1. Introduction

The HITECH Act (Health Information Technology for Economic and Clinical Health Act) of the United States (

Centers for Medicare & Medicaid Services, 2024a), enacted in 2009, is an example that plays a critical role in accelerating digital government, defined as the use of digital technology to better deliver services and streamline operations, particularly in the healthcare sector. The Act, by incentivizing the adoption of Electronic Health Records (EHRs), sought to improve the quality of care, enhance patient safety, secure data privacy, and streamline care coordination. In particular, the Meaningful Use (renamed Promoting Interoperability), a key component of the Act, encouraged the sharing of health information among various stakeholders within and between agencies, which, in turn, has the potential to reduce costs and improve care delivery (

Centers for Medicare & Medicaid Services, 2024b). Recognizing the importance of exchanging data electronically, especially during the pandemic (

Hong & Cho, 2023;

Sharma et al., 2022), and with the help of advanced technology (

Spanakis et al., 2021), several countries also adopted systems for digital information sharing (

Holmgren et al., 2023;

Nair et al., 2022).

However, as highlighted in the Digital Government Model Framework for Sustainable Development (

United Nations, 2024), the long-term success of these objectives depends on continued efforts to identify and address challenges in the implementation of information technology (

Chen & Esmaeilzadeh, 2023). One of the challenges faced by digital government is how to regulate the IT vendors used to share information among various stakeholders, especially given the increasing market consolidation among vendors (

Wanderer et al., 2014).

According to existing theory, in a concentrated market where only a single firm or a few firms operate, vendors can exert control over prices and supply through collusion, inhibit innovation by discouraging incentives for improving their positions in the market, and limit consumers’ outside options, leading to the risk of data insecurity (

Gilbert, 2006;

Stucke, 2017). Due to this logic, the concentrated market structure raises concerns among policymakers, prompting them to impose antitrust or regulatory actions that could prevent market concentration (

Berger & Hannan, 1989). This concern was particularly prevalent, as noted in a report from the Office of the National Coordinator for Health Information Technology (ONC) in late 2014 (

Department of Health and Human Services, Office of the National Coordinator for Health Information Technology, 2015). Specifically, they maintain that dominant vendors in the concentrated market would even impose information barriers on other non-dominant vendors by charging fees, for instance, so that they can maintain or increase their market share (

Everson & Adler-Milstein, 2016).

However, there is another aspect that policymakers need to consider regarding vendor market concentration. Utilizing the same vendor might facilitate information exchange, as patient data are managed and handled similarly. A previous study found that hospitals using dominant vendors exchange more information than those using non-dominant vendors, indirectly supporting the idea of the positive effect of vendor concentration on information sharing (

Everson & Adler-Milstein, 2016). Considering the challenges hospitals face, including limited technical capacity for electronic information exchange, difficulties in accurately identifying and matching patients across different systems, and struggles in accessing precise addresses of healthcare providers, among others (

De Benedictis et al., 2020;

Johnson & Pylypchuk, 2019;

Rudin et al., 2011), hospitals sharing the same vendors can effectively address these issues. By operating on a unified system, they can increase overall efficiency.

These two composing views lead to the following research question: How does market concentration affect information sharing? This question is particularly important because governments need to effectively balance the risks arising from non-competitive behavior with the potential for improved efficiency from health information sharing, which is expected to reduce costs and increase the quality of care (

Buntin et al., 2011;

Castillo et al., 2018;

Hersh et al., 2015;

Kash et al., 2017). On one hand, if market concentration enhances information sharing, policymakers face a dilemma in choosing between efficiency and addressing noncompetitive behavior. Additionally, if such facilitation varies with different organizational types, it becomes necessary to tailor policies accordingly for each type based on the findings. On the other hand, if market concentration among vendors impedes sharing, policymakers have stronger reasons to impose restrictions on mergers and acquisitions that further exacerbate market concentration, in addition to addressing collusion or other noncompetitive behaviors. Thus, the current study aims to closely examine whether the market concentration of vendors facilitates or impedes information exchange, especially considering potential variations among different types of hospitals.

