Intellectual Capital of Technology-Based Incubators

Abstract

1. Introduction

2. Theoretical Background

2.1. Intellectual Capital

2.2. Incubators

2.3. Sustainability as a Corporate Goal

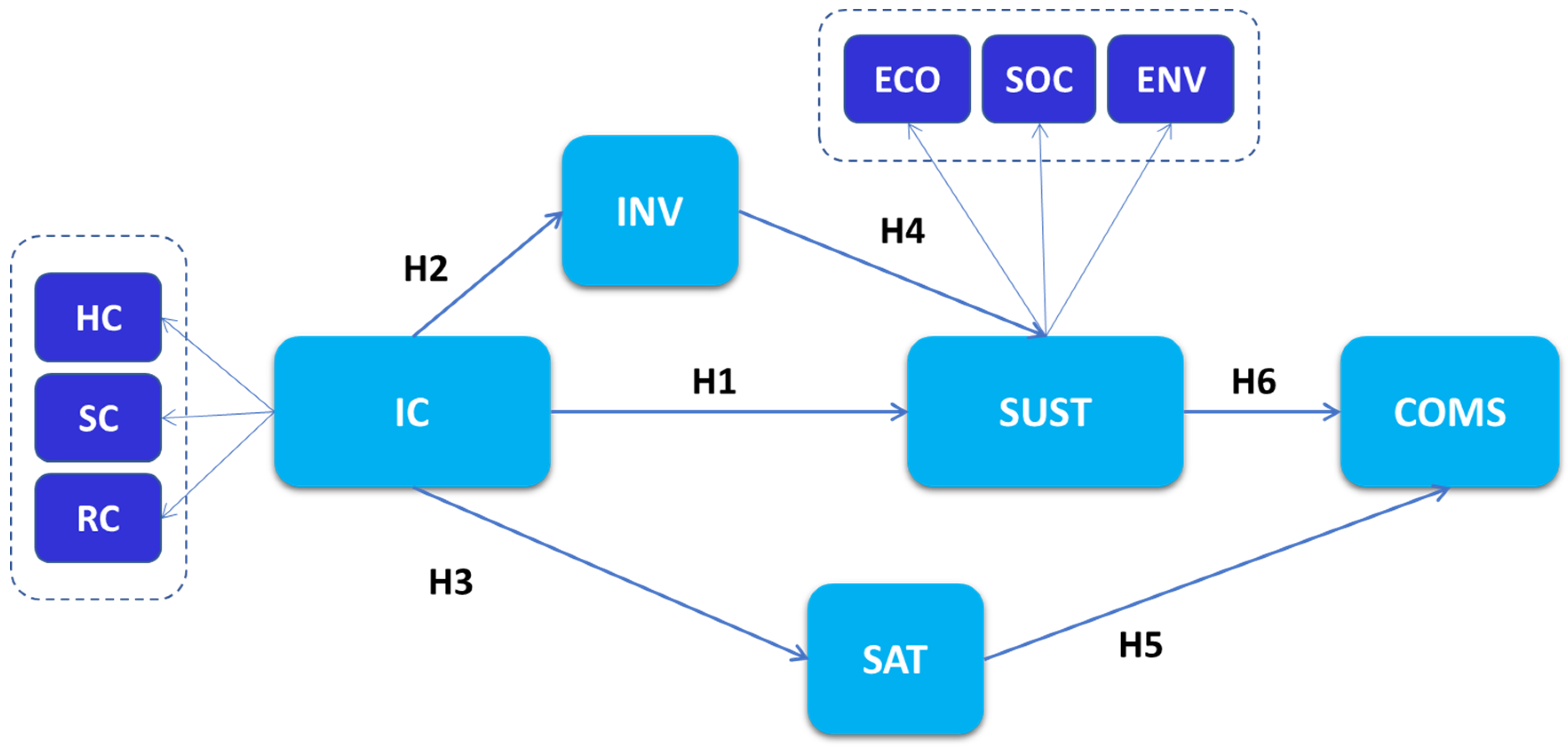

2.4. Conceptual Model

3. Methodology

3.1. Stages of the Quantitative Study

3.2. Measurement Scales

3.3. Procedure, Sample Selection, and Characterization

