Abstract

In this study, we examined the association between CEO greed and corporate social responsibility (CSR) performance with a particular emphasis on the curtailing role of corporate governance. We found that CEO greed has a negative effect on CSR, since an uncontrolled pursuit of personal gain typically reveals myopic behavior and the foregoing of investment in CSR by a greedy CEO. Additionally, we found that CEO compensation in the form of large bonuses, support, and restricted stocks options weakened the link between CEO greed and CSR. Concerning the power dynamics amongst CEOs (CEO duality and tenure), we found that CEO duality moderates the negative relation between CEO greed and CSR. We also explored the curtailing role of corporate governance (proxies represented by board gender diversity and board independence) in the association between CEO greed and CSR. Our findings show that gender diversity curtails the negative effect of CEO greed on CSR once it reaches critical mass on the corporate board. Gender critical mass also curtails the negative impact of CEO greed on CSR, even if the CEO exercises duality. Our findings have empirical and practical implications. This study contributes to the existing literature by exploring the relationship between CEO greed and CSR in Asia, a region not renowned for CSR performance. This study also provides evidence for the curtailing role of compensation and governance factors in the negative relationship between CEO greed and CSR.

1. Introduction

According to Greek Philosophy, greed is a classic social concept of humanity (Takacs Haynes et al. 2017), documented as a social evil by early theorists (St. Thomas Aquinas). In the twenty-first century, the overwhelming concerns of the 2007–2008 global financial crisis urged scholarly devotion to management science (Wang et al. 2011), behavioral finance, law (Olazabal and Abril 2008), and political economy (Collier and Hoeffler 1998). Whereas researchers relate greed to power (Takacs Haynes et al. 2017), wealth and self-centeredness (Delbecq 1999), and corporate governance practices (Page and Spira 2016), they have captured the particulars of the notion of greed but paid little attention to management research. Greed, which is defined as “the pursuit of excessive or extraordinary material wealth” (Hitt and Haynes 2018), is a personal motive branded by a form of self-centered conduct and a little apprehension for social welfare (Takacs Haynes et al. 2015). Although there is a predominant agreement on the destructive outcomes of executives’ greed, empirical evidence does not significantly corroborate these concerns (Takacs Haynes et al. 2019).

As a result, the current study investigates how CEO greed is connected with firms’ attitudes toward corporate social responsibility (CSR), the role of CEO power qualities in the association between CEO greed and CSR, and the role of board oversight in the Asian setting. Beyond legitimacy, CSR represents strategies that benefit shareholders (McWilliams and Siegel 2001). Directors set a company’s CSR policies (Waldman et al. 2006). A growing body of literature from the upper-echelons point of view suggests that a significant positive change in a company’s CSR policies shows that the company is stakeholder-oriented (Rusinova and Wernicke 2019). Based on the upper-echelons hypothesis, we argue that a CEO’s greed mirrors a firm’s lack of commitment to stakeholders. As a proxy for stakeholder engagement, CSR is a long-term strategic investment option with partial short-run returns (Jain and Jamali 2016). A greedy CEO focused only on short-term return schemes (Takacs Haynes et al. 2019) is more likely to overlook stakeholders’ interests. Upper-echelon conduct is influenced by extrinsic and intrinsic motivations (Wowak et al. 2017); thus, in this study, we hypothesize that the impact of CEO greed on CSR depends on the type of executive pay structures in place (Wowak and Hambrick 2010).

According to agency theory, CEOs’ motives toward stakeholders are directed by executive monetary motivations (Cavaco et al. 2020). Because a greedy CEO is wealth-oriented (Wang et al. 2011), CSR, as an investment choice for a greedy CEO, is likely to be particularly sensitive to pay mechanisms, such as bonuses or restricted stock (Boesso et al. 2017). Scholars have hypothesized that CEO greed is an “individual” trait or linked it to pay arrangements; the significance of power dynamics between CEO greed and the corporate board in a decision-making context has been entirely overlooked. The 2007–2008 global financial crises compelled modern organizational settings to adopt executive power balances. As a result, our argument is valid since corporate choices are usually the result of interaction between the CEO and the board of directors (Boesso et al. 2017). We propose a corporate governance mechanism to observe how CEO greed interacts with CEO power dynamics and governance procedures to influence CSR (Jain and Jamali 2016). Our results posit that CEO greed negatively impacts CSR and that the relation is amplified by CEO pay linkage with short-term targets (bonus).

In contrast, the negative association between CEO greed and CSR is controlled if a significant percentage of the CEO’s compensation is in the form of restricted stock (Sajko et al. 2021). In the context of CEO power dynamics, we found a negative relation between CEO greed and CSR. We also explored the role of board oversight (corporate governance mechanism) and found that gender critical mass mitigates the negative relationship between CEO greed and CSR. Board independence also mitigates the negative relationship between CEO greed and CSR, but only if a CEO does not chair the board.

This research makes several contributions to the literature. First, it adds to the current literature on the factors influencing executive (CEO) behavior (Neely et al. 2020). According to the study’s upper-echelon perspective, CEO greed shapes organizations’ CSR profiles. The study also replies to suggestions concerning reasons to consider CEO bonus (pecuniary) and restricted stock (non-pecuniary) compensation as antecedents of a firm’s strategic choice (CSR) (Wowak et al. 2017). Second, the study predicts the involvement of CEO power dynamics in the negative relationship between CEO greed and CSR. In this context, we contribute to the current research on power dynamics that magnify CEO greed. Third, by merging the upper-echelon viewpoint with agency theory, we highlight the restraining role of board supervision (corporate governance contingencies) in the negative relationship between CEO greed and CSR. Finally, we add to the corpus of literature in the Asian context. Existing research has primarily concentrated on Western contexts (Boone et al. 2022), although it is critical to investigate Asian contexts for external validity and generalization of findings. We present conclusive proof in this regard in the Asian environment. There is no “Asian CSR” paradigm—only a variety of diverse governance patterns of CSR behavior derived from business systems rather than development. We present nuanced evidence for the relevance of CEO greed in Asia. We discovered that organizations operating with greedy CEOs are less likely to adopt CSR than those operating with non-greedy CEOs, indicating the impact of CEO greed on CSR. One might expect that CEO greed would be curtailed by different mechanisms (compensation and governance). We found strong support for these arguments in the Asian context. In light of our findings, the myopic behavior of a CEO can be constrained in Asia, which lacks CSR performance relative to that of the rest of the world.

2. Theory and Background

Based on the dominant strategic management philosophy, one school of thought contends that senior executives greatly influence what happens to their firms. The opposing view emerged from population ecology (Hannan and Freeman 1977) and new institutional theory (e.g., DiMaggio and Powell 1983), which posits that executives have little influence because organizations are extremely inertial, swept along by external forces and constrained by a slew of conventions and norms. These points of view are conditionally legitimate, depending on how much managerial discretion or leeway is available. Discretion is exercised when there is no constraint and a considerable amount of means–ends ambiguity. We claim that discretion stems from environmental variables, organizational characteristics (e.g., a weak board), and the CEO. The implications of managerial discretion for upper-echelons theory are simple and profound: upper-echelons theory predicts organizational results in direct proportion to the amount of managerial discretion available. If there is a lot of discretion, managerial qualities show themselves in strategy and results. However, if discretion is lacking, executive traits are meaningless. Numerous studies have found that managerial discretion is an essential mediator of upper-level forecasts (Finkelstein and Hambrick 1990).

The current analysis adds to the discussion between two conventional viewpoints on a firm’s and a manager’s concerns and goals (Smith and Rönnegard 2016). According to shareholders, executives ought to act in their best interests in a free market. Thus, the interests of the upper echelon may result in agency conflicts if they are not aligned with stakeholders’ interests. Such conflicts may be more pronounced once an upper echelon exercises their discretion. Thus, the current research combines the upper-echelon and agency theories.

According to Husted and de Jesus Salazar (2006), executives have a social responsibility to increase the company’s profits while acting morally. Therefore, working in their owners’ best interests is within the purview of their fiduciary duties (Smith and Rönnegard 2016). According to the stakeholder perspective, the executive must consider all stakeholders’ rights while making strategic decisions (Freeman and Phillips 2002). Therefore, they are accountable to their firm’s owners and its primary stakeholders, such as its employees and customers, as well as its secondary stakeholders, such as neighborhood or non-profit groups (Boone et al. 2022).

This perspective claims that CSR encompasses all selfless actions that benefit anyone other than shareholders (McWilliams and Siegel 2011; McWilliams et al. 2006). CSR is a strategic choice that involves foregoing immediate profits to generate long-term shareholder value (Crifo et al. 2016). Despite taking differing stances on executive responsibility, both models are normative (Donaldson and Preston 1995). Notably, the justifications describe what CEOs ought to do. A growing corpus of studies indicates that CEOs’ motivations are heterogeneous in both perspectives (Aguinis et al. 2018; A. Gupta et al. 2018). As a result, we concentrate on the debate regarding what executives do (executive motive) instead of what they ought to do.

