Comparing the Innovation and Export Performance of Hungarian Family and Non-Family Enterprises: Experiences Drawn from Empirical Surveys

Abstract

1. Introduction

2. Theoretical Framework

2.1. Concept and Measurement of Innovation

2.2. Definition of Family Firms

- The majority of decision-making rights are in the possession of the natural person(s) who established the firm, or in the possession of the natural person(s) who has/have acquired the share capital of the firm, or in the possession of their spouses, parents, child, or children’s direct heirs.

- The majority of decision-making rights are indirect or direct.

- At least one representative of the family or kin is formally involved in the governance of the firm.

- Listed companies meet the definition of family enterprise if the person who established or acquired the firm (share capital) or their families or descendants hold 25 per cent of the decision-making rights mandated by their share capital.

2.3. Innovation in Family Businesses

- Long-term orientation, which can offset risk aversion and have a positive impact on export activity and new product development (see more: Gomez-Mejia et al. 2010);

- Faster decision making, which can help seize opportunities more quickly;

- Interests and preferences are more easily aligned, reducing information asymmetries;

- Greater altruism among owners and managers can create an organisational culture of risk awareness and risk appetite that enables the pursuit of long-term growth strategies (see more: Gomez-Mejia et al. 2003; Schulze et al. 2003; Zahra 2003);

- It allows for more frequent interactions and more opportunities for learning (see more: (Veider and Matzler 2016)) while the parties speak a unique family language.

3. Methodology

4. Results

5. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | In alphabetical order, Croatia, Czechia, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovenia, and Slovakia. |

| 2 | Using the annual average exchange rates of the European Central Bank (European Central Bank 2023), this value corresponds to EUR 161.71 thousand, EUR 142.35 thousand, and EUR 127.78 thousand in 2017, 2020 and 2022, respectively, due to the continuous devaluation of the Hungarian forint against the euro. |

References

- Akram, Manzoor Ul, Koustab Ghosh, and Dheeraj Sharma. 2021. A Systematic Review of Innovation in Family Firms and Future Research Agenda. International Journal of Emerging Markets 17: 1759–92. [Google Scholar] [CrossRef]

- Alayo, Mikel, Txomin Iturralde, and Amaia Maseda. 2021. Innovation and Internationalization in Family SMEs: Analyzing the Role of Family Involvement. European Journal of Innovation Management 25: 454–78. [Google Scholar] [CrossRef]

- Anderson, Ronald C., and David M. Reeb. 2003. Founding-Family Ownership and Firm Performance: Evidence from the S&P 500′. The Journal of Finance 58: 1301–28. [Google Scholar] [CrossRef]

- Annus, István, Bándi Gábor, Borsi Balázs, Hollóné Kacsó Erzsébet, Katona József, Lengyel Balázs, Papanek Gábor, Perényi Áron, Szarka Ernő, and Szegner Erzsébet. 2006. Innováció menedzsment kézikönyv. Edited by János Dr Pakucs and Gábor Dr Papanek. Budapest: Magyar Innovációs Szövetség. [Google Scholar]

- Basco, Rodrigo. 2013. The Family’s Effect on Family Firm Performance: A Model Testing the Demographic and Essence Approaches. Journal of Family Business Strategy 4: 42–66. [Google Scholar] [CrossRef]

- Braga, Vitor, Aldina Correia, Alexandra Braga, and Sofia Lemos. 2017. The Innovation and Internationalisation Processes of Family Businesses. Review of International Business and Strategy 27: 231–47. [Google Scholar] [CrossRef]

- Calabrò, Andrea, Mariangela Vecchiarini, Johanna Gast, Giovanna Campopiano, Alfredo De Massis, and Sascha Kraus. 2019. Innovation in Family Firms: A Systematic Literature Review and Guidance for Future Research. International Journal of Management Reviews 21: 317–55. [Google Scholar] [CrossRef]

- De Massis, Alfredo, Federico Frattini, and Ulrich Lichtenthaler. 2013. Research on Technological Innovation in Family Firms: Present Debates and Future Directions. Family Business Review 26: 10–31. [Google Scholar] [CrossRef]

- Directorate-General for Research and Innovation (European Commission), Hugo Hollanders, Nordine Es-Sadki, and Aishe Khalilova. 2022. European Innovation Scoreboard 2022. Luxembourg: Publications Office of the European Union. Available online: https://data.europa.eu/doi/10.2777/309907 (accessed on 25 May 2023).

