1. Introduction

Offshore wind energy is a key player in the global transition to renewable power, offering a sustainable solution for energy generation. As wind farms increase in complexity, optimizing structural components is essential for enhancing both efficiency and reliability. Various foundation systems, including gravity bases, tripod structures, suction caissons, jackets, and monopiles, support these turbines. Among these, monopile foundations have emerged as the preferred option for moderate water depths of up to 35 m, thanks to their strength and adaptability [

1,

2,

3]. One of the key structural elements in offshore wind turbine foundations is the tubular joint system, which connects monopiles or jacket structures to turbine towers.

Traditionally, grouted joints and bolted flange joints have been commonly used for connections in offshore wind structures. Grouted joints are primarily utilized to connect the monopile and transition piece (referred to as the MP–TP joint). In this arrangement, the transition piece (outer sleeve) is placed over the monopile (inner pile), and the annular gap between them is filled with high-strength cementitious grout, as illustrated in

Figure 1a. Load transfer is facilitated through shear keys or surface roughening, with the grout playing a vital role in transferring axial and bending loads [

4,

5,

6]. Grouted joints have been the dominant choice in offshore wind applications due to their ease of installation and tolerance for fabrication and installation deviations [

7,

8].

Conversely, bolted flange joints are used at the top of the transition piece to connect the wind turbine tower and are sometimes employed in preassembled MP–TP systems. This type of joint consists of large-diameter ring flanges welded to each tubular section, which are then connected by high-strength preloaded bolts, as per

Figure 1b. Load transfer in bolted flange joints occurs through bolt shear and flange compression/friction, allowing the joint to effectively handle axial, bending, and torsional loads [

4,

5,

6]. Bolted flange joints are increasingly preferred in the industry because of their superior fatigue performance, reusability, and the ease with which they can be inspected and maintained [

9].

Both joint systems, grouted joints and bolted flange joints, have significant drawbacks that must be weighed against their advantages. In the case of grouted joints, long-term issues such as grout cracking, fatigue, and slippage have prompted the development of improved detailing techniques, including high-friction interfaces and shear keys. Additionally, their reliance on precise installation, extended curing periods, and the challenges associated with inspection and maintenance make them less desirable compared to more modern, cost-effective, and installation-friendly alternatives [

4,

10].

On the other hand, bolted flange joints face several challenges, including the need for high precision in flange manufacturing and assembly, as well as strict control over bolt preload to prevent fatigue failures. There are numerous potential failure mechanisms related to bolts, flanges, and shells. Significant parametric studies have been conducted to identify key factors that influence ultimate strength, assess failure mechanisms, and evaluate the effects of different aspect ratios and flange segment widths. The design criteria are also evaluated considering these failures [

11,

12]. The forging process of flanges is also noteworthy in this context. Innovative forging technologies have been developed to eliminate welding operations in conveyor driver forgings, utilizing numerical modeling and automation to optimize the process. Furthermore, cold forging techniques for producing hollow flanged parts from tubular blanks have been analyzed using finite element methods to assess product geometry quality and process parameters [

13,

14]. Despite these advancements, bolted flange joints are not easily detachable. Moreover, the forging process for flanges incurs substantial costs, mainly due to the significant heat required [

15,

16,

17]. This process involves heating steel billets to temperatures between 1150 °C and 1250 °C (2100 °F to 2300 °F) to achieve the necessary malleability for shaping. The high-temperature requirement increases energy consumption and operational costs, highlighting the need for substantial resources and craftsmanship to produce high-quality products. Therefore, it is essential to explore new hybrid connections that facilitate easier installation and mobility when needed.

Given these considerations, PIP slip joints emerge as a highly effective alternative to traditional tubular joint systems, as they proficiently resolve the aforementioned challenges. Pile-in-Pile (PIP) slip joints are innovative structural connections that enable the surfaces of circular hollow sections (CHSs) to slide apart, as depicted in

Figure 1c. By employing friction-based connections, PIP slip joints significantly enhance reliability and minimize the risk of failure, proving to be a superior choice over other options available [

18,

19]. Furthermore, due to their slender and lightweight design, wind turbines are particularly vulnerable to lateral loads such as wind and wave action [

20]. In this context, utilizing PIP slip joints provides a structural advantage by introducing a degree of semi-flexibility at the connections. This semi-flexible behavior is mechanically governed by frictional resistance and geometric tolerances at the slip interface, and experimental studies on similar friction-based joints suggest that the allowable rotational flexibility typically ranges between 0.01 and 0.03 radians—sufficient to absorb service-level lateral displacements without compromising structural integrity [

18,

19]. Additionally, incorporating a ring stopper to resist axial loads facilitates a self-locking mechanism, accelerates the installation and decommissioning process, and offers potential long-term benefits [

19]. Experimental and numerical analyses have shown that the structural design life can be extended, leading to fewer repairs and reduced operational risks [

18,

21,

22]. With these advantages, PIP slip joints present an innovative and compelling solution for sustainable and efficient infrastructure. However, a comparative economic study between these joints has yet to be developed, and a significant research gap remains. Investigating this research question is crucial for the advancement of suitable tubular joints.

Due to the high costs of offshore wind projects, it is necessary to explore a detailed lifecycle cost assessment (LCCA) while analyzing economic viability. This assessment examines the financial impact of different joint technologies over the project’s entire lifespan. By analyzing costs related to material cost, fabrication, transportation, installation, maintenance, and decommissioning, this study aims to determine whether PIP slip joints provide a more cost-effective solution than traditional grouted or bolted flange joints. Ultimately, a detailed economic analysis will help investors, engineers, and policymakers make informed decisions about selecting the most efficient and financially sustainable joint system for offshore wind applications [

23,

24].

