3. Methodology and Data

Sometimes survey creators offer overly complicated surveys with too many response options or too many items to discuss. This makes reading the survey difficult for people and can encourage poor survey-taking behavior, like straightlining or randomly selecting responses, because they want to escape the survey (

Cho 2022). In other words, respondents cannot concentrate on long and complex survey questions, especially if they are tired, bored, or distracted by unpredictable circumstances (

Baušys et al. 2021). Moreover, survey construction also depends on the data origins.

Reips (

2002) analyzed the psychometric aspects of internet-based experiments and suggested that different survey items should be presented on separate pages when unrelated questions are being assessed. However, the researcher also highlighted that if the same variable’s various aspects are being analyzed, all these aspects should be intentionally evaluated on a single page. While people are better able to making comparative judgements than absolute ones, matrix questions are frequently employed in online data collection processes (

Sung and Wu 2018). However, because of the cognitive load of human memory, precaution should be taken in presenting long matrix questions in online surveys.

Thorndike et al. (

2009) conducted a study to find out whether the participants respond differently to online questionnaires presenting many items on a single webpage compared to questionnaires presenting only one item per page. A matrix question consisting of 21 lines was analyzed in this study. Participants seeking self-help treatment on the Internet for social phobia, depression, or panic disorder completed both questionnaires. According to the results, participants preferred questionnaires that show only one item per page, even though it took more time for them to complete the survey. This experiment shows that a matrix question of 21 items might be too long for survey participants.

Toepoel et al. (

2009) also analyzed how the number of items placed on a single webpage affects survey results. Four different situations were analyzed, when one, four, ten, and forty questions (items) were presented on a single screen. Results of the experiments revealed that putting more items on a screen increases item non-response levels. However, it also reduces the survey duration and provides more judicial appraisals. While the necessity of webpage scrolling was detected as the feature most negatively impacting survey results, the authors of this study suggested that placing four to ten items with a single header on the page might be the optimal decision, preventing scrolling while also allowing respondents to answer the multiple-item questions. For the sake of accuracy, it should be mentioned that the matrix questions employed by

Toepoel et al. (

2009) were constructed using a five-point Likert scale, which requires more width and length than the matrix questions composed of visual analogue scales that are going to be used in this study.

By summarizing the above information, we can see that matrix questions are beneficial for collecting information about the different features of the same latent variable and reducing the survey time. However, the length of the matrix questions might negatively affect the survey results. Shortening the matrix questions might be a solution to better data quality; however, it must be done consciously; since it is a frequent case, insights on the importance of large parameter sets are necessary, and such a splitting might increase information uncertainties. Thus, a data processing technique capable of reducing these uncertainties of this type is required.

The VASMA (visual analogue scale matrix for criteria weighting) methodology was recently proposed by (

Lescauskiene et al. 2020) to analyze data collected via matrix questions consisting of visual analogue scales (VAS scales). This survey-based criteria weighting methodology combines objective entropy weights and subjective criteria weights calculated by the WASPAS-SVNS multi-criteria decision-making technique to reflect the psychometric features of the VAS scales. Moreover, VASMA does not require the respondent to answer all the questions in the VAS matrix and exploits the non-response data information for the objective weight calculations. The multi-criteria decision-making approach WASPAS-SVNS is used for the calculation of the subjective weights’ in the VASMA methodology. Recently, the WASPAS SVNS method as well as other multi-criteria decision methods (

Liao et al. 2022;

Jencova et al. 2022;

Baležentis 2022;

Lukyanova et al. 2022;

Ginevičius 2023) have been used for various multi-criteria decision-making tasks (

Bausys et al. 2020;

Baušys et al. 2020;

Friesner et al. 2016;

Mardani et al. 2020;

Zavadskas et al. 2019), and its application possibilities continue to grow. The WASPAS-SVNS application in the VASMA criteria weighting methodology is constructed to reflect the psychometric features of the matrix questions consisting of the VAS scales and analysis of both the ordinal and nominal information of the criteria valuations.

However, the original VASMA weighting technique was applied in study cases where 12 to 14 items in total had to be assessed according to their importance to the analyzed problem of crowdfunding campaign selection (

Lescauskiene et al. 2020;

Venslavienė et al. 2021). When matrix questions consisting of 14 or fewer VAS scales do not require scrolling, the size of the matrix question does not affect the quality of the survey data. Nevertheless, there are many situations in life when the larger sets of related criteria must be assessed for research purposes. Thus, in this paper, we propose adapting the VASMA methodology, which can be applied to analyze and compare the importance of the criteria of the large parameter sets. This adaptation is called VAS-MA-L and is explained further.