Greed is a relevant motivation for an empirical investigation (Takacs Haynes et al. 2017). According to our argument, excessive CEO greed typically transgresses stakeholders’ normative views. Executive avarice negatively affects shareholder interests (Takacs Haynes et al. 2017). When a CEO is self-centered and greedy, the company’s long-term success suffers (Murray et al. 2017). We extend the previously reported analysis by arguing that CEO greed harms ethical corporate behavior as assessed by CSR. According to Wang et al. (2011), the “black” end of the self-interest continuum is represented by greed, which is defined as an excessively selfish drive to maximize personal wealth (Takacs Haynes et al. 2017).

CEO greed goes against “higher moral” and common interests (Takacs Haynes et al. 2017). Extreme self-interest can be viewed as a continuum of “unnatural” self-interest (Takacs Haynes et al. 2017). According to Helfat et al. (2009), moral identity refers to a person’s innate propensity to uphold accepted norms of ethical behavior. Greed is closely tied to moral identity (Aquino and Reed 2002). It disregards societal welfare (Wang et al. 2011). As a result, we argue that greed may limit or lessen CEOs’ willingness to consider stakeholders’ interests when making strategic decisions for the company, which would significantly worsen CSR performance. In agreement with this argument, evidence indicates that the moral identity of the CEO plays a crucial role in CSR (Ormiston and Wong 2013).

Our justifications presented above unequivocally demonstrate that CEO greed negatively affects CSR performance; however, it is essential to look into other factors that may lessen or intensify this link. These corporate governance instruments capture the power relationships between the firm’s board and the CEO. According to the managerial entrenchment theory, the CEO frequently attempts to undermine the governance structure that stakeholders have imposed (Walsh and Seward 1990). Given that a company’s strategic decisions often result from communication between the corporate board and the CEO (Takacs Haynes et al. 2019), the governance environment regularly affects a greedy CEO’s counterproductive plans. A CEO may be able to indulge his avarice at the expense of the well-being of his stakeholders once he has established himself. The dynamic power viewpoint, which emphasizes the efficiency of board supervision and CEO authority, contends that corporate governance likelihoods consist of a sequence of power tradeoffs between the corporate board and the CEO (Zajac and Westphal 1996a; Helfat et al. 2009). However, under certain circumstances, the BOD might pay close attention, possibly discouraging self-centered CEOs from acting in their best interests (O’Sullivan 2009). Based on our main contention that there is a conflict between CEO greed and CSR, we argue that CEO authority facilitates CEO greed, whereas board monitoring restrains it.

3. Hypotheses Development

3.1. CEO Greed and CSR Performance

Based on the theoretical foundation, we suggest that the CEO greed has a detrimental impact on CSR performance because the CEO may disregard the impact of his strategic decisions on stakeholders’ wealth. A ruthless CEO’s pursuit of material wealth may allow him to seize control of company assets that may later be the subject of public concerns, threaten employee safety, or result in shocking consequences for nature (Takacs Haynes et al. 2015). Modern businesses are subject to aggressive pressures from stakeholders, including organizations, society, and the government, to contribute to social well-being (Wang et al. 2016). However, a stingy CEO is less likely to accept arguments unless these demands do not jeopardize the CEO’s wealth (Takacs Haynes et al. 2015). We contend that CEO greed is expected to have detrimental effects in the current economic climate. The corporate environment is frequently focused on the short term and leaves out initiatives that benefit the community (Hambrick and Wowak 2012).

Modern corporations emphasize short-term plans due to increased quarterly profit demands and a high CEO turnover ratio (Mizruchi and Marshall 2016). Furthermore, CEO compensation is frequently correlated with firm ROA/ROE, and businesses that fail to fulfill periodic objectives see their market value decline (Mizruchi and Marshall 2016). Because investing in societal causes requires making short-term financial sacrifices, a CEO with an excessive desire to amass considerable cash may value specific short-term benefits at the expense of long-term objectives (CSR) (Kang et al. 2016). As a result, we speculate the following hypothesis.

Hypothesis 1.

A greedy CEO negatively impacts a firm’s stance on CSR in Asia.

3.2. CEO Incentives, CEO Greed, and Firm CSR Performance

In agency theory, monetary incentives prompt executive behavior (Eisenhardt 1989). Different CEO packages primarily reward CEOs for achieving specific desired results. CSR scholars contend that specific reward packages direct a CEO to accept longer prospects, which might lead him to establish strong stakeholder associations (Bansal and Song 2017; Griffin 2017). Therefore, two types of CEO compensation packages are of particular significance: (1) monetary compensation (bonuses), which directs the CEO to short-run performance (Hou et al. 2013), and (2) non-pecuniary compensation, which is satisfied only after a long period (Johnson and Greening 1999). Empirical evidence of the association between CEO compensation packages and CSR has not yet been established (del Mar Miras-Rodríguez and Di Pietra 2018; Hart et al. 2015). Similarly, in the context of environmental performance, researchers have provided evidence of positive impacts (Berrone and Gomez-Mejia 2009) and negative associations (Berrone et al. 2010). Given this ambiguity concerning the rationality of CEO compensation packages (Wowak and Hambrick 2010), in this study, we theorize that a CEO’s propensity to support CSR as a strategic choice depends on CEO greed.

3.2.1. Pecuniary Compensation (Bonus)

We use annual bonuses as a proxy for pecuniary compensation for a performance-based instrument that links CEO pay to mostly economic objects (McGuire et al. 2003). A CEO has an asymmetric payoff structure: he is compensated for achieving yearly objectives without being penalized for failing to realize those objectives (W. Hou et al. 2013). This solidifies a CEO’s motivation to increase short-run performance to exploit his benefit. Stakeholder commitment necessitates longer prospects for economic payback accumulation (Flammer and Bansal 2017). Researchers have contended that CEO compensation associated with a high percentage of short-run performance (bonuses) negatively impacts CSR performance (Fabrizi et al. 2014). The payoff construction of a bonus gears a greedy CEO to accrue personal wealth based on short-run strategic choices when his compensation is heavily contingent on a bonus, hypothetically forgoing investor s’ interests. Therefore, this study argues that implementing more considerable bonus-based compensation than overall compensation may moderate CEO greed and short-term returns relationship. Consequently, we propose the following hypothesis.

Hypothesis 2a.

In Asian firm, the negative relationship between CEO greed and CSR performance is amplified if a higher percentage of a CEO’s compensation in the form of an annual bonus.

3.2.2. Non-Pecuniary Compensation (Restricted Stock)

Firms may offer restricted stock ownership, incentivizing CEOs to choose long-term opportunities. A CEO who accepts such pay engagement is prohibited from selling his stock under contract unless several conditions are satisfied, typically prolonged service for a predetermined period (Johnson and Greening 1999). This arrangement eases the urge to maximize short-term earnings by interweaving a significant portion of the CEO’s compensation with the company’s long-term success (Deckop et al. 2006). It is anticipated that the CEO will be more motivated by this longer-term pay horizon to understand the value of ongoing stakeholder support and acceptance (Johnson and Greening 1999). Therefore, a CEO is encouraged by the engagement of restricted stock to evaluate and care about the needs of stakeholders (Hambrick and Wowak 2012). Evidence suggests that longer-term CEO compensation leads to more robust CSR performance (Wernicke et al. 2022). Therefore, whether CEO compensation includes long-term motivations may affect the negative relationship between CEO greed and CSR. A CEO who holds a considerable portion of restricted shares may develop a strong desire to raise significant funds and may become particularly accustomed to the welfare of all stakeholders (Boone et al. 2022). Therefore, this study suggests that the CEO may be prompted to contemplate long-term strategic decisions by implementing a more significant restricted stock-based pay incentive relative to overall compensation (CSR). Based on these points of view, we propose the following hypothesis.

Hypothesis 2b.

In Asian firms, the negative relationship between CEO greed and CSR performance is moderated if a higher percentage of a CEO’s compensation is in the form of restricted stock.

3.3. CEO Power Dynamics

The techniques that allow a person to exercise influence and control are known as power dynamics, which explain how relationships between two or more people are impacted by power. Power in a particular relationship refers to a person’s ability to use willpower to achieve a goal (Shen 2003). Particularly in an organizational situation where a CEO has authority over the management and his position is crucial, the concept of power dynamics is particularly pertinent. The CEO’s ability to control the board is what gives him power. CEOs generally accrue more authority over time in their existing position, regardless of the various sources (Daily and Johnson 1997; Shen 2003). Additionally, since a dual function lessens the board’s influence, the CEO can gain authority if he chairs the board (Del Baldo 2012). Therefore, we include CEO tenure and duality as two power dynamics that may moderate the negative association between CEO greed and CSR.

3.3.1. CEO Greed and CEO Tenure

- A CEO’s power is mainly related to tenure (Song and Wan 2019). A newly appointed CEO is thrust into conditions he has never encountered before. To secure his authority over the board, a newly appointed CEO needs to be accepted by his corporate board (Rogler 2019; Shen and Cannella 2002; Zhou et al. 2020). A new CEO needs to meet the prospects of the board; otherwise, his power may be considerably weaker than that of an established CEO (Boone et al. 2022). Nevertheless, a CEO’s managerial expertise and discretion correlate with increased tenure (Combs et al. 2007; Bhuyan et al. 2020). A longer tenure also enables a CEO to take advantage of amplified expertise and discretion, and he may attempt to reinforce his power by selecting “compliant” directors (Westphal and Zajac 1995; Chen et al. 2019). The board may be unable to monitor a greedy CEO, so his tendency to accumulate excessive wealth through resource expropriation may become more severe. In turn, social welfare (CSR) may undergo more serious damage. Thus, we propose the following hypothesis.

