Reflections on the Customer Decision-Making Process in the Digital Insurance Platforms: An Empirical Study of the Baltic Market

Abstract

1. Introduction

- How do digital environments and technological factors influence the decision-making process in insurance distribution platforms?

- What are the predominant factors of insurance decision-making processes in digital insurance platforms?

2. The Theoretical Background of Digital Non-Life Insurance Concepts and Insurance Customer Decision-Making Processes

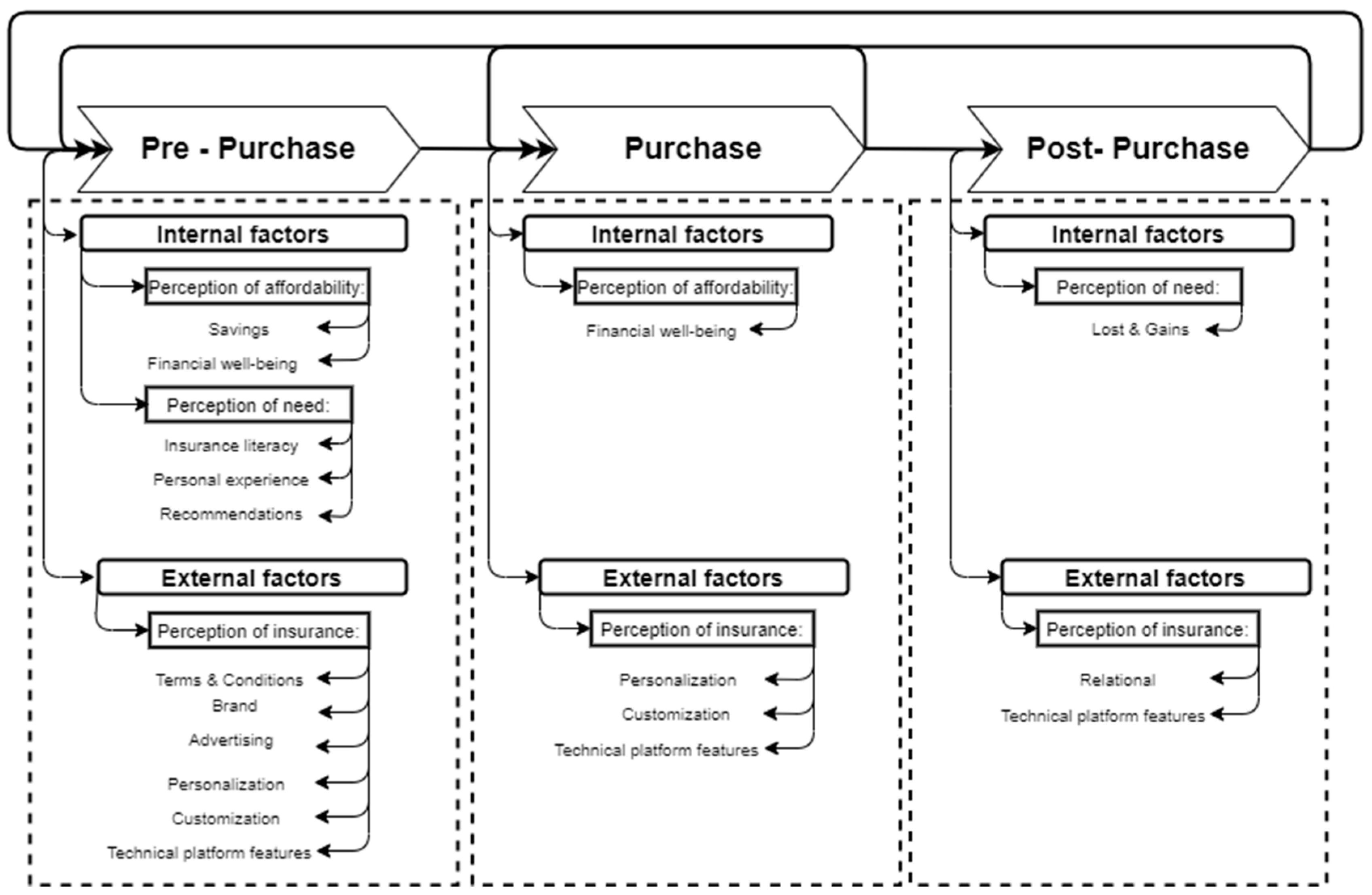

- CDM and HCDM, regarding behavior and purchase decision-making of insurance customers. It can be defined as a continuous sequence of mental considerations and physical actions, which are divided into the two following main groups and two stages: a perception group of a need for insurance and a perception group of affordability; a personal evaluation stage of needs and affordability factors and objective evaluation stage of insurance content [12,13,18,19]. On the other hand, organizations, including the non-life insurance market, still focus on favorable customer experience management with limited attention and analysis on the multifaceted concept of customer experience and journey management [19]. This situation illustrates a need for conceptualization of insurance customer experience drivers and outcomes in the traditional model of three process stages and comprehensive evaluation categories. These categories combine customer experience drivers and customer integration via value co-creation efforts within different processes of insurance decision-making [20]. This type of holistic customer experience evaluation approach indicates that the customer value and experience are context-dependent, systematic, and interactive within all stages of the process [19,21];

- Information system theories and models of technology acceptance and self-service technologies (SSTs), in the form of constructs and determinant groups of behavioral intentions, usage behavior, and digital insurance platforms. The following constructs and determinants of behavioral intentions and usage behavior can be identified as slightly modified, but reflecting both traditional (face-to-face) and digital insurance distribution channels, such as performance expectancy, effort expectancy, social influence/boundaries, facilitating conditions (organizational and technical infrastructure) and attitude factors (cognitive processes and emotional reactions) [22,23].

