A Behavioral Cultural-Based Development Analysis of Entrepreneurship in China

Abstract

:1. Introduction

2. Literature Review

2.1. Drivers of the Difference in Regional Entrepreneurship

2.2. CBD as a Driver for the Development of Entrepreneurship

2.3. Entrepreneurship in China

3. Application of the CBD Model on Chinese Entrepreneurship

3.1. Model and Estimation Strategy

| PEnt | the number of private enterprises |

| HC | human capital |

| K | physical capital |

| L | labor |

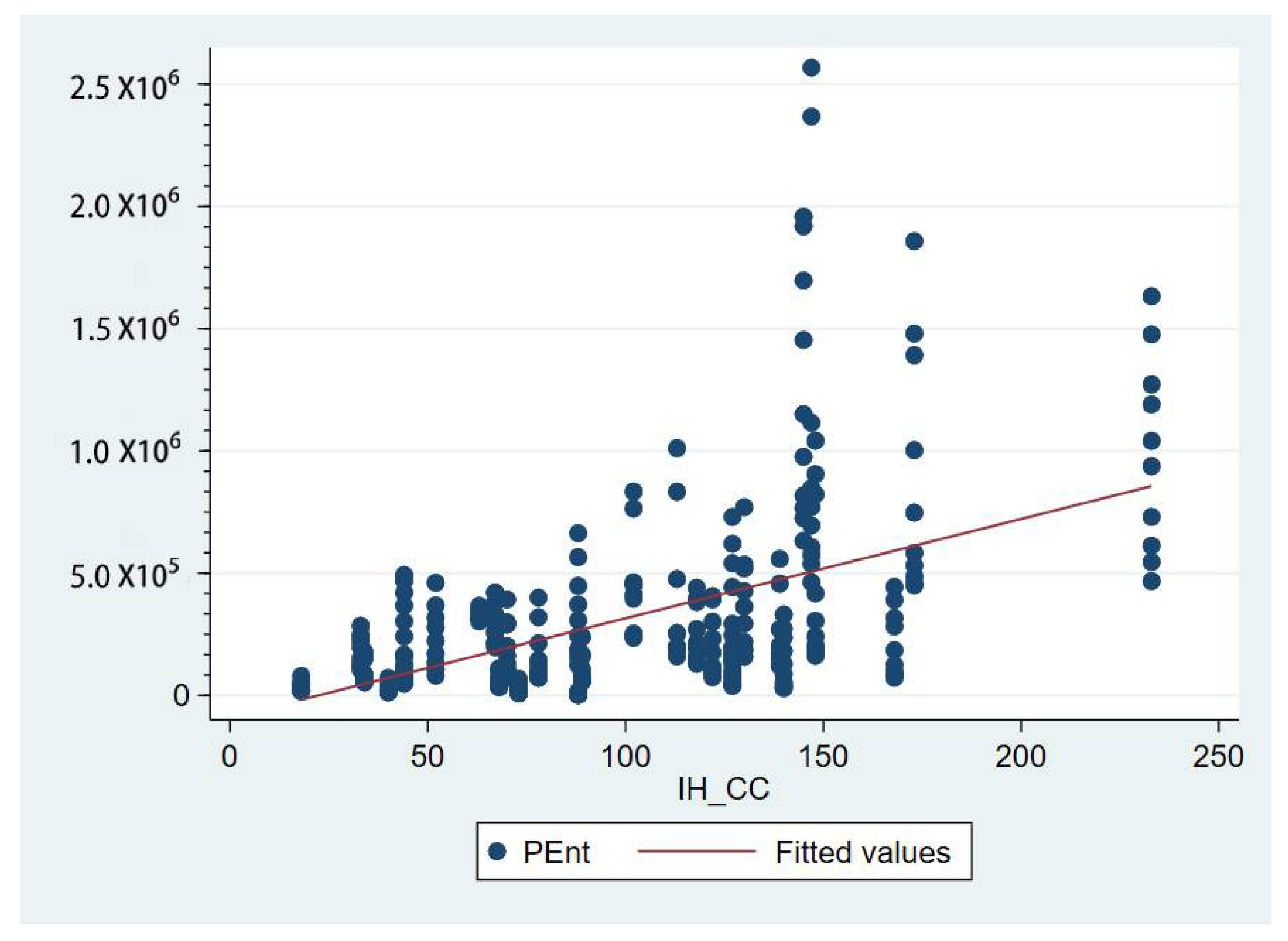

| IH_CC | immaterial historical cultural capital |

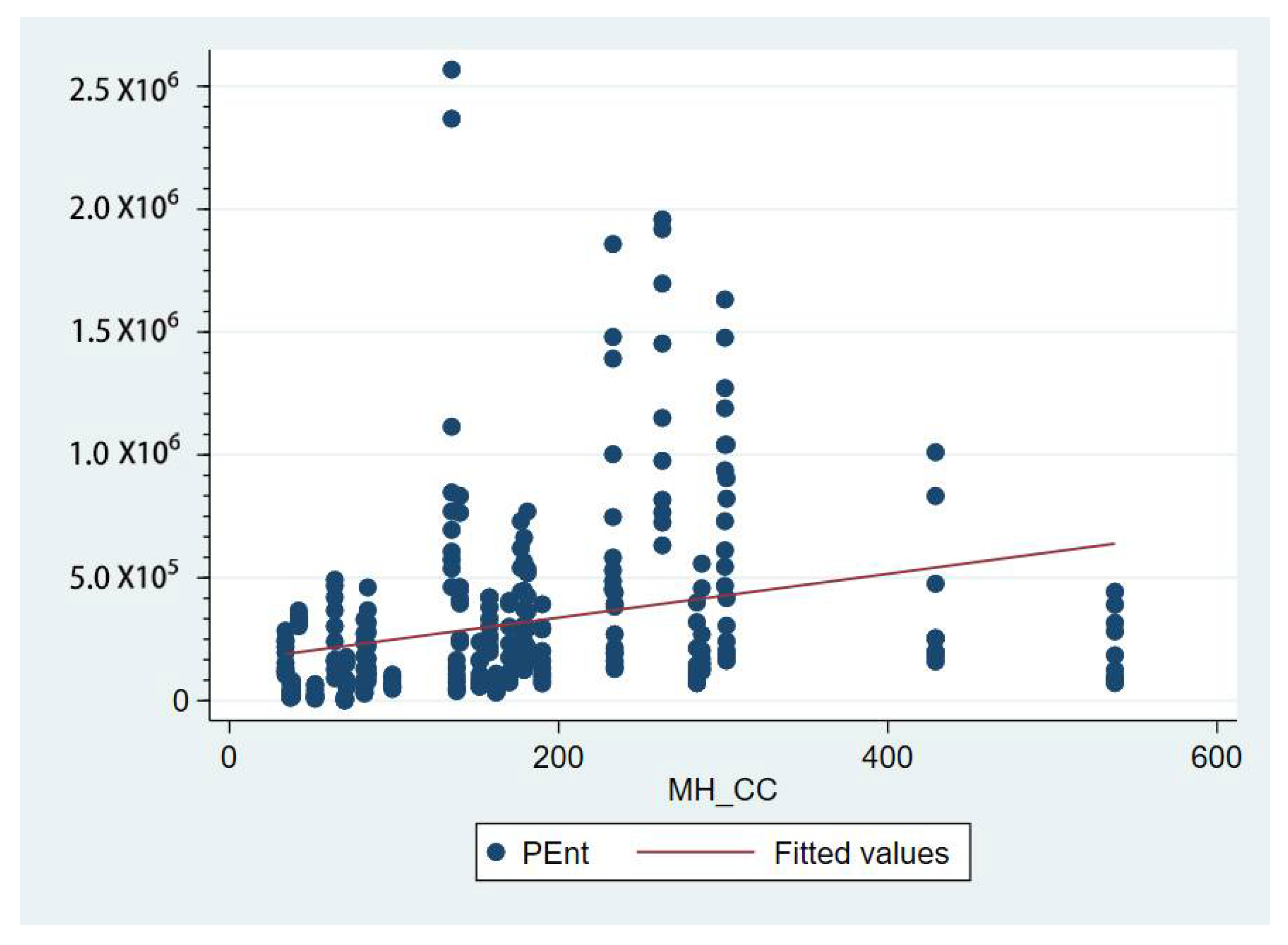

| MH_CC | material historical cultural capital |

