The Relevance of Sectoral Clustering in Corporate Debt Policy: The Case Study of Slovak Enterprises

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Addoum, Jawad M., Stefanos Delikouras, Da Ke, and George M. Korniotis. 2023. Industry Clusters and the Geography of Portfolio Choice. Journal of Financial and Quantitative Analysis, 1–33. [Google Scholar] [CrossRef]

- Adjei, Raymond Kofi, and Libor Grega. 2023. Economic growth effects of de facto and de jure trade globalization in ECOWAS. Journal of Competitiveness 15: 18–35. [Google Scholar] [CrossRef]

- Afzal, Saima, Ayesha Afzal, Muhammad Amin, Sehar Saleem, Nouman Ali, and Muhammad Sajid. 2021. A Novel Approach for Outlier Detection in Multivariate Data. Mathematical Problems in Engineering 2021: 1899225. [Google Scholar] [CrossRef]

- Aharonson, Barak, Joel Baum, and Maryann Feldman. 2014. Industrial Clustering and Innovative Output. In Innovation and IT in an International Context. London: Palgrave Macmillan, pp. 65–81. [Google Scholar]

- Ahmad, Issam Abdo, and Ali Fakih. 2022. Does the legal form matter for firm performance in the MENA region? Annals of Public and Cooperative Economics 93: 205–27. [Google Scholar] [CrossRef]

- Ahmed, Naveed, and Talat Afza. 2019. Capital structure, competitive intensity and firm performance: Evidence from Pakistan. Journal of Advances in Management Research 16: 796–813. [Google Scholar] [CrossRef]

- Ahsan, Tanveer, Man Wang, and Muhammad Azeem Qureshi. 2016. Firm, industry, and country level determinants of capital structure: Evidence from Pakistan. South Asian Journal of Global Business Research 5: 362–84. [Google Scholar] [CrossRef]

- Al Amosh, Hamzeh, Saleh Khatib, and Khaled Hussainey. 2022. The Financial Determinants of Integrated Reporting Disclosure by Jordanian Companies. Journal of Risk and Financial Management 15: 375. [Google Scholar] [CrossRef]

- Allaya, Manel, Imen Derouiche, and Anke Muessig. 2022. Voluntary disclosure, ownership structure, and corporate debt maturity: A study of French listed firms. International Review of Financial Analysis 81: 101300. [Google Scholar] [CrossRef]

- Alshehhi, Yahya, and Jozsef Popp. 2017. Sectoral analysis: Growth accounting of tertiary industries. Practical Application of Science 14: 221–30. [Google Scholar]

- Alvarez-Botas, Celia, and Vicotr Gonzalez. 2021. Institutions, banking structure and the cost of debt: New international evidence. Accounting & Finance 61: 265–303. [Google Scholar] [CrossRef]

- Amare, Ayalew. 2021. Capital structure and profitability: Panel data evidence of private banks in Ethiopia. Cogent Economics & Finance 9: 1953736. [Google Scholar] [CrossRef]

- Anderson, Theodore Wilbur, and Donald Allan Darling. 1954. A test of goodness of fit. Journal of the American Statistical Association 49: 765–69. [Google Scholar] [CrossRef]

- Andronie, Mihai, Mariana Iatagan, Cristian Uță, Iulian Hurloiu, Adrian Dijmărescu, and Irina Dijmărescu. 2023. Big data management algorithms in artificial Internet of Things-based fintech. Oeconomia Copernicana 14: 769–93. [Google Scholar] [CrossRef]

- Armstrong, Richard. 2014. When to use the Bonferroni correction. Ophthalmic and Physiological Optics 34: 502–8. [Google Scholar] [CrossRef]

- Athari, Seyed Alireza, and Mahboubeh Bahreini. 2023. Does economic policy uncertainty impact firms’ capital structure policy? Evidence from Western European economies. Environmental Science and Pollution Research 30: 37157–73. [Google Scholar] [CrossRef]

- Bagh, Tanveer, Mirza Muhammad Naseer, Muhammad Asif Khan, Paula Pypłacz, and Judit Oláh. 2023. Sustainable growth rate, corporate value of US firms within capital and labor market distortions: The moderating effect of institutional quality. Oeconomia Copernicana 14: 1211–55. [Google Scholar] [CrossRef]

- Baines, Joseph, and Sandy Brian Hager. 2021. The great debt divergence and its implications for the Covid-19 crisis: Mapping corporate leverage as power. New Political Economy 26: 885–901. [Google Scholar] [CrossRef]

- Barbu, Cătălin Mihail, Dorian Laurenţiu Florea, Dan-Cristian Dabija, and Mihai Constantin Răzvan Barbu. 2021. Customer experience in fintech. Journal of Theoretical and Applied Electronic Commerce Research 16: 1415–33. [Google Scholar] [CrossRef]

- Barbuta-Misu, Nicoleta, and Mara Madaleno. 2020. Assessment of bankruptcy risk of large companies: European countries evolution analysis. Journal of Risk and Financial Management 13: 58. [Google Scholar] [CrossRef]

- Basic, Filip, and Tomislav Globan. 2023. Early bird catches the worm: Finding the most effective early warning indicators of recessions. Economic Research-Ekonomska Istrazivanja 36: 2120040. [Google Scholar] [CrossRef]

- Batrancea, Larissa. 2021. The influence of liquidity and solvency on performance within the healthcare industry: Evidence from publicly listed companies. Mathematics 9: 2231. [Google Scholar] [CrossRef]

- Bazhair, Ayman Hassan, and Mohammad Naif Alshareef. 2022. Dynamic relationship between ownership structure and financial performance: A Saudi experience. Cogent Business & Management 9: 2098636. [Google Scholar] [CrossRef]

- Benlemlih, Mohammed, and Li Cai. 2020. Corporate environmental performance and financing decisions. Business Ethics: A European Review 29: 248–65. [Google Scholar] [CrossRef]

- Bhattacharya, Sonali, and Dipasha Sharma. 2019. Do environment, social and governance performance impact credit ratings: A study from India. International Journal of Ethics and Systems 35: 466–84. [Google Scholar] [CrossRef]

- Bhaumik, Pritwish, and Subhashis Ghosal. 2017. Efficient Bayesian estimation and uncertainty quantification in ordinary differential equation models. Bernoulli 23: 3537–70. [Google Scholar] [CrossRef]

- Boateng, Prince Yeboah, baba Issah Ahamed, Michael Gift Soku, Salomey Osei Addo, and Lexis Alexander Tetteh. 2022. Influencing factors that determine capital structure decisions: A review from the past to present. Cogent Business & Management 9: 2152647. [Google Scholar] [CrossRef]

- Borowiecki, Ryszard, Barbara Siuta-Tokarska, Mateusz Janas, Sylwia Kruk, Pawel Krzeminski, Agnieszka Thier, and Katarzyna Zmija. 2022. The Competitive Position of Small Business Furniture Industry Enterprises in Poland in the Context of Sustainable Management: Relationships, Interdependencies, and Effects of Activities. Sustainability 14: 9368. [Google Scholar] [CrossRef]

- Boulhaga, Monia, Abdelfettah Bouri, Ahmed Elamer, and Bassam Ibrahim. 2023. Environmental, social and governance ratings and firm performance: The moderating role of internal control quality. Corporate Social Responsibility and Environmental Management 30: 134–45. [Google Scholar] [CrossRef]

- Bradley, Michael, Gregg Jarrell, and E. Han Kim. 1984. On the existence of an optimal capital structure: Theory and evidence. Journal of Finance 39: 857–78. [Google Scholar] [CrossRef]

- Brendea, Gabriela, Fanuta Pop, and Loredana Mihalca. 2022. Capital structure and firm performance: The case of Central and Eastern European economies. Ekonomicky Casopis 70: 430–49. [Google Scholar] [CrossRef]

- Breuer, Wolfgang, Linh Nguyen, and Bertram Steininger. 2023. Decomposing industry leverage: The special cases of real estate investment trusts and technology & hardware companies. Journal of Financial Research. early access. [Google Scholar] [CrossRef]

- Campos, Eduardo Lima, and Rubens Penha Cysne. 2021. Estimating debt limits for emerging countries. International Review of Economics & Finance 76: 836–55. [Google Scholar] [CrossRef]

- Casu, Barbara, Filippo Di Pietro, and Antonio Trujillo-Ponce. 2019. Liquidity creation and bank capital. Journal of Financial Services Research 56: 307–40. [Google Scholar] [CrossRef]

- Cegarra-Navarro, Juan Gabriel, Elena-Mădălina Vatamanescu, Dan-Cristian Dabija, and Luminița Nicolescu. 2023. The role of knowledge and interpersonal competences in the development of civic and public engagement and entrepreneurial intention. International Entrepreneurship and Management Journal, 1–25. [Google Scholar] [CrossRef]