- Operational activities and product-levels via the mediation of a customer’s journey, by personalized easy-access communication tools and information exchange. It also allows ensuring operational capabilities for value co-creation processes and a spectrum of product customization options;

- Customer experience management activities and individual-levels via a well-designed purchase process in graphical interface solutions, situations involving flow interruptions or overwhelming information. It also promotes a continuous positive social interaction and an emotional brand connection after the purchase stage [26].

3. Materials and Methods

- A descriptive thematic analysis and synthesis of scientific findings within digital non-life insurance and decision-making models.

- The online survey of 157 insurance-related specialists from three Baltic countries, using a structured questionnaire of 24 questions, a full-blown Likert evaluation scale, and visualized prototypes of online customization frameworks. Visual outcomes were illustrated by using the design and prototyping software Axure RP Pro (version 8).

- Descriptive statistics, multiple factors, and correlation analyses of online survey results. The exploratory factor analysis (EFA), confirmatory factors analyses (CFA), and Pearson correlation analysis were applied by using the statistical analysis software IBM SPSS Statistics 26 (Armonk, NY, USA: IBM Corp.).

- The research object of the conceptual framework regarding the customer decision-making processes in digital insurance platforms follows the multi-criteria decision making (MCDM) approach. It concerns the design of the criteria evaluation scale and validity of results, using the traditional ranking scale [52,53]. It is also recommended to reduce possible risks of uncertainty, subjective interpretation, and bias within responses, by applying specific wording techniques, reversed forms, as well as an improved scale for evaluations [52];

- The research aims to evaluate the influence of the digital environment and technological factors as well as identify the predominant factors, as it is not aligned to the classical set theory, binary terms, and bivalent conditions. It requires a comparison concerning a certain criterion (a degree of influence to purchase), gradual membership, and a combined linguistic and visual analog scale for easier interpretation and understanding of questions [54];

- Provision of responses grounded with a well-balanced and gradual assessment for further interpretation within methods of descriptive statistics, and comparative and correlation analysis [54].