Hypothesis 3a.

In Asian firms, a long CEO tenure strengthens the negative relationship between CEO greed and CSR performance.

3.3.2. CEO Greed and CEO Duality

A CEO’s discretion is supported whenever they serve as the board’s chair, weakening board oversight (Goergen et al. 2020; Hayward and Hambrick 1997) because a chair–CEO (a) leads the agendas of board meetings (Aktas et al. 2019; Ozbek and Boyd 2020), (b) manages the most critical information that emerges from meetings (DeBoskey et al. 2019), and (c) strengthens his powers by selecting compliant directors (Finkelstein and D’aveni 1994. In this way, the job of chair–CEO gives him the freedom to pursue benefits somewhat erratically (Taylor and O’Sullivan 2009). As a result, the likelihood of negative effects of CEO greed is enhanced. In contrast, when the roles of CEO and board chair are separated, such a CEO is more likely to have less power to influence the company board (Park et al. 2018; Schepker and Oh 2013; Zajac and Westphal 1996b). Since a CEO has unrestricted power in a CEO dual function, we contend that the negative relationship between CEO greed and CSR is more robust in such a scenario. Therefore, we propose the following hypothesis.

Hypothesis 3b.

In Asian firm, the negative relationship between CEO greed and CSR performance is stronger in the case of CEO duality in the Asian context.

3.4. CEO Greed and Corporate Governance

An appropriate corporate governance structure is required to help organizations run more effectively and morally. Board monitoring is the fundamental purpose of the corporate governance process. It is defined as the extent to which boards successfully oversee and control senior executives’ (especially the CEO’s) self-interests (Jain and Jamali 2016). Because of the inherent principal–agent contradiction and the fragile board oversight framework, greedy CEOs can serve themselves (Petrovic-Lazarevic 2008). Poor board oversight allows self-centered CEOs to help themselves, which concerns stakeholders. As a result, they are more prone to prioritize short-term goals that meet their selfish desires. However, various governance circumstances may necessitate board oversight. We emphasize board independence and gender diversity as corporate governance characteristics that lead to successful board monitoring (gender critical mass).

3.4.1. CEO Greed and Board Independence

Corporate boards should have independent directors for several reasons. Independent directors can be more objective since, unlike executive and owner board members, they are not as closely connected to the company (Bammens et al. 2011; Vandewaerde et al. 2011). Second, they provide a focused and in-depth understanding of the firm and industry (Gaur et al. 2015). Third, stakeholders can select a professional in a specific area in which the firm wishes to expand or is lacking or in an area that has become more critical owing to market deviations, new opportunities, or an unfortunate event (Vandewaerde et al. 2011). Fourth, they can be very helpful in resolving board member conflicts of interest. Fifth, they can serve as whistleblowers in the event of misconduct and as a tool to guide the company’s strategic decisions toward socially responsible practices (Oh et al. 2019). Independent directors allow for board monitoring and the possibility of restraining greedy CEOs’ discretionary authority, which may have negative implications regarding CEO greed and the negative impact of CEO greed on CSR. Recently, research has shown a positive effect of board independence on business performance and board oversight (Helfat et al. 2009).

Additionally, an outside director is more motivated to promote his position as a director (Helfat et al. 2009), so we believe that his presence will restrain the CEO’s greedy self-interest and drive the company toward moral decisions such as CSR. Increased independent director representation can help prevent the devastating effects of CEO greed. Based on these viewpoints, the negative interactions between CEO greed and CSR will be lessened when the board’s independent monitoring system restrains greedy CEO authority. Therefore, we propose the following hypothesis.

Hypothesis 4a.

In Asian firms, the higher the level of board independence, the weaker the negative relationship between CEO greed and a firm’s CSR performance.

3.4.2. CEO Greed and Gender Critical Mass

Companies with women in leadership may emphasize stakeholder well-being, boosting CSR performance, given the opportunities for the social role (Adams et al. 2015; Terjesen et al. 2009). Given these insights, women are more likely than men to be interested in CSR. The career paths of the two sexes also vary, and women frequently have to apply for governance positions in a longer and more onerous manner ((Bruna et al. 2019; Terjesen et al. 2016). However, academics link their leadership responsibilities to social welfare (Yarram and Adapa 2021). Due to this association, women may focus more on CSR performance in their firms. However, the token status may be implied by including one or two female directors on corporate boards (Mavin et al. 2016; Yarram and Adapa 2021).

On the other hand, a critical mass of female directors can actively balance the corporate board and express their various competencies when defining the business strategy. We contend that gender critical mass is a two-edged sword in the context of the negative relationship between CEO greed and CSR. First, their presence enhances board monitoring because of their more significant attendance percentage, interest in essential topics, and long-term outlook (Joecks et al. 2013). Second, they must reject policies that are not stakeholder-focused on their social role prospects. In gender politics, the critical mass theory is described as the critical number of persons required to affect policy and make a difference not as a token but as an influential body. This figure has been set at three before women can make a significant difference in decision-making (Rehman et al. 2020). Therefore, we anticipate that board gender diversity will impact a firm’s strategic decisions toward stakeholders and constrain the CEO’s greedy behavior (such as CSR). Therefore, we propose the following hypothesis.

Hypothesis 4b.

In Asian firms, gender critical mass on corporate boards weakens the negative relationship between CEO greed and CSR performance.

4. Research Perspective in Asia

Ecological deterioration, from forests to fisheries; human health difficulties; and freshwater shortages limit economic growth and poverty reduction in some parts of Asia, despite four decades of high economic expansion. Poverty is a concern because many impoverished people live on less than USD 1 daily. Many economies have growing income disparity, which may promote social unrest and hinder human capital growth (Khan 2019; Khan et al. 2019). This requires native business concerns to be more involved in sensitive decisions (Miotto et al. 2019) to ensure sustainable economic development and environmental and socioeconomic balance. CSR is a Western concept, and the managerial mechanisms to handle it have primarily been developed within organizations (Bhattacharyya 2019). Asia has played a minor role. Over the past two decades, the field has improved significantly. In Asia, CSR is primarily measured defensively, and firms must defend their reputation if they appear irresponsible (Kim and Jung 2020). CSR may also create durable competitive advantages by being proactive. Many firms struggle to grasp this idea’s positive/negative ramifications.

The literature warns against CEO greed, and the public values firms on short-term performance (ROA or Tobin Q). This is the norm, and shorter CEO tenure suggests corporations neglect CSR, which hurts long-term performance. Mainstream investors also seek speedy returns, although Asia’s stock-holding duration has decreased (Batten et al. 2017). Management uses CSR to increase profits at any cost unless stakeholders examine its long-term impact. A firm’s leaders wary of CSR can take advantage of this. Management salaries are linked explicitly to the company’s financial performance.

Asian corporate governance lags compared that in developed markets (Schuster et al. 2016). Asian CG has increased transparency and board diversity in the 21st century. Investors have become more vocal about Asian companies and governments. Regulators help shareholders become activists. Although gender gaps in education and the labor market sharing have narrowed, Asian women face a glass ceiling when accessing corporate boards, where their presence remains low (Lathabhavan and Balasubramanian 2017). Stakeholders are focusing on board gender diversity.

Thus, we investigated the moderating influence of CG in the negative relationship between CEO greed and CSR (board independence and gender critical mass). The region’s heterogeneity may affect CSR drivers. Thus, in this study, we conceptualize the general trend in research to examine the relationship between CEO greed and CSR by studying the moderating roles of CEO power dynamics and board supervision in Asia.

5. Data and Variables Description

Initially, we collected data for Asian firms based on data available in the Bloomberg ESG database from 2010 to 2018. As the number of firms that provide ESG data in the Bloomberg database increases yearly, our sample size will significantly increase. A description of the sample is provided in Table 1. The sample period is restricted to 2018 to avoid the impact of COVID-19 on firms’ policies. Furthermore, the data span is sufficient (9 years) to justify the arguments proposed in our thesis. Our dependent variable is CEO greed. We used hand-collected data on CEO greed from firms’ financial reports from 2010 to 2018. On the other hand, we collected data on financial variables from Thomson Reuters; we specifically observed each financial report for CEO pay to determine whether compensation was based on monetary or non-monetary basis.

Table 1.

Data description.

In this study, we applied several conditions. First, we included only Asian firms that provided data on ESG and for which data were available in the Bloomberg ESG database. Second, we excluded firms that were delisted during the sample period. Third, following earlier empirical accounting studies, we excluded all financial firms, such as banks, insurance companies, real estate firms, and regulated utilities (SIC codes 60–67 and 49) (Ding et al. 2007; Shen and Lin 2016; Shen et al. 2019) due to their different capital structures, accounting policies, and risk models. Fourth, we excluded firms with CEOs with less than three years of tenure, ensuring ample time for the CEO to impact the firm’s policies. Lastly, we included only countries with at least ten firms in our sample to avoid under-representation. For further clarity, we described the sample yearly basis in Table 1.

