The Predicting Abilities of Social Trust and Good Governance on Economic Crisis Duration

Abstract

1. Introduction

2. Theory and Hypotheses

2.1. Creation of Social Trust

2.2. Social Trust and Economics

2.3. Corruption and Its Origins

2.4. Social Trust and Corruption

2.5. Economic Crisis Duration and Its Consequences

3. Method

3.1. Presentation of Databases

3.2. Analysis Techniques

3.3. Structuring of Data

3.4. Dependent Variables

3.5. Independent Variables

3.6. Control Variables

4. Results

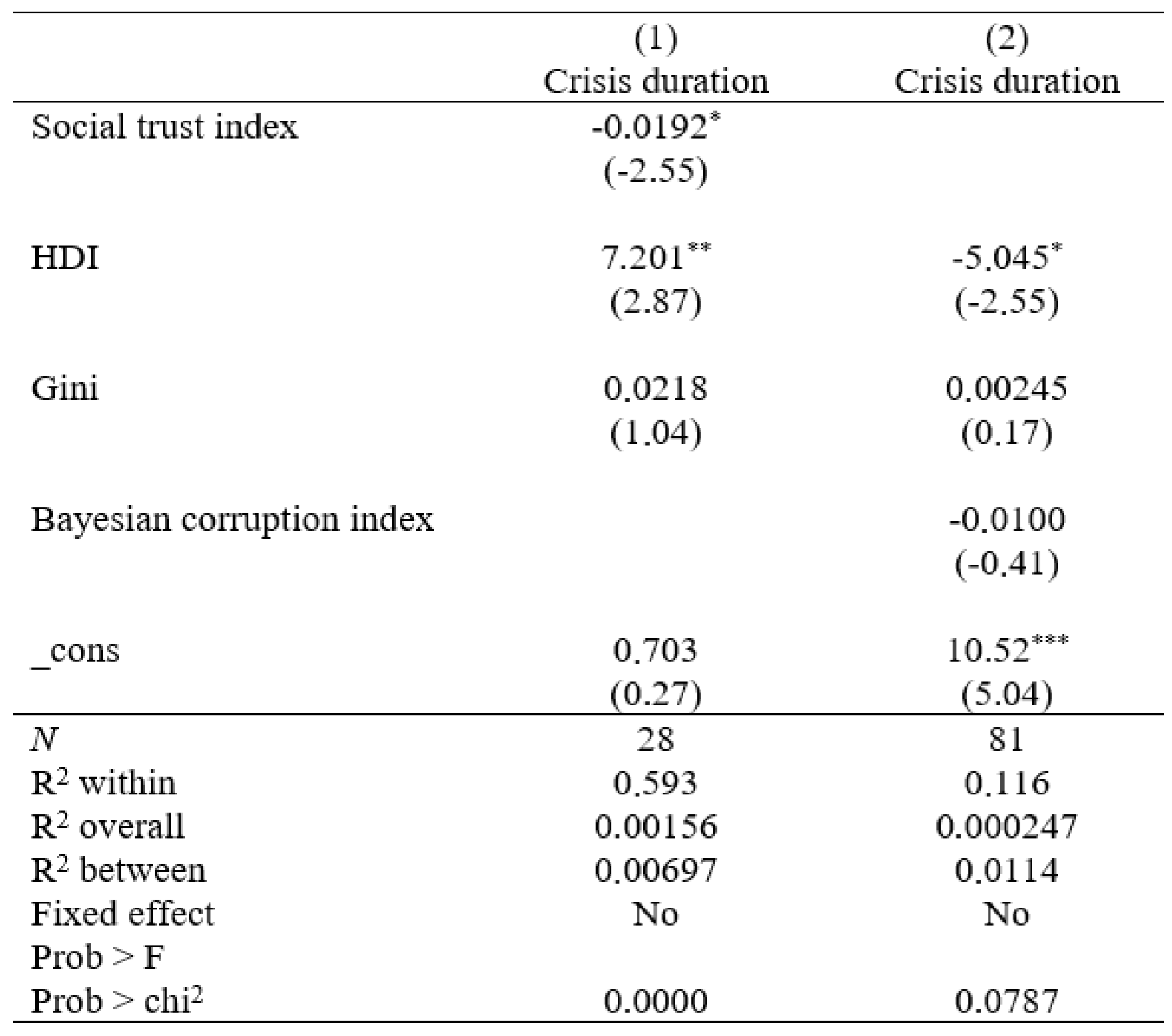

4.1. Empirical Specifications

- A: Crisis durationi,t = α + β1 × Social Trusti,t + β2 × HDIi,t + β3 × Ginii,t + Vt + ai + ui,t.

