The Impact of Plant Variety Protection Regulations on the Governance of Agri-Food Value Chains

Abstract

1. Introduction

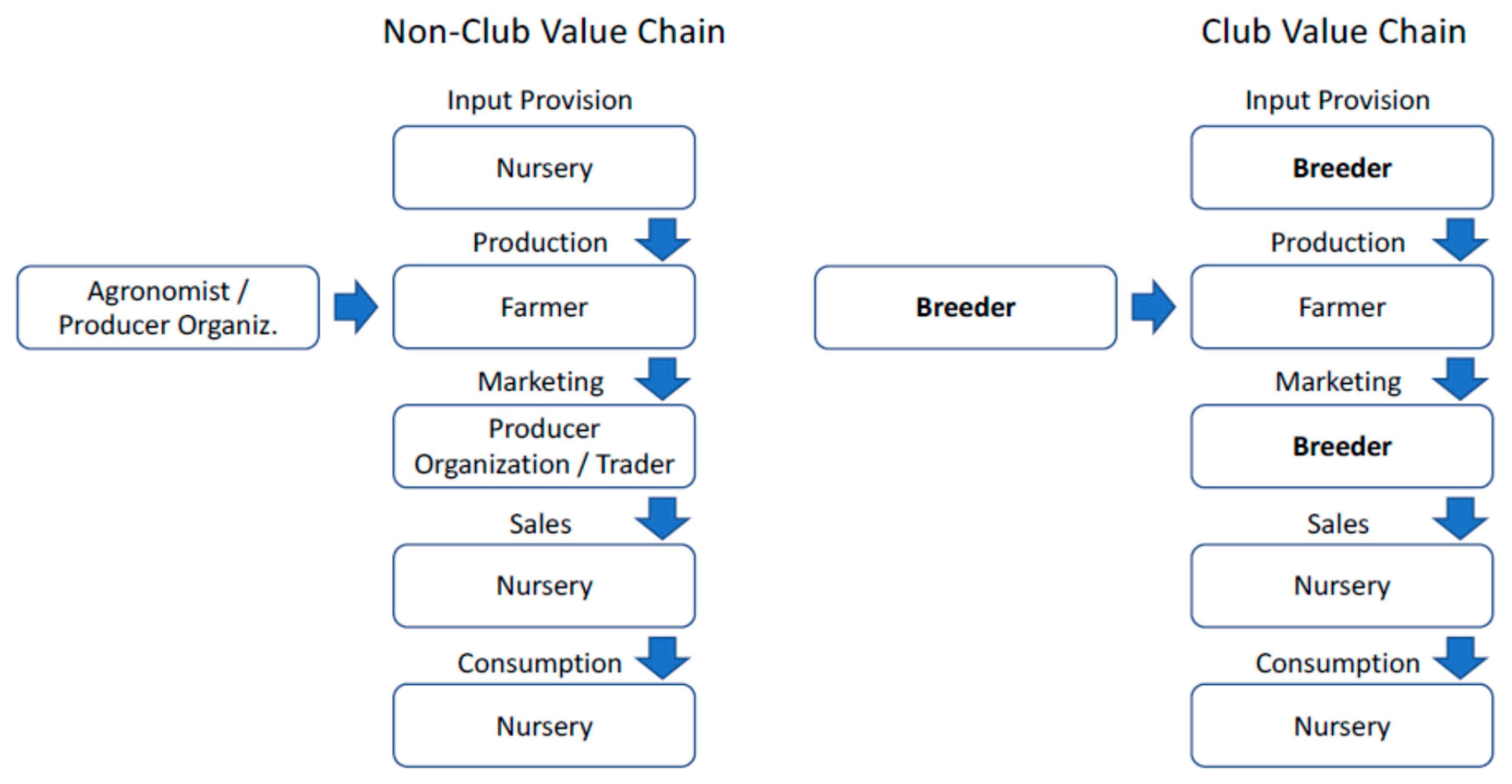

2. The Protection of Intellectual Property Rights on Plant Varieties

- Branding: the variety can be associated with a unique name. The protection is extended to the final product (for example, pink lady apples or sungold kiwis)

- Production control. The breeder can plan the production of the final product by controlling the license agreement.