5.1. Measures of CSR Performance

In this study, we collected CSR data from the Bloomberg ESG database. The ESG database was developed by Bloomberg’s Environmental, Social, and Governance group in early 2008, and it makes available an assessment of firm ESG performance (Wang et al. 2018; Xie et al. 2019). The Bloomberg ESG data service, which started with the acquisition of New Energy Finance, covers more than 20,000 of the most actively traded public companies and provides ESG data on more than 11,700 companies in 102 countries, with over 310,000 subscribers to the Bloomberg Professional service in 2019. Bloomberg ESG disclosure scores rate firms based on their voluntary disclosure of non-financial data collected from CSR or sustainability reports, annual reports, and other public sources (such as the press) and through third-party research. The rating scale ranges from 0 to 100. It includes more than 100 indicators of ESG activities1, such as carbon emissions, energy use, waste disposal, resource use in the supply chain, workforce diversity, community relations, human rights, board diversity, shareholder rights, takeover defense, staggered boards, and independent directors. Furthermore, scores from third-party rating agencies such as RobecoSam, ISS Quality Score, and CDP Climate Disclosure Score are included to provide a retrospective overview of a company’s ESG efforts, as well as to offer comparability to industry peers2 (Taylor et al. 2018). In the current study, we used total CSR (environmental CSR + social CSR performance) scores as proxies of CSR performance (Nollet et al. 2016). The KLD database is the most often-used data source in the context of CSR measures and presents certain limitations. First, KLD only provides information on the number of initiatives and weaknesses for various CSR dimensions (Z. Wang et al. 2018). Second, it evaluates CSR outcomes by considering whether a company behaves on each CSR dimension using a 0–1 binary score for each item included in a CSR dimension, ignoring the magnitude of the impact. Third, both Innovest and KLD were acquired by Risk Metrics in 2009, with significant variations in data collection. These “new” KLD data are not openly comparable with the historical KLD data from before 2011. MSCI explicitly denotes this in its MSCI KLD STATS Methodology document.

Alternatively, the Bloomberg ESG database provides a more comprehensive evaluation of CSR achievements and overcomes some of the limitations of the KLD database. Furthermore, it includes data on a significant number of Asian firms, which enables researchers to widen their research scope. In addition, Bloomberg’s score covers the S&P 500 firms and serves as a proxy for actual CSR performance (Nollet et al. 2016; Taylor et al. 2018).

5.2. CEO Greed

To construct CEO greed, we used a novel method for obtaining a modest measure of CEO greed following (Takacs Haynes et al. 2017), who developed a novel approach to obtain a hidden estimate of CEO greed. They established the construct’s discriminant and predictive validity by conducting numerous meetings with experts, executives, and industry analysts. They empirically demonstrated that greed is a distinct and independent construct from related narcissism and hubris.

Following (Takacs Haynes et al. 2017), in this study, we used three proxies of unexpected CEO pay that calculate CEO greed: (1) the market-based reward, (2) pay relative to that of the highest-paid executive, and (3) expected pay established according to recognized predictors of executive reward. These measures signify realized unexpected wealth, which measures greed, i.e., a desire to gain undue material wealth. However, we used learned forms of pay to quantify greed, depending on modest indicators from archival data. At the same time, poor response rate and data reliability remain question marks in primary data due to the topic’s sensitivity. Abnormally high executive compensation presents a case in which the probability of solid pursuit of wealth is likely to be reflected since the BOD is responsible for evaluating and setting executive pay (Jeong 2019). The actual purpose of wealth is more likely to be represented by a high score on the compensation-based measure of greed.

Based on these viewpoints, we used annual compensation not considered a bonus, lasting inducement, or salary as a first proxy. This proxy captures CEO perks and related benefits, which are inclined to reveal agency costs and rent extraction, since stockholders usually ignore these forms of return to show pay for executive ability. Modern executives receive little prerequisite reward, and the poor correlation between perks and firm size supports this opinion (Takacs Haynes et al. 2017). Our second proxy represents pay inconsistency measured by the CEO’s cash pay scaled relative to the next most highly paid officer (Boone et al. 2022). A CEO’s position enables them to considerably influence the pay of top executives in the firm (Chatterjee and Hambrick 2007). Therefore, the more significant the pay gap, the higher the pay disparity. The pay disparity between CEO and top executives reveals the presence of greedy CEOs since such a disparity leads to uneven resource distribution, a key outcome of greed (Wang and Murnighan 2011). Our third proxy is based on an overpayment, i.e., unexplained CEO pay, measured as residuals from a CEO pay regression (Fong et al. 2010). Following the standardized approach, we used CEO level and firm control to obtain the residual from regression. We also included country and year fixed effects to avoid any misconception about the residual, and we are sure that the residual represents CEO overpayment logic. We used GMM regression to avoid any endogeneity concerns. The regression is expressed as follows:

This represents CEO overpayment, i.e., the excessive portion of CEO pay that a firm and its related aspects cannot not justify (Takacs Haynes et al. 2017). In Equation (1), we used the log of CEO pay. As we are interested in capturing the overpayment of the CEO, which firm-level aspects cannot justify, we used the residual from the above equation to construct a measure of CEO greed in line with earlier findings (Takacs Haynes et al. 2017). We created a CEO overpayment dummy equal to 1 if the residual is positive and 0 otherwise.

We constructed the CEO greed variable for regression by combining the three proxies through principal component analysis with varimax rotation (Takacs Haynes et al. 2019), a statistical method used at one level of factor analysis to elucidate the association among different factors. Rotation is mainly applied to maximize the variance shared among other items. The finding of PCA (principal component analysis) with varimax rotation depicted discriminant validity for our dependent variable (CEO greed). Three variables loaded on a factor, with significant loadings on the expected factor (CEO greed) and insignificant cross-loadings. In a single element, we found substantial loadings of all three pay-based measures of greed (eigenvalue = 1.17; 43% variance explained). Therefore, the factor weighting technique was used to compute a single estimate of CEO greed. We Winsorized variables at the 1% and 99% levels to mitigate outlier concerns.

5.3. Control Variables

We also include several control variables for CEO greed and CSR performance variances. We controlled for the firm’s size, measured as the natural log of total sales (Gupta and Wowak 2017); age, measured as the difference between the year of observation and the year of incorporation (Tang et al. 2015); ROA, measured as the ratio of income before extraordinary items to the book value of assets (Tang et al. 2015); financial leverage, measured as the ratio of long-term debt to the book value of assets (Stevens et al. 2015); R&D expenses, measured as the ratio of R&D relative to total sales (McWilliams and Siegel 2000); and firm growth, measured as the compound annual growth rate of annual sales over five years (Gupta et al. 2017).

6. Regression Models

In this research, we applied the dynamic panel estimator proposed by Arellano and Bond (1991) based on the GMM. Many regression models have been employed in previous studies to empirically assess the relationship between board members’ qualities and CSR. In this regard, Cho et al. (2020) examined the impact of financial reporting conservatism on CSR using the ordinary least square approach. Similarly, Haque and Jones (2020) investigated the determinants of biodiversity initiative disclosure using a three-way fixed-effect model. However, these strategies do not consider the possible concerns of endogeneity. Estimates suffer greatly as a result of endogeneity. OLS and panel models (fixed and random effects) can provide biased and inconsistent parameter estimates in the presence of endogeneity. As a result, hypothesis tests can be deceiving or misleading. Only one endogenous variable could severely affect these models’ estimates. As a result, in this study, we transitioned from static panel data analysis to dynamic panel data analysis. The static model overlooks unobserved time-variant effects and the endogeneity of dependent variables, which may result in contradictory estimates. Dynamic panel data analysis requires a correlation between the lagged dependent variable and the model’s random disturbance term to account for dynamic effects (Wintoki et al. 2012; Altaf and Shah 2017). To account for the dynamic character of the interaction between the variables and control the endogeneity bias, in this study, we employ the Arellano and Bond (1991) dynamic panel model based on the generalized technique of moments. The dependent variable’s lagged value was introduced as an independent variable (GMM). We employed a generalized two-step method of moments (GMM) to overcome this issue. The GMM estimation technique produces a more robust result for dynamic panels than any other model (Arellano and Bond 1991; Arellano and Bover 1995; Blundell and Bond 1998). GMM estimation was used based on the following criteria:

- There is no exogeneity among the independent variables;

- GMM estimation addresses issues with heteroskedasticity and autocorrelation;

- It enables researchers to get around the issue with subpar tools (Wooldridge 2002).

The following prediagnostic tests were employed in this study:

- Wooldridge test to determine whether autocorrelation exists;

- White–Koenker test to determine if heteroskedasticity is present;

- Wu–Hausman test to determine whether endogeneity exists.

Other post-diagnostic procedures include those listed below:

- Estimates of AR (1) and AR (2) test whether autocorrelation is present or absent at AR (1) and AR (2), respectively;

- Instrument validity is checked using Hansen’s J-test;

- Wald statistics are employed to evaluate the model’s suitability.

The following regression model examines the association between CEO greed and CSR.

In model 1, we are interested in the direct relationship between CEO greed and CSR (Hypothesis 1). Firm controls are mentioned in Appendix A. represents the error term.

In model 2, we tested the role of CEO compensation as a moderator of the association between CEO greed and CSR. The interaction terms are used to justify Hypotheses 2a and 2b. We also controlled each model’s CEO incentives (restricted stock and bonus). Thus, models 2a and 2b are regressed with bonus and restricted stock, respectively.

