storage facilities.

However, the development cycle for hydrogen infrastructure is extensive, often requiring between 6 and 12 years to complete [

17]. Moreover, the capital investment required is substantial. China launched the construction of the world’s longest hydrogen pipeline in 2024 with a projected cost of USD 845 million. Germany allocated USD 230 million for a 40 km hydrogen pipeline, while Belgium plans to invest USD 2.2 billion over the next decade, three times more than previously estimated.

Another complication is the lack of international standards governing the construction and operation of hydrogen pipelines [

48]. Currently, most regulatory frameworks are adapted from those applicable to natural gas pipelines, despite the inherent differences in the chemical and physical properties between hydrogen and natural gas. This regulatory gap presents safety and technical challenges for developers, particularly for both onshore and offshore pipeline systems.

Additionally, due to its physical properties [

27,

49], hydrogen must be compressed or liquefied for efficient transport. Compressed hydrogen requires about four times more storage volume than gasoline, while liquid hydrogen demands advanced insulation and incurs high energy costs for liquefaction and storage. These limitations place hydrogen at a disadvantage compared to conventional fuels in Vietnam, particularly in terms of transport efficiency, storage feasibility, and scalability.

In addition to challenges related to hydrogen’s physical properties, the availability of key resources, namely wind, solar, and water, should also be carefully evaluated. In Vietnam, solar and wind potential is unevenly distributed, leading to an imbalanced development of renewable energy projects [

23,

38,

42]. Most large-scale solar and wind power plants are located in the South Central region, particularly in the Ninh Thuan and Binh Thuan provinces. While this concentration offers potential for green hydrogen production, these areas are also among the driest in Vietnam [

20,

23], posing challenges for the electrolysis process. In contrast, the Southern region has favorable wind, solar, and water resources, but limited land availability prevents the development of large-scale renewable and hydrogen projects.

Clearly, Vietnam is at a strategic inflection point in the global shift toward clean energy, with green hydrogen offering significant potential as a driver of deep decarbonization and energy diversification. However, unlocking this potential requires addressing a range of critical challenges, particularly those related to infrastructure, technology, and regulatory frameworks.

Despite favorable renewable energy resources and rising international interest, Vietnam currently lacks the necessary pipeline networks, storage systems, and standardized regulations to support large-scale hydrogen deployment. The absence of repurposable natural gas infrastructure further compounds these limitations.

To position itself as a competitive player in the global hydrogen economy, Vietnam must adopt a clear and comprehensive national hydrogen strategy. This should be underpinned by strong policy support, targeted domestic and foreign investment, and sustained international collaboration. Only through coordinated efforts across sectors can Vietnam fully leverage its renewable potential and establish a resilient and scalable hydrogen ecosystem.

4.5. High Production Costs

Global investment in green hydrogen is accelerating, driven largely by increasing government support and policy mandates [

17]. China currently leads these efforts, having allocated approximately USD 3.5 billion to green hydrogen development by 2024. This investment surge is supported by national and subnational strategies aimed at reducing renewable energy curtailment and expanding the use of clean energy across multiple sectors. The EU follows closely, having committed around USD 2 billion, primarily targeting the decarbonization of industry and transport, as well as the advancement of biofuels.

This global push reflects green hydrogen as a cornerstone of a sustainable energy system [

