Risk Assessment of Large-Scale Infrastructure Projects—Assumptions and Context

Abstract

Featured Application

Abstract

1. Introduction

2. Materials and Methods

2.1. Data

2.2. Methods

2.2.1. Qualitative Analysis

2.2.2. Sensitivity Analysis

| Minimum | project value reduced by 10%, |

| Most likely | project value, |

| Maximum | project value increased by 50%. |

| Minimum | project value reduced by 10%, |

| Most likely | project value, |

| Maximum | project value increased by 50%. |

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Demart, S.; Roy, B. The uses of cost-benefit analysis in public transportation decision-making in France. Transp. Policy 2009, 16, 200–212. [Google Scholar] [CrossRef]

- Hyard, A. Cost-benefit analysis according to Sen: An application in the evaluation of transport infrastructures in France. Transp. Res. Part A Policy Pract. 2012, 46, 707–719. [Google Scholar] [CrossRef]

- Jones, H.; Moura, F.; Domingos, T. Transport Infrastructure Project Evaluation Using Cost-Benefit Analysis. Procedia Soc. Behav. Sci. 2014, 111, 400–409. [Google Scholar] [CrossRef]

- Mackie, P.; Worsley, T.; Eliasson, J. Transport Appraisal Revisited. Res. Transp. Econ. 2014, 47, 3–18. [Google Scholar] [CrossRef]

- Korytárová, J.; Papežíková, P. Assessment of Large-Scale Projects Based on CBA. Procedia Comput. Sci. 2015, 64, 736–743. [Google Scholar] [CrossRef]

- Sartori, D. Guide to Cost-benefit Analysis of Investment Projects. Economic appraisal tool for Cohesion Policy 2014–2020. In Directorate-General for Regional and Urban Policy; European Commission: Brussels, Belgium, 2014; ISBN 978-92-79-34796-2. [Google Scholar]

- Ministry of Transport of the Czech Republic (MoT CZ). Departmental Guideline for the Evaluation of Economic Effectiveness of Transport Construction Projects. 2017. Available online: https://www.sfdi.cz/soubory/obrazky-clanky/metodiky/2017_03_departmental-methodology-full.pdf (accessed on 25 August 2020).

- Mokhtari, H.; Kiani, K.; Tahmasebpoor, S. Economic evaluation of investment projects under uncertainty: A probability theory perspective. Sci. Iran. 2020, 27, 448–468. [Google Scholar] [CrossRef]

- Liu, Y.; Ting-Hua, Y.; Cui-Qin, W. Investment decision support for engineering projects based on risk correlation analysis. Math. Probl. Eng. 2012, 2012. [Google Scholar] [CrossRef]

- Marović, I.; Androjić, I.; Jajac, N.; Hanák, T. Urban road infrastructure maintenance planning with application of neural networks. Complexity 2018. [Google Scholar] [CrossRef]

- Nesticò, A.; He, S.; De Mare, G.; Benintendi, R.; Maselli, G. The ALARP Principle in the Cost-Benefit Analysis for the Acceptability of Investment Risk. Sustainability 2018, 10, 4668. [Google Scholar] [CrossRef]

- Bilenko, D.; Lavrov, R.; Onyshchuk, N.; Poliakov, B.; Kabenok, Y. The Normal Distribution Formalization for Investment Economic Project Evaluation Using the Monte Carlo Method. Montenegrin J. Econ. 2019, 15, 161–171. [Google Scholar] [CrossRef]

- Acebes, F.; Pajares, J.; Galán, J.M.; López-Paredes, A. A new approach for project control under uncertainty. Going back to the basics. Int. J. Proj. Manag. 2014, 32, 423–434. [Google Scholar] [CrossRef]

- Bowers, J.; Khorakian, A. Integrating risk management in the innovation project. Eur. J. Innov. Manag. 2014, 17, 25–40. [Google Scholar] [CrossRef]

- Software Oracle Crystal Ball, Perpetual Licencs, 2020–2021. Available online: https://www.oracle.com/cz/applications/crystalball/ (accessed on 25 August 2020).