4. Results and Discussion

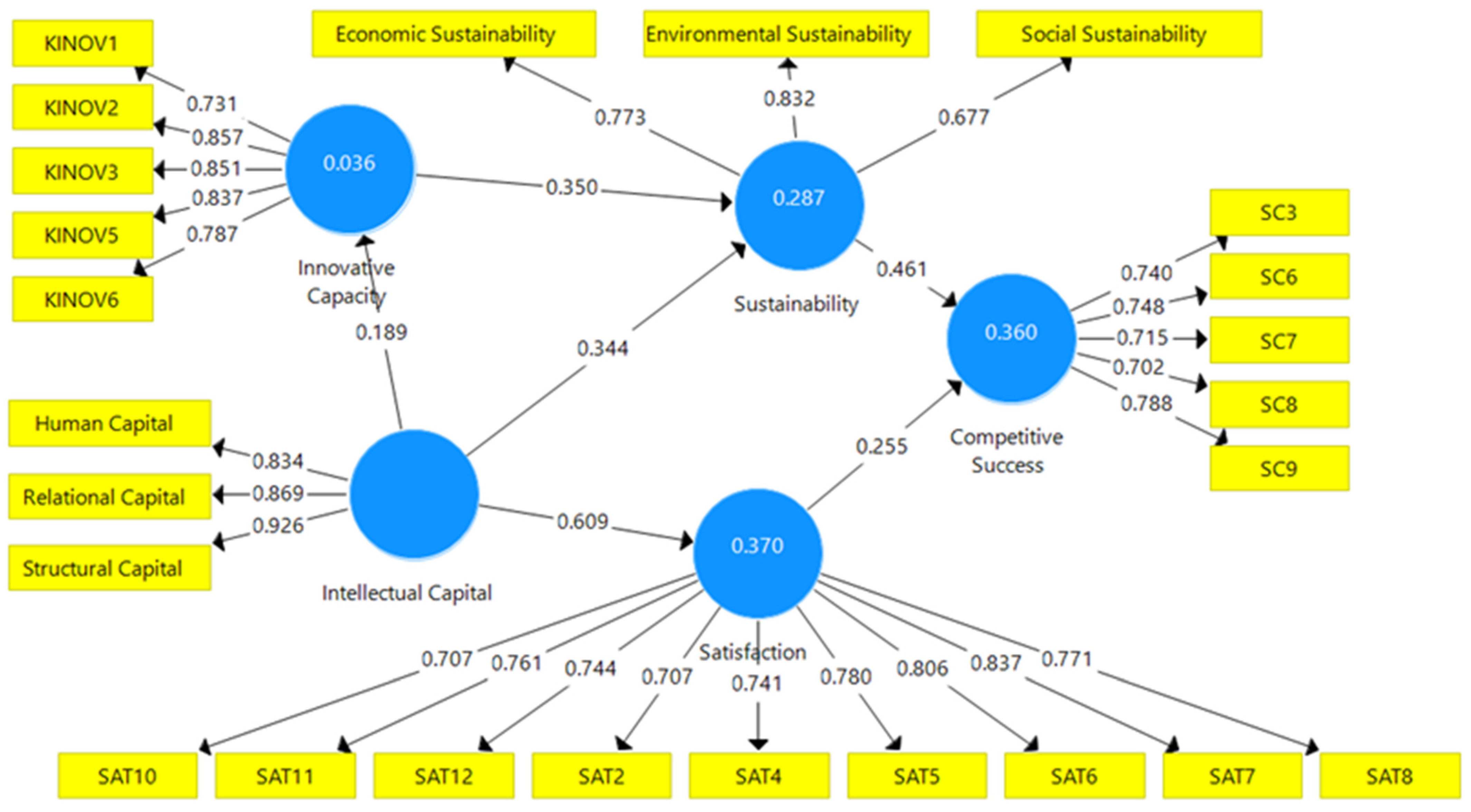

4.1. Analysis of the Measurement Model

4.2. Structural Model Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abduh, Muhamad, Clare D’Souza, Ali Quazi, and Henry T. Burley. 2007. Investigating and classifying clients’ satisfaction with business incubator services. Managing Service Quality 17: 74–91. [Google Scholar] [CrossRef]

