1. Introduction

South Africa’s local municipalities have been in the spotlight in recent decades for financial mismanagement, maladministration and poor service delivery. According to the audit outcomes contained in the 2021 state of local governance finances and financial management report, most local municipalities were in a dire financial position. The same report indicates that 25 municipalities could not provide sufficient documentation for the financial information disclosed in their financial statements, while irregular expenditure stood at R21.9 billion in 2020/21. This maladministration has, in most instances, culminated in poor service delivery. In 2021, for instance, and for the first time in a democratic South Africa, the High Court had to intervene in one of the financially distressed municipalities following what the Auditor General’s 2020/21 report described as a service delivery crisis in the municipality. As of 30 June 2021, 38 municipalities were under some intervention either through mandatory or discretionary, in terms of Section 139 of the Constitution, which empowers provincial executives to intervene in municipalities that fail to fulfill their constitutional or legislative obligations, including approving budgets or providing basic services.

Despite the policy relevance of this maladministration, very few empirical studies have paid attention to the cost management of local municipalities and its effect on service delivery. The majority of the existing studies have qualitatively explored challenges facing local municipalities without necessarily quantifying cost efficiency and its effect on service delivery. These studies include

Kanyane (

2014),

Laubscher (

2012), and more recently

Mamokhere and Thusi (

2024),

Mashabela and Thusi (

2024),

Mamokhere (

2024) and

Ralinala et al. (

2024). The few available studies that have quantified the efficiency of local municipalities in utilizing public resources include

Monkam (

2014) and

Adedeji Amusa and Fadiran (

2024). While these studies provide valuable insights into the efficient use of public resources by municipalities, they do not explicitly focus on cost efficiency, defined as the ability of local municipalities to deliver basic services at the minimum cost.

The current study therefore differs from these studies by measuring the cost inefficiency of local municipalities and estimating its effect on service delivery. The specific aim of the study is to measure the level of cost inefficiency across municipalities and establish its impact on service delivery with a specific focus on water and refuse collection. The primary objective is to understand the extent to which cost inefficiency of municipalities culminates in poor service delivery. The research hypothesis raised in this study is that municipalities characterised by wasteful expenditure are associated with poor service delivery. The empirical evidence is drawn from four local municipalities belonging to the Frances Baard District of the Northern Cape province of South Africa, where concerns of financial mismanagement and poor service delivery have been raised in recent years. Filling this empirical gap is important considering that cost inefficiency in local municipalities has direct implications for public sector accountability, optimum allocation of public resources, and service delivery outcomes. In a context where municipalities face increasing fiscal pressure and public dissatisfaction due to poor service provision, quantifying cost inefficiency allows for evidence-based interventions that target the root causes of wasteful expenditure. In addition, unlike qualitative and explorative studies, an empirical approach provides measurable benchmarks that can inform policy decisions and performance monitoring from a perspective of local governance. By explicitly linking cost inefficiency to service delivery outcomes, this study has the potential to guide reforms aimed at achieving the constitutional and policy mandates of efficient and equitable local governance.

The study contributes to the body of knowledge by exclusively focusing on local municipalities situated in a desert economy. The study area is particularly located in a dry region where economic activity is heavily concentrated in diamond mining. This provides an interesting case as local governments in such areas face a dual challenge of managing the volatility of commodity-dependent revenue streams and navigating the governance complexities that accompany rent-seeking behaviors endemic to resource-rich contexts. Frances Baard particularly exemplifies a broader phenomenon observed in resource-dependent economies where local governments often struggle to balance fiscal stability with the provision of essential services. Price shocks in commodity markets often erode municipal revenues, exacerbating inefficiencies in service delivery. Understanding how these dynamics play out in the Northern Cape, where weather conditions further complicate economic certainty, potentially sheds light on broader governance challenges faced by municipalities in similar economic settings. The literature additionally highlights the governance challenges affecting municipalities in mining regions where local elites may capture public resources and distort expenditure patterns, which undermines cost efficiency. While the findings are geographically specific, they carry broader implications for Sub-Saharan Africa, where several municipalities grapple with the governance challenges associated with resource dependency and volatility of fiscal revenues.

Using stochastic frontier analysis, the study finds that, on average, municipalities spent 17.23% more than the minimum cost required to deliver existing services, while service delivery performance—specifically in water provision and refuse collection—was 23% below its potential. The analysis identifies high operating costs and spending on contracted services as the main drivers of cost inefficiency, which in turn contributed to poor service delivery outcomes. In light of these findings, the study recommends that municipalities reduce non-essential expenditures such as entertainment and travel allowances and enhance accountability in the management of contracted services.

The remainder of the study is structured as follows.

Section 2 provides theoretical and empirical literature.

Section 3 outlines the materials and methods used, including the data sources, variables, and the stochastic frontier analysis technique employed to estimate cost and service delivery inefficiency.

Section 4 presents and interprets the empirical results, highlighting key findings on expenditure patterns and service delivery outcomes.

Section 5 provides a discussion of the results, linking the empirical evidence to the existing literature and South Africa’s local governance landscape.

Section 6 provides limitations of the study, while

Section 7 concludes the study, offers policy recommendations, and suggests directions for future research.

3. Materials and Methods

This section provides the methodology of the study. It starts by describing and justifying the study area as well as the measurement of key variables before specifying the empirical models and justifying the estimation strategy.

3.1. Study Area

South Africa’s system of local government comprises 257 municipalities that fall into three categories in terms of the Constitution: Category A (metropolitan municipalities), which have exclusive municipal executive and legislative authority in their areas; Category B (local municipalities), which share authority with district municipalities; and Category C (district municipalities), which coordinate development and service delivery across multiple local municipalities. Local municipalities, particularly those in smaller towns and rural areas, are often faced with persistent challenges related to financial management and efficient service provision. This study focuses on Category B municipalities within the Frances Baard District, aiming to assess the extent of cost inefficiency and its implications for service delivery outcomes with a specific focus on water provision and refuse collection. The Frances Baard District is purposefully selected due to its economic and administrative significance, as it is home to Kimberley, the provincial capital of the Northern Cape.