Based on the existing literature highlighting the network effect, i.e., the value of a product or service increases as more people use it (

J. Lin, 2023;

Metcalfe, 1995;

Shapiro & Varian, 1999), we hypothesize that vendor market concentration is positively associated with information sharing among stakeholders. In other words, when hospitals are connected to a large communication network using the same vendor, they face fewer technological barriers, which facilitates information sharing. Furthermore, to explore potential variations in this association, we focus on three organizational types: government, for-profit, and not-for-profit hospitals. Given that the objective functions differ based on hospital ownership, we hypothesize that the association between market concentration and information sharing will vary by ownership type. Specifically, since government hospitals are funded through taxes or grants and face less pressure to operate efficiently compared to the other two types, the pattern of information sharing may differ.

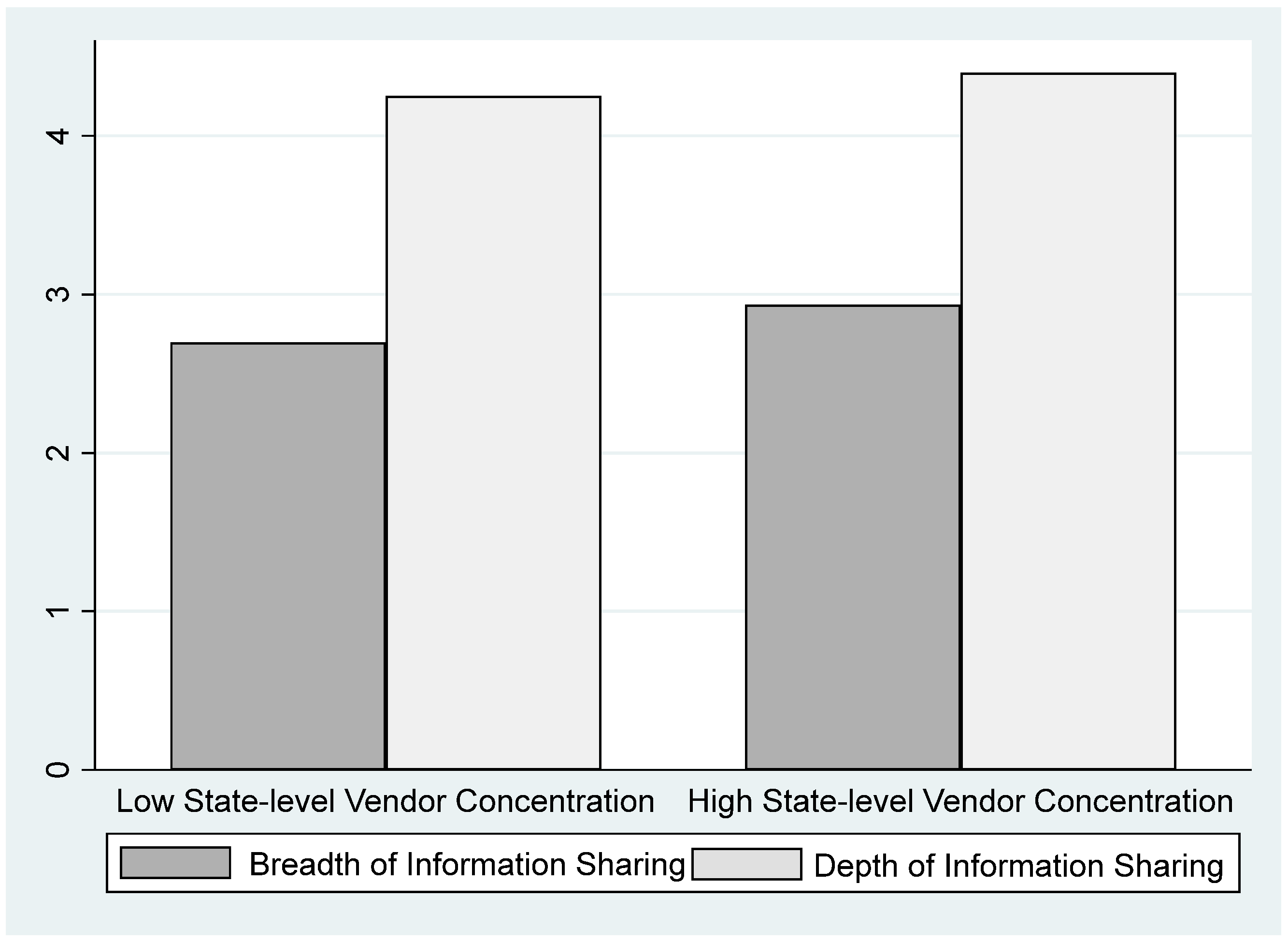

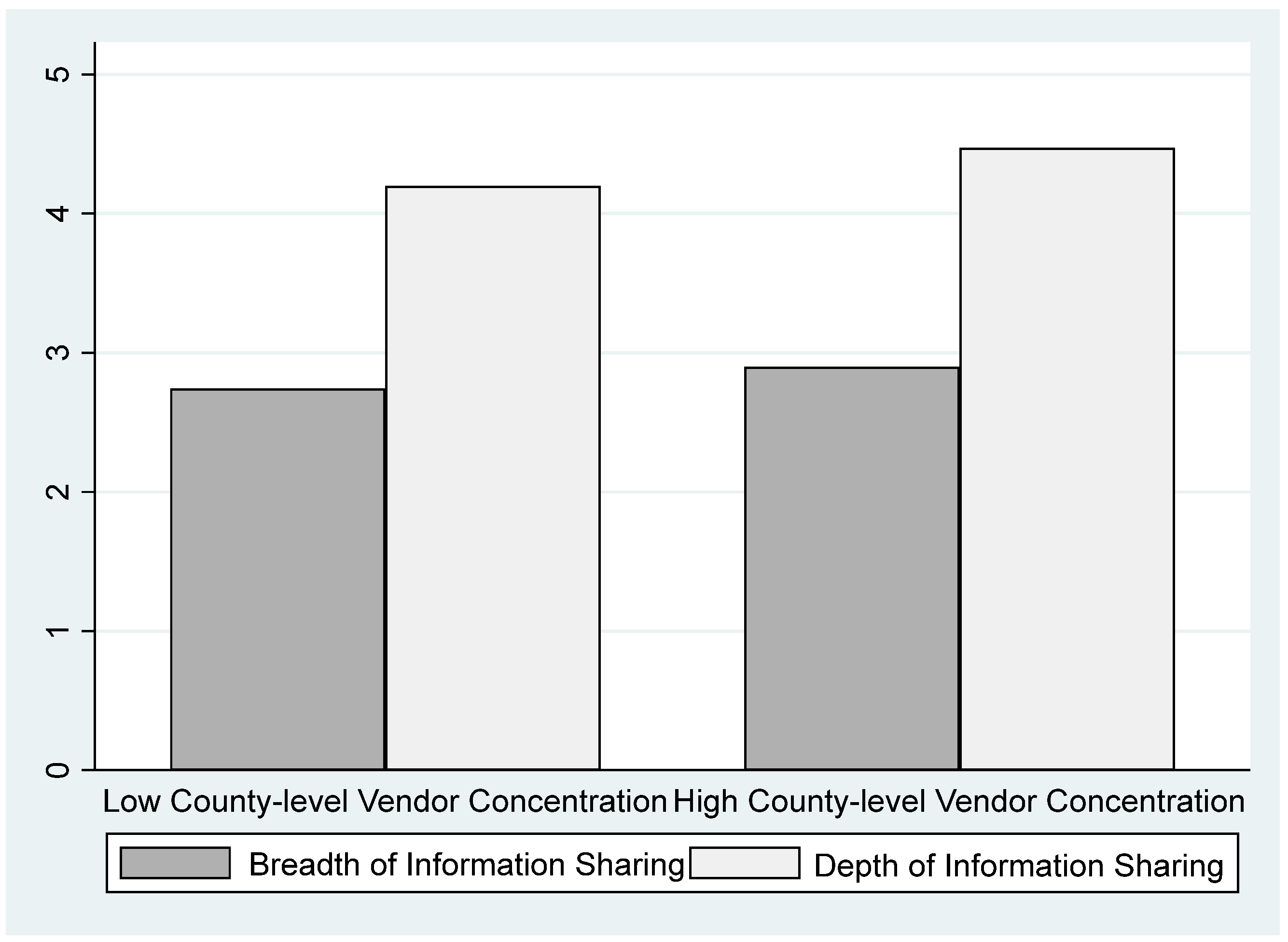

Analyzing data between 2014 and 2016 from the American Hospital Association’s surveys, we found that information sharing—the extent to which information is shared (i.e., breadth) and the level of detail shared (i.e., depth)—both increased with higher state- and county-level market concentration. Additionally, not-for-profit and for-profit hospitals showed increased sharing at both levels, while government hospitals enhanced sharing only at the county level.