In model 3, we tested the role of CEO power dynamics and corporate governance as a moderator of the association between CEO greed and CSR. The interaction terms justify Hypotheses 3a, 3b, and 4b.

7. Results

7.1. Descriptive Statistics and Correlation

Descriptive statistics and correlation are presented in Table 2. In addition, the variance inflation factor (VIF) is used to check the multicollinearity problem. We also provided the VIF value in Table 2. The value of the individual variance inflation factors (VIFs) ranges between 0.715 and 3.917, which is quite acceptable, as it is far below the generally accepted VIF of the range of 10 (Rehman et al. 2020; West et al. 2007). Hence, we are sure that our sample has a minimal threat of multicollinearity.

Table 2.

Descriptive statistics, variance inflation factor, and correlation.

7.2. CEO Greed and CSR Performance

We used the GMM (generalized method of moments) for analysis. The GMM approach addresses the endogeneity concern by including internal instruments (first differences of multiple lags on all right-hand-side variables). We used lags of t − 2 and t − 3 as instruments following Roodman (2009). Although the lag structure reduces our sample size observation, it minimizes any endogeneity concern in our model (Rehman et al. 2020). The dynamic panel model assumes that the random disturbance term is substantially correlated with the lagged dependent variable, allowing for dynamic effects to be accounted for (Wintoki et al. 2012). We adopted a two-step GMM estimation technique to address the endogeneity bias, which also addresses the issue of the dynamic of the variable association. Moreover, the Arellano–Bond test for autocorrelation and the Sargan (1958) over-identification test indicates the presence of autocorrelation. The number of instruments employed in the primary model was validated using AR (1) and Sargan (1958) tests. Several pre- and post-diagnostic tests validated the validity of the GMM model in the current investigation.

Table 3 shows the results of the association between CEO and CSR performance. The findings show that CSR (t − 1) is positively and significantly associated with CSR performance (β = 0.772, p = 0.000; refer to model 1 in Table 3). We found a 42.03% average change in CSR for one standard deviation in CSR (t − 1). In economic terms, a one-unit increase in lag CSR causes a 0.772 change in current-year CSR. Thus, a firm’s CSR performance is likely to be influenced by last year’s CSR performance. Furthermore, we found that CEO greed is a negative predictor of CSR performance (β = −0.117, p = 0.05; refer to model 1), in line with Hypothesis 1. Notably, the average change3 in CSR for one standard deviation in greed is −2.3%. This means that given a one-standard-deviation increase in greed, CSR decreases by 2.3%. The calculation demonstrates the economic significance of CEO greed concerning CSR performance within the sample firms. The literature has shown that a greedy CEO exhibits low or no apprehension for the well-being of the firm’s stakeholders and tends to forego CSR because it involves short-term financial sacrifices (Francoeur et al. 2017; Sajko et al. 2021; Takacs Haynes et al. 2017). This evidence provides support for Hypothesis 1.

Table 3.

CEO greed and CSR—model 1 and model 2 (a and b).

