1. Introduction

Coal is the most important energy source in China, a country with a prominent coal-dominated energy structure. Power generation companies are the largest customers of the coal industry; there is a high degree of interdependence between coal and electrical power [

1]. However, there are double price regulations in the coal and electricity markets: market-based coal pricing and regulated electricity pricing. The different degrees of the marketization of coal and electricity have created barriers to price shifting between coal and electricity and have aggravated the conflict between the two sectors [

2]. In recent years, both the coal mining and power generation industries have seen over-production capacity and unstable markets. Trading conflicts between the two sectors continue to grow. In January 2018, four large power generation conglomerates in China bemoaned their predicament by submitting an urgent report to the National Development and Reform Commission on the grave situation of coal supply for power generation companies. In November 2019, 11 giant coal mining companies in China, including the China Energy Investment Corporation, issued a joint statement to advocate for stabilizing the coal supply and price. The statement called for smoothing the abnormal price fluctuations and introducing a credit rating system for firms in order to ensure that coal prices remained within the green zone. In April 2020, the Fuel Branch of China Electricity Council held a meeting to coordinate the signing of the 2020 medium- and long-term contracts for coal to be shipped through marine transport. The meeting aimed to address the coal supply issues that occurred during the early days of the COVID-19 pandemic, including the supply shortages, price increases, and certain coal mining companies ceasing to supply coal under their long-term contracts.

Given the unstable coal and electricity markets and the conflicts between coal mining and power generation companies, the government frequently identifies policies to help to smooth the operations of the two sectors [

3]. However, there are significant barriers for central government-owned power generation companies and coal mining companies to execute the “long-term contract price”, which is set mainly through governmental interference [

4]. Market fluctuations lead to conflicts between the two prices that are in play at the same time: the market-based price and the long-term contract price. Due to the “wait-and-see” attitude of both of the sides of the negotiations, agreements are difficult to reach and the outcomes of the execution are less ideal. In 2016, the State-owned Assets Supervision and Administration Commission of the State Council in China issued an arrangement for ensuring the long-term and stable collaboration between central government-owned coal mining and power generation companies in an effort to improve the long-term collaboration mechanism between the two sectors. From 2017 to 2021, the General Office of the National Development and Reform Commission issued a notice on improving the signing and execution of medium- and long-term coal trading contracts; this was aimed at enforcing certain regulations in order to ensure the smooth operation of the medium- and long-term contracts between coal mining and power generation companies. However, under the government-dominated trading mechanism, coal price fluctuations always increase uncertainty in the negotiations; it is impossible to reach agreements that satisfy both sides of the trade and the execution of the contracts is difficult. As a result, the long-term, stable growth of coal mining and power generation companies is undermined.

Since the coal mining and power generation companies—the two important sectors in the supply chain—are always clashing with each other, the government encourages the firms in the two sectors to develop joint ventures [

5]. In May 2019, China’s National Development and Reform Commission, the Ministry of Industry and Information Technology, and the National Energy Administration issued a joint policy,

Strategies for Absorbing Surplus Coal Production Capacity. This policy continues to encourage coal mining and power generation companies to jointly invest in projects that integrate coal mining and power generation; it also encourages the coal mining and power generation companies to hold each other’s stocks and to exchange stocks in order to formulate joint coal–electricity operations. These joint operations are intended to internalize the external conflicts, thereby easing the clashes between the two sectors. The government supervisory authorities have placed high expectations on this approach.

Despite the governments’ continuous pushing through of policy statements for joint coal–electricity operations in recent years, the results have fallen short of expectations. The most important reason behind this failure is that the two sectors operate in two incompatible systems with different degrees of marketization. The initiative of joint coal–electricity operations is more of a government requirement than a business decision that was formed voluntarily by coal mining and power generation companies to secure long-term coal supply and stable sales [

6]. Due to lack of a shared interest, the bond within the joint operation is weak.

How can the interests of coal mining and power generation companies be balanced when the coal price fails to convey the appropriate signal to firms and when is there a barrier to price shifting between coal and electricity? How can the conflicts between the two sectors be eased? How can the trading markets be stabilized for coal mining and power generation companies? These are questions that deserve immediate attention. To address the micro market preferences and matching priorities of both the coal mining and power generation companies, this study has applied stable matching and market design theories in order to design an innovative market mechanism and a stable matching algorithm for trading between coal mining and power generation companies.