3.1. The VASMA-L Methodology Suitable for Large Criteria Sets

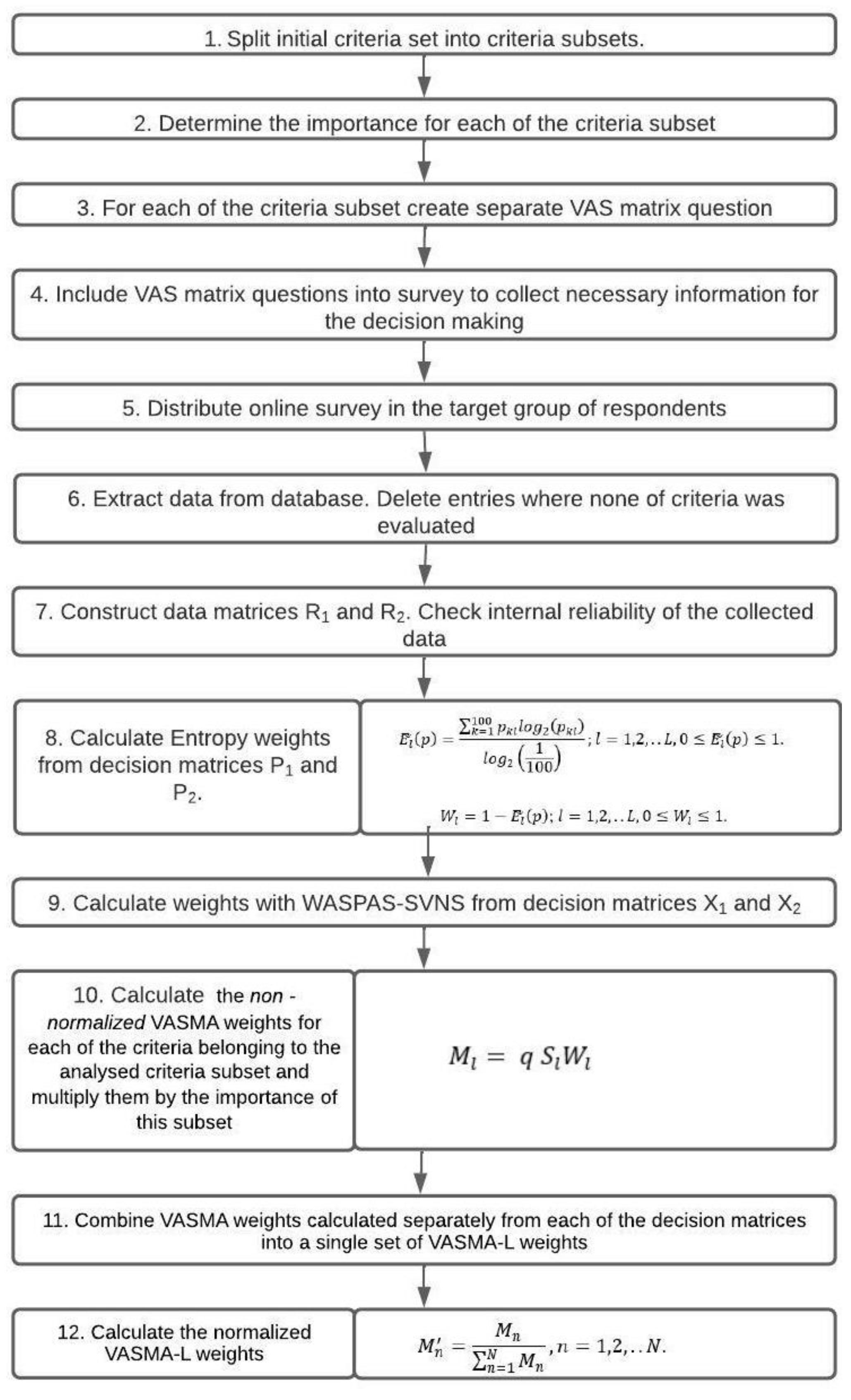

VASMA-L is a modified weights method, where weights are calculated from a large criteria set, splitting it into smaller data sets and later combining them to compare criteria importance. Below, the entire procedure for this method is described.