- B: Crisis durationi,t = α + β1 × BCIi,t + β2 × HDIi,t + β3 × Ginii,t + Vt + ai + ui,t.

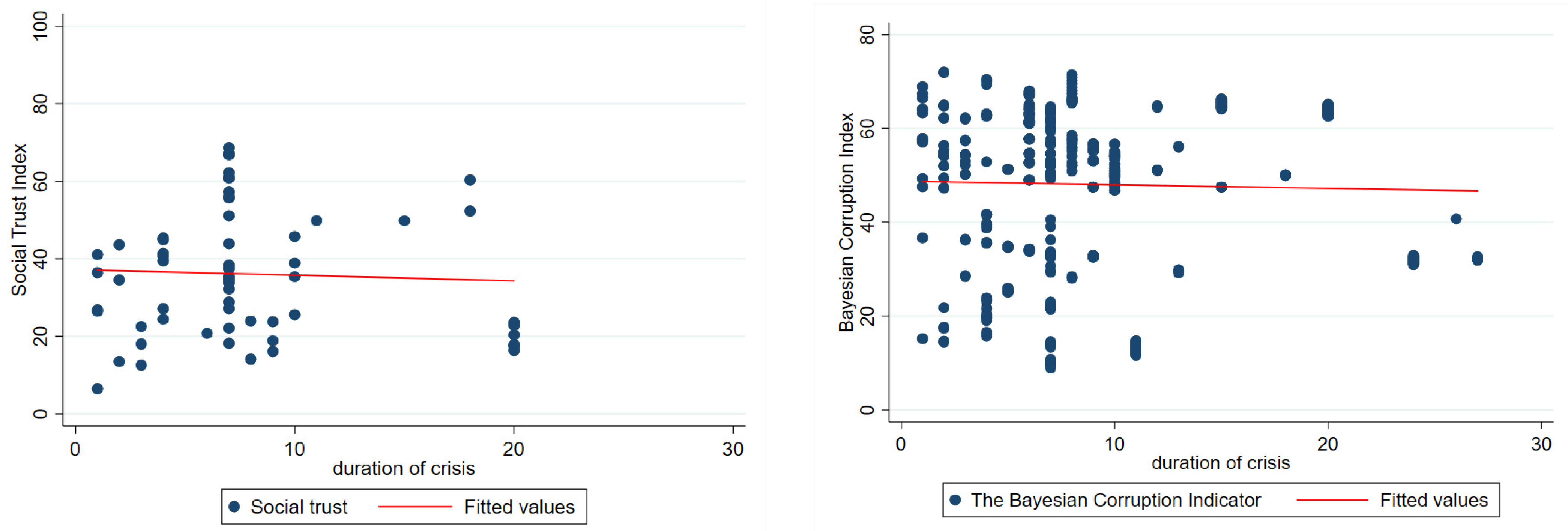

4.2. Descriptive Analysis

4.3. Econometric Analysis

4.4. Fitness of the Model

5. Discussion

5.1. Theoretical Implications

5.2. Practical Implications

5.3. Limitations

5.4. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | See https://www.hbs.edu/behavioral-finance-and-financial-stability/data/Pages/global.aspx (accessed on 20 December 2019). |

References

- Acemoglu, D., Johnson, S., & Robinson, J. A. (2001). The colonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369–1401. [Google Scholar] [CrossRef]

