Abstract

In the post-COVID-19 era, the content of work and the necessary skills are rapidly changing due to the digital transformation of the way people work. Entrepreneurial adaptability and digital capability are the most necessary competencies for exploring opportunities and quickly turning them into a professional career amid a crisis. Financial literacy is also essential for expanding skills in economic and social life. The purpose of this study is to verify the influence of university students’ financial literacy and digital capability on entrepreneurial intention and the mediating effect of entrepreneurship. To this end, a survey was conducted on university students in Busan and Gyeongnam, and a sample of 162 respondents was verified using SPSS 28.0. As a result of the study, it was found that financial literacy had a partially positive effect on entrepreneurship and entrepreneurial intention. Digital capability was found to have a positive effect on entrepreneurship and entrepreneurial intention. It was found that entrepreneurship had a partially positive effect on entrepreneurial intention. It was found that entrepreneurship had a partially positive mediating effect between financial literacy and entrepreneurial intention. It was found that entrepreneurship had a positive mediating effect between digital capability and entrepreneurial intention. As a result of this study, it was confirmed that financial literacy, digital capability, and entrepreneurship are very important competencies for university students to adapt to new trends and promote start-ups in a rapidly changing job environment after COVID-19, suggesting the need for further education.

1. Introduction

After the COVID-19 era, Korean society is at an important inflection point. It has succeeded in developing into an economic powerhouse, centering on large companies with technological advantages, and recently, the number of start-ups has been increasing. Innovative mold-breakers such as BTS, New Jeans, and Squid Game and trends such as meok-bang and skincare are increasing their influence on the global market. In 2021, domestic start-ups grew by 78% compared to the previous year, and the number of new jobs created by start-ups was greater than the number of jobs created by the four major companies combined [1]. However, although recent developments have been made thanks to government support systems such as the Tech Incubator Program for Start-ups (TIPS), the entrepreneurial diversity that is a driving force of creativity and resilience is still insufficient for the start-up ecosystem to spread in all directions in our society.

The WEF’s Future Jobs Report presented a mixed picture of the 2023–2027 global labor market outlook. Despite the chaos of millions of jobs being lost, the emergence of advanced technologies and increasing digital access are creating new employment opportunities with innovative products and services [2]. IT-related technologies, such as big data, cloud computing, and AI, are planned to be adopted by more than 75% of companies within the next five years and comprise 16 of the top 100 jobs on the rise, being the third-highest among all occupational groups.

In the post-COVID-19 era, not only the ways of working but also the job content, necessary skills, and replacement jobs are changing. When opportunities are taken advantage of and growth slows down, the biggest employment skill is entrepreneurial adaptability—that is, trying to find creative solutions, adapting quickly to build skills, and finding new opportunities. Developing financial understanding is also essential for expanding economic and social skills. The right knowledge, attitudes, and actions toward money increase one’s responsible decision making and willingness to act to achieve financial independence.

Personal characteristics, environmental factors, and educational factors can influence university students’ career decisions of whether they pursue a start-up or employment. Providing experiences through financial literacy and entrepreneurship education in universities can be seen as promoting important life skills related to income activities or work life by university students entering society [3]. In addition, it is important to systematically teach start-up education because it can provide directions for career paths.

Regarding entrepreneurship, many studies have been conducted on the temporal, environmental, economic, and social backgrounds. In the unpredictable post-pandemic world, more than ever, students should be prepared to expand their life skills into self-defined jobs. In this context, research examining the dynamic relationship between digital capability and financial literacy, entrepreneurial intention, and entrepreneurship in the era of expanding digital access is of considerable significance.

The results of this study will contribute to presenting practical and policy directions necessary for students to respond to crises and adapt to new trends to have self-defined jobs, digital capability, and entrepreneurship.

2. Theoretical Background

2.1. Financial Literacy

Financial literacy is defined as the overall degree of understanding of finance, such as the financial knowledge, financial behavior, and financial attitude necessary for a reasonable and sound financial life [4]. The International Network on Financial Education (INFE), under the OECD, defines it as “a combination of cognition, knowledge, skills, attitudes, and actions necessary for individuals to make sound financial decisions and ultimately achieve their financial welfare” [5].

