The Evaluation of Creditworthiness of Trade and Enterprises of Service Using the Method Based on Fuzzy Logic

Abstract

1. Introduction

2. Materials and Methods

3. Results

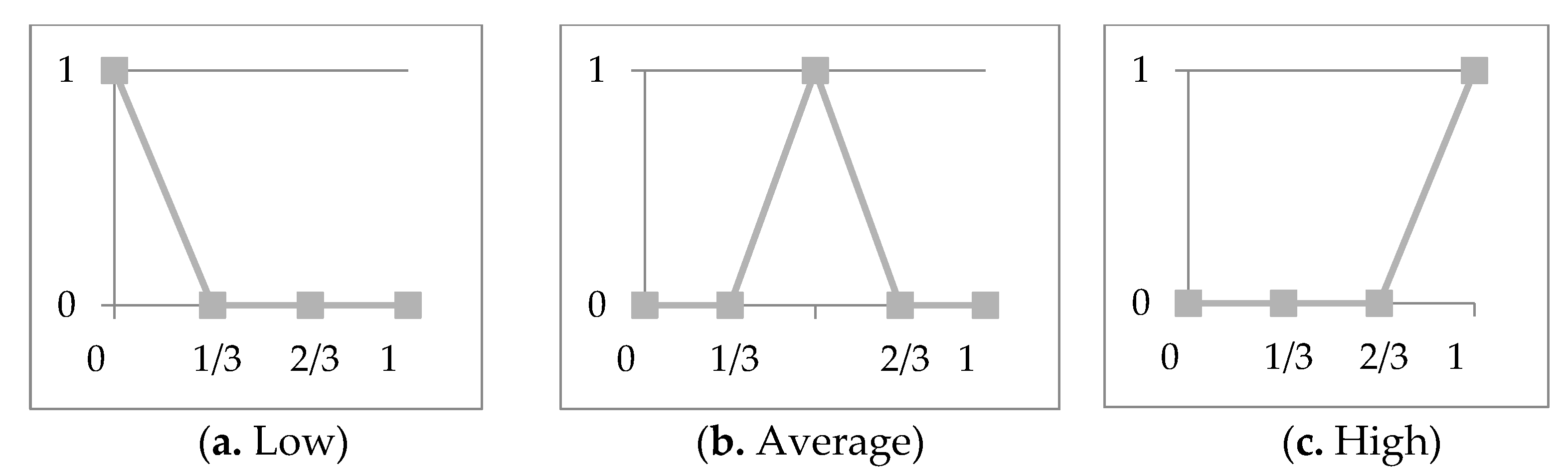

3.1. Indicator Unification Process

3.2. Decision-Making Process

3.3. Examples of Lending to Enterprises

- −

- Indicators of industry and regional specifics;

- −

- Financial and economic indicators;

- −

- Small business performance indicators.

4. Discussion

5. Conclusions

- −

- Maintain the quality of the analysis of creditworthiness due to the participation of a loan officer in the decision-making process, while correctly operating with expert assessments through the use of the mathematical apparatus of fuzzy sets;

- −

- Carry out an assessment of the creditworthiness of an enterprise as a dynamic process throughout the entire period of lending, which makes it possible for a commercial bank to organize a system for monitoring the state of the borrower, as well as to signal the period of the onset of credit risk;

- −

- Replace the set of financial indicators depending on the preferences of the loan officer, the specifics of the borrower’s activities, or in accordance with the financial information provided by the borrower, which can be taken from standard financial statements or data from the simplified taxation system;

- −

- Form a single automated database based on indicators for assessing the dynamics of development by industry and the region as a whole, which will allow banks to avoid the recalculation of quality indicators when assessing the creditworthiness of a small enterprise.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bazmara, A.; Donighi, S.S. Bank Customer Credit Scoring by Using Fuzzy Expert System. Int. J. Intell. Syst. Appl. 2014, 11, 29–35. [Google Scholar] [CrossRef]

- Nosratabadi, H.E.; Nadali, A.; Pourdarab, S. Credit Assessment of Bank Customers by a Fuzzy Expert System Based on Rules Extracted from Association Rules. Int. J. Mach. Learn. Comput. 2012, 2, 662–666. [Google Scholar] [CrossRef][Green Version]

