Behavior and Sustainable Finance: A Bibliometric Approach

Abstract

1. Introduction

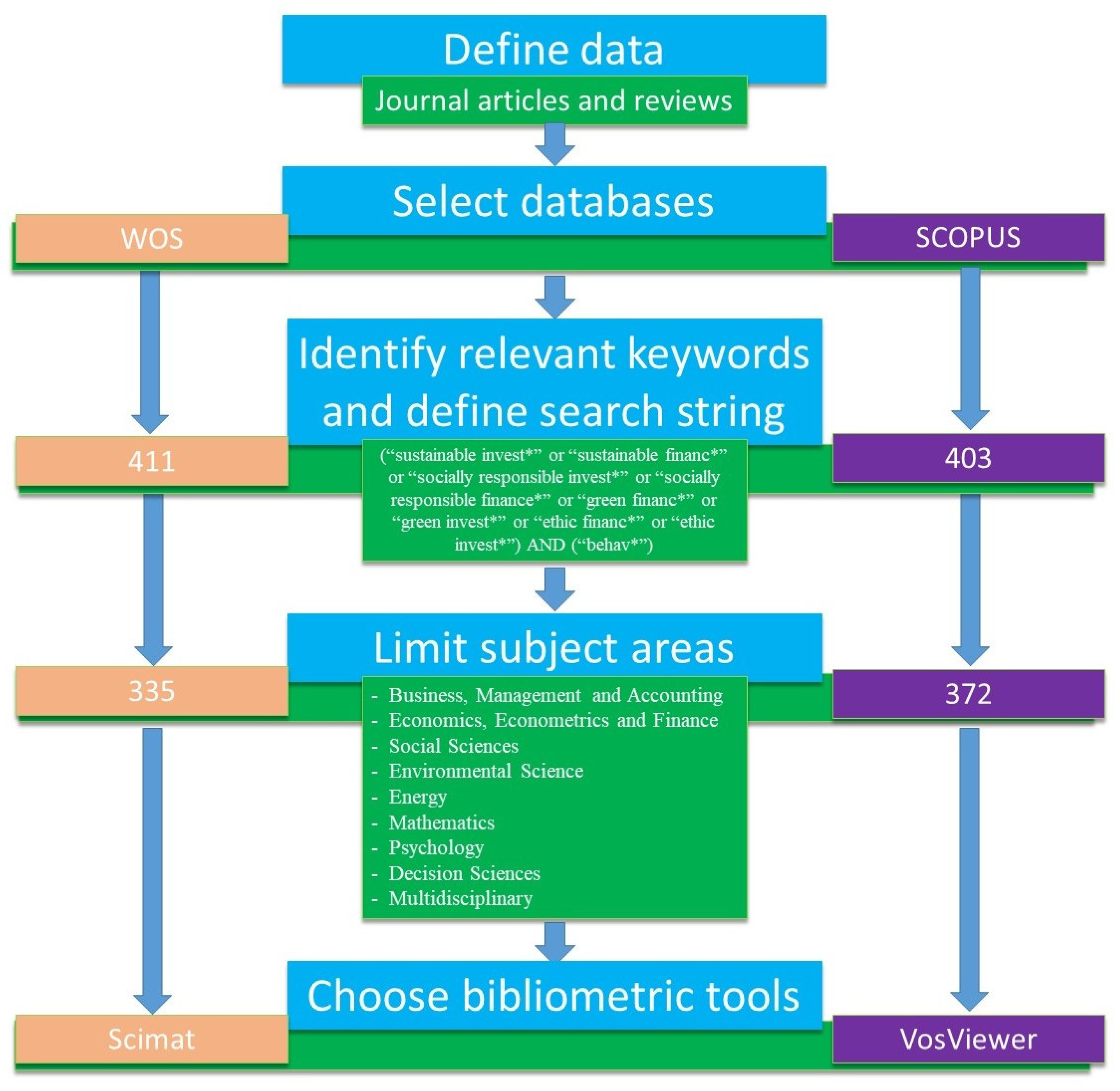

2. Materials and Methods

2.1. Choice of Methodology

2.2. Source Acquisition

3. Results and Discussion

3.1. Bibliometric Analysis Using Scopus and VOSviewer

3.1.1. Bibliometric Analysis of Growth Rate

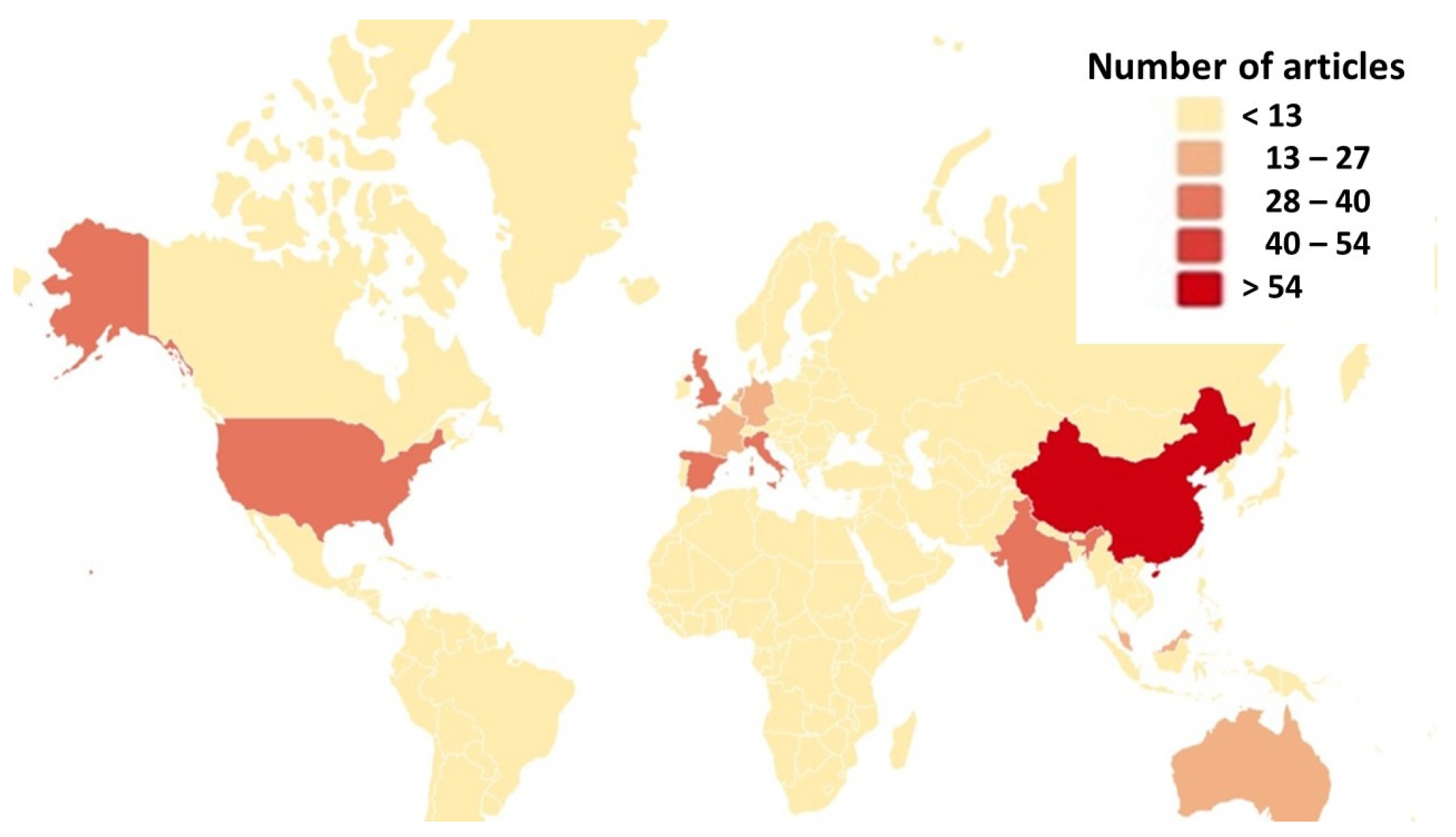

3.1.2. Geographical Distribution of the Research Output

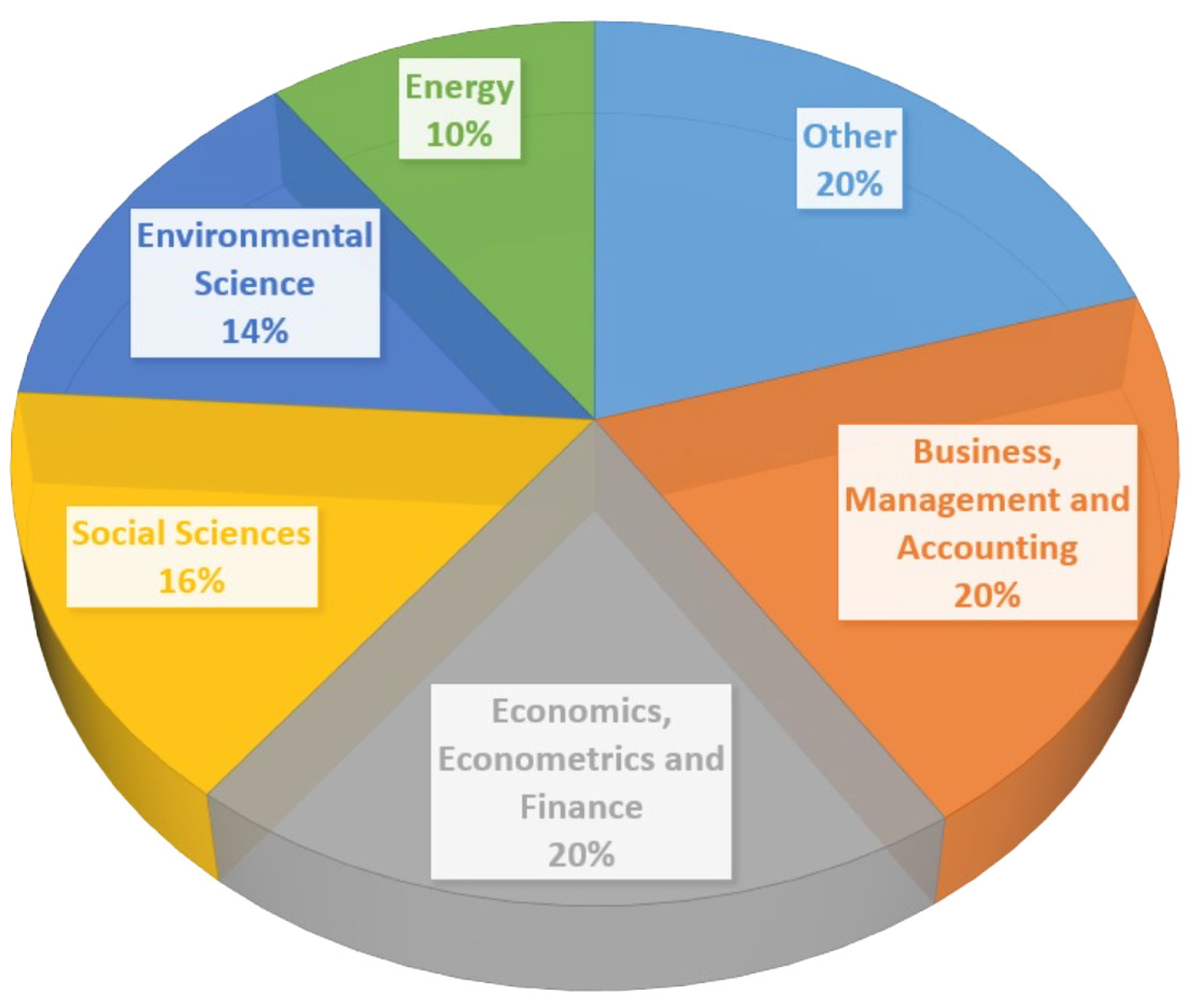

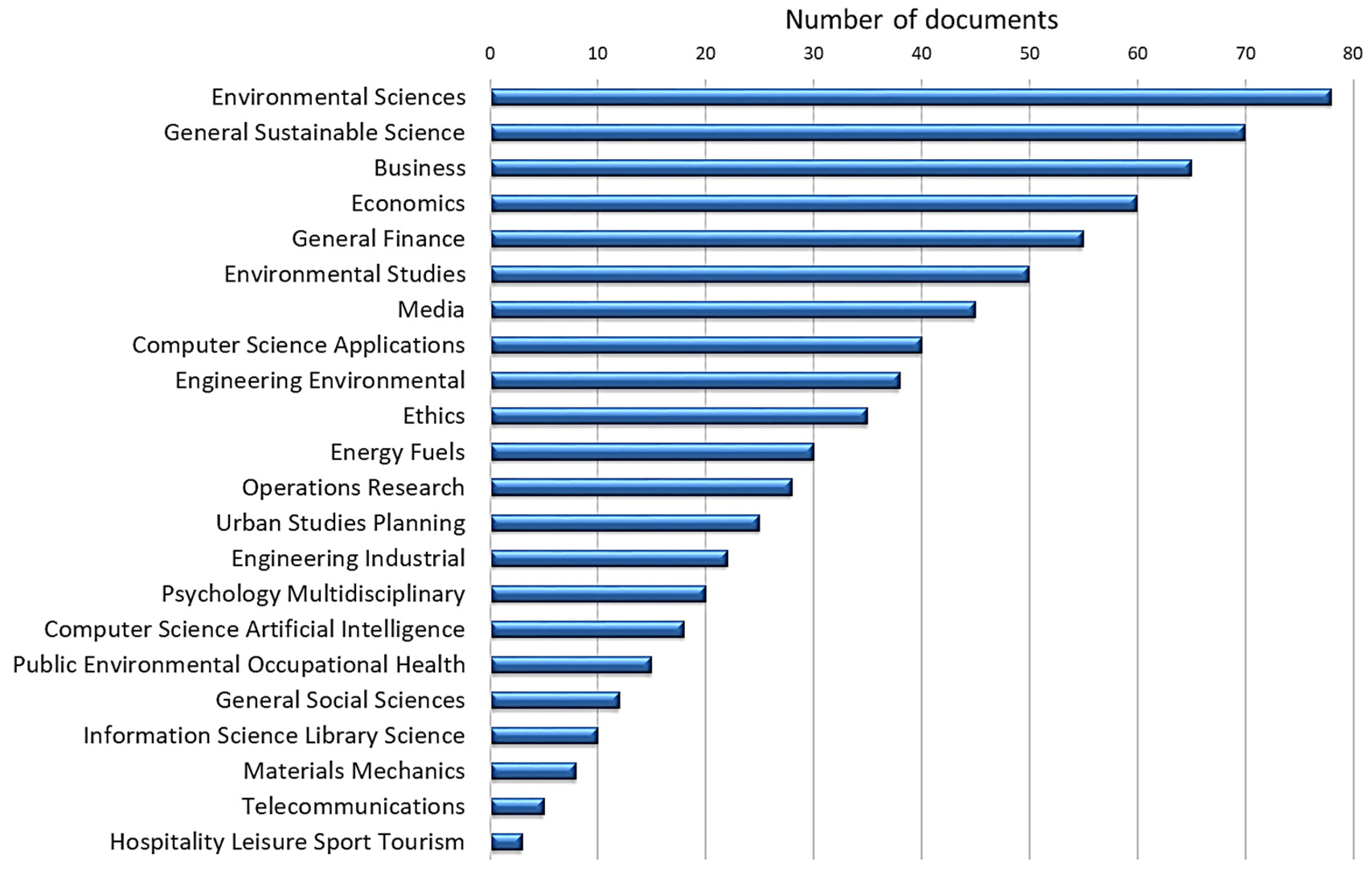

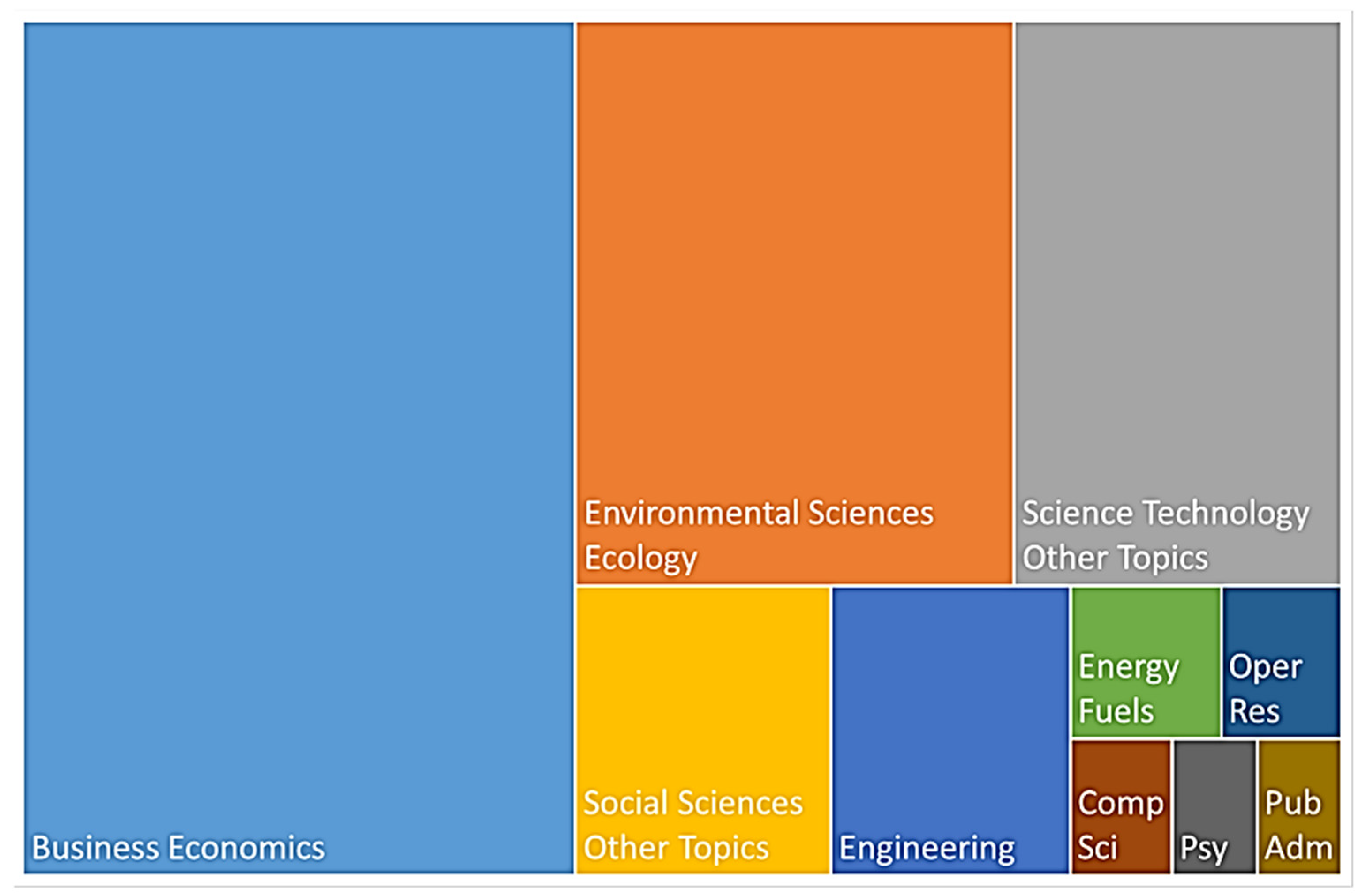

3.1.3. Subject Areas

3.1.4. Most Prolific Journals

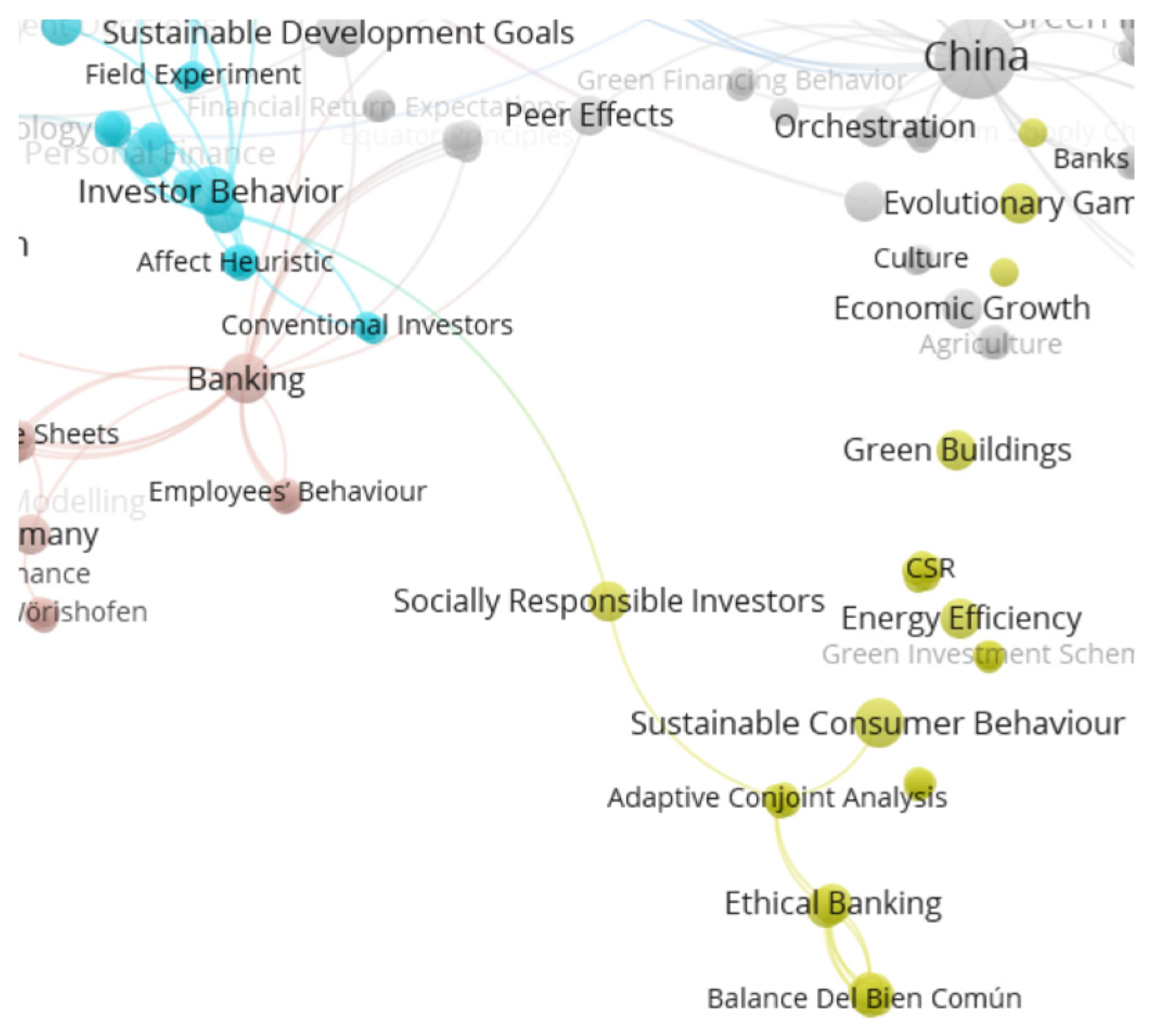

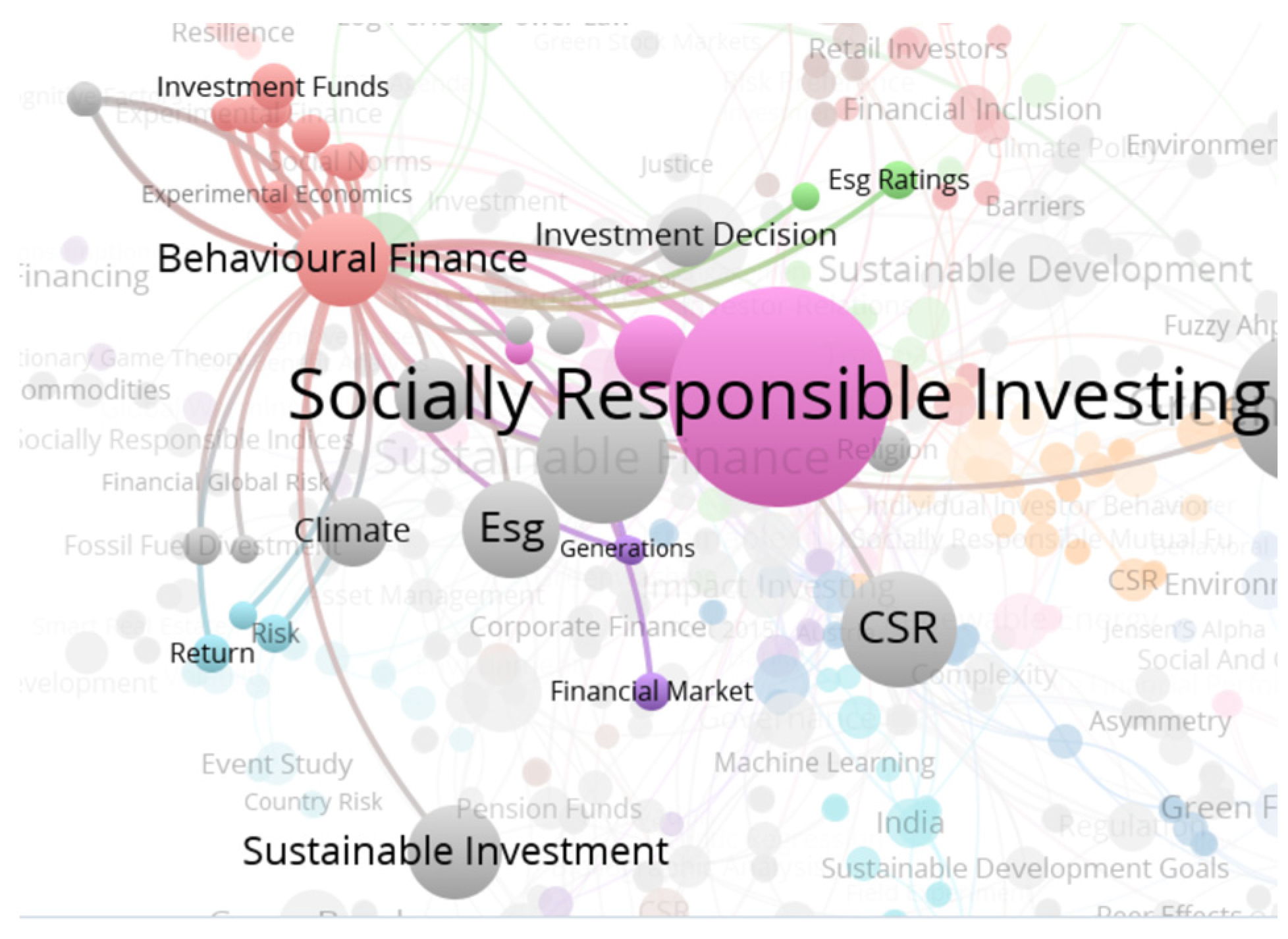

3.1.5. Co-Occurrence Analysis

3.1.6. Authors’ Analysis

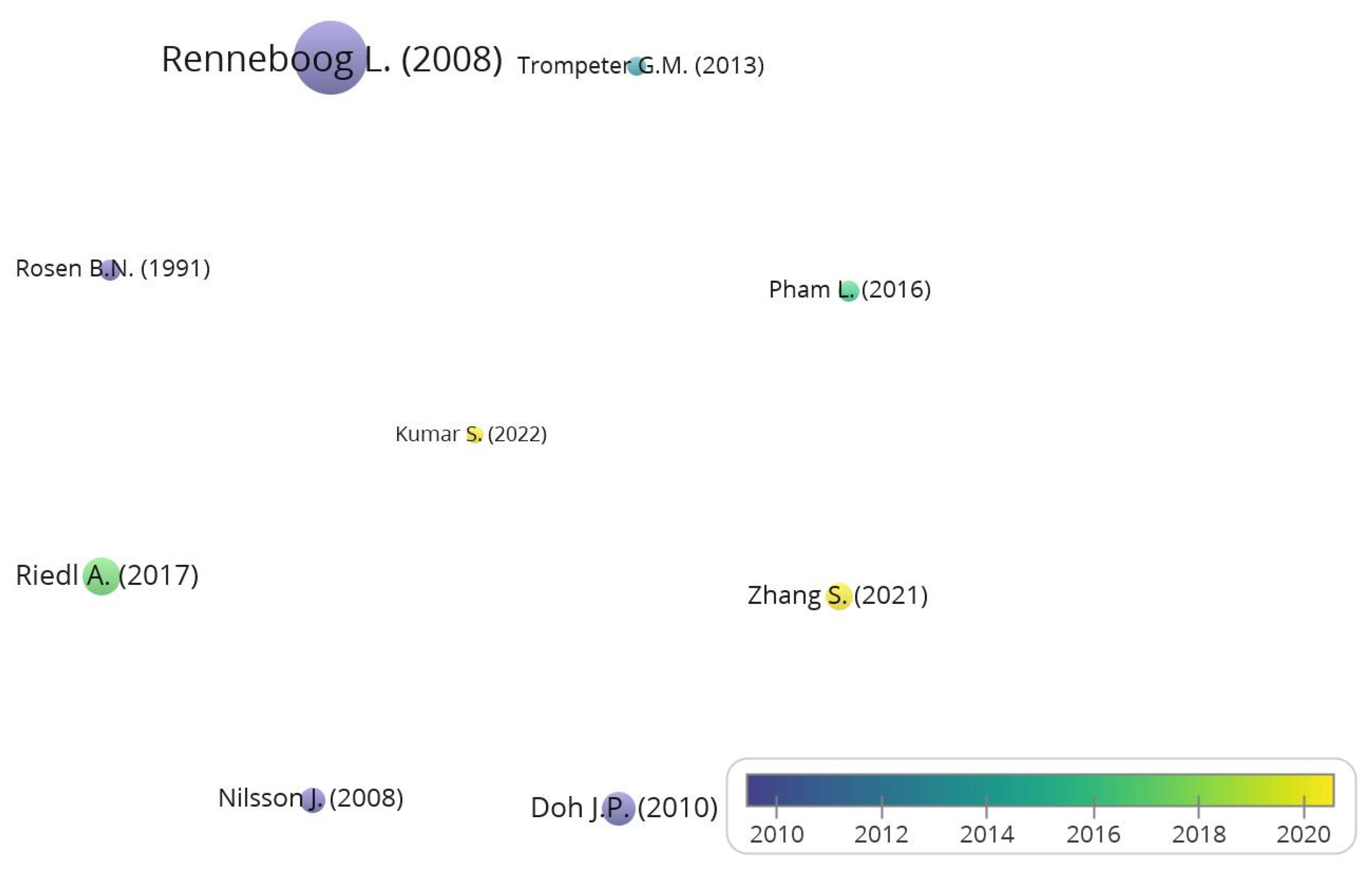

3.1.7. Most Cited Articles

3.2. Bibliometric Analysis Using WOS and SciMAT

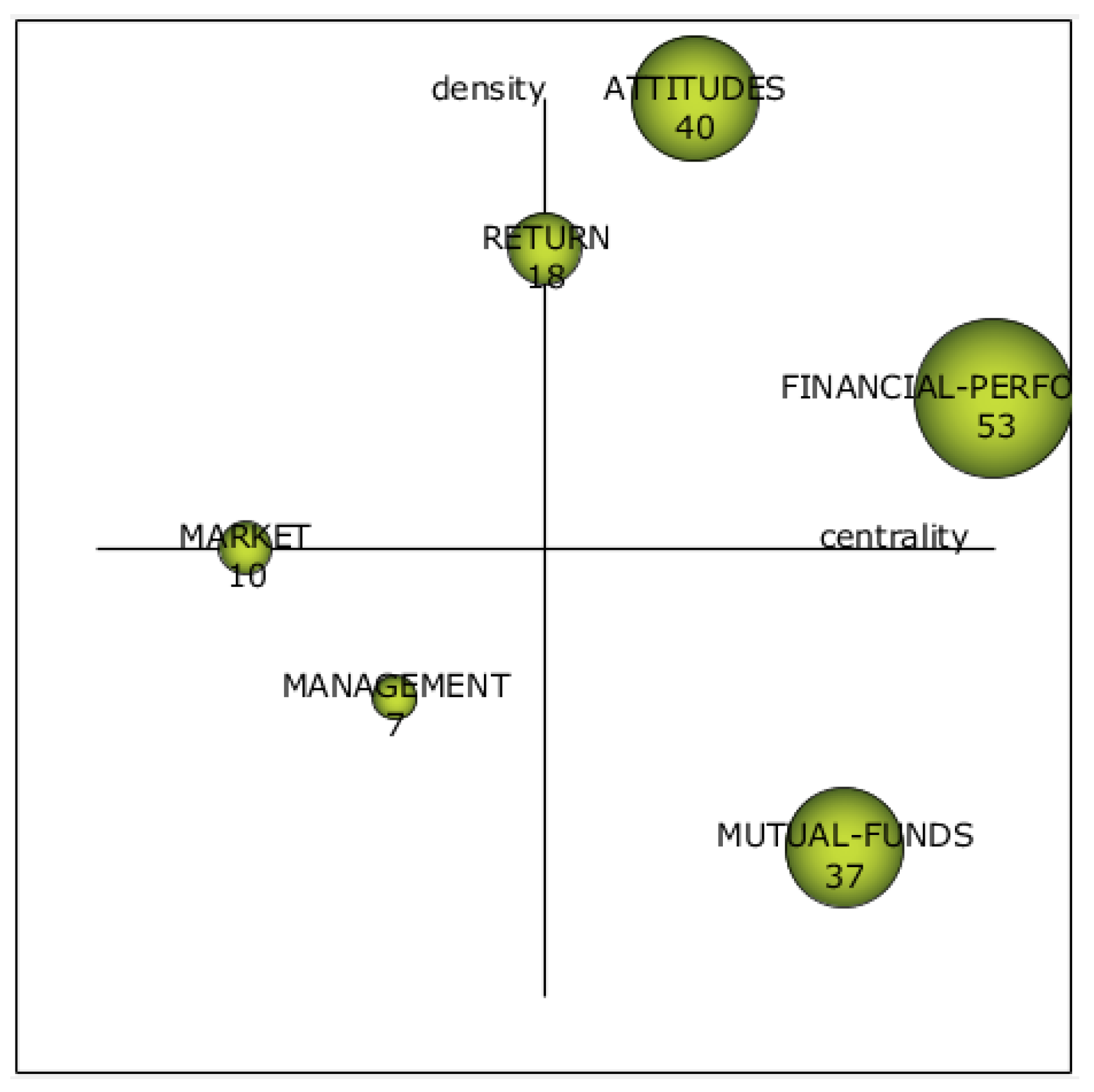

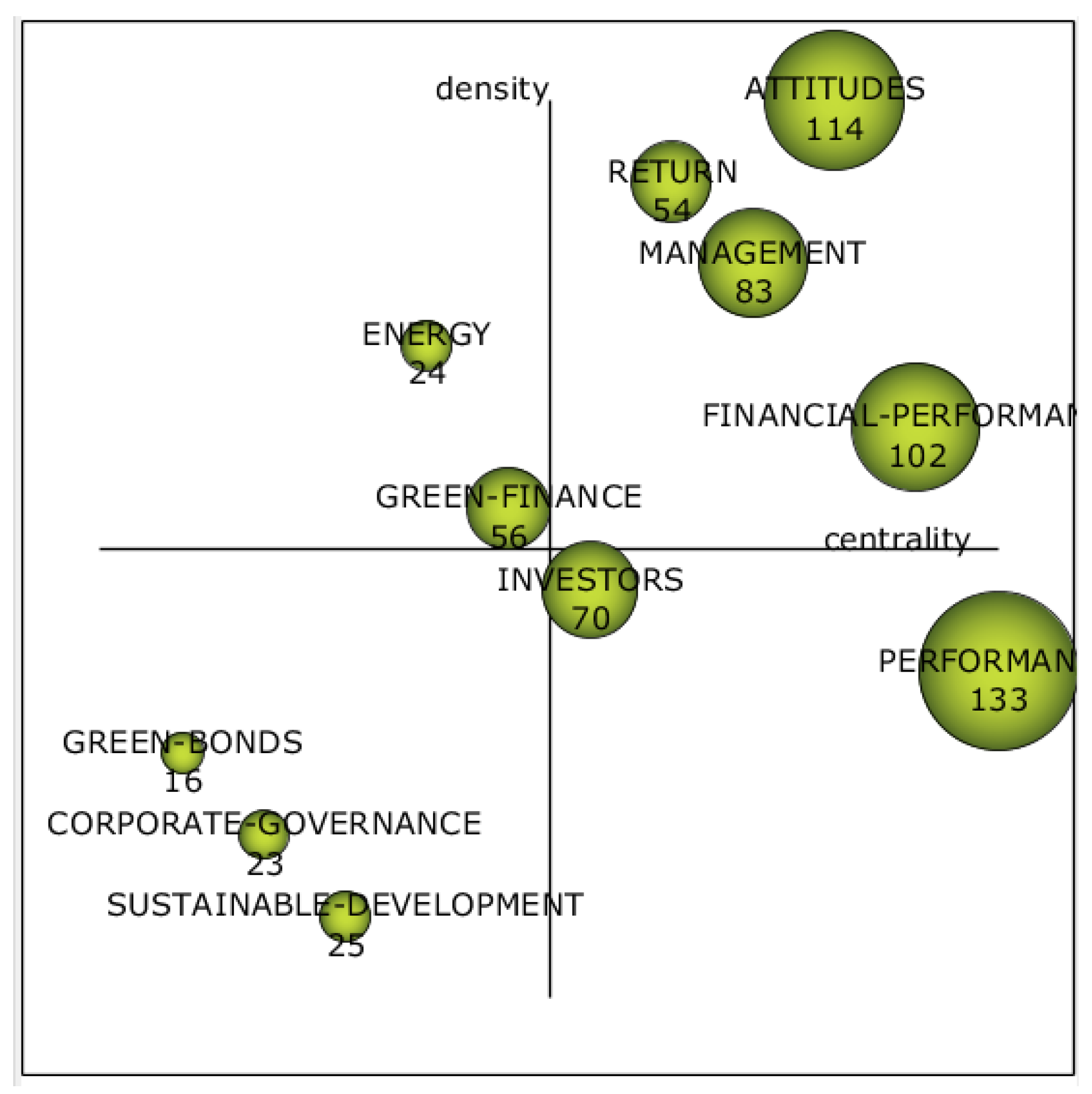

3.2.1. Visualization of Themes and Thematic Networks

3.2.2. Thematic Networks: Evolution of the Themes

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abdul-Muhmin, A. G. (2008). Consumer attitudes towards debt in an islamic country: Managing a conflict between religious tradition and modernity? International Journal of Consumer Studies, 32(3), 194–203. [Google Scholar] [CrossRef]

