Abstract

Many academic studies have focused on exploring various interactions between entrepreneurial orientation (EO) and firm performance, where, in general, the findings confirmed their existence to be of positive character. However, many authors indicated a need to further test the possibilities concerning the nonlinearity between EO and firm performance. Moreover, since many research studies on this topic have been conducted in developed countries, there is still a need for such studies in developing countries, especially in the region of southeast Europe. Therefore, the purpose of this paper is to investigate the existence of nonlinearity between EO and subjective financial performance among SMEs in southeastern European countries. Data was collected from decisionmakers of the 963 SMEs operating in Slovenia, Croatia, Bosnia and Herzegovina, Serbia, Montenegro, and North Macedonia. Proposed hypotheses were tested using hierarchical linear regression analysis. Research results confirmed existence of the positive direct relationship EO has on financial performance, including the positive effects on sales growth and profit-to-sales ratio. On the other hand, results have not confirmed existence of nonlinearity effects that EO has on financial performance, sales growth, nor on the profit-to-sales ratio. In other words, the observed relationship does not exhibit inversed U-shape characteristics among southeast European SMEs.

1. Introduction

Over the last three decades, entrepreneurial orientation (EO), also referred to as entrepreneurial posture, entrepreneurial style, or even corporate entrepreneurship, has received growing attention from academic researchers and managers, respectively (Wales et al. 2021; Putniņš and Sauka 2020; Gupta and Wales 2017; Covin and Wales 2012). Entrepreneurial orientation is seen as an organizational-level phenomenon, as Covin and Slevin (1991, p. 20) strongly argue that entrepreneurship should not be limited only to individuals, pointing out that organizations can, like individuals, “create new value for society through the thoughtful and productive assemblage of resources”. This entrepreneurial posture allows them to “renew themselves and their markets by pioneering, innovation, and risk taking” (Miller 1983, p. 770).

Considerable amount of research focused on the effects EO has on firm performance (Morić-Milovanović 2022; Putniņš and Sauka 2020; Gupta and Wales 2017; Wales et al. 2015). Generally, a positive relationship has been established (Morić-Milovanović 2022; Putniņš and Sauka 2020; Andersén 2010; Rauch et al. 2009); however, many authors question the linearity of such a connection (Lomberg et al. 2017; Gupta and Batra 2016; Kreiser et al. 2013; Wales et al. 2013; Tang and Tang 2012). Some studies found a linear relationship in one group of companies and presence of nonlinear relationship in others (Kreiser et al. 2013; Tang and Tang 2012; Su et al. 2011). These results imply the relationship may be context-dependent (Luu and Ngo 2019; Su et al. 2011) and under the influence of various external factors such as environmental hostility (Morić-Milovanović et al. 2021; Zahra and Garvis 2000), industry dynamism (Morić-Milovanović et al. 2021; Rauch et al. 2009) and investment intensity (Kohtamäki et al. 2019). Tang et al.’s (2008) findings indicate that the EO–performance relationship might be moderated by institutional framework. Thus, many researchers (Morić-Milovanović 2022; Morić-Milovanović et al. 2021; Šlogar 2021; Veselinović et al. 2021; Petrović et al. 2015; Morić-Milovanović 2012) from southeast European (SEE) countries have responded to Tang et al.’s (2008) call for further research on the EO–firm performance relationship, specifically in the context of transitional economies. Transitional economies are interesting for investigating the effects of EO on firm performance since they are characterized by volatility of the business and institutional environments, and the importance social capital has on political ties and government control of resources (Luu and Ngo 2019).

When looking at the conducted research in southeast Europe, in a study that included 105 manufacturing SMEs in Croatia, Morić-Milovanović (2012) analyzed collected data using multiple linear regression analysis and concluded that EO positively affects their financial and nonfinancial performance. Additionally, findings indicate that environment does not moderate the EO–performance relationship (Morić-Milovanović 2012). Petrović et al. (2015) analyzed data from 180 construction firms in Serbia using hierarchical linear regression and concluded national culture is significant moderator of the positive relationship between EO and small firm performance. With the use of structural equation modelling on a sample of 477 firms in a study by Veselinović et al. (2021), results imply that the positive effect of EO on the performance of Bosnia and Hercegovina’s SMEs strengthens as the intensity of competition increases. Veselinović et al. (2021) also found that the EO–performance relationship is partially mediated by total quality management. Morić-Milovanović et al. (2021), on a sample of 136 Croatian SMEs, using multiple linear regression analysis, showed the positive impact of EO on performance of service SMEs, expressed both as financial and nonfinancial performance indicators. Findings also imply environmental factors have no moderation effect on the EO–performance relationship (Morić-Milovanović et al. 2021). Šlogar’s (2021) results of the longitudinal study on 101 Croatian companies reveal positive and direct influence of EO on both innovativeness and firm performance and imply that the relationship was not significantly changed during the studied period (2016–2019). Moreover, Morić-Milovanović (2022), on a sample of 109 Montenegrin SMEs, investigated the effects EO dimensions have on small firm performance, where he found these effects to be in the shape of inverted U, and no effect of environmental turbulence (Morić-Milovanović 2022). Regardless of the growing number of papers, researchers still call for further studies with a larger data sets and a larger geographical scope to improve validity of the findings (Morić-Milovanović 2022; Morić-Milovanović et al. 2021; Šlogar 2021). Therefore, aside from the previously stated research results, the relationship between EO and firm performance could be more complex in transitional economies of southeast European countries compared to the developed economies of western Europe and the USA, which calls for further clarification of the (non)linear character of the EO–firm performance relationship.

Based on the previously stated research gap, the purpose of this paper is to examine the nonlinearity between EO and subjective financial performance among SMEs in SEE countries. Researchers use firm size, country, environmental turbulence, and industry effects as control variables to exclude their potential effects while observing the previously stated relationship. Firm performance is mainly focused on subjective financial indicators and thus measured as sales growth and profit-to-sales ratio. This research further explores the linearity between EO and firm performance within a different context to the one of big companies in developed economies and test the findings of the previous research conducted on SMEs operating within SEE on the bigger sample and with more control variables, thus in turn contributing to the current literature.

The next section lays out the literature review on EO and firm performance and presents the developed hypotheses for character examination when EO and subjective financial performance are placed in interaction. Section three introduces the methodology, followed by the presentation of obtained results in the fourth section. Findings, research implications, limitations, and future research are discussed in the final section.

2. Literature Review and Hypotheses

2.1. Entrepreneurial Orientation

So far, multiple scholars have tried to explain the concept of EO, resulting in more than ten different definitions (Covin and Wales 2012, p. 679). Miller (1983) claims “An entrepreneurial firm is one that engages in product-market innovation, undertakes somewhat risky ventures, and is first to come up with ‘proactive’ innovations, beating competitors to the punch” (Miller 1983, p. 771), while Lumpkin and Dess (1996) suggest that “EO refers to the processes, practices, and decision-making activities that lead to new entry” (Lumpkin and Dess 1996, p. 136). According to Miller (1983), the condition for presence of EO is a covariation of three subdimensions, namely proactiveness, risk-taking and innovation. Building on these attributes, Lumpkin and Dess (1996) added two new dimensions—competitive aggressiveness and autonomy—and claimed that, as opposed to Miller’s (1983) argument about covariance, EO is multidimensional and that subdimensions do not need to covary in order for EO to exist. Even though there is no consensus on the definition of EO, as Kohtamäki et al. (2019, p. 101) noticed, the majority of the literature perceives EO as “an entrepreneurial strategic posture strongly characterized by a willingness to proactively observe and capture new market opportunities”, which is reflected in organizational decision-making that favors entrepreneurial activities (Lumpkin and Dess 1996). This is the understanding of EO that is applied in this paper.

Miller and Friesen (1982) claim there are two types of firm attitudes towards innovation—conservative and entrepreneurial. While conservative firms reluctantly innovate, mainly provoked by serious external challenges, entrepreneurial firms always aggressively pursue innovation unless management is warned to slow down (Miller and Friesen 1982). A firm with high EO, according to Miller (1983), continuously engages in innovation, embraces risk-taking, and proactively pursues market opportunities. As described by Rauch et al. (2009), innovativeness is willingness to engage in the research and development of both new processes and products, risk-taking is connected to committing resources to such actions characterized by uncertain outcomes, while proactiveness is characterized as opportunity-seeking and anticipating future demand. Finally, it has to be noted that EO is a continuum with conservative firms on one side and highly entrepreneurial on the other, meaning all firms fall somewhere in between (Covin and Wales 2012).