- Marketing control. The breeder may claim ownership rights on the final product. This means that farmers may be subjected to a delivery obligation. Consequently, the breeder maintains an influence on the marketing decision.

3. The Empirical Strategy

3.1. Defining Governance

3.2. Empirical Investigation of Differences in the Governance of Vegetable Value Chains

4. The Agro Pontino Kiwifruit Value Chain

4.1. Description of the Agro Pontino Kiwifruit Chain

4.2. A Comparison of the Forms of Governance

4.3. The Role of Governance in the Adoption of New Varieties

5. Summary and Conclusions

Author Contributions

Funding

Conflicts of Interest

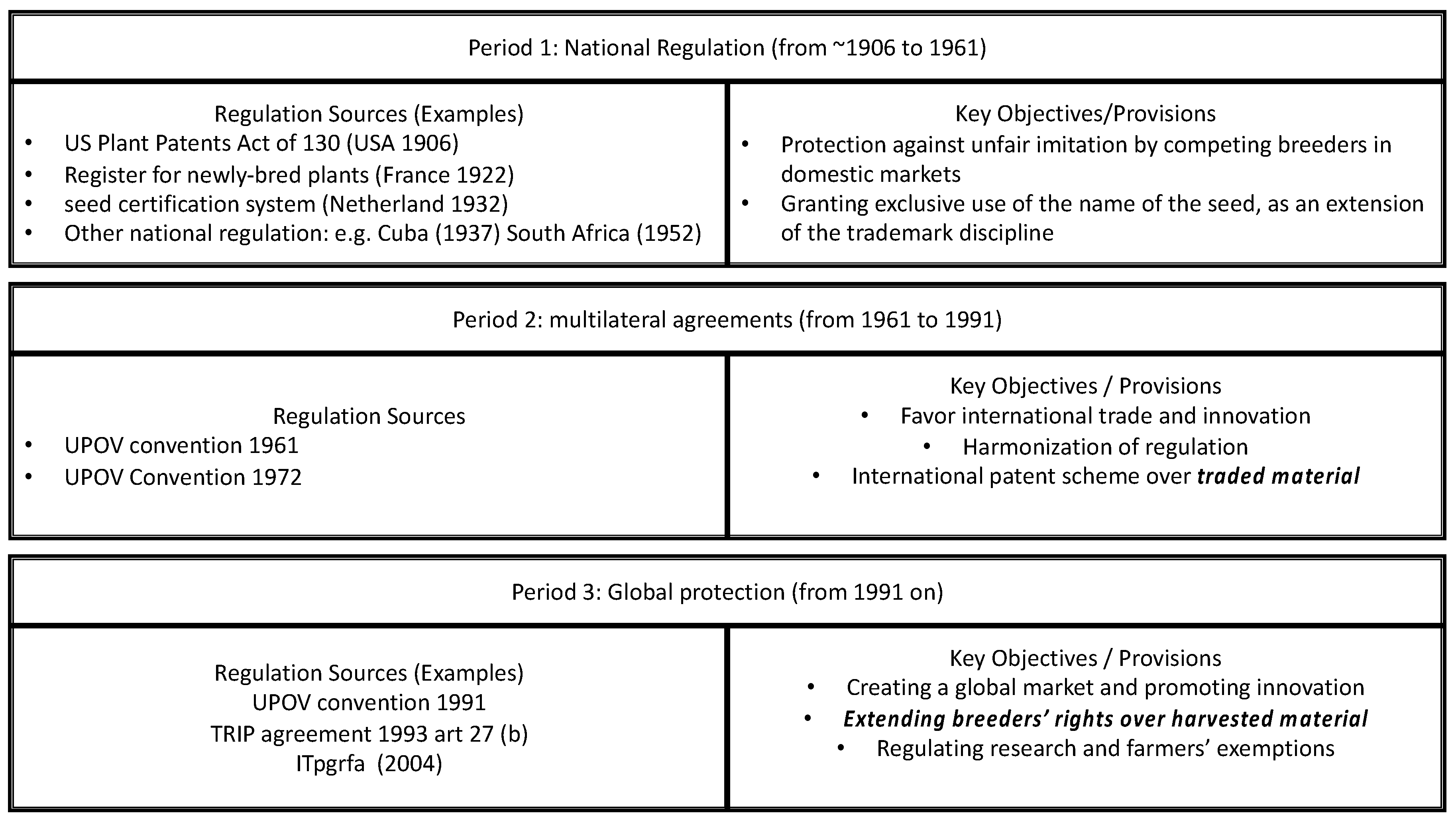

Appendix A. A Short History on the Regulation of PVP

References

- Asioli, Daniele, Canavari Maurizio, Malaguti Luca, and Mignani Chiara. 2016. Fruit branding: Exploring factors affecting adoption of the new pear cultivar ‘Angelys’ in Italian large retail. International Journal of Fruit Science 16: 284–300. [Google Scholar] [CrossRef]

- Blakeney, Micheal. 2005. Stimulating Agricultural Innovation. In International Public Goods and Transfer of Technology under a Globalized. Edited by Keith E. Maskus and Jerome H. Reichman. Cambridge: Cambridge University Press. [Google Scholar]

- Blakeney, Micheal. 2010. Intellectual Property, Traditional Knowledge and Genetic Resources: Policy, Law and Current Trends. Paper presented at the WIPO National Seminar on Intellectual Property for Faculty Members and Students of Ajman University, Ajman, UAE, May 5–6. [Google Scholar]