The initial investment costs for PIP slip joints may differ from those for traditional tubular joints due to the advanced technology and materials used in their construction. Also, these costs can be offset by the long-term benefits associated with their use. Moreover, PIP slip joints are designed to provide enhanced performance and durability, which can lead to significant savings in maintenance and repair costs over the lifecycle of the joint [

13,

14]. Operational costs are another major consideration in lifecycle sustainability. Traditional tubular joints often require frequent maintenance and repairs due to wear and tear, which can result in high operational expenses. In contrast, PIP slip joints are engineered to minimize these issues, thereby reducing the frequency and cost of maintenance activities. This reduction in maintenance requirements not only lowers operational costs, but also minimizes downtime, leading to increased productivity and efficiency [

25,

26]. Another important factor in the lifecycle sustainability of PIP slip joints is their potential to generate revenue through improved performance. The enhanced design and materials used in PIP slip joints can lead to better performance in terms of load-bearing capacity and resistance to environmental factors. This improved performance can translate into longer service life and reduced need for replacements, thereby providing a steady revenue stream from the continued use of the joints [

22]. Furthermore, the use of PIP slip joints can contribute to sustainability by reducing the environmental impact associated with frequent replacements and repairs. Traditional tubular joints, due to their shorter lifespan and higher maintenance needs, often result in increased waste and resource consumption. By contrast, the longer lifespan and reduced maintenance requirements of PIP slip joints can lead to a decrease in the overall environmental footprint of the project. In addition to the direct financial and environmental benefits, the adoption of PIP slip joints can also align with broader sustainability goals and regulatory requirements. Many regions have implemented stringent regulations aimed at promoting sustainable practices and reducing environmental impact [

27,

28]. The use of PIP slip joints, with their lower lifecycle costs and reduced environmental impact, can help organizations comply with these regulations and demonstrate their commitment to sustainability.

Overall, the lifecycle sustainability of PIP slip joints compared to traditional tubular joints is influenced by a combination of factors, including initial investment costs, operational costs, potential revenue streams, and environmental impact. By considering these factors, organizations can make informed decisions about the adoption of PIP slip joints, ultimately leading to more sustainable and cost-effective outcomes.

Consequently, adopting PIP slip joints can positively impact the LCOE by lowering fabrication, installation, and maintenance costs, making offshore wind energy more competitive. Their use also promotes environmental benefits, such as reduced emissions and lower waste generation, contributing to economic sustainability [

29,

30,

31]. Therefore, a comprehensive assessment of the lifecycle costs of PIP slip joints versus conventional joints is vital for informed investment decisions. Developers and investors rely on LCCA insights to select the most efficient joint technology, optimizing offshore wind farm economics while ensuring structural integrity and reducing operational risks. Lifecycle sustainability is a critical aspect when evaluating the economic feasibility and overall financial implications of using PIP slip joints compared to traditional tubular joints. This analysis encompasses various factors, including initial investment costs, operational costs related to maintenance and repairs, and potential revenue streams from improved performance and reduced maintenance expenses.

NPV analysis is a critical financial tool used to evaluate the profitability of investment projects by calculating the present value of expected future cash flows [

32,

33,

34]. It is widely used in corporate finance to make informed decisions about project acceptance or rejection. NPV analysis can be enhanced by incorporating various methodologies and sensitivity analyses to account for uncertainties and improve decision-making. The following sections explore different aspects of NPV analysis, as discussed in the provided papers. Embedding NPV analysis into a binomial tree allows for dynamic evaluation over time, accommodating different states of the world. This approach models cash flows with both fixed and variable components, enhancing the analysis of projects with real options [

35,

36,

37]. By considering local climatic conditions, practical retrofit measures, and relevant retrofit costs, these models provide a comprehensive framework for evaluating the financial implications of various renovation strategies [

31].

Another important factor in the NPV analysis is the potential revenue streams generated from improved performance and reduced maintenance expenses [

38,

39]. PIP slip joints may offer superior performance characteristics, such as increased reliability and efficiency, which can translate into higher productivity and reduced downtime. These performance improvements can lead to increased revenue generation, offsetting the initial investment and operational costs. Additionally, the reduced need for maintenance and repairs can result in lower operational disruptions and associated costs, further enhancing the financial attractiveness of PIP slip joints [

34,

40]. The analysis also considers the broader economic implications of adopting PIP slip joints. For instance, the use of these joints may align with sustainability goals by reducing the environmental impact associated with frequent maintenance and repairs.

The primary objective of this study is to assess the overall financial implications of using PIP slip joints in comparison to conventional joint types. The design of various joints was conducted based on the findings of a prior study, which utilized seven years of average monthly wind and wave data from Buan offshore monitoring station (Buan-gun, Jeollabuk-do, South Korea) in Korea (35.667°N, 125.733°E) [

24]. Using this design data, we can calculate both the initial material costs and the fabrication expenses. Initial investment costs are a significant consideration in the adoption of PIP slip joints. These costs include the expenses associated with the procurement and installation of the joints. Also, the installation process for PIP slip joints is different from that of traditional tubular joints, potentially leading to variations in labor and equipment costs. It is essential to account for these differences to provide an accurate comparison of the initial financial outlay required for each joint type [

24,

40]. Operational costs, particularly those related to maintenance and repairs, play a crucial role in the lifecycle cost analysis of the joints. Traditional tubular joints may require more frequent maintenance due to their susceptibility to wear and tear, which can result in higher long-term costs. In contrast, PIP slip joints are designed to offer enhanced durability and reduced maintenance needs, potentially leading to significant cost savings over time. Evaluating these operational costs is vital to understanding the long-term economic benefits of these different connection systems [

41].

The comprehensive NPV analysis of PIP slip joints compared to traditional tubular joints evaluates the initial investment, maintenance, and repair costs, as well as potential revenue gains from enhanced performance and reduced upkeep. This assessment provides a thorough understanding of the financial implications of adopting PIP slip joints, highlighting their economic advantages and viability as an alternative to conventional joint systems.

2. Methodology

This study employs an LCCA and NPV analysis to compare PIP slip joints with traditional tubular joint systems, such as grouted joints and bolted flange joints, in offshore wind turbine foundations. The methodology consists of three major components—Definition and Characteristics, Data Collection, Cost Estimation, and Economic Analysis—to assess the feasibility of PIP slip joints over their lifecycle.

2.1. Definition and Characteristics

PIP slip joints are an innovative structural connection method designed to enhance the performance and ease of the installation of tubular joints. These joints are characterized by their unique configuration, where a smaller diameter pile is inserted into a larger diameter pile, creating a slip joint that allows for relative movement between the two piles. This design offers several advantages over traditional tubular joints, particularly in terms of economic feasibility, installation, maintenance, and lifecycle costs. The primary characteristic of PIP slip joints is their ability to accommodate various loading conditions, including axial loads (e.g., self-weight and vertical loads from superstructures), lateral loads (e.g., wind and wave forces), and combined loading, such as bending moments and shear forces. This flexibility is achieved using frictional contact between the piles, which can be adjusted to optimize the joint’s performance under different loading conditions. Frictional contact is a critical factor in the joint’s behavior, as it influences the load transfer mechanism and the overall stability of the structure.