EO is affected by many organizational elements such as organizational structure, culture, management’s philosophies, resources, and competencies, as well as strategic variables, which can support or hinder entrepreneurial behavior (Wales et al. 2021; Wales et al. 2020; Putniņš and Sauka 2020; Covin and Slevin 1991). Covin et al. (2006) point out how EO is a strategic construct that involves both management-related values and behaviors and firm-level outcomes. In line with this, many researchers have studied the variance in EO among different companies using upper echelon theory (Kiani et al. 2022; Zhang et al. 2021; Ameer and Khan 2020). For example, Bauweraerts and Colot (2017) studied family firms and found that while low levels of family involvement in TMT can positively affect EO, when family involvement in a board rises, the positive effects start to diminish due to agency and resource-based issues making a relationship curvilinear. On the other hand, Sciascia et al. (2013) addressed the issue of the dual effects of top-management team (TMT) diversity and found an inverted U-shaped relationship between generational involvement and EO, where positive effects of knowledge diversity on EO depend on the number of generations involved. This is because after a certain number of generations involved, task and relationship conflicts start to inhibit the information benefits from different perspectives (Sciascia et al. 2013). Their results imply that EO is highly influenced by the top-management team and its characteristics. In addition to internal factors, many scholars (Hina et al. 2021; Zaidi and Zaidi 2021; Wang et al. 2020; Zahra 1991) have found that EO is also influenced by external factors such as environmental dynamisms, hostility, and heterogeneity.

As a critical review by Andersén (2010) showed, researchers have mainly established a positive relationship between EO and firm performance. However, due to the dependence of the relationship on contextual factors (Basco et al. 2020; Morgan and Anokhin 2020; Gonzalez and de Melo 2018) and inconsistent findings related to linearity of the relationship (Alonso-Dos-Santos and Llanos-Contreras 2019; Laskovaia et al. 2019; Kohtamäki et al. 2019), there is a need to further examine the effects of EO on firm performance.

2.2. EO and Firm Performance

EO is perceived as a powerful determinant of different performance levels among firms (Abu-Rumman et al. 2021; Donbesuur et al. 2020; Covin and Slevin 1991). Zahra (1991) claim that generally, EO has a positive association with firm performance. According to research by Šlogar and Bezić (2020), EO has positive effects on innovativeness, which can have a significant positive influence on the value of a business. This is because innovation generates new products and processes that can be capitalized upon in order to better satisfy customer needs (Wang et al. 2020; Ghantous and Alnawas 2020; Wiklund and Shepherd 2005). Additionally, early entry into the market, which is also a characteristic of highly entrepreneurial firms, allows firms to occupy a larger market share and pose barriers to competitors in terms of brand recognition (Genc et al. 2019; Acosta et al. 2018; Wiklund and Shepherd 2005), technical leadership, and buyer switching costs (Chavez et al. 2020; Zhang et al. 2020; Zahra and Garvis 2000). Furthermore, as explained by Rauch et al. (2009), due to fast-changing business environment and short product lifecycles, businesses need to constantly innovate and seek new opportunities if they want to continue reap profits from business operations. In such an environment, innovativeness, risk taking, and proactiveness, all considered dimensions of EO, result in better firm performance (Wales et al. 2021; Putniņš and Sauka 2020; Rauch et al. 2009). Zahra et al. (1999) suggest that entrepreneurial orientation generally has positive effects on firm performance, whereas firm performance is measured in two primary dimensions—growth and profitability (Covin and Slevin 1991). The financial criteria of firm performance would include sales growth rate, return on assets, and profit-to-sales ratio (Covin and Slevin 1991).

Based on the extensive literature review, many authors have confirmed the positive direct effects of EO on firm performance, observed through both financial and nonfinancial indicators (Morić-Milovanović 2022; Putniņš and Sauka 2020; Kraus et al. 2012); however, there are plenty of studies that have not confirmed the effects to be positive (Messersmith and Wales 2013; Chaston and Sadler-Smith 2012). Moreover, not many studies have focused on observing firm performance solely through a nonfinancial prism, which calls for further clarification. Therefore, following the findings of the previous research laid out above, we presume that there is a direct positive effect of EO on firm performance and formulate following hypotheses:

H1:

Entrepreneurial orientation has a direct positive effect on subjective financial performance in southeast European SMEs.

H1.1:

Entrepreneurial orientation has a direct positive effect on sales growth in southeast European SMEs.

H1.2:

Entrepreneurial orientation has a direct positive effect on profit-to-sales ratio in southeast European SMEs.

2.3. Linearity of EO–Firm Performance Relationship

As mentioned earlier, previous research has resulted in inconsistent findings related to the linearity between EO and firm performance (Kohtamäki et al. 2019), especially in smaller firms. Even though many studies have confirmed positive interaction between EO and firm performance (Morić-Milovanović 2022; Putniņš and Sauka 2020), some researchers have argued the relationship is not linear, implying that there is a point of saturation after which the positive effects of EO on firm performance start to decline (Alonso-Dos-Santos and Llanos-Contreras 2019; Laskovaia et al. 2019; Gonzalez and de Melo 2018). Namely, EO mainly affects innovation performance (Alegre and Chiva 2013) by increasing experimentation within a company, which can lead to high returns but also significant failures (Kohtamäki et al. 2019). The general perception is that initially, by increasing EO, firms experience positive returns, and then after a certain point they start to experience negative returns from further increasing entrepreneurial activities (Zahra and Garvis 2000). Tang et al. (2008) also found that the EO–performance relationship is curvilinear, more specifically inversely-U shaped, and that indeed too much EO might have adverse outcomes on firm performance. Their findings imply that firms should not blindly strive to reach the highest EO possible, but rather find the optimal level to maximize the benefits resulting from EO (Tang et al. 2008).

Research by Su et al. (2011) implies that the linearity of the EO–performance relationship is impacted by the newness of the firm, while research by Wales et al. (2013) showed that small and large firms might experience different impacts of EO on performance. Su et al. (2011) found an inversely U-shaped effect of EO on firm performance in new Chinese ventures, while finding a positive and linear effect in established Chinese firms. Moreover, they found that without sufficient resources, social ties, and appropriate organizational structure, which smaller firms often lack, EO has negative effect on firm performance. In order to gain benefits from EO, firms should match EO with their available resources and organizational structure (Su et al. 2011). Wales et al.’s (2013) findings imply that in small firms, the effect of EO on firm performance is in an inverted U shape. They claim that increasing EO in small firms that, as opposed to large companies, do not possess critical resource orchestration capabilities is harmful for the firms’ performance. Additionally, their results indicate that ICT and network capabilities help small firms to overcome the lack of resources. Furthermore, research by Wales et al. (2013) implies that in order to gain benefits, EO needs to follow the growth in size, otherwise, if EO increase is not followed by growth in size, it would have harmful effects on the firm’s performance. Luu and Ngo (2019) conducted research on 137 Vietnamese firms and concluded that proactiveness and innovativeness have an inverted U-shaped relationship with firm performance, while on the other hand, risk-taking is positively related but does not have the shape of an inverse U. Additionally, research by Morić-Milovanović (2022) also showed that the EO–firm performance relationship in Montenegrin SMEs is inversely U-shaped.

Therefore, following the findings of the previously stated research results, we hypothesize that the relationship between EO and SME’s subjective financial performance is curvilinear, more specifically shaped in form of an inverted U. We formulate following hypotheses:

H2:

The relationship between EO and subjective financial performance is shaped as an inverted U for southeast European SMEs.

H2.1:

The relationship between EO and sales growth is shaped as an U for southeast European SMEs.

H2.2:

The relationship between EO and profit to sales ratio is shaped as an U for southeast European SMEs.

2.4. Moderators, Controls, and Context-Specific Factors Affecting the EO–Firm Performance Relationship

Some researchers argue that EO is not universally beneficial (Wiklund and Shepherd 2005) and question methodological limitations of core references upon which the premise of EO having positive effects on performance are based (Andersén 2010). Extensive meta-analysis by Rauch et al. (2009) showed that in general, EO and firm performance have a correlation coefficient of 0.242, which is a moderately strong positive relationship, but since EO accounts for only 22.38% variance in firm performance, the relationship is likely influenced by moderators (Rauch et al. 2009). The following paragraphs discuss moderating factors.

