1. Introduction

In current electrical systems, the growth of demand electrification [

1], driven by the increase in electric vehicles, climate control systems, and data centers [

2], is creating new operational conditions on the grid. This is leading to the emergence of novel challenges that were not anticipated during the original design of the electrical infrastructure, such as line congestion, transformer overloads, and voltage issues.

Traditionally, issues related to grid congestion, increasing electricity demand, and the need to enhance supply reliability have been addressed through network expansion planning (NEP) [

3,

4]. These plans typically involve conventional infrastructure solutions such as the construction of new transmission lines, the development of additional substations, or the reinforcement of existing assets. In this context, the most recent studies address multistage planning to upgrade and expand the network, as in [

5], where reliability assessment is also incorporated. The N-1 security criterion is applied in [

6] to develop the expansion plan. In the work presented in [

7], current relevant issues such as energy storage systems (ESSs) and electric vehicle (EV) charging stations are considered for network expansion planning. Similarly, as shown in [

8], ESSs are used in the expansion plan to support the integration of generation.

Although NEPs have proven effective over the years in solving grid-related problems and ensuring the reliable operation of the power system, such solutions often entail high investment costs for the Distribution System Operator (DSO), long implementation timelines, and potentially significant environmental and social impacts in the construction of new transmission lines. In response to these challenges, new approaches have emerged within the concept of non-wire alternatives (NWAs) [

9], which encompass technologies and operational strategies aimed at avoiding, deferring, or reducing the need for physical grid expansion. The two main categories of strategies involve the deployment of distributed resources [

10] and the implementation of demand-side management techniques [

11].

There is an emerging field in NWAs related to mobile resources. In [

12], by coordinating the flexibility of building HVAC systems and electric buses, it is possible to address localized issues in the network. In [

13], the use of mobile energy storage systems (MESSs) is proposed to enhance the resilience of distribution networks against extreme events through their deployment. As described in [

14], MESSs enhance the resilience of distribution networks against extreme events and support rapid supply restoration. In [

15], mobile batteries were used to reduce energy losses and minimize voltage deviations. The work developed in [

16] proposes a collaborative electric vehicle charging approach that reduces network congestion, flattens the load curve, and minimizes the total energy cost for users.

Focusing on the area of NWAs that utilize DERs strategically located in the network to help solve grid issues, two main approaches can be identified: the DSO perspective and the objective of investors. In [

17], the use of energy storage systems (ESSs) owned by the Distribution System Operator (DSO) is studied to address network problems, identifying relevant applications and evaluating battery performance. The objective is to quantify the economic benefits for the operator. Similarly, aligned with the DSO’s interests, the study in [

18] shows that hybrid solar generation and storage plants can lead to reduced investment costs in NWAs. In [

19], a bilevel optimization approach is proposed to evaluate distributed resources as NWAs, ensuring an economic return for investors while minimizing operational costs for the DSO. In [

20], the economic perspective is also considered to determine the optimal placement and integration of resources into the network.

One of the most relevant aspects in power system planning, whether for NWAs or expansion plans, is the uncertainty associated with demand growth and renewable resource variability since the viability of the proposed solutions largely depends on it [

21,

22]. In this context, different analytical approaches are applied, among which robust optimization and stochastic optimization are the most prominent. In robust optimization, decisions are made based on the worst-case scenario, which is taken as the reference [

23,

24]. Conversely, stochastic optimization relies on a set of possible scenarios, with decisions driven by their respective probabilities of occurrence [

25,

26].

Despite the relevance of this topic, there are few methods in the state of the art that incorporate stochastic models, highlighting a gap in the literature that remains to be addressed. The most notable study in this area is [

27], which evaluates the value of ESSs under long-term demand uncertainty conditions to address issues arising in the grid. In [

28], the authors focus on the combination of photovoltaic (PV) generation and demand response (DR) as NWAs in various uncertainty scenarios, highlighting the importance of appropriately selecting the NWA mix based on the evolution of different load scenarios. The absence of methodologies that implicitly incorporate uncertainty in the study of NWAs highlights the need to adopt approaches capable of addressing the variable conditions of real-world scenarios to solve network problems. Techniques such as stochastic and robust optimization enable the development of more realistic solutions applicable to uncertain situations, making it important to promote their use in the analysis of NWAs.

This work presents a review of methods for addressing uncertainty in the deployment of non-wire alternatives (NWAs), which involve fixed costs in uncertain scenarios. Building on this, it develops a planning model for NWAs based on the integration of hybrid photovoltaic–storage plants, formulated as a MINLP problem with a DistFlow representation to realistically capture network constraints. On this basis, a systematic comparison of optimization methodologies under uncertainty conditions was conducted to evaluate their implications in terms of investment—mainly driven by fixed costs (CAPEX)—technical feasibility, and computational time. The main contributions can be summarized as follows:

A detailed assessment of robust, probabilistic, weighted multi-scenario, and multi-scenario with penalty approaches was carried out for a fixed sizing and location, an aspect that has been little explored in the literature.