- Makovšek, D. Systematic construction risk cost estimation mechanism and unit price movements. Transp. Policy 2014, 35, 135–145. [Google Scholar] [CrossRef]

- Emhjellen, K.; Emhjellen, M.; Osmundsen, P. Investment cost estimates and investment decisions. Energy Policy 2002, 30, 91–96. [Google Scholar] [CrossRef]

- Kumar, L.; Apurva, J.; Velaga, N.R. Financial risk assessment and modelling of PPP based Indian highway infrastructure projects. Transp. Policy 2018, 62, 2–11. [Google Scholar] [CrossRef]

- Jasiukevicius, L.; Vasiliauskaite, A. Risk Assessment in Public Investment Projects: Impact of Empirically-grounded Methodology on Measured Values of Intangible Obligations in Lithuania. Procedia Soc. Behav. Sci. 2015, 213, 370–375. [Google Scholar] [CrossRef]

- Jasiukevicius, L.; Vasiliauskaite, A. Cost Overrun Risk Assessment in the Public Investment Projects: An Empirically-Grounded Research. Inz. Ekon. Eng. Econ. 2015, 26, 245–254. [Google Scholar] [CrossRef]

- Gorecki, J.; Diaz-Madronero, M. Who Risks and Wins?—Simulated Cost Variance in Sustainable Construction Projects. Sustainability 2020, 12, 3370. [Google Scholar] [CrossRef]

- Hnilica, J.; Fotr, J. Aplikovaná Analýza Rizika ve Finančním Management a Investičním Rozhodování; Grada Publishing: Prague, Czech Republic, 2009; ISBN 978-80-247-2560-4. [Google Scholar]

- De Mare, G.; Nesticò, A.; Benintendi, R.; Maselli, G. ALARP approach for risk assessment of civil engineering projects. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Berlin/Heidelberg, Germany, 2018; pp. 75–86. ISBN 978-3-319-95174-4. [Google Scholar] [CrossRef]

| No. | Name of the Project | IC € | ERR % | ENPV € | BCR |

|---|---|---|---|---|---|

| P1 | Vestec connection | 73,655,517 | 13.15% | 134,141,506 | 2.90 |

| P2 | I/22 Draženov-Horažďovice | 253,477,033 | 5.67% | 25,929,610 | 1.11 |

| P3 | I/27 Kaznejov, bypass | 91,192,128 | 9.50% | 74,002,422 | 1.83 |

| P4 | I/13 Ostrov-Smilov, right bank | 141,082,434 | 5.88% | 19,811,383 | 1.15 |

| P5 | I/13 Ostrov-Smilov, left bank | 116,820,770 | 7.52% | 50,193,343 | 2.01 |

| P6 | I/26 Horšovský Týn | 50,375,269 | 5.60% | 4,578,849 | 1.09 |

| P7 | D0 Březiněves-Satalice var. 1 | 371,886,072 | 39.45% | 2,576,573,157 | 8.28 |

| P8 | D0 Březiněves-Satalice var. 2 | 434,933,917 | 30.46% | 2,395,820,591 | 6.92 |

| P9 | D0 Březiněves-Satalice var. 3 | 757,919,450 | 17.89% | 1,934,644,942 | 3.81 |

| P10 | I11– Hradec Králové, tangent | 111,776,135 | 17.24% | 336,621,090 | 4.15 |

| P11 | I/18 Příbram-bypass var. 1 | 28,417,453 | 14.20% | 54,410,634 | 2.96 |

| P12 | I/18 Příbram-bypass var. 2 | 49,497,029 | 13.21% | 74,973,161 | 2.61 |

| P13 | I/50 Bučovice | 78,579,450 | 7.56% | 32,937,152 | 1.44 |

| P14 | I/36 Trnová-Fablovka-Dubina | 53,652,370 | 19.20% | 190,286,624 | 4.73 |

| P15 | I/11 Nové Sedlice-Opava Komárov | 91,436,523 | 5.52% | 7,834,232 | 1.09 |

