1. Introduction

Environmental protection has received growing attention due to the intensifying global climate crisis. In response, China has committed to achieving carbon neutrality by 2060 and peaking its carbon emissions by 2030. These targets have accelerated the integration of environmental, social, and governance (ESG) principles into corporate decision-making, emphasizing firms’ roles in environmental stewardship, social responsibility, and corporate governance. China’s regulatory landscape has evolved accordingly, with the China Securities Regulatory Commission enhancing ESG disclosure requirements. As a result, ESG reporting among A-share listed companies increased from 25% in 2018 to over 40% in 2022. The expanding role of ESG principles in China’s energy sector, a major contributor to global carbon emissions, has further emphasized sustainable development, energy transformation, and green investment. However, challenges remain, including inconsistent ESG assessment standards and funding constraints that affect firms’ financial stability and sustainability strategies.

Although ESG performance and default risk, frequently assessed by Z-scores, have been extensively examined in the global literature, most existing studies prioritize long-term financial outcomes and focus primarily on developed markets. This paper offers a unique contribution by analyzing the short-term relationship between ESG performance and default risk in China’s energy sector, a critical and under-researched setting in the global green transition. Furthermore, by incorporating green innovation as a moderating variable, we provide new insights into how organizations’ innovation capabilities may help alleviate financial pressures linked to ESG-related expenditures.

Moreover, given the dual pressures of meeting ESG performance standards and maintaining financial resilience, this study investigates the relationship between ESG performance and firms’ default risk in China’s energy sector. We propose that high ESG scores may not always correspond with improved financial health—particularly in the short term. Therefore, our first hypothesis posits that higher ESG performance may increase financial stress and reduce the distance to default. The second hypothesis introduces green innovation as a moderating variable, suggesting that while it can ease some financial burdens through efficiency and technological gains, it also demands significant capital and may intensify short-term financial pressure, thereby strengthening the relationship between ESG and default risk.

To test these hypotheses, the study uses panel data from 2015 to 2023, covering listed Chinese energy companies. Data were obtained from the WIND database and include ESG scores and key financial indicators. The analysis employs ordinary least squares (OLS) regression with firm fixed effects and year-specific controls to examine the relationship between ESG performance and distance to default. The chosen period reflects China’s rapid ESG regulatory development and green transition efforts, including the 2015 revision of the Environmental Protection Law and the formal announcement of dual-carbon goals in 2020. This period also coincides with a surge in ESG-related investment activity in China, making the study both timely and policy-relevant.

Empirical results show a significant inverse relationship between ESG scores and distance to default, indicating that higher ESG performance is associated with greater short-term financial risk. This supports the first hypothesis, particularly in capital-intensive sectors like energy, where ESG investments take time to yield returns and may initially strain financial resources. The interaction between ESG performance and green innovation is also significant, confirming the second hypothesis. While green innovation enhances technological advancement and competitiveness, it also increases capital expenditure, thereby contributing to short-term financial stress. These findings remain robust across various model specifications.

The findings contribute to the growing literature on ESG and corporate financial risk by challenging the assumption that high ESG scores inherently indicate stronger financial health. Instead, this study demonstrates that in China’s energy sector, ESG investments can lead to short-term financial strain, necessitating a more nuanced understanding of sustainability trade-offs. These insights highlight the importance of developing ESG strategies that balance long-term sustainability goals with short-term financial realities. They also emphasize the need for investors, firms, and policymakers to interpret ESG signals within sector-specific and time-sensitive contexts.

The remainder of the paper is organized as follows:

Section 2 presents a review of the relevant literature and the development of hypotheses.

Section 3 outlines the data sources and methodology.

Section 4 presents the empirical results,

Section 5 discusses the findings, and

Section 6 concludes the study by highlighting its theoretical and practical implications.

2. Literature Review and Hypothesis Development

2.1. ESG and Default Risk Relationship

In today’s financial markets, credit assessments increasingly incorporate ESG considerations, driven by regulatory pressure, greater transparency, and rising public interest. A company’s cash flows, which are critical for short-term debt repayment, can be directly affected by ESG-related investments (

Barth et al., 2022). ESG activities may also influence a firm’s asset value and, in turn, its default risk. Therefore, evaluations of credit risk, including default probability, should take a firm’s ESG performance into account (

Li et al., 2022). Firms with high ESG scores often enjoy stronger reputations and greater customer loyalty, attracting investment and providing resilience during economic downturns (

Goss & Roberts, 2011). Yet maintaining high ESG performance entails higher operating and maintenance costs, which may adversely affect short-term financial health (

Ghoul et al., 2017). These competing dynamics indicate that ESG principles may have differing short-term effects on financial performance and default risk, making them a topic worthy of further research.

Several mechanisms help explain how ESG performance may affect corporate default risk. High ESG performance can stabilize cash flows and reduce organizational risk, consistent with

Merton’s (

1974) theoretical framework. For example, a strong environmental reputation may allow firms to charge premium prices, negotiate better supplier terms, and lower hiring costs due to reputational advantages (

Albuquerque et al., 2019;

Sun et al., 2024). Such outcomes may enhance firm value and reduce default probability (

Goss & Roberts, 2011).

At the same time, ESG investments can impose significant financial strain. As

Ghoul et al. (

2017) note, substantial ESG expenditures may create uneven cash flow allocation and interdepartmental tensions, potentially lowering operational efficiency. Shareholders may bear these costs, leading to reduced short-term returns and possible dissatisfaction. In capital-intensive sectors such as energy, these pressures are often magnified. High ESG performance frequently requires ongoing stakeholder engagement and higher fixed costs, which may boost reputation without delivering proportional financial returns (

Perez-Batres et al., 2012;

Li & Hu, 2025). Collectively, these factors indicate that while ESG initiatives may mitigate regulatory and reputational risks, they can also heighten short-term financial stress, particularly for energy companies undergoing a green transition, where capital demands are high and payback periods are long.

We hypothesize the following:

H1. ESG performance has a negative impact on reducing default risk in the short run in China’s energy sector.

2.2. Impact of Green Innovation on ESG and Default Risk

When environmental deterioration emerges as a pervasive challenge confronting humanity, organizations and enterprises increasingly prioritize green innovation as a key dimension of environmental management. While often positioned as an essential mechanism for firms to address environmental pressures, it also functions as a strategic pathway to safeguard economic interests (

Takalo & Tooranloo, 2021). Although widely highlighted, the benefits of green innovation require closer examination. It is commonly argued that such innovation fosters sustainable competitive advantages (

Hur et al., 2013) while enhancing organizational resilience and improving long-term survival prospects, thereby enabling firms to secure greater market share. Whether such benefits materialize remains contingent on sectoral, regulatory, and organizational conditions. By introducing environmentally responsible products and services, companies can strengthen their corporate image, attract customers who are committed to sustainable development, and mitigate the risk of default (

Gürlek & Tuna, 2018;

Roy & Khastagir, 2016). Even so, the assumption that such measures uniformly yield reputational and financial dividends risks oversimplifying the complex interplay between corporate sustainability narratives and actual market outcomes. Thus, while the integration of green innovation may contribute to energy conservation and resource efficiency, the claim of substantial economic gains remains more conditional than self-evident (

Q. Zhang et al., 2017;

S. Chen et al., 2023).

The process of embedding green innovation is likewise far from straightforward, with firms encountering substantial barriers that complicate implementation. These include the burden of high research and development costs alongside constrained financial resources (

Iranmanesh et al., 2017), the lack of accessible and reliable public information and data (

Kunapatarawong & Martínez-Ros, 2016), and insufficient policy frameworks and governmental support (

Aguilera-Caracuel & Ortiz-de-Mandojana, 2013). Such constraints highlight the tension between the widely asserted promise of green innovation and the structural limitations that firms face in practice. Overcoming these obstacles requires deliberate organizational strategies: firms can harness both internal and external knowledge, adopt adaptive and flexible R&D processes, and foster interdepartmental collaboration to cultivate a more conducive environment for innovation. While these practices may enhance top management’s confidence in advancing environmental governance, they also underscore how heavily firms remain dependent on governmental incentives and external support to pursue innovation effectively (

Chiou et al., 2011;

Ebrahimi & Mirbargkar, 2017). Accordingly, green innovation should not be regarded merely as an environmentally responsive practice but as a contested risk management instrument, equipping firms to navigate shifts in environmental regulation and potential liability risks. In this sense, its contribution to enduring competitive advantage and sustainable development must be read as both enabling and constrained, reflecting the ongoing challenge of reconciling environmental stewardship with economic profitability.