- Abhayawansa, S., & Mooneeapen, O. (2022). Directions for future research to steer environmental, social and governance (ESG) investing to support sustainability: A systematic literature review. In C. A. Adamas (Ed.), Handbook of accounting and sustainability (pp. 318–341). Edward Elgar Publishing. [Google Scholar] [CrossRef]

- Agrawal, A., & Hockerts, K. (2021). Impact investing: Review and research agenda. Journal of Small Business and Entrepreneurship, 33(2), 153–181. [Google Scholar] [CrossRef]

- Aldowaish, A., Kokuryo, J., Almazyad, O., & Goi, H. C. (2022). Environmental, social, and governance integration into the business model: Literature review and research agenda. Sustainability, 14(5), 2959. [Google Scholar] [CrossRef]

- Bauer, R., Ruof, T., & Smeets, P. (2018). Get real! Individuals prefer more sustainable investments. The Review of Financial Studies, 34(8), 3976–4043. [Google Scholar] [CrossRef]

- Beisenbina, M., Fabregat-Aibar, L., Barberà-Mariné, M. G., & Sorrosal-Forradellas, M. T. (2023). The burgeoning field of sustainable investment: Past, present and future. Sustainable Development, 31(2), 649–667. [Google Scholar] [CrossRef]

- Berg, L. (2008). Loyalty, naivety and powerlessness among Norwegian retail bank customers. International Journal of Consumer Studies, 32(3), 222–232. [Google Scholar] [CrossRef]

- Börner, K., Chen, C., & Boyack, K. W. (2003). Visualizing knowledge domains. Annual Review of Information Science and Technology, 37, 179–255. [Google Scholar] [CrossRef]

- Broadus, R. N. (1987). Toward a definition of “bibliometrics”. Scientometrics, 12(5–6), 373–379. [Google Scholar] [CrossRef]

- Cahlik, T. (2000). Comparison of the maps of science. Scientometrics, 49, 373–387. [Google Scholar] [CrossRef]

- Callon, M., Courtial, J. P., & Laville, F. (1991). Co-word analysis as a tool for describing the network of interactions between basic and technological research: The case of polymer chemistry. Scientometrics, 22, 155–205. [Google Scholar] [CrossRef]

- Chiţimiea, A., Minciu, M., Manta, A. M., Ciocoiu, C. N., & Veith, C. (2021). The drivers of green investment: A bibliometric and systematic review. Sustainability, 13(6), 3507. [Google Scholar] [CrossRef]

- Cobo, M. J., Lõpez-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2012). SciMAT: A new science mapping analysis software tool. Journal of the American Society for Information Science and Technology, 63(8), 1609–1630. [Google Scholar] [CrossRef]

