Management Control Practices as Performance Facilitators in a Crisis Context

Abstract

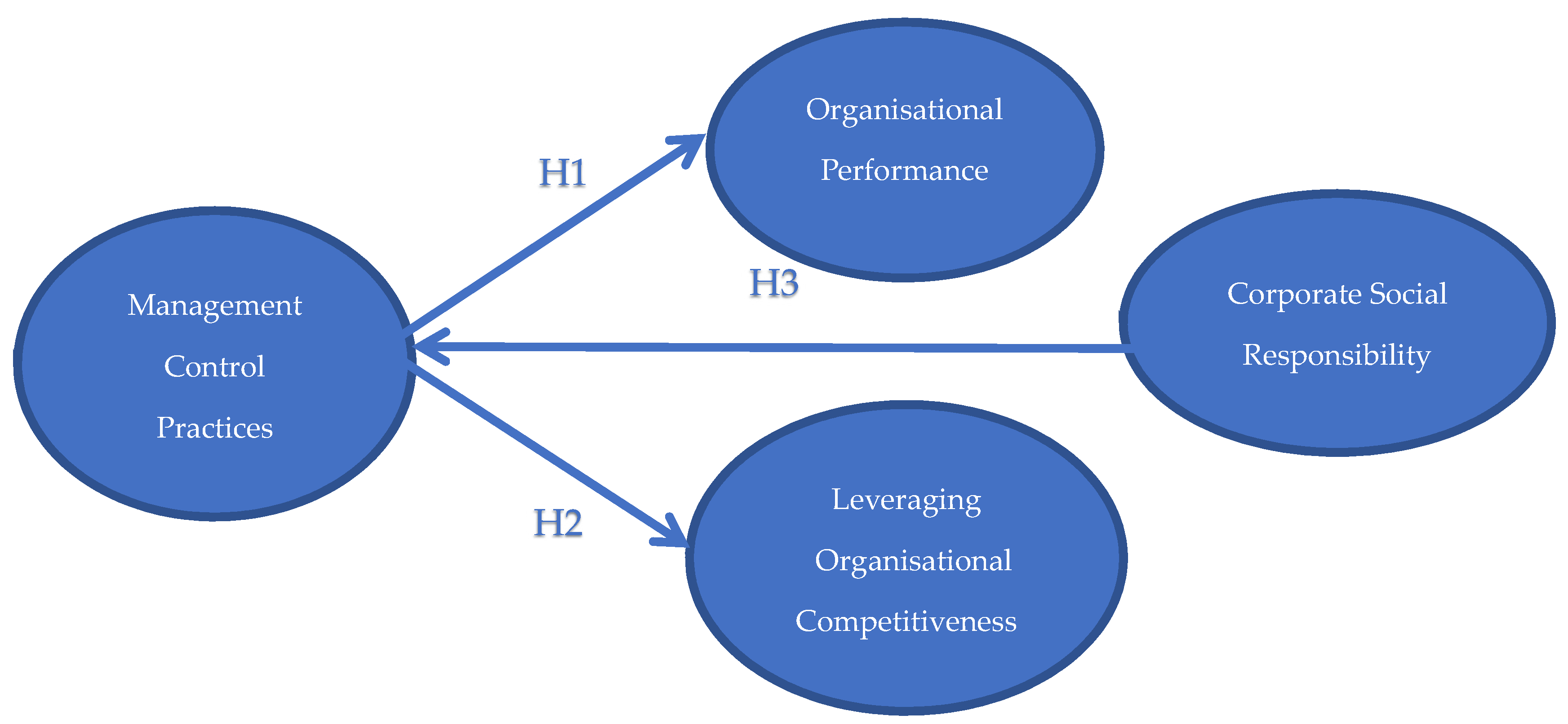

1. Introduction

- Q1

- Do managers perceive that MCP have an influence on organisational performance and competitiveness?

- Q2

- Do managers perceive that CSR influences MCP?