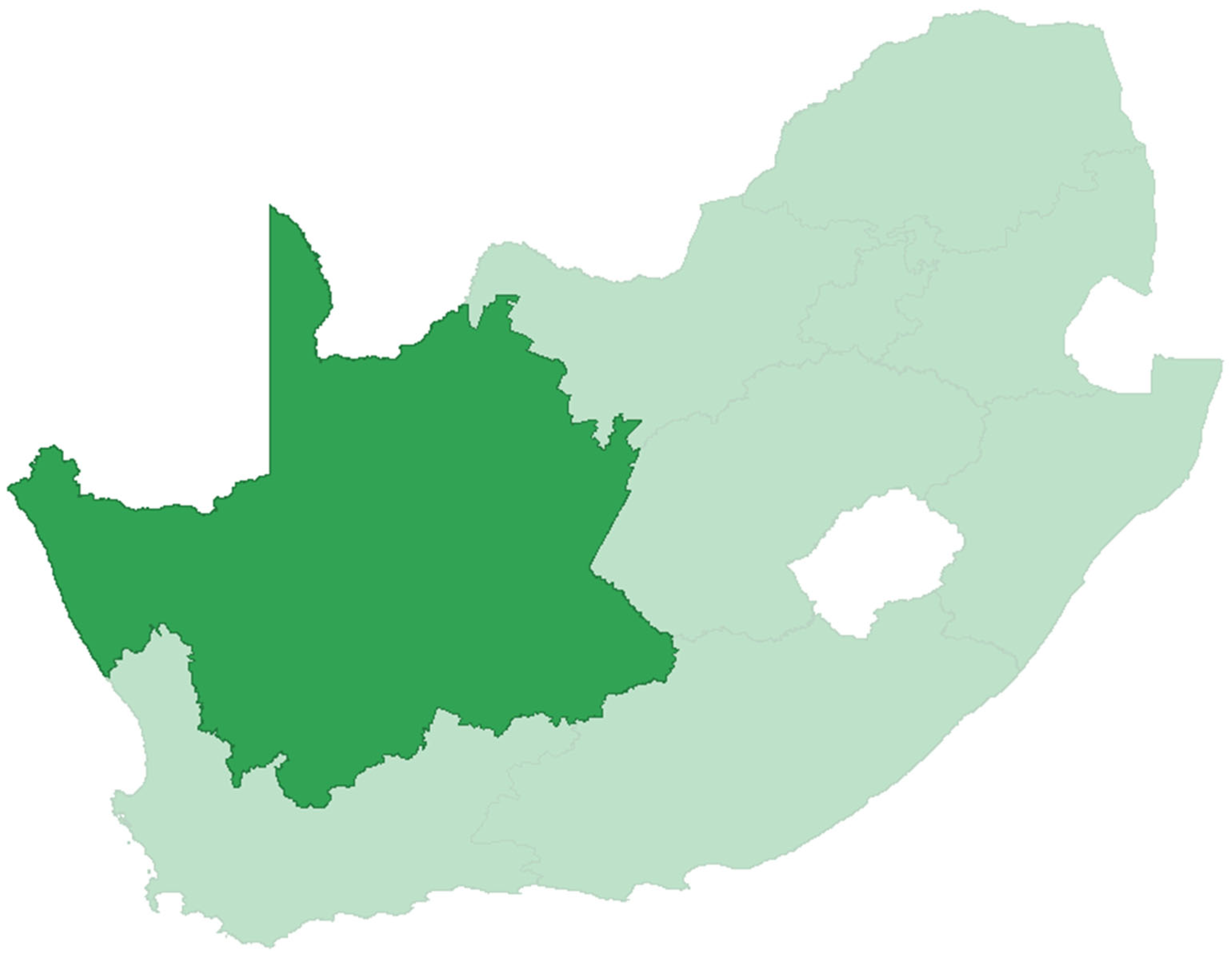

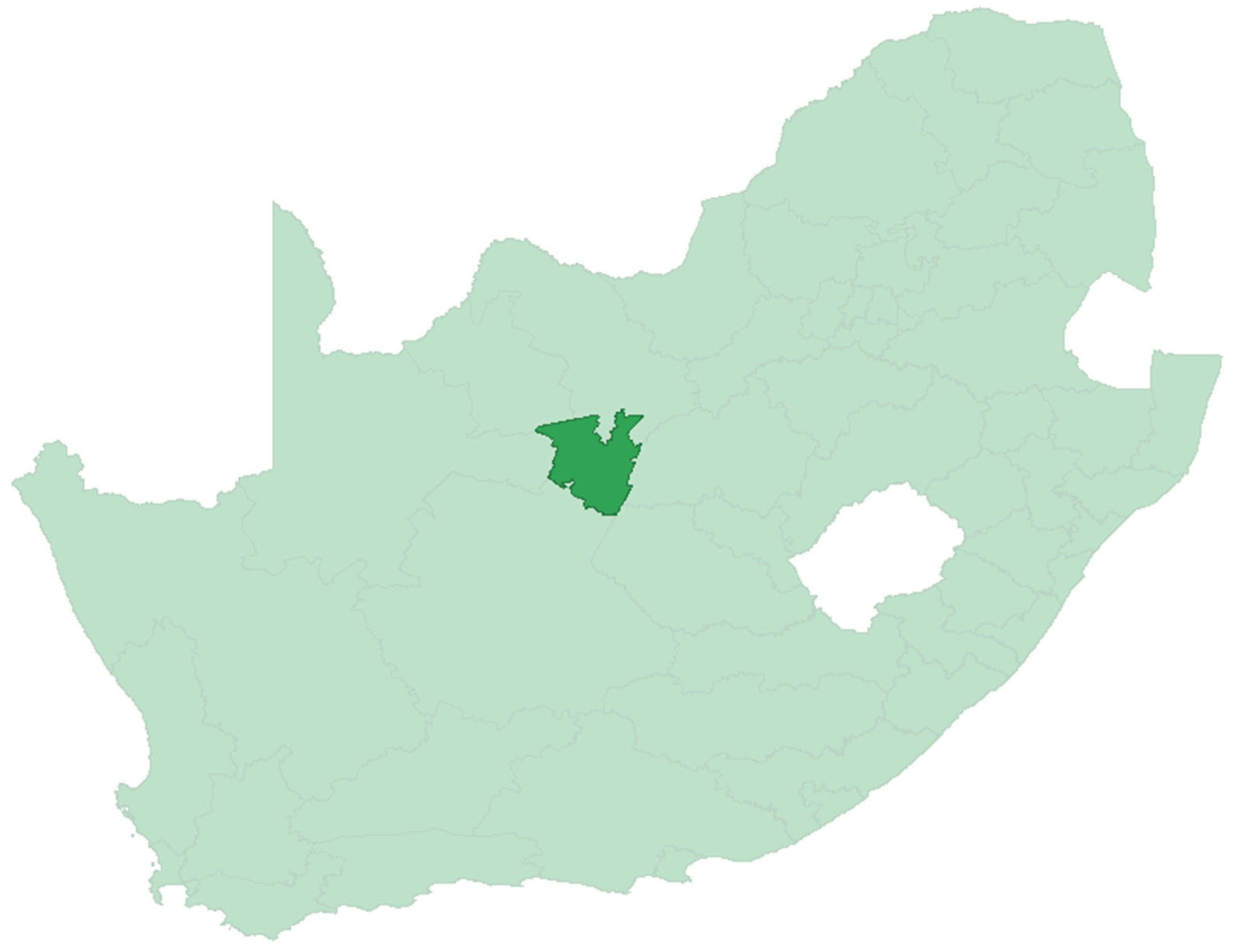

Figure 1 and

Figure 2 show the provincial and district demarcations of South Africa, respectively. In

Figure 1, the Northern Cape is represented by the dark green colour. In

Figure 2, Frances Baard, situated in the Northern Cape province, is similarly represented by the dark green colour.