The formulation of multi-scenario optimization with expected penalty is introduced, balancing investment and risk while demonstrating improved technical and economic performance in the case study.

The validation on the CIGRE MV European network demonstrates the practical applicability and comparability of the results, facilitating their extrapolation to other distribution networks.

The structure of the article is organized as follows.

Section 2 presents the general formulation for the siting and sizing of hybrid plants combining photovoltaic generation and storage, based on problematic demand profiles, photovoltaic resource availability, and technology costs.

Section 3 reviews the main methodologies used to address uncertainty in this type of problem.

Section 4 describes the case study, and

Section 5 presents the results obtained from applying the uncertainty-handling methodologies to the proposed case. Finally,

Section 6 outlines the main conclusions of this work.

2. Hybrid NWA Planning Model

This section presents a general model [

18] for the siting and sizing of hybrid photovoltaic generation resources with integrated storage, intended to function as non-wire alternatives (NWAs). The problem is formulated as a Mixed-Integer Nonlinear Programming (MINLP) model since a nonlinear network representation is necessary to accurately capture line congestion effects. In addition, binary variables are required to support decision-making regarding the selection and placement of generation and storage assets.

Table 1 summarizes the parameters and variables used in the formulation of the optimization problem.

The input data required for the NWA planning model are divided into two categories. First, the topological information and electrical parameters of the network under study (, ) must be specified. Additionally, the admissible current limits on the lines () and the voltage limits at the nodes () are required as violations of these constraints define the network issues to be addressed. The model also requires the photovoltaic generation availability profile () and the demand profiles at the nodes (), which represent the main sources of uncertainty. In contrast, the installation costs of generation and ESSs are assumed to be deterministic as these prices are typically known with sufficient accuracy at the time of project execution.

Based on this data, the optimization model determines the optimal location and combination of photovoltaic generation as the primary resource, together with ESSs to address network issues through power injections. The objective is to minimize the total investment cost required to resolve these issues. The outputs of the method include the location of the resources (), the required installed capacities (, ), and the corresponding operational strategy of the assets.

Thus, the objective function, which aims to minimize the total cost of the solution, is defined as

where the main decision variables are the size and location (

) of the PV generation and the size and configuration of the ESS (

,

) in the hybrid plant.

The DistFlow model [

29] is used to represent the electrical network. This formulation provides an accurate representation of power flows in radial distribution networks, capturing the nonlinear relationships between voltage, power, and current. Equations incorporate the variables associated with non-wire alternatives.

The active and reactive power balance at each node are represented by Equations (

2) and (

3), which include the injections from the hybrid plant. Equations (

4) and (

5) define the voltage and current through the lines, respectively. Finally, constraints (

6) and (

7) define the voltage and current limits.

The equations associated with PV generation are described below. The minimum and maximum generation capacity that can be installed are constrained by Equation (

8). The active power output is defined based on resource availability, as expressed in Equation (

9).

To form hybrid plants with storage and a generation source, binary decision variables are used, as defined in Equation (

10). The installation of the storage system is only possible if the generation source has been previously installed.

The active and reactive power at the point of interconnection (POI) between the hybrid plants (or generation units) and the network are defined by Equations (

11) and (

13). The total active power,

, is calculated as the net balance between generation, battery charging, and discharging. This variable is constrained to be non-negative as the battery can only be charged using energy from the generation source, not from the grid, as described by Equation (

12). The total reactive power,

, is determined as a function of the total active power injected at the POI.

Equation (

12) is defined to relate the battery charge to the associated resource.

The size of the ESS is related to the installed photovoltaic capacity according to Equation (

14), limiting the maximum power to that of the associated resource. The constraints for defining the power and energy capacity of the ESS are expressed in Equations (

15) and (

16), respectively. The maximum charging and discharging power are modeled in Equations (

17) and (

18), and the constraint to prevent simultaneous charging and discharging is defined in Equation (

19). The state of charge update is given in Equation (

20), and Equation (

21) sets the minimum and maximum state of charge limits to ensure safe battery operation.

3. Uncertainty in NWA Planning

Investment planning in generation resources or hybrid plants conceived as NWAs focuses on fixed costs (CAPEX). Addressing uncertainty in this type of problem involves specific challenges. Since operating costs are almost negligible (except in cases of demand response or controllable generation). For a case such as the one described, the objective is to obtain a single set of asset location and sizing decisions (, , ), regardless of the scenarios considered or the range of uncertainty.