- Brown, Susan K., and Kevin E. Maloney. 2009. Making sense of new apple varieties, trademarks and clubs: Current status. New York Fruit Quarterly 17: 9–12. [Google Scholar]

- Campi, Mercedes, and Alessandro Nuvolari. 2015. Intellectual property protection in plant varieties: A worldwide index (1961–2011). Research Policy 444: 951–64. [Google Scholar] [CrossRef]

- Canavari, Maurizio. 2018. Marketing Research on Fruit Branding: The Case of the Pear Club Variety “Angelys”. In Case Studies in the Traditional Food Sector. A Volume in the Consumer Science and Strategic Marketing Series. A volume in Woodhead Publishing Series in Food Science, Technology and Nutrition. Amsterdam: Elsevier, Chapter 9. pp. 239–254. [Google Scholar] [CrossRef]

- Carbone, Anna. 2017. Food supply chains: Coordination governance and other shaping forces. Agricultural and Food Economics 5: 3. [Google Scholar] [CrossRef]

- Dutfield, Graham. 2011. The role of the international Union for the Protection of New Varieties of Plants (UPOV). Intellectual Property Issue Paper, January 15. [Google Scholar]

- Dutfield, Graham. 2017. Intellectual Property Rights and the Life Science Industries: A Twentieth Century History. Abingdon: Routledge. [Google Scholar]

- Gellynck, Xavier, and Adrien Molnár. 2009. Chain governance structures: The European traditional food sector. British Food Journal 111: 762–75. [Google Scholar] [CrossRef]

- Gereffi, Gari, and Miguel Korzeniewicz, eds. 1994. Commodity Chains and Global Capitalism (No. 149). Santa Barbara: ABC-CLIO. [Google Scholar]

- Gereffi, Gari, Humphrey John, and Sturgeon Thimothy. 2005. The governance of global value chains. Review of International Political Economy 12: 78–104. [Google Scholar] [CrossRef]

