Abstract

The possession of diverse knowledge is vital for countries to maintain competitive advantages as new technologies and other disruptive changes emerge. Foreign Direct Investment (FDI) has become an important instrument to access knowledge and innovation available in other countries with the increasing trend of globalization. However, little is known about how the knowledge base of a country can be enriched in the context of knowledge sourcing through FDI, drawing upon general contexts of knowledge and innovation in countries. By adopting the social network analysis methodology to model and analyze the global outward FDI network for the period 2009–2016 and conducting longitudinal regression analyses, this study reveals that the global outward FDI network has a core–periphery structure, the network centrality position of a country is positively and significantly associated with the knowledge base of the country, and the absorptive capacity of a country positively moderates the association. Equipped with empirical evidence to support our theory, we develop the K-NACK framework to understand the context of knowledge sourcing through FDI. This empirical research article offering novel analysis and a theoretical and conceptual framework will be useful for policymakers at firms and in individual countries to find advanced as well as complementary knowledge from host countries to improve the knowledge base in home countries.

1. Introduction

Possession of different types of knowledge and technology is important for innovation and creativity as well as for economic development in a country (Balland and Rigby 2017; Scalera et al. 2018). With the increasing globalization of knowledge, innovation benefits disproportionately from connections to foreign knowledge hotspots (Turkina and Van Assche 2018). As a result, Foreign Direct Investment (FDI) has become an important instrument to access knowledge and innovation available in other countries that may lead to the enhancement of the knowledge base of a country. Foreign Direct Investment (FDI) is a category of cross-border investment made by a resident in one economy with the objective of establishing a lasting interest in an enterprise that is resident in an economy other than that of the direct investor. The motivation of the direct investor is a strategic long-term relationship with the direct investment enterprise to ensure a significant degree of influence by the direct investor in the management of the direct investment enterprise and to acquire knowledge of the research status quo (ibid.). Knowledge sourced from host countries can lead to learning and growth in the future, acceleration of technological innovation, and enhancement of global competence (Peng and Wang 2000). The variety of knowledge coming from different host countries and their composition contributes to knowledge generation and thereby the knowledge base in a country. Thereby, outward FDI can be a key factor contributing to the development of a country by contributing to the knowledge base (Dunning 1986; Potterie and Lichtenberg 2001). Scholars have increasingly been suggesting FDI as instrumental for investors to tap into knowledge and capabilities abroad to offset their weaknesses, access resources, and deepen their expertise (Awate et al. 2015; Dunning 1994; Nelaeva and Nilssen 2022; Peng and Wang 2000; Potterie and Lichtenberg 2001). Researchers also focus on knowledge combinations in understanding knowledge complexity and knowledge accumulation (Balland and Rigby 2017; Cantwell and Salmon 2018; Kogut and Zander 1993).

However, little is known about how the knowledge base of a country can be enriched in the context of globalization. The literature is fragmented regarding the characteristics and forms of knowledge, as well as the ways of knowledge generation and accumulation. To begin with, the existing literature on knowledge-seeking FDI focused on MNEs from emerging countries (Knoerich 2017), although investors tend to access knowledge in host countries regardless of their country of origin (Scott-Kennel 2007). Next, MNEs from emerging countries do not follow the same rules as the MNEs from developed countries, which brings the validity of the traditional internationalization theories into question (da Silva-Oliveira et al. 2021). Furthermore, researchers in earlier studies usually consider the direct FDI relationships between countries, but not the indirect relationships resulting from the interconnectivity between countries. Knowledge and technology transfer through FDI can take place in both inward and outward directions and can occur both directly and indirectly (Ding et al. 2021; Grossman and Helpman 1993; Jackson and Rogers 2005; Kang et al. 2021; Lecraw 1993). In addition, the transfer of knowledge and technology between countries is not an automatic outcome of FDI but depends on the existing knowledge and capacity of relevant actors to absorb available knowledge and technology (Berry 2014; Cohen and Levinthal 1990; Hausmann et al. 2014). As a result, there is still a need for a better theoretical and empirical understanding of the context of knowledge sourcing through FDI, drawing upon general contexts of knowledge and innovation in countries (Almeida and Phene 2004; Song and Shin 2008). Therefore, we ask whether FDI is instrumental in sourcing knowledge from host countries to develop the knowledge base of home countries and whether the absorptive capacity matters in the context.

The objective of this research article is to understand the relationship between knowledge sourced through FDI and the knowledge base of a country and the role of the absorptive capacity of the country in knowledge sourcing through FDI. In other words, given that FDI is an important tool for transferring knowledge between countries, we use the flow of FDI between countries to model the global FDI network and investigate the context of knowledge transfer. FDI broadens an investor’s network from local to international, provides opportunities to draw from resources in different networks, and enhances the richness and diversity of investors’ resource pools (Ding et al. 2021). To understand the knowledge base of a country, connecting it to FDI, we need to consider both the direct and the indirect connections, because the knowledge base of an economy can be determined by the interaction between diverse actors in terms of economic exchange relations and knowledge-based innovations (Leydesdorff and Fritsch 2006). The social network analysis approach is most suited to this context because this approach considers both direct and indirect linkages and provides insights into how investors can access resources, knowledge, and competencies through FDI linkages. Recently, da Silva-Oliveira et al. (2021) pointed out the necessity to find theoretical lenses that explicate management practice variations between EMNEs and developed-economy MNEs. Adopting the social network approach and absorptive capacity perspective is helpful in this context to broaden the scope of our understanding.

The study brings together the literature on economic geography and international business and makes a multifaceted contribution to the relevant literature. We develop an international business perspective on the knowledge base of a country by elucidating the role of FDI in sourcing knowledge that is developed in host countries to enrich the knowledge base in home countries. First, we model the global outward FDI networks for the period 2009–2016 to understand the structure of the network. Next, using the centrality indicator obtained from the network analysis, we conduct a longitudinal regression analysis. This study provides insights into the theoretical lenses necessary to understand the internationalization of business to improve the knowledge base of a given country. Empirically, we believe that this is the first attempt to map the global outward FDI network and investigate the context of knowledge sourcing through FDI connecting to the knowledge base of a country. We provide an empirical foundation to state that outward foreign direct investment is instrumental to accessing knowledge and technologies available in other countries and contributing to the knowledge base of a country. Following the findings, policymakers can take necessary steps to improve a country’s position in the global outward FDI network, invest in specific countries to access specific knowledge and technologies, and devote resources to improve the absorptive capacity of the country.

2. Literature Review and the Conceptual Framework

2.1. Knowledge, Knowledge Complexity, and Knowledge Base

The knowledge base in a country can be understood as an assemblage of knowledge available in a country. The variety of knowledge present in a country provides local economic agents with a larger set of combinable knowledge and facilitates the generation of new knowledge (Antonelli et al. 2020). For example, most activities require more than one type of knowledge base and varying degrees of different knowledge (Martin and Moodysson 2013). Therefore, products produced in a country depend substantially on the knowledge and capabilities available in the country (Hidalgo and Hausmann 2009). The knowledge base of a country becomes more interconnected as countries draw complex knowledge from diverse domains of expertise and geographic locations (Cantwell and Salmon 2018). Complex knowledge can be defined as knowledge configured in a structure, the development of which requires numerous interactions and interdependencies (Cantwell and Salmon 2018; Van Wijk et al. 2008). Similarly, the complexity of an economy is manifested in the wide range of knowledge and capabilities that are combined to make different products, and countries that amass a larger set of capabilities tend to produce products that are difficult to replicate (Hidalgo and Hausmann 2009). Knowledge creation activities in a location are influenced by both local and external knowledge flows (Ardito and Petruzzelli 2017; Bathelt et al. 2004; Rodriguez et al. 2017).

Scholars have discussed the characteristics and forms of knowledge from different perspectives that build upon each other. Among those, the most well-known distinction is possibly codified knowledge and tacit knowledge. The codified knowledge can be made explicit and transferred easily, whereas the tacit knowledge embodied in humans and organizations and is considered spatially sticky (Hausmann et al. 2014; Miller 2008). Tacit knowledge is built around interpersonal contact and embodied in individual firms and networks (Balland et al. 2018). However, it can also be argued that tacit knowledge and codified knowledge are not necessarily distinct categories, but are two distinct dimensions of knowledge (Brown and Duguid 2001; Tsoukas 2005). Lundvall and Johnson (1994) went beyond this binary discussion and promoted an alternative view of knowledge—the distinction between know-what, know-why, know-how, and know-who. In this distinction, know-what refers to knowledge about mere facts, know-why refers to knowledge about principles and laws in nature and society, know-how refers to skills and the capability of doing something, and know-who refers to knowledge about possible partners for cooperation and knowledge exchange (Hausmann et al. 2014; Lundvall and Johnson 1994).

Recently, another alternative conceptualization of knowledge has been introduced by making a distinction between three types of knowledge bases: analytical knowledge base, synthetic knowledge base, and symbolic knowledge base. An analytical knowledge base prevails where knowledge creation is mainly based on formal models, codified sciences, and rational processes using scientific knowledge, whereas a synthetic knowledge base prevails where knowledge creation occurs through combining new and existing knowledge to solve practical problems. The knowledge creation in the symbolic knowledge base emphasizes the importance of cultural production and is focused on aesthetic value and images rather than a physical production process (Asheim and Gertler 2006; Asheim and Coenen 2005; Martin and Moodysson 2013). This distinction considers the tacit codified dimension and context specificity of knowledge, as well as the interaction between actors in networks in different geographies.