One of the key benefits of PIP slip joints is their ease of installation. Unlike traditional tubular joints, which often require complex welding and alignment procedures, PIP slip joints can be assembled more quickly and with less specialized equipment. This is particularly advantageous in offshore and remote construction sites, where reducing installation time and labor costs can significantly impact the overall project budget. In previous studies, the maximum likelihood method was applied to estimate the parameters of the fitted probability density functions, emphasizing the critical role of accurate parameter estimation in designing these joints [

19,

25]. Maintenance and lifecycle costs are also important considerations when evaluating the economic feasibility of PIP slip joints. The design of these joints allows for easier inspection and maintenance, as the slip joint can be disassembled and reassembled without the need for extensive welding or cutting. This reduces the downtime and costs associated with maintenance and repairs, leading to potential savings over the lifecycle of the structure. Additionally, the improved performance of PIP slip joints can lead to increased revenue streams from reduced maintenance expenses and enhanced operational efficiency. The initial investment costs for PIP slip joints might be varied compared to those for traditional tubular joints due to the need for materials and manufacturing processes. However, these costs can be offset by the savings in installation and maintenance expenses, as well as the potential for improved performance and longer service life. The overall financial implications of using PIP slip joints must be carefully evaluated, considering the specific requirements and constraints of each project.

The comparison between PIP slip joints and traditional tubular joints is multifaceted, encompassing various economic and technical aspects. One of the primary considerations is the initial investment cost. Traditional tubular joints generally have lower upfront costs due to their simple design and familiarity. When analyzing the cost, the key areas of analysis are as follows.

Material Costs: Comparing the cost of the materials used for different types of joints.

Installation Costs: Compare the costs of installing PIP slip joints, bolted joints, and grout joints, considering factors such as labor, equipment, and site preparation.

Maintenance Costs: Evaluate the expected maintenance requirements and costs for each joint type over their lifespan.

Upgradation and Retrofitting Costs: Assess the costs associated with modifying existing structures using different joint types.

Disassembly and Transportation Costs: Compare the costs of dismantling and transporting structures with different joint types.

Risk Assessment: Identify potential risks associated with each joint type and quantify their financial impact.

Another pivotal cost parameter is welding cost, which can significantly influence the initial cost. Welding material costs can vary widely based on several factors, including the type of materials used, the welding process, and the specific requirements of the project. Here is a breakdown of different welding material costs:

Base Metals: The cost of the base metal is a significant factor in welding expenses. For instance, in one paper, S420ML steel is used, which is a structural steel that meets specific standards. The price of structural steel can fluctuate based on market conditions, availability, and the specifications required for the project [

42].

Filler Materials: Filler materials, such as welding wires or rods, are essential for many welding processes. For example, the use of HTW-58 welding wire—known for its specific mechanical properties and chemical composition—has been documented in previous studies [

43]. The cost of filler materials can vary based on their type, diameter, and manufacturer. Generally, higher-quality filler materials that match or exceed the properties of the base metal may come at a premium.

Shielding Gases: In processes like CO

2 gas-shielded arc welding, the cost of shielding gases is an important consideration. The price of gases such as argon, carbon dioxide, or mixed gases can vary based on purity, supplier, and regional availability. These gases are crucial for protecting the weld pool from contamination during the welding process [

44].

Consumables: Other consumables, such as flux, electrodes, and protective gear, also contribute to the overall material costs. The choice of consumables can depend on the welding process and the specific requirements of the job [

45].

Surface Preparation Materials: Before welding, surface preparation may require additional materials, such as cleaning agents or heating equipment. Surfaces are typically heated before welding, which may involve costs related to heating equipment and fuel usage, as documented in prior studies [

46].

Post-Welding Treatment Materials: After welding, materials for stress relief, inspection, and finishing may also incur costs. These treatments are essential for ensuring the integrity and performance of the welded structure [

47].

The loading factors for the different joint types were carefully extracted from a comprehensive analysis of a 15 MW wind turbine design, ensuring a robust foundation for our engineering approach [

23]. Following that study, the average monthly wind load over 7 years at Buan (an offshore site in South Korea) was used, as per

Figure 2 [

24].

Accurate and comprehensive data acquisition forms the foundation of reliable wind economic modeling. This section presents a detailed description of the raw dataset and experimental conditions employed in the present study. The primary source of data is the Korea Meteorological Administration (KMA), which offers long-term offshore wind and wave observations. These datasets encompass critical meteorological and oceanographic variables, including wind speed, wind direction, air temperature, wave height, wave period, and water temperature, all recorded with high temporal resolution.

Table 1 summarizes the key characteristics of the wind dataset utilized, acquired from the Buan offshore monitoring station in Korea. Wind measurements were taken at a height of 10 m above mean sea level with a temporal resolution of 10 min, enabling high-frequency monitoring. Wind speed and direction were captured using ultrasonic anemometers mounted on automatic weather stations (AWS) and buoys, with measurement accuracies of ±0.3 m/s and ±3°, respectively. Air temperature data, recorded by AWS, exhibited a precision of ±0.1 °C, ensuring dependable meteorological input. The extended data record spanning from 2017 to 2023 provided a robust basis for developing an economically optimized wind energy model. Please note that in

Table 1, TI is measured turbulence intensity in % and St. Dev. is standard deviation in measured wind speed.

DNV-ST-0126 guides the design of the grout joint (refer to Section 6 for grouted connections and Appendix C for the design of grouted connections). DNV-OS-C502 is used for concrete strength [

4,

48]. For the design of bolted flange joints, EN-1993-1-8 (2005, Section 3.6.1) and IEC 61400-6 (2020, Section 6.7.2) have been utilized [

49,

50].

Conversely, the structural design of the PIP slip joint has been developed through insights from prior research and experimental model results [

19]. The dimensions of three different joints are provided in the following

Table 2,

Table 3 and

Table 4. In each case, S355 steel is used [

50].

2.2. Data Collection

To ensure a comprehensive and standardized comparison among different joint types, data were collected from a variety of credible sources. These included industry reports on offshore wind energy projects, manufacturer specifications for joint materials and fabrication, historical data on installation and maintenance costs, and peer-reviewed research evaluating the structural and economic performance of grouted, bolted flange, and PIP slip joints.

The support structure cost data were obtained from the references listed in

Section 2.1, which provide robust and previously validated estimates. The structural designs were developed according to a prior study on PIP slip joints, as well as NORSOK and Eurocode standards, from which accurate dimensions were derived [

19,

50,

51]. These dimensions enabled detailed material quantity estimations, which in turn contributed to the calculation of initial material and fabrication costs.