- Drótos, György, Attila Wieszt, Barbara Meretei, and Éva Vajda. 2019. Családi Vállalkozások Magyarországon—Kutatási Jelentés a 2017-18-as Magyar Családi Vállalkozási Felmérésről. Kutatási jelentés. Corvinus—Center of Family Business. Available online: http://magyarvallalatok2030.hu/wp-content/uploads/2019/04/kutata%CC%81s_2018_CFB__PRESS.pdf (accessed on 3 March 2023).

- EFB. n.d. About European Family Businesses. European Family. Available online: https://europeanfamilybusinesses.eu/about-european-family-businesses/ (accessed on 11 February 2022).

- European Central Bank. 2023. Euro Foreign Exchange Reference Rates. European Central Bank. February 9. Available online: https://www.ecb.europa.eu/stats/policy_and_exchange_rates/euro_reference_exchange_rates/html/index.en.html (accessed on 3 March 2023).

- European Commission. 2003. Commission Recommendation of 6 May 2003 Concerning the Definition of Micro, Small and Medium-Sized Enterprises (Text with EEA Relevance) (Notified under Document Number C(2003) 1422). Available online: http://data.europa.eu/eli/reco/2003/361/oj/eng (accessed on 3 March 2023).

- European Commission DG-ENTR. 2009. Final Report of the Expert Group—Overview of Family-Business-Relevant Issues: Research, Networks, Policy Measures and Existing Studies. Available online: https://ec.europa.eu/docsroom/documents/10388/attachments/1/translations (accessed on 17 April 2023).

- Fernandez, Zulima, and Maria J. Nieto. 2005. Internationalization Strategy of Small and Medium-Sized Family Businesses: Some Influential Factors. University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship. Available online: https://ssrn.com/abstract=1507554 (accessed on 20 April 2023).

- Freixanet, Joan, Joaquin Monreal, and Gregorio Sánchez-Marín. 2020. Family Firms’ Selective Learning-by-Exporting: Product vs Process Innovation and the Role of Technological Capabilities. Multinational Business Review 29: 210–36. [Google Scholar] [CrossRef]

- Gomez-Mejia, Luis R., Marianna Makri, and Martin Larraza Kintana. 2010. Diversification Decisions in Family-Controlled Firms. Journal of Management Studies 47: 223–52. [Google Scholar] [CrossRef]

- Gomez-Mejia, Luis R., Martin Larraza-Kintana, and Marianna Makri. 2003. The Determinants of Executive Compensation in Family-Controlled Public Corporations. Academy of Management Journal 46: 226–37. [Google Scholar] [CrossRef]

- Hillebrand, Sebastian, Thorsten Teichert, and Jonas Steeger. 2020. Innovation in Family Firms: An Agency and Resource-Based Lens on Contingencies of Generation and Management Diversity. British Journal of Management 31: 792–810. [Google Scholar] [CrossRef]

- Kása, Richárd, László Radácsi, and Judit Csákné Filep. 2019. Családi vállalkozások definíciós operacionalizálása és hazai arányuk becslése a kkv-szektoron belül. Statisztikai Szemle 97: 146–74. [Google Scholar] [CrossRef]

- Kelley, Donna, William B. Gartner, and Mathew Allen. 2020. Global Entrepreneurship Monitor Family Business Report. Babson Park: Babson College Press. Available online: https://www.gemconsortium.org/report/20192020-global-entrepreneurship-monitor-gem-family-entrepreneurship-report-2 (accessed on 14 April 2023).

- Li, Zonghui, and Joshua J. Daspit. 2016. Understanding Family Firm Innovation Heterogeneity: A Typology of Family Governance and Socioemotional Wealth Intentions. Edited by Manisha Singal and Celine Barrédy Esra Memili. Journal of Family Business Management 6: 103–21. [Google Scholar] [CrossRef]

- Makó, Csaba, Illéssy Miklós, and Heidrich Balázs. 2020. Az innovációs és tanulási képesség egyenlőtlenségei: A magyar kkv-k nemzetközi összehasonlításban. Külgazdaság 64: 3–32. [Google Scholar] [CrossRef]

- Mandl, Irene. 2008. Overview of Family Business Relevant Issues Contract No. 30-CE-0164021/00-51 Final Report. Vienna: Austrian Institute for SME Research. Available online: https://ec.europa.eu/docsroom/documents/10389/attachments/1/translations/en/renditions/native (accessed on 25 March 2021).