The selection of municipalities in the Northern Cape Province is a deliberate choice based on structural economic characteristics and governance dynamics that typify resource-dependent, desert economies. The Northern Cape is a dry province known for its diamond mines. In regions where diamond mining constitutes the primary economic activity, municipal revenue generation is inextricably linked to exogenous commodity price shocks. This dependence introduces fiscal vulnerabilities as fluctuations in commodity prices can rapidly destabilize local revenue streams, undermining the financial base necessary for cost-effective service delivery. In particular, Frances Baard, being a major diamond-mining region, is characterized by cyclical booms and busts driven by global market demand and geopolitical factors. This cyclical nature creates unique governance challenges as municipalities ought to navigate periods of resource windfalls and revenue contractions. Such volatility, coupled with limited economic diversification, makes this region unique and interesting for modelling municipal cost inefficiencies and establishing their impact on service delivery.

In addition, mining regions often operate within governance frameworks that are particularly susceptible to rent-seeking behavior, where those in power may have disproportionate influence over resource allocation, distorting expenditure patterns and exacerbating cost inefficiencies. In other words, the study area’s fiscal dependence on a volatile mining sector and institutional weaknesses that often accompany resource-dependent municipalities provide conditions conducive to municipal inefficiency and poor service delivery. While geographically specific, the findings have broader relevance for municipalities across Sub-Saharan Africa where similar economic and governance dynamics prevail. Consequently, the study advances the discourse on municipal governance in resource-dependent contexts, providing empirically grounded recommendations for mitigating cost inefficiencies in settings where economic fortunes are closely tied to commodity cycles.

Frances Baard district comprises municipalities whose governance and service delivery challenges have been in the spotlight in recent years. In 2021, for instance, according to a report by the Parliamentary Monitoring Group (PMG), three of the four local municipalities in this district—namely Dikgatlong, Magareng, and Phokwane—were in distress while the fourth, Sol Plaatje, was unable to pay its Eskom debt and faced declining service delivery. These governance, financial and service delivery challenges make Frances Baard District ideal for analyzing municipal cost inefficiency and its drivers.

3.2. Measuring Cost Efficiency of Municipalities

While there are different types of efficiency, this study primarily focuses on cost efficiency as a key factor that affects service delivery. Focusing on cost efficiency is particularly relevant in South African municipalities given the increasing pressure on municipalities to do more with less amidst declining fiscal transfers and escalating operational costs. Cost efficiency analysis allows the identification of potential cost-saving measures without compromising service quality, thus serving as a critical mechanism for enhancing financial sustainability and facilitating accountability.

Empirically, cost inefficiencies and their sources can be estimated broadly using either the Stochastic Frontier Analysis (SFA) of

Meeusen and van den Broeck (

1977) and

Aigner et al. (

1977) or the Data Envelopment Analysis (DEA) of

Charnes et al. (

1978). The DEA is, in the main, deterministic and uses programming methods to construct a frontier from which deviations of actual costs are referred to as cost inefficiencies. The SFA, on the contrary, separates random noise from cost inefficiencies, making it superior to the DEA as its stochastic nature makes it less susceptible to exaggerating cost inefficiencies. In addition, municipal data are usually characterized by measurement error in reporting, something that the SFA is designed to handle. It is for these reasons that the stochastic frontier analysis was preferred over the data envelopment approach for this analysis. In the main, the stochastic cost frontier model estimates the minimum possible cost beyond which municipalities are deemed to be cost inefficient. Intuitively, in the context of local governance, the estimated minimum cost level would represent necessary spending while actual costs above this estimated minimum cost level would signify wasteful expenditure.

3.3. Measuring Service Delivery

While municipalities, in the main, deliver a wide range of services, this study focuses on water provision and refuse collection. Electricity and housing are deliberately excluded. The exclusion of electricity as a service delivery measure in this study is justified on several grounds. Firstly, the responsibility for electricity distribution in South Africa is not uniformly handled by municipalities. While some municipalities are directly involved in electricity distribution, others rely on Eskom, the national electricity supplier. This fragmented structure creates inconsistencies in the provision of electricity as a municipal service, making it less suitable for a comparative analysis across local municipalities within the Frances Baard District. Secondly, data availability and consistency present significant challenges. Data on electricity provision are often aggregated at the national or provincial level, particularly in areas where Eskom is the sole distributor. In contrast, data on refuse collection and water provision are more consistently available and directly attributable to municipal operations, allowing for more accurate measurement and comparison of cost inefficiency. In addition, municipalities typically have greater control over refuse collection and water services as these functions fall entirely within their constitutional mandates under the Municipal Systems Act and the Water Services Act. Electricity distribution, however, is subject to external regulation and operational decisions by Eskom, limiting the ability of municipalities to influence service quality and efficiency. Additionally, the cost structures of electricity provision differ substantially from those of water and refuse collection, given the capital-intensive nature of electricity infrastructure and the regulation of tariffs at the national level. Including electricity in the analysis would therefore introduce variability in cost structures that could confound the interpretation of cost inefficiency estimates.

The exclusion of housing as a service delivery measure, on the other hand, is premised on its distinct administrative structure and the limited role of local municipalities in its provision. In South Africa, the responsibility for housing delivery primarily resides with provincial and national governments, as stipulated under the Housing Act (Act No. 107 of 1997). Municipalities are typically involved in the identification of suitable land, basic service provision (such as water and sanitation), and facilitation of housing projects, but they are not the primary implementers of housing delivery. As such, including housing as a service delivery measure would not accurately reflect the cost efficiency of municipal operations in the Frances Baard District.

In addition, the funding structures for housing projects are distinct from those of refuse collection and water provision. Housing projects are largely financed through conditional grants and subsidies allocated by provincial and national authorities, which are earmarked for specific purposes and are not subject to municipal discretion in the same way as operational budgets for refuse collection and water services. Consequently, incorporating housing in the analysis would introduce variability in funding and expenditure patterns that could obscure the assessment of municipal cost inefficiencies. Moreover, housing delivery involves long-term capital-intensive projects with extended implementation timelines, whereas refuse collection and water services are ongoing operational functions with more regular expenditure patterns. Including housing in the cost inefficiency analysis would therefore necessitate a fundamentally different methodological approach, potentially involving capital expenditure assessments and project-based cost analysis, which falls outside the scope of this study.