Step 1. Split the initial criteria set into criteria subsets , where , and . For instance, if g = 3 and N is the total number of the analyzed criteria, then , and . Because of the possible cognitive overload of the human memory, the amount of the criteria in each of the subsets is recommended to be 10 ± 4 items.

Step 2. Determine the importance for each of the subset . All the determined weights should follow the rule . An expert-based methodology like SWING, DR, or even AHP can be employed for this purpose.

Step 3. For each of the subset , create a separate VAS matrix question and include all of them in the same survey. Each of the matrix questions should be presented one after the other, with a clear title distinguishing them in between.

Step 4. Spread the survey among the respondents of the target group and record the data collected from each of the matrix questions into the separate decision matrices .

Step 5. For each of the , calculate the non-normalized VASMA weights M1, M2, … .

Clean the data and update the decision matrix R. Since survey respondents are not required to assess all the criteria in the analyzed VAS matrix question, answers with some of the non-response levels should not be deleted without additional consideration.

Check the internal reliability of the data recorded into the decision matrix R. If appropriate, continue the calculations.

Calculate the objective weights

for each of the criteria

l belonging to the analyzed data set by applying the information entropy theory:

Calculating of the subjective weights

for each of the criteria l belonging to the analyzed data set and applying the WASPAS-SVNS multi-criteria decision-making technique and the psychometric features of the VAS scales,

Lescauskiene et al. (

2020) explain the mathematics of subjective weights.

Calculate the non-normalized VASMA weights

for each of the criteria

l belonging to the analyzed criteria subset and multiply them by the importance

of this subset.

Step 6. Calculate the global VASMA weights. Combine local VASMA weights calculated separately from each of the decision matrices

into a single set of VASMA weights

consisting of N items. For the previous example, when g = 3 and

,

, the set

can be described as

Step 7. Normalize global VASMA weights

All of the data collection and processing steps required to employ the VASMA-L methodology for the survey-based preferences elicitation process are shown in

Figure 1.

3.2. Data

Initially, the data was collected from various literature to collect all relevant success factors for blockchain-based crowdfunding. All found success factors were summarized in

Table 1. Some success factors were merged due to their similarity. The final success factor list of the 18 most important success factors was used in the survey of the target group of respondents. Moreover, success factors were split into two groups according to their relevance to the specific crowdfunding type. According to the literature, we grouped six success factors that fit both financial and blockchain-based crowdfunding types. For the second success factor group, we took success factors that specifically fit blockchain-based crowdfunding, 12 success factors in total. The split should be done due to the fact that it is hard for respondents to evaluate all 18 success factors at once, and all criteria items should fit in one screen without the necessity of scrolling (

Baušys et al. 2021;

Lescauskiene et al. 2020). The final groups of success factors are given in

Table 2 and

Table 3. These two lists of success factors will be used in survey matrix questions, and they perfectly fit onto one screen: a computer desktop or a mobile device (

Toepoel et al. 2009).

It is planned to combine results from both groups to find out the importance of specific success factors for the whole success factor group.

3.3. Blockchain-Based Crowdfunding Campaign Criteria Evaluation Based on VASMA-L Methodology

Blockchain-based crowdfunding and cryptocurrencies have become novel and fascinating opportunities for investors worldwide. An increasing number of such crowdfunding campaigns have attracted specific attention from investors. However, it is unclear how to find the best blockchain-based crowdfunding campaigns to invest in. Since a high variety of criteria impact the decision to invest, the best option would be to ask the blockchain investors what criteria they consider the most important. Therefore, an eight-question survey was created for the target group of respondents. Two VAS matrices were placed as the third and fifth questions, where respondents were asked to indicate the importance of specific factors when selecting a blockchain-based crowdfunding campaign to invest in. Six and twelve criteria (eighteen in total) adapted from the analysis were presented in VAS matrices.

Overall, 36 expert individuals answered the online survey. Two respondents were removed in the data cleaning phase, as one was marked as an outlier, and the other did not evaluate very many factors. The demographic profile of respondents is given in

Table 4, and the proof of expert knowledge is revealed in

Table 5.

