Abstract

This study examines the current trajectory and future research directions of environmental, social, and governance (ESG) integration within the banking industry. Utilizing bibliometric and scientometric approaches, it highlights trend topics, influential studies, and notable contributors. Drawing from an analysis of 681 studies from Scopus and Web of Science databases, a comprehensive dataset was curated using scientometric networks with VOSviewer and Bibliometrix tools. This study emphasizes the evolving nature of ESG integration within banking, emphasizing an interdisciplinary shift encompassing environmental, social, and governance considerations. Keyword analysis reveals emerging trends, including the influence of ESG factors on banks’ financial performance, regional variations in ESG integration within banking, and risk assessment related to ESG factors and credit risk in banks. By offering insights into the evolving topic of ESG integration within banking and identifying promising avenues for further exploration, such as the fundamental connection between ESG and sustainability, particularly in climate change and green finance, this research contributes to ongoing discussions surrounding ESG integration in the banking industry, guiding future research efforts in this vital financial sector.

1. Introduction

In recent years, the Sustainable Development Goals (SDGs), which were adopted by all United Nations members in 2015, have been highly relevant in the design of public policies and corporate strategies. In this way, Cordova and Celone (2019) showed that there are three main categories into which the SDGs can be divided, namely environmental, social, and governance (ESG). In this sense, regarding the importance of how policymakers should select the priority SDG indicators to measure their impact, they should be action-oriented, concise, precise, and globally applicable (Hák et al. 2016).

Moreover, integrating ESG issues into core business has become a critical driver of change within the global banking industry, impacting risk management and long-term sustainability (Tashtamirov 2023). This shift represents a significant departure from traditional, purely profit-driven models, prompting banks to adopt new strategies with complex challenges, which include ESG issues (Hayretci and Aydemir 2021). While navigating this transformation poses difficulties, it also presents exciting opportunities for banking institutions to enhance their long-term sustainability and attract socially conscious investors (Weber and Feltmate 2016). However, during the COVID-19 pandemic, the largest banks in the United States experienced a decline in their ESG scores (Kaminskyi and Nehrey 2023).

Furthermore, research on ESG practices in the banking industry has transformed in the last two decades. Initially characterized by a broad and ethical lens, it has expanded to include the pioneering of ESG-conscious practices, turning attention to examining the behavior of banking institutions concerning ESG issues (Galletta et al. 2022).

It is also noted that banks can exert considerable economic influence on corporate investment decisions and provide valuable support for government and firm sustainability agendas (Carnevale and Drago 2024). In this way, as highlighted by Schücking (2015), coal is the principal source of carbon dioxide (CO2) emissions, with coal-fired power plants costing around USD 2 billion. Regarding this, the banking industry has the power to drive those financial resources toward supporting renewal and green energy initiatives. According to this, the banking industry should have a proper development plan to apply environmental and social principles successfully, aligning with the decision-making processes of their foundation business activities. In fact, research indicates that banks provide at least 71% of the finance that is used for such investment projects (Serafimova and Vellacott 2015). Consequently, it is crucial to establish indicators that assess the integration of ESG within the banking industry, which should encompass various dimensions and variables to measure the level of transparency (Gai et al. 2023). Thus, it is important to highlight that before emerging ESG issues, corporate social responsibility laid the foundation for sustainable banking actions (Schücking 2015).

Regarding research conducted on the impact of ESG on banks’ financial performance, it shows mixed findings. While overall ESG scores may not directly impact return on assets (ROA), they can negatively affect market performance based on Tobin’s Q ratio (Khoury et al. 2023). Remarkably, studies within the Asia Pacific region suggest a positive correlation between overall ESG and return on equity (ROE) for banks (Anio et al. 2023). In this way, banks’ robust ESG issues can buffer against systemic tail risk shocks. By demonstrating strong ESG issues, banks enhance their capacity to withstand and mitigate the contagious effects of severe financial disruptions within the financial system (Ling et al. 2023).

Therefore, the highlights of the crucial role of green and social finance in mitigating environmental and social risks and fostering economic growth emphasize the need for collaboration between policymakers and bank regulators to incentivize the banking industry to adopt these initiatives (Agrawal et al. 2023). Also, they underscore the value of ESG issues for society and bank efficiency, encouraging bank managers to prioritize such initiatives (Shaddady and Alnori 2024). According to Lee et al. (2024), it is important to consider a positive association between banks’ ESG issues and their ability to create liquidity, which is particularly explicit in countries characterized by elevated geopolitical instability, prevalent corruption, and limited democratic development.

Knowledge Gap, Objective, and Contributions

The implementation of ESG in the banking industry has been increasing and gaining more importance in recent years. Thus, it is essential to understand how these actions impact the financial process and how they could be implemented (Ahmed et al. 2018). It is also crucial to study how the banks’ performance is better when implementing ESG (Alam et al. 2022). Indeed, Rastogi and Singh (2022) sustained the relevance of the research on how information and communications technology hold a key role in the implementation of ESG issues in the banking industry. Moreover, as a relatively new field, ongoing research holds diverse perspectives on the most appropriate approach.

This study offers a more in-depth, multifaceted, state-of-the-art analysis of ESG’s influence on the banking industry. It systematically identifies key themes, emerging trends, and notable scholars and publications in this domain. Importantly, it reveals the interconnectedness of ESG practices in the banking industry with other research fields, fostering a broader understanding of its impact. Beyond its theoretical contributions, this study delivers practical insights that are valuable to scholars and practitioners. For practitioners, the findings illuminate the intricacies of ESG practices in banking, assisting them in identifying potential investment opportunities and avenues for collaboration. This knowledge empowers them to make informed decisions aligned with financial and ESG practices. By analyzing the academic literature using a bibliometric and scientometric approach, this study seeks to identify and clarify the existing knowledge gaps regarding the relationship between ESG and financial performance in the banking industry.

This study aims to analyze existing ESG research to identify the topics currently leading the scientific discourse and pinpoint areas where further investigation is needed. This will provide valuable insights for the banking industry to optimize its financial performance and risk management practices for sustainability. In this way, this paper analyzes the multifaceted impact of ESG on the banking industry, examining the challenges and opportunities it presents for its future development. This employs an analysis with VOSviewer (Jan van Eck and Waltman 2010) and Bibliometrix tools (Aria and Cuccurullo 2017). Thus, regarding a better understanding of the influence of ESG on the banking industry and research course, considering the concerns, this study seeks to answer the following research questions (RQs).

First, we will explore the specific impacts of ESG issues on the banking industry. This analysis examines the significant contributions of ESG to the transformation of the banking industry. To fulfill this objective, we investigate the following research questions:

RQ 1: What is the status of ESG within banking industry research?

RQ 2: What are the areas of further research and future opportunities in the ESG practices in the banking industry?

Second, our analysis delves into the principal themes driving ESG integration in the banking industry and examines the growth and prospects of this trend following these research questions:

RQ 3: What are the trends of ESG within the banking industry?

RQ 4: Which are the leading countries and institutions in research on ESG within the banking sector?

Third, we analyze the leading researchers and cluster collaborative exertion for producing cooperative research, following the question:

RQ 5: Who are the most significant researchers in ESG in the banking industry?

Following this introduction section, the remainder of the paper proceeds as follows. Section 2 delves into the theoretical framework. Section 3 presents the materials and methods, which include the literature search strategy. Section 4 presents a detailed examination of the key findings using scientometric analysis. Finally, Section 5 and Section 6 culminate with the Discussion and Conclusions sections.

2. Theoretical Framework

Examining the integration of environmental, social, and governance (ESG) principles within the banking industry makes a thorough exploration of relevant theoretical frameworks imperative. This section delves into key theoretical perspectives that emphasize the intricate relationship between ESG considerations and banking practices.

2.1. Stakeholder Theory

Stakeholder theory, originating from the seminal work of Freeman (1984), offers valuable insights into how organizations, including banks, explore the diverse interests of stakeholders in their decision-making processes. This theory suggests that organizations should consider the interests of all stakeholders, ranging from shareholders and customers to employees and the broader community. Within the banking sector, stakeholder theory provides a lens through which to understand how banks balance the expectations of various stakeholders regarding ESG practices. By prioritizing stakeholder interests, banks can develop sustainable strategies that not only enhance long-term value creation but also contribute positively to societal welfare. As discussed earlier, this re-convergence between stakeholder theory and strategy theory holds significant promise in shaping a new type of strategy theory—one that simultaneously addresses both the economic and moral dimensions of the human organization focusing on value creation and appropriation (McGahan 2021).