| P16 | I/26 Holysov, bypass | 56,624,471 | 9.19% | 42,452,457 | 1.80 |

| P17 | D10 Praha-Kosmonosy | 361,367,050 | 5.72% | 35,994,616 | 1.11 |

| P18 | I/67 Bohumín-Karviná | 83,937,876 | 5.33% | 4,067,671 | 1.05 |

| P19 | D43 Bořitov-Staré Město | 56,624,471 | 9.19% | 42,452,457 | 1.80 |

| P20 | D27 Přeštice-Klatovy | 128,638,259 | 5.12% | 22,333,326 | 1.02 |

| No. | Risk Description |

|---|---|

| Demand-related risks | |

| R1 | Different development of demand than expected |

| Risks related to the project design | |

| R2 | Inadequate surveys and inquiries in the given locality |

| R3 | Inadequate estimates of project work costs |

| Administrative and public procurement risks | |

| R4 | Delays in awarding |

| R5 | Building permit |

| Risks related to the land purchase | |

| R6 | Land price |

| R7 | Delays in land purchase |

| Risks related to construction | |

| R8 | Exceeding investment costs |

| R9 | Floods, landslides, etc. |

| R10 | Archaeological findings |

| R11 | Risks related to the contractor (bankruptcy, lack of resources) |

| Operational risks | |

| R12 | Higher maintenance costs than expected |

| Regulatory risks | |

| R13 | Environmental requirement change |

| Other risks | |

| R14 | Public opposition |

| Classification | Verbal Description | Percentage Expression |

|---|---|---|

| A | Very improbable | 0–9% |

| B | Improbable | 10–32% |

| C | Neutral | 33–65% |

| D | Probable | 66–89% |

| E | Very probable | 90–100% |

| Category | Name | Verbal Description |

|---|---|---|

| I | Imperceptible | no significant effect on expected social benefits of the project |

| II | Mild | long-term project benefits are not affected but corrective measures are needed |

| III | Medium | loss of expected social benefits of the project, mostly financial loss and in medium- and long-term time horizon, corrective measures may solve the problem |

| IV | Critical | large loss of expected social benefits of the project, occurrence of adverse effects causes a loss of the project’s primary function; corrective measures, even if taken on a large scale, are not sufficient to prevent major losses |

| V | Catastrophic | significant to complete loss of function of the project, project objectives cannot be achieved even in the long term |

| Risk No. | VH and H Risks | M Risk | Total | Dependent Variable |

|---|---|---|---|---|

| R1 | 3 | 5 | 8 | Revenues alias operating phase savings |

| R2 | 5 | 8 | 12 | Investment costs, beginning of the construction |

| R3 | 4 | 6 | 10 | Investment costs |

| R4 | 0 | 5 | 5 | Beginning of the construction |

| R5 | 0 | 9 | 9 | Beginning of the construction |

| R6 | 0 | 2 | 2 | Investment costs |

| R7 | 12 | 2 | 14 | Beginning of the construction |

| R8 | 8 | 5 | 13 | Investment costs |

| R9 | 0 | 1 | 1 | Investment costs, extension of construction, delay/shortening of the operational phase for evaluation |

| R10 | 0 | 1 | 1 | Investment costs, extension of construction, delay/shortening of the operational phase for evaluation |

| R11 | 0 | 2 | 2 | Investment costs, extension of construction, delay/shortening of the operational phase for evaluation |

| R12 | 0 | 0 | 0 | Operating costs, reduction of benefits under “Infrastructure operating costs” item |

