Critical Perspectives of Organisational Behaviour towards Stakeholders through the Application of Corporate Governance Principles

Abstract

1. Introduction

- These companies were considered economically representative of Romania’s financial intermediation and insurance sector. Their presence in the capital market indicates a certain level of maturity and stability, making them relevant for analysing the application and compliance with corporate governance principles. This selection suggests that the research findings will have broad applicability and can contribute to improving corporate governance practices within this sector.

- As the only companies in this field listed on the BSE, their analysis provides a comprehensive picture of how the financial intermediation and insurance sector aligns its practices with the corporate governance code. Therefore, the study can highlight areas of strength and aspects that require improvement in corporate governance, thus contributing to strengthening investor confidence and increasing operational transparency.

- According to the BVB’s corporate governance code, these companies’ presence on the capital market requires compliance with strict reporting and transparency standards. Their analysis provides the opportunity to assess how well companies’ current practices align with these requirements, identifying good practices and potential gaps.

- The research adds value to the speciality literature by specifically examining companies in financial intermediation and insurance listed on the BVB, a field less explored in the Romanian context. This aspect may encourage further studies and contribute to developing improved theoretical and practical frameworks in corporate governance.

- Focusing on BSE-listed companies, the research underlines the importance of corporate governance in the Romanian capital market. The study’s results can provide valuable insights for regulators, investors, and other stakeholders on the current state of corporate governance and how it can be improved to support sustainable capital market development.

2. Literature Review

- managers’ attention to the correctness of the existing information in the financial reports (Măciucă et al. 2015);

- compliance with the limited deadlines in terms of financial reporting (Sorici et al. 2021);

- transparent display of all financial results (Coca et al. 2021);

- the actual transmission of the internal, external, and existing audit processes (Bostan and Grosu 2010; Boghean and Cibotariu 2018).

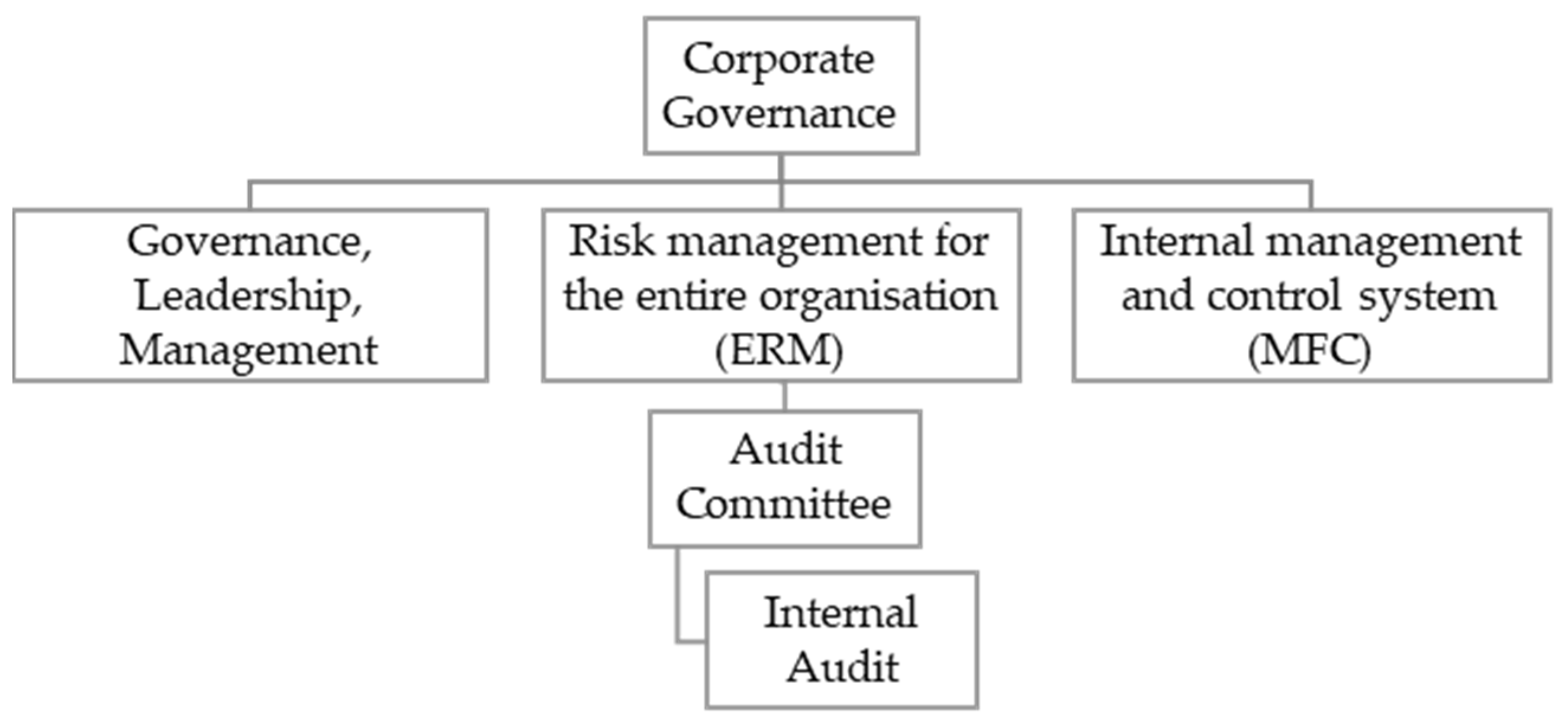

- complex supervision of the branch of a field, an institution, or a field;

- risk analysis;

- effective management through verification, evaluation, and control.