The decision to focus on water and refuse collection services is substantiated by documented challenges in the Frances Baard District Municipality, particularly within Sol Plaatje Municipality. These services are fundamental to public health and urban sustainability, yet they face systemic issues that impede effective delivery. Kimberley, the capital of the Northern Cape, relies on the Riverton Water Treatment Works and associated infrastructure for its water supply. However, the aging infrastructure has led to frequent water interruptions, with residents reporting prolonged periods without water. In early 2024, a compilation of 242 complaints highlighted widespread dissatisfaction, with residents citing daily hardships and violations of their constitutional right to clean water. The provincial Department of Water and Sanitation has identified Sol Plaatje Municipality as a focal point for infrastructure improvement. A Bulk Infrastructure Grant Facility has been allocated to address bulk water infrastructure challenges, focusing on projects to be implemented over seven to eight years. This initiative underscores the critical need for substantial investment in water infrastructure to mitigate service delivery issues. At the same time, refuse collection and waste management issues are persistent concerns in the region, with residents reporting irregular and inadequate waste removal services. In response, the Frances Baard District Municipality allocated a refuse collection truck valued at ZAR 1.3 million to Sol Plaatje Municipality to enhance service delivery and address backlogs. Illustratively, the district has faced criticism regarding landfill management practices. In November 2024, for instance, the region was criticised for illegal dumping at landfill sites, demonstrating systemic issues in waste management and the need for strategies to ensure compliance with environmental regulations. On account of these considerations, focusing on water and refuse collection services in Frances Baard is imperative to the extent that it allows for a targeted examination of critical service delivery areas that directly impact residents’ quality of life. The documented challenges in Frances Baard particularly provide a compelling case for prioritizing these sectors when modelling service delivery as an outcome variable.

3.4. Data Description

The study particularly uses a micro-panel dataset comprising four category B municipalities in the Frances Baard District—Dikgatlong, Magareng, Phokwane, and Sol Plaatje—observed annually from 2006 to 2023. The choice of panel over time-series and cross-sectional data is justified by the need to account for unobserved heterogeneity (

Baltagi et al., 2009). The sampling period is dictated by data availability on municipal revenue and expenditure. We draw our data from Statistics South Africa, through Quantec. From this source, revenue and expenditure data are only available from 2006 to 2023.

3.5. Model Specification

The model specification has two parts. The first part measures cost inefficiency of local municipalities and estimates its relevant sources. The second part uses the measured cost inefficiencies to establish their impact on service delivery. Following

Arcelus et al. (

2015) with modifications in the estimation procedure and the handling of endogeneity, the panel stochastic cost frontier model applied in this study for the first objective takes the following form.

where subscripts

and

denote municipality and year

is the full cost of running a municipality,

is a vector of two output indicators namely refuse collection and water supply proxying the scale of service delivery in line with the stochastic cost frontier literature (

Kumbhakar et al., 2015),

is a vector of cost frontier parameters to be estimated,

is an error term comprising the stochastic component (

) and the cost inefficiency term (

) capturing the extent to which actual costs exceed the minimum cost as indicated in Equation (2).

The inefficiency term is then specified as a dependent variable to appreciate the sources of cost inefficiencies as follows:

where

is a vector capturing the sources of cost inefficiency,

is a corresponding vector of slope coefficients to be estimated, and

is the error term. Vector

includes the share of bulk purchases on total expenditure, the share of expenditure on contracted services, operating costs, debt impairment arising from households not paying municipal rates, and employee remuneration as a share of total expenditure. This approach is consistent with the stochastic frontier cost function methodology, where total cost is modeled as a function of outputs, while inefficiency is explained by cost management variables. Operational costs are included as they represent the recurrent expenditures that underpin service delivery. Prior studies such as

Farsi and Filippini (

2004) and

Worthington and Dollery (

2001) indicate that higher operational costs are associated with inflated expenditure structures, suggesting that municipalities with higher operating costs relative to outputs are likely to exhibit higher inefficiency. This inclusion additionally aligns with the X-inefficiency theory reviewed earlier, which posits that public sector entities without competitive pressures may exhibit managerial slack and operational waste. Hence, municipalities with higher operational costs relative to outputs are expected to be more inefficient, leading to a positive expected sign. The expected sign is therefore positive.

Debt impairment, reflecting poor debt collection and financial mismanagement, is considered a crucial source of inefficiency. As highlighted by

Działo et al. (

2019), higher levels of debt impairment are indicative of fiscal stress, which can divert resources away from service provision and inflate overall costs. This is also consistent with principal-agent theory, where municipal managers may engage in budgetary manipulation to obscure fiscal stress. Consequently, the coefficient on debt impairment is anticipated to be positive. Employee remuneration as a share of total expenditure is included to capture the potential effects of bureaucratic expansion on cost inefficiency.

Monkam (

2014) documents that elevated payroll expenses are symptomatic of inefficient administrative structures, suggesting that municipalities with higher employee remuneration relative to outputs are more likely to incur excessive costs. Thus, the expected sign is positive.

The share of expenditure on contracted services is added to assess the implications of outsourcing on cost efficiency.

Balaguer-Coll et al. (

2007) underscore the potential for contracted services to facilitate rent-seeking behavior, thereby increasing inefficiency. The public choice and the principal-agent theories suggest that municipalities with high shares of expenditure on contracted services and employee remuneration may experience cost inefficiencies driven by opportunistic behavior and bureaucratic expansion. Consequently, a positive coefficient is expected for contracted services, indicating that municipalities with higher contracted service expenses are more likely to be inefficient. Lastly, the share of bulk purchases on total expenditure is included to examine potential cost savings arising from economies of scale. In theory, bulk purchasing could mitigate cost inefficiencies by lowering per-unit costs through economies of scale. This expectation is consistent with resource dependence theory, where municipalities that largely depend on external funding may strategically manage resource allocation to mitigate cost inefficiencies. Therefore, a negative coefficient is anticipated.

The panel stochastic production frontier for the second objective takes the following form.

where

Y is an output vector capturing water provision and refuse collection,

is a vector capturing municipal revenue and municipal workers, while

is a composite error term which comprises the random term (

) and a component

which captures the inability of municipalities to provide a maximum level of service delivery as follows:

Since we hypothesize that cost inefficiencies may prevent municipalities from providing service delivery at full potential, we specify the

as a function of cost inefficiencies measured earlier as follows:

where

is a slope coefficient capturing how cost inefficiencies affect the ability of municipalities to provide service delivery at full potential and

is a vector of control variables namely the log of population, unemployment, the log of Gross Value Added (GVA) and functional literacy measured by the percentage of people with at least secondary school education. Guided by economic intuition, the log of population is included as larger municipalities may have greater service delivery challenges due to higher demand for services and potential congestion effects. Unemployment is considered to capture socio-economic pressures that may exacerbate service delivery constraints, as municipalities in areas with high unemployment may face higher demands for social services and limited revenue bases. Gross Value Added (GVA) serves as a proxy for the economic capacity of municipalities to generate revenue and allocate resources efficiently. Finally, functional literacy, defined as the percentage of people with at least secondary school education, is included to account for the human capital component, as higher literacy rates may correspond with better management practices and more effective governance structures in municipalities. Noteworthy is that Equation (5) assumes that municipalities’ objective function seeks to maximise water provision and refuse collection from given revenue and a fixed number of municipal workers. Their ability to achieve this objective is assumed to depend on how well they manage their costs (i.e., cost efficiency) based on Equation (6).

