1. Introduction

Modernising agriculture necessitates the development of an efficient agricultural supply chain that connects producers, enterprises, and consumers. Historically, this supply chain has faced challenges such as lengthy sales processes and high costs. The introduction of the “Agricultural and Supermarket Docking” model has addressed these issues by enabling direct sales to supermarkets [

1], thereby eliminating intermediaries and reducing costs. This streamlined approach enhances efficiency, benefiting both producers and consumers, and results in a more resilient and responsive agricultural system.

The rise of rural e-commerce has become a crucial driver of agricultural development, a trend accelerated by the COVID-19 pandemic [

2,

3]. As consumers increasingly turned to online shopping for safety and convenience, the agricultural supply chain evolved to operate under a dual-channel model that combines offline supermarket docking with online e-commerce direct sales. This allows producers to sell agricultural products to retailers through offline channels while simultaneously reaching consumers directly via e-commerce platforms using methods such as live streaming. This online direct sales model helps farmers and leading agricultural enterprises meet consumer demand more effectively, breaking down information barriers and mitigating issues of overproduction and unsold stock caused by information asymmetry. Additionally, with more sales channels available, producers’ bargaining power within the supply chain is enhanced.

Despite these advancements, the traditional agricultural supply chain often places farmers in a disadvantaged negotiating position due to their dispersed and small-scale operations. They typically wait passively for retailers to purchase their products at prices set by the retailers. Consequently, the profit gained by farmers represents a relatively insignificant proportion of the overall profit generated by the supply chain. The mode of “leading enterprises + farmers” can help solve this problem. This mode refers to a strategic partnership where small-scale farmers collaborate with larger, well-established agricultural enterprises, known as leading enterprises. These leading enterprises, typically large companies or cooperatives with significant market power, centralise the purchase and distribution of agricultural products produced by the farmers. This arrangement enhances the bargaining power of small farmers, ensuring a steady supply of products while allowing them to benefit from the resources and influence of the leading enterprises. As a result, small farmers are transformed from decentralised producers into a cohesive group under the leadership of these core enterprises, which play a central role in the supply chain by holding substantial influence and high user preference.

However, there are notable differences in the level of logistics services between various distribution channels, including logistics delivery time and after-sales services, which significantly affect the demand for agricultural products. This paper examines the impact of these logistics differences, starting with the “leading enterprises + farmers” agricultural production mode, and focuses on the decision-making problems in the supply chain of the agricultural producers represented by leading enterprises. This paper aims to address a critical gap in the existing literature by analysing the role of logistics service levels in agricultural supply chains, particularly within a dual-channel framework. We try to develop and validate a model under centralised decision-making and decentralised decision-making that examines how different logistics service levels affect supply chain performance and decision-making processes. Specifically, we studied the supply chain channel selection and optimal decision-making problem under centralised decision-making and decentralised decision-making that incorporates logistics service levels, which contributes to understanding how integrating online channels influences the profitability and operational strategies of the agricultural supply chain, particularly in light of the logistics service considerations.

The remaining sections of the study are organised as follows. A literature review is presented in

Section 2. The model description and assumptions are presented in

Section 3. The models for centralised and decentralised decision-making are discussed in

Section 4 and

Section 5. Finally, we present the results of the sensitivity analysis in

Section 6 and give conclusions in

Section 7.

2. Literature Review

In this section, we divide the literature review into two sub-sections. The first sub-section reviews the representative studies on the agricultural supply chain, and the second sub-section introduces the dual-channel supply chain related to the problem studied in this paper.

2.1. Agricultural Supply Chain

The agricultural supply chain contains the whole process of agricultural products from production to sales, how to make a contract to achieve the coordination of the interests of all the subjects in the agricultural supply chain, how to make pricing decisions under the influence of different factors, how to deal with the impact of the New Crown epidemic in the agricultural supply chain, and how to realise the construction of information technology in the agricultural supply chain, which are all urgent problems to be researched in the agricultural supply chain, and therefore, at present, the research on the agricultural supply chain mainly focuses on three aspects. Research on the agricultural supply chain mainly focuses on the three aspects of supply chain coordination, supply chain risk, and agricultural informatisation.

Zi et al. [

4] studied a three-level fresh produce supply chain, analysed the impacts of a flexible quantity contract and relational contract on the supply chain, and found that the former can effectively improve the overall profit and efficiency of the produce supply chain, and the latter can improve the optimal freshness level and the overall profit of the supply chain through incentives. Pancino et al. [

5] used Barilla’s agri-food supply chain as a case study to discuss the supply chain sustainability and cooperation and concluded through empirical analysis that the supply chain sustainability and cooperation can be achieved in the agricultural supply chain. Barilla concluded that horizontal contracts should be developed between the three supplier partners, and supply contracts should be developed between suppliers and buyers. Huo et al. [

6] analysed the collaboration strategies of producers and retailers in a farmer cooperative-led agri-food supply chain, and found that the introduction of incentives and disincentives under the strategy of strengthened regulation could increase the probability of collaboration and promote supply chain coordination.

