From Start to Scale: Navigating Innovation, Entrepreneurial Ecosystem, and Strategic Evolution

Abstract

1. Introduction

2. Literature Review

2.1. Economic and Societal Impact of Startups and Scaleups

2.2. Challenges of Transition from Startup to Scaleup Stage

2.3. Unveiling the Catalysts: Entrepreneurial Motivation, the Startup Ecosystem, and Strategic Adaptability and Disruption

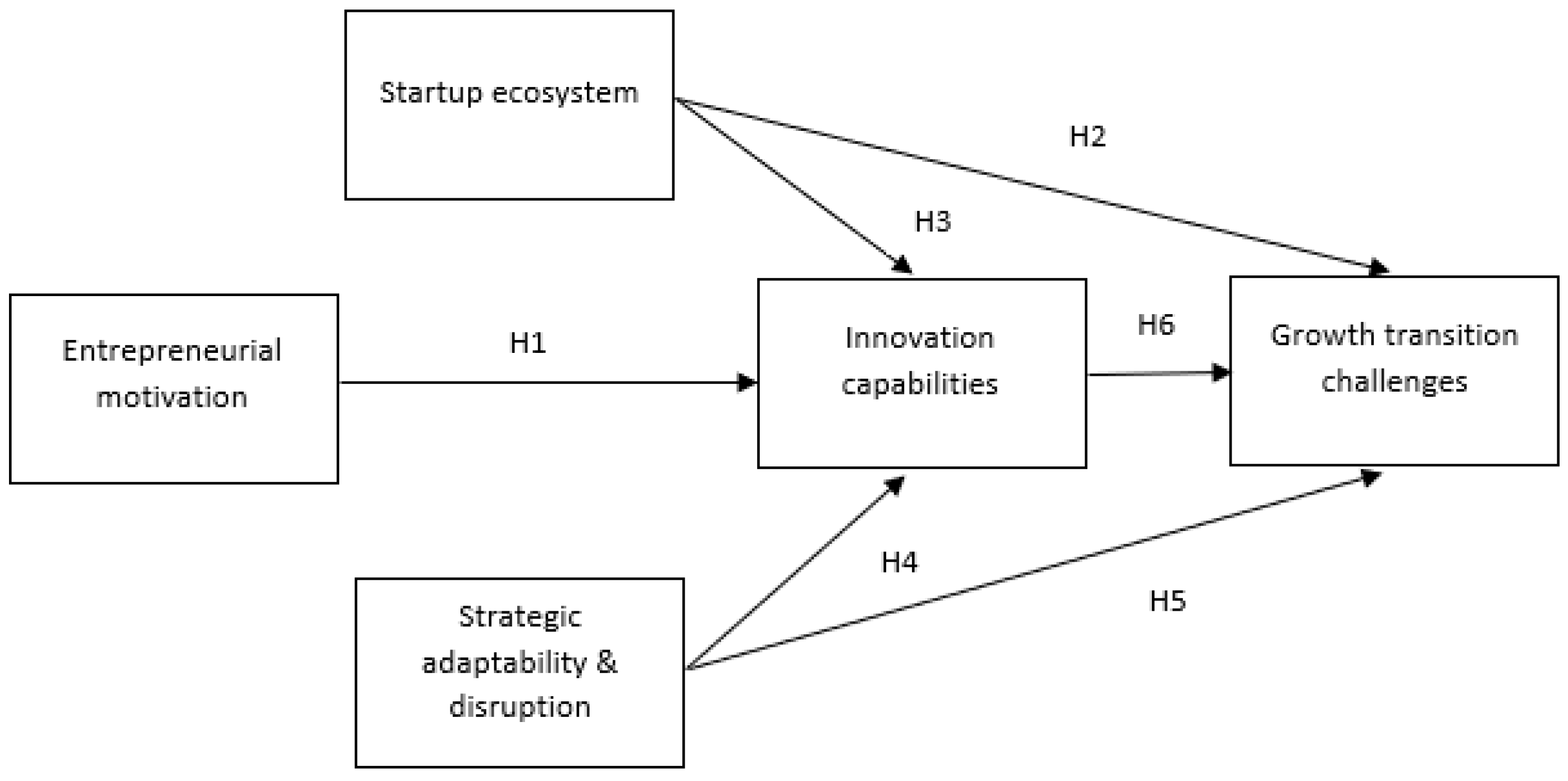

3. Methodology

3.1. Data and Sample

3.2. Research Instrument

3.3. Statistical Analysis

4. Results

4.1. Model 1

4.2. Model 2

4.3. Model 3

4.4. Model 4

4.5. Model 5

4.6. Model 6

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Construct | Item | Communalities | Loading | Cronbach’s Alpha |

|---|---|---|---|---|

| Entrepreneurial motivation | The problem I/we wanted to solve | 0.873 | 0.934 | 0.975 |

| Working with great people in a great company | 0.848 | 0.921 | ||

| To influence/help people | 0.882 | 0.939 | ||

| Being your own boss | 0.856 | 0.925 | ||

| Opportunities for higher incomes | 0.879 | 0.938 | ||

| Need for change | 0.861 | 0.928 | ||

| Finding a balance between work and family | 0.799 | 0.894 | ||

| Flexible working hours | 0.822 | 0.907 | ||

| Difficulty finding a job | 0.703 | 0.839 | ||

| At the invitation of a company acquaintance, friend… | 0.667 | 0.816 | ||

| Innovation capabilities | Product innovation—technological innovation, radical upgrade of existing solutions or a completely new solution | 0.880 | 0.938 | 0.934 |

| Process innovation of production or performance of services | 0.891 | 0.944 | ||

| Innovation of the organization (new way of working, production, or running a company) | 0.902 | 0.950 | ||

| Marketing innovation (new sales channels, innovative communication, new user experience, design…) | 0.820 | 0.906 | ||

| Other | 0.495 | 0.704 | 0.977 | |

| Startup ecosystem | Legislation in light of the support of startups and scaleups | 0.928 | 0.963 | |

| Measures of the state in the light of the support of startups and scaleups (public tenders, support services environments, such as counselling, mentoring, training…) | 0.923 | 0.961 | ||