According to the Bank of Korea’s [4] “2022 National Financial Literacy Survey,” Korea’s financial literacy was 66.5 points, with 75.5 points for financial knowledge, 52.4 points for financial attitude, and 65.8 points for financial activities, indicating that activities related to long-term financial plans are weak. In particular, those in their 20s (18–29 years old) have relatively high financial knowledge at 74.9 points, but their financial attitude is 48.9 points, suggesting that early financial and economic education for teenagers should be strengthened to foster their growth as economic actors who lead healthy financial lives [5]. The comprehension components of financial literacy are shown in Table 1.

Table 1.

Comprehension components of financial literacy [4].

Financial literacy establishes various perspectives on economic and financial phenomena, and considering that individual economic decision making can affect the country and the world from the small social unit of family to the country, the global civic quality of implementing ethical and responsible economic actions and further solving economic problems in cooperation with the community is expanding as the main goal of financial education [6].

2.2. Digital Capabilities

Digital capabilities refers to knowledge and understanding of the nature, role, and opportunity of ICT as a required set of skills and attitudes when using digital media to perform various tasks confidently and discerningly [7]. Digital capabilities consist of a variety of skills, including using digital technology in media, communication, technology and computing, literacy, and information science, as well as evaluating digital technology critically with the right attitude to participate in digital culture [8].

Lee and Jeon [9] defined the digital capabilities that digital education should pursue in a modern society where digital transformation is accelerating as ‘digital knowledge, skills, and attitudes necessary to comply with responsibilities and obligations, exercise rights, and realize professionally required tasks as citizens of a digital society‘.

2.3. Entrepreneurship

Entrepreneurship can be defined from a wide variety of perspectives. Entrepreneurship is “discovering opportunities and embodying them to create new values,” which refers to a mindset that overcomes scarce resources and focuses on opportunities with the attitude and spirit that must be equipped in the process of pursuing profits and fulfilling social responsibilities through risk sensitivity [10]. This includes a calculated risk sensitivity attitude, efficient exploratory ability, skills to gather the necessary resources, and the ability to recognize opportunities in uncertain and chaotic situations [11]. Entrepreneurship is the ability to create innovation and new values by taking high risks, capturing opportunities, and taking initiative with respect to challenges in uncertain situations. Most scholars hold innovation, initiative, and risk sensitivity as components of entrepreneurship [12,13]. Recently, research on entrepreneurship has shifted from interest in life to implementing the combination of individuals with entrepreneurial temperament and valuable opportunities [14].

2.4. Entrepreneurial Intention

While some jobs will become obsolete or disappear as technological advances change the labor market, developing skills and excellent flexibility could provide aworking environment that suits various interests and preferences [15]. Entrepreneurial intention encompasses personal and background characteristics, a general level of understanding of start-ups and how the founder’s background is mobilized in start-ups. Gnyawali and Fogel [16] argued that while positive perceptions of start-ups or entrepreneurs positively affect start-up motivation, start-up efficacy, start-up will, and start-up-related activities, negative perceptions of start-ups negatively affect start-up motivation, start-up efficacy, start-up will, and related activities. Lies et al. [17] analyzed whether there was a significant statistical difference in entrepreneurial intention between two groups: those who were educated in economics and entrepreneurship and those who were not educated. As a result, it was confirmed that those who received economics and entrepreneurship education had higher entrepreneurial intention. Yoon [18] argued that a positive perception that a start-up or entrepreneur is contributing to the country and society influences the formation of a positive attitude toward start-ups, and entrepreneurship plays a positive mediating role between start-up motivation and start-up will.