- Miller, Danny, and Isabelle Le Breton-Miller. 2014. Deconstructing Socioemotional Wealth. Entrepreneurship Theory and Practice 38: 713–20. [Google Scholar] [CrossRef]

- Mosolygó-Kiss, Ágnes, Judit Csákné Filep, and Balázs Heidrich. 2018. Do First Swallows Make a Summer? On the Readiness and Maturity of Successors of Family Businesses in Hungary. Working Paper 6. Budapest LAB Working Paper Series; Budapest: Available online: https://budapestlab.hu/wp-content/uploads/2019/02/WP-6-2018-1_zart.pdf (accessed on 14 April 2023).

- OECD/Eurostat. 2018. Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation, 4th Edition, The Measurement of Scientific, Technological and Innovation Activities; Paris and Luxembourg: OECD Publishing/Eurostat. Available online: https://nkfih.gov.hu/download.php?docID=3068 (accessed on 25 May 2023).

- Pukall, Thilo J., and Andrea Calabrò. 2014. The Internationalization of Family Firms: A Critical Review and Integrative Model. Family Business Review 27: 103–25. [Google Scholar] [CrossRef]

- Sánchez-Marín, Gregorio, María Pemartín, and Joaquín Monreal-Pérez. 2020. The Influence of Family Involvement and Generational Stage on Learning-by-Exporting among Family Firms. Review of Managerial Science 14: 311–34. [Google Scholar] [CrossRef]

- Schulze, William S, Michael H Lubatkin, and Richard N Dino. 2003. Toward a Theory of Agency and Altruism in Family Firms. Journal of Business Venturing, Theories of Family Business 18: 473–90. [Google Scholar] [CrossRef]

- Schumpeter, Joseph A. 1980. A gazdasági fejlődés elmélete: Vizsgálódás a vállalkozói profilról, a tőkéről, a hitelről, a kamatról és a konjunktúraciklusról. Edited by Aladár Madarász. Translated by Tamás Bauer. Budapest: Közgazdasági és Jogi Könyvkiadó. [Google Scholar]

- Sharma, Pramodita, and Sanjay Sharma. 2011. Drivers of Proactive Environmental Strategy in Family Firms. Business Ethics Quarterly 21: 309–34. [Google Scholar] [CrossRef]

- Surdej, Aleksander. 2016. What Determines the Innovativeness of Polish Family Firms? Empirical Results and Theoretical Puzzles. Vezetéstudomány/Budapest Management Review 47: 38–45. [Google Scholar] [CrossRef]

- Urbaníková, Marta, Michaela Štubňová, Viera Papcunová, and Jarmila Hudáková. 2020. Analysis of Innovation Activities of Slovak Small and Medium-Sized Family Businesses. Administrative Sciences 10: 80. [Google Scholar] [CrossRef]

- Veider, Viktoria, and Kurt Matzler. 2016. The Ability and Willingness of Family-Controlled Firms to Arrive at Organizational Ambidexterity. Journal of Family Business Strategy 7: 105–16. Available online: https://ideas.repec.org/a/eee/fambus/v7y2016i2p105-116.html (accessed on 2 November 2021). [CrossRef]

- Wiseman, Robert M., and Luis R. Gomez-Mejia. 1998. A Behavioral Agency Model of Managerial Risk Taking. The Academy of Management Review 23: 133–53. [Google Scholar] [CrossRef]

- Zahra, Shaker A. 2003. International Expansion of U.S. Manufacturing Family Businesses: The Effect of Ownership and Involvement. Journal of Business Venturing 18: 495–512. [Google Scholar] [CrossRef]

| Variable Name | Survey Question | Scale of Measurement |

|---|---|---|

| IN01 | Which changes were implemented in your business out of the followings in the last 2 years/A significant development/improvement in the product/service. | dummy |

| IN02 | Which changes were implemented in your business out of the followings in the last 2 years/A significant development/improvement in the process used to produce the product/service | dummy |

| IN03 | Which changes were implemented in your business out of the followings in the last 2 years/Entering to a new market (consumer segment/geographical unit) with the product/service | dummy |

| IN04 | Which changes were implemented in your business out of the followings in the last 2 years/Exploring new sources of raw materials | dummy |

| IN05 | Which changes were implemented in your business out of the followings in the last 2 years/Introduction of significant developments, improvements, more efficient methods of operating the organisation | dummy |

| INNOV_sum | Number of innovation types carried out in the last 2 years | scale, ranged between 0 and 5 |

| PZ05 | Does your business undertake any export activity? | dummy |

| TGA_CSV | Familiness of the business | categorical (0 = non-family business; 1 = family business without generational transitioning aspirations; 2 = family business with generational transitioning aspirations) |