2. Literature Review

2.1. Proposition of Two-Sided Matching Theory

The two-sided matching issue was first raised in the paper

College Admissions and the Stability of Marriage by Gale and Shapley (the latter author being a joint winner of the 2012 Nobel Memorial Prize in Economic Sciences). This paper discussed the decision-making issues in marriage matching and matching between colleges and applicants. It marked the beginning of the research on two-sided matching theory. The deferred acceptance algorithm that was proposed by Gale and Shapley was the pilot of the two-sided matching theory. In their paper, Gale and Shapley examined matching for marriages, supposing that a certain community consists of m women and n men. Each person ranks those of the opposite sex in accordance with his or her preferences for a marriage partner. How to achieve a set of stable marriages and optimal satisfaction for both sides was the emphasis of the research on marriage matching. Based on cooperative game theory, Shapley proposed the stable assignment theory and the deferred acceptance algorithm. The focus of the theory is on how not to upset the current matching arrangement and how to maintain the stability of the matches [

7]. Building on the analysis of marriage matching that was performed by Gale and Shapley, Roth, a Harvard professor, first proposed the “two-sided matching” concept and identified the practical applications of stable matching theory and its algorithm. Following this, more scholars have turned their research interests to the study of two-sided matching theory. Based on the study of marriage matching, researchers have made theoretical improvements to the Gale–Shapley (G–S) algorithm for two-sided matching and expanded it in light of real situations [

8].

2.2. Development of Two-Sided Matching Theory

Over the 50-plus years from the proposition of the two-sided matching theory in 1962, a large body of literature on this subject has been developed. The evolution of the theory and the new developments in its application can be summarized as representing three themes: first, the traditional research on two-sided theory that was presented by Gale and Shapley (1962), in which money is not involved; second, the research that was presented by Shapley and Shubik (1972) and Kelso and Crawford (1982), wherein money was introduced into the theory; and third, the research on the theory of matching with contracts, as presented by Hatfield and Milgrom (2005), which incorporated the two-sided matching theories with and without money into one framework [

9,

10,

11]. In a two-sided matching market where no money exists, stability is the most important element. Orders of preferences or orders of priority are the basis for the matching between the two sides and the deferred acceptance—the key feature of the G–S algorithm—ensures matching stability in the market. Shapley and Shubik (1972) creatively identified another research perspective and developed a new theoretical matching model that is referred to as the “assignment game model”. Under this model, the two-sided matching market that contains money is defined and money is used to measure the utility in the market. The introduction of money connects two-sided matching theory with auction theory and competitive equilibrium theory. As one of the most important developments in matching theory over the past two decades, the theory of matching with contracts is at the forefront of the research on two-sided matching theory. This theory integrates the two-sided matching problem into markets with and without money [

12].

The continuous introduction of money and contracts into traditional two-sided matching models makes the theory more applicable to reality. The progress in the research on two-sided matching is not only demonstrated by the continuous evolution of the matching model, this research has also advanced market design and expansion. Examples include the matching between colleges and applicants, job matching in the labor market, matching kidney transplant donors and recipients, auctions of vehicle licenses, ratio spectrums, and internet advertisements. The stable matching concept originated first from practice and then its theoretical development followed. The earliest example of its practice was the National Resident Matching Program (NRMP), which was adopted in 1952 in the United States. Stable matching theory has now been applied to a range of academic subjects and markets. It has also been successfully adopted in a wide array of places, such as Canada, Britain, South Korea, the Netherlands, and Hong Kong.

2.3. Research on the Stable Matching Mechanism

The major research focus of the international academic community on stable matching mechanisms has been to develop economic theories that are based on matching stability and the deferred acceptance procedure. Stability is critical for the participants to make their choices while considering the choices of the others in the two-sided market. Roth (2008) pointed out that, although the algorithms that are used by the centralized clearinghouse had been improved multiple times so as to meet the evolving needs of hospitals and medical students, stability remained the key to the success of the matching mechanism; the deferred acceptance procedure, in turn, is critical to matching stability and many matching mechanisms have been designed based on this procedure [

13]. Lee (2017) found that incentive compatibility extends to many-to-one matching when the agents employ truncation strategies and capacity manipulations in a Gale–Shapley mechanism [

14]. Alimudin and Ishida (2022) proposed a matching–updating mechanism which is a solution for the stable marriage problem with dynamic preferences [

15]. Research on stable matching mechanisms can be sorted into three categories: one-to-one matching, many-to-one matching, and many-to-many matching.

A one-to-one matching mechanism is also referred to as the marriage matching mechanism because it resembles the matching that is required for monogamous heterosexual marriages: each participant on one side can only match with one participant on the other side. The one-to-one matching mechanism is the most classical matching model in two-sided matching theories and scholars have conducted considerable research on this topic.

The many-to-one matching mechanism is also referred to as the college admission matching mechanism, another subject on which many scholars have performed in-depth studies. Roth and Sotomayor (1989) compared the marriage matching mechanism with the college admission matching mechanism and pointed out that the two cannot be viewed as equivalent, as the college admission mechanism only retains the main features of the marriage matching mechanism [

16].

The many-to-many matching mechanism is also referred to as the worker–firm matching mechanism. As the depth of the research has been extended, scholars have generalized the marriage matching mechanism and the college admission matching mechanism, expanding the research to the many-to-many problem [

17]. Worker–firm matching is a typical many-to-many matching model. In comparison to many-to-one and one-to-one matching, there is less research devoted to many-to-many matching, but this is mainly due to the sequence of theoretical development, not because the many-to-many market is unimportant.