Table 1 and

Table 2 present the variable description for objectives 1 and 2, respectively. All data are from Quantec.

3.6. Estimation Approach

The appropriate estimation approach was determined based on three methodological caveats which, if ignored, could lead to bias in both cost inefficiencies and slope parameters. The first caveat is unobserved heterogeneity, which, if ignored, could lead to cost inefficiencies that are contaminated with time-invariant factors specific to each municipality. The model will additionally suffer from heterogeneity endogeneity if municipal-specific factors such as management style, work ethics, and geography, among others, are correlated with frontier and inefficiency variables. The second caveat relates to the treatment of idiosyncratic endogeneity, which occurs when time-varying factors nested in

and

are correlated with frontier variables and drivers of cost inefficiency. Ignoring this caveat invites a bias that does not disappear even in large samples. The third aspect is the question of whether the stochastic cost frontier model should be estimated using the two-step or the one-step procedure. Traditionally, as indicated by

Wang and Schmidt (

2002), studies have used the two-step procedure where the cost inefficiencies are estimated in the first step and then separately linked to their determinants in the second, mostly using Tobit regressions.

Wang and Schmidt (

2002) have demonstrated, however, that this procedure leads to severe bias. They recommend a one-step procedure in which the stochastic cost frontier model and the inefficiency specification are simultaneously estimated using the maximum likelihood method. This is the approach used in this study.

Within the literature, stochastic frontier models have evolved significantly. Earlier models and estimation procedures include

Cornwell et al. (

1990) and

Lee and Schmidt (

1993),

Pitt and Lee (

1981), and

Battese and Coelli (

1988,

1995). In this paper, our estimation procedure follows

Karakaplan (

2022) and

Greene (

2005). These modelling approaches are preferred over their alternatives due to their ability to handle idiosyncratic endogeneity and unobserved heterogeneity, respectively. It is important to point out, however, that in their original forms, none of the modelling approaches account for both unobserved heterogeneity and idiosyncratic endogeneity.

Greene’s (

2005) approach addresses unobserved heterogeneity but does not account for idiosyncratic endogeneity. On the other hand,

Karakaplan’s (

2022) approach handles idiosyncratic endogeneity through using instrumental variables but does not handle unobserved heterogeneity leaving it susceptible to exaggerating the levels of municipal cost inefficiencies. Against this background, we adopt an ad hoc approach in which the within transformation recommended by

Wang and Ho (

2010) is applied to all variables in the stochastic cost frontier model before applying

Karakaplan’s (

2022) instrumental variable approach. The alternative approach of including N-1 dummy variables is less appealing as it would expose the model to the incidental parameters problem since we have a small to moderate panel dataset. The within-transformation therefore circumvented the incidental parameters problem while ensuring that

Karakaplan’s (

2022) estimates are free from both heterogeneity endogeneity and idiosyncratic endogeneity. We particularly applied this ad hoc procedure to address the first aim as a post-estimation test found inefficiency drivers endogenous. To address the second aim of the study, we applied

Greene’s (

2005) approach as the same test found inefficiency drivers exogenous, rendering the correction for endogeneity unnecessary.

One important aspect is noteworthy. In the

Greene (

2005) model, we estimate the sources of cost inefficiency through the conditional mean specification. This follows the parameterization applied in

Kumbhakar et al. (

1991) and

Huang and Liu (

1994). In the

Karakaplan (

2022) specification, we estimate the sources of cost inefficiency through the conditional variance specification. This parameterization involves scaling the distribution of inefficiency, as similarly applied in

Caudill and Ford (

1993),

Caudill et al. (

1995), and

Hadri (

1999). In both parameterizations, a negative sign on a variable implies a positive effect on cost efficiency. Similarly, a positive sign on a variable implies a negative effect on cost efficiency. The model uses lagged values of endogenous variables as instruments. The assumption is that lagged values of expenditure are predetermined and therefore exogenous to contemporaneous inefficiency shocks, making them valid instruments. Despite the plausibility of this assumption, the use of lagged instruments is not without limitations. If the error term exhibits autocorrelation, a first-order lag may still be correlated with the contemporaneous disturbance, violating the exogeneity assumption. As a robustness check, therefore, we considered in secondary regressions two external instruments, namely government grants and a 3-year rolling standard deviation of gross domestic product weighted by the population share of each municipality in the district. This reasoning is based on the notion that macroeconomic shocks and government grants, which are allocated by the national treasury, affect municipal expenditures but are exogenous to cost inefficiency.

Estimation is through the maximum likelihood estimator. It is important to mention at this stage that the panel dimensions generally dictate the type of econometric care when estimating panel data. In our case, we have a small N and small T, which makes the asymptotics of fixed N and fixed T relevant. In particular, while such dimensions downplay concerns of non-stationarity and potential slope heterogeneity across the municipalities, traditional asymptotic theory may not apply. Finite-sample issues, including bias when dealing with dynamic panel data and weak instrument problems, become severe. We do not worry about the bias, however, since our model is static and not dynamic. To mitigate finite sample problems, we bootstrap our standard errors in a bid to improve efficiency. Lastly, we perform weak instrumental variable tests to ensure their validity.