- De Carlos Fraile, L., Crespo-Cebada, E., Mirón-Sanguino, Á. S., & Díaz-Caro, C. (2023). Is investor behavior on sustainable products heterogeneous? The case of Spanish investors on investment in SGDs. Economics and Business Letters, 12(2), 115–120. [Google Scholar] [CrossRef]

- Delle Foglie, A., & Keshminder, J. S. (2024). Challenges and opportunities of SRI sukuk toward financial system sustainability: A bibliometric and systematic literature review. International Journal of Emerging Markets, 19(10), 3202–3225. [Google Scholar] [CrossRef]

- De Moya-Anegón, F., Chinchilla-Rodríguez, Z., Corera-Álvarez, E., González-Molina, A., López-Illescas, C., & Vargas-Quesada, B. (2013). Principales indicadores bibliométricos de la actividad científica española: 2010. Informe 2013. Fundación Española para la Ciencia y la Tecnología. [Google Scholar]

- De Solla Price, D. J. (1965). Networks of scientific papers. Science, 149(3683), 510–515. [Google Scholar] [CrossRef]

- Dervi, U. D., Khan, A., Saba, I., Hassan, M. K., & Paltrinieri, A. (2022). Green and socially responsible finance: Past, present and future. Managerial Finance, 48(8), 1250–1278. [Google Scholar] [CrossRef]