2.2. Agency Theory

The discussion on managers’ potential overinvestment in sustainability activities, driven by personal gain and at the expense of shareholders, aligns with the insights provided by agency theory (Jensen and Meckling 1976; Masulis and Reza 2015). Agency theory, rooted in the seminal work of Jensen and Meckling (1976), explores conflicts of interest between principals (e.g., shareholders) and agents (e.g., bank executives), which can arise due to differences in goals and incentives and suggests that managers may prioritize their own interests over those of shareholders due to the separation of ownership and control in modern corporations (Krüger 2015). Within the banking industry, this theory illustrates how executives’ actions regarding ESG integration may be influenced by their own interests. By understanding these dynamics, banks can implement mechanisms to align executives’ interests with those of stakeholders, thereby mitigating agency conflicts. Transparency and accountability are essential factors in this process, enabling banks to integrate ESG considerations effectively while maximizing shareholder value.

Additionally, managers may engage in ESG activities to mitigate the effects of corporate wrongdoing and reduce scrutiny from stakeholders, a phenomenon supported by prior literature (Hemingway and Maclagan 2004; Petrovits 2006; Prior et al. 2008; Zhang et al. 2024).

2.3. Institutional Theory

Institutional theory emphasizes the role of institutions, norms, and values in shaping organizational behavior and practices. Originating from the seminal work of DiMaggio and Powell (1983), this theory highlights how regulatory frameworks, industry norms, and societal expectations influence organizational responses to environmental and social issues. In the context of ESG and banking, institutional theory elucidates the institutional pressures and legitimacy concerns banks face when adopting ESG principles. Banks can enhance their legitimacy and reputation by conforming to institutional norms and expectations while fostering sustainable business practices.

This alignment with institutional expectations not only contributes to societal welfare but also has implications for financial performance within the banking sector. The influence of institutional theory underscores the importance of understanding the nuanced relationship between ESG activities and bank performance, particularly in the context of diverse regulatory environments, cultural norms, and institutional quality indices (Shabir et al. 2024). By elucidating these theoretical frameworks, researchers can better understand the complex dynamics surrounding ESG integration within the banking industry. Moreover, integrating theoretical insights into empirical research enables scholars to formulate hypotheses, testable propositions, and practical recommendations that contribute to both theoretical advancement and managerial practice.

3. Materials and Methods

3.1. Data Collection

Considering the PRISMA reporting guidelines, which are designed to help researchers transparently report methods and findings, this study performs a scientometric and bibliometric analysis, which is carried out using two prominent databases, Scopus and WoS, which were gathered over 20 years from 2003 to March 2024. Merging these two databases provided an understanding of the progress and the trends in the study area. WoS is a broad repository of distinguished journals known for its strong significance factor. Institutions, universities, and organizations are extensively used to access and appraise superior studies with citations and impact factors. It is a suitable and reputable database well fitted for bibliometric and scientometric analyses. Scopus is the most extensive research database, with immense coverage across multiple disciplines. Both offer the option to export data in BibTex format, which smooths the use of bibliographic packages for further analysis. Likewise, this study used Google Scholar to obtain the total global citation indicator (TGC).

3.2. Keywords and Inclusion Criteria

The fitting terminology to fetch data from WoS and Scopus was thoughtfully selected. The search terminologies were “bank*” AND ESG. Moreover, the search equation was the following: TITLE-ABS-KEY (bank* AND ESG) AND (EXCLUDE (SUBJAREA, “ARTS”) OR EXCLUDE (SUBJAREA, “MEDI”) OR EXCLUDE (SUBJAREA, “PHYS”) OR EXCLUDE (SUBJAREA, “BIOC”) OR EXCLUDE (SUBJAREA, “NURS”) OR EXCLUDE (SUBJAREA, “PSYC”) OR EXCLUDE (SUBJAREA, “VETE”)). Thus, 416 and 476 results were found, respectively, from 2003 to March 2024.

3.3. Data Formatting, Merging, and Cleaning

In pursuit of conducting an extensive scientometric analysis of the intersection of the banking industry and ESG, 681 studies conformed to the stipulated criteria. The Bibliometrix R-package was used to harmonize both search cohorts into a compiled database to obtain an integrated database. This procedure effectively expunged 205 duplicative entries, culminating in consolidating a refined corpus comprising 673 unique research studies, thus constituting the bedrock of this scholarly inquiry. Subsequently, the compendium of identified studies was judiciously imported and cataloged with Mendeley, laying the groundwork for systematic analysis and meticulous citation prescriptions.

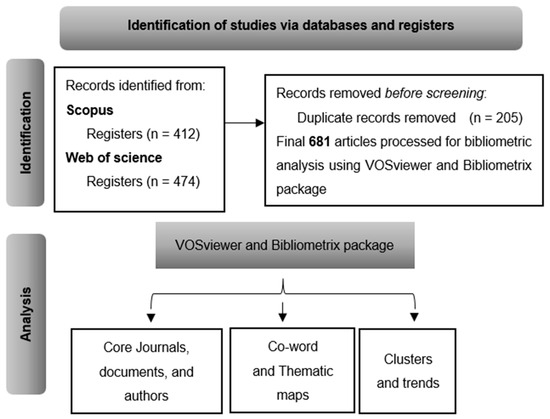

We visualized the research results using VOSviewer version 1.6.20 and Bibliometrix R-package 4.1. These techniques allowed the identification of principal researchers, institutions, countries, and sources in the field. It also identified the principal researchers and performed bibliographic coupling to infer the emerging research topics in the area. Figure 1 shows the strategy used to carry out this study.

Figure 1.

Literature search strategy.

3.4. Tools and Techniques Used for Scientometric Analysis

In this study, we conduct a scientometric analysis to analyze studies and citation information (Waltman 2016). This uses mathematical techniques, such as network analysis and clustering algorithms, to spot prominent researchers in a distinct field and reveal recent and related research topics (Chen and Song 2019). The extensive collection of studies in bibliometrics contributes to an exhausting examination of important research subjects, fields, or trends (Aksnes et al. 2019).

In recent years, bibliometric analysis has become popular in business, management, accounting, economics, econometrics, finance, and social sciences (Price 1976). This is because it is an easy way to access a number of volumes of bibliometric data through the expansion of scientific databases, and this is made feasible through specialized software tools that simplify the efficient analysis of such data (Moral-Muñoz et al. 2019). Two types of bibliometric analysis are usually considered: performance analysis and science mapping. Performance analysis conducted by Donthu et al. (2021) centers on the productivity of individual researchers, institutions, and countries, while science mapping (Chen 2017) focuses on the relationships between these entities. This research incorporates both methods to give better and more inclusive insight into the field.

The bibliographic data were analyzed using two software tools: Biblioshiny (Jan van Eck and Waltman 2017; Dervis 2019; Linnenluecke et al. 2020) in RStudio and VOSviewer (Jan van Eck and Waltman 2010; Jan van Eck and Waltman 2017). Biblioshiny is an R package that offers different functions for thematic mapping, clustering, keyword analysis, citation analysis, and content analysis. It gives comprehensive insights into situations to consider, such as the annual publication count, collaboration index, total citations, citation paper, average citation per year, relevant sources, prominent journals in the specific field, local and global cited sources, influential authors, country-specific research output, highly cited documents, locally cited references, and frequently recurring keywords. Visually representing the growth of sources, words, and authors facilitates the exploration of emerging topics, the analysis of development over time, and the examination of word citation patterns. Conversely, VOSviewer generates graphical representations that depict relationships among authors, keywords, affiliations, countries, and sources. The proximity of nodes within the visualization indicates the level of closeness and interconnection between the respective entities.