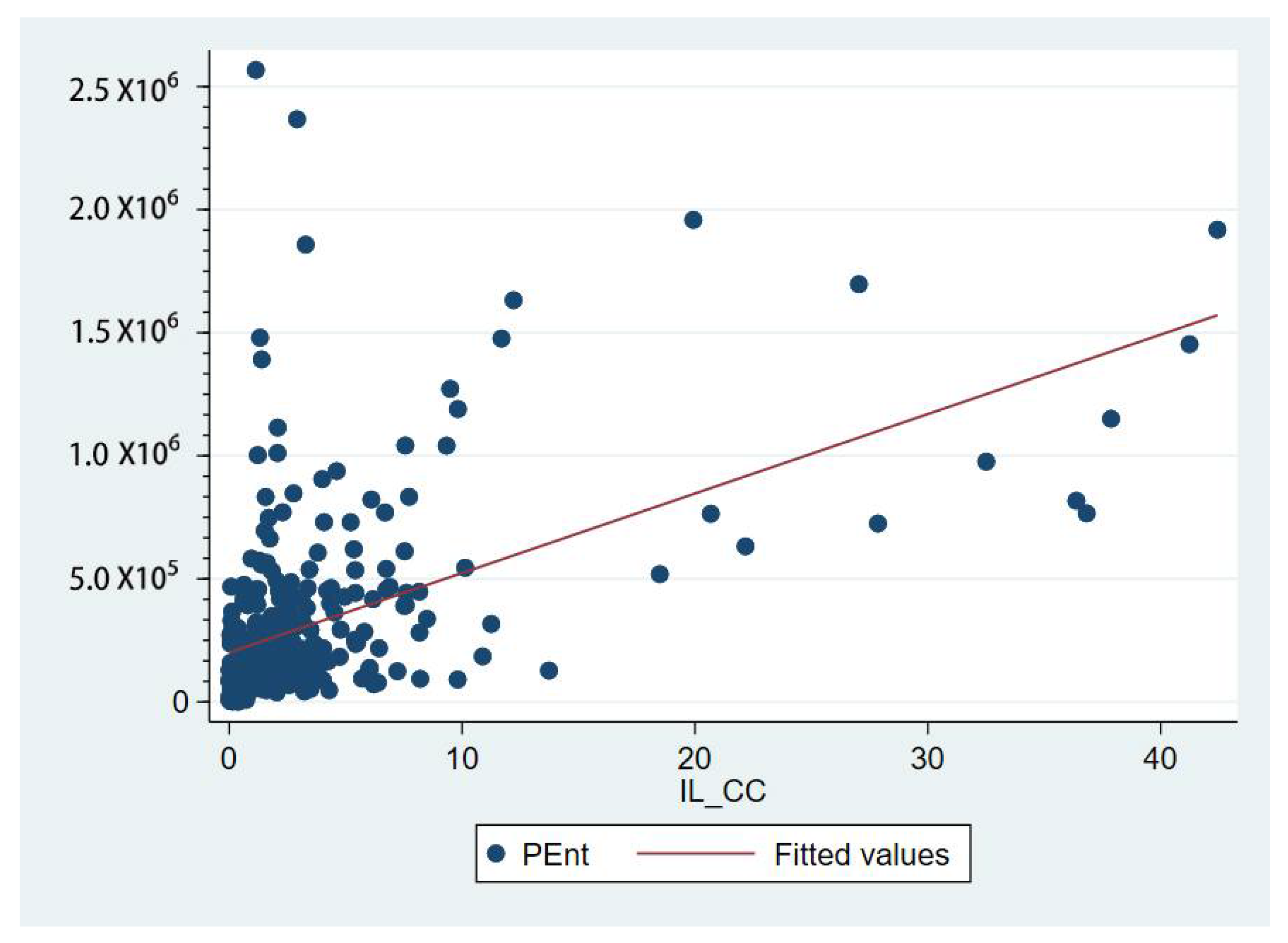

| IL_CC | immaterial living cultural capital |

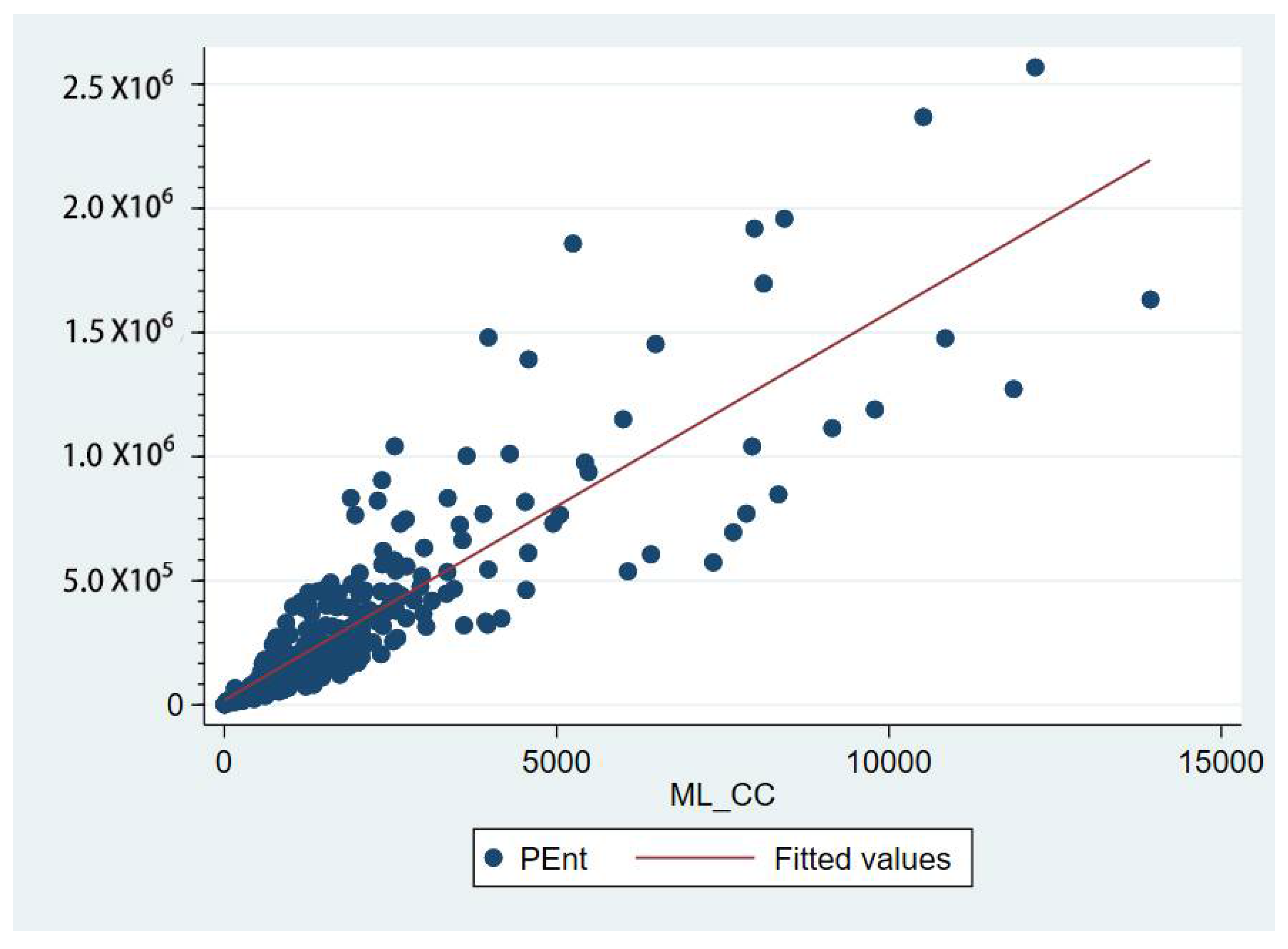

| ML_CC | material living cultural capital |

| CONT | control variables for controlling urban level and geographic factors |

3.2. Data and Definition of Variables

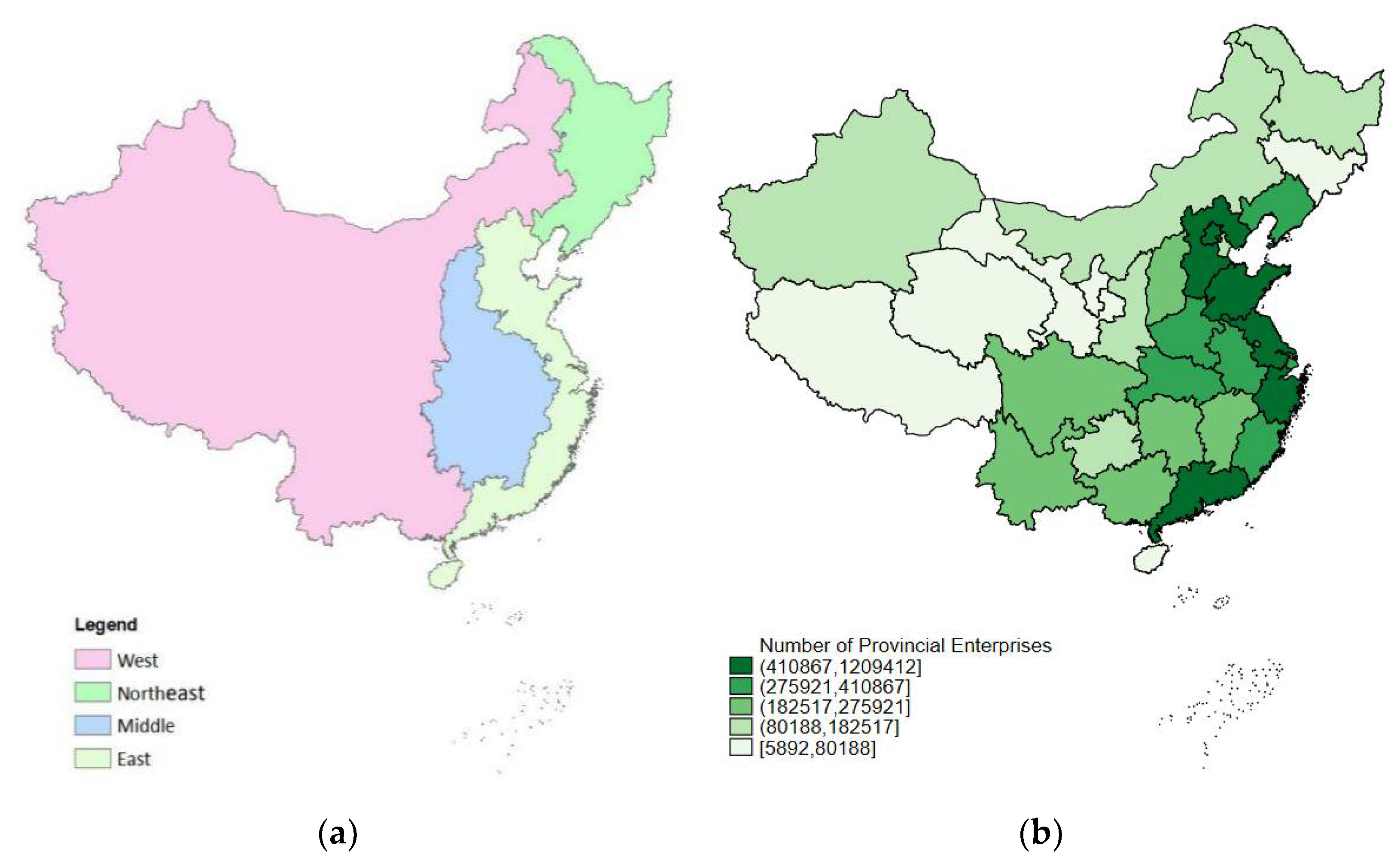

3.3. Descriptive Evidence

3.4. Results

4. Limitations

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Anderson, Alistair R., and Edward Yiu-Chung Lee. 2008. From tradition to modern: Attitudes and applications of guanxi in Chinese entrepreneurship. Journal of Small Business and Enterprise Development 15: 775–87. [Google Scholar] [CrossRef] [Green Version]