| The school system in the light of acquiring the competences of entrepreneurship, encouragement entrepreneurial thinking and activation | 0.941 | 0.970 | ||

| Universities in light of the acquisition of the competences of entrepreneurship, encouragement entrepreneurial thinking and activation | 0.945 | 0.972 | ||

| Established companies in the light of cooperation with startups and scaleups | 0.869 | 0.932 | ||

| Strategic adaptability and disruption | Rapid growth | 0.920 | 0.959 | 0.989 |

| Profitability | 0.902 | 0.950 | ||

| Product development | 0.912 | 0.955 | ||

| Organizational development (processes, structure, communication…) | 0.953 | 0.976 | ||

| Strengthening motivation for businesspeople and their development | 0.930 | 0.964 | ||

| Strengthening of organizational culture (norms, standards, values…) | 0.951 | 0.975 | ||

| Sustainable development of the company or products/services | 0.927 | 0.963 | ||

| Corporate social responsibility | 0.932 | 0.966 | ||

| Growth transition challenges | Required physical presence when concluding company contracts | 0.826 | 0.909 | 0.970 |

| Difficulty optional rewarding | 0.819 | 0.905 | ||

| Employment of foreigners (demanding obtaining visas) | 0.784 | 0.885 | ||

| Financial barriers | 0.879 | 0.938 | ||

| Lack of access to knowledge | 0.866 | 0.930 | ||

| Maintaining qualified personnel | 0.837 | 0.915 | ||

| Lack of networking | 0.805 | 0.897 | ||

| Lack of leadership capacity | 0.864 | 0.929 | ||

| Low capacity for product/service growth | 0.793 | 0.890 | ||

| Other legal regulations | 0.656 | 0.810 | ||

| Other challenges | 0.594 | 0.728 |

References

- Aghion, Philippe, Nick Bloom, Richard Blundell, Rachel Griffith, and Peter Howitt. 2005. Competition and innovation: An inverted-U relationship. The Quarterly Journal of Economics 120: 701–28. [Google Scholar]

- Aminova, Munira, and Edoardo Marchi. 2021. The role of innovation on start-up failure vs. its success. International Journal of Business Ethics and Governance, 41–72. [Google Scholar] [CrossRef]

- Aulet, William, and Fiona Murray. 2013. A Tale of Two Entrepreneurs: Understanding Differences in the Types of Entrepreneurship in the Economy. Available online: https://ssrn.com/abstract=2259740 (accessed on 3 February 2023).