2. Theory and Hypotheses

3. Research Design

4. Data Analysis and Findings

4.1. Exploratory Factorial Analysis

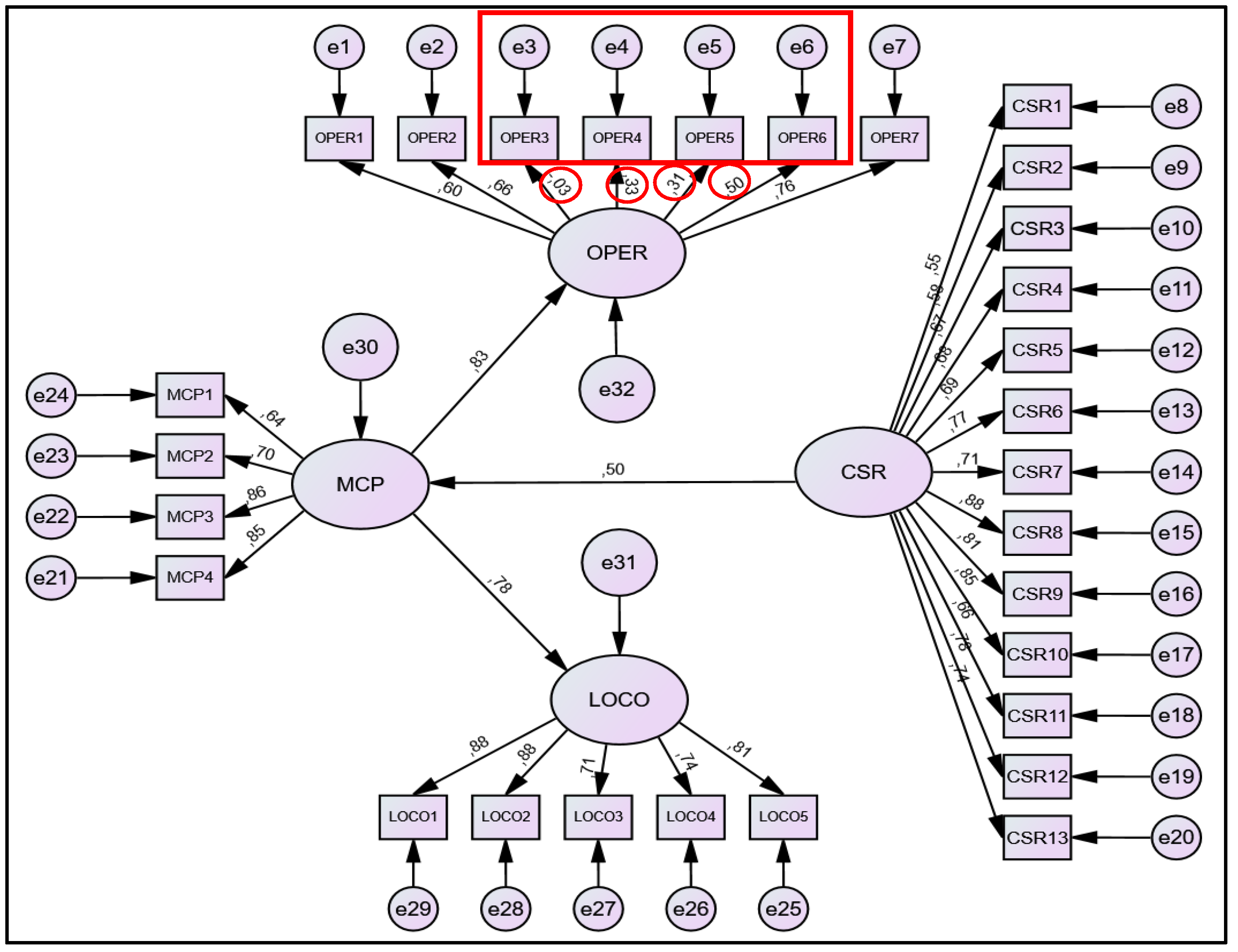

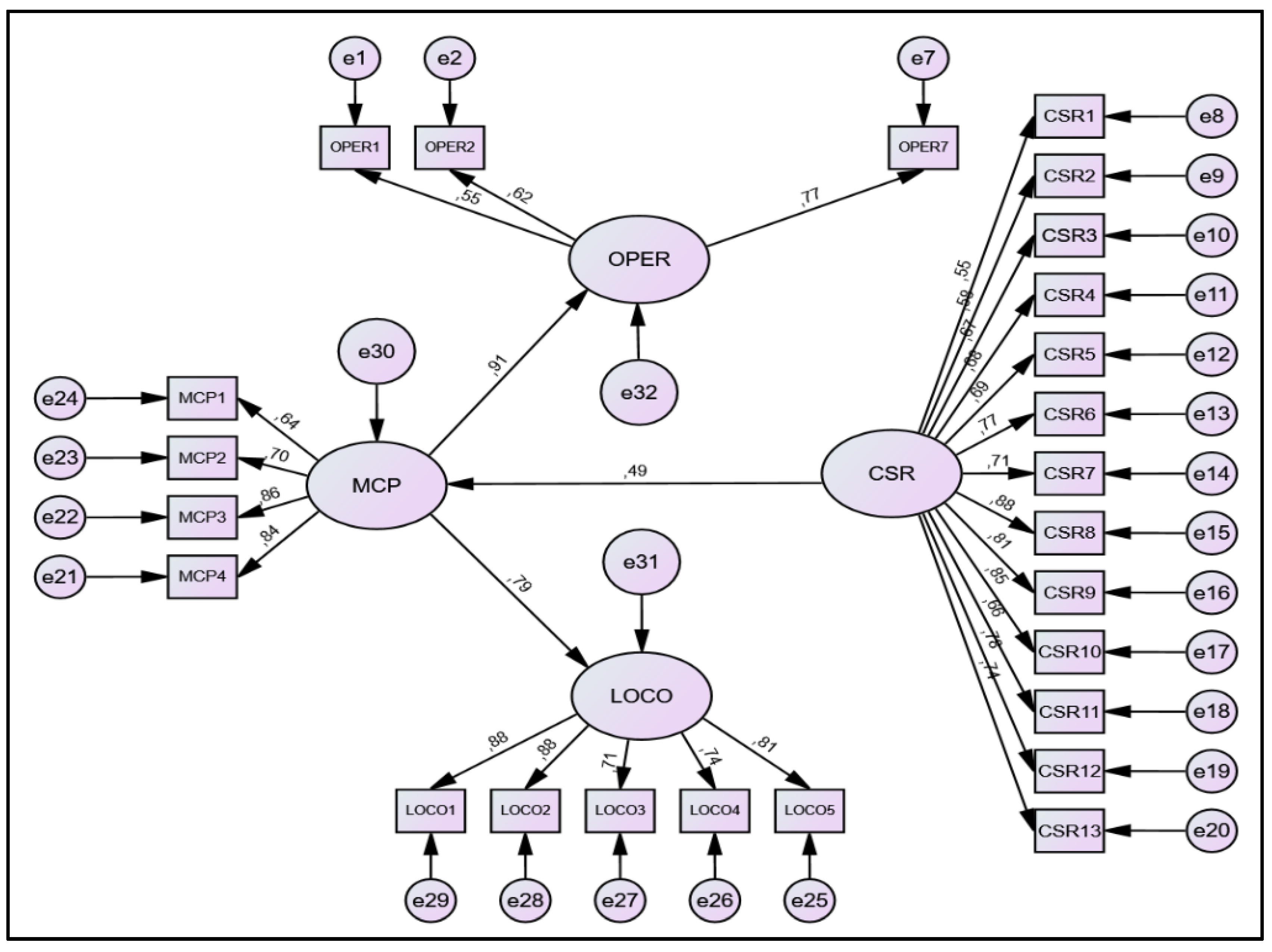

4.2. Confirmatory Factorial Analysis

4.3. Final Research Model and Hypotheses Results

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Dimensions | Items | Questions | Authors |

| Organisational Performance | OPER1 | Management control tools make it possible to measure and monitor the company’s performance; | (Grafton et al. 2010; Kaplan and Norton 1993, 2005, 2007; Micheli and Mura 2017; Sarker et al. 2021; Zizlavsky 2014) |

| OPER2 | To achieve the desired success, it is essential that managers can rely on an efficient measurement system; | ||

| OPER3 | Our organisation is still only guided by financial indicators; | ||

| OPER4 | Financial indicators alone are insufficient to monitor the performance of the organisation; | ||