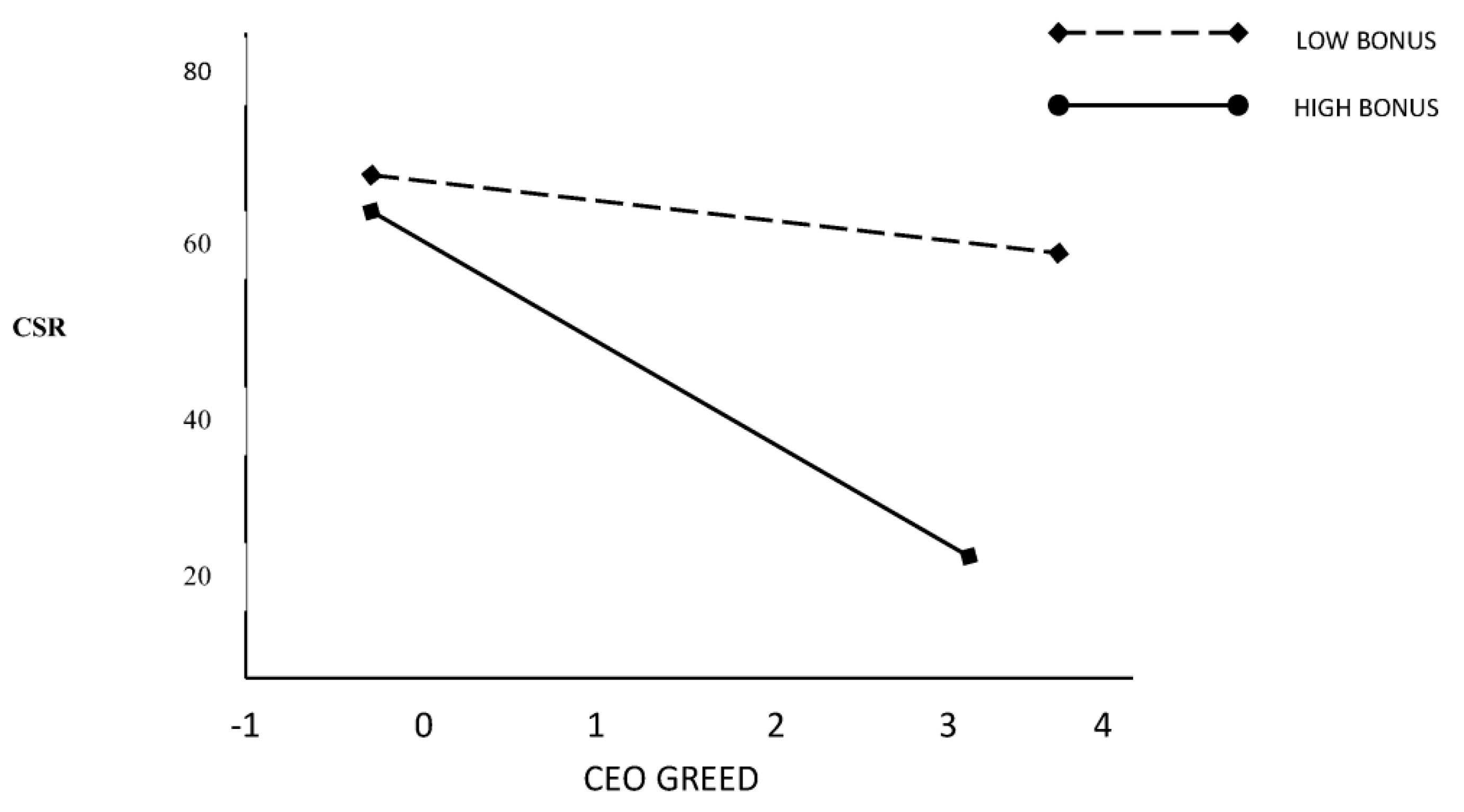

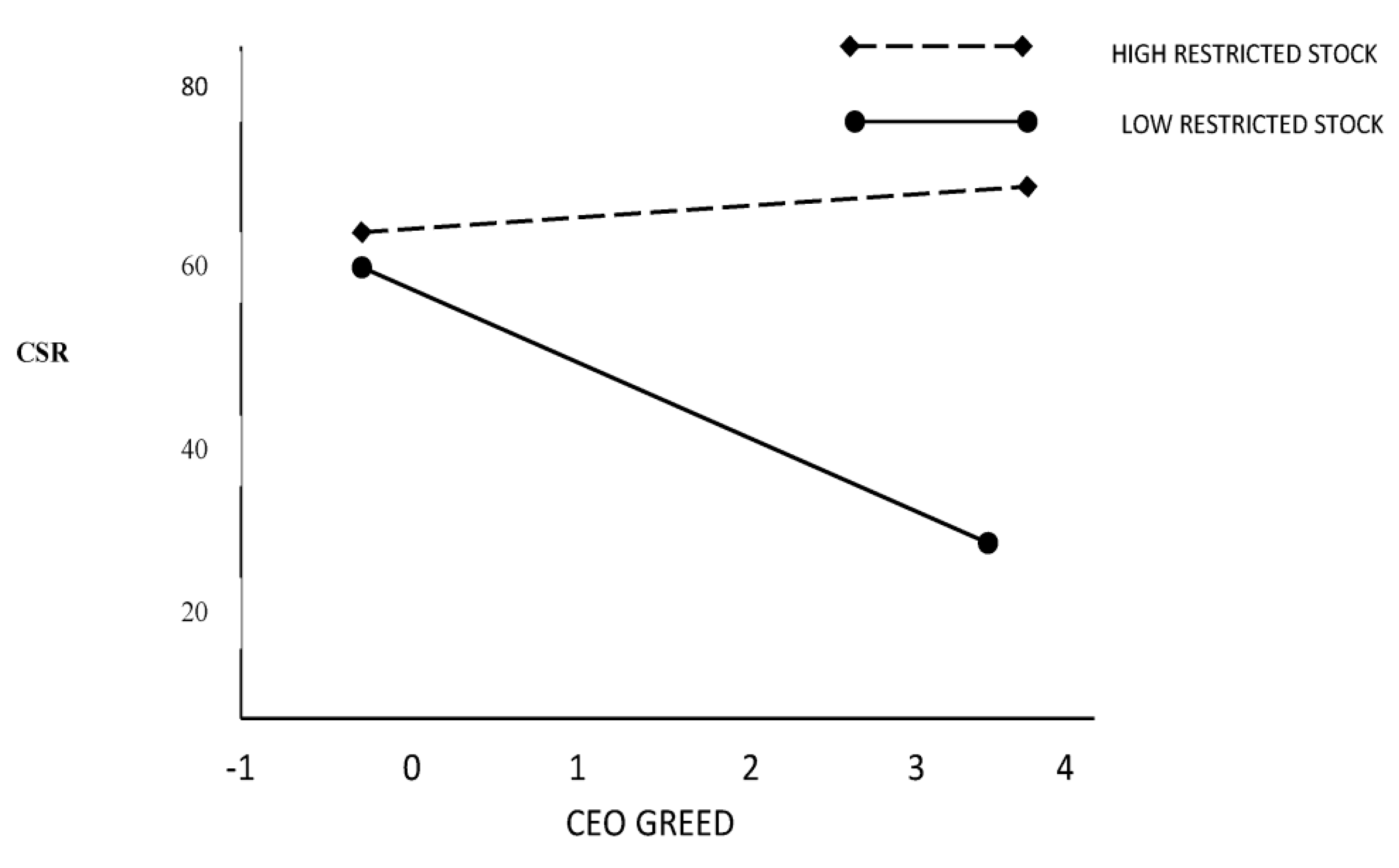

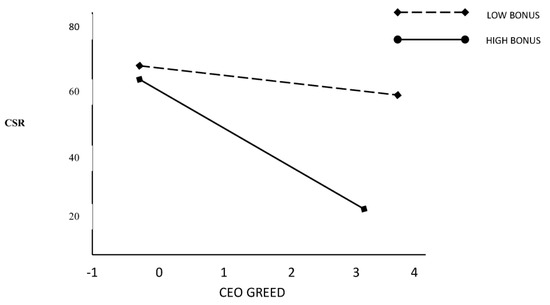

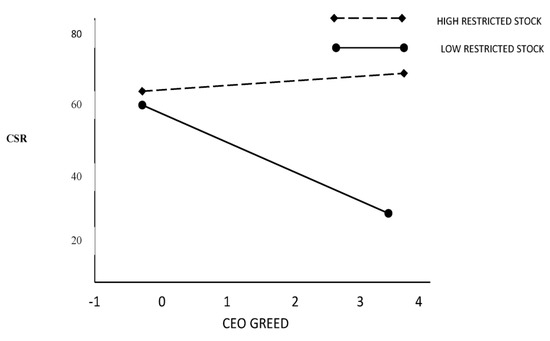

Our second argument is the person–pay and incentive interaction logic (Wowak et al. 2017). We found a negative relation between bonus (pecuniary compensation) and CSR performance (β = −0.094, p = 0.06; refer to model 2). In contrast, restricted stock (non-pecuniary compensation) has an insignificant association with CSR performance (refer to model 3). However, we are interested in CEO greed and CEO compensation interaction terms. The findings show that the interaction between CEO greed and the bonus is negative and significant (β = −0.235, p = 0.000; refer to model 2a. We observed a −6.4% average change in CSR for one standard deviation in the interaction term. This increase is more than the direct effect of the negative relation between CEO greed and CSR (i.e., −2.3%). Therefore, the negative impact of CEO greed on CSR is augmented by −4.1% (−6.4–(−2.3)) if the CEO’s compensation is in the form of a bonus. Hence, Hypothesis 2a is supported, i.e., that bonuses moderate the negative relationship between CEO greed and CSR (both in magnitude and significance level). Furthermore, the interaction term between CEO greed and restricted stock is negative and significant (β = −0.041 and p < 0.10; refer to model 2b). This finding shows that the introduction of restricted stock weakens the negative relationship between CEO greed and CSR, with −0.37% average changes in CSR for one standard deviation in the interaction term. Thus, the negative impact of CEO greed on CSR is curtailed by −2.3% ((−0.37)–(−2.3)) if the CEO’s compensation is in the form of restricted stock. Hence, Hypothesis 2b is also supported, i.e., that restricted stock curtails the negative relationship between CEO greed and CSR.

Figure 1 shows the association between CEO greed and CSR in association with low and high bonuses to visualize these interactions. We used median split criteria to define high and low amounts of bonuses. Thus, we created a dummy equal to 1 if a CEO receives a bonus in a year equals to the mean value of that year or above and 0 otherwise. Following a similar procedure, we also visualized the relationship between CEO greed and CSR at low and high levels of restricted stock options. Figure 1 and Figure 2 demonstrate the interaction effect of CEO greed with bonuses and restricted stock for high and low holding on firm CSR score, respectively.

Figure 1.

Interaction effect of CEO greed and bonus on CSR.

Figure 2.

Interaction effect of CEO greed and restricted stock on CSR.

Regarding CEO control, we found that CEO duality is a negative and significant predictor of CSR performance (p < 0.10), whereas CEO tenure and age are insignificant determinants of CSR performance. The results show that board independence is a positive and significant predictor of CSR performance. We used three measures of gender diversity to test its role in CSR performance. We found an insignificant impact of gender dummy and gender-2 on a firm’s CSR performance. It is important to note that the introduction of one additional female on the board changes the coefficient value from negative to positive, but their role is more pronounced and significant (p < 0.05) once they achieve the critical mass on the corporate board (3 seats).

Furthermore, the results of the firm’s control show that the firm’s size (p < 0.05), age (p < 0.05), and growth (p < 0.10) are positive and significant determinants of CSR performance. In contrast, financial leverage (p < 0.05) and cash flow volatility (p < 0.05) are negative and significant predictors of CSR performance. However, we found no significant impact of ROA and R&D on CSR performance. Our models also include year, industry, and country effects to control for year, industry, and country effects.

7.3. CEO Power Dynamics, CEO Greed, and CSR Performance

In the second stage, we explored the impacts of CEO power dynamics on the negative relationship between CEO greed and CSR. For this purpose, we used a GMM estimator; our main findings are presented in Table 4. Here, we are only interested in CEO power variables and their interaction with CEO greed; therefore, we did not report the results of the corporate governance control and firm control variables. We used different models for each interaction term. Findings show that only CEO duality is a negative predictor of CSR performance, whereas CEO tenure is an insignificant determinant of CSR. We found that the interaction term between CEO greed and CEO tenure is negative and significant at 5%. Therefore, CEO tenure does not weaken the negative relationship between CEO greed and CEO tenure in terms of magnitude (β = −0.098) − (−0.108) = 1%; refer to model 1) or level of significance. Hence, the finding fails to support Hypothesis 3a. In addition, the interaction term between CEO greed and CEO duality is negative and significant, implying that CEO duality amplifies the negative relationship between CEO greed and CSR both in terms of magnitude (9%, β = −0.199) − (−0.109) = −0.090; refer model 2) and level of significance (5% to 1%). Thus, Hypothesis 3b is strongly supported.

Table 4.

CEO greed, CEO power dynamics, and corporate governance—model 3.

7.4. Corporate Governance Contingencies, CEO Greed, and CSR Performance

In the third stage, we are interested in the role of corporate governance contingencies in the Asian context. We used two different models to analyze the impact of governance mechanisms on CSR performance. The results are presented in Table 4. The findings show that board independence and gender critical mass positively and significantly predict CSR performance at 10% and 1%, respectively. Furthermore, the interaction between CEO greed and board independence is negative and significant (p < 0.10). This finding predicts that board independence weakens the negative relationship between CEO greed and CSR both in terms of magnitude (6.4%; β = −0.115) − (−0.051) = −0.064; refer to model 3) and level of significance (5% to 10%). This implies that board governance significantly weakens the negative relationship between CEO greed and CSR. For further clarity, we introduced the interaction term CEO greed × CEO duality × board independence. The findings show that the interaction term is negatively significant (p < 0.01), but the significance level is not, and the coefficient does change to a reduced value. Based on the interaction terms, we conclude that board independence weakens the negative relationship between CEO greed and CSR only when the CEO does not chair the board. If the CEO is also the chair, his dual role dilutes the monitoring role of board independence. Therefore, we conclude that Hypothesis 4a is partially supported.

Furthermore, we found that the interaction term between CEO greed and gender critical mass is positive and significant (p < 0.05). Importantly, the interaction term CEO greed × CEO duality × gender critical mass is also positive and significant (p < 0.10; refer to model 6). These findings show that gender critical mass is a substitutive mechanism in the context of the negative relationship between CEO greed and CSR. Thus, Hypothesis 4b is strongly supported in the context of substitutive mechanisms rather than moderating/weakening roles.