The structure of the paper is outlined as follows. In

Section 2, we delineate our data and model, while

Section 3 explains our results from the empirical tests and discusses the results, and

Section 4 explains the limitations and future research directions. Our conclusions are presented in

Section 5.

2. Materials and Methods

2.1. Data

We aggregated data from 2014 to 2016 from two distinct sources, namely the American Hospital Association (AHA) Annual Surveys and IT Surveys. The AHA collects detailed data from hospitals in the United States annually. The AHA Annual Surveys encompass a wide array of hospital-level data, including ownership type, bed size, teaching status, system affiliation, physician-hospital integration, and revenue models. Additionally, the AHA IT Surveys provide comprehensive insights into the breadth and depth of information sharing among hospitals and their vendors.

While some institutions have purchased access to the AHA data platform, allowing researchers to access data for free, the authors of this paper did not have an institutional subscription and therefore directly purchased access to the datasets for both surveys using research grants. It is noteworthy that, because these datasets do not pertain to human subjects, the present study is exempt from review and approval by the institutional review board (IRB).

2.2. Our Model and Measurement

According to previous literature (

Cho et al., 2018), our primary dependent variable, information sharing, was derived from AHA IT Surveys. Information sharing, specifically, was measured in two ways: breadth and depth. The breadth of information sharing variable was determined by binary responses to inquiries regarding whether a hospital shares data electronically with (1) other hospitals within its system, (2) hospitals outside its system, (3) ambulatory providers within its system, and (4) ambulatory providers outside its system. The variable is calculated by adding the responses for each, resulting in a minimum value of 0 and a maximum value of 4. The higher the value of breadth, the more stakeholders the focal hospital shares information with.

The depth of information sharing variable was assessed based on binary responses to questions regarding the extent of detailed data shared, categorized into five types: patient demographics, laboratory results, medication history, radiology reports, and clinical/summary care records. Similarly to breadth, the depth variable is calculated by adding the responses for each, resulting in a minimum value of 0 and a maximum value of 5. The higher the value of depth, the more detailed information the focal hospital shares with others.

As both the breadth and depth of information sharing variables [Information Sharing] are generated by summing the values of dummy variables, and the resulting variable can be counted in whole numbers where zero represents the complete absence of breadth and depth (i.e., no information sharing), these variables are ratio variables.

Our main independent variable is vendor concentration [

Vendor Concentration]. To investigate our research question regarding whether hospitals in states and counties with concentrated vendors are more or less likely to exchange information with other providers, and to what extent, we developed measures of vendor concentration at both the state and county level. Using data from AHA IT Surveys, we first obtained information on the vendors directly used by each hospital to electronically exchange patient health information. We then calculated the concentration level using the Herfindahl-Hirschman Index, a commonly used measure of market concentration in economics, business, and various industries (

Calkins, 1983;

Rhoades, 1993), based on the number of vendors used in each state and county. If the coefficient of vendor market concentration is positive and statistically significant, it supports our hypothesis and confirms the dilemma policymakers face. Conversely, if the coefficient is either non-positive or statistically insignificant, our hypothesis is not supported, and the argument that concentration can lead to efficiency gains loses explanatory power.

Other key independent variables, particularly useful in sub-sample analysis, include ownership types: for-profit ownership [For-profit Hospital] and government ownership [Government Hospital], sourced from AHA annual surveys. Since there are three ownership types, two ownership dummy variables are utilized to represent each. For instance, when both dummy variables are zero, it indicates a not-for-profit hospital. As one of the objectives of this study is to identify any variations in the information sharing facilitation or hindrance of vendor market concentration among hospital types, the effect of ownership type on information exchange is not predicted in our study.

For our control variables, we included several variables sourced from AHA annual surveys. Firstly, we controlled for bed size, measured as the total number of hospital beds [

Bed Size], as we expect larger hospitals to find it easier to exchange information than smaller hospitals (

Hanna & McDowell, 1984;

Kazley & Ozcan, 2007;

Wang et al., 2005). Additionally, teaching status and system affiliation dummies were included. Teaching hospital [

Teaching], a dummy variable that takes the value of 1 if the hospital is a teaching hospital, is controlled for, as previous research indicates that teaching hospitals are more adept with new technology, making it easier for them to share information with others (

Wang et al., 2005). System affiliation [

System Affiliation], also a dummy variable, is controlled for, as hospitals with similar culture and practices are more likely to exchange information (

