In this section we present our results in subsections based upon our three research questions focused on the racial and ethnic differences in participation in the sharing and informal economies (RQ#1), the rationale of Hispanic engagement in the sharing and informal economies (RQ#2), and the drivers of Hispanic participation in the sharing and informal economies (RQ#3). We also include a discussion at the end of this section.

4.1. EIWA Differences across Racial and Ethnic Groups

In this section, we report the engagement in EIWA for Hispanics and other racial and ethnic groups. For comparison, Whites, Blacks and others are included as they are the distinguishable groups in the data set (though other refers to “other, non-Hispanic” and those of “two or more races other than Hispanic” and does not offer much further detail). The first module of the EIWA survey contained eleven questions in three categories: personal services, online and online sharing economy which captures asynchronous online market exchanges (e.g., eBay, Craigslist) and real time synchronous market exchanges (e.g., Uber, Lyft), and selling goods offline (see

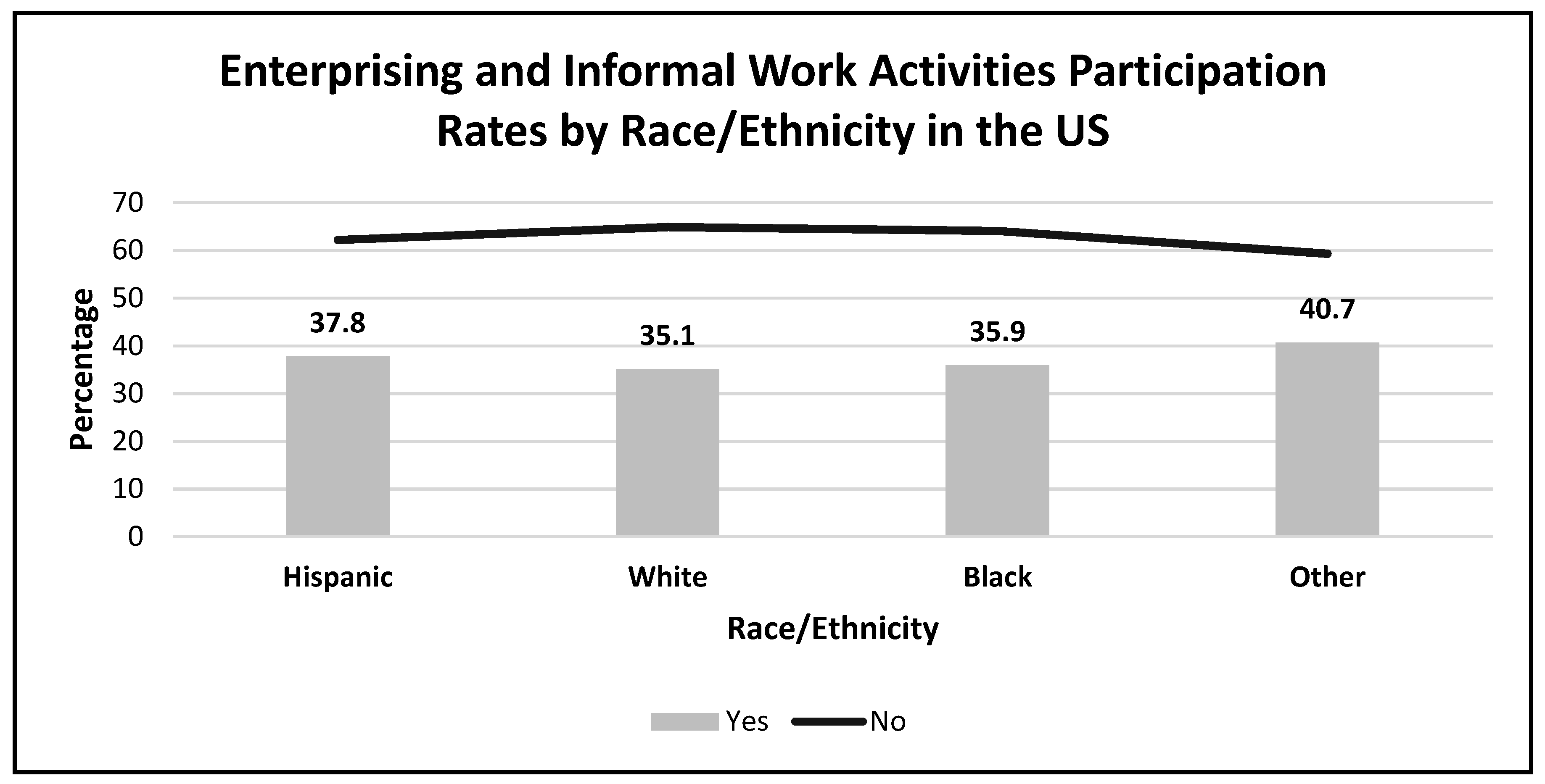

Table 4). Personal services included four questions focused on in-home services (e.g., childcare, elder care, house cleaning, landscaping) and reports that 21.7% of Hispanic respondents engaged in at least one of these activities—a higher rate than in other groups. The online sharing economy has the highest participation rate of 22.2% of Hispanic respondents engaging in at least one of the four areas of consideration: completing online tasks, renting out a property, selling new or used goods, or other online paid activities. Hispanics participate in asynchronous online and real time online sharing economy at higher rates than Whites and Blacks. More traditional methods of selling goods offline netted 10.3% of Hispanic respondents a rate in between Whites (11.9%) and Blacks (8.8%). As previously stated, 37.8% of Hispanics participate in the sharing and informal economies, a rate higher than Whites and Blacks.

With regard to the online sharing economy, two websites have the highest Hispanic participation as income earners: Craigslist and eBay (see

Table 5). Latinos participate at a higher rate than Whites and Blacks in all but one of the listed online EIWA areas except for eBay, where Whites participate at a slightly higher level. Sundararajan suggests that Craigslist and eBay online platforms are precursors to the sharing economy because they are low risk asynchronous retail exchanges where proximity is not very important. These activities, nonetheless, may be gateway actions that permit a deeper future engagement with the mainline sharing economy Sundararajan describes, as reported in