- Andersson, Martin, and Sierdjan Koster. 2010. Sources of persistence in regional start-up rates—Evidence from Sweden. Journal of Economic Geography 11: 179–201. [Google Scholar] [CrossRef]

- Arenius, Pia, and Maria Minniti. 2005. Perceptual Variables and Nascent Entrepreneurship. Small Business Economics 24: 233–47. [Google Scholar] [CrossRef]

- Bjørnskov, Christian, and Nicolai J. Foss. 2007. Economic freedom and entrepreneurial activity: Some cross-country evidence. Public Choice 134: 307–28. [Google Scholar] [CrossRef] [Green Version]

- Bosma, Niels, and Veronique Schutjens. 2010. Understanding regional variation in entrepreneurial activity and entrepreneurial attitude in Europe. The Annals of Regional Science 47: 711–42. [Google Scholar] [CrossRef] [Green Version]

- Bullough, Amanda, Maija Renko, and Tamara Myatt. 2014. Danger Zone Entrepreneurs: The Importance of Resilience and Self–Efficacy for Entrepreneurial Intentions. Entrepreneurship Theory and Practice 38: 473–99. [Google Scholar] [CrossRef]

- Chen, Xiao-Ping, and Chao C. Chen. 2004. On the Intricacies of the Chinese Guanxi: A Process Model of Guanxi Development. Asia Pacific Journal of Management 21: 305–24. [Google Scholar] [CrossRef]

- Davidsson, Per, Jan Recker, and Frederik von Briel. 2021. COVID-19 as External Enabler of entrepreneurship practice and research. BRQ Business Research Quarterly 24: 214–23. [Google Scholar] [CrossRef]

- Du, Jun-Liang, Yong Liu, and Wei-Xue Diao. 2019. Assessing Regional Differences in Green Innovation Efficiency of Industrial Enterprises in China. International Journal of Environmental Research and Public Health 16: 940. [Google Scholar] [CrossRef] [Green Version]

- Ebert, Tobias, Friedrich M. Götz, Martin Obschonka, Leor Zmigrod, and P. Jason Rentfrow. 2019. Regional variation in courage and entrepreneurship: The contrasting role of courage for the emergence and survival of start-ups in the United States. Journal of Personality 87: 1039–55. [Google Scholar] [CrossRef]

- Falck, Oliver, Stephan Heblich, and Elke Luedemann. 2010. Identity and entrepreneurship: Do school peers shape entrepreneurial intentions? Small Business Economics 39: 39–59. [Google Scholar] [CrossRef]

- Falck, Oliver, Michael Fritsch, and Stephan Heblich. 2011. The phantom of the opera: Cultural amenities, human capital, and regional economic growth. Labour Economics 18: 755–66. [Google Scholar] [CrossRef] [Green Version]

- Fazio, Catherine E., Jorge Guzman, Yupeng Liu, and Scott Stern. 2021. How Is COVID Changing the Geography of Entrepreneurship? Evidence from the Startup Cartography Project. National Bureau of Economic Research Working Paper Series; Cambridge: National Bureau of Economic Research, Available online: http://www.nber.org/papers/w2878 (accessed on 10 July 2020).

- Florida, R. 2006. The Rise of the Creative Class. New York: Basic Books. [Google Scholar]

- Fotopoulos, Georgios. 2013. On the spatial stickiness of UK new firm formation rates. Journal of Economic Geography 14: 651–79. [Google Scholar] [CrossRef] [Green Version]

- Frese, Michael. 2009. Towards a Psychology of Entrepreneurship: An Action Theory Perspective. Foundations and Trends in Entrepreneurship 5: 437–96. [Google Scholar] [CrossRef]

- Fritsch, Michael, and Sandra Kublina. 2019. Persistence and change of regional new business formation in the national league table. Journal of Evolutionary Economics 29: 891–917. [Google Scholar] [CrossRef] [Green Version]

- Fritsch, Michael, and Pamela Mueller. 2007. The persistence of regional new business formation-activity over time—assessing the potential of policy promotion programs. Journal of Evolutionary Economics 17: 299–315. [Google Scholar] [CrossRef] [Green Version]

- Fritsch, Michael, and Michael Wyrwich. 2014. The Long Persistence of Regional Levels of Entrepreneurship: Germany. 1925–2005. Regional Studies 48: 955–73. [Google Scholar] [CrossRef]

- Fritsch, Michael, Martin Obschonka, and Michael Wyrwich. 2019. Historical roots of entrepreneurship-facilitating culture and innovation activity: An analysis for German regions. Regional Studies 53: 1296–307. [Google Scholar] [CrossRef] [Green Version]

- Gregory, Neil F., Stoyan Tenev, and Dileep M. Wagle. 2000. China’s Emerging Private Enterprises: Prospects for the New Century. Washington, DC: International Finance Corp. [Google Scholar]

- Haltiwanger, John C. 2021. Entrepreneurship during the COVID-19 Pandemic: Evidence from the Business Formation Statistics. NBER Book Chapter Series; Cambridge: National Bureau of Economic Research, Available online: http://www.nber.org/papers/w28912 (accessed on 30 June 2021).