2.2. Knowledge Generation and Transfer

Scholars also have different perspectives on knowledge generation. From the economic geography perspective, the focus is mainly on the interaction between local actors to understand the localized nature of knowledge creation, whereas the international business perspective connects knowledge creation to the interaction between actors across national borders (Bathelt and Li 2020). However, the creation of new knowledge is not necessarily limited to specific local knowledge pools, because actors need to develop trans-local, trans-regional, and trans-national connections at a global scale to create new knowledge (Bathelt and Cohendet 2014; Wang and Hu 2020; Yue 2022). It is important to understand how such interactions and interdependencies are made. Combining knowledge from distant geographic locations may result in a systemic increase in the complexity of the knowledge system of a country and enrich its knowledge base. Hidalgo and Hausmann (2009) developed measures of the complexity of a country’s economy. However, they note that this interpretation says nothing about the process whereby countries accumulate capabilities and characteristics of an economy that might affect them. It is possible to understand changes in a country’s productive structure by investigating how countries accumulate new capabilities and combine them with previously available capabilities to develop new products (Hidalgo and Hausmann 2009). Therefore, the development of the knowledge base of a nation is about its ability to generate, transfer, and apply both local and foreign knowledge.

Knowledge can be transferred through technology transfer as well as adopting new management and organizational practices, contributing to the improvement in technological, managerial, and organizational capabilities of firms (Mehreen et al. 2022; Pina Stranger et al. 2023; Scott-Kennel 2007). Knowledge can also be transferred through R&D collaborations and training. Firms’ involvement in innovation collaborations with various outside parties enriches their knowledge base and develops a better ability to assimilate and exploit external knowledge (Kostopoulos et al. 2011; Kang et al. 2021; Pereira et al. 2023). For example, firms set up R&D labs close to clusters where valuable knowledge is concentrated and have the competence to absorb and transfer the knowledge in their internal network as well as external networks (Castellani et al. 2013; Turkina and Van Assche 2018). Buyers often arrange various training programs as well as technical assistance with the production process and quality control (Narula and Marin 2003; Pereira et al. 2023; Wang and Hu 2020), given that the quality of products and services exported is decided by the communication between buyer and seller (Ding et al. 2021; Lecraw 1993). Cultural exchange between actors also facilitates the complex process of knowledge generation and transfer, because the same knowledge can be interpreted and used differently by people in different organizations in different places (Van Wijk et al. 2008). The process of knowledge transfer can also be simplified by intellectual property rights (IPRs) by providing an incentive to the inventors to contribute to the production of knowledge and economic growth of a nation. Stronger IPRs enhance knowledge and technology transfer (Ben Chou and Passerini 2009; Tung 1994) and lead to strategic interaction between countries depending on their levels of knowledge structure and IPR standards (Ben Chou and Passerini 2009). For example, sharing intellectual property and technological know-how is often necessary to deal with global challenges. For example, Erfani et al. (2021) points out the necessity of an IP waiver for COVID-19 vaccines and related goods to advance global health equity.

To sum up, knowledge transfer in local and global contexts may require different tools. However, FDI is known as an important tool to transfer knowledge across borders due to the rising cost and risks associated with other mechanisms. By being part of different networks, MNEs interact with actors in different local and international ecosystems and have access to knowledge available in these ecosystems (Li and Gao 2021; Yue 2022). MNEs have the unique ability to absorb and transfer knowledge on a global scale (Castellani et al. 2013).

Therefore, we attempt to elaborate our understanding of knowledge sourcing through FDI and the effect on the knowledge base of a country by arguing that FDI is a way to accumulate knowledge from diverse sources so as to increase knowledge complexity and contribute to the knowledge base of a country. Just as “the variety of inputs that go into the production of goods produced by a country affects that country’s overall productivity” (Hidalgo and Hausmann 2009), the variety of knowledge sourced by a country through direct and indirect FDI linkages contributes to the country’s knowledge base. We aim to explore the context by modeling the global outward FDI network because attaining knowledge existing elsewhere requires decision and investment (Bathelt et al. 2004). This study should be seen as an attempt to empirically underpin the argument that FDI is instrumental to sourcing knowledge from host countries and that such knowledge contributes to the knowledge base in home countries.

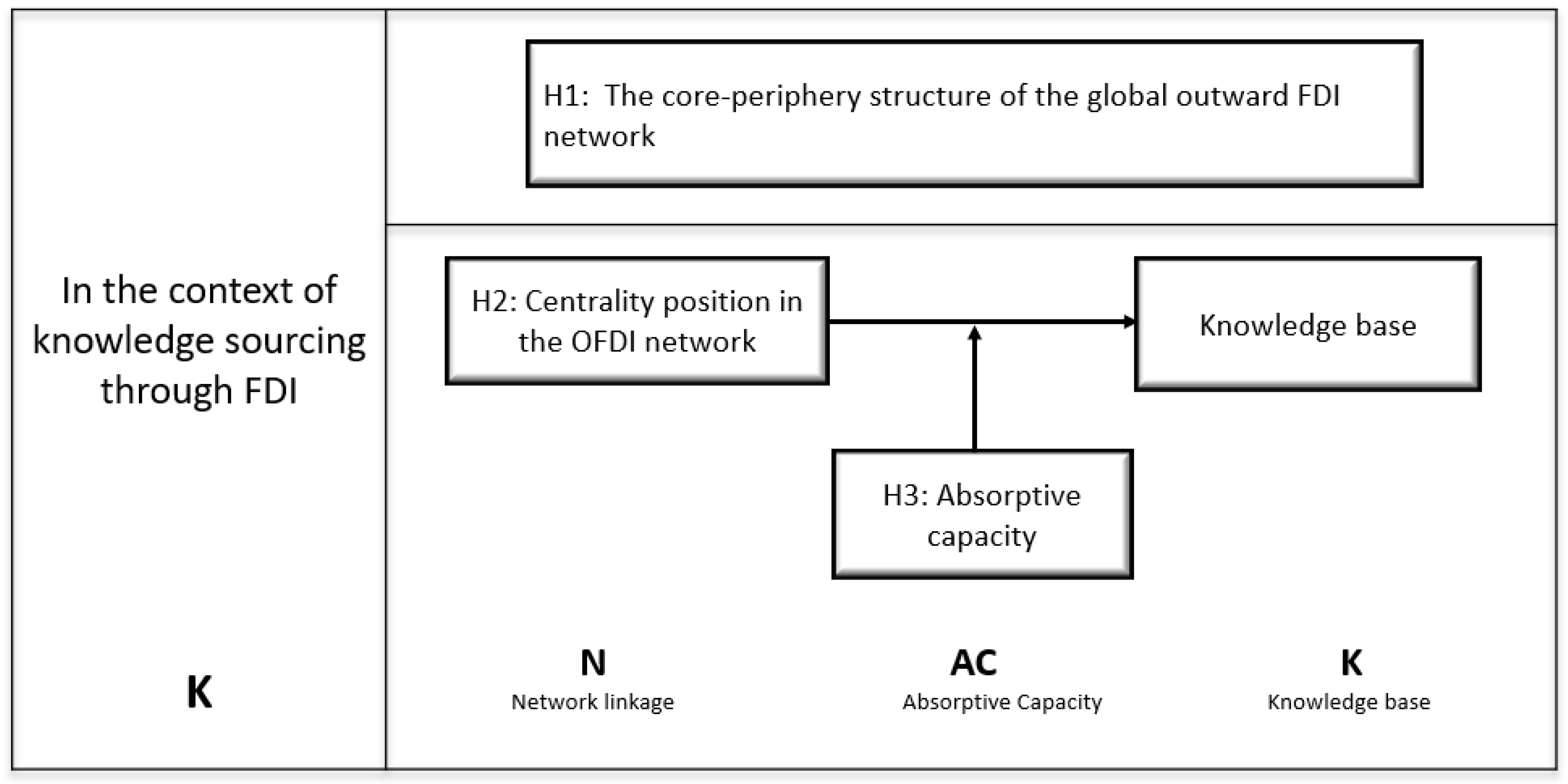

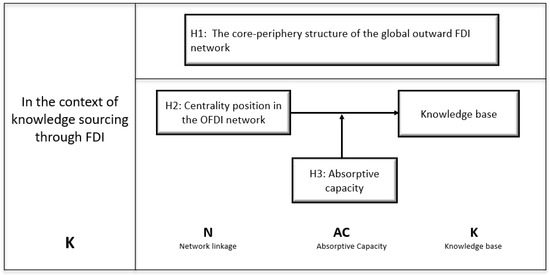

2.3. The Conceptual Framework: K-NACK Model

Interaction across spaces enables a combination of knowledge from different locations to create new knowledge. We take a network approach to provide a deeper understanding of knowledge and technology transfer through outward FDI connecting to the knowledge base in a country. The network approach views FDI as a link between domestic and foreign networks and as a strategic choice to seek advanced knowledge and technologies in host countries to enhance the knowledge base in home countries (Chen and Chen 1998). Through FDI, investors can tap into knowledge in host countries that may not exist elsewhere in their networks and can absorb the knowledge to contribute to the knowledge base in their home countries. We theorize that investors can source knowledge, through direct and indirect FDI linkages, from host countries to enrich the knowledge base in home countries and the absorptive capacity of countries matters in knowledge sourcing through FDI. We test the theory by modeling the global outward FDI network and investigating the association between a county’s centrality position in the global outward FDI network and its knowledge base. We also investigate the moderating effect of absorptive capacity in the relationship.