Table 5.

On average, Hispanics engaged in EIWA spend 14 h per month working in the sharing and informal economies (see

Table 6, Panel A). On average, this compares to 12.2 h for Whites, 19.3 h for Blacks, and 16.0 h for others per month (Panels A–D). Latino households with the least income (5.8 h) and most income (6.1 h) work the fewest hours in EIWA per month. Hispanic households earning between USD 75,000 and USD 100,000 work, on average, the most hours at 29.7 per month, or about the equivalent of one full 8 h day per week. For Whites, the general pattern of hours worked in EIWA decreases with household income. Hourly participation rates for Blacks vary considerably by income with no discernable pattern. The other group pattern more closely aligns with Latino households.

At the request of a reviewer, a more focused univariate (cross-tabulation) look at gender differences within Hispanics only is reported here by EIWA sub-category. Women are 1.3 times more likely than men to be engaged in personal services; men are 1.2 times more likely than women to be engaged in the online sharing economy; women are 1.1 times more than men likely to be selling goods offline; there are virtually no gender differences for total combined EIWA activities.

4.3. Hispanic Participation in EIWA—The Drivers

Hispanic participants in EIWA were asked variations of the importance of the income earned from EIWA. Reported in

Table 10, Panel A are the results of how EIWA income may have offset any negative economic household shocks over the past six months. Those respondents with the lowest household incomes found the greatest income support from EIWA. However, a plurality (i.e., largest response group) of respondents indicated across all incomes no discernable impact.

Table 10, Panel B focused on the importance of EIWA earnings as a significant source of household income. Here a majority of all income groups noted that EIWA was not a significant source of household income, though about one quarter indicated that EIWA income was somewhat or very much significant for household income. Lastly, Panel C of

Table 10 reports the regularity and consistency of EIWA income for household earnings. For about one-fifth of the lowest household income respondents, EIWA earnings were very much a regular component of household income. For sizable portions of all income groups, EIWA earnings were at least a somewhat regular component of household income.