2.5. Influence Relationship between Variables

Regarding the determinants of university students’ willingness to start a business, Jeong and Cho [19] compared the importance by classifying them into social factors, university factors, and personal factors, and argued that entrepreneurship, a personal factor, had the greatest influence on the will to start a business. Valdez-Juárez et al. [20] argued that the discovery of business opportunities and the psychological profile of individuals had an indirect effect on personal characteristics and entrepreneurial intention in the influence of university students’ personal traits and psychological profiles on entrepreneurial intention based on the theory of reasoned action and the theory of planned behavior. Kim [21] argued that as the spread of smartphones has led to the broad growth of the one-person media industry and an environment in which anyone can easily access and create media, the ability to utilize media devices has improved, digital-friendly attitudes and confidence have increased, and more diverse business opportunities can be captured. Hwang [22] empirically analyzed the effects of digital education and digital capabilities on start-up recognition, and presented research results that the higher the level of digital education and digital capabilities, the more positive effect it has on start-up recognition. Kim et al. [23] argued that the ability to utilize digital media is an essential factor in securing a competitive advantage in the start-up market. Retzmann and Seber [24] argued that individuals with economic education can consider the interests, profits, and values of others in economic interaction by making independent financial decisions and making reasonable financial choices among given alternatives and pursuing legitimate profits. Digital capability has a positive effect on the capture of new business opportunities in today’s rapidly digitalizing way of working [22,23]. Financial literacy increases the practical will to achieve the expected financial level of the future [24,25,26]. People with an entrepreneurial temperament can create new value by discovering opportunities and implementing combinations even in uncertain situations [10,14]. Putting previous studies together, it can be seen that entrepreneurship has a close correlation between digital capability, financial literacy, and entrepreneurial intention variables.

3. Research Design

3.1. Establishment of Research Model and Hypothesis

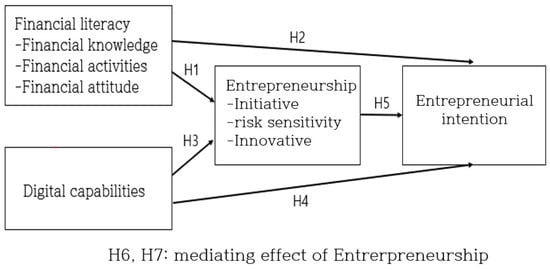

In this study, research models and hypotheses were established, as shown in Figure 1, to verify the influence of university students’ financial literacy and digital capabilities on entrepreneurial intention and the mediating effect of entrepreneurship.

Figure 1.

Research model.

Direct research on financial literacy and entrepreneurial intention is rare in Korea. Similar studies confirm that the higher a university student’s financial literacy, the more desirable financial management behavior can be [25,26]. Retzmann and Seber [24] argued that individuals with financial education can consider the interests, profits, and values of others in economic interactions by making rational financial choices and pursuing legitimate profits at the same time. Hypotheses 1 and 2 were established based on previous studies.

Hypothesis 1 (H1).

Financial literacy will have a significant positive (+) effect on entrepreneurship.

Hypothesis 2 (H2).

Financial literacy will have a significant positive (+) effect on entrepreneurial intention.

In the knowledge and information society, start-up investment trends account for a high proportion of investment in the Internet sector, which can be seen as idea that the higher the digital capability, the more opportunities to capture various business opportunities, which increases the entrepreneurial intention [21,22]. Kim et al. [23] argued that the ability to utilize digital media is an essential factor in securing a competitive advantage in the start-up market. Therefore, Hypotheses 3 and 4 were established.

Hypothesis 3 (H3).

Digital capabilities will have a significant positive (+) effect on entrepreneurship.

Hypothesis 4 (H4).

Digital capabilities will have a significant positive (+) effect on entrepreneurial intention.

Several factors, such as start-up motivation, start-up efficacy, social support, and entrepreneurship, have been studied as factors that influence the start-up intention of university students, and in most previous studies, entrepreneurship has been found to have a positive effect on the will to start a business [16,19]. Hypothesis 5 was established based on previous studies.

Hypothesis 5 (H5).

Entrepreneurship will have a significant positive (+) effect on entrepreneurial intention.

Entrepreneurship is the attitude and spirit that must be equipped in the process of pursuing profits and fulfilling social responsibilities through risk sensitivity ‘to discover opportunities and embody them to create new values’ [10]. People with an entrepreneurial temperament can create new value by discovering opportunities and implementing combinations even in uncertain situations. Therefore, Hypotheses 6 and 7 were established, as it was judged that entrepreneurship had a positive (+) mediating effect in the relationship between financial literacy, digital capability, and entrepreneurial intention.

Hypothesis 6 (H6).