| Hypothesis | Methodology Used |

|---|---|

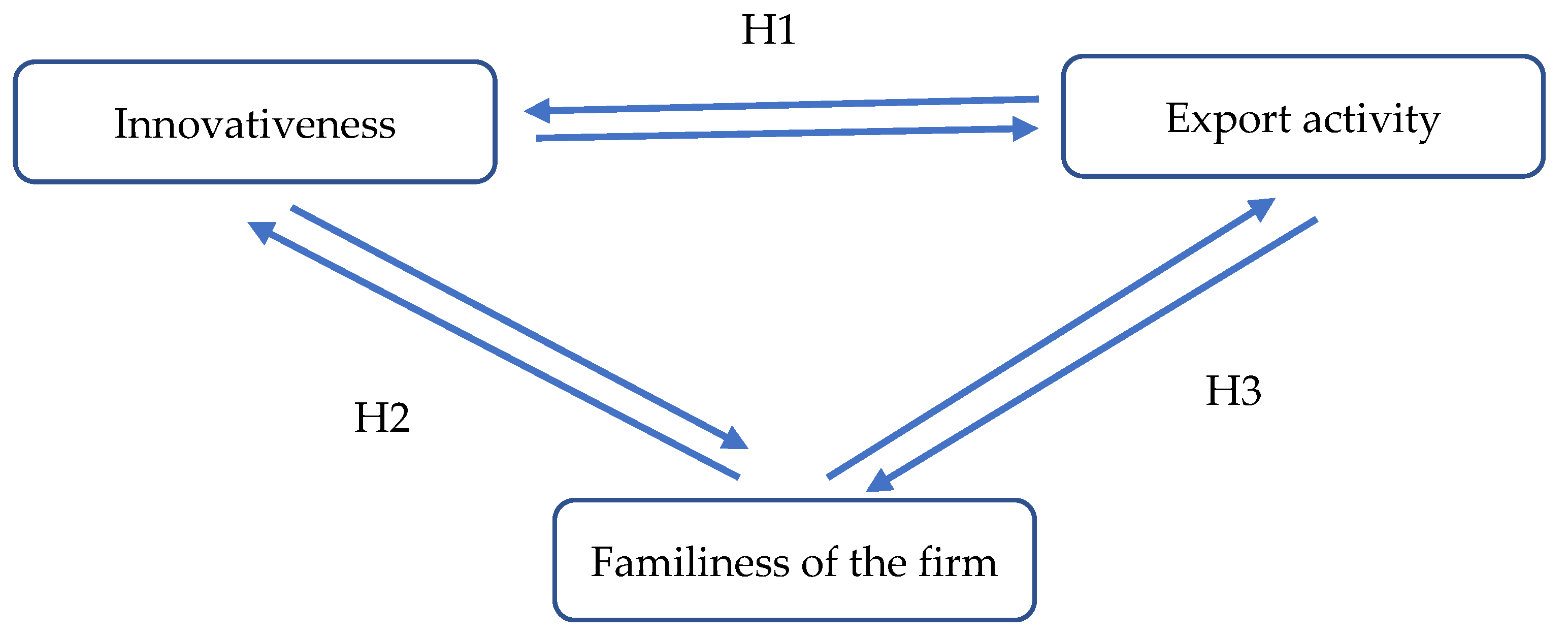

| H1: The innovation activity of exporting firms is higher than that of firms not active in foreign markets. | Pearson’s chi-square test |

| t-test | |

| H2: Family businesses are more innovative than non-family businesses. | Pearson’s chi-square test |

| one-way ANOVA | |

| H3: A link can be found between the familiness of enterprises and their activity in export markets. | Pearson’s chi-square test |

| 2017 | 2020 | 2022 | |

|---|---|---|---|

| Product/service has undergone a significant development/improvement | 1.576 | 1.280 | 2.006 |

| Significant development/improvement has been made in the process that produced the product/service | 1.517 | 2.224 | 2.291 |

| A new market was entered with the product/service (consumer segment/geographic unit) | 2.483 | 2.216 | 1.314 |

| New sources of raw materials were explored | 1.555 | 1.626 | 2.867 |

| Significant developments, improvements and more efficient methods have been introduced in the operation of the organisation | 1.434 | 1.674 | 1.981 |

| Pearson’s Chi-Square | Cramer’s V | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2017 | 2020 | 2022 | 2017 | 2020 | 2022 | ||||

| Asymptotic Sig. (2-Sided) | Asymptotic Sig. (2-Sided) | Asymptotic Sig. (2-Sided) | Value | Approx. Sig. | Value | Approx. Sig. | Value | Approx. Sig. | |