4. Bibliometric and Scientometric Analysis

4.1. General Description

The Scopus and WoS databases contained 412 and 474 research studies, respectively. After identifying and eliminating the duplicate records, 673 unique research studies were made available from both sources, as shown in Figure 1. The documents cited a total of 21,575 references. The publication period is from 2003 to March 2024. The analysis of the publication outputs showed an unsteady growth pattern, with an average annual growth rate of 21.62%, 1589 researchers, and 1892 author’s keywords, as shown in Figure 2.

Figure 2.

Summary of the studies. Source: Bibliometrix tool using Scopus and WoS databases.

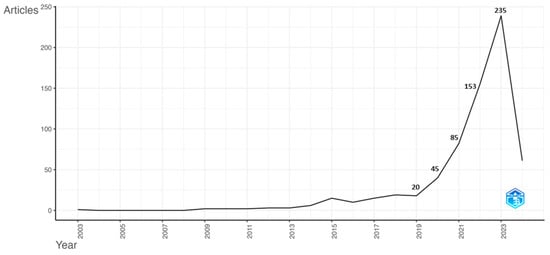

Figure 3 represents a considerable growth of interest in publishing the subject in the academic community. From 2003 to mid-2019, the annual growth rate was low, with near to nonsignificant publications. The relatively few publications between 2003 and 2013 can be attributed to several factors: (1) Early stage of ESG awareness: During this period, ESG considerations were not as prominently integrated into mainstream financial analysis and banking operations as they are today. The concept of ESG was still evolving, and its relevance to the banking sector was not fully recognized. (2) Lack of regulatory pressure: There was less regulatory focus on sustainability issues in the banking sector. Without stringent regulations or guidelines, there was less impetus for banks and researchers to prioritize ESG criteria in their studies and operations. (3) Market focus on profitability: The banking sector’s primary focus was on profitability and risk management from a traditional financial perspective, rather than incorporating ESG factors. This focus limited the scope and number of publications on ESG topics.

Figure 3.

Scientific production output. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

The sharp increase in publications from 2019 to 2023 can be partly attributed to the COVID-19 pandemic, which began in early 2020. The pandemic brought unprecedented challenges and highlighted the importance of sustainability and resilience in the banking sector. Financial institutions faced increased scrutiny regarding ESG practices as stakeholders demanded greater transparency and accountability in managing environmental and social risks. This analysis likely encouraged more research and publications to address these concerns and adapt to the new normal. Likewise, during the pandemic, several regulatory bodies and international organizations introduced specific guidelines and regulations to enhance sustainability in the banking sector. For instance, the European Central Bank released its guide on climate-related and environmental risks in 2020, urging banks to integrate them into risk management frameworks. The Task Force on Climate-related Financial Disclosures (TCFD) continued to promote its recommendations, which gained wider acceptance among financial institutions. The adoption of the European Green Deal and similar initiatives globally also increased awareness and regulatory pressure on banks to adopt sustainable practices. These regulatory measures likely contributed to the surge in ESG-related publications as banks and researchers sought to understand and comply with new requirements.

In contrast, from 2009 to 2019, the publications each year were between 1 and 25, indicating a memorable rise. This boost could be attributed to all the changes caused by the COVID-19 pandemic and the challenges made through 2020–2021, which made the banking industry rethink its ESG issues and how it was taking them into account.

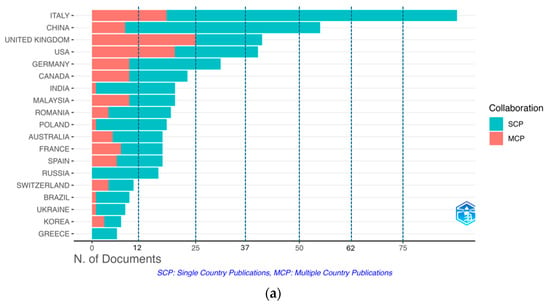

4.2. Leading Countries and Institutions

Research on the banking industry and ESG has been conducted in 46 countries. Figure 4a gives an understanding of the leading countries in the publications related to the field, with Italy leading the way, followed by China, the United Kingdom (UK), the United States of America (USA), and Germany. Italy is ruling in this research field, registering for 79% of single-country publications (SCPs) and 21% of multi-country publications (MCPs). Countries like China and Germany are primarily drawn to SCPs. At the same time, countries like the UK and the USA are most likely drawn to MCPs. Figure 4b emphasizes the most cited countries in this field, with the USA and Italy leading. Figure 4c displays the study counts and collaboration network of each engaged country. A total of 44 countries collaborated globally, with the leaders being Italy–USA, Italy–Germany, and Italy–England.

Figure 4.

Authors’ country analysis: (a) corresponding authors’ countries, (b) most cited countries, and (c) cooperation networks among countries. Source: authors’ own research using Bibliometrix and VOSviewer tools, as well as Scopus and WoS databases.

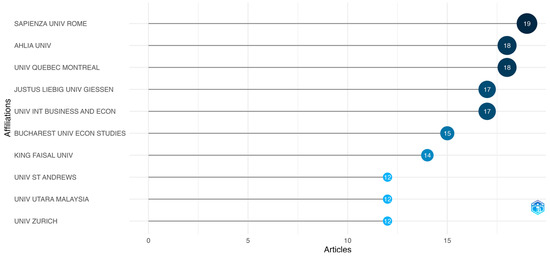

In the time lapse between 2003 and 2024, 342 institutions have been involved in the banking industry and ESG field. Positioned based on their registered publications, the ones that stand out most are displayed in Figure 5. Sapienza Università di Roma has 19 studies, Ahlia University has 18 studies, and Université du Québec à Montreal has 18 publications, disputing the lead with just one study being the difference between them. Behind the top three places are Justus Liebig University Giessen and the University of International Business and Economics with 17 studies each, as RQ 4 established.

Figure 5.

The top 10 institutions publishing studies. Source: authors’ own research using Bibliometrix and VOSviewer tools, as well as Scopus and WoS.

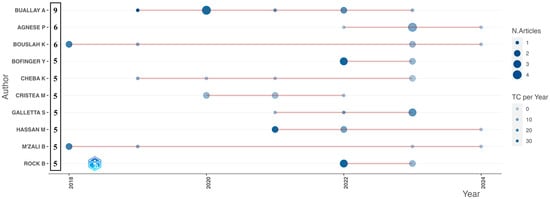

4.3. Most Relevant Researchers

A total of 1589 authors made essential contributions in this field. Figure 6 shows that Amina Buallay from Brunel University, Uxbridge, United Kingdom, appears to be the field’s most productive author with nine research studies, the focuses of which are mainly on the effects of sustainability on the banking industry, as RQ 5 established.

Figure 6.

Productivity of the authors. Number of publications by authors and authors’ production over time. Source: authors’ own research using Bibliometrix tool, as well as Scopus and WoS databases.

The second most productive authors are Paolo Agnese (Università Telematica Internazionale Uninettuno, Rome, Italy) and Kais Bouslah (Centre for Responsible Banking & Finance, School of Management, University of St Andrews, Scotland, UK) with six studies each, where the main focus was the impact of ESG issues on value and risk firms. The remaining authors in the list have five studies.

Also, it can be noted how the production over time of research on the banking industry and ESG started in 2016, but production in this field after 2019 is when researchers started to note the importance of the ESG issues in the banking industry, leading to the level of development in recent years.

Table 1 displays the ten most cited authors in this field of research, their affiliations, total citations, and others based on Marín-Rodríguez et al. (2023). The authors are cataloged based on the total citations in the topic (TCT) to recognize the most prominent author in the banking industry and ESG issues corresponding to the number of citations in Scopus and WoS. Likewise, this study used Google Scholar to obtain the total global citation indicator (TGC), and a comparison was made with TCT by Bibliometrix in R, which added Scopus and WoS citations. The aim was to contrast the themes the authors recognized as more prominent. Later, related to TCT, Table 1 exhibits the top 10 most relevant authors researching the banking industry and ESG issues between 2003 and 2024.

Table 1.

Top 10 most relevant researchers on the banking industry and ESG issues.

For example, Amina Buallay is the most valuable researcher on the influence of ESG issues in the banking sector. The most important studies are Buallay et al. (2020a), Buallay (2019), and Buallay et al. (2020b), with 62, 61, and 52 citations, respectively. The aspects covered by Amina Buallay, in collaboration with other researchers, are about the banking industry and the influence of diverse issues such as environmental, sustainability, governance, and social issues in the banks’ financial performance and risk management.