- Dhayal, K. S., Giri, A. K., Esposito, L., & Agrawal, S. (2023). Mapping the significance of green venture capital for sustainable development: A systematic review and future research agenda. Journal of Cleaner Production, 396, 136489. [Google Scholar] [CrossRef]

- Doh, J. P., Howton, S. D., Howton, S. W., & Siegel, D. S. (2010). Does the market respond to an endorsement of social responsibility? The role of institutions, information, and legitimacy. Journal of Management, 36(6), 1461–1485. [Google Scholar] [CrossRef]

- Erasmus, A. C., & Mathunjwa, G. Q. (2011). Idiosyncratic use of credit facilities by consumers in an emerging economy. International Journal of Consumer Studies, 35(3), 359–371. [Google Scholar] [CrossRef]

- Ertz, M., & Sarigöllü, E. (2022). Consumer intentions to use collaborative economy platforms: A meta-analysis. International Journal of Consumer Studies, 46(5), 1859–1876. [Google Scholar] [CrossRef]

- Fan, J. H., Omura, A., & Roca, E. (2022). An industry-guided review of responsible investing: Bridging the divide between academia and industry. Journal of Cleaner Production, 354, 131685. [Google Scholar] [CrossRef]

- Folqué, M., Escrig-Olmedo, E., & Corzo Santamaría, M. T. (2023). Contribution of sustainable investment to sustainable development within the framework of the SDGS: The role of the asset management industry. Sustainability Accounting, Management and Policy Journal, 14(5), 1075–1100. [Google Scholar] [CrossRef]

- Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance and Investment, 5(4), 210–233. [Google Scholar] [CrossRef]

- Gutsche, G., & Ziegler, A. (2019). Which private investors are willing to pay for sustainable investments? Empirical evidence from stated choice experiments. Journal of Banking & Finance, 102, 193–214. [Google Scholar] [CrossRef]

- Halisçelik, E., & Soytas, M. A. (2019). Sustainable development from millennium 2015 to sustainable development goals 2030. Sustainable Development, 27(4), 545–572. [Google Scholar] [CrossRef]

- Hamilton, S., Jo, H., & Statman, M. (1993). Doing well while doing good? The investment performance of socially responsible mutual funds. Financial Analysts Journal, 49(6), 62–66. [Google Scholar] [CrossRef]

- Hidalgo-Oñate, D., Fuertes-Fuertes, I., & Cabedo, J. D. (2023). Climate-related prudential regulation tools in the context of sustainable and responsible investment: A systematic review. Climate Policy, 23(6), 704–721. [Google Scholar] [CrossRef]