2.4. Applications of Two-Sided Matching Theory

In recent years, two-sided matching theory has been extended to a few applications. Jiang et al. (2016) proposed an optimal matching approach for one-shot multiattribute exchanges with simultaneous fuzzy information and indivisible demand considerations [

18]. Wang et al. (2017) presented mathematical programming approaches to quickly find good stable or nearly stable matchings for single-rider, single-driver dynamic ridesharing [

19]. Gao et al. (2017) formulated the cooperative spectrum sharing between multiple PUs and multiple SUs as a two-sided market and studied the market equilibrium under both complete and incomplete information [

20]. Wang et al. (2020) applied the lexicographical method in order to solve the multi-objective linear programming model so as to obtain the optimal bilateral transaction matching pair [

21]. Lee et al. (2020) proposed an app-matching system and generalized deferred acceptance algorithms so as to match mobile applications with users [

22]. Yang et al. (2021) presented a two-sided matching framework in order to model the resource allocation among customers and manufacturers and leveraged the stable matching algorithm to optimize the matches between customers and AM providers [

23]. Shurrab et al. (2021) showed a realistic modelling of the V2V energy sharing problem and proposed a two-layer matching approach that can efficiently match the EVs [

24].

Our present study started from the above-mentioned existing literature, including matching agents and rules, matching approach and optimization, and matching mechanism and algorithm. To our knowledge, this is an innovative study in its aim to design a stable mechanism for the trading between coal mining and power companies. In the market in which coal mining companies and power generation companies participate, the trading matchings are different, as are the preferences. From the matching perspective, the essence of the trading that occurs between coal mining companies and power generation companies is to achieve an agreement between the coal mining companies’ description of the coal that will be supplied and the power generation companies’ description of the coal that has been demanded. In other words, the two sides behind the supply and demand have reached an agreement with the order. The coal mining and power generation companies may agree upon multiple orders and ultimately reach multiple matchings.

2.5. Research Overview

Two-sided matching theory has high theoretical and practical value; the gist of the G–S deferred acceptance algorithm is to make the two sides unwilling to break the match, in order to maintain its stability. The one-to-one, many-to-one, and many-to-many stable matching models have wide applications in the real world. In the heterosexual marriage matching model, both the men and the women have preferences for each other and the match between a man and a woman is the choice of these two people of opposite sexes based on their preferences. In the college admission matching model, the applicants have preferences for colleges and the colleges have preferences for applicants and may also have preferences for applicant sets. In the worker–firm matching model, the firms have preferences for workers as well as for worker sets and vice versa.

Compared with the existing research, the contribution of this paper is mainly reflected in the following: Firstly, the theory of two-sided matching is applied to the field of coal–power transaction, which expands the research field of stable allocation and market design theory, optimizes the matching path of the coal–power transaction, and reflects the interest demands of the coal mining and power generation companies. Secondly, based on current situation of the coal–power transaction conflict, this paper puts forward the concept of pairwise stable matching for the coal–power transaction creatively. The anti-dismantling of the transaction relations makes it impossible for both the coal mining and power generation companies to easily change the existing pairwise stable matching relationship. This situation then lays a sturdy foundation for the coal mining and power generation companies to establish medium- and long-term stable cooperation. Thirdly, this paper creatively designs the stable matching algorithm and mechanism for coal–power transaction considering the trading volume. It is a complement and perfection of the existing coal–power trading platform in transaction mechanism and trading function.

On this basis, this paper builds on the two-sided matching theory and further expands its application. It employs the deferred acceptance algorithm that was proposed by Gale and Shapley and applies two-sided matching theory to coal trading between coal mining and power generation companies. Considering the uniqueness of the market transactions that involve these companies, this paper proposes a deferred acceptance algorithm that takes into consideration the trading quantity in order to establish stable matching between the coal mining and power generation companies. It is expected that the proposed algorithm will help coal mining and power generation companies to find satisfactory trading partners, improve the current trading mechanism, complement the matching functions of existing coal-trading centers, and help to stabilize the medium- and long-term trading relations between coal mining and power generation companies.

3. Mechanism and Algorithm

3.1. Description of Stable Trading Matching

In the two-sided trading matching problem, information about the order of preferences is the common method for the buyer and seller to express their satisfaction with the matching partner. The seller tends to focus on the buyers’ offer price, time of payment, and credibility and then specifies its order of preferences for buyers. The buyer tends to focus on the information about the product quality, prices, and delivery dates that is provided by the sellers and then makes its seller preference order known. It should be noted that, under certain circumstances, both the buyers and sellers are interested in all of the participants on the other side of the market and accordingly provide an order of preferences for all of the participants; this is referred to as complete preferences. However, the buyers and sellers are sometimes only interested in certain participants on the other side of the market and only provide an order of preferences for the parties that they are interested in; this is referred to as incomplete preferences.

