Abstract

Construction development of Commercial and Recreational Complex Building Projects (CRCBPs) is one of the community needs of many developing countries. Since the implementation of these projects is usually very costly, identifying and evaluating their Critical Risk Factors (CRFs) are of significant importance. Therefore, the current study aims to identify and prioritize CRFs of CRCBPs in the Iranian context. A descriptive-survey method was used in this research; the statistical population, selected based on the purposive sampling method, includes 30 construction experts with hands-on experience in CRCBPs. A questionnaire related to the risk identification stage was developed based on a detailed study of the research literature and also using the Delphi survey method; 82 various risks were finally identified. In order to confirm the opinions of experts in identifying the potential risks, Kendall’s coefficient of concordance was used. In the first stage of data analysis, qualitative evaluation was performed by calculating the severity of risk effect and determining the cumulative risk index, based on which 25 CRFs of CRCBPs were identified for more accurate evaluation. At this stage, the identified CRFs were evaluated based on multi-criteria decision-making techniques and using the TOPSIS technique. Results show that the ten CRFs of CRCBPs are external threats from international relations, exchange rate changes, bank interest rate fluctuations, traffic licenses, access to skilled labor, changes in regional regulations, the condition of adjacent buildings, fluctuations and changes in inflation, failure to select a suitable and qualified consultant, and employer’s previous experiences and records. Obviously, the current study’s results and findings can be considered by CRCBPs in both the private and public sectors for proper effective risk identification, evaluation, and mitigation.

1. Introduction

“Risk is an uncertain event or conditions that, if it occurs, has a positive or negative effect on a project objective” [1]; from that, construction projects are massively pervaded by risks due to the fact that they are planned and managed on the basis of uncertain forecasts [2,3]. These uncertainties come from the ‘variability’ and ‘ambiguity’ in relation to performance measures like cost, duration, or quality and, according to [4], they can be grouped into five areas in relation to construction projects: The variability associated with estimates of project parameters, the basis of estimates of project parameters, design and logistics, objectives and priorities, and relationships between project parties. From the cited categories of uncertainty, some risks are inherently related to the project operating organizations and only they are responsible for managing them, while others are related to the economic, social, political, and technological environments [5].

Hence, identifying and evaluating risks in projects is necessary and can play a very important role in achieving project objectives. Project management literature identified several techniques for identifying and assessing risks involved in the construction industry. For instance, it has been found that the main reference in risk identification is historical data, past experience, and judgement [6]. According to Chapman [7], risk identification methods can be grouped into three general categories: Identifying the risks by the risk analyst; risk identification by interviewing key members of the project team; and risk identification through brainstorming meetings. In this regard, research has shown that the questionnaire survey is the most frequently used technique for risk identification in the construction sector [8,9]. However, despite the literature produced (see also [10,11,12,13,14]), few contributions (e.g., Tamošaitienė et al. [12]) have been dedicated to the risks in Commercial and Recreational Complex Building Projects (CRCBPs)—which comprise shops connected to each other with sidewalks that are designed and built alongside recreational, residential, office, hotel, restaurant, and cinema spaces [15,16]. Among them, it is worth mentioning the work of Comu et al. [17] that, despite classifying risks for CRCBPs, has the drawback of diverging from a very extensive list of risk factors (i.e., 21; much less than the 82 included in this study). This is the gap addressed in this work and that can be synthesized in the following research question: What are the most severe risks in commercial and recreational complex building projects (CRCBPs)?

To answer the above research question, the Delphi method is used to identify common risks of CRCBPs. Then, the qualitative method of probability of occurrence and the effect of risk on project objectives is adopted to identify CRFs of CRCBPs. Finally, a multi-criteria decision making (MCDM) method is employed, i.e., Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS). This is another great advancement with respect to prior works that have been interested in CRFs of CRCBPs (i.e., [5]). As a result, the findings of this research are an unseen contribution to the original body of CRCBPs and the construction industry. Such an outcome would enable decision makers to make more informed decisions with regard to, for example, proper risk allocation, bid pricing, selection of the optimum procurement route, and evaluation of different construction projects.

2. Commercial and Recreational Complex Building Projects (CRCBPs)

The increase of the urban population in large metropolises, followed by the increase in demand for better building infrastructure on a global scale, paints a positive outlook for improving the construction market’s situation in developing countries [18]. Over the past two decades, the construction of CRCBPs, to develop the welfare of citizens and increase socio-economic development indicators and subsequent sustainable development in Iran, has been greatly increased. Stemming from that, realizing projects faster and cheaper has been prioritized by policymakers and, as a consequence, the amount of construction has exceeded its quality [19].

Projects are divided into different types depending on the purpose and type of expected operation. In the field of construction projects, we are faced with different types that the 2015 United Nations’ product classification (see Section 5) categorizes as Constructions Buildings and Civil Engineering Works [20]. A subclass of Construction Buildings is Commercial Buildings and among them there are Commercial and Recreational Complex Buildings. CRCBPs comprise a series of interconnected sidewalk shops designed and constructed in conjunction with entertainment, residential, office, hotel, restaurant, and cinema spaces [5]. In order to achieve economic growth, developing countries are forced to increase investment in infrastructures [21]. In fact, development of an infrastructure, such as construction of CRCBPs, can positively affect economic development [22]. Some examples of CRCBPs include Siam Paragon in Bangkok, Berjaya Times in Kuala Lumpur, Jewelry in Istanbul, West Edmonton in Edmonton, Canada, Dubai Mall in the UAE, Aventra Mall in Miami, and Harrods in London.

However, some CRCBPs construction projects have been unsuccessful due to various marketing, financial and investment issues. A clear example of such projects is the CRCBP of Arge Jahannam in Isfahan, which has failed due to a lack of detailed market studies and non-compliance with social rules and conditions [23]. In general, the existence of risk and uncertainty in the project reduces the accuracy and proper estimation of objectives and the efficiency of the project itself; in sum, the need to recognize and manage the risk of full CRCBPs is being increasingly perceived.

3. Perceived Risks of CRCBPs

Risk is an inherent component of all projects, and it is not possible to eliminate it completely. Therefore, identifying and analyzing risks can play an important role in the success of the project. In identifying the critical risk factors (CRFs) of any project, it is not enough to identify the risks that occur gradually. However, with a well-defined risk statement, weighing up not only what might happen, but also all the characteristics of the time of occurrence, probability of occurrence, and its impacts must also be considered. Determining a process for identifying, evaluating, and responding to CRFs will cause improvements in the mechanism, increase the accuracy and quality of work, and have a direct impact on time and cost [24]. Marle and Gidel [25] also stated that uncertainty and risk in projects affect project objectives more than anything else. Therefore, risk management plays an important role in the quality and reliability of decisions during a project.

The first step of risk management is to identify and record the characteristics of the risks that may affect the project (i.e., listing any potential risk to a project’s cost, schedule, or any other critical success factor [1]). Risk identification is an iterative process, as new risks may be identified and discovered as the project progresses through its lifespan [16]. In order to identify the risks, several methods have been proposed, including interviews, hypothesis analysis, document review, the Delphi technique, brainstorming, graphing methods [26], Artificial Neural Network (ANN) [27], Failure Mode and Effects Analysis (FMEA) [28], Cross Analytical-Machine Learning models [29], and the Integration Definition for Function Modeling (IDEF0) process [30]. In the risk identification phase, the risks affecting the objectives should be prioritized and the impact of risks that do not affect the objectives should be avoided [12]. In this regard, the methods such as the Delphi technique are useful due to their simplicity, flexibility, and ease of access to experts [10,31,32,33,34]. With regard to CRCBPs, Chen and Khumpaisal [35] adopted an Analytic Network Process model based on 29 defined risk assessment criteria associated with commercial real estate development, then classified the data under four risk clusters: Social risks, economic risks, environmental risks, and technological risks. However, no prioritization of these risks was offered. The same applies for the work by Tamošaitienė et al. [12], who identified 19 types of risks for CRCBPs divided into macro- (i.e., country, industry), meso- (i.e., project, enterprise), and micro- (i.e., management, organization) categories.

The second step is risk analysis (i.e., the scope of the risk must be determined [1]), considered as a key factor in risk management that greatly aids the process. Risk classification is an important part of risk management issues with significant effects on the risk management process. General classifications can include cost, financing, demand, and political risks [36]. Risk classification should always be done with regard to the project’s objectives [37]. There are different classification methods for risks that can be used for different purposes. Based on this, the risks can be divided into main and subsidiary risks [38]. They can also be categorized according to their impact on project objectives for project status reporting purposes [39]. However, according to PMI [1], the most appropriate approach for identifying and responding to risks is to determine risk groups based on their origin (instead of their impact), e.g., external risks, internal risks, technical risks, and legal risks [40]. Risk classification is usually done in the form of the Risk Breakdown Structure (RBS), which identifies the groups and subgroups of risks that may occur in a typical project, and they are classified based on their origin [41]. Then, the RBS prioritizes these risks according to their weight—i.e., potential and probable harmful impact [1].