- Transparently carrying out company operations, audit and accounting, and other external relations to reduce corruption that can affect the organisation’s resources, competition, and investors’ trust.

- The company’s management is improved by establishing strategies by the directors and the board of directors, leading to an increase in the company’s performance.

- In anticipation of circular banking crises, the relationship between society and creditors or investors is not felt as much to prevent business bankruptcy.

- The emergence of financial markets in some countries whose objective is to protect the interests of minorities has led to remarkable financial results.

- approval of accounting policies and the internal control system that favours correct financial reporting;

- verifying the existence of optimal internal controls that maintain risk assessment;

- the establishment of directors, as well as their revocation according to national legislation and the scoring of their remuneration;

- the responsibility of establishing the executive chairman, the chairman of the council, as well as the appointment of the other members;

- participation in the meetings aimed at achieving the attributions.

3. Findings and Discussion

- A corporate governance statement in the annual report. As a rule, the corporate governance statement includes the following elements:

- -

- Statement of compliance with the Code—This statement presents how the company complies with the Code’s provisions and adequately explains its deviations from the Code.

- -

- Board Composition—This includes the names and experiences of board members and executive directors, the date of first appointment, the term of office, and the status (executive/non-executive, independent).

- -

- Responsibilities and activities of the Council and its Committees—Descriptive reports from the President of the Council and the chairpersons of the committees regarding their activities during the year under review and how the responsibilities established in the internal regulations were fulfilled.

- -

- Report on remuneration—This report presents the implementation of the company’s policy on the remuneration of its executive directors and members of the Board.

- -

- Risk and internal control—This Section describes the main characteristics of the risk management and internal control systems, including the internal audit function, and evaluates their effectiveness.

- -

- Shareholders—Organisation and primary duties of the general meeting of shareholders; identification of significant shareholders; description of shareholder rights and information on any restrictions on voting rights.

- The investor relations sections of the website. These include up-to-date critical governance information and provide access to documents governing the company’s governance (e.g., articles of association, terms of reference of the Board, and board committees).

- Current reports to the BSE informing market participants of changes in compliance with the Code since the publication of the last corporate governance statement and market-relevant corporate governance information (e.g., change in the Chairman of the Board).

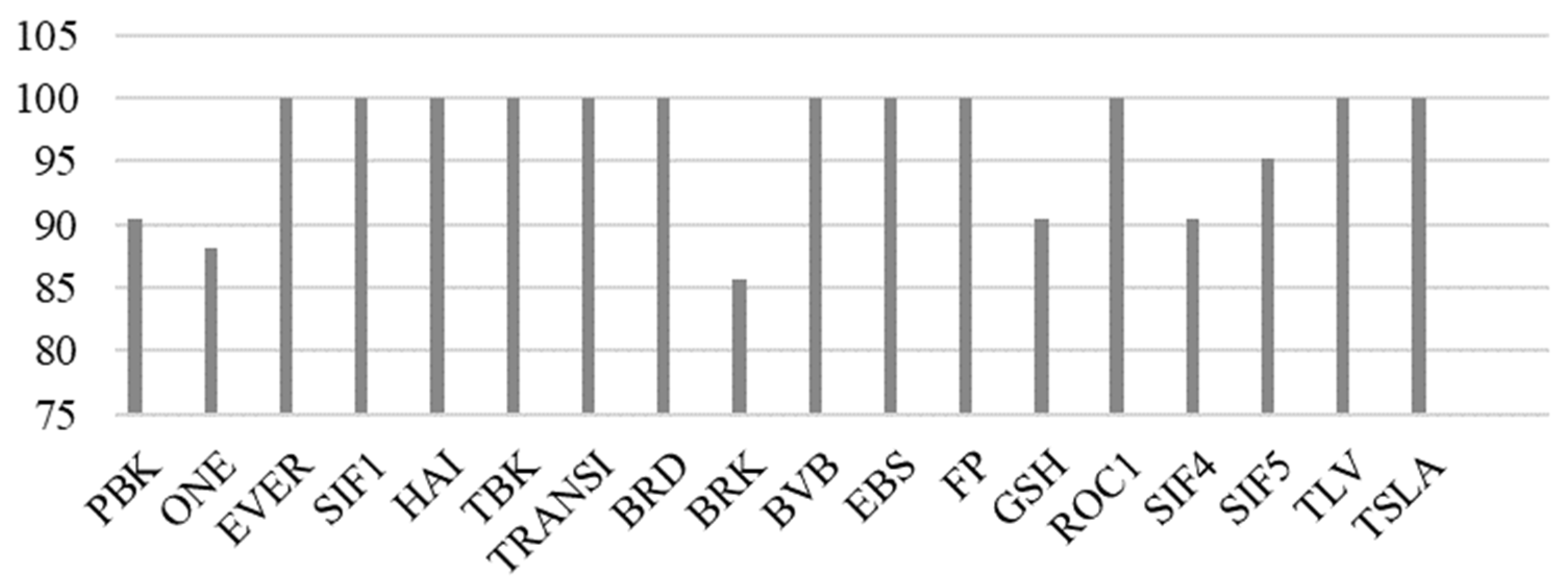

- The members of the Board of Directors will not hold executive positions in the company: This principle is not respected or partially respected 18 times, being the most frequently not respected. It points to a significant challenge for companies in separating executive from supervisory roles.