- The introductory section and the questionnaire were translated to English and three local languages of the Baltic countries, Lithuanian, Latvian, and Estonian respectively. Translation was handled in collaboration with native speakers of local languages and a qualified English linguist;

- The main survey distribution channel involved a direct contact with insurance service distributors and institutions via publicly available and/or personal contact emails. Supplementary channels and forms involved messaging and posting on Facebook and via the authors’ personal professional network;

- The online survey process was held between 16 February and 22 May 2021.

4. Results

4.1. Descriptive Statistics

4.2. Factor and Correlation Analysis

4.2.1. Pre-Factor Analysis

4.2.2. EFA, CFA, and Pearson’s Correlation Analysis

- The first-factor group (F1) consists of six internal factors, which together represent a factor group of personal evaluation and considerations. These six factors represent the evaluation of the influence level within insurance purchases in digital insurance platforms: perception of a need of insurance, financial well-being, potential financial savings, consideration of loss and gains probability, recommendations, and insurance literacy.

- The second-factor group (F2) was formed of four external factors of technological features and the marketing domain, which influence the insurance purchase process in digital insurance platforms: advertising, the brand of insurance service provider, key technical platform features, and graphical user interface features.

- The third-factor group (F3) has two factors inside, representing a status regarding evaluation of the digitalization level and level of preparation of insurance service providers to apply digital solutions.

- The fourth-factor group (F4) composes four combined factors of insurance knowledge and operational features level, which influence the insurance purchase process in digital insurance platforms: insurance literacy, product terms, and conditions acceptability, customization of insurance products, personalization of insurance processes, and services.

- The fifth-factor group (F5) has two factors, representing an “as-is” evaluation status of the service personalization level and product customization level in existing digital insurance platforms.

- External factors of technological platform features and marketing domains do not have any significant influence on the digital insurance decision-making process for the customers in the age group 18–25, because members of this very age group are considered tech-savvy-type customers without any strong brand recognition in insurance.

- External factors of technological platform features and marketing domains have a significant influence on the digital insurance decision-making process for customers in the age group of 46–55. Members of this age group tend to have a higher need for a technologically friendly platform, are already experienced with a specific brand of insurance service providers, and possess an overall emotional connection to the brand.

5. Discussion and Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Pousttchi, K.; Gleiss, A. Surrounded by middlemen—How multi-sided platforms change the insurance industry. Electron. Mark. 2019, 29, 609–629. [Google Scholar] [CrossRef]

- Porrini, D. The effects of innovation on market competition: The case of the insurance comparison websites. Mark. Manag. Innov. 2018, 3, 324–332. [Google Scholar] [CrossRef]

- Wiesböck, F.; Matt, C.; Hess, T.; Li, L.; Richter, A. How management in the German insurance industry can handle digital transformation. Manag. Rep. 2017, 1, 1–26. [Google Scholar]

- Warg, M.; Zolnowski, A.; Frosch, M.; Weiß, P. From product organization to platform organization—Observations of organizational development in the insurance industry. In Proceedings of the Conference of the 10 Years Naples Forum on Service, Ischia, Italy, 4–7 June 2019; pp. 2–16. [Google Scholar]

- Łyskawa, K.; Kędra, A.; Klapkiv, L.; Klapkiv, J. Digitalization in insurance companies. In Proceedings of the Conference Contemporary Issues in Business, Management and Economics Engineering, Vilnius, Lithuania, 9–10 May 2019; pp. 842–852. [Google Scholar]

- Zarina, I.; Voronova, I.; Pettere, G. Internal model for insurers: Possibilities and issues. In Proceedings of the Conference Contemporary Issues in Business, Management and Economics Engineering, Vilnius, Lithuania, 9–10 May 2019; pp. 255–265. [Google Scholar]

- Hsee, C.K.; Kunreuther, H.C. The affection effect in insurance decisions. J. Risk Uncertain. 2000, 20, 141–159. [Google Scholar] [CrossRef]

- Kunreuther, H.; Pauly, M.V. Insurance decision-making and market behavior. Found. Trends Microecon. 2006, 1, 63–127. [Google Scholar] [CrossRef]