- Adlesic, Renata Valentina, and Alenka Slavec. 2012. Social Capital and Business Incubators Performance: Testing the Structural Model. Economic and Business Review 14: 201–22. [Google Scholar]

- Bag, Surajit, Pavitra Dhamija, David J. Bryde, and Rajesh Kumar Singh. 2022. Effect of eco-innovation on green supply chain management, circular economy capability, and performance of small and medium enterprises. Journal of Business Research 141: 60–72. [Google Scholar] [CrossRef]

- Baron, Angela, and Michael Armstrong. 2007. Gestão do Capital Humano: Gerar Valor Acrescentado Através das Pessoas. Lisboa: Instituto Piaget, Divisão Editorial. [Google Scholar]

- Bayraktaroglu, Ayse Elvan, Fethi Calisir, and Murat Baskak. 2019. Intellectual capital and firm performance: An extended VAIC model. Journal of Intellectual Capital 20: 406–25. [Google Scholar] [CrossRef]

- Benevene, Paula, Ilaria Buonomo, Eric Kong, Martina Pansini, and Maria Luisa Farnese. 2021. Management of green intellectual capital: Evidence-based literature review and future directions. Sustainability 13: 8349. [Google Scholar] [CrossRef]

- Beske, Philip, Anna Land, and Stefan Seuring. 2014. Sustainable supply chain management practices and dynamic capabilities in the food industry: A critical analysis of the literature. International Journal of Production Economics 152: 131–43. [Google Scholar] [CrossRef]

- Bhatti, Sabeen Hussain, Dmitriy Vorobyev, Ramsha Zakariya, and Michael Christofi. 2021. Social capital, knowledge sharing, work meaningfulness, and creativity: Evidence from the Pakistani pharmaceutical industry. Journal of Intellectual Capital 22: 243–59. [Google Scholar] [CrossRef]

- Bontis, Nick, Mary M. Crossan, and John Hulland. 2002. Managing an organizational learning system by aligning stocks and flows. Journal of Management Studies 39: 437–69. [Google Scholar] [CrossRef]

- Bontis, Nick, William Chua Chong Keow, and Stanley Richardson. 2000. Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital 1: 85–100. [Google Scholar] [CrossRef]

- Bookstein, Fred. L., and Claes Fornell. 1982. Two Structural Equation Models: LISREL and PLS Applied to Consumer Exit-Voice Theory. Journal of Marketing Research 19: 440–52. [Google Scholar]

- Chang, An-Yuan, and Yen-Tse Cheng. 2019. Analysis model of the sustainability development of manufacturing small and medium-sized enterprises in Taiwan. Journal of Cleaner Production 207: 458–73. [Google Scholar] [CrossRef]

- Chen, Lei, Jo Danbolt, and John Holland. 2014. Rethinking bank business models: The role of intangibles. Accounting. Auditing and Accountability Journal 27: 563–89. [Google Scholar] [CrossRef]

- Chin, Wynne W. 1998. The Partial Least Squares Approach to Structural Equation Modeling. Modern Methods for Business Research 295: 295–336. [Google Scholar]

- Cohen, Jacab. 1988. Statistical Power Analysis for the Behavioral Sciences, 2nd ed. New York: Psychology Press. [Google Scholar]

- Commission of the European Communities. 2001. Livro Verde-Promover um Quadro Europeu para a Responsabilidade Social das Empresas. Available online: https://www.europarl.europa.eu/meetdocs/committees/empl/20020416/doc05a_pt.pdf (accessed on 20 October 2022).