- Autio, Erkko, and Zoltan Acs. 2010. Intellectual property protection and the formation of entrepreneurial growth aspirations. Strategic Entrepreneurship Journal 4: 234–51. [Google Scholar] [CrossRef]

- Babina, Tania, Anastassia Fedyk, Alex He, and James Hodson. 2021. Artificial intelligence, firm growth, and product innovation. Firm Growth, and Product Innovation, November 9. [Google Scholar]

- Bednár, Richard, and Natália Tarišková. 2017. Indicators of startup failure. Industry 4.0 2: 238–40. [Google Scholar]

- Bennett, Roger. 2016. Factors contributing to the early failure of small new charity start ups. Journal of Small Business and Enterprise Development 23: 333–48. [Google Scholar] [CrossRef]

- Birkinshaw, Julian. 2022. Move fast and break things: Reassessing IB research in the light of the digital revolution. Global Strategy Journal 12: 619–31. [Google Scholar] [CrossRef]

- Blank, Steve, and Bob Dorf. 2012. The Startup Owner’s Manual: The Step-by-Step Guide for Building a Great Company. Pescadero: K&S Ranch. Inc., Publishers. [Google Scholar]

- Bocken, Nancy, and Yuliya Snihur. 2020. Lean Startup and the business model: Experimenting for novelty and impact. Long Range Planning 53: 101953. [Google Scholar] [CrossRef]

- Busch, Christian, and Harry Barkema. 2021. From necessity to opportunity: Scaling bricolage across resource-constrained environments. Strategic Management Journal 42: 741–73. [Google Scholar] [CrossRef]

- Cambra Fierro, Jesús J., and Pérez Lourdes. 2018. Value creation and appropriation in asymmetric alliances: The case of tech startups. Management 21: 534–73. [Google Scholar] [CrossRef][Green Version]

- Cavusgil, S.Tamer, and Gary Knight. 2009. Born Global Firms: A New International Enterprise, 1st ed. International Business Collection. New York: Business Expert Press, pp. 1–128. [Google Scholar]

- Chesbrough, H. William. 2003. Open Innovation: The New Imperative for Creating and Profiting from Technology. Boston: Harvard Business Press. [Google Scholar]

- Chiavarini, Lorenzo. 2021. A UiPath to Success: Central and Eastern European Startups Coming of Age. Available online: https://dealroom.co/blog/central-and-eastern-european-startups-2021 (accessed on 15 December 2022).

- Chliova, Myrto, and Dimo Ringov. 2017. Scaling impact: Template development and replication at the base of the pyramid. Academy of Management Perspectives 31: 44–62. [Google Scholar] [CrossRef]

- Christensen, Clayton M. 2013. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Boston: Harvard Business Review Press. [Google Scholar]

- Chronbach, Lee J. 1951. Coefficient alpha and the internal structure of tests. Psychometrika 16: 297–334. [Google Scholar] [CrossRef]

- Clevenger, Morgan R., and Michael W. -P. Fortunato. 2022. Empowering Entrepreneurial Communities and Ecosystems: Case Study Insights. New York: Rutledge. [Google Scholar]

- Cohen, Boyd. 2006. Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment 15: 1–14. [Google Scholar] [CrossRef]

- Corrêa, Victor Silva, Maciel M. Queiroz, Marina Almeida Cruz, and Helena Belintani Shigaki. 2022. Entrepreneurial orientation far beyond opportunity: The influence of the necessity for innovativeness, proactiveness and risk-taking. International Journal of Entrepreneurial Behavior & Research 28: 952–79. [Google Scholar]

- Costello, Anna B., and Jason W. Osborne. 2005. Best practices in exploratory factor analysis: Four recommendations for getting the most from your analysis. Practical Assessment, Research & Evaluation 10: 1–9. [Google Scholar]

- Dealroom & Sifted. 2021. The Past, Present and Future of European Tech. Available online: https://europeanstartups.co/reports/the-past-present-and-future-of-european-tech (accessed on 3 December 2022).