8. Discussion of Main Findings

We integrated the literature on the upper-echelon theory, CSR, and corporate governance to examine the negative impacts of CEO greed on CSR. We intended to identify the mechanisms that may curtail negative effects. First, studies showed conflicting correlations between CEO greed and CSR in the Asian context. Our results show that CEO greed negatively correlates with CSR performance (p = 0.10). The findings support the notion that upper echelons use their position to follow their self-interest (Salazar and Raggiunti 2016). They forego CSR as a strategic choice to fill their greed. Additionally, in line with prior findings, bonuses amplify the negative relationship between CEO greed and CSR (Boone et al. 2022; Salazar and Raggiunti 2016). Unsurprisingly, a greedy CEO has little concern for the company’s stakeholders and tends to forego CSR (long-term investment) that entails short-term financial sacrifices (Hitt and Haynes 2018). Because short-term performance is typically viewed as the primary performance metric, many CEOs obtain lavish rewards (Perel 2003). Short-run performance often focuses only on shareholder returns at the expense of stakeholders, and monetary compensation (bonus) augments this focus (Y. Hou et al. 2018). When an entrenched CEO foregoes long-term strategies (CSR), which are the essence of modern businesses and the core of modern organizations, in favor of short-run objectives, his conduct shows tunneling behavior (Wowak and Hambrick 2010). Overall, these findings show the myopic behavior of CEOs as they pursue their self-interest.

When we used restricted stock options as a curtailing mechanism for the negative effect of CEO greed on CSR, we did not find a positive relationship between restricted stock and CSR. However, an interaction term between CEO greed and restricted stock option is our variable of concern. The interaction term between CEO greed and restricted stock demonstrates that restricted stock mitigates the negative association between CEO greed and CSR. A restricted stock option curtails tunneling behavior (Flammer and Luo 2017).

In the second step, we looked into the role of CEO power dynamics in the context of the negative interaction between CEO greed and CSR. We predict that CEO duality enhances the negative effect of CEO greed on CSR. Earlier studies showed negative correlations between CEO duality and CSR (Combs et al. 2007; Velte and Stawinoga 2020). A CEO who also serves as the board’s chair uses his position to further his interests (greed) at the expense of stakeholders and the company’s prospects. However, empirical evidence is lacking in investigating the association between CEO tenure and CSR and the amplifying role of CEO tenure in the negative association between CEO greed and CSR. Our findings contradict earlier findings, which may be attributed to the career concern of the CEO, as more extended CEO succession represents the trust of stakeholders (Walters and McCumber 2019).

Jain and Jamali (2016) stated that corporate governance represents the board’s effectiveness in monitoring and disciplining managers, specifically CEOs. We also tested the constraining role of board oversight in the context of the negative relationship between CEO greed and CSR in the Asian context (Helfat et al. 2009). According to our findings, the negative association between CEO greed and CSR in Asia is reduced by board independence. The effectiveness of board independence is compromised when a CEO also serves as board chair. This reduces agency conflicts in firms where the CEO pursues his self-interest in hunting for private gain. Therefore, when a CEO does not preside over the board, the board’s independence curtails negative interactions between CEO greed and CSR. Contrarily, the role of gender critical mass ensures board performance, regardless of CEO duality. This aligns with the notion that gender-critical mass enables the corporation to match business decisions with stakeholder interests strategically. Many arguments have been advanced in the literature as to why board gender diversity increases the quality of board governance. Greater gender diversity on boards leads to more diverse perspectives, which aid in correcting informational biases in strategy formulation and problem-solving. Similarly, resource dependency theory provides a theoretical framework for the role of the board of directors as a firm resource. Consequently, it may be claimed that female board members reduce agency conflicts by contributing diverse abilities, accountability, and perspectives and by introducing fresh dynamics to corporate governance. Our findings support the notion that gender critical mass is an important feature of board governance and is predicted to improve board effectiveness.

9. Additional Tests

We also addressed the concern that CEO pay may be higher due to human capital. We captured human capital through different measures (Western national, Western degree, Western experience, and local experience); the results are shown in Table 5. For clarity, we also introduced interaction terms of additional CEO measures. Our findings show that CEO nationality and Western experience have an insignificant impact on CSR. On the other hand, the CEO’s local experience negatively affects CSR (p < 0.10). Interaction terms are the main variables of concern. The interaction terms between CEO greed and two measure of human capital (CEO nationality (dummy) and CEO Western experience) are positive but statistically insignificant. These findings imply that CEO nationality and Western experience curtail the negative impact of CEO greed on CSR. However, the construct of human capital mitigates the negative effect of CEO greed on CSR.

Table 5.

CEO affiliation and CEO greed.

In contrast, the interaction terms between CEO greed and the other two measures of human capital (CEO degree and local experience) amplify the negative impact of CEO greed on CSR. Hence, CEOs with Western nationality and Western experience are less likely to be driven by greedy attitudes. Therefore, our argument does not hold for Western-national and Western-experienced CEOs in the Asian context.

10. Robustness of Our Findings

Our primary argument is centered on CEO greed. The negative relationship between CEO greed and CSR is based on the maxim that a greedy CEO sacrifices long-term opportunities (CSR) for short-term goals. To support our argument, we looked into the positive relationship between CEO greed and ROA. We used the GMM estimator; the results are shown in Table 6 below. According to the findings, CEO greed is a positive but insignificant predictor of short-term performance (β = 0.049 and p = 0.201; see model 2). We used the interaction term between CEO greed and bonus to support our argument. Our findings show a positive and significant association between CEO greed and ROA, supporting our view that monetary benefits amplify the relationship between CEO greed and ROA (β = 0.112 and p < 0.05; refer to model 2).

Table 6.

Robustness of main findings.

Our third argument is based on the role of corporate governance in mitigating the negative relationship between CEO greed and CSR. The results support the notion that a gender-critical mass on corporate boards assures a substitution effect for the negative relationship between CEO greed and CSR. We used propensity score-matching estimates to address potential sample selection biases and endogeneity concerns to reduce overlooked variables that could instantly determine gender critical mass and CSR performance. To accomplish this, we pair-matched sample firm-year observations between gender-critical mass and non-gender-essential-mass firms based on year, industry, and country effects (one-digit SIC code) and firm-specific matching criteria. Firm size, age, financial leverage, growth, board size, and board independence are all firm-level factors. We reran our baseline model (3) with our propensity score-matched sample; Table 7 summarizes our main findings. We discovered a minor difference in coefficient value; however, the direction and level of significance remain unchanged. As a result, the findings support our main findings, which are presented in Table 3, model 3, and its submodels.

Table 7.

Propensity-matching score results.

11. Conclusions

There is a widespread belief in academia, the media, and industry that excessive incentive packages presented to CEOs are to blame for much of the ethical misconduct in the business world (Moghaddasi and Sheikhtaheri 2010). These packages, combined with rising short-run performance and comparatively lax formal controls, incentivize CEOs to make any decision necessary to keep a firm’s short-run performance high (Sardana et al. 2016). Despite numerous criticisms of rampant CEO greed owing to its negative impact on ethics (CSR) (Francoeur et al. 2017) and the firm’s long-run outcomes (Ferrell et al. 2019), there is a scarcity of empirical evidence supporting the negative consequences of CEO greed. However, no empirical evidence is available in Asia. Asia has been criticized for playing a negative role in CSR. We addressed these concerns by emphasizing the role of CEO greed concerning CSR performance. We discovered that the negative relationship between CEO greed and CSR is more pronounced when a larger proportion of CEO pay consists of annual bonuses. In contrast, compensation in the form of restricted stocks mitigates the negative relationship between CEO greed and CSR performance.

Once the negative relationship between CEO greed and CSR performance was established, we investigated the amplifying role of CEO power dynamics. We empirically demonstrated that CEO duality amplifies the magnitude and significance of the negative relationship between CEO greed and CSR performance. We also addressed the concern that CEO pay may increase due to human capital. We used different proxies to measure human capital (Western National, Western degree, Western experience, and local experience). Our findings show that the interaction terms between CEO greed and two measures of human capital (CEO nationality and degree) are negative and statistically significant (p < 0.05; see model 3). These imply that a CEO’s nationality and degree do not curtail the negative association between CEO greed and CSR.

In contrast, the interaction term between CEO greed and other measures of human capital (CEO nationality (dummy) and Western experience) have positive but statistically insignificant coefficient values, implying that CEOs with Western nationality and Western experience are less likely to engage in short-term strategies. As a result, our argument does not apply to Western nationals or Western-experienced CEOs in Asia.

Our research focuses on the negative consequences of CEO greed and offers solutions to mitigate or substitute negative outcomes. Our findings show that board independence reduces the negative relationship between CEO greed and CSR only when the CEO does not chair the board. In contrast, even when the CEO chairs the board, gender critical mass replaces the negative relationship between CEO greed and CSR. This study provides an integrative perspective on how a CEO’s motives are amplified by presenting that a combination of CEO intrinsic motives (CEO greed) and extrinsic motives (monetary compensation) contours a CEO’s preference to build strong stakeholder associations. At the same time, we present empirical evidence to mitigate/substitute the negative consequences of CEO greed.

12. Theoretical Contributions

The study makes several theoretical contributions. First, in this study, we investigated the relationship between CEO greed and CSR. According to the upper-echelons perspective (Hambrick and Mason 1984), the massive adjustment of CSR reflects the heterogeneity of firm leaders’ objectives (Rusinova and Wernicke 2019). The study results also suggest that greedy CEO entrenchment to bonuses harms firm CSR in Asia because Asian firms operate in an environment where market pressure for CSR is relatively less concentrated. A company’s short-term performance is a primary metric used to assess CEO ability (Rusinova and Wernicke 2019). As a result, agency conflicts are more prevalent in these firms. Therefore, the negative relationship between CEO greed and CSR is more prevalent in Asian firms.

