1. Introduction

Social Sciences aims to integrate considerations regarding the sustainability of humanity (

Lin 2012). The global warming is one the most important hazards for the Earth’s future and the use of renewable energy sources (RES) is a valid solution to stop their adverse influences on human life (

Saavedra et al. 2018).

Global energy demand increased by 2.1% in 2017 and also, global energy-related CO

2 emissions grew by 1.4% in 2017 (

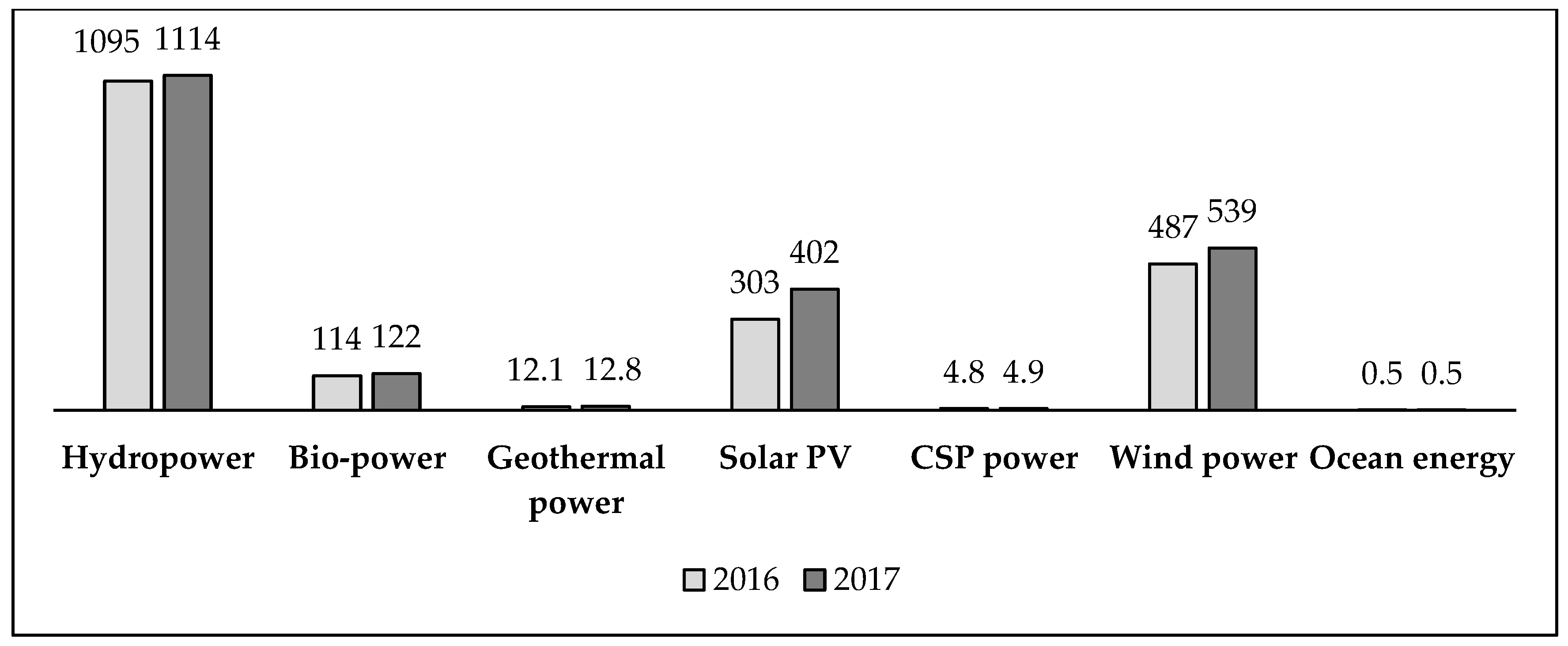

IEA 2015). Recently, the whole energy sector changes towards the use of low-carbon applications. Renewable energy (RE) power generating capacity is equal to 2195 GW in 2017 (+8.8% than previous year). This electricity transition is driven by increases in installed capacity of solar PV (+99 GW with an increase of 32.7% than 2016) and wind power (+52 GW with an increase of 10.7% than 2016)—

Figure 1 (

REN21 2018).

