A Multistage Sustainable Production–Inventory Model with Carbon Emission Reduction and Price-Dependent Demand under Stackelberg Game

Abstract

1. Introduction

2. Literature Review

2.1. Inventory Model Introducing Carbon Emissions Management

2.2. Inventory Model Based on Price-Dependent Demand

2.3. Inventory Model Applying Game Theory

2.4. Research Gap Analysis

3. Notations and Assumptions

3.1. Notations

| Manufacturer’s production rate | |

| Retailer’s ordering cost of finished products per order | |

| Amount of fixed carbon emissions per order for the retailer | |

| Manufacturer’s ordering cost of raw material per order | |

| Amount of fixed carbon emissions per order for the manufacturer | |

| Amount of raw materials required to produce one unit of finished product | |

| Manufacturer’s setup cost per production cycle | |

| Amount of fixed carbon emissions per setup for the manufacturer | |

| Manufacturer’s unit raw material cost | |

| Amount of associated carbon emissions per unit of raw material procurement for the manufacturer | |

| Manufacturer’s unit production cost | |

| Amount of associated carbon emissions per unit of production for the manufacturer | |

| Retailer’s unit purchase price at the manufacturer | |

| Amount of associated carbon emissions per unit of purchase for the retailer | |

| Retailer’s holding cost of finished goods per unit per unit time | |

| Amount of carbon emissions per unit of finished goods held per unit time for the retailer | |

| Manufacturer’s holding cost of raw material per unit per unit time | |

| Amount of carbon emissions per unit of raw material held per unit time for the manufacturer | |

| Manufacturer’s holding cost of finished goods per unit per unit time | |

| Amount of carbon emissions per unit of finished goods held per unit time for the manufacturer | |

| Retailer’s fixed shipping cost per shipment | |

| Amount of fixed carbon emissions per shipment for the retailer | |

| Retailer’s variable shipping cost per unit | |

| Amount of associated carbon emissions per unit shipped for the retailer | |

| Carbon tax per unit of carbon emission | |

| Carbon deterioration rate of the raw material | |

| Deterioration rate of the finished goods | |

| Retailer’s unit selling price | |

| Demand rate, which is dependent on the unit selling price | |

| Technology investment for carbon emission reduction | |

| Proportion of reduced carbon emissions as a function of | |

| Retailer’s order quantity | |

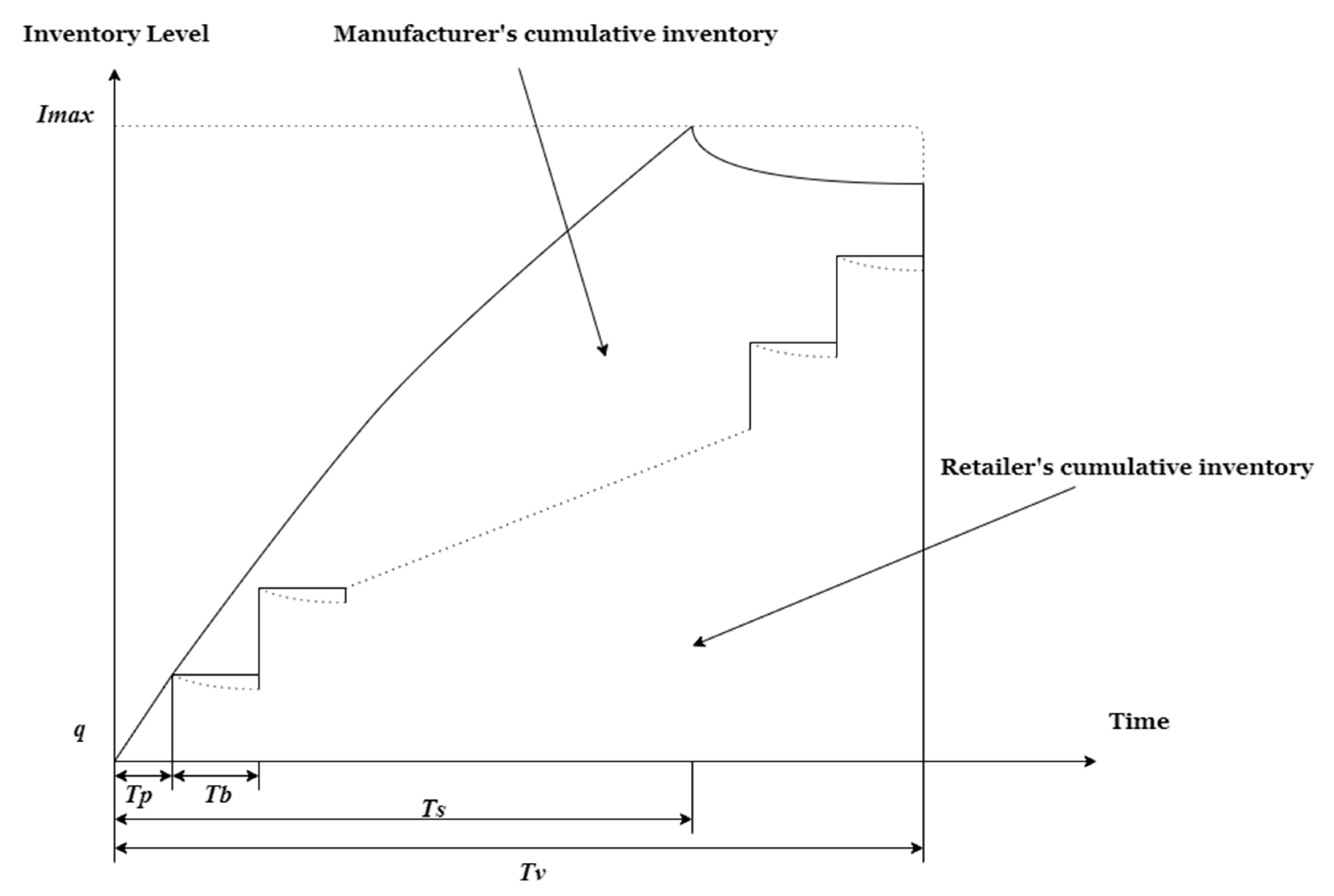

| Number of shipments from the manufacturer to the retailer during a production cycle | |