2.3. Green Innovation and ESG Performance

Green innovation is closely related to ESG factors and plays a key role in corporate sustainability. Porter and Linde’s hypothesis (

Porter & Linde, 1995) points out that well-designed environmental regulations can encourage innovation and control corporate expenses to a certain extent by reducing idle resources and carbon emissions. This hypothesis has been supported by some studies, and green innovation does have a positive impact on environmental benefits (

Cai et al., 2020). On the other hand, social and governance factors in ESG principles also promote green innovation. Good social responsibility practices and governance structures help the effective allocation and use of corporate resources, thus fostering the execution of green innovation initiatives (

Singh et al., 2015). The broad adoption of ESG standards has driven companies to allocate more resources to green innovation to fulfill the expectations of stakeholders and comply with regulatory demands, in addition to undertaking social responsibility (

Y. S. Chen, 2008;

Mukhtar et al., 2024).

However, green innovation is not without challenges in enhancing environmental performance. Studies have shown that rebound effects and strategic green innovations may limit their environmental benefits, as the rebound effect refers to the increase in resource use after technological progress reduces the cost of use, which offsets the environmental benefits (

Barbieri et al., 2017). The same can be said for strategic green innovation, which means enterprises carry out superficial environmental innovation for market competition or policy requirements, but the actual environmental benefits are limited (

Hall & Harhoff, 2012). To this end, enterprises need to comprehensively consider ESG factors when implementing green innovation to ensure that they truly achieve environmental benefits.

2.4. Green Innovation and Default Risk

Green innovation has attracted much public attention in recent years and has created additional challenges for many businesses. It not only contributes to improved environmental performance and market competitiveness but also affects a firm’s default risk. Prior studies suggest that green innovation enhances corporate sustainability, potentially lowering environmental liability and regulatory risks. It may also attract socially responsible investors, reduce financing costs, and diversify funding sources—factors that can reduce the risk of default (

Gürlek & Tuna, 2018). Technological innovation is also considered critical for corporate competitiveness and long-term viability, especially for firms facing debt-financing difficulties (

X. Chang et al., 2019).

Unlike traditional capital investments, corporate innovation creates intangible assets that may provide long-term strategic value (

Holmstrom, 1989). However, green innovation typically involves high upfront capital requirements and delayed profitability, making investors more cautious and requiring longer time horizons for return. Additionally, such innovation is shaped by environmental regulations and access to green financing (

Zheng et al., 2022). Successful outcomes depend on whether environmental and financial performance can be maintained simultaneously to earn the trust of financiers (

Xu et al., 2021).

Green innovation also faces unique risks. Firms often conceal details of innovation activities to protect intellectual property, contributing to information asymmetry and agency problems (

Wang & Hu, 2020). These factors may reduce transparency and increase financing costs. Moreover, the early stages of green product development often involve higher costs and lower sales, which can hurt firm profitability (

Wang et al., 2024). Managerial uncertainty and misalignment between innovation outputs and investment levels may further intensify these challenges, potentially increasing default risk. In summary, while green innovation can support long-term resilience and sustainability, it may also create short-term financial strain due to high uncertainty and investment intensity. We hypothesize the following:

H2. Green innovation strengthens the relationship between ESG performance and default risk.

3. Data and Methodology

3.1. Data Sources

Our data come from the WIND database and China Intellectual’s patent search website. To maintain the sample’s representativeness and data reliability, this study focuses exclusively on listed companies within China’s energy sector. Given that the ESG score has exerted different incentive effects on emerging energy companies in China’s energy industry across various periods, we chose the past nine years (i.e., 2015 to 2023) as the sample period for the study. The sample period from 2015 to 2023 is selected to align with the development of China’s ESG regulatory framework and its increasing policy emphasis on environmental sustainability. Notably, the enforcement of the revised Environmental Protection Law in 2015 marked a turning point in regulatory stringency. Furthermore, China’s “dual-carbon” goals—carbon peaking by 2030 and neutrality by 2060—announced in 2020 further accelerated ESG integration, particularly in the energy sector (

D. Zhang et al., 2019;

Lu & Cheng, 2023). In the sample selection process, we excluded some energy companies with relatively small sizes and incomplete data to maintain the robustness and reliability of our analysis. Finally, our sample consists of 234 listed companies in China’s energy industry, including 2106 observations. In addition, we collected specific data related to green innovation from China Intellectual’s patent search website, including the number of green patents accessed. We used distance to default as the primary measure of default risk. These companies offer valuable insights into ESG performance and default risk during green transformation, allowing for a thorough assessment of green innovation’s impact.

3.2. Variable Definition and Interpretation

First, we identify the proxy for default risk, which is the dependent variable. To assess default risk, we utilize distance to default, grounded in

Merton’s (

1974) theoretical framework:

In the equation, Vi,t is the market value of the asset, and Li,t is the long-term liability plus short-term liability. T will be set for 1 year with drift µ and volatility αA,i,t. A shorter default distance indicates a higher default risk.

The independent variable, the ESG comprehensive rating, is calculated from the WIND database based on publicly disclosed information and the company’s annual report; then, we generate a score based on the rating, ranging from AAA to C and 9 to 1. The moderator is green innovation, measured using green patent access data for listed companies. We match this data with the chosen company. The control variables encompass firm size, financial leverage, which is determined by dividing the sum of total assets and total liabilities by total assets, beta, the age of the firm, return on assets (ROA), return on equity (ROE), and earnings per share (EPS). A summary of all variable definitions and measurements is provided in

Table 1.

The paper examines the relationship between ESG performance and default risk in the context of the green transition in the Chinese energy sector using a range of methodological approaches. First, we conduct a basic regression analysis using the fixed effects model of ordinary least squares (OLS). Since the fixed effects model can control heterogeneity within the company, the estimation results are more reliable and accurate with the firm’s fixed and time fixed effects for panel data (

Bennett et al., 2015). The specific model is set as follows:

DefRiski,t represents the annual default risk of the company i in year t, serving as the dependent variable. ESGratei,t shows the ESG score of the company i in year t, and GIi,t denotes the accessed green innovation data of company i in year t, acting as the moderate variable. Sizei,t refers to company size, Agei,t represents the number of years since the company was listed, Levi,t indicates the financial leverage, ROEi,t means the return on equity, EPSi,t represents the earning per share, ROAi,t stands for the return on asset, and Betai,t measures the risk of individual stocks relative to the market; these are all control variables commonly employed in previous studies.

3.3. Advanced Analysis and Robustness Check

Thereafter, we use some methods to check the result. To ensure the stationarity of the variables and avoid misleading regression results, we perform a unit-root test. In terms of specific methods, we use the Harris–Tzavalis unit-root test and the Im–Pesaran–Shin test, which can deal with the cross-section dependence of panel data and the autocorrelation of time series simultaneously. Then, correlation analysis follows. In the model setting, we introduce interaction term analysis to how green innovation moderates the relationship between ESG scores and default risk. The interaction terms help us understand how the impact of green innovation on corporate default risk varies across different scenarios, providing a more comprehensive insight into its mechanisms. To verify the robustness of our findings, we employ alternative measurements, using different methods to calculate default risk and applying quartiles in the estimation results. In addition, we present the endogeneity test methodology to investigate the effects of endogeneity on the connection between ESG scores and default risk. Using the lagged independent variable ESG score, we test whether endogeneity is of the robust type, thus revealing the complex dynamic relationship. Finally, we use component-based analysis, E-score, S-score, and G-score to test the robustness of the results. In summary, this paper employs a multi-angle and multi-method empirical analysis to reveal the critical role that ESG principles play in default risk under the green transition. Through rigorous data processing and multivariate measurement methods, we expect to provide more accurate and in-depth research conclusions, which can provide a valuable reference for policymaking and enterprise strategy.

4. Results and Discussion

In this section, data results and tables are presented. Firstly, we present the descriptive and correlative test. Secondly, OLS regression and interaction term analysis produce the main results, including the relationship between ESG score and default risk, as well as the moderating effect of green innovation. After that, we will use alternative tests, endogeneity tests, and component-based tests to test the stability of the results. Finally, we conclude with a discussion and elaboration of the results.

4.1. Descriptive Statistics

In terms of descriptive statistics, we calculated the number of observations, mean, median, standard deviation, and minimum and maximum values of each variable. These descriptive statistics, presented in

Table 2, provide insight into the distribution and fundamental characteristics of the data. The following are a few remarkable statistics. The total number of observations is 2106, and the companies’ ESG rating is roughly 3.943 on average. The dependent variable used to measure default risk is the distance to default, with an average of 8.22 and a maximum distance of 46.646; a shorter distance suggests a higher probability of bankruptcy. China’s energy enterprises are 12.671 years old on average. The average beta, which quantifies the risk of a stock concerning the market, stands at 0.87. The energy sector shows an average return on equity of 4.7%. The average value of financial leverage is 0.483.