- Malhotra, R.; Malhotra, D.K. Differentiating between good credits and bad credits using neuro-fuzzy systems. Eur. J. Oper. Res. 2002, 136, 190–211. [Google Scholar] [CrossRef]

- Lai, K.K.; Yu, L.; Zhou, L.G.; Wang, S.Y. Neural Network Metalearning for Credit Scoring. In Proceedings of the International Conference on Intelligent Computing, Kunming, China, 16–19 August 2006; pp. 403–408. [Google Scholar]

- Lee, T.-S.; Chen, I.-F. A two-stage hybrid credit scoring model using artificial neural networks and multivariate adaptive regression splines. Expert Syst. Appl. 2005, 28, 743–752. [Google Scholar] [CrossRef]

- Pacelli, V.; Azzollini, M. An Artificial Neural Network Approach for Credit Risk Management. J. Intell. Learn. Syst. Appl. 2011, 3, 103–112. [Google Scholar] [CrossRef][Green Version]

- Ravi Kumar, P.; Ravi, V. Bankruptcy prediction in banks and firms via statistical and intelligent techniques—A review. Eur. J. Oper. Res. 2007, 180, 1–28. [Google Scholar] [CrossRef]

- Chourmouziadis, K.; Chatzoglou, P.D. An intelligent short term stock trading fuzzy system for assisting investors in portfolio management. Expert Syst. Appl. 2016, 43, 298–311. [Google Scholar] [CrossRef]

- Carvalho, J.P.; Tome, J.A.B. Rule based fuzzy cognitive maps in socio-economic systems. In Proceedings of the 2009 International Fuzzy Systems Association World Congress and 2009 European Society for Fuzzy Logic and Technology Conference, Lisbon, Portugal, 20–24 July 2009; pp. 1821–1826. [Google Scholar]

- Neocleous, C.; Schizas, C.; Papaioannou, M. Fuzzy cognitive maps in estimating the repercussions of oil/gas exploration on politico-economic issues in Cyprus. IEEE Int. Conf. Fuzzy Syst. 2011, 6007655, 1119–1126. [Google Scholar]

- Lebedeva, M.E. Fuzzy logic in economics—The formation of a new direction. Ideas Ideals 2019, 11, 197–212. (In Russian) [Google Scholar] [CrossRef]

- Zadeh, L.A. Shadows of fuzzy sets. In Advancess in Fuzzy Systems—Applications and Theory Fuzzy Sets, Fuzzy Logic, and Fuzzy Systems; World Scientific Book: Singapore, 1996; pp. 51–59. [Google Scholar]

- Keisler HJChang, C.C. Continuous Model Theory; Princeton University Press: Princeton, NJ, USA, 1966. [Google Scholar]

- Mukasheva, M.; Omirzakova, A. Computational thinking assessment at primary school in the context of learning programming. World J. Educ. Technol. Curr. Issues 2021, 13, 336–353. [Google Scholar] [CrossRef]

- Tussupov, J.; La, L.; Mukhanova, A. A Model of fuzzy synthetic evaluation method realized by a neural network. Int. J. Math. Model. Methods Appl. Sci. 2014, 8, 103–106. [Google Scholar]

- Sinyanskaya, E.R.; Bazhenov, O.V. Fundamentals of Accounting and Analysis; Urals University Press: Ekaterinburg, Russia, 2014; p. 267. ISBN 978-5-7996-1141-5. (In Russian) [Google Scholar]

- Ilisheva, N.N.; Krylov, S.I. Analysis of Financial Statements; Finance and Statistics: Moscow, Russia, 2020; p. 372. ISBN 978-5-279-03603-5. (In Russian) [Google Scholar]

- Zadeh, L.A. The concept of a linguistic variable and its application to approximate resoning. Inf. Sci. 1975, 8, 199–249. [Google Scholar] [CrossRef]

- Pivkin, V.Y.; Bakulin, E.P.; Korenkov, D.I. Fuzzy Sets in Control Systems; Novosibirsk State University Press: Novosibirsk, Russia, 1997; p. 52. (In Russian) [Google Scholar]

- Wang, Y.-J. Ranking triangle and trapezoidal fuzzy numbers based on the relative preference relation. Appl. Math. Model. 2015, 39, 586–599. [Google Scholar] [CrossRef]

