Abstract

The primary purpose of the research is to investigate the impact of Islamic banking corporate governance on green banking in Iraq. In other words, the current study seeks to find an answer to whether corporate governance in Islamic banking can affect green banking in Iraq. For this purpose, the research method is applied based on the objective and descriptive survey. The statistical population of this research is all the managers, employees, and customers of the public and private banks of Iraq, and a total of 70 questionnaires have been completed and analyzed. The sampling method is non-random, and the available population was selected as the sample size. In this research, PLS tests have been used to investigate the effect of independent variables on the dependent variable. The results indicate that corporate governance in Islamic banking has had a positive effect on green banking, meaning that the increase of corporate governance mechanisms in Iraqi Islamic banking increase the level of attention of Iraqi Islamic banks to green banking matters. The current research was conducted in Iraq’s developing or emerging financial markets, which are highly competitive and under insufficient supervision.

1. Introduction

Green banking is an integral part of Islamic banking that provides the basis for protecting the environment (Ikram and Akhtar 2021). This study tries to investigate the impact of corporate governance in Islamic banking on green banking to contribute to banks’ sustainable development and improve their performance. This study has used primary data through a structured questionnaire that includes different dimensions of green banking of Islamic banks in Iraq. This study revealed that Islamic banks have significantly contributed to green banking, which improves the environment by saving money and energy, protecting natural resources, and requiring respect for all people (Sudhalakshmi and Chinnadorai 2014).

On the other hand, environmental changes have harmful effects on the environment and, as a result, agriculture, forestry, water resources, and human health have faced significant problems (Dewi and Dewi 2017). This issue has become a global concern to protect the environment against any harmful effects on sustainable development. Since Islam promotes the protection of natural resources and the need to respect all living beings regarding the relationship between humans and the environment, in this situation Islamic banking can play a supporting role in improving the environment for sustainable development (Handajani 2019). Therefore, addressing the category of green banking is a severe and challenging matter. Green banking is ethical and socially responsible banking that reduces harmful environmental effects (Bose et al. 2018). This banking is dedicated to man and society. In addition, it has a high potential to contribute to a sustainable financing ecosystem for a green world (Hossain et al. 2020). Green banking is one of the central issues of society and businesses in the country, which also has its meaning and examples in the banking system of Iraq. The fact is that this concept is very new in Iraq and has not been seriously considered so far. By reviewing the subject literature, we found that the conducted studies (Black et al. 2019; Karyani and Obrien 2020; Bose et al. 2021; Park and Kim 2020) were mainly focused on the importance and broad impact of corporate governance and have not investigated the effect of corporate governance on green banking.

This study seems to have excellent research value because a few studies have been conducted in this field. Despite the incremental global warming rate attracting the attention of many scholars in the fields of economics, accounting, and finance in developed and developing countries (Li et al. 2021; Dantas et al. 2021; Ali et al. 2021; Melnyk et al. 2022; Al-Qudah et al. 2022), such a critical issue has received little attention in developing countries, particularly Iraq. In this regard, previous studies in Iraq mainly investigate the interaction between green banking and banking efficiency (Al-Sabaawy 2019), the general role of the banking system in sustainable development (Jarrah and Salem 2021), stakeholder participation in green banking (Bukhari et al. 2020), and green financing of banks in sustainable performance (Al-Badran 2022). Consequently, the role of corporate governance mechanisms of listed banks in the Iraq business environment is an essential academic gap, which may enlighten the authorities to employ a sustainability approach. For instance, as a major producer of fossil fuels such as crude oil and gas, policymakers of Iraq might benefit significantly from this paper’s outcome to design banking strategies in line with naturally friendly standards. To make it more apparent, the designation and implementation of appropriate corporate governance mechanisms in the banking system of Iraq by related authorities seem to promote environmental conservation activities. Therefore, by examining this issue, the present research, in addition to helping to develop thematic literature in this field, also solves the existing research gap around this issue. However, a brief overview of the performance of world-class banks opens up new horizons of business paradigms based on greenness, which this article tries to investigate through showing the impact of corporate governance on green banking. Corporate governance is probably more important for banking institutions than other business units because of the significant role of banks’ financial intermediation in the economy, and the need to protect depositors’ funds and their high sensitivity to possible problems caused by inefficient corporate governance. Effective corporate governance practices, which are vital for the proper functioning of the banking sector and the economy as a reference, both at the system level and on an individual bank basis, are necessary to achieve and maintain public trust in the banking system (Basel Committee on Banking Supervision 2015). Hence, it can be concluded that banks’ corporate governance will significantly impact their performance from all environmental aspects (Bhattrai 2017; Lamichhane 2018). Taken together, this paper seeks to answer the question of whether corporate governance mechanisms can improve the level of green banking in Iraq as a major fossil fuel producer.

In what follows, theoretical foundations, research background, methodology, data analysis, and then discussion and conclusions have been discussed.

2. Theoretical Principles and Hypothesis Development

By promoting a sustainable environment and investment focused on social responsibility, the banking industry can create sustainable development and be considered a company’s competitive advantage. The expansion of the activity of banks and financial institutions, the increase in the number of beneficiaries, and the extent of asymmetric information indicate the necessity of establishing corporate governance in today’s banking system (Ikram and Akhtar 2021). The duty of corporate governance in the banking system is weighted to arrange a mechanism that defends all the rights of the beneficiaries of this area. Meanwhile, Islamic banking can effectively implement corporate governance principles (Senan et al. 2021). This system, having incentives such as competitiveness, special rules, and regulations in Islamic banking, requires people to comply with Islamic ethics and ethical conditions of the socio-political environment of the Islamic society, and it can be a suitable platform for the realization of corporate governance in the banking system (Hossain et al. 2020). The rapid development of financial technology has profoundly impacted the banking industry (Hossain et al. 2020), and banking services have evolved through financial technology in the past decade. The implementation of principles and standards helps to increase the efficiency of banks due to the profound link between the governance of banks and financial markets because it requires investment in property rights that create and implement sound principles and standards for the management of banks (Mertzanis et al. 2019). Bank performance can be improved by generating fee income in exchange for the convenience of innovative financial services or by increasing value-added services to customers. The innovation growth hypothesis states that financial innovation changes how banks provide financial assistance and increases the variety of banking services (Berger et al. 2016). Therefore, financial innovation enhances bank growth thanks to improved services and diversification, risk sharing, and efficiency. The literature shows that banks in countries with a higher level of financial innovation offer better assets, loans, and profit growth. A country needs to cope with financial innovations for its financial development by strengthening the performance of banks and providing more diverse financial services. Financial innovation forces the banking industry to deal with change, leading to a deeper study of whether it has affected banks. One of these innovative activities of banks, especially in the last one or two years due to the spread of the COVID-19 disease, has been the use of electronic banking in the banking industry around the world. Electronic banking is one of the prominent examples of green banking in countries because when it comes to green banking, the initial impression is more than anything else on electronic banking and systems that use less paper, which is part of the discussion. It includes the same issues that the new techniques used in banks naturally lead to in protecting the environment. This saving can be examined from two dimensions: firstly, electronic banking reduces the consumption of paper; on the other hand, it also includes growth in protecting the environment (Wang and Cao 2022).