The demographic profile of respondents (

Table 4) shows that the blockchain-based crowdfunding investors are mainly males (74%) aged from 25 to 30 years old. Moreover, these investors have high levels of education, such as bachelor’s or master’s degrees. When considering the knowledge about blockchain-based crowdfunding (

Table 5), all respondents knew what blockchain-based crowdfunding is. Additionally, 91% of respondents had tried at least once to invest in blockchain-based crowdfunding campaigns. Finally, they were asked to mention some blockchain-based crowdfunding platforms if they know of any. The most popular platform Tecra Space was mentioned four times, three platforms (Bitfund, Coinlist, and Kickstarter) were mentioned two times, and four platforms (Revolut, Binance, Crypto.com, and Huobi) were mentioned once.

3.4. Data Extraction

Since there were two success criteria groups, the data were collected from two VAS matrices and automatically transformed to the data matrices R

1 and R

2, where columns characterize the set of criteria, and rows represent the respondent’s ID (

Table 6). Values with r

nl = 0 were considered as cases with non-response values.

Data descriptive statistics from VAS matrices were found using one of the statistical software packages and are presented in

Table 7. As given, the factors were evaluated by all 34 respondents that are analyzed in this study.

Despite the fact that all respondents evaluated all the factors, the reliability of the data was checked. Here, Cronbach’s alpha was used to control the internal reliability of the collected data. The total Cronbach’s alpha reliability coefficient was 0.8071. This means that the total internal reliability of the collected data is very high. Normally, it is considered to have reliable data if Cronbach’s alpha is 0.70 or above.

4. Results

Calculation of the entropy, the WASPAS-SVNS, and VASMA-L weights: Entropy weights describe the objective part of the VASMA weights. To calculate entropy weights, first, decision matrices P1 and P2 should be built from data matrices R

1 and R

2. The detailed description and matrix P construction and entropy weights calculation are provided in

Lescauskiene et al. (

2020).

The final measures of entropy weights and their ranks are shown in

Table 8 and

Table 9.

The subjective part of the VASMA weights is covered by the WASPAS-SVN multi-criteria decision-making approach. To calculate subjective weights, decision matrices X1 and X2 should be shaped from data matrices R1 and R2. An explanation of the matrix X construction and how variables are found is given in (

Lescauskiene et al. 2020;

Venslavienė et al. 2021).

The final estimates of WASPAS-SVNS weights and their ranks are given in

Table 10 and

Table 11.

To calculate the global VASMA weights, the importance of each of the criteria sets C1 and CR was determined previously.

This is necessary since respondents assess criteria set C1 and CR through the VAS matrices presented in the separate webpage. While local VASMA weights are calculated from each matrix and allow for comparison of the criteria importance, comparing the individual parameters belonging to the separate criteria groups cannot be straightforward. To avoid inaccuracies and errors in the survey results, determination of the importance of the analyzed criteria sets is required to calculate global VASMA weights from VAS criteria matrices separately and not evaluate and compare criteria from different VAS matrices together.

Three experts representing the decision-makers, investors, and blockchain experts distantly participated in determining the importance of the criteria sets C1 and CR. Their assessments and the calculated DR weights are presented in

Table 12.

Finally, the global VASMA weights were calculated by applying Equations (3)–(5) of the VASMA-L methodology. The global VASMA weights and their ranks are presented in

Table 13.

The results show that the most important criteria are industry (C11), early investments (C15), and share of retained equity/token (C16), as they have the highest ranks and the highest VASMA-L weights (0.0779, 0.0675, and 0.0643). Moreover, these three criteria fall into the first criteria group. Conversely, the least important criteria are considered to be using Ethereum (CR2), KYC/pre-registration (CR5), and white paper availability, content, and multi-language (CR11), with VASMA-L weights 0.0425, 0.0442, and 0.0474, respectively.

5. Discussion

Using a visual analogue scale (VAS) matrix in online surveys, ranking information and importance value can be collected from a single question. In this study, the VAS matrix question was employed to identify the primary success factors that influence investors’ decisions to invest in blockchain-based crowdfunding campaigns. The results demonstrated that participants were able to evaluate and compare factors more effectively when they were presented with all of them in a single question. The research drew data from both online survey responses and expert evaluations, with the online survey specifically targeting investors in blockchain-based crowdfunding campaigns.

Moreover, expert evaluation was applied before the survey due to the factor group split and the importance of every success factor sub-group of blockchain-based crowdfunding campaigns. The expert evaluation revealed that the first criteria subgroup, which is valid for both financial and blockchain-based crowdfunding, is more important than the second sub-criteria group. The three most important factors with the highest weights and ranks fall in the first sub-criteria group. However, it is common for one criteria group to be more important than the other, and survey organizers understand that. That is why two separately assessed criteria sets should be joined carefully by employing the specific weights for the separate data sets. The modified weighting methodology VASMA-L helped compare two criteria groups together and evaluate them.