- de Souza, Jose Henrique, Jose Eduardo Rodrigues de Souza, and Isidora Doria Bonilha. 2008. Avaliação do processo de incubação no Estado de São Paulo. Revista Da Micro e Pequena Empresa 2: 21–39. [Google Scholar]

- do Rosário Cabrita, Maria, and Jorge Landeiro Vaz. 2005. Intellectual capital and value creation: Evidence from the Portuguese banking industry. Electronic. Journal of Knowledge Management 4: 11–20. [Google Scholar]

- Dornelas, José. 2002. Planejando Incubadoras de Empresas: Como Desenvolver um Plano de Negócios para Incubadoras. Futura. Amsterdam: Elsevier Science. [Google Scholar]

- Edvinsson, Leif, and Michael S. Malone. 1997. Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower, 1st ed. Manhattan: Harper Business. [Google Scholar]

- Elkington, John. 1994. Towards the Sustainable Corporation: Win-Win-Win Business Strategies for Sustainable Development. California Management Review 36: 90–100. [Google Scholar] [CrossRef]

- Elkington, John. 1999. Cannibals with Forks: The Triple-Bottom-Line of 21st Century Business. Hoboken: Wiley. 424p. [Google Scholar]

- Faul, Franz, Edgar Erdfelder, Axel Buchner, and Albert-Georg Lang. 2009. Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods 41: 1149–60. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating structural equations models with unobservable variables and measurement error. Journal of Marketing 18: 39–50. [Google Scholar]

- Gallardo Vázquez, Dolores, M. Isabel Sánchez Hernández, and Francisca Castilla Polo. 2012. Modelización estructural de la orientación a la responsabilidad social en las sociedades cooperativas y su impacto en los resultados. Paper presented at II Congresso Ibero-Americano de Responsabilidade Social, Lisboa 2012 (CRIARS 2012), Lisboa, Portugal, October 25–27. [Google Scholar]

- Geisser, Seymour. 1974. A predictive approach to the random effect model. Biometrika 61: 101–7. [Google Scholar] [CrossRef]

- Ghobakhloo, Morteze, Mohammad Iranmanesh, Andrius Grybauskas, Mantas Vilkas, and Monika Petraitė. 2021. Industry 4.0, innovation, and sustainable development: A systematic review and a roadmap to sustainable innovation. Business Strategy and the Environment 30: 4237–57. [Google Scholar] [CrossRef]

- Giuliani, Marco. 2013. Not all sunshine and roses: Discovering intellectual liabilities “in action”. Journal of Intellectual Capital 14: 127–44. [Google Scholar] [CrossRef]

- Guthrie, James, Feder Ricceri, and John Dumay. 2012. Reflections and projections: A decade of Intellectual Capital Accounting Research. British Accounting Review 44: 68–82. [Google Scholar] [CrossRef]

- Hair, Joseph F., G. Tomas M. Hult, Christina M. Ringle, and Marko Sarstedt. 2017. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed. Thousand Oaks: Sage Publications. [Google Scholar]

- Hair, Joseph F., Marko Sarstedt, Christina M. Ringle, and Siegfried P. Gudergan. 2018. Advanced Issues in Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks: Sage. [Google Scholar]

- Hii, Jasper, and Andy Neely. 2000. Innovative capacity of firms: On why some firms are more innovative than others. Paper presented at the 7th International Annual EurOMA Conference 2000, Ghent, Belgium, June 4–7. [Google Scholar]

- Huang, Ching Choo, Robert Luther, and Michael Tayles. 2007. An evidence-based taxonomy of intellectual capital. Journal of Intellectual Capital 8: 386–408. [Google Scholar] [CrossRef]

- Kiran, Ravi, and S. C. Bose. 2020. Stimulating business incubation performance: Role of networking, university linkage, and facilities. Technology Analysis & Strategic Management 32: 1407–21. [Google Scholar]