In these cases, where projects deal with a significant set of variables and there is a need to prioritize decision-making parameters based on their relative importance, using several techniques is a good tool for prioritizing and making more accurate scientific decisions. In most previous research, risk ranking has been done by applying different methods such as the Analytic Hierarchy Process (AHP) [42,43], the Analytic Network Process (ANP) [11,24], the Choosing by Advantages (CBA) method [44], and the Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS) [10,45]. Furthermore, more sophisticated techniques have been advanced (e.g., Mata et al. [46]). For example, Liu et al. [47] proposed a model that integrates the Internet of Things (IoT), Building Information Modeling (BIM), a security risk analysis method, the Apriori algorithm, and a complex network.

In terms of produced results, with a focus on construction project delay, Cheng and Darsa [27] found that the most important risk factors in the Ethiopian context are ‘change order’, ‘corruption/bribery’, and ‘delay in payment’. Yet, recently, Chattapadhyay et al. [29] while investigating risks in megaprojects—by collecting and prioritizing risks as stated by 70 Indian megaprojects experts—found that the most severe risks are a delay in obtaining traffic regulation orders, inappropriate equipment, political and legal issues, political instability, government intervention, regulatory confirmation and regulation order delays, and wrong engineering designs. Comu et al. [17], instead, prioritized these risks for CRCBPs in the Turkish context by using the ANP model; they found that ‘Exchange rate and inflation rate fluctuations’ ‘Political instability’, and ‘Location selection’ were risk factors for CRCBPs projects in developing countries.

In terms of categories that can result from the application of the above tools, Draji Jahromi et al.’s [48] study identified twelve criteria for assessing risks, which are vulnerability, threat, consequence, uniqueness, risk uncertainty, proximity of risk, interaction of each risk, risk identification, response to risk occurrence, risk manageability, risk occurrence, and risk forecasting. In another study, Mohammadi Talvar and Panahi [49] also introduced various criteria for risk assessment, including technical dimensions, experimental, management, good track record and credibility, competence, and proposed price.

Failure to manage risks in CRCBPs usually leads to excessive costs and prolongation of the project [50] and considering the implementation of a risk management process in CRCBPs is necessary in order to try to countervail these failures.

4. Research Methodology

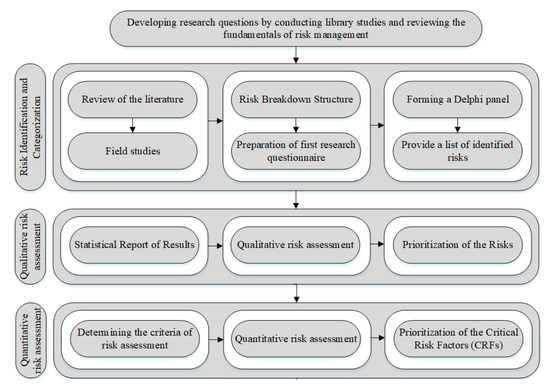

The present study seeks to provide clear guidance for the stakeholders to properly identify and classify the risks of CRCBPs. For this purpose, both qualitative and quantitative approaches were used for the current research. There are three main stages in this study, as displayed in the following flowchart (Figure 1).

Figure 1.

Research methodology of the study.

In situations where the prioritization of decision-making units, based on their relative importance and according to various criteria, is considered, the use of multi-criteria decision-making techniques is suitable for ranking and making rational decisions. Among these techniques, we can mention the multi-criteria decision-making methods that have been used according to the advantages and results as well as the characteristics of the TOPSIS method as a priority of risk prioritization [1].

According to the risk management cycle [1], the first step aimed to identify the risks of the construction of the CRCBPs. To this end, similarly to Khosravi et al. [5], a literature review was carried out and the resulting list of identified risks was strengthened by the application of a three-round Delphi survey method—already used for similar and recent research works (e.g., [51]). Then, to assess the risks, two different risk assessment methods were used in this study: (1) Qualitative and (2) quantitative.

The literature review confirms that in many previous studies (e.g., Khosravi et al. [5]), two indicators, “impact rate” and “probability of occurrence” of risk, have been used to assess risks in construction projects. Qualitative risk analysis is usually a quick and cost-effective tool for prioritizing risks, and it forms the basis for quantitative risk analysis, if needed. The output of this process can be the input to the quantitative risk analysis process or, directly, the input of risk response planning [1]. In this work, qualitative risk assessment has been used for evaluating risks and identifying CRFs. In particular, a survey questionnaire was distributed among identified experts and used to determine the importance of each identified risk. In fact, experts were asked to determine the importance of each risk based on the probability of occurrence and the impact of risks on project objectives (i.e., cost, time, and quality). Accordingly, 25 CRFs were identified.

However, some researchers have also emphasized the unreliability of the qualitative assessment of risks [52]. One of the problems with using the probability–risk effect matrix is that the importance of low-probability is that high-impact risks may be overlooked. Because of this approach, high-risk and low-impact risks are equated, which is not necessarily the will of the decision maker. To overcome this problem, quantitative risk assessment was applied to evaluate CRFs. Based on PMI [1], quantitative assessment is performed on risks that have a high priority in qualitative assessment and can significantly affect the project objectives. In this step, new criteria were identified and adopted for assessing the importance of the identified CRFs (i.e., risk response criteria, risk management, influencing the occurrence of other risks, accepting threat, risk detection, risk probability, and vulnerability) (e.g., [48]).

TOPSIS was then performed for the quantitative prioritization of CRFs of CRCBPs. It is worth noting that the use of TOPSIS is a greater advancement with respect to similar works [5,53] because it has been proved to work satisfactorily across different application areas and industrial sectors with varying terms and subjects [54], and “although several techniques have been combined or integrated with the classical TOPSIS, many other techniques have not been investigated. These techniques make the classical TOPSIS more representative and workable in handling practical and theoretical problems”. Stemming from that recognized value of the TOPSIS method, in a series of studies. it has been empirically found to be better performing than other techniques, such as the Analytical Hierarchy Process (e.g., [55]), under some contextual circumstances. With regard to the proposed application, TOPSIS has been successfully used in works concerning the assessment of risks in construction projects and it is the preferred method, rather than simple/probit/logit regressions in risk analysis works [54]; this is due to its ability to fully use attribute information, providing a cardinal ranking of alternatives, and not requiring attribute preferences to be independent. Indeed, Gebrehiwet and Luo [56] recently adopted it for risk level evaluation on a construction project lifecycle and found that the construction stage is the most influenced by risk factors. Yet, Dandage et al. [57] used TOPSIS for reviewing the risk categories that are predominant in international projects and ranked them according to their effect on project success; they found political risks, technical risks, and design-related risks as the most important.

Investing in construction projects in Iran is one of the most lucrative decisions, but the lack of regular supervision in this sector has caused the people in the community to be exposed to human and financial damage due to the quality of construction of buildings [58]. Iran’s economic problems, along with the country’s situation in the international arena, are issues that foster project-related risks. In fact, political issues related to nuclear energy and subsequent sanctions against Iran have led to an increase in Iran’s economic risk index in recent years [11]. The growth of the economic risk index has undoubtedly reduced Iran’s economic interactions with other parts of the world, which can increase the likelihood of occurrence and severity of the impact of various other internal and external risks of projects [59]. At the same time, building construction is one of the main problems in developing countries today and because of rapid population growth, lack of financial resources, land problems, lack of skilled manpower, and, most importantly, lack of proper policy and planning, this issue has become critical [60]. In light of the above, construction projects in Iran, as a developing country, are always associated with many risks and uncertainties. Therefore, Iran was selected for this study to identify and evaluate the CRFs of large and complex CRCBPs.

4.1. Delphi Survey Technique

The Delphi technique is often used for risk determination and screening before the application of a MCDM method. The Delphi technique’s main goal is to obtain the most reliable experts’ opinions through a series of structured questionnaires with controlled feedback. For the selection of experts that were asked to respond to the Delphi questionnaires, one important rule is to prioritize the quality of experts over their quantity [50]. From that, participants of the Delphi survey are experts with solid knowledge and experience in the same subject, with time to participate in the research, and with effective communication skills [61,62]. Regarding the number of involved experts, this is usually less than 50, and often from 10 to 20 [62,63]. The survey also depends on a series of factors, such as desired sample homogeneity, the Delphi goal, difficulty range, quality of decision, ability of the research team, internal and external validity, time of data collection, available resources, and the scope of the problem under study [63]. The study adopted a purposive sampling technique in the selection of respondents, as done by other scholars for similar research [51,62]. In this regard, 30 experts were selected among practitioners of CRCBPs in Iran based on their level of knowledge and expertise in the field. In this regard, all the experts in this study have experience in the construction of CRCBPs. The survey was launched in May and June 2019. Table 1 shows the demographic data of the experts participating in the Delphi process.

Table 1.

Specifications of interviewed experts.

In this study, 53 construction risks—classified into 14 categories—of CRCBPs were identified based on a detailed and comprehensive literature review (e.g., [5,16,24,31,64]). Table 2 outlines the risks affecting the objectives of CRCBPs and categorizes them into internal and external risks as well as grouping them into 14 clusters at the second level (i.e., social, economic, political, legal, natural, technical, work force, investment, management, safety, design, contract, market and environmental) and 53 risks at the third level. Because of different uses in previous studies and because the risks of each project vary widely depending on the environmental and social conditions, the present study uses past records and library studies as well as interviews with reporters to design a comprehensive RBS for CRCBPs.