Results show that industry is the most important success factor to consider when selecting a blockchain-based crowdfunding campaign to invest in. Depending on the industry, specific crowdfunding campaigns might be more or less interesting to investors. This aligns with another study, where some campaign industry categories were chosen the most by investors (

Venslavienė and Stankevičienė 2021). However, in blockchain-based crowdfunding, ICO valuations are not different across industries (

Fisch 2019). Another very important success factor is early investments. Some studies find that early investments positively impact investment choices in both traditional and blockchain-based crowdfunding (

Lee et al. 2019;

Lukkarinen et al. 2016;

Vulkan et al. 2016). The third most important success factor, according to the VASMA-L weighting method, was the share of retained equity/token. This is in line with the literature, where it is discussed that a share of retained equity or token might influence the success of both financial crowdfunding and blockchain-based crowdfunding (

Cerchiello et al. 2019;

Colombo et al. 2015;

Mollick 2013;

Vismara 2016;

Zheng et al. 2017).

In conclusion, this research has identified three key success factors for investors in blockchain-based crowdfunding campaigns. These success criteria, as determined by the highest VASMA-L methodology rankings, can be helpful in guiding practical investment decisions in both financial and blockchain-based crowdfunding campaigns. Additionally, this modified methodology can be applied to various sets of criteria. The findings of this research also make a significant contribution to the academic literature on blockchain-based crowdfunding campaign success factors, as there are currently limited academic studies on this topic. The unique methodology utilized in this research, which selects success factors from diverse criteria groups for investment in crowdfunding campaigns, is a major strength of this study.

7. Conclusions

Blockchain-based crowdfunding has become an important strategy to finance endeavors and economic phenomena. Blockchain-based crowdfunding, being a new form of crowdfunding, is usually characterized by ICOs (Initial Cryptoasset Offerings) and STOs (Security Token Offerings). Frequently, blockchain-based crowdfunding and traditional crowdfunding not only have lots of similarities but also have some differences as well. Consequently, the success factors that affect investments in traditional crowdfunding may not work for blockchain-based crowdfunding. It is crucial to know what success factors impact investors’ decisions to invest in one or another crowdfunding model, successful blockchain-based fundraising campaigns, and their evaluation. Therefore, the most crucial issue is to choose the proper criteria that show the value of the specific blockchain-based crowdfunding campaign.

Intending to determine possible success factors for blockchain-based crowdfunding campaigns, we looked mainly at traditional crowdfunding literature and tried to compare it to blockchain-based crowdfunding. We were able to find some literature discussing blockchain-based crowdfunding success factors as well. According to the existing literature on success factors of crowdfunding campaigns, they can be split into two groups: those valid for both traditional and blockchain-based crowdfunding models and those specific only to the blockchain-based crowdfunding model. Overall, six success factors are from the first group, and 15 success factors are only exceptional for blockchain-based crowdfunding. The whole list of 21 success factors was summarized in this research. Due to their similarity, the list of success factors was shortened to 18 success factors and applied to the survey. The list was split into two groups and used in two survey questions, as it is too hard for respondents to evaluate all of them at once.

This study used the modified VASMA-L weighting methodology to determine the main criteria affecting investors’ decisions to invest in blockchain-based crowdfunding campaigns. Initially, the VASMA weighting methodology combines entropy weights and the WASPAS-SVNS multi-criteria decision-making method for one criteria group. Two criteria groups for evaluation were needed, so the VASMA-L methodology was introduced in this research. The results showed that industry, early investments, and share of retained equity/token impact investors’ decisions the most when they choose to fund blockchain-based crowdfunding campaigns. These three factors fall into the group of factors that fit both traditional and blockchain-based crowdfunding models. This means that investors do not consider factors that are specific only to blockchain-based crowdfunding. Conversely, the least important criteria are using Ethereum, KYC/pre-registration, and white paper availability, content, and multi-language. They gained the lowest VASMA-L weights.

In the future, it would be interesting to apply this weighting methodology to more criteria groups or other aspects of blockchain-based crowdfunding, such as blockchain-based crowdfunding platforms, and see whether these criteria remain equally important.