- Drucker, Peter. 2014. Innovation and Entrepreneurship. London and New York: Routledge. [Google Scholar]

- Drucker, Peter. F. 1985. Entrepreneurial strategies. California Management Review 27: 9–25. [Google Scholar] [CrossRef]

- Dushnitsky, Gary, and Sharon F. Matusik. 2019. A fresh look at patterns and assumptions in the field of entrepreneurship: What can we learn? Strategic Entrepreneurship Journal 13: 437–47. [Google Scholar] [CrossRef]

- Eftekhari, Nazanin, and Marcel Bogers. 2015. Open for entrepreneurship: How open innovation can foster new venture creation. Creativity and Innovation Management 24: 574–84. [Google Scholar] [CrossRef]

- Eisenmann, Tom. 2021. Why Startups Fail: A New Roadmap for Entrepreneurial Success. New York: Currency. [Google Scholar]

- Erevelles, S., N. Fukawa, and L. Swayne. 2016. Big Data consumer analytics and the transformation of marketing. Journal of Business Research 69: 897–904. [Google Scholar] [CrossRef]

- ESN. 2021. European Startup Monitor 2020/2021. European Startup Network. Available online: https://www.europeanstartupmonitor2021.eu/_files/ugd/58f704_e4b5004e9ba44b4dbd0b75a893da0e36.pdf (accessed on 15 December 2022).

- Eurostat-OECD. 2007. Eurostat-OECD Manual on Business Demography Statistics. Luxembourg: Office for Official Publications of the European Communities. [Google Scholar]

- Frederiksen, Dennis Lyth, and Alexander Brem. 2017. How do entrepreneurs think they create value? A scientific reflection of Eric Ries’ Lean Startup approach. International Entrepreneurship and Management Journal 13: 169–89. [Google Scholar] [CrossRef]

- Garcia-Tapial, Joaquín, and Manuel Alejandro Cardenete. 2023. Start-Up or Scale-Up? An Approach through Economic Impact. Journal of Management for Global Sustainability 8: 10. [Google Scholar] [CrossRef]

- Giustiziero, Gianluigi, Tobias Kretschmer, Deepak Somaya, and Brian Wu. 2022. Hyperspecialization and hyperscaling: A resource-based theory of the digital firm. Strategic Management Journal 44: 1391–424. [Google Scholar] [CrossRef]

- Grilo, António, André Águeda, Aneesh Zutshi, and Tahereh Nodehi. 2017. Relationship between investors and European startup ecosystems builders. Paper presented at 2017 International Conference on Engineering, Technology and Innovation (ICE/ITMC), Madeira Island, Portugal, June 27–29; pp. 538–50. [Google Scholar] [CrossRef]

- Isenberg, Daniel. 2011. Introducing the Entrepreneurship Ecosystem: Four Defining Characteristics. Available online: https://www.forbes.com/sites/danisenberg/2011/05/25/introducing-the-entrepreneurship-ecosystem-four-defining-characteristics/ (accessed on 14 December 2022).