As a result, all decisions must be taken in advance under incomplete information conditions. Once executed, these decisions are difficult to reverse, which makes it essential to ensure robustness against a wide range of possible future scenarios. In this context, optimization methodologies under uncertainty conditions become crucial, providing a structured way to evaluate and manage risk while enabling more reliable and resilient investment decisions in uncertain environments. The main optimization techniques under uncertain conditions applicable to this type of problem are described below.

3.1. Robust Optimization

Robust optimization [

30,

31,

32] ensures decision feasibility against any realization of uncertain parameters within a predefined range, without relying on scenario definition or probability assignment. By explicitly addressing the worst case within the uncertainty set, it provides resilient planning that guarantees technical constraints even under extreme conditions.

From an economic perspective, robust optimization generally leads to more conservative decisions, which often translates into higher initial CAPEX, due to the need to guarantee feasibility under worst-case conditions, regardless of the probability of such a worst case occurring.

3.2. Deterministic Optimization in Probabilistic Scenarios

Deterministic optimization in probabilistic scenarios is formulated as an approach in which uncertainty is not explicitly modeled through multiple scenarios but instead synthesized into a single representative scenario. This scenario is constructed by weighting the different possible demand (or generation) profiles according to their probabilities of occurrence, thereby generating an average or expected projection of system behavior. In this way, the optimization problem is formulated deterministically, simplifying its resolution and reducing computational complexity while still incorporating relevant information about demand variability. This approach is particularly useful when the objective is to obtain an efficient and practical solution that reflects the most likely operating conditions of the system, without the need to explicitly model the full set of scenarios.

3.3. Formulation

The formulation of deterministic optimization in probabilistic scenarios is based on the construction of an equivalent scenario that aggregates variability from all possible realizations:

where

denotes the uncertain profile in period

t corresponding to scenario

s, with

representing its probability of occurrence. The equivalent deterministic demand profile is thus obtained as the probability-weighted average.

3.4. Multi-Scenario Optimization

A conceptually close alternative to robust optimization, but one that can lead to different decisions in terms of investment, sizing, and siting, is the multi-scenario approach [

33,

34,

35,

36]. This type of model is suitable when a finite set of scenarios is available, each representing a possible realization of uncertain variables such as demand or generation. No probabilities are assigned to the scenarios, and all of them are treated with equal importance. The objective is to find a single investment solution that remains valid and feasible across all defined scenarios. Thus, it is possible to capture the worst-case scenario when multiple scenarios are available, rather than a range where the parameters vary with uncertainty.

3.5. Weighted Multi-Scenario Optimization

In this approach, the objective is to obtain an average sizing based on the available scenarios

S and their associated probabilities

. This is based on the use of probabilities to weight the operating costs of different scenarios but applied to sizing [

37,

38,

39,

40]. The optimization problem is formulated independently for each scenario, allowing the sizing of generation and storage resources to adapt to the specific conditions of each case. All technical constraints are imposed on a scenario-by-scenario basis. Once the optimal solutions for the set of scenarios are obtained, the resulting investments are evaluated through a weighted sum, where the contribution of each scenario is scaled according to its probability of occurrence.

This formulation does not enforce a common design across scenarios but provides insight into the sizing and expected cost under uncertainty conditions. It serves as a useful reference for analyzing how different levels of uncertainty affect infrastructure needs and investment strategies. For this uncertainty-based optimization model, it is necessary to assume that the installation locations are the same across all scenarios. This constraint ensures that the installed capacities, although sized independently per scenario, are comparable and can be meaningfully aggregated or weighted according to scenario probabilities

3.6. Multi-Scenario-Based Optimization with Expected Penalty

In this approach, the objective is to determine a single sizing solution by considering the set of available scenarios S and their associated probabilities . Unlike approaches that compute an average sizing across scenarios, here the probabilities are used to weight the expected cost of failing to resolve network overloads. The optimization problem is formulated by enforcing all technical constraints on a scenario-by-scenario basis and introducing slack variables to capture possible violations. These violations are penalized in the objective function according to their magnitude and probability of occurrence, such that the investment in generation and storage balances the capital expenditures (CAPEX) with the expected risk of overloads in the distribution network.

3.7. Chance-Constrained Optimization

The chance-constrained approach [

41,

42,

43] is conceptually related to the multi-scenario formulation. If the scenarios are associated with a probability of occurrence, the model allows for the adoption of a partial coverage criterion: instead of requiring the solution to be feasible in all considered scenarios, a minimum threshold of cumulative probability is defined. Thus, the scenarios that represent a predetermined coverage percentage are included. This allows the planner to decide how much uncertainty to accept as the maximum level of risk.