| R13 | 0 | 0 | 0 | Changes in benefits under “Externalities” item |

| R14 | 0 | 0 | 0 | Influence on the beginning of construction |

| Variable | 0 ≤ EC < 0.5 | 0.5 ≤ EC < 1 | 1 ≤ EC < 1.5 | EC ≥ 1.5 |

|---|---|---|---|---|

| Total investment costs | 5 | 4 | 4 | 5 |

| Vehicle operating costs | 16 | 1 | 1 | 0 |

| User time costs | 1 | 7 | 5 | 5 |

| Accident rate | 13 | 3 | 0 | 2 |

| Other externalities | 13 | 2 | 0 | 3 |

| Variable/Switching Value | 0 ≤ PH < 10% | 10% ≤ PH < 30% | PH ≥ 30% |

|---|---|---|---|

| Total investment costs | 3 | 3 | 13 |

| Time savings of users | 2 | 3 | 14 |

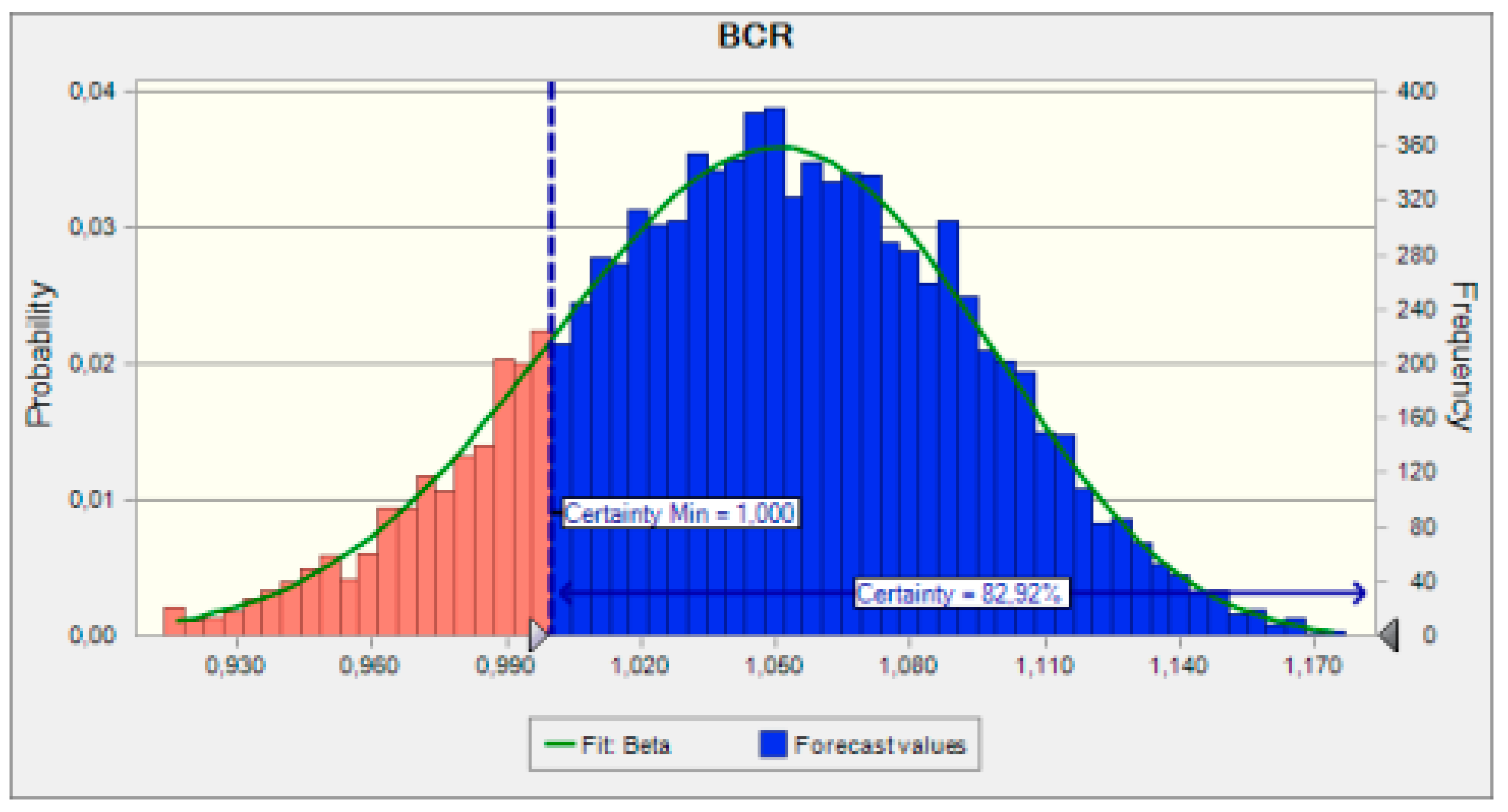

| Statistics | Forecast Values |

|---|---|

| Trials | 10,000 |

| Base Case | 1.112 |

| Mean | 1.045 |

| Median | 1.047 |

| Standard Deviation | 0.047 |

| Variance | 0.002 |

| Coeff. of Variation | 0.0449 |

| Minimum | 0.876 |

| Maximum | 1.194 |

| Range Width | 0.318 |

| Statistics | Forecast Values |

|---|---|

| Trials | 10,000 |

| Base Case | 1.112 |

| Mean | 0.978 |

| Median | 0.980 |

| Standard Deviation | 0.060 |

| Variance | 0.004 |

| Coeff. of Variation | 0.004 |

| Minimum | 0.747 |

| Maximum | 1.146 |

| Range Width | 0.400 |

| No. | BCR | Variant 1 | Variant 2 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | σ | CL | Mean | Median | σ | CL | ||

