Application of Continuous Non-Gaussian Mortality Models with Markov Switchings to Forecast Mortality Rates

Abstract

:Featured Application

Abstract

1. Introduction

- S1.

- The family of extended Milevsky and Promislov mortality models with Gaussian linear scalar filters (GLSF) is studied. This family is described by stochastic processes representing a mortality rate for a person aged X at time t. The solutions of the mentioned stochastic differential equations are considered with switches (Section 2.1).

- S2.

- Considering the ln-function of , and applying the Ito formula, a new vector state with unknown parameters is introduced (Section 2.2).

- S3.

- Using moment equations for GLSF with Markov switches, the first- and the second-order moments of equations for a particular case of two subsystem models (stationary and nonstationary solutions) are obtained, and approximate solutions are analysed (Section 2.2.1, Section 2.2.2 and Section 2.2.3).

- S4.

- A similar analysis to step S3 for the non-Gaussian linear scalar filters (nGLSF) model with Markov switches is repeated (Section 2.3).

- S5.

- The estimation procedure of the parameters (introduced in step S2) is applied (Section 2.4).

2. Materials and Methods

2.1. Mathematical Preliminaries

2.2. Model with Gaussian Linear Scalar Filter (GLSF)

2.2.1. Moment Equations for GLFS Model with Markov Switchings

2.2.2. Analysis of First Order Moments

2.2.3. Analysis of Second-Order Moments

2.3. Model with a Non-Gaussian Linear Scalar Filters (nGLSF)

2.4. Procedure

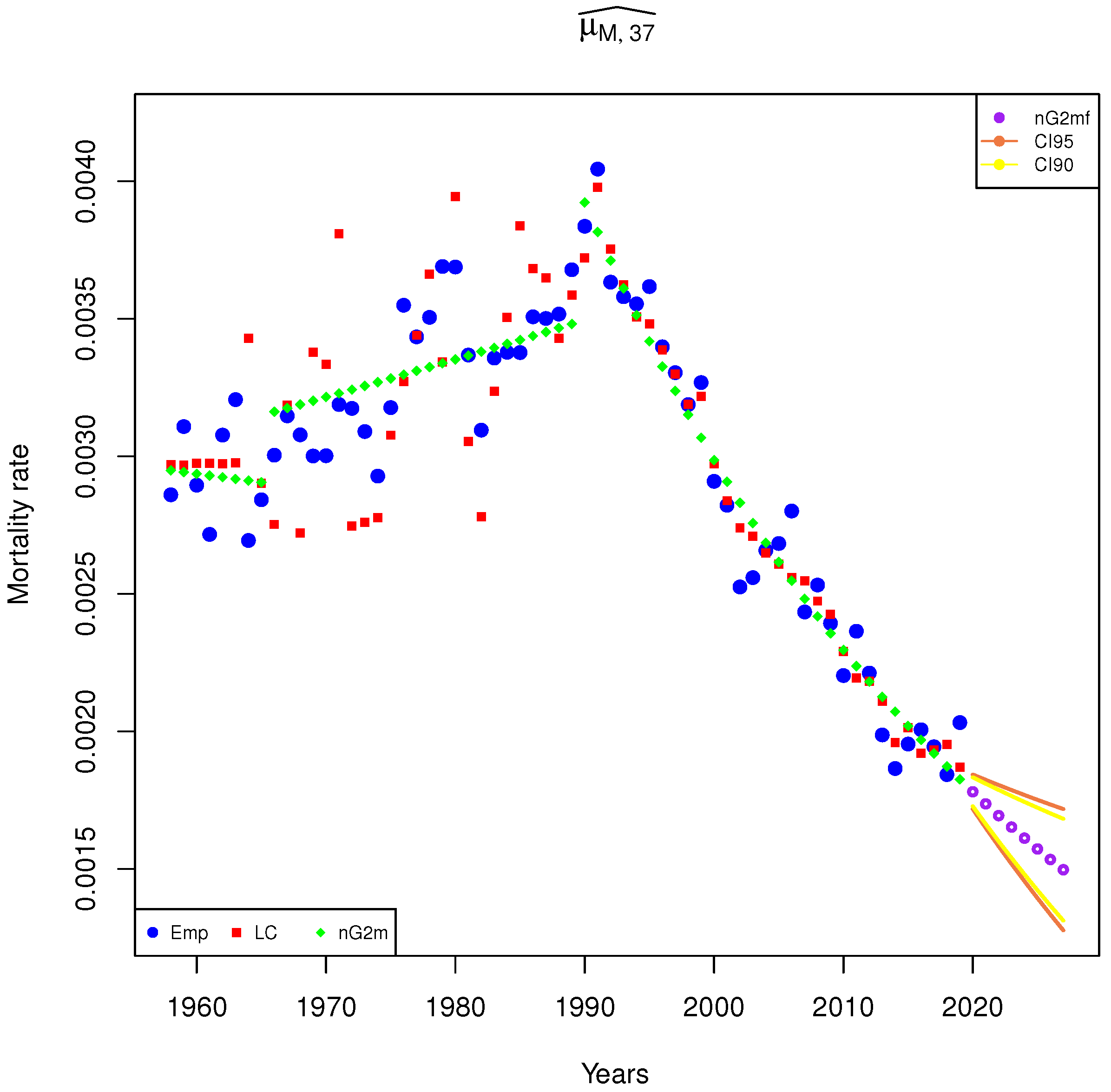

3. Results

4. Discussion

- All the results obtained in the article regarding the proposed model were compared with the benchmark, i.e., the LC model,

- In all the studied cases, the MSE value for the nGMs model, which took into account the divisions of periods into higher and lower dispersion, is lower than for the LC model,

- As a consequence of the above observation, the respective confidence intervals are narrower, thereby resulting in more accurate forecasts,

- In cases that neither contained higher or lower periods of dispersion nor switchings, the LC model works as a better model, one better suited to the empirical data, the LC model usually fits the empirical data better (),