Sharma et al. [

7] analysed agricultural supply chains under disruptions during the New Crown epidemic, assessed the supply and demand risks, financial risks, etc. faced by different types of firms in the supply chain based on multicriteria decision-making and recommended that firms adopt advanced Industry 4.0 technologies to reduce risks by improving supply chain agility. Aday et al. [

8] analysed the impact of the New Crown epidemic on agri-food supply chains, i.e., the New Crown epidemic both promoted the optimisation of risk-coping mechanisms and caused losses for small producers and operators, and based on this, they put forward recommendations to strengthen demand forecasting, develop e-commerce platforms, and use information technology, among other recommendations.

Seydanlou et al. [

9] proposed a practical optimisation model for sustainable closed-loop supply chain (SCLSC) management in the agricultural industry, focusing on the olive crop in Iran. The study emphasised the importance of considering economic, environmental, and social sustainability (the triple bottom line) in supply chain decisions, particularly under uncertainty.

Fang et al. [

10] conducted an evaluation study of agricultural supply chains with the application of IoT technology, noting that IoT technology can optimise supply chain processes, reduce supply chain costs, and improve the quality of agricultural products. Based on the survey data on small farmers in developing countries, Perdana et al. [

11] proposed a distributed governance approach for the logistics network of the agricultural supply chain which can effectively reduce the information delay between the upstream and downstream of the supply chain and lower the logistics cost.

2.2. Dual-Channel Supply Chain

A dual-channel supply chain can be defined as a supply chain that exists concurrently with both a producer’s direct sales channel and a traditional retailer’s distribution channel. The advent of the Internet has precipitated a shift in consumer purchasing patterns, with an increasing number of consumers opting to purchase products directly from producers via e-commerce platforms. This has led to the emergence of a hybrid model, characterised by the coexistence of online direct sales channels and offline distribution channels. The majority of research conducted on dual-channel supply chains focuses on three key areas: pricing strategy, channel selection, and channel coordination.

Balasubramanian [

12] conducted an early study on dual-channel supply chains, established a mathematical model for analysing the Nash equilibrium under pricing decisions, and highlighted that the addition of direct sellers will have an impact on existing retailers. Mondal et al. [

13] conducted a study on green supply chains with reverse logistics, calculating the pricing decisions and green strategies of different subjects as core enterprises. Their findings revealed the existence of a market share threshold, determining whether a producer enterprise would choose to open a direct sales channel. Perlman et al. [

14] considered a scenario where a supplier provides both organic and conventional agricultural products and analysed the optimal pricing decisions and consumer demand for a dual-channel supply chain in such circumstances. In their study on the pricing decision problem in a dual-channel supply chain, Li et al. [

15] considered the retailer’s tendency towards fairness in a closed-loop dual-channel supply chain. They concluded that while the retailer’s risk aversion may increase the manufacturer’s profit, the manufacturer’s profit may also be decreased by the retailer’s fairness concerns.

Although the development of e-commerce has brought about a boom in online shopping, it is not clear whether the addition of new online channels is profitable for each subject in the supply chain. Zong et al. [

16] studied the channel choice problem for producers in the supply chain and found that producers can choose an online dual-channel sales strategy when the consumers in the new channel are price-insensitive. Tao et al. [

17] analysed the pricing and channel choice problems when producers sell green products to environmentally conscious consumers. They conducted an analysis of the pricing and channel selection problems when producers sell green products to environmentally conscious consumers. They proposed that consumers’ green awareness affects the channel selection behaviour of supply chain members. Fathollahi-Fard et al. [

18] proposes a dual-channel, multi-product, multi-period, multi-echelon closed-loop supply chain under uncertainty for the tyre industry. They find that setting the appropriate prices in different channels for the available tyre types is critical for sustainable tyre supply chain management.

2.3. Literature Summary

This section presents a literature review on the subjects of agricultural supply chains and dual-channel supply chains, examining the existing research in these areas from two perspectives. The main literature is summarised in

Table 1.

From

Table 1, it can be seen that there are still several underexplored areas:

- (1)

While much research has focused on supply chain coordination, risk management, and the implementation of information technology, there is comparatively less investigation into the issue of dual-channels within agricultural supply chains.

- (2)

The majority of studies on dual-channel supply chains employ mathematical models and game theory to analyse decision-making by supply chain actors. However, few papers consider how the logistics service level of the different channels influences supply chain efficiency and decision-making.

This research aims to address these gaps by examining how the level of logistics services in different channels affects decision-making in agricultural supply chains, thereby contributing to a deeper understanding of the logistics service dimension in supply chain management.

3. Model Description and Assumptions

This section presents the model description and assumptions, where

Section 3.1 presents the model description and

Section 3.2 sets the assumptions of the model.