Entrepreneurship will have a significant positive (+) mediating effect between financial literacy and entrepreneurial intention.

Hypothesis 7 (H7).

Entrepreneurship will have a significant positive (+) mediating effect between digital capabilities and entrepreneurial intention.

3.2. Construction of Measurement Tools and Data Collection

The sample selection and data collection of this study were conducted in parallel with online and offline questionnaires using Google Web for university students located in Busan and Gyeong-nam. It consisted of a total of 34 questions, and a 5-point Likert scale was used. The data collection period lasted from 1 June 2023 to 31 October 2023, and a total of 173 copies were collected, and 162 copies were used as final analysis data, excluding 11 missing copies. For the collected data, reliability and validity analysis and factor analysis were performed using the SPSS 28.0 program, and the hypothesis was verified by multiple regression analysis and mediated regression analysis.

The questionnaire composition includes a total of 34 questions, including 14 independent variable measurement questions, 12 parameters, 1 dependent variable, and 3 demographic questions, and a 5-point Likert scale was used. The composition of the measurement questionnaire is shown in Table 2. And the operational definition of measurement variables is shown in Table 3.

Table 2.

Composition of the measurement questionnaire.

Table 3.

Operational definition of measurement variables.

4. Analysis of Research Results

4.1. Demographic Characteristics

The general characteristics of the sample are shown in Table 4.

Table 4.

General characteristics of the sample.

4.2. Reliability, Factor Analysis, Technical Statistics, and Correlation Analysis

In factor analysis, the factor loading value for each measurement item was analyzed from a maximum of 0.866 to a minimum of 0.608, and the eigenvalue was analyzed from a maximum of 3.3361 to a minimum of 1.220. The KMO value was above 0.7. In addition, it can be seen that the reliability was secured because Cronbach’s α coefficient for analyzing the reliability of the measurement item was above 0.7. As a result of the correlation analysis, it showed a positive (+) correlation overall, and there was a high correlation between financial knowledge, financial behavior, and digital capabilities and entrepreneurial intention. The result of the correlation analysis is shown in Table 5.

Table 5.

Correlation analysis.

4.3. Test Results of Hypothesis

4.3.1. Regression Results

The results of the regression analysis are shown in Table 6.

Table 6.

Regression analysis.

4.3.2. Mediated Regression Results

Table 7 shows the results of the Sobel test as a method of verifying the significance of the mediating effect. It was found that the mediating effect of entrepreneurship between financial literacy and entrepreneurial intention was significant in initiative and risk sensitivity, but not significant in innovation. It was verified that entrepreneurship had a significant mediating effect between digital capability and entrepreneurial intention.

Table 7.

Mediation effect analysis and Sobel test.

4.4. Hypothesis Verification Results and Discussion

This study examined the relationship between financial literacy, digital capabilities, and entrepreneurship as factors influencing university students’ entrepreneurial intention. Personal characteristics and environmental and educational factors can affect university students when they are deciding beyween employment or start-ups. The development of digital technology and the convergence of heterogeneous industries are innovating the way people work and creating new jobs. In the smart digital world, financial understanding and digital capabilities help to make rational financial decisions, recognizing that start-ups create value in achieving long-term individual goals.

First, it was confirmed that financial literacy had a partially positive effect on entrepreneurship. Specifically, it was confirmed that financial knowledge had a positive effect on risk sensitivity and innovation and did not affect initiative. It was confirmed that financial behavior did not affect entrepreneurship. Financial attitudes have been confirmed to have a positive effect on entrepreneurship. Hypothesis 1 was therefore partially accepted.

Second, it was confirmed that financial literacy had a positive effect on the entrepreneurial intention. Hypothesis 2 was therefore accepted. Financial literacy helps set long-term financial goals and work to implement them. Retzmann and Seber [24] argued that individuals with financial and economic education can make financial decisions and financial choices independently and pursue legitimate profits at the same time. Therefore, financial literacy can be interpreted as raising the entrepreneurial intention when university students decide their career paths in the present era when the job environment is changing.