| P1 | 2.90 | 2.73 | 2.73 | 0.15 | 100 | 2.57 | 2.57 | 0.17 | 100 |

| P2 | 1.11 | 1.00 | 0.97 | 0.06 | 47 | 0.94 | 0.94 | 0.06 | 18 |

| P3 | 1.83 | 1.50 | 4.51 | 0.07 | 100 | 1.43 | 1.44 | 0.10 | 100 |

| P4 | 1.15 | 1.09 | 1.09 | 0.05 | 96 | 1.02 | 1.02 | 0.06 | 64 |

| P5 | 1.43 | 1.35 | 1.35 | 0.06 | 100 | 1.28 | 1.28 | 0.06 | 100 |

| P6 | 1.09 | 1.03 | 1.03 | 0.07 | 66 | 0.97 | 0.97 | 0.08 | 37 |

| P7 | 8.28 | 8.19 | 8.19 | 0.13 | 100 | 8.12 | 8.12 | 0.14 | 100 |

| P8 | 6.92 | 6.85 | 6.85 | 0.11 | 100 | 6.78 | 6.78 | 0.12 | 100 |

| P9 | 3.81 | 3.74 | 3.74 | 0.07 | 100 | 3.68 | 3.68 | 0.08 | 100 |

| P10 | 4.15 | 3.97 | 3.97 | 0.08 | 95 | 3.91 | 3.91 | 0.09 | 100 |

| P11 | 2.96 | 2.05 | 2.05 | 0.08 | 100 | 1.98 | 1.99 | 0.10 | 100 |

| P12 | 2.61 | 2.46 | 0.46 | 0.12 | 100 | 2.31 | 2.31 | 0.14 | 100 |

| P13 | 1.44 | 1.22 | 1.23 | 0.06 | 100 | 1.15 | 1.16 | 0.08 | 97 |

| P14 | 4.73 | 4.44 | 4.44 | 0.07 | 100 | 4.37 | 4.38 | 0.09 | 100 |

| P15 | 1.09 | 1.02 | 1.02 | 0.06 | 65 | 0.96 | 0.96 | 0.07 | 31 |

| P16 | 1.80 | 1.69 | 1.70 | 0.08 | 100 | 1.60 | 1.60 | 0.09 | 100 |

| P17 | 1.11 | 1.05 | 1.05 | 0.05 | 83 | 0.98 | 0.98 | 0.06 | 37 |

| P18 | 1.05 | 0.99 | 0.99 | 0.05 | 41 | 0.92 | 0.92 | 0.07 | 11 |

| P19 | 1.80 | 1.69 | 1.70 | 0.08 | 100 | 1.59 | 1.59 | 0.09 | 100 |

| P20 | 1.02 | 0.96 | 0.96 | 0.04 | 16 | 0.90 | 0.90 | 0.05 | 2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Korytárová, J.; Hromádka, V. Risk Assessment of Large-Scale Infrastructure Projects—Assumptions and Context. Appl. Sci. 2021, 11, 109. https://doi.org/10.3390/app11010109

Korytárová J, Hromádka V. Risk Assessment of Large-Scale Infrastructure Projects—Assumptions and Context. Applied Sciences. 2021; 11(1):109. https://doi.org/10.3390/app11010109

Chicago/Turabian StyleKorytárová, Jana, and Vít Hromádka. 2021. "Risk Assessment of Large-Scale Infrastructure Projects—Assumptions and Context" Applied Sciences 11, no. 1: 109. https://doi.org/10.3390/app11010109

APA StyleKorytárová, J., & Hromádka, V. (2021). Risk Assessment of Large-Scale Infrastructure Projects—Assumptions and Context. Applied Sciences, 11(1), 109. https://doi.org/10.3390/app11010109