Coal mining companies and power generation companies all have an order of preferences for each participant on the other side of the market. We denote the vector of coal mining company Si’s order of preference for power generation company dj as Xij = {xi1, xi2, …, xij} and use xij to indicate that coal mining company Si’s preference for power generation company dj ranks xijth. We denote the vector of power generation company dj’s order of preference for power generation company Si as Yij = {y1j, y2j, …, yij} and use yij to indicate that power generation company dj’s preference for coal mining company Si ranks yijth.

The goal of trading matching between the coal mining and power generation companies that was set in this paper is to reach stable matching between the two sides. We define pairwise stable matching as follows: for coal mining company Si and power generation company dj, if, under matching scheme μ, the following conditions are met: the matching achieves a trading amount u(i,j) = 0; the order of preferences xij > xim, m∈μ(Si); and the order of preferences yij > ynj, n∈μ(dj), then matching μ is pairwise unstable; otherwise matching μ is pairwise stable.

In the above conditions, u(i,j) = 0 indicates that, under matching μ, coal mining company Si and power generation company dj reach a zero trading amount in their dealings. This can be expressed through a verbal description: on the trading platform of the China (Taiyuan) Coal Exchange Center, coal mining companies and power generation companies are unwilling to sign medium- or long-term sales contracts; based on their own demand and supply situations as well as their expectations for the market, the participants on the two sides of the market cannot reach an agreement on the sales amounts.

The orders of preferences are the basis on which both the coal mining and power generation companies find their matching partner and the participants on either side of the market have strict, transitive preferences for the participants on the other side. For any power generation company m that trades with coal mining company Si under the matching scheme μ, the inequality xij > xim indicates that there exists a power generation company dj such that the coal mining company Si’s preference for dj is higher than its preference for any other power generation company m; for any coal mining company n that trades with power generation company dj under the matching scheme μ, the inequality yij > ynj indicates that there exists a coal mining company Si such that power generation company dj’s preference for coal mining company Si is higher than its preference for any other coal mining company n. This can be expressed through a verbal description: on the trading platform of China (Taiyuan) Coal Exchange Center, given the new trading market, the satisfaction of the coal mining and power generation companies with their respective trading partners has declined and the parties are trying to find better partners; they are very likely to break the existing trading matching agreements in order to start a better relationship for meeting their supply and demand needs and to find better options in terms of the quantities of supply and demand. Under the above conditions, the matching scheme μ that had been reached between the coal mining and power generation companies is unstable; otherwise, it would be a pairwise stable matching scheme.

The stable trading matching scheme could be viewed as a trading relationship that is reached by coal mining and power generation companies that is a result of competitive selection of each other. The coal mining company that supplies coal for power generation is a power generation company’s optimal choice among all of the coal mining companies that are willing to trade with this power generation company. In the same vein, the power generation company that demands coal for power generation is a coal mining company’s optimal choice among all of the power generation companies that are willing to trade with this coal mining company. Neither coal mining companies nor power generation companies would want to lose optimal trading partners or stop maximizing their utility. Pairwise stable matching between coal mining and power generation companies is of critical significance. Under pairwise stable matching, coal mining or power generation companies that have not entered into a matching relation cannot realize any benefit from trading. The resistance to the disintegration of the pairwise matching relation aligns with the government’s requirement that coal mining and power generation companies develop stable medium- and long-term trading relations.