- Cerkovskis, Edgars, Dominika Gajdosikova, and Cristian Florin Ciurlau. 2022. Capital structure theories: Review of literature. Ekonomicko-Manazerske Spektrum 16: 12–24. [Google Scholar] [CrossRef]

- Chang, Chun, Xin Chen, and Guanmin Liao. 2014. What are the reliably important determinants of capital structure in China? Pacific-Basin Finance Journal 30: 87–113. [Google Scholar] [CrossRef]

- Chen, Suijun, Pankaewta Lakkanawanit, Muttanachai Suttipun, and He Xue. 2023. Environmental regulation and corporate performance: The effects of green financial management and top management’s environmental awareness. Cogent Business & Management 10: 2209973. [Google Scholar] [CrossRef]

- Chen, Zhongfei, Mingmei Yin, and Mengling Zhou. 2022. Does environmental regulatory pressure affect corporate debt financing? Resources, Conservation and Recycling 184: 106405. [Google Scholar] [CrossRef]

- Cipresso, Pietro, Irene Alice Chicchi Giglioli, Mariano Alcaniz Raya, and Guiseppe Riva. 2018. The past, present, and future of virtual and augmented reality research: A network and cluster analysis of the literature. Frontiers in Psychology 9: 2086. [Google Scholar] [CrossRef] [PubMed]

- Cramer, Harald. 1928. On the composition of elementary errors. Scandinavian Actuarial Journal 1928: 141–80. [Google Scholar] [CrossRef]

- Crișan-Mitra, Cătălina Silvia, Liana Stanca, and Dan-Cristian Dabija. 2020. Corporate social performance: An assessment model on an emerging market. Sustainability 12: 4077. [Google Scholar] [CrossRef]

- Crișan-Mitra, Cătălina Silvia, Vasile Dinu, Catalin Postelnicu, and Dan-Cristian Dabija. 2016. Corporate Practice of Sustainable Development on an Emerging Market. Transformations in Business & Economics 15: 228–43. [Google Scholar]

- Dana, Leo Paul, Mohammad Mahdi Rounaghi, and Gholamreza Enayati. 2021. Increasing productivity and sustainability of corporate performance by using management control systems and intellectual capital accounting approach. Green Finance 3: 1–14. [Google Scholar] [CrossRef]

- Dang, Thu. 2020. Determinants of liquidity of listed enterprises: Evidence from Vietnam. Journal of Asian Finance, Economics and Business 7: 67–73. [Google Scholar] [CrossRef]

- Danso, Albert, Samuel Fosu, Samuel Owusu-Agyei, Collins Ntim, and Emmanuel Adegbite. 2021. Capital structure revisited. Do crisis and competition matter in a Keiretsu corporate structure? International Journal of Finance & Economics 26: 5073–92. [Google Scholar] [CrossRef]

- De Almeida, Luiza, and Thierry Tressel. 2020. Non-Financial corporate debt in advanced Economies, 2010–17. IMF Working Paper 2020: 35. [Google Scholar] [CrossRef]

- De Jong, Abe, Rezaul Kabir, and Thuy Thu Nguyen. 2008. Capital structure around the world: The roles of firm-and country-specific determinants. Journal of Banking & Finance 32: 1954–69. [Google Scholar] [CrossRef]

- Degryse, Hans, Peter de Goeij, and Peter Kappert. 2012. The impact of firm and industry characteristics on small firms’ capital structure. Small Business Economics 38: 431–47. [Google Scholar] [CrossRef]

- Dolinsek, Tatjana, Polona Tominc, and Andrea Lutar Skerbinjek. 2014. The determinants of internet financial reporting in Slovenia. Online Information Review 38: 842–60. [Google Scholar] [CrossRef]

- Dong, Zhao, Haodong Xu, Zhifeng Zhang, Yipin Lyu, Yugi Lu, and Hongyan Duan. 2022. Whether green finance improves green innovation of listed companies—Evidence from China. International Journal of Environmental Research and Public Health 19: 10882. [Google Scholar] [CrossRef]

- Dunn, Olive Jean. 1961. Multiple comparisons among means. Journal of the American Statistical Association 56: 52–64. [Google Scholar] [CrossRef]

- Durana, Pavol, Roman Blazek, Veronika Machova, and Miroslav Krasnan. 2022. The use of Beneish M-scores to reveal creative accounting: Evidence from Slovakia. Equilibrium. Quarterly Journal of Economics and Economic Policy 17: 481–510. [Google Scholar] [CrossRef]

- Durica, Marek, Jaroslav Frnda, and Lucia Svabova. 2023. Artificial neural network and decision tree-based modelling of non-prosperity of companies. Equilibrium. Quarterly Journal of Economics and Economic Policy 18: 1105–31. [Google Scholar] [CrossRef]

- Dvoulety, Ondrej, and Ivana Blazkova. 2021. Exploring firm-level and sectoral variation in total factor productivity (TFP). International Journal of Entrepreneurial Behavior & Research 27: 1526–47. [Google Scholar] [CrossRef]

- Dzuba, Sergey, and Denis Krylov. 2021. Cluster analysis of financial strategies of companies. Mathematics 9: 3192. [Google Scholar] [CrossRef]

- Endri, Endri, Kasmir Kasmir, and Andam Dewi Syarif. 2020. Delisting sharia stock prediction model based on financial information: Support Vector Machine. Decision Science Letters 9: 207–14. [Google Scholar] [CrossRef]

- Farahani, Abolfazl, Holger Wallbaum, and Jan-Olof Dalenbäck. 2020. Cost-optimal maintenance and renovation planning in multifamily buildings with annual budget constraints. Journal of Construction Engineering and Management 146: 04020009. [Google Scholar] [CrossRef]

- Farhangdoust, Shayan, Mahdi Salehi, and Homa Molavi. 2020. Management stock ownership and corporate debt: Evidence from an emerging market. Management Research Review 43: 1221–39. [Google Scholar] [CrossRef]

- Ferlie, Ewan, and Susan Trenholm. 2019. Exploring new organisational forms in English higher education: A think piece. Higher Education 77: 229–45. [Google Scholar] [CrossRef]

- Fernandes, Nikki, and Andrew Stone. 2011. Multiplicity adjustments in trials with two correlated comparisons of interest. Statistical Methods in Medical Research 20: 579–94. [Google Scholar] [CrossRef]

- Fischer, Marcel, and Bjarne Astrup Jensen. 2019. The debt tax shield in general equilibrium. Journal of Banking & Finance 100: 151–66. [Google Scholar] [CrossRef]

- Gajdosikova, Dominika, George Lăzăroiu, and Katarina Valaskova. 2023. How Particular Firm-Specific Features Influence Corporate Debt Level: A Case Study of Slovak Enterprises. Axioms 12: 183. [Google Scholar] [CrossRef]

- Gajdosikova, Dominika, Katarina Valaskova, Tomas Kliestik, and Veronika Machova. 2022. COVID-19 pandemic and its impact on challenges in the construction sector: A case study of Slovak enterprises. Mathematics 10: 3130. [Google Scholar] [CrossRef]

- Galant, Adriana, and Dajana Cvek. 2021. The effect of environmental performance investments on financial performance: Analysis of Croatian companies. Central European Business Review 10: 37–51. [Google Scholar] [CrossRef]

- Gaud, Phillipe, Elion Jani, Martin Hoesli, and Andre Bender. 2005. The capital structure of Swiss companies: An empirical analysis using dynamic panel data. European Financial Management 11: 51–69. [Google Scholar] [CrossRef]

- Ghardallou, Wafa. 2022. Capital structure decisions and corporate performance: Does firm’s profitability matter? Journal of Scientific & Industrial Research 81: 859–65. [Google Scholar] [CrossRef]

- Goel, Puneeta. 2021. Rising standards of sustainability reporting in India: A study of impact of reforms in disclosure norms on corporate performance. Journal of Indian Business Research 13: 92–109. [Google Scholar] [CrossRef]

- Guariglia, Alessandra, Marina-Eliza Spaliara, and Serafeim Tsoukas. 2016. To what extent does the interest burden affect firm survival? Evidence from a panel of UK firms during the recent financial crisis. Oxford Bulletin of Economics and Statistics 78: 576–94. [Google Scholar] [CrossRef]

- Gungoraydinoglu, Ali, and Ozde Oztekin. 2022. Financial crises, banking regulations, and corporate financing patterns around the world. International Review of Finance 22: 506–39. [Google Scholar] [CrossRef]

- Guo, Jianhao, and Chunkai Zhao. 2019. Impacting factors of the Chinese military enterprises’ capital structure and approaches of importing private capital. Defence and Peace Economics 30: 858–76. [Google Scholar] [CrossRef]

- Hall, Graham, Patrick Hutchinson, and Nicos Michaelas. 2004. Determinants of the capital structures of European SMEs. Journal of Business Finance & Accounting 31: 711–28. [Google Scholar] [CrossRef]