Economic growth is typically coupled with the use of energy consumption (

Sun et al. 2018). However, the energy consumption is usually linked to a great level of emissions and pollutions. This effect is significantly reduced when the green electricity is used (

Sampaio and González 2017). In addition, two actions push towards more effective future global initiatives. The first regards strategies that engage all political parties, the second aims to educate individuals on climate change (

Dadural and Reznikov 2018). At the same time, residential energy consumption can be improved not only through adequate technological solutions but also with a behavior more eco-friendly to citizens (

Escoto Castillo and Peña 2017).

PV sources can play a key role in this energy transition for the global energy supply (

Breyer et al. 2017). Solar PV is a mature technology suitable for both small and large scale applications. It is a clean energy according to the principle of sustainability (

Hosenuzzaman et al. 2015;

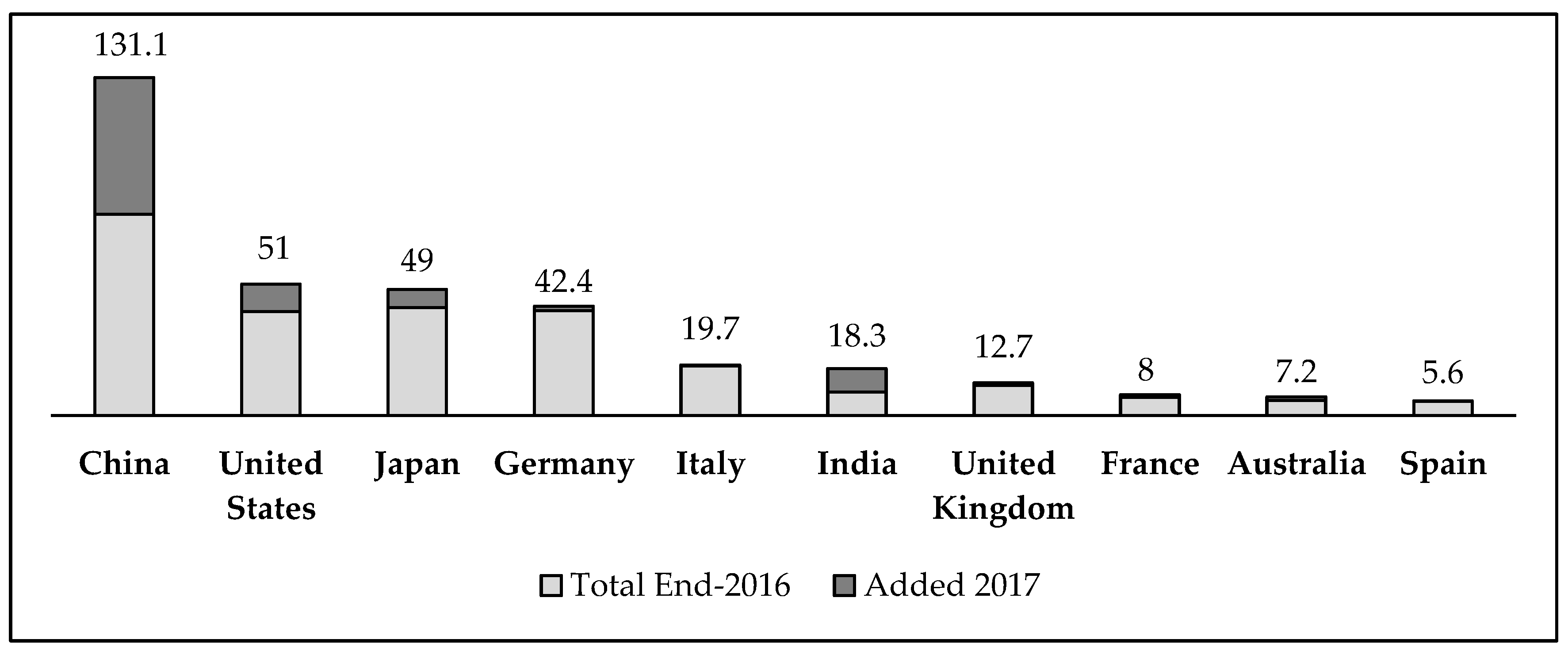

Khan and Arsalan 2016). Solar PV power capacity is equal to 402 GW in 2017 and it is concentrated in a short list of countries. In fact, about 86% of this power is installed in 10 countries with a role predominant of China (

Figure 2). China (53.1 GW), United States (10.6 GW) and India (9.1 GW) represent the first three countries of solar PV power installed in 2017 (

REN21 2018).

The Feed-in-Tariff (FIT) scheme has encouraged investors to be involved in RE production worldwide. Large energy providers offer long-term contracts to smaller-scale RE producers to sell their green energy to the market under a fixed tariff above the market rate (

Pyrgou et al. 2016;

Tanaka et al. 2017). The policy subsidy has determined the development of PV source with the aim to tackle the climate change. At the same time, the guaranteed security of tariffs, defined in a FIT scheme, has driven several investors to choose this resource (

Avril et al. 2012;

Strupeit and Palm 2016). In addition, it has determined an improvement of the technology, a reduction of costs and an increase of know-how of firms (

Baur and Uriona 2018).

The economic feasibility of PV plants is well analysed in literature. Residential applications represent a typical case-study (

Lee et al. 2017;