Already, Lumpkin and Dess (1996) argued that impacts of EO on firm performance is context-specific and depends on both organizational and situational factors. The literature indicates that the EO–performance relationship varies across different external environments and depends on access to resources (Hina et al. 2021; Zaidi and Zaidi 2021; Luu and Ngo 2019; Wiklund and Shepherd 2005). For example, research by Zahra and Garvis (2000) showed that the EO–firm performance (growth and profitability) relationship is positive; however, it is moderated by environmental hostility. Covin et al. (2006) found that the EO–performance relationship is contingent on strategic variables of decision-making, strategy formation, and strategic learning. Furthermore, since EO is a strategic orientation that requires large resource commitments, the availability of resources represents a significant factor when observing interactions between EO and firm performance (Su et al. 2011) coupled with network capabilities, which are critical to obtaining resources outside of the organization (Su et al. 2011). Kohtamäki et al. (2019) found that in a mature and investment-intensive context at lower levels of EO, there is no correlation with sales growth in small firms. However, from moderate to high levels of EO, supported by absorptive capacity (ACAP) and slack resources, a positive relationship with sales growth appears (Kohtamäki et al. 2019). The importance of ACAP increases at moderate to high levels of EO, because advanced knowledge is seen as a requirement for the successful exploration of new business opportunities that involve risky and innovative endeavors (Kohtamäki et al. 2019). The aforementioned information fits well with the findings of Sciascia et al. (2014) on the need for absorptive capacity to increase performance. Again, authors emphasized that the results are context-specific and should not be generalized.

Furthermore, Rauch et al. (2009) suggested that the relationship between EO and firm performance differs based on the firm size and industry. Smaller firms are more flexible, which enables adaptation and the seizing of opportunities, and usually there is stronger direct influence from top management due to a flatter organizational structure. Moreover, as Rauch et al. (2009) argue, EO has stronger impact on firm performance in industries that are more dynamic and where consumer preferences and technology experience rapid change, such as computer software and hardware, biotechnology, electric and electronic products, pharmaceuticals, and new energy (Rauch et al. 2009, p. 776). Additionally, the EO–firm performance relationship is also influenced by institutional framework (Su et al. 2015). For example, Tang et al. (2008) found that the Chinese institutional environment restricts the benefits of EO on firm performance and suggested that there is an optimal level of EO after which positive outcomes start to decrease, implying a curvilinear relationship. On the other hand, Seo (2019) studied the EO–firm performance relationship in Korea which, as opposed to the Chinese transition economy, is characterized by capitalism and a free market, and found that the EO–sales growth relationship is linear, while the EO–technology and product innovation relationship is inversely U-shaped.

So far, the EO–firm performance relationship has been widely researched on firm samples in Canada (Miller 1983), US (Wales et al. 2013; Covin et al. 2006; Zahra and Garvis 2000), Sweden (Wales et al. 2013; Wiklund and Shepherd 2005), China (Su et al. 2015; Su et al. 2011; Tang et al. 2008), Japan (Anderson and Eshima 2013), Korea (Seo 2019), and Finland (Kohtamäki et al. 2019), and since the EO–performance relationship is context-specific (Wales 2016; Lumpkin and Dess 1996) and culturally bounded (Rauch et al. 2009), the conclusions on EO–firm performance should not be generalized to other countries and regions without further investigation. Thus, this study contributes to the field by exploring the EO–performance relationship in southeast European firms. Furthermore, as argued by Wales et al. (2013), Su et al. (2011), and Wiklund and Shepherd (2005), EO might differently affect firm performance depending on the size of the company. Findings by Rauch et al. (2009) imply that the effects of EO on performance are higher in smaller companies due to flexibility and the stronger influence of TMT. This study specifically focuses on investigating the effects that EO has on the subjective financial performance of SMEs.

3. Research Method

3.1. Sample and Data Collection Procedure

Perceptual (subjective) data was collected from an online respondent survey sent via email to the email addresses of key decisionmakers within firms. By employing a key decisionmaker framework, we managed to utilize subjective reports from firm owners, firm directors, and their respective managements to measure EO. The sample firms were drawn from the databases of consulting companies operating in southeast European countries, namely: Slovenia, Croatia, Serbia, Bosnia and Herzegovina, Montenegro, and North Macedonia, where, according to the European Union definition of SMEs, a random sample of 9000 small and medium sized firms was taken. To test the proposed hypothesis, a self-administered questionnaire was developed, where the questionnaire was pretested with several small firm owners and directors to enhance external validity. Moreover, the questionnaire was translated from English to each of the official languages of each country, and then translated back into English to make sure there were no potential errors due to language differences. Out of 9000 firms that were selected in the sample, 963 firms responded and correctly filled out an email questioner, providing an effective response rate of almost 11%.

3.2. Measures

3.2.1. Controls

Country as a control variable was coded as the following: 1 = Slovenia, 2 = Croatia, 3 = Bosnia and Herzegovina, 4 = Serbia, 5 = Montenegro, and 6 = North Macedonia.

Firm size was controlled as the total number of employees within the firm following the European Union’s classification of SMEs.

Industry effects were controlled by classifying the industry in which the firm operates into eight different industry sectors according to the Statistical Offices of the observed countries. Industry sectors were classified as the following: 1 = agriculture, 2 = manufacturing, 3 = construction, 4 = transportation/communications, 5 = wholesale/retail, 6 = tourism/hospitality, 7 = financial and other services, and 8 = other.

Environmental turbulence was measured by using an eight-item, seven-point Likert scale of environmental dynamism (Cronbach’s α = 0.65) and environmental hostility (Cronbach’s α = 0.61) developed by Miller and Friesen (1982), where the authors adhered to the approach developed by Naman and Slevin (1993). The environmental turbulence index has a mean of 4.25, a standard deviation of 1.05, and a Cronbach’s α value of 0.63.

3.2.2. Independent Variable

Entrepreneurial orientation (EO) was measured using Covin and Slevin’s (1989) nine-item, seven-point Likert scale for assessing innovativeness (Cronbach’s α = 0.79), proactiveness (Cronbach’s α = 0.76), and risk-taking (Cronbach’s α = 0.80). The entrepreneurial orientation index has a mean of 4.26, a standard deviation of 1.13, and a Cronbach’s α value of 0.71.

3.2.3. Dependent Variable

Performance was measured with a modified version of an instrument developed by Gupta and Govindarajan (1984), where the respondents were asked to evaluate on a seven-point Likert-type scale the extent of importance and satisfaction with sales growth and profit-to-sales ratio. To minimize the potential impact of individual bias while assessing firm performance, authors adhered to the approach developed by Naman and Slevin (1993). Firm performance has a mean of 3.88, standard deviation of 1.49, and Cronbach’s α value of 0.81.

3.3. Analysis

Hierarchical linear regression analysis was used to assess the form and magnitude of the relationship between entrepreneurial orientation and firm performance. More precisely, to test the nonlinear effect (inverted U-shape) of EO on firm performance, whereas in the first step, control variables were included in the model, followed by an examination of the direct effects of EO on performance variables. In the third step, the curvilinear EO term was added to test the nonlinear effects. Inverted U-shaped hypotheses have traditionally been tested using significance levels for the square term of the observed variable. If the square term is significant and negative, then the observed relationship is considered as exhibiting an inverse U-shape characteristic. All variables were mean-centered to reduce the potential effects of multicollinearity and improve the interpretability of the results. Several robustness tests were applied to further test the reliability of the results, including multicollinearity, heteroscedasticity, and autocorrelation, where variance inflation factors, the Durbin–Watson statistic, and maximum Cook’s distance were well below critical values. Furthermore, a nonresponse analysis and common method bias analysis were conducted, where the results showed that nonresponse bias and common method bias were not present in this study.

4. Results

Table 1 displays the means, standard deviations, and correlation coefficients between the observed variables. As can be seen, correlation coefficients are relatively modest, ranging from −0.276 to 0.355. When observing the relation with performance, firm size (r = 0.153), turbulence (r = −0.065), and EO (r = 0.355) have statistically significant correlation coefficients. When analyzing the performance indices in more detail, the relationships are basically the same except for turbulence and sales growth, since the correlation coefficient between these two variables is not statistically significant.

Table 1.

Means, SDs, and correlations (n = 963).