- In cases that neither contained higher or lower periods of dispersion nor switchings, the nGs model fits the empirical data better (),

- In cases of determining periods with significantly smaller and higher dispersion, the proposed method of modelling reflects the shape of the empirical data better than the LC model and the nGs model,

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Model with Gaussian Linear Scalar Filter

Appendix A.1. Moment Equations for GLSF Model

Appendix A.2. Partially Stationary Solutions for GLSF Model

Appendix B. Model with Non-Gaussian Linear Scalar Filter

Appendix B.1. Moment Equations and Stationary Solutions for Non-GLSF Model

Appendix B.2. Partially Stationary Solutions for Non-GLSF Model

References

- Shang, Y.; Liu, T.; Wei, Y.; Li, J.; Shao, L.; Liu, M.; Zhang, Y.; Zhao, Z.; Xu, H.; Peng, Z.; et al. Scoring systems for predicting mortality for severe patients with COVID-19. eClinicalMedicine 2020, 24, 100426. [Google Scholar] [CrossRef] [PubMed]

- Alaraj, M.; Majdalawieh, M.; Nizamuddin, N. Modeling and forecasting of COVID-19 using a hybrid dynamic model based on SEIRD with ARIMA corrections. Infect. Dis. Model. 2021, 6, 98–111. [Google Scholar] [CrossRef] [PubMed]

- Booth, H.; Tickle, L. Mortality modelling and forecasting: A review of methods. Ann. Actuar. Sci. 2008, 3, 3–43. [Google Scholar] [CrossRef]

- Cairns, A.J.G.; Blake, D.; Dowd, K. Modelling and management of mortality risk: A review. Scand. Actuar. J. 2008, 2–3, 79–113. [Google Scholar] [CrossRef]

- Jahangiri, K.; Aghamohamadi, S.; Khosravi, A.; Kazemi, E. Trend forecasting of main groups of causes-of-death in Iran using the Lee-Carter model. Med. J. Islam. Repub. Iran 2018, 32, 124. [Google Scholar] [CrossRef] [PubMed]

- Lee, R.D.; Carter, L. Modeling and forecasting the time series of U.S. mortality. J. Am. Stat. Assoc. 1992, 87, 659–671. [Google Scholar]

- Lee, R.D.; Miller, T. Evaluating the performance of the Lee-Carter method for forecasting mortality. Demography 2001, 38, 537–549. [Google Scholar] [CrossRef]