- Ghijsen, Huib. 1998. Plant Variety Protection in a Developing and Demanding World. Biotechnology and Development Monitor 36: 2–5. [Google Scholar]

- Humphrey, John, and Hubert Schmitz. 2001. Governance in global value chains. IDS Bulletin 32: 19–29. [Google Scholar] [CrossRef]

- Janis, Mark D., and Jay P. Kesan. 2002. US plant variety protection: Sound and fury. Houston Law Review 39: 727. [Google Scholar]

- Lombard, Cyril, and Roger R. B. Leakey. 2010. Protecting the rights of farmers and communities while securing long term market access for producers of non-timber forest products: Experience in southern Africa. Forests, Trees and Livelihoods 19: 235–49. [Google Scholar] [CrossRef]

- Ménard, Claude. 2018. Organization and governance in the agrifood sector: How can we capture their variety? Agribusiness 34: 142–60. [Google Scholar] [CrossRef]

- Ménard, Claude, and Valceschini Egizio. 2005. New institutions for governing the agri-food industry. European Review of Agricultural Economics 32: 421–440. [Google Scholar] [CrossRef]

- Moore, Gerald K., and Witold Tymowski. 2005. Explanatory Guide to the International Treaty on Plant Genetic Resources for Food and Agriculture (No. 57). Gland: IUCN. [Google Scholar]

- Moschini, GianCarlo, and Harvey Lapan. 1997. Intellectual property rights and the welfare effects of agricultural R&D. American Journal of Agricultural Economics 79: 1229–42. [Google Scholar]

- Plant Variety Database. 2018. Available online: www.upov.int/pluto/data/current.pdf (accessed on 1 January 2019).

- Raustiala, Kal, and David G. Victor. 2004. The regime complex for plant genetic resources. International Organization 58: 277–309. [Google Scholar] [CrossRef]

- Rossman, Joseph. 1935. The Preparation and Prosecution of Plant Patent Applications. Journal of the Patent Office Society 17: 632. [Google Scholar]

- Sanderson, Jay. 2017. Plants, People and Practices: The Nature and History of the UPOV Convention. Cambridge: Cambridge University Press. [Google Scholar]

- Tripp, Robert, Louwaars Niels, and Eaton Derek. 2007. Plant variety protection in developing countries. A report from the field. Food Policy 32: 354–71. [Google Scholar] [CrossRef]

- Van Overwalle, Geertrui. 1998. Patent protection for plants: A comparison of American and European approaches. IDEA 39: 143. [Google Scholar]

- Vurro, Clodia, Russo Angeloantonio, and Perrini Francesco. 2009. Shaping sustainable value chains: Network determinants of supply chain governance models. Journal of Business Ethics 90: 607–21. [Google Scholar] [CrossRef]

| 1 | The 2016 yield suffered a sharp loss (−31% compared to 2015) due to severe pest problems. In 2015, the share of global production reached 5.1%. Data source: CSO (Latina production) and FaoStat (world production). |

| 2 | In the computation of the test statistics, we excluded the case of the hierarchical governance form because of the zero frequency. The degrees of freedom of the test were adjusted accordingly. |

| 3 | The χ2 test requires a large sample. Usually, it is considered inappropriate for a sample size smaller than 30 or 40 observations. Because our simple size is just sufficient, we computed a Fisher’s exact test in order to support our conclusion. The test returns the exact probability of observing the actual data if the null hypothesis was true. The downside of the test is that it requires a 2 × 2 table. For this reason, we aggregated the governance forms into two groups: Market and Modular on the one side and Relational and Captive on the other one. Fisher’s exact probability is p1 = 0.0016, which allows us to reject the null hypothesis of equal distribution in the two groups. The test confirms that the observed differences in the distributions are unlikely to be due to chance alone. |

| 4 | Gereffi et al. (2005, p. 84) define the captive governance form these words: “Captive value chains. In these networks, small suppliers are transactionally dependent on much larger buyers. Suppliers face significant switching costs and are, therefore, ‘captive’. Such networks are frequently characterized by a high degree of monitoring and control by lead firms. |