Several assumptions were made to standardize the comparative analysis. All joint types were assumed to meet the same structural performance criteria. Installation scenarios were modeled under moderate offshore conditions. The lifecycle of the project was fixed at 20 years, a duration that aligns with standard industry practices for offshore wind infrastructure and is commonly adopted in lifecycle cost assessments and financial feasibility studies [

36,

38,

52]. This timeframe reflects the typical operational lifespan of wind turbines and associated substructures before major refurbishment or decommissioning is required. The discount rate applied in the net present value (NPV) analysis is based on prevailing financial market conditions, typically ranging between 6 and 8% for offshore energy projects, and accounts for investment risk, inflation expectations, and opportunity cost [

19,

52].

2.3. Economic Analysis

The economic viability of PIP slip joints is assessed through

LCCA and

NPV analysis to compare long-term costs and benefits. The

LCCA methodology accounts for all costs incurred throughout the lifespan of the offshore wind foundation, including initial investment, installation, maintenance, and decommissioning [

53,

54,

55].

The total lifecycle cost (

Ct) is calculated using

where

Cinit is the initial investment cost,

Cinstall covers installation expenses,

Cmaint represents periodic maintenance costs, and

Cdecom includes the final decommissioning costs. The discount rate

r accounts for the time value of money, and

t represents each year of the project’s lifespan.

The initial cost also includes factors such as the turbine cost, foundation cost, and others. This can be detailed as shown in Equation (2).

where

Cturb: Turbine cost—procurement and transportation of wind turbine components.

Cfound: Foundation cost—materials and design associated with the selected joint type.

Cfab: Fabrication cost—manufacturing costs of structural elements, including joints.

Cdev: Development and other costs—includes permitting, engineering, design studies, insurance, and contingencies.

In addition to lifecycle cost estimation, the

NPV method is used to assess the present value of future costs and revenues associated with each joint system. The

NPV is calculated using

where

Rt is the revenue or cost savings in year

t.

A higher NPV signifies better economic feasibility and cost-effectiveness.

Another key financial metric, the

LCOE, is used to determine the overall cost of generating electricity when considering the different joint types of offshore wind farms. The

LCOE is defined as

Here, Et is the energy generated in year t.

A lower LCOE implies that the joint system is more cost-efficient in energy production.

The IRR is the discount rate at which the NPV of all future cash flows equals zero. It shows the expected annual rate of return on the investment.

The formula for the IRR is the same as the NPV equation—but instead of solving for NPV, you solve for the discount rate r that makes NPV = 0.

Therefore,

where

is the net cash flow in year

t.

For this condition, r = IRR.

Another important parameter is the Benefit–Cost Ratio, which is extensively studied in this paper. It is a financial metric used in cost–benefit analysis to evaluate the economic feasibility or efficiency of a project or investment. The Benefit–Cost Ratio (

BCR) is the ratio of the PV of benefits to the present value of costs over the lifetime of a project.

In case of BCR,

BCR > 1: Project is economically viable (benefits outweighs the costs).

BCR = 1: Break-even point (benefits equal costs).

BCR < 1: Project is not economically viable (costs outweigh the benefits).

To understand a quick snapshot of profitability and for easy comparison between different projects and joint types, the rate of investment (

ROI) is widely used, which measures the profitability of an investment. This financial metric shows how much return you earn on an investment relative to its cost. It can be expressed as follows:

where

Net Profit = Total Revenue—Total Costs.

Total Investment = Initial Capital or Total Cost of the Project.

2.4. Comparative Analysis

Once the

NPV,

LCOE, and total lifecycle costs are computed for each joint system, a comparative analysis is conducted to determine the most cost-effective solution [

56,

57,

58]. The analysis identifies which system offers the best trade-off between structural performance and economic viability. Key cost drivers, such as fabrication expenses, maintenance frequency, and material costs, are examined to highlight areas where cost reductions can be achieved. The results are presented through graphical representations, featuring several bar charts that compare total lifecycle costs, NPV trends, LCOE, and additional comparisons, as shown in Figures 5–9.