- The Board’s establishment of an audit committee: It has not met or partially met four times, suggesting that some companies are still working on strengthening their internal audit functions.

- At the shareholders’ meeting, at the Board’s invitation, members of the audit committee and the external auditor will also participate: This principle has been not respected or partially respected three times, which shows that the commitment between shareholders and key governance parties needs improvement.

- The company will have a policy on the remuneration of board members and executive directors in its composition. Also, this principle has not been respected or partially respected three times, highlighting the challenges related to transparency and equity in remuneration policies.

- The existence of internal regulations of the board of directors: They were not respected or were partially respected two times, indicating that most companies respect this fundamental principle of governance.

- 4.

- Protection of investors’ interests: A well-defined and enforced corporate governance code helps protect the interests of investors by providing them with a transparent and fair environment in which to invest their capital. This can increase investor confidence in the company and generate access to additional financial resources for development.

- 5.

- Promotion of responsibility and ethics: The corporate governance code encourages compliance with ethical principles and moral values at all levels of the organisation. This can prevent conflicts of interest, abuses, and improper practices and promote social responsibility and respect for the environment and communities.

- 6.

- Increasing transparency and information disclosure: A corporate governance code will establish precise requirements for fair and full disclosure of financial, operational, and corporate governance information. This will enable investors and other stakeholders to obtain relevant information and make decisions based on accurate data.

- 7.

- Improved management and decision-making: A well-designed corporate governance system will ensure effective management and rational and responsible decision-making. This can help to increase the company’s performance and avoid unnecessary risks.

- 8.

- Promoting economic stability and development: Sound corporate governance can contribute to a country’s economic stability and development. It attracts investments, supports the development of the private sector, and increases companies’ market competitiveness.

- Rigorous Internal Assessment and Audit: Implementing a regular internal assessment and audit process to identify non-conformities and areas for improvement in corporate governance. This may include reviewing the organisational structure, internal policies, and decision-making processes.

- Training and Continuing Education: Organisation of training sessions and educational workshops for board members and executive directors to improve their understanding and application of corporate governance principles.

- Improving Transparency and Communication: Ensuring full transparency in financial reporting and communications with investors and other stakeholders by regularly publishing sustainability and corporate governance reports.

- Renovation of the Board of Directors Structure: Diversification of the board of directors by including independent members with extensive experience and varied perspectives to ensure effective control and supervision.

- Implementation of Fair Remuneration Policies: Creating and implementing fair and transparent remuneration policies for board members and executive directors based on company performance and individual achievements.

- Strengthening Corporate Social Responsibility (CSR): Integrating CSR practices into the company’s overall strategy demonstrates its commitment to sustainable development and the communities in which it operates.

- Improving Internal Control Mechanisms and Risk Management: Develop and strengthen internal control systems and risk management practices to prevent fraud and errors and ensure compliance with applicable laws and regulations.

- Promoting Business Ethics and Integrity: Implementing a solid code of ethics and promoting an organisational culture that values integrity, business ethics, and mutual respect.

4. Conclusions and Recommendations

- 9.

- The introduction of clear rules and standards regarding corporate governance through specific legislation. These rules should include requirements regarding the independence of board directors, transparency and disclosure of relevant information, corporate social responsibility, and shareholder involvement in decision-making processes.

- 10.

- Encouraging the formation of independent and professional boards of directors. This could be achieved by promoting diversity and experience in the board’s composition and by introducing mechanisms for evaluating and continuously training board members.

- 11.

- Developing a culture of respect for shareholders’ rights. This could be achieved by ensuring effective and transparent communication with shareholders, consulting them in making important decisions, and recognising their rights to vote and participate in general meetings.

- 12.

- Improving the level of transparency and disclosure of financial and operational information. Companies should provide quality and relevant information to shareholders and stakeholders so that they can make informed decisions.

- 13.

- Creating an adequate framework for supervision and internal control in companies. This could be ensured by developing clear policies and procedures, periodically reviewing and auditing operational activities and risks, and implementing an internal reporting system.

- 14.

- Promoting companies’ social responsibility. Companies should be aware of their impact on the environment, employees, and communities and develop social responsibility and sustainability practices and policies.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

Primary Sources

Law no. 31 of November 16. 1990. Regarding commercial companies, republished.Law no. 82 of December 24. 1991. Accounting law, republished.Law no. 297 of Iune 26. 2004. Regarding the capital market, republished.Secondary Sources

- ACFE. 2024. Occupational Fraud 2024: A Report to the Nations. Available online: https://www.acfe.com/-/media/files/acfe/pdfs/rttn/2024/2024-report-to-the-nations.pdf (accessed on 5 April 2024).