- Handoko, Jesica, Made Narsa, and Basuki Basuki. 2021. Role difference and negativity bias relevance in strategy review: An experiment. Cogent Business & Management 8: 1938928. [Google Scholar] [CrossRef]

- Hanusz, Zofia, Joanna Tarasinska, and Wojciech Zielinski. 2016. Shapiro–Wilk test with known mean. REVSTAT-Statistical Journal 14: 89–100. [Google Scholar]

- Harris, Milton, and Artur Raviv. 1991. The theory of capital structure. Journal of Finance 46: 297–355. [Google Scholar] [CrossRef]

- Hazelton, Martin. 2003. A graphical tool for assessing normality. American Statistician 57: 285–88. [Google Scholar] [CrossRef]

- Hecke, Tanja. 2012. Power study of Anova versus Kruskal-Wallis test. Journal of Statistics and Management Systems 15: 241–47. [Google Scholar] [CrossRef]

- Hedija, Veronika, and Danike Nemec. 2021. Gender diversity in leadership and firm performance: Evidence from the Czech Republic. Journal of Business Economics and Management 22: 156–80. [Google Scholar] [CrossRef]

- Henze, Norbert, and Stefan Koch. 2020. On a test of normality based on the empirical moment generating function. Statistical Papers 61: 17–29. [Google Scholar] [CrossRef]

- Herman, Emilia, Kinga-Emese Zsido, and Veronika Fenyves. 2022. Cluster analysis with k-mean versus k-medoid in financial performance evaluation. Applied Sciences 12: 7985. [Google Scholar] [CrossRef]

- Hidayat, Kadarisman, Mokhamad Khifni, Sri Mangesti Rahayu, and Muhammad Saifi. 2022. A Cross-Tabulation to Know the Relationship between Financial Performance and Leverage on a Company’s Tax Reporting and Tax Compliance. Review of Pacific Basin Financial Markets and Policies 25: 2250012. [Google Scholar] [CrossRef]

- Hong, Min, Zhenghiu Li, and Benjamin Drakeford. 2021. Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. International Journal of Environmental Research and Public Health 18: 1682. [Google Scholar] [CrossRef]

- Hudakova, Maria, Peter Kardos, Jan Dvorsky, Charles Randy Afful, and Jitka Kloudova. 2023. Management of Operational Risk in the Context of Financial Performance of SMEs. Systems 11: 408. [Google Scholar] [CrossRef]

- Ibrahim, Husaini, and Teik-Cheng Lau. 2019. The determinants of financial leverage for surviving listed companies in Malaysia. International Journal of Business and Society 20: 75–94. [Google Scholar]

- Iqbal, Najaf, Ju Feng Xu, Zeeshan Fareed, Guangcai Wan, and Lina Ma. 2022. Financial leverage and corporate innovation in Chinese public-listed firms. European Journal of Innovation Management 25: 299–323. [Google Scholar] [CrossRef]

- Jacobs, Jan, Kazuo Ogawa, Elmer Sterken, and Ichiro Tokutsu. 2020. Public debt, economic growth and the real interest rate: A panel VAR Approach to EU and OECD countries. Applied Economics 52: 1377–94. [Google Scholar] [CrossRef]

- Jameson, Melvin, Tao-Hsien Dolly King, and Andrew Prevost. 2021. Top management incentives and financial flexibility: The case of make-whole call provisions. Journal of Business Finance & Accounting 48: 374–404. [Google Scholar] [CrossRef]

- Jamshidi, Ehsan Jolous, Yusri Yusup, John Stephen Kayode, and Mohaman Anuar Kamaruddin. 2022. Detecting outliers in a univariate time series dataset using unsupervised combined statistical methods: A case study on surface water temperature. Ecological Informatics 69: 101672. [Google Scholar] [CrossRef]

- Jaworski, Jacek, and Leszek Czerwonka. 2021. Determinants of enterprises’ capital structure in energy industry: Evidence from European Union. Energies 14: 1871. [Google Scholar] [CrossRef]

- Jedrzejczak-Gas, Janina. 2013. Factors determining the profitability of equity in small and medium-sized enterprises in Poland. Management-Poland 17: 185–98. [Google Scholar] [CrossRef]

- Jencova, Silvia, Ivan Petruska, and Marta Lukacova. 2021. Relationship between ROA and total indebtedness by threshold regression model. Montenegrin Journal of Economics 17: 37–46. [Google Scholar] [CrossRef]

- Jin, Ling, Jun Hyeok Choi, Saerona Kim, and Kwanghee Cho. 2022. Slack resources, corporate performance, and COVID-19 pandemic: Evidence from China. International Journal of Environmental Research and Public Health 19: 14354. [Google Scholar] [CrossRef] [PubMed]

- Johnson, Craig, and Andrey Yushkov. 2023. On the determinants of regional government debt in Russia. Eurasian Geography and Economics 64: 484–522. [Google Scholar] [CrossRef]

- Jyoti, Gaurav, and Ashu Khanna. 2021. Does sustainability performance impact financial performance? Evidence from Indian service sector firms. Sustainable Development 29: 1086–95. [Google Scholar] [CrossRef]

- Kaczmarek, Jaroslaw, Sergio Luis Nanez Alonso, Andrzej Sokolowski, Kamil Fijorek, and Sabina Denkowska. 2021. Financial threat profiles of industrial enterprises in Poland. Oeconomia Copernicana 12: 463–98. [Google Scholar] [CrossRef]

- Kalusova, Lenka, and Peter Badura. 2017. Factors determining the financial structure of Czech and Slovak agricultural enterprises. Agricultural Economics 63: 24–33. [Google Scholar] [CrossRef]

- Kang, Che-Yung, and Min-Ho Kim. 2023. Born Global Strategies and the Corporate Performance of Korean Firms. Journal of Korea Trade 27: 159–75. [Google Scholar] [CrossRef]

- Kayani, Umar Nawaz, Christopher Gan, Mustafa Raza Rabbani, and Yousra Trichilli. 2023. Is short-term firm performance an indicator of a sustainable financial performance? Empirical evidence. Studies in Economics and Finance. early access. [Google Scholar] [CrossRef]

- Kayo, Eduardo, and Herbert Kimura. 2011. Hierarchical determinants of capital structure. Journal of Banking & Finance 35: 358–71. [Google Scholar] [CrossRef]

- Kengne, Sophie Kasse. 2022. A resource dependence theory perspective on low savings, cost of capital, leverage and bank valuation in South Africa. Macroeconomics and Finance in Emerging Market Economies, 1–25. [Google Scholar] [CrossRef]

- Khan, Kanwal Iqbal, Faisal Qadeer, Mario Nuno Mata, Rui Miquel Dantas, Joao Xavier Rita, and Jessica Nunes Martins. 2021. Debt market trends and predictors of specialization: An analysis of Pakistani corporate sector. Journal of Risk and Financial Management 14: 224. [Google Scholar] [CrossRef]

- Khan, Khurram Ajaz, Mohammad Anam Akhtar, Rohit Kumar Vishwakarma, and Hung-Cuong Hoang. 2023. A sectoral perspective on the sustainable growth of SMEs. Empirical research in the V4 countries. Journal of Business Sectors 1: 10–19. [Google Scholar] [CrossRef]

- Kincaid, Bonnie. 2005. Competitive Advantage of Clusters within Lesser Developed Countries of the South Pacific: An Empirical Case Study Extending the Porter Diamond Model. Ph.D. thesis, Doctor of Philosophy, Capella University, Minneapolise, MN, USA. [Google Scholar]

- Kliestik, Tomas, Alena Novak Sedlackova, Martin Bugaj, and Andrej Novak. 2022. Stability of profits and earnings management in the transport sector of Visegrad countries. Oeconomia Copernicana 13: 475–509. [Google Scholar] [CrossRef]

- Kliestik, Tomas, Katarina Valaskova, Elvira Nica, Mária Kovacova, and George Lăzăroiu. 2020a. Advanced methods of earnings management: Monotonic trends and change-points under spotlight in the Visegrad countries. Oeconomia Copernicana 11: 371–400. [Google Scholar] [CrossRef]

- Kliestik, Tomas, Katarina Valaskova, George Lăzăroiu, Maria Kovacova, and Jaromir Vrbka. 2020b. Remaining Financially Healthy and Competitive: The Role of Financial Predictors. Journal of Competitiveness 12: 74–92. [Google Scholar] [CrossRef]

- Kljucnikov, Alexandr, Mehmet Civelek, Cyril Klimes, and Radim Farana. 2022. Export risk perceptions of SMEs in selected Visegrad countries. Equilibrium. Quarterly Journal of Economics and Economic Policy 17: 173–90. [Google Scholar] [CrossRef]