- Illarionov, A.V. Development of Mathematical Models and Decision-Making Algorithms for Lending to Small and medium Businesses Based on Fuzzy Sets Theory. Ph.D. Thesis, Vladimir State University, Vladimir, Russia, 2006; p. 231. (In Russian). [Google Scholar]

- Abramov, E.P.; Makhazhanova, U.T.; Murzin, F.A. Credit decision making based on Zadeh’s fuzzy logic. In Proceedings of the 12th International Ershov Conference on Informatics (PSI’19), Russia, Novosibirsk, 2–5 July 2019; pp. 20–25. (In Russian). [Google Scholar]

- Makhazhanova, U.T.; Murzin, F.A.; Mukhanova, A.A.; Abramov, E.P. Fuzzy logic of Zadeh and decision-making in the field of loan. J. Theor. Appl. Inf. Technol. 2020, 98, 1076–1086. [Google Scholar]

- Lin, J.; Meng, F.; Chen, R.; Zhang, Q. Preference attitude-based method for ranking intuitionistic fuzzy numbers and its ap-plication in renewable energy selection. Complexity 2018, 2018, 6251384. [Google Scholar] [CrossRef]

- Chou, C.-C. The canonical representation of multiplication operation on triangular fuzzy numbers. Comput. Math. Appl. 2003, 45, 1601–1610. [Google Scholar] [CrossRef]

- Saati, T. Decision-making. Method of the analysis of hierarchies. M. Radio Commun. 1993, 278, 302. [Google Scholar]

- Saaty, T.L.; Vargas, L.G. Uncertainty and rank order in the analytic hierarchy process. Eur. J. Oper. Res. 1987, 32, 107–117. [Google Scholar] [CrossRef]

- Kundu, S. Min-transitivity of fuzzy leftness relationship and its application to decision making. Fuzzy Sets Syst. 1997, 86, 357–367. [Google Scholar] [CrossRef]

- Herrera, F.; Martınez, L.; Sánchez, P.J. Managing non-homogeneous information in group decision making. Eur. J. Oper. Res. 2005, 166, 115–132. [Google Scholar] [CrossRef]

- Liu, F.; Pan, L.-H.; Liu, Z.-L.; Peng, Y.-N. On possibility-degree formulae for ranking interval numbers. Soft Comput. 2018, 22, 2557–2565. [Google Scholar] [CrossRef]

- Lipovetsky, S.; Tishler, A. Interval estimation of priorities in the AHP. Eur. J. Oper. Res. 1999, 114, 153–164. [Google Scholar] [CrossRef]

- Sugihara, K.; Ishii, H.; Tanaka, H. Interval priorities in AHP by interval regression analysis. Eur. J. Oper. Res. 2004, 158, 745–754. [Google Scholar] [CrossRef]

- Wang, Y.M.; Yang, J.B.; Xu, D.L. A two-stage logarithmic goal programming method for generating weights from interval comparison matrices. Fuzzy Sets Syst. 2005, 152, 475–498. [Google Scholar] [CrossRef]

- Zhang, Z. Logarithmic least squares approaches to deriving interval weights, rectifying inconsistency and estimating missing values for interval multiplicative preference relations. Soft Comput. 2017, 21, 3993–4004. [Google Scholar] [CrossRef]

- Sengupta, A.; Pal, T.K. On comparing interval numbers: A study on existing ideas. In Fuzzy Preference Ordering of Interval Num-bers in Decision Problems; Springer: Berlin/Heidelberg, Germany, 2009; pp. 25–37. [Google Scholar]

- Dombi, J.; Jónás, T. Ranking trapezoidal fuzzy numbers using a parametric relation pair. Fuzzy Sets Syst. 2020, 399, 20–43. [Google Scholar] [CrossRef]

- Kosko, B. Fuzzy Thinking: The New Science of Fuzzy Logic; Hyperion Books: Westport, CT, USA, 1993. [Google Scholar]