Comello and Reichelstein 2017). The key-parameter of profitability depends by the typology of the market in residential PV systems: subsidies and the share of self-consumption are the main variable in developing and developed markets, respectively (

Cucchiella et al. 2017a).

From environmental side, the greenhouse gas (GHG) emissions produced by PV systems are estimated equal to 29–35 gCO

2eq/kWh (

Fthenakis et al. 2008). Literature analysis presents a variety of approaches to calculate GHG emissions. Consequently, there is a wide variety in the evaluation of this value: for example some authors propose 20–25 gCO

2eq/kWh (

Louwen et al. 2016), other 60.1–87.3 gCO

2eq/kWh (

Hou et al. 2016). However, all studies converge to define that this environmental effect is widely balanced by the reduction of GHG emissions determined by the use of PV resource as alternative to fossil fuels. Assuming a lifetime of PV plant equal to 20 year, the environmental advantage is quantified equal to 21 tCO

2eq per kW installed (

Cucchiella et al. 2016). Another work has calculated a reduction of about 742.7 gCO

2eq/kWh. It considers 37.3 gCO

2eq/kWh and 780 gCO

2eq/kWh for PV and coal resources, respectively (

Mauleón 2017).

A review of CO

2 price with government subsidy through FIT scheme is analysed for European countries (

Bakhtyar et al. 2017). The evaluation of PV systems under carbon market is proposed also in Chinese context (

Tian et al. 2017). A low carbon tax is able to finance the investment in PV plants (

Mauleón 2017). The economic evaluation of PV systems is required for the development of the sector also in a market developed (

Cucchiella et al. 2017b). A new research can try to consider policy, environmental and economic aspects. This work proposes the economic impact of a residential PV plant and a small size equal to 3 kW located in Italy is considered. The idea is to implement a new policy of subsidies for residential consumers that implemented PV systems. The subsidy is given to the amount of energy produced and its value is calculated according to the reduction of CO

2 emissions.

The paper is organised as follows.

Section 2 presents a literature review concerning the mechanisms of market of CO

2. An economic model based on DCF is proposed in

Section 3. Starting by input data, NPV and DPBT are used to evaluate the economic performance of PV systems considering several scenarios (

Section 4).