- Kluiters, Leon, Mohit Srivastava, and Ladislav Tyll. 2023. The impact of digital trust on firm value and governance: An empirical investigation of US firms. Society and Business Review 18: 71–103. [Google Scholar] [CrossRef]

- Kolmogorov, Andrey. 1933. Sulla Determinazione Empirica di Una Legge di Distribuzione. Giornale dell’Istituto Italiano degli Attuari 4: 83–91. [Google Scholar]

- Koralun-Bereznicka, Julia. 2017. How does the firm size affect the relative importance of country and industry effect in capital structure? Empirical evidence from Europe. Argumenta Oeconomica 38: 99–119. [Google Scholar] [CrossRef]

- Kral, Pavol, and Katarina Janoskova. 2023. Interdependence of selected socio-demographic characteristics of consumers and consumer preferences toward brands. Innovative Marketing 19: 197–207. [Google Scholar] [CrossRef]

- Kristof, Tamas, and Miklos Virag. 2022. What drives financial competitiveness of industrial sectors in Visegrad Four countries? Evidence by use of machine learning techniques. Journal of Competitiveness 14: 117–36. [Google Scholar] [CrossRef]

- Kristofik, Peter, and Juraj Medzihorsky. 2022. Capital structure determinants of wood-processing enterprises in Slovakia. Acta Facultatis Xylologiae Zvolen 64: 135–46. [Google Scholar] [CrossRef]

- Kruskal, William, and Allen Wallis. 1952. Use of ranks in one-criterion variance analysis. Journal of the American Statistical Association 47: 583–621. [Google Scholar] [CrossRef]

- Kucera, Jiri, Marek Vochozka, and Zuzana Rowland. 2021. The ideal debt ratio of an agricultural enterprise. Sustainability 13: 4613. [Google Scholar] [CrossRef]

- Kukalis, Sal. 2010. Agglomeration economies and firm performance: The case of industry clusters. Journal of Management 36: 453–81. [Google Scholar] [CrossRef]

- Kumar, Satish, Sisira Colombage, and Purnima Rao. 2017. Research on capital structure determinants: A review and future directions. International Journal of Managerial Finance 13: 106–32. [Google Scholar] [CrossRef]

- La Rocca, Maurizio, Tiziana La Rocca, and Alfio Cariola. 2011. Capital structure decisions during a firm’s life cycle. Small Business Economics 37: 107–30. [Google Scholar] [CrossRef]

- Langfelder, Peter, and Steve Horvath. 2012. Fast R functions for robust correlations and hierarchical clustering. Journal of Statistical Software 46: 1–17. [Google Scholar] [CrossRef]

- Lăzăroiu, George, and Elżbieta Rogalska. 2023. How generative artificial intelligence technologies shape partial job displacement and labor productivity growth. Oeconomia Copernicana 14: 703–6. [Google Scholar] [CrossRef]

- Lăzăroiu, George, Luminița Ionescu, Cristian Uță, Iulian Hurloiu, Mihai Andronie, and Irina Dijmărescu. 2020a. Environmentally Responsible Behavior and Sustainability Policy Adoption in Green Public Procurement. Sustainability 12: 2110. [Google Scholar] [CrossRef]

- Lăzăroiu, George, Luminița Ionescu, Mihai Andronie, and Irina Dijmărescu. 2020b. Sustainability Management and Performance in the Urban Corporate Economy: A Systematic Literature Review. Sustainability 12: 7705. [Google Scholar] [CrossRef]

- Lăzăroiu, George, Mădălina Bogdan, Marinela Geamănu, Lăcrămioara Hurloiu, Luminița Ionescu, and Roxana Ștefănescu. 2023. Artificial intelligence algorithms and cloud computing technologies in blockchain-based fintech management. Oeconomia Copernicana 14: 707–30. [Google Scholar] [CrossRef]

- Li, Hui, and Petros Stathis. 2017. Determinants of capital structure in Australia: An analysis of important factors. Managerial Finance 43: 881–97. [Google Scholar] [CrossRef]

- Li, Zhyyong, Jonathan Crook, Galina Andreeva, and Ying Tang. 2021. Predicting the risk of financial distress using corporate governance measures. Pacific-Basin Finance Journal 68: 101334. [Google Scholar] [CrossRef]

- Liao, Gordon. 2020. Credit migration and covered interest rate parity. Journal of Financial Economics 138: 504–25. [Google Scholar] [CrossRef]

- Lukac, Jozef, Katarina Teplicka, Katarina Culkova, and Daniela Hrehova. 2021. Evaluation of the financial performance of the municipalities in Slovakia in the context of multidimensional statistics. Journal of Risk and Financial Management 14: 570. [Google Scholar] [CrossRef]

- Madaleno, Mara, and Elisabete Vieira. 2020. Corporate performance and sustainability: Evidence from listed firms in Portugal and Spain. Energy Reports 6: 141–47. [Google Scholar] [CrossRef]

- Magni, Carlo Alberto, and Andrea Marchioni. 2020. Average rates of return, working capital, and NPV-consistency in project appraisal: A sensitivity analysis approach. International Journal of Production Economics 229: 107769. [Google Scholar] [CrossRef]

- Marousek, Josef, and Beata Gavurova. 2022. Recovering phosphorous from biogas fermentation residues indicates promising economic results. Chemosphere 291: 133008. [Google Scholar] [CrossRef] [PubMed]

- Martin, Philippe, Thierry Mayer, and Florian Mayneris. 2011. Spatial concentration and plant-level productivity in France. Journal of Urban Economics 69: 182–95. [Google Scholar] [CrossRef]

- Martins, Henrique Castro, Eduardo Schiehll, and Paulo Renato Soares Terra. 2020. Do shareholder protection and creditor rights have distinct effects on the association between debt maturity and ownership structure? Journal of Business Finance & Accounting 47: 708–29. [Google Scholar] [CrossRef]

- Mazanec, Jaroslav. 2023. Capital Structure and Corporate Performance: An Empirical Analysis from Central Europe. Mathematics 11: 2095. [Google Scholar] [CrossRef]

- Mazzucchelli, Alice, Roberto Chierici, Manlio Del Giudice, and Ilena Bua. 2022. Do circular economy practices affect corporate performance? Evidence from Italian large-sized manufacturing firms. Corporate Social Responsibility and Environmental Management 29: 2016–29. [Google Scholar] [CrossRef]

- Michulek, Jakub, and Anna Krizanova. 2023. Is there an impact of company size and industry on corporate culture? An empirical study from the Slovak Republic. Management Dynamics in the Knowledge Economy 11: 1–15. [Google Scholar] [CrossRef]

- Michulek, Jakub, Lubica Gajanova, Anna Krizanova, and Margareta Nadanyiova. 2023. Determinants of improving the relationship between corporate culture and work performance: Illusion or reality of serial mediation of leadership and work engagement in a crisis period? Frontiers in Psychology 14: 1135199. [Google Scholar] [CrossRef]

- Moritz, Alexandra, Joern Block, and Andreas Heinz. 2016. Financing patterns of European SMEs–an empirical taxonomy. Venture Capital 18: 115–48. [Google Scholar] [CrossRef]

- Nagy, Marek, and George Lazaroiu. 2022. Computer vision algorithms, remote sensing data fusion techniques, and mapping and navigation tools in the Industry 4.0-based Slovak automotive sector. Mathematics 10: 3543. [Google Scholar] [CrossRef]

- Nagy, Marek, George Lăzăroiu, and Katarina Valaskova. 2023. Machine Intelligence and Autonomous Robotic Technologies in the Corporate Context of SMEs: Deep Learning and Virtual Simulation Algorithms, Cyber-Physical Production Networks, and Industry 4.0-Based Manufacturing Systems. Applied Sciences 13: 1681. [Google Scholar] [CrossRef]

- Nahalkova Tesarova, Eva, and Anna Krizanova. 2023. How shopping was transformed from offline to online space—A case study within the Slovak Republic. Management Dynamics in the Knowledge Economy 11: 128–37. [Google Scholar] [CrossRef]

- Naz, Aziza, and Nadeem Ahmed Sheikh. 2023. Capital structure and earnings management: Evidence from Pakistan. International Journal of Accounting & Information Management 31: 128–47. [Google Scholar] [CrossRef]

- Nemțeanu, Sefora-Marcela, Dan-Cristian Dabija, Patrizia Gazzola, and Elena-Mădălina Vătămănescu. 2022. Social Reporting Impact on Non-Profit Stakeholder Satisfaction and Trust during the COVID-19 Pandemic on an Emerging Market. Sustainability 14: 13153. [Google Scholar] [CrossRef]

- Neykov, Nikolay, Stanislava Kristakova, Petar Antov, Aureliu-Florin Halalisan, Iveta Hajduchova, Marianna Sedliacikova, Roman Sloup, and Ludek Sisak. 2022. Capital Structure Determinants of Forest Enterprises: Empirical Study Based on Panel Data Analysis from the Czech Republic, Slovakia, and Bulgaria. Forests 13: 749. [Google Scholar] [CrossRef]