3.1. Model Description

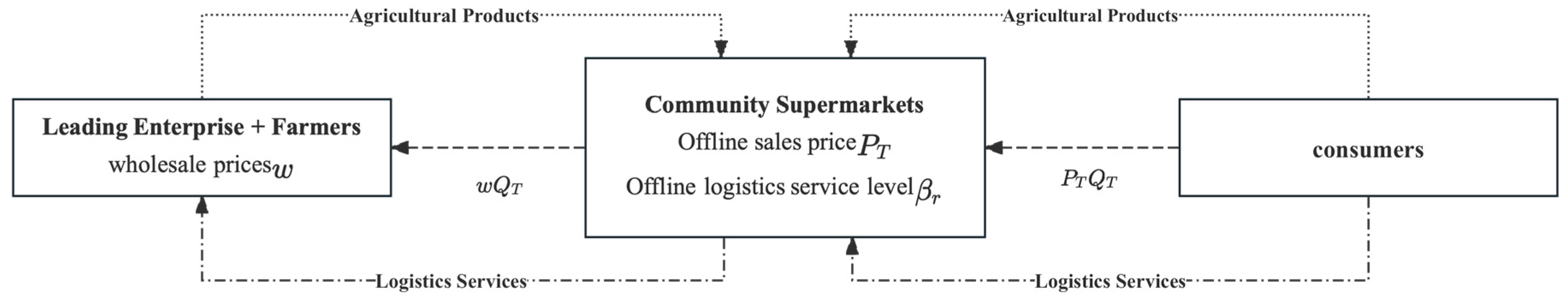

Under the single-channel model, leading agricultural product producers distribute agricultural products to community superstores only through traditional offline channels, and the community superstores decide the level of offline logistics services, bear the logistics costs of agricultural products such as warehousing and transport, and sell the agricultural products to consumers. Under the dual-channel model, leading agricultural producers distribute agricultural products to community superstores through traditional channels and sell agricultural products directly to consumers through online e-commerce platforms. Leading producers also decide the level of online logistics services and bear the logistics costs corresponding to online sales.

Figure 1 and

Figure 2 show the structure of the single-channel agricultural supply chain and the dual-channel agricultural supply chain, respectively.

Table 2 shows the notations and descriptions for this paper.

3.2. Assumptions

The assumptions of this paper are as follows:

Assumption 1: Based on Green et al. [

19]’s research, it can be assumed that the market demand for agricultural products is linearly related to the sales price and logistics service level of the product. It is negatively correlated with the sales price and positively correlated with the logistics service level.

In the single-channel model, producers distribute agricultural products to retailers only through offline traditional channels; at this time, there is only a market demand for traditional channels, and some of the potential market demand has not been stimulated. With the market demand

for agricultural products in the single-channel model, the demand function is:

Assumption 2: There is a substitution effect between products sold in different channels. It can be posited that market demand in the channel increases in direct proportion to the market price in the channel, and that this effect is linearly positively correlated.

In the dual-channel supply chain model, producers are able to distribute agricultural products through traditional offline channels as well as sell them directly through online channels. This results in the coexistence of online and offline market demand, which in turn stimulates the potential market demand. The homogeneity of agricultural products gives rise to price competition between online and offline channels, with a substitution effect between agricultural products of different channels. The market demand for agricultural products of channel i is not only inversely proportional to the selling price of agricultural products of its own channel, but also directly proportional to the selling price of agricultural products of channel j.

We can denote the offline channel market demand for agricultural products in the dual-channel model by

and the online channel market demand for agricultural products in the dual-channel model by

, then the demand functions are, respectively:

Assumption 3: In the offline and online channels, retailers and producers provide logistics services for agricultural products, determine the level of logistics services and bear the cost of logistics services. The cost of logistics services increases as the level of logistics services for agricultural products increases.

In the offline channel, the retailer purchases agricultural products from producers and subsequently sells them to consumers. The retailer is responsible for bearing the costs associated with the logistics of the agricultural products, including warehousing and transportation. The retailer is responsible for paying the costs of logistics services for agricultural products, determining the level of service provided by logistics services in the offline environment, and bearing the costs associated with the provision of logistics services in this context. In the context of offline channels, producers engage in the direct sales of agricultural products via e-commerce platforms. In order to facilitate the analysis, this paper does not take into account the e-commerce platform’s pre-invested costs associated with the construction of logistics lines and other sunk costs. Instead, the focus is on the producers in the supply chain, with the aim of examining the warehousing, transport, and other logistics costs that they are responsible for bearing. Consequently, the onus falls on the producers to remunerate the logistics service providers for the handling of the agricultural products, to stipulate the requisite online logistics service level, and to assume the associated costs.

The cost-effectiveness of a logistics service, represented by the variable k, is defined as the relationship between the level of service provided and the associated cost. In this context, a smaller value of k indicates a more efficient logistics service, whereby the benefit generated by the service is greater than the unit cost.

Assumption 4: In order to ensure that optimal solutions exist within the supply chain model, the relevant parameter settings need to meet the following conditions: .

Assumption 5: The product demand information of the agricultural supply chain is symmetrical to each other, while not considering the situations of out-of-stock product and losses.

Assumption 6: The producer is the core firm in the agricultural supply chain; under decentralised decision-making, the producer is the leader and the retailer is the follower in the Stackelberg game model.

4. A Dual-Channel Agricultural Supply Chain Model under Centralised Decision-Making

Under centralised decision-making, the leading producers of agricultural products in the supply chain and the community superstores make decisions at the same time, and both take the optimal profit of the supply chain as the decision-making goal.