Table 2.

Identified risks affecting the objectives of CRCBPs based on the review of the literature.

The first stage of the Delphi questionnaire was developed based on the risks identified from the literature. By collecting the Delphi first-round questionnaires and statistically analyzing them, a small number of risks were eliminated, and new ones, such as tax and toll risk, site access risk, and traffic permits risk, were added. In the second stage, a questionnaire containing 67 risks of CRCBPs was sent to the experts. By reviewing the results of the second round, a number of risks were removed, and a number of new ones were added; 15 new risks were finally added. As a result, 82 risks were identified as relevant for CRCBPs and were classified into 16 different groups. By distributing the questionnaire based on the risks categorized in the third round, it was found that according to the Delphi panel experts, all 82 identified risks can be considered as relevant for CRCBPs. As it can be seen, 29 new risk factors were identified by the experts in three rounds of the Delphi survey. The authors believe that the identification of this volume of new risks could be due to several different reasons, including (i) the high volume of construction risks of CRCBPs compared to the construction of other urban projects and (ii) the high volume of construction project risks in developing countries compared to developed countries. Yet, this huge addition of risk factors is in line with other similar works [16,24]. In each Delphi round, the questionnaires were confirmed in terms of reliability and validity. Cronbach’s alpha coefficient was used to evaluate reliability, while the content validity of Kendall’s Coefficient of Concordance (W) was used to examine the degree of agreement (similarly to Sarvari et al. [51] and Khosravi et al. [5]). Kendall’s coefficient of concordance shows (i) whether people who sorted items according to their importance used similar criteria for their judgment with regard to these items and (ii) whether these people agree with each other [65,66]. Kendall’s coefficient of concordance is calculated using the following Formula (1).

Within this formula, K is the sum of all rankers (number of judges); N is the number of ranked items; is the maximum value of the sum of squares of variations from average Rj (which is equal to S in case of complete agreement between K judges); S is the sum of squares of Rj variations minus the mean Rj (i.e., all ranks for an item). From that, S is, therefore, calculated as follows: . However, due to the complexity and time-consuming calculations of the value of S, Kendall’s coefficient of concordance is computed by the Statistical Packages for Social Sciences (SPSS) computer software (similarly to other scholars [67,68,69]).

4.2. Qualitative Risk Assessment

To identify CRFs of CRCBPs, a qualitative method of probability of occurrence and impact of risks on project objectives (i.e., cost, time, and quality) was used. To do this, a questionnaire, concerning the 82 identified risks, was developed. Based on this questionnaire, experts were asked to comment on the probability of occurrence and impact of each of the risks of CRCBPs based on a 5-point Likert scale measurement (very low, low, medium, high and very high). The questionnaire used at this stage, like the Delphi stage, was evaluated and approved in terms of content reliability and validity. Risk refers to the number of expectations for that event to occur; in cases where the probability of occurrence is random, it is only possible to rely on the opinion of experts [12]. The magnitude of the impact of risk and the probability of occurrence are expressed by using descriptive or numerical expressions. Unlike the probability of occurrence, which is one, the impact of risk can have more than one effect; that is, it affects more than one project goal. In preparing the questionnaire, an attempt was made to obtain more valid results by inserting the structure of risk failure and determining the group of internal and external origins of the risks. Yet, with the aim of prioritizing risks by using the risk failure structure and calculating the effect of each risk, the score of each risk in the set of risk failure structure can be determined. The intensity of the impact of each risk is obtained by multiplying the probability of occurrence of each risk by the impact of the same risk on the project objectives. Thus, at first an initial risk index is defined based on the criteria of probability of occurrence and the effect of risk on project time, cost, and quality (Formula (2)).

PIR = ∑ (PIt) + (PIc) + (PIq),

In this equation, PIR represents the initial risk index for each risk. Furthermore, ‘P’ is the probability of occurrence of risk; ‘It’ is the impact of risk on project time; ‘Ic’ is the impact of risk on project cost; and ‘Iq’ is the impact of risk on project quality. These indicators are separately measured based on each expert’s opinion. To this end, according to Formula (3), the arithmetic mean method is used to aggregate indicators and the aggregated initial risk index is calculated for each of the risks.

In this formula, the APIR represents the cumulative primary risk index for each of the risks. ‘PIRi’ means initial risk index per risk for each specialist and ‘N’ is the total number of experts; in this study, there are 30. Finally, by using this index, it is possible to rank the risks qualitatively based on the severity of the impact of each risk.

4.3. Quantitative Risk Assessment

After evaluating and qualitatively prioritizing the risks, a quantitative evaluation is performed for CRFs of CRCBPs. To do this, the TOPSIS technique was used as one of the MCDM methods (Taylan et al., 2014). There are eight steps of the TOPSIS technique, based on Hwang and Yoon [75]: (i) setting risk assessment criteria; (ii) adjusting the decision matrix based on the prepared questionnaires; (iii) converting the decision matrix into a scaleless matrix; (iv) creating a weightless scale matrix; (v) identifying positive and negative ideal solutions; (vi) calculating the relative distance through the ideal positive and negative solutions; (vii) determining the relative proximity to each alternative; and (viii) determining the most important and least significant risks based on the proximity obtained. In this study, quantitative evaluation of CRFs has been done based on the same steps. In addition, the calculations related to the TOPSIS method were done using Microsoft Excel Office software.

In particular, to identify the risk assessment criteria, the results of the research of Draji Jahromi et al. [48]—which was performed to evaluate the risk assessment criteria—were used. Thus, seven risk assessment criteria were selected to evaluate CRFs of CRCBPs. These criteria are (i) risk response criteria, (ii) risk management, (iii) influencing the occurrence of other risks, (iv) accepting threat, (v) risk detection, (vi) risk probability, and (vii) vulnerability. Risks iii, iv, and vii were considered as criteria with a negative effect on risk assessment, while risks i, ii, v, and vi were considered as criteria with a positive effect on risk assessment.

The questionnaire at this stage was developed based on seven criteria and 25 CRFs of CRCBPs, based on which the results of the decision matrix will be formed. In this questionnaire, the importance of each risk was measured based on the criteria evaluated using a 9-point Likert scale measurement, so that 1 indicates very low importance and 9 indicates extremely high importance.

5. Calculation Results

5.1. Results of Delphi Survey

The risk identification step aimed to record the details of the uncertainties before the occurrence of risks. In the present study, after identifying the various risks of CRCBPs based on the study of research literature (e.g., [5,16,24,31,64,70,76]), the relevance of the identified risks was evaluated and monitored. Finally, based on three rounds of the Delphi technique, 82 risks of CRCBPs were identified and recorded; see Table 3 and Table 4, respectively, for internal and external risks.

Table 3.

The identified risks of CRCBPs based on literature review and the Delphi survey technique—internal risks.

Table 4.

The identified risks of CRCBPs based on literature review and the Delphi survey technique—external risks.

The agreement of experts in the Delphi method was investigated using Kendall’s coefficient of concordance (W); the experts rank several categories based on their importance in a similar manner by using, essentially, the same judgment criteria of importance for each category. This Kendall’s coefficient of concordance has a range from zero to one, indicating the degree of consensus between individuals (with W > 0.9 indicating very strong consensus; W > 0.7 strong consensus; W = 0.5 average consensus; W = 0.3 weak consensus and W = 0.1 very weak consensus). Furthermore, the significance of W is not enough for stopping the Delphi panel since for panels with more than 10 members, even small values of W are sometimes significant [65,66]. In this study, Kendall’s coefficient of concordance was computed using SPSS computer software. According to the calculations, Kendall’s concordance coefficient of the current study was equal to W = 0.734, which indicates a strong consensus and favorable agreement between respondents in identifying risks. The results of calculating the Kendall’s coefficient of concordance are reported in Table 5. In addition, based on Formula (1) the value of W has been provided.

Table 5.

Results of Kendall’s coefficient of concordance analysis using SPSS software version 25.

5.2. Calculation and Results of Qualitative Risk Assessment

The importance and severity of each risk depend on the probability of occurrence and the effect of that risk. Hence, a qualitative evaluation is adopted based on these two dimensions. In particular, qualitative ranking is determined according to the source of risk by using the risk failure structure [12]. The severity of each risk’s impact is calculated by using the probability of occurrence for each risk and its impact on the objectives. After calculating the PI values, the importance of each area of the risk failure structure can be calculated as the sum of the PI values. In the present study, in order to qualitatively rank the risks—by calculating the probability of occurrence and the effect of risk on the main objectives of the project (i.e., time, cost, and quality) with the same weight—qualitative risk rating has been performed. In order to achieve the desired result, the Primary Risk Index (PIR) is calculated after determining the probability of occurrence of each risk and each risk’s impact on the time, cost, and quality of the project. It is worth mentioning that the above index is calculated separately based on the presentation of each expert. PIR1 to PIR30 is then determined for each of the 82 risks. The aggregated risk index will then be calculated for each of the risks. By calculating the PIR of all risks, the APIR value is calculated, and the final ranking is provided. Table 6 shows the overall PIR and APIR results of the risks and the degree of rating of each risk based on the probability and effect method. According to the results of the qualitative evaluation stage, risks with an APIR value of 0.6 and above were identified as CRFs. Thus, a total of 25 risks were identified as CRFs of CRCBPs that will be quantitatively analyzed.