4. Test Case

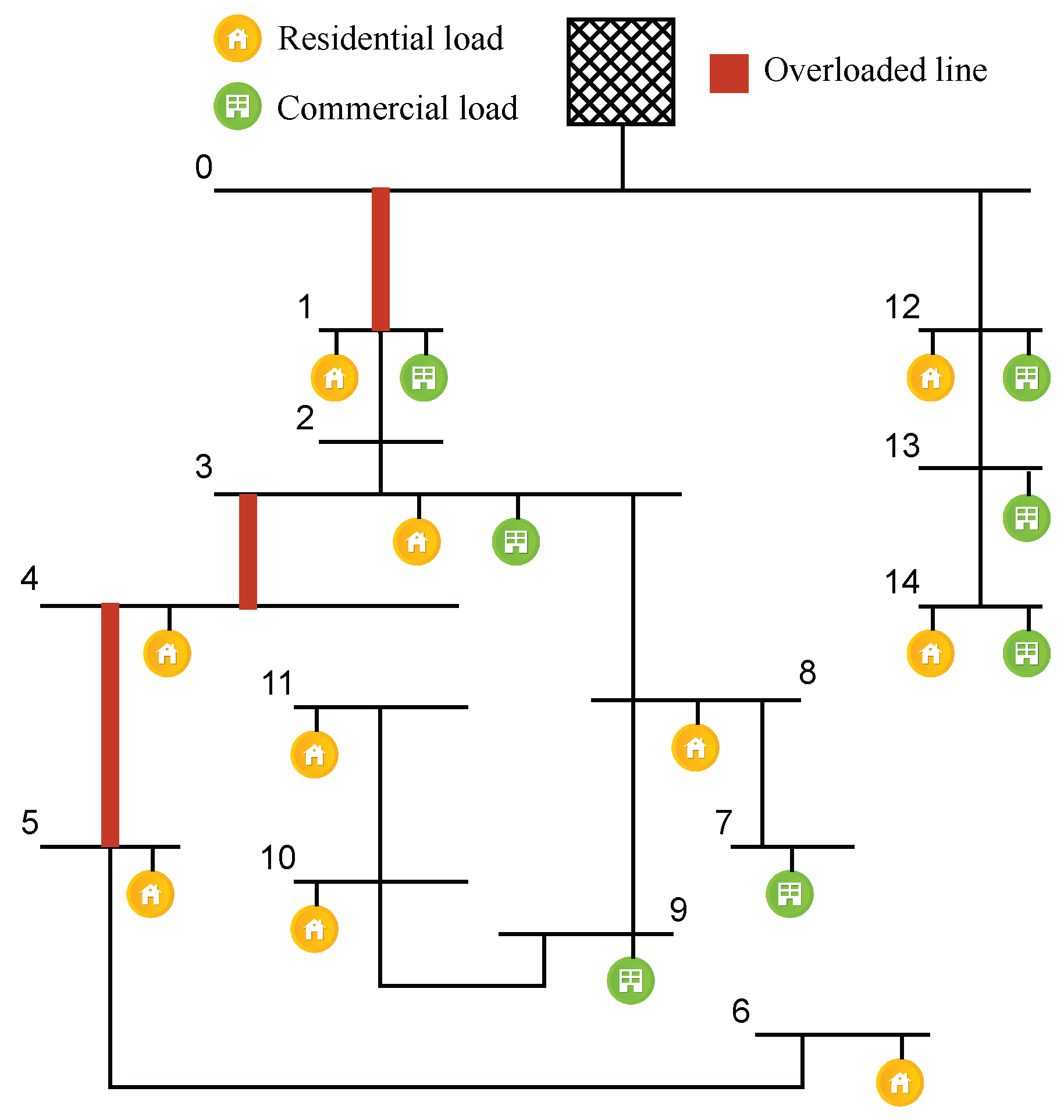

To analyze and compare the performance of different techniques for handling uncertainty, the CIGRE medium-voltage (MV) distribution network benchmark, in its European configuration, is used as a case study, as shown in

Figure 1. This schematic also illustrates the existing issues within the network. The minimum voltage limit is set at 0.90 pu, based on the IEC 60038 standard for medium-voltage systems. Information on the nominal power, location, and type of loads is provided in [

44]. Initially, the network does not include any distributed generation resources.

Table 2 presents the ampacity ratings of the distribution lines, while their resistance and reactance values can also be found in [

44].