- Lacerda, Rogeria Tadeu de Oliveira Lacerda, Brianna Luiza Klein, Julia Figueiredo Fulco, Gabriel Santos, and Kamilla Bittarello. 2017. Integração Inovadora entre Empresas Incubadas e Universidades para Geração Contínua de Vantagens Competitivas em Ambientes Dinâmicos. NAVUS-Revista de Gestão e Tecnologia 7: 78–96. [Google Scholar] [CrossRef][Green Version]

- Lahane, Swapnil, and Ravi Kant. 2022. Investigating the sustainable development goals derived due to adoption of circular economy practices. Waste Management 143: 1–14. [Google Scholar] [CrossRef] [PubMed]

- Lam, Eddie T. C., James J. Zhang, and Barbara E. Jensen. 2005. Service Quality Assessment Scale (SQAS): An instrument for evaluating service quality of health-fitness clubs. Measurement in Physical Education and Exercise Science 9: 79–111. [Google Scholar] [CrossRef]

- Lopes, João M., Sofia Gomes, Rosselyn Pacheco, Elizabete Monteiro, and Caralina Santos. 2022. Drivers of Sustainable Innovation Strategies for Increased Competition among Companies. Sustainability 14: 5471. [Google Scholar] [CrossRef]

- Macedo, Fernanda Maria Felício, and Diego Luiz Teixeira Boava. 2009. Relação incubadora de empresas e ação empreendedora Relationship business incubators to entrepreneurial actions Introdução Atualmente, as discussões acerca do empreendedorismo e seus. Revista Ciências Administrativas 15: 221–40. [Google Scholar]

- Mansano, Adriana Toledo Rodrigues, and Patrícia Monteiro Gorni. 2014. Satisfação do Consumidor com o Comércio Electrónico: Estudo de Caso de uma Fabricante de Tapetes. Revista de Extensão e Iniciação Científica SOCIESC—REIS, Santa Catarina 1: 12–22. [Google Scholar]

- Mcwilliams, Abagail, Annaleena Parhankangas, Jason Coupet, Eric Welch, and Darold T. Barnum. 2016. Strategic Decision-Making for the Triple Bottom Line. Business Strategy and the Environment 25: 193–204. [Google Scholar] [CrossRef]

- Mouritsen, Jan. 2009. Classification, measurement, and the ontology of intellectual capital entities. Journal of Human Resource Costing & Accounting 13: 154–62. [Google Scholar]

- Mousavi, Seyedesmaeil, Bart Bossink, and Mario van Vliet. 2019. Microfoundations of companies’ dynamic capabilities for environmentally sustainable innovation: Case study insights from high-tech innovation in science-based companies. Business Strategy and the Environment 28: 366–87. [Google Scholar] [CrossRef]

- Muhammad, Nik Maheran Nik, and Md Khairu Amin Ismail. 2009. Intellectual Capital Efficiency and Firm’s Performance: Study on Malaysian Financial Sectors. International Journal of Economics and Finance 1: 206–19. [Google Scholar] [CrossRef]

- Neely, Andy, and Jasper Hii. 2014. The Innovative Capacity of Firms. Nang Yan Business Journal 1: 47–53. [Google Scholar] [CrossRef]

- Nylund, Petra A., Alexander Brem, and Nivedita Agarwal. 2021. Innovation ecosystems for meeting sustainable development goals: The evolving roles of multinational enterprises. Journal of Cleaner Production 281: 125329. [Google Scholar] [CrossRef]

- ONU-United Nations. 1987. Informe de la Comisión Mundial sobre el Medio Ambiente y el Desarrollo. Nueva York: ONU. [Google Scholar]

- O’Neal, Thomas. 2005. Evolving a Successful University-Based Incubator: Lessons Learned from the UCF Technology Incubator. Engineering Management Journal 17: 11–25. [Google Scholar] [CrossRef]

- Pestana, Maria Helena, and João Manuel Nunes. 2014. Análise de Dados para Ciências Sociais A Complementaridade do SPSS, 6ª edição revista, Atualizada e Aumentada. Lisboa: Edições Sílabo, p. 1237. [Google Scholar]