3. Result and Discussion

3.1. Average Financial Performance Metrics

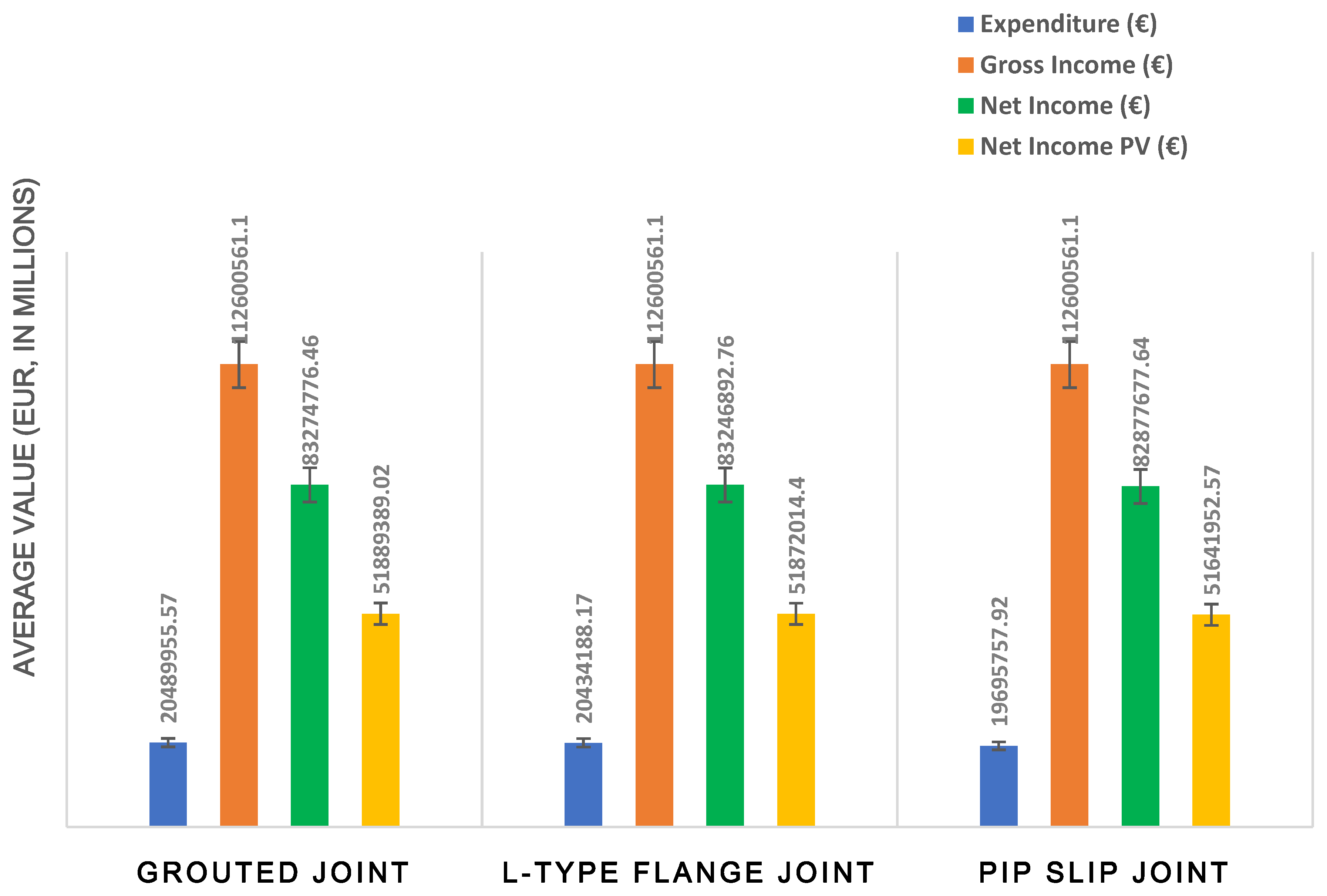

A comparative financial analysis of three different joint types—grouted joint, bolted flange joint, and PIP slip joint—was performed, as per

Figure 3. While the gross income remains largely consistent across all joint configurations, attributable to uniform project output assumptions, a detailed analysis reveals nuanced differences in net income and net present value (NPV). The grouted joint demonstrates the highest net income, followed closely by the bolted flange joint. In contrast, the PIP slip joint exhibits a slightly lower net income, primarily due to its reduced capital and operational expenditures, thereby underscoring its cost efficiency. Correspondingly, the NPV values indicate minimal variation, yet they reflect the same expenditure dynamics observed in net income.

NPV, or net present value, is an essential metric that takes into account the time value of money by discounting future cash flows to present-day values. It considers risk, inflation, and opportunity costs, providing a solid measure of long-term financial viability. Although the grouted joint has a marginally higher NPV, the PIP slip joint excels in other financial indicators, such as payback period, internal rate of return (IRR), and annualized costs, which are further discussed in

Section 3.1.

These results reveal an important insight: while the financial profiles of different joint types seem similar at first glance, a deeper economic evaluation highlights the PIP slip joint’s advantages in cost efficiency and risk mitigation. Its lower initial investment, simpler installation process, and reduced maintenance requirements make it a compelling option—especially for offshore wind projects that prioritize shorter construction timelines and lower upfront costs.

Furthermore, the recent literature supports the practical applicability of slip-joint technology in offshore environments, noting benefits such as vibration-assisted installation and removal, as well as adaptability for modular turbine structures [

21,

22]. While differences in net income present value are relatively minor, a comprehensive decision-making framework that considers structural, logistical, and economic factors reinforces the suitability of PIP slip joints as an optimal solution for future wind turbine foundations.

3.2. Annual Expenditure Comparison

Annual expenditure comparison refers to the analysis of how much is spent each year across different options—in this case, the three joint types: grouted joint, bolted flange joint, and PIP slip joint (

Figure 3). It allows stakeholders to evaluate operational efficiency, cost-effectiveness, and long-term financial impact by comparing year-by-year expenses such as maintenance, inspection, and minor repairs. For this study, the expenditure comparison is shown in

Figure 4. The graph shows that all three joint types incur high initial capital expenditures in the first year, representing fabrication and installation costs, with the grouted joint having the highest cost, followed by the bolted flange joint, while the PIP slip joint has the lowest initial investment—making it the most cost-effective option at the start. From year 2 onward, the expenditures stabilize across all joint types, reflecting consistent and relatively low annual operation and maintenance costs (approximately EUR 380,687). While the differences are minor, the PIP slip joint consistently exhibits the lowest ongoing costs, indicating greater financial efficiency throughout the project’s lifetime. The graph illustrates the expenditure trends over a 21-year period for three joint types—grouted joints, bolted flange joints, and PIP slip joints. The initial capital expenditures are highest in year 0, with the grouted joint costing EUR 12.88 million, the bolted flange joint EUR 12.82 million, and the PIP slip joint costing the lowest at EUR 12.08 million. From year 1, expenditures drop sharply by over 96% to EUR 380,687.40 for all joints, representing ongoing operation and maintenance costs. This amount remains stable through to year 21, highlighting consistent annual spending. On average, the PIP slip joint demonstrates the lowest mean annual expenditure (EUR 937,893.23), followed by the bolted flange joint (EUR 973,056.58) and the grouted joint (EUR 975,712.17), reinforcing the PIP slip joint’s cost-efficiency across the project lifespan.