Firstly, we consider an ideal single-channel agricultural supply chain model (CS), where each member of the supply chain makes decisions with the goal of optimising the overall profit of the supply chain, and at the same time determines the level of logistics services and the retail price of agricultural products in the supply chain. As a producer, the leading agricultural enterprise sells agricultural products to community supermarkets or large-scale superstores through offline channels, and the supermarkets, as retailers, sell agricultural products to consumers.

Under centralised decision-making, the producer’s profit function is:

The retailer’s profit function is:

So, the overall supply chain profit function is:

By calculating the concavity of the Hessian matrix judgement function, it can be concluded that there exists a unique optimal solution. The optimal decision and the overall optimal profit of the CS under centralised decision-making is:

Among them, .

In the dual-channel agricultural supply chain model (CD), different from the CS, the leading agricultural products enterprise, as a producer, can sell agricultural products to community supermarkets or large-scale superstores through offline channels and can also sell agricultural products directly to consumers on the e-commerce platform through online channels.

Under centralised decision-making, the producer’s profit function is:

The retailer’s profit function is:

So, the overall supply chain profit function is:

First, we can solve the Hessian matrix to determine the concavity of the overall profit function of the supply chain and to determine whether there is an optimal solution to the function. Under centralised decision-making, the decision variable of the overall supply chain profit function is , and the Hessian matrix of the overall supply chain profit function about is . We can solve the Hessian matrix of each order of the principal subequations, , , , , and .

where is the price elasticity coefficient, which indicates that when the selling price of channel rises by 1 unit, the demand in channel falls by m units, and is the cross-price elasticity, which indicates that when the price of channel rises by 1 unit, the demand in channel falls by units due to channel substitution effects. The former is the direct effect of price on demand and the latter is the indirect effect of price on demand, thus , .

For the principal subforms of the Hessian matrix, . It is known that , then when , and , the Hessian matrix is negatively definite, and an optimal solution exists for centralised decision-making.

Let

,

,

,

, the optimal decisions of the dual-channel agricultural supply chain under centralised decision-making are:

Among them, , , .

We can substitute the above optimal decisions into the demand function and the overall profit function of the supply chain.

When a retailer is unprofitable, the retailer will exit the market. In order to conform to a realistic scenario and ensure that the retailer’s profit > 0, let .

5. A Dual-Channel Agricultural Supply Chain Model under Decentralised Decision-Making

Under decentralised decision-making, producers and retailers make decisions with the goal of maximising their own profits. The producer is the dominant player in the Stackelberg game and will fully estimate the reaction function of the retailers’ followers generated by its own decision; it sets the wholesale price, online sales price, and online logistics service level on this basis, and the retailers as followers set the offline sales price and offline logistics service level according to the producer’s decision-making results.

Consider a supply chain model of agricultural products with single-channel sales in the traditional mode under decentralised decision-making, where each member of the supply chain makes decisions with the objective of optimising its own profit. Agricultural leading enterprises are the producers, and only through the offline channel to sell agricultural products to community supermarkets or large supermarkets, with supermarkets as retailers, agricultural products are sold to consumers.

Under decentralised decision-making, the producer’s profit function is:

The retailer’s profit function is:

The overall profit function of the supply chain is expressed as:

The first part of the equation represents the revenue gained through the sale of agricultural products, while the second part represents the cost paid for the provision of logistics services. In the context of the supply chain’s overall profit function, the producer’s wholesale price is no longer a decision variable. Rather, it solely influences the distribution of profits within the supply chain, specifically between the producer and the retailer. The optimal decision result under centralised decision-making can be used as a basis for evaluating the extent to which the supply chain is coordinated under decentralised decision-making.

Since the producer is the core firm in the supply chain, under decentralised decision-making, consider the Stackelberg game, where the producer is the leader and makes the decision first, and the retailer is the follower and makes its own optimal decision based on the decision-making behaviour of the producer.

Under decentralised decision-making, the retailer’s decision variable is , the retailer’s profit function is the Hessian matrix , where , , by assumption , so , the retailer’s profit function is the joint concave function on , and there is an optimal solution.

Solving for

yields the retailer’s reaction function for

as follows:

Substituting the retailer’s reaction function with respect to

into the producer’s profit function yields:

Under decentralised decision-making, the producer’s decision variable is

. The first- and second-order derivatives of the producer’s profit function

with respect to the wholesale price

are:

Substituting the optimal solution

into

, then:

Substituting the above results into the demand function and the profit function of the supply chain and each subject, the optimal solution is obtained as follows:

It is assumed that the producer is a leading agricultural product company with a core position in the supply chain, with product pricing rights, and can choose both online and offline channels to distribute agricultural products. In addition to wholesaling to brick-and-mortar superstores, the producer can also sell agricultural products directly through online platforms and bear the logistics costs such as warehousing and transport by itself. Under decentralised decision-making, producers and retailers no longer take the overall profit maxim of the supply chain as a common goal; they consider their own profit maxim and formulate the optimal strategies.

Under decentralised decision-making, the profit function of a dual-channel supply chain producer is:

where the first part represents the revenue earned by the producer from selling the produce to the retailer, and the second part represents the revenue earned by the producer from selling the produce directly through the online channel, as well as the cost incurred in providing the logistics services of the online channel.