The following tables, Table 2, Table 3 and Table 4, show three different hierarchical regression models. The first model entails only country, firm size, industry, and turbulence as controls. EO as an independent variable is added to the second model, showing its direct effect on firm performance in Table 2, sales growth in Table 3, and profit-to-sales in Table 4, thus providing answers to hypothesis H1, sub-hypothesis H1.1, and sub-hypothesis H1.2, respectively. The quadratic term of entrepreneurial orientation is added to the third model, providing answers to hypothesis H2 in Table 2, sub-hypothesis H2.1, and H2.2 in Table 3 and Table 4, respectively.

Table 2.

Results of hierarchical regression analysis for financial firm performance (n = 963).

Table 3.

Results of hierarchical regression analysis for sales growth (n = 963).

Table 4.

Results of hierarchical regression analysis for profit-to-sales (n = 963).

Robustness tests for the model showing the nonlinear effects of EO on performance (Table 2) are all below critical values since the Durbin–Watson statistic is 1.958, VIFs are lower than 1.2, and maximum Cook’s distance is 0.02, proving there are no issues with multicollinearity, heteroscedasticity, and autocorrelation. The same conclusion can be made for the other two models, where the Durbin–Watson statistic is 1.942, VIFs are lower than 1.1, and maximum Cook’s distance is 0.03 for the model with sales growth as the dependent variable (Table 3), and where the Durbin–Watson statistic is 1.934, VIFs are lower than 1.1, and maximum Cook’s distance is 0.01 for the model with profit-to-sales as a dependent variable (Table 4).

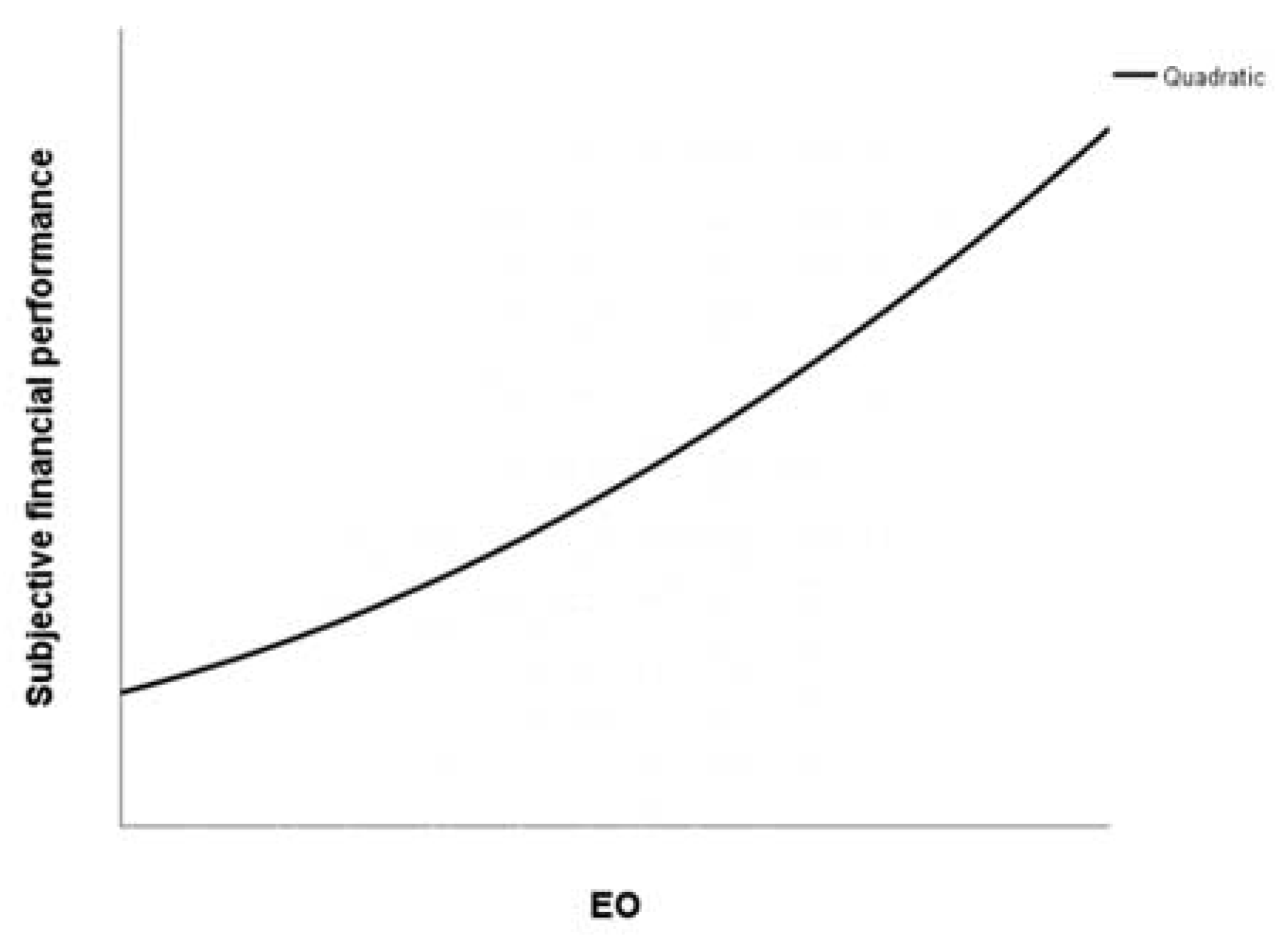

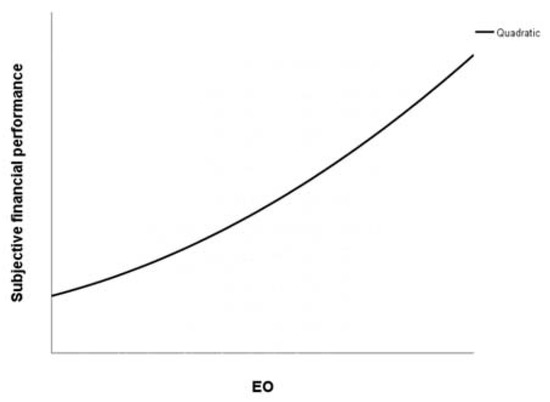

By observing the regression output in Table 2 in more detail, it can be concluded that firm size (β = 0.266, p < 0.01), EO (β = 0.517, p < 0.01), and quadratic term of EO (β = 0.056, p < 0.05) have a statistically significant positive effect on firm performance, while turbulence (β = −0.192, p < 0.01) has a statistically significant negative effect on firm performance. Therefore, there is enough statistically significant evidence to support hypothesis H1, i.e., that EO has a direct positive effect on subjective financial performance in southeastern European SMEs. Furthermore, since the square term of EO is significant but positive, the observed relationship is considered to exhibit a U-shape characteristic, meaning that there is no evidence to support hypothesis H2. Moreover, Figure 1 depicts the nonlinear effect of EO on subjective financial firm performance, which further proves the absence of an inverted U-shape curve. Therefore, it can be stated that the relationship between EO and subjective financial performance is not an inverted U-shap for southeastern European SMEs.

Figure 1.

Nonlinear effect of EO on financial firm performance.