Wang et al., 2005). Physician–hospital integration [

Physician-Hospital Integration] is another binary variable, taking the value of 1 if the hospital employs an integrated salary model where physicians are hospital employees, otherwise 0. When employed, providers are more likely to have aligned incentives with hospitals, encouraging them to make efforts to share information with others both inside and outside the hospitals (

Lammers, 2013). Lastly, capitation revenue [

Capitation Revenue] is a binary variable that assumes a value of 1 if a hospital’s contract with its employees is based on a capitated, predetermined, or shared risk basis. The rationale is that when it is capitated and shared risk-based, employees are more encouraged to reduce costs, pushing them to engage more in information exchange, which is known to reduce costs (

S. C. Lin et al., 2018,

2019;

Young et al., 2021).

Before explaining the results, we would like to elaborate on our choice of statistical model, specifically ordinary least squares (OLS) regression analysis. Since our main independent and dependent variables are observed (not latent), and given the simplicity of our model, we chose OLS over Structural Equation Modeling (SEM), which is better suited for models involving latent variables or complex relationships. To account for within-subject correlation in our longitudinal data, we cluster standard errors at the hospital level. Clustering the standard errors in this way helps prevent overestimation of the precision of our estimates and ensures more robust inferences in cases where clustering or dependence within our data exists.

3. Results and Discussion

Table 1 presents descriptive statistics for 10,028 hospitals. It is worth noting that the maximum value of county-level vendor concentration is 1, while the maximum value of state-level vendor concentration is 0.465. This means that it is possible for all hospitals located in a given county to use the same vendor, while using the exact same vendor across an entire state is not feasible. Additionally, according to the table, 19% of our observations correspond to for-profit hospitals, 22% to government-owned hospitals, and the remaining observations pertain to nonprofit hospitals.

Before presenting the results of our OLS regression, we have included the bar charts to provide a glimpse of the overall dataset. The simple association between market concentration at both the state and county levels and information sharing is shown in

Figure 1 and

Figure 2 below.

The results of our OLS regression analyses examining the effects of state-level and county-level vendor concentration on information sharing are presented in

Table 2 and

Table 3. Additionally,

Table 4 and

Table 5 display the results of subsample analyses, indicating whether such facilitation or impediment varies with ownership. Before delving into the results in detail, it is worth noting that we conducted a variance inflation factor (VIF) test to assess multicollinearity in our models. The VIF test results suggest that there is insufficient evidence to conclude that our model suffers from multicollinearity issues.

The coefficients of the state-level vendor concentration in

Table 2 and the county-level vendor concentration in

Table 3 are both positive and statistically significant for both the breadth (column 1) and depth of information sharing (column 2), supporting our hypothesis. These findings suggest that improved interoperability, facilitated by the use of the same health IT vendor, enables hospitals to share information with a wider range of stakeholders (breadth of information sharing) and in greater detail (depth of information sharing). The common system and similar culture induced by the same vendor appear to help hospitals overcome the various challenges they may encounter during the sharing process (

De Benedictis et al., 2020;

Johnson & Pylypchuk, 2019;

Rudin et al., 2011). It is interesting to note that the coefficients on for-profit ownership and government ownership are both negative. These findings suggest that not-for-profit hospitals, which are established with a focus on altruistic values rather than monetary profits (base group), prioritize information sharing more seriously compared to for-profit or government hospitals (

Cho et al., 2021). The coefficients of our control variables—bed size, system affiliation, physician–hospital integration, and capitation revenue—are all in line with our expectations. However, there is one exception, namely the coefficient for teaching hospitals. Contrary to our prediction, its insignificance may suggest that despite the interest of teaching hospitals in sharing information with external parties, other organizations might lack the capability to engage in electronic exchanges (

Cho et al., 2021).

With the results presented in

Table 2 and

Table 3, we now understand that the market concentration of vendors, both at the state and county levels, enhances information sharing among stakeholders. This prompts us to question whether such facilitation arising from similarity in culture and practices varies according to one of the key organizational forms in the hospital industry, namely ownership type. Therefore, we conducted a sub-sample analysis to investigate any variations among the three types, namely government, for-profit, and not-for-profit hospitals. The results are reported in

Table 4 (state-level vendor concentration) and

Table 5 (county-level vendor concentration).