2.3.1. The Global FDI Network

Researchers have increasingly been using network analysis to understand different contexts, including the transfer of ideas, knowledge, technologies, and financial contagion (Ferrier et al. 2016; Goyal 2012; Jackson 2008; Kali and Reyes 2007; Sultana and Turkina 2020; Turkina and Van Assche 2018). By modeling a network of relationships and analyzing the structure of the network, we can have deeper insights into the direct and the indirect relationships between actors in a network and the structure of the network, as well as predict which structures are likely to emerge in a society (Goyal 2012; Jackson 2008). Understanding the linkages and structures of a network provides us with important insights into the relationships among actors in a network. A network can be of different forms and shapes, among which the core–periphery structure is well known. For example, “Large social networks tend to be organized in a core-periphery structure, in which high-status people are linked in a densely connected core, while the low-status people are atomized around the periphery of the network” (Easley and Kleinberg 2010). We notice a similar trend in the global distribution of FDI (Bolívar et al. 2019; Sultana and Turkina 2020). Investors are constantly in search of complementary resources that will ensure the maximum return on their investment, which suggests the asymmetrical flow of FDI.

Investors try to establish operations close to the related and supporting industries, and such concentration of firms in a location facilitate the creation of global pipelines to transfer knowledge (Bathelt and Cohendet 2014). Similarly, the flow of knowledge may be geographically localized, and a key reason for geographically localized knowledge flows is the establishment of linkages between the knowledge-producing actors (Almeida and Phene 2004). Regardless of their country of origin, investors tend to seek developed countries to carry out FDI and access knowledge (Scott-Kennel 2007). Investors can develop competitive advantages by sourcing knowledge from foreign knowledge hotspots that offer differentiated streams of knowledge, so long as they can identify, transfer, and integrate the knowledge through their operations (Almeida and Phene 2004; Song and Shin 2008; Turkina and Van Assche 2018; Zahra and George 2002). Knowledge-seeking FDI is usually directed to countries that offer a relatively advanced environment to promote the advancement of different types of knowledge (Kedia et al. 2012). Therefore, the flow of outward FDI will be higher between the countries that have relatively advanced knowledge and technology, given that FDI is a major channel of knowledge and technology transfer. Investors from countries with a higher knowledge base are motivated to invest in other countries, because on the one hand, they have relatively little to learn in their own countries, and on the other hand, they are more likely to outsource knowledge from host countries that have a higher knowledge base relative to their home countries (Song and Shin 2008). Countries that are central in the global FDI network possess diverse and complex knowledge and are able to produce knowledge-intensive products. We summarize the discussion above in the following hypotheses.

Hypothesis 1.

The global outward FDI network has a core–periphery structure.

2.3.2. Country Knowledge Base and Access to Knowledge through Foreign Direct Investment

Knowledge can be accumulated, transferred, and preserved when networks of individuals and organizations put that knowledge into productive use (Hausmann et al. 2014; Pina Stranger et al. 2023). By studying the network of relatedness between products, Hidalgo et al. (2007) find that most upscale products are located in a densely connected core of the network, which suggests the accumulation of knowledge in the core. Investors can access new knowledge, technology, and resources to complement or supplement their existing capabilities through FDI (Cantwell and Janne 1999; Kedia et al. 2012). While making foreign direct investments, investors usually look for complementary resources that will enable them to maintain competitiveness (Kedia et al. 2012). Since countries differ in their knowledge profile (Chung and Yeaple 2008), investors can successfully combine knowledge across country locations to generate competitive advantages that other firms will find difficult to replicate or match (Gupta and Govindarajan 2000; Zahra and George 2002). FDI enables investors to gain access to knowledge and technology as well as acquire expertise in different areas, including marketing and general management. Investors can not only exploit their ownership advantages but also access and develop ownership advantages that they did not possess prior through outward FDI (Ding et al. 2021; Hsu and Chen 2009; Lecraw 1993). Linkages between local and foreign firms are important mechanisms for transferring knowledge and technologies between firms, as well as for improving the technological, managerial, and organizational capabilities of firms (Scott-Kennel 2007). Investors can draw from diverse knowledge and technology available in host countries through outward FDI (Chung and Alcácer 2002; Almeida and Phene 2004).

MNEs are embedded in different networks (Ghoshal and Bartlett 1990), and the embeddedness in a network gives an actor access to resources of other actors in the network, resulting in superior power and status as well as the possession of superior knowledge (Bonacich 1987; Li and Gao 2021; Yue 2022). FDI can be seen as a strategic choice to seek advanced knowledge and technologies in host countries to enhance the knowledge base in home countries (Chen and Chen 1998). For instance, Ferrier et al. (2016) analyzed the effect of the trade network on technology transfer and found that in most cases, countries that are better connected to the trade network have higher technology intensities. Through outward FDI, investors can access the advanced knowledge and technology available in host countries that would otherwise have been costly and unavailable (Deng and Lu 2022; Keller 2004; Nelaeva and Nilssen 2022). Knowledge and technology transfer between investors and recipients occurs when they are exposed to one another’s products or production processes, marketing techniques, or receive technical assistance. For example, in a host country, investors from different countries often bring together knowledge and ideas from different perspectives, which facilitates further development of knowledge in a combination of the knowledge specific to investors (Lecraw 1993).

Based on the statement that societies can expand their knowledge base “by facilitating the interaction of individuals in increasingly complex webs of organizations and markets (Hausmann et al. 2014)”, it is possible to argue that forming FDI linkages is instrumental in sourcing knowledge from host countries and enriching the knowledge base in home countries. It can be argued that countries amass diverse knowledge through FDI and that countries that have more FDI linkages tend to possess more complex knowledge than the countries that have fewer FDI linkages. Therefore, countries that establish more outward FDI linkages will have a higher position in the global outward FDI network and higher knowledge bases. We summarize this discussion in the following hypothesis.

Hypothesis 2.

The knowledge base in a country is positively associated with the country’s centrality position in the global outward FDI network.

2.3.3. Access to Knowledge through FDI and the Role of Absorptive Capacity

We understand from the literature that investors can access knowledge and technologies in host countries through networks of relationships with local actors (Bathelt and Cohendet 2014; Cantwell and Janne 1999; Deng and Lu 2022; Kedia et al. 2012; Turkina and Van Assche 2018). However, making an outward FDI does not guarantee that investors will be able to access the advanced knowledge available in host countries or contribute to the knowledge base of a country. Knowledge is often defined as tacit, which is not easily transferrable, and codified, which is easily transferable. However, the distinction might not be so easy. For example, tacit knowledge may not necessarily remain embodied in people, but can spill over when people articulate their thoughts, experiences, and viewpoints through gestures or language (Martin 2012). Similarly, the interpretation of codified knowledge depends on the subjective understanding of the actors involved (Amesse and Cohendet 2001). The effectiveness of an actor’s external knowledge-sourcing strategies to build new knowledge depends on the actor’s internal knowledge (Grigoriou and Rothaermel 2017). Therefore, investors need to have the basic capacity to understand and absorb knowledge from external sources (Nelaeva and Nilssen 2022; Sultana and Turkina 2020). Such basic capacity is defined as absorptive capacity (Cohen and Levinthal 1990). Developing absorptive capacities is important because the incentive to accumulate depends, among other things, on how new capabilities complement existing capabilities to create new products and services (Hidalgo and Hausmann 2009; Hidalgo et al. 2007).

According to Cohen and Levinthal (1990), absorptive capacity is an actor’s ability to identify, assimilate, and exploit knowledge from their environment. The absorption of knowledge and technology from foreign sources depends on the presence of absorptive capacity (Amesse and Cohendet 2001; Bathelt and Cohendet 2014; Deng and Lu 2022). For example, the knowledge and technology available in host countries can be of a tacit nature and highly context-specific, which requires certain capabilities to be absorbed (Cohen and Levinthal 1989; Fritsch and Kauffeld-Monz 2010; Narula and Marin 2003). The existing capabilities of investors influence their motivation to source knowledge from host countries (Song and Shin 2008; Sultana and Turkina 2023). Recently, Deng and Lu (2022) found that absorptive capacity strengthens the positive relationship between transnational knowledge transfer and innovation. Therefore, whether a country will benefit from outward FDI depends on the activities undertaken in the country to enhance the absorptive capacity of investors. Following the literature, we use R&D expenditure to measure the absorptive capacity of a country (Sultana and Turkina 2020). R&D expenditure in a country drives technological change, innovation, and economic growth by enabling actors to both generate new information and absorb information from external sources (Cohen and Levinthal 1989; Sultana and Turkina 2020). The combined benefit of the network embeddedness and absorptive capacity for the knowledge base of a country will be stronger. We summarize this discussion in the following hypothesis.

Hypothesis 3.

The association between a country’s position in the global outward FDI network and its knowledge base is positively moderated by the country’s internal capacity.

To sum up, we develop the following conceptual framework (Figure 1) to understand the context of knowledge sourcing through FDI, connecting knowledge in host countries to the knowledge base in home countries.

Figure 1.

The K-NACK framework connecting knowledge in host countries to the knowledge base in home countries.