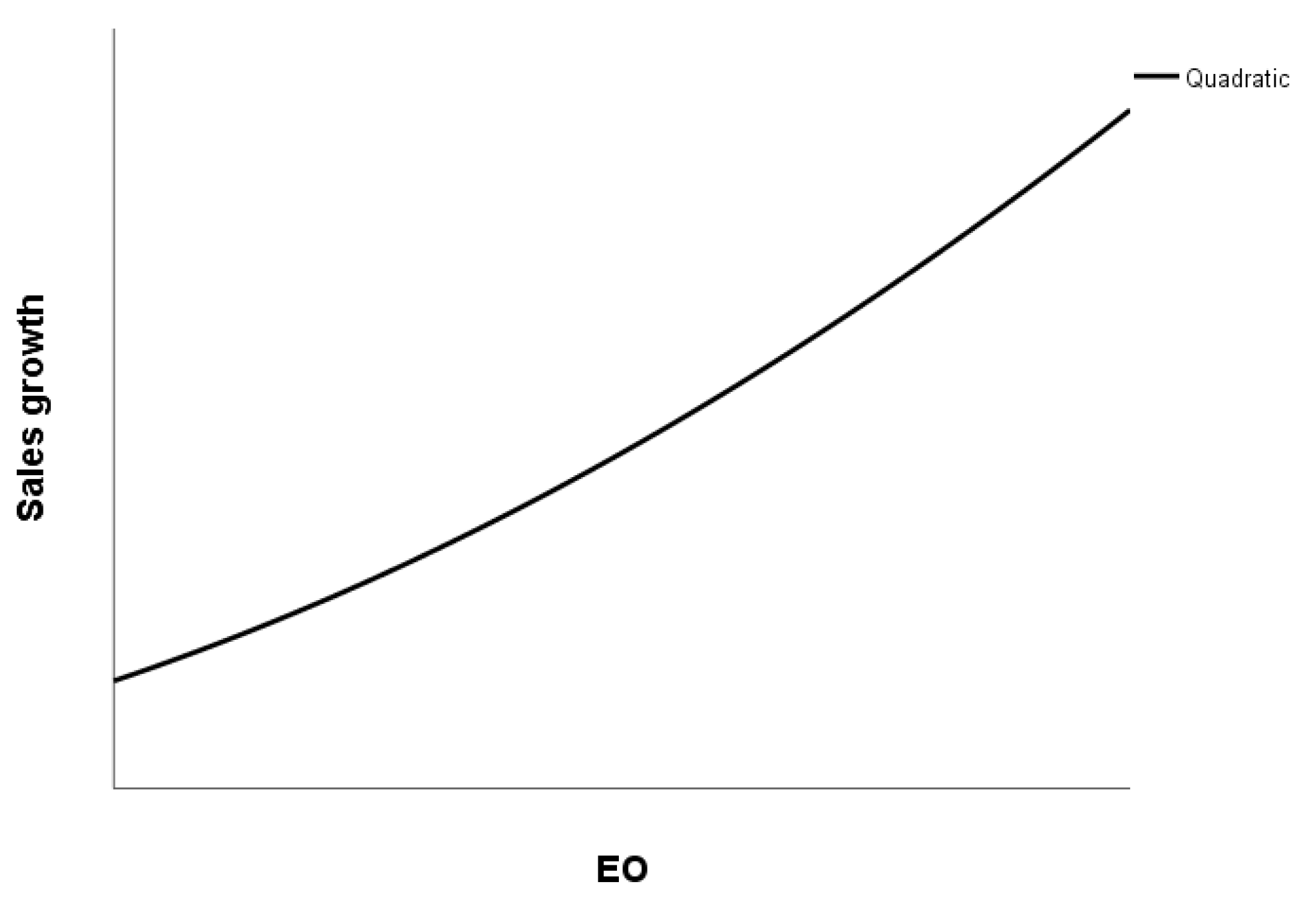

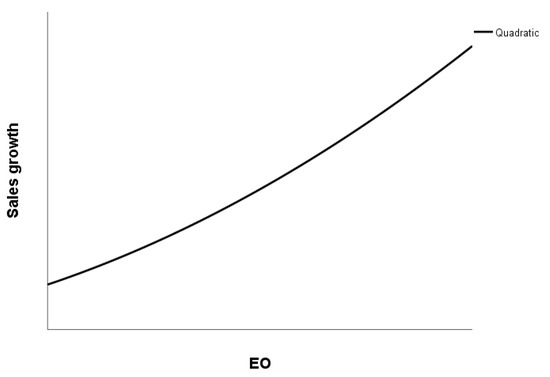

Like the previously analyzed models in Table 2, models in Table 3 provide the same conclusions, since firm size (β = 0.319, p < 0.01), EO (β = 0.538, p < 0.01), and quadratic term of EO (β = 0.047, p < 0.1) have a positive effect on sales growth as an indicator of firm performance, while turbulence (β = −0.164, p < 0.01) has a negative effect. Therefore, there is enough statistically significant evidence to support sub-hypothesis H1.1, i.e., that EO has a direct positive effect on sales growth in southeastern European SMEs. However, there is no evidence to support sub-hypothesis H2.1, since the square term of EO is significant but positive, and since Figure 2 depicts nonlinear effect of EO on sales growth, which proves the absence of an inverted U-shaped curve. Therefore, it can also be stated that the EO and sales growth relationship is not of inverted U-shaped character for southeastearn European SMEs.

Figure 2.

Nonlinear effect of EO on sales growth.