Generally, agency problems occur when the CEOs take advantage of enterprises. Corporate governance mechanisms are designed to mitigate opportunistic behaviour. Corporate governance mechanisms are typically divided into external and internal control procedures, whereas the most critical external mechanisms are auditors and their characteristics (Salehi et al. 2019; Daemigah 2020), as well as the most effective internal mechanisms are the board and ownership structure (Edogbanya and Kamardin 2014). In addition, other elements, such as CEO characteristics and market environment (Salehi et al. 2018), are documented to play the corporate governance role. To be more specific, Islamic corporate governance mechanisms are similar to traditional mechanisms such as corporate control and supervision; nevertheless, these are discriminated against in some respects, including Islamic values and norms (Ajili and Bouri 2018; Bukhari et al. 2013). Generally, Islamic corporate governance mechanisms are shaped by two elements comprising Shariah governance and corporate governance, in which the Shariah governance mechanisms control the fatwa (Shariah opinions) compliance with Islamic rules and regulations in products and services (Ahmad et al. 2021). Considering Islamic banking, employing two board systems, such as Shariah and regular boards of directors, is a typical strategy to increase the efficiency and effectiveness of banking systems. The primary role of the Shariah board consists of scholar jurists in Islamic regulations and financing who are accountable for ensuring the consistency of the banking process with Shariah rules. More importantly, the Quran, as the most important and authentic source of Islam, remarkably emphasizes efficient governance mechanisms (3:104, 5:2 and 9:71); these verses reveal the need for effective governance and stress the valuable collaboration between individual Muslims.

In Islamic corporate finance, Shariah compliance in business performance and affairs is the mainstream of Islamic banking. In this regard, a Shariah board, as an agency theory proposition, is implemented to fulfill the needs of different stakeholders, the importance of which might be the conformity of Islamic banking and institutional operation in compliance with Islamic values and discipline. Moreover, Shariah boards, besides conventional boards, may significantly contribute to ameliorated directorship and management generally since it has been proposed that the diversity of boards may lead to greater independence of boards. Under this approach, the Shariah board is recognized as an internal governance structure whose function is monitoring the managerial behaviour and the compliance of corporate strategy employment. Additionally, the Shariah board are also expected to play a critical role in increasing green banking strategies by motivating CEOs to disclose early and publicly available green-related information. As Shariah has greatly emphasized efficient and sensible usage of natural resources and properties, it is expected that Shariah boards are willing to control the sufficiency of environmentally friendly activities and affiliated information disclosure. Therefore, the Shariah board’s intense diversity may lead to banks’ improved sustainability performances. In addition, the institutional sociology theory, which new corporate governance scholars develop, might be considered the other framework that is determining the level of sustainability performance activities. This theory assesses the impact of external elements driving sustainable corporate activities. In this regard, there are three institutional factors, such as coercive, normative, and mimetic impacts, proposed by prior researchers, which companies have used to create and improve their sustainability performance. The coercive impact is determined by stakeholders’ decisions, such as parent firms, regulatory authorities, customers, and leading service providers. The normative implications might be explained by the role of social players similar to training groups or academic bodies, activists, social communities, institutional creditors, media, and non-governmental organizations. Finally, the mimetic impact elaborates on the strategic employment of firms, mainly when they follow the most efficient procedures of their main competitor.

Alternatively, the legitimacy theory, counted as a firm-level factor, is critical for explaining green banking and sustainability performance. The advocates of legitimacy theory have observed it as a mechanism that increases the probability of a corporation’s environmentally friendly activities. Lindblom (1994) argued that organizational legitimacy, which might be understood as the picture of a firm in the public eye, is a mechanism describing how an organization may disclose voluntary information about its sustainability performance. Additionally, Guthrie and Parker (1989) suggest that legitimacy is a leading factor that motivates the firms’ authorities to establish and monitor social activities. Therefore, we expect that there are several factors under the concept of corporate governance in Islamic banking that may strengthen green banking. In particular, since Islam greatly emphasises environmental conservation, Islamic corporate governance may play a critical role.

Khan et al. (2021) showed that the disclosure of green banking has a positive and significant effect on the value of companies. Karyani and Obrien (2020), Bose et al. (2021), and Park and Kim (2020) also found that green banking has a decisive role in improving the financial performance of banks in countries. The results of Hossain et al. (2020), Shaumya and Arulrajah (2016), Karyani and Obrien (2020), Bose et al. (2021), and Park and Kim (2020) stated that green banking improves the performance of banks. Bhattrai (2017) addressed the impact of corporate governance on bank performance in Nepal. The results of his research showed that corporate governance had a significant impact on the performance of Nepalese banks. Chenini and Anis (2018) also showed that corporate governance significantly impacted the performance of Tunisian banks. Demir and Danisman (2021) also showed that during the Corona era, corporate governance played a significant role in advancing banks’ goals so, during the crisis, corporate governance significantly impacted banks’ performance. In addition, Georgantopoulos and Filos (2017), Khatib and Nour (2021), Lamichhane (2018), Mertzanis et al. (2019), Nguyen et al. (2020), and Permatasari (2020) also confirmed that corporate governance affects the performance of banks. Scherer and Voegtlin (2020) also found that corporate governance significantly impacts banks’ innovation and flexibility. Sivaprasad and Mathew (2021) also showed that banks’ corporate governance significantly impacts dealing with crises. Therefore, according to what was said, the hypothesis of the research is as follows:

Research hypothesis: corporate governance in Islamic banking has a positive and significant effect on green banking.

3. Research Methodology

This research is practical in terms of purpose and type and is based on the analysis of information collected in a survey. In this method, also called the field method, the researcher will collect data and information by being present at the level of the statistical community and using various tools, including questionnaires. Survey research is used to investigate the distribution of characteristics of the statistical population in order to examine the current situation and discover the relationship between events. The collected data are analyzed through PLS statistical software. Using the collected information and their analysis, the correctness of the assumptions of the test research and the results will be generalized to the entire statistical population.