The results of sub-sample analysis provide some inconsistency in regard to variation in the effect of market concentration on information sharing. While the coefficients of state-level vendor concentration are positive and statistically for only for-profit and not-for-profit hospitals, but not for government hospitals in

Table 4, the coefficients of county-level vendor concentration are all positive and statistically significant among all three ownership types in

Table 5. We can interpret the results as follows. On the one hand, the findings at the state level (

Table 4) suggest that the commonality induced by using the same vendor successfully helps both for-profit and not-for-profit hospitals overcome challenges faced during the process of information sharing, while such commonality is not sufficient to overcome challenges for government hospitals. On the other hand, the findings at the county level (

Table 5) suggest that hospitals located in a given county are small enough to be connected via informal ties. The combination of commonality induced by using the same vendor and familiarity in a given county helps even government hospitals overcome challenges related to sharing information with others, and in greater detail.

Lastly, we conducted an ordered logit analysis as a robustness check to ensure that our results are not sensitive to the assumption that the dependent variable, [information sharing], is a ratio variable rather than ordinal. The results of the ordered logit analysis were consistent with our OLS analysis, confirming the robustness of our findings. The results of the ordered logit analysis are available upon request.

Based on the results of our paper, we can assert that the contributions of our study are multifaceted. In the realm of research, our findings confirm the network effect (

J. Lin, 2023;

Metcalfe, 1995;

Shapiro & Varian, 1999)—the benefits of being connected to a large communication network—and expand the existing literature by highlighting the critical importance of enhanced interoperability among users of the same vendor (

Castillo et al., 2018;

Everson & Adler-Milstein, 2016). Specifically, prior studies have shown that hospitals using the dominant vendor are more likely to exchange information than those that do not (

Everson & Adler-Milstein, 2016). We further confirm that not only hospitals using the dominant vendor, but all hospitals—regardless of the vendor dominance—engage in more information exchange as the state- or county-level concentration of vendors increases. Additionally, our study provides nuanced insights into the contextual factors that influence this facilitation, offering a deeper understanding of the issue. Overall, the results of our paper shed light on a previously understudied aspect and expands our understanding of information sharing in healthcare settings (

Cho et al., 2021).

In terms of practical implications, our study helps the digital government address challenges in enhancing the interoperability of health information technology. Specifically, our findings suggest a pressing need for policymakers and practitioners to carefully calibrate their strategies regarding vendor concentration, as facilitating data exchange among stakeholders within the same vendor network can help digital government achieve the desired sustainable outcomes by integrating and streamlining services across the ecosystem. Hastily imposed restrictions on vendor market concentration could potentially compromise the efficiency of information sharing—a vital component for both cost reduction and quality improvement (

Buntin et al., 2011;

Castillo et al., 2018;

Hersh et al., 2015;

Kash et al., 2017). Even when regulating against price collusion or other noncompetitive behavior due to market concentration, it is important to at least acknowledge the potential side effects, such as the loss of efficiency, namely enhanced information sharing.

Furthermore, our findings shed light on the behavior of government hospitals in information exchange. Specifically, the observation that government hospitals tend to engage in more extensive information exchange with a broader range of stakeholders and provide more detailed information as the county-level concentration of vendors increases, rather than with an increase in state-level concentration, underscores the significance of informal ties. These ties seem to be more viable within closely located hospitals within a given county as opposed to hospitals scattered across a state. As a result, government hospitals, even when geographically distant, can proactively pursue avenues to enhance information exchange, thereby mitigating potential incentives lacking in efficiency or profit maximization. To summarize, by fostering collaboration and informal networks, policymakers and practitioners can create a more resilient and effective healthcare information-sharing ecosystem.

4. Limitations and Future Research Directions

Despite the numerous valuable contributions highlighted earlier, the current study, like many others, has its limitations. First, while our in-depth analysis of the varying impact of vendor market concentration across ownership types sheds light on enhancing information sharing, it focuses solely on one organizational structure. Future studies could delve into additional contextual factors to provide a more comprehensive understanding.

Second, the current study relies on data from the AHA IT survey, in which hospitals report the names of vendors they use for direct electronic patient health information exchange. However, it is plausible that hospitals also share information through alternative methods, such as non-vendor-mediated approaches or regional health information exchanges.