| Quantity shipped from the manufacturer to the retailer per shipment | |

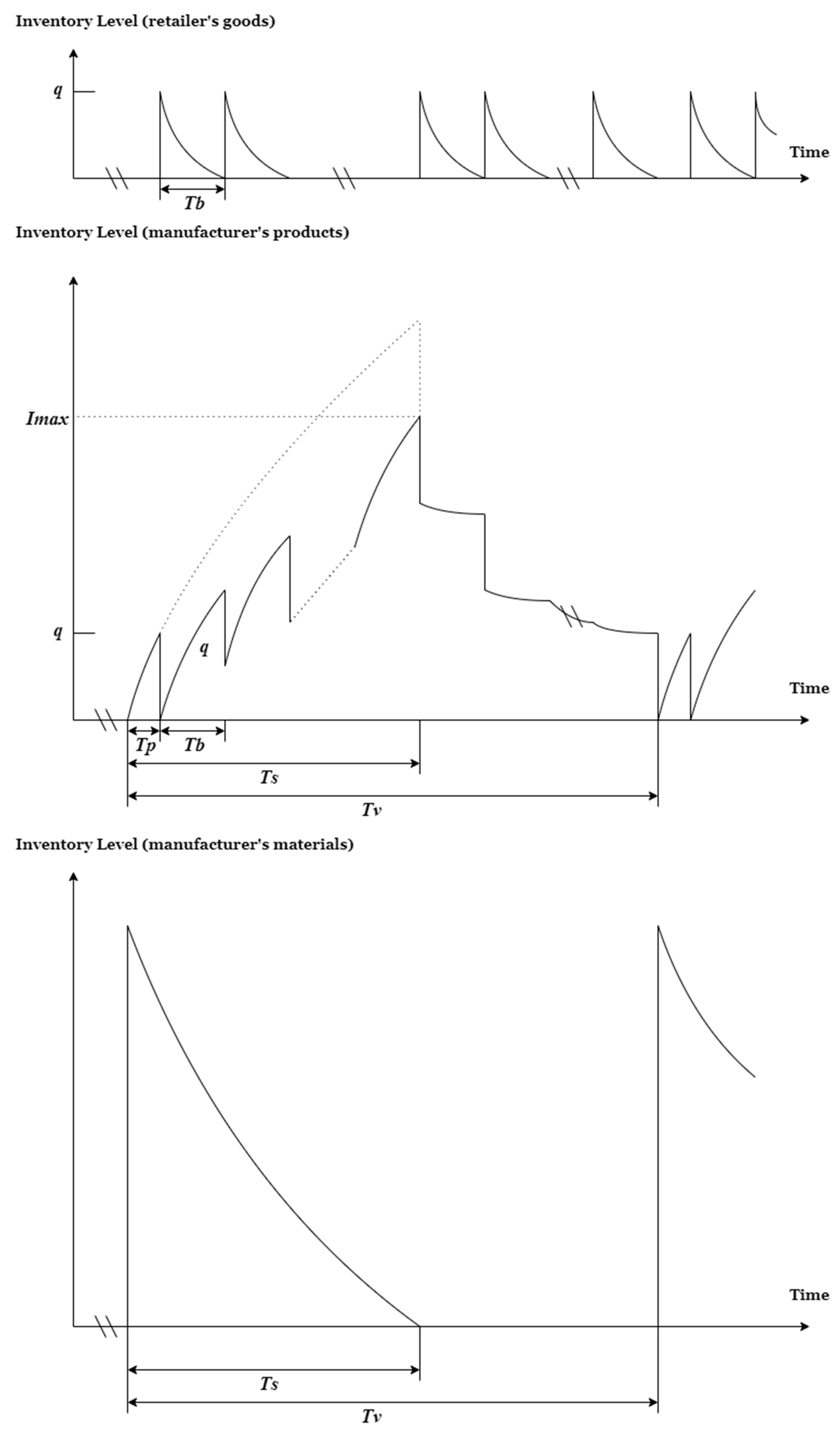

| Length of the retailer’s replenishment cycle | |

| Length of the manufacturer’s production cycle | |

| Length of the manufacturer’s production period per production cycle | |

| Length of period for the manufacturer to manufacture and deliver the first batch of finished products to the retailer | |

| The superscript represents the optimal equilibrium value. |

3.2. Assumptions

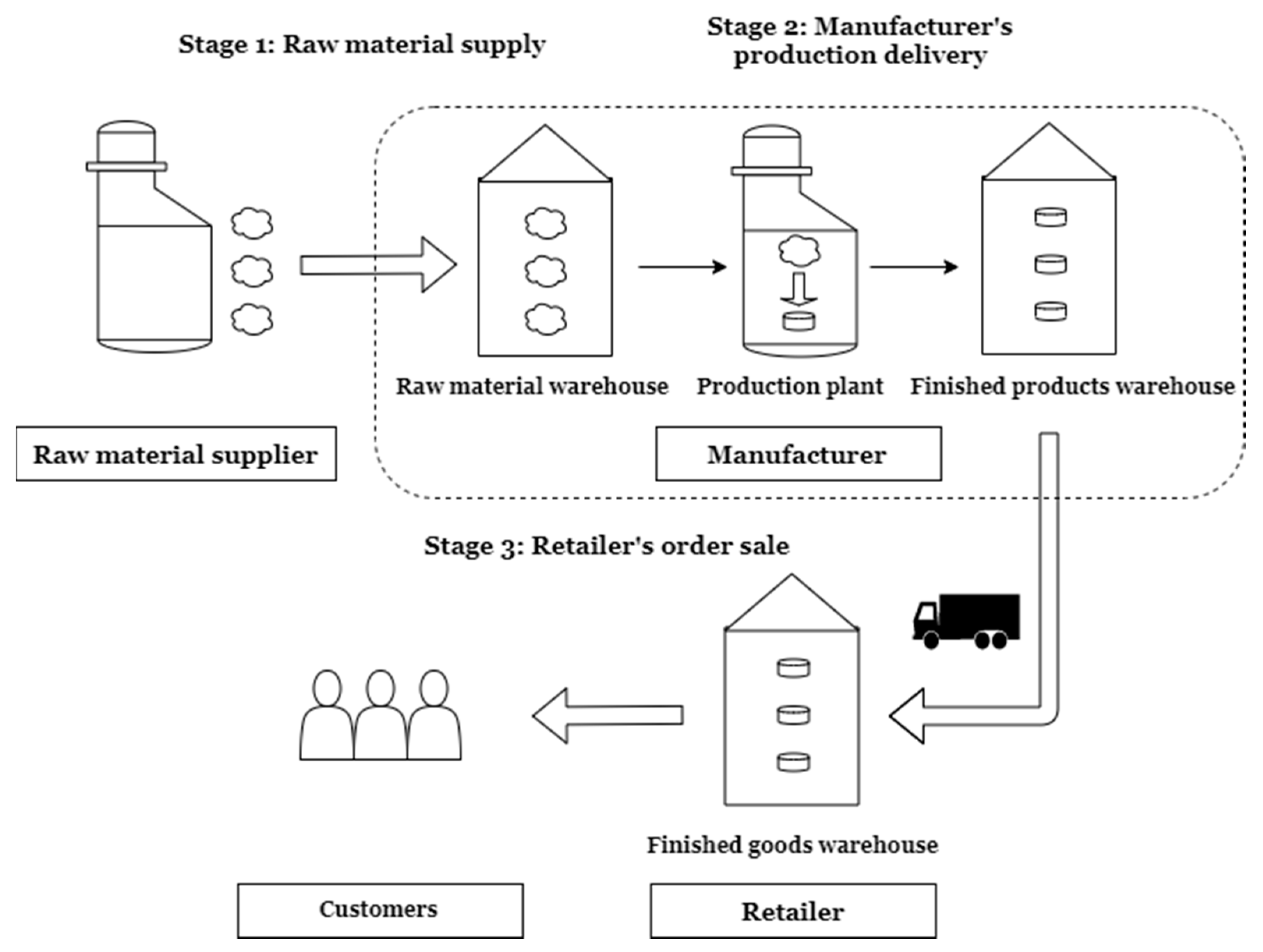

- The sustainable multistage supply chain system considers a single manufacturer, single retailer, single material, and single commodity under carbon tax regulation.

- The demand rate is a non-negative continous function of the selling price (Please refer to Yang et al. [36]).