- Howell, Anthony. 2018. Ethnic entrepreneurship, initial financing, and business performance in China. Small Business Economics 52: 697–712. [Google Scholar] [CrossRef]

- Huggins, Robert, and Piers Thompson. 2020. A behavioral Theory of Economic Development. New York: Oxford University Press. [Google Scholar]

- Huggins, Robert, Piers Thompson, and Martin Obschonka. 2018. Human behavior and economic growth: A psychocultural perspective on local and regional development. Environment and Planning A: Economy and Space 50: 1269–89. [Google Scholar] [CrossRef] [Green Version]

- Kirby, David A. Kirby, and Ying Fan. 1995. Chinese cultural values and entrepreneurship: A preliminary consideration. Journal of Enterprising Culture 3: 245–60. [Google Scholar] [CrossRef]

- Kuckertz, Andreas, Leif Brändle, Anja Gaudig, Sebastian Hinderer, Morales Carlos Arturo Reyes, Alicia Prochotta, Kathrin M. Steinbrink, and Elisabeth S. C. Berger. 2020. Startups in Times of Crisis—A Rapid Response to the COVID-19 Pandemic. Journal of Business Venturing Insights 13: e00169. [Google Scholar] [CrossRef]

- Li, Jun, and Harry Matlay. 2006. Chinese entrepreneurship and small business development: An overview and research agenda. Journal of Small Business and Enterprise Development 13: 248–62. [Google Scholar] [CrossRef]

- Liu, Zhikuo, Huihang Wu, and Jianfeng Wu. 2018. Location-based tax incentives and entrepreneurial activities: Evidence from Western Regional Development Strategy in China. Small Business Economics 52: 729–42. [Google Scholar] [CrossRef]

- Liu, Zhiyang, Zuhui Xu, Zhao Zhou, and Yong Li. 2019. Buddhist entrepreneurs and new venture performance: The mediating role of entrepreneurial risk-taking. Small Business Economics 52: 713–27. [Google Scholar] [CrossRef]

- Li-Ying, Jason, and Phillip Nell. 2020. Navigating opportunities for innovation and entrepreneurship under COVID-19. California Management Review. Available online: https://cmr.berkeley.edu/2020/06/innovation-entrepreneurship/ (accessed on 10 October 2020).

- Luo, Yadong. 2000. Guanxi and Business. Singapore: World Scientific, p. 356. [Google Scholar]

- Martin, Ron, and Peter Sunley. 2006. Path dependence and regional economic evolution. Journal of Economic Geography 6: 395–437. [Google Scholar] [CrossRef]

- McClelland, David Clarence. 1961. The Achieving Society. New York: Free Press. [Google Scholar]

- McClelland, David Clarence. 1965. N achievement and entrepreneurship: A longitudinal study. Journal of Personality and Social Psychology 1: 389–92. [Google Scholar] [CrossRef] [PubMed]

- McCrae, Robert R., and Paul T. Costa. 2008. The five-factor theory of personality. In Handbook of Personality: Theory and Research. New York: Guilford Press. [Google Scholar]

- McMullen, Jeffery S., D. Ray Bagby, and Leslie E. Palich. 2008. Economic Freedom and the Motivation to Engage in Entrepreneurial Action. Entrepreneurship Theory and Practice 32: 875–95. [Google Scholar] [CrossRef]

- Möller, Joachim, and Annie Tubadji. 2009. The Creative Class, Bohemians and Local Labor Market Performance. Jahrbücher für Nationalökonomie und Statistik 229: 270–91. [Google Scholar] [CrossRef]

- Obschonka, Martin, and Michael Stuetzer. 2017. Integrating psychological approaches to entrepreneurship: The Entrepreneurial Personality System (EPS). Small Business Economics 49: 203–31. [Google Scholar] [CrossRef]

- Obschonka, Martin, Eva Schmitt-Rodermund, Rainer K. Silbereisen, Samuel D. Gosling, and Jeff Potter. 2013. The regional distribution and correlates of an entrepreneurship-prone personality profile in the United States, Germany, and the United Kingdom: A socioecological perspective. Journal of Personality and Social Psychology 105: 104–22. [Google Scholar] [CrossRef] [Green Version]

- Obschonka, Martin, Michael Stuetzer, S. Gosling, P. Rentfrow, M. Lamb, J. Potter, and D. Audretsch. 2015. Entrepreneurial Regions: Do Macro-Psychological Cultural Characteristics of Regions Help Solve the “Knowledge Paradox” of Economics? PLoS ONE 10: e0129332. [Google Scholar] [CrossRef] [Green Version]