3.3. Cost of Energy and Rate of Return

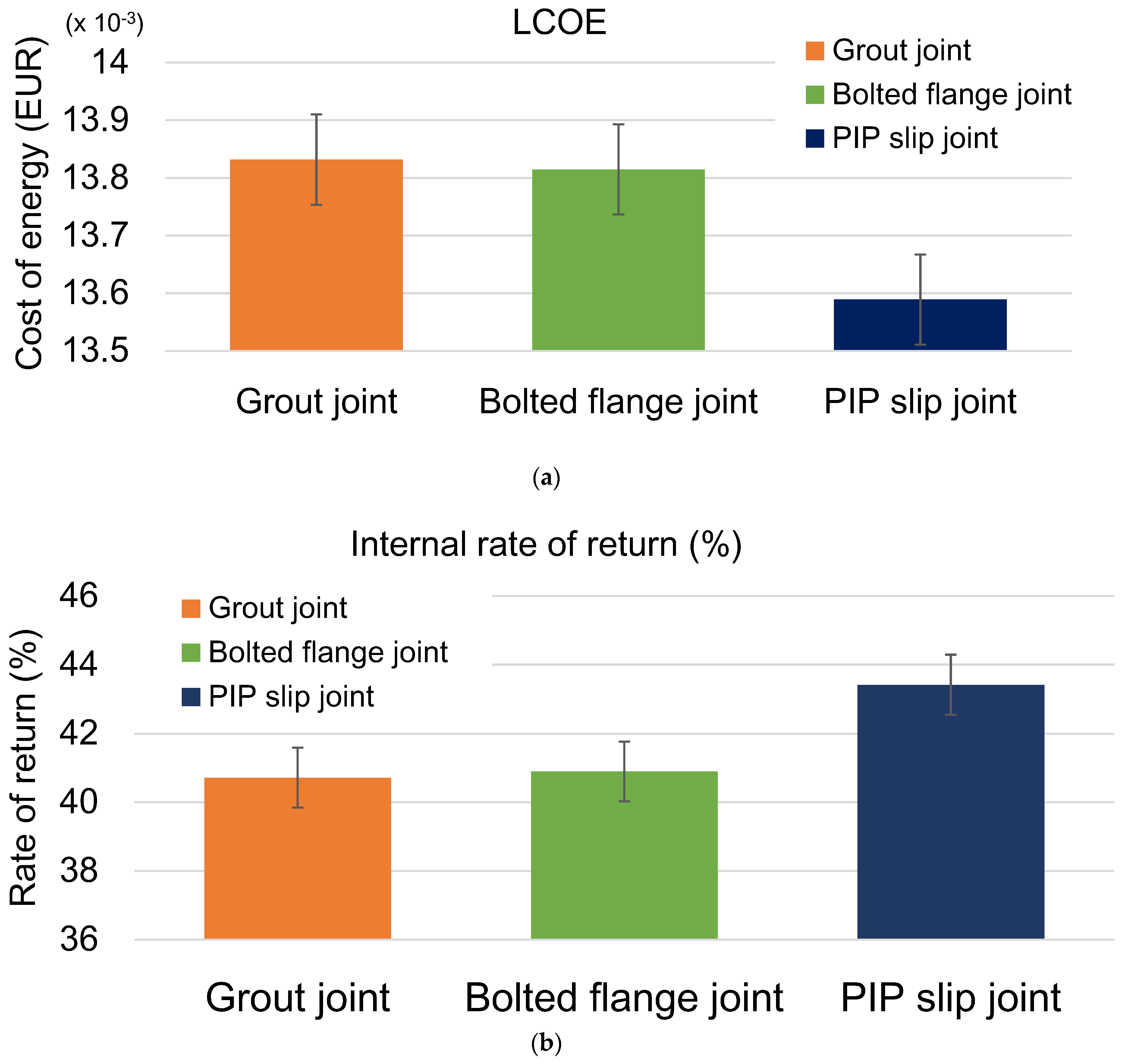

In

Figure 5, the LCOE and the IRR are presented. From the plot, it is evident that the PIP slip joint emerges as the most financially advantageous option among the three joint types evaluated. With an IRR of 43.42%, it surpasses the grout joint by 6.63% and the bolted flange joint by 6.16%, thereby providing the highest return on investment. Furthermore, it features the lowest LCOE at 0.0136 EUR/kWh, establishing it as the most cost-effective solution for energy production. This remarkable performance is corroborated by additional key metrics, including the highest NPV, the shortest payback period, the highest BCR, the highest ROI, and the lowest annualized cost, affirming its overall dominance across financial indicators.

While the grout joint and bolted flange joint do not demonstrate the same level of financial superiority as the PIP slip joint, their performance metrics are closely comparable. The IRR of the bolted flange joint is recorded at 40.9%, which is marginally higher than the IRR of the grout joint at 40.72%. Regarding LCOE, the bolted flange joint (0.013814 EUR/kWh) is only 0.12% lower than that of the grout joint. These minimal differences suggest that the decision between these two options may rely more on practical considerations, such as structural performance, installation complexity, or long-term maintenance, rather than exclusively on financial factors.

All three joint types demonstrate strong financial viability, as evidenced by IRRs that notably exceed the typical discount rates used in offshore wind investment assessments (commonly ranging between 7% and 10%). Among them, the PIP slip joint stands out due to its exceptionally high IRR and lower Levelized Cost of Energy (LCOE), making it the most financially attractive option for stakeholders aiming to optimize investment returns and reduce energy production costs.

This superior performance is largely driven by the PIP system’s reduced initial capital expenditure, simplified installation process, and lower ongoing maintenance requirements, all of which contribute to lower annualized costs. These economic efficiencies not only enhance short-term profitability, but also support long-term operational sustainability. As a result, the PIP slip joint presents a compelling case for adoption in offshore wind developments where cost-effectiveness, streamlined deployment, and lifecycle performance are critical to project success.

3.4. Net Present Value

The NPV analysis of joint types in offshore wind structures, as per

Figure 6, reveals significant insights into their long-term financial viability, as depicted in the bar chart comparing grout joints, bolted flange joints, and PIP slip joints. The PIP slip joint demonstrates the highest NPV at EUR 39.559 M, surpassing grout joints (EUR 39.013 M) by 1.40% and bolted flange joints (39.051 EUR M) by 1.30%, indicating its superior profitability over the project’s lifetime. This advantage can be attributed to PIP slip joint’s streamlined installation process and enhanced durability, which minimize operational costs and extend service life, thereby maximizing discounted cash flows. In contrast, the negligible 0.10% difference between grout joints and bolted flange joints suggests comparable financial performance, with the latter holding a marginal edge. These findings, consistent with PIP slip joint’s leadership in other financial metrics, such as LCOE, IRR, and ROI, underscore its potential to optimize the economic performance of offshore wind farms, offering a compelling case for its adoption in future projects aiming to balance cost-efficiency with long-term returns.