3.1. Information and Data Collection Instrument

The data used in the current research is categorized into two branches. First, information about the theoretical framework and research literature is gathered through scanning internal and external resources, and the second category is information collected by distributing a questionnaire among individuals. The current research questionnaire is based on the green banking standard questionnaire and the corporate governance researcher’s questionnaire. Since there are a considerable number of questions, some of which are irrelevant and incompatible with the environment of Iraq, they have been removed or modified. The year of implementation of the research is 2022 AD, conducted in the Iraqi stock exchange in the private and state banks section. The research questionnaire in the specialized section consists of two parts, including the first part, green banking (Risal and Joshi 2018; Shaumya and Arulrajah 2017), with 16 questions, and the second part, corporate governance in Islamic banks in Iraq, with 43 questions (Hasan 2011). In this section, respondents are faced with two parts to answer. By answering the first part of the question, it is determined whether this factor currently exists in Iraqi banks according to the professional experience of the respondent. The answer to the second part of the question, the degree of importance (very high, high, medium, low and very low), expresses the factor from the respondents’ point of view. The validity of the questionnaire is evaluated based on the opinion of experts, and its reliability is based on Cronbach’s alpha, the composite reliability coefficient, and the average variance extracted.

The questionnaire is presented in Appendix A.

3.2. Research Population and Sample

The statistical population of this research is all managers, heads, employees, and customers of public and private banks in Iraq in 2022, and a total of 70 questionnaires have been completed and analyzed in this population.

3.3. Research Model

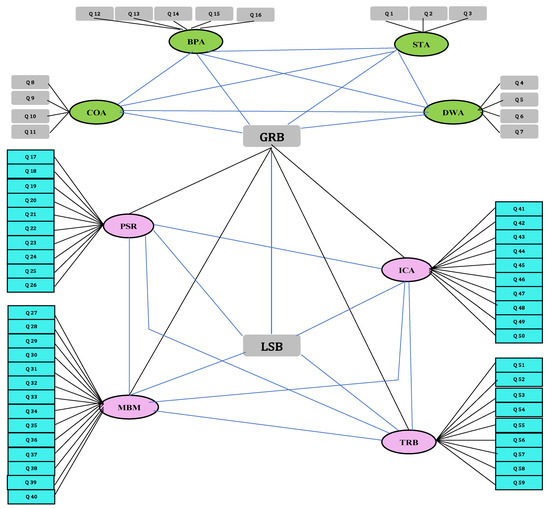

According to the subject literature and research background, the following conceptual models have been used to test the hypothesis:

Researchers use structural equation modeling in Figure 1, because it is a comprehensive statistical approach to test hypotheses about the relationships between research variables. Structural equation modeling is a very general and powerful multivariate analysis technique from the multivariate regression group that allows researchers to test a set of regression equations simultaneously. This method is a comprehensive statistical approach to test hypotheses about relationships between variables.

Figure 1.

The Conceptual model of research.

In human and social science studies, research data analysis is mainly applied according to a process with a specific and uniform general format, related to which numerous statistical analysis methods have been introduced so far. Meanwhile, structural equation modeling, introduced in the late 1960s, provided a tool for researchers to investigate the relationship between several variables in a model. The power of this technique in developing theories has caused its wide application in various sciences such as marketing, human resource management, strategic management, and information systems.

One of the most important reasons for researchers to use structural equation modeling is the ability to test theories in equations between variables. Another reason is this method’s inclusion of measurement error allows the researchers to report their data analysis, including measurement error. So far, structural equation modeling has been introduced with two generations of data analysis methods. The first generation of structural equation modeling methods is a covariance-based method; the primary purpose of this method is to validate the model, which also needs large samples to apply. LISREL, AMOS, EQS and MPLUS software is among the most used software of this generation.

A few years after introducing the covariance-based method, the second generation of structural equation modeling, a component-based approach, was introduced due to the weaknesses in this method. The component-based techniques, which were later renamed to the partial least squares method, provided different strategies for data analysis than the first generation. After introducing the partial least squares method, this method gained many enthusiasts, and many researchers wanted to use this method. The most important software for this method is Smart PLS. According to the above discussions, a small sample size is the best reason to use PLS. The first generation of structural equation modeling methods, implemented with software such as LISREL, EQS, and AMOS require many statistical samples. At the same time, PLS can run the model with a very small number of samples. In the structural equation modeling, the error value is announced for each correlation.

4. The Analyses

4.1. Data Description

Table 1 shows the frequency of demographic data.

Table 1.

The frequency of demographic data.

Most of the respondents (more than 60 percent) to the questionnaire, out of 70 participants, were women. Most respondents are over 35 years old and have less than 5 years of work experience. More than 70% have master’s degrees, doctorate, and higher, and all the respondents have university degrees. In addition, most respondents have university degrees in accounting and auditing, and more than 50% have bank employee positions.

Table 2 and Table 3 show the descriptive statistics of the data related to the two sections of green banking and corporate governance questions, and are presented separately to identify the influencing factors on corporate governance. The selectable options presented for each question in all sections of the questionnaire include: 1—very little, 2—low, 3—moderate, 4𠄴high, and 5—very high.

Table 2.

The descriptive statistics of data related to the green banking sector.

Table 3.

The descriptive statistics of data related to corporate governance in Islamic banks in Iraq.

In Table 2, the descriptive statistics of the data related to the green banking sector are presented, and the mean, median, and mode for all the answers are on mean option (2) or “I agree”. Considering that this part of the question is related to green banking, by choosing the “I agree” option, the respondents show the companies’ attention to issues such as environmental protection, energy saving, waste management, environmental rewards, etc.

As shown in Table 3, the mean, median, and mode for all the answers is an option (2) or “I agree”. Considering that this part of the question is related to corporate governance in Iraqi Islamic banks, the choice of the “I agree” option by the respondents suggests the fact that the studied banks are concerned with issues such as paying attention to the rights of shareholders and beneficiaries, the competence and independence of the board of directors, the ability and independence of the audit committee, as well as the creation of transparency, shows they are in a good position and have acceptable measures in this field.

4.2. Data Description

Before examining the research hypotheses, the validity and reliability of the research questionnaire are examined. When enough evidence is obtained about the validity and reliability of the questionnaires, the research hypotheses can be evaluated correctly. The results of these cases are shown in Table 4 in the form of indices of Cronbach’s alpha coefficient, composite reliability coefficient, and extracted average variance. First, Cronbach’s alpha is used to calculate the reliability of the questionnaire. Cronbach’s alpha is an index to measure internal consistency. Through this criterion, the average correlation of the questions in a survey tool is calculated and used to measure the reliability of the questionnaire.

Table 4.

Results of reliability and convergent validity.