- Kunreuther, H.; Pauly, M. Behavioral economics and insurance: Principles and solutions. In Research Handbook on the Economics of Insurance Law; Schwarcz, D., Siegelman, P., Eds.; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2015. [Google Scholar]

- Suter, J.; Duke, C.; Harms, A.; Joshi, A.; Rzepecka, J.; Lechardoy, L.; Hausemer, P.; Wilhelm, C.; Dekeulenaer, F.; Lucica, E. Study on consumers’ decision making in insurance services: A behavioural economics perspective. In Final Report Prepared by London Economics, Ipsos and VVA Europe; Publications Office of the European Union: Luxembourg, 2017. [Google Scholar]

- Kiyak, D.; Pranckevičiūtė, L. Causal survey of purchase of non-life insurance products for Lithuanian consumers. Reg. Form. Dev. Stud. 2014, 3, 112–122. [Google Scholar] [CrossRef][Green Version]

- Ulbinaitė, A.; Kučinskienė, M.; Moullec, Y.L. Conceptualising and simulating insurance consumer behaviour: An agent-based-model approach. Int. J. Modeling Optim. 2011, 1, 250–257. [Google Scholar] [CrossRef][Green Version]

- Ulbinaitė, A.; Moullec, Y.L. Towards an ABM-based framework for investigating consumer behaviour in the insurance industry. Ekonomika 2010, 89, 250–257. [Google Scholar] [CrossRef]

- Ulbinaitė, A.; Kučinskienė, M. Insurance service purchase decision-making rationale: Expert-based evidence from Lithuania. Ekonomika 2013, 92, 137–155. [Google Scholar] [CrossRef]

- Ulbinaitė, A.; Moullec, Y.L. Determinants of insurance purchase decision making in Lithuania. Eng. Econ. 2013, 24, 144–159. [Google Scholar] [CrossRef][Green Version]

- Zolnowski, A.; Warg, M. Let’s get digital: Digitizing the insurance business with service platforms. Cut. Bus. Technol. J. 2017, 30, 3–8. [Google Scholar]

- Allodi, E.; Cervellati, E.M.; Stella, G.P. A new proposal to define insurance literacy: Paving the path ahead. Risk Gov. Control Financ. Mark. Inst. 2020, 10, 22–32. [Google Scholar]

- Weedige, S.S.; Ouyang, H. Consumers’ insurance literacy: Literature review, conceptual definition, and approach for a measurement instrument. Eur. J. Bus. Manag. 2019, 11, 49–65. [Google Scholar]

- Åkesson, M.; Edvardsson, B.; Tronvoll, B. Customer experience from a self-service system perspective. J. Serv. Manag. 2014, 25, 677–698. [Google Scholar] [CrossRef]

- Rosebaum, M.S.; Otalora, M.L.; Ramírez, G.C. How to create a realistic customer journey map. Bus. Horiz. 2017, 60, 143–150. [Google Scholar] [CrossRef]

- Ulaga, W.; Eggert, A. Value-based differentiation in business relationships: Gaining and sustaining key supplier status. J. Mark. 2006, 70, 119–136. [Google Scholar] [CrossRef]

- Taherdoost, H. A review of technology acceptance and adoption models and theories. Procedia Manuf. 2018, 22, 960–967. [Google Scholar] [CrossRef]

- Monami, A.M. The unified theory of acceptance and use of technology: A new approach in technology acceptance. Int. J. Sociotechnol. Knowl. Dev. 2020, 12, 79–98. [Google Scholar]

- Klauss, P.; Edvardsson, B.; Maklan, S. Developing a typology of customer experience management practice—From preservers to vanguards. In Proceedings of the 12th International Research Conference in Service Management, La Londe les Maures, France, 29 May–1 June 2012. [Google Scholar]

- Baek, J.; Lee, J.A. Conceptual framework on reconceptualizing customer share of wallet (SOW): As a perspective of dynamic process in the hospitality consumption context. Sustainability 2021, 13, 1423. [Google Scholar] [CrossRef]