- Acemoglu, D., & Verdier, T. (2000). The choice between market failures and corruption. American Economic Review, 90, 194–211. [Google Scholar] [CrossRef]

- Altig, D., Baker, S., Barrero, J. M., Bloom, N., Bunn, P., Chen, S., Davis, S. J., Leather, J., Meyer, B., Mihaylov, E., & Mizen, P. (2020). Economic uncertainty before and during the COVID-19 pandemic. Journal of Public Economics, 191, 1–13. [Google Scholar] [CrossRef]

- Baker, S., Bloom, N., Davis, S. J., & Terry, S. J. (2020). COVID-induced economic uncertainty. National Bureau of Economic Research. [Google Scholar]

- Barnett, S. W. (2010). Universal and targeted approaches to preschool education in the United States. International Journal of Child Care and Education Policy, 4(1), 1–12. [Google Scholar] [CrossRef]

- Bjørnskov, C. (2009). Economic growth. In Handbook of social capital (pp. 337–353). Oxford University Press. [Google Scholar]

- Bjørnskov, C. (2012). How does social trust affect economic growth? Southern Economic Journal, 78(4), 1346–1368. [Google Scholar] [CrossRef]

- Black, J., Hashimzade, N., & Myles, a. G. (2009). A dictionary of economics. Oxford University Press. [Google Scholar]

- Blekesaune, M. (2013). Economic strain and public support for redistribution: A comparative analysis of 28 European countries. Journal of Social Policy, 42(1), 57–72. [Google Scholar] [CrossRef]

- Boix, C., & Posner, D. N. (1998). Social capital: Explaining its origins and effects on government performance. British Journal of Political Science, 28(4), 686–693. [Google Scholar] [CrossRef]

- Brehm, J., & Rahn, W. (1997). Individual-level evidence for the causes and consequences of social capital. American Journal of Political Science, 41(3), 999–1023. [Google Scholar] [CrossRef]

- Checchi, D. (2001). Education, inequality and income inequality (LSE STICERD Research Paper No. 52). Available online: https://ssrn.com/abstract=1094825 (accessed on 20 December 2019).

- Chetty, R., Friedman, J. N., & Stepner, M. (2024). The economic impacts of COVID-19: Evidence from a public database built using private sector data. The Quarterly Journal of Economics, 139, 829–889. [Google Scholar] [CrossRef]

- Chzhen, Y. (2016). Perceptions of the economic crisis in Europe: Do adults in households with children feel a greater impact? Social Indicators Research, 127(1), 341–360. [Google Scholar] [CrossRef]

- Collier, P., & Goderis, B. (2007). Commodity prices, growth, and the natural resource curse: Reconciling a conundrum (CSAE working paper series). Centre for the Study of African Economies, University of Oxford. [Google Scholar]

- Day, J. C., & Newburger, E. C. (2002). The big payoff: Educational attainment and synthetic estimates of work-life earnings (Special Studies Current Population Reports) (pp. 23–210). Bureau of the Census (DOC), Economics and Statistics Administration. [Google Scholar]

- Delhey, J., & Newton, K. (2003). Who trusts? The origins of social trust in seven societies. European Societies, 5(2), 93–137. [Google Scholar] [CrossRef]

- Deng, W.-S., Lin, Y.-C., & Gong, J. (2012). A smooth coefficient quantile regression approach to the social capital–economic growth nexus. Economic Modelling, 29(2), 185–197. [Google Scholar]

- Dinesen, & Thisted, P. (2013). Where you come from or where you live? Examining the cultural and institutional explanation of generalized trust using migration as a natural experiment. European Sociological Review, 29(1), 114–128. [Google Scholar] [CrossRef]

- Di Tella, R., MacCulloch, R. J., & Oswald, A. J. (2003). The macroeconomics of happiness. Review of Economics and Statistics, 85(4), 809–827. [Google Scholar]

- Dix-Carneiro, R., & Kovak, B. K. (2015). Trade reform and regional dynamics: Evidence from 25 years of Brazilian matched employer-employee data (NBER Working Paper No. 20908). National Bureau of Economic Research. Available online: https://www.nber.org/papers/w20908.pdf (accessed on 20 December 2019).