| Product/service has undergone a significant development/improvement | 0.005 | 0.257 | 0.019 | 0.165 | 0.005 | 0.051 | 0.257 | 0.105 | 0.019 |

| Significant development/improvement has been made in the process that produced the product/service | 0.015 | 0.000 | 0.007 | 0.148 | 0.015 | 0.167 | 0.000 | 0.121 | 0.007 |

| A new market was entered with the product/service (consumer segment/geographic unit) | 0.000 | 0.000 | 0.508 | 0.333 | 0.000 | 0.164 | 0.000 | 0.030 | 0.508 |

| New sources of raw materials were explored | 0.012 | 0.026 | 0.000 | 0.151 | 0.012 | 0.100 | 0.026 | 0.176 | 0.000 |

| Significant developments, improvements and more efficient methods have been introduced in the operation of the organisation | 0.035 | 0.020 | 0.028 | 0.132 | 0.035 | 0.104 | 0.020 | 0.098 | 0.028 |

| Year | Export Activity | Number of Businesses (n) | Innovation Types | ||

|---|---|---|---|---|---|

| Mean | Std. Deviation | Std. Error Mean | |||

| 2017 | yes | 128 | 2.1797 | 1.55950 | 0.13784 |

| no | 256 | 1.2891 | 1.43706 | 0.08982 | |

| 2020 | yes | 75 | 1.8163 | 1.68870 | 0.19533 |

| no | 422 | 1.1427 | 1.26313 | 0.06151 | |

| 2022 | yes | 49 | 1.2954 | 1.13378 | 0.16277 |

| no | 451 | 0.6588 | 0.95424 | 0.04491 | |

| Pearson’s Chi-Square | Cramer’s V | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2017 | 2020 | 2022 | 2017 | 2020 | 2022 | ||||

| Asymptotic Sig. (2-Sided) | Asymptotic Sig. (2-Sided) | Asymptotic Sig. (2-Sided) | Value | Approx. Sig. | Value | Approx. Sig. | Value | Approx. Sig. | |

| Product/service has undergone a significant development/improvement | 0.506 | 0.004 | 0.858 | 0.059 | 0.506 | 0.147 | 0.004 | 0.858 | 0.858 |

| Significant development/improvement has been made in the process that produced the product/service | 0.357 | 0.475 | 0.719 | 0.073 | 0.357 | 0.055 | 0.475 | 0.719 | 0.719 |

| A new market was entered with the product/service (consumer segment/geographic unit) | 0.272 | 0.000 | 0.787 | 0.082 | 0.272 | 0.175 | 0.000 | 0.787 | 0.787 |

| New sources of raw materials were explored | 0.792 | 0.002 | 0.786 | 0.035 | 0.792 | 0.156 | 0.002 | 0.786 | 0.786 |

| Significant developments, improvements and more efficient methods have been introduced in the operation of the organisation | 0.889 | 0.047 | 0.226 | 0.025 | 0.889 | 0.111 | 0.047 | 0.226 | 0.226 |

| 2017 | 2020 | 2022 | ||

|---|---|---|---|---|

| Pearson’s Chi-Square | Asymptotic Significance (2-sided) | 0.719 | 0.050 | 0.470 |

| Cramer’s V | Value | 0.052 | 0.110 | 0.055 |

| Approximate Significance | 0.719 | 0.050 | 0.470 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Csákné Filep, J.; Radácsi, L.; Szennay, Á. Comparing the Innovation and Export Performance of Hungarian Family and Non-Family Enterprises: Experiences Drawn from Empirical Surveys. Adm. Sci. 2023, 13, 146. https://doi.org/10.3390/admsci13060146

Csákné Filep J, Radácsi L, Szennay Á. Comparing the Innovation and Export Performance of Hungarian Family and Non-Family Enterprises: Experiences Drawn from Empirical Surveys. Administrative Sciences. 2023; 13(6):146. https://doi.org/10.3390/admsci13060146

Chicago/Turabian StyleCsákné Filep, Judit, László Radácsi, and Áron Szennay. 2023. "Comparing the Innovation and Export Performance of Hungarian Family and Non-Family Enterprises: Experiences Drawn from Empirical Surveys" Administrative Sciences 13, no. 6: 146. https://doi.org/10.3390/admsci13060146

APA StyleCsákné Filep, J., Radácsi, L., & Szennay, Á. (2023). Comparing the Innovation and Export Performance of Hungarian Family and Non-Family Enterprises: Experiences Drawn from Empirical Surveys. Administrative Sciences, 13(6), 146. https://doi.org/10.3390/admsci13060146