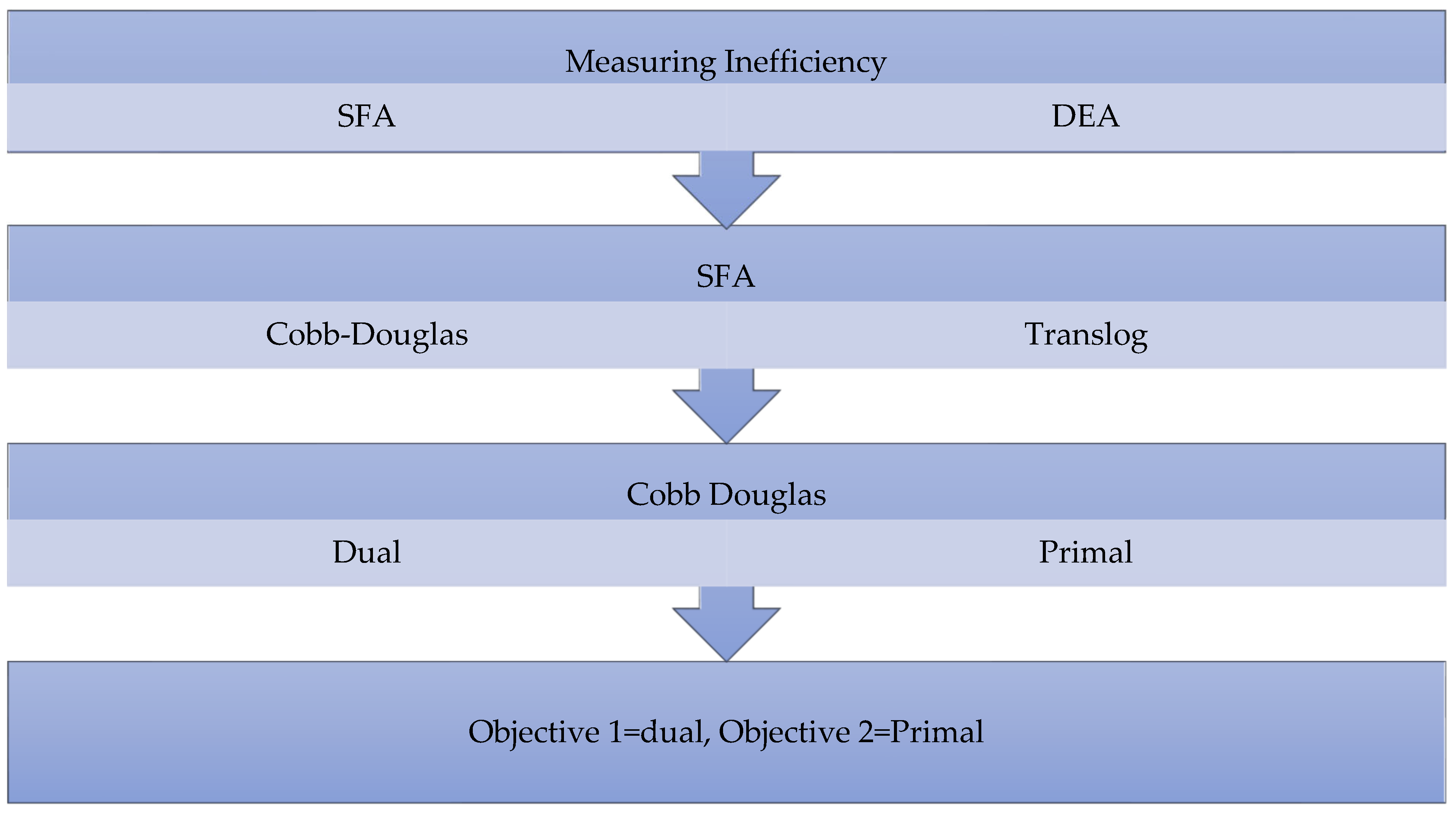

Figure 3 summarizes the methodology. The first choice is about the approach to measuring inefficiency. From the two broad approaches (the SFA and the DEA), this study prefers the SFA. Within the SFA, functional form plays a critical role in shaping the estimates of efficiency. Two main functional forms used are the Cobb–Douglas specification and the Translog. The former is relatively simple and easy to estimate but comes with restrictive assumptions of unitary elasticity of substitution and constant returns to scale. In contrast, the Translog functional form provides a second-order approximation to any twice-differentiable production function, which consequently allows for variable returns to scale and non-constant elasticities of substitution between inputs. This added flexibility makes the Translog particularly appealing in settings where input interactions are complex, albeit at the expense of higher data requirements and potential multicollinearity. The selection between these functional forms is generally based on statistical tests. In this study, as the diagnostic tests will later show, the Cobb–Douglas specification was preferred. Within the Cobb–Douglas specification, one has to decide between estimating a dual specification (typically a cost frontier) or a primal one (a production function). In this study, both approaches are used. The dual approach, which measures efficiency from a cost perspective, is applied to the first objective, which measures municipal cost inefficiencies. The primal approach is used in the second objective, as municipalities are viewed as producers who combine inputs to provide service delivery.

3.7. Diagnostic Checks

As a customary practice in empirical modelling, we conduct several diagnostic tests within the stochastic cost frontier framework to determine the reliability of the results. First, as indicated above, we assess the appropriate functional form by testing whether the Translog specification provides a better fit than the Cobb–Douglas alternative using the likelihood ratio (LR) test. The LR test statistic is calculated as LR = −2(LR(Ho)-LR(Ha)) where LR(Ho) is the LR value from the restricted Cobb–Douglas specification while LR(Ha) is the LR value from the unrestricted Translog specification. This diagnostic test is crucial, as an incorrect functional form may lead to biased efficiency estimates. Rejection of the null will be evidence in favour of the Translog specification and vice versa. Second, we examine the presence of frontier shifts over time by performing a joint significance test on time dummies. Additionally, and most importantly, we test for cost inefficiency, as the absence of cost inefficiency would render the stochastic cost frontier model unnecessary. Put differently, in the absence of cost inefficiency, the stochastic cost frontier model reduces to a standard total cost function with normal errors. In this test, LR(Ho) is the LR value from the standard ordinary least squares (OLS) regression with normal errors estimated through the glm command. LR(Ha) is the LR value from the estimated stochastic frontier model. The 5% critical values are from a mixed distribution tabulated in

Kodde and Palm (

1986) with one degree of freedom. A significant LR value will serve as evidence of inefficiencies justifying the stochastic frontier analysis over the standard OLS regression with normal errors. We also conduct the weak instrumental variable test recommended by

Karakaplan (

2022). Lastly, since we are using the maximum likelihood estimator, we pay attention to the iteration procedure to identify any potential estimation challenge that may produce invalid results. We particularly check for the “not concave” message in the last step, as it could signal the problem of near collinearities, which may not be detected automatically by Stata, and the optimizer entering a flat region of the likelihood, which may lead to a premature declaration of convergence. We additionally check for the “backed up” message at the last step, which may arise when the optimizer works itself into a bad concave spot where the computed gradient and Hessian give a bad direction for stepping. The analysis is performed using Stata 17. The

Karakaplan (

2022) model is implemented using the xtsfkk command. Prior to its implementation, frontier variables are subjected to the within-transformation in Stata 17 using the command: egen M_mean = mean(M), by(id), where M is the frontier variable and id is the unique identifier variable that distinguishes the four local municipalities. This is followed by the command: gen M_within = M − M_mean. Regarding the true-fixed effects and the

Battese and Coelli (

1995) estimated as a robustness check with bootstrapped standard errors, we use the sfpanel command in Stata 17 with the vce(bootstrap) option. The former uses the tfe option while the latter contains bc95. The weak instruments test is implemented using the commands “est res ModelEN” after estimation. This is then followed by test iv1, iv2, …, ivn, where ivn signifies the n number of instruments used in the estimation. A chi2 statistic above 10 is taken as evidence of valid instruments (

Karakaplan, 2022). Lastly, frontier shifts were tested through a Wald test for joint significance of time dummies. This was achieved through the Stata command testparm i.year post-estimation.

4. Results

Table 3 presents summary statistics. The within-transformed log values of total expenditure, water, and refuse collection all have a mean of zero, which is expected due to the within transformation. Log total expenditure exhibits the highest dispersion, followed by log water and log refuse collection. Among the included expenditure shares, employee remuneration constitutes the largest portion, followed by debt impairment and contracted services. Bulk purchases account for an average of 18.1% of total expenditure, while operating costs are 4.2%. The standard deviations of debt impairment and employee remuneration indicate moderate variability across the four municipalities. The minimum and maximum values, on the other hand, indicate considerable variation, particularly in debt impairment (ranging from 0 to 40.9%) and bulk purchases (10.7% to 27.8%). The minimum values of zero for operating costs and debt impairment are, respectively, picking up a year in the sample in which operating costs were covered by external grants and a year in which provisions for bad debts in previous years might have eliminated the need to record new impairments. A takeaway result from these summary statistics is that the dataset does not appear to be plagued by atypical observations, looking at the mean values and the range.