| OPER5 | Currently, non-financial indicators, namely, intangible indicators, are the basis for organisational differentiation; | ||

| OPER6 | The search for competitiveness forces managers to identify the needs of consumers quickly and at the lowest possible cost while maintaining the objective of achieving success; | ||

| OPER7 | Management control systems are essential in shaping risk management processes. | ||

| Leveraging Organisational Competitiveness | LOCO1 | Management control tools improve the decision-making process in a crisis context; | (Endenich 2014) |

| LOCO2 | Management control tools play an important role in a crisis context; | ||

| LOCO3 | The integration and interconnection of indicators is fundamental for effective management control; | ||

| LOCO4 | The monitoring, guidance and control of strategic decisions depend on using appropriate management tools in a crisis context; | ||

| LOCO5 | The management control tools increase our capacity for learning and continuous improvement in a crisis context. | ||

| Corporate Social Responsibility | CSRE1 | A company’s social performance significantly reduces the systemic risk to which the company is exposed; | (Braune et al. 2019; Maqbool 2019) |

| CSRE2 | At a time of crisis and uncertainty, companies with a social performance assume upward attractiveness towards multiple stakeholders; | ||

| CSRE3 | Corporate social responsibility has a positive impact on financial performance; | ||

| CSRE4 | Companies able to communicate social responsibility policies achieve the higher social performance of the company; | ||

| CSRE5 | The benefits derived from corporate social responsibility outweigh the costs of its implementation; | ||

| CSRE6 | As a valuable and rare resource, corporate social responsibility can be exploited to gain a competitive advantage for the company; | ||

| CSRE7 | Business entities should integrate social and environmental issues into their business strategy to gain a competitive advantage and improve long-term profitability; | ||

| CSRE8 | Corporate social responsibility produces substantial benefits related to the company’s business; | ||

| CSRE9 | Corporate social responsibility allows returns to the company in the form of tangible and intangible benefits over an extended period; | ||

| CSRE10 | Corporate social responsibility improves the performance of the company; | ||

| CSRE11 | Management control systems are essential to creating quality corporate environmental reporting in response to external pressures or disturbances; | ||

| CSRE12 | Involvement in corporate social responsibility activities generates favourable attitudes in its stakeholders that better supportive behaviour; | ||

| CSRE13 | Corporate social responsibility builds the company’s image, reinforces stakeholders’ attitudes, and improves advocacy behaviours. | ||

| Management Control Practices | MCP1 | The management tools we use allow us to manage our company better strategically; | (Bollinger 2020; Hu et al. 2017; Kaplan and Norton 1993, 1996, 2001; Lebas 1994; Leoni et al. 2021) |

| MCP1 | Management Control tools are implemented because of the interconnection they allow between indicators and strategy; | ||

| MCP1 | Strategic performance is improved through the complete integration of a strategic map; | ||

| MCP1 | The Management Control tools allow us to keep the focus on the strategy previously defined. |

References

- Agyemang, Gloria, and Jane Broadbent. 2015. Management control systems and research management in universities: An empirical and conceptual exploration. Accounting, Auditing & Accountability Journal 28: 1018–46. [Google Scholar]

- Ahmad, Noor Hazlina, and T. Ramayah. 2012. Does the notion of ‘doing well by doing good prevail among entrepreneurial ventures in a developing nation? Journal of Business Ethics 106: 479–90. [Google Scholar] [CrossRef]

- Ahrens, Thomas, and Christopher S. Chapman. 2007. Management accounting as practice. Accounting, Organizations and Society 32: 1–27. [Google Scholar] [CrossRef]

- Anthony, Robert N. 1965. Planning and Control Systems: A Framework for Analysis. Cambridge: Division of Research, Graduate School of Business Administration, Harvard University. [Google Scholar]

- Asiaei, Kaveh, and Nick Bontis. 2019. Translating knowledge management into performance: The role of performance measurement systems. Management Research Review 43: 113–32. [Google Scholar] [CrossRef]

- Asiaei, Kaveh, Neale G. O’Connor, Majid Moghaddam, Nick Bontis, and Jasvinder Sidhu. 2023. Corporate social responsibility and performance measurement systems in Iran: A levers of control perspective. Corporate Social Responsibility and Environmental Management 30: 574–88. [Google Scholar] [CrossRef]

- Asiaei, Kaveh, Nick Bontis, Omid Barani, and Ruzita Jusoh. 2021a. Corporate social responsibility and sustainability performance measurement systems: Implications for organizational performance. Journal of Management Control 32: 85–126. [Google Scholar] [CrossRef]

- Asiaei, Kaveh, Zabihollah Rezaee, Nick Bontis, Omid Barani, and Noor Sharoja Sapiei. 2021b. Knowledge assets, capabilities and performance measurement systems: A resource orchestration theory approach. Journal of Knowledge Management 25: 1947–76. [Google Scholar] [CrossRef]

- Baker, Max, and Stefan Schaltegger. 2015. Pragmatism and new directions in social and environmental accountability research. Accounting, Auditing & Accountability Journal 28: 263–94. [Google Scholar]

- Bansal, Pratima, and Kendall Roth. 2000. Why companies go green: A model of ecological responsiveness. Academy of Management Journal 43: 717–36. [Google Scholar] [CrossRef]

- Barney, Jay B. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Barney, Jay B., David J. Ketchen, Jr., and Mike Wright. 2011. The future of resource-based theory: Revitalization or decline? Journal of Management 37: 1299–315. [Google Scholar] [CrossRef]

- Barney, Jay B., David J. Ketchen, Jr., and Mike Wright. 2021. Bold voices and new opportunities: An expanded research agenda for the resource-based view. Journal of Management 47: 1677–83. [Google Scholar] [CrossRef]

- Barros, Rúben Silva, and Ana Maria Dias Simões da Costa Ferreira. 2021. Management Control Systems and Innovation: A levers of control analysis in an innovative company. Journal of Accounting and Organizational Change 18: 571–91. [Google Scholar] [CrossRef]

- Baumgartner, Rupert J. 2014. Managing corporate sustainability and CSR: A conceptual framework combining values, strategies and instruments contributing to sustainable development. Corporate Social Responsibility and Environmental Management 21: 258–71. [Google Scholar] [CrossRef]