- Anugerah, Rita. 2014. Peranan good corporate governance dalam pencegahan fraud. Jurnal Akuntansi 3: 101–13. [Google Scholar]

- Arjoon, Surendra. 2005. Corporate governance: An ethical perspective. Journal of Business Ethics 61: 343–52. [Google Scholar] [CrossRef]

- Band, David. 1992. Corporate governance: Why agency theory is not enough. European Management Journal 10: 453–59. [Google Scholar] [CrossRef]

- Boghean, Florin, and Irina-Stefana Cibotariu. 2018. The Role of Internal Audit in Corporate Governance to Substantiate the Decision. Ovidius University Annals, Economic Sciences Series 18: 561–65. [Google Scholar]

- Boghean, Florin, Hlaciuc Elena, Moroşan-Dănilă Lucia, and Boghean Carmen. 2009. Objectives and Particularities of Decisions in the Context of Corporate Governance. Annales Universitatis Apulensis Series Oeconomica 11: 1. [Google Scholar]

- Bordeianu, Otilia-Maria, Grigoras-Ichim Claudia-Elena, and Morosan-Danila Lucia. 2021. SMEs Sustainability in Times of Crisis. Lumen Proceedings 17: 58–65. [Google Scholar] [CrossRef] [PubMed]

- Bostan, Ionel, and Veronica Grosu. 2010. The Role of Internal Audit in Optimization of Corporate Governance at the Groups of Companies. Theoretical & Applied Economics 17: 89–110. [Google Scholar]

- Bravo-Urquiza, Francisco, and Elena Moreno-Ureba. 2021. Does compliance with corporate governance codes help to mitigate financial distress? Research in International Business and Finance 55: 101344. [Google Scholar] [CrossRef]

- BSE Corporate Governance Code. n.d. Available online: https://bvb.ro/info/Rapoarte/Diverse/RO_Cod%20Guvernanta%20Corporativa_WEB_revised.pdf (accessed on 21 January 2024).

- Bucharest Stock Exchange. n.d. Available online: https://bvb.ro/ (accessed on 25 May 2023).

- Bushman, Robert, Piotroski Joseph, and Smith Abbi. 2003. What Determines Corporate Transparency? Economic Growth 42: 207–52. [Google Scholar] [CrossRef]

- Buzatu, Laura. 2004. Perspectivele Pietei de Capital in Romania. Bucuresti: ASE. [Google Scholar]

- Chrisman, James. 2019. Stewardship Theory: Realism, Relevance, and Family Firm Governance. Entrepreneurship Theory and Practice 43: 1051–66. [Google Scholar] [CrossRef]

- Coca, Timofte Cristina, Socoliuc Marian, Grosu Veronica, and Coca Dan Andrei. 2021. Fiscal and accounting fraud risk detection using beneish model. A Romanian case study. International Journal of Business and Society 22: 296–312. [Google Scholar] [CrossRef]

- Cosmulese, Cristina Gabriela, Socoliuc Marian, Ciubotariu Marius Sorin, Mihaila Svetlana, and Grosu Veronica. 2019. An empirical analysis of stakeholders’ expectations and integrated reporting quality. Economic research-Ekonomska istraživanja 32: 3963–86. [Google Scholar] [CrossRef]

- Daily, Catherine, Dalton Dan, and Cannella Albert. 2003. Corporate Governance: Decades of Dialogue and Data. Academy of Management Review 28: 371–82. [Google Scholar] [CrossRef]

- Davis, James, Schoorman David, and Donaldson Lex. 1997. Toward A Stewardship Theory Of Management. Academy of Management Review 22: 20–47. [Google Scholar] [CrossRef]

- Dawkins, Cedric. 2014. The Principle of Good Faith: Toward Substantive Stakeholder Engagement. Journal of Business Ethics 121: 283–95. [Google Scholar] [CrossRef]

- Defond, Mark L., and Mingyi Hung. 2004. Investor protection and corporate governance: Evidence from worldwide CEO turnover. Journal of Accounting Research 42: 269–312. [Google Scholar] [CrossRef]

- Dictionary of the Romanian Language. n.d. Available online: https://dexonline.ro/definitie/guvernare (accessed on 25 May 2023).

- Donaldson, Lex, and James Davis. 1991. Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Australian Journal of Management 16: 49–64. [Google Scholar] [CrossRef]

- Donaldson, Thomas, and Lee Preston. 1995. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Academy of Management Review 20: 65–91. [Google Scholar] [CrossRef]

- Doyle, Peter. 2001. Building value-based branding strategies. Journal of Strategic Marketing 9: 255–68. [Google Scholar]

- Eisenhardt, Kathleen. 1989. Agency Theory: An Assessment and Review. Academy of Management Review 14: 57–74. [Google Scholar] [CrossRef]

- Elia, John. 2009. Transparency rights, technology, and trust. Ethics and Information Technology 11: 145–53. [Google Scholar] [CrossRef]

- European Commission. n.d. Available online: https://ec.europa.eu/ (accessed on 3 April 2024).