3. Methods

To understand the knowledge base of a country in the context of outward FDI, we conduct both network analysis and longitudinal regression analysis. We aim to understand the structure of the global outward FDI network to explore whether investors can access and absorb the knowledge and technology available in host countries and whether doing so affects the knowledge base in the home country. At first, we conduct a network analysis to understand the structure of the global outward FDI network and determine the centrality position of a country in the network. The network analysis approach focuses on the relationship among entities to define the state of a system in terms of nodes and links at a given point in time (Schiavo et al. 2010). The nodes can be individuals, firms, countries, or any other entity. Jackson (2008) defines such entities in a network as nodes that have the same probability of being linked, and two nodes can either be connected or not in a network. By using the network analysis approach, we can also examine the interaction and the structure of a relationship among the different actors in a network and understand the role of such networks in different areas (Goyal 2012; Jackson 2008). Some recent examples of using this approach include Pina Stranger et al. (2023), Sultana and Turkina (2020), Bolívar et al. (2019), Ferrier et al. (2016), and Kali and Reyes (2007), who study different international networks. In the network analysis approach, both the direct and the indirect connections between actors are considered, and the position of an actor in a network is important, whether it is fortuitous or strategic (Jackson 2008). The simplest type of network can be explained as a binary, and an undirected graph in which any two nodes can be either connected by a link or not, and link directions are unimportant (Jackson 2008; Schiavo et al. 2010).

In this study, we consider the binary graph, that is, the mere presence or absence of outward FDI flow between two countries, not the actual value of the outward FDI. We conduct a network analysis of 246 countries, including islands and territories, and a longitudinal regression analysis covering the period from 2009 to 2016. Some territories and islands contribute and receive a significant amount of the total FDI flow. Therefore, we considered all islands and territories for which FDI information is available to create a better representation of the global FDI network while conducting network analyses. The rationale behind the period of our study is the availability of bilateral FDI data. Bilateral outward FDI data about total foreign direct investment stock in the partner countries is available from the Coordinated Direct Investment Survey (CDIS) conducted by the International Monetary Fund (IMF)1. As defined by the OECD, the outward FDI stock is the value of the resident investors’ equity in and net loans to enterprises in foreign economies. We conduct a core–periphery analysis and eigenvector centrality analysis to determine the structure of the global outward FDI network and a country’s centrality position in the network. Eigenvector centrality has been used in earlier studies to explore network resources, including status, competitive advantage, and performance (Benjamin and Podolny 1999; Faulk et al. 2017). Eigenvector centrality captures the centrality position of an actor in a network in terms of the overall structures of the network and considers the position of neighboring actors (Bonacich 1987), and therefore is most suitable in this context. We use the UCINET software (Version 6.759) to plot the diagrams of binary networks and conduct network analyses.

Next, we conduct a longitudinal regression analysis using the knowledge base of a country as the dependent variable, the network centrality position of countries obtained from the network analysis as the independent variable, and the interactions between the network centrality position, and the indicators of absorptive capacity—R&D—as the moderator variable. A longitudinal regression analysis allows us to investigate the development in home countries over a longer period while controlling for other factors (Volberda et al. 2010). For the regression analysis, we excluded the information on non-reporting countries and used a final sample of 102 countries including all the OECD member countries. The OECD member countries are estimated to be involved in 65% of the global FDI flow (Bolívar et al. 2019; Sultana and Turkina 2020). We also control for trade, trade openness, GDP per capita, and property rights in the longitudinal regression analysis. We use the STATA statistical software to conduct the regression analysis. The model is expressed in the following formula2:

3.1. Dependent Variable: Knowledge Base

The knowledge base in a country can be understood as an assemblage of knowledge available in a country. Knowledge can be accumulated, transferred, and preserved when networks of individuals and organizations put that knowledge into productive use (Hausmann et al. 2014). Some kinds of knowledge are more difficult to develop or replicate than other kinds, but we have no readily available measure of the complexity or nature of knowledge (Balland and Rigby 2017). While the network facilitates the flow of knowledge, the knowledge base of an economy is shaped by the linkages between actors at both the national and regional levels (Leydesdorff and Fritsch 2006). Scholars have used occupation data, industry sector data, or education data to measure the knowledge base of an economic system (Leydesdorff and Fritsch 2006; Martin 2012). Occupation data reflect tasks and duties undertaken by the local workforce, industry sector data reflect industries in which the local workforce is active, and education data reflect the type and level of education of the local workforce (Martin 2012). However, these measurements do not consider the interactions between diverse actors or connections between activities and do not provide us with a complete understanding of the knowledge base of a country. For example, education data are not sufficient to capture the knowledge base of a person because on-the-job training and continuous training allow people to go beyond their certified level of education (Martin 2012).

Therefore, in this study, we use the Economic Complexity Index (ECI) to measure the knowledge base of a country. We argue that the ECI is a better measurement of the knowledge base of an economy because it involves network techniques and is used to assess the current state of a country’s productive knowledge (Hidalgo 2021; Hidalgo et al. 2007). According to Hausmann et al. (2014), if making a product requires a particular type and mix of knowledge, then the countries that make the product reveal having the requisite knowledge: “The Economic Complexity Index tries to capture the total amount of productive knowledge that is embedded in a society as a whole and is related to the diversity of knowledge that a society holds” (p. 34). Products produced in a country depend substantially on the knowledge and capabilities available in a country (Hidalgo and Hausmann 2009). The productive capabilities of a country are the knowledge including technologies and ideas that determine the knowledge prospects of the country (Hausmann et al. 2014). The ECI data come from the Economic Complexity Observatory.

3.2. Independent Variable: Network Centrality Position

The network centrality position of a country in the global outward FDI network is our independent variable. By using the bilateral outward FDI data, we conduct the eigenvector centrality analysis (Bonacich 1987) to obtain information on the network centrality position of a country in the global outward FDI network. Following earlier studies, we consider each country as a node and the presence of outward FDI as the linkage between two countries or nodes to model the global outward FDI network (Bolívar et al. 2019; Kali and Reyes 2007; Sultana and Turkina 2020). Table 1 presents a sample of data on the first ten countries extracted from the IMF database and analyzed to conduct the network analysis.

Table 1.

Bilateral outward FDI data of the first ten countries in 2009.

In Table 1, the value of the outward FDI stock is reported in millions of US dollars; the empty cells reflect that the data on the outward FDI relationship between respective countries are unavailable; the cells with “0” reflect the value is less than ±500,000, and cells with “C” reflect that the data were suppressed by the reporting economy to preserve confidentiality. We convert the available data into a binary matrix to conduct the network centrality analysis. To build the network, we emphasize the presence or absence of the FDI linkages, regardless of the positive, negative, and concealed values, and we do not attempt to identify the weight of the FDI. In the binary matrix, cells containing a dollar value or C are considered as the presence of the outward FDI linkage between two countries and are coded as “1”, whereas empty cells are considered as the absence of the linkage and are coded as “0”. Table 2 presents the binary matrix of the first ten countries3 calculated using the bilateral outward FDI stock data available in the IMF database.

Table 2.

A sample of binary matrix prepared by using the IMF data 2009.

We used the UCINET software to conduct network analysis. Although we used the bidirectional outward FDI stock data, we symmetrized the data using the “symmetrize” option of the UCINET software to strengthen our analysis. The symmetrize option turns asymmetric or direct network data into symmetric or undirected data. After symmetrizing the data, we conducted the eigenvector centrality analysis to obtain a country’s centrality position in the global outward FDI network. The eigenvector centrality analysis is the appropriate analysis to study the context of technology transfer because it considers not only the value of a particular node but also the value of the neighboring nodes to calculate the centrality position of a node (Bonacich 1987).

In UCINET, the eigenvector centrality analysis calculates the eigenvector of the largest possible eigenvalue as a measure of centrality. This measure was used in earlier studies to report network resources and attributes including status, power, performance, and competitive advantage (Bonacich 1987; Li and Gao 2021). Table 3 presents the eigenvalue of countries obtained from the eigenvector centrality analysis.

Table 3.

Eigenvalues of the first ten countries (2009–2016).

3.3. Moderator Variable: Absorptive Capacity

We understand from the literature that knowledge and technology transfer is not an automatic outcome of FDI, and investors need to have the required capacity to understand the advanced knowledge and technology available in foreign countries. The absorptive capacity generated by the internal research of an actor improves the actor’s ability to connect with external knowledge (Cohen and Levinthal 1990; Fabrizio 2009). Following earlier studies, we use R&D expenditure in a country to operationalize the absorptive capacity of a country (Sultana and Turkina 2020). R&D is generally considered important for new knowledge creation and innovation, but it is also important for developing an actor’s absorptive capacity (Cohen and Levinthal 1989; Griffith et al. 2003). The intensity of R&D activities in a country triggers technological advancement and contributes to the absorptive capacity of actors (Griffith et al. 2003). R&D efforts contribute to the existing knowledge base and constitute a necessary condition for the successful exploitation of knowledge and its conversion to new knowledge (Caloghirou et al. 2004). Therefore, R&D plays an important role in knowledge creation and absorption, but R&D activities also require skilled personnel to continue the pursuit of knowledge and manage a competitive position. The R&D data used in this study include R&D performed within a country and funded from abroad but exclude payments for R&D made from abroad. We extracted the data on government R&D expenditure from the Euromonitor International database.