| 5 | Sanderson (2017) found an 1833 Papal State Edict about the ownership of new inventions and discoveries in the fields of agriculture and technical arts. However, this Edict was not specifically designed to protect new plant varieties. For a more detailed discussion of the application of standard patent laws to plant varieties before the sui generis regulation, see Van Overwalle, G. (Van Overwalle 1998). |

| 6 | The 1883 Paris Convention for the Protection of Industrial Property considered agriculture as one of the areas in respect to which property rights can be granted. However, this provision was just an extension of the standard regulation. Furthermore, its applicability to new plant varieties was questioned by Blakeney 2010. |

| 7 | Janis and Kesan (2002) noted that this requisite approximates the “novelty” requisite of the general patent law. |

| 8 | For an analysis of the economic principles of this scheme in the agri-food system, see Moschini and Lapan 1997. |

| Type of Governance | ||||||

|---|---|---|---|---|---|---|

| Items | Market | Modular | Relational | Captive | Hierarchy | |

| General | Ownership | Own | Own | Own | Own | Employee |

| Items | Sales | Free | Contract | Contract | Contract | |

| Negotiation of terms of sale | Everything is negotiated | Standard contracts that are equal for all growers | The grower can negotiate some terms (others are imposed) | Terms are dictated by the buyer | ||

| Complexity | Complexity of production | Easy | Difficult for unexperienced growers only | Difficult requires high skills | Must use buyer’s tech support | |

| Codify info | Production specifications | None/custom rules | Simple standards | Complex standards | Follow directions | |

| Capabilities | Replaceability | Easy | Easy | Difficult | Easy | |

| Termination cost (growers) | Very low | High | High | Impossible/very costly | ||

| Other | Type of PVP | |||||

| Items | Farm size(ha) | |||||

| Years of farming | ||||||

| Producer Association | ||||||

| Country | Tonnes | % |

|---|---|---|

| China | 2,390,287 | 55.9 |

| Italy | 523,595 | 12.2 |

| New Zealand | 434,048 | 10.2 |

| Iran | 294,413 | 6.9 |

| Chile | 225,797 | 5,3 |

| Greece | 182,589 | 4.3 |

| Others | 224,141 | 5.2 |

| Total | 4,274,870 | 100.0 |

| Governance | PVP | ||

|---|---|---|---|

| Forms | Free | Club | Total |

| Market | 4 | 1 | 5 |

| Modular | 17 | 3 | 20 |

| Relational | 1 | 0 | 1 |

| Captive | 4 | 10 | 14 |

| Hierarchy | 0 | 0 | 0 |

| Total | 27 | 13 | 40 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Fonzo, A.; Nardone, V.; Fathinejad, N.; Russo, C. The Impact of Plant Variety Protection Regulations on the Governance of Agri-Food Value Chains. Soc. Sci. 2019, 8, 91. https://doi.org/10.3390/socsci8030091

Di Fonzo A, Nardone V, Fathinejad N, Russo C. The Impact of Plant Variety Protection Regulations on the Governance of Agri-Food Value Chains. Social Sciences. 2019; 8(3):91. https://doi.org/10.3390/socsci8030091

Chicago/Turabian StyleDi Fonzo, Antonella, Vanessa Nardone, Negin Fathinejad, and Carlo Russo. 2019. "The Impact of Plant Variety Protection Regulations on the Governance of Agri-Food Value Chains" Social Sciences 8, no. 3: 91. https://doi.org/10.3390/socsci8030091

APA StyleDi Fonzo, A., Nardone, V., Fathinejad, N., & Russo, C. (2019). The Impact of Plant Variety Protection Regulations on the Governance of Agri-Food Value Chains. Social Sciences, 8(3), 91. https://doi.org/10.3390/socsci8030091