Third, Hypotheses 3 and 4 were accepted, as it was confirmed that digital competency had a positive effect on entrepreneurship and entrepreneurial intention. Jeon [28] recently argued that digital capabilities are an important factor in discovering new business opportunities and recognizing start-ups in a smart society centered on information and communication as investments in digital sectors such as mobile, digital health, and HR tech have been activated as a trend of global start-ups.

Fourth, it was confirmed that entrepreneurship had a partially positive effect on the entrepreneurial intention. Specifically, it was confirmed that innovation had a positive effect on entrepreneurial intention, and initiative and risk sensitivity did not affect entrepreneurial intention. Hypothesis 5 was therefore partially accepted. Innovation is an attitude that actively accepts original and innovative ideas, and it can be seen that it prefers and prepares for the future rather than the present. In most previous studies, innovation has been shown to have a positive effect on entrepreneurship or entrepreneurial intention [18,27], and this study is the same. The reason that initiative and risk sensitivity did not positively affect the entrepreneurial intention is interpreted as being because the target of the sample is a university student, and the direction or perception of their future career has not yet been formed in detail. In the future, it is believed that significant results can be obtained if the sample is expanded to general adults, including graduate students.

Fifth, it was confirmed that entrepreneurship has mostly a positive mediating effect between financial literacy and entrepreneurial intention. However, Hypothesis 6 was partially accepted, as risk sensitivity was confirmed to have no mediating effect between financial knowledge and entrepreneurial intention.

Sixth, Hypothesis 7 was accepted, as entrepreneurship was found to have a positive mediating effect between digital capabilities and entrepreneurial intention. It is interpreted that entrepreneurship has a positive mediating effect in Kim [21] and Hwang [22], such that the better the ability to use digital devices, the higher an individual’s digital affinity and confidence, thus raising entrepreneurial intention through opportunity search or discovery. The results of the hypothesis test are shown in Table 8.

Table 8.

Hypothesis test results.

5. Conclusions

Since the COVID-19 pandemic, our society has been changing the development of new cutting-edge technologies, the way we work with digital access, and the skills necessary for it. In addition, in today’s rapidly digitizing society, digital technology is playing an increasingly important role as a facilitator of creating new ventures. This can be seen as confirming that the use of digital technology is an important success factor of entrepreneurship in several studies comparing the results of digital and non-digital entrepreneurs [29,30]. Entrepreneurial adaptability is the most necessary competency for university students, the future leaders of our society, to adapt to chaos and change, explore new opportunities, and transform into professionals. This study examined the relationship between university students’ financial literacy, digital capability, and entrepreneurial intention, focusing on the mediating effect of entrepreneurship.

The study, determined that financial literacy had a partially positive effect on entrepreneurship and entrepreneurial intention, while digital capability was found to have an overall positive effect on the same. Entrepreneurship was found to have a partially positive effect on entrepreneurial intention, including a partially positive mediating effect between financial literacy and entrepreneurial intention. It was found that entrepreneurship had an overall positive mediating effect between digital capability and entrepreneurial intention.

The academic significance and implications of this study are as follows. First, the mediating effect of entrepreneurship was examined concerning the relationship between digital capability, financial literacy, and entrepreneurial intention. Personal, background and environmental characteristics were studied as factors promoting entrepreneurship, but the relationships between digital capability and financial literacy, entrepreneurial intention, and entrepreneurship in a rapidly changing digital world were dynamically examined.

Second, it was confirmed that digital capability is an important variable in discovering new business opportunities and the intention to start a business in the information-oriented digital society. The emergence of advanced technologies and the increase in digital access are creating new employment with innovative products and services despite the confusion of millions of jobs disappearing. More than 75% of companies plan to adopt IT-related technologies such as big data, cloud computing, and AI within the next five years, making up 16 of the top 100 jobs on the rise, the third-highest number among all job groups [2]. Efforts should be made to enhance the digital affinity of digital-native university students and young people and to actively utilize them to find digital-based start-up opportunities.

Third, it suggested the need to strengthen financial literacy education in the university curriculum. Financial literacy helps individuals plan life goals in the long run and make rational decisions in various processes, and enhances responsible choices for financial independence and the practices necessary to achieve them.