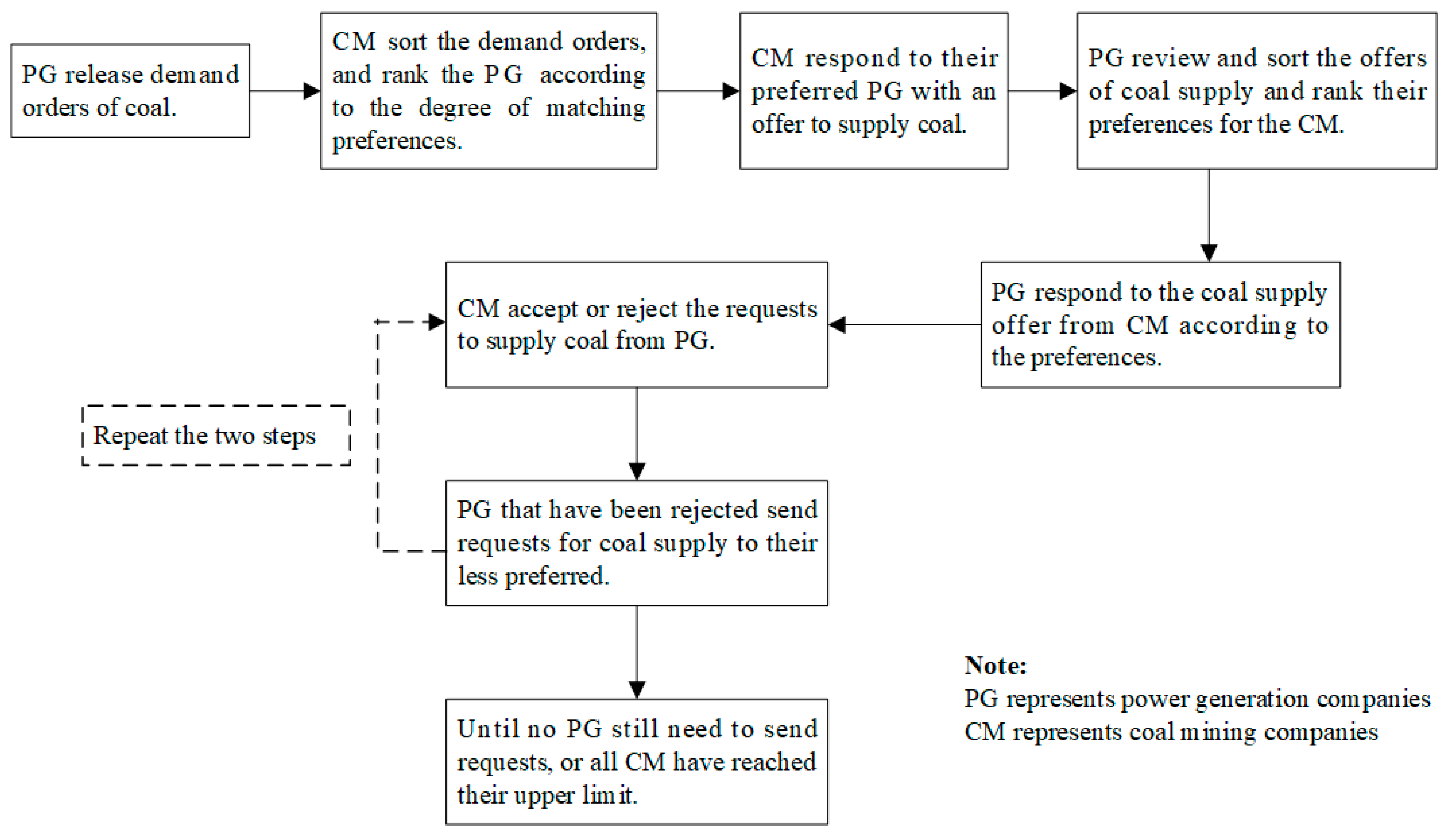

3.2. The Stable Trading Matching Mechanism

Coal mining and power generation companies negotiate for medium- and long-term contracts for the coal supply and demand that are required in power generation. The stable matching mechanism refers to the process and rules through which these coal mining and power generation companies reach stable trading relations. First, the participants on both sides of the market disclose their trading information, providing a list of their preferences for the participants on the other side of the market based on their own satisfaction with such matches. Second, both the coal mining and power generation companies release their expected orders with regard to the coal supply and demand, respectively; the participants then review and shortlist their trading partners based on the released orders and their preferences for matching. Last, when the demand for coal by the power generation companies is met, or the maximum coal quantity that the coal mining companies can supply has been reached, the trading matching is complete. Based on the above outline, this research designs the following process and mechanism to achieve stable matching between coal mining and power generation companies (as shown in

Figure 1).

Process 1: Based on the matching information that is provided by the participants on both sides of the trading relationship, the coal mining and power generation companies provide a list of preferences for the matches based on their own circumstances.

Process 2: The power generation companies release their anticipated orders to meet their demand, including information about the amount of coal that they want, the expected contracts, and the volume of coal trading that the power generation company wants to reach.

Process 3: The coal mining companies review and sort the orders that were provided by the power generation companies. Based on the degree of matching preferences, the coal mining companies rank the power generation companies that they are interested in. Furthermore, they respond to all of the power generation companies that they are interested in with an offer to supply coal. The total quantity of coal in all of the offers that are provided by one coal mining company cannot exceed the company’s upper limit of coal supply.

Process 4: The power generation companies review and sort the offers of coal supply, rank their preferences for the coal mining companies that have offered to supply coal, and delete the companies that they are not willing to trade with or the offers that they believe are impossible to materialize from their list of preferences.

Process 5: The power generation companies send requests to their preferred participants for their coal supply. This is done one by one in the order of their preference for the coal mining companies until the total quantity of coal that was demanded by the power generation company has been met.

Process 6: The coal mining companies accept or reject the requests to supply coal that have come from the power generation companies. This is done by accepting the requests one by one in the order of preference for the power generation companies until the company’s upper limit of coal supply has been reached. The rest of the requests are then rejected.