3.4. Control Variables

We use several controls to understand the association between a country’s outward FDI and its knowledge base. The selection of our control variables has been guided by earlier studies. We use GDP per capita, measured in thousands of USD, to account for the economic performance and development status of a country. Economically developed countries are in a better position to make FDI in target countries (Keller 2004). FDI is an important internationalization strategy that can be influenced by both the flow of total trade and the openness of both home and host countries. For example, a country’s gaining benefit from foreign R&D depends on its openness to trade (Potterie and Lichtenberg 2001). Therefore, we control for trade, measured using the total value of imports plus exports in a country in thousands of USD, and trade openness, measured using the ratio of total trade to GDP. We also control for the total tax rates in home countries, since FDIs are often made to avoid tax barriers (da Silva-Oliveira et al. 2021). An adequate level of protection of intellectual property rights is important for actors to feel comfortable in introducing their latest knowledge and technology to others (Tung 1994). We control for property rights using the property rights index. For a given country, a higher score between 0 and 100 indicates better protection of property rights.

Finally, we control for the human capital, since knowledge and technology can be embodied in products, processes, and persons, and therefore transferring knowledge through all these components involves human resources (Mehreen et al. 2022; Tung 1994). Although scholars have used human capital as an indicator of absorptive capacity (Sultana and Turkina 2020), they have done so in the context of knowledge spillover from inward FDI. For example, knowledge can be transferred from a foreign firm to local firms through employee turnover (Fosfuri et al. 2001). However, the contexts of inward FDI and outward FDI are not the same. Only the personnel required to manage the investment go to host countries in cases of outward FDI, whereas the scope of personnel involved in dealing with a foreign firm is not limited in the case of inward FDI. To operate in a foreign location, a firm creates different types of relationships with local firms. Nonetheless, qualified staff are required to keep abreast of the status quo of knowledge creation (Cohen and Levinthal 1990), and therefore need to be controlled to understand the relationship between knowledge sourced through FDI and the knowledge base of a country. Human capital in a country is measured by using the literacy rate. All information on the control variable comes from the Euromonitor International database. Table 4 summarizes the descriptions and sources of all variables used in this study.

Table 4.

Descriptions of variables and data sources.

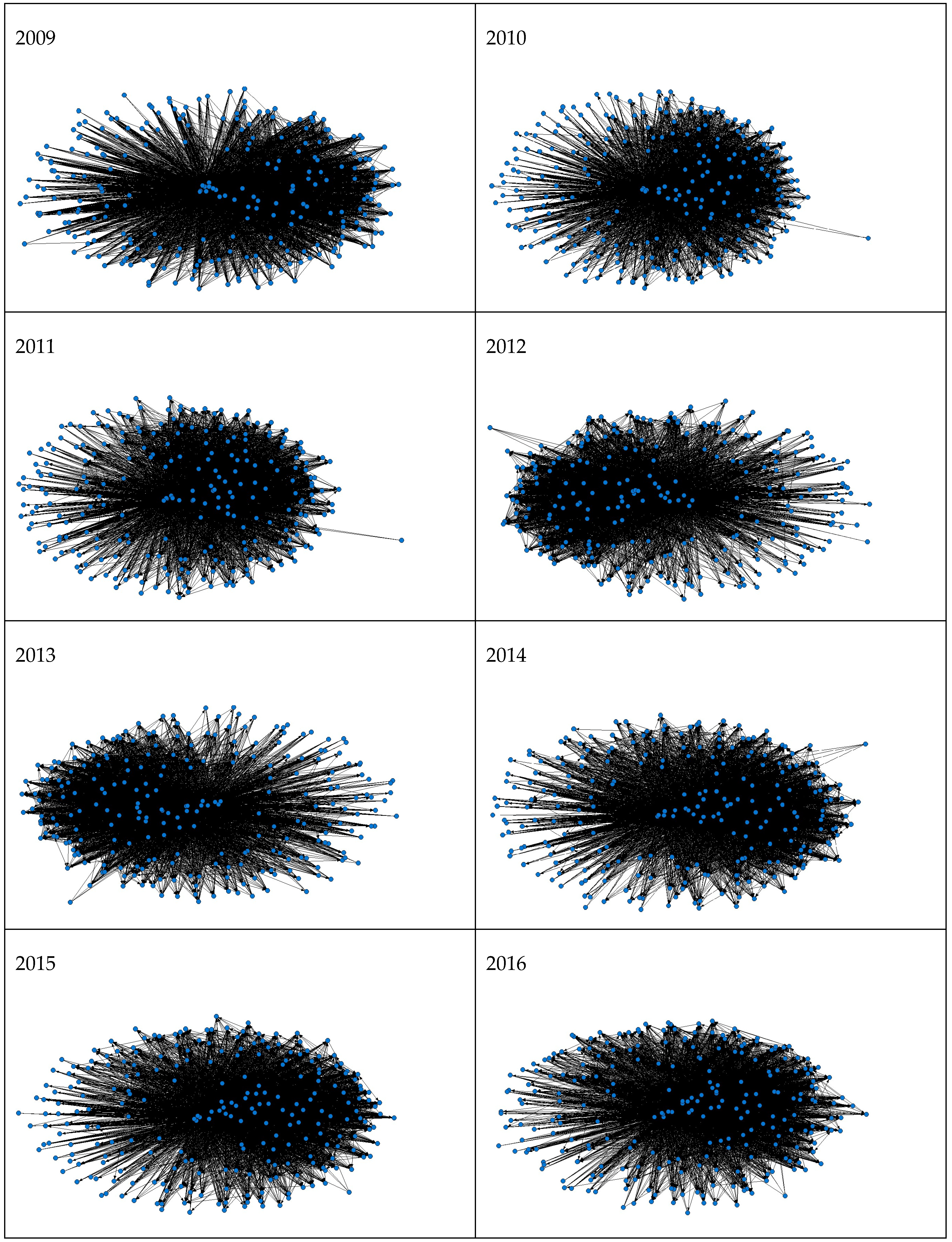

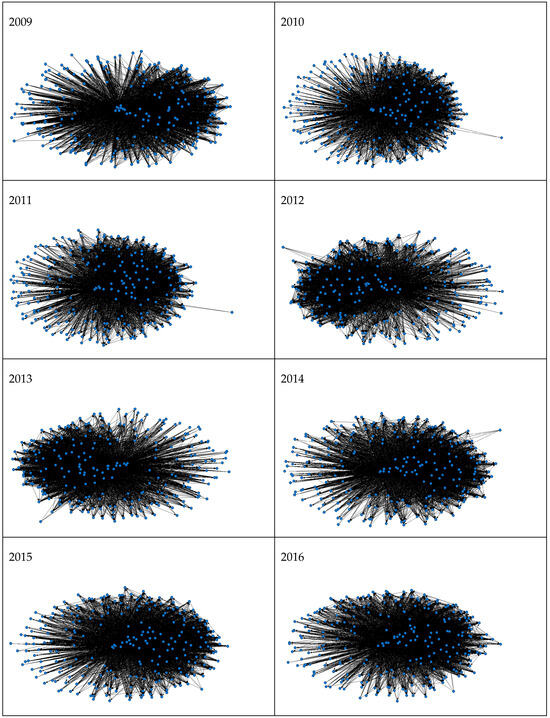

4. Results

The result of the network analysis reveals that the global outward FDI network has a core–periphery structure (Figure 2). A close look at the diagrams indicates that there are some countries that have more connections than other countries and that the structure of the networks remained the same throughout the period. We also observed that a core country may not necessarily have a higher knowledge base and that a country with a higher knowledge base may not necessarily be in the core. The core–periphery structure fits in the global outward FDI network during the study period have been close to 1, which suggests a strong fit of the network structure (Table 5). The findings provide support for our first hypothesis that the global outward FDI network has a core–periphery structure.

Figure 2.

Diagrams of the global outward FDI network model (2009–2016).

Table 5.

Core–periphery structure in the global outward FDI network and robustness of the analysis.

Next, after finding the structure of the global outward FDI network, we conducted the eigenvector centrality analysis to obtain the network centrality position of a country in the network. We calculated the ratios of the largest eigenvalue and the second-largest eigenvalue for each network to verify the robustness of our findings; a ratio greater than or equal to 1.5 indicates the robustness of the centrality measure. In our analysis, the minimum ratio is 3.819, confirming the robustness of the findings (Table 5).

Supported by the robust findings of the network analysis, we proceed to conduct the longitudinal regression analysis in which the network centrality position, measured using the eigenvalue, is the independent variable, and the knowledge base of a country, measured using the Economic Complexity Index, is the dependent variable. Since the core position of a country in the global outward FDI network may not always indicate the higher knowledge base of that country and investors need to have the capacity to absorb the advanced knowledge and technology available in host countries, we use the absorptive capacity of a country as a moderator variable in the longitudinal regression analysis. Table 6 presents the descriptive and correlation statistics. From the correlation statistics, we observe that the network centrality position of a country (coef. −0.6957) and R&D, the indicator of absorptive capacity of a country (coef. −0.3246), are positively and significantly correlated with the knowledge base of a country, as expected.

Table 6.

Descriptive and correlation statistics.

Next, we conduct longitudinal regression analyses. All the models are globally significant (Table 7). In Model A, we conduct the regression analysis including only control variables and find the network centrality position of a country in the global outward FDI network to be positively associated with the knowledge base of the country. The positive coefficient of the independent variable—the centrality position (10.931)—indicates the positive association between a country’s centrality position in the global outward FDI network and the knowledge base of the country. Next, we include R&D expenditure in model B to understand the role of the absorptive capacity of a country in knowledge sourcing through FDI.