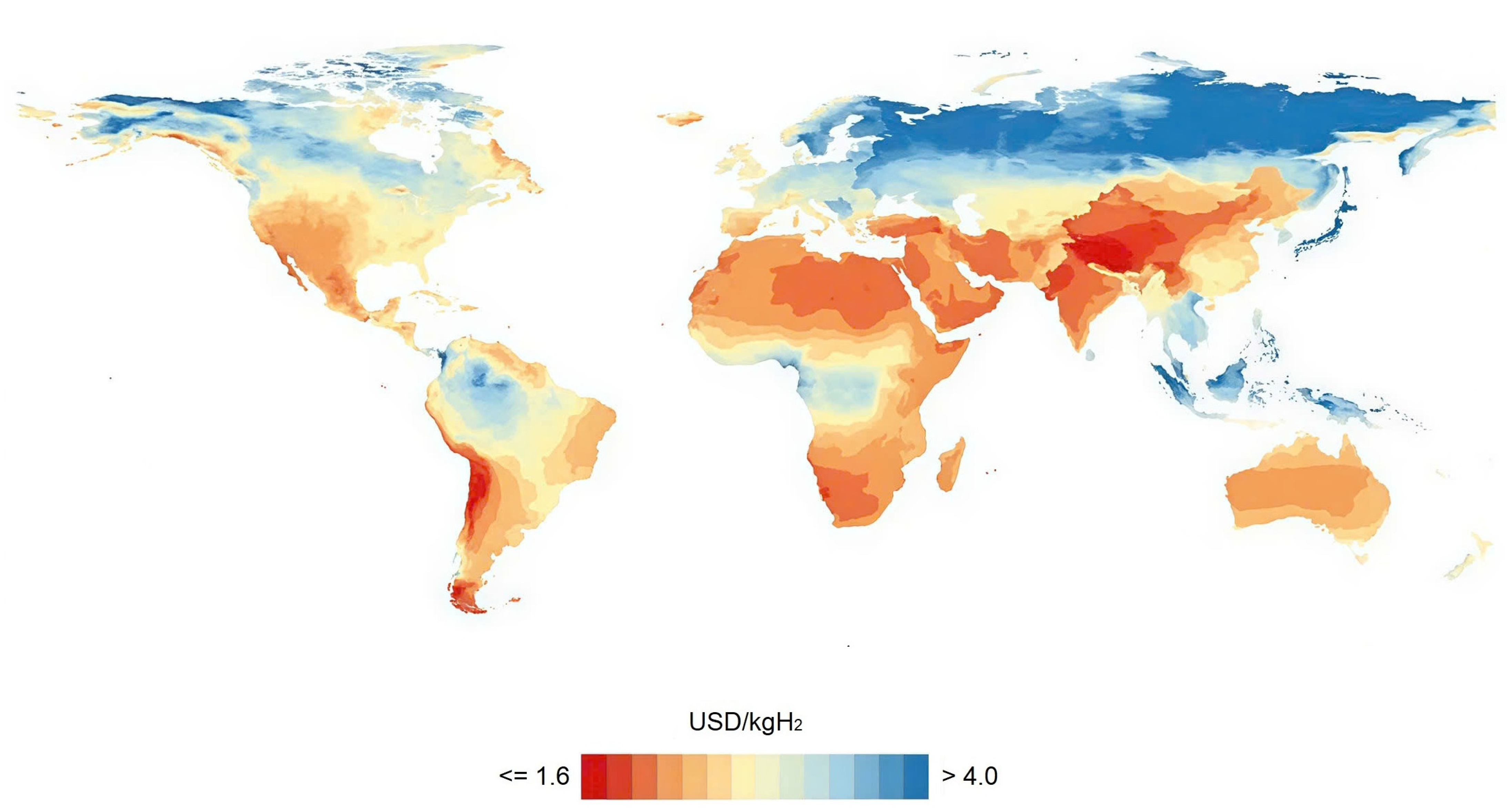

17]. However, high production costs remain a significant barrier to widespread adoption. According to [

50], the Levelized Cost of Hydrogen (LCOH) for green hydrogen ranges from 2.44 to 2.93 EUR/kg H

2, approximately 1.2 to 1.5 times higher than the cost of grey hydrogen, and 1.1 to 1.3 times higher than blue hydrogen.

Among the key cost determinants, the Levelized Cost of Electricity (LCOE) is the most influential factor affecting the LCOH of green hydrogen [

50]. Studies show that achieving an LCOE below 30 EUR/MWh, combined with Full Load Hours (FLHs) exceeding 3500 h, could enable cost parity between green and grey hydrogen. However, most renewable electricity sources still fall short of this threshold, except for onshore wind, which reports an average LCOE of 33 EUR/MWh [

51]. Consequently, reducing the LCOE of renewables, particularly solar and wind, is essential to lowering green hydrogen production costs.

In Vietnam, green hydrogen production offers two key strategic advantages: (i) the creation of a clean and flexible energy supply; and (ii) the mitigation of renewable electricity curtailment, particularly in rich-RE provinces such as Ninh Thuan and Binh Thuan [

23,

38].

Despite these advantages, production costs remain a significant hurdle [

7,

51]. Vietnam’s green hydrogen production costs are estimated at approximately 3.6 to 3.8 USD/kg, nearly double the cost reported in China and India, as seen in

Figure 14. These elevated costs reflect variations in local resource availability, infrastructure maturity, and energy pricing.

Addressing these cost disparities requires targeted investments in renewable energy infrastructure, hydrogen production and storage systems, grid modernization, and overall cost-reduction strategies. For example, in the United States (US), clean hydrogen development is guided by a strategic roadmap extending to 2050 [

52]. However, production costs remain high, with the LCOH exceeding 5 USD/kg when using renewable electricity. Most of this cost arises from capital expenditures for electrolyzers and electricity input. To address this, the US government has set ambitious targets to reduce the LCOH to 2 USD/kg by 2026 and 1 USD/kg by 2031, supported by advancements in electrolyzer technologies and falling renewable electricity prices. Additionally, a survey in [

53] suggests that utilizing off-peak electricity can reduce the LCOH to below 4 USD/kg, a strategy already piloted in countries such as Ireland, Denmark, and Canada. Such approaches also require significant investment in storage and compression infrastructure.

While the challenges are considerable, Vietnam’s vast solar and wind potential can provide a strong foundation for large-scale green hydrogen. Additionally, leveraging surplus renewable electricity for hydrogen generation can help reduce curtailment, enhance grid efficiency, and improve energy security.

To capitalize on these opportunities, Vietnam should adopt a comprehensive and forward-looking strategy that includes the following: (1) strong policy support and regulatory frameworks; (2) international collaboration and technology transfer; and (3) sustained investment in hydrogen-related research and development. By aligning national objectives with international best practices, Vietnam can enhance its competitiveness in the emerging hydrogen economy and in the global energy transition.

5. Conclusions

Green hydrogen holds significant potential to accelerate socio-economic development and is increasingly recognized as a clean energy vector that aligns with global Sustainable Development Goals. Its diverse applications across the energy sector not only support the efficient use of renewable energy resources but also enhance national energy security, a strategic priority for Vietnam.

With abundant renewable energy potential, particularly from solar and wind, Vietnam is well-positioned to become one of the leaders in green hydrogen production. The Vietnamese Government acknowledges this opportunity through a series of recent policies and strategies that underscore green hydrogen’s role in the country’s long-term socio-economic development.

However, integrating green hydrogen into the national economy requires careful planning and coordination, especially concerning energy security and infrastructure readiness. As a relatively new component of Vietnam’s energy landscape, green hydrogen presents both opportunities and challenges that demand rigorous assessment and inclusive stakeholder engagement.

To ensure a successful transition, the government must take a proactive policy approach, including the following: developing enabling frameworks that support green hydrogen production and utilization; ensuring policy coherence across the energy, transport, industry, and finance sectors; and assessing costs and investment needs, while identifying sustainable funding mechanisms.

Overall, Vietnam’s energy transition presents a unique opportunity to foster a low-carbon, resilient economy. While challenges are inevitable, they can be effectively addressed through collaborative, cross-sectoral partnerships, both domestically and across the ASEAN region and global platforms.