- Islam, S. M. (2022). Impact investing in social sector organisations: A systematic review and research agenda. Accounting and Finance, 62(1), 709–737. [Google Scholar] [CrossRef]

- Kim, C. S. (2019). Can socially responsible investments be compatible with financial performance? A meta-analysis. Asia-Pacific Journal of Financial Studies, 48(1), 30–64. [Google Scholar] [CrossRef]

- Kumar, S., Sharma, D., Rao, S., Lim, W. M., & Mangla, S. K. (2022). Past, present, and future of sustainable finance: Insights from big data analytics through machine learning of scholarly research. Annals of Operations Research, 345, 1061–1104. [Google Scholar] [CrossRef]

- Lagerkvist, C. J., Edenbrandt, A. K., Tibbelin, I., & Wahlstedt, Y. (2020). Preferences for sustainable and responsible equity funds—A choice experiment with Swedish private investors. Journal of Behavioral and Experimental Finance, 28, 100406. [Google Scholar] [CrossRef]

- Landi, G., & Sciarelli, M. (2019). Towards a more ethical market: The impact of ESG rating on corporate financial performance. Social Responsibility Journal, 15(1), 11–27. [Google Scholar] [CrossRef]

- Lewis, A., & Cullis, J. (1990). Ethical investments: Preferences and morality. Journal of Behavioral Economics, 19(4), 395–411. [Google Scholar] [CrossRef]

- MacAskill, S., Roca, E., Liu, B., Stewart, R. A., & Sahin, O. (2021). Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. Journal of Cleaner Production, 280(2), 124491. [Google Scholar] [CrossRef]

- Marín-Rodríguez, N. J., González-Ruiz, J. D., & Botero Botero, S. (2022). Dynamic co-movements among oil prices and financial assets: A scientometric analysis. Sustainability, 14(19), 12796. [Google Scholar] [CrossRef]

- Masih, M., Kamil, N. K. M., & Bacha, O. I. (2018). Issues in Islamic equities: A literature survey. Emerging Markets Finance and Trade, 54(1), 1–26. [Google Scholar] [CrossRef]

- McGregor, S. (2005). Structural adjustment programmes and human well-being. International Journal of Consumer Studies, 29(3), 170–180. [Google Scholar] [CrossRef]

- McGregor, S. L. T. (2002). Home economists’ perceptions of international development. International Journal of Consumer Studies, 26(4), 303–312. [Google Scholar] [CrossRef]

- Mehta, P., Singh, M., & Mittal, M. (2020). It is not an investment if it is destroying the planet: A literature review of socially responsible investments and proposed conceptual framework. Management of Environmental Quality: An International Journal, 31(2), 307–329. [Google Scholar] [CrossRef]

- Mirón Sanguino, Á. S., Crespo-Cebada, E., Muñoz-Muñoz, E., & Díaz-Caro, C. (2024). Working capital: Development of the field through scientific mapping: An updated review. Administrative Sciences, 14(4), 67. [Google Scholar] [CrossRef]

- Mirón-Sanguino, Á. S., & Díaz-Caro, C. (2022). The agricultural cooperative as an instrument for economic development: An approach from Spanish investors’ preferences through a choice experiment. Agronomy, 12(3), 560. [Google Scholar] [CrossRef]

- Mishra, A. K., Bansal, R., Maurya, P. K., Kar, S. K., & Bakshi, P. K. (2023). Predicting the antecedents of consumers’ intention toward purchase of mutual funds: A hybrid PLS-SEM-neural network approach. International Journal of Consumer Studies, 47(2), 563–587. [Google Scholar] [CrossRef]

- Mittal, R. K., Sinha, N., & Aggarwal, M. K. (2021). Evolutionary issues in social impact investment: A literature review. Review of Professional Management, 19(1), 24–43. [Google Scholar]

- Mukherjee, D., Lim, W. M., Kumar, S., & Donthu, N. (2022). Guidelines for advancing theory and practice through bibliometric research. Journal of Business Research, 148, 101–115. [Google Scholar] [CrossRef]

- Muñoz-Muñoz, E., Crespo-Cebada, E., Mirón-Sanguino, A. S., & Díaz-Caro, C. (2025). Investors personality correlates with sustainability preferences in investment—A choice experiment with Spanish investors. Journal of Behavioral and Experimental Economics, 114, 102332. [Google Scholar] [CrossRef]

- Nicolaisen, J., & Hjørland, B. (2007). Practical potentials of Bradford’s law: A critical examination of the received view. Journal of Documentation, 63(3), 359–377. [Google Scholar] [CrossRef]

- Nilsson, J. (2008). Investment with a conscience: Examining the impact of pro-social attitudes and perceived financial performance on socially responsible investment behaviour. Journal of Business Ethics, 83, 307–325. [Google Scholar] [CrossRef]

- Palmatier, R. W., Houston, M. B., & Hulland, J. (2018). Review articles: Purpose, process, and structure. Journal of the Academy of Marketing Science, 46(1), 1–5. [Google Scholar] [CrossRef]

- Park, J. (2009). Sustainable consumption and the financial sector: Analysing the markets for responsible investment in Hong Kong and Japan. International Journal of Consumer Studies, 33(2), 206–214. [Google Scholar] [CrossRef]

- Patterson, Z., & McEachern, M. G. (2018). Financial service providers: Does it matter if banks don’t behave ethically? International Journal of Consumer Studies, 42(5), 489–500. [Google Scholar] [CrossRef]

- Paul, J., & Benito, G. R. G. (2018). A review of research on outward foreign direct investment from emerging countries, including China: What do we know, how do we know and where should we be heading? Asia Pacific Business Review, 24(1), 90–115. [Google Scholar] [CrossRef]

- Paul, J., & Criado, A. R. (2020). The art of writing literature review: What do we know and what do we need to know? International Business Review, 29(4), 101717. [Google Scholar] [CrossRef]

- Pham, L. (2016). Is it risky to go green? A volatility analysis of the green bond market. Journal of Sustainable Finance & Investment, 6(4), 263–291. [Google Scholar] [CrossRef]

- Poyser, A., & Daugaard, D. (2023). Indigenous sustainable finance as a research field: A systematic literature review on indigenising ESG, sustainability and indigenous community practices. Accounting and Finance, 63(1), 47–76. [Google Scholar] [CrossRef]

- Prakash, N., & Sethi, M. (2022). A review of innovative bond instruments for sustainable development in Asia. International Journal of Innovation Science, 14(3–4), 630–647. [Google Scholar] [CrossRef]

- Rahman, M., Isa, C. R., Dewandaru, G., Hanifa, M. H., Chowdhury, N. T., & Sarker, M. (2020). Socially responsible investment sukuk (Islamic bond) development in Malaysia. Qualitative Research in Financial Markets, 12(4), 599–619. [Google Scholar] [CrossRef]

- Renneboog, L., Ter Horst, J., & Zhang, C. (2008). Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking and Finance, 32(9), 1723–1742. [Google Scholar] [CrossRef]

- Riedl, A., & Smeets, P. (2017). Why do investors hold socially responsible mutual funds? The Journal of Finance, 72(6), 2505–2550. [Google Scholar] [CrossRef]

- Romero-Pérez, I., & Pulido-Rojano, A. (2018). Aplicaciones del método de análisis de palabras asociadas (Co-Words). In J. H. Avila-Toscano (Ed.), Cienciometría y bibliometría. El estudio de la producción científica (pp. 147–194). Corporación Universitaria Reformada. [Google Scholar]

- Rosado-Serrano, A., Paul, J., & Dikova, D. (2018). International franchising: A literature review and research agenda. Journal of Business Research, 85, 238–257. [Google Scholar] [CrossRef]