Table 7.

Regression results.

The regression analysis in Model A has been conducted under the assumption that the variables used in the models are independent of each other. However, there are possibilities of variables interacting and causing substantial changes in the outcome. Therefore, in Model B, we consider the interaction between the network centrality position of a country in the outward FDI network and the indicators of absorptive capacity. In Model B, this positively moderates the association between the network centrality position and knowledge base, although the coefficient of R&D is not significant. The coefficient for the network centrality position is stronger when the interaction between the network centrality position and the absorptive capacity is considered (coef. 13.521 in Model B compared to coef. 10.931 in Model A). Therefore, the findings in Model A (coef. 10.931) support our second hypothesis that the knowledge base in a country is positively associated with the country’s centrality position in the global outward FDI network, and the findings in Model B (coef. 13.521) support the third hypothesis that the association between a country’s position in the global outward FDI network and its knowledge base is positively moderated by the country’s internal capacity.

Finally, to verify the robustness of our findings, we use an instrumental variable, the ease of doing business, in the analyses to address possible endogeneity, due to the possibility of reverse causality between FDI and knowledge base. We conduct a two-stage least square (2SLS) analysis and generalized method of moments (GMM) analysis using an instrumental variable to substantiate our argument. Model C presents the findings of the second-stage least square (2SLS), and Model D presents the findings of the generalized methods of moments using the instrumental variable. The negative coefficients are expected due to the nature of the instrumental variable. Findings in Model C and Model D are consistent with the findings of the previous models and support the robustness of our analyses. Furthermore, since knowledge sourcing and creation are related to innovation, we conduct a separate analysis using the innovative capability of the country as the dependent variable. The findings remain true.

5. Discussion

The objective of this research article is to understand the relationship between knowledge sourced through FDI and the knowledge base of a country and the role of the absorptive capacity of the country in knowledge sourcing through FDI. In this research article, we adopt the network analysis approach to provide insights into how investors can access knowledge available in host countries through FDI linkages and contribute to the knowledge base in their home countries. We model the global outward FDI network to understand the structure of the network and each country’s position in it. Next, we examine the relationship between the knowledge base of a given country and its centrality position in the global FDI network. Finally, we examine the importance of the absorptive capacity of a country in the relation between the knowledge base and network centrality position. The results from our analysis support all our arguments: the global outward FDI network has a core–periphery structure, the network centrality position of a country is positively and significantly associated with the knowledge base of the country, and the absorptive capacity of a country positively moderates the association. Finding empirical evidence to support our theory, we develop a conceptual framework—the K-NACK framework—depicting the context of knowledge sourcing through FDI to develop the knowledge base of a country.

The finding of the core–periphery structure in the global outward FDI network provides empirical support to the global distribution of FDI being asymmetrical. Since investors are more likely to outsource knowledge from host countries that have a higher knowledge base relative to their home countries (Kedia et al. 2012; Song and Shin 2008), they concentrate on countries that have higher knowledge and technologies (Keller 2004). As a result, the set of countries have more FDI linkages between themselves, form a core, and have a higher knowledge base compared to the countries in the periphery with fewer FDI linkages. The finding of the higher knowledge base in core countries is consistent with the idea of associated benefits of network embeddedness (Fritsch and Kauffeld-Monz 2010; Kali and Reyes 2007). Our findings highlight the contribution of outward FDI to the knowledge base of a country. Through outward FDI, investors can accumulate, acquire, and integrate knowledge available in host countries regardless of their national status, albeit the extent might differ (Awate et al. 2015; Nelaeva and Nilssen 2022). Depending on their intentions and strategies, investors can unambiguously benefit from knowledge available in host countries regardless of their nationalities (Dunning 1994; Potterie and Lichtenberg 2001). Regardless of their nationality, investors can access knowledge in host countries through outward FDI (Awate et al. 2015; Dunning 1994).

Finding a significant positive association between a country’s centrality position in the global outward FDI network and the knowledge base of the country indicates opportunities for a country to strengthen connections with other countries and improve its knowledge base. The knowledge base of an economy can be determined by the interaction between diverse actors (Leydesdorff and Fritsch 2006; Van Wijk et al. 2008). The activities concerning knowledge generation and integration rely critically on the connectedness between actors, and such connectedness does not occur automatically, but depends on the actors’ decision to connect with other actors (Bathelt and Cohendet 2014; Jackson 2008; Pina Stranger et al. 2023). The diversity in knowledge of actors and the efficiency of the communication among them is crucial for making efficient use of that aggregate knowledge (Hausmann et al. 2014; Li and Gao 2021). The embeddedness in a network gives an actor access to ample knowledge of other actors in the network (Li and Gao 2021; Yue 2022), which enables the actor to conduct successful innovation (Moaniba et al. 2020) and maintain a competitive edge. A country’s centrality position in the global FDI network captures information regarding the diversity of knowledge the country possesses, as well as the country’s capacity to invest in other countries to source knowledge.

In other words, the embeddedness of the countries in the global outward FDI network facilitates their access to the advanced and complementary knowledge available in host countries, as well as their strategic decisions regarding outward FDI in target countries. For example, according to the UNCTAD World Investment Report 20204, outward FDI will create opportunities for structurally weak and vulnerable economies to attain sustainable development goals, even when their outlook for FDI is extremely negative. Similarly, our findings provide insights for developing knowledge-based economies. The knowledge infrastructure of the institutional relationship between universities, industries, and governments is a necessary but not sufficient condition for developing a knowledge-based economy considering the growing interdependence between economies (Leydesdorff and Fritsch 2006). By making FDI in countries with a higher knowledge base, investors can gain access to knowledge available in host countries. Knowledge management is the key to successful innovation, and it requires effective strategies for external knowledge sourcing (Ardito and Petruzzelli 2017; Moaniba et al. 2020; Rodriguez et al. 2017; Sultana and Turkina 2023). MNEs’ knowledge linkages to host countries have a positive impact on innovation (Almeida and Phene 2004; Scalera et al. 2018; Wang and Hu 2020). Innovation is not only about discovering new knowledge or developing new products and services but also about the process of integrating new knowledge into the development of new products and services (Adner and Kapoor 2016). Outward FDI could change the knowledge and innovation status quo of countries. We develop the K-NACK framework, presented in Figure 1, to understand the context of knowledge sourcing through FDI, connecting knowledge in host countries to the knowledge base in home countries.

The findings of this study shed light on the importance of absorptive capacity. We find the strongest association between the network centrality position and the knowledge base of a country when the interaction between the network centrality position and the absorptive capacity is considered. Just as knowledge transfer cannot be taken for granted, outward FDI will not have the same contribution to the knowledge base of all countries; the absorptive capacity of a country influences the association between the country’s position in the global outward FDI network and its knowledge base. New knowledge will more easily be accumulated when such knowledge is combined with existing knowledge (Hidalgo and Hausmann 2009; Hidalgo et al. 2007). In a host country, investors from different countries often bring together knowledge and ideas from different perspectives and are involved in different social, professional, and technological relationships that permit knowledge flow, which facilitates further development of knowledge in a combination of the knowledge specific to each investor (Almeida and Phene 2004; Ghoshal and Bartlett 1990; Lecraw 1993; Kostopoulos et al. 2011). Therefore, investors benefit from both direct and indirect relations in accessing diverse knowledge and technology. Unlike previous studies on knowledge-seeking FDI, this study broadens the scope of our understanding by taking into account both direct and indirect FDI relationships between countries.

The long-run development of a country is linked to the absorptive capacity and connections to pools of knowledge generated elsewhere (Cohen and Levinthal 1990; Bathelt et al. 2004; Asheim and Coenen 2005). The state of actors’ internal knowledge-production process determines the effectiveness of their external knowledge-sourcing efforts (Grigoriou and Rothaermel 2017; Rodriguez et al. 2017). Spatial diffusion of knowledge is linked to the complexity of knowledge, and spatial concentration of complex knowledge is linked to regional competitive advantages (Balland and Rigby 2017). Development efforts in a country should focus on generating conditions that allow the convergence of knowledge from diverse sources to sustain growth and prosperity. Just as the knowledge sourced through FDI contributes to the knowledge base in a country, the knowledge base in the country enhances and determines the extent of innovation in that country (Asheim and Coenen 2005). Antonelli et al. (2020) found empirical evidence that the variety of knowledge exerts a positive effect on the generation of new knowledge in a region. The innovation process of firms and industries is dependent on a specific knowledge base (Asheim and Gertler 2006). In the long run, an enriched knowledge base of a country will help it to transform its knowledge core, upgrade technologies, and maintain a competitive edge in the global competition.

6. Conclusions

In this study, we argue and find empirical evidence that the global outward FDI network has a core–periphery structure, the network centrality position of a country is positively and significantly associated with the knowledge base of the country, and the absorptive capacity of a country positively moderates the association. A summary of hypotheses and findings are provided in Table 8. No one country can sustain the entire range of expertise that is needed to maintain a competitive edge in the information age. To maintain a competitive advantage, actors need to combine knowledge in novel and challenging ways sourced from diverse connections that often are geographically and internationally dispersed (Cantwell and Salmon 2018). First, conducting the network analysis, we find that there are some core countries that make more outward FDI to each other than to other countries in the global outward FDI network. Next, we conduct a longitudinal regression analysis to explore further. The findings support our arguments that the knowledge base of a country is positively associated with the country’s centrality position in the global outward FDI network and that the absorptive capacity of a country positively moderates the association. We find the strongest association between the network centrality position and the knowledge base in a country when the interaction between the network centrality position and the absorptive capacity is considered. The robustness of our findings is confirmed by the 2SLS and GMM analyses using an instrumental variable estimator.