- Baumgartner, Rupert J., and Daniela Ebner. 2010. Corporate sustainability strategies: Sustainability profiles and maturity levels. Sustainable Development 18: 76–89. [Google Scholar] [CrossRef]

- Bedford, David, and Teemu Malmi. 2015. Configurations of control: An exploratory analysis. Management Accounting Research 27: 2–26. [Google Scholar] [CrossRef]

- Bedford, David, David A. Brown, Teemu Malmi, and Prabhu Sivabalan. 2008. Balanced scorecard design and performance impacts: Some Australian evidence. Journal of Applied Management Accounting Research 6: 17–36. [Google Scholar]

- Bedford, David, Teemu Malmi, and Mikko Sandelin. 2016. Management control effectiveness and strategy: An empirical analysis of packages and systems. Accounting, Organizations and Society 51: 12–28. [Google Scholar] [CrossRef]

- Bhimani, Alnoor. 1999. Mapping methodological frontiers in cross-national management control research. Accounting, Organizations and Society 24: 413–40. [Google Scholar] [CrossRef]

- Bollinger, Sophie Raedersdorf. 2020. Creativity and forms of managerial control in innovation pro-cesses: Tools, viewpoints and practices. European Journal of Innovation Management 23: 214–29. [Google Scholar] [CrossRef]

- Bonett, Douglas G., and Thomas A. Wright. 2015. Cronbach’s alpha reliability: Interval estimation, hypothesis testing, and sample size planning. Journal of Organizational Behavior 36: 3–15. [Google Scholar] [CrossRef]

- Bourne, Mike, Monica Franco-Santos, Pietro Micheli, and Andrey Pavlov. 2018. Performance measurement and management: A system of systems perspective. International Journal of Production Research 56: 2788–99. [Google Scholar] [CrossRef]

- Bracci, Enrico, and Mouhcine Tallaki. 2021. Resilience capacities and management control systems in public sector organisations. Journal of Accounting and Organizational Change 17: 332–51. [Google Scholar] [CrossRef]

- Branco, Manuel Castelo, and Lucia Lima Rodrigues. 2006. Corporate social responsibility and resource-based perspectives. Journal of Business Ethics 69: 111–32. [Google Scholar] [CrossRef]

- Braune, Eric, Pablo Charosky, and Lubica Hikkerova. 2019. Corporate social responsibility, financial performance and risk in times of economic instability. Journal of Management and Governance 23: 1007–21. [Google Scholar] [CrossRef]

- Broadbent, Jane, and Richard Laughlin. 2009. Performance management systems: A conceptual model. Management Accounting Research 20: 283–95. [Google Scholar] [CrossRef]

- Brown, Timothy A. 2006. Confirmatory Factor Analysis for Applied Research. New York: Guilford. [Google Scholar]

- Brown, Timothy A. 2015. Confirmatory Factor Analysis for Applied Research. New York: Guilford Publications. [Google Scholar]

- Bundy, Jonathan, Michael D. Pfarrer, Cole E. Short, and W. Timothy Coombs. 2017. Crises and crisis management: Integration, interpretation, and research development. Journal of Management 43: 1661–92. [Google Scholar] [CrossRef]

- Byrne, Barbara M. 2010. Structural Equation Modeling with AMOS: Basic Concepts, Applications, and Programming (Multivariate Applications Series). New York: Taylor & Francis Group, pp. 396, 7384. [Google Scholar]

- Byrne, David, and Charles Ragin. 2009. The Sage Handbook of Case-Based Methods. Los Angeles: Sage Publications. [Google Scholar]

- Chahal, Hardeep, Mahesh Gupta, Namrita Bhan, and T. C. E. Cheng. 2020. Operations management research grounded in the resource-based view: A meta-analysis. International Journal of Production Economics 230: 107805. [Google Scholar] [CrossRef]

- Cheffi, Walid, Ahmed Abdel-Maksoud, and Muhammad Omer Farooq. 2021. CSR initiatives, organizational performance and the mediating role of integrating CSR into management control systems: Testing an inclusive model within SMEs in an emerging economy. Journal of Management Control 32: 333–67. [Google Scholar] [CrossRef]

- Chen, Jinhua, Lu Jiao, and Graeme Harrison. 2022. Transformational leadership and management control systems in human service not-for-profit organizations. Financial Accountability & Management, 1–19. [Google Scholar] [CrossRef]

- Chenhall, Robert H. 2003. Management control systems design within its organizational context: Findings from contingency-based research and directions for the future. Accounting, Organizations and Society 28: 127–68. [Google Scholar] [CrossRef]

- Ciruela-Lorenzo, Antonio Manuel, Ana González-Sánchez, and Juan José Plaza-Angulo. 2020. An exploratory study on social entrepreneurship, empowerment and peace process. The case of Colombian women victims of the armed conflict. Sustainability 12: 10425. [Google Scholar] [CrossRef]

- Conner, Kathleen, and Coimbatore K. Prahalad. 1996. A Resource-Based Theory of the Firm: Knowledge Versus Opportunism. Organization Science 7: 477–501. [Google Scholar] [CrossRef]

- Corsi, Katia, and Brunella Arru. 2020. Role and implementation of sustainability management control tools: Critical aspects in the Italian context. Accounting, Auditing & Accountability Journal 34: 29–56. [Google Scholar]

- Costas, Jana, and Dan Kärreman. 2013. Conscience as control–managing employees through CSR. Organization 20: 394–415. [Google Scholar] [CrossRef]

- Delfino, Gianluca F., and Berend van der Kolk. 2021. Remote working, management control changes and employee responses during the COVID-19 crisis. Accounting, Auditing & Accountability Journal 34: 1376–87. [Google Scholar]

- Dimes, Ruth, and Charl de Villiers. 2020. How management control systems enable and con-strain integrated thinking. Meditari Accountancy Research 29: 851–72. [Google Scholar] [CrossRef]

- Ditillo, Angelo, and Irene Eleonora Lisi. 2016. Exploring Sustainability Control Systems’ Integration: The Relevance of Sustainability Orientation. Journal of Management Accounting Research 28: 125–48. [Google Scholar] [CrossRef]