4.2. Correlation Analysis

The correlation coefficients for each variable between 2015 and 2023 are displayed in

Table 3. The ESG score showed significant correlations with several variables. There are some points that can be discussed. At a significance level of 10%, the correlation coefficient between distance to default and ESG is −0.042. Companies with higher ESG performance also have stronger governance, according to the 0.289 correlation coefficient and 1% significance threshold between ESG scores and green innovation. At a significance level of 1%, the correlation coefficients between default distance and return on assets, return on equity, and earning per share are 0.099, 0.070 and 0.130, respectively, showing a significant association between strong ESG performance and default distance. However, the firm’s size shows a negative (−0.135) correlation with default distance at 1% significance. Furthermore, at a significance level of 1%, the firm age is 0.118, meaning that older companies typically have a lower default risk. The correlation coefficient with financial leverage is −0.150, and the significance level is 1%, indicating that companies with higher financial leverage have higher default risk.

4.3. Main Result (OLS with Fixed Effect)

We conduct a thorough examination of the association between ESG and default distance for Chinese energy enterprises using OLS regression analysis with fixed factors.

Table 4 shows the regression results for the three models. The first model’s only consideration of the ESG score reveals a significant negative relationship between the ESG score and the default distance, with a regression coefficient of −0.595, which is highly significant at the 1% level, indicating that companies with higher ESG scores have shorter default distances and thus a higher possibility of default risk. The ESG score’s regression coefficient reached −0.375 when all control variables were included in the second model, and this result is still significant at the 5% level of significance. This implies that the underlying influence of the ESG score remains unchanged when control variables are added. The regression coefficient of the ESG score was −0.671 with the addition of the moderating variable of green innovation in the third model, suggesting significance at the 1% level. The model demonstrates that green innovation has an essential influence, highlighting its crucial function as a moderating variable on default risk.

From an economic perspective, column (1) indicates that for every 1% improvement in the ESG rating, the default distance falls by 0.595%; columns (2) and (3) show reductions of 0.375% and 0.671% units, respectively. This implies that although better ESG ratings might reflect larger ESG inputs, in the short run, these inputs could spread financial resources and raise a firm’s default risk. In addition, the size of the organization is found to have a significant negative impact on the default distance. Specifically, the distance to default drops by roughly 0.664 to 0.980 units for every unit increase in firm size. As a result of their intricate organizational structures and greater operational risks, larger companies may have more resources and market power, but they may also be more vulnerable to default. The default distance is significantly positively impacted by return on assets, increasing by around 6.893% to 8.714% for every 1% increase, respectively. This implies that a higher return on assets indicates improved firm profitability and financial stability, which lowers the default risk. To keep their finances stable, firms should concentrate on increasing return on assets. The default distance is significantly impacted negatively by beta, decreasing by approximately 1.802 to 1.999 units for each unit increase. A company with a high beta is more vulnerable to fluctuations in the market, which raises the possibility of default. To mitigate the influence of market risk on a company’s financial stability, investors and managers should implement hedging and risk management measures.

4.4. Interaction Term Analysis

For acquiring deeper comprehension of the interaction term test, we investigate the integrated impact of green innovation and ESG score on the distance to default, as follows:

According to the regression data, there is a substantial negative correlation, approximately −0.287 at 10% significance, between the ESG score and default distance, meaning that a higher ESG score will typically result in a shorter default distance. The interaction term between ESG scores and green innovation still exhibits a negative connection with the default distance, and the coefficient shows a rise to −0.012 from −0.287 when green innovation is included as a moderator variable. When combined, green innovation and ESG scores reduce default distance, leading to a more pronounced negative effect. Furthermore, the significance of control variables in the default risk of firms is further validated by the fact that they exhibit the expected significant impacts in every model, including company size, return on assets, and financial leverage, at about −1.278, 4.785, and −2.615, respectively.

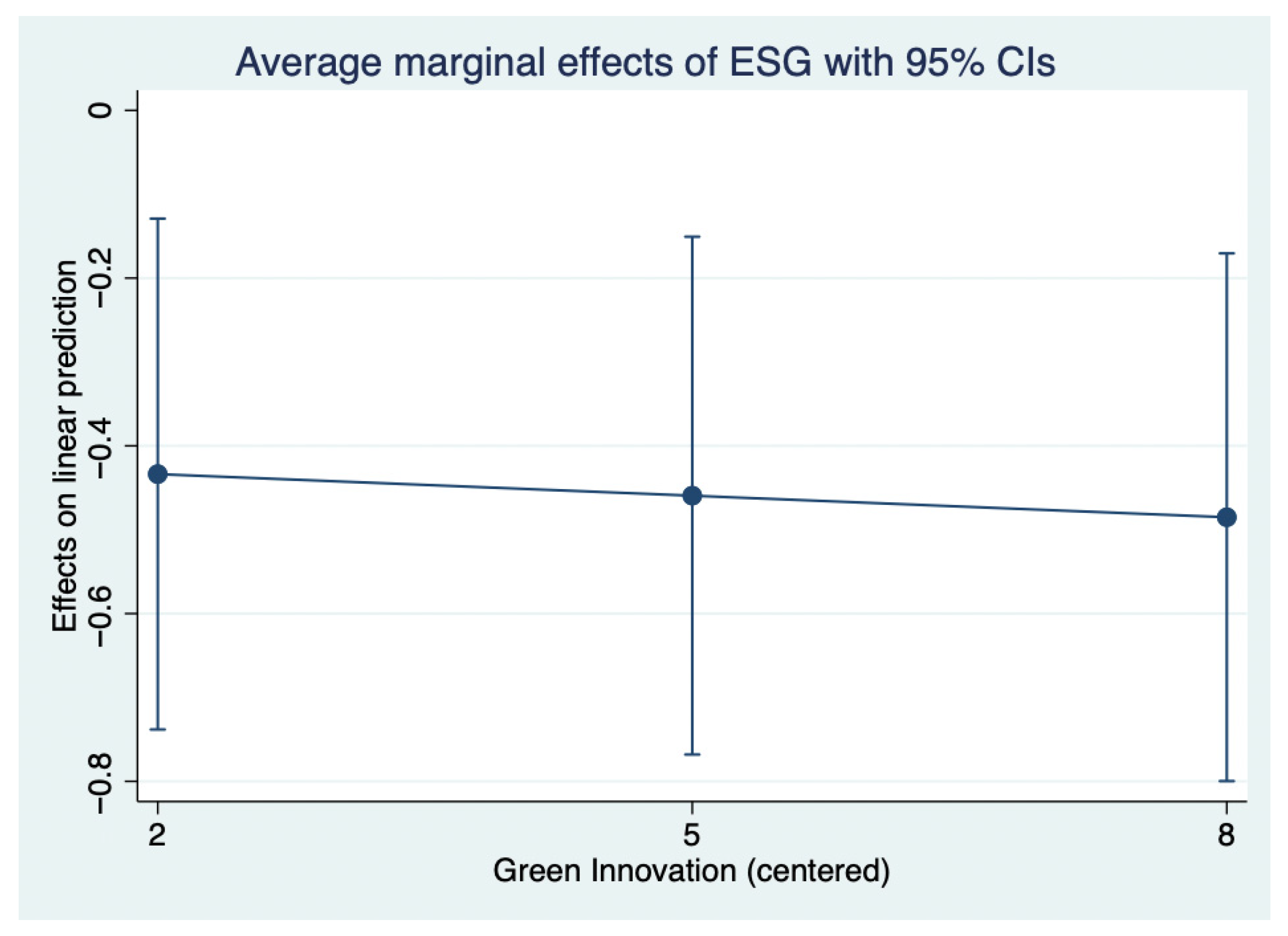

From the interaction plots, GI at 2 represents firms in the 25th quantile, indicating a lower level of green innovation. GI at 5 corresponds to firms in the 50th quantile, reflecting a medium level of green innovation, while GI at 8 represents firms in the 75th quantile, indicating a higher level of green innovation. The interaction plots reveal an intriguing pattern regarding the moderating effect of green innovation on the relationship between ESG scores and default risk. As the level of GI increases, the impact of ESG scores on default risk becomes more negative, suggesting that firms with higher levels of green innovation significantly amplify the negative effect of ESG principles on default risk.