- Dix-Carneiro, R., Soares, R. R., & Ulysse, G. (2017). Economic shocks and crime: Evidence from the Brazilian trade liberalization (NBER Working Paper No. 23400). National Bureau of Economic Research. Available online: https://www.nber.org/papers/w23400.pdf (accessed on 20 December 2019).

- Eurofund. (2012). Third European quality of life survey: Quality of life in Europe: Impacts of the crisis. Publications Office of the European Union. [Google Scholar] [CrossRef]

- Fisman, R., & Miguel, E. (2010). Economic gangsters: Corruption, violence, and the poverty of nations. Princeton University Press. [Google Scholar]

- Fougère, D., Kramarz, F., & Pouget, J. (2010). Youth unemployment and crime in France. Journal of the European Economic Association, 7(5), 909–938. [Google Scholar] [CrossRef]

- Fraile, M., & Fons, M. F. (2005). Explaining the determinants of public support for cuts in unemployment benefits spending across OECD Countries. International Sociology, 20(4), 459–481. [Google Scholar] [CrossRef]

- Freitag, M., & Buhlmann, M. (2005). Political institutions and the formation of social trust: An international comparison. Politische Vierteljahresschrift, 46(4), 575–586. [Google Scholar] [CrossRef]

- Fukuyama, F. (1995). Trust: The social virtues and the creation of prosperity. Free Press. [Google Scholar]

- George, D., & Mallery, P. (2011). SPSS for Windows step by step: A simple guide and reference 18.0 update. Pearson Education. [Google Scholar]

- Graeff, P., & Svendsen, G. T. (2013). Trust and corruption: The influence of positive and negative social capital on the economic development in the European Union. Quality & Quantity: International Journal of Methodology, 47(5), 2829–2846. [Google Scholar]

- Hariri, J. G., Bjørnskov, C., & Justesen, M. K. (2016). Economic shocks and subjective well-being: Evidence from a quasi-experiment. The World Bank Economic Review, 30(1), 55–77. [Google Scholar] [CrossRef][Green Version]

- Heckman, J. J. (2011). The economics of inequality: The value of early childhood education. American Educator, 35(1), 31–35. [Google Scholar]

- Jeene, M., van Oorschot, W., & Uunk, W. (2014). The dynamics of welfare opinions in changing economic, institutional and political contexts: An empirical analysis of Dutch deservingness opinions, 1975–2006. Social Indicators Research, 115(2), 731–749. [Google Scholar] [CrossRef]

- Jorgenson, D. (1991). Productivity and economic growth. In R. Ernst, & J. Triplett (Eds.), Fifty years of economic measurement: The jubilee of the conference on research in income and wealth (pp. 19–118). University of Chicago Press. [Google Scholar]

- Kluegel, J. R. (1988). Economic problems and socioeconomic beliefs and attitudes. Research in Social Stratification and Mobility, 7, 273–302. [Google Scholar]

- Knack, P. J., & Stephen, Z. (2001). Trust and growth. The Economic Journal, 111(470), 295–321. [Google Scholar]

- Kolstad, I., & Wiig, A. (2011). Natural resources, corruption and trust: A complex relationship. Chr. Michelsen Institute. Available online: https://www.cmi.no/publications/4316-natural-resources-corruption-and-trust (accessed on 20 December 2019).

- Laeven, L., & Valencia, F. (2018). Systemic banking crises revisited (IMF Working Paper No. 18/206). International Monetary Fund.