- The manufacturer production rate is finite and greater than the demand rate, i.e., ; otherwise, no inventory problems would occur.

- Operational activities, such as ordering, holding inventory of finished goods, shipping, and purchasing, are the source of carbon emissions produced by the retailer. On the manufacturer’s part, the source includes operations, such as purchase of materials, setting up, production, and holding inventories of raw material and finished goods (Please refer to Shaw et al. [18]).

- Based on Ghosh et al. [17], carbon tax is levied on the manner by which carbon is emitted—that is, it is in the form of a unit tax in the proposed model.

- Carbon emissions can be reduced by investments in technology, at a proportion defined by the reduced rate , where , and is an increasing function of .

- Both the manufacturer and retailer share in the technological investment to reduce carbon emission, according to capital investment proportions (retailer) and (manufacturer), where .

- Shortages are not allowed for either the manufacturer or the retailer to avoid losing customers (Chen et al. [4]).

4. Model Formulation and Solution

4.1. Retailer’s Total Profit with Carbon Tax

- (a)

- The sales revenue per unit time is

- (b)

- The ordering cost per unit time is

- (c)

- The retailer’s purchasing cost per unit time is:

- (d)

- The retailer’s transportation cost consists of fixed and variable costs per unit time and is given by:

- (e)

- The retailer’s holding cost per unit time is:

- (f)

- The technological investment in carbon emission reduction is . Because the technology investment is shared between the retailer and manufacturer, with being the proportion of the retailer’s investment, the investment reduces the carbon emission per unit time for the retailer as indicated by .

4.2. Manufacturer’s Total Profit with Carbon Tax

- (a)

- The manufacturer’s sales revenue per unit time is:

- (b)

- The manufacturer’s setup cost per unit time is .

- (c)

- The manufacturer’s ordering cost for material per unit time is .

- (d)

- The manufacturer’s material cost per unit time is:

- (e)

- The manufacturer’s production cost per unit time is:

- (f)

- The manufacturer’s holding cost is computed from the raw materials and the finished goods. The holding cost of the raw materials per unit time is:

- (g)

- As in the case of the retailer, the technological investment in carbon emission reduction is . Because the investment is shared between the two players, with the proportion of the manufacturer’s being at , the investment reduces the carbon emission per unit time for the manufacturer by .

4.3. Stackelberg Equilibrium

| Algorithm 1. Equilibrium Solution for Stackelberg Game. |

|

5. Numerical Examples

- 1.

- Except for carbon taxes, changes in carbon emission-related parameters are relatively insensitive to the optimal equilibrium solutions or profits. Nevertheless, for the sustainable development of the enterprise, it is necessary to take carbon emission parameters into consideration of the proposed model.

- 2.

- The optimal equilibrium technology investment for carbon emission reduction increases with an increase in the values of the carbon emission parameters, except for the amounts of fixed carbon emissions per order or per shipment for the retailer and the amount of carbon emission to hold finished goods inventory for the manufacturer.

- 3.

- The retailer may increase the optimal equilibrium selling price to respond to an increase in the carbon emission parameters, amount of carbon emission to hold finished goods inventory for the manufacturer, and carbon tax. When the manufacturer’s other carbon parameters increase, the retailer’s optimal equilibrium selling price decreases.

- 4.

- The manufacturer’s optimal equilibrium shipping quantity and the retailer’s optimal equilibrium order quantity decrease with an increase in the value of the carbon emission parameters, except for the amounts of fixed carbon emissions per order or per shipment for the retailer, amount of carbon emission to hold finished goods inventory for the manufacturer, and carbon tax.

- 5.

- Increases in the values of carbon emission parameters negatively impact the manufacturer’s total profit, except for the amounts of fixed carbon emissions per order or per shipment for the retailer and amount of carbon emission to hold finished goods inventory for the manufacturer.

- 6.

- Increases in the amount of carbon emission to hold finished goods inventory for the manufacturer positively affect the retailer’s total profit.

- 7.

- The optimal amount of carbon emissions produced by the manufacturer increases with increases in the values of the carbon emissions parameters, except for the amount of carbon emission to hold finished goods inventory. Otherwise, it decreases as the values of the retailer’s carbon emission parameters increase, except for the amount of carbon emission to hold finished goods inventory. Moreover, a higher carbon tax helps the manufacturer reduce carbon emissions.

- 8.

- The optimal amount of carbon emissions produced by the retailer increases with an increase in the values of the carbon emission parameters. Conversely, it decreases with an increase in the manufacturer’s carbon emission parameters, except for the amount of carbon emission to hold finished goods inventory. A higher carbon tax also helps the retailer reduce carbon emissions.

- 1.

- For the demand parameters and , an increase in the value of causes increases in , , , , , , , and . Contrarily, an increase in the value of decreases , , , , , , , and . The results show that autonomous consumption has positive effects whereas induced consumption has negative effects on the manufacturer’s and retailer’s optimal equilibrium policies. In addition, all manufacturer’s and retailer’s total profits and carbon emissions increase as autonomous consumption increases or induced consumption decreases.

- 2.

- An increase in the retailer’s order cost or fixed shipping cost corresponds to an increase in the manufacturer’s optimal equilibrium shipping quantity and the retailer’s optimal equilibrium order quantity but a decrease in the manufacturer’s optimal equilibrium technology investment for carbon emission reduction. Furthermore, the retailer’s order cost or fixed shipping cost has positive effects on the manufacturer’s total profit but negative effects on the retailer’s total profit. With regard to the amount of carbon emissions from both the manufacturer and retailer, it decreases with higher retailer’s order cost or fixed shipping cost.

- 3.

- Higher retailer’s holding cost or deterioration rate of finished goods implies a corresponding decrease in the manufacturer’s optimal equilibrium shipping quantity and the retailer’s optimal equilibrium order quantity, which results in a drop in the total profits of both players. This is very intuitive because the retailer does not want to keep too much inventory when the holding cost or deterioration rate is high.

- 4.

- Moreover, any increases in the retailer’s variable shipping cost lessens the manufacturer’s optimal equilibrium technology investment for carbon emission reduction, shipping quantity, the retailer’s optimal order quantity, the total profits of the manufacturer and the retailer, and the carbon emissions from the manufacturer and the retailer. Furthermore, the retailer’s selling price increases with higher retailer’s variable shipping cost.

- 5.

- Overall, changes in autonomous or induced consumption is relatively sensitive to the optimal equilibrium solutions, profits or carbon emissions for the manufacturer and the retailer. Conversely, changes in retailer’s other parameters are less sensitive to the optimal equilibrium solutions (especially the technology investment for carbon emission reduction and selling price).

- 1.

- Higher manufacturer productivity leads to an increase in optimal equilibrium technology investment for carbon emission reduction but decreases the manufacturer’s optimal equilibrium shipping quantity and retailer’s equilibrium optimal order quantity. Furthermore, the manufacturer’s productivity has a positive effect on the manufacturer’s total profit and carbon emissions but a negative effect on the retailer’s total profit and carbon emissions.

- 2.

- As with the increases in the manufacturer’s unit sales price, it raises the manufacturer’s optimal equilibrium technology investment for reducing carbon emissions and total profit, as well as the retailer’s optimal equilibrium selling price, but lowers the manufacturer’s optimal equilibrium shipping quantity and the retailer’s optimal equilibrium order quantity, which results in less retailer’s total profit with carbon emissions from the manufacturer and the retailer.