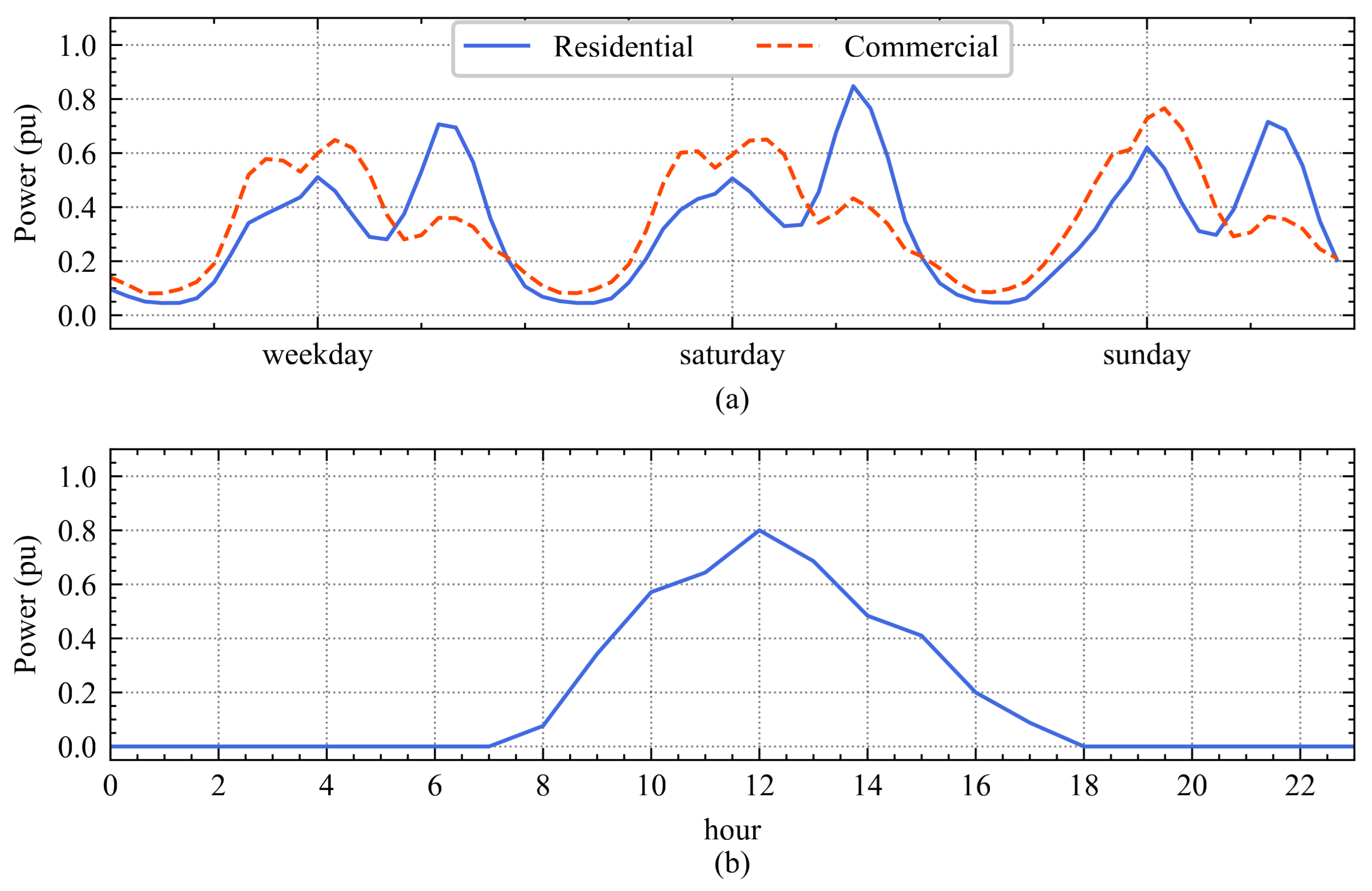

The consumption profiles used are based on those described in [

45], specifically for a winter period, which is the time of highest consumption and, therefore, when the most problems may arise.

Figure 2 shows the profiles of residential and commercial use (a). The availability profile of photovoltaic generation considered for installation is also shown (b). A daily profile is presented, which is considered the typical generation pattern for winter and, for simplicity, is repeated cyclically throughout the entire analyzed period. These are the two uncertain parameters considered in this study. A total of five representative days are considered: three weekdays and two weekend days (Saturday and Sunday). The analysis is carried out with hourly resolution. In total, the analysis period is defined as the set

, based on hourly data sampling.

To account for demand uncertainty, two demand evolution scenarios have been defined. Each scenario introduces additional network issues compared to the previous ones due to variations in demand levels. Scenario

, with the highest probability of occurrence (90%), results in overloads on lines 0–1 and 3–4. Scenario

, which increases the load by 6% compared to scenario

and is associated with a 10% probability, causes overloads on lines 0–1, 3–4, and 4–5. The increase in demand results in higher overloads and the congestion of an additional line.