- Ringle, Christian M., Dirceu Silva, and Diógenes de Souza Bido. 2014. Modelagem de Equações Estruturais com utilização do Smartpls. Revista Brasileira de Marketing 13: 54–71. [Google Scholar] [CrossRef]

- Santos-Rodrigues, Helena, Pedro Figueroa Dorrego, and Carlos Jardon. 2011. The main intellectual capital components that are relevant to the product, process, and management firm innovativeness. International Journal of Transitions and Innovation Systems 1: 271. [Google Scholar] [CrossRef]

- Saunders, Mark N. K., Philip Lewis, and Adrian Thornhill. 2012. Research Methods for Business Students. Harlow: Pearson Education Ltd. [Google Scholar]

- Saura, Jose Ramon, Pedro Palos-Sanchez, and Antonio Grilo. 2019. Detecting indicators for startup business success: Sentiment analysis using text data mining. Sustainability 11: 917. [Google Scholar] [CrossRef]

- Schoemaker, Paul J. H., Sohvi Heaton, and David Teece. 2018. Innovation, dynamic capabilities, and leadership. California Management Review 61: 15–42. [Google Scholar] [CrossRef]

- Serra, Bernardo, Fernando Ribeiro Serra, Manuel Aníbal Silva Portugal Vasconcelos Ferreira, and Gabriela G. Fiates. 2011. Fundamental Factors for the Performance of Technology-Based Incubators. Review of Administration and Innovation-RAI 8: 221–48. [Google Scholar] [CrossRef][Green Version]

- Silvestri, Antonella, and Stefania Veltri. 2020. Exploring the relationships between corporate social responsibility, leadership, and sustainable entrepreneurship theories: A conceptual framework. Corporate Social Responsibility and Environmental Management 27: 585–94. [Google Scholar] [CrossRef]

- Soewarno, Noorlailie, and Bambang Tjahjadi. 2020. Measures that matter: An empirical investigation of intellectual capital and financial performance of banking firms in Indonesia. Journal of Intellectual Capital 21: 1085–106. [Google Scholar] [CrossRef]

- Stone, M. 1974. Cross-Validatory Choice and Assessment of Statistical Predictions. Journal of the Royal Statistical Society Series B (Methodological) 36: 111–47. [Google Scholar] [CrossRef]

- Subramaniam, Mohan, and Mark A. Youndt. 2005. The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal 48: 450–63. [Google Scholar] [CrossRef]

- Subramanian, Ashok, and Sree Nilakanta. 1996. Organizational innovativeness: Exploring the relationship between organizational determinants of innovation, types of innovations, and measures of organizational performance. Omega 24: 631–647. [Google Scholar] [CrossRef]

- Sveiby, Karl E. 1997. The New Organizational Wealth: Managing and Measuring Knowledge-Based Assets. Oakland: Berrett-Koehler. [Google Scholar]

- Sydler, Renato, Stefan Haefliger, and Robert Pruksa. 2014. Measuring intellectual capital with financial figures: Can we predict firm profitability? European Management Journal 32: 244–59. [Google Scholar] [CrossRef]

- Tu, Yu, and Weiku Wu. 2021. How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustainable Production and Consumption 26: 504–16. [Google Scholar] [CrossRef]

- Vedovello, Conceição. 2000. Aspectos relevantes de parques tecnológicos e incubadoras de empresas. Revista do Banco Nacional de Desenvolvimento Econômico e Social (Revista do BNDES) 7: 273–300. [Google Scholar]

- Vedovello, Conceição, and Paulo N. Figueiredo. 2005. Incubadora de inovação: Que nova espécie é essa? RAE Eletrônica 4: 1–19. [Google Scholar] [CrossRef]

- Welbourne, Theresa M., and Manuela Pardo-del-Val. 2009. Relational Capital: Strategic Advantage for Small and Medium-Size Enterprises (SMEs) Through Negotiation and Collaboration. Group Decision and Negotiation 18: 483–97. [Google Scholar] [CrossRef]

- Youndt, Mark A., and Scott A. Snell. 2004. Human Resource Configurations, Intellectual Capital, and Organizational Performance. Journal of Managerial Issues 16: 337. [Google Scholar]