- 3.

- The manufacturer’s higher ordering cost of raw material lowers the manufacturer’s optimal equilibrium technology investment for reducing carbon emissions and total profit but increases the manufacturer’s optimal equilibrium shipping quantity, retailer’s optimal equilibrium order quantity and total profit, and carbon emissions from the manufacturer and retailer. The manufacturer’s setup cost, unit raw material cost, and unit production cost have the same impact trends on the results as the manufacturer’s ordering cost of raw material.

- 4.

- Increases in the manufacturer’s holding cost of raw material or finished goods results in higher manufacturer’s optimal equilibrium technology investment for reducing carbon emissions but lower manufacturer’s optimal equilibrium shipping quantity, retailer’s optimal equilibrium selling price, and order quantity that correspondingly decrease the total profits of the manufacturer and the retailer, as well as the carbon emissions from the manufacturer and retailer.

- 5.

- As to the deterioration rate of raw material, the impact on the optimal equilibrium solutions is the same as the deterioration rate of finished goods, except on the retailer’s selling price. Faster deterioration rate of finished good positively impacts the retailer’s optimal equilibrium selling price, whereas the deterioration rate of the raw material decreases the retailer’s optimal equilibrium selling price.

- 6.

- An increase in the amount of raw materials for the finished goods lessens the manufacturer’s optimal equilibrium technology investment and shipping quantity and the retailer’s optimal equilibrium selling price and order quantity, resulting in lower total profits of both players. Meanwhile, the manufacturer’s carbon emissions increase whereas that of the retailer’s decrease as the amount of raw materials for the finished goods increases.

- 7.

- It is obvious that changes in manufacturer’s parameters except for its unit sales price are relatively insensitive to the optimal equilibrium solutions. Especially in the retailer’s optimal equilibrium selling price, the degree of impact is very small.

6. Conclusions

- From a macro perspective, it can be concluded that increased carbon tax does help the manufacturer and retailer reduce carbon emissions. However, this may inspire the government’s carbon reduction policy. In addition, a change in the carbon tax has a relatively significant impact on manufacturer’s optimal equilibrium technology investment for reducing carbon emissions.

- For companies, the most intuitive conclusion is that the optimal equilibrium technology investment for carbon emission reduction will increase with higher values of most carbon emission parameters; however, such increases will negatively affect both the manufacturer’s and retailer’s total profits. However, changes in carbon emission parameters are relatively insensitive to the optimal equilibrium solutions or profits. Nevertheless, for the sustainable development of the enterprise, it is necessary to take carbon emission parameters into consideration of the proposed model.

- From the retailer’s perspective, the retailer may raise the optimal equilibrium selling price to respond to increases in the values of the carbon emission parameters or carbon tax. The retailer’s carbon reduction technology investment may seem to be subsidized from selling prices. Moreover, the retailer’s optimal equilibrium order quantity decreases with higher values of most carbon emission parameters, whereas the retailer’s order cost or fixed shipping cost positively impacts the manufacturer’s total profit but lessens the retailer’s total profit. Greater retailer’s holding cost or deterioration rate of finished goods causes the optimal equilibrium order quantity to decrease, resulting in less total profits of both players. Obviously, the retailer tends to decrease inventory when holding cost or deterioration rate is high.

- From the manufacturer’s perspective, an increase in the unit sales price will raise the optimal equilibrium technology investment for reducing carbon emissions, total profit, and retailer’s optimal equilibrium selling price. Contrarily, the retailer’s optimal equilibrium order quantity decreases, resulting in less total profit. Furthermore, it is found that changes in manufacturer’s parameters except for its unit sales price are relatively insensitive to the optimal equilibrium solutions, especially for the retailer.

- As to the impact of changes in market demand, autonomous consumption positively affects both the manufacturer’s and retailer’s optimal equilibrium policies, whereas induced consumption does the opposite. Furthermore, an increase in autonomous consumption or a decrease in induced consumption results in higher manufacturer’s and retailer’s total profits and carbon emissions.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Feng, W.; Ji, G.; Pardalos, P.M. Effects of government regulations on Manufacturer’s behaviors under carbon emission reduction. Environ. Sci. Pollut. Res. 2019, 26, 17918–17926. [Google Scholar] [CrossRef] [PubMed]

- Marklund, J.; Berling, P. Green Inventory Management. In Sustainable Supply Chains; Springer: Berlin, Germany, 2017; pp. 189–218. [Google Scholar]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chain: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Chen, X.; Benjaafar, S.; Elomri, A. The carbon-constrained EOQ. Oper. Res. Lett. 2013, 41, 172–179. [Google Scholar] [CrossRef]

- Datta, T.K.; Nath, P.; Dutta Choudhury, K. A hybrid carbon policy inventory model with emission source-based green investments. Opsearch 2020, 57, 202–220. [Google Scholar] [CrossRef]

- Huang, S.; Wen, Z.; Chen, J.; Chen, J.; Cui, N. Optimal technology investment under emission trading policy. J. Syst. Sci. Syst. Eng. 2020, 29, 143–162. [Google Scholar] [CrossRef]

- Emmons, H.; Gilbert, S.M. The role of returns policies in pricing and inventory decisions for catalogue goods. Manag. Sci. 1998, 44, 276–283. [Google Scholar] [CrossRef]

- Hua, G.; Cheng, T.C.E.; Wang, S. Managing carbon footprints in inventory management. Int. J. Prod. Econ. 2011, 132, 178–185. [Google Scholar] [CrossRef]

- Battini, D.; Persona, A.; Sgarbossa, F. A sustainable EOQ model: Theoretical formulation and applications. Int. J. Prod. Econ. 2014, 149, 145–153. [Google Scholar] [CrossRef]

- Hovelaque, V.; Bironneau, L. The carbon-constrained EOQ model with carbon emission dependent demand. Int. J. Prod. Econ. 2015, 164, 285–291. [Google Scholar] [CrossRef]

- Liao, H.; Deng, Q. A carbon-constrained EOQ model with uncertain demand for remanufactured products. J. Clean. Prod. 2018, 199, 334–347. [Google Scholar] [CrossRef]

- Tao, Z.; Xu, J. Carbon-Regulated EOQ Models with Consumers’ Low-Carbon Awareness. Sustainability 2019, 11, 1004. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M.; Widyadana, G.A. Low carbon supply chain coordination for imperfect quality deteriorating items. Mathematics 2019, 7, 234. [Google Scholar] [CrossRef]

- Jiang, Y.; Li, B.; Qu, X.; Cheng, Y. A green vendor-managed inventory analysis in supply chains under carbon emissions trading mechanism. Clean Technol. Environ. Policy 2016, 18, 1369–1380. [Google Scholar] [CrossRef]

- Chen, X.; Gong, W.; Wang, F. Managing carbon footprints under the Trade Credit. Sustainability 2017, 9, 1235. [Google Scholar] [CrossRef]

- Ghosh, A.; Jha, J.K.; Sarmah, S.P. Optimal lot-sizing under strict carbon cap policy considering stochastic demand. Appl. Math. Model. 2017, 44, 688–704. [Google Scholar] [CrossRef]