Table 3 summarizes the issues identified in each scenario, indicating the time periods during which they occur and the magnitude of the overloads. For PV generation, two scenarios are considered: a base case,

(

Figure 2b), with a 90% probability (base case), and a second scenario (

) with a 10% probability. In scenario

, resource availability is reduced by 10% compared to scenario

to account for a significant deviation of the primary resource, which is essential for problem resolution. These scenarios are used for stochastic optimization and also serve to define the uncertainty bounds for robust optimization.

The input data, such as electricity demand and the availability of renewable generation resources, are represented by independent scenarios with uncertainty, probability, and no correlation. Therefore, it is necessary to generate a combined set of scenarios. The combined set is defined as

and includes all possible combinations. The joint probability of each combination is calculated as the product of the individual probabilities.

Table 4 presents the possible combinations and their corresponding joint probabilities.

The project analysis is conducted over a 25-year planning horizon, where the investment costs considered are 758,000 EUR/MW for photovoltaic generation and 258,000 EUR/MW and 242,000 EUR/MWh for the power and energy capacities of the ESSs, respectively [

46,

47]. The ESS cost is increased by 20% to cover degradation and mid-life refurbishment, ensuring it maintains capacity and reliability throughout the project horizon.

5. Results and Discussion

This section presents the main results obtained from the application of most relevant methods that account for location and sizing uncertainty in hybrid solar generation plants. The optimization problems were solved using the GAMS software package, with MINLP solvers such as KNITRO and DICOPT. All computations were performed on a PC equipped with an Intel i7-1065G7 processor running at 1.3 GHz, 8 GB of RAM, and the Windows 10 operating system.

5.1. Deterministic Optimization Results

In this section, the siting and sizing problem is solved deterministically, assuming that the demand profile with a probability of 90% and the generation profile with the same probability will occur. Therefore, the scenarios considered are those with the highest associated probability.

In

Table 5, the economic and sizing results obtained are shown, resulting in a total investment in assets of EUR 3.54 million. Storage plays a fundamental role, with the same capacity being installed as generation, with a ratio of more than 2 h of energy.

Table 6 shows the results of installed sizes at the nodes. The largest installation occurs at node 5, with 0.7 MW of generation and a storage system configured as 0.7 MW/1.47 MWh.

5.2. Robust Optimization Results

For the robust optimization case, coinciding with the multi-scenario analysis, the case of highest demand and lowest generation availability is chosen. These constitute the worst-case scenario that may occur.

The economic and sizing results obtained are shown in

Table 7. To solve problems in the event that the worst-case scenario occurs, an investment of EUR 5.4 million is required, which represents EUR 1.8 million more compared to the deterministic scenario. This is due to an increase in the required sizes, with a generation of 3.19 MW and a storage configuration of 3.14 MW/6.89 MWh.

The installation takes place at fewer nodes than in the previous case, but with larger sizes, with the largest installation located at node 5 together with the largest storage system associated with this generator. The second largest installation is located at node 10. This can be observed in

Table 8.

5.3. Probabilistic Scenario Optimization Results

The results in this section are determined by the way demand and generation inputs are represented, modeled through two scenarios with different occurrence probabilities. From these, a unified probabilistic profile is constructed, enabling their analysis within a single equivalent scenario. This approach aims to obtain results based on a probabilistic profile of demand and generation, rather than relying solely on a purely deterministic or robust analysis.

The results presented in

Table 9 show a slightly higher investment compared to the deterministic case, where the 90% probability profile was considered as secure. A significant increase in investment is observed with respect to the robust case, which accounted for the most unfavorable scenario with a 10% probability of occurrence.

As shown in

Table 10, intermediate sizes are obtained with respect to the deterministic and robust cases as a consequence of their probabilistic profile. The largest installation is located at node 5, consisting of a 1.19 MW generator and a storage system sized at 1.19 MW/2.46 MWh. This represents an increase in the power capacity of 70% compared to the deterministic case but a decrease of 20.67% compared to the robust case. In terms of investment, the increase compared to the deterministic case is 4.8% higher and 31.3% lower than in the robust case.

5.4. Weighted Multi-Scenario Optimization Results

The objective of this scenario is to determine a sizing weighted according to the scenarios and their associated probabilities. Instead of computing a single sizing solution valid for all scenarios, the asset sizes are calculated individually while keeping the same locations fixed. The aim is to obtain an average sizing that can perform reasonably well across all cases.

Table 11 presents the total investment results for each scenario individually. As expected, the most unfavorable scenarios, such as S2 and S3, require larger investments and asset sizes.

The sizes associated with each scenario, located at the common nodes, are shown in

Table 12. These sizes are used to compute a weighted average according to the probability of occurrence of each scenario to obtain an average sizing. It can be observed once again that, in the most unfavorable scenarios, despite their low probability, the largest installations are carried out at the nodes.