Table 6.

PRI and APRI results of qualitative risk evaluation.

5.3. Calculation and Results of Quantitative Risk Assessment

To determine the final priority of the identified CRFs, first the decision matrix should be formed based on the evaluation criteria and using the TOPSIS technique. Then, the normal matrix is extracted and the relative proximity of each option to the solution is determined.

The first step in the TOPSIS technique is the formation of a decision matrix, which is prepared by gathering the opinions of experts through a decision matrix questionnaire. This matrix is needed for evaluating the importance of risks based on criteria. Table A1 (Appendix A) shows the results of the questionnaires collected from 30 experts. Normalization is the second step in solving all MCDM techniques based on the decision matrix. In the present study, normalization is performed by the vector method, which results in normalization according to Table A2. In the TOPSIS method, to create a normal matrix, the weight of each criterion is multiplied by all the numbers below each of the same criteria. Accordingly, the weight of the proposed criteria is according to Table A3. After applying in the normal matrix, the normal matrix will be in accordance with Table A4.

In order to determine the risk rating, the relative proximity of each option to the ideal solution must be extracted. The Euclidean distance of each option from the positive and negative ideals was calculated, and the positive and negative ideals of each criterion were calculated according to Table A5. Formula (6) is also used to calculate the relative proximity of each option to the ideal solution. Finally, the rating of each risk is determined based on Confidence Interval (CL), which is a number between one and zero. The closer this value is to one, the higher the risk priority; conversely, the closer the value is to zero, the lower the risk significance. Table 7 shows the final results of the CRFs ranking of CRCBPs using the TOPSIS method.

Table 7.

Prioritization of CRFs of CRCBPs using the TOPSIS method.

Results shown in Table 7 highlight that the five CRFs with the highest importance for CRCBPs are (1) the risk of external threats due to international factors (with a relative distance of 0.895), (2) exchange rate fluctuations and changes (with a relative distance of 0.852), (3) bank interest rate fluctuations (with a relative distance of 0.795), (4) traffic licenses (with a relative distance of 0.681), and (5) access to skilled labor (with a relative distance of 0.678).

6. Discussions and Conclusions

What are the most severe risks in commercial and recreational complex building projects (CRCBPs)? This is the question at the center of the presented study, and results of the quantitative step (see Table 7) showed that the 10 most important CRFs of CRCBPs are (i) threats from international relations, (ii) exchange rate fluctuations and changes, (iii) bank interest rate fluctuations, (iv) traffic licenses, (v) access to skilled labor, (vi) changes in regional regulations, (vii) the condition of adjacent buildings, (viii) fluctuations and changes in inflation rates, (ix) failure to select a suitable and qualified advisor, and (x) previous experiences and records related to the employer.

The results of the current study are partly aligned with those of some previous scholars interested in identifying and ranking CRFs in construction projects, even if not specifically considering CRCBPs. For example, [10] reported that construction project risk indicators are mainly related to changes in domestic and international situations and the efficiency of a country’s economics/workforce/construction characteristics/consultative and contractual services. Yet, Hatefi and Mohseni [73] also ranked the CRFs as high in relation to initial price fluctuations, rising inflation, exchange rate fluctuations, bank interest rate fluctuations, tax increases, and the uncertainty of fiscal policies. Results are slightly in contrast to Dey [74] who, by evaluating project risks using a MCDM method, identified that also risks connected with government bonds and equipment suppliers and technology selection have a high priority in construction projects (not ranked high in the proposed study).

With regard to CRCBPs, the produced results extend the contributions by Chen and Khumpaisal [35] and by Tamošaitienė et al. [12], who identified risks for CRCBPs without, however, providing their prioritization. Yet, when considering prior studies that identified and prioritized CRFs of CRCBPs, results of the proposed work are partly in accord; indeed, with regard to Comu et al. [17], this is despite ‘exchange rate and inflation rate fluctuations’ and ‘political instability’ not being included with other CRFs ranked as important in the proposed work (e.g., traffic licenses, access to skilled labor, changes in regional regulations, etc.). Differences in these findings can come from the different economic, social, and cultural contexts, as well as from the different features of the samples involved. Indeed, respondents for the proposed contribution are more experienced, they come from distinct stakeholders’ categories (clients and consultants have been included), and they are more heterogeneous in terms of field of specialty. These individual differences, according to the literature [77], can lead to different perceptions and, as a consequence, to distinct prioritization of categories. Yet, project risks can also vary from time to time depending on the progress level of the project [78], and this is more important for financial risks, such as the exchange rate instabilities, which can occur suddenly due to unforeseen factors [79], most of which are often external ones.

If looking at risks identified and prioritized for megaprojects that have some parallelism with CRCBPs [80], results are slightly in contrast. Indeed, Cheng and Darsa [27] found that the most important risk factors in the Ethiopian context are ‘change order’, ‘corruption/bribery’, and ‘delay in payment’, while Chattapadhyay et al. [29] found that the most severe risks are delay in obtaining traffic regulation orders, inappropriate equipment, political and legal issues, political instability, government intervention, regulatory confirmation and regulation order delays, and wrong engineering designs. Obviously, these differences can be associated to the usual distinct nature of megaprojects and CRCBPS, mainly public and private, respectively [81].

Among the ten identified risks, some were external risks of CRCBPs while others were internal risks. However, all the identified risks have significant effects on project development in the setting of developed or developing countries. As expected, given the timing of the investigation into sanctions and severe economic problems in Iran, the most important CRFs were in the economic risk group. Sanctions imposed on Iran have reduced liquidity and increased inflation, which is reflected on the price of equipment and materials. Therefore, factors, such as exchange rate fluctuations and inflation, followed by changes in bank interest rates, certainly cause serious uncertainties in CRCBPs projects. The reason can be found in the fact that most of the mechanical, electrical, and even construction materials and equipment of these projects in Iran are supplied through imports from industrialized countries. Consequently, the cost of manufacturing CRCBPs in Iran is directly related to exchange rate fluctuations. Furthermore, the procurement of these projects is often faced with problems and therefore this issue causes negative effects during the implementation of the project and the construction of CRCBPs in Iran is always delayed. Given that such projects have a certain delicacy at the joining stage, the need for skilled and experienced labor is a condition for achieving the desired work. This is why, in Iran, the main experience of the staff is in uniform construction items and the need for training in this field is strongly felt. This is also evident in the installation of mechanical and electronic equipment. Yet, the increase in the exchange rate has made it practically impossible for public and private employers to employ non-Iranian specialized forces in the construction of CRCBPs, basically because the import of technical and engineering services in this situation will greatly affect the cost of manufacturing CRCBPs. Regarding the risk of the contractor’s claim, acknowledging that economic problems will definitely lead to a reduction in the contractors’ profit margins, various claims will therefore follow. The result of this issue will not only affect the executive affairs and the quality of the finished product but will also cause legal problems and difficulties for all parties.

The present study was conducted to identify and evaluate CRFs of CRCBPs, using a MCDM method, and identify the most severe ones. For this purpose, based on a careful study of the research literature and the implementation of the Delphi method, 82 risks of CRCBPs were identified and ranked; then, they were empirically analyzed through the TOPSIS method. Results showed that the most severe risks for CRCBPs are (1) the risk of external threats due to international factors, (2) exchange rate fluctuations and changes, (3) bank interest rate fluctuations, (4) traffic licenses, and (5) access to skilled labor.

In terms of theoretical implications, when considering similar works that prioritized CRFs of CRCBPs, the proposed contribution overcomes their main limitation in having considered just a small sample of risks to be assessed; see Comu et al. [17] who included only 21 risks, a small amount compared to the 82 risks included in this study. If considering results of this and prior studies on CRFs of CRCBPs, it can be stated that external risks, such as the exchange rate and inflation rate fluctuations and political instability, are the most severe. However, from the identified differences compared with prior literature, it can be put forward that the economic, social, and cultural contexts of the study and the socio-demographic/personality features of the sample involved are pivotal for the identification and prioritization of CRFs. This undermines the generalizability of results. Yet, this study also underlines the importance of considering the stage of the project life cycle [82] for which risks are assessed. The influence of different groups of identified risks cannot be separately studied in some phases of the CRCBPs. As an example, in the ‘management’ category of risks, individual identified risk factors can be important at different or for multiple phases of the CRCBPs’ life cycle. This is very clear in the risk factor ‘site unavailability and delay in delivery of land to the presenter’, which has a significantly higher importance during the first phases of the CRCBPs compared to later phases. In contrast, a risk factor such as ‘poor coordination and management’ can be important in all CRCBPs’ phases (e.g., design and engineering, and procurement and construction). This means that practitioners should aim to mitigate single risks that are more likely to occur in each phase of the CRCBPs’ life cycle (but are not exclusive to that phase), while controlling the evolution of risks and their effects on project performance, even if the project is passed the phase during which these risks are expected to manifest. This can be done, for example, by the use of the real options method or a scenario-based approach [83]. In summary, the external and internal conditions of CRCBPs may vary significantly, resulting in the appearance of risks that were thought to be unlikely to occur. As a result, scholars interested in risk management should pay a great deal of attention to risks and changes in the internal and external environment of the project and be prepared for manifestation of such risk factors.