Third, given the nature of our dataset, understanding the mechanism underlying the relationship between concentration and data sharing is challenging. This relationship could be influenced by factors such as enhanced capabilities, financial incentives, or organizational culture (

J. Lin, 2023;

Pendergrass & Ranganathan, 2021). Qualitative studies, which are better suited to exploring these mechanisms, would help policymakers address the issue more effectively.

Fourth, we acknowledge that the limited number of years available for our analysis may be viewed as a constraint. However, the years for which we have data are still highly relevant to our research question, as the healthcare IT market has undergone significant consolidation, particularly between 2012 and 2021. Nevertheless, future research with a broader time range would be ideal for capturing long-term trends and providing valuable insights.

Lastly, our results, generated through OLS analysis, indicate a correlation rather than causation between market concentration and the breadth and depth of information sharing. One of the primary limitations of OLS in this context is its inability to establish causal relationships. While our findings are valuable, additional research employing more robust methodologies, such as instrumental variables (IV) or experimental designs, could help explore the causal relationships in greater detail and provide more reliable insights into the mechanisms at play.

5. Conclusions

When enhancing information sharing among various stakeholders to achieve the goal of reducing costs and improving care delivery in the healthcare industry, policymakers find themselves grappling with a pivotal question: should we prioritize efficiency or seek to mitigate anti-competition? On the one hand, in the context of high vendor market concentration, many policymakers express concerns, such as elevated pricing driven by significant bargaining power and limited consumer options. On the other hand, there are also proponents who argue that a concentrated vendor market could enhance efficiency by streamlining infrastructure and operations among different agencies. This dilemma highlights the complex task policymakers face as they decide how to regulate highly concentrated vendor markets effectively.

Delving into national data to deepen our understanding of this dilemma, our study offers valuable insights into the dynamics of information exchange among hospitals. As anticipated in the introduction of this study, we confirmed that higher concentrations of vendors at the state or county level are associated with increased information exchange across all hospitals, regardless of the vendor used.

While this finding aligns with our hypothesis, it may still come as a surprise to policymakers, as it suggests that, rather than solely imposing restrictions on mergers and acquisitions of health IT vendors to prevent non-competitive behavior, it is crucial to recognize that vendor concentration presents both positive and negative aspects. Specifically, while concentration may often enable vendors to collude or strategically erect barriers to entry for other vendors, from the standpoint of information sharing, a concentrated vendor market can potentially foster efficiency by facilitating information exchange among vendors. This underscores the complexity of the issue and the need for nuanced policy approaches.

Our study also highlights the importance of considering these dynamics not only in countries with well-established health IT systems, such as the U.S., but also in those where the use of health IT is still emerging. By acknowledging the multifaceted nature of vendor concentration and its implications for information sharing, policymakers can develop more effective and targeted strategies to regulate and manage highly concentrated markets in the healthcare industry.

In addition, even when such positive aspects suggest that vendor concentration indeed helps most hospitals achieve better information sharing in most cases, our findings show that government hospitals did not increase their information sharing with others, even when the market concentration of vendors increased at the state level. However, at the county level, both not-for-profit and for-profit hospitals increased their information sharing in both state-level and county-level concentrated markets of vendors. This suggests that government hospitals, in particular, seem to have found it troublesome to overcome challenges despite the commonality induced by sharing the same vendor system. Policymakers should thus pay even more careful attention to addressing the dilemmas arising from concentration.

In conclusion, our study helps address the challenges and provide opportunities faced by digital government in the healthcare sector across various aspects. First, the current paper highlights the potential to boost healthcare efficiency by showing that greater vendor concentration may improve the exchange of information. Our findings indicate that this increased concentration could lead to more streamlined healthcare delivery. By facilitating efficient utilization of resources, including data, this approach can help decrease redundancy, reduce waste, and optimize the use of medical supplies and human resources, thereby contributing to both environmental and economic sustainability. Second, the policy dilemma discussed in this paper can result in improved healthcare quality as more comprehensive and accessible patient data across different providers enhances care. This can lead to quicker diagnoses and more effective treatments, ultimately decreasing the healthcare system’s resource consumption by reducing the need for prolonged treatments and shortening hospital stays. Third, this paper has a significant impact on policy considerations. The findings can shape policies that balance market control with public health benefits. Regulations informed by these dynamics could create environments that address anti-competitive practices while advancing sustainability in healthcare. Such policies could ensure that efforts to enhance market efficiency do not compromise competitive equity or public health standards.