The alpha coefficient ranges from 0 to 1. The alpha coefficient for the planned questionnaire section is equal to 0.941, which is in the appropriate range.

In this research, to evaluate the validity of the questionnaire, the validity of the content and structure of the questionnaire has been examined. To evaluate the validity of the construct, the average variance index was extracted and the Fornell and Larcker criteria were used. The AVE index reported in Table 4 shows that the mean obtained variance of each aspect of the model possesses an amount more than 0.5; hence, the questionnaire’s convergent validity is acceptable. Table 4 reports reveal that the AVE amount for the model is greater than 0.5. Therefore, it can be said that the sharing index used the validity of the convergence of the measurement model.

The researchers used the goodness of fit indices to evaluate the hypothetical model fitted with the observed data. The most common index is the chi-square index, which expresses the importance of the difference between the fitted model’s covariance matrix and the observed sample’s covariance matrix. The null hypothesis indicates no difference between the selected samples designed to model and the covariance matrix. The prominent note is that the sample size might influence such an index. Hence, in the case of having a large sample size, the difference might be small, indicating that the model is sufficiently fit. Therefore, the adjusted index, including chi-square, is applied to obtain a degree of freedom beside other criteria of fitness, comprising (1) Goodness of Fit Index (GFI), (2) Adjusted Goodness of Fit Index (AGFI), (3) Comparative Fit Index (CFI), (4) Tucker-Lewis Index (TLI), (5) Root Mean Square of Standardized Errors (SRMR), and (6) Root Mean Square Error of Approximation (RMSEA), where a value less than 0.08 indicates reasonable errors to approximate in society.

The goodness of fit indices of measurement models are reported separately in Table 5. It can be concluded that the model fit is suitable for the data, and the results can be reliable.

Table 5.

The goodness of fit criteria of the questionnaire.

As it was said earlier, in order to investigate the corporate governance in Islamic banking on the green banking of Iraqi banks, 59 main questions have been evaluated in the form of 8 topics. Table 6 shows the mentioned components and the number of questions that make up each. In addition, Cronbach’s alpha of each part of the questionnaire was calculated. Considering that Cronbach’s alpha was calculated between 0.847 and 0.941, the questionnaires have a suitable internal structure as a result.

Table 6.

The components, number of questions, Cronbach’s alpha, and factor analysis results.

Table 7 shows the descriptive statistics of research variables. As mentioned earlier, 70 people have completed the questionnaire for this research. It also shows that the green banking component consists of four indicators. The information on each indicator is collected through several questions. Activities related to employees are measured through three questions, activities related to daily operations through four questions, activities related to customers through four questions, and activities related to bank policy through five questions. By using the method of exploratory factor analysis and the weighted average of the questions, the indicators of green banking, which are the hidden variables of the research, have been obtained. After that, the green banking variable was created through these four factors and using the exploratory factor analysis method again. The same has been done for corporate governance. First, the questions raised in each part create the four axes. Then, the corporate representation index is obtained using the exploratory factor analysis method through the weighted average.

Table 7.

The Descriptive statistics of hidden research variables.

According to the observations of the above table, the highest average of green banking components is related to the variable of activities related to employees, and the lowest average is related to activities related to bank policy. Therefore, it is expected that the variables related to employees’ activities have less impact on green banking than other variables, and the activities related to bank policy have more impact. Among the axes of corporate governance, the lowest average is related to the first axis. Therefore, guaranteeing shareholders’ rights is expected to have the greatest effect on corporate governance. In addition, considering that the highest average is related to the fourth axis, bank transparency is expected to have the least effect on the corporate governance variable compared to the other three components. Other information on the mentioned variables is shown in the table mentioned above.

In order to avoid bias in the observations, the normality of the main research variables has been checked. For this purpose, the Kolmogorov-Smirnov test has been used; the correspondence of the distribution of the statistical population with a certain distribution is called the “goodness of fit test”. In this way, if we have collected data from a field experiment and want to compare the probability distribution of the results with, for example, the Cauchy distribution, we can use the Kolmogorov-Smirnov test. In this way, we compare the experimental distribution obtained from the sample with the Cauchy distribution. It is clear that to perform the Kolmogorov-Smirnov test, we need the empirical distribution of the data. According to the mentioned cases, Table 8 shows the information related to the normality test of the model variables. According to the results of the normality test, it can be seen that all the variables of the model have a normal distribution.

Table 8.

The results of variable normality.

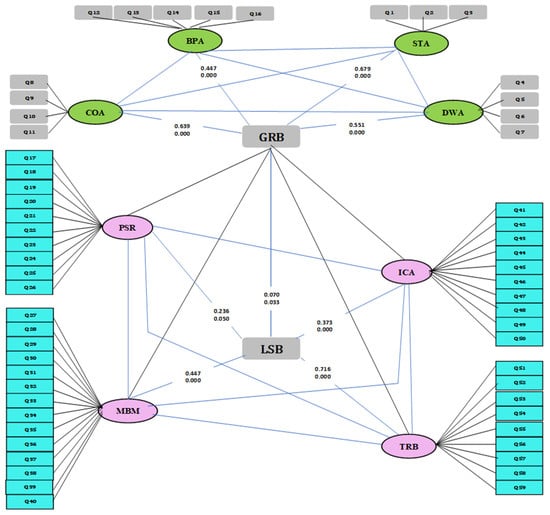

In Table 9, the correlation between the hidden components of research and green banking has been calculated. All four components of green banking have a positive and significant effect on the GRB variable at the 99% confidence level. According to the displayed correlation, the highest correlation and effect among the four variables is related to the variable of activities related to employees. After that, there are activities related to customers and daily operations. The lowest correlation is related to bank policy activities. The four axes of corporate governance positively affect corporate governance at the 99% confidence level. According to the Pearson correlation coefficient, the four most effective axes are related to the fourth axis. After that, the highest effect is related to the second and third axes, and the least is related to the first axis. It is worth mentioning that corporate governance has a positive correlation and a significant confidence level of 99% in green banking. The coefficient of this correlation is equal to 0.070.

Table 9.

The correlation matrix of hidden variables of the study.

Figure 2 shows the effect of corporate governance axes on green banking. As shown in the figure, all four components positively and significantly affect green banking. All four axes have a positive and significant effect on corporate governance. In addition, the corporate governance variable has a positive and significant effect on green banking.

Figure 2.

The modality and hidden effect of research.

After that, to investigate the relationship between corporate governance and the demographic variables of the green banking questionnaire, ordinary least squares regression was used. The results of this fitting are presented in Table 10.

Table 10.

The fit of the main research models.