The research with the most citations of Amina Buallay about the influence of ESG issues in the banking industry is Buallay (2018). It provides insight into the reporting on how sustainability has gained a significant role in the banking industry in which the stakeholders take an interest in transparency on ESG issues and their influence on ROA, return on equity (ROE), and market performance. This research deduced that ESG issues positively and significantly affect the ROA. However, the individual relationship of each ESG issue varies, and environmental issues positively affect ROA and market performance. On the other hand, the social issue has a negative relationship with the three performances. Lastly, the governance issue has a negative relationship with ROA and ROE, but it has a positive relationship with market performance. Additionally, recent research by Amina Buallay about the banking industry (Buallay et al. 2023) centers on how the ROA, ROE, and market performance of the banks are influenced by the ESG issues in seven different regions, such as Asia, Europe, the Middle East, North Africa, and South America, from 2008 to 2017. The findings showed a limited connection between ESG scores and the performance of banks, which were measured mainly by ROA and ROE. Furthermore, the research highlights the importance of ESG issues in sustainable finance and how they are integrated into the banking industry as a guideline for investment and credit decisions.

4.4. Reference Analysis

Table 2 contains the most cited papers that have gained attention and were cited by other researchers on how ESG issues influence the banking industry.

Table 2.

Top 10 cited studies researching the banking industry and ESG issues. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

These cited research studies are bound to represent seminal or outstanding works with significant impact on the influence of ESG issues over the banking industry in different regions over the past two decades. They explore the different scenarios of how ESG issues positively or negatively impact the banking industry using different methodologies such as bibliometric analysis and quantitative approaches.

The research landscape on ESG criteria in banking reveals mixed findings. Buallay (2019) underscores the positive impact of ESG disclosures on bank performance, yet notes variability across different ESG dimensions, with environmental disclosure enhancing return on assets (ROA) and Tobin’s Q, while corporate social responsibility disclosures exhibit mixed effects. This highlights the complexity in how different aspects of ESG can influence financial metrics. Nizam et al. (2019) extended this inquiry by examining how access to finance and environmental financing affect banking performance globally. Their findings suggest that enhanced access to finance positively correlates with financial performance, particularly through increased loan growth and improved management quality. This underscores the instrumental role of financial mechanisms in fostering ESG-aligned practices within banking operations.

On the other hand, Birindelli et al. (2018) explores a board composition’s impact on ESG performance in banks, revealing an inverted U-shape relationship between female board representation and ESG outcomes. This challenges the notion of a critical mass theory, emphasizing instead the importance of balanced board dynamics and corporate governance structures in driving sustainable practices. Azmi et al. (2021) delve into the nonlinear relationship between ESG activities and bank value across emerging economies, identifying that moderate ESG engagement positively influences bank value, albeit with diminishing returns. Their study highlights the dual impact of ESG activities—enhancing operational efficiency and cash flows while potentially constraining equity costs, reflecting diverse stakeholder perspectives on ESG’s financial implications.

Shakil et al. (2019) focus on emerging market banks, revealing a positive association between environmental and social performance and financial metrics, though governance performance shows limited influence. This underscores regional variations in how ESG practices translate into financial outcomes, suggesting a need for tailored strategies in diverse economic contexts. Miralles-Quirós et al. (2019a) examines shareholder value creation through social responsibility in banks across various legal and developmental contexts, highlighting the evolving importance of ESG considerations following a global financial crisis. Their findings underscore the growing investor recognition of ESG factors, particularly in common law jurisdictions, reshaping stakeholder expectations and regulatory environments. Finally, Chiaramonte et al. (2022) investigates ESG’s impact on bank stability during financial crises, revealing that higher ESG ratings correlate with reduced fragility, particularly in times of economic stress. This underscores the systemic benefits of robust ESG practices in enhancing financial resilience and supporting regulatory frameworks aimed at promoting sustainable banking practices.

Overall, these studies collectively underscore the evolving role of ESG considerations in banking, from enhancing financial performance and stability to reshaping governance and board dynamics. However, they also highlight the need for nuanced approaches to ESG integration that account for regional contexts, stakeholder expectations, and regulatory environments to maximize both financial and societal outcomes.

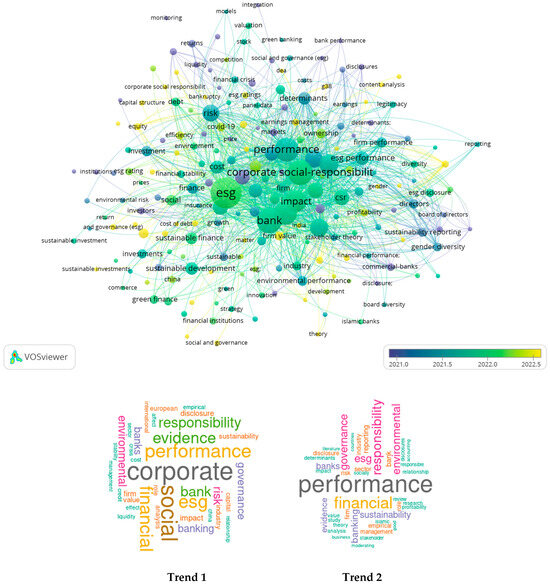

4.5. Keywords Analysis

The survey of the keywords revealed two different research trends in the academic literature, as RQ 3 established. In Figure 7, the top section characterizes the coupling amidst leading research on corporate social responsibility, whereas the under section identifies three research trends. The first trend, illustrated in Figure 7, examines the influence of corporate social responsibility, financial performance, and ESG issues on banks. The actual research that has studied this connection can be found in Birindelli et al. (2024), Cao et al. (2024), Carnevale and Drago (2024), Curcio et al. (2024), and Ielasi et al. (2023), where the conclusions are similar, indicating that in the recent years the banking industry is taking ESG issues into account more seriously, not only inside their core business but in the loans offered to firms as well.

Figure 7.

Analyzing the interrelationships between keywords and research trends in publications retrieved from Scopus and WoS databases concerning the banking industry and ESG issues. Source: elaborated by the authors using VOSviewer and Bibliometrix tools.

Cao et al. (2024), in their research based on a heterogenous stochastic frontier analysis on panel data for 37 banks in China from 2014 to 2021, showed that the reputation gained by ESG investments improved the financial performance of banks, considering that the real profits are seen from environmental (E) and governance (G) investments. In the same path, Curcio et al. (2024) conclude in their research on European banks that banks tend to be affected by those firms affiliated with the oil and gas industry.

The link between ESG, banks, and cost can be seen in Andrieș and Sprincean (2023). This research shows that banks have a positive relationship while incorporating ESG issues into financial decisions, reducing liabilities to raise the total cost of funds, where all ESG issues have an impact; however, the environmental issues have a minor role, indicating that the depositors do not have an environmental vision but prefer a prime CSR and corporate governance.

Figure 7 displays the second trend, in which Buallay et al. (2020a), Djalilov and Piesse (2016), Nasrallah and Khoury (2022), and Youssef and Diab (2021) have common ground between them. These studies focus on a particular country for their research or diverse countries, indicating their characteristics, whether the country is undeveloped, developed, or developing, and how this alters the banking industry’s performance under the influence of ESG. Some regions are the Middle East and North Africa (MENA), Lebanon, Central and Eastern Europe, and the former countries of the USSR.

Thus, literature review as a methodology is on the second trend. Leading studies have used literature review to explore the results of implementing the different bifurcations of ESG issues into the banking industry for its financial performance or management (Brooks and Oikonomou 2018; Engert et al. 2016; Fernandes et al. 2017; Krisciukaityte et al. 2023). Furthermore, the stakeholder is pointed out in diverse research (Choi and Wang 2009; Ferrell et al. 2010; Jones 2016; Renneboog et al. 2008). These studies delve into stakeholder activities involving ESG issues that transform the bank’s performance.