- Orazbayev, B.B.; Orazbayeva, K.N.; Utenova, B.T. Development of mathematical models and modeling of chemical engineering systems under uncertainty. Theor. Found. Chem. Eng. 2014, 48, 138–148. [Google Scholar] [CrossRef]

| № | Initial Indicators |

|---|---|

| 1 | Dynamics of development of the industry |

| 2 | Prospects for the development of the industry |

| 3 | Needs of the market (industry) for such products (work, services) |

| 4 | Dynamics of the development of the economy of the region |

| 5 | Prospects for the development of the economy of the region |

| 6 | Needs of the market (region) for such products (work, services) |

| 7 | Current liquidity ratio |

| 8 | Financial independence ratio |

| 9 | Working capital financed by equity to total assets ratio |

| 10 | Debt service coverage ratio |

| 11 | Accounts receivable turnover ratio |

| 12 | Accounts payable turnover ratio |

| 13 | Inventory turnover ratio |

| 14 | Debt-to-equity ratio |

| 15 | Profit margin ratio |

| 16 | Evaluation of the professional level of staff |

| 17 | Evaluation of the moral and psychological atmosphere in the enterprise |

| 18 | Sufficiency of the period of stay of the enterprise in the market |

| 19 | Economic policy of the enterprise |

| 20 | Technical policy of the enterprise |

| 21 | Personnel policy of the enterprise |

| 22 | Credit history of the borrower (if not absent) |

| № | Types of Workers | Type 1 | Type 2 | … | Type k |

|---|---|---|---|---|---|

| 1 | Number of existing employees | … | |||

| 2 | Required number of workers | … |

| Indicators | E-1 | E-2 | E-3 | E-4 | |

|---|---|---|---|---|---|

| K1 | Dynamics of development of the industry | M (0.75; 0.25) | M (0.75; 0.25) | M (0.75; 0.25) | HM (1; 0.5) |

| K2 | Prospects for the development of the industry | M (0.75; 0.25) | M (0.75; 0.25) | M (0.75; 0.25) | HM (1; 0.5) |

| K3 | Needs of the market (industry) for such products (work, services) | M (0.75; 0.25) | M (0.75; 0.25) | M (0.75; 0.25) | HM (1; 0.5) |

| K4 | Dynamics of the development of the economy of the region | HM (1; 0.5) | H (1; 0.75) | M (0.75; 0.25) | HM (1; 0.5) |

| K5 | Prospects for the development of the economy of the region | M (0.75; 0.25) | M (0.75; 0.25) | M (0.75; 0.25) | H (1; 0.75) |

| K6 | Needs of the market (region) for such products (work, services) | HM (1; 0.5) | HM (1; 0.5) | M (0.75; 0.25) | HM (1; 0.5) |

| Indicators | Recommended Value | E-1 | E-2 | E-3 | E-4 | |

|---|---|---|---|---|---|---|

| K7 | Current liquidity ratio | K7 | K7 = 8 H (1; 0.75) | K7 = 0.02 L (0.25; 0) | K7 = 0.18 L (0.25; 0) | K7 = 1.83 HM (1; 0.5) |

| K8 | Ratio of financial independence | K8 | K8 = 93% H (1; 0.75) | K8 = 91% H (1; 0.75) | K8 = 60% H (1; 0.75) | K8 = 84% H(1; 0.75) |

| K9 | Working capital financed by equity to total assets ratio | K9 | K9 = 89% H (1; 0.75) | Not recommended | Not recommended | K9 = 0.47 HM (1; 0.5) |

| K10 | Debt service coverage ratio | 2 > K10 ≥ 1.5 | K10 = 2.21 HM (1; 0.5) | K10 = 1.5 H (1; 0.75) | K10 = 1.29 HM (1; 0.5) | K10 = 1.33 HM (1; 0.5) |

| K11 | Accounts receivable turnover ratio | K11 ≥ 12 | K11 = 15.77 H (1; 0.75) | K11 = 0 L (0.25; 0) | K11 = 19 H (1; 0.75) | K11 = 5.89 M (0.75; 0.25) |

| K12 | Accounts payable turnover ratio | K12 ≥ 1 | K12 = 1.83 H (1; 0.75) | K12 = 0.95 HM (1; 0.5) | K12 = 0.65 M (0.75; 0.25) | K12 = 0.9 HM (1; 0.5) |

| K13 | Inventory turnover ratio | 18 > K13 ≥ 8 | K13 = 248 L (0.25; 0) | Not recommended | K13 = 7 HM (1; 0.5) | Not recommended |