- Fontaine, Charles, Haarman Antoine, and Schmid Stefan. 2006. The Stakeholder Theory. London: SAGE Publications Ltd. [Google Scholar] [CrossRef][Green Version]

- Freeman, Edward, Wicks Andrew, and Parmar Bidhan. 2004. Stakeholder Theory and “The Corporate Objective Revisited”. Organization Science 15: 364–69. [Google Scholar] [CrossRef]

- Georgescu, Cristina Elena. 2012. Theoretical Framework for Corporate Governance. Ovidius University Annals: Economic Sciences Series 2021: 493–98. [Google Scholar]

- Ghita, Marcel, Boghean Florin, Hlaciuc Elena, and Ghita Razvan. 2010. Guvernanța Corporativă și Auditul Intern. Iași: Editura Tipo Moldova. [Google Scholar]

- Gibson, Kevin. 2000. The Moral Basis of Stakeholder Theory. Journal of Business Ethics 26: 245–57. [Google Scholar] [CrossRef]

- Greenwood, Michelle. 2007. Stakeholder Engagement: Beyond the Myth of Corporate Responsibility. Journal of Business Ethics 74: 315–27. [Google Scholar] [CrossRef]

- Heller, Victor, and John R. Darling. 2011. Toyota in crisis: Denial and mismanagement. Journal of Business Strategy 32: 4–13. [Google Scholar] [CrossRef]

- Jelal, Roshan, and Charles Mbohwa. 2014. A Study of Management Principles Incorporating Corporate Governance and Advocating Ethics to Reduce Fraud at a South African Bank. International Journal of Humanities and Social Sciences 8: 1223–28. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1979. Rights and production functions: An application to labor-managed firms and codetermination. Journal of Business 1979: 469–506. [Google Scholar] [CrossRef]

- Johnson, Simon, Boone Peter, Breach Alasdair, and Friedman Eric. 2000. Corporate governance in the Asian financial crisis. Journal of financial Economics 58: 141–86. [Google Scholar] [CrossRef]

- Jones, Thomas. 1995. Instrumental Stakeholder Theory: A Synthesis Of Ethics And Economics. Academy of Management Review 20: 404–37. [Google Scholar] [CrossRef]

- La Porta, Rafael, Lopez-de-Silanes Florencio, Shleifer Andrei, and Vishny Robert. 2000. Investor protection and corporate governance. Journal of Financial Economics 58: 3–27. [Google Scholar] [CrossRef]

- Lan, Luh, and Loizos Heracleous. 2010. Rethinking Agency Theory: The View from Law. Academy of Management Review 35: 294–314. [Google Scholar] [CrossRef][Green Version]

- Letza, Stephen, Kirkbride James, Sun Xiuping, and Smallman Clive. 2008. Corporate governance theorising: Limits, critics and alternatives. International Journal of Law and Management 50: 17–32. [Google Scholar] [CrossRef]

- Maher, Maria, and Thomas Andersson. 2000. Corporate Governance: Effects on Firm Performance and Economic Growth. Oxford: Oxford University Press. [Google Scholar]

- Măciucă, Geanina, Hlaciuc Elena, and Ursache Antonela. 2015. The role of prudence in financial reporting: IFRS versus Directive 34. Procedia Economics and Finance 32: 738–44. [Google Scholar] [CrossRef][Green Version]

- Mease, Lindley, Erickson Arickson, and Hicks Christina. 2018. Engagement takes a (fishing) village to manage a resource: Principles and practice of effective stakeholder engagement. Journal of Environmental Management 212: 248–57. [Google Scholar] [CrossRef] [PubMed]

- Morariu, Ana, Suciu Gheorghe, and Stoian Flavia. 2008. Audit Intern și Guvernanță Corporativă. București: Editura Universitară. [Google Scholar]

- Morosan-Danila, Lucia, Bordeianu Otilia Maria, Grigoras-Ichim Claudia Elena, and Bitca Alexandra. 2022. The Performance of Companies Listed on the Stock Exchange. The USV Annals of Economics and Public Administration 22: 134–41. [Google Scholar]

- OECD. 2023. OECD Corporate Governance Factbook 2023. Available online: https://www.oecd-ilibrary.org/finance-and-investment/oecd-corporate-governance-factbook-2023_6d912314-en (accessed on 3 April 2024).

- Pande, Santosh, and Valeed Ahmad Ansari. 2014. A Theoretical Framework for Corporate Governance. Indian Journal of Corporate Governance 7: 56–72. [Google Scholar] [CrossRef]

- Prelipcean, Gabriela, Boscoianu Mircea, Lupan Mariana, and Nastase Carmen Eugenia. 2014. Innovative Financing Solutions Based on Venture Capital and Private Equity to Support the Development of Entrepreneurship in Romania. Transformations in Business & Economics 13: 331. [Google Scholar]

- Rostami, Vahab, and Leyla Rezaei. 2022. Corporate governance and fraudulent financial reporting. Journal of Financial Crime 29: 1009–26. [Google Scholar] [CrossRef]

- Sabău, Elena Monica, Şendroiu Cleopatra, and Sgârdea Florinel Marian. 2013. Corporate Anti-fraud Strategies-Ethic Culture and Occupational Integrity. Cross-Cultural Management Journal 15: 59–65. [Google Scholar]

- Schnackenberg, Andrew, and Edward Tomlinson. 2016. Organizational Transparency. Journal of Management 42: 1784–810. [Google Scholar] [CrossRef]

- Shahid, Mohammad Sadiq, and Muhammad Abbas. 2019. Does corporate governance play any role in investor confidence, corporate investment decisions relationship? Evidence from Pakistan and India. Journal of Economics and Business 105: 105839. [Google Scholar] [CrossRef]