The retailer’s profit function is:

The overall supply chain profit function is:

As the dominant player, in order to maximise its profit, the producer needs to first determine its logistics service level , the retail price of agricultural products sold directly through the online platform , and the wholesale price of agricultural products distributed through the offline superstore w. The offline superstore, after the producer has made its decision, determines the selling price of the offline agricultural products based on the producer’s pricing and logistics service information.

Similar to the centralised decision, the retailer’s decision variables under the decentralised decision are , and the retailer’s profit function is the Hessian matrix with respect to , where , and by implication . Therefore, the retailer’s profit function is about the joint concave function with an optimal solution.

Solve

and obtain the reaction function of retailer profit function about

, as follows:

When substituting the retailer’s reaction function on into the producer’s profit function, the decision variables of the producer’s profit function are , and the corresponding Hessian matrix is , then the master equation of each order is: , , .

Where , , so and the Hessian matrix is negative definite, and the producer profit function has a unique optimal solution.

Associating

, the solution is:

Substituting the above results into the demand function and the profit function of the supply chain and each subject, the optimal solution is obtained as follows:

where, according to the basic Assumption 4,

, and

.

6. Sensitivity Analysis

6.1. Sensitivity Analysis under Centralised Decision-Making

In this section, the results of the model are analysed with specific numerical analysis to explore the optimal decision-making of the supply chain with different channel modes under centralised decision-making, and to analyse the impact of the relevant parameters on the supply chain profitability, product pricing, and logistic service level. The simulation analysis was carried out using Python 3.12, with reference to the relevant literature, and the numerical basis of the parameters was set as follows: a = 1000, s = 0.5, m = 50, n = 10, k = 60, = 4, w = 3.