| K14 | Debt-to-equity ratio | K14 ≤ 1 | K14 = 0.07 H (1; 0.75) | K14 = 0.09 H (1; 0.75) | K14 = 0.64 H (1; 0.75) | K14 = 0.19 H (1; 0.75) |

| K15 | Profit margin ratio | K1 ≥ 40% | K15 = 50% H (1; 0.75) | K15 = 100% H (1; 0.75) | K15 = 57% H (1; 0.75) | K15 = 45% H (1; 0.75) |

| Indicators | Assessment Criteria | E-1 | E-2 | E-3 | E-4 | |

|---|---|---|---|---|---|---|

| K16 | Evaluation of the professional level of staff | Number of specialists by level | LM (0.5; 0) | LM (0.5; 0) | LM (0.5; 0) | M (0.75; 0.25) |

| K17 | Evaluation of the moral and psychological atmosphere in the enterprise | Specializations: qualifications, education, and work experience | HM (1; 0.5) | M (0.75; 0.25) | M (0.75; 0.25) | M (0.75; 0.25) |

| K18 | Sufficiency of the period of stay of the enterprise in the market | These data were extracted from the survey | H (1; 0.75) | H (1; 0.75) | H (1; 0.75) | H (1; 0.75) |

| K19 | Economic policy of the enterprise | Enterprises on the market | LM (0.5; 0) | M (0.75; 0.25) | LM (0.5; 0) | HM (1; 0.5) |

| K20 | Technical policy of the enterprise | Compliance with submitted business plan | LM (0.5; 0) | HM (1; 0.5) | LM (0.5; 0) | HM (1; 0.5) |

| K21 | Personnel policy of the enterprise | Availability of real estate, transport, equipment, and their use within work at the enterprise | M (0.75; 0.25) | HM (1; 0.5) | M (0.75; 0.25) | M (0.75; 0.25) |

| K22 | Credit history of the borrower (if not absent) | Human resources management: selection, staffing, certification, training | L (0.25; 0) | H (1; 0.75) | H (1; 0.75) | H (1; 0.75) |

| № | Name of Enterprises | Creditworthiness of the Enterprise |

|---|---|---|

| 1 | Enterprise-1 | M (0.83; 0.42) |

| 2 | Enterprise-2 | M (0.81; 0.41) |

| 3 | Enterprise-3 | M (0.73; 0.31) |

| 4 | Enterprise-4 | HM (0.96; 0.52) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Makhazhanova, U.; Kerimkhulle, S.; Mukhanova, A.; Bayegizova, A.; Aitkozha, Z.; Mukhiyadin, A.; Tassuov, B.; Saliyeva, A.; Taberkhan, R.; Azieva, G. The Evaluation of Creditworthiness of Trade and Enterprises of Service Using the Method Based on Fuzzy Logic. Appl. Sci. 2022, 12, 11515. https://doi.org/10.3390/app122211515

Makhazhanova U, Kerimkhulle S, Mukhanova A, Bayegizova A, Aitkozha Z, Mukhiyadin A, Tassuov B, Saliyeva A, Taberkhan R, Azieva G. The Evaluation of Creditworthiness of Trade and Enterprises of Service Using the Method Based on Fuzzy Logic. Applied Sciences. 2022; 12(22):11515. https://doi.org/10.3390/app122211515

Chicago/Turabian StyleMakhazhanova, Ulzhan, Seyit Kerimkhulle, Ayagoz Mukhanova, Aigulim Bayegizova, Zhankeldi Aitkozha, Ainur Mukhiyadin, Bolat Tassuov, Ainur Saliyeva, Roman Taberkhan, and Gulmira Azieva. 2022. "The Evaluation of Creditworthiness of Trade and Enterprises of Service Using the Method Based on Fuzzy Logic" Applied Sciences 12, no. 22: 11515. https://doi.org/10.3390/app122211515

APA StyleMakhazhanova, U., Kerimkhulle, S., Mukhanova, A., Bayegizova, A., Aitkozha, Z., Mukhiyadin, A., Tassuov, B., Saliyeva, A., Taberkhan, R., & Azieva, G. (2022). The Evaluation of Creditworthiness of Trade and Enterprises of Service Using the Method Based on Fuzzy Logic. Applied Sciences, 12(22), 11515. https://doi.org/10.3390/app122211515