- Obschonka, Martin, M. Stuetzer, David B. Audretsch, Peter J. Rentfrow, Jeff Potter, and Samuel D. Gosling. 2016. Macropsychological Factors Predict Regional Economic Resilience During a Major Economic Crisis. Social Psychological and Personality Science 7: 95–104. [Google Scholar] [CrossRef]

- Obschonka, Martin, Elisabeth Hahn, and Nida ul Habib Bajwa. 2018a. Personal agency in newly arrived refugees: The role of personality, entrepreneurial cognitions and intentions, and career adaptability. Journal of Vocational Behavior 105: 173–84. [Google Scholar] [CrossRef]

- Obschonka, Martin, Michael Stuetzer, Peter J. Rentfrow, Leigh Shaw-Taylor, Max Satchell, Rainer K. Silbereisen, Jeff Potter, and Samuel D. Gosling. 2018b. In the shadow of coal: How large-scale industries contributed to present-day regional differences in personality and well-being. Journal of Personality and Social Psychology 115: 903–27. [Google Scholar] [CrossRef] [Green Version]

- Obschonka, Martin, Michael Fritsch, and Michael Stuetzer. 2021. The Geography of Entrepreneurial Psychology. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Pan, Fenghua, and Bofei Yang. 2018. Financial development and the geographies of startup cities: Evidence from China. Small Business Economics 52: 743–58. [Google Scholar] [CrossRef]

- Rentfrow, Peter J., Samuel D. Gosling, and Jeff Potter. 2008. A Theory of the Emergence, Persistence, and Expression of Geographic Variation in Psychological Characteristics. Perspectives on Psychological Science 3: 339–69. [Google Scholar] [CrossRef]

- Rutter, Michael. 2006. Genes and Behavior: Nature-Nurture Interplay Explained. Malden: Blackwell Pub. [Google Scholar]

- Sorenson, Olav, and Pino G. Audia. 2000. The Social Structure of Entrepreneurial Activity: Geographic Concentration of Footwear Production in the United States. 1940–1989. American Journal of Sociology 106: 424–62. [Google Scholar] [CrossRef] [Green Version]

- The Entrepreneurship Research Center on G20 Economies. 2019. 2018/2019 Global Entrepreneurship Monitor China Report. London: Global Entrepreneurship Research Association. [Google Scholar]

- Tubadji, Annie. 2012. Culture-based development: Empirical evidence for Germany. International Journal of Social Economics 39: 690–703. [Google Scholar] [CrossRef]

- Tubadji, Annie. 2013. Culture-based development-culture and institutions: Economic development in the regions of Europe. International Journal of Society Systems Science 5: 355–91. [Google Scholar] [CrossRef]

- Tubadji, Annie. 2020. Value-Free Analysis of Values: A Culture-Based Development Approach. Sustainability 12: 9492. [Google Scholar] [CrossRef]

- Tubadji, Annie, and Peter Nijkamp. 2015. Cultural impact on regional development: Application of a PLS-PM model to Greece. The Annals of Regional Science 54: 687–720. [Google Scholar] [CrossRef] [Green Version]

- Tubadji, Annie, and Peter Nijkamp. 2016. Impact of Intangible Cultural Capital on Regional Economic Development: A Study on Culture-Based Development in Greece. Journal of Regional Analysis and Policy 46: 1–12. [Google Scholar]

- Tubadji, Annie, and Frank Pelzel. 2015. Culture based development: Measuring an invisible resource using the PLS-PM method. International Journal of Social Economics 42: 1050–70. [Google Scholar] [CrossRef]

- Tubadji, Annie, Brian J. Osoba, and Peter Nijkamp. 2015. Culture-based development in the USA: Culture as a factor for economic welfare and social well-being at a county level. Journal of Cultural Economics 39: 277–303. [Google Scholar] [CrossRef]

- Van Stel, André, David J. Storey, and A. Roy Thurik. 2007. The Effect of Business Regulations on Nascent and Young Business Entrepreneurship. Small Business Economics 28: 171–86. [Google Scholar] [CrossRef] [Green Version]

- Wang, Ruixiang. 2012. Chinese Culture and Its Potential Influence on Entrepreneurship. International Business Research 5: 76–90. [Google Scholar] [CrossRef]

- Yang, Kaizhong, and Ying Xu. 2006. Regional differences in the development of Chinese small and medium-sized enterprises. Journal of Small Business and Enterprise Development 13: 174–84. [Google Scholar] [CrossRef]

- Zahra, Shaker A. 2021. International entrepreneurship in the post Covid world. Journal of World Business 56: 101143. [Google Scholar] [CrossRef]

- Zhang, Anming, Yimin Zhang, and Ronald Zhao. 2003. A study of the R&D efficiency and productivity of Chinese firms. Journal of Comparative Economics 31: 444–64. [Google Scholar]

- Zheng, Jinghai, Xiaoxuan Liu, and Arne Bigsten. 1998. Ownership Structure and Determinants of Technical Efficiency: An Application of Data Envelopment Analysis to Chinese Enterprises (1986–1990). Journal of Comparative Economics 26: 465–84. [Google Scholar] [CrossRef]