Finally, the association of the different banks’ risk is examined by Erhemjamts et al. (2024); in this research, it is stated that the banks that undergo climate risk outrage delegated to the US National Oceanic Atmospheric Administration show an improvement in ESG performance and ESG ratings, while a negative ESG sentiment as the result of a climate risk liability has a negative impact on financial performance. Di Tommaso and Thornton’s (2020) results are consequently with the stakeholders’ view on ESG issues, and the reduction of risk-taking is positively correlated to a higher ESG, which implies a deteriorated bank value. In this sense, Staroverova (2022) supports that banks’ value is affected directly by the possible ESG polemics, and the investors take the nature of ESG polemics into account, such as the ones related to the community and employees.

4.6. Trend Topics

4.6.1. Evolution of the Topics

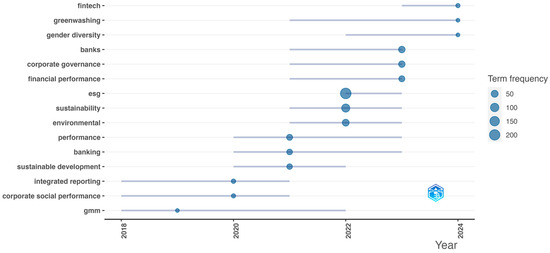

Figure 8 illustrates the different topics from the authors’ keywords, considering a minimum of five words per article across intervals of three times a year.

Figure 8.

Trend topics over the years based on the authors’ keywords. Source: authors’ own research using the Bibliometrix tools, as well as Scopus and WoS databases.

The examination of the authors’ keywords, from 2003 to March 2024, discloses dominant topics such as fintech, greenwashing, gender diversity, sustainable development, corporate governance, and integrated reporting. This gives a broader overview of how the research and interest have evolved, designating the relevance of these topics to how ESG issues influence the banking sector nowadays.

The analysis of the dominant topics is key to understanding the different changes the academy has had over the years. It elucidates the numerous issues that linger regarding the influence of ESG on the banking industry. The exhaustive research and accentuation on fintech, greenwashing, gender diversity, corporate governance, and other main elements reveal a developing course of action on the influence of ESG issues in the banking industry. These tendencies point to an increased consciousness of the numerous demands on a banking industry with adequate social corporate responsibility, including the board of directors’ policies and the sustainable standards on investment policies around different regions and economic situations.

4.6.2. Topics with High Development and Relevance

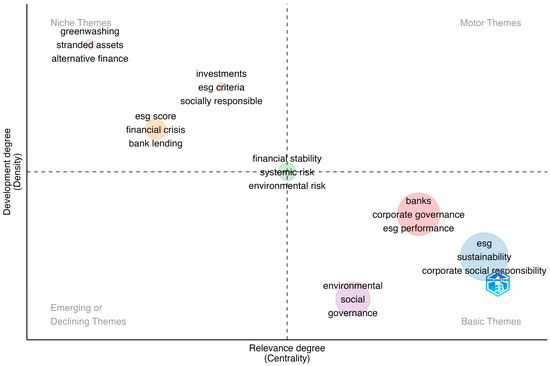

The survey displays a thematic map with four defined quadrants based on the density (development degree) and centrality (relevance degree) of the topics examined in Figure 9, which are fundamental to answering RQ 1. In a thematic map with four defined quadrants, density measures the concentration and maturity of a research theme, indicating its internal development, coherence, and richness of connections within itself. A high density suggests a well-developed and robust area of research.

Figure 9.

Thematic map. Source: authors’ own research using the Bibliometrix tool, as well as Scopus and WoS databases.

Centrality assesses a theme’s importance and influence within the broader scientific field, reflecting its connectivity and integration with other research themes. High centrality indicates that a theme is highly relevant and serves as a critical node, bridging various research areas and contributing significantly to the overall knowledge structure.

Niche themes such as greenwashing, stranded assets, and alternative finance are well developed but lack centrality. This indicates that while these areas have been thoroughly researched, their impact on the broader ESG discourse is limited. The specialization of these themes suggests a need for integration into more central frameworks to enhance their relevance and applicability across the banking sector. Basic themes like corporate governance, ESG performance, and corporate social responsibility are fundamental to ESG integration but are less developed. This suggests that foundational aspects of ESG still require significant research and development. The low density of these themes points to a gap in comprehensive studies that can provide robust frameworks for banks to follow.

On the other hand, the intersection of themes between quadrants, such as financial stability, systematic risk, and environmental risk, are centrally positioned, reflecting their critical importance. However, their moderate development degree indicates that while these themes are recognized as essential, there is still considerable room for deeper exploration and practical implementation. Enhancing the development of these themes could lead to more effective risk management and stability in the banking sector.

The absence of themes in the Motor quadrant is particularly outstanding. This suggests a lack of well-developed, central themes driving the ESG discourse forward. Without strong motor themes, the integration of ESG factors in the banking sector may lack the necessary momentum and cohesive direction. This gap highlights an urgent need for research to identify and develop key drivers of ESG integration, facilitating more systemic and impactful adoption of sustainable practices. Likewise, the lack of themes in the Emerging or Declining quadrant indicates a stable research focus but also points to a potential blind spot. Emerging themes could represent future challenges and opportunities in ESG integration that are not yet being adequately addressed. Identifying and promoting emerging themes can ensure that the banking sector remains adaptable and proactive in the face of evolving ESG criteria, as RQ 2 established.

Finally, the thematic map reveals both strengths and weaknesses in the current state of ESG research in the banking sector. While niche and basic themes are being explored, the lack of motor and emerging themes suggests a need for a more dynamic and integrated approach to ESG research. Addressing these gaps can drive more effective and comprehensive ESG integration, ultimately leading to a more sustainable and resilient banking sector.

5. Discussion

Galletta et al. (2022) cover the state of the banking industry regarding ESG issues until 2021. It explores, through an extensive number of studies (271) in a bibliometric analysis, the behavior of the banking industry towards ESG issues and the current growth of their importance over the last decades. It also discusses the evolution of the focus the banking industry had in the first place, the social issue being CSR until emergence of ESG issues. It found a gap in previous studies where the banking industry’s principles were centered on CSR and had an almost non-existent environmental aim. It also discusses how ESG-based strategies started to become important to the banking industry and the path changes in the banking industry.

Additionally, Galletta and Mazzù (2023), in more recent research with panel data from 2011 to 2020, show the positive effects that banks have once ESG issues are implemented in their core system. Banks with less ESG polemics show evidence of lower risks. This is based on the Basel Committee on Banking Supervision and the European Central Bank’s climate and environmental risk strategies.

Furthermore, Shakil et al. (2019) examine the banks in emerging countries listed on the S&P Dow Jones and the data from 2015 to 2018 from the Asset4 database of Refinitiv on ESG for 93 banks. It offers a perspective on how environmental and social issues positively affect financial performance in the banking industry and on the personal level of importance stakeholders have in ESG strategies. On the other hand, the research found a non-existent relationship between governance and bank financial performance, leading to controversy on whether it has a positive or negative effect caused by the findings of Buallay (2018), where the findings are negative and Dincer et al. (2014) and Esteban-Sanchez et al. (2017) found a positive relationship.

Additionally, based on Buallay (2018), each one of the components of ESG issues has a different effect on the ROA, ROE, and Tobin’s Q. The environmental component has a positive relationship with the ROA and Tobin’s Q. On the other hand, CSR (from a social perspective) has a negative relationship with the ROA, ROE, and Tobin’s Q. Governance positively affects Tobin’s Q but has a negative effect on the ROA and ROE. The results come from 235 banks listed in countries in the European Union from 2007 to 2016 on Bloomberg. CSR is possibly the issue, with a negative impact on banks’ performance due to attention primarily being given to environmental issues and their relevance to investment decisions. This gives a complete perspective on how ESG issues have influenced the banking sector over the years and a broad vision that ESG, while separated, has another effect on the banks’ performance. However, despite the European Union’s strong effort to report ESG, there were no strong laws in this regard when the study was conducted.

According to the findings in past studies and the authors, it is important to consider each ESG issue to broaden the understanding of the influence on the possible performance of the banking industry. It is noted how recent studies show the importance of ESG in the banking industry and the influence it has gained in the decision-making process. Moreover, the findings are mixed, and the focus region and the source of the databases could be the cause of this. However, the studies mainly focus on the performance level (ROA, ROE, Tobin’s Q) of the banks and the regulations of the banking industry concerning investment projects or the firms they are financing. In this sense, the latest studies have established the ideal procedure for less risk taking in the banking industry. Additionally, some studies have included crisis eras and the positive influence of ESG or CSR on the course of events in the banking industry.