In terms of practical implications, it is worth noting that a number of external risks, such as fluctuations in currency exchange rates, changes in inflation rate, foreign threats due to international relations, and fluctuations of banking interest rates, are outside of the power of CRCBPs’ managers while also having a large impact—especially on the project’s conceptual planning and feasibility study’s life cycle. Indeed, the presence of these economic and financial risks during the initial phases of the project can result in CRCBPs’ decision makers abandoning the project before significant investments are made. Alternatively, decision makers can try implementing projects in countries and/or during periods of stable exchange rates that can facilitate the fulfillment of project objectives. Another practical strategy to reduce these risks is to insure CRCBPs’ against possible economic and financial risks. The cost of such insurance is even more financially acceptable if investors in CRCBPs also have significant investments in other projects. The increase in the number of projects in the investors’ portfolio allows them to control investments with different levels of risk manifestation and can reduce the risk of overall failure in practice. However, insurance protection is not possible for risks such as traffic permits and the condition of adjacent buildings, which are always outside a project management team’s control. If such risks are verified, they can result in significant delays in CRCBPs (or undermine their fruition), and therefore decrease the overall value of the CRCBPs. In such a case, CRCBPs’ decision makers must choose to either continue with the project while attempting to maintain economic and financial equilibrium or liquidate the project if the cost of these risks can reach or exceed the planned return on investments.

Finally, the risks of lack of access to skilled labor, lack of qualified consultants, and unrealistic preliminary estimation can also have significant effects, similar to the previously discussed risks, by delaying the execution of the CRCBPs while also undermining risk management and coordination efforts. However, since these risks are related to processes actively controlled by CRCBPs’ management, their direct control is possible. For instance, the lack of access to resources or qualified consultants can often be resolved through human resource agencies, headhunters, or other qualified players capable of identifying and delivering suitable employees and consultants for participation in CRCBPs. Similarly, simple solutions are possible for unrealistic primary estimation, including conducting suitable feasibility studies on the CRCBPs. Furthermore, using skilled labor and qualified consultants can help minimize the forecasted mistakes and problems in the project’s progress.

There are few limitations to this study. Despite the fact that the categories of identified risks overlap with the ones identified in the extensive and recent review on construction risks by Siraj et al. [70], all the risks identified by these scholars (i.e., 571) have not been included in our survey due to the: (i) Lack of a complete list of these risks (authors just propose a sample of 10 risks for each category), and (ii) methodological difficulty in proposing a related lengthy questionnaire for the ranking of risks. Always with regard to the method adopted, i.e., the Delphi technique, it has inner reliability and validity limits. In particular, considering the reliability problem of the Delphi study (i.e., two or more different groups of experts can lead to different results even if facing the same questions/phenomena); and the criteria for qualitative studies—i.e., truthfulness, applicability, consistency and confirmability—were followed to ensure that credible interpretations of the findings are produced [84]. These criteria are based on the following issues; however, as Keeney et al. [85] stated, following these criteria cannot totally limit the involvement of different panels that may lead to obtaining the same results. Despite that, results emerging from the Delphi study can be considered reliable, in as much as the best (in terms of knowledge and expertise) possible panelists are involved. With regard to the validity problem (i.e., whether the produced results are the right expression of the investigated phenomena), the involvement of a respondent with great knowledge in the field is the most used approach within the technique [85] and this solves also the problem of convergence of opinions that can occur over three rounds of the Delphi technique. However, it is true that this study involved a small number of experts, even though their expertise was in line with the study’s aims and that this number is similar to works in the same field adopting the Delphi method [15]. Future studies should increase the validity of the results through interviewing a larger group of experts, at least around 50, or expanding their scope to that of other developing countries. Additionally, comparing the results of similar studies conducted in developed countries to that of developing countries could lead to interesting results. Furthermore, the socio-demographic characteristics of the experts participating in the initial phase of identifying risks of CRCBPs can play a role through their opinions regarding the existence and/or importance of certain risk factors. Therefore, an interesting future prospect will be to carry out future quantitative studies based on Upper Echelons Theory literature [77,86], regarding the effects of socio-demographic characteristics and/or other psychological variables on definition and evaluation of CRCBPs’ risks at the individual and group levels. Another main limitation of this study is the adoption of the TOPSIS method. Indeed, as well accounted by Madi et al. [87], TOPSIS uses crisp information that is impractical in many real-world situations (e.g., human judgements are often vague and cannot estimate preferences in exact numerical form). Yet, TOPSIS suffers from the rank reversal problem that is related to the change in the ranking of alternatives when a criterion or an alternative is added or dropped; yet, since TOPSIS uses Euclidean distance (that does not consider correlations), results are affected due to information overlap [88]. To try to overcome this limitation, future research is encouraged to combine MCDM techniques [89]. Another solution is to adopt established developments of the TOPSIS method, such as fuzzy TOPSIS; the sets can be used to express preferences using linguistic variables [90]. The adoption of this more sophisticated technique can help also to overcome the limitation of this study having been based on a MCDM approach; indeed, the fuzzy set theory has led to a new decision theory, known today as fuzzy MCDM where decision-maker models are able to deal with incomplete and uncertain knowledge and information [91].

Author Contributions

Conceptualization, H.S. and J.T.; methodology, H.S. and M.K.; formal analysis, H.S. and M.K.; investigation, J.T., H.S., and D.W.M.C.; data curation, H.S. and D.W.M.C.; writing—original draft preparation, H.S. and J.T.; writing—review and editing, M.C. and H.S.; visualization, H.S. and M.C.; supervision, H.S.; project administration, J.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Decision matrix based on the results of the collected questionnaires.

Table A1.

Decision matrix based on the results of the collected questionnaires.

| Code | Risks | Vulnerability (−) | Probability of Occurrence of Risk (−) | Risk Detection (+) | Accepting Threat (−) | Impact on the Occurrence of Other Risks (−) | Risk Manageability (+) | Risk Response (+) |

|---|---|---|---|---|---|---|---|---|

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | ||

| CRF1 | Exchange rate fluctuation | 1/333 | 1/625 | 6/375 | 2/25 | 2/5 | 4/625 | 4/25 |

| CRF2 | Inflation fluctuation | 2/667 | 2/375 | 6 | 4 | 3/625 | 4 | 3/875 |

| CRF3 | Access to skilled worker | 4/167 | 3/875 | 4/625 | 2/25 | 4/875 | 4/5 | 4 |

| CRF4 | Contractor’s claim | 4/5 | 3/625 | 4/75 | 4/125 | 4/875 | 3/5 | 3/625 |

| CRF5 | Foreign threats | 2/667 | 2/25 | 5/375 | 1/375 | 2/625 | 5/625 | 5 |

| CRF6 | Bank interest fluctuation | 2/167 | 3/5 | 4/875 | 2/25 | 2/25 | 5 | 5/375 |

| CRF7 | Lack of qualified consultant | 1/833 | 3/375 | 5/125 | 4/125 | 5/25 | 3/375 | 3/25 |

| CRF8 | Traffic permits | 2/333 | 1/375 | 4/625 | 3/75 | 3 | 4/125 | 3/625 |

| CRF9 | Unrealistic primary estimation | 4/167 | 4/75 | 3/875 | 4/625 | 4/875 | 3/75 | 3/625 |

| CRF10 | Adjacent building condition | 3/333 | 3 | 5 | 3/375 | 5/375 | 4/625 | 4/375 |

| CRF11 | Mismatch of job referrals to personnel with related specialized skills | 5/833 | 5/625 | 4/25 | 5/5 | 5/75 | 4 | 4/125 |

| CRF12 | Previous employer-related experience and background | 4/667 | 4/625 | 5 | 4 | 4/25 | 4/25 | 4/5 |

| CRF13 | Delays in construction | 5 | 4/375 | 4/125 | 4/75 | 4/25 | 4/125 | 3/75 |

| CRF14 | Regional standard changes (firefighting-master plans, etc.) | 4/5 | 3/5 | 5/25 | 3/25 | 4 | 4/625 | 4/625 |

| CRF15 | Changes in the legal obligations of contracts | 5/633 | 5/5 | 3/375 | 5/75 | 6 | 3 | 3/625 |

| CRF16 | Mismatch between demand and available resources | 5/167 | 4/625 | 4 | 4/875 | 4/375 | 3/375 | 3 |

| CRF17 | Lack of using appropriate methods in workshop management | 6/167 | 5/865 | 3/375 | 6/125 | 6/75 | 3/25 | 3/625 |

| CRF18 | Change in duties of imported equipment | 4/5 | 4/125 | 4/625 | 4/5 | 4/625 | 3/5 | 3/875 |

| CRF19 | Lack of on time finance | 4/167 | 4 | 5/25 | 4/25 | 5 | 3/25 | 3/5 |

| CRF20 | Inappropriate finance | 4/167 | 4 | 4/625 | 4 | 5/625 | 3/375 | 3/5 |

| CRF21 | Law changes and economic policies of materials | 5/633 | 5/5 | 3/5 | 4/875 | 6/25 | 2/75 | 3/125 |

| CRF22 | Bankruptcy | 4/833 | 5/875 | 3 | 3/875 | 3/5 | 4/875 | 4 |

| CRF23 | Incomplete plan | 6/333 | 6/125 | 2 | 6/375 | 6/625 | 2/125 | 1/625 |

| CRF24 | Poor technical specifications | 6/5 | 6/375 | 1/75 | 7/25 | 7 | 1/375 | 1/125 |

| CRF25 | Failure to complete work items in anticipated times | 5 | 4/75 | 4/25 | 5 | 5 | 3/625 | 3 |

Table A2.