- Shapira, Zur. 2000. Governance in Organizations: A Cognitive Perspective. Journal of Management and Governance 4: 53–67. [Google Scholar] [CrossRef]

- Shaukat, Amama, and Carol Padgett. 2005. The UK Code of Corporate Governance: Link between Compliance and Firm Performance. European Public Law: National eJournal 2008: 167. [Google Scholar] [CrossRef][Green Version]

- Shrives, Philip, and Niamh Brennan. 2015. A typology for exploring the quality of explanations for non-compliance with UK corporate governance regulations. British Accounting Review 47: 85–99. [Google Scholar] [CrossRef]

- Shrives, Philip, and Niamh Brennan. 2017. Explanations for corporate governance non-compliance: A rhetorical analysis. Critical Perspectives on Accounting 49: 31–56. [Google Scholar] [CrossRef]

- Smallman, Clive. 2004. Exploring theoretical paradigms in corporate governance. International Journal of Business Governance and Ethics 1: 78–94. [Google Scholar] [CrossRef]

- Sorici, Monica Laura, Grosu Veronica, Cosmulese Cristina Gabriela, and Socoliuc Marian. 2021. Adjusting Financial Reporting in the Perspective of Transferring Financial Transactions to the Cryptocurrency Market. LUMEN Proceedings 17: 597–610. [Google Scholar] [CrossRef] [PubMed]

- Stan, Stefan. 2024. Final violent pentru unul dintre cei mai bogaţi şi puternici oameni din lume. A murit după ce a fost împuşcat. El s-a aflat în centrul uneia dintre cele mai mari fraude corporative din Africa de Sud. Business Magazin. Available online: https://www.businessmagazin.ro/actualitate/final-violent-pentru-unul-dintre-cei-mai-bogati-si-puternici-oameni-22303280 (accessed on 3 April 2024).

- Sternberg, Elaine. 1997. The Defects of Stakeholder Theory. Corporate Governance: An International Review 5: 3–10. [Google Scholar] [CrossRef]

- Subramanian, Shanmugasundaram. 2018. Stewardship Theory of Corporate Governance and Value System: The Case of a Family-owned Business Group in India. Indian Journal of Corporate Governance 11: 102–88. [Google Scholar] [CrossRef]

- Sundaramurthy, Chamu, and Lewis Marianne Lewis. 2003. Control and Collaboration: Paradoxes of Governance. Academy of Management Review 28: 397–415. [Google Scholar] [CrossRef]

- The Committee on the Financial Aspects of Corporate Governance. 1992. Financial Aspects of Corporate Governance. Available online: http://www.ecgi.org/codes/documents/cadbury.pdf (accessed on 12 March 2023).

- Toma, Constantin, and Dan Chirleșan. 2011. Informația Contabilă și Guvernanța Corporativă în Context European și Global. Iași: Editura Junimea. [Google Scholar]

- Vaccaro, Antomio, and Peter Madsen. 2009. Corporate dynamic transparency: The new ICT-driven ethics? Ethics and Information Technology 11: 113–22. [Google Scholar] [CrossRef]

- Vasile, Tiberiu. 2024. Una dintre cele mai mari fraude financiare din istoria SUA: Un “rege al criptomonedelor”, închis pentru 25 de ani după ce a furat miliarde de dolari de la clienții FTX. DCNews. Available online: https://www.dcnews.ro/una-dintre-cele-mai-mari-fraude-financiare-din-istoria-sua-un-rege-al-criptomonedelor-inchis-pentru-25-de-ani-dupa-ce-a-furat-miliarde-de-dolari-de-la-clientii-ftx_954236.html (accessed on 3 April 2024).

- Voda, Ana Iolanda, Martinez Ignacio, Tiganas Claudiu Gabriel, Maha Liviu George, and Filipeanu Dumitru. 2019. Examining The Effects Of Creativity And Willingness To Take Risk On Young Students’entrepreneurial Intention. Transformations in Business & Economics 18: 469. [Google Scholar]

- World Trade Organization. 2013. International Standards and the WTO TBT Agreement: Improving Governance for Regulatory Alignment. Available online: https://www.wto.org/english/res_e/reser_e/ersd201306_e.pdf (accessed on 21 May 2023).

- Yusoff, Wan, Fauziah Wan, and Alhaji Idris Adamu. 2012. Insight of Corporate Governance Theories. Journal of Business Management 1: 52–63. [Google Scholar] [CrossRef]

- Zehir, Cemal, Çınar Fadime, and Şengül Halil. 2016. Role of Stakeholder Participation between Transparency and Qualitative and Quantitive Performance Relations: An Application at Hospital Managements. Procedia—Social and Behavioral Sciences 229: 234–45. [Google Scholar] [CrossRef]

| Corporative Governance Goal | Classification of the Goals | Characteristics | Limitations |

|---|---|---|---|

| Transparency in Corporate Governance | Financial and Governance Transparency | Financial transparency captures the timeliness and reliability of financial disclosures, while governance transparency concerns the disclosure of governance practices and mechanisms (Bushman et al. 2003) | Risk of information overload and misinterpretation (Bushman et al. 2003; Schnackenberg and Tomlinson 2016) Balancing transparency with the need for confidentiality (Schnackenberg and Tomlinson 2016) |