The studies’ findings show the tendency to explore the USA and European market. Moreover, the results show the recent positive drive ESG has gained and its effects on the banking industry. However, research in the Latin American region is non-existent, since it is not considered essential to the financial industry due to the developing term referenced. In this way, it is important to approach the theory from past studies and research if ESG has the same effect on the Latin American banking industry as it has in the USA and Europe or the issues on why it can vary.

6. Conclusions

This study’s scientometric and bibliometric analysis provides invaluable insights into the present state, trends, and prospects of ESG integration within the banking sector, thereby establishing a robust foundation for continued research and advancement in this pivotal domain. By accurately collecting data and selecting keywords, 681 studies meeting the specified criteria were identified across Scopus and WoS databases, forming the bedrock for comprehending the trajectory and trends in ESG integration within the banking industry.

The findings underscore many future research opportunities in ESG practices within the banking sector, revealing diverse and abundant avenues for exploration. Key areas warranting further investigation include assessing the impact of ESG integration on bank performance, delineating best practices for ESG implementation, and formulating frameworks for evaluating the long-term sustainability of ESG initiatives. Additionally, a compelling need exists to delve into the role of regulatory frameworks and institutional pressures in shaping ESG practices in the banking domain.

Moreover, overcoming trends in implementing ESG principles within the banking industry indicates a discernible shift towards enhanced transparency, heightened stakeholder engagement, and adoption of sustainable finance strategies. However, challenges persist, underscoring the need to establish standardized ESG reporting frameworks. These frameworks play a crucial role in integrating ESG considerations into risk management practices and aligning ESG goals with financial performance objectives.

The analysis of impactful studies within the intersection of the banking industry and ESG issues brings to light the seminal contributions of researchers such as Amina Buallay, Christian Klein, and George Serafeim. Buallay’s influential research, particularly the seminal study from 2018, delves into the intricate dynamics of sustainability within banking, offering profound insights into its implications for key performance metrics. Furthermore, recent investigations underscore the enduring relevance of ESG considerations in shaping sustainable finance practices. Klein and Serafeim’s contributions further enrich our understanding of these complex interrelationships, collectively serving as indispensable pillars of scholarly inquiry and advancing our comprehension of the evolving landscape of banking operations amidst burgeoning ESG imperatives.

Future research directions in ESG integration within the banking industry may explore corporate governance and ESG performance. Likewise, although research on financial stability, systematic risk, and environmental risk are centrally positioned, highlighting their critical importance, their moderate development degree suggests that, despite their recognized essentiality, there remains significant scope for deeper exploration and practical implementation. Further development, from practitioner and academic perspectives, could result in more effective risk management and greater stability within the banking sector. On the other hand, comparative studies across diverse banking sectors and regions hold promise for providing valuable insights into the drivers and barriers of ESG integration.

While the analysis provides critical insights and identifies avenues for future research, it is important to acknowledge and address potential limitations and challenges associated with studying ESG integration within the banking industry. For instance, ESG encompasses a broad spectrum of environmental, social, and governance factors, each with its own metrics and indicators, posing challenges in determining the most relevant and reliable metrics for assessing ESG integration in banking. Additionally, interpreting these metrics and their implications for financial performance may vary depending on the context and stakeholder perspectives, warranting careful consideration.

It is essential to recognize that this study’s scope is confined to utilizing solely two bibliographic databases, Scopus and WoS, and does not encompass grey literature. While this limitation may introduce bias into the findings, it also presents an opportunity for future exploration and investigation, underscoring the need for continued scholarly inquiry and advancement in this crucial study area.

This study significantly contributed to the existing literature, both empirically and theoretically. Building upon existing knowledge, this research highlighted the landscape of the influence of ESG practices through the innovative application of cutting-edge scientometric tools and the combined resources of Scopus and Web of Science (WoS). This refined approach surpasses the fragmented methods of previous studies, delivering a deeper and more accurate understanding of the field. This research encourages further exploration of emerging trends as well as collaboration between researchers, policymakers, and financial institutions to address the complex challenges and opportunities ESG integration presents in the banking industry. Also, the findings can help scholars develop new research questions and hypotheses.

Author Contributions

Conceptualization, J.D.G.-R. and N.J.M.-R.; Methodology, J.D.G.-R. and N.J.M.-R.; Validation, C.O.P. and N.J.M.-R.; Formal analysis, J.D.G.-R., C.O.P. and N.J.M.-R.; Investigation, C.O.P. and N.J.M.-R.; Writing—original draft, J.D.G.-R. and C.O.P.; Writing—review & editing, N.J.M.-R. and J.D.G.-R.; Visualization, C.O.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Datasets are available upon request.

Acknowledgments

We would like to express our sincere gratitude to the four anonymous reviewers and the editor for their valuable feedback and constructive suggestions. Their insights and comments have significantly contributed to the improvement of this manuscript. We appreciate their time and effort in reviewing our work and helping us enhance the quality and clarity of our research. Thank you for your dedication and support.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Agrawal, Rohit, Shruti Agrawal, Ashutosh Samadhiya, Anil Kumar, Sunil Luthra, and Vranda Jain. 2023. Adoption of Green Finance and Green Innovation for Achieving Circularity: An Exploratory Review and Future Directions. Geoscience Frontiers 15: 101669. [Google Scholar] [CrossRef]

- Ahmed, Sarwar Uddin, Samiul Parvez Ahmed, and Ikramul Hasan. 2018. Why Banks Should Consider ESG Risk Factors in Bank Lending? Banks and Bank Systems 13: 71–80. [Google Scholar] [CrossRef]

- Aksnes, Dag W., Liv Langfeldt, and Paul Wouters. 2019. Citations, Citation Indicators, and Research Quality: An Overview of Basic Concepts and Theories. SAGE Open 9: 2158244019829575. [Google Scholar] [CrossRef]

- Alam, Ahmed W., Hasanul Banna, and M. Kabir Hassan. 2022. ESG ACTIVITIES AND BANK EFFICIENCY: ARE ISLAMIC BANKS BETTER? 66 ESG Activities and Bank Efficiency: Are Islamic Banks Better? Journal of Islamic Monetary Economics and Finance 8: 65–88. [Google Scholar] [CrossRef]

- Andrieș, Alin Marius, and Nicu Sprincean. 2023. ESG Performance and Banks’ Funding Costs. Finance Research Letters 54: 103811. [Google Scholar] [CrossRef]

- Anio, Suma, Lui Alamsyah, and Hery Harjono Muljo. 2023. The Effect of ESG Dimensions on Banking Performance: An Empirical Investigation in Asia Pacific. E3S Web of Conferences 426: 02053. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Cuccurullo. 2017. Bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Azmi, Wajahat, M. Kabir Hassan, Reza Houston, and Mohammad Sydul Karim. 2021. ESG Activities and Banking Performance: International Evidence from Emerging Economies. Journal of International Financial Markets, Institutions and Money 70: 101277. [Google Scholar] [CrossRef]

- Bătae, Oana Marina, Voicu Dan Dragomir, and Liliana Feleagă. 2021. The Relationship between Environmental, Social, and Financial Performance in the Banking Sector: A European Study. Journal of Cleaner Production 290: 125791. [Google Scholar] [CrossRef]

- Birindelli, Giuliana, Helen Chiappini, and Raja Nabeel Ud Din Jalal. 2024. Greenwashing, Bank Financial Performance and the Moderating Role of Gender Diversity. Research in International Business and Finance 69: 102235. [Google Scholar] [CrossRef]

- Birindelli, Giuliana, Stefano Dell’Atti, Antonia Patrizia Iannuzzi, and Marco Savioli. 2018. Composition and Activity of the Board of Directors: Impact on ESG Performance in the Banking System. Sustainability 10: 4699. [Google Scholar] [CrossRef]

- Brooks, Chris, and Ioannis Oikonomou. 2018. The Effects of Environmental, Social and Governance Disclosures and Performance on Firm Value: A Review of the Literature in Accounting and Finance. The British Accounting Review 50: 1–15. [Google Scholar] [CrossRef]