To discern the major drivers (i.e., significant variables or determinants) of Hispanic EIWA participation, more advanced analyses of the survey data were undertaken. As the dependent variable is dichotomous (participates in EIWA = 1, or does not participate in EIWA = 0) with multiple independent variables, we employed a binomial logistic regression model. The independent or predictor variables are age, gender, education, civil status, housing and ownership type, Internet access, urban or rural residence, regional residence, employment status, and annual household income. Categorical variables were assigned a reference category. The assigned reference categories are: gender = female; education = BA/BS or Higher; civil status = married/living with partner; housing type = detached 1-family house (boat, van, omitted because of a very low response rate); Internet access at home = yes; urban residence = urban; residence ownership = owned/purchasing; US residence location = west; employment status = working wage and salaried; annual household income = under USD 15,000. As this is an exploratory study, these variables were chosen due to their availability and connection to the sharing and informal economies literature. Logistic regression predicts the odds of an event occurring, in the present case the odds or likelihood of Hispanic EIWA participation.

Table 11 displays our logistic regression results for Hispanics engaged in EIWA. Significant variables include age, education, civil status, Internet access, residence ownership type, regional residential location, employment status, and annual household income and are described below. Gender is an insignificant variable in this analysis. Each additional year of age reduces the likelihood of EIWA participation by 2.2%. This is calculated as 1-β. For age, see

Table 11, row 3. The exp(β) found in column 6 is 0.978. Thus 1 − 0.978 equals 0.022. As the variable age is a count variable in one-unit increments beginning at 18, a 25-year-old is 15.4% less likely than an 18-year-old to participate in EIWA (25 − 18 = 7; then 7 × 0.022 = 0.154). The reference category for education is a college degree or higher, hence, those Hispanics with less than a high school education are 63.9% more likely to be EIWA participants than college graduates. Divorced and separated respondents are 88.9% more likely to participate in EIWA than married and couples living together. Those respondents without Internet access at home are 43.8% less likely to be EIWA participants than those respondents with home-based Internet access. Renters and those respondents living in rent-free spaces are 56.2% and 79.7%, more likely to participate in EIWA, respectively, then home-owning respondents.

As compared to US residence in the West, the odds of EIWA participation increase by 61.2% and 35.5% for residence in the US Midwest and South, respectively. Regarding those respondents working full time for a wage and salary, the self-employed, and those not working and (a) looking for work, (b) retired, and (c) disabled are all more likely to be EIWA participants. The odds of greater EIWA participation are 66.2% for the self-employed, 118.9% for those looking for work, 94.7% for the retired, and 82.7% for the disabled. Respondents with annual household earnings of less than USD 15,000 served as the reference category for income. Hispanic households earning between USD 15,000 and USD 34,999, USD 35,000 and USD 49,999, and over USD 100,000 were 61.04%, 83.2% and 155.4%, respectively, more likely to participate in EIWA than the lowest earning Hispanic households. The model diagnostics appear at the bottom of

Table 11 and fall within acceptable ranges. This also includes checks for multicollinearity where the correlation matrices for the various binary logistic regression estimates fall within acceptable ranges.

We also estimated logistic regression models for the three subcategories of EIWA: personal services, the asynchronous online and real-time sharing economy, and selling goods offline (described in

Table 4). The results are briefly reported here in condensed form, the tables may be viewed in

Appendix A. Hispanics that have participated in any of the personal services were less likely to participate if they were men and as respondents aged (see

Table A1). Increasing the odds of participating in personal services were those with less than a high school education, single individuals who had never married, those living in mobile homes, respondents who were rented their housing, respondents living in the Midwest, the self-employed, those out of work and those looking for a job, and those with household incomes above USD 15,000 except for those households earning between USD 50,000 and USD 74,999. Hispanics that participate in any aspect of the online and sharing economy were more likely to do so if they rent or occupy rent-free housing, live in the South, were laid-off from work, were retired, and were part of household that earned USD 100,000 or more per year. Decreasing the odds of participating in the online and sharing economy for Hispanics was increasing age, status as never married single, and lack of internet access at home (see

Table A2). The odds for Hispanics participating in the selling of goods decreased for those living in urban environments and for those without Internet access at home (see

Table A3). Conversely, Hispanics were more likely to sell goods offline if they possessed less than a high school education, lived in households with more members present, were divorced or separated, occupied free rent housing, and were out of work for an unspecified reason.