| Dynamic Transparency | ICT facilitated it, making information exchange between corporations and stakeholders collaborative. This transparency goes beyond static disclosure, fostering greater openness and stakeholder engagement (Vaccaro and Madsen 2009). | Technological and accessibility barriers (Vaccaro and Madsen 2009) Balancing transparency with confidentiality (Elia 2009) | |

| Stakeholder Engagement | Beyond Corporate Responsibility | It challenges the assumption that stakeholder engagement is intrinsically responsible. While traditionally seen as a manifestation of corporate responsibility, stakeholder engagement is a morally neutral practice that requires careful consideration of its ethical dimensions and impacts (Greenwood 2007). | Divergent stakeholder interests and expectations (Greenwood 2007) Resource and time constraints (Dawkins 2014) Measuring impact and effectiveness (Mease et al. 2018) |

| Transparency and Stakeholder Participation | Transparency principles positively affect qualitative and quantitative corporate performance through stakeholder participation (Zehir et al. 2016). | Complexity in managing diverse stakeholder expectations (Greenwood 2007) Resource and capacity constraints (Dawkins 2014) Challenges in measuring the impact of engagement (Mease et al. 2018) |

| Theories | Authors | Key Aspects of Corporate Governance Theories |

|---|---|---|

| Agency Theory | Eisenhardt (1989) Band (1992) Sternberg (1997) Lan and Heracleous (2010) Pande and Ansari (2014) | It is central to corporate governance literature, focusing on the relationship between principals (shareholders) and agents (managers). It suggests that governance structures are necessary to align managers’ and shareholders’ interests due to the potential for conflicting interests. The Anglo-Saxon model of corporate governance, heavily influenced by agency theory, emphasises the role of the board of directors in curbing executive power to protect shareholders’ interests. |

| Stakeholder Theory | Donaldson and Preston (1995) Jones (1995) Gibson (2000) Freeman et al. (2004) Fontaine et al. (2006) Pande and Ansari (2014) | It expands the focus of corporate governance beyond shareholders to include other stakeholders, such as employees, customers, suppliers, and the community. This theory contends that corporations should consider the interests and welfare of all stakeholders in their decision-making processes. However, integrating stakeholder theory into governance frameworks can sometimes conflict with directors’ legal obligations to prioritise shareholder interests. |

| Stewardship Theory | Donaldson and Davis (1991) Davis et al. (1997) Smallman (2004) Subramanian (2018) Chrisman (2019) | Offers a perspective that contrasts with the agency theory by proposing that managers are stewards whose interests align with those of the shareholders. Managers, as stewards, are motivated by a desire to achieve high performance and the organisation’s success rather than by personal gain. This theory supports governance models that empower managers rather than strictly control them. |

| Beyond Traditional Theories | Shapira (2000) Daily et al. (2003) Sundaramurthy and Lewis (2003) Letza et al. (2008) Georgescu (2012) Yusoff et al. (2012) | According to the literature, fresh theoretical perspectives beyond conventional frameworks, such as agency, stakeholder, and stewardship theories, are required. There is an increasing demand for a comprehensive theory of governance, with some experts suggesting the concept of the organisation as an organism that emphasises long-term strategic value and growth. |

| Model | Main Characteristics |

|---|---|

| The American model | - individual shareholders who have business relationships, and numerous shareholders are interested in the most profitable earnings and sustainable investments - shareholders aim to invest capital inefficient activities - the model presents profitability at the expense of development strategies |

| The German model | - it is highlighted by the connection of common interests between the majority shareholders and the corporation; they participate in the control and management action - the primary objective of the shareholders is long-term stability - making decisions in connection with the liquidation or application for some inefficient branches of the business makes the majority shareholders show inflexibility |

| The Japanese model | - marks the existence of holding companies, the state has a vital role in supporting the strategic planning of enterprises - cooperation, long-term relationships, and the common interest of the companies within the keiretsu characterise it - shareholders do not have a central role in the decision-making process of companies - executive managers and boards of directors often make crucial decisions to support the long-term interests of the company and stakeholders in general |

| Principle No. | Principle Explanation |

|---|---|

| Principle 1 | Respecting the rights of shareholders in commercial companies traded on the BSE. |

| Principle 2 | Communication between commercial companies and their shareholders; fair treatment of all shareholders holding the same shares; the promptness of the participation of company shareholders in the AGM meetings; free expression of shareholders’ opinion during the AGM; the participation of shareholders in the works of the AGM and the communication between them and the Board of Directors; making information available to shareholders; creating the steps necessary for the relationship between commercial companies traded on the BSE and investors. |

| Principle 3 | The Board of Directors of commercial companies traded on the BSE market makes effective decisions and meets regularly. |

| Principle 4 | The Board of Directors acts in the company’s interest and develops the company. |

| Principle 5 | The Board of Directors ensures a balance between all executive and non-executive members. |

| Principle 6 | The existence of independent members of the Board of Directors for objective opinions. |

| Principle 7 | The efficiency of the supervisory activity is determined by the balanced number of members of the Board of Directors, who make decisions based on their powers. |

| Principle 8 | A transparent, official, precise procedure will be used to appoint the members of the Board of Directors, considering their personal and professional qualifications. |

| Principle 9 | Establishing a Nomination Committee comprising the Board of Directors members to evaluate the members’ competencies is being considered. |