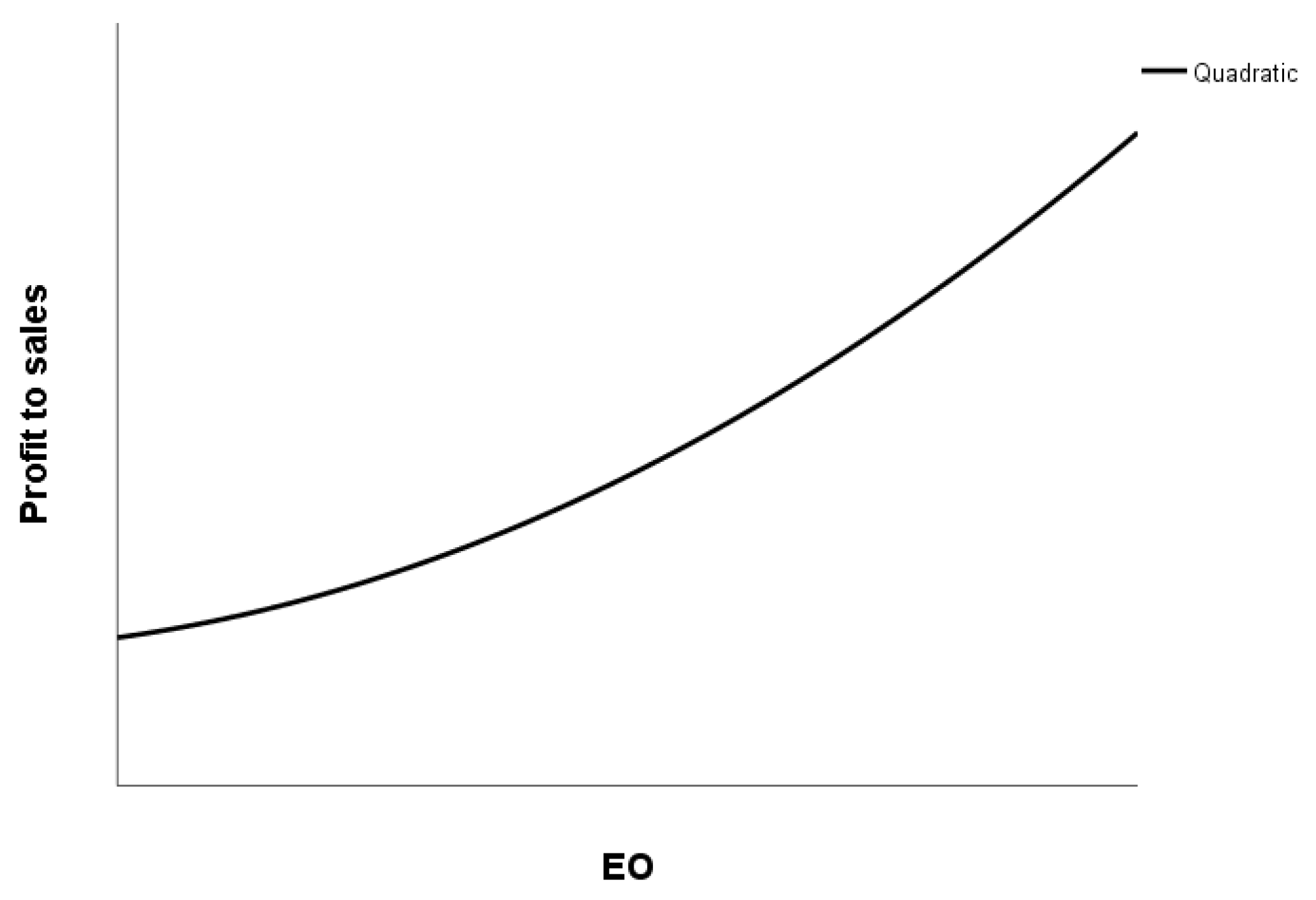

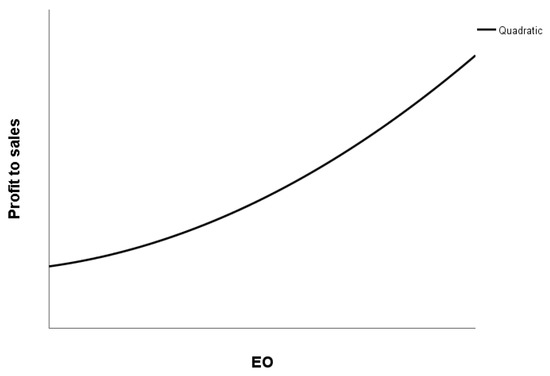

The models in Table 4, with profit-to-sales as the dependent variable, lead to the same conclusions as previously analyzed models with subjective financial performance and sales-to-growth as dependent variables, respectively. Firm size (β = 0.214, p < 0.01), EO (β = 0.495, p < 0.01), and quadratic term of EO (β = 0.064, p < 0.5) have a positive effect on profit-to-sales as an indicator of firm performance, while turbulence (β = −0.219, p < 0.01) has a negative effect. Therefore, it can be concluded there is enough statistically significant evidence to support sub-hypothesis H1.2, i.e., that EO has a direct positive effect on profit-to-sales in southeastern European SMEs. Moreover, while there is no evidence to support sub-hypothesis H2.2, i.e., the relationship between EO and profit to sales is not an inverted U-shape for southeastern European SMEs. Figure 3 provides additional support for not confirming sub-hypothesis H2.2.

Figure 3.

Nonlinear effect of EO on profit-to-sales.

5. Discussion

Much academic research has focused on exploring the effects that EO has on firm performance, where in general, findings confirmed the existence of a positive relationship (Wales et al. 2021; Putniņš and Sauka 2020; Gupta and Wales 2017). However, many authors indicated a need to further test if the relationship between EO and firm performance is of nonlinear character, where such relationship could even be context-dependent and moderated by various external factors, such as environmental hostility, industry dynamism, networking, institutional framework, etc. (Wales et al. 2021; Luu and Ngo 2019; Gonzalez and de Melo 2018; Wales 2016). Moreover, since a lot of research covering this topic has been conducted in developed countries, there is still a need for such studies in developing countries, and especially in the region of southeast Europe (Morić-Milovanović 2022). Therefore, the aim of this paper was to examine the existence of linearity and nonlinearity between EO and subjective financial performance among southeast European SMEs, where firm performance was measured by sales growth and profit-to-sales ratio. Our research results show that firm size has a positive effect, while the environmental turbulence has a negative effect on the financial performance of southeast European SMEs. More importantly, this research’s results confirmed the existence of the positive direct relationship EO has on financial performance, including the positive effects on sales growth and profit-to-sales ratio. On the other hand, the obtained results did not confirm the existence of nonlinearity effects that EO presumably has on the financial performance, the sales growth, nor on the profit-to-sales ratio. In other words, the observed relationship does not exhibit inversed U-shape characteristics among southeast European SMEs.

5.1. Theoretical and Managerial Implications

There are several contributions this paper provides to the existing literature. One of the main contributions is further confirmation of the direct and positive relationship between EO and subjective financial firm performance in southeast European SEMs. These findings are in line with previous academic findings (Putniņš and Sauka 2020; Kraus et al. 2012; Wiklund and Shepherd 2005), and more importantly in line with the previous academic findings conducted within this region (Morić-Milovanović 2022; Morić-Milovanović et al. 2021; Šlogar 2021; Šlogar and Bezić 2020; Veselinović et al. 2021; Petrović et al. 2015; Morić-Milovanović 2012). A contribution that is also reflected in the findings is that there are no nonlinear effects between EO and small firm financial performance. Again, these findings support the previous academic findings, which have not found an inversed U-shaped characteristic (Lomberg et al. 2017; Gupta and Batra 2016; Schepers et al. 2014). On the other hand, these findings differ from the previous findings conducted in the region of southeastern Europe, which found that the relationship between EO and firm performance has the shape of an inverted U (Morić-Milovanović 2022). Furthermore, this research further contributed by exploring the above-mentioned relationships in a different context to the one related to big companies operating in developed economies, conducting the research on a much larger SME sample (n = 963), and by adding more control variables than previously applied in research focused on southeast European countries.

When observing the managerial implications, this study provides some interesting findings for SMEs’ decisionmakers, as well. Once again, this study confirmed that EO is a very helpful theoretical concept for increasing performance results. However, since the results of this study did not confirm the nonlinear character of the EO–performance relationship, which is in contrast to the previous findings (Morić-Milovanović 2022), it is ambiguous whether SME decisionmakers operating in southeast Europe should place significant importance on developing very aggressive EO strategies or not. Meaning, it is unclear whether SMEs’ management should limit their investments, both in terms of time and resources, to heavily pursue innovative, proactive, and risk-taking operational and tactical activities or not. Therefore, further studies in this respect need to be conducted. Nevertheless, the findings of this study further confirm that SMEs’ decisionmakers operating in highly turbulent environments need to pay close attention to devising a broader set of strategic countermeasures in order to offset the negative impact the turbulent environment has on their business.

5.2. Limitations and Future Research

Without a question, this study has certain limitations. In general, research studies within the EO field mainly suffer from the small sample size, which was not the case in this research. Following the call by Morić-Milovanović (2022) to conduct multi-country analysis research on a larger sample size to strengthen the external validity of his study, this research responded to his call and conducted the research on six selected countries of southeastern Europe and a sample size of 963 SMEs. However, since this research was conducted among six countries characterized by different institutional and cultural contexts, there is a strong possibility that various factors outside of firms’ control could potentially influence the results. Therefore, future studies should focus on examining various environmental variables. Moreover, since Slovenia and Croatia are EU member-states, while Serbia, Bosnia and Herzegovina, Montenegro, and North Macedonia are not, future research should focus on examining various nuances within the EO–performance relationship related to institutional developments, free trade implications, SME internalization, etc. Furthermore, this study suffers from result triangulation validation, since data was gathered via respondents’ answers to the email questionnaire, where only one decisionmaker per firm participated in the research, providing their subjective view on the questions within questionnaire. Therefore, future research should focus on gathering responses from several decisionmakers within one firm and go even further by triangulating the findings with objective secondary data sources, such as a firm’s financial statements. Another direction for future research that could be taken is exploring the nonlinear effects of each of the EO’s dimensions, i.e., the nonlinear effects of innovativeness, proactiveness, and risk-taking, could potentially have on firm performance. Finally, future research could also look into the longitudinal effects that adopted EO strategies could have on small firm performance.

5.3. Conclusions

The aim of this paper was to investigate the relationship between EO and subjective firm performance in southeastern European SMEs. Data were collected from decisionmakers of 963 SMEs in Slovenia, Croatia, Bosnia and Herzegovina, Serbia, Montenegro, and North Macedonia. The proposed hypotheses were tested using hierarchical linear regression analysis. This study had two main findings: In line with previous research, these results imply that EO has a direct positive effect on the performance of SMEs, measured in terms of sales growth and profitability, respectively. However, contrary to the hypothesized nature of the relationship, the findings indicate that the EO–performance relationship is not inversely-U shaped. Examining the cause for such nature of the EO–performance relationship was out of the scope of this research; thus, future studies could further investigate external and other contextual factors affecting the relationship between EO and SMEs’ performance.