- Donthu, Naveen, and Anders Gustafsson. 2020. Effects of COVID-19 on business and research. Journal of Business Research 117: 284–89. [Google Scholar] [CrossRef]

- Endenich, Christoph. 2014. Economic crisis as a driver of management accounting change: Comparative evidence from Germany and Spain. Journal of Applied Accounting Research 15: 123–49. [Google Scholar] [CrossRef]

- Endrikat, Jan, Frank Hartmann, and Philipp Schreck. 2017. Social and ethical issues in management accounting and control: An editorial. Journal of Management Control 28: 245–49. [Google Scholar] [CrossRef]

- Epstein, Marc J., and Priscilla S. Wisner. 2005. Managing and controlling environmental performance: Evidence from Mexico. In Advances in Management Accounting. Edited by Marc J. Epstein and John Y. Lee. Bingley: Emerald Group Publishing Limited, vol. 14, pp. 115–37. [Google Scholar]

- Erokhin, Vasilii, Dmitry Endovitsky, Alexey Bobryshev, Natalia Kulagina, and Anna Ivolga. 2019. Management accounting change as a sustainable economic development strategy during pre-recession and recession periods: Evidence from Russia. Sustainability 11: 3139. [Google Scholar] [CrossRef]

- Farhikhteh, Shirzad, Ali Kazemi, Arash Shahin, and Majid Mohammad Shafiee. 2020. How competitiveness factors propel SMEs to achieve competitive advantage? Competitiveness Review 30: 315–38. [Google Scholar] [CrossRef]

- Feder, Madeleine, and Barbara E. Weißenberger. 2019. Understanding the behavioral gap: Why would managers (not) engage in CSR-related activities? Journal of Management Control 30: 95–126. [Google Scholar] [CrossRef]

- Ferreira, Aldónio, and David Otley. 2009. The design and use of performance management systems: An extended framework for analysis. Management Accounting Research 20: 263–82. [Google Scholar] [CrossRef]

- Gibson, Cristina B., Stephen C. Gibson, and Quinn Webster. 2021. Expanding our resources: Including community in the resource-based view of the firm. Journal of Management 47: 1878–98. [Google Scholar]

- Gond, Jean-Pascal, Suzana Grubnic, Christian Herzig, and Jeremy Moon. 2012. Configuring management control systems: Theorizing the integration of strategy and sustainability. Management Accounting Research 23: 205–23. [Google Scholar]

- Grafton, Jennifer, Anne M. Lillis, and Sally K. Widener. 2010. The role of performance measurement and evaluation in building organizational capabilities and performance. Accounting, Organizations and Society 35: 689–706. [Google Scholar] [CrossRef]

- Hahn, Tobias, and Frank Figge. 2018. Why architecture does not matter: On the fallacy of sustainability balanced scorecards. Journal of Business Ethics 150: 919–35. [Google Scholar]

- Hair, Joseph F., Rolph E. Anderson, Ronald L. Tatham, and William C. Black. 1999. Análisis Multivariante. Madrid: Prentice Hall Madrid, vol. 491. [Google Scholar]

- Hair, Joseph F., William C. Black, Barry Babin, Rolph E. Anderson, and Ronald L. Tatham. 2010. Multivariate Data Analysis. Upper Sadd: Pearson Prentice Hall. [Google Scholar]

- Hansen, Erik G., and Stefan Schaltegger. 2016. The Sustainability Balanced Scorecard: A Systematic Review of Architectures. Journal of Business Ethics 133: 193–221. [Google Scholar] [CrossRef]

- Hansen, Erik G., and Stefan Schaltegger. 2018. Sustainability balanced scorecards and their architectures: Irrelevant or misunderstood? Journal of Business Ethics 150: 937–52. [Google Scholar] [CrossRef]

- He, Hongwei, and Lloyd Harris. 2020. The impact of Covid-19 pandemic on corporate social responsibility and marketing philosophy. Journal of Business Research 116: 176–82. [Google Scholar] [CrossRef]

- Henri, Jean-François. 2006. Management control systems and strategy: A resource-based perspective. Accounting, Organizations and Society 31: 529–58. [Google Scholar] [CrossRef]

- Henri, Jean-François, and Marc Wouters. 2020. Interdependence of management control practices for product innovation: The influence of environmental unpredictability. Accounting, Organizations and Society 86: 101073. [Google Scholar] [CrossRef]

- Hitt, Michael A., Kai Xu, and Christina Matz Carnes. 2016. Resource-based theory in operations management research. Journal of Operations Management 41: 77–94. [Google Scholar] [CrossRef]

- Hopwood, Anthony G. 2009. The economic crisis and accounting: Implications for the research community. Accounting, Organizations and Society 34: 797–802. [Google Scholar] [CrossRef]

- Hu, Bo, Ulrike Leopold-Wildburger, and Jürgen Strohhecker. 2017. Strategy Map Concepts in a Balanced Scorecard Cockpit Improve Performance. European Journal of Operational Research 258: 664–76. [Google Scholar] [CrossRef]

- Humphreys, Kerry A., and Ken T. Trotman. 2022. Judgment and decision making research on CSR reporting in the COVID-19 pandemic environment. Accounting & Finance 62: 739–65. [Google Scholar]

- Instituto Nacional de Estatística. 2019. 250 Maiores Empresas Exportadoras. Available online: https://www.ine.pt/xportal/xmain?xpid=INE&xpgid=ine_base_dados (accessed on 15 October 2020).