- Ghosh, A.; Sarmah, S.P.; Jha, J.K. Collaborative model for a two-echelon supply chain with uncertain demand under carbon tax policy. Sādhanā 2018, 43, 144. [Google Scholar] [CrossRef]

- Shaw, B.K.; Sangal, I.; Sarkar, B. Joint effects of carbon emission, deterioration, and multi-stage inspection policy in an integrated inventory model. In Optimization and Inventory Management; Springer: Singapore, 2020; pp. 195–208. [Google Scholar]

- Wee, H.M.; Daryanto, Y. Imperfect quality item inventory models considering carbon emissions. In Optimization and Inventory Management; Springer: Singapore, 2020; pp. 137–159. [Google Scholar]

- Xu, C.; Liu, X.; Wu, C.; Yuan, B. Optimal inventory control strategies for deteriorating items with a general time-varying demand under carbon emission regulations. Energies 2020, 13, 999. [Google Scholar] [CrossRef]

- Panda, S.; Saha, S.; Basu, M. An EOQ model for perishable products with discounted selling price and stock dependent demand. Cent. Eur. J. Oper. Res. 2009, 17, 31. [Google Scholar] [CrossRef]

- Ruidas, S.; Seikh, M.R.; Nayak, P.K. An EPQ model with stock and selling price dependent demand and variable production rate in interval environment. Int. J. Syst. Assur. Eng. Manag. 2020, 11, 385–399. [Google Scholar] [CrossRef]

- Sahoo, A.K.; Indrajitsingha, S.K.; Samanta, P.N.; Misra, U.K. Selling price dependent demand with allowable shortages model under partially backlogged-deteriorating items. Int. J. Appl. Comput. 2019, 5, 104. [Google Scholar] [CrossRef]

- Li, R.; Teng, J.; Zheng, Y. Optimal credit term, order quantity and selling price for perishable products when demand depends on selling price, expiration date, and credit period. Ann. Oper. Res. 2019, 280, 377–405. [Google Scholar] [CrossRef]

- Rahman, M.S.; Duary, A.; Shaikh, A.A.; Bhunia, A.K. An application of parametric approach for interval differential equation in inventory model for deteriorating items with selling-price-dependent demand. Neural. Comput. Applic. 2020. [Google Scholar] [CrossRef]

- Sinha, S.; Modak, N.M.; Sana, S.S. An entropic order quantity inventory model for quality assessment considering price sensitive demand. Opsearch 2020, 57, 88–103. [Google Scholar] [CrossRef]

- Jabbarzadeh, A.; Aliabadi, L.; Yazdanparast, R. Optimal payment time and replenishment decisions for retailer’s inventory system under trade credit and carbon emission constraints. Oper. Res. Int. J. 2019. [Google Scholar] [CrossRef]

- Nash, J. Non-Cooperative Games. Ann. Math. 1951, 54, 286–295. [Google Scholar] [CrossRef]

- Breton, M.; Alj, A.; Haurie, A. Sequential Stackelberg equilibria in two-person games. J. Optim. Theory Appl. 1988, 59, 71–97. [Google Scholar] [CrossRef]

- Hsiao, J.M.; Lin, C. A buyer-vendor EOQ model with changeable lead-time in supply chain. Int. J. Adv. Manuf. Technol. 2005, 26, 917–921. [Google Scholar] [CrossRef]

- Liou, Y.C.; Schaible, S.; Yao, J.C. A Stackelberg Equilibrium model for supply chain inventory management. Perspectives on operations research. In Perspectives on Operations Research; Springer: Berlin, Germany, 2006; pp. 319–337. [Google Scholar]

- Chern, M.S.; Chan, Y.L.; Teng, J.T.; Goyal, S.K. Nash equilibrium solution in a vendor–buyer supply chain model with permissible delay in payments. Comput. Ind. Eng. 2014, 70, 116–123. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Gupta, M.; Kausar, A.; Tiwari, S. Inventory and credit decisions for deteriorating items with displayed stock dependent demand in two-echelon supply chain using Stackelberg and Nash equilibrium solution. Ann. Oper. Res. 2019, 274, 309–329. [Google Scholar] [CrossRef]

- Tao, Z. Two-stage supply-chain optimization considering consumer low-carbon awareness under cap-and-trade regulation. Sustainability 2019, 11, 5727. [Google Scholar] [CrossRef]

- Zhang, Y.; Rong, F.; Wang, Z. Research on cold chain logistic service pricing-based on tripartite Stackelberg game. Neural Comput. Appl. 2020, 32, 213–222. [Google Scholar] [CrossRef]

- Yang, C.T.; Ouyang, L.Y.; Yen, H.F.; Lee, K.L. Joint pricing and ordering policies for deteriorating item with retail price-dependent demand in response to announced supply price increase. J. Ind. Manag. Optim. 2013, 9, 437–454. [Google Scholar] [CrossRef]

- Arslan, M.C.; Turkay, M. EOQ revisited with sustainability considerations. Found. Comput. Decis. Sci. 2013, 38, 223–249. [Google Scholar] [CrossRef]

| References | Model | Demand | Carbon Emission | Carbon Emission Reduction Technology | Game Theory Application |

|---|---|---|---|---|---|

| Chen et al. [4], Hua et al. [8], Battini et al. [9], Hovelaque & Bironneau [10], Tao & Xu [12], Daryanto et al. [13] | EOQ | Constant | V | ||

| Datta et al. [5] | Supply chain | Price-dependent | V | V | |

| Emmons & Gilbert [7], Breton et al. [30] | EOQ | Constant | V | ||

| Liao & Deng [11] | EOQ | Uncertain | V | ||

| Jiang et al. [14] Chen et al. [15], Shaw et al. [18], Wee & Daryanto [19] | Supply chain | Constant | V | ||

| Ghosh et al. [16,17] | Supply chain | Stochastic | V | ||

| Xu et al. [20] | Supply chain | Time-varying | V | ||

| Panda et al. [21] | EOQ | Price-dependent | |||

| Ruidas et al. [22] | EPQ | Price-dependent | |||

| Sahoo et al. [23], Li et al. [24], Rahman et al. [25], Sinha et al. [26] | Supply chain | Price-dependent | |||

| Jabbarzadeh et al. [27] | Supply chain | Price-dependent | V | ||

| Liou et al. [31], Chern et al. [32] | Supply chain | Constant | V | ||

| Jaggi et al. [33] | Supply chain | Inventory- dependent | V | ||

| Tao [34] | Supply chain | Constant | V | V | |

| Zhang et al. [35] | Multistage Supply chain | Constant | V | ||

| This paper | Multistage Supply chain | Price-dependent | V | V | V |

| 1 | 43.7111 | 90.0119 | 162.355 | 8531.01 | 9307.73 |

| 2 | 40.7474 | 90.0137 | 162.376 | 9280.55 | 9308.12 |

| 3 | 39.5397 | 90.0145 | 162.385 | 9375.44 | 9308.23← |

| 4 | 38.9014 | 90.0149 | 162.391 | 9290.00 | 9308.28 |

| 5 | 38.5576 | 90.0152 | 162.393 | 9123.64 | 9308.30 |

| Parameter | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 24 | 39.5662 | 90.0110 | 161.711 | 3 | 485.133 | 9375.31 | 9312.03 | 202.025 | 252.476 | |