- Lambsdorff, J. G. (2015). Preventing corruption by promoting trust—Insights from behavioral science. Passauer Diskussionspapiere, Volkswirtschaftliche Reihe, 69(15). [Google Scholar]

- Leschke, J., & Jepsen, M. (2012). Introduction: Crisis, policy responses and widening inequalities in the EU. International Labour Review, 151(4), 289–312. [Google Scholar] [CrossRef]

- Leung, A., Kier, C., Fung, T., Fung, L., & Sproule, R. (2011). Searching for happiness: The importance of social capital. Journal of Happiness Studies, 12(3), 443–462. [Google Scholar]

- Lin, M.-J. (2008). Does unemployment increase crime? Evidence from U.S. data 1974–2000. Journal of Human Resources, 43(2), 413–436. [Google Scholar]

- Mertens, A., & Beblo, M. (2016). Self-reported satisfaction and the economic crisis of 2007–2010: Or how people in the UK and Germany perceive a severe cyclical downturn. Social Indicators Research, 125(2), 537–565. [Google Scholar] [CrossRef]

- Michie, J. (2020). The COVID-19 crisis—And the future of the economy and economics. International Review of Applied Economics, 34, 301–303. [Google Scholar] [CrossRef]

- Mirowsky, J., & Ross, C. E. (2005). Education, cumulative advantage, and health. Ageing International, 30(1), 27–62. [Google Scholar] [CrossRef]

- Montagnoli, A., & Moro, M. (2014). Everybody hurts: Banking crises and individual wellbeing (SERPS no. 2014010). Department of Economics, University of Sheffield.

- Naumann, E., Buss, C., & Bähr, J. (2016). How unemployment experience affects support for the welfare state: A real panel approach. European Sociological Review, 32(1), 81–92. [Google Scholar] [CrossRef]

- Nguyen, J., & Dinh, T. (2019). Towards a model of economic crisis, social trust & corruption. Norwegian School of Economics. [Google Scholar]

- OECD. (2019). Society at a glance 2019: OECD social indicators. OECD Publishing. [Google Scholar] [CrossRef]

- Ostrom, E., & Ahn, T. (2009). The meaning of social capital and its link to collective action. In G. Svendsen, & G. Svendsen (Eds.), Handbook of social capital. The troika of sociology, political science and economics (pp. 17–35). Edward Elgar. [Google Scholar]

- Raphael, S., & Winter-Ebmer, R. (2001). Identifying the effect of unemployment on crime. Journal of Law and Economics, 44(1), 259–283. [Google Scholar] [CrossRef]

- Reeskens, T., & van Oorschot, W. (2014). European feelings of deprivation amidst the financial crisis: Effects of welfare state effort and informal social relations. Acta Sociologica, 57(3), 191–206. [Google Scholar] [CrossRef]

- Reinhart, C. M., & Rogoff, K. S. (2009). This time is different: Eight centuries of financial folly. Princeton University Press. [Google Scholar]

- Richey, S. (2010). The impact of corruption on social trust. American Politics Research, 38(4), 676–690. [Google Scholar] [CrossRef]

- Robinson, J., Torvik, R., & Verdier, T. (2006). The Political foundations of the resource curse. Journal of Development Economics, 79, 447–468. [Google Scholar] [CrossRef]

- Rothstein, B. (2005). All for all: Equality, corruption, and social trust. World Politics, 58, 41–72. [Google Scholar] [CrossRef]

- Rothstein, B. (2013). Corruption and social trust: Why the fish rots from the head down. Social Research, 80(4), 1009–1032. [Google Scholar] [CrossRef]

- Rueda, D. (2012). West European welfare states in times of crisis. In N. G. Bermeo, & J. Pontusson (Eds.), Coping with crisis: Government reactions to the great recession (pp. 361–409). Russell Sage Foundation. [Google Scholar]

- Sachweh, P. (2018). Conditional solidarity: Social class, experiences of the economic crisis, and welfare attitudes in Europe. Social Indicators Research, 139(1), 47–76. [Google Scholar] [CrossRef]

- Saunders, M., Lewis, P., & Thornhill, A. (2016). Research methods for business students. Pearson. [Google Scholar]

- Scruggs, L., & Allan, J. P. (2006). Welfare state decommodification in 18 OECD countries: A replication and revision. Journal of European Social Policy, 16(1), 55–72. [Google Scholar] [CrossRef]

- Soss, J. (2001). Unwanted claims: The politics of participation in the U.S. welfare system. Social Service Review, 75(4), 691–693. [Google Scholar]