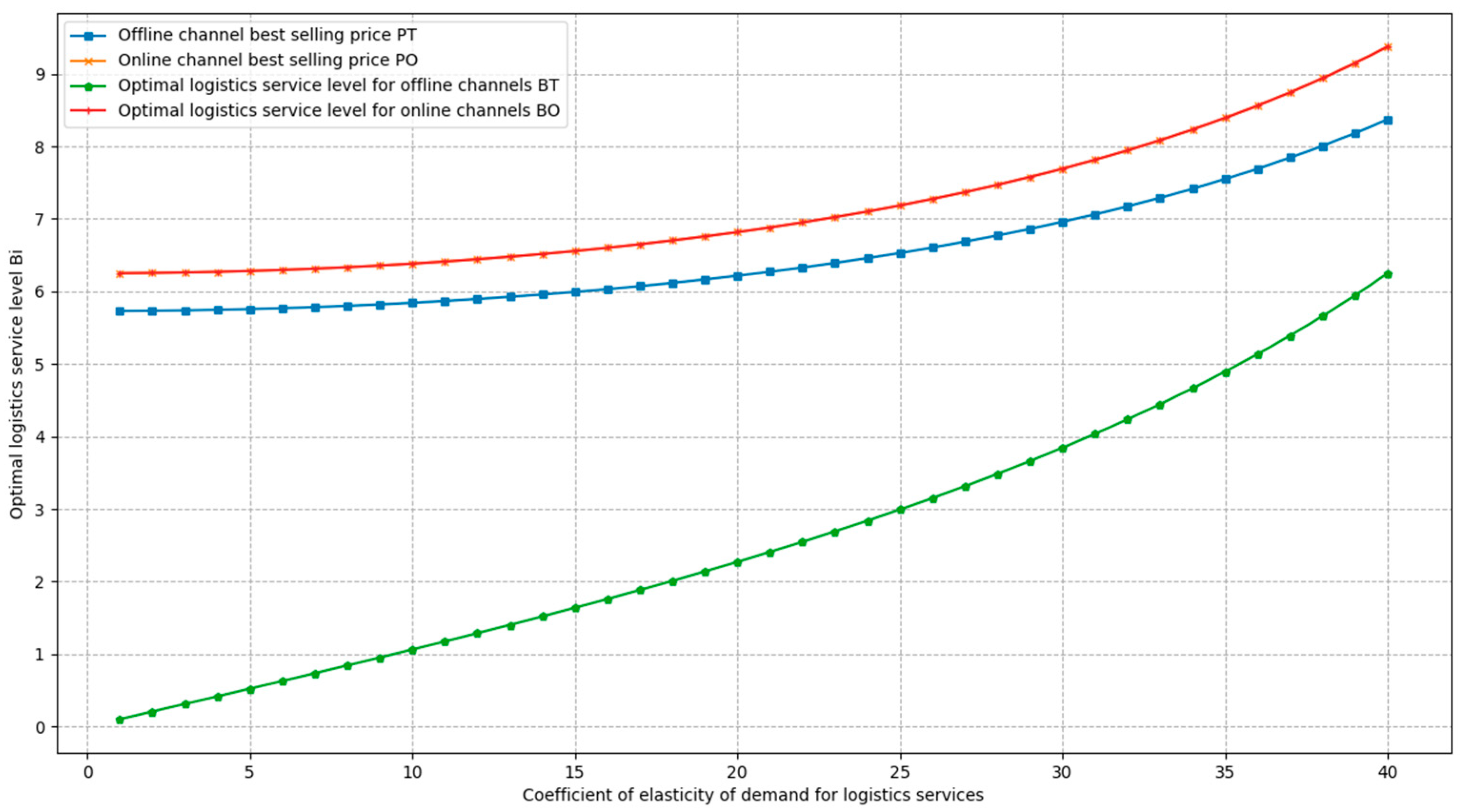

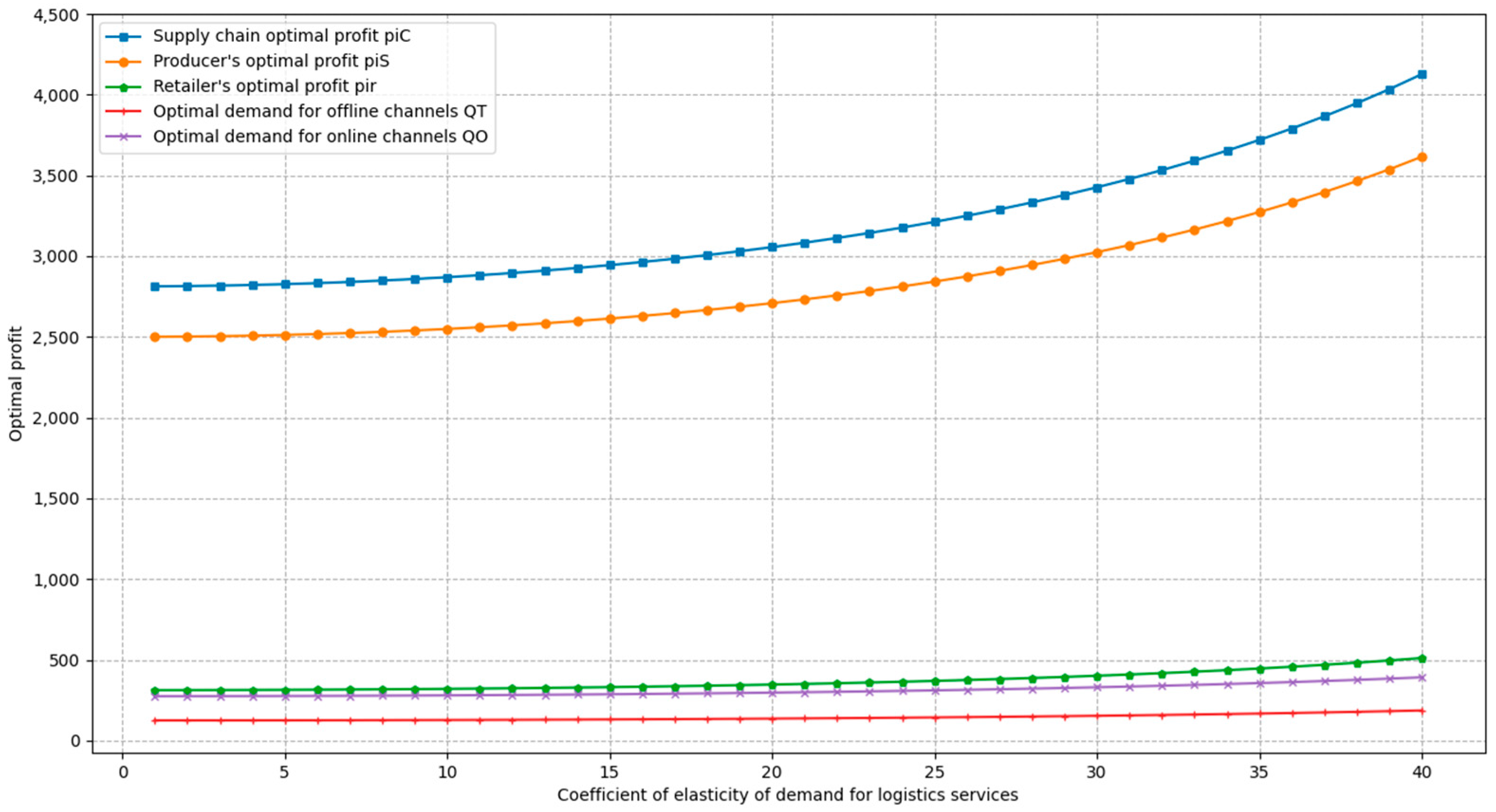

6.1.1. Impact of Demand Sensitivity Factor for Logistics Services

To analyse the impact of changes in the logistics demand elasticity coefficient on optimal profit, optimal demand, and optimal decision-making in agricultural supply chains, the value of is taken between 1 and 40. Only the value of was changed, leaving the values of the other parameters at the base setting, and the graphs describing the relationship between optimal profit, optimal demand, optimal decision variables and the sensitivity coefficients of logistics services are plotted in supply chains under centralised decision-making.

From

Figure 3 and

Figure 4, it can be seen that the profit of the supply chain, the profit of the producer, the profit of the retailer, the market demand of the offline channel, and the demand of the online channel, all increase with the increase in the coefficient of elasticity of demand for logistics services. As the elasticity coefficient of demand for logistics services increases, the optimal profit, optimal demand, and optimal decision variables grow faster, indicating that as consumers pay more attention to the level of logistics services, the overall profit of the supply chain under centralised decision-making will increase at a higher level of logistics services.