From an economic perspective, the interaction term for green innovation then has a considerable impact on the distance to default, as shown based on the outcomes in columns 2 and 3 of

Table 5. In particular, the default distance declines by 0.012 units in column 2 and by 0.009 units in column 3 for every unit increase in green innovation and ESG interaction term. The existence of this interaction effect implies that default risk and ESG ratings are significantly moderated by green innovation. That is, if businesses raise their investment in green innovation, they can drastically increase their default risk because it puts pressure on the financial performance of companies. In addition to this, the effects of other variables on the distance to default also provide significant economic implications. For example, firm size has a significant negative effect on default distance. According to column 3, the default distance drops by 1.278 units for every unit increase in firm size. This supports the previous finding that larger firms may have higher default risk and need more careful risk management (

Cathcart et al., 2020). In column 3, the return on assets significantly increases default distance; for every unit rise in default distance, the return on assets increases by 4.785 units. This again indicates that a higher return on assets is effective in reducing the default risk of firms. Beta has a significant negative impact on the distance to default in all models, with the distance to default decreasing by 3.068 units for every one-unit increase, at a significance level of 1 percent. This indicates that high market risk remains an important driver of firms’ default risk.

4.5. Alternative Measurement

Equation (4), which provides a thorough assessment of a company’s financial health and default risk through the weighting of numerous financial ratios, is used to generate the logarithm of the Z-score (

Altman, 1968). OC

i,t refers to the operating capital of company i in year t, TA

i,t represents the total asset, RE

i,t stands for retained earnings, EBT

i,t refers to earnings before tax, E

i,t refers to the equity of the company, TL

i,t represents the total liability, and R

i,t represents revenue. The lower the score, the more likely a company is to go bankrupt:

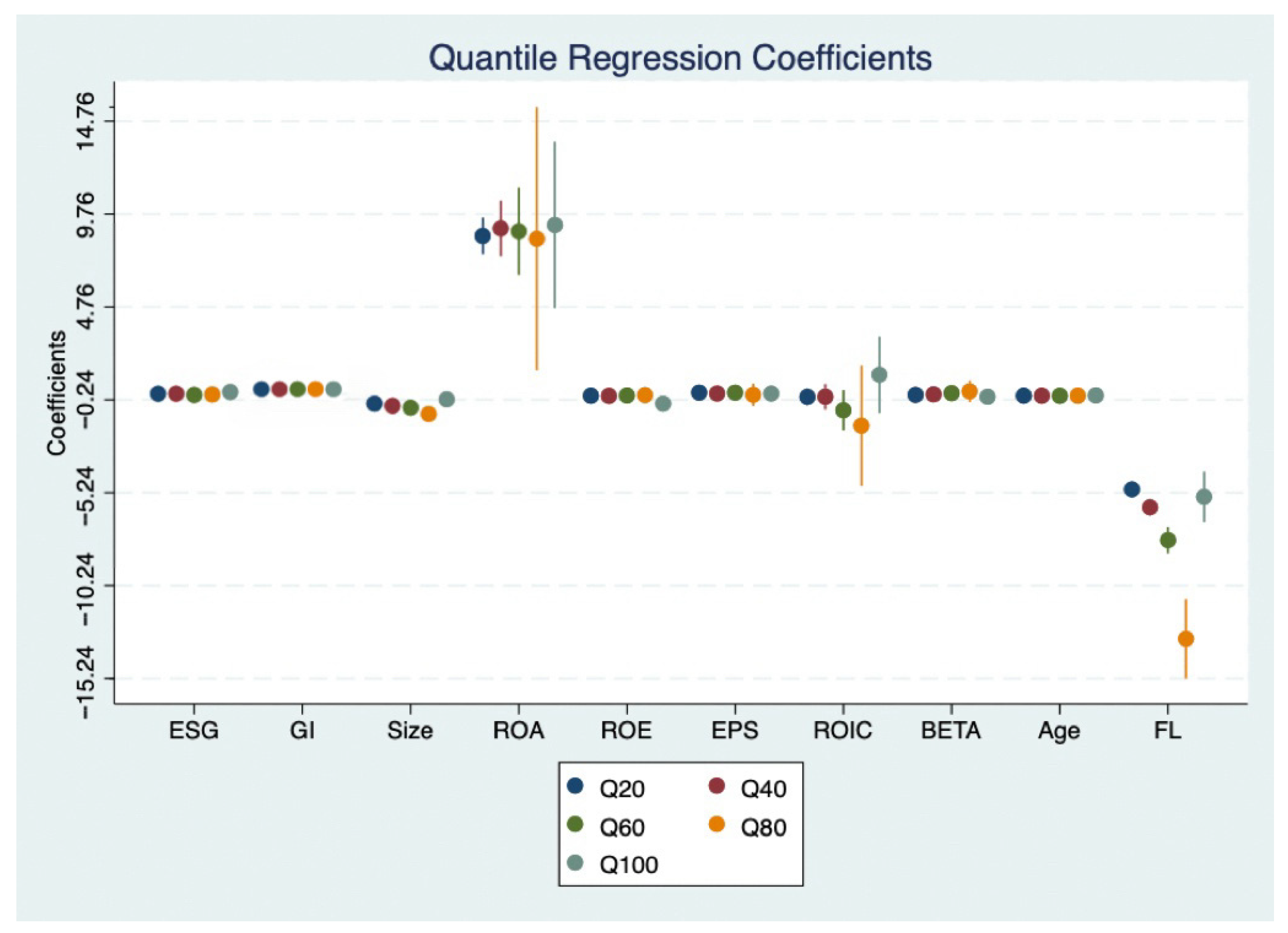

To fully understand the impact of corporate ESG scores on corporate default risk (expressed as Z-score), we divide the Z-score into four quartiles and use quantile regression analysis to observe the specific impact of each grouping. This approach helps us to reveal the characteristics of ESG scores at different default risk levels In the lowest quartile, representing firms with a higher likelihood of default risk, the results reported in

Table 6 (columns 1 and 2) indicate that the ESG score is negatively associated with default risk, with regression coefficients of −0.0902 and −0.0899, which are statistically significant at the 1% and 5% levels, respectively. For companies in the lower quantile, there is a noticeable and adverse relationship between default risk and ESG scores. In the third quartile, column 3, the regression coefficient for the ESG score is −0.0178, but this result is not significant. This means that as the Z-score increases to the middle and upper reaches, the impact of the ESG score on default risk weakens. In the high quartile, column 4, the regression coefficient for the ESG score is 0.0420, again insignificant. Even in the highest Z-score group, the effect of the ESG score on default risk is not significant. The moderating variable, green innovation, is significant in all quantiles except the last column, showing that the governance index has a consistent impact on default risk. The significance and direction of control variables, including other variables such as firm size, return on assets, return on equity, and financial leverage, in each quartile are as expected.

In terms of economic significance, in columns (1) and (2), for the Z-score of the low quantile, every 1% increase in the ESG score decreases the default distance by 0.0902% and 0.0899%, respectively, and the effect is significant, indicating that ESG principles in China’s energy industry have an obvious negative impact on companies with a high default risk possibility. In addition, from a low Z-score to a high Z-score, for every 1% increase in green innovation, the default distance increases by 0.00619% and 0.00716%, 0.00871% and 0.0103%, respectively, indicating that green innovation in Chinese energy enterprises has a significant role in reducing the possibility of default risk, and with the increase in Z-score, the role of green innovation is more relevant. In addition, for each unit increase in financial leverage, the default distance decreases by 5.043, 6.020, 7.799, 13.13, and 5.625, respectively. For each unit increase in return on assets, the default distance increases by 8.460, 8.897, 7.649, 6.362, and 11.87, respectively.

4.6. Endogeneity Test

To better detect stability, we use a lagged dependent variable, the ESG score, to detect endogeneity, for which we adopted two-stage least squares (2SLS) along with one- and two-period lags, respectively, using x as the instrumental variable, as shown in the following equation (

Atif & Ali, 2021):

The regression coefficient of the one-period-lagged ESG score in column 1 on the default distance is −0.504, suggesting that the ESG score has a negative relationship with the default distance at the one-year-lagged level and is significant at the 10% significance level. The ESG regression coefficient, lagged by two periods, in column 2 is −1.847, at the 1% significance level, suggesting that the negative impact caused by the ESG score on default distance increases with time. Other factors that have a substantial impact on the distance to default in various lag periods include financial leverage, company size, and green innovation. These findings suggest that these variables are crucial in determining the distance to default of firms.