| 27 | 39.5524 | 90.0128 | 162.049 | 3 | 486.147 | 9375.38 | 9310.13 | 201.863 | 256.221 | |

| 30 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 33 | 39.5282 | 90.0162 | 162.721 | 3 | 488.163 | 9375.49 | 9306.34 | 201.541 | 263.664 | |

| 36 | 39.5179 | 90.0179 | 163.057 | 3 | 489.171 | 9375.54 | 9304.45 | 201.379 | 267.362 | |

| 0.8 | 38.1841 | 89.9787 | 162.581 | 3 | 487.743 | 9385.64 | 9328.94 | 202.744 | 220.000 | |

| 0.9 | 38.8734 | 89.9966 | 162.483 | 3 | 487.449 | 9380.53 | 9318.56 | 202.207 | 240.061 | |

| 1.0 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 1.1 | 40.1846 | 90.0323 | 162.289 | 3 | 486.867 | 9370.35 | 9297.94 | 201.225 | 279.770 | |

| 1.2 | 40.8093 | 90.0501 | 162.193 | 3 | 486.579 | 9365.28 | 9287.69 | 200.773 | 299.522 | |

| 0.040 | 39.5192 | 90.0142 | 162.439 | 3 | 487.317 | 9375.59 | 9308.52 | 201.692 | 259.386 | |

| 0.045 | 39.5294 | 90.0144 | 162.412 | 3 | 487.236 | 9375.51 | 9308.38 | 201.697 | 259.668 | |

| 0.050 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.055 | 39.5500 | 90.0146 | 162.359 | 3 | 487.077 | 9375.36 | 9308.09 | 201.707 | 260.233 | |

| 0.060 | 39.5603 | 90.0147 | 162.332 | 3 | 486.996 | 9375.29 | 9307.94 | 201.712 | 260.516 | |

| 2.4 | 39.5422 | 90.0141 | 162.318 | 3 | 486.954 | 9375.4249 | 9308.6097 | 201.734 | 259.206 | |

| 2.7 | 39.5409 | 90.0143 | 162.352 | 3 | 487.056 | 9375.4307 | 9308.4202 | 201.718 | 259.579 | |

| 3.0 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.4364 | 9308.2308 | 201.702 | 259.951 | |

| 3.3 | 39.5385 | 90.0146 | 162.419 | 3 | 487.257 | 9375.4421 | 9308.0414 | 201.686 | 260.323 | |

| 3.6 | 39.5373 | 90.0148 | 162.453 | 3 | 487.359 | 9375.4477 | 9307.8521 | 201.670 | 260.695 | |

| 0.040 | 39.4741 | 90.0127 | 162.395 | 3 | 487.185 | 9375.95 | 9309.26 | 201.751 | 257.965 | |

| 0.045 | 39.5069 | 90.0136 | 162.390 | 3 | 487.170 | 9375.69 | 9308.75 | 201.726 | 258.958 | |

| 0.050 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.055 | 39.5725 | 90.0154 | 162.380 | 3 | 487.140 | 9375.18 | 9307.72 | 201.677 | 260.943 | |

| 0.060 | 39.6052 | 90.0163 | 162.376 | 3 | 487.128 | 9374.93 | 9307.20 | 201.653 | 261.936 | |

| 40 | 39.2757 | 90.0147 | 162.387 | 3 | 487.161 | 9377.50 | 9308.25 | 197.738 | 260.173 | |

| 45 | 39.4082 | 90.0146 | 162.386 | 3 | 487.158 | 9376.47 | 9308.24 | 199.720 | 260.061 | |

| 50 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 55 | 39.6704 | 90.0144 | 162.384 | 3 | 487.152 | 9374.40 | 9308.22 | 203.683 | 259.842 | |

| 60 | 39.8003 | 90.0143 | 162.383 | 3 | 487.149 | 9373.37 | 9308.21 | 205.663 | 259.735 | |

| 80 | 39.0082 | 90.0148 | 162.390 | 3 | 487.170 | 9379.57 | 9308.33 | 180.122 | 261.259 | |

| 90 | 39.2757 | 90.0147 | 162.387 | 3 | 487.161 | 9377.50 | 9308.28 | 190.922 | 260.580 | |

| 100 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 110 | 39.8003 | 90.0143 | 162.383 | 3 | 487.149 | 9373.37 | 9308.17 | 212.463 | 259.366 | |

| 120 | 40.0575 | 90.0141 | 162.381 | 3 | 487.143 | 9371.31 | 9308.10 | 223.207 | 258.820 | |

| 0.24 | 38.6463 | 90.0151 | 162.393 | 3 | 487.179 | 9382.21 | 9308.29 | 188.729 | 260.714 | |

| 0.27 | 39.0980 | 90.0148 | 162.389 | 3 | 487.167 | 9378.82 | 9308.26 | 195.219 | 260.324 | |

| 0.30 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.33 | 39.9719 | 90.0142 | 162.382 | 3 | 487.146 | 9372.06 | 9308.19 | 208.178 | 259.594 | |

| 0.36 | 40.3949 | 90.0139 | 162.379 | 3 | 487.137 | 9368.68 | 9308.16 | 214.648 | 259.252 | |

| 0.40 | 38.0320 | 90.0155 | 162.398 | 3 | 487.194 | 9386.70 | 9308.33 | 180.122 | 261.256 | |

| 0.45 | 38.8001 | 90.0150 | 162.391 | 3 | 487.173 | 9381.06 | 9308.28 | 190.922 | 260.580 | |

| 0.50 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.55 | 40.2530 | 90.0140 | 162.380 | 3 | 487.140 | 9369.82 | 9308.17 | 212.463 | 259.366 | |

| 0.60 | 40.9416 | 90.0135 | 162.374 | 3 | 487.122 | 9364.22 | 9308.10 | 223.207 | 258.820 | |

| 0.024 | 40.0644 | 90.0141 | 162.381 | 3 | 487.143 | 9371.40 | 9308.19 | 209.432 | 259.518 | |

| 0.027 | 39.8038 | 90.0143 | 162.383 | 3 | 487.149 | 9373.42 | 9308.21 | 205.568 | 259.732 | |

| 0.030 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.033 | 39.2721 | 90.0147 | 162.387 | 3 | 487.161 | 9377.46 | 9308.25 | 197.833 | 260.176 | |

| 0.036 | 39.0008 | 90.0148 | 162.390 | 3 | 487.170 | 9379.48 | 9308.27 | 193.961 | 260.407 | |

| 0.008 | 39.5381 | 90.0144737 | 162.385333 | 3 | 487.15600 | 9375.4487 | 9308.23093 | 201.678 | 259.9522 | |

| 0.009 | 39.5389 | 90.0144731 | 162.385327 | 3 | 487.15598 | 9375.4425 | 9308.23088 | 201.690 | 259.9516 | |

| 0.010 | 39.5397 | 90.0144726 | 162.385321 | 3 | 487.15596 | 9375.4364 | 9308.23081 | 201.702 | 259.9509 | |

| 0.011 | 39.5405 | 90.0144720 | 162.385314 | 3 | 487.15594 | 9375.4303 | 9308.23075 | 201.714 | 259.9502 | |

| 0.012 | 39.5413 | 90.0144715 | 162.385308 | 3 | 487.15592 | 9375.4242 | 9308.23068 | 201.725 | 259.9495 | |