Normalized decision matrix based on the results of the collected questionnaires.

Table A2.

Normalized decision matrix based on the results of the collected questionnaires.

| Risks | − | − | + | − | − | + | + |

|---|---|---|---|---|---|---|---|

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | |

| CRF1 | 0/0590 | 0/074 | 0/284 | 0/101 | 0/101 | 0/238 | 0/225 |

| CRF2 | 0/118 | 0/108 | 0/267 | 0/179 | 0/147 | 0/205 | 0/205 |

| CRF3 | 0/184 | 0/176 | 0/206 | 0/101 | 0/197 | 0/231 | 0/211 |

| CRF4 | 0/199 | 0/165 | 0/212 | 0/185 | 0/197 | 0/180 | 0/192 |

| CRF5 | 0/118 | 0/102 | 0/239 | 0/062 | 0/106 | 0/289 | 0/264 |

| CRF6 | 0/096 | 0/159 | 0/217 | 0/101 | 0/091 | 0/257 | 0/284 |

| CRF7 | 0/081 | 0/153 | 0/228 | 0/185 | 0/212 | 0/173 | 0/172 |

| CRF8 | 0/103 | 0/063 | 0/206 | 0/168 | 0/121 | 0/212 | 0/192 |

| CRF9 | 0/184 | 0/216 | 0/173 | 0/207 | 0/197 | 0/193 | 0/192 |

| CRF10 | 0/148 | 0/136 | 0/223 | 0/151 | 0/217 | 0/228 | 0/231 |

| CRF11 | 0/258 | 0/256 | 0/189 | 0/246 | 0/233 | 0/205 | 0/218 |

| CRF12 | 0/207 | 0/210 | 0/223 | 0/179 | 0/172 | 0/218 | 0/238 |

| CRF13 | 0/221 | 0/199 | 0/184 | 0/213 | 0/212 | 0/212 | 0/198 |

| CRF14 | 0/199 | 0/159 | 0/234 | 0/145 | 0/162 | 0/238 | 0/244 |

| CRF15 | 0/249 | 0/250 | 0/150 | 0/257 | 0/243 | 0/154 | 0/192 |

| CRF16 | 0/229 | 0/210 | 0/178 | 0/218 | 0/177 | 0/173 | 0/158 |

| CRF17 | 0/273 | 0/267 | 0/150 | 0/274 | 0/273 | 0/167 | 0/192 |

| CRF18 | 0/199 | 0/188 | 0/206 | 0/201 | 0/187 | 0/180 | 0/205 |

| CRF19 | 0/184 | 0/182 | 0/234 | 0/190 | 0/202 | 0/167 | 0/185 |

| CRF20 | 0/184 | 0/182 | 0/206 | 0/179 | 0/228 | 0/173 | 0/185 |

| CRF21 | 0/249 | 0/25 | 0/156 | 0/218 | 0/253 | 0/141 | 0/165 |

| CRF22 | 0/214 | 0/267 | 0/134 | 0/173 | 0/142 | 1/250 | 0/211 |

| CRF23 | 0/280 | 0/279 | 0/089 | 0/285 | 0/268 | 0/109 | 0/086 |

| CRF24 | 0/288 | 0/290 | 0/078 | 0/325 | 0/283 | 0/071 | 0/059 |

| CRF25 | 0/221 | 0/216 | 0/189 | 0/224 | 0/202 | 0/186 | 0/158 |

Table A3.

Weight of criteria.

Table A3.

Weight of criteria.

| Criteria | C1 | C2 | C3 | C4 | C5 | C6 | C7 |

|---|---|---|---|---|---|---|---|

| wj | 0/0633 | 0/089 | 0/0544 | 0/135 | 0/08 | 0/1 | 0/053 |

Table A4.

Harmonic decision matrix.

Table A4.

Harmonic decision matrix.

| Risks | (−) | (−) | (+) | (−) | (−) | (+) | (+) |

|---|---|---|---|---|---|---|---|

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | |

| CRF1 | 0/004 | 0/007 | 0/015 | 0/014 | 0/008 | 0/024 | 0/012 |

| CRF2 | 0/007 | 0/010 | 0/015 | 0/024 | 0/012 | 0/021 | 0/011 |

| CRF3 | 0/012 | 0/016 | 0/011 | 0/014 | 0/016 | 0/023 | 0/011 |

| CRF4 | 0/013 | 0/015 | 0/012 | 0/025 | 0/016 | 0/018 | 0/010 |

| CRF5 | 0/007 | 0/009 | 0/013 | 0/008 | 0/008 | 0/029 | 0/014 |

| CRF6 | 0/006 | 0/014 | 0/012 | 0/014 | 0/007 | 0/026 | 0/015 |

| CRF7 | 0/005 | 0/014 | 0/012 | 0/025 | 0/017 | 0/017 | 0/009 |

| CRF8 | 0/007 | 0/006 | 0/011 | 0/023 | 0/010 | 0/021 | 0/010 |

| CRF9 | 0/012 | 0/019 | 0/009 | 0/028 | 0/016 | 0/019 | 0/010 |

| CRF10 | 0/009 | 0/012 | 0/012 | 0/020 | 0/017 | 0/024 | 0/012 |

| CRF11 | 0/016 | 0/023 | 0/010 | 0/023 | 0/019 | 0/021 | 0/012 |

| CRF12 | 0/013 | 0/019 | 0/012 | 0/024 | 0/014 | 0/022 | 0/013 |

| CRF13 | 0/014 | 0/018 | 0/010 | 0/029 | 0/017 | 0/021 | 0/011 |

| CRF14 | 0/013 | 0/014 | 0/013 | 0/020 | 0/013 | 0/024 | 0/013 |

| CRF15 | 0/016 | 0/022 | 0/008 | 0/035 | 0/019 | 0/015 | 0/010 |

| CRF16 | 0/014 | 0/019 | 0/010 | 0/029 | 0/014 | 0/017 | 0/008 |

| CRF17 | 0/017 | 0/024 | 0/008 | 0/037 | 0/022 | 0/017 | 0/010 |

| CRF18 | 0/013 | 0/017 | 0/011 | 0/027 | 0/015 | 0/018 | 0/011 |

| CRF19 | 0/012 | 0/016 | 0/013 | 0/026 | 0/016 | 0/017 | 0/010 |

| CRF20 | 0/012 | 0/016 | 0/011 | 0/024 | 0/018 | 0/017 | 0/010 |

| CRF21 | 0/016 | 0/022 | 0/008 | 0/029 | 0/020 | 0/014 | 0/009 |

| CRF22 | 0/014 | 0/024 | 0/007 | 0/023 | 0/011 | 0/025 | 0/011 |

| CRF23 | 0/018 | 0/025 | 0/005 | 0/038 | 0/021 | 0/011 | 0/005 |

| CRF24 | 0/018 | 0/026 | 0/004 | 0/044 | 0/023 | 0/007 | 0/002 |

| CRF25 | 0/014 | 0/019 | 0/010 | 0/030 | 0/016 | 0/019 | 0/008 |

Table A5.

Positive and negative ideals of each creation.

Table A5.

Positive and negative ideals of each creation.

| Positive and Negative Ideals | (−) | (−) | (+) | (−) | (−) | (+) | (+) |

|---|---|---|---|---|---|---|---|

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | |

| A+ | 0/004 | 0/006 | 0/015 | 0/008 | 0/007 | 0/029 | 0/015 |

| A− | 0/018 | 0/026 | 0/004 | 0/044 | 0/023 | 0/007 | 0/003 |

References

- Project Management Institute (PMI). A Guide to the Project Management Body of Knowledge: PMBOK® Guide, 6th ed.; Project Management Institute: Newton Square, PA, USA, 2017. [Google Scholar]

- Yuan, J.; Chen, K.; Li, W.; Ji, C.; Wang, Z.; Skibniewski, M.J. Social network analysis for social risks of construction projects in high-density urban areas in China. J. Clean. Prod. 2018, 198, 940–961. [Google Scholar] [CrossRef]

- Wuni, I.Y.; Shen, G.Q.P.; Mahmud, A.T. Critical risk factors in the application of modular integrated construction: A systematic review. Int. J. Constr. Manag. 2019, 1–15. [Google Scholar] [CrossRef]

- Ward, S.; Chapman, C. Transforming project risk management into project uncertainty management. Int. J. Proj. Manag. 2003, 21, 97–105. [Google Scholar] [CrossRef]