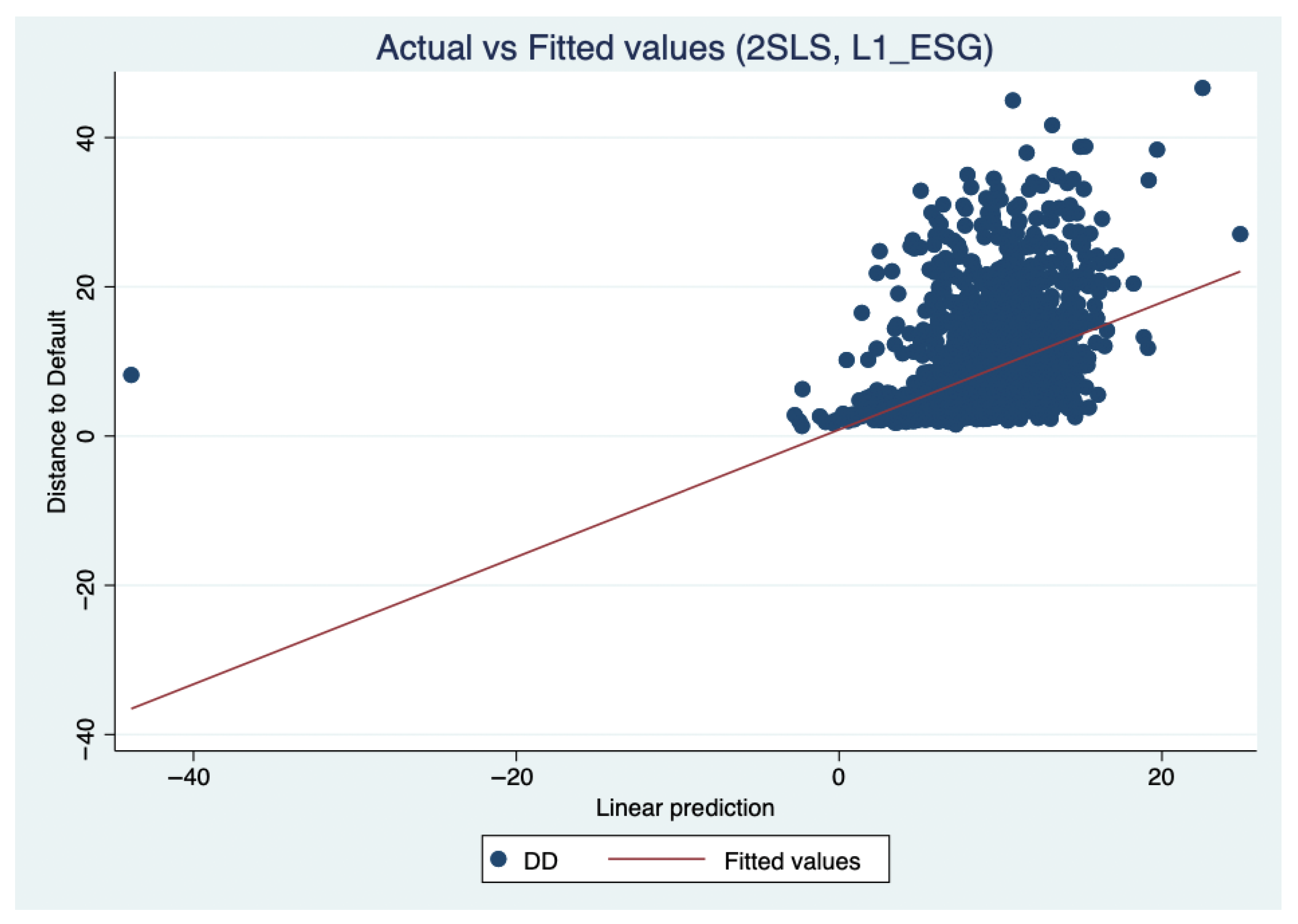

Scatter plots provide further insight into the data.

Figure 1 shows the actual versus fitted values of the distance to default for a one-period ESG lag, while

Figure 2 illustrates the corresponding results for a two-period ESG lag. The fitted values and the actual values lagged by one and two periods have a strong linear connection, as shown in

Figure 1 and

Figure 2, suggesting that the ESG score significantly reduces default distance during these two periods. The changes in the scatter plot reflect the possibility that ESG investments will threaten default risk for China’s energy industry over a relatively short period of time.

From an economic perspective, in

Table 7 (columns 1 and 2), a 1% increase in the one-period and two- period lagged ESG scores reduces the default distance by 0.504% and 1.847%, respectively, and the effect is significant, indicating that the effect of the lagged ESG score is also the same as the relationship in the main regression in

Table 4. Thus, short-term ESG scores that affect the significance of the distance to default are robust. In addition, a 1% increase in green innovation increases the default distance by 0.0242% and 0.0304%, respectively, indicating that green innovation of Chinese energy enterprises has a significant role in reducing the possibility of default risk. In addition, every unit increase in financial leverage reduces the default distance by 2.947 and 4.420, respectively, and every unit increase in return on assets increases the default distance by 6.647 and 7.600, respectively.

Figure 3 illustrates that one-period lagged ESG scores contribute to predicting Distance to Default; however, there is still a significant amount of unexplained variation present.

Figure 4 presents the correlation between predicted and actual DD values, indicating that ESG scores (with a two-period lag) have explanatory power, yet they do not entirely capture all the variability in firms’ default risk.

4.7. Component-Based Analysis

To better understand the impact of various indicators of ESG standards on default risk, we obtain the E-score, S-score, and G-score from the WIND database for regression analysis, to obtain more specific results.

Erol et al. (

2023) believed that the index of ESG principles was conducive to the stability of the results, as follows: CSP is the variable of interest, that is, the individual E-score, S-score, and G-score variables:

The results in

Table 8 show that E-score, S-score, and G-score are significantly negatively correlated in all models, with coefficients of −1.822, −2.082, and −2.914, respectively, and are significant at the 1% level. This shows that the default risk of the company rises with increasing environmental scores. On the other hand, green innovation is significantly positively correlated in all models, with a coefficient of 0.970, and is significant at the 1% level, indicating that the greener innovation, the lower the firm’s default risk. Firm size, beta coefficient, and financial leverage are significantly and negatively related to default risk, with coefficients of −1.254, −2.748, and −5.018, respectively, while earnings per share and firm age are significantly and positively related to default risk, with coefficients of 1.561 and 0.278, respectively. These findings mean that larger and highly leveraged firms may be more prone to financial distress, increasing the risk of default. A higher beta coefficient indicates that the market risk of the firm is greater, and the default risk increases accordingly. However, firms with strong profitability and long operating times have more financial stability and lower default risk.

From an economic perspective, columns 1, 2, and 3 reveal that a 1% increase in the E-score results in a 1.822% decrease in the default distance. Similarly, a 1% increase in the S-score and G-score results in a decrease in the default distance by 2.082% and 2.914%, respectively, indicating that E, S, and G have significantly negative impacts on default risk. This demonstrates the robustness of the ESG score in affecting the significance of the distance to default. Additionally, a 1% increase in green innovation leads to a 0.970% increase in the default distance, highlighting the significant effect of green innovation in reducing the possibility of default risk for Chinese energy enterprises. Furthermore, for each unit increase in company size, Beta, and financial leverage, the default distance decreases by 1.254, 2.748, and 5.018, respectively. Conversely, the default distance increases by 1.561 and 0.278 for each unit increase in company age and earnings per share, respectively.

4.8. State-Owned Enterprises vs. Private Enterprises Analysis

To better compare the impact of the ESG on score the default risk of different firm types, we will obtain two types of firm nature from the WIND database to conduct regression analyses and obtain more specific results. We set the state-owned firms to 1 and the privately owned firms to 0 to make it more convenient for us to carry out the analysis as follows, with Firm type as the variable of interest, i.e., state-owned enterprises or privately owned enterprises:

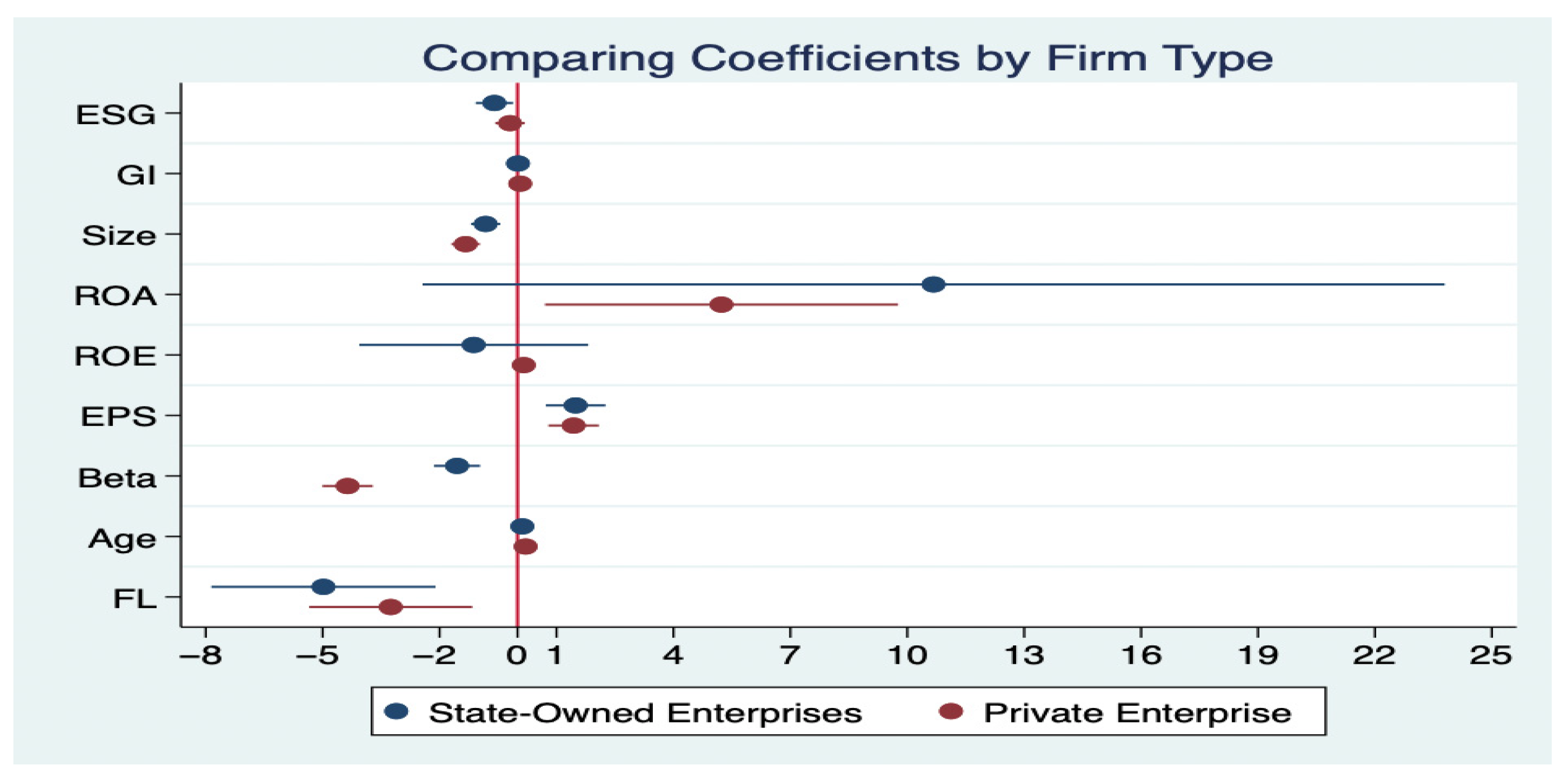

The regression coefficient of the ESG score on distance to default for state-owned firms in column 1 is −0.594, indicating that the ESG scores of state-owned firms are negatively related to distance to default at the level of and are significant at the 5% significance level. The regression coefficient of the ESG score of privately owned firms in column 2 is −0.322, which is significant at the 10% significance level, indicating that ESG scores of privately owned firms have a significant negative effect on the distance to default. Other control variables that have a substantial effect on the distance to default include financial leverage, firm size, green innovation, risk factor, and firm age.

As the coefficient plots show, ESG scores have a negative impact on default risk for both SOEs and private firms. The effect appears to be larger among SOEs, suggesting that these firms may be more stringent in their compliance with ESG requirements. The coefficient on firm size is negative and statistically significant for both SOEs and private firms. Size is more pronounced in privately owned firms, suggesting that large privately owned firms are more costly to transition.

From an economic perspective, a 1% increase in the ESG score for SOEs and private firms (columns 1 and 2 of

Table 9) reduces the distance to default by 0.594% and 0.322%, respectively, and the effects are significant, suggesting that the roles of ESG scores for SOEs and private firms are the same as in the main regression of

Table 4. Therefore, the short-term ESG scores affecting the significance of default distance are of a robust type. In addition, for every 1% increase in the level of green innovation, the distance to default increases by 0.013% and 0.069%, respectively, suggesting that green innovation in Chinese energy firms has a significant effect on reducing the likelihood of default risk. In addition, for every unit increase in financial leverage, the default distance will decrease by 4.980 and 3.253, respectively.

Figure 5 displays the differences and similarities in the factors influencing default risk between state-owned firms and private companies, with ESG exhibiting generally consistent negative effects in both categories.

5. Discussion

The empirical study presented in this research shows a significant inverse relationship between the distance to default of firms and their ESG scores, which suggests that higher ESG scores may shorten firms’ distance to default and then increase default risk. Therefore, Hypothesis 1 of this study is validated. Although good ESG performance enhances a firm’s image in society and in the market, in the short term, a firm’s investment in ESG standards may lead to diversification of resources and increased financial stress (

Ghoul et al., 2017). This is particularly evident in energy firms, as the sector typically has high capital intensity and long payback cycles, and large investments cannot be quickly converted into financial returns in the initial period but may instead temporarily deteriorate the financial position (

L. Chang et al., 2015). Analyzing the external environment, increased investor and consumer demand for firms with high ESG scores prompts firms to invest heavily in the short term to maintain their ESG performance, which further increases financial pressure, consistent with the analysis of

Perez-Batres et al. (

2012). After three years of the COVID-19 blockade, the industrial economy stagnated, but firms needed to invest heavily to maintain high ESG metrics. In the internal environment, to meet ESG criteria, firms need to make organizational adjustments and process re-engineering, and these short-term increases in operating costs and capital expenditures deteriorate financial indicators (

Ghoul et al., 2017). The negative effect of ESG scores remains significant even after all control variables are included, suggesting that ESG scores still have a significant shortening effect on the distance to default after controlling for other influencing factors. Although high ESG ratings could increase default risk in the short term due to heightened financial strain, they do not negate the prospective long-term advantages of sustainability, operational resilience, and stakeholder trust. This explanation helps in aligning the short-term financial effects with the long-term strategic benefits of ESG investment (

Li & Hu, 2025). In the European Union, ESG standards have been progressively rigorous under frameworks such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy. While these initiatives enhance transparency and long-term sustainability, numerous organizations encounter short-term financial pressure stemming from increased compliance expenses and administrative responsibilities (

Hummel & Jobst, 2024). Furthermore, in the United States, ESG adoption has been predominantly market-driven and politically divisive, with regulatory uncertainty posing obstacles to uniform implementation (

Chisogne, 2025). These analogies emphasize that the short-term financial pressures linked to ESG investment constitute a common concern for both emerging and industrialized nations, hence underlining the wider relevance of our findings.

After introducing green innovation as a moderating variable, the effect of ESG scores remains significant despite a slight weakening, with a negative coefficient, which is the same as in the main regression, showing the strengthening role of green innovation in corporate risk management. This proves that though green innovation can partially offset the short-term financial pressure from ESG investments by bringing about technological advances and market competitiveness enhancement, the implementation of green innovation still requires a large amount of capital and has a long payback period, so the coefficient of the interaction term becomes smaller but still negative (

Wang et al., 2024). In addition, green innovation in the energy industry depends on China’s relevant policies and green financing channels, and their capital chain may be reduced and cut off when the economy is in a downturn. Therefore, their pursuit of high standards and efficiency increases enterprises’ financial burden (

Zheng et al., 2022) This supports Hypothesis 2, which states that green innovation will strengthen the relationship between ESG, and default risk and firms are facing challenges to balance the financial pressure. Other control variables such as firm size, return on assets, return on net worth, and financial leverage also show the expected significant effects, further validating the importance of these factors in terms of default distance. For example, companies with larger sizes and higher returns on assets have relatively longer default distances, which is consistent with the predictions of economic theory. Furthermore, the model exhibits a noteworthy negative correlation with the market risk coefficient (beta), suggesting that market volatility has a greater impact on the default distance.