Section 5 presents some concluding remarks.

2. Literature Review

The European Union (EU) launched the EU ETS to fight global warming in 2005. EU ETS covers around 11,000 power stations and industrial plants. The inspiring principle of EU ETS is to give firms an incentive to move towards less fossil-fuel intensive production. It works on the ‘cap and trade’ principle. The emission allowance (EUA) allows the firms to emit one tonne of CO

2 and each of them has assigned a limit of CO

2 emissions (cap). The following year, a defined number of EUAs must be returned. If this number is lower than the assigned cap, the firm has the opportunity to sell EUAs (trade). When, instead, it is greater the firm must buy the missing shares. Alternately, heavy fines are provided. The limit is reduced over time so that total emissions decrease (

European Commision 2016).

Several works have considered the European context. Energy prices are considered by some authors as the main driver of carbon price because power generators can use several fuel inputs (

Christiansen et al. 2005;

Convery and Redmond 2007). Other works have underlined the relevance of other critical variables as weather conditions, policy and regulatory issues and economy activities. Prices vary to uncontrollable temperatures changes during colder events (

Alberola et al. 2008). At the same time, institutional strategies have a direct impact (

Aatola et al. 2013). In fact, during the First Phase of EU ETS coal and gas prices have influenced CO

2 prices, while electricity price has played a role more during the Second Phase (

Keppler and Mansanet-Bataller 2010). Foreign direct investment (FDI) increase carbon emissions in the host country influencing the carbon price (

Doytch and Uctum 2016).

The market instrument of CO

2 ETS is been implemented also in several Chinese regions and it is regulated by the government (

Yang et al. 2017). The analysis of market highlights that the carbon price is closely linked to the supply and demand of carbon allowance. The supply is determined by Government policies, while the demand is determined by the regional economic pattern and energy structure (

Yang et al. 2018). The development of an ETS is more complex in a vast country with regional differences (

Böhringer et al. 2014). Other international initiatives to tackle the increase of CO

2 emissions are California cap-and-trade program (

Olson et al. 2016), cap-and-trade programs of the Republic of Korea (

Park and Hong 2014). A comparative among several programs is investigated and EU ETS is the main cornerstone to combat climate change (

Xiong et al. 2017).

However, several works have identified the criticism of EU ETS. Three limits are identified: (i) it is not an attractive market for its economic added value, (ii) it is not able to maintain the carbon price sufficiently high and (iii) it has no reduced significantly the overall emissions (

Gerbeti 2017). In particular, EU ETS had not encouraged green investments (

Segura et al. 2018) and its ineffectiveness is substantiated in times of economic crisis (

Vlachou and Pantelias 2017). Another work defines that EU ETS lacks fairness on both effectiveness and the distribution of the duties involved in climate change (

Dirix et al. 2015). The risk of carbon leakage is extremely high for energy-intensive industries. Some firms can transfer their production in countries with lower emission constraints (

Gerbeti 2018). This work does not aim to define a judgement on EU ETS. It is based on the approach that the emissions must be quantified in economic terms and considering the European context, in this moment EU ETS represents the main reference.

Literature review has covered mainly the first two phases of EU ETS. The main mechanism was free allocation based on past emissions. Since 2013, auctioning is the default method of allocating emission allowances (

Cai and Pan 2017). The accurate prediction of carbon prices is an information useful for carbon traders, brokers and firms, who can use this information to manage their portfolios. This data is necessary also for policy makers, who have inputs on marginal abatement costs adjusting the emission cap (

Zhao et al. 2018).

The development of carbon trading aims to tackle the climate change, to improve the energy system, to promote energy-saving and emission-reduction (ESER) system and to accelerate the transformation of economic growth (

Fang et al. 2018b). The government control is a sensitive parameter in carbon trading system. In fact, policy measures can accelerate its development reaching the peak value of carbon emissions in short terms, but the effect can be also negative in specific economic periods. The equilibrium between demand and supply requires generally a run-in period to achieve balance (

Fang et al. 2018a).