According to Table 10, the effect of the corporate governance variable on green banking has been measured in the first model. The variable coefficient of ISB is equal to 1.340, which is significant at the 99% confidence level. Therefore, corporate governance has a positive and significant effect on green banking. In the second model, considering that the PSR variable coefficient is estimated as 0.889 and is significant at the 99% confidence level, the first axis of corporate governance has a positive and significant effect on green banking.

The variable coefficient of MBM in the third model is equal to 0.784. Therefore, the second axis of corporate governance positively affects green banking and is significant at the 99% confidence level. The ICA variable coefficient in the fourth model is estimated as 1.089, which is significant at the 95% confidence level. Therefore, the third axis of corporate governance positively and significantly impacts green banking. In the fifth model, the TRB variable coefficient is estimated as 0.478. Thus, the fourth axis of corporate governance positively affects green banking and is significant at the 99% confidence level. Among the control variables of the model, according to the fit of the five models in Table 10, it can be said that the level of education is a significant factor in the increase of green banking. In contrast, the variables of people’s age, gender, work experience, and position do not affect green banking.

5. Discussion and Conclusions

Corporate social responsibility has recently become a growing global concern among governments and corporate managers. The movement towards social responsibility at the worldwide level originates from companies’ international growth. The growth and development of companies at the global level, in addition to contributing to the economic prosperity of societies, has also led to an increase in public concern and a decrease in trust in how companies operate. To exploit the benefits of business globalization, governments must promote their companies’ social responsibility. Companies play a vital role in achieving the benefits of globalization. Companies’ social responsibility makes it possible to avoid the adverse social and environmental effects of global activities as much as possible while enjoying the benefits of globalization (Khan et al. 2021). Banks play a crucial role in institutionalizing social responsibility in societies compared to other companies. The role of banks as facilitators and drivers of economic and trade cycles, as wealth-generating institutions, and as service providers for local, national, and international communities, shows the importance of these institutions in promoting the intellectual movement of social responsibility in general. Banks have performed their role of social responsibility towards society through green banking. In other words, green banking is one of the issues that banks have strongly considered and investigated in the past few decades. Especially in the last one or two years, following the epidemic of COVID-19 and the measures to prevent the spread of this disease, many bank services were done electronically, which has caused a reduction in paperwork at the banking industry level. Reducing the paperwork itself reduces the damage to the environment from this industry. Therefore, this research investigates corporate governance’s impact as banks’ pillar on green banking in Iraq. The results of the current study show that there is a positive and significant relationship between corporate governance and its four components with green banking, which is consistent with the results of Hossain et al. (2020), Shaumya and Arulrajah (2016), Karyani and Obrien (2020), Bose et al. (2021), and Park and Kim (2020). In addition, the results showed that, among the four components, the first axis has the highest correlation with green banking. The level of education is considered the factor in increasing the green banking component.

According to the robust findings of this paper, it is obtained that establishing a proper and strong corporate governance mechanism is likely to motivate the banks to be engaged in environmentally friendly activities. In this regard, we expect factors, such as Shariah governance mechanisms which control the fatwa (Shariah opinions) compliance with Islamic rules and regulations in products and services (Ahmad et al. 2021), are likely to explain such findings. As Islam has dramatically emphasised the establishment of corporate governance among individual Muslims, as well as motivating Muslims to conserve all the blessings of God and, more importantly, the earth as the basic house of human beings, Shariah corporate governance mechanisms seem to play a significant role in this regard. To be more precise, the Shariah board, as an agency theory proposition, are implemented to fulfill the needs of different stakeholders, particularly environmentalists. Moreover, according to Lindblom (1994), organizational legitimacy, which might be translated as the picture of a firm in the public eye, is another mechanism describing how an organization may engage and disclose voluntary information about its sustainability performance.

The findings of the current paper provide practical implications for banks, policymakers, and society as general stakeholders demanding environmentally friendly activities. Banks and their managers know that establishing efficient corporate governance mechanisms not only improves their financial performance but also ameliorates their bank ranking in naturally friendly actions, improving their social position through promoted legitimacy. In addition, the policymakers may restrict the naturally detrimental projects by designing and enforcing effective and efficient corporate governance mechanisms, such as establishing a Shariah board of directors and extending Islamic culture among the organizations. Finally, society is likely to benefit from the findings of this paper in a way that their economic and social prosperity remarkably depends on the appropriate activities of banks, particularly their green actions (Salehi et al. 2021; Daemigah 2020).

This paper suffers from some limitations similar to any other study, which the authors have seriously attempted to tackle. The main limitation of this paper might be its small statistical population, as Iraq possesses a small economy at both macro and micro levels, and only a few banks are listed in its financial market. As well as this, while the authors have distributed the questionnaires among most banks’ affiliated individuals, some of them have not answered them, and others have answered them incompletely; therefore, in case of covering a complete statistical population, the findings could be more robust.

Considering the findings of this paper, prospective studies may examine the impact of Islamic culture and the level of Islamic education of individual banks’ affiliates on the level of green banking and the degree of environmental responsibility of investment projects of banks. Moreover, as a fossil fuel producer, Iraq might be a good geographical venue for investigating the macroeconomic and national accounts of the country on the level of green activities employed in society.

Author Contributions

Conceptualization, J.S.I.; methodology, M.R.A.; software, M.R.A.; validation, M.S.; formal analysis, M.R.A.; investigation, M.S.; resources, M.R.A.; writing—original draft preparation, J.S.I.; writing—review and editing, M.R.A.; visualization, J.S.I.; supervision, M.R.A.; project administration, J.S.I.; funding acquisition, M.R.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The animal study protocol was approved by the Institutional Review Board (or Ethics Committee) of Ferdowsi University of Mashhad (protocol code IR.UM.REC.1401.181 date 27 November 2022 of approval).

Informed Consent Statement

Not applicable.