| Principle 10 | Ensuring a remuneration policy suited to the company’s long-term interests, with the remuneration committee comprising non-executive directors. |

| Principle 11 | A company’s corporate governance, which is traded on the BSE, produces periodic reports on its financial situation, management, performance, and ownership. |

| Principle 12 | The strict rules imposed by the Board of Directors will protect the company’s interests. |

| Principle 13 | When an administrator presents a material interest of his own or in the interest of third parties, the Board of Directors is responsible for making optimal decisions regarding the resolution of the situation. |

| Principle 14 | The Board of Directors is responsible for adopting decisions aimed at the company’s interest. |

| Principle 15 | The Board of Directors will decide on the approval procedures and implementation procedures for the transactions carried out by the issuer. |

| Principle 16 | The company’s directors and administrators keep data confidential during their terms of office. |

| Principle 17 | The corporate governance of the trading company traded on the BSE will be responsible for communication between the company and stakeholders. |

| Principle 18 | The existence of the Corporate Governance Regulation/Statute is where the Board of Directors functions are found. |

| Principle 19 | Adoption of the unitary or dual leadership system. |

| Type of Company | Specific Characteristics |

|---|---|

| Leasing companies | They offer financial leasing services, through which customers can rent goods for a certain period, with the possibility of purchasing them at the end of the contract. |

| Factoring companies | They provide working capital financing services by purchasing trade receivables from other companies. |

| Financial investment companies | They manage investment or pension funds, offering asset management services and investing sums in various financial instruments. |

| Insurance companies | They offer insurance services for various risks and fields, such as life insurance, health insurance, car insurance, and home insurance. |

| Brokerage firms | They trade financial instruments, such as stocks, bonds, currencies, or commodities. |

| Symbol | Issue Name | The Type of Government System | Comply | Does not Comply/Partially Comply | % Comply | % Does Not Comply |

|---|---|---|---|---|---|---|

| PBK | Patria Bank S.A. | unitary | 38 | 4 | 90.5 | 9.5 |

| ONE | One United Properties | unitary | 37 | 5 | 88.1 | 11.9 |

| EVER | Evergent Investments S.A. | unitary | 42 | 0 | 100 | 0 |

| SIF1 | SIF Banat Crisana S.A. | unitary | 42 | 0 | 100 | 0 |

| HAI | Holde Agri Invest S.A. | - | 42 | 0 | 100 | 0 |

| TBK | Transilvania Broker De Asigurare | unitary | 42 | 0 | 100 | 0 |

| TRANSI | Transilvania Investments Alliance S.A. | dualist | 42 | 0 | 100 | 0 |

| BRD | Groupe Societe Generale S.A | unitary | 42 | 0 | 100 | 0 |

| BRK | Ssif BRK Financial Group S.A. | dualist | 36 | 6 | 85.7 | 14.3 |

| BVB | Bursa De Valori Bucuresti S.A. | unitary—dualist | 42 | 0 | 100 | 0 |

| EBS | Erste Group Bank A.G. | dualist | 42 | 0 | 100 | 0 |

| FP | Fondul Proprietatea | unitary | 42 | 0 | 100 | 0 |

| GSH | Grup Serban Holding | unitary | 38 | 4 | 90.5 | 9.5 |

| ROC1 | Holdingrock1 | - | 42 | 0 | 100 | 0 |

| SIF4 | Sif Muntenia S.A. | unitary | 38 | 4 | 90.5 | 9.5 |

| SIF5 | Sif Oltenia S.A. | unitary | 40 | 2 | 95.2 | 4.8 |

| TLV | Banca Transilvania S.A. | unitary | 42 | 0 | 100 | 0 |

| TSLA | Transilvania Leasing și Credit IFN S.A. Brasov | unitary—dualist | 42 | 0 | 100 | 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luca, F.-A.; Tiganas, C.-G.; Grigoras-Ichim, C.-E.; Filipeanu, D.; Morosan-Danila, L. Critical Perspectives of Organisational Behaviour towards Stakeholders through the Application of Corporate Governance Principles. Adm. Sci. 2024, 14, 84. https://doi.org/10.3390/admsci14050084

Luca F-A, Tiganas C-G, Grigoras-Ichim C-E, Filipeanu D, Morosan-Danila L. Critical Perspectives of Organisational Behaviour towards Stakeholders through the Application of Corporate Governance Principles. Administrative Sciences. 2024; 14(5):84. https://doi.org/10.3390/admsci14050084

Chicago/Turabian StyleLuca, Florin-Alexandru, Claudiu-Gabriel Tiganas, Claudia-Elena Grigoras-Ichim, Dumitru Filipeanu, and Lucia Morosan-Danila. 2024. "Critical Perspectives of Organisational Behaviour towards Stakeholders through the Application of Corporate Governance Principles" Administrative Sciences 14, no. 5: 84. https://doi.org/10.3390/admsci14050084

APA StyleLuca, F.-A., Tiganas, C.-G., Grigoras-Ichim, C.-E., Filipeanu, D., & Morosan-Danila, L. (2024). Critical Perspectives of Organisational Behaviour towards Stakeholders through the Application of Corporate Governance Principles. Administrative Sciences, 14(5), 84. https://doi.org/10.3390/admsci14050084