- Kaiser, Henry F. 1974. An index of factorial simplicity. Psychometrika 39: 31–36. [Google Scholar] [CrossRef]

- Kenney, Martin, and Urs Von Burg. 2001. Paths and regions: The creation and growth of Silicon Valley. In Path Dependence and Creation. New York: Psychology Press, pp. 127–48. [Google Scholar] [CrossRef]

- Kotsch, Christoph. 2017. Which Factors Determine the Success or Failure of Startup Companies. A Startup Ecosystem Analysis of Hungary. Hamburg: Anchor Academic Publishing. [Google Scholar]

- Krishna, Amar, Ankit Agrawal, and Alok Choudhary. 2016. Predicting the outcome of startups: Less failure, more success. Paper presented at 2016 IEEE 16th International Conference on Data Mining Workshops (ICDMW), Barcelona, Spain, December 12–15; pp. 798–805. [Google Scholar]

- Lafuente, Esteban, Zoltan J. Acs, Mark Sanders, and László Szerb. 2020. The global technology frontier: Productivity growth and the relevance of Kirznerian and Schumpeterian entrepreneurship. Small Business Economics 55: 153–78. [Google Scholar] [CrossRef]

- Levinthal, Daniel A., and James G. March. 1993. The myopia of learning. Strategic Management Journal 14: 95–112. [Google Scholar] [CrossRef]

- Lichtenstein, Benyamin M. Bergmann, and Candida G. Brush. 2001. How do “resource bundles” develop and change in new ventures? A dynamic model and longitudinal exploration. Entrepreneurship Theory and Practice 25: 37–58. [Google Scholar] [CrossRef]

- Marmer, Max, Bjoern Lasse Herrmann, Ertan Dogrultan, Ron Berman, Chuck Eesley, and Steve Blank. 2011. Startup genome report extra: Premature scaling. Startup Genome 10: 1–56. [Google Scholar]

- Martínez-Fierro, Salustiano, José María Biedma-Ferrer, and José Ruiz-Navarro. 2020. Impact of high-growth start-ups on entrepreneurial environment based on the level of national economic development. Business Strategy and the Environment 29: 1007–20. [Google Scholar] [CrossRef]

- Mason, Colin, and Ross Brown. 2014. Entrepreneurial ecosystems and growth oriented entrepreneurship. Final Report to OECD, Paris 30: 77–102. [Google Scholar]

- McDonald, Rory M., and Kathleen M. Eisenhardt. 2020. Parallel play: Startups, nascent markets, and effective business-model design. Administrative Science Quarterly 65: 483–523. [Google Scholar] [CrossRef]

- McGrath, Rita Gunther, and Ian C. MacMillan. 2000. The Entrepreneurial Mindset: Strategies for Continuously Creating Opportunity in an Age of Uncertainty. Boston: Harvard Business Press, vol. 284. [Google Scholar]

- McKelvie, Alexander, Anna Brattström, and Karl Wennberg. 2017. How young firms achieve growth: Reconciling the roles of growth motivation and innovative activities. Small Business Economic 49: 273–93. [Google Scholar] [CrossRef]

- McKinsey & Company. 2021. Winning Formula: How Europe’s Top Tech Start-Ups Get It Right. Available online: https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/winning-formula-how-europes-top-tech-start-ups-get-it-right (accessed on 15 September 2023).

- Mikle, Lenka. 2020. Startups and reasons for their failure. SHS Web of Conferences 83: 01046. [Google Scholar] [CrossRef]

- Mintzberg, Henry. 1979. The Structuring of Organization. Englewood Cliffs: Prentice Hall. [Google Scholar]

- Mintzberg, Henry. 2000. The Rise and Fall of Strategic Planning. London: Pearson Education. [Google Scholar]

- Monaghan, Sinéad, and Esther Tippmann. 2018. Becoming a multinational enterprise: Using industry recipes to achieve rapid multinationalization. Journal of International Business Studies 49: 473–95. [Google Scholar] [CrossRef]

- Monteiro, Guilherme Fowler A. 2019. High-growth firms and scale-ups: A review and research agenda. RAUSP Management Journal 54: 96–111. [Google Scholar] [CrossRef]

- Piaskowska, Dorota, Esther Tippmann, and Sinéad Monaghan. 2021. Scale-up modes: Profiling activity configurations in scaling strategies. Long Range Planning 54: 102101. [Google Scholar] [CrossRef]

- Porter, Michael E. 1990. The competitive advantage of nations. Harvard Business Review, April 19, 73–93. [Google Scholar]

- Prajogo, Daniel, and Pervaiz Ahmed. 2006. Relationships between innovation stimulus, innovation capacity, and innovation performance. R&D Management 36: 499–515. [Google Scholar]