- Ittner, Christopher D., and David F. Larcker. 2001. Assessing empirical research in managerial accounting: A value-based management perspective. Journal of Accounting and Economics 32: 349–410. [Google Scholar] [CrossRef]

- Joshi, Satish, and Yue Li. 2016. What is corporate sustainability and how do firms practice it? A management accounting research perspective. Journal of Management Accounting Research 28: 1–11. [Google Scholar] [CrossRef]

- Jukka, Tapio. 2021. Does business strategy and management control system fit determine performance? International Journal of Productivity and Performance Management 72: 659–78. [Google Scholar] [CrossRef]

- Kaplan, Robert S., and David P. Norton. 1993. Putting the Balanced Scorecard to Work. Harvard Business Review 71: 134–47. [Google Scholar]

- Kaplan, Rober. S., and David P. Norton. 1996. The Balanced Scorecard: Translating Strategy into Action. Boston: Harvard Business School Publishing. [Google Scholar]

- Kaplan, Robert S., and David P. Norton. 2001. Leading change with the balanced scorecard. Financial Executive 17: 64–66. [Google Scholar]

- Kaplan, Robert S., and David P. Norton. 2005. The balanced scorecard: Measures that drive performance. Harvard Business Review 83: 172–80. [Google Scholar]

- Kaplan, Robert S., and David P. Norton. 2007. Using the Balanced Scorecard as a strategic management system. Harvard Business Review 85: 150–61. [Google Scholar]

- Kaplan, Sarah. 2020. Why Social Responsibility Produces More Resilient Organizations. MIT Sloan Management Review 62: 85–90. [Google Scholar]

- Kober, Ralph, and Paul J. Thambar. 2021. Coping with COVID-19: The role of accounting in shaping charities’ financial resilience. Accounting, Auditing & Accountability Journal 34: 1416–29. [Google Scholar]

- König, Andreas, Lorenz L. Graf-Vlachy, Jonathan Bundy, and Laura M. Little. 2020. A blessing and a curse: How CEOs’ trait empathy affects their management of organisational crises. Academy of Management Review 45: 130–53. [Google Scholar] [CrossRef]

- Laguir, Issam, Shivam Gupta, Indranil Bose, Rebecca Stekelorum, and Lamia Laguir. 2022. Analytics capabilities and organizational competitiveness: Unveiling the impact of management control systems and environmental uncertainty. Decision Support Systems 156: 113744. [Google Scholar] [CrossRef]

- Langfield-Smith, Kim. 1997. Management control systems and strategy: A critical review. Accounting, Organizations and Society 22: 207–32. [Google Scholar] [CrossRef]

- Lebas, Michel. 1994. Managerial accounting in France Overview of past tradition and current practice. European Accounting Review 3: 471–88. [Google Scholar] [CrossRef]

- Leoni, Giulia, Alessandro Lai, Riccardo Stacchezzini, Ileana Steccolini, Stephen Brammer, Martina Linnenluecke, and Istemi Demirag. 2021. Accounting, management and accountability in times of crisis: Lessons from the COVID-19 pandemic. Accounting, Auditing and Accountability Journal 34: 1305–19. [Google Scholar] [CrossRef]

- Lodhia, Sumit, Umesh Sharma, and Mary Low. 2021. Creating value: Sustainability and accounting for non-financial matters in the pre- and post-corona environment. Meditari Accountancy Research 29: 185–96. [Google Scholar] [CrossRef]

- Lozano, Rodrigo, Angela Carpenter, and Donald Huisingh. 2015. A review of ‘theories of the firm’ and their contributions to Corporate Sustainability. Journal of Cleaner Production 106: 430–42. [Google Scholar] [CrossRef]

- Lueg, Rainer, and Ronny Radlach. 2016. Managing sustainable development with management control systems: A literature review. European Management Journal 34: 158–71. [Google Scholar] [CrossRef]

- Malmi, Teemu, and David A. Brown. 2008. Management control systems as a package: Opportunities, challenges and research directions. Management Accounting Research 19: 287–300. [Google Scholar] [CrossRef]

- Malmi, Teemu, David S. Bedford, Rolf Brühl, Johan Dergård, Sophie Hoozée, Otto Janschek, and Jeanette Willert. 2022. The use of management controls in different cultural regions: An empirical study of Anglo-Saxon, Germanic and Nordic practices. Journal of Management Control 33: 273–334. [Google Scholar] [CrossRef]

- Manuel, Timothy, and Terri L. Herron. 2020. An ethical perspective of business CSR and the COVID-19 pandemic. Society and Business Review 15: 235–53. [Google Scholar] [CrossRef]

- Maqbool, Shafat. 2019. Does corporate social responsibility lead to superior financial performance? Evidence from BSE 100 index. Decision 46: 219–31. [Google Scholar]

- Marôco, João. 2010. Structural Equation Analysis: Theoretical Fundamentals, Software & Applications. Pêro Pinheiro: ReportNumber, Lda. [Google Scholar]

- Martins, Adelaide, Delfina Gomes, and Manuel Castelo Branco. 2020. Managing corporate social and environmental disclosure: An accountability vs. impression management framework. Sustainability 13: 296. [Google Scholar] [CrossRef]

- Melgarejo, Mauricio, Carlos Rodríguez, and Jose Torres. 2021. Effects of the adoption of management control practices on profitability: Evidence from Latin America. Revista Espanola de Financiacion y Contabilidad 51: 1–20. [Google Scholar] [CrossRef]

- Micheli, Pietro, and Matteo Mura. 2017. Executing strategy through comprehensive performance measurement systems. International Journal of Operations and Production Management 37: 423–43. [Google Scholar] [CrossRef]

- Mio, Chiara, Sonia Baggio, Silvia Panfilo, and Antonio Costantini. 2020. CSR and management control integration. Evidence from an employee welfare plan implementation. Management Control S1: 151–75. [Google Scholar] [CrossRef]

- Monteiro, Albertina Paula, Joana Vale, and Amélia Silva. 2021. Factors determining the success of decision making and performance of Portuguese companies. Administrative Sciences 11: 108. [Google Scholar] [CrossRef]

- Mouritsen, Jan, Isabel Pedraza-Acosta, and Sof Thrane. 2022. Performance, risk, and overflows: When are multiple management control practices related? Management Accounting Research 55: 100796. [Google Scholar] [CrossRef]

- Müller-Stewens, Benedikt, Sally K. Widener, Klaus Möller, and Jan-Christoph Steinmann. 2020. The role of diagnostic and interactive control uses in innovation. Accounting, Organizations and Society 80: 101078. [Google Scholar] [CrossRef]

- Munck, Jan Christoph, Alexander Tkotz, Sven Heidenreich, and Andreas Wald. 2020. The performance effects of management control instruments in different stages of new product development. Journal of Accounting & Organizational Change 16: 259–84. [Google Scholar]