Carbon price is a tool for scientists to reduce global warming. The value indicated by several authors varies in a significant way. Nationally efficient CO

2 prices are referred to domestic environmental benefits per ton of CO

2 reduction. For example, it is equal to 63

$/tCO

2 and 57.5

$/tCO

2 in USA and China in 2010, respectively. A greater difference is instead found for 2013 between Europe (below 10

$/tCO

2) and USA (35

$/tCO

2) (

Parry et al. 2015). Another work has calculated a global carbon price in order to estimate the annual transfer payments that would be required to compensate the damages linked to the emissions. It is equal to 35

$/tCO

2 (

Landis and Bernauer 2012). Other authors quantified the economic advantages linked to the technological solutions able to capture CO

2 emissions. Benefits are evaluated considering a price of 13

$/tCO

2 (

Ogland-Hand et al. 2017). The substitution of fossil fuels with a renewable resource (wind) is evaluated in Chinese context. Carbon price varies from 233 CNY/tCO

2 to 251 CNY/tCO

2 and it is higher than real markets because a high proportion of free allowances is used (

Lin and Chen 2018).

A group of economists has defined that about 75% of emissions regulated by carbon pricing are covered by a price below 10 €/tCO

2 in 2017. This price is considered too low in order to support the low carbon transition (

Metivier et al. 2017). There are other studies (

Gerbeti 2016) that claim to economically enhance the CO

2 contained in the goods, representing it as a raw material of industrial production processes.

The effective carbon rate (ECR) is the sum of carbon taxes, specific taxes on energy use and tradable emission permit prices. The OECD has estimated the ECR for 41 countries. ECR is assumed equal to 30 €/tCO

2 (

OECD 2016). This value is lower than other studies: 50 €/tCO

2 (

Alberici et al. 2014) and 50

$/tCO

2 (

Smith and Braathen 2015).

A recent report of the High-Level Commission on Carbon Prices guided by Stiglitz and Stern has defined relevant several indications for the future. From one side, a consistent quantity of emissions are not covered by a carbon price and from the other side, about three quarters of the emissions have a price lower than 10

$/tCO

2. The Nationally Determined Contributions (NDCs) for 2030 associated with the Paris Agreement are not suitable to achieve the Paris target of “well below 2 °C.” This target could be reach using a price from 40

$/tCO

2 to 80

$/tCO

2 by 2020 and from 50

$/tCO

2 to 100

$/tCO

2 by 2030. In fact, the use of carbon pricing must be considered also non-climate benefits, for example access to modern energy, the health of ecosystems and improvements in air pollution and congestion (

Stiglitz et al. 2017).

Some authors have identified the value of certified emission reduction equal to 20 CNY/ tCO

2 and it is applied a case study of PV systems. Their results define that firms have not benefits until carbon price does not exceed 38 CNY/tCO

2 (

Tian et al. 2017). A comprehensive review has identified the social cost of carbon. Its minimum value is equal to 6.1 €/tCO

2 (

Isacs et al. 2016). The value of CO

2 emissions is strictly linked to possible economic downturns and also to the volatility of energy prices in an organized market, as EU ETS (

Mauleón 2017). The substitute price of avoiding CO

2 emission (SPAC) is calculated for each technology and country in Europe. Values obtained are extremely far from market prices (

Bakhtyar et al. 2017).

4. Results

The first step is represented by the calculation of RECD. This value is reported in Equation (12) and it is applied also for the following years of lifetime of PV systems. Currently, there are no robust estimates on the future energy mix. However, alternative scenarios concerning this variable will be examined in the following section.

The following step is the economic quantification of reduction of carbon dioxide. According to Equation (4) and input data reported in

Table 1, E

Out,1 is equal to 4680 kWh/year during the first year. Consequently the unitary value of subsidies is reported in Equations (13)–(15) according to the single value of P

CD.