- Zhang, Qian, Bee Lan Oo, and Benson Teck Heng Lim. 2019. Drivers, motivations, and barriers to the implementation of corporate social responsibility practices by construction enterprises: A review. Journal of Cleaner Production 210: 563–84. [Google Scholar] [CrossRef]

| General Data of the Incubated Company | Name of the Company and Position of the Respondent to the Questionnaire |

|---|---|

| Characteristics of the incubated company | Identification and sectors of economic activity of the company |

| Human capital of the incubator | 20 questions |

| Structural capital of the incubator | 21 questions |

| Relational capital of the incubator | 10 questions |

| Innovative capacity of the incubator | 06 questions |

| Competitive incubation success | 10 questions |

| Satisfaction with the incubation | 12 questions never/no time |

| Sustainability of the incubation | 35 questions |

| Construct | Indicators | Loadings | Cronbach’s α | rho_A | CR | AVE | R2 |

|---|---|---|---|---|---|---|---|

| Sustainability | Economic | 0.773 | 0.645 | 0.655 | 0.806 | 0.583 | 0.287 |

| Environmental | 0.832 | ||||||

| Social | 0.677 | ||||||

| Intellectual Capital | SC | 0.926 | 0.850 | 0.856 | 0.909 | 0.769 | - |

| RC | 0.869 | ||||||

| HC | 0.834 | ||||||

| Innovative Capacity | KINOV1 | 0.731 | 0.872 | 0.876 | 0.907 | 0.663 | 0.036 |

| KINOV2 | 0.857 | ||||||

| KINOV3 | 0.851 | ||||||

| KINOV5 | 0.837 | ||||||

| KINOV6 | 0.787 | ||||||

| Satisfaction | SAT10 | 0.707 | 0.910 | 0.912 | 0.926 | 0.582 | 0.370 |

| SAT11 | 0.761 | ||||||

| SAT12 | 0.744 | ||||||

| SAT2 | 0.707 | ||||||

| SAT4 | 0.741 | ||||||

| SAT5 | 0.780 | ||||||

| SAT6 | 0.806 | ||||||

| SAT7 | 0.837 | ||||||

| SAT8 | 0.771 | ||||||

| Competitive Success | SC3 | 0.740 | 0.794 | 0.803 | 0.857 | 0.546 | 0.360 |

| SC6 | 0.748 | ||||||

| SC7 | 0.715 | ||||||

| SC8 | 0.702 | ||||||

| SC9 | 0.788 |

| Construct | COMS | INVC | IC | SAT | SUST |

|---|---|---|---|---|---|

| Competitive Success (COMS) | 0.739 | ||||

| Innovative Capacity (INVC) | 0.488 | 0.814 | |||

| Intellectual Capital (IC) | 0.396 | 0.189 | 0.877 | ||

| Satisfaction (SAT) | 0.416 | 0.315 | 0.609 | 0.763 | |

| Sustainability | 0.550 | 0.415 | 0.411 | 0.348 | 0.763 |

| Indicators | COMS | INVC | IC | SAT | SUST |

|---|---|---|---|---|---|

| SC3 | 0.740 | 0.337 | 0.286 | 0.296 | 0.455 |

| SC6 | 0.748 | 0.395 | 0.276 | 0.361 | 0.320 |

| SC7 | 0.715 | 0.396 | 0.239 | 0.260 | 0.302 |

| SC8 | 0.702 | 0.353 | 0.255 | 0.333 | 0.371 |

| SC9 | 0.788 | 0.344 | 0.379 | 0.292 | 0.529 |

| KINOV1 | 0.200 | 0.731 | 0.122 | 0.208 | 0.312 |

| KINOV2 | 0.357 | 0.857 | 0.180 | 0.279 | 0.367 |

| KINOV3 | 0.457 | 0.851 | 0.098 | 0.289 | 0.355 |