As a result of this study, it was confirmed that digital capability and financial literacy are important variables in the entrepreneurial intention of university students in a rapidly changing digital transformation society. In addition, it also suggested the need to train entrepreneurship and strengthen digital capabilities and financial literacy to promote start-ups.

Despite academic and practical contributions, this study has the following limitations. First, we approached a digital transformation society that is rapidly changing due to the COVID-19 pandemic. There are several factors, such as digital literacy, digital communication, digital problem solving, and digital citizenship, but since related prior research is rare, only one upper variable for digital capability was set as a factor. In future research, more detailed and in-depth research is needed for classifying each sub-element of digital capability.

Second, this study has sample limitations. The number of university student samples in Busan and Gyeongnam was only 162, so demographic characteristics such as major and entrepreneurship experience were not included in the analysis. If the scope of the sample is expanded to general adults, including graduate students, in the future, it is expected that more meaningful research results will be produced on the effect of financial literacy and digital capability on entrepreneurial intention and the mediating effect of entrepreneurship.

As a result of this study, it will contribute to the presentation of practical and policy directions necessary for university students to adapt to new trends and have their own defined jobs in the post-COVID-19 era.

Author Contributions

Conceptualization, G.-L.K.; methodology, G.-L.K.; software, C.-W.P.; validation, C.-W.P.; formal analysis, C.-W.P.; investigation, G.-L.K.; resources, G.-L.K.; data curation, G.-L.K.; writing—original draft preparation, G.-L.K.; writing—review and editing, S.-H.J.; visualization, S.-H.J.; supervision, G.-L.K.; project administration, S.-H.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The analyzed datasets during this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

References

- Yoon, S.M. WEF Geneva. 2022. Available online: https://www.weforum.org (accessed on 11 January 2020).

- Future of Jobs Report. 2023. WEF. Available online: https://www.weforum.org (accessed on 30 April 2023).

- Langdal, T.H.; Johansen, V.; Sølvberg, A.M. Learn to teach and learn from teaching: Teacher’s experiences with programs focusing on financial literacy and entrepreneurship education. Int. J. Innov. Educ. 2022, 7, 145–161. [Google Scholar] [CrossRef]

- Bank of Korea. Results of the 2022 National Financial Literacy Survey. 2023. Available online: https://www.bok.or.kr/portal/cmmn/file/fileDown.do?menuNo=200690&atchFileId=FILE_000000000037734&fileSn=1 (accessed on 29 March 2023).

- OECD INFE. OECD/INFE High-Level Principles on National Strategies for Financial Education; OECD: Paris, France, 2012. [Google Scholar]

- Aprea, C.; Wuttke, E. Financial literacy of adolescents and young adults: Setting the course for a competence-oriented assessment instrument. In International Handbook of Financial Literacy; Springer: Singapore, 2016; pp. 397–414. [Google Scholar]

- European Commission Joint Research Centre. Dig Comp 2.1 The Digital Competence Framework for Citizens with Eight Proficieny, Levels and Examples of Use; European Commission Joint Research Centre: Brussels, Belgium, 2017. [Google Scholar]

- Ilomäki, L.; Kantosalo, A.; Lakkala, M. What Is Digital Competence? In Linked Portal; European Schoolnet: Brussels, Belgium, 2011; Available online: http://linked.eun.org/web/guest/in-depth3 (accessed on 30 April 2023).

- Lee, C.H.; Jeon, J.O. Exploring Digital Competence for the Era of the 4th Industrial Revolution. J. Learn. Centered Curric. Instr. 2020, 20, 311–338. [Google Scholar] [CrossRef]

- Timmons, J.A.; Spinelli, S.; Tan, Y. New Venture Creation: Entrepreneurship for the 21st Century; Irwin: Burr Ridge, IL, USA, 1994; Volume 4. [Google Scholar]

- Kuratko, D.F.; Hodgetts, R.M. Entrepreneurship: Theory, Process, Practice, 6th ed.; Thomson/South-Western: Mason, OH, USA, 2004. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it to performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Miller, D. Revisited: A Reflection on EO Research and Some Suggestions for the Future. Entrep. Theory Pract. 1983, 35, 873–894. [Google Scholar] [CrossRef]

- Shane, S.; Venkataraman, S. The promise of entrepreneurship as a field of research. Acad. Manag. Rev. 2000, 25, 217–226. [Google Scholar] [CrossRef]

- OECD. 2017. Available online: www.oecd.org (accessed on 30 April 2023).