The following series of robustness tests better reflect the stability of the results. First, the test of substitution effects found that the ESG scores of Chinese energy firms have a significant impact on default risk in the low-Z-score group and the second lowest-Z-score group. This is because these firms are more likely to receive attention from external investors and stakeholders, and good ESG performance can improve a firm’s market image and trust, but cause pressed financial problems (

Albuquerque et al., 2019;

Ghoul et al., 2017). However, in the high-Z-score group, although the regression coefficients are not significant, this does not mean that ESG scores have no impact on firms. In fact, firms with high Z- cores usually have well-established environmental, social, and governance systems, better risk management capabilities, and higher market trust (

Neitzert & Petras, 2022), so the marginal effect of ESG scores is reduced. After that, the significant negative correlation between one- and two-period lagged ESG scores and the distance to default reveals the financial challenges faced by the Chinese energy sector in the short term. Meanwhile, market expectations for companies with high ESG scores drive these companies to increase their ESG investments, which, while potentially rewarding in the long term, increase financial pressure on companies in the short term, leading to shorter default distances (

L. Chang et al., 2015).

Moreover, when using component-based analysis, the E-score, S-score, and G-score all show a significant negative correlation with default risk. These findings all prove that the negative impact of ESG scores and default risk in China’s energy industry is robust. In particular, under the Chinese government’s increasingly stringent environmental regulations and social expectations, energy companies need to adjust quickly to meet the new standards, and this rapid adjustment requires significant capital and resources (

Zheng et al., 2022); maintaining a high E-score increases competitiveness but also financial pressure in the short term, while companies with a high S-score enhance their image through social responsibility activities but increase operating costs and default risk in the short term. Companies with a high G-score have a good governance structure but incur management reform costs in the short term. These lead to capital diversification and increased costs, which undermine the financial soundness of companies (

Ghoul et al., 2017). An analysis of the relationship between ESG performance and default risk for both state-owned and privately owned firms reveal that ESG principles may increase firms’ default risk in the short run. Specifically, the pressure on SOEs is particularly significant. On the one hand, SOEs tend to undertake more green transformation and social responsibility tasks given by the government, and their ESG promotion is not only based on market orientation, but also reflects more policy requirements; on the other hand, due to the influence of institutional and governance efficiency, SOEs are more costly and less flexible in terms of resource allocation and implementation, which exacerbates their financial pressure (

Zhu et al., 2016).

Overall, good ESG performance and green innovation strategies in China’s energy sector, despite their positive impact on society and the market in the future, put financial pressure on current firms, thus shortening the default distance. The interaction term of ESG scores and green innovation also has a significantly negative impact on the default distance, indicating that green innovation does increase the financial expenditure of enterprises and the investment in innovation and R&D; on the one hand, it increases the possibility of default risk. So, the green transformation of China’s energy industry is taking some time to balance financial pressure and social responsibility, and their task will not be completed in just a few years; it will take a long time to enhance the process.

6. Conclusions

Our first research question is to explore how ESG principles affect the default risk of China’s energy companies: through comprehensive regression analyses, we find that higher ESG scores in the Chinese energy sector are significantly associated with shorter default distances, indicating higher default risk. Then, this study answered the second research question of whether green innovation has an impact on ESG and default risk, with green innovation as a moderating variable indeed having a significant and reinforcing influence on the relationship between ESG and default risk; thus, understanding the financial impact of sustainable business practices extends the application of default risk in ESG analyses, which can help assess the challenges faced by energy companies during the transition process. These findings cut across different default risk quartiles, endogeneity tests, and component-based analyses, enhancing the robustness of the results. In our analyses, to ensure a thorough analysis of the relationship between ESG practices and default risk, we account for eight variables, including business size, return on assets, financial leverage, and so on. Against the backdrop of China’s green transformation in the energy sector, this study develops important theoretical contributions to the existing literature on corporate sustainability and financial performance in several ways and answers the research questions. Since we challenge the common notion that high ESG scores inevitably lead to better financial health, revealing a possibility that more attention on ESG scores also gives more financial stress to firms, a trade-off between sustainable practices and financial stability is particularly important for Chinese energy firms that are striving for a green transition.

In addition, the findings of this study have significant practical implications. For corporate managers, the results of the negative correlation between ESG scores and financial health suggest the need to maintain a balance when pursuing sustainability goals. Managers in energy companies should execute a phased or prioritized ESG approach, aligning ESG objectives with fundamental business and financial planning to mitigate undue short-term financial pressure. Potential strategies to mitigate the effects of adverse outcomes include enhanced internal risk management, increased integration of ESG initiatives with profit-generating activities, and the exploration of cost-effective environmentally sustainable concepts. Investors can use our findings to better assess the financial risks faced by energy companies with high ESG scores and thus make more informed investment decisions. To lessen ESG-related risks, investors should integrate ESG criteria into their asset allocation strategies and prioritize investments in firms with robust ESG performance. Moreover, policymakers can leverage our findings to enhance their understanding of the potential financial implications of evolving ESG standards. This will enable them to formulate policies that promote sustainable practices while guaranteeing financial stability. ESG performance must be integrated into the allocation criterion for green subsidies and incentive programs to guarantee that assistance is directed towards financially robust and authentically sustainable enterprises.

Limitations and Future Developments

There are several limitations to the research that should be mentioned. First, the number of time series and firm samples is limited. The data focuses on specific companies in China’s new energy industry, as samples with missing data were removed during the data cleaning process, including some companies with international influence. Data from the past nine years were selected for the study, since before 2015, data on ESG ratings for many listed companies in China’s energy industry were severely lacking. Therefore, these sample selections may not be fully representative of the industry. After that, this study adopts a cross-sectional data analysis methodology, which ignores changes in the time dimension and fails to reflect the long-term trends and dynamic impacts. For example, green innovation and a range of environmental governance indicators have a certain lag, and the green development performance in the previous year will not be immediately reflected in their default risk and financial indicators, which may take a longer period to become apparent. Therefore, the results of the study may vary depending on the period. Finally, this paper does not fully consider the internal and external factors of Chinese companies in the energy sector. Firstly, the focus and strategy of different companies in making investments will differ depending on their size structure, business model, and market positioning. Secondly, the influence of external policies and regulations that they face is huge. Because the Chinese government has great confidence in the transformation and upgrading of the energy industry, their promotion role gives the energy industry opportunities, on the one hand, but also pressure. The correlation between default risk and ESG ratings could be greatly impacted by these factors.

Considering the limitations existing in the study, future research can be explored in several ways. First, the sample could be expanded to cover energy companies in more countries and regions to increase the generalizability and representativeness of the findings. At the same time, the number of company samples can be increased, and internationally influential companies that were excluded during the data cleaning process can be reprocessed through various methods, such as linear prediction, to provide a more comprehensive picture of the industry. Second, longitudinal data analysis methods can also be used to study the long-term impact and dynamics of ESG ratings on the distance to default, especially considering the lagged effects of green innovation and environmental governance indicators and exploring the impact of longer time horizons on the findings. In addition, more variables, such as business models and market positioning, could be introduced to assess the moderate role of these factors in the relationship between ESG ratings and default risk. We did not formally test for autocorrelation or cross-sectional dependence, nor apply data transformations to address skewness or outliers. The lack of variable standardization may also affect comparability in multivariate analyses. Future research could address these limitations to improve robustness and replicability, providing a clearer understanding of how ESG ratings influence corporate financial performance and long-term development, with implications for both policymaking and corporate strategy.

Author Contributions

Conceptualization, Y.G., C.M.O., S.B. and C.N.; methodology, Y.G.; software, Y.G., C.M.O., S.B. and C.N.; validation, Y.G., C.M.O., S.B. and C.N.; formal analysis, Y.G. and S.B.; investigation, Y.G., C.M.O., S.B. and C.N.; resources, Y.G., C.M.O., S.B. and C.N.; data curation, Y.G. and S.B.; writing—original draft preparation, Y.G., C.M.O., S.B., C.N.; writing—review and editing, Y.G., C.M.O., S.B., C.N.; visualization, Y.G., C.M.O., S.B. and C.N.; supervision, S.B., C.N.; project administration, Y.G., C.M.O., S.B. and C.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no interest of conflict.