- Søreide, T. (2016). Corruption and criminal justice: Bridging economic and legal perspectives. Edward Elgar. [Google Scholar]

- Starke, P., Kaasch, A., & van Hooren, F. (2013). The welfare state as crisis manager: Explaining the diversity of policy responses to economic crisis. Palgrave Macmillan. [Google Scholar]

- Stolle, D., & Hooghe, M. (2003). Generating social capital: Civil society and institutions in a comparative perspective. Palgrave/Macmillan. [Google Scholar]

- Sun, W., & Wang, X. (2012). Do government actions affect social trust? Cross-city evidence in China. Social Science Journal, 49, 447–457. [Google Scholar] [CrossRef]

- Taylor, P., Funk, C., & Clark, A. (2007). Americans and social trust: Who, where and why. Available online: http://www.pewresearch.org/wp-content/uploads/sites/3/2010/10/SocialTrust.pdf (accessed on 20 December 2019).

- Tella, R. D., & MacCulloch, R. (2009). Why doesn’t capitalism flow to poor countries? Brookings Papers on Economic Activity, 40(1), 285–332. [Google Scholar]

- Thomas, V., Wang, Y., & Fan, X. (2001). Measuring education inequality: Gini coefficients of education (English) (Policy, Research working paper no. WPS 2525). World Bank. Available online: http://documents.worldbank.org/curated/en/361761468761690314/Measuring-education-inequality-Gini-coefficients-of-education (accessed on 20 December 2019).

- Uslaner, E. (2002). The moral foundations of trust. Cambridge University Press. [Google Scholar]

- Uslaner, E. (2012). Trust and corruption revisited: How and why trust and corruption shape each other. Quality & Quantity, 47(6), 3603–3608. [Google Scholar]

- van Hooren, F., Starke, P., & Kaasch, A. (2014). The shock routine: Economic crisis and the nature of social policy responses. Journal of European Public Policy, 21(4), 605–623. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2016). Introductory econometrics: A modern approach. Cengage Learning. [Google Scholar]

| Number of Countries and Territories | Number of Observations | Number of Variables | |

|---|---|---|---|

| Original datasets | 211 | 15,403 | 2202 |

| Our dataset | 211 | 11,364 | 9 |

| Percentage | 100% | 73.78% | 0.41% |

| Statistic | Social Trust | Corruption | Crisis Duration |

|---|---|---|---|

| Obs | 1168 | 5639 | 1103 |

| Crisis | 873 | 4310 | 1103 |

| Non-crisis | 295 | 1329 | - |

| Mean | 35.69 | 47.17 | 9.71 |

| Median | 35.75 | 51.14 | 7 |

| Std. Dev | 17.03 | 15.80 | 7.39 |

| Skewness | 0.27 | −0.64 | 0.85 |

| Kurtosis | 2.45 | 2.45 | 2.55 |

| Percentiles: | |||

| 1 | 4.68 | 10.35 | 1 |

| 50 | 35.75 | 51.14 | 7 |

| 99 | 71.12 | 72.62 | 27 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, J.; Dinh, T.; Selart, M. The Predicting Abilities of Social Trust and Good Governance on Economic Crisis Duration. Adm. Sci. 2025, 15, 123. https://doi.org/10.3390/admsci15040123

Nguyen J, Dinh T, Selart M. The Predicting Abilities of Social Trust and Good Governance on Economic Crisis Duration. Administrative Sciences. 2025; 15(4):123. https://doi.org/10.3390/admsci15040123

Chicago/Turabian StyleNguyen, Jessica, Tue Dinh, and Marcus Selart. 2025. "The Predicting Abilities of Social Trust and Good Governance on Economic Crisis Duration" Administrative Sciences 15, no. 4: 123. https://doi.org/10.3390/admsci15040123

APA StyleNguyen, J., Dinh, T., & Selart, M. (2025). The Predicting Abilities of Social Trust and Good Governance on Economic Crisis Duration. Administrative Sciences, 15(4), 123. https://doi.org/10.3390/admsci15040123