- Agadi, R.P.; Talawar, A.S. Stochastic differential equation: An application to mortality data. Int. J. Res. Granthaalayah 2020, 8, 229–235. [Google Scholar] [CrossRef]

- Christiansen, M.C. Gaussian and Affine Approximation of Stochastic Diffusion Models for Interest and Mortality Rates. Risks 2013, 1, 81. [Google Scholar] [CrossRef] [Green Version]

- Gao, N.; Wang, X.; Liu, J. Dynamics of stochastic SIS epidemic model with nonlinear incidence rates. Adv. Differ. Equ. 2019, 2019, 41. [Google Scholar] [CrossRef] [Green Version]

- Kareem, A.M.; Al-Azzawi, S.N. A stochastic differential equations model for internal COVID-19 Dynamics. J. Phys. Conf. Ser. 2021, 1818, 012121. [Google Scholar] [CrossRef]

- Zhang, X.; Liao, P.; Chen, X. The negative impact of COVID-19 on live insurers. Front. Public Health 2021, 9. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Z.; Zeb, A.; Hussain, S.; Alzahrani, E. Dynamics of COVID-19 mathematical model with stochastic perturbation. Adv. Differ. Equ. 2020, 2020, 451. [Google Scholar] [CrossRef] [PubMed]

- Akushevich, I.; Akushevich, L.; Manton, K.; Yashin, A. Stochastic process model of mortality and aging: Application to longitudinal data. Nonlinear Phenom. Complex Syst. 2003, 6, 515–523. [Google Scholar]

- Biffis, E. Affine processes for dynamic mortality and actuarial valuations. Insur. Math. Econom. 2005, 37, 443–468. [Google Scholar] [CrossRef]

- Giacometti, R.; Ortobelli, S.; Bertocchi, M. A stochastic model for mortality rate on Italian Data. J. Optim. Theory Appl. 2011, 149, 216–228. [Google Scholar] [CrossRef]

- Janssen, J.; Skiadas, C.H. Dynamic modelling of life table data. Appl. Stoch. Model. Data Anal. 1995, 11, 35–49. [Google Scholar] [CrossRef]

- Russo, V.; Giacometti, R.; Ortobelli, S.; Rachev, S.; Fabozzi, F.J. Calibrating affine stochastic mortality models using term assurance premiums. Insur. Math. Econom. 2011, 49, 53–60. [Google Scholar] [CrossRef]

- Hainaut, D.; Devolder, P. Mortality modelling with Lévy processes. Insur. Math. Econom. 2008, 42, 409–418. [Google Scholar] [CrossRef]

- Bravo, J.M.; Braumann, C.A. The value of a random life: Modelling survival probabilities in a stochastic environment. Bull. Intern. Stat. Inst. 2007, LXII, 1–4. [Google Scholar]

- Bravo, J.M. Modelling mortality using multiple stochastic latent factors. In Proceedings of the 7th International Workshop on Pension, Insurance and Saving, Paris, France, 28–29 May 2009; pp. 1–15. [Google Scholar]

- Boukas, E.K. Stochastic Hybrid Systems: Analysis and Design; Birkhauser: Boston, MA, USA, 2005. [Google Scholar]

- Liberzon, D. Switching in Systems and Control, Boston, Basel, Berlin; Birkhauser: Basel, Switzerland, 2003. [Google Scholar]

- Biffis, E.; Denuit, M. Lee-Carter goes risk-neutral: An application to the Italian annuity market. Giornalle Dell’Institutonitaliano Degli Attuari 2006, LXIX, 1–21. [Google Scholar]

- Biffis, E.; Denuit, M.; Devolder, P. Stochastic mortality under measure changes. Scand. Actuar. J. 2010, 4, 284–311. [Google Scholar] [CrossRef]

- Hainaut, D. Multi dimensions Lee-Carter model with switching mortality processes. Insur. Math. Econom. 2012, 47, 409–418. [Google Scholar]

- Rossa, A.; Socha, L.; Szymanski, A. Hybrid Dynamic and Fuzzy Models of Mortality, 1st ed.; WUL: Lodz, Poland, 2018. [Google Scholar]