Process 7: The power generation companies that have been rejected continue to send requests for coal supply to their less preferred coal mining companies. This is done by sending requests one by one in the order of their preference for the coal mining companies until the remaining coal demand is met.

Process 8: The previous two steps are repeated until no power generation companies still need to send requests for coal supply or all of the coal mining companies have reached the upper limit of their coal supply.

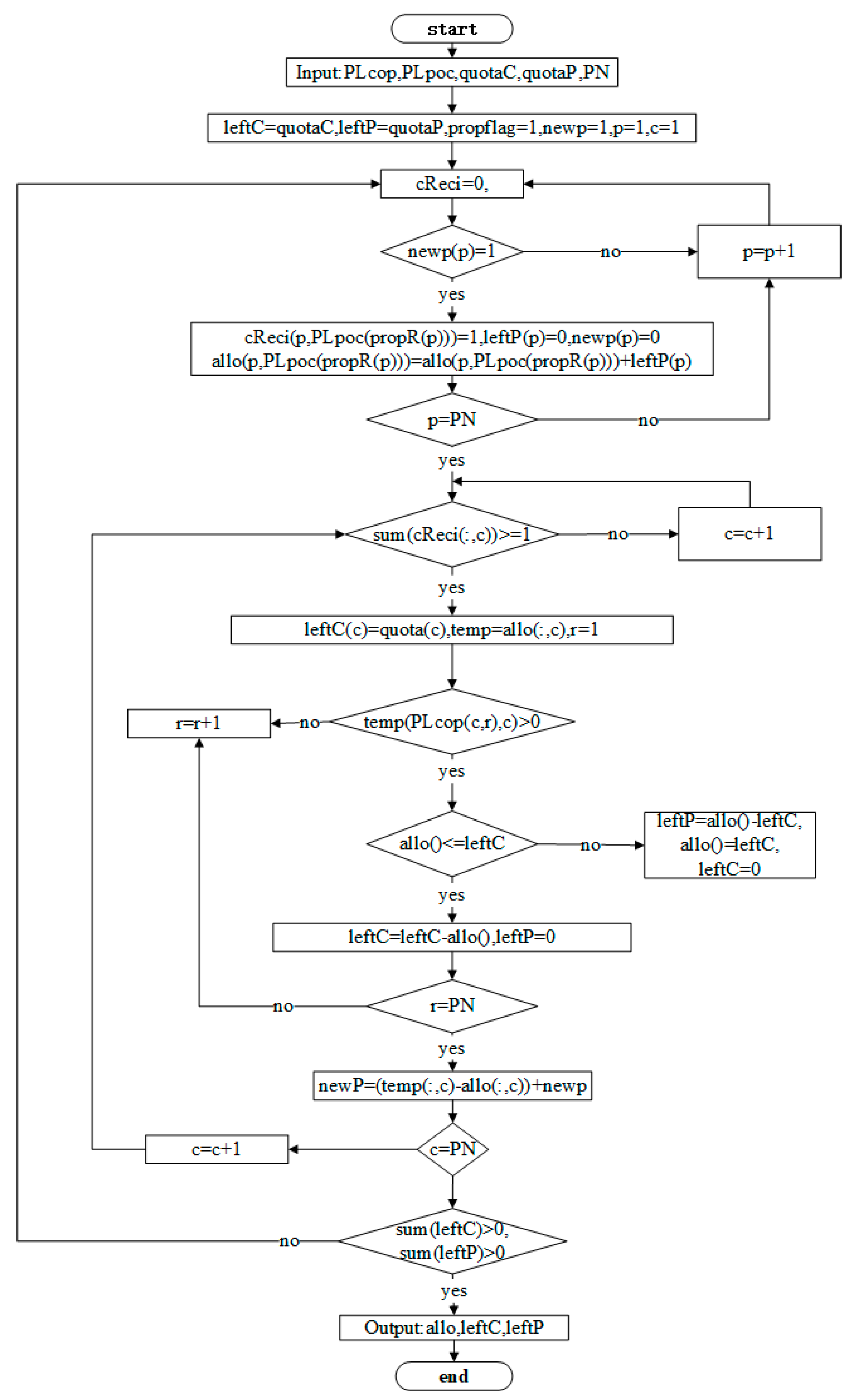

3.3. The Stable Trading Matching Algorithm

This paper has designed the deferred acceptance algorithm for stable matching between coal mining and power generation companies. From the rankings that are put forth by the coal mining and power generation companies to the interactive selection of partners on both sides of the trading relationship to the pursuit of stable trading partners by the coal mining and power generation companies, this algorithm supplements and improves upon the traditional deferred acceptance algorithm. The deferred acceptance algorithm in this paper was designed based on the general algorithms in Gao et al. (2017) [

20], Lee et al. (2020) [

22], and Alimudin and Ishida (2022) [

15], but it differs from the existing studies. Based on the typical stable matching model, this paper builds a stable matching algorithm of coal–power trading considering the trading volume and obtains a more general matching trading framework. It has certain theoretical innovation significance from the matching problem of non-separable commodities to that of separable commodities considering the trading volume between the coal mining and power generation companies. It is a better solution to the medium- and long-term trading problems between the coal mining and power generation companies on the electronic trading platform. This algorithm comprises the following aspects: variable initialization, initiating requests, rejecting requests, and termination conditions (as shown in

Figure 2).