- Pyataeva, Olga, Liliya Ustinova, Maya Evdokimova, Anna Khvorostyanaya, and Artyom Gavrilyuk. 2021. Digitalization of Technology Transfer for High-Technology Products. In International Scientific and Practical Conference Digital and Information Technologies in Economics and Management. Cham: Springer International Publishing, pp. 15–26. [Google Scholar]

- Reuber, A. Rebecca, Esther Tippmann, and Sinéad Monaghan. 2021. Global scaling as a logic of multinationalization. Journal of International Business Studies 52: 1031–46. [Google Scholar] [CrossRef]

- Reypens, Charlotte, Julie Delanote, and Désirée Rückert. 2020. From Starting to Scaling: How to Foster Startup Growth in Europe. Luxembourg: European Investment Bank. [Google Scholar] [CrossRef]

- Rosenbusch, Nina, Jan Brinckmann, and Andreas Bausch. 2011. Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing 26: 441–57. [Google Scholar] [CrossRef]

- Schumpeter, Joseph, and Ursula Backhaus. 1934. The theory of economic development. In Joseph Alois Schumpeter: Entrepreneurship, Style and Vision. Boston: Springer US, pp. 61–116. [Google Scholar]

- Shahzad, Muhammad Farrukh, Kanwal Iqbal Khan, Saima Saleem, and Tayyiba Rashid. 2021. What factors affect the entrepreneurial intention to start-ups? The role of entrepreneurial skills, propensity to take risks, and innovativeness in open business models. Journal of Open Innovation: Technology, Market, and Complexity 7: 173. [Google Scholar] [CrossRef]

- Shane, Scott, Edwin A. Locke, and Christopher J. Collins. 2003. Entrepreneurial motivation. Human Resource Management Review 13: 257–79. [Google Scholar] [CrossRef]

- Skawińska, Eulalia, and Romuald I. Zalewski. 2020. Success factors of startups in the EU—A comparative study. Sustainability 12: 8200. [Google Scholar] [CrossRef]

- Snable Hagemann, Jim, and Bruce Weinelt. 2016. Digital Transformation of Industries: Demystifying Digital and Securing $100 Trillion for Society and Industry by 2025. Geneva: World Economic Forum. [Google Scholar]

- Szarek, Joanna, and Jakub Piecuch. 2018. The importance of startups for construction of innovative economies. International Entrepreneurship Review 4: 389. [Google Scholar] [CrossRef]

- Szulanski, Gabriel, Dimo Ringov, and Robert J. Jensen. 2016. Overcoming stickiness: How the timing of knowledge transfer methods affects transfer difficulty. Organization Science 27: 304–22. [Google Scholar] [CrossRef]

- Tatarinov, Katherine, and Tina C. Ambos. 2022. Innovation for Impact: An International Business Perspective on Transforming the United Nations. AIB Insights 22: 1–6. [Google Scholar] [CrossRef]

- Teece, David J. 2010. Business models, business strategy and innovation. Long Range Planning 43: 172–94. [Google Scholar] [CrossRef]

- Tippmann, Esther, Sinéad Monaghan, and Rebecca A. Reuber. 2022. Navigating the paradox of global scaling. Global Strategy Journal 13: 735–73. [Google Scholar] [CrossRef]

- Tippmann, Eather, Tina C. Ambos, Manlio Del Giudice, Sinéad Monaghan, and Dimo Ringov. 2023. Scale-ups and scaling in an international business context. Journal of World Business 58: 101397. [Google Scholar] [CrossRef]

- Tripathi, Nirnaya, Pertti Seppänen, Ganesh Boominathan, Markku Oivo, and Kari Liukkunen. 2019. Insights into startup ecosystems through exploration of multi-vocal literature. Information and Software Technology 105: 56–77. [Google Scholar] [CrossRef]

- Tushman, Michael L., and Philip Anderson. 2018. Technological discontinuities and organizational environments. In Organizational Innovation. London: Rutledge, pp. 345–72. [Google Scholar]