- Noghondari, Amirhossein Taebi, Hadis Zeinali, and Asghar Beytollahi. 2022. The Effect of Company’s Interest Coverage Ratio on the Structural and Reduced-Form Models in Predicting Credit Derivatives Price. Iranian Journal of Management Studies 15: 169–88. [Google Scholar]

- Nurmet, Marie, Katrin Lemsalu, and Anne Poder. 2012. Financial performance in micro and medium sized rural companies. Management Theory & Studies for Rural Business & Infrastructure Development 34: 139–47. [Google Scholar]

- Nyantakyi, George, Francis Atta Sarpong, Philip Adu Sarfo, Nneka Uchenwoke Ogochukwu, and Winnifred Coleman. 2023. A boost for performance or a sense of corporate social responsibility? A bibliometric analysis on sustainability reporting and firm performance research (2000–2022). Cogent Business & Management 10: 2220513. [Google Scholar] [CrossRef]

- Ogunode, Olubunmi Adewole, Olaolu Ayodeji Awoniyi, and Ayodeji Temitope Ajibade. 2022. Capital adequacy and corporate performance of non-financial firms: Empirical evidence from Nigeria. Cogent Business & Management 9: 2156089. [Google Scholar] [CrossRef]

- Oliver, John. 2022. Chronic corporate performance in media-tech firms: A new perspective. Journal of Media Business Studies 19: 263–83. [Google Scholar] [CrossRef]

- Olujobi, Olusola Joshua. 2021. Combating insolvency and business recovery problems in the oil industry: Proposal for improvement in Nigeria’s insolvency and bankruptcy legal framework. Heliyon 7: e06123. [Google Scholar] [CrossRef]

- Onegina, Viktoriya, Vitalina Alekseevna Babenko, Yuliia Kravchenko, Yurii Vitkovskyi, and Olga Anisimova. 2022. Management of Product quality and competitiveness of agricultural enterprises in the context of international integration. International Journal of Information Technology Project Management 13: 1–14. [Google Scholar] [CrossRef]

- Oztekin, Ozde. 2015. Capital structure decisions around the world: Which factors are reliably important? Journal of Financial and Quantitative Analysis 50: 301–23. [Google Scholar] [CrossRef]

- Peng, Yongzhang, and Changqi Tao. 2022. Can digital transformation promote enterprise performance?—From the perspective of public policy and innovation. Journal of Innovation & Knowledge 7: 100198. [Google Scholar] [CrossRef]

- Pham, Phuong My Thai, and Binh Thanh Thi Dao. 2022. A meta-analysis of risk taking and corporate performance. Cogent Business & Management 9: 2064263. [Google Scholar] [CrossRef]

- Pivac, Snjezana, and Mario Pecariec. 2010. Multivariate and multicriterial foreign debt analysis of the selected transition economies. Croatian Operational Research Review 1: 124–35. [Google Scholar]

- Porter, Michael E. 2003. The economic performance of regions. Regional Studies 37: 549–78. [Google Scholar] [CrossRef]

- Privara, Andrej. 2022. Economic growth and labour market in the European Union: Lessons from COVID-19. Oeconomia Copernicana 13: 355–77. [Google Scholar] [CrossRef]

- Pulawska, Karolina. 2021. Financial stability of European insurance companies during the COVID-19 pandemic. Journal of Risk and Financial Management 14: 266. [Google Scholar] [CrossRef]

- Rahim, Rida, Cynthia Afriani Utama, and Rofkoh Rokhim. 2019. Does Religion Affect Capital Structure in Indonesia? Pertanika Journal of Social Sciences & Humanities 27: 131–51. [Google Scholar]

- Rahmati, Zahra, Amin Noshadi, and Shahroch Bozorgmehrian. 2012. Studying the Variations in Ratio of Capital Resources toward the Equity Returnin Tehran Stock Exchange. Life Science Journal 9: 664–69. [Google Scholar]

- Ramelli, Stefano, and Alexander Wagner. 2020. Feverish stock price reactions to COVID-19. Review of Corporate Finance Studies 9: 622–55. [Google Scholar] [CrossRef]

- Ramli, Nur Ainna, Hengky Latan, and Grace Solovida. 2019. Determinants of capital structure and firm financial performance—A PLS-SEM approach: Evidence from Malaysia and Indonesia. Quarterly Review of Economics and Finance 71: 148–60. [Google Scholar] [CrossRef]

- Rayner, John, and Glen Livingston, Jr. 2020. The Kruskal–Wallis tests are Cochran–Mantel–Haenszel mean score tests. Metron 78: 353–60. [Google Scholar] [CrossRef]

- Rodriguez, Alex, and Alessandro Laio. 2014. Clustering by fast search and find of density peaks. Science 344: 1492–96. [Google Scholar] [CrossRef]

- Ross, Stephen, Randolph Westerfield, Jaffrey Jaffe, and Bradford Jordan. 2016. Corporate Finance, 11th ed. New York: McGraw-Hill. [Google Scholar]

- Roy, Priyanka, and Binoti Patro. 2021. Financial performance analysis of NBFC-MFIs in India using TOPSIS and IV-TOPSIS. International Journal of Mathematical, Engineering and Management Sciences 6: 1423–38. [Google Scholar] [CrossRef]

- Ruckova, Petra, and Nicole Skulanova. 2022. The firm-specific and macroeconomic determinants of the financial structure of construction companies in selected European countries. Review of Economic Perspectives 22: 117–33. [Google Scholar] [CrossRef]

- Ruland, William. 2013. Does Cluster Membership Enhance Financial Performance. iBusiness 5: 1–11. [Google Scholar] [CrossRef]

- Sakk, Ol, Maria Nurmet, and Anne Poder. 2013. Financing Trends in Estonian Rural Enterprises during the Period of 2005–2010. Rural Development 6: 317–21. [Google Scholar]

- Sangthong, Montri. 2020. The effect of the Likert point scale and sample size on the efficiency of parametric and nonparametric tests. Thailand Statistician 18: 55–64. [Google Scholar]

- Santos, Eleonora, Ines Lisboa, and Teresa Eugenio. 2022. The financial performance of family versus non-family firms operating in nautical tourism. Sustainability 14: 1693. [Google Scholar] [CrossRef]

- Santos-Jaén, Jose Manuel, Gema Martín de Almagro Vázquez, and María del Carmen Valls Martínez. 2023. Is earnings management impacted by audit fees and auditor tenure? An analysis of the Big Four audit firms in the US market. Oeconomia Copernicana 14: 899–934. [Google Scholar] [CrossRef]

- Sardo, Filipe, Zelia Serrasqueiro, Elisabete Vieira, and Manuel Rocha Armada. 2022. Is financial distress risk important for manufacturing SMEs to rebalance the short-term debt ratio? Journal of Risk Finance 23: 516–34. [Google Scholar] [CrossRef]

- Scalzer, Rodrigo, Adriano Rodrigues, Marcelo Alvaro Macedo, and Peter Wanke. 2019. Financial distress in electricity distributors from the perspective of Brazilian regulation. Energy Policy 125: 250–59. [Google Scholar] [CrossRef]

- Schwartz, Eli, and J. Richard Aronson. 1967. Some surrogate evidence in support of the concept of optimal financial structure. Journal of Finance 22: 10–18. [Google Scholar] [CrossRef]

- Shapiro, Samuel Sanford, and Martin Wilk. 1965. An analysis of variance test for normality (complete samples). Biometrika 52: 591–611. [Google Scholar] [CrossRef]

- Shapiro, Samuel Sanford, and R. S. Francia. 1972. An approximate analysis of variance test for normality. Journal of the American Statistical Association 67: 215–16. [Google Scholar] [CrossRef]

- Sierpinska, Maria. 2022. Dividend policy of listed energy companies in Poland. Inzynieria Mineralna-Journal of The Polish Mineral Engineering Society 49: 35–41. [Google Scholar] [CrossRef]

- Smirnov, Nikoali. 1936. Sui la distribution de w2. Comptes Rendus 202: 449–52. [Google Scholar]

- Smith, David, Jianguo Chen, and Hamish Anderson. 2015. The influence of firm financial position and industry characteristics on capital structure adjustment. Accounting & Finance 55: 1135–69. [Google Scholar] [CrossRef]

- Sobiech, Anna, Dimitris Chronopoulos, and John Wilson. 2021. The real effects of bank taxation: Evidence for corporate financing and investment. Journal of Corporate Finance 69: 101989. [Google Scholar] [CrossRef]

- Sohrabi, Narges, and Hadi Movaghari. 2020. Reliable factors of Capital structure: Stability selection approach. Quarterly Review of Economics and Finance 77: 296–310. [Google Scholar] [CrossRef]