- Khosravi, M.; Sarvari, H.; Chan, D.W.M.; Cristofaro, M.; Chen, Z. Determining and assessing the risks of commercial and recreational complex building projects in developing countries: A survey of experts in Iran. J. Facil. Manag. 2020, 18, 259–282. [Google Scholar] [CrossRef]

- Hlaing, N.N.; Singh, D.; Tiong, R.L.K.; Ehrlich, M. Perceptions of Singapore construction contractors on construction risk identification. J. Financ. Manag. Prop. Constr. 2008, 13, 85–95. [Google Scholar] [CrossRef]

- Chapman, R.J. The effectiveness of working group risk identification and assessment techniques. Int. J. Proj. Manag. 1998, 16, 333–343. [Google Scholar] [CrossRef]

- Goh, C.S.; Abdul-Rahman, H.; Abdul Samad, Z. Applying risk management workshop for a public construction project: Case study. J. Constr. Eng. Manag. 2013, 139, 572–580. [Google Scholar] [CrossRef]

- Marcelino-Sádaba, S.; Pérez-Ezcurdia, A.; Lazcano, A.M.E.; Villanueva, P. Project risk management methodology for small firms. Int. J. Proj. Manag. 2014, 32, 327–340. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z.; Tamošaitienė, J. Risk assessment of construction projects. J. Civ. Eng. Manag. 2010, 16, 33–46. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Md Noor, N.; Kildienė, S.; Sarvari, H.; Mardani, A. A fuzzy analytic network process method for risk prioritization in freeway PPP projects: An Iranian case study. J. Civ. Eng. Manag. 2015, 21, 933–947. [Google Scholar] [CrossRef]

- Tamošaitienė, J.; Zavadskas, E.K.; Turskis, Z. Multi-criteria risk assessment of a construction project. Procedia Comput. Sci. 2013, 17, 129–133. [Google Scholar] [CrossRef]

- Tamošaitienė, J.; Sarvari, H.; Chan, D.W.M.; Cristofaro, M. Assessing the Barriers and Risks to Private Sector Participation in Infrastructure Construction Projects in Developing Countries of Middle East. Sustainability 2021, 13, 153. [Google Scholar] [CrossRef]

- Tamošaitienė, J.; Yousefi, V.; Tabasi, H. Project Portfolio Construction Using Extreme Value Theory. Sustainability 2021, 13, 855. [Google Scholar] [CrossRef]

- Tamošaitienė, J.; Sarvari, H.; Cristofaro, M.; Chan, D.W.M. Identifying and prioritizing the selection criteria of appropriate repair and maintenance methods for commercial buildings. Int. J. Strateg. Prop. Manag. 2021, 25, 413–431. [Google Scholar] [CrossRef]

- Sarvari, H.; Valipour, A.; Yahya, N.; Noor, N.; Beer, M.; Banaitiene, N. Approaches to Risk Identification in Public–Private Partnership Projects: Malaysian Private Partners’ Overview. Adm. Sci. 2019, 9, 17. [Google Scholar] [CrossRef]

- Comu, S.; Elibol, A.Y.; Yucel, B. A risk assessment model of commercial real estate development projects in developing countries. J. Constr. Eng. 2021, 4, 52–67. [Google Scholar] [CrossRef]

- Sarvari, H.; Chan, D.W.M.; Alaeos, A.K.F.; Olawumi, T.O.; Abdalridah Aldaud, A.A. Critical success factors for managing construction small and medium-sized enterprises in developing countries of Middle East: Evidence from Iranian construction enterprises. J. Build. Eng. 2021, 43, 103152. [Google Scholar] [CrossRef]

- Mirkatouli, J.; Samadi, R.; Hosseini, A. Evaluating and analysis of socio-economic variables on land and housing prices in Mashhad, Iran. Sustain. Cities Soc. 2018, 41, 695–705. [Google Scholar] [CrossRef]

- United Nations. Central Product Classification; United Nations Statistics Division: New York, NY, USA, 2015. [Google Scholar]

- Sarvari, H.; Mehrabi, A.; Chan, D.W.M.; Cristofaro, M. Evaluating urban housing development patterns in developing countries: Case study of Worn-out Urban Fabrics in Iran. Sustain. Cities Soc. 2021, 70, 102941. [Google Scholar] [CrossRef]

- Kumaraswamy, M.M.; Zhang, X.Q. Governmental role in BOT-led infrastructure development. Int. J. Proj. Manag. 2001, 19, 195–205. [Google Scholar] [CrossRef]

- Ghaed Rahmati, S.; Daneshmandi, N. Analysis of urban tourism spatial pattern (case study: Urban tourism space of Isfahan city). Hum. Geogr. Res. 2018, 50, 945–961. [Google Scholar]

- Sarvari, H.; Rakhshanifar, M.; Tamošaitienė, J.; Chan, D.W.M.; Beer, M. A risk based approach to evaluating the impacts of Zayanderood drought on sustainable development indicators of riverside urban in Isfahan-Iran. Sustainability 2019, 11, 6797. [Google Scholar] [CrossRef]

- Marle, F.; Gidel, T. A multi-criteria decision-making process for project risk management method selection. Int. J. Multicriteria Decis. Mak. 2012, 2, 189–223. [Google Scholar] [CrossRef]

- Yatsalo, B.; Gritsyuk, S.; Sullivan, T.; Trump, B.; Linkov, I. Multi-criteria risk management with the use of DecernsMCDA: Methods and case studies. Environ. Syst. Decis. 2016, 36, 266–276. [Google Scholar] [CrossRef]

- Cheng, M.Y.; Darsa, M.H. Construction Schedule Risk Assessment and Management Strategy for Foreign General Contractors Working in the Ethiopian Construction Industry. Sustainability 2021, 13, 7830. [Google Scholar] [CrossRef]

- Czajkowska, A.; Ingaldi, M. Structural Failures Risk Analysis as a Tool Supporting Corporate Responsibility. J. Risk Financ. Manag. 2021, 14, 187. [Google Scholar] [CrossRef]

- Chattapadhyay, D.B.; Putta, J.; Paneem, R.M. Risk Identification, Assessments, and Prediction for Mega Construction Projects: A Risk Prediction Paradigm Based on Cross Analytical-Machine Learning Model. Buildings 2021, 11, 172. [Google Scholar] [CrossRef]

- Tserng, H.P.; Cho, I.; Chen, C.H.; Liu, Y.F. Developing a Risk Management Process for Infrastructure Projects Using IDEF0. Sustainability 2021, 13, 6958. [Google Scholar] [CrossRef]

- Chan, D.W.M.; Chan, J.H.L.; Ma, T. Developing a fuzzy risk assessment model for guaranteed maximum price and target cost contracts in South Australia. Facilities 2014, 32, 624–646. [Google Scholar] [CrossRef]

- Siu, F.M.F.; Leung, J.W.Y.; Chan, D.W.M. A Data-driven approach to identify-quantify-analyse construction risk for Hong Kong NEC projects. J. Civ. Eng. Manag. 2018, 24, 592–606. [Google Scholar] [CrossRef]

- Chatterjee, K.; Zavadskas, E.K.; Tamošaitienė, J.; Adhikary, K.; Kar, S. A hybrid MCDM technique for risk management in construction projects. Symmetry 2018, 10, 46. [Google Scholar] [CrossRef]

- Zhou, H.; Zhao, Y.; Shen, Q.; Yang, L.; Cai, H. Risk assessment and management via multi-source information fusion for undersea tunnel construction. Autom. Constr. 2020, 111, 103050. [Google Scholar] [CrossRef]

- Chen, Z.; Khumpaisal, S. An analytic network process for risks assessment in commercial real estate development. J. Prop. Invest. Financ. 2009, 27, 238–258. [Google Scholar] [CrossRef]

- Irimia Diéguez, A.I.; Sánchez Cazorla, Á.; Alfalla Luque, R. Risk management in megaprojects. Procedia Soc. Behav. Sci. 2014, 119, 407–416. [Google Scholar] [CrossRef][Green Version]

- Krane, H.P.; Rolstadås, A.; Olsson, N.O. Categorizing risks in seven large projects—Which risks do the projects focus on? Proj. Manag. J. 2010, 41, 81–86. [Google Scholar] [CrossRef]

- Wang, H.; Tong, Y. Algorithm Study on Models of Multiple Objective Risk Decision under Principal and Subordinate Hierarch Decision-making. Oper. Res. Manag. Sci. 2007, 16, 1–8. [Google Scholar]

- Wideman, R.M. A Guide to Managing Project Risks and Opportunities; Project Management Institute: Newtown Square, PA, USA, 1992. [Google Scholar]

- Sigmund, Z.; Radujković, M. Risk breakdown structure for construction projects on existing buildings. Procedia-Soc. Behav. Sci. 2014, 119, 894–901. [Google Scholar] [CrossRef]

- Hillson, D.; Grimaldi, S.; Rafele, C. Managing project risks using a cross risk breakdown matrix. Risk Manag. 2006, 8, 61–76. [Google Scholar] [CrossRef]

- Dabiri, M.; Oghabi, M.; Sarvari, H.; Sabeti, M.; Kashefi, H. A combination risk-based approach to post-earthquake temporary accommodation site selection: A case study in Iran. Iran. J. Fuzzy Syst. 2020, 17, 54–74. [Google Scholar] [CrossRef]