- Buallay, Amina. 2018. Is Sustainability Reporting (ESG) Associated with Performance? Evidence from the European Banking Sector. Management of Environmental Quality: An International Journal 30: 98–115. [Google Scholar] [CrossRef]

- Buallay, Amina. 2019. Sustainability Reporting and Firm’s Performance: Comparative Study between Manufacturing and Banking Sectors. International Journal of Productivity and Performance Management 69: 431–45. [Google Scholar] [CrossRef]

- Buallay, Amina, Meera Al Marri, Nohade Nasrallah, Allam Hamdan, Elisabetta Barone, and Qasim Zureigat. 2023. Sustainability Reporting in Banking and Financial Services Sector: A Regional Analysis. Journal of Sustainable Finance & Investment 13: 776–801. [Google Scholar] [CrossRef]

- Buallay, Amina, Sayed M. Fadel, Jasim Alajmi, and Shahrokh Saudagaran. 2020a. Sustainability Reporting and Bank Performance after Financial Crisis: Evidence from Developed and Developing Countries. Competitiveness Review: An International Business Journal 31: 747–70. [Google Scholar] [CrossRef]

- Buallay, Amina, Sayed M. Fadel, Jasim Yusuf Al-Ajmi, and Shahrokh Saudagaran. 2020b. Sustainability Reporting and Performance of MENA Banks: Is There a Trade-Off? Measuring Business Excellence 24: 197–221. [Google Scholar] [CrossRef]

- Cao, Qiang, Tingting Zhu, and Wenmei Yu. 2024. ESG Investment and Bank Efficiency: Evidence from China. Energy Economics 133: 107516. [Google Scholar] [CrossRef]

- Carnevale, Concetta, and Danilo Drago. 2024. Do Banks Price ESG Risks? A Critical Review of Empirical Research. Research in International Business and Finance 69: 102227. [Google Scholar] [CrossRef]

- Chen, Chaomei. 2017. Science Mapping: A Systematic Review of the Literature. Journal of Data and Information Science 2: 1–40. [Google Scholar] [CrossRef]

- Chen, Chaomei, and Min Song. 2019. Visualizing a Field of Research: A Methodology of Systematic Scientometric Reviews. PLoS ONE 14: e0223994. [Google Scholar] [CrossRef]

- Chiaramonte, Laura, Alberto Dreassi, Claudia Girardone, and Stefano Piserà. 2022. Do ESG Strategies Enhance Bank Stability during Financial Turmoil? Evidence from Europe. The European Journal of Finance 28: 1173–211. [Google Scholar] [CrossRef]

- Choi, Jaepil, and Heli Wang. 2009. Stakeholder Relations and the Persistence of Corporate Financial Performance. Strategic Management Journal 30: 895–907. [Google Scholar] [CrossRef]

- Cordova, Maria Federica, and Andrea Celone. 2019. SDGSs and innovation in the business context literature review. Sustainability 11: 7043. [Google Scholar] [CrossRef]

- Curcio, Domenico, Igor Gianfrancesco, Grazia Onorato, and Davide Vioto. 2024. Do ESG Scores Affect Financial Systemic Risk? Evidence from European Banks and Insurers. Research in International Business and Finance 69: 102251. [Google Scholar] [CrossRef]

- Dervis, Hamid. 2019. Bibliometric Analysis Using Bibliometrix an R Package. Journal of Scientometric Research 8: 156–60. [Google Scholar] [CrossRef]

- DiMaggio, Paul J., and Walter W. Powell. 1983. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. American Sociological Review 48: 147. [Google Scholar] [CrossRef]

- Dincer, Hasan, Ismail Erkan Celik, Recep Yilmaz, and Ümit Hacioglu. 2014. The Financial Implications of Corporate Social Responsibility in the Banking Sector. In Managerial Issues in Finance and Banking: A Strategic Approach to Competitiveness. Cham: Springer, pp. 197–207. ISBN 9783319013879. [Google Scholar] [CrossRef]

- Di Tommaso, Caterina, and John Thornton. 2020. Do ESG Scores Effect Bank Risk Taking and Value? Evidence from European Banks. Corporate Social Responsibility and Environmental Management 27: 2286–98. [Google Scholar] [CrossRef]

- Djalilov, Khurshid, and Jenifer Piesse. 2016. Determinants of Bank Profitability in Transition Countries: What Matters Most? Research in International Business and Finance 38: 69–82. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Debmalya Mukherjee, Nitesh Pandey, and Weng Marc Lim. 2021. How to Conduct a Bibliometric Analysis: An Overview and Guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Engert, Sabrina, Romana Rauter, and Rupert J. Baumgartner. 2016. Exploring the Integration of Corporate Sustainability into Strategic Management: A Literature Review. Journal of Cleaner Production 112: 2833–50. [Google Scholar] [CrossRef]

- Erhemjamts, Otgontsetseg, Kershen Huang, and Hassan Tehranian. 2024. Climate Risk, ESG Performance, and ESG Sentiment in US Commercial Banks. Global Finance Journal 59: 100924. [Google Scholar] [CrossRef]

- Esteban-Sanchez, Pablo, Marta de la Cuesta-Gonzalez, and Juan Diego Paredes-Gazquez. 2017. Corporate Social Performance and Its Relation with Corporate Financial Performance: International Evidence in the Banking Industry. Journal of Cleaner Production 162: 1102–10. [Google Scholar] [CrossRef]

- Fernandes, Catarina, Jorge Farinha, Francisco Vitorino Martins, and Cesario Mateus. 2017. Bank Governance and Performance: A Survey of the Literature. Journal of Banking Regulation 19: 236–56. [Google Scholar] [CrossRef]

- Ferrell, O. C., Tracy L. Gonzalez-Padron, G. Tomas M. Hult, and Isabelle Maignan. 2010. From Market Orientation to Stakeholder Orientation. Journal of Public Policy and Marketing 29: 93–96. [Google Scholar] [CrossRef]

- Freeman, R. Edward. 1984. Strategic Management: A Stakeholder Approach. Boston: Cambridge University Press. [Google Scholar]

- Gai, Lorenzo, Marco Bellucci, Mario Biggeri, Lucia Ferrone, and Federica Ielasi. 2023. Banks’ ESG Disclosure: A New Scoring Model. Finance Research Letters 57: 104199. [Google Scholar] [CrossRef]

- Galletta, Simona, and Sebastiano Mazzù. 2023. ESG Controversies and Bank Risk Taking. Business Strategy and the Environment 32: 274–88. [Google Scholar] [CrossRef]

- Galletta, Simona, Sebastiano Mazzù, and Valeria Naciti. 2022. A Bibliometric Analysis of ESG Performance in the Banking Industry: From the Current Status to Future Directions. Research in International Business and Finance 62: 101684. [Google Scholar] [CrossRef]

- Hák, Tomáš, Svatava Janoušková, and Bedřich Moldan. 2016. Sustainable Development Goals: A Need for Relevant Indicators. Ecological Indicators 60: 565–73. [Google Scholar] [CrossRef]

- Hayretci, Hasan Emre, and Fatma Başak Aydemir. 2021. A Multi Case Study on Legacy System Migration in the Banking Industry. In Advanced Information Systems Engineering. CAiSE 2021. Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Cham: Springer, vol. 12751, pp. 536–50. [Google Scholar] [CrossRef]

- Hemingway, Christine A., and Patrick W. Maclagan. 2004. Managers’ Personal Values as Drivers of Corporate Social Responsibility. Journal of Business Ethics 50: 33–44. [Google Scholar] [CrossRef]

- Ielasi, Federica, Marco Bellucci, Mario Biggeri, and Lucia Ferrone. 2023. Measuring Banks’ Sustainability Performances: The BESGI Score. Environmental Impact Assessment Review 102: 107216. [Google Scholar] [CrossRef]

- Jan van Eck, Nees, and Ludo Waltman. 2010. Software Survey: VOSviewer, a Computer Program for Bibliometric Mapping. Scientometrics 84: 523–38. [Google Scholar] [CrossRef]