| KINOV5 | 0.462 | 0.837 | 0.154 | 0.257 | 0.348 |

| KINOV6 | 0.498 | 0.787 | 0.212 | 0.243 | 0.304 |

| SC | 0.343 | 0.132 | 0.926 | 0.506 | 0.347 |

| HG | 0.297 | 0.250 | 0.834 | 0.483 | 0.311 |

| RC | 0.391 | 0.123 | 0.869 | 0.599 | 0.412 |

| SAT10 | 0.316 | 0.236 | 0.464 | 0.707 | 0.251 |

| SAT11 | 0.463 | 0.473 | 0.395 | 0.761 | 0.308 |

| SAT12 | 0.301 | 0.312 | 0.408 | 0.744 | 0.243 |

| SAT2 | 0.448 | 0.278 | 0.458 | 0.707 | 0.290 |

| SAT4 | 0.258 | 0.177 | 0.417 | 0.741 | 0.301 |

| SAT5 | 0.212 | 0.140 | 0.419 | 0.780 | 0.231 |

| SAT6 | 0.268 | 0.197 | 0.512 | 0.806 | 0.253 |

| SAT7 | 0.339 | 0.214 | 0.523 | 0.837 | 0.289 |

| SAT8 | 0.197 | 0.103 | 0.553 | 0.771 | 0.214 |

| Soc | 0.314 | 0.323 | 0.269 | 0.266 | 0.677 |

| Eco | 0.510 | 0.382 | 0.338 | 0.261 | 0.773 |

| Env | 0.403 | 0.229 | 0.324 | 0.273 | 0.832 |

| Construct | CV RED (Q²) | CV COM (f²) |

|---|---|---|

| Competitive Success | 0.174 | 0.312 |

| Innovative Capacity | 0.018 | 0.483 |

| Intellectual Capital | - | 0.517 |

| Satisfaction | 0.205 | 0.476 |

| Sustainability | 0.144 | 0.194 |

| Hypotheses | β | STDEV | T Statistics | p Values | Decision |

|---|---|---|---|---|---|

| H1: Intellectual Capital > Sustainability | 0.344 | 0.087 | 4.566 | 0.000 | Supported |

| H2: Intellectual Capital > Innovative Capacity | 0.189 | 0.098 | 1.923 | 0.027 | Supported |

| H3: Intellectual Capital > Satisfaction | 0.609 | 0.081 | 7.510 | 0.000 | Supported |

| H4: Innovative Capacity > Sustainability | 0.350 | 0.075 | 4.041 | 0.000 | Supported |

| H5: Satisfaction > Competitive Success | 0.255 | 0.118 | 2.160 | 0.015 | Supported |

| H6: Sustainability > Competitive Success | 0.461 | 0.099 | 4.645 | 0.000 | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rodrigues, M.C.M.; Barbosa, R.P.; Barbieri da Rosa, L.A.; Sousa, M.J.; Zavatti Campos, W.Y.Y. Intellectual Capital of Technology-Based Incubators. Adm. Sci. 2022, 12, 191. https://doi.org/10.3390/admsci12040191

Rodrigues MCM, Barbosa RP, Barbieri da Rosa LA, Sousa MJ, Zavatti Campos WYY. Intellectual Capital of Technology-Based Incubators. Administrative Sciences. 2022; 12(4):191. https://doi.org/10.3390/admsci12040191

Chicago/Turabian StyleRodrigues, M. Carolina Martins, Raul Pommer Barbosa, Luciana Aparecida Barbieri da Rosa, Maria José Sousa, and Waleska Yone Yamakawa Zavatti Campos. 2022. "Intellectual Capital of Technology-Based Incubators" Administrative Sciences 12, no. 4: 191. https://doi.org/10.3390/admsci12040191

APA StyleRodrigues, M. C. M., Barbosa, R. P., Barbieri da Rosa, L. A., Sousa, M. J., & Zavatti Campos, W. Y. Y. (2022). Intellectual Capital of Technology-Based Incubators. Administrative Sciences, 12(4), 191. https://doi.org/10.3390/admsci12040191