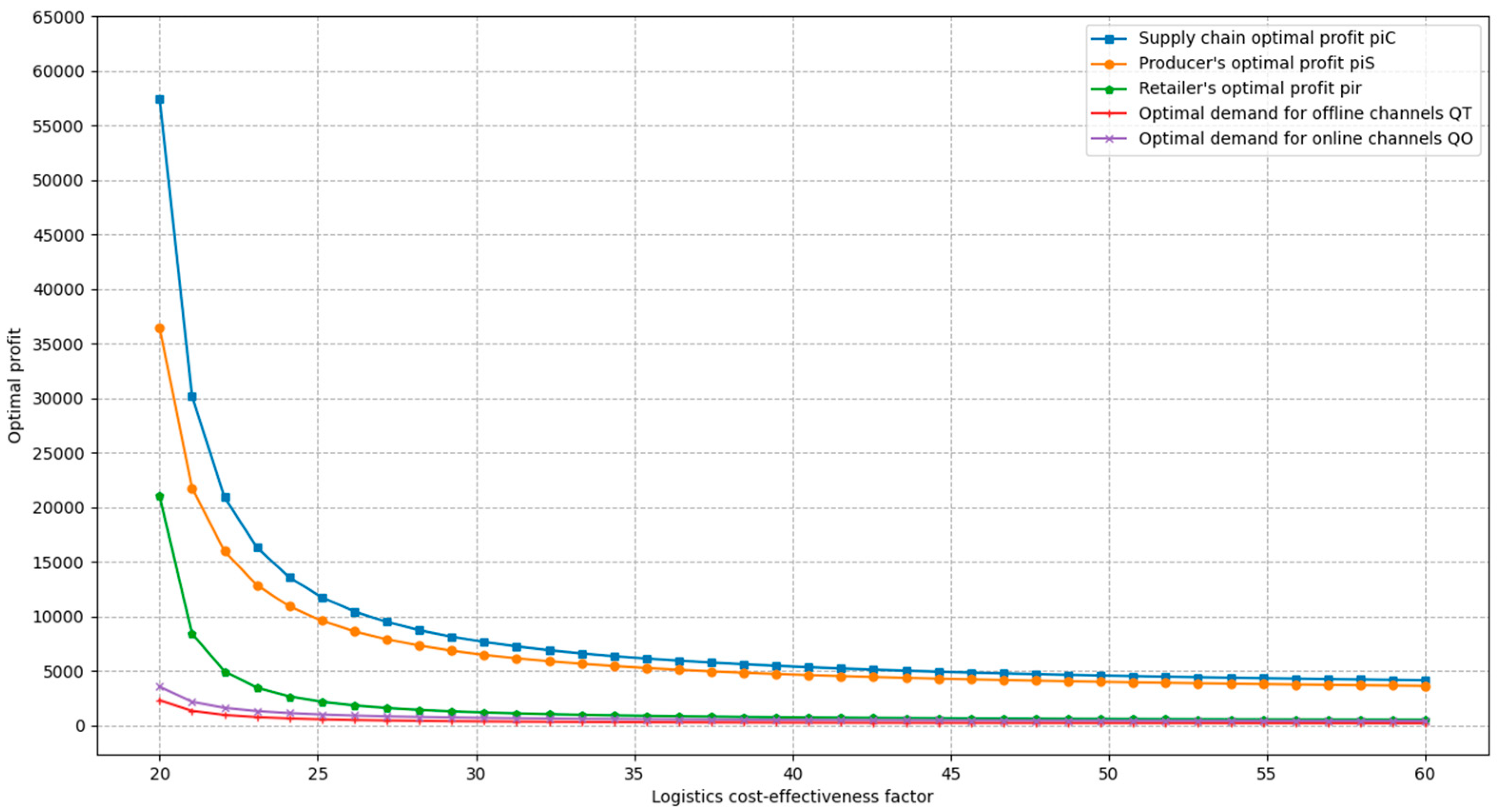

6.1.2. Impact of Logistics Cost-Effectiveness Factors

We analysed the impact of changes in the logistics cost-effectiveness coefficient on the optimal profit, optimal demand, and optimal decision-making in the supply chain for values taken between 20 and 60. Only the value of was varied, and the values of other parameters were consistent with the base setting. The graphs describing the relationship between optimal profit, optimal demand, optimal decision variables and logistics cost-effectiveness coefficients were plotted for supply chains under centralised decision-making.

From

Figure 5 and

Figure 6, it can be seen that in the dual-channel supply chain model under centralised decision-making, the profit of the supply chain, the profit of the producer, the profit of the retailer, the market demand of the offline channel, and the demand of the online channel, all decrease with the increase in the logistics cost-effectiveness coefficient. Observing the slopes of the curves in

Figure 5 and

Figure 6, it can be found that as the coefficient of logistics cost-effectiveness increases, the decreasing speed of optimal profit, optimal demand, and optimal decision-making variables becomes slower and slower, which indicates that as the unit logistics cost corresponding to the level of logistics service increases, the marginal benefits of decreasing profit, demand, and optimal decision-making variables brought about by the increase in unit logistics cost are also decreasing, and under the higher unit logistics cost, the decline in the overall profit of the supply chain under centralised decision-making slows down.