A simplified summary table of all the logistic regression models is provided in

Table 12). Where a variable is significant, either a “+” or a “−” is inserted to indicate more likely or less likely to impact the odds of participation. For all but one variable, the directionality of signs are in concert with one another. The results generally indicate an increase in age lessens the odds of EIWA participation, respondents with less than a high school education were active EIWA participants, divorced or separated Hispanics participated in EIWA, lack of internet access at home decreased EIWA participation, rental housing increased participation in EIWA, Midwest and Southern locations increased EIWA participation, the self-employed and out of work were likely EIWA participants, and higher income households were more likely to participate in EIWA. More specifically, men were less likely to provide personal services, larger member households were more likely to be involved in selling goods offline, living in a mobile home or an urban environment was likely to enhance participation in personal services. Mixed findings for singles meant singles who were more likely to participate in personal services and less likely to participate in online and sharing economy.

4.4. Discussion

Hispanics have higher rates of EIWA participation than African Americans and Anglos in the US economy. This higher rate also holds for personal services and for the online and online sharing economy. Higher personal services rates for Hispanics may reflect more recent immigrant experiences including challenges associated with work authorization which are important in connecting economic participation. The EIWA survey did not ask questions of work authorization or immigration history, so this direct connection is left unanswered in the EIWA survey. Latino engagement in the online and online sharing economy illustrates a willingness to pursue income earning opportunities innovatively and asynchronously. Asynchronous online participation allows for the juggling and management of time, altering the scheduling of time from one of reaction to pro-action. Innovations, such as involvement in Craigslist or eBay, provide a safe first step into the online environment that may provide greater confidence in the participation in EIWA activities creating a gateway to further more sustained and perhaps synchronous future involvement. Additionally, this online activity has been accomplished with the constraint of internet usage and broadband access gaps between Hispanics and African Americans and Anglos, where Hispanics lag behind. However, these gaps are quickly narrowing and may disappear in a few years (

Brown et al. 2016). Selling goods offline is an American tradition, be they yard sales, flea markets or

pulgas, craft fairs, or food stands, and selling goods offline is not highly distinguishable, especially among Hispanics and Anglos.

Time committed to EIWA activities varies substantially by ethnic and racial group. While Whites may be using EIWA to supplement incomes, so that lower income households devote more time to EIWA, the households of Latinos and Blacks, on the other hand, may find their time involvement constrained or augmented by additional factors. These may include access to the sharing and informal economies, perhaps stunted or augmented by internet availability, available income earning opportunities, and market information. Focusing on Hispanics, the EIWA survey clearly indicates that the motivation for EIWA involvement is to earn income, be it as a primary or secondary income with the intention to continue or accelerate EIWA participation.

One of the more interesting findings is that relatively affluent Hispanic households (USD 75,000 to USD 99,999 annual incomes) are the most engaged in EIWA by time spent and income earned. This, in part, may reflect the added stress of incomes keeping up and catching up to others in America where many households are still digging out from the economic and housing crisis of 2008/2009 and the malaise in income growth over the past decade. Other economic stresses, such as college education for children, may also be at play. The added income may simply help to maintain a middle-class lifestyle in America. For many, extra income earned in EIWA for this group, most of it likely unreported, is perhaps a rational economic response and strategy to get ahead. Gender differences are mostly muted, perhaps a fertile area for future investigators to explore and explain.

Our multivariate statistical results indicate those variables critical to EIWA participation. It is certain that youth matters, as younger respondents were more likely to engage in EIWA. This result may, in part, have to do with technological familiarity for the online sharing economy and possibly immigrant status and ease of employment access for personal services. Where education and income tend to be highly correlated, earning extra household income for those respondents with less than a high school education seems to be a plausible supplemental income strategy. This may be true of renters and those that occupy rent-free residences as well as those not working. The divorced and separated may find time spent previously with family may now be reoriented to EIWA. With little doubt, home-based internet access is the gateway to the online sharing economy. While public access to the internet allows some to participate in EIWA, the convenience of, and ready access to, home-based broadband internet is a key element in EIWA engagement. Respondents in the Midwest and South find themselves more engaged in EIWA, perhaps an area for more study to uncover the reasons for this phenomenon. Additionally, as stated and described above, it is not the poorest households that are the most engaged in EIWA.