Table 4 presents a correlation matrix whose primary purpose is to identify any potential multicollinearity among the regressors. The presence of high collinearity makes it difficult to isolate the partial effects of regressors on both total cost and cost inefficiency. Looking at

Table 4, we notice a strong positive association between log water and log refuse collection, suggesting that municipalities with higher access to water also allocate resources to waste management. Although this high collinearity could pose challenges with estimation in the cost frontier specification, we resist the temptation to drop one of the variables to prevent a potential omitted variable bias, given the strong theoretical justification for having both output variables in a cost frontier specification. The high collinearity is theoretically justified by the complementary nature of these services. Both are essential public utilities that share infrastructure, budget allocations, and policy frameworks. Additionally, urbanization and population growth drive simultaneous demand for both services, while regulatory mandates require municipalities to manage water supply and sanitation, including waste collection, collectively. Against this background, we preferred the do-nothing approach, as our parameters remain consistent and unbiased even in the presence of multicollinearity.

With respect to the drivers of cost inefficiency where theory is not particularly clear on variable selection, we computed variance inflation factors. As

Appendix A shows, none of the potential sources of cost inefficiency have a variance inflation factor above 5, which downplays concerns of near multicollinearity.

Table 5 presents the regression results. The table contains two columns of results. The first column is essentially a within-transformed version of

Karakaplan (

2022), which uses two external instruments, namely government grants and a 3-year rolling standard deviation of gross domestic product weighted by the population share of each municipality in the district. The second column uses internal instruments, namely lagged values of the endogenous inefficiency regressors. The upper part of the table contains the cost frontier estimates, while the lower part identifies the sources of cost inefficiency. The mean cost efficiency score in the baseline specification is 0.853, suggesting that the total cost of running a municipality was, on average, above its minimum cost level by 17.23% (i.e., [1/(0, 853)] − 1) × 100 = 17.23%). Put differently, we find wasteful expenditure of 17.23%. This finding is consistent with the broader literature on public sector inefficiencies in developing countries, where governance challenges often impede optimal resource utilization (

Afonso & Fernandes, 2008;

Geys & Moesen, 2009;

Adedeji Amusa & Fadiran, 2024;

Rella et al., 2025). Looking at the results from the lower part of the table, we notice that wasteful expenditure was primarily driven by operating costs and contracted services. It is these two variables whose coefficients are positive and statistically significant at 1% and 5%, respectively. The former result is in line with

Dollery and Grant (

2011), who argue that outsourcing municipal services, when improperly regulated, tends to inflate costs. The latter result agrees with

Geys and Moesen (

2009), who find non-productive operational spending contributing to inefficiency in local government.

The remuneration of employees has a positive and sizeable causal effect on municipal cost efficiency, which is significant at the 1% level. The positive and significant coefficient suggests that municipalities that compensate their employees well tend to operate closer to their cost frontier and therefore record less wasteful expenditure. This result is consistent with the efficiency wage hypothesis, which posits that higher wages can enhance worker productivity (

Akerlof & Yellen, 1986). In the context of local municipalities and governance, this result possibly suggests that well-remunerated employees may be more motivated and accountable, which reduces the likelihood of service delays, corruption and other factors that are often associated with inefficiency in municipal operations. In addition, the result is plausible, as higher remuneration may strengthen institutional capacity and promote the efficient use of public resources. Within the literature, this finding agrees with

Ncube and Monnakgotla (

2016), who find adequate compensation critical for the effective functioning of local government in South Africa.

Interestingly, while debt impairment is often cited as a financial management concern for local municipalities, its coefficient is statistically insignificant in both specifications. The insignificance of debt impairment suggests that unpaid debts by households are not a significant driver of cost inefficiency of local municipalities in the district. There are two possible reasons for this result. The first possible explanation is that cost inefficiency of local municipalities may be more strongly linked to expenditure patterns rather than revenue shortfalls, as similarly argued in

Afonso and Fernandes (

2008). This is plausible since debt impairment in South Africa is generally more indicative of socio-economic conditions such as poverty and unemployment than managerial inefficiency. The second possible reason is that since municipalities often adjust their budgets to accommodate non-payment, the cost structure observed in the data may have already internalized these losses, which consequently limits their marginal impact on cost inefficiency.

Lastly, the results reveal that bulk purchases exhibit a negative but statistically insignificant effect on municipal cost inefficiency. Despite being statistically significant, the negative sign is encouraging, as it shows the potential of bulk purchases to reduce municipal cost inefficiencies, likely due to economies of scale of bulk procurement. In the South African municipal context, bulk purchases, particularly of water and electricity, are often governed by long-term supply contracts, which can potentially lower average costs.

The endogeneity test returns a significant probability value, justifying the correction of endogeneity in the model. This result particularly supports the use of

Karakaplan’s (

2022) instrumental variable approach compared to

Greene’s (

2005) true-fixed-effects stochastic cost frontier model, which ignores idiosyncratic endogeneity.

While the above results are plausible, we consider the potential criticism that conventional asymptotic standard errors can be, in small-sample settings, unreliable due to downward bias and over-rejection of null hypotheses (

Cameron & Trivedi, 2005). With only 68 observations, these concerns can be quite severe and non-trivial. Against this background, we consider additional regressions for robustness purposes in which we lag all variables to mitigate endogeneity within

Greene’s (

2005) and

Battese and Coelli’s (

1995) stochastic cost frontier framework and then bootstrap standard errors. Bootstrapping relies on resampling rather than large-sample theory, making it better at approximating the finite-sample distribution of estimators (

Tibshirani & Efron, 1993). This approach is additionally useful in the presence of heteroskedasticity, autocorrelation, or non-normal errors (

Horowitz, 2001), making it crucial to improving the reliability of inference in small samples (

Davidson & MacKinnon, 2006).

Table 6 presents these results. In this table, TFE Bootstrap SE represents results from the true-fixed effects of

Greene (

2005), while BC95 Bootstrap SE contains results from the

Battese and Coelli (

1995) specification. While these two secondary regressions with bootstrapped standard errors have notable limitations with respect to handling idiosyncratic endogeneity and unobserved heterogeneity, respectively, it is reassuring and comforting to note how remarkably similar their results are to the baseline model which handles both idiosyncratic endogeneity and unobserved heterogeneity. Both specifications particularly confirm operating costs and contracted services as the significant drivers of cost inefficiencies. In addition, the evidence still demonstrates the negative association between employee remuneration and cost inefficiency. Overall, therefore, our baseline results are not severely impacted by micronumerosity (problems associated with small sample sizes).