- Warner, Karl S., and Maximilian Wäger. 2019. Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Planning 52: 326–49. [Google Scholar] [CrossRef]

- Williamson, Oliver E. 1991. Strategizing, economizing, and economic organization. Strategic Management Journal 12: 75–94. [Google Scholar] [CrossRef]

- Winter, Sidney G., Gabriel Szulanski, Dimo Ringov, and Robert J. Jensen. 2012. Reproducing knowledge: Inaccurate replication and failure in franchise organizations. Organization Science 23: 672–85. [Google Scholar] [CrossRef]

- Zaidi, Raza Ali, Muhammad Majid Khan, Rao Aamir Khan, and Bahaudin G. Mujtaba. 2023. Do entrepreneurship ecosystem and managerial skills contribute to startup development? South Asian Journal of Business Studies 12: 25–53. [Google Scholar] [CrossRef]

- Zieba, Krzysztof. 2017. High Growth Aspirations of Nascent Entrepreneurs: Why Do They Fall? Studia i Materiały, 94–102. [Google Scholar] [CrossRef]

- Zott, Christoph, Raphael Amit, and Lorenzo Massa. 2011. The business model: Recent developments and future research. Journal of Management 37: 1019–42. [Google Scholar] [CrossRef]

| Unstandardized Coefficients | Standardized Coefficients | |||||

|---|---|---|---|---|---|---|

| Dependent Variable | Independent Variable | B | Std. Error | Beta | t | Sig. |

| Innovation capabilities | Entrepreneurial motivation | 0.824 | 0.062 | 0.824 | 13.336 | 0.000 |

| Model 1: R = 0.824; Adjusted R-square = 0.675; F-test: F = 177.849, p < 0.001 | ||||||

| Growth-transition challenges | Startup ecosystem | 0.857 | 0.056 | 0.857 | 15.227 | 0.000 |

| Model 2: R = 0.857; Adjusted R-square = 0.731; F-test: F = 231.863, p < 0.001 | ||||||

| Innovation capabilities | Startup Ecosystem | 0.790 | 0.067 | 0.790 | 11.793 | 0.000 |

| Model 3: R = 0.790; Adjusted R-square = 0.619; F-test: F = 139.069, p < 0.001 | ||||||

| Innovation capabilities | Strategic adaptability and disruption | 0.948 | 0.035 | 0.948 | 27.356 | 0.000 |

| Model 4: R = 0.948; Adjusted R-square = 0.898; F-test: F = 748.338, p < 0.001 | ||||||

| Growth-transition challenges | Strategic adaptability and disruption | 0.896 | 0.048 | 0.896 | 18.543 | 0.000 |

| Model 5: R = 0.896; Adjusted R-square = 0.801; F-test: F = 343.826, p < 0.001 | ||||||

| Growth-transition challenges | Innovation capabilities | 0.901 | 0.047 | 0.901 | 19.047 | 0.000 |

| Model 6: R = 0.901; Adjusted R-square = 0.810; F-test: F = 362.772, p < 0.001 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Crnogaj, K.; Rus, M. From Start to Scale: Navigating Innovation, Entrepreneurial Ecosystem, and Strategic Evolution. Adm. Sci. 2023, 13, 254. https://doi.org/10.3390/admsci13120254

Crnogaj K, Rus M. From Start to Scale: Navigating Innovation, Entrepreneurial Ecosystem, and Strategic Evolution. Administrative Sciences. 2023; 13(12):254. https://doi.org/10.3390/admsci13120254

Chicago/Turabian StyleCrnogaj, Katja, and Matej Rus. 2023. "From Start to Scale: Navigating Innovation, Entrepreneurial Ecosystem, and Strategic Evolution" Administrative Sciences 13, no. 12: 254. https://doi.org/10.3390/admsci13120254

APA StyleCrnogaj, K., & Rus, M. (2023). From Start to Scale: Navigating Innovation, Entrepreneurial Ecosystem, and Strategic Evolution. Administrative Sciences, 13(12), 254. https://doi.org/10.3390/admsci13120254