Using the previous sizes and averaging them with the information from

Table 4, the resulting sizes are obtained as shown in

Table 13. This corresponds to an investment of EUR 4.39 million, which represents 18.33% more than in the case of probabilistic profiles.

5.5. Multi-Scenario-Based Optimization with Expected Penalty

This section presents the results of applying the single-sizing technique with a penalty for overload violations across all possible scenarios. To define w, the equivalent cost of the overload, the total cost obtained from the robust method is considered together with the total amount of overloads for the most critical line, line 0–1. This makes it possible to decide whether it is preferable to install additional generation to resolve all issues or to allow certain overloads that reduce the total investment. As a constraint, it is also established that at most 25% of the initial overloads per scenario are allowed.

Table 14 presents the investment results obtained with this method and the total installed capacity of generation and storage assets. The total investment, EUR 4.56 M, is similar to the case of weighted multi-scenario optimization, which considers the same scenarios and probabilities but applies a different formulation.

As shown in

Table 15, the largest installation occurs at node 5, with 1.04 MW of generation and a storage configuration of 1.04 MW and 2.39 MWh. This node also hosts the largest capacity in both the robust case and the probabilistic profile case. The second largest installation is at node 11, with 0.73 MW of generation and storage of 0.73 MW and 2.26 MWh.

5.6. Comparison and Evaluation of Optimization Techniques Under Uncertainty Conditions

In this section, the different optimization techniques are compared across the various scenarios. First, the previously presented methods are evaluated in terms of how they address the problems in the worst-case scenario and their violation rates. The robust optimization meets the requirements without any issues.