The lambda term is greater than one and significant at the 1% level in both specifications, indicating that cost inefficiencies dominate the error term. In other words, much of the variation in cost inefficiencies of these municipalities from the minimum cost level is largely a result of man-made cost inefficiencies rather than random factors beyond the control of municipal managers. This result is important, as it serves as crude evidence in support of a stochastic cost frontier model over the standard total cost regression with normal errors.

To achieve the second objective, we estimated a stochastic production function in which water provision and refuse collection were the output variables. We assumed that municipalities thrive to maximize the provision of water and refuse collection from the given revenue and municipal workers. In the inefficiency specification, we include cost inefficiency scores measured earlier as the regressor of interest. In this specification, population, functional literacy (the percentage of people with at least secondary school education), gross value added capturing local economic performance, and unemployment are included as controls. Noteworthy is that the endogeneity test turned out to be insignificant, rendering the instrumental variable approach unnecessary for this objective. We therefore used the true-fixed effects approach with bootstrapped standard errors.

Table 7 presents these results. As the lower part of

Table 7 confirms, the average efficiency score is 0.796 for water provision and 0.766 for refuse collection. This suggests that, on average, water provision and refuse collection were about 23% and 20% lower than their potential level of service provision. These scores particularly suggest that, on average, a typical municipality in Frances Baard District could have improved service provision by approximately 20–23% without requiring additional resources.

With respect to the main explanatory variable, we observe a positive and significant coefficient of municipal cost inefficiency across both specifications. The positive sign indicates that higher cost inefficiency of municipalities increases the gap between actual and potential service provision. This result validates the proposition that municipal cost inefficiencies contribute to poor service delivery. Since the model is non-linear, the coefficient on cost inefficiency cannot be interpreted as a marginal effect. To compute the marginal effect, we used the predict marginal command following

Kumbhakar et al. (

2015) post-estimation. The computed marginal effects of cost inefficiency are presented in

Table 8. A percentage point increase in municipal cost inefficiency is associated with a 0.096% increase in the service gap for water provision and a 0.0085% increase in the service gap for refuse collection. These elasticities underscore the detrimental impact of municipal cost inefficiency on service delivery.

From

Table 7, functional literacy enters with a negative and significant coefficient, as expected. This result indicates that a literate population is better equipped to demand accountability and participate in public debates for better governance (

Glaeser et al., 2004). In the context of municipal service delivery, higher functional literacy may also improve the responsiveness and administrative capacity of local governments, which contributes to more efficient service delivery. The negative effect of gross value added (GVA) needs to be interpreted with caution. While it may be tempting to argue that higher GVA reflects stronger local economic activity, which can enhance a municipality’s revenue base and improve service delivery following

Bahl et al. (

1992), this explanation does not apply here, as the frontier specification is holding constant each municipality’s total revenue. A more plausible explanation is that municipalities with higher GVA tend to have better infrastructure, better connectivity, and stronger institutional frameworks, all of which facilitate better coordination and delivery of services such as water provision and waste management (

Rodríguez-Pose & Gill, 2004).

The positive coefficient of population indicates that larger municipal populations are associated with poor service delivery. This finding may be attributed to the increased demand normally placed on municipalities as populations grow, which can strain infrastructure and institutional capacity, particularly in contexts with limited planning and constrained resources. With regard to unemployment, we do not find its effect on service delivery statistically significant. Since unemployment tends to increase with population growth, the significance could be reflecting the fact that its effect on service delivery is indistinguishable from that of population growth.

Diagnostic Tests

Table 9 presents the results from diagnostic tests performed to assess the reliability of the regression results. As the results show, the likelihood ratio is insignificant in our functional form tests. This indicates that the restricted model (the Cobb-Douglas specification) is preferable over the unrestricted model (the Translog specification). This result is true for both objectives 1 and 2. Evidence further shows that null hypotheses of no inefficiencies are strongly rejected by the LR tests, indicating that the estimated stochastic frontier models were more appropriate compared to standard regressions with normal errors. Lastly, the null hypothesis of weak instrument is strongly rejected, suggesting that the instruments used in the baseline specification of the first objective are valid. The endogeneity test for the second objective returns an insignificant probability value, rendering the correction for endogeneity unnecessary for this objective. Lastly, the Hausman specification tests favored the fixed effects transformation over the inclusion of random effects, while the Wald test for joint significance found time dummies statistically insignificant at the 10% level in both specifications. These diagnostic tests, therefore, support the within-transformation in all specifications without time dummies.

5. Discussion

The study has addressed two objectives. The first sought to measure the degree of cost inefficiency and estimate its key sources. The second sought to identify how the measured municipal cost inefficiencies affect service delivery with a specific focus on water provision and refuse collection. The findings from the first objective indicate that municipalities in South Africa are operating with a considerable degree of inefficiency. The result particularly observed that local governments are, on average, spending over 17% more than the minimum cost required to deliver a given level of service delivery. This result echoes prior studies which document inefficiency in public sector operations (

Afonso & Fernandes, 2008;

Geys & Moesen, 2009).

From a policy and governance perspective, this level of inefficiency aligns with the recurring findings of the Auditor-General of South Africa, whose reports have consistently raised concerns over irregular expenditure, non-compliance with procurement regulations, and inadequate financial oversight within municipalities. A look into the sources of municipal cost inefficiencies finds operating expenditures and contracted services the most influential drivers. Both variables are positively and significantly associated with inefficiency, suggesting that these spending categories are not being effectively controlled and optimally allocated in these municipalities. This is in line with earlier findings by

Geys and Moesen (

2009), who found administrative bloat and ineffective spending practices associated with high inefficiency in the local public sector. In South Africa, and looking at our metadata, this finding is not surprising since operating costs include general expenses, travel allowances, entertainment and support functions that may not directly enhance service provision. Contracting services, although potentially beneficial in theory, have often been associated with limited transparency, rent-seeking activities, and limited accountability (

Dollery & Grant, 2011). This result particularly corroborates the view that municipalities that outsource core functions may record higher costs and poor value for money in the absence of transparency and accountability.

In the second objective, we found that municipal cost inefficiency increases the gap between actual and potential service delivery, which is consistent with the empirical literature on public sector efficiency. Several studies have documented a negative relationship between cost inefficiency and the quality or quantity of public services. For instance,

Worthington and Dollery (

2001) found that Australian local governments with higher inefficiency scores tended to underperform in service delivery, especially in utilities and community services. Similarly, studies in developing country contexts, such as that by

Coelli (

2003), show that inefficiencies in municipal resource allocation led to poor service delivery, particularly in essential services such as water, sanitation, and waste management. The positive association observed in this study supports these findings by confirming that inefficiency not only results in wasteful expenditure but also directly impairs service outcomes. In addition, the results agree with

De Borger and Kerstens (

1996), who argue that inefficiencies in local governments are often driven by weak fiscal discipline, which ultimately contributes to poor service delivery.