PLcop records the coal mining companies’ preferences for power generation companies; PLpoc records the power generation companies’ preferences for coal mining companies. PLcop(i,j) denotes a power generation company that ranks jth in the order of preferences of coal mining company i and PLpoc(j,i) denotes a coal mining company that ranks ith in the order of preferences of power generation company j. The variables quotaC and quotaP record each coal mining company’s total coal supply capacity and each power generation company’s total demand for coal, respectively.

At each stage of the algorithm, the coal mining companies’ residual supply capacities and the power generation companies’ unmet demands for coal are denoted by leftC and leftP, where leftC(i) denotes the residual coal supply capacity of the coal mining company i and leftP(j) denotes the unmet demand for coal of the power generation company j. The residual coal supply capacity and unmet demand for coal are then initialized as the total supplied by coal mining companies and the total demanded by power generation companies, respectively. Then, propflag is used to indicate the place on the order of preferences at which the power generation companies begin to initiate requests; propflag(j) = r denotes that power generation company j initiated a request to a coal mining company that ranks rth on its order of preferences for coal mining companies; newp records each of the power generation companies and is initialized as a new request.

When a power generation company receives requests, the requests are reviewed one by one in order to determine whether they are new requests. If a request is not new, then the power generation company looks to the next coal mining company to initiate a request. If that request is new, then the request to supply coal is added to the unmet demand for coal leftP(p) and the unmet demand is reduced to zero. Then the next power generation company continues to initiate requests until all of the companies have competed their requests.

Step 1: Determine, in turn, whether each coal mining company has received new requests (sum(cReci(:,c)) ≥ 1).

Step 2: If it has, then the total residual coal supply capacity, leftC(c) = quota(c), is reallocated. The information that is related to the quantity that has been allocated is saved to the temp. Then, the coal mining company’s order of preferences for power generation companies (from the first to the last on the preference list) is followed in order to determine whether it has received requests from each of the power generation companies. If requests have been received, then coal will be allocated to the power generation company. If the quantity to be allocated to the current power generation company is less than the total residual supply capacity of the coal mining company (there is sufficient supply, allo(PLcop(c,r),c) ≤ leftC), then the quantity allocated will be allo(PLcop(c,r),c) and the residual coal supply capacity is reduced accordingly. Otherwise, if there is not sufficient supply, the quantity that will be allocated to the current power generation company is the total residual coal supply capacity (allo(PLcop(c,r),c) = leftC) and the residual coal supply capacity falls to zero. The unmet demand of the power generation company is reduced by leftC; namely, leftP = allo(PLcop(c,r),c) − leftC. After this step has traversed all of the power generation companies, the next step is implemented.

Step 3: If no new requests have been received, the process will continue to the next coal mining company.

Step 4: If, in Step 2, the supply capacity of the coal mining company has changed, this indicates that some requests of the power generation companies have been rejected and new requests will be initiated.

The algorithm continues its operations of initiating and rejecting requests, i.e., repeating steps (2) and (3), until the total coal supply capacity of all of the coal mining companies has been reached (total residual coal supply capacity is zero, namely, sum(leftC) = 0, which occurs when the total supply capacity is less than the total demand) or until the total demand for coal from all of the power generation companies is met (the unmet demand is zero, namely, sum(leftP) = 0, which occurs when the total supply capacity is greater than the total demand), at which time the algorithm will stop running.

4. Numerical Example

By searching China’s portal websites that are related to coal and power, major regional trading centers, and major port information platforms, this study has sorted out the transaction information of some of the coal mining and power generation companies and listed the supply-demand information and matching preference rankings of nine coal mining companies and six power generation companies. Based on the degree of matching between the coal mining and power generation companies, we derived their order of preferences for each other. As shown in

Table 1, we used (

m,

n) to indicate these companies’ orders of preferences for the trading partners on the other side of the market, where

m denotes the rank of power generation company

dj for coal mining company

Si, and

n denotes the rank of coal mining company

Si for power generation company

dj. Power generation company

dj’s demand for coal

qdj = (25, 50, 50, 50, 100, 50) (unit: kilotons); coal mining company

Si’s coal supply capacity

qsi = (30, 5, 40, 5, 20, 60, 50, 100, 20) (unit: kilotons).

Based on the orders of preferences of the coal mining and power generation companies for matching, we employed the deferred acceptance algorithm that takes into account the trading quantity in order to perform matching and arrive at the stable matching results. Through numerical examples, we can more intuitively understand the features of this matching mechanism.