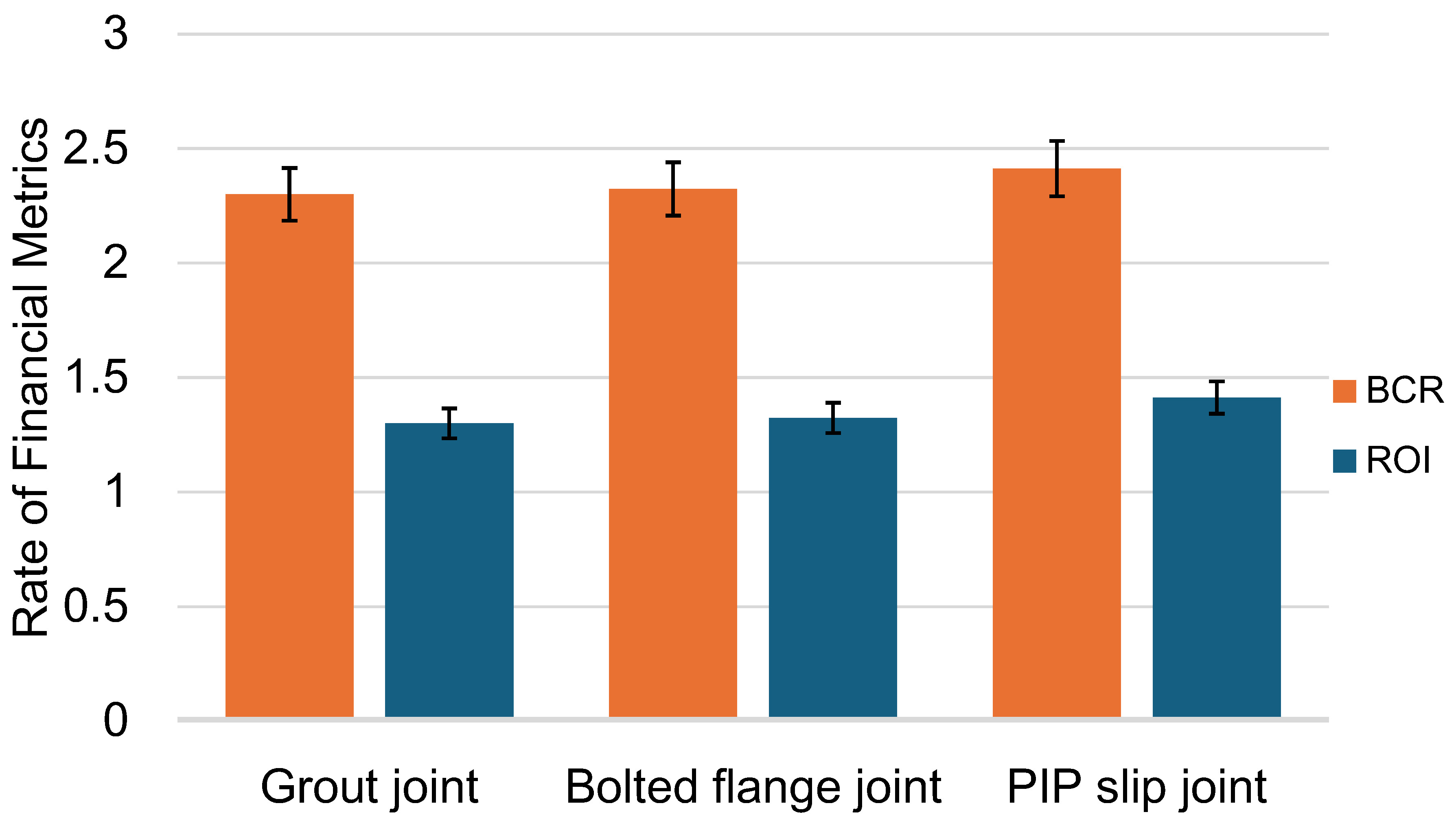

3.5. Benefit–Cost Ratio (BCR) and Return on Investment (ROI)

The comparative analysis of BCR and ROI for grout joints, bolted flange joints, and PIP slip joints, as depicted in the bar chart, underscores the superior economic performance of PIP slip joints in offshore wind applications (

Figure 7). With a BCR of 2.413 and an ROI of 141.29%, the PIP slip joint surpasses the grout joint (BCR: 2.300, ROI: 130.04%) and bolted flange joint (BCR: 2.324, ROI: 132.38%) by 4.91% and 3.83% in BCR, and 8.65% and 6.73% in ROI, respectively, highlighting its ability to deliver the highest economic benefits and returns per euro invested. This advantage stems from the PIP slip joint’s higher NPV (EUR 39.559 M) and lower initial investment (EUR 28 M), which enhance its profitability and cost-efficiency. The marginal differences between grout joints and bolted flange joints (1.04% in BCR and 1.80% in ROI) indicate similar economic viability, though the bolted flange joint performs slightly better. These findings, consistent with PIP slip joint’s leadership in LCOE, IRR, and payback period, position it as the optimal choice for offshore wind projects, balancing economic feasibility with high financial returns, thereby supporting sustainable investment decisions in renewable energy infrastructure.