Data Availability Statement

The data will be available at request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Employed Questionnaire

| No. | Description | Totally Agreed | Agreed | Indifference | Disagreed | Totally Disagreed |

| 1 | My Bank provides training for employees about the environmental protection, energy saving, etc. | |||||

| 2 | My Bank has environmental (green) performance evaluation methods (sustainable environmental measures, energy saving measures and carbon footprint calculation). | |||||

| 3 | My bank implements an environmental (green) reward system in branches that support green banking initiatives. | |||||

| Benefits related to daily operations | ||||||

| 4 | My bank has taken steps to reduce the use of paper and other materials. | |||||

| 5 | My bank has introduced energy efficient equipment, solutions and system practices (ATMs, LED lighting, SWIFT transfer, etc.). | |||||

| 6 | My bank uses e-waste management practices. | |||||

| 7 | My Bank has environmental banking practices (email, intranet, electronic statements, online verification system, etc.). | |||||

| Activities related to customers | ||||||

| 8 | My bank provides loans for projects related to environmental protection and energy saving. | |||||

| 9 | My bank implements some independent and unique green schemes, projects, etc. (such as tree planting). | |||||

| 10 | My Bank promotes and facilitates environmental enterprises through special grants, loans and guidance. | |||||

| 11 | My bank uses social and environmental management system or any other mechanism to evaluate all credit proposals. | |||||

| Activities related to bank policy | ||||||

| 12 | My bank is setting up green branches (energy efficient buildings/green buildings). | |||||

| 13 | My bank has an environmental (green) policy. | |||||

| 14 | My bank has environmental related contracts with related parties/stakeholders (suppliers, customers, etc.). | |||||

| 15 | In my bank, the head office or senior management level deal with environmental protection planning and implementation. | |||||

| 16 | My Bank buys its supplies, equipment and other items (such as printers, computers, etc.) from environmentally friendly companies. | |||||

| Corporate Governance in Islamic Banks of Iraq (Based on the Dissertation Questionnaire) | ||||||

| The first axis: the actions of the bank regarding guaranteeing the rights of shareholders and beneficiaries | ||||||

| 1 | The bank undertakes to treat all stakeholders fairly, including shareholders, depositors and investors. | |||||

| 2 | The bank tries to avoid illegal activities that put the shareholders’ rights at financial risk | |||||

| 3 | The bank has a fair structure for rewards and damages | |||||

| 4 | The bank is committed to take immediate measures for any violation of the owners’ rights | |||||

| 5 | The transfer of ownership of shares is done based on guaranteed legal measures | |||||

| 6 | Bank management is trying to give appropriate information to the shareholders through appropriate networks. | |||||

| 7 | banks are committed to the upper limits of ownership by large shareholders (10%) and otherwise obtain in-principle approval. | |||||

| 8 | The bank undertakes that the share of the founders does not exceed (20%) of the shares and (50%) of the capital, and the rest is subscribed. | |||||

| 9 | The company’s board of directors is encouraged to build strong relationships with common stakeholders to strengthen governance practices | |||||

| 10 | Bank management is required to fulfill its obligations to debtors and other related parties based on the payment schedule | |||||

| The second axis: the competence and independence of the board of directors and executive management | ||||||

| 11 | Banks have an internal regulation that guarantees candidacy for membership of the board of directors based on the criteria of experience and competence. | |||||

| 12 | Most of the members of the board of directors have scientific qualifications, experience and talents suitable for managing banking activities | |||||

| 13 | The board of directors establishes general goals, plans and policies based on applicable criteria by the executive management. | |||||

| 14 | The board of directors tries not to share the members of the board of directors and the executive management | |||||

| 15 | The activity of the board of directors is for four years, and it is not possible to re-candidate to be a member of the board of directors except by evaluation, and it should not be more than three periods. | |||||

| 16 | The board of directors tries to have two independent members outside the bank who have no direct or indirect connection with the bank. | |||||

| 17 | The board of directors provides clear bills and instructions that guarantee the legal measures of the bank | |||||

| 18 | Bank has a charter and policy-plan for proper management (training of human resources, integrated quality and job behavior, etc.). | |||||

| 19 | The performance of the board of directors and executive management is evaluated by independent observers at least once a year. | |||||

| 20 | The board of directors has permanent and temporary committees based on the expertise and capabilities of the members, and its duties and powers have been specified. | |||||

| 21 | The established committees perform their duties efficiently and advise the board of directors based on appropriate timing. | |||||

| 22 | There is a governance committee that is managed by qualified individuals and reports on the implementation of governance criteria. | |||||

| 23 | The board of directors presents in an annual report the actual amounts earned by the chairman of the board of directors and members and executive management. | |||||

| 24 | The board of directors interacts with all shareholders on the basis of equality, which guarantees justice in rights and duties. | |||||

| The third axis: the ability and independence of audit committees | ||||||

| 25 | The independence and realism of the internal auditor plays a role in the governance of the bank’s performance and prevents the conflict of interests between the administration and the owners. | |||||

| 26 | Banks are trying to ensure that the internal auditors are at a good scientific and practical level and are familiar with the company’s process and actions | |||||

| 27 | Audit units are connected with the board of directors and its employees are independent and capable. | |||||

| 28 | In the bank, there is a special audit unit, which is called the internal supervision department, and its employees have ability and independence. | |||||

| 29 | The audit committee ensures that the financial reports issued by the banks reflect the truth of the bank’s financial strength | |||||

| 30 | The audit committee follows up the work of the internal auditor and is concerned about their independence | |||||

| 31 | The internal audit department has an active role in risk management by determining and evaluating important areas that are at risk in the bank. | |||||

| 32 | The internal audit department is under the internal control of the periodical evaluation process, and attempts are made to check the problems in it and follow its correction. | |||||

| 33 | Internal audit plays a role in guaranteeing the right of shareholders to comment on the appointment of board members | |||||

| 34 | Internal audit helps in guaranteeing the right of shareholders to vote in person or proxy, and all votes should be given the same value. | |||||

| The fourth axis: transparency policy in the bank | ||||||

| 35 | All information of relative importance, in addition to those specified by law, is provided at the right time and it is guaranteed that the information reaches all stakeholders. | |||||

| 36 | The existence of equal opportunities in reaching information to all people at the right time and at the lowest cost. | |||||

| 37 | Banks provide future perspectives and risks periodically and continuously. | |||||

| 38 | The bank’s transparency policy is consistent with international accounting standards or the National Control Department. | |||||

| 39 | Banks provide governance structure and policies and the degree of its implementation in the bank. | |||||

| 40 | The process of providing transparent information is continuous and available to the public at a specified time and with simple tools at no cost. | |||||

| 41 | Commitment to transparency and accuracy of information and providing it at a specified time increases the trust of shareholders and customers. | |||||

| 42 | The board of directors is committed to publish specific information about the capital structure and related facilities to protect the interests of small owners. | |||||

| 43 | Transparency is pervasive and has an assessment of the bank’s financial strength and risk-taking activities. | |||||

| Dependent variable axis: implementation of banking corporate governance and its effect on green banking | ||||||

| 44 | Bank management focuses on the quality of electronic banking performance and considers it a strategic task for the success of the work and improvement of electronic banking. | |||||

| 45 | Bank employees have the necessary documents to perform their duties in the bank in terms of quality, time and cost. | |||||

| 46 | Governance and its standards give the bank the competitive power to attract more customers and this issue improves the performance indicators of electronic banking. | |||||

| 47 | The bank administration is continuously improving working methods and advanced banking services, especially in the field of electronic banking. | |||||

| 48 | Banks are looking for continuous improvement of the quality of services provided in a way that matches the customer’s needs. | |||||

| 49 | Bank employees have advanced methods and tools to provide electronic banking services. | |||||

| 50 | Banks use real and measurable metrics of e-banking performance. | |||||

| 51 | The reputation of the bank is related to the level of services provided to the people. | |||||

| 52 | The bank administration periodically compares the electronic services provided by the bank with other banks. | |||||

| 53 | The number of customers and their quality has a role in the performance of the bank and the quality of services provided to them. | |||||