- Tueanrat, Y.; Papagiannidis, S.; Alamanos, E. Going on a journey: A review of the customer journey literature. J. Bus. Res. 2021, 125, 336–353. [Google Scholar] [CrossRef]

- Ponsignon, F.; Smart, A.P.; Phillips, L. A customer journey perspective on service delivery system design: Insights from healthcare. Int. J. Qual. Reliab. Manag. 2018, 35, 1–16. [Google Scholar] [CrossRef]

- Germanakos, P.; Tsianos, N.; Lekkas, Z.; Mourlas, C.; Belk, M.; Samaras, G. intelligent authoring tools for enhancing mass customization of e-services—The smarTag framework. In Proceedings of the 11th International Conference on Enterprise Information Systems—Human-Computer Interaction, Milano, Italy, 6–10 May 2009; pp. 91–96. [Google Scholar]

- Zopounidis, C.; Doumpos, M. Multi-criteria decision aid in financial decision making: Methodologies and literature review. J. Multi-Criteria Decis. Anal. 2002, 11, 167–186. [Google Scholar] [CrossRef]

- Milner, T.; Rosenstreich, D. A review of consumer decision-making models and development of a new model for financial services. J. Financ. Serv. Mark. 2013, 18, 106–120. [Google Scholar] [CrossRef]

- Sahu, A.K.; Padhy, P.; Dhir, A. Envisioning the future of behavioral decision-making: A systematic literature review of behavioral reasoning theory. Australas. Mark. J. 2020, 28, 145–159. [Google Scholar] [CrossRef]

- Vij, A.; Walker, J.L. Hybrid choice models: The identification problem. In Handbook of Choice Modelling; Hess, S., Daly, A., Eds.; Edward Elgar Pub: Cheltenham, UK; Northamptom, MA, USA, 2014; pp. 519–564. [Google Scholar]

- Goodhope, O.O. Major classic consumer buying behaviour models: Implications for marketing decision-making. J. Econ. Sustain. Dev. 2013, 4, 164–173. [Google Scholar]

- Gómez-Díaz, J.A. Reviewing a consumer decision making model in online purchasing: An ex-post-fact study with a Colombian sample. Av. En Psicol. Latinoam. 2016, 34, 273–292. [Google Scholar] [CrossRef]

- Ragothaman, N.; Shanmugam, V. Impact of market drivers on consumers purchase decision with reference to steel products in tamilnadu. Int. J. Appl. Bus. Econ. Res. 2017, 15, 35–40. [Google Scholar]

- Holland, J. Navigating Uncertainty: Tourists’ Perceptions of Risk in Ocean Cruising. Ph.D. Thesis, University of Brighton, Brighton, UK, 2019. [Google Scholar]

- Nicosia, F.M. Consumer Decision Processes: Marketing and Advertising Implications; Prentice-Hall: Englewood Cliffs, NJ, USA, 1966. [Google Scholar]

- Engel, J.F.; Kollat, D.T.; Blackwell, R. Consumer Behavior; Holt Rinehart and Winston: New York, NY, USA, 1968. [Google Scholar]

- Howard, J.A.; Sheth, J.N. The Theory of Buyer Behavior; John, Wiley and Sons: Hoboken, NJ, USA, 1969. [Google Scholar]

- Um, S.; Crompton, J.L. Attitude determinants in tourism destination choice. Ann. Tour. Res. 1990, 17, 432–448. [Google Scholar] [CrossRef]

- Kotler, P. Marketing Management: Analysis, Planning, Implementation, and Control, 9th ed.; Prentice Hall: Upper Saddle River, NJ, USA, 1997. [Google Scholar]

- McCarthy, J.E.; Perreault, W.D.; Quester, P.G. Basic Marketing: A Managerial Approach, 1st Australasian ed.; Irwin: Sydney, Australia, 1993. [Google Scholar]