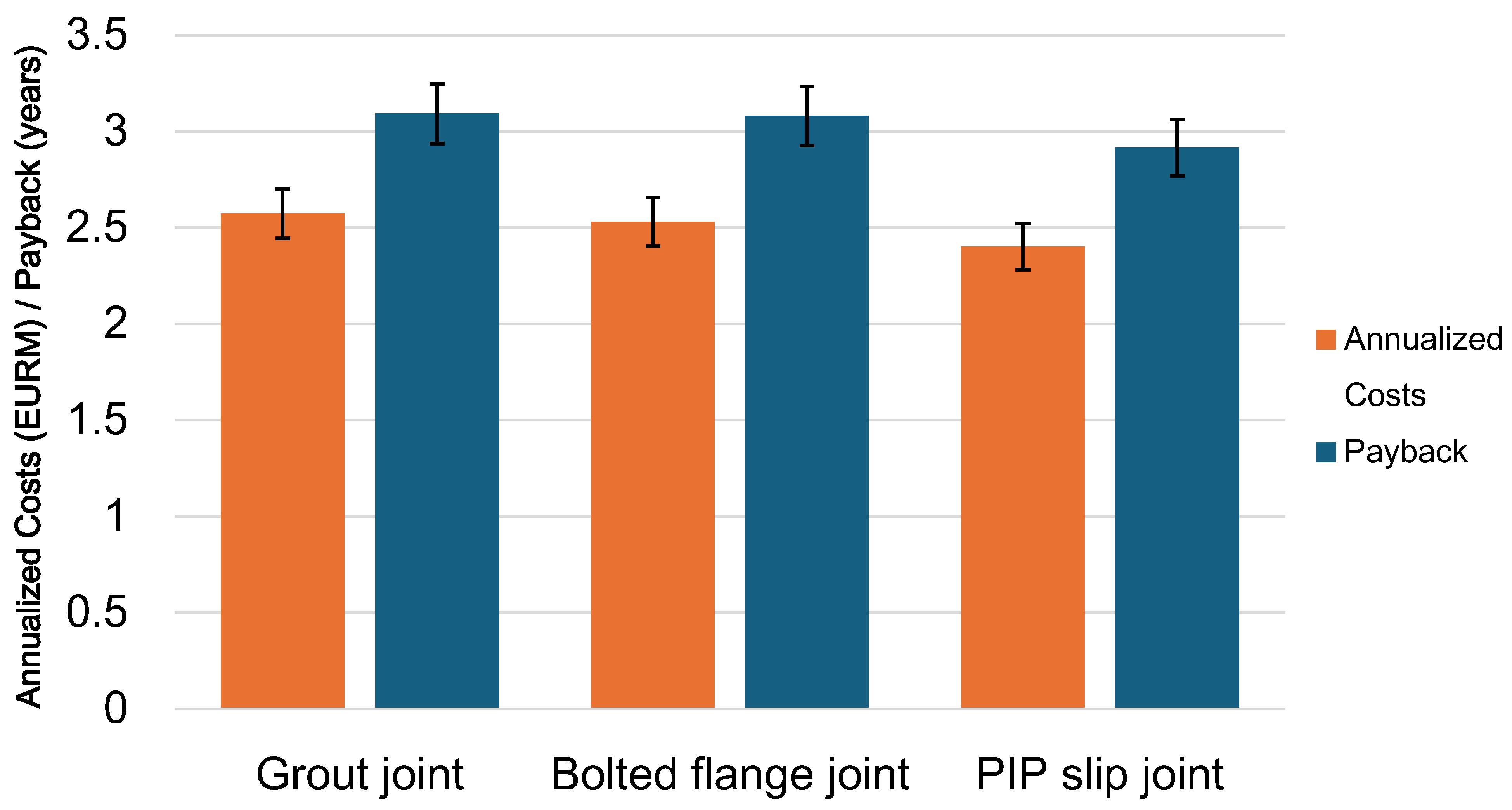

3.6. Advantages in Annualized Cost and Payback Period

The bar chart in

Figure 8, comparing annualized costs and payback period for grout joints, bolted flange joints, and PIP slip joints in offshore wind applications, underscores the financial superiority of the PIP slip joint, with the lowest annualized costs of EUR 2.402 M/year and the shortest payback period of 2.915 years. These figures represent a 6.68% reduction in annualized costs and a 5.72% shorter payback period compared to grout joints (EUR 2.574 M/year, 3.092 years), and a 5.10% and 5.34% improvement over bolted flange joints (EUR 2.531 M/year, 3.080 years), respectively, highlighting the PIP slip joint’s enhanced affordability and reduced financial risk due to its lower initial investment (EUR 28 M). The marginal differences between grout joints and bolted flange joints (1.67% in annualized costs and 0.40% in payback period) indicate similar financial performance, with bolted flange joints being slightly more efficient. These findings, consistent with the PIP slip joint’s leadership in LCOE, IRR, and NPV, position it as the optimal choice for offshore wind projects, offering a compelling balance of cost-efficiency, quick investment recovery, and long-term financial sustainability, thereby supporting informed decision-making for renewable energy investments.

3.7. Performance Advantage

The bar chart presented in

Figure 9 illustrates the percentage differences in payback period, NPV, and LCOE, which are the three major parameters for comparing the PIP slip joint compared to the bolted flange joint and grout joint. This data highlights the superior financial performance of the PIP slip joint in offshore wind applications.

The PIP slip joint has a payback period that is 5.34% shorter than that of the bolted flange joint and 5.72% shorter than the grout joint, indicating faster investment recovery at 2.916 years, which helps minimize financial risk. Additionally, its NPV, at EUR 39.559 M, is 1.30% higher than that of the bolted flange joint and 1.40% higher than the grout joint. This suggests enhanced long-term profitability, driven by reduced operational costs and improved structural reliability.

Furthermore, the LCOE of the PIP slip joint, at 0.014, is 1.63% lower than that of the bolted flange joint and 1.76% lower than the grout joint, underscoring its cost efficiency in energy production—a critical factor for the competitiveness of offshore wind energy.

These findings support the PIP slip joint’s leadership in IRR, BCR, and ROI, positioning it as the optimal joint type for maximizing economic returns and sustainability in offshore wind projects. This provides a compelling case for its adoption in future developments.

The findings of this study regarding the economic and operational benefits of PIP slip joints are consistent with conclusions drawn from existing technical reports and the peer-reviewed literature. For instance, a prior study demonstrated the practical viability of slip-joint systems, highlighting their advantages in terms of simplified installation and decommissioning processes, as well as reduced environmental footprint [

21]. Similarly, another study identified the growing interest in alternative connection technologies, such as PIP joints, within the offshore wind sector as part of broader trends towards cost reduction and structural efficiency [

22]. However, despite their promising attributes, PIP slip joints still face several limitations. These include a lack of long-term fatigue data under combined loading conditions, limited design standardization within current regulatory frameworks (e.g., DNV-ST-0126 and IEC 61400-3-1), and potential challenges related to manufacturing tolerances and installation alignment [

4,

49]. These limitations underscore the need for further field validation, industry-specific guidelines, and full-scale demonstration projects to support widespread adoption. Nonetheless, the present analysis demonstrates that, when evaluated through a lifecycle cost perspective, PIP slip joints offer a technically and economically viable alternative for offshore wind foundation connections.

4. Conclusions

A comprehensive financial assessment comparing three offshore wind monopile joint types—grouted joints, bolted flange joints, and PIP slip joints—reveals the PIP slip joint as the most cost-effective and financially superior option. While gross income remains consistent across all types, the PIP slip joint stands out due to its lowest initial investment, simplest installation, and minimal annual operational costs. Although the grouted joint shows slightly higher net income PV, the PIP slip joint offers improved short-term profitability, reduced financial risk, and better suitability for projects prioritizing streamlined implementation.

Across key financial metrics such as NPV, LCOE, IRR, ROI, BCR, and payback period, the PIP slip joint consistently ranks highest. For instance, it has the highest IRR (43.42%), lowest LCOE (0.0136 EUR/kWh), and the shortest payback period (2.92 years), confirming its overall dominance. While bolted flange and grouted joints offer similar financial results, their marginal differences indicate that practical factors like ease of installation and structural performance may influence the final choice between them.

The expenditure analysis further supports the PIP slip joint’s long-term cost efficiency, with the lowest average annual expenditure (EUR 937,893) and highest financial performance sustainability. This joint type’s 1.4% higher NPV, 5.72% shorter payback period, and 1.76% lower LCOE compared to the grouted joint highlights its superior economic return and energy cost reduction capabilities. Overall, the PIP slip joint emerges as the optimal choice for offshore wind projects aiming for financial viability, reduced risk, and sustainable energy production.