References

- Ahmad, Ali Jan, Fong-Woon Lai, and Muhammad Tahir. 2021. Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. Journal of Cleaner Production 315: 128099. [Google Scholar] [CrossRef]

- Ajili, Hana, and Abdelfettah Bouri. 2018. Corporate governance quality of Islamic banks: Measurement and effect on financial performance. International Journal of Islamic and Middle Eastern Finance and Management 11: 470–87. [Google Scholar] [CrossRef]

- Al-Badran, Orooba Rashid Ali. 2022. Using Green Finance for Attaining Sustainability: A Comparative Study Of The Iraqi Private Banks. American Journal of Economics and Business Management 5: 184–94. [Google Scholar]

- Ali, Shahid, Qingyou Yan, Muhammad Sajjad Hussain, Muhammad Irfan, Munir Ahmad, Asif Razzaq, Vishal Dagar, and Cem Işık. 2021. Evaluating Green Technology Strategies for the Sustainable Development of Solar Power Projects: Evidence from Pakistan. Sustainability 13: 12997. [Google Scholar] [CrossRef]

- Al-Qudah, Anas Ali, Manaf Al-Okaily, and Hamza Alqudah. 2022. The relationship between social entrepreneurship and sustainable development from economic growth perspective: 15 ‘RCEP’ countries. Journal of Sustainable Finance & Investment 12: 44–61. [Google Scholar]

- Al-Sabaawy, Noor N. 2019. Analysis of the Relationship between Banking Efficiency and Green Banking by the Application on Iraqi Banks Listed on the Iraq Stock Market for the Period 2012–2015. Tanmiat Al-Rafidain 38: 211–32. [Google Scholar]

- Basel Committee on Banking Supervision. 2015. Guidelines Corporate Governance Principles for Banks. Available online: https://www.bis.org/bcbs/publ/d328 (accessed on 20 July 2022).

- Berger, Allen N., Björn Imbierowicz, and Christian Rauch. 2016. The roles of corporate governance in bank failures during the recent financial crisis. Journal of Money, Credit and Banking 48: 729–70. [Google Scholar] [CrossRef]

- Bhattrai, Himal. 2017. Effect of corporate governance on financial performance of bank in Nepal. International Journal of Multidisciplinary Research 7: 97–110. [Google Scholar]

- Black, Bernard S., Antonio Gledson De Carvalho, Vikramaditya S. Khanna, Woochan Kim, and B. Burcin Yurtoglu. 2019. Which aspects of corporate governance do and do not matter in emerging markets. Journal of Law, Finance, and Accounting 5: 137–77. [Google Scholar] [CrossRef]

- Bose, Sudipta, Habib Zaman Khan, Afzalur Rashid, and Shajul Islam. 2018. What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pacific Journal of Management 35: 501–27. [Google Scholar] [CrossRef]

- Bose, Sudipta, Habib Zaman Khan, and Reza M. Monem. 2021. Does green banking performance pay off? Evidence from a unique regulatory setting in Bangladesh. Corporate Governance: An International Review 29: 162–87. [Google Scholar] [CrossRef]

- Bukhari, Khuram Shahzad, Hayat M. Awan, and Faareha Ahmed. 2013. An evaluation of corporate governance practices of Islamic banks versus Islamic bank windows of conventional banks: A case of Pakistan. Management Research Review 36: 400–16. [Google Scholar] [CrossRef]

- Bukhari, Syed Asim Ali, Fathyah Hashim, Azlan Bin Amran, and Kalim Hyder. 2020. Green Banking and Islam: Two sides of the same coin. Journal of Islamic Marketing 11: 977–1000. [Google Scholar] [CrossRef]

- Chenini, Hajer, and Jarboui Anis. 2018. Analysis of the Impact of Governance on Bank Performance: Case of Commercial Tunisian Banks. Journal of the Knowledge Economy 9: 871–95. [Google Scholar]

- Daemigah, Ali. 2020. A Meta-Analysis of Audit Fees Determinants: Evidence from an Emerging Market. Iranian Journal of Accounting, Auditing and Finance 4: 1–17. [Google Scholar] [CrossRef]

- Dantas, Thales Eduardo Tavares, Eduarda Dutra De Souza, Iuri Rafael Destro, Gabriela Hammes, Carlos Manuel Taboada Rodriguez, and Sebastião Roberto Soares. 2021. How the combination of Circular Economy and Industry 4.0 can contribute towards achieving the Sustainable Development Goals. Sustainable Production and Consumption 26: 213–27. [Google Scholar] [CrossRef]

- Demir, Ender, and Gamze Ozturk Danisman. 2021. Banking sector reactions to COVID-19: The role of bank-specific factors and government policy responses. Research in International Business and Finance 58: 101508. [Google Scholar] [CrossRef] [PubMed]

- Dewi, I. Gusti Ayu Agung Omika, and I. Gusti Ayu Agung Pradnya Dewi. 2017. Corporate social responsibility, green banking, and going concern on banking company in Indonesia stock exchange. International Journal of Social Sciences and Humanities (IJSSH) 1: 118–34. [Google Scholar] [CrossRef]

- Georgantopoulos, Andreas G., and John Filos. 2017. Corporate governance mechanisms and bank performance: Evidence from the Greek banks during crisis period. Investment, Management and Financial Innovations 14: 160–72. [Google Scholar] [CrossRef]

- Guthrie, James, and Lee D. Parker. 1989. Corporate Social Reporting A Rebuttal of Legitimacy Theory. Accounting and Business Research 19: 343–52. [Google Scholar] [CrossRef]

- Handajani, Lilik. 2019. Corporate governance dan green banking disclosure: Studi pada bank di Indonesia. Jurnal Dinamika Akuntansi Dan Bisnis 6: 121–36. [Google Scholar] [CrossRef]

- Hasan, Zulkifli. 2011. A survey on Shari’ah governance practices in Malaysia, GCC countries and the UK. International Journal of Islamic and Middle Eastern Finance and Management 4: 30–51. [Google Scholar] [CrossRef]