- Walker, J.; Ben-Akiva, M. Generalized random utility model. Math. Soc. Sci. 2002, 43, 303–343. [Google Scholar] [CrossRef]

- Kotler, P.; Keller, K.L. Marketing Management, 12th ed.; Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Kotler, P.; Keller, K.L. Marketing Management, 14th ed.; Prentice Hall: Upper Saddle River, NJ, USA, 2012. [Google Scholar]

- Muzondo, N. Modelling consumer behaviour conceptually through the seven Ps of marketing: A revised theoretical generic consumer stimulus-response mode. Univ. Zimb. Bus. Rev. 2016, 4, 89–107. [Google Scholar]

- Robinson, S. Conceptual modelling for simulation part II: A framework for conceptual modelling. J. Oper. Res. Soc. 2008, 59, 291–304. [Google Scholar] [CrossRef]

- Robinson, S. Conceptual modelling for simulation part I: Definition and requirements. J. Oper. Res. Soc. 2008, 59, 278–290. [Google Scholar] [CrossRef]

- Robinson, S. A tutorial on conceptual modeling for simulation. In Proceedings of the 2015 Winter Simulation Conference, Huntington Beach, CA, USA, 6–9 December 2015; pp. 1820–1834. [Google Scholar]

- Edmonds, W.A.; Kennedy, T.D. Convergent-parallel approach. In An Applied Guide to Research Designs: Quantitative, Qualitative, and Mixed Methods, 2nd ed.; Edmonds, W.A., Kennedy, T.D., Eds.; SAGE Publications, Inc.: Los Angeles, CA, USA, 2017; pp. 181–188. [Google Scholar]

- Razali, F.M.; Aziz, N.A.A.; Rasli, M.R.; Zulkefly, N.F.; Salim, S.A. Using convergent parallel design mixed method to assess the usage of multi-touch hand gestures towards fine motor skills among pre-school children. Int. J. Acad. Res. Bus. Soc. Sci. 2019, 9, 153–166. [Google Scholar]

- Suárez-Álvarez, J.; Pedrosa, I.; Lozano, L.; García-Cueto, E.; Cuesta, M.; Muñiz, J. Using reversed items in Likert scales: A questionable practice. Psicothema 2018, 30, 149–158. [Google Scholar] [PubMed]

- Musani, S.; Jemain, A. A fuzzy MCDM approach for evaluating school performance based on linguistic information. AIP Conf. Proc. 2013, 1571, 1006–1012. [Google Scholar]

- Quirós, P.; Alonso, J.M.; Pancho, D.P. Descriptive and comparative analysis of human perceptions expressed through Fuzzy rating scale-based questionnaires. Int. J. Comput. Intell. Syst. 2016, 9, 450–467. [Google Scholar] [CrossRef]

- Peculis, R.; Rogers, D.; Campbell, P. Task model of software intensive acquisitions: Integrated tactical avionics system for a maritime helicopter case study. In Proceedings of the Twelfth Australian Aeronautical Conference, Melbourne, Australia, 17–19 October 2007; pp. 510–522. [Google Scholar]

- Goepel, K. Comparison of judgment scales of the analytical hierarchy process—A new approach. Int. J. Inf. Technol. Dec. Making 2019, 18, 445–463. [Google Scholar] [CrossRef]

- Taherdoost, H. Sampling methods in research methodology: How to choose a sampling technique for research. Int. J. Acad. Res. Manag. 2016, 5, 18–27. [Google Scholar] [CrossRef]

- Koyuncu, I.; Kılıç, A.F. The use of exploratory and confirmatory factor analyses: A document analysis. Eğitim Bilim 2019, 44, 361–388. [Google Scholar] [CrossRef]

- Dhillon, H.K.; Zain, M.; Zain, A.Z.; Quek, K.F.; Singh, H.; Kaur, G.; Nordin, R. Exploratory and confirmatory factor analyses for testing validity and reliability of the Malay language Questionnaire for Urinary Incontinence Diagnosis (QUID). Open J. Prev. Med. 2014, 4, 844–851. [Google Scholar] [CrossRef]