6.2. Sensitivity Analysis under Decentralised Decision-Making

In this section, the results of the model are analysed with specific numerical analysis to explore the optimal decision-making of the dual-channel supply chain under decentralised decision-making with different distribution channel models, and to analyse the impact of relevant parameters on supply chain profit, product pricing, and logistic service level, using Python for the simulation analysis, and with reference to the relevant literatures, and with the parameter values set as follows: It should be noted that the wholesale price w is no longer an exogenous variable under decentralised decision-making, but a decision-making variable of the producer.

6.2.1. Impact of Demand Sensitivity Factor for Logistics Services

We analysed the impact of changes in the coefficient of elasticity of demand for logistics, , on the optimal decision-making in the supply chain, taking the value of between 1 and 40. Only the value of was changed, and the values of other parameters were consistent with the base setting. The graphs of the relationship between optimal profit, optimal demand, optimal decision variables, and the sensitivity coefficient of logistics services in supply chains with different channel types under decentralised decision-making were obtained.

Analysing

Figure 7 and

Figure 8, it can be concluded that in the dual-channel supply chain model under decentralised decision-making, the profit of the supply chain

, the profit of the producer

, the profit of the retailer

, the market demand of the offline channel

, and the market demand of the online channel

, all increase with the increase in the coefficient of elasticity of demand of the logistic service

. The optimal decision variables in the supply chain models with different channel modes under decentralised decision-making all increase with the increase in the elasticity coefficient of demand for logistics services

. Meanwhile, observing the slope of the curve, it can be found that under decentralised decision-making, as the elasticity coefficient of demand for logistics services

increases, the optimal profit, optimal demand and optimal decision-making variables grow faster, which indicates that with the increase in consumers’ attention to the level of logistics services, the overall profit enhancement of the supply chain under decentralised decision-making will be greater under a higher level of logistics services.

6.2.2. Impact of Logistics Cost-Effectiveness Factors

We analysed the impact of changes in the logistics cost-effectiveness coefficient on the optimal profit, optimal demand, and optimal decision-making in the supply chain, and to ensure that the range of values of met the basic Assumption 5, taking the value of between 20 and 60. Only the value of was changed, and the values of other parameters were consistent with the base setting. The graphs describing the relationship between the optimal profit, optimal demand, optimal decision variables, and the logistics cost-effectiveness coefficient in supply chains with different channel types under decentralised decision-making were plotted.

From

Figure 9 and

Figure 10, it can be seen that in the dual-channel supply chain model under decentralised decision-making the profit

of the supply chain, the profit

of the producer, the profit

of the retailer, the market demand

of the offline channel, and the demand

of the online channel all decrease with the increase in the logistics cost-effectiveness factor

. In the dual-channel supply chain model, the overall supply chain profit

increases significantly, the producer profit

increases more, the retailer profit

decreases slightly, and the market demand

increases in the offline channel. Under decentralised decision-making, the producer’s profit is higher than the retailer’s in all cases. As the logistics cost-effectiveness coefficient k increases, the overall supply chain profit differential between the dual-channel supply chain models decreases, and the producer’s profit differential, the retailer’s profit differential, and the offline market demand differential all decrease.

Observing the slope of the curve, it can be found that as the coefficient of logistics cost-effectiveness k increases, the decreasing speed of optimal profit, optimal demand, and optimal decision variables is slower and slower, which indicates that as the unit logistics cost corresponding to the level of logistics service increases, the marginal benefits of decreasing profit, demand, and optimal decision variables brought by the increase in unit logistics cost are also decreasing, and the decision-making under higher unit logistics cost shows that the decline in the overall profit of the supply chain under decentralisation slows down.

7. Conclusions

The agricultural producers in this paper adopted the model of “leading enterprises + farmers”, so that each farmer is linked to a leading enterprise, the leading enterprise drives small farmers, the supply of agricultural products is guaranteed, and the agricultural producers represented by the leading enterprises have stronger bargaining power in the whole supply chain. In addition, taking into account the reality of how the e-commerce platforms have sunk into the market of agricultural products, and through live broadcasts with goods and other forms to help farmers sell agricultural products directly on the network platform, this paper studies the dual-channel agricultural supply chain model that combines direct e-commerce sales and offline sales channels. The emergence of e-commerce platforms has increased the sales channels of farmers and leading enterprises, and the bargaining power has been further enhanced. By establishing a dual-channel supply chain model, the model is analysed under two scenarios of centralised and decentralised decision-making, respectively. Through the sensitivity analysis of the model, we find that as consumers’ focus on logistics service levels increases, the overall profit of the supply chain improves, and as the unit logistics cost corresponding to the level of logistics service increases, the marginal benefits of decreasing profit brought about by the increase in unit logistics cost are also decreasing. Moreover, we find that when logistics cost-effectiveness coefficient is about 30, it is unprofitable for the retailer, and as logistics cost-effectiveness increases, the producer’s profit tends to a fixed value. However, in agricultural supply chains, government subsidies have an impact on the entire supply chain, and we will measure this impact in future research.