Author Contributions

Conceptualization, B.M.M.; methodology, B.M.M.; validation, B.M.M. and H.Š.; formal analysis, B.M.M.; investigation, B.M.M.; data curation, B.M.M.; writing—original draft preparation, B.M.M., H.Š. and S.H.; writing—review and editing, B.M.M., H.Š. and S.H; visualization, B.M.M.; supervision, B.M.M. and H.Š. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abu-Rumman, Ayman, Ata Al Shraah, Faisal Al-Madi, and Tasneem Alfalah. 2021. Entrepreneurial networks, entrepreneurial orientation, and performance of small and medium enterprises: Are dynamic capabilities the missing link? Journal of Innovation and Entrepreneurship 10: 1–16. [Google Scholar] [CrossRef]

- Acosta, Alexandra Solano, Ángel Herrero Crespo, and Jesus Collado Agudo. 2018. Effect of market orientation, network capability and entrepreneurial orientation on international performance of small and medium enterprises (SMEs). International Business Review 27: 1128–40. [Google Scholar] [CrossRef]

- Alegre, Joaquin, and Ricardo Chiva. 2013. Linking Entrepreneurial Orientation and Firm Performance: The Role of Organizational Learning Capability and Innovation Performance. Journal of Small Business Management 51: 491–507. [Google Scholar] [CrossRef]

- Alonso-Dos-Santos, Manuel, and Orlando Llanos-Contreras. 2019. Family business performance in a post-disaster scenario: The influence of socioemotional wealth importance and entrepreneurial orientation. Journal of Business Research 101: 492–98. [Google Scholar] [CrossRef]

- Ameer, Farah, and Naveed R. Khan. 2020. Manager’s age, sustainable entrepreneurial orientation and sustainable performance: A conceptual outlook. Sustainability 12: 3196. [Google Scholar] [CrossRef]

- Andersén, Jim. 2010. A Critical Examination of the EO-performance Relationship. International Journal of Entrepreneurial Behavior & Research 16: 309–28. [Google Scholar] [CrossRef]

- Anderson, Brian S., and Yoshihiro Eshima. 2013. The Influence of Firm Age and Intangible Resources on the Relationship between Entrepreneurial Orientation and Firm Growth among Japanese SMEs. Journal of Business Venturing 28: 413–29. [Google Scholar] [CrossRef]

- Basco, Rodrigo, Felipe Hernández-Perlines, and María Rodríguez-García. 2020. The effect of entrepreneurial orientation on firm performance: A multigroup analysis comparing China, Mexico, and Spain. Journal of Business Research 113: 409–21. [Google Scholar] [CrossRef]

- Bauweraerts, Jonathan, and Olivier Colot. 2017. Exploring Nonlinear Effects of Family Involvement in the Board on Entrepreneurial Orientation. Journal of Business Research 70: 185–92. [Google Scholar] [CrossRef]

- Chaston, Ian, and Eugene Sadler-Smith. 2012. Entrepreneurial cognition, entrepreneurial orientation and firm capability in the creative industries. British Journal of Management 23: 415–32. [Google Scholar] [CrossRef]

- Chavez, Roberto, Wantao Yu, Muhammad Shakeel Sadiq Jajja, Antonio Lecuna, and Brian Fynes. 2020. Can entrepreneurial orientation improve sustainable development through leveraging internal lean practices? Business Strategy and the Environment 29: 2211–25. [Google Scholar] [CrossRef]

- Covin, Jeffrey G., and Dennis P. Slevin. 1989. Strategic management of small firms in hostile and benign environments. Strategic Management Journal 10: 75–87. [Google Scholar] [CrossRef]

- Covin, Jeffrey G., and Dennis P. Slevin. 1991. A Conceptual Model of Entrepreneurship as Firm Behavior. Entrepreneurship Theory and Practice 16: 7–26. [Google Scholar] [CrossRef]

- Covin, Jeffrey G., and William J. Wales. 2012. The Measurement of Entrepreneurial Orientation. Entrepreneurship: Theory and Practice 36: 677–702. [Google Scholar] [CrossRef]

- Covin, Jeffrey G., Kimberly M. Green, and Dennis P. Slevin. 2006. Strategic Process Effects on the Entrepreneurial Orientation–Sales Growth Rate Relationship. Entrepreneurship Theory and Practice 30: 57–81. [Google Scholar] [CrossRef]

- Donbesuur, Francis, Nathaniel Boso, and Magnus Hultman. 2020. The effect of entrepreneurial orientation on new venture performance: Contingency roles of entrepreneurial actions. Journal of Business Research 118: 150–61. [Google Scholar] [CrossRef]

- Genc, Ebru, Mumin Dayan, and Omer Faruk Genc. 2019. The impact of SME internationalization on innovation: The mediating role of market and entrepreneurial orientation. Industrial Marketing Management 82: 253–64. [Google Scholar] [CrossRef]

- Ghantous, Nabil, and Ibrahim Alnawas. 2020. The differential and synergistic effects of market orientation and entrepreneurial orientation on hotel ambidexterity. Journal of Retailing and Consumer Services 55: 102072. [Google Scholar] [CrossRef]

- Gonzalez, Rodrigo Valio Dominguez, and Tatiana Massaroli de Melo. 2018. The Effects of Organization Context on Knowledge Exploration and Exploitation. Journal of Business Research 90: 215–25. [Google Scholar] [CrossRef]

- Gupta, Anil K., and Vijay Govindarajan. 1984. Business unit strategy, managerial characteristics, and business unit effectiveness at strategy implementation. Academy of Management Journal 27: 25–41. [Google Scholar] [CrossRef]

- Gupta, Vishal K., and Safal Batra. 2016. Entrepreneurial Orientation and Firm Performance in Indian SMEs: Universal and Contingency Perspectives. International Small Business Journal 34: 660–82. [Google Scholar] [CrossRef]

- Gupta, Vishal K., and William J. Wales. 2017. Assessing Organisational Performance Within Entrepreneurial Orientation Research: Where Have We Been and Where Can We Go from Here? The Journal of Entrepreneurship 26: 51–76. [Google Scholar] [CrossRef]

- Hina, Syeda Mahlaqa, Gul Hassan, Mahwish Parveen, and Syeda Arooj. 2021. Impact of Entrepreneurial Orientation on Firm Performance through Organizational Learning: The Moderating Role of Environmental Turbulence. Performance Improvement Quarterly 34: 77–104. [Google Scholar] [CrossRef]

- Kiani, Ataullah, Delin Yang, Usman Ghani, and Mathew Hughes. 2022. Entrepreneurial passion and technological innovation: The mediating effect of entrepreneurial orientation. Technology Analysis & Strategic Management 34: 1139–52. [Google Scholar] [CrossRef]

- Kohtamäki, Marko, Jesse Heimonen, and Vinit Parida. 2019. The Nonlinear Relationship between Entrepreneurial Orientation and Sales Growth: The Moderating Effects of Slack Resources and Absorptive Capacity. Journal of Business Research 100: 100–10. [Google Scholar] [CrossRef]

- Kraus, Sascha, J. P. Coen Rigtering, Mathew Hughes, and Vincent Hosman. 2012. Entrepreneurial Orientation and the Business Performance of SMEs: A Quantitative Study from the Netherlands. Review of Managerial Science 6: 161–82. [Google Scholar] [CrossRef]

- Kreiser, Patrick, Louis D. Marino, Donald Kuratko, and Mark K. Weaver. 2013. Disaggregating Entrepreneurial Orientation: The Non-Linear Impact of Innovativeness, Proactiveness and Risk-Taking on SME Performance. Small Business Economics 40: 273–91. [Google Scholar] [CrossRef]

- Laskovaia, Anastasiia, Louis D. Marino, Galina Shirokova, and William Wales. 2019. Expect the unexpected: Examining the shaping role of entrepreneurial orientation on causal and effectual decision-making logic during economic crisis. Entrepreneurship & Regional Development 31: 456–75. [Google Scholar] [CrossRef]

- Lomberg, Carina, Diemo Urbig, Christoph Stöckmann, Louis D. Marino, and Pat H. Dickson. 2017. Entrepreneurial Orientation: The Dimensions’ Shared Effects in Explaining Firm Performance. Entrepreneurship Theory and Practice 41: 973–98. [Google Scholar] [CrossRef]

- Lumpkin, George Thomas, and Gregory G. Dess. 1996. Clarifying the Entrepreneurial Orientation Construct and Linking It to Performance. The Academy of Management Review 21: 135. [Google Scholar] [CrossRef]

- Luu, Ngoc, and Liem Viet Ngo. 2019. Entrepreneurial Orientation and Social Ties in Transitional Economies. Long Range Planning 52: 103–16. [Google Scholar] [CrossRef]

- Messersmith, Jake G., and William J. Wales. 2013. Entrepreneurial orientation and performance in young firms: The role of human resource management. International Small Business Journal 31: 115–36. [Google Scholar] [CrossRef]

- Miller, Danny. 1983. The Correlates of Entrepreneurship in Three Types of Firms. Management Science 29: 770–91. [Google Scholar] [CrossRef]

- Miller, Danny, and Peter H. Friesen. 1982. Innovation in Conservative and Entrepreneurial Firms: Two Models of Strategic Momentum. Strategic Management Journal 3: 1–25. [Google Scholar] [CrossRef]

- Morgan, Todd, and Sergey Alexander Anokhin. 2020. The joint impact of entrepreneurial orientation and market orientation in new product development: Studying firm and environmental contingencies. Journal of Business Research 113: 129–38. [Google Scholar] [CrossRef]