References

- Aguilera-Caracuel, J., & Ortiz-de-Mandojana, N. (2013). Green innovation and financial performance: An institutional approach. Organization & Environment, 26(4), 365–385. [Google Scholar] [CrossRef]

- Albuquerque, R., Koskinen, Y., & Zhang, C. (2019). Corporate social responsibility and firm risk: Theory and empirical evidence. Management Science, 65(10), 4451–4469. [Google Scholar] [CrossRef]

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609. [Google Scholar] [CrossRef]

- Atif, M., & Ali, S. (2021). Environmental, social and governance disclosure and default risk. Business Strategy and the Environment, 30(8), 3937–3959. [Google Scholar] [CrossRef]

- Barbieri, N., Ghisetti, C., Gilli, M., Marin, G., & Nicolli, F. (2017). A survey of the literature on environmental innovation based on main path analysis. Environmental Economics and Sustainability, 30, 221–250. [Google Scholar] [CrossRef]

- Barth, F., Hübel, B., & Scholz, H. (2022). ESG and corporate credit spreads. The Journal of Risk Finance, 23(2), 169–190. [Google Scholar] [CrossRef]

- Bennett, R. L., Güntay, L., & Unal, H. (2015). Inside debt, bank default risk, and performance during the crisis. Journal of Financial Intermediation, 24(4), 487–513. [Google Scholar] [CrossRef]

- Cai, X., Zhu, B., Zhang, H., Li, L., & Xie, M. (2020). Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Science of the Total Environment, 746, 140810. [Google Scholar] [CrossRef] [PubMed]

- Cathcart, L., Dufour, A., Rossi, L., & Varotto, S. (2020). The differential impact of leverage on the default risk of small and large firms. Journal of Corporate Finance, 60, 101541. [Google Scholar] [CrossRef]

- Chang, L., Li, W., & Lu, X. (2015). Government engagement, environmental policy, and environmental performance: Evidence from the most polluting Chinese listed firms. Business Strategy and the Environment, 24(1), 1–19. [Google Scholar] [CrossRef]

- Chang, X., Chen, Y., Wang, S. Q., Zhang, K., & Zhang, W. (2019). Credit default swaps and corporate innovation. Journal of Financial Economics, 134(2), 474–500. [Google Scholar] [CrossRef]

- Chen, S., Song, Y., & Gao, P. (2023). Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. Journal of Environmental Management, 345, 118829. [Google Scholar] [CrossRef]

- Chen, Y. S. (2008). The driver of green innovation and green image–green core competence. Journal of Business Ethics, 81, 531–543. [Google Scholar] [CrossRef]

- Chiou, T. Y., Chan, H. K., Lettice, F., & Chung, S. H. (2011). The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transportation Research Part E: Logistics and Transportation Review, 47(6), 822–836. [Google Scholar] [CrossRef]

- Chisogne, D. (2025). How do ESG practices influence systemic risk and financial performance in US and European banks?: A comparative analysis [Master’s thesis, University of Oulu]. [Google Scholar]

- Ebrahimi, P., & Mirbargkar, S. M. (2017). Green entrepreneurship and green innovation for SME development in market turbulence. Eurasian Business Review, 7(2), 203–228. [Google Scholar] [CrossRef]

- Erol, I., Unal, U., & Coskun, Y. (2023). ESG investing and the financial performance: A panel data analysis of developed REIT markets. Environmental Science and Pollution Research, 30(36), 85154–85169. [Google Scholar] [CrossRef]

- Ghoul, S. E., Guedhami, O., & Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48, 360–385. [Google Scholar] [CrossRef]

- Goss, A., & Roberts, G. S. (2011). The impact of corporate social responsibility on the cost of bank loans. Journal of Banking & Finance, 35(7), 1794–1810. [Google Scholar] [CrossRef]

- Gürlek, M., & Tuna, M. (2018). Reinforcing competitive advantage through green organizational culture and green innovation. The Service Industries Journal, 38(7–8), 467–491. [Google Scholar] [CrossRef]

- Hall, B. H., & Harhoff, D. (2012). Recent research on the economics of patents. Annual Review of Economics, 4(1), 541–565. [Google Scholar] [CrossRef]

- Holmstrom, B. (1989). Agency costs and innovation. Journal of Economic Behavior & Organization, 12(3), 305–327. [Google Scholar] [CrossRef]

- Hummel, K., & Jobst, D. (2024). An overview of corporate sustainability reporting legislation in the European Union. Accounting in Europe, 21(3), 320–355. [Google Scholar] [CrossRef]

- Hur, W. M., Kim, Y., & Park, K. (2013). Assessing the effects of perceived value and satisfaction on customer loyalty: A ‘green’ perspective. Corporate Social Responsibility and Environmental Management, 20(3), 146–156. [Google Scholar] [CrossRef]

- Iranmanesh, M., Zailani, S., Moeinzadeh, S., & Nikbin, D. (2017). Effect of green innovation on job satisfaction of electronic and electrical manufacturers’ employees through job intensity: Personal innovativeness as moderator. Review of Managerial Science, 11, 299–313. [Google Scholar] [CrossRef]

- Kunapatarawong, R., & Martínez-Ros, E. (2016). Towards green growth: How does green innovation affect employment? Research Policy, 45(6), 1218–1232. [Google Scholar] [CrossRef]

- Li, H., & Hu, Y. (2025). ESG rating and default risk: Evidence from China. The North American Journal of Economics and Finance, 75(Part A), 102314. [Google Scholar] [CrossRef]

- Li, H., Zhang, X., & Zhao, Y. (2022). ESG and firm’s default risk. Finance Research Letters, 47, 102713. [Google Scholar] [CrossRef]

- Lu, S., & Cheng, B. (2023). Does environmental regulation affect firms’ ESG performance? Evidence from China. Managerial and Decision Economics, 44(4), 2004–2009. [Google Scholar] [CrossRef]

- Merton, R. C. (1974). On the pricing of corporate debt: The risk structure of interest rates. The Journal of Finance, 29(2), 449–470. [Google Scholar] [CrossRef]

- Mukhtar, B., Shad, M. K., Lai, F. W., & Waqas, A. (2024). Empirical analysis of ESG-driven green innovation: The moderating role of innovation orientation. Management & Sustainability: An Arab Review, 3(4), 361–384. [Google Scholar] [CrossRef]

- Neitzert, F., & Petras, M. (2022). Corporate social responsibility and bank risk. Journal of Business Economics, 92(3), 397–428. [Google Scholar] [CrossRef]

- Perez-Batres, L. A., Doh, J. P., Miller, V. V., & Pisani, M. J. (2012). Stakeholder pressures as determinants of CSR strategic choice: Why do firms choose symbolic versus substantive self-regulatory codes of conduct? Journal of Business Ethics, 110, 157–172. Available online: https://www.jstor.org/stable/41684022 (accessed on 23 May 2025). [CrossRef]

- Porter, M. E., & Linde, C. V. D. (1995). Toward a new conception of the environment- competitiveness relationship. Journal of Economic Perspectives, 9(4), 97–118. [Google Scholar] [CrossRef]

- Roy, M., & Khastagir, D. (2016). Exploring role of green management in enhancing organizational efficiency in petro-chemical industry in India. Journal of Cleaner Production, 121, 109–115. [Google Scholar] [CrossRef]

- Singh, M., Brueckner, M., & Padhy, P. K. (2015). Environmental management system ISO 14001: Effective waste minimisation in small and medium enterprises in India. Journal of Cleaner Production, 102, 285–301. [Google Scholar] [CrossRef]

- Sun, H., He, S., Cheng, N., & Liu, Z. (2024). Climate transition risk and enterprise default probability. Business Strategy and the Environment, 33(8), 8929–8945. [Google Scholar] [CrossRef]

- Takalo, S. K., & Tooranloo, H. S. (2021). Green innovation: A systematic literature review. Journal of Cleaner Production, 279, 122474. [Google Scholar] [CrossRef]

- Wang, X., Guo, Y., & Fu, S. (2024). Will green innovation strategies trigger debt default risk? Evidence from listed companies in China. Finance Research Letters, 62, 105216. [Google Scholar] [CrossRef]

- Wang, X., & Hu, G. (2020). Green innovation, corporate reputation and earnings information content. Journal of Beijing Technology and Business University, 35, 50–63. [Google Scholar]

- Xu, J., Liu, F., & Shang, Y. (2021). R&D investment, ESG performance and green innovation performance: Evidence from China. Kybernetes, 50(3), 737–756. [Google Scholar] [CrossRef]

- Zhang, D., Rong, Z., & Ji, Q. (2019). Green innovation and firm performance: Evidence from listed companies in China. Resources, Conservation and Recycling, 144, 48–55. [Google Scholar] [CrossRef]

- Zhang, Q., Zhang, J., & Tang, W. (2017). Coordinating a supply chain with green innovation in a dynamic setting (Volume 15, pp. 1054–1070). Springer. [Google Scholar]

- Zheng, J., Khurram, M. U., & Chen, L. (2022). Can green innovation affect ESG ratings and financial performance? Evidence from Chinese GEM listed companies. Sustainability, 14(14), 8677. [Google Scholar] [CrossRef]

- Zhu, Q., Liu, J., & Lai, K. H. (2016). Corporate social responsibility practices and performance improvement among Chinese national state-owned enterprises. International Journal of Production Economics, 171, 417–426. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).