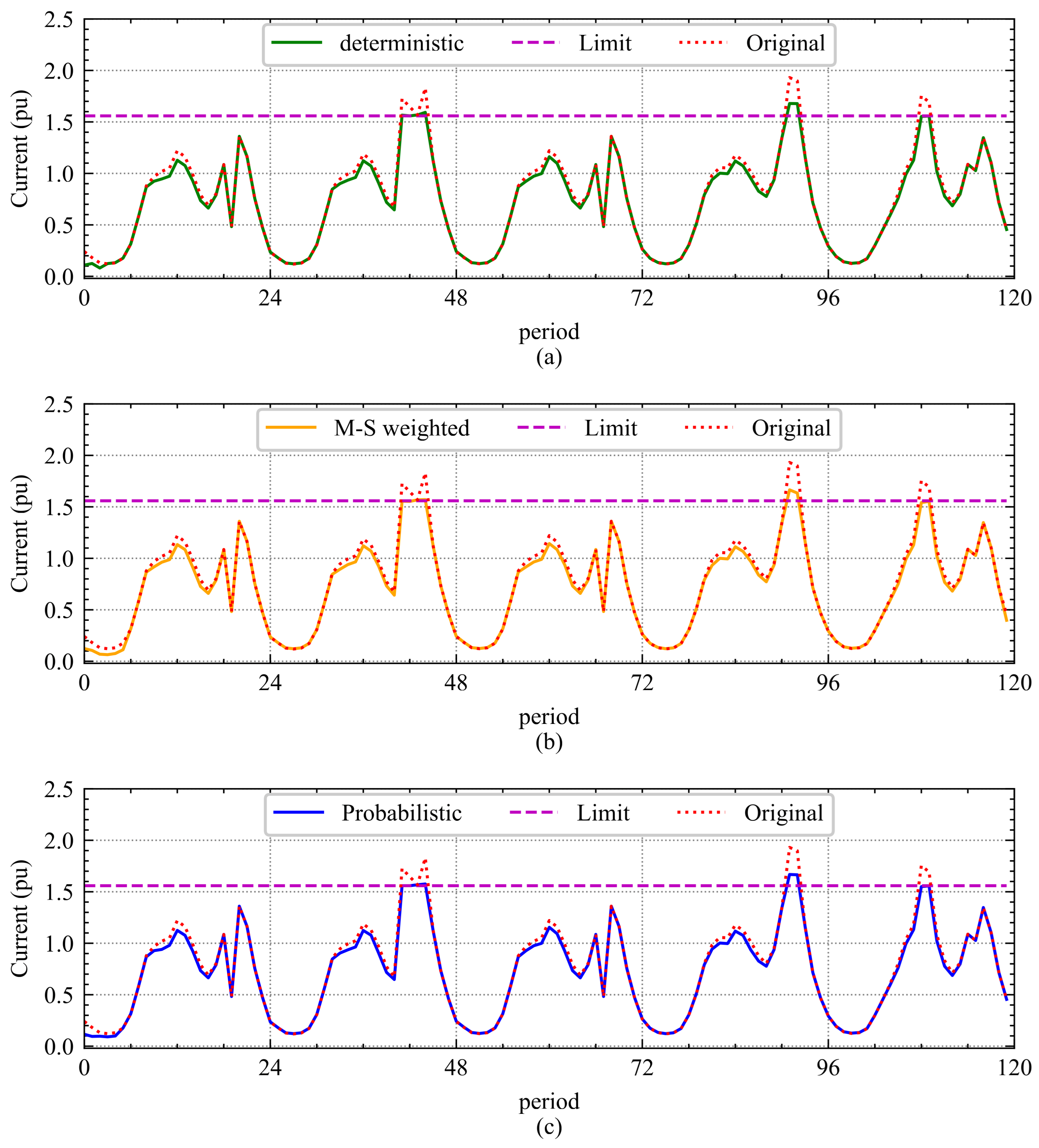

Figure 3 illustrates the evolution of the currents along the originally overloaded line 0–1 and how the problems are corrected according to each methodology.

As can be observed, the model that performs worst in the most adverse scenario is the deterministic one. It exhibits overloads in 5 out of the 8 h of the analysis period, with a total deviation of 544.15 A, since it only considers the most likely demand and generation scenario. In contrast, when all scenarios are taken into account, the weighted multi-scenario optimization results in a deviation of 454.08 A, while the probabilistic scenario approach achieves a deviation of 413.63 A. Considering that the initial total overload on line 0–1 was estimated at 453.78 A for the entire period, only the probabilistic scenario approach is capable of mitigating some of the issues arising in the worst-case scenario, achieving a reduction of 8.84%.

Regarding the computation times for obtaining the optimal solutions, the deterministic case required 90.28 s, the multi-scenario case 1865.86 s, and the probabilistic profiles case 63.60 s. The major difference arises in the multi-scenario case, which requires a significantly longer solution time (almost 30 times more) to obtain a worse solution than that achieved with the probabilistic scenario approach.

By analyzing in detail the results obtained with the multi-scenario-based optimization with expected penalty, it can be observed in

Figure 4 that this method provides the best correction in the worst-case scenario among all approaches (excluding the robust case). This is achieved by setting a maximum violation of 25% per scenario and considering the total cost obtained from the robust optimization result. By applying the probabilities of each scenario, the total deviation in amperes for line 0–1 amounts to 292.21 A, representing a 35.60% reduction. The solution time for this optimization is 668 s.

In terms of performance, this option proves to be the most attractive, as confirmed by the obtained results, since it incorporates all scenarios with their respective probabilities and additionally assigns a cost to the non-fulfillment of overload mitigation, enabling a direct comparison with the investment.

Table 16 presents a summary of the different methods for considering uncertainty in the optimization model, comparing investment, solution time, and reduction rate of the maximum line current (negative value is considered an increase). The deterministic case is included to highlight the risk of addressing uncertainty problems solely through the most likely case.

The results show that the way uncertainty is handled decisively affects investment, technical performance, and computation time. Multi-scenario optimization with expected penalty emerges as the most attractive compromise: it integrates all realizations with their associated probabilities, internalizes the cost of violations, and directs capacity to the locations with the greatest impact on mitigation, achieving significant reductions in overload with intermediate investment efforts and reasonable solution times.

6. Conclusions

The increasing need to reduce network reinforcement investments and efficiently integrate renewable resources highlights the role of distributed energy resources (DERs) as non-wire alternatives (NWAs) to alleviate overloads and operational issues in stressed distribution grids.

This paper proposes an MINLP-based methodology for the optimal siting and sizing of hybrid photovoltaic–storage plants, minimizing total investment while accounting for solar availability and battery flexibility in both power and energy. The framework integrates multiple optimization approaches under uncertainty conditions, including deterministic, robust, probabilistic, and multi-scenario formulations.

The results indicate that robust optimization guarantees feasibility under worst-case conditions but leads to significant oversizing and high investment costs. In contrast, deterministic and weighted average approaches reduce investment but may fail to prevent violations in adverse scenarios, potentially compromising network security.

The multi-scenario optimization with expected penalty emerges as the most balanced solution. By incorporating all scenarios with their probabilities and translating violations into expected costs, it achieves a single sizing solution that significantly mitigates critical overloads while maintaining intermediate investment levels and reasonable computational times. This approach offers a practical trade-off between robustness, economic efficiency, and computational feasibility.

A key conclusion is that appropriately sizing storage in both power and energy reduces the additional generation capacity required and moderates total investment compared to robust solutions, while ensuring network security.

Future research will focus on multi-year analyses according to N-1 security criteria and explore hybrid plant participation in electricity markets to enhance economic benefits and accelerate deployment.