- Spencer, Gregory M., Tara Vinodrai, Meric S. Gertler, and David A. Wolfe. 2010. Do clusters make a difference? Defining and assessing their economic performance. Regional Studies 44: 697–715. [Google Scholar] [CrossRef]

- Srhoj, Stjepan. 2022. Can we predict high growth firms with the financial ratios? Financial Internet Quarterly 18: 66–73. [Google Scholar] [CrossRef]

- Stahl, Daniel, and Hannah Sallis. 2012. Model-based cluster analysis. Wiley Interdisciplinary Reviews-Computational Statistics 4: 341–58. [Google Scholar] [CrossRef]

- Stashchuk, Olena, Tetiana Shmatkovska, Mykola Dziamulych, Myroslava Kupyra, Nataliya Vahnovska, and Petro Kosinskyi. 2021. Model for efficiency evaluation of financial security management of joint stock companies operating in the agricultural sector: A case study of Ukraine. Scientific Papers-Series Management, Economic Engineering in Agriculture and Rural Development 21: 715–28. [Google Scholar]

- Stasova, Lenka. 2022. Evaluation of the Financial Health of Food Retail Outlets in a Market Environment. A Case Study from the Slovak Republic. E+M Ekonomie a Management 25: 122–41. [Google Scholar] [CrossRef]

- Stefko, Robert, Petra Vasanicova, Silvia Jencova, and Aneta Pachura. 2021. Management and economic sustainability of the Slovak industrial companies with medium energy intensity. Energies 14: 267. [Google Scholar] [CrossRef]

- Stratone, Madalina-Elena. 2023. Mapping the impact of the intellectual capital on the agility and performance of an organization: A bibliometric study. Ekonomicko-Manazerske Spektrum 17: 39–53. [Google Scholar] [CrossRef]

- Su, Larry. 2010. Ownership structure, corporate diversification and capital structure: Evidence from China’s publicly listed firms. Management Decision 48: 314–39. [Google Scholar] [CrossRef]

- Tarighi, Hossein, Andrea Appolloni, Ali Shirzad, and Abdullah Azad. 2022. Corporate social responsibility disclosure (CSRD) and financial distressed risk (FDR): Does institutional ownership matter? Sustainability 14: 742. [Google Scholar] [CrossRef]

- Toemoeri, Gergo, Vilmos Lakatos, and Bernadett Beresne Martha. 2021. The effect of financial risk taking on profitability in the pharmaceutical industry. Economies 9: 153. [Google Scholar] [CrossRef]

- Umeair, Shahzad, Fukai Luo, Jing Kiu, Mahmood Faisal, and Hafeez Ullah. 2022. The most consistent and reliable predictors of corporate financial choices in Pakistan: New evidence using BIC estimation. International Journal of Finance & Economics 27: 237–57. [Google Scholar] [CrossRef]

- Valaskova, Katarina, and Dominika Gajdosikova. 2022. Corporate debt and earnings management: Evidence from Slovakia. Paper presented at 12th International Scientific Conference Business and Management, Vilnius, Lithuania, May 12–13, vol. 2022, pp. 414–21. [Google Scholar] [CrossRef]

- Valaskova, Katarina, and Marek Nagy. 2023. Macro-economic development of the EU countries in the context of performance and competitiveness of SMEs. Business, Management and Economics Engineering 21: 124–39. [Google Scholar] [CrossRef]

- Valaskova, Katarina, Dominika Gajdosikova, and George Lăzăroiu. 2023. Has the COVID-19 pandemic affected the corporate financial performance? A case study of Slovak enterprises. Equilibrium. Quarterly Journal of Economics and Economic Policy 18: 1133–78. [Google Scholar] [CrossRef]

- Valaskova, Katarina, Dominika Gajdosikova, and Tomislava Pavic Kramaric. 2022. How important is the business environment for the performance of enterprises? Case study of selected European countries. Central European Business Review 11: 85–110. [Google Scholar] [CrossRef]

- Valaskova, Katarina, Tomas Kliestik, and Maria Kovacova. 2018. Management of financial risks in Slovak enterprises using regression analysis. Oeconomia Copernicana 9: 105–21. [Google Scholar] [CrossRef]

- Vătămănescu, Elena-Mădălina, Constantin Brătianu, Dan-Cristian Dabija, and Simona Popa. 2023. Capitalizing Online Knowledge Networks: From Individual Knowledge Acquisition towards Organizational Achievements. Journal of Knowledge Management 27: 1366–89. [Google Scholar] [CrossRef]

- Vătămănescu, Elena-Mădălina, Vlad-Andrei Alexandru, Andreea Mitan, and Dan-Cristian Dabija. 2020. From the Deliberate Managerial Strategy towards International Business Performance: A Psychic Distance vs. Global Mindset Approach. Systems Research and Behavioral Science 37: 374–87. [Google Scholar] [CrossRef]

- Vukovic, Bojana, Suncica Milutinovic, Kristina Mijic, Branko Krsmanovic, and Dejan Jaksic. 2022. Analysis of financial performance determinants: Evidence from the European agricultural companies. Custos e Agronegocio 18: 285–306. [Google Scholar]

- Wade, Sara, and Zoubin Ghahramani. 2018. Bayesian cluster analysis: Point estimation and credible balls (with discussion). Bayesian Analysis 13: 559–626. [Google Scholar] [CrossRef]

- Wang, Jianxin, Min Li, Jianer Chen, and Yi Pan. 2010. A fast hierarchical clustering algorithm for functional modules discovery in protein interaction networks. IEEE/ACM Transactions on Computational Biology and Bioinformatics 8: 607–20. [Google Scholar] [CrossRef]

- Wang, Keling, Yaqiong Miao, Ching-Hui Su, Ming-Hsiang Chen, Zhongjun Wu, and Tie Wang. 2019. Does corporate charitable giving help sustain corporate performance in China? Sustainability 11: 1491. [Google Scholar] [CrossRef]

- Wei, Jie. 2022. The adoption of repeated measurement of variance analysis and Shapiro—Wilk test. Frontiers of Medicine 16: 659–60. [Google Scholar] [CrossRef]

- Weqar, Faizi, Ahmed Musa Khan, Mohd. Anas Raushan, and Imamul Haque. 2021. Measuring the impact of intellectual capital on the financial performance of the finance sector of India. Journal of the Knowledge Economy 12: 1134–51. [Google Scholar] [CrossRef]

- Wynn, Martin, and Peter Jones. 2019. Context and entrepreneurship in Knowledge Transfer Partnerships with small business enterprises. International Journal of Enterprenueurship and Innovation 20: 8–20. [Google Scholar] [CrossRef]

- Xu, Jian, and Jingsuo Li. 2019. The impact of intellectual capital on SMEs’ performance in China: Empirical evidence from non-high-tech vs. high-tech SMEs. Journal of Intellectual Capital 20: 488–509. [Google Scholar] [CrossRef]

- Yadav, Inder Sekhar, Debasis Pahi, and Phanindra Goyari. 2020. The size and growth of firms: New evidence on law of proportionate effect from Asia. Journal of Asia Business Studies 14: 91–108. [Google Scholar] [CrossRef]

- Yang, Ying, Che Hassan, Mohamed Al-Baity, and Xiang Zou. 2015. Determinants of debt across sectors: Evidence from Chinese a-share listed firms. The Journal of Developing Areas 49: 391–405. [Google Scholar] [CrossRef]

- Yim, Odilia, and Kylee Ramdeen. 2015. Hierarchical cluster analysis: Comparison of three linkage measures and application to psychological data. Quantitative Methods for Psychology 11: 8–21. [Google Scholar] [CrossRef]

- Zakaria, Firano, and Doughmi Salawa. 2023. Hierarchical financing and reality of the financial structure of Moroccan listed companies. Journal of Modelling in Management 18: 1277–90. [Google Scholar] [CrossRef]

- Zeynalli, Elay. 2023. Innovative methodology in financial analysis of insurance organizations. Academy Review 58: 77–95. [Google Scholar] [CrossRef]

- Zhan, Xintong, Bing Han, Jie Cao, and Qing Tong. 2022. Option return predictability. Review of Financial Studies 35: 1394–442. [Google Scholar] [CrossRef]

- Zhang, Bin. 2022. Visualization of the Digital Enterprise Performance Management System Integrating the Simulated Annealing Algorithm. Mathematical Problems in Engineering 2022: 5936334. [Google Scholar] [CrossRef]

- Zhang, Hui, and Vesarach Aumeboonsuke. 2022. Technological innovation, risk-taking and firm performance—Empirical evidence from Chinese listed companies. Sustainability 14: 14688. [Google Scholar] [CrossRef]