- Jan van Eck, Nees, and Ludo Waltman. 2017. Citation-Based Clustering of Publications Using CitNetExplorer and VOSviewer. Scientometrics 111: 1053–70. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Jones, Thomas M. 2016. Instrumental Stakeholder Theory: A Synthesis of Ethics and Economics. In The Corporation and Its Stakeholders. Toronto: University of Toronto Press, pp. 205–42. [Google Scholar] [CrossRef]

- Kaminskyi, Andrii, and Maryna Nehrey. 2023. Cluster Method Applying to COVID-19 Event Study for the Largest USA Banks. Paper presented at the 3rd International Workshop of IT-Professionals on Artificial Intelligence, Waterloo, ON, Canada, November 20–22. [Google Scholar]

- Khoury, R. El, N. Nasrallah, and B. Alareeni. 2023. ESG and Financial Performance of Banks in the MENAT Region: Concavity–Convexity Patterns. Journal of Sustainable Finance & Investment 13: 406–30. [Google Scholar] [CrossRef]

- Krisciukaityte, Karolina, Tomas Balezentis, and Dalia Streimikiene. 2023. Linking Financial Performance and Efficiency to Sustainability in Banking Sector: A Literature Synthesis. Journal of Business Economics and Management 24: 506–26. [Google Scholar] [CrossRef]

- Krüger, Philipp. 2015. Corporate Goodness and Shareholder Wealth. Journal of Financial Economics 115: 304–29. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, Meiting Lu, Chih-Wei Wang, and Chia-Yu Cheng. 2024. ESG Engagement, Country-Level Political Risk and Bank Liquidity Creation. Pacific-Basin Finance Journal 83: 102260. [Google Scholar] [CrossRef]

- Ling, Aifan, Jinlong Li, and Yugui Zhang. 2023. Can Firms with Higher ESG Ratings Bear Higher Bank Systemic Tail Risk Spillover?—Evidence from Chinese A-Share Market. Pacific-Basin Finance Journal 80: 102097. [Google Scholar] [CrossRef]

- Linnenluecke, Martina K., Mauricio Marrone, and Abhay K. Singh. 2020. Conducting Systematic Literature Reviews and Bibliometric Analyses. Australian Journal of Management 45: 175–94. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David Gonzalez Ruiz, and Sergio Botero. 2023. Assessing Fiscal Sustainability in the Landscape of Economics Research. Economies 11: 300. [Google Scholar] [CrossRef]

- Masulis, Ronald W., and Syed Walid Reza. 2015. Agency Problems of Corporate Philanthropy. Review of Financial Studies 28: 592–636. [Google Scholar] [CrossRef]

- McGahan, Anita M. 2021. Integrating Insights From the Resource-Based View of the Firm Into the New Stakeholder Theory. Journal of Management 47: 1734–56. [Google Scholar] [CrossRef]

- Miralles-Quirós, María Mar, José Luis Miralles-Quirós, and Jesús Redondo Hernández. 2019a. ESG Performance and Shareholder Value Creation in the Banking Industry: International Differences. Sustainability 11: 1404. [Google Scholar] [CrossRef]

- Miralles-Quirós, María Mar, José Luis Miralles-Quirós, and Jesús Redondo-Hernández. 2019b. The Impact of Environmental, Social, and Governance Performance on Stock Prices: Evidence from the Banking Industry. Corporate Social Responsibility and Environmental Management 26: 1446–56. [Google Scholar] [CrossRef]

- Moral-Muñoz, José A., Enrique Herrera-Viedma, Antonio Santisteban-Espejo, Manuel J. Cobo, Periodista Daniel, and Saucedo Aranda. 2019. Software Tools for Conducting Bibliometric Analysis in Science: An up-to-Date Review Enrique Herrera-Viedma Antonio Santisteban-Espejo. Profesional de la Información 29: 1699–2407. [Google Scholar] [CrossRef]

- Nasrallah, Nohade, and R. El Khoury. 2022. Is Corporate Governance a Good Predictor of SMEs Financial Performance? Evidence from Developing Countries (the Case of Lebanon). Journal of Sustainable Finance & Investment 12: 13–43. [Google Scholar] [CrossRef]

- Nizam, Esma, Adam Ng, Ginanjar Dewandaru, Ruslan Nagayev, and Malik Abdulrahman Nkoba. 2019. The Impact of Social and Environmental Sustainability on Financial Performance: A Global Analysis of the Banking Sector. Journal of Multinational Financial Management 49: 35–53. [Google Scholar] [CrossRef]

- Petrovits, Christine M. 2006. Corporate-Sponsored Foundations and Earnings Management. Journal of Accounting and Economics 41: 335–62. [Google Scholar] [CrossRef]

- Price, Derek De Solla. 1976. A General Theory of Bibliometric and Other Cumulative Advantage Processes. Journal of the American Society for Information Science 27: 292–306. [Google Scholar] [CrossRef]

- Prior, Diego, Jordi Surroca, and Josep A. Tribó. 2008. Are Socially Responsible Managers Really Ethical? Exploring the Relationship Between Earnings Management and Corporate Social Responsibility. Corporate Governance: An International Review 16: 160–77. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, and Kuldeep Singh. 2022. The Impact of ESG on the Bank Valuation: Evidence of Moderation by ICT. Journal of Global Responsibility 14: 273–88. [Google Scholar] [CrossRef]

- Renneboog, Luc, Jenke Ter Horst, and Chendi Zhang. 2008. The Price of Ethics and Stakeholder Governance: The Performance of Socially Responsible Mutual Funds. Journal of Corporate Finance 14: 302–22. [Google Scholar] [CrossRef]

- Schücking, Heffa. 2015. Sustainability on Planet Bank. In Responsible Investment Banking. CSR, Sustainability, Ethics and Governance. Cham: Springer, pp. 427–38. [Google Scholar] [CrossRef]

- Serafimova, Katharina, and Thomas Vellacott. 2015. Prepared for the Future? ESG Competences Are Key. In Responsible Investment Banking. CSR, Sustainability, Ethics and Governance. Cham: Springer, pp. 601–7. [Google Scholar] [CrossRef]

- Shabir, Mohsin, Jiang Ping, Özcan Işik, and Kamran Razzaq. 2024. Impact of Corporate Social Responsibility on Bank Performance in Emerging Markets. International Journal of Emerging Markets, 1–24. [Google Scholar] [CrossRef]

- Shaddady, Ali, and Faisal Alnori. 2024. ESG Practices and Bank Efficiency: New Evidence from an Oil-Driven Economy. International Journal of Islamic and Middle Eastern Finance and Management. [Google Scholar] [CrossRef]

- Shakil, Mohammad Hassan, Nihal Mahmood, Mashiyat Tasnia, and Ziaul Haque Munim. 2019. Do Environmental, Social and Governance Performance Affect the Financial Performance of Banks? A Cross-Country Study of Emerging Market Banks. Management of Environmental Quality: An International Journal 30: 1331–44. [Google Scholar] [CrossRef]

- Staroverova, Mariia. 2022. The Impact of ESG Controversies on Bank Value and Risk-Taking. Journal of Corporate Finance Research/Kopпopaтивныe Φинaнcы 16: 5–29. [Google Scholar] [CrossRef]

- Tashtamirov, Magomed. 2023. The Place of Sustainable Development in ESG Risks Formation in Banking Sector. E3S Web of Conferences 371: 03051. [Google Scholar] [CrossRef]

- Waltman, Ludo. 2016. A Review of the Literature on Citation Impact Indicators. Journal of Informetrics 10: 365–91. [Google Scholar] [CrossRef]

- Weber, Olaf, and Blair Feltmate. 2016. Sustainable Banking: Managing the Social and Environmental Impact of Financial Institutions. Toronto: University of Toronto Press. [Google Scholar]

- Youssef, Jamile, and Sara Diab. 2021. Does Quality of Governance Contribute to the Heterogeneity in Happiness Levels across MENA Countries? Journal of Business and Socio-Economic Development 1: 87–101. [Google Scholar] [CrossRef]

- Zhang, Junru, Chen Zheng, and Yuan George Shan. 2024. What Accounts for the Effect of Sustainability Engagement on Stock Price Crash Risk during the COVID-19 Pandemic—Agency Theory or Legitimacy Theory? International Review of Financial Analysis 93: 103167. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).