- Sliwka, P.; Socha, L. A proposition of generalized stochastic Milevsky-Promislov mortality models. Scand. Actuar. J. 2018, 8, 706–726. [Google Scholar] [CrossRef]

- Sliwka, P. Application of the Markov Chains in the Prediction of the Mortality Rates in the Generalized Stochastic Milevsky–Promislov Model. In Trends in Biomathematic 2018; Mondaini, R., Ed.; Springer: Cham, Switzerland, 2019; pp. 191–208. [Google Scholar] [CrossRef]

- Sliwka, P. Application of the Model with a Non-Gaussian Linear Scalar Filters to Determine Life Expectancy, Taking into Account the Cause of Death. In Computational Science—ICCS 2019; Springer: Cham, Switzerland, 2019; Volume 11538, pp. 435–449. [Google Scholar] [CrossRef]

- Sliwka, P.; Socha, L. A Comparison of Generalized Stochastic Milevsky-Promislov Mortality Models with continuous non-Gaussian Filters. In Computational Science—ICCS 2020; Krzhizhanovskaya, V., Ed.; Springer: Cham, Switzerland, 2020; Volume 12140, pp. 348–362. [Google Scholar] [CrossRef]

- Sliwka, P. Markov (Set) chains application to predict mortality rates using extended Milevsky-Promislov generalized mortality models. J. Appl. Stat. 2021, 1–21. [Google Scholar] [CrossRef]

- Lovrić, M.; Milanović, M.; Stamenković, M. Algorithmic methods for segmentation of time series: An overview. J. Contemp. Econ. Bus. Issues 2014, 1, 31–53. [Google Scholar]

- Milevsky, M.A.; Promislov, S.D. Mortality derivatives and the option to annuitise. Insur. Math. Econ. 2001, 29, 299–318. [Google Scholar] [CrossRef]

- Khasminski, R.Z.; Zhu, C.; Yin, G. Stability of regime-switching diffusions. Stoch. Proc. Appl. 2007, 117, 1037–1051. [Google Scholar] [CrossRef] [Green Version]

- Mao, X. Stability of stochastic differential equations with Markovian switching. Stoch. Proc. Appl. 1999, 79, 45–67. [Google Scholar] [CrossRef] [Green Version]

- Sliwka, P.; Swistowska, A. Economic Forecasting Methods with the R Package; UKSW: Warszawa, Poland, 2019; ISBN 978-83-8090-667-9. [Google Scholar]

- Statistical Office, Poland. 2020. Available online: http://demografia.stat.gov.pl/bazademografia/TrwanieZycia.aspx (accessed on 23 May 2022).

- The Human Mortality Database. 2020. Available online: https://mortality.org/hmd/POL/STATS/Deaths-1x1.txt (accessed on 23 May 2022).

| Age | MSEEM-LC | MSEEM-nG | MSEEM-nGMs | ||

|---|---|---|---|---|---|

| 0.195 (0.02) | 8.69 (0.004) | ||||

| 0.22 (0.03) | 0.18 (0.02) | ||||

| 0.12 (0.01) | 5.15 (0.02) | ||||

| – | 0.27 (0.0197) | 192 () | |||

| – | – | – | |||

| – | – | – |

| CI | ||||||

|---|---|---|---|---|---|---|

| 90% L | 4.57 | |||||

| 90% R | ||||||

| 95% L | ||||||

| 95% R |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sliwka, P.; Socha, L. Application of Continuous Non-Gaussian Mortality Models with Markov Switchings to Forecast Mortality Rates. Appl. Sci. 2022, 12, 6203. https://doi.org/10.3390/app12126203

Sliwka P, Socha L. Application of Continuous Non-Gaussian Mortality Models with Markov Switchings to Forecast Mortality Rates. Applied Sciences. 2022; 12(12):6203. https://doi.org/10.3390/app12126203

Chicago/Turabian StyleSliwka, Piotr, and Leslaw Socha. 2022. "Application of Continuous Non-Gaussian Mortality Models with Markov Switchings to Forecast Mortality Rates" Applied Sciences 12, no. 12: 6203. https://doi.org/10.3390/app12126203