- Nartey, Edward, Francis K. Aboagye-Otchere, and Samuel Nana Y. Simpson. 2021. Management control and supply chain operational performance of public health emergency to pandemic control. Management Research Review 45: 398–435. [Google Scholar] [CrossRef]

- Oliveira, Cidália, Adelaide Martins, Mark Anthony Camilleri, and Shital Jayantilal. 2021. Using the balanced scorecard for strategic communication and performance management. In Strategic Corporate Communication in the Digital Age, 1st ed. Edited by Mark Anthony Camilleri. Bingley: Emerald Publishing Limited, pp. 73–88. [Google Scholar] [CrossRef]

- Passetti, Emilio, Massimo Battaglia, Lara Bianchi, and Nora Annesi. 2021. Coping with the COVID-19 pandemic: The technical, moral and facilitating role of management control. Accounting, Auditing and Accountability Journal 34: 1430–44. [Google Scholar] [CrossRef]

- Pavlatos, Odysseas, and Hara Kostakis. 2022. Exploring the Relationship between Target Costing Functionality and Product Innovation: The Role of Information Systems. Australian Accounting Review 32: 124–40. [Google Scholar] [CrossRef]

- Penrose, Edith. 1959. The Theory of the Growth of the Firm. New York: John Wiley. [Google Scholar]

- Petera, Petr, Jaroslav Wagner, and Renáta Pakšiová. 2021. The influence of environmental strategy, environmental reporting and environmental management control system on environmental and economic performance. Energies 14: 4637. [Google Scholar] [CrossRef]

- Pondeville, Sophie, Valérie Swaen, and Yves De Rongé. 2013. Environmental management control systems: The role of contextual and strategic factors. Management Accounting Research 24: 317–32. [Google Scholar] [CrossRef]

- Porter, Michael E. 1980. Competitive Strategy: Techniques for Analyzing Industries and Companies. New York: The Free Press. [Google Scholar]

- Porter, Michael E., and Mark R. Kramer. 2006. The link between competitive advantage and corporate social responsibility. Harvard Business Review 84: 78–92. [Google Scholar] [PubMed]

- Rahi, ABM Fazle, Jeaneth Johansson, Arne Fagerström, and Marita Blomkvist. 2022. Sustainability Reporting and Management Control System: A Structured Literature Review. Journal of Risk and Financial Management 15: 562. [Google Scholar]

- Rehman, Shafique Ur, Anam Bhatti, Sascha Kraus, and João J. M. Ferreira. 2020. The role of environmental management control systems for ecological sustainability and sustainable performance. Management Decision 59: 2217–37. [Google Scholar] [CrossRef]

- Rigby, Darrell. 2001. Management Tools and Techniques: A survey. California Management Review 43: 139–60. [Google Scholar] [CrossRef]

- Robinson, Michael, Anne Kleffner, and Stephanie Bertels. 2011. Signaling sustainability leadership: Empirical evidence of the value of DJSI membership. Journal of Business Ethics 101: 493–505. [Google Scholar] [CrossRef]

- Sabahi, Sima, and Mahour M. Parast. 2020. Firm innovation and supply chain resilience: A dynamic capability perspective. International Journal of Logistics Research and Applications 23: 254–69. [Google Scholar] [CrossRef]

- Sageder, Martina, and Birgit Feldbauer-Durstmüller. 2019. Management control in multinational companies: A systematic literature review. Review of Managerial Science 13: 875–918. [Google Scholar] [CrossRef]

- Sandelin, Mikko. 2008. Operation of management control practices as a package—A case study on control system variety in a growth firm context. Management Accounting Research 19: 324–43. [Google Scholar] [CrossRef]

- Sarker, Md Rayhan, Syed Mithun Ali, Sanjoy Kumar Paul, and Ziaul Haque Munim. 2021. Measuring sustainability performance using an integrated model. Measurement 184: 109931. [Google Scholar] [CrossRef]

- Schaltegger, Stefan, Roger Burritt, Dimitar Zvezdov, Jacob Hörisch, and Joanne Tingey-Holyoak. 2015. Management roles and sustainability information. Exploring corporate practice. Australian Accounting Review 25: 328–45. [Google Scholar] [CrossRef]

- Schumacker, Randall Richard, and Richard G. Lomax. 2016. A Beginner’s Guide to Structural Equation Modeling, 4th ed.New York: Routledge. [Google Scholar]

- Searcy, Cory. 2012. Corporate sustainability performance measurement systems: A review and research agenda. Journal of Business Ethics 107: 239–53. [Google Scholar] [CrossRef]

- Shaulska, Larysa, Sergey Kovalenko, Shamsiddin Allayarov, Oleksii Sydorenko, and Alla Sukhanova. 2021. Strategic enterprise competitiveness management under global challenges. Academy of Strategic Management Journal 20: 1–7. [Google Scholar]

- Simons, Robert. 1990. The role of management control systems in creating competitive advantage: New perspectives. Accounting, Organizations and Society 15: 127–43. [Google Scholar] [CrossRef]

- Surroca, Jordi, Josep A. Tribó, and Sandra Waddock. 2010. Corporate responsibility and financial performance: The role of intangible resources. Strategic Management Journal 31: 463–90. [Google Scholar] [CrossRef]

- Taber, Keith S. 2018. The use of Cronbach’s alpha when developing and reporting research instruments in science education. Research in Science Education 48: 1273–96. [Google Scholar] [CrossRef]

- Traxler, Albert Anton, Daniela Schrack, and Dorothea Greiling. 2020. Sustainability reporting and management control—A systematic exploratory literature review. Journal of Cleaner Production 276: 122725. [Google Scholar] [CrossRef]

- Vale, José, Joanaa Amaral, Luis Abrantes, Carmen Leal, and Rui Silva. 2022. Management accounting and control in higher education institutions: A systematic literature review. Administrative Sciences 12: 14. [Google Scholar] [CrossRef]

- Van der Stede, Wim. A. 2003. The effect of national culture on management control and incentive system design in multi-business firms: Evidence of intracorporate isomorphism. European Accounting Review 12: 263–85. [Google Scholar] [CrossRef]

- Wijethilake, Chaminda, Rahat Munir, and Ranjith Appuhami. 2017. Strategic responses to institutional pressures for sustainability: The role of management control systems. Accounting, Auditing & Accountability Journal 30: 1677–710. [Google Scholar]