- Zhou, Wubiao. 2011. Regional deregulation and entrepreneurial growth in China’s transition economy. Entrepreneurship & Regional Development 23: 853–76. [Google Scholar]

| PEnt | K | L | HC | IH_CC | MH_CC | IL_CC | ML_CC | Urban Level | Middle | West | Northeast | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PEnt | 1 | |||||||||||

| K | 0.758 *** | 1 | ||||||||||

| L | 0.299 *** | −0.00839 | 1 | |||||||||

| HC | 0.198 *** | −0.0627 | 0.871 *** | 1 | ||||||||

| IH_CC | 0.522 *** | 0.524 *** | 0.0713 | −0.103 | 1 | |||||||

| MH_CC | 0.269 *** | 0.472 *** | −0.106 | −0.162 ** | 0.662 *** | 1 | ||||||

| IL_CC | 0.517 *** | 0.415 *** | 0.266 *** | 0.194 *** | 0.351 *** | 0.301 *** | 1 | |||||

| ML_CC | 0.871 *** | 0.648 *** | 0.293 *** | 0.125 * | 0.533 *** | 0.241 *** | 0.446 *** | 1 | ||||

| Urban Level | 0.392 *** | 0.145 * | 0.799 *** | 0.807 *** | −0.0602 | −0.148 ** | 0.267 *** | 0.389 *** | 1 | |||

| middle | −0.200 *** | 0.019 | −0.342 *** | −0.254 *** | −0.026 | 0.284 *** | −0.166 ** | −0.217 *** | −0.292 *** | 1 | ||

| west | −0.271 *** | −0.235 *** | −0.306 *** | −0.259 *** | −0.0414 | −0.203 *** | −0.205 *** | −0.267 *** | −0.484 *** | −0.0775 | 1 | |

| northeast | −0.134 * | −0.107 | −0.0504 | 0.0374 | −0.341 *** | −0.177 ** | −0.107 | −0.0949 | 0.0945 | −0.260 *** | −0.209 *** | 1 |

| Variables | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| K | 24.152 *** | 23.132 *** | 11.717 *** | 11.916 *** | 11.870 *** |

| −1.726 | −2.041 | −1.694 | −1.711 | −1.695 | |

| L | 2.506 × 1010 *** | 1.550 × 1010 *** | −3.66 × 109 | −2.53 × 109 | −4.57 × 109 |

| −5.44 × 109 | −5.16 × 109 | −3.28 × 109 | −3.64 × 109 | −4.00 × 109 | |

| HC | −477,030.07 | 178,819.75 | 962,665.209 *** | 1,099,878.268 *** | 1,240,621.867 *** |

| −405,921.93 | −409,157.66 | −289,868.65 | −295,936.99 | −326,731.12 | |

| IH_CC | 2168.017 *** | 657.436 ** | 550.766 * | 384.99 | |

| −359.75 | −265.368 | −317.967 | −325.179 | ||

| MH_CC | −739.720 *** | −337.122 *** | −335.585 *** | −306.805 *** | |

| −180.895 | −108.328 | −111.665 | −114.299 | ||

| IL_CC | 5973.026 ** | 5963.003 ** | 5462.350 ** | ||

| −2699.13 | −2680.08 | −2727.07 | |||

| MH_CC | 101.325 *** | 104.103 *** | 104.543 *** | ||

| −16.019 | −17.212 | −17.347 | |||

| Urban_Level | −150,462.40 | −213,544.46 | |||

| −133,353.28 | −144,277.43 | ||||

| middle | −34,801.625 * | ||||

| −19,626.78 | |||||

| west | −35,066.239 * | ||||

| −20,978.24 | |||||

| northeast | −69,486.392 *** | ||||

| −23,215.32 | |||||

| Constant | −332,850.437 *** | −364,230.703 *** | −165,435.329 *** | −110,251.054 ** | −22,794.36 |

| −37,646.91 | −33,568.81 | −24,754.96 | −53,987.71 | −64,982.26 | |

| Observations | 310 | 310 | 309 | 309 | 309 |

| R-squared | 0.67 | 0.709 | 0.854 | 0.855 | 0.857 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dai, Y. A Behavioral Cultural-Based Development Analysis of Entrepreneurship in China. Adm. Sci. 2021, 11, 91. https://doi.org/10.3390/admsci11030091

Dai Y. A Behavioral Cultural-Based Development Analysis of Entrepreneurship in China. Administrative Sciences. 2021; 11(3):91. https://doi.org/10.3390/admsci11030091

Chicago/Turabian StyleDai, Yue. 2021. "A Behavioral Cultural-Based Development Analysis of Entrepreneurship in China" Administrative Sciences 11, no. 3: 91. https://doi.org/10.3390/admsci11030091

APA StyleDai, Y. (2021). A Behavioral Cultural-Based Development Analysis of Entrepreneurship in China. Administrative Sciences, 11(3), 91. https://doi.org/10.3390/admsci11030091