- Rosen, B. N., Sandler, D. M., & Shani, D. (1991). Social issues and socially responsible investment behaviour: A preliminary empirical Investigation. Journal of Consumer Affairs, 25(2), 221–234. [Google Scholar] [CrossRef]

- Ruggeri, G., Orsi, L., & Corsi, S. (2019). A bibliometric analysis of the scientific literature on fairtrade labelling. International Journal of Consumer Studies, 43(2), 134–152. [Google Scholar] [CrossRef]

- Singhania, M., Chadha, G., & Prasad, R. (2023). Sustainable finance research: Review and agenda. International Journal of Finance & Economics, 29(4), 4010–4045. [Google Scholar] [CrossRef]

- Trompeter, G. M., Carpenter, T. D., Desai, N., Jones, K. L., & Riley, R. A., Jr. (2013). A synthesis of fraud-related research. Auditing: A Journal of Practice & Theory, 32(1), 287–321. [Google Scholar] [CrossRef]

- van Eck, N. J., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. [Google Scholar] [CrossRef] [PubMed]

- Van Raan, A. F. J. (2005). For your citations only? Hot topics in bibliometric analysis. Measurement: Interdisciplinary Research and Perspectives, 3(1), 50–62. [Google Scholar] [CrossRef]

- Voguel, R., Gobel, M., Grewe-Salfeld, M., Hertbert, B., Matsuo, Y., & Weber, C. (2021). Cross-sector partnerships: Mapping the field and advancing an institutional approach. International Journal of Management Reviews, 24(3), 394–414. [Google Scholar] [CrossRef]

- Waseem, N., & Kota, S. (2017). Sustainability definitions—an analysis. In A. Chakrabarti, & D. Chakrabarti (Eds.), Research into design for communities, volume 2. ICoRD 2017. Smart innovation, systems and technologies (Vol. 66, pp. 361–371). Springer. [Google Scholar] [CrossRef]

- Xiao, J., Yang, Z., Li, Z., & Chen, Z. (2023). A review of social roles in green consumer behaviour. International Journal of Consumer Studies, 47(6), 2033–2070. [Google Scholar] [CrossRef]

- Zhang, S., Wu, Z., Wang, Y., & Hao, Y. (2021). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. Journal of Environmental Management, 296, 113159. [Google Scholar] [CrossRef]

| Source | Documents | Citations |

|---|---|---|

| Sustainability (Switzerland) | 43 | 494 |

| Journal of Cleaner Production | 15 | 413 |

| Journal of Sustainable Finance and Investment | 14 | 289 |

| Journal of Business Ethics | 11 | 500 |

| Resources Policy | 8 | 56 |

| Energy Economics | 7 | 116 |

| Managerial Finance | 6 | 79 |

| Journal of Banking and Finance | 6 | 1005 |

| Critical Studies on Corporate Responsibility, Governance and Sustainability | 6 | 16 |

| Environmental Science and Pollution Research | 5 | 73 |

| Authors | Title | Citations | Year | Source |

|---|---|---|---|---|

| (Renneboog et al., 2008) | Socially responsible investments: Institutional aspects, performance, and investor behavior | 874 | 2008 | Journal of Banking and Finance |

| (Riedl & Smeets, 2017) | Why do investors hold socially responsible mutual funds? | 335 | 2017 | Journal of Finance |

| (Doh et al., 2010) | Does the market respond to an endorsement of social responsibility? The role of institutions, information, and legitimacy | 292 | 2010 | Journal of Management |

| (Zhang et al., 2021) | Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China | 216 | 2021 | Journal of Environmental Management |

| (Nilsson, 2008) | Investment with a conscience: Examining the impact of pro-social attitudes and perceived financial performance on socially responsible investment behaviour | 190 | 2008 | Journal of Business Ethics |

| (Pham, 2016) | Is it risky to go green? A volatility analysis of the green bond market | 147 | 2016 | Journal of Sustainable Finance and Investment |

| (Rosen et al., 1991) | Social issues and socially responsible investment behaviour: A preliminary empirical investigation | 144 | 1991 | Journal of Consumer Affairs |

| (Trompeter et al., 2013) | A synthesis of fraud-related research | 134 | 2013 | Auditing |

| (Kumar et al., 2022) | Past, present, and future of sustainable finance: insights from big data analytics through machine learning of scholarly research | 100 | 2022 | Annals of Operations Research |

| (Landi & Sciarelli, 2019) | Towards a more ethical market: the impact of ESG rating on corporate financial performance | 96 | 2019 | Social Responsibility Journal |

| Period | Documents | Keywords |

|---|---|---|

| All | 335 | 1678 |

| 2020–2024 | 219 | 1249 |

| Until 2019 | 116 | 643 |

| Themes | Centrality | Centrality Range | Density | Density Range |

|---|---|---|---|---|

| Return | 1.09 | 0.50 | 24.69 | 0.83 |

| Financial performance | 105.41 | 1.00 | 17.67 | 0.67 |

| Attitudes | 7.59 | 0.67 | 30.45 | 1.00 |

| Mutual funds | 47.81 | 0.83 | 9.86 | 0.17 |

| Market | 11.29 | 0.17 | 17.20 | 0.50 |

| Management | 11.44 | 0.33 | 14.26 | 0.33 |

| Table | Centrality | Centrality Range | Density | Density Range |

|---|---|---|---|---|

| Attitudes | 51.16 | 0.57 | 15.26 | 0.86 |

| Management | 41.35 | 0.43 | 9.84 | 0.43 |

| Financial performance | 66.21 | 0.86 | 15.73 | 1.00 |

| Performance | 69.60 | 1.00 | 10.37 | 0.57 |

| Green finance | 35.24 | 0.29 | 5.43 | 0.29 |

| Investment | 54.86 | 0.71 | 5.17 | 0.14 |

| Themes | Centrality | Centrality Range | Density | Density Range |

|---|---|---|---|---|

| Attitudes | 70.62 | 0.82 | 14.3 | 1.00 |

| Return | 43.65 | 0.64 | 11.9 | 0.91 |

| Management | 54.8 | 0.73 | 9.28 | 0.82 |

| Performance | 88.97 | 1.00 | 5.94 | 0.36 |

| Financial performance | 72.35 | 0.91 | 8.21 | 0.64 |

| Green finance | 30.55 | 0.45 | 7.03 | 0.55 |

| Investors | 33.97 | 0.55 | 6.55 | 0.45 |

| Energy | 12.62 | 0.36 | 8.46 | 0.73 |

| Green bonds | 5.11 | 0.09 | 5.83 | 0.27 |

| Corporate governance | 9.66 | 0.18 | 4.60 | 0.18 |

| Sustainable development | 10.59 | 0.27 | 4.09 | 0.09 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muñoz-Muñoz, E.; Crespo-Cebada, E.; Corchado, J.C.; Diaz-Caro, C. Behavior and Sustainable Finance: A Bibliometric Approach. Adm. Sci. 2025, 15, 270. https://doi.org/10.3390/admsci15070270

Muñoz-Muñoz E, Crespo-Cebada E, Corchado JC, Diaz-Caro C. Behavior and Sustainable Finance: A Bibliometric Approach. Administrative Sciences. 2025; 15(7):270. https://doi.org/10.3390/admsci15070270

Chicago/Turabian StyleMuñoz-Muñoz, Elena, Eva Crespo-Cebada, José C. Corchado, and Carlos Diaz-Caro. 2025. "Behavior and Sustainable Finance: A Bibliometric Approach" Administrative Sciences 15, no. 7: 270. https://doi.org/10.3390/admsci15070270

APA StyleMuñoz-Muñoz, E., Crespo-Cebada, E., Corchado, J. C., & Diaz-Caro, C. (2025). Behavior and Sustainable Finance: A Bibliometric Approach. Administrative Sciences, 15(7), 270. https://doi.org/10.3390/admsci15070270