We used MATLAB to perform the calculations in order to arrive at a pairwise stable matching scheme. As shown in

Table 2, we used

Si,

dj (the value of the matching result at the

ith row and

jth column) to denote the quantity of coal supplied by coal mining company

Si to power generation company

dj (unit: kilotons), where a quantity of zero means there is no trading matching.

The stable matching results indicate that the demand for coal of each power generation company had been met, which led to the termination of the algorithm. The matching produced 13 trading pairs and achieved a total coal trading amount of 325 kilotons. Under this matching, only coal mining company S8 still held a residual supply capacity of 5 kilotons, which, to certain extent, indicates that this company’s production plan was somewhat high.

The analysis indicates that the matching results have pairwise stability. We viewed the matching results as individual matrices, each comprising four elements in

Table 2. Any two zero elements that are not in the same row and not in the same column form a rectangular loop with the other two nonzero elements. Pairwise stability means that there are no random rectangular loops in the matrix. By increasing the value of the zero elements or decreasing the value of the nonzero elements in the rectangular loop, the matching preferences of both the coal mining and power generation companies to which the original nonzero elements correspond are all increased (the rankings in the order of preferences become higher).

To more intuitively describe the above problem, we can select the double pairs

S3,

d3 and

S4,

d2, which do not achieve coal trading, as an example for the analysis. We placed the matrix loop that involves

S3,

d3 and

S4,

d2 into

Table 3 in order to perform a separate analysis. Under the stable matching result, only the two pairs

S3,

d2 and

S4,

d3 achieved coal trading, at amounts of 20 and 5 kilotons, respectively. Suppose the allocation results are adjusted as follows: coal mining company

S3 reduces its supply to power generation company

d2 by 5 kilotons and coal mining company

S4 reduces its supply to power generation company

d3 by 5 kilotons. Now the quantity that coal mining company

S4 supplies to power generation company

d2 has increased from 0 to 5 kilotons and the supply of coal mining company

S3 to power generation company

d3 has also increased from 0 to 5 kilotons as shown in

Table 4.

Analysis of the matching preferences indicates that the matching in

Table 4 is unstable.

Table 1 shows that coal mining company

S4 ranks power generation companies

d2 and

d3 6th and 3rd, respectively, in its order of preferences; it prefers to sell coal to power generation company

d3 over

d2 but ends up signing an agreement with

d2 to sell 5 kilotons of coal. Similarly, power generation company

d3 ranks coal mining companies

S3 and

S4 8th and 3rd, respectively, in its order of preference; it prefers to purchase coal from coal mining company

S4 instead of

S3 but ends up signing an agreement with

S3 to purchase 5 kilotons of coal. In this situation, coal mining company

S4 and power generation company

d3 would find that, if they signed an agreement with each other for the purchase of 5 kilotons of coal and cancelled their respective agreements with power generation company

d2 and coal mining company

S3, they would be in better trading relationships and both parties would benefit from this change. Therefore, the matching between coal mining companies

S3 and

S4 and power generation companies

d2 and

d3 is likely to revert to the original allocation in

Table 2.

In theory, based on matching preferences, regardless of however much more coal coal mining company S4 sells to power generation company d2 and however much more coal coal mining company S3 sells to power generation company d3, the result would be pairwise unstable. This unstable matching result would lead to conflicts between the coal mining and power generation companies. It is even likely that, because the two market participants insist that they should match each other, other parties’ interests will be undermined.

We further analyzed the sensitive degree of the pairwise stable matching that is discussed above; namely, the impact of changes in the coal supply or demand on the stable matching relation, which is a different analysis perspective and gives further discussions of stable matching results compared with the studies of Jiang et al. (2016) [

18], Wang et al. (2020) [

21], and Yang et al. (2021) [

23]. In the simulation, we only changed the supply or demand of one pair of coal mining and power generation companies without causing changes to the trading relations in order to analyze the sensitivity of the pairwise stable matching to marginal supply and demand changes.

Under the condition that the matching relation between coal mining and power generation companies will not be changed, we randomly changed the supply or demand for one pair of trading partners in order to test the sensitivity of the matching results to the marginal changes in demand and supply on the two sides. Through a program that was designed to test the sensitivity of stable matching, we were able to calculate the marginal changes in the coal supply and demand that would not alter the matching between the coal mining and power generation companies.

Table 5 indicates that when power generation companies

d1,

d4, and

d5 increase their demands for coal by 4, 2, and 5 kilotons, respectively, the stable matching relation is not affected; when power generation company

d5 decreases its demand by 5 kilotons, the stable matching is still not affected. As shown in

Table 6, when coal mining company

S8 increases its supply by 8 kilotons, the stable matching is not affected and when coal mining companies

S1,

S3,

S7, and

S8 decrease their coal supplies by 6, 4, 2, and 15 kilotons, respectively, the stable matching is not affected.