- Mathur, B.; Kaushik, M. Data analysis of students marks with descriptive statistics. Int. J. Recent Innov. Trends Comput. Commun. 2014, 2, 1188–1191. [Google Scholar]

- Chan, L.L.; Idris, N. Validity and reliability of the instrument using exploratory factor analysis and Cronbach’s alpha. Int. J. Acad. Res. Bus. Soc. Sci. 2017, 7, 400–410. [Google Scholar]

- Guadagnoli, E.; Velicer, W. Relation of sample size to the stability of component patterns. Psychol. Bull. 1988, 103, 265–275. [Google Scholar] [CrossRef] [PubMed]

- Rocha, A.Q.; Botelho, D. Attitudes towards insurance for personal assets: Antecedents and consequents. Eur. J. Bus. Soc. Sci. 2018, 6, 62–80. [Google Scholar]

- Weedige, S.S.; Ouyang, H.; Gao, Y.; Liu, Y. Decision making in personal insurance: Impact of insurance literacy. Sustainability 2019, 11, 6795. [Google Scholar] [CrossRef]

- Shadfar, S.; Malekmohammadi, I. Application of Structural Equation Modeling (SEM) in restructuring state intervention strategies toward paddy production development. Int. J. Acad. Res. Bus. Soc. Sci. 2013, 3, 576–618. [Google Scholar] [CrossRef]

- Bollen, K.; Liang, J. Some properties of Hoelter’s CN. Sociol. Methods Res. 1988, 16, 492–503. [Google Scholar] [CrossRef]

- Tarka, P. Likert scale and change in range of response categories vs. the factors extraction in EFA model. Acta Univ. Lodz. Folia Oeconomica 2015, 1, 27–35. [Google Scholar] [CrossRef][Green Version]

- Reig-Mullor, J.; Pla-Santamaria, D.; Garcia-Bernabeu, A. Extended fuzzy analytic hierarchy process (E-FAHP): A general approach. Mathematics 2020, 8, 2014. [Google Scholar] [CrossRef]

| Model | Influence Points |

|---|---|

| F.M. Nicosia’s model (1966) [37] |

|

| J.F. Engel, D.T. Kollat, and R.D. Blackwell (EKB) model (1968) [38] |

|

| J.A. Howard and J.N. Sheth model (1969) [39] |

|

| S. Um and J.L. Crompton model (1990) [40] |

|

| P. Kotler model (1997) [41] |

|

| J.E. McCarthy, W.E. Perreault and P.G. Quester model (1997) [42] |

|

| J. Walker and M. Ben-Akiva model (2002) [43] |

|

| P. Kotler and K.L. Keller model (2006, 2012) [44,45] |

|

| Element | Content |

|---|---|

| Logic of structure | Twenty-four close-ended questions and statements: Three demographic-type questions about the respondent’s geographic location, age group, and gender; Four questions about the “state-of-the-art”, regarding country specifics, within levels of insurance digitalization, insurance service provider preparation for digitalization, customization, and personalization in digital insurance platforms; Three comparative statements about the visualized prototypes of three online customization frameworks; Fourteen questions oriented to the conceptual framework about the multi-criteria influencing customer decision making in digital insurance platforms. |

| Methodological foundation | A full-blown Likert scale of 9 points and linguistic variables in the following parts of the questionnaire:

|

| Variables | Data Values | Absolute Number | % |

|---|---|---|---|

| Gender | Female | 123 | 78 |

| Male | 34 | 32 | |

| Age group | 18–25 | 36 | 23 |

| 26–35 | 54 | 34 | |

| 36–45 | 47 | 30 | |

| 46–55 | 17 | 11 | |

| 56–65 | 3 | 2 | |

| +65 | 0 | 0 | |

| Country | Estonia | 32 | 20 |

| Latvia | 31 | 20 | |

| Lithuania | 94 | 60 |

| Indices | Result |

|---|---|

| Cronbach α | 0.875 |

| Spearman–Brown | 0.701 |

| Kaiser–Meyer–Olkin (KMO) | 0.839 |

| Bartlett’s test of sphericity χ2 | 0.000 |

| Indices | Result |

|---|---|

| SRMR | 0.063 |

| RMSEA | 0.065 |

| CFI | 0.921 |

| TLI-NNFI | 0.903 |

| Factor Group 1 | Factor Group 2 | Factor Group 3 | Factor Group 4 | Factor Group 5 | ||

|---|---|---|---|---|---|---|

| Factor Group 1 | Pearson Correlation | 1 | 0.654 ** | 0.327 ** | 0.726 ** | 0.528 ** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 157 | 157 | 157 | 157 | 157 | |

| Factor Group 2 | Pearson Correlation | 0.654 ** | 1 | 0.173 * | 0.758 ** | 0.279 ** |

| Sig. (2-tailed) | 0.000 | 0.030 | 0.000 | 0.000 | ||

| N | 157 | 157 | 157 | 157 | 157 | |

| Factor Group 3 | Pearson Correlation | 0.327 ** | 0.173 * | 1 | 0.444 ** | 0.763 ** |

| Sig. (2-tailed) | 0.000 | 0.030 | 0.000 | 0.000 | ||

| N | 157 | 157 | 157 | 157 | 157 | |

| Factor Group 4 | Pearson Correlation | 0.726 ** | 0.758 ** | 0.444 * | 1 | 0.663 ** |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 157 | 157 | 157 | 157 | 157 | |

| Factor Group 5 | Pearson Correlation | 0.528 ** | 0.279 ** | 0.763 ** | 0.663 ** | 1 |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 157 | 157 | 157 | 157 | 157 |

| Variable | Factor Group | Results of Kruskal–Wallis H Tests | ||

|---|---|---|---|---|

| Kruskal–Wallis H | Df | Asymptotic Significance | ||

| Age group | F1 | 3.453 | 4 | 0.485 |

| F2 | 15.209 | 4 | 0.004 | |

| F4 | 2.736 | 4 | 0.603 | |

| Country | F1 | 0.986 | 2 | 0.611 |

| F2 | 2.317 | 2 | 0.314 | |

| F4 | 1.732 | 2 | 0.421 | |

| Variable | Factor Group | Results of Mann–Whitney U Test Statistics Table | |||

|---|---|---|---|---|---|

| Mann–Whitney U | Wilcoxon W | Z | Asymptotic Significance. (2-Tailed) | ||

| Gender | F1 | 1980.000 | 2575.000 | −0.473 | 0.636 |

| F2 | 2086.000 | 9712.000 | −0.021 | 0.986 | |

| F4 | 2011.00 | 2606.000 | −0.341 | 0.733 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baranauskas, G.; Raišienė, A.G. Reflections on the Customer Decision-Making Process in the Digital Insurance Platforms: An Empirical Study of the Baltic Market. Appl. Sci. 2021, 11, 8524. https://doi.org/10.3390/app11188524

Baranauskas G, Raišienė AG. Reflections on the Customer Decision-Making Process in the Digital Insurance Platforms: An Empirical Study of the Baltic Market. Applied Sciences. 2021; 11(18):8524. https://doi.org/10.3390/app11188524

Chicago/Turabian StyleBaranauskas, Gedas, and Agota Giedrė Raišienė. 2021. "Reflections on the Customer Decision-Making Process in the Digital Insurance Platforms: An Empirical Study of the Baltic Market" Applied Sciences 11, no. 18: 8524. https://doi.org/10.3390/app11188524

APA StyleBaranauskas, G., & Raišienė, A. G. (2021). Reflections on the Customer Decision-Making Process in the Digital Insurance Platforms: An Empirical Study of the Baltic Market. Applied Sciences, 11(18), 8524. https://doi.org/10.3390/app11188524