- Zhang, Zhibin, and Youqiang Ding. 2023. The impact of green financial development on stock price crash risk from the perspective of information asymmetry in Chinese listed companies. Environmental Science and Pollution Research 30: 87199–214. [Google Scholar] [CrossRef] [PubMed]

| Firm Size | |

| Small enterprise | 40.76% |

| Medium sized enterprise | 51.36% |

| Large enterprise | 5.92% |

| Very large enterprise | 1.96% |

| Legal Form and Ownership Structure | |

| Private limited companies | 86.83% |

| Public limited companies | 8.87% |

| Partnerships | 4.20% |

| Other legal form | 0.09% |

| Firm Age | |

| <10 | 6.23% |

| 10–20 | 50.15% |

| 20–30 | 35.40% |

| 30–40 | 5.97% |

| >40 | 2.24% |

| Economic Sector (Nace Classification) | |

| A. Agriculture, forestry and fishing | 8.97% |

| B. Mining and quarrying | 0.24% |

| C. Manufacturing | 20.75% |

| D. Electricity, gas, steam and air conditioning supply | 2.01% |

| E. Water supply; sewerage, waste management, etc. | 1.18% |

| F. Construction | 8.85% |

| G. Wholesale and retail trade, repair of motor vehicles/motorcycles | 24.92% |

| H. Transportation and storage | 8.50% |

| I. Accommodation and food service activities | 2.31% |

| J. Information and communication | 2.41% |

| K. Financial and insurance activities | 0.21% |

| L. Real estate activities | 5.66% |

| M. Professional, scientific and service activities | 6.94% |

| N. Administrative and support service activities | 4.22% |

| O. Public administration and defence; compulsory social security | 0.12% |

| P. Education | 0.12% |

| Q. Human health and social work activities | 1.63% |

| R. Arts, entertainment and recreation | 0.57% |

| S. Other service activities | 0.40% |

| Total | 100.00% |

| Ratio | Algorithm |

|---|---|

| Total indebtedness ratio | Current and non-current liabilities to total assets |

| Self-financing ratio | Shareholders’ funds to total assets |

| Current indebtedness ratio | Current liabilities to total assets |

| Non-current indebtedness ratio | Non-current liabilities to total assets |

| Debt-to-equity ratio | Current and non-current liabilities to shareholders’ funds |

| Equity leverage ratio | Total assets to shareholders’ funds |

| Interest coverage ratio | Earnings before interest and taxes to interests paid |

| Interest burden ratio | Interests paid to earnings before interest and taxes |

| Avg. | Med. | Std. Dev. | Min. | Max. | CV | |

|---|---|---|---|---|---|---|

| TOAS | 7161.948 | 1347.558 | 69,003.100 | 212.519 | 3,713,083.750 | 9.635 |

| SHFD | 2916.782 | 455.927 | 30,935.019 | −32,817.872 | 1,668,769.102 | 10.606 |

| NCLI | 1732.874 | 138.945 | 30,310.989 | −2.009 | 1,832,068.500 | 17.492 |

| CULI | 2512.292 | 569.755 | 13,487.812 | −12.638 | 441,089.759 | 5.369 |

| EBIT | 318.087 | 66.331 | 2878.779 | −18,995.197 | 112,899.250 | 9.050 |

| INTE | 39.201 | 9.119 | 180.489 | 0.123 | 5350.675 | 4.604 |

| Ratio | 4-Year Average Values |

|---|---|

| Total indebtedness ratio | 0.619 |

| Self-financing ratio | 0.381 |

| Current indebtedness ratio | 0.457 |

| Non-current indebtedness ratio | 0.162 |

| Debt-to-equity ratio | 2.520 |

| Equity leverage ratio | 3.520 |

| Interest coverage ratio | 13.389 |

| Interest burden ratio | 0.131 |

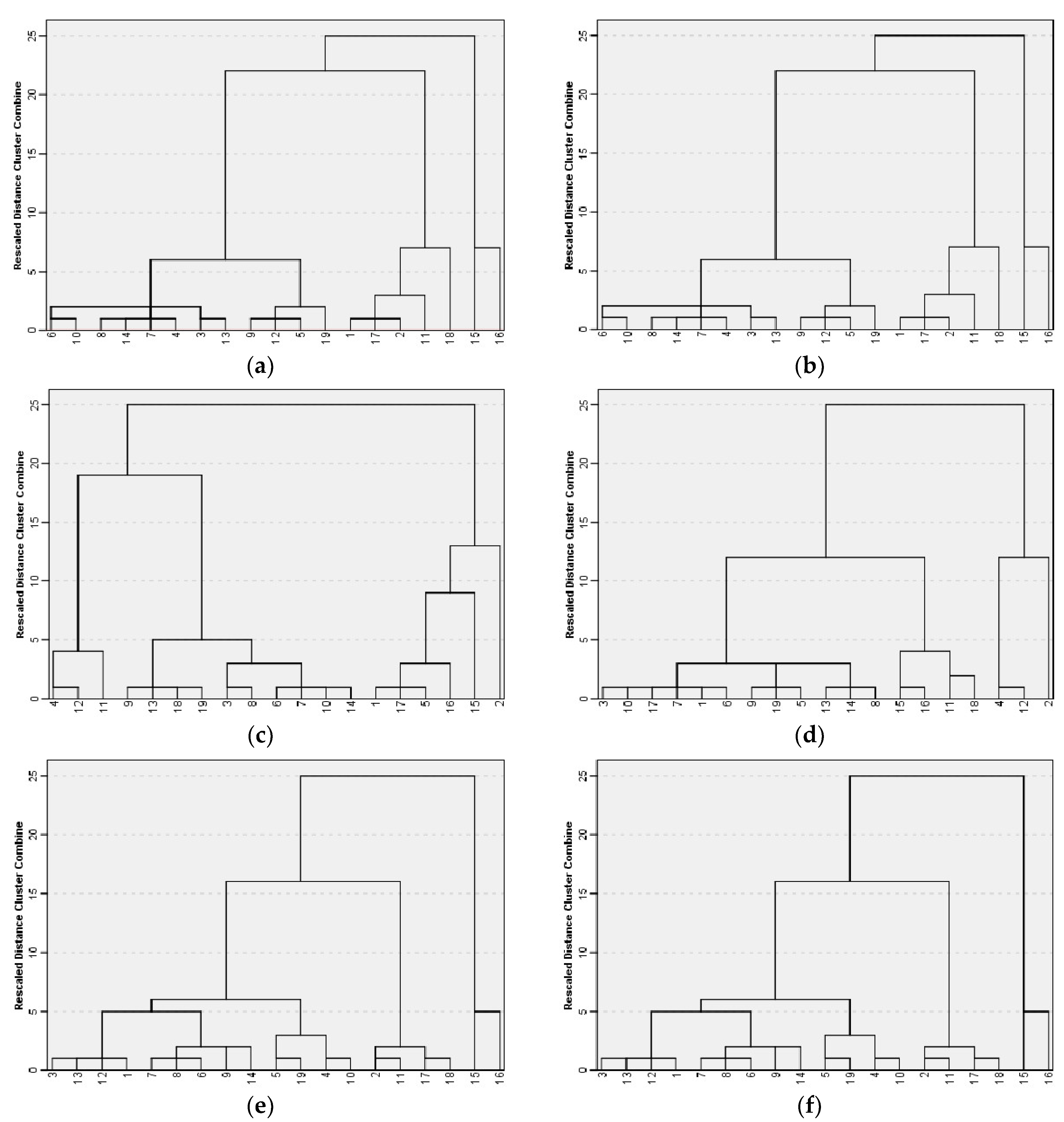

| Cluster | Cluster 1 | Cluster 2 | Cluster 3 |

|---|---|---|---|

| Number of sectors | 12 | 5 | 2 |

| Economic sectors (classified by NACE) | C, D, E, F, G, H, I, J, L, M, N, S | A, B, K, Q, R | O, P |

| Cluster | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 |

|---|---|---|---|---|

| Number of sectors | 3 | 10 | 5 | 1 |

| Economic sectors (classified by NACE) | D, K, L | C, F, G, H, I, J, M, N, R, S | A, E, O, P, Q | B |

| Cluster | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 |

|---|---|---|---|---|

| Number of sectors | 12 | 4 | 2 | 1 |

| Economic sectors (classified by NACE) | A, C, E, F, G, H, I, J, M, N, Q, S | K, O, P, R | D, L | B |

| Cluster | Cluster 1 | Cluster 2 | Cluster 3 |

|---|---|---|---|

| Number of sectors | 13 | 4 | 2 |

| Economic sectors (classified by NACE) | A, C, D, E, F, G, H, I, J, L, M, N, S | B, K, Q, R | O, P |

| Cluster | Cluster 1 | Cluster 2 | Cluster 3 |

|---|---|---|---|

| Number of sectors | 13 | 4 | 2 |

| Economic sectors (classified by NACE) | A, C, D, E, F, G, H, I, J, L, M, N, S | B, K, Q, R | O, P |