- Lyu, H.M.; Sun, W.J.; Shen, S.L.; Zhou, A.N. Risk assessment using a new consulting process in fuzzy AHP. J. Constr. Eng. Manag. 2020, 146, 04019112. [Google Scholar] [CrossRef]

- Milion, R.N.; Alves, T.D.C.; Paliari, J.C.; Liboni, L.H. CBA-Based Evaluation Method of the Impact of Defects in Residential Buildings: Assessing Risks towards Making Sustainable Decisions on Continuous Improvement Activities. Sustainability 2021, 13, 6597. [Google Scholar] [CrossRef]

- Taylan, O.; Bafail, A.O.; Abdulaal, R.M.; Kabli, M.R. Construction projects selection and risk assessment by fuzzy AHP and fuzzy TOPSIS methodologies. Appl. Soft Comput. 2014, 17, 105–116. [Google Scholar] [CrossRef]

- Mata, P.; Silva, P.F.; Pinho, F.F. Risk Management of Bored Piling Construction on Sandy Soils with Real-Time Cost Control. Infrastructures 2021, 6, 77. [Google Scholar] [CrossRef]

- Liu, Z.; Meng, X.; Xing, Z.; Jiang, A. Digital Twin-Based Safety Risk Coupling of Prefabricated Building Hoisting. Sensors 2021, 21, 3583. [Google Scholar] [CrossRef] [PubMed]

- Draji Jahromi, A.; Valipour, A.; Pakdel, A. Ranking of risk assessment criteria in construction projects using network analysis. In Proceedings of the 4th International Congress on Civil Engineering, Architecture & Urban Development, Tehran, Iran, 27–29 December 2016. [Google Scholar]

- Mohammadi Talvar, Z.; Panahi, J. Identifying effective criteria in assessing and ranking the risk management of construction projects. In Proceedings of the Conference on Civil Engineering, Architecture and Urbanism of the Islamic Countries, Tabriz, Iran, 10 May 2018. [Google Scholar]

- Muriana, C.; Vizzini, G. Project risk management: A deterministic quantitative technique for assessment and mitigation. Int. J. Proj. Manag. 2017, 35, 320–340. [Google Scholar] [CrossRef]

- Sarvari, H.; Cristofaro, M.; Chan, D.W.M.; Noor, N.M.; Amini, M. Completing abandoned public facility projects by the private sector: Results of a Delphi survey in the Iranian Water and Wastewater Company. J. Facil. Manag. 2020, 18, 547–566. [Google Scholar] [CrossRef]

- Cox, L.A., Jr.; Babayev, D.; Huber, W. Some limitations of qualitative risk rating systems. Risk Anal. Int. J. 2005, 25, 651–662. [Google Scholar] [CrossRef]

- Zou, P.X.; Zhang, G.; Wang, J. Understanding the key risks in construction projects in China. Int. J. Proj. Manag. 2007, 25, 601–614. [Google Scholar] [CrossRef]

- Behzadian, M.; Otaghsara, S.K.; Yazdani, M.; Ignatius, J. A state-of the-art survey of TOPSIS applications. Expert Syst. Appl. 2012, 39, 13051–13069. [Google Scholar] [CrossRef]

- Jozaghi, A.; Alizadeh, B.; Hatami, M.; Flood, I.; Khorrami, M.; Khodaei, N.; Ghasemi Tousi, E.A. Comparative Study of the AHP and TOPSIS Techniques for Dam Site Selection Using GIS: A Case Study of Sistan and Baluchestan Province, Iran. Geosciences 2018, 8, 494. [Google Scholar] [CrossRef]

- Gebrehiwet, T.; Luo, H. Risk level evaluation on construction project lifecycle using fuzzy comprehensive evaluation and TOPSIS. Symmetry 2019, 11, 12. [Google Scholar] [CrossRef]

- Dandage, R.; Mantha, S.S.; Rane, S.B. Ranking the risk categories in international projects using the TOPSIS method. Int. J. Manag. Proj. Bus. 2018, 11, 317–331. [Google Scholar] [CrossRef]

- Jalal, M.P.; Shoar, S. A hybrid framework to model factors affecting construction labour productivity: Case study of Iran. J. Financ. Manag. Prop. Constr. 2019, 24, 630–654. [Google Scholar] [CrossRef]

- Ghasseminejad, S.; Jahan-Parvar, M.R. The impact of financial sanctions: Case Iran. J. Policy Modeling 2021, 43, 601–621. [Google Scholar] [CrossRef]

- Arnott, R. Housing policy in developing countries: The importance of the informal economy. In Urbanization and Growth; Spence, M., Annez, P.C., Buckley, R.M., Eds.; The World Bank: Washington, DC, USA, 2008; pp. 167–196. [Google Scholar]

- Yeung, J.F.Y.; Chan, A.P.C.; Chan, D.W.M.; Li, L.K. Development of a partnering performance index (PPI) for construction projects in Hong Kong: A Delphi study. Constr. Manag. Econ. 2007, 25, 1219–1237. [Google Scholar] [CrossRef]

- Chan, D.W.M.; Chan, J.H.L. Developing a Performance Measurement Index (PMI) for target cost contracts in construction: A Delphi study. Constr. Law J. 2012, 28, 590–613. [Google Scholar]

- Olawumi, T.O.; Chan, D.W.M. Critical success factors for implementing building information modeling and sustainability practices in construction projects: A Delphi survey. Sustain. Dev. 2019, 27, 587–602. [Google Scholar] [CrossRef]

- Ezeldin, S.; Ibrahim, H.H. Risk analysis for mega shopping mall projects in Egypt. J. Civ. Eng. Archit. 2015, 9, 444–651. [Google Scholar]

- Schmidt, R.C. Managing Delphi surveys using nonparametric statistical techniques. Decis. Sci. 1997, 28, 763–774. [Google Scholar] [CrossRef]

- Chan, D.W.M.; Chan, A.P.C.; Lam, P.T.I.; Wong, J.M.W. An empirical survey of the motives and benefits of adopting guaranteed maximum price and target cost contracts in construction. Int. J. Proj. Manag. 2011, 29, 577–590. [Google Scholar] [CrossRef][Green Version]

- Yeung, J.F.Y.; Chan, A.P.C.; Chan, D.W.M. Developing a performance index for relationship-based construction projects in Australia: Delphi study. J. Manag. Eng. 2009, 25, 59–68. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Potential obstacles to successful implementation of public-private partnerships in Beijing and the Hong Kong special administrative region. J. Manag. Eng. 2010, 26, 30–40. [Google Scholar] [CrossRef]

- Durdyev, S.; Mbachu, J.; Thurnell, D.; Zhao, L.; Hosseini, M.R. BIM Adoption in the Cambodian Construction Industry: Key Drivers and Barriers. ISPRS Int. J. Geo-Inf. 2021, 10, 215. [Google Scholar] [CrossRef]

- Siraj, N.B.; Fayek, A.R. Risk identification and common risks in construction: Literature review and content analysis. J. Constr. Eng. Manag. 2019, 145, 03119004. [Google Scholar] [CrossRef]

- Shin, D.W.; Shin, Y.; Kim, G.H. Comparison of risk assessment for a nuclear power plant construction project based on analytic hierarchy process and fuzzy analytic hierarchy process. J. Build. Constr. Plan. Res. 2016, 4, 157–171. [Google Scholar] [CrossRef]

- Tian, J.; Yan, Z.F. Fuzzy analytic hierarchy process for risk assessment to general-assembling of satellite. J. Appl. Res. Technol. 2013, 11, 568–577. [Google Scholar] [CrossRef]

- Hatefi, S.; Mohseni, H. Evaluating and prioritizing the risks of BOT projects using structural equations and integrated model of fuzzy AHP and fuzzy TOPSIS. J. Struct. Constr. Eng. 2019, 6, 111–130. [Google Scholar] [CrossRef]

- Dey, P.K. Project risk management using multiple criteria decision-making technique and decision tree analysis: A case study of Indian oil refinery. Prod. Plan. Control 2012, 23, 903–921. [Google Scholar] [CrossRef]

- Hwang, C.L.; Yoon, K. Methods for multiple attribute decision making. In Multiple Attribute Decision Making; Springer: Berlin/Heidelberg, Germany, 1981; pp. 58–191. [Google Scholar] [CrossRef]

- Taroun, A. Towards a better modelling and assessment of construction risk: Insights from a literature review. Int. J. Proj. Manag. 2014, 32, 101–115. [Google Scholar] [CrossRef]

- Abatecola, G.; Cristofaro, M. Upper echelons and executive profiles in the construction value chain: Evidence from Italy. Proj. Manag. J. 2016, 47, 13–26. [Google Scholar] [CrossRef]

- Perroni, M.; Dalazen, L.L.; Da Silva, W.V.; Gouv, S.; Da Veiga, C.P. Evolution of risks for energy companies from the energy efficiency perspective: The Brazilian case. Int. J. Energy Econ. Policy 2015, 5, 612–623. [Google Scholar]

- Froot, K.A. The intermediation of financial risks: Evolution in the catastrophe reinsurance market. Risk Manag. Insur. Rev. 2008, 11, 281–294. [Google Scholar] [CrossRef]