- Hossain, Md Azmir, Md Mominur Rahman, Md Sazzad Hossain, and Md Razaul Karim. 2020. The effects of green banking practices on financial performance of listed banking companies in Bangladesh. Canadian Journal of Business and Information Studies 2: 120–28. [Google Scholar]

- Ikram, Umara, and Shahzad Akhtar. 2021. Green Banking, Corporate Governance and Performance of Selected SAARC Countries. Review of Economics and Development Studies 7: 543–59. [Google Scholar] [CrossRef]

- Jarrah, Naeem Sabah, and Elaf Sameer Salem. 2021. The role of the banking sector in achieving sustainable development (Study of a sample of Iraqi banks). Economic Sciences 16: 131–48. [Google Scholar]

- Edogbanya, Adejoh, and Hasnah Kamardin. 2014. Adoption of International Financial Statements Standards in Nigeria. Journal of Advanced Management Science 2: 72–75. [Google Scholar] [CrossRef]

- Karyani, Etikah, and Vangi Vinanda Obrien. 2020. Green Banking and Performance: The Role of Foreign and Public Ownership. Jurnal Dinamika Akuntansi dan Bisnis 7: 221–34. [Google Scholar] [CrossRef]

- Khan, Habib Zaman, Sudipta Bose, Benedict Sheehy, and Ali Quazi. 2021. Green banking disclosure, firm value and the moderating role of a contextual factor: Evidence from a distinctive regulatory setting. Business Strategy and the Environment 30: 3651–70. [Google Scholar] [CrossRef]

- Khatib, Saleh F. A., and Abdul-Naser Ibrahim Nour. 2021. The impact of corporate governance on firm performance during the COVID-19 pandemic: Evidence from Malaysia. Journal of Asian Finance, Economics and Business 8: 943–52. [Google Scholar]

- Lamichhane, Pitambar. 2018. Corporate governance and financial performance in Nepal. NCC Journal 3: 108–20. [Google Scholar] [CrossRef]

- Li, Yurui, Xuanchang Zhang, Zhi Cao, Zhengjia Liu, Zhi Lu, and Yansui Liu. 2021. Towards the progress of ecological restoration and economic development in China’s Loess Plateau and strategy for more sustainable development. Science of the Total Environment 756: 143676. [Google Scholar]

- Lindblom, Cristi K. 1994. The Implications of Organizational Legitimacy for Corporate Social Performance and Disclosure. Critical Perspectives on Accounting Conference, New York. Available online: https://cir.nii.ac.jp/crid/1571135650849054080 (accessed on 6 November 2022).

- Melnyk, Leonid, Iryna Dehtyarova, and Oleksandr Kubatko. 2022. Sustainable development strategies in conditions of the 4th Industrial revolution: The EU experience. In Reducing Inequalities towards Sustainable Development Goals. Denmark: River Publishers, pp. 241–56. [Google Scholar]

- Mertzanis, Charilaos, Mohamed A. K. Basuony, and Ehab K. A. Mohamed. 2019. Social institutions, corporate governance and firm-performance in the MENA region. Research in International Business and Finance 48: 75–96. [Google Scholar] [CrossRef]

- Nguyen, Thi Dieu Chi, Huu Nghi Phan, Hung Son Le, Thi Thuy Trang Nguyen, and Aleksandr Petrov. 2020. Corporate governance and bank performance: A case of the Vietnam banking sector. Journal of Security and Sustainability Issues 10: 63–75. [Google Scholar] [CrossRef] [PubMed]

- Park, Hyoungkun, and Jong Dae Kim. 2020. Transition towards green banking: Role of financial regulators and financial institutions. Asian Journal of Sustainability and Social Responsibility 5: 5. [Google Scholar] [CrossRef]

- Permatasari, Ika. 2020. Does corporate governance affect bank risk management? Case study of Indonesian banks. International Trade, Politics and Development 4: 127–39. [Google Scholar] [CrossRef]

- Risal, Nischal, and Sanjeev Kumar Joshi. 2018. Measuring Green Banking Practices on Bank’s Environmental Performance: Empirical Evidence from Kathmandu Valley. Journal of Business and Social Sciences 2: 44–56. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Nasrin Ziba, and Ali Daemi Gah. 2018. The relationship between cost stickiness and financial reporting quality in Tehran Stock Exchange. International Journal of Productivity and Performance Management 67: 1550–65. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Farzaneh Komeili, and Ali Daemi Gah. 2019a. The impact of financial crisis on audit quality and audit fee stickiness: Evidence from Iran. Journal of Financial Reporting and Accounting 17: 201–21. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Ali Daemi Gah, Farzana Akbari, and Nader Naghshbandi. 2021. Does accounting details play an allocative role in predicting macroeconomic indicators? Evidence of Bayesian and classical econometrics in Iran. International Journal of Organizational Analysis 29: 194–219. [Google Scholar] [CrossRef]

- Scherer, Andreas Georg, and Christian Voegtlin. 2020. Corporate governance for responsible innovation: Approaches to corporate governance and their implications for sustainable development. Academy of Management Perspectives 34: 182–208. [Google Scholar] [CrossRef]

- Senan, Nabil Ahmed Mareai, Aida Abdulaziz Ali Noaman, Borhan Omar Ahmad Al-dalaien, and Eissa A. Al-Homaidi. 2021. Corporate social responsibility disclosure and profitability: Evidence from Islamic banks working in Yemen. Banks and Bank Systems 16: 91–102. [Google Scholar] [CrossRef]

- Shaumya, K., and Anthonypillai Arulrajah. 2016. Measuring green banking practices: Evidence from Sri Lanka. Paper present at the 13th International Conference on Business Management (ICBM), Colombo, Sri Lanka, December 8. [Google Scholar]

- Shaumya, K., and Anton Arulrajah. 2017. The Impact of Green Banking Practices on Bank’s Environmental Performance: Evidence from Sri Lanka. Journal of Finance and Bank Management 5: 77–90. [Google Scholar]

- Sivaprasad, Sheeja, and Sudha Mathew. 2021. Corporate governance practices and the pandemic crisis: UK evidence. Corporate Governance 21: 983–96. [Google Scholar] [CrossRef]

- Sudhalakshmi, K., and K. Chinnadorai. 2014. Green banking practices in Indian banks. International Journal of Management and Commerce Innovations 2: 232–35. [Google Scholar]

- Wang, Lie-Huey, and Xin-Yuan Cao. 2022. Corporate Governance, Financial Innovation and Performance: Evidence from Taiwan’s Banking Industry. International Journal of Financial Studies 10: 32. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).