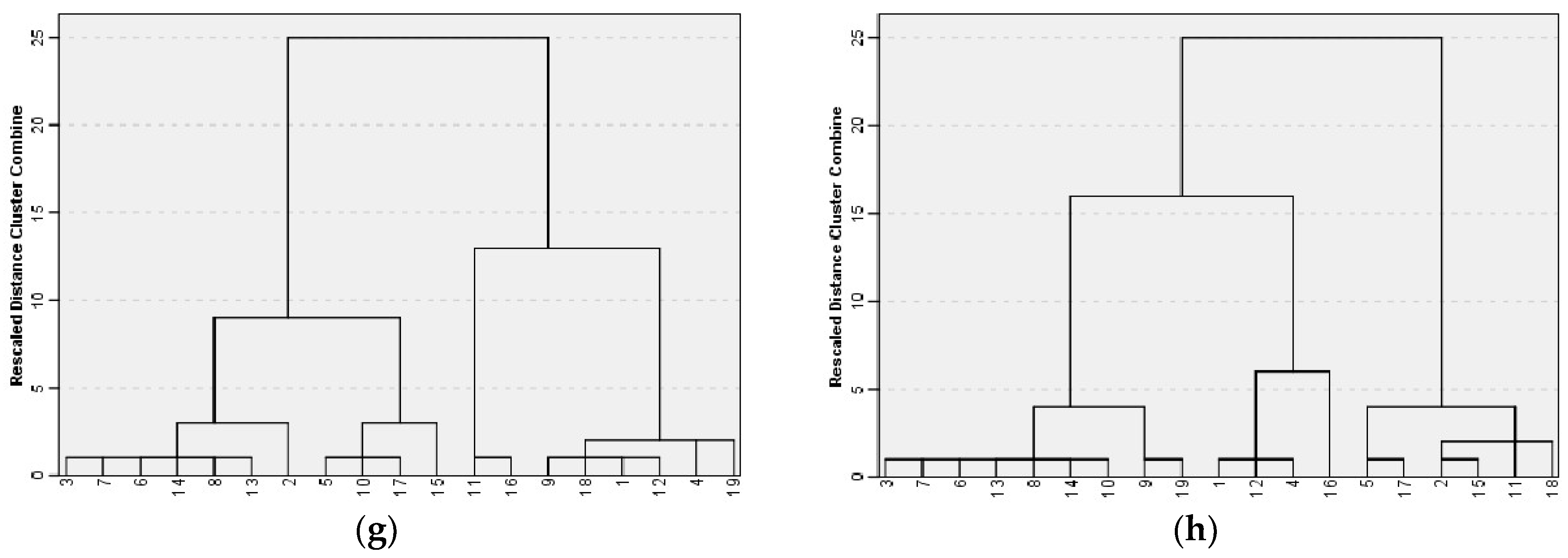

| Cluster | Cluster 1 | Cluster 2 | Cluster 3 |

|---|---|---|---|

| Number of sectors | 11 | 2 | 6 |

| Economic sectors (classified by NACE) | B, C, E, F, G, H, J, M, N, O, Q | K, P | A, D, I, L, R, S |

| Cluster | Cluster 1 | Cluster 2 | Cluster 3 |

|---|---|---|---|

| Number of sectors | 9 | 4 | 6 |

| Economic sectors (classified by NACE) | C, F, G, H, I, J, M, N, S | A, D, L, P | B, E, K, O, Q, R |

| TI | SF | CI | NCI | |

| Kruskal–Wallis H | 55.600 | 55.600 | 165.838 | 101.793 |

| df | 2 | 2 | 3 | 3 |

| Asymp. Sig. | 0.000 | 0.000 | 0.000 | 0.000 |

| DE | EL | IC | IB | |

| Kruskal–Wallis H | 14.764 | 14.764 | 196.419 | 74.444 |

| df | 2 | 2 | 2 | 2 |

| Asymp. Sig. | 0.001 | 0.001 | 0.000 | 0.000 |

| TI | Test Statistics | Std. Error | Std. Test Statistics | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | 434.901 | 58.669 | 7.413 | 0.000 | 0.000 |

| Cluster 1–Cluster 3 | −261.717 | 387.347 | −0.676 | 0.499 | 1.000 |

| Cluster 2–Cluster 3 | −696.618 | 390.740 | −1.783 | 0.075 | 0.224 |

| SF | Test Statistics | Std. Error | Std. Test Statistic | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | 434.901 | 58.669 | 7.413 | 0.000 | 0.000 |

| Cluster 1–Cluster 3 | −261.717 | 387.347 | −0.676 | 0.499 | 1.000 |

| Cluster 2–Cluster 3 | −696.618 | 390.740 | −1.783 | 0.075 | 0.224 |

| CI | Test Statistics | Std. Error | Std. Test Statistic | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | −769.474 | 70.159 | −10.968 | 0.000 | 0.000 |

| Cluster 1–Cluster 3 | −354.037 | 86.139 | −4.110 | 0.000 | 0.000 |

| Cluster 1–Cluster 4 | 545.595 | 392.577 | 1.390 | 0.165 | 0.988 |

| Cluster 2–Cluster 3 | 415.636 | 58.155 | 7.144 | 0.000 | 0.000 |

| Cluster 2–Cluster 4 | 1315.068 | 387.400 | 3.395 | 0.001 | 0.004 |

| Cluster 3–Cluster 4 | 899.632 | 390.610 | 2.303 | 0.021 | 0.128 |

| NCI | Test Statistics | Std. Error | Std. Test Statistic | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | 243.811 | 187.582 | 1.300 | 0.194 | 1.000 |

| Cluster 1–Cluster 3 | −680.961 | 70.654 | −9.638 | 0.000 | 0.000 |

| Cluster 1–Cluster 4 | −1029.489 | 387.330 | −2.658 | 0.008 | 0.047 |

| Cluster 2–Cluster 3 | −924.772 | 198.503 | −4.659 | 0.000 | 0.000 |

| Cluster 2–Cluster 4 | −1273.300 | 429.460 | −2.965 | 0.003 | 0.018 |

| Cluster 3–Cluster 4 | −348.528 | 392.735 | −0.887 | 0.375 | 1.000 |

| DE | Test Statistics | Std. Error | Std. Test Statistic | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | 432.363 | 117.150 | 3.691 | 0.000 | 0.001 |

| Cluster 1–Cluster 3 | −402.621 | 387.299 | −1.040 | 0.299 | 0.896 |

| Cluster 2–Cluster 3 | −834.984 | 403.729 | −2.068 | 0.039 | 0.116 |

| EL | Test Statistics | Std. Error | Std. Test Statistic | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | 432.363 | 117.150 | 3.691 | 0.000 | 0.001 |

| Cluster 1–Cluster 3 | −402.621 | 387.299 | −1.040 | 0.299 | 0.896 |

| Cluster 2–Cluster 3 | −834.984 | 403.729 | −2.068 | 0.039 | 0.116 |

| IC | Test Statistics | Std. Error | Std. Test Statistic | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | 228.139 | 327.607 | 0.696 | 0.486 | 1.000 |

| Cluster 1–Cluster 3 | 659.570 | 47.072 | 14.012 | 0.000 | 0.000 |

| Cluster 2–Cluster 3 | 431.431 | 329.631 | 1.309 | 0.191 | 0.572 |

| IB | Test Statistics | Std. Error | Std. Test Statistic | Sig. | Adj. Sig. |

| Cluster 1–Cluster 2 | −416.673 | 50.526 | −8.247 | 0.000 | 0.000 |

| Cluster 1–Cluster 3 | 172.341 | 96.983 | 1.777 | 0.076 | 0.227 |

| Cluster 2–Cluster 3 | 589.015 | 105.204 | 5.599 | 0.000 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gajdosikova, D.; Valaskova, K.; Lazaroiu, G. The Relevance of Sectoral Clustering in Corporate Debt Policy: The Case Study of Slovak Enterprises. Adm. Sci. 2024, 14, 26. https://doi.org/10.3390/admsci14020026

Gajdosikova D, Valaskova K, Lazaroiu G. The Relevance of Sectoral Clustering in Corporate Debt Policy: The Case Study of Slovak Enterprises. Administrative Sciences. 2024; 14(2):26. https://doi.org/10.3390/admsci14020026

Chicago/Turabian StyleGajdosikova, Dominika, Katarina Valaskova, and George Lazaroiu. 2024. "The Relevance of Sectoral Clustering in Corporate Debt Policy: The Case Study of Slovak Enterprises" Administrative Sciences 14, no. 2: 26. https://doi.org/10.3390/admsci14020026

APA StyleGajdosikova, D., Valaskova, K., & Lazaroiu, G. (2024). The Relevance of Sectoral Clustering in Corporate Debt Policy: The Case Study of Slovak Enterprises. Administrative Sciences, 14(2), 26. https://doi.org/10.3390/admsci14020026