| 0.40 | 35.1241 | 89.9748 | 161.921 | 3 | 485.763 | 9406.59 | 9334.79 | 205.398 | 264.492 | |

| 0.45 | 37.4561 | 89.9946 | 162.154 | 3 | 486.462 | 9390.94 | 9321.44 | 203.368 | 261.988 | |

| 0.50 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.55 | 41.4224 | 90.0343 | 162.616 | 3 | 487.848 | 9360.05 | 9295.13 | 200.300 | 258.252 | |

| 0.60 | 43.1392 | 90.0542 | 162.846 | 3 | 488.538 | 9344.76 | 9282.12 | 199.097 | 256.808 | |

| Parameter | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 800 | 35.3989 | 77.7273 | 130.445 | 3 | 391.335 | 5882.60 | 3580.46 | 138.451 | 176.232 | |

| 900 | 37.5738 | 83.8582 | 147.356 | 3 | 442.068 | 7636.10 | 6126.56 | 170.639 | 218.658 | |

| 1000 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 1100 | 41.3220 | 96.1974 | 176.058 | 3 | 528.174 | 11102.8 | 13122.7 | 231.941 | 300.469 | |

| 1200 | 42.9478 | 102.394 | 188.692 | 3 | 566.076 | 12819.2 | 17568.1 | 261.530 | 340.420 | |

| 6.4 | 39.6797 | 105.581 | 174.471 | 3 | 523.413 | 10893.6 | 15912.1 | 229.316 | 296.896 | |

| 7.2 | 39.6054 | 96.9278 | 168.549 | 3 | 505.647 | 10136.4 | 12175.5 | 215.587 | 278.496 | |

| 8.0 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 8.8 | 39.4855 | 84.3678 | 155.946 | 3 | 467.838 | 8610.30 | 7073.72 | 187.642 | 241.237 | |

| 9.6 | 39.4468 | 79.6732 | 149.189 | 3 | 447.567 | 7840.46 | 5314.35 | 173.382 | 222.325 | |

| 160 | 39.6948 | 89.9478 | 149.295 | 3 | 447.885 | 9369.53 | 9382.07 | 208.624 | 263.166 | |

| 180 | 39.6232 | 89.9818 | 155.972 | 3 | 467.916 | 9373.50 | 9344.38 | 204.974 | 261.444 | |

| 200 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 220 | 39.4491 | 90.0459 | 168.564 | 3 | 505.692 | 9375.75 | 9273.45 | 198.739 | 258.643 | |

| 240 | 39.3545 | 90.0764 | 174.533 | 3 | 523.599 | 9374.75 | 9239.90 | 196.033 | 257.486 | |

| 0.40 | 39.5115 | 90.0073 | 163.893 | 3 | 491.679 | 9379.67 | 9316.31 | 201.057 | 259.732 | |

| 0.45 | 39.5257 | 90.0109 | 163.134 | 3 | 489.402 | 9377.55 | 9312.26 | 201.381 | 259.842 | |

| 0.50 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.55 | 39.5537 | 90.0180 | 161.647 | 3 | 484.941 | 9373.32 | 9304.22 | 202.021 | 260.060 | |

| 0.60 | 39.5675 | 90.0216 | 160.918 | 3 | 482.754 | 9371.20 | 9300.22 | 202.338 | 260.169 | |

| 40 | 39.5826 | 89.9983 | 159.210 | 3 | 477.630 | 9374.69 | 9326.12 | 203.296 | 260.672 | |

| 45 | 39.5614 | 90.0064 | 160.805 | 3 | 482.415 | 9375.12 | 9317.13 | 202.489 | 260.305 | |

| 50 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 55 | 39.5176 | 90.0224 | 163.951 | 3 | 491.853 | 9375.65 | 9299.41 | 200.934 | 259.608 | |

| 60 | 39.4951 | 90.0303 | 165.502 | 3 | 496.506 | 9375.77 | 9280.67 | 200.185 | 259.276 | |

| 2.4 | 39.6131 | 89.7066 | 163.940 | 3 | 491.820 | 9461.10 | 9481.66 | 202.798 | 261.785 | |

| 2.7 | 39.5765 | 89.8605 | 163.161 | 3 | 489.483 | 9418.27 | 9394.75 | 202.251 | 260.868 | |

| 3.0 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 3.3 | 39.5029 | 90.1684 | 161.614 | 3 | 484.842 | 9332.59 | 9222.09 | 201.151 | 259.032 | |

| 3.6 | 39.4659 | 90.3224 | 160.848 | 3 | 482.544 | 9289.74 | 9136.33 | 200.598 | 258.113 | |

| 0.08 | 38.0601 | 89.9355 | 179.198 | 3 | 537.594 | 9467.89 | 9397.08 | 180.752 | 257.375 | |

| 0.09 | 38.8805 | 89.9759 | 170.160 | 3 | 510.480 | 9420.31 | 9351.53 | 192.197 | 258.631 | |

| 0.10 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 0.11 | 40.0882 | 90.0514 | 155.605 | 3 | 466.815 | 9332.77 | 9266.89 | 209.827 | 261.295 | |

| 0.12 | 40.5569 | 90.0870 | 149.623 | 3 | 448.869 | 9291.96 | 9227.28 | 216.927 | 262.641 | |

| c | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 4000 | 39.4248 | 90.01455 | 162.3862 | 3 | 487.1586 | 9332.01 | 9308.240 | 201.022 | 260.047 | |

| 4500 | 39.4886 | 90.01451 | 162.3857 | 3 | 487.1571 | 9356.09 | 9308.235 | 201.399 | 259.994 | |

| 5000 | 39.5397 | 90.01447 | 162.3853 | 3 | 487.1559 | 9375.44 | 9308.231 | 201.702 | 259.951 | |

| 5500 | 39.5817 | 90.01444 | 162.3850 | 3 | 487.1550 | 9391.32 | 9308.227 | 201.950 | 259.916 | |

| 6000 | 39.6167 | 90.01442 | 162.3847 | 3 | 487.1541 | 9404.59 | 9308.224 | 202.158 | 259.887 | |

| 40 | 38.8036 | 84.8913 | 191.002 | 3 | 573.006 | 7569.39 | 12397.80 | 220.210 | 291.848 | |

| 45 | 39.1700 | 87.4511 | 175.825 | 3 | 527.775 | 8575.03 | 10800.10 | 211.237 | 275.984 | |

| 50 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 55 | 39.9188 | 92.5823 | 150.043 | 3 | 450.129 | 9970.42 | 7922.15 | 191.639 | 243.726 | |

| 60 | 40.3132 | 95.1559 | 138.640 | 3 | 415.920 | 10359.20 | 6641.76 | 181.064 | 227.287 | |

| 240 | 39.6324 | 90.01441 | 162.3846 | 3 | 487.1538 | 9410.21 | 9308.223 | 201.642 | 259.874 | |

| 270 | 39.5861 | 90.01444 | 162.3850 | 3 | 487.1550 | 9392.82 | 9308.227 | 201.672 | 259.912 | |

| 300 | 39.5397 | 90.01447 | 162.3853 | 3 | 487.1559 | 9375.44 | 9308.231 | 201.702 | 259.951 | |