- Morić-Milovanović, Bojan. 2012. Moderating effect of external environment on the entrepreneurial orientation and business performance relationship of Croatian small and medium sized manufacturing enterprises. Poslovna Izvrsnost 6: 9–23. [Google Scholar]

- Morić-Milovanović, Bojan. 2022. Exploring Direct and Non-Linear Effects of Entrepreneurial Orientation and Its Dimensions on Firm Performance in a Small, Open, Transitional Economy. Strategic Management 27: 26–38. [Google Scholar] [CrossRef]

- Morić-Milovanović, Bojan, Zoran Wittine, and Zoran Bubaš. 2021. Examining Entrepreneurial Orientation–Performance Relationship among Croatian Service SMEs. Ekonomska Misao i Praksa 30: 509–26. [Google Scholar] [CrossRef]

- Naman, John L., and Dennis P. Slevin. 1993. Entrepreneurship and the concept of fit: A model and empirical tests. Strategic Management Journal 14: 137–153. [Google Scholar] [CrossRef]

- Petrović, Želimir, Svetlana Vukotić, Jugoslav Aničić, and Nebojša Zakić. 2015. Moderating Effect of National Culture on the Relationship between Entrepreneurial Orientation and Business Performance: An Evidence from Serbia. New Technologies 3: 84–89. [Google Scholar]

- Putniņš, Talis J., and Arnis Sauka. 2020. Why Does Entrepreneurial Orientation Affect Company Performance? Strategic Entrepreneurship Journal 14: 711–35. [Google Scholar] [CrossRef]

- Rauch, Andreas, Johan Wiklund, George Thomas Lumpkin, and Michael Frese. 2009. Entrepreneurial Orientation and Business Performance: An Assessment of Past Research and Suggestions for the Future. Entrepreneurship Theory and Practice 33: 761–87. [Google Scholar] [CrossRef]

- Schepers, Jelle, Wim Voordeckers, Tensie Steijvers, and Eddy Laveren. 2014. The Entrepreneurial Orientation–Performance Relationship in Private Family Firms: The Moderating Role of Socioemotional Wealth. Small Business Economics 43: 39–55. [Google Scholar] [CrossRef]

- Sciascia, Salvatore, Laura D’Oria, Massimiliano Bruni, and Barbara Larrañeta. 2014. Entrepreneurial Orientation in Low- and Medium-Tech Industries: The Need for Absorptive Capacity to Increase Performance. European Management Journal 32: 761–69. [Google Scholar] [CrossRef]

- Sciascia, Salvatore, Pietro Mazzola, and Francesco Chirico. 2013. Generational Involvement in the Top Management Team of Family Firms: Exploring Nonlinear Effects on Entrepreneurial Orientation. Entrepreneurship Theory and Practice 37: 69–85. [Google Scholar] [CrossRef]

- Seo, Ribin. 2019. Entrepreneurial Orientation and Innovation Performance: Insights from Korean Ventures. EJIM 23: 675–95. [Google Scholar] [CrossRef]

- Šlogar, Helena. 2021. Longitudinal Research—Entrepreneurial Orientation Impact, Innovativeness, and Business Performance in Croatian Companies. Entrepreneurship and Sustainability Issues 9: 152–68. [Google Scholar] [CrossRef] [PubMed]

- Šlogar, Helena, and Heri Bezić. 2020. The Relationship between Entrepreneurial Orientation and Innovativeness in Croatian Companies. Poslovna Izvrsnost—Business Excellence 14: 71–87. [Google Scholar] [CrossRef]

- Su, Zhongfeng, En Xie, and Dong Wang. 2015. Entrepreneurial Orientation, Managerial Networking, and New Venture Performance in China. Journal of Small Business Management 53: 228–48. [Google Scholar] [CrossRef]

- Su, Zhongfeng, En Xie, and Yuan Li. 2011. Entrepreneurial Orientation and Firm Performance in New Ventures and Established Firms. Journal of Small Business Management 49: 558–77. [Google Scholar] [CrossRef]

- Tang, Jintong, Zhi Tang, Louis D. Marino, Yuli Zhang, and Qianwen Li. 2008. Exploring an Inverted U–Shape Relationship between Entrepreneurial Orientation and Performance in Chinese Ventures. Entrepreneurship Theory and Practice 32: 219–39. [Google Scholar] [CrossRef]

- Tang, Zhi, and Jintong Tang. 2012. Entrepreneurial Orientation and SME Performance in China’s Changing Environment: The Moderating Effects of Strategies. Asia Pacific Journal of Management 29: 409–31. [Google Scholar] [CrossRef]

- Veselinović, Ljiljan, Mirza Kulenović, Lejla Turulja, and Merima Činjarević. 2021. The Interplay of Entrepreneurial Orientation, Total Quality Management, and Financial Performance. Total Quality Management & Business Excellence 32: 1732–50. [Google Scholar] [CrossRef]

- Wales, William John. 2016. Entrepreneurial Orientation: A Review and Synthesis of Promising Research Directions. International Small Business Journal 34: 3–15. [Google Scholar] [CrossRef]

- Wales, William John, Jeffrey G. Covin, and Erik Monsen. 2020. Entrepreneurial orientation: The necessity of a multilevel conceptualization. Strategic Entrepreneurship Journal 14: 639–60. [Google Scholar] [CrossRef]

- Wales, William John, Pankaj C. Patel, Vinit Parida, and Patrick M. Kreiser. 2013. Nonlinear Effects of Entrepreneurial Orientation on Small Firm Performance: The Moderating Role of Resource Orchestration Capabilities: Nonlinear Effects of EO on Small Firm Performance. Strategic Entrepreneurship Journal 7: 93–121. [Google Scholar] [CrossRef]

- Wales, William John, Sascha Kraus, Matthias Filser, Christoph Stöckmann, and Jeffrey G. Covin. 2021. The Status Quo of Research on Entrepreneurial Orientation: Conversational Landmarks and Theoretical Scaffolding. Journal of Business Research 128: 564–77. [Google Scholar] [CrossRef]

- Wales, William, Johan Wiklund, and Alexander McKelvie. 2015. What about new entry? Examining the theorized role of new entry in the entrepreneurial orientation–performance relationship. International Small Business Journal 33: 351–73. [Google Scholar] [CrossRef]

- Wang, Ming Chao, Pei Chen Chen, and Shih Chieh Fang. 2020. How environmental turbulence influences firms’ entrepreneurial orientation: The moderating role of network relationships and organizational inertia. Journal of Business & Industrial Marketing 36: 48–59. [Google Scholar] [CrossRef]

- Wiklund, Johan, and Dean Shepherd. 2005. Entrepreneurial Orientation and Small Business Performance: A Configurational Approach. Journal of Business Venturing 20: 71–91. [Google Scholar] [CrossRef]

- Zahra, Shaker A. 1991. Predictors and Financial Outcomes of Corporate Entrepreneurship: An Exploratory Study. Journal of Business Venturing 6: 259–85. [Google Scholar] [CrossRef]

- Zahra, Shaker A., and Dennis M. Garvis. 2000. International Corporate Entrepreneurship and Firm Performance: The Moderating Effect of International Environmental Hostility. Journal of Business Venturing 15: 469–92. [Google Scholar] [CrossRef]

- Zahra, Shaker A., Daniel F. Jennings, and Donald F. Kuratko. 1999. The Antecedents and Consequences of Firm-Level Entrepreneurship: The State of the Field. Entrepreneurship Theory and Practice 24: 45–65. [Google Scholar] [CrossRef]

- Zaidi, Syed Shahan Ali, and Syed Shahid Zaheer Zaidi. 2021. Linking Entrepreneurial Orientation and Innovation Intensity: Moderating Role of Environmental Turbulence. Journal of Entrepreneurship, Management, and Innovation 3: 202–36. [Google Scholar] [CrossRef]

- Zhang, Jing A., Conor O’Kane, and Guoquan Chen. 2020. Business ties, political ties, and innovation performance in Chinese industrial firms: The role of entrepreneurial orientation and environmental dynamism. Journal of Business Research 121: 254–67. [Google Scholar] [CrossRef]

- Zhang, Zhe, Xin Wang, and Ming Jia. 2021. Echoes of CEO entrepreneurial orientation: How and when CEO entrepreneurial orientation influences dual CSR activities. Journal of Business Ethics 169: 609–29. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).