Table 8.

Summary of hypotheses and findings.

Our findings will help governments and policymakers to organize country-specific growth plans and promote outward FDI through policy packages to decide where to invest and which capabilities to build to contribute to the knowledge base in the country. Countries can make outward foreign direct investment in foreign knowledge hotspots to access foreign knowledge and technologies (Bathelt and Cohendet 2014; Sultana and Turkina 2023; Turkina and Van Assche 2018) and focus on building absorptive capacity to reinforce knowledge and technology absorption (Amesse and Cohendet 2001; Deng and Lu 2022; Griffith et al. 2003; Hausmann et al. 2014; Sultana and Turkina 2020). The findings of this study will be helpful for cities and regions to transform their knowledge cores toward greater complexity (Balland and Rigby 2017). Nevertheless, there are some caveats in this study that indicate both a need and opportunities for further research. Since scholars have used different measures including occupation data, industry sector data, or education data to measure the knowledge base of an economic system, there is no standard measurement to operationalize the construct. The opportunities are vast for researchers to use different variables that might lead to different findings or strengthen our findings. Future studies focusing on different regions and areas will provide insights into the trends and evolution of FDI, as well as the challenges or opportunities for regional development. It might be of interest to conduct comparative studies of the contexts of developed and developing countries or core and peripheral countries. Such studies will provide insights into the trends and evolutions as well as the challenges and opportunities for regional development. Further studies investigating the geographic origin of knowledge sources will provide a better understanding of knowledge creation by combining knowledge from different sources. Studying a longer period in future research may provide more insights into the context of knowledge sourcing through outward FDI and the resulting impact on the knowledge base of a country.

Author Contributions

Conceptualization, N.S. and E.T.; methodology, N.S.; software, N.S.; validation, N.S. and E.T.; formal analysis, N.S.; investigation, N.S.; resources, N.S.; data curation, N.S.; writing—original draft preparation, N.S.; writing—review and editing, N.S. and E.T.; visualization, N.S.; supervision, E.T.; project administration, N.S.; funding acquisition, E.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Research Chair in Global Innovation Networks, HEC Montreal. And The APC was funded by the Research Chair in Global Innovation Networks, HEC Montreal.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

We converted the available data from IMF into a binary matrix to conduct the network analysis. Supplementary data can be accessed here. https://docs.google.com/spreadsheets/d/1YnnsscxfdF8QWHpZIsIPqbh1bngAy8Ii/edit?usp=sharing&ouid=112988447538570941716&rtpof=true&sd=true.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | https://www.imf.org/external/np/sta/fdi/eng/2003/102803.pdf (accessed on: 10 January 2023). |

| 2 | https://www.stata.com/manuals/xtxtologit.pdf (accessed on: 26 January 2023). |

| 3 | |

| 4 | https://unctad.org/system/files/official-document/wir2020_en.pdf (accessed on: 10 January 2023). |

References

- Adner, Ron, and Rahul Kapoor. 2016. Innovation Ecosystems and the Pace of Substitution: Re-examining Technology S-curves. Strategic Management Journal 37: 625–48. [Google Scholar] [CrossRef]

- Almeida, Paul, and Anupama Phene. 2004. Subsidiaries and Knowledge Creation: The Influence of the MNC and Host Country on Innovation. Strategic Management Journal 25: 847–64. [Google Scholar] [CrossRef]

- Amesse, Fernand, and Patrick Cohendet. 2001. Technology Transfer Revisited from the Perspective of the Knowledge-Based Economy. Research Policy 30: 1459–78. [Google Scholar] [CrossRef]

- Antonelli, Cristiano, Francesco Crespi, and Francesco Quatraro. 2020. Knowledge Complexity and the Mechanisms of Knowledge Generation and Exploitation: The European Evidence. Research Policy 51: 104081. [Google Scholar] [CrossRef]

- Ardito, Lorenzo, and Antonio Messeni Petruzzelli. 2017. Breadth of External Knowledge Sourcing and Product Innovation: The Moderating Role of Strategic Human Resource Practices. European Management Journal 35: 261–72. [Google Scholar] [CrossRef]

- Asheim, Bjørn T., and Lars Coenen. 2005. Knowledge Bases and Regional Innovation Systems: Comparing Nordic Clusters. Research Policy 34: 1173–90. [Google Scholar] [CrossRef]

- Asheim, Bjørn T., and Meric S. Gertler. 2006. The Geography of Innovation: Regional Innovation Systems. In The Oxford Handbook of Innovation. Oxford: Oxford University Press. [Google Scholar]

- Awate, Snehal, Marcus M. Larsen, and Ram Mudambi. 2015. Accessing vs Sourcing Knowledge: A Comparative Study of R&D Internationalization between Emerging and Advanced Economy Firms. Journal of International Business Studies 46: 63–86. [Google Scholar]

- Balland, Pierre-Alexandre, and David Rigby. 2017. The Geography of Complex Knowledge. Economic Geography 93: 1–23. [Google Scholar] [CrossRef]

- Balland, Pierre-Alexandre, Ron Boschma, Joan Crespo, and David L. Rigby. 2018. Smart Specialization Policy in the European Union: Relatedness, Knowledge Complexity and Regional Diversification. Regional Studies 53: 1252–68. [Google Scholar] [CrossRef]

- Bathelt, Harald, and Patrick Cohendet. 2014. The Creation of Knowledge: Local Building, Global Accessing and Economic Development—Toward an Agenda. Journal of Economic Geography 14: 869–82. [Google Scholar] [CrossRef]

- Bathelt, Harald, and Pengfei Li. 2020. Processes of Building Cross-Border Knowledge Pipelines. Research Policy 49: 103928. [Google Scholar] [CrossRef]

- Bathelt, Harald, Anders Malmberg, and Peter Maskell. 2004. Clusters and Knowledge: Local Buzz, Global Pipelines and the Process of Knowledge Creation. Progress in Human Geography 28: 31–56. [Google Scholar] [CrossRef]

- Ben Chou, P., and Katia Passerini. 2009. Intellectual Property Rights and Knowledge Sharing across Countries. Journal of Knowledge Management 13: 331–44. [Google Scholar] [CrossRef]

- Benjamin, Beth A., and Joel M. Podolny. 1999. Status, Quality, and Social Order in the California Wine Industry. Administrative Science Quarterly 44: 563–89. [Google Scholar] [CrossRef]

- Berry, Heather. 2014. Global Integration and Innovation: Multicountry Knowledge Generation within MNC s. Strategic Management Journal 35: 869–90. [Google Scholar] [CrossRef]

- Bolívar, Luis Miguel, Cristóbal Casanueva, and Ignacio Castro. 2019. Global Foreign Direct Investment: A Network Perspective. International Business Review 28: 696–712. [Google Scholar] [CrossRef]

- Bonacich, Phillip. 1987. Power and Centrality: A Family of Measures. American Journal of Sociology 92: 1170–82. [Google Scholar] [CrossRef]

- Brown, John Seely, and Paul Duguid. 2001. Knowledge and Organization: A Social-Practice Perspective. Organization Science 12: 198–213. [Google Scholar] [CrossRef]

- Caloghirou, Yannis, Ioanna Kastelli, and Aggelos Tsakanikas. 2004. Internal Capabilities and External Knowledge Sources: Complements or Substitutes for Innovative Performance? Technovation 24: 29–39. [Google Scholar] [CrossRef]

- Cantwell, John, and Jessica Salmon. 2018. The Effects of Global Connectivity on Knowledge Complexity in the Information Age. In International Business in the Information and Digital Age. Bentley: Emerald Publishing Limited, pp. 123–37. [Google Scholar]

- Cantwell, John, and Odile Janne. 1999. Technological Globalisation and Innovative Centres: The Role of Corporate Technological Leadership and Locational Hierarchy. Research Policy 28: 119–44. [Google Scholar] [CrossRef]

- Castellani, Davide, Alfredo Jimenez, and Antonello Zanfei. 2013. How Remote Are R&D Labs? Distance Factors and International Innovative Activities. Journal of International Business Studies 44: 649–75. [Google Scholar]

- Chen, Homin, and Tain-Jy Chen. 1998. Network Linkages and Location Choice in Foreign Direct Investment. Journal of International Business Studies 29: 445–67. [Google Scholar] [CrossRef]

- Chung, Wilbur, and Juan Alcácer. 2002. Knowledge Seeking and Location Choice of Foreign Direct Investment in the United States. Management Science 48: 1534–54. [Google Scholar] [CrossRef]

- Chung, Wilbur, and Stephen Yeaple. 2008. International Knowledge Sourcing: Evidence from US Firms Expanding Abroad. Strategic Management Journal 29: 1207–24. [Google Scholar] [CrossRef]

- Cohen, Wesley M., and Daniel A. Levinthal. 1989. Innovation and Learning: The Two Faces of R & D. The Economic Journal 99: 569–96. [Google Scholar]