- Wijethilake, Chaminda, Rahat Munir, and Ranjith Appuhami. 2018. Environmental innovation strategy and organizational performance: Enabling and controlling uses of management control systems. Journal of Business Ethics 151: 1139–60. [Google Scholar] [CrossRef]

- Wu, Minyu, and Kun Kong. 2021. Business strategies responding to COVID-19: Experience of Chinese corporations. Corporate Governance 21: 1072–99. [Google Scholar] [CrossRef]

- Yoshikuni, Adilson Carlos, and Alberto Luiz Albertin. 2018. Effects of strategic information systems on competitive strategy and performance. International Journal of Productivity and Performance Management 67: 2018–45. [Google Scholar] [CrossRef]

- Yuan, Ke-Hai, and Peter M. Bentler. 2001. Effect of outliers on estimators and tests in co-variance structure analysis. British Journal of Mathematical and Statistical Psychology 54: 161–75. [Google Scholar] [CrossRef] [PubMed]

- Zizlavsky, Ondrej. 2014. The Balanced Scorecard: Innovative Performance Measurement and Management Control System. Journal of Technology Management & Innovation 9: 210–22. [Google Scholar]

| Variables | Frequency | % | |

|---|---|---|---|

| Type of management | State-owned | 1 | 1% |

| Private | 81 | 99% | |

| Type of company | Public Limited Company | 62 | 76% |

| Private Limited Company | 19 | 23% | |

| Sole Proprietorship | 0 | 0% | |

| Other | 1 | 1% | |

| Average number of employees | <5 | 1 | 1% |

| 5 to 9 | 1 | 1% | |

| 10 to 49 | 8 | 10% | |

| 50 to 249 | 13 | 16% | |

| >249 | 59 | 72% | |

| MCP used | Balanced Scorecard | 42 | 51% |

| Tableau de Bord | 17 | 29% | |

| Business Model Canvas | 4 | 7% | |

| Pyramid Prism | 0 | 0% | |

| Other | 19 | 32% | |

| Variables | Frequency | % | |

|---|---|---|---|

| Gender | Male | 46 | 56% |

| Female | 36 | 44% | |

| Age (years) | <30 | 0 | 0% |

| 30 to 39 | 12 | 15% | |

| 40 to 49 | 31 | 38% | |

| 50 to 59 | 29 | 35% | |

| >59 | 10 | 12% | |

| Education | Middle school | 5 | 6% |

| Undergraduate | 54 | 66% | |

| Master’s | 17 | 21% | |

| PhD | 6 | 7% | |

| Educational background in the management area | Yes | 61 | 74% |

| No | 21 | 26% | |

| Years of experience in the management area | <5 | 1 | 1% |

| 5 to 15 | 15 | 18% | |

| >15 | 66 | 81% | |

| Job | Top management | 52 | 63% |

| Middle management | 22 | 27% | |

| Operational management | 8 | 10% | |

| Items | Loadings | Label | (α) |

|---|---|---|---|

| OPER1 | 0.571 | Organisational Performance | 0.738 |

| OPER2 | 0.639 | ||

| OPER3 | −0.034 | ||

| OPER4 | 0.326 | ||

| OPER5 | 0.309 | ||

| OPER6 | 0.474 | ||

| OPER7 | 0.791 | ||

| LOCO1 | 0.883 | Leveraging Organisational Competitiveness | 0.902 |

| LOCO2 | 0.876 | ||

| LOCO3 | 0.710 | ||

| LOCO4 | 0.743 | ||

| LOCO5 | 0.812 | ||

| CSRE1 | 0.546 | Corporate Social Responsibility | 0.934 |

| CSRE2 | 0.579 | ||

| CSRE3 | 0.669 | ||

| CSRE4 | 0.682 | ||

| CSRE5 | 0.691 | ||

| CSRE6 | 0.771 | ||

| CSRE7 | 0.706 | ||

| CSRE8 | 0.877 | ||

| CSRE9 | 0.811 | ||

| CSRE10 | 0.847 | ||

| CSRE11 | 0.664 | ||

| CSRE12 | 0.781 | ||

| CSRE13 | 0.744 | ||

| MCP1 | 0.640 | Management Control Practices | 0.860 |

| MCP2 | 0.700 | ||

| MCP3 | 0.860 | ||

| MCP4 | 0.840 |

| CR | AVE | α | LOCO | OPER | CSR | |

|---|---|---|---|---|---|---|

| LOCO | 0.872 | 0.652 | 0.903 | 0.764 | ||

| OPER | 0.709 | 0.453 | 0.738 | 0.804 | 0.718 | |

| CSR | 0.934 | 0.528 | 0.934 | 0.487 | 0.472 | 0.710 |

| Hypotheses | Relationship | Coefficient | Standard Error | t | p-Value |

|---|---|---|---|---|---|

| H1 | MCP → OPER | 0.555 | 0.119 | 4.649 | <0.001 |

| H2 | MCP → LOCO | 0.939 | 0.131 | 7.142 | <0.001 |

| H3 | CSR → MCP | 0.644 | 0.185 | 3.481 | <0.001 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Martins, A.; Oliveira, C.; Silva, R.; Castelo Branco, M. Management Control Practices as Performance Facilitators in a Crisis Context. Adm. Sci. 2023, 13, 163. https://doi.org/10.3390/admsci13070163

Martins A, Oliveira C, Silva R, Castelo Branco M. Management Control Practices as Performance Facilitators in a Crisis Context. Administrative Sciences. 2023; 13(7):163. https://doi.org/10.3390/admsci13070163

Chicago/Turabian StyleMartins, Adelaide, Cidália Oliveira, Rui Silva, and Manuel Castelo Branco. 2023. "Management Control Practices as Performance Facilitators in a Crisis Context" Administrative Sciences 13, no. 7: 163. https://doi.org/10.3390/admsci13070163

APA StyleMartins, A., Oliveira, C., Silva, R., & Castelo Branco, M. (2023). Management Control Practices as Performance Facilitators in a Crisis Context. Administrative Sciences, 13(7), 163. https://doi.org/10.3390/admsci13070163