| 330 | 39.4933 | 90.01450 | 162.3857 | 3 | 487.1571 | 9358.05 | 9308.234 | 201.732 | 259.990 | |

| 360 | 39.4467 | 90.01454 | 162.3861 | 3 | 487.1583 | 9340.66 | 9308.238 | 201.762 | 260.029 | |

| 400 | 39.6939 | 90.01437 | 162.3841 | 3 | 487.1523 | 9433.40 | 9308.218 | 201.603 | 259.823 | |

| 450 | 39.6170 | 90.01444 | 162.3847 | 3 | 487.1541 | 9404.42 | 9308.225 | 201.652 | 259.886 | |

| 500 | 39.5397 | 90.01447 | 162.3853 | 3 | 487.1559 | 9375.44 | 9308.231 | 201.702 | 259.951 | |

| 550 | 39.4622 | 90.01453 | 162.3859 | 3 | 487.1577 | 9346.46 | 9308.239 | 201.752 | 260.016 | |

| 600 | 39.3843 | 90.01458 | 162.3866 | 3 | 487.1598 | 9317.48 | 9308.243 | 201.802 | 260.081 | |

| 2.4 | 39.6150 | 90.01442 | 162.3847 | 3 | 487.1541 | 9565.14 | 9308.225 | 201.653 | 259.888 | |

| 2.7 | 39.5774 | 90.01445 | 162.3850 | 3 | 487.1550 | 9470.29 | 9308.228 | 201.678 | 259.919 | |

| 3.0 | 39.5397 | 90.01447 | 162.3853 | 3 | 487.1559 | 9375.44 | 9308.231 | 201.702 | 259.951 | |

| 3.3 | 39.5020 | 90.01449 | 162.3856 | 3 | 487.1568 | 9280.58 | 9308.234 | 201.726 | 259.982 | |

| 3.6 | 39.4641 | 90.01452 | 162.3859 | 3 | 487.1577 | 9185.73 | 9308.237 | 201.751 | 260.014 | |

| 8 | 39.7928 | 90.01430 | 162.383 | 3 | 487.149 | 10006.07 | 9308.21 | 201.539 | 259.741 | |

| 9 | 39.6666 | 90.01439 | 162.384 | 3 | 487.152 | 9690.76 | 9308.22 | 201.620 | 259.845 | |

| 10 | 39.5397 | 90.01447 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 11 | 39.4120 | 90.01456 | 162.386 | 3 | 487.158 | 9060.12 | 9308.24 | 201.785 | 260.058 | |

| 12 | 39.2834 | 90.01465 | 162.387 | 3 | 487.161 | 8744.80 | 9308.25 | 201.868 | 260.166 | |

| 0.24 | 39.5166 | 90.014488 | 162.3855 | 3 | 487.1565 | 9385.66 | 9308.2326 | 201.717 | 259.970 | |

| 0.27 | 39.5282 | 90.014481 | 162.3854 | 3 | 487.1562 | 9380.55 | 9308.2317 | 201.709 | 259.961 | |

| 0.30 | 39.5397 | 90.014473 | 162.3853 | 3 | 487.1559 | 9375.44 | 9308.2308 | 201.702 | 259.951 | |

| 0.33 | 39.5513 | 90.014465 | 162.3852 | 3 | 487.1556 | 9370.32 | 9308.2299 | 201.694 | 259.941 | |

| 0.36 | 39.5628 | 90.014457 | 162.3851 | 3 | 487.1553 | 9365.21 | 9308.2290 | 201.687 | 259.932 | |

| 0.24 | 39.5378 | 90.0144739 | 162.385335 | 3 | 487.156005 | 9376.47 | 9308.23096 | 201.7031 | 259.9525 | |

| 0.27 | 39.5388 | 90.0144733 | 162.385328 | 3 | 487.155984 | 9375.95 | 9308.23088 | 201.7025 | 259.9517 | |

| 0.30 | 39.5397 | 90.0144726 | 162.385321 | 3 | 487.155963 | 9375.44 | 9308.23081 | 201.7019 | 259.9509 | |

| 0.33 | 39.5407 | 90.0144719 | 162.385313 | 3 | 487.155939 | 9374.92 | 9308.23073 | 201.7012 | 259.9501 | |

| 0.36 | 39.5416 | 90.0144713 | 162.385305 | 3 | 487.155915 | 9374.41 | 9308.23066 | 201.7006 | 259.9493 | |

| 0.040 | 39.5363 | 90.014475 | 162.38535 | 3 | 487.15605 | 9375.97 | 9308.2311 | 201.667 | 259.954 | |

| 0.045 | 39.5380 | 90.014474 | 162.38533 | 3 | 487.15599 | 9375.70 | 9308.2309 | 201.685 | 259.952 | |

| 0.050 | 39.5397 | 90.014473 | 162.38532 | 3 | 487.15596 | 9375.43 | 9308.2308 | 201.702 | 259.951 | |

| 0.055 | 39.5414 | 90.014471 | 162.38531 | 3 | 487.15593 | 9375.17 | 9308.2307 | 201.719 | 259.949 | |

| 0.060 | 39.5431 | 90.014470 | 162.38529 | 3 | 487.15587 | 9374.90 | 9308.2305 | 201.736 | 259.948 | |

| 0.8 | 38.7214 | 90.0150 | 162.392 | 3 | 487.176 | 9572.96 | 9308.29 | 188.657 | 260.164 | |

| 0.9 | 39.1347 | 90.0148 | 162.389 | 3 | 487.167 | 9474.19 | 9308.26 | 195.183 | 260.293 | |

| 1.0 | 39.5397 | 90.0145 | 162.385 | 3 | 487.155 | 9375.44 | 9308.23 | 201.702 | 259.951 | |

| 1.1 | 39.9367 | 90.0142 | 162.382 | 3 | 487.146 | 9276.68 | 9308.20 | 208.213 | 259.623 | |

| 1.2 | 40.3259 | 90.0139 | 162.379 | 3 | 487.137 | 9177.93 | 9308.16 | 214.718 | 259.307 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, C.-J.; Lee, T.-S.; Gu, M.; Yang, C.-T. A Multistage Sustainable Production–Inventory Model with Carbon Emission Reduction and Price-Dependent Demand under Stackelberg Game. Appl. Sci. 2020, 10, 4878. https://doi.org/10.3390/app10144878

Lu C-J, Lee T-S, Gu M, Yang C-T. A Multistage Sustainable Production–Inventory Model with Carbon Emission Reduction and Price-Dependent Demand under Stackelberg Game. Applied Sciences. 2020; 10(14):4878. https://doi.org/10.3390/app10144878

Chicago/Turabian StyleLu, Chi-Jie, Tian-Shyug Lee, Ming Gu, and Chih-Te Yang. 2020. "A Multistage Sustainable Production–Inventory Model with Carbon Emission Reduction and Price-Dependent Demand under Stackelberg Game" Applied Sciences 10, no. 14: 4878. https://doi.org/10.3390/app10144878

APA StyleLu, C.-J., Lee, T.-S., Gu, M., & Yang, C.-T. (2020). A Multistage Sustainable Production–Inventory Model with Carbon Emission Reduction and Price-Dependent Demand under Stackelberg Game. Applied Sciences, 10(14), 4878. https://doi.org/10.3390/app10144878