- Cohen, Wesley M., and Daniel A. Levinthal. 1990. Absorptive Capacity: A New Perspective on Learning and Innovation. Administrative Science Quarterly 35: 128–52. [Google Scholar] [CrossRef]

- da Silva-Oliveira, Keilla Dayane, Edson Keyso de Miranda Kubo, Michael J. Morley, and Rodrigo Médici Cândido. 2021. Emerging Economy Inward and Outward Foreign Direct Investment: A Bibliometric and Thematic Content Analysis. Management International Review 61: 643–79. [Google Scholar] [CrossRef]

- Deng, Ping, and Hao Lu. 2022. Transnational Knowledge Transfer or Indigenous Knowledge Transfer: Which Channel Has More Benefits for China’s High-Tech Enterprises? European Journal of Innovation Management 25: 433–53. [Google Scholar] [CrossRef]

- Ding, Sasa, Frank McDonald, and Yingqi Wei. 2021. Is Internationalization Beneficial to Innovation? Evidence from a Meta-Analysis. Management International Review 61: 469–519. [Google Scholar] [CrossRef]

- Dunning, John H. 1986. The Investment Development Cycle Revisited. Weltwirtschaftliches Archiv 122: 667–76. [Google Scholar] [CrossRef]

- Dunning, John H. 1994. Multinational Enterprises and the Globalization of Innovatory Capacity. Research Policy 23: 67–88. [Google Scholar] [CrossRef]

- Easley, David, and Jon Kleinberg. 2010. Networks, Crowds, and Markets: Reasoning about a Highly Connected World. Cambridge: Cambridge University Press, vol. 1. [Google Scholar]

- Erfani, Parsa, Agnes Binagwaho, Mohamed Juldeh Jalloh, Muhammad Yunus, Paul Farmer, and Vanessa Kerry. 2021. Intellectual Property Waiver for Covid-19 Vaccines Will Advance Global Health Equity. BMJ 374: n1837. [Google Scholar] [CrossRef] [PubMed]

- Fabrizio, Kira R. 2009. Absorptive Capacity and the Search for Innovation. Research Policy 38: 255–67. [Google Scholar] [CrossRef]

- Faulk, Lewis, Jasmine McGinnis Johnson, and Jesse D. Lecy. 2017. Competitive Advantage in Nonprofit Grant Markets: Implications of Network Embeddedness and Status. International Public Management Journal 20: 261–93. [Google Scholar] [CrossRef]

- Ferrier, Gary D., Javier Reyes, and Zhen Zhu. 2016. Technology Diffusion on the International Trade Network. Journal of Public Economic Theory 18: 291–312. [Google Scholar] [CrossRef]

- Fosfuri, Andrea, Massimo Motta, and Thomas Rønde. 2001. Foreign Direct Investment and Spillovers through Workers’ Mobility. Journal of International Economics 53: 205–22. [Google Scholar] [CrossRef]

- Fritsch, Michael, and Martina Kauffeld-Monz. 2010. The Impact of Network Structure on Knowledge Transfer: An Application of Social Network Analysis in the Context of Regional Innovation Networks. The Annals of Regional Science 44: 21–38. [Google Scholar] [CrossRef]

- Ghoshal, Sumantra, and Christopher A. Bartlett. 1990. The Multinational Corporation as an Interorganizational Network. Academy of Management Review 15: 603–26. [Google Scholar] [CrossRef]

- Goyal, Sanjeev. 2012. Social Networks on the Web. In The Oxford Handbook of the Digital Economy. Oxford: Oxford University Press, pp. 434–59. [Google Scholar]

- Griffith, Rachel, Stephen Redding, and John Van Reenen. 2003. R&D and Absorptive Capacity: Theory and Empirical Evidence. Scandinavian Journal of Economics 105: 99–118. [Google Scholar]

- Grigoriou, Konstantinos, and Frank T. Rothaermel. 2017. Organizing for Knowledge Generation: Internal Knowledge Networks and the Contingent Effect of External Knowledge Sourcing. Strategic Management Journal 38: 395–414. [Google Scholar] [CrossRef]

- Grossman, Gene M., and Elhanan Helpman. 1993. Innovation and Growth in the Global Economy. Cambridge, MA: MIT Press. [Google Scholar]

- Gupta, Anil K., and Vijay Govindarajan. 2000. Knowledge Flows within Multinational Corporations. Strategic Management Journal 21: 473–96. [Google Scholar] [CrossRef]

- Hausmann, Ricardo, César A. Hidalgo, Sebastián Bustos, Michele Coscia, and Alexander Simoes. 2014. The Atlas of Economic Complexity: Mapping Paths to Prosperity. Cambridge, MA: MIT Press. [Google Scholar]

- Hidalgo, César A. 2021. Economic Complexity Theory and Applications. Nature Reviews Physics 3: 92–113. [Google Scholar] [CrossRef]

- Hidalgo, César A., and Ricardo Hausmann. 2009. The Building Blocks of Economic Complexity. Proceedings of the National Academy of Sciences 106: 10570–75. [Google Scholar] [CrossRef] [PubMed]

- Hidalgo, César A., Bailey Klinger, A.-L. Barabási, and Ricardo Hausmann. 2007. The Product Space Conditions the Development of Nations. Science 317: 482–87. [Google Scholar] [CrossRef] [PubMed]

- Hsu, Chia-Wen, and Homin Chen. 2009. Foreign Direct Investment and Capability Development: A Dynamic Capabilities Perspective. Management International Review 49: 585–605. [Google Scholar] [CrossRef]

- Jackson, Matthew O. 2008. Social and Economic Networks. Princeton: Princeton University Press, vol. 3. [Google Scholar]

- Jackson, Matthew O., and Brian W. Rogers. 2005. The Economics of Small Worlds. Journal of the European Economic Association 3: 617–27. [Google Scholar] [CrossRef]

- Kali, Raja, and Javier Reyes. 2007. The Architecture of Globalization: A Network Approach to International Economic Integration. Journal of International Business Studies 38: 595–620. [Google Scholar] [CrossRef]

- Kang, Yuanfei, Joanna Scott-Kennel, Martina Battisti, and David Deakins. 2021. Linking Inward/Outward FDI and Exploitation/Exploration Strategies: Development of a Framework for SMEs. International Business Review 30: 101790. [Google Scholar] [CrossRef]

- Kedia, Ben, Nolan Gaffney, and Jack Clampit. 2012. EMNEs and Knowledge-Seeking FDI. Management International Review 52: 155–73. [Google Scholar] [CrossRef]

- Keller, Wolfgang. 2004. International Technology Diffusion. Journal of Economic Literature 42: 752–82. [Google Scholar] [CrossRef]

- Knoerich, Jan. 2017. How Does Outward Foreign Direct Investment Contribute to Economic Development in Less Advanced Home Countries? Oxford Development Studies 45: 443–59. [Google Scholar] [CrossRef]

- Kogut, Bruce, and Udo Zander. 1993. Knowledge of the Firm and the Evolutionary Theory of the Multinational Corporation. Journal of International Business Studies 24: 625–45. [Google Scholar] [CrossRef]

- Kostopoulos, Konstantinos, Alexandros Papalexandris, Margarita Papachroni, and George Ioannou. 2011. Absorptive Capacity, Innovation, and Financial Performance. Journal of Business Research 64: 1335–43. [Google Scholar] [CrossRef]

- Lecraw, Donald J. 1993. Outward Direct Investment by Indonesian Firms: Motivation and Effects. Journal of International Business Studies 24: 589–600. [Google Scholar] [CrossRef]

- Leydesdorff, Loet, and Michael Fritsch. 2006. Measuring the Knowledge Base of Regional Innovation Systems in Germany in Terms of a Triple Helix Dynamics. Research Policy 35: 1538–53. [Google Scholar] [CrossRef]

- Li, Zhenhua, and Xuan Gao. 2021. Makers’ Relationship Network, Knowledge Acquisition and Innovation Performance: An Empirical Analysis from China. Technology in Society 66: 101684. [Google Scholar] [CrossRef]

- Lundvall, Bengt-äke, and Björn Johnson. 1994. The Learning Economy. Journal of Industry Studies 1: 23–42. [Google Scholar] [CrossRef]

- Martin, Roman. 2012. Measuring Knowledge Bases in Swedish Regions. European Planning Studies 20: 1569–82. [Google Scholar] [CrossRef]

- Martin, Roman, and Jerker Moodysson. 2013. Comparing Knowledge Bases: On the Geography and Organization of Knowledge Sourcing in the Regional Innovation System of Scania, Sweden. European Urban and Regional Studies 20: 170–87. [Google Scholar] [CrossRef]

- Mehreen, Hina, Hussain Gulzar Rammal, Vijay Pereira, and Manlio Del Giudice. 2022. Investigating the Influence of Absorptive Capacity of Recipients within Cross-Border Transfer of Knowledge: Evidence from Emerging Markets. International Marketing Review 39: 734–54. [Google Scholar] [CrossRef]

- Miller, Kent D. 2008. Simon and Polanyi on Rationality and Knowledge. Organization Studies 29: 933–55. [Google Scholar] [CrossRef]

- Moaniba, Igam M., Pei-Chun Lee, and Hsin-Ning Su. 2020. How Does External Knowledge Sourcing Enhance Product Development? Evidence from Drug Commercialization. Technology in Society 63: 101414. [Google Scholar] [CrossRef]