We provided empirical support for agency conflict based on agency theory. A greedy CEO with power dynamics (dual role) is more likely to pursue projects that satisfy his greed, resulting in severe agency problems. From an ethical standpoint, the situation is exacerbated by power dynamics (CEO duality), which amplify CEO greed and the negative relationship between CEO greed and CSR. As a result, this study contributes to the literature by contextualizing the possibility of the negative effect of CEO greed on CSR, allowing the CEO greed–CSR relationship to be better understood. Furthermore, the study results suggest that stakeholders should pay closer attention to board mechanisms that can reduce such dynamism. Based on the negative relationship between CEO greed and CSR, we propose a set of corporate governance likelihoods that can mitigate the negative effect of CEO greed on CSR, contributing to the development of a theoretical framework for the relationship between CEO greed and CSR that is comprehensive enough to express its complexity and sufficiently illuminating to make future predictive models of the effect of CEO greed on CSR feasible. Finally, the theoretical contributions of this study are novel in a unique context (Asia), as the issue and solutions are highlighted at an appropriate time. In the Asian context, this area is completely ignored, and we found only a few pieces of evidence supporting our logic in the West.

13. Suggested Solutions to the Problem

We offer radical solutions to the abovementioned problems based on our main findings. One radical solution to the vexing problem of CEO greed is to create compensation packages that reward CEOs for achieving desired outcomes in Asia. According to the 2018 Global Top 250 Compensation Survey conducted by FW Cook and FIT Remuneration Consultants (CEO and CFO), annual bonus levels are significantly higher than long-term incentives for executives in other regions. Our findings show that a firm with poor CSR performance must limit bonus compensation to meet the firm’s long-term objectives. Furthermore, restricted stock options are a mechanism whereby firms can mitigate the negative consequences of CEO greed. As a result, Asian firms must design their compensation packages to align with their desired outcomes.

CEO role duality is more prominent in Asia than in other parts of the world, and research suggests that it does not improve the monitoring capacity of boards. Another radical idea is be to limit CEO power (duality) so that the CEO cannot dilute board effectiveness (board independence). This limits potentially fraudulent CEO activity associated with lax board oversight, making CEO–board member relationships visible to all firm stakeholders. Both of these radical solutions are difficult for businesses and may result in unwelcome CEO turnover.

To alleviate this concern, companies can increase the number of women on their boards. A gender-critical mass on the board ensures a compensatory mechanism for the negative relationship between CEO greed and CSR, despite CEO duality. As a result, firms exposed to CEO greed and CSR performance concerns must ensure the presence of a gender-critical mass to address challenges in a planned manner. Simultaneously, we offer a radical solution to stakeholders (specifically policymakers) to reform corporate governance rules to ensure CEO non-duality and board independence or the presence of a gender-critical mass in firms with poor CSR performance firms to address these concerns. The rate of female representation on corporate boards is significantly lower in Asia than in other parts of the world; thus, stakeholders must ensure their representation on corporate boards. Finally, there is a need to encourage the nomination of Western nationals and experienced Western CEOs, as their presence alleviates CEO greed issues in the Asian context. Firms with experienced Western CEOs outperform other firms in terms of CSR performance.

14. Research Limitations and Future Research

Although our study makes significant contributions, it is critical to highlight some limitations to provide ample opportunities for future research. First, our analysis did not account for two CEO characteristics that have recently received considerable attention: narcissism (Petrenko et al. 2016) and hubris (Tang et al. 2015). Because we argued that CEO greed is a distinct concept, the comparative analysis would shed more light on these myths. Second, we did not account for CEO board membership, which could provide new insight into the negative relationship between CEO greed and CSR. Any CEO–board connection could be an additional power mechanism for the CEO to influence the board. Third, we could not identify many CEO founders to address the CEO power dynamic in the context of CEO founders. Fourth, we only used two corporate governance mechanisms as mitigation/amplifier mechanisms; it would be interesting to investigate the role of other corporate contingencies, such as audit independence, audit quality, etc. Fifth, our sample consists of firms listed for at least five years. This may introduce survivorship bias in our analyses. Future research might address the effect of survivorship bias on our findings.

Author Contributions

Conceptualization, S.U.R.; methodology, S.U.R.; software, Y.H.H.; validation, S.U.R. and Y.H.H.; formal analysis, S.U.R. and Y.H.H.; investigation, Y.H.H.; resources, S.U.R. and Y.H.H.; data curation, S.U.R. and Y.H.H.; writing—original draft preparation, S.U.R.; writing—review and editing, S.U.R. and Y.H.H.; visualization, S.U.R.; supervision, S.U.R. and Y.H.H.; project administration, S.U.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research receives no external funding.

Institutional Review Board Statement

The present study does not involve humans or animals.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

| Year | Description |

| CSR | CSR score obtained from the ESG database |

| Bonus | The annual value of the bonus scaled by all CEO compensation |

| Restricted stock | The annual value of restricted stocks scaled by all CEO compensation |

| Gender diversity | A dummy variable equal to 1 if there exists board gender diversity and 0 otherwise |

| Gender critical mass | A dummy variable equal to 1 if there are three or more females members on the corporate board and 0 otherwise |

| Board independence | Number of independent directors scaled by total directors |

| Financial leverage | Debt-to-equity ratio |

| R&D | The ratio of R&D expenses to total expenses |

| Firm age | The difference in the year of observation and year of incorporation of a firm |

| Firm size | Natural log of the firm’s total assets |

| Firm growth | The compound annual growth rate of annual sales over five years |

| Cash flow volatility | The standard deviation of operating cash flows |

| ROA | Net income scaled by total assets |

| CEO duality | A dummy variable equal to 1 if the CEO exercises a duality role and otherwise |

| CEO tenure | Age of the CEO |

| CEO foreign national | A dummy variable equal to 1 if the CEO is a foreign national and 0 otherwise |

| CEO foreign education | A dummy variable equal to 1 if the CEO has foreign education and 0 otherwise |

| CEO foreign experience | A dummy variable equal to 1 if the CEO has foreign experience and otherwise |

| CEO local experience | A dummy variable equal to 1 if the CEO has local experience and 0 otherwise |

Notes

| 1 | Bloomberg’s ESG score by construction considers the sustainability and ethical impacts of an investment within a company; therefore, it is directly related to spending financial resources in specific CSR areas (Bloomberg 2013). |

| 2 | To avoid any confusion, the ESG score considers governance performance related to CSR. More specifically, Bloomberg’s ESG score by construction considers the sustainability and ethical impacts of an investment within a company. The governance score, in particular, considers CSR-oriented issues such as “internally developed statements of mission or values, codes of conduct, and principles relevant to economic, environmental, and social performance and the status of their implementation”; “externally developed economic, environmental, and social charters, principles, or other initiatives to which the organization subscribes or endorses”; and “key topics and concerns that have been raised through stakeholder engagement, and how the organization has responded to those key topics and concerns, including through its reporting” (Bloomberg 2013). |

| 3 | This is done by multiplying the coefficient (−0.117) by the standard deviation of greed (0.053), then dividing by the mean value of CSR = (−0.117 × 0.053)/0.271 = 0.02288 = −2.3%. |

References

- Adams, Renée B., Jakob de Haan, Siri Terjesen, and Hans van Ees. 2015. Board diversity: Moving the field forward. Corporate Governance: An International Review 23: 77–82. [Google Scholar] [CrossRef]

- Aguinis, Herman, Luis R. Gomez-Mejia, Geoffrey P. Martin, and Harry Joo. 2018. CEO pay is indeed decoupled from CEO performance: Charting a path for the future. Management Research: Journal of the Iberoamerican Academy of Management 16: 117–36. [Google Scholar] [CrossRef]

- Aktas, Nihat, Panayiotis C. Andreou, Isabella Karasamani, and Dennis Philip. 2019. CEO Duality, Agency Costs, and Internal Capital Allocation Efficiency. British Journal of Management 30: 473–93. [Google Scholar] [CrossRef]

- Altaf, Nufazil, and Farooq Shah. 2017. Working capital management, firm performance and financial constraints: Empirical evidence from India. Asia-Pacific Journal of Business Administration 9: 206–219. [Google Scholar] [CrossRef]

- Aquino, Karl, and Americus Reed, II. 2002. The self-importance of moral identity. Journal of Personality and Social Psychology 83: 1423. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies 58: 277. [Google Scholar] [CrossRef]

- Bammens, Yannick, Wim Voordeckers, and Anita Van Gils. 2011. Boards of Directors in Family Businesses: A Literature Review and Research Agenda. International Journal of Management Reviews 13: 134–52. [Google Scholar] [CrossRef]

- Bansal, Pratima, and Hee-Chan Song. 2017. Similar But Not the Same: Differentiating Corporate Sustainability from Corporate Responsibility. Academy of Management Annals 11: 105–49. [Google Scholar] [CrossRef]

- Batten, Jonathan A., Harald Kinateder, Peter G. Szilagyi, and Niklas F. Wagner. 2017. Can stock market investors hedge energy risk? Evidence from Asia. Energy Economics 66: 559–70. [Google Scholar] [CrossRef]