- Gnyawali, D.R.; Fogel, D.S. Environments for entrepreneurship development: Key dimensions and research implications. Entrep. Theory Pract. 1994, 18, 43–62. [Google Scholar] [CrossRef]

- Lieș, G.L.; Mureșan, I.C.; Arion, I.D.; Arion, F.H. The Influence of Economic and Entrepreneurial Education on Perception and Attitudes towards Entrepreneurship. Adm. Sci. 2023, 13, 212. [Google Scholar] [CrossRef]

- Yoon, N.S. The Effect of Potential Entrepreneurial Motivations on Entrepreneurship and Commitment to Starts-up: Mediating Role of Entrepreneurship. J. Ind. Econ. Bus. 2012, 25, 1537–1557. [Google Scholar]

- Jeong, Y.S.; Cho, D.H. A Study on the Comparison of the Importance of Determinants in the Intention of Start-up of University Students. J. Korean Entrep. Socieity 2020, 15, 145–165. [Google Scholar]

- Valdez-Juárez, L.E.; Ramos-Escobar, E.A.; Ruiz-Zamora, J.A.; Borboa-Álvarez, E.P. Personal and Psychological Traits of University-Going Women That Affect Opportunities and Entrepreneurial Intentions. Behav. Sci. 2024, 14, 66. [Google Scholar] [CrossRef] [PubMed]

- Kim, W.J. The Effects of Entrepreneurship and Strategic Orientation on the Firm Performance: Moderated Mediation Effect of Digital Literacy and Learning Orientation. Ph.D. Thesis, The Graduate School of Chung-Ang University, Seoul, Republic of Korea, 2016. [Google Scholar]

- Hwang, S.Y. Study on the Effect of Digital Education and Digital Competency on the Entrepreneurial Intention in the Fourth Industrial Revolution Age: Based on the Perception of Elementary School Students. Master’s Thesis, The Graduate School of Industrial & Entrepreneurial Management Chung-Ang University, Seoul, Republic of Korea, 2019. [Google Scholar]

- Kim, K.S.; Park, W.J.; Bae, B.Y. A Study of Influence of B anker’s Big5 Personality Traits on Entrepreneurial Intention: Mediated Effect of Digital Media Utilization Capability. Asia-Pac. J. Bus. Ventur. Entrep. 2020, 15, 209–220. [Google Scholar] [CrossRef]

- Retzmann, T.; Seeber, G. Financial education in general education schools: A competence model. In International Handbook of Financial Literacy; Springer: Singapore, 2016; pp. 9–23. [Google Scholar]

- Kim, A.R.; Yang, H.K. The Effects of Financial Literacy and Financial Distress on the Financial Management Behavior of Young Working Adults. Financ. Plan. Rev. 2016, 9, 79–105. [Google Scholar] [CrossRef]

- Choi, A.R.; Koo, J.Y. A Study on the Interrelationship between Financial Literacy and Financial Management Behaviors of University Students. J. Korean Data Anal. Soc. 2016, 18, 2637–2650. [Google Scholar] [CrossRef]

- Ahn, H.S.; Yang, D.W. The Influence of Entrepreneurs’ Personal Characteristics on Entrepreneurial Intention with the Moderating Effect of Perception of Startup Support System. J. Korean Entrep. Soc. 2019, 14, 378–410. [Google Scholar] [CrossRef]

- Jeon, H.Y. Current status and implications of domestic and overseas startups. Koreanstud. Inf. Serv. Syst. 2016, 16, 1–17. [Google Scholar]

- von Briel, F.; Davidsson, P.; Recker, J. Digital Technologies as External Enablers of New Venture Creation in the IT Hardware Sector. Entrep. Theory Pract. 2018, 42, 47–69. [Google Scholar] [CrossRef]

- Bachmann, N.; Rose, R.; Maul, V.; Hölzle, K. What makes for future entrepreneurs? The role of digital competencies for entrepreneurial intention. J. Bus. Res. 2024, 174, 1–18. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).