The results of economic feasibility are subdivided as follows:

4.1. Baseline Scenarios

The profitability of a 3 kW PV plant is evaluated in this work. The baseline scenario is composed by fifteen case studies obtained multiplying three scenarios linked to consumer choices and five scenarios related to political decisions. Two distinct indexes are proposed, because NPV quantifies the amount of money generated by PV investment (

Table 2), while DPBT gives an information concerning the number of years in which the investment is recovered (

Table 3).

The profitability is verified in thirteen case-studies. It ranges from 1357 €/kW (scenarios Subsidies High P

CD and Self-consumption 50%) to 48 €/kW (scenarios Fiscal deduction 50% and Self-consumption 30%). NPV is negative when it is hypothesized a w

self,c equal to 30% considering or a rate of fiscal deduction of 36% or an unitary value of subsidy of 10 €/tCO

2eq. These values can be referred to the existing literature also when was applied a FIT scheme: 716–913 €/kW (

Chiaroni et al. 2014), 1804–2386 €/kW (

Campoccia et al. 2014), (−1300)–3300 €/kW (

Bortolini et al. 2013).

Results proposed in this work underline that the share of self-consumption plays a role more critical than subsidies. The profitability of residential PV systems depends by this variable in a mature market (

Sarasa-Maestro et al. 2016). A value of 30% is used typically in the evaluation of economic feasibility, because the production of energy from PV modules has its peak during the day, while consumers are busy to work outside the home. A possible solution to intermittent nature of this RES is represented by the application of a battery storage, but this choice requires also an appropriate environmental evaluation (

Üçtuğ and Azapagic 2018). The use of intelligent machinery represents another technical solution to solve this issue (

Zhou et al. 2016).

The comparison among several political tools underline as the increase of rate of fiscal deduction to 50% permits to reach better economic performance than the application of a subsidies with a low price of carbon dioxide. In addition, there is an increase of 226 €/kW applying a fiscal deduction of 50% than 36%. Consequently, the choice of subsidized fiscal deduction is useful, but the quantity of PV power installed is been low and so the market has not rewarded this choice.

The re-introduction of subsidies can have a shock effect pushing the investors to opt for this choice. In fact, starting by the idea to support the contrast to climate change when also economic opportunities are verified, the development of PV plants can involve homes in which currently renewable plants are not installed. The increase of energy self-sufficiency is a long-term objective.

NPV obtained in scenarios Subsidies Moderate P

CD are greater than ones of Fiscal deduction 50% and an analysis of Break-Even point notes that this point is equal to 18.50 €/tCO

2eq. A comparison with recent values reported in the market (see

Figure 4) underlines that there is a difference very low with current values (about 1 €/tCO

2eq). NPV increases of 313 €/kW using a moderate P

CD than low P

CD and this increase becomes 438 €/kW when is choice a high P

CD than moderate P

CD.

The DPBT results are coherent with the NPV ones. Two unprofitable case studies are characterised by a value >20. In fact, in the worse scenario the cut-off period is fixed equal to the lifetime of the plant and when is reported a DPBT >20 the investment cannot be recovered within this interval time. The difference between DCI and DCO has always a negative sign. In three case studies (Subsidies Moderate PCD with Self-consumption 30%, Fiscal deduction 50% with Self-consumption 40% and Fiscal deduction 36% with Self-consumption 50%) has more sign changes. While, the remaining case studies have only one sign change.

DPBT varies from 3 years (scenarios Subsidies High P

CD and Self-consumption 50%) to 19 years (scenarios Fiscal Deduction 50% and Self-consumption 30%). This result is justified by application of third-party funds that distribute the investment cost over the years of loan. Seven case studies have a value that does not exceed 6 years and it is comparable with other works: 3–12 years (

Chiaroni et al. 2014), 4–8 years (

Rodrigues et al. 2016) and 7–15 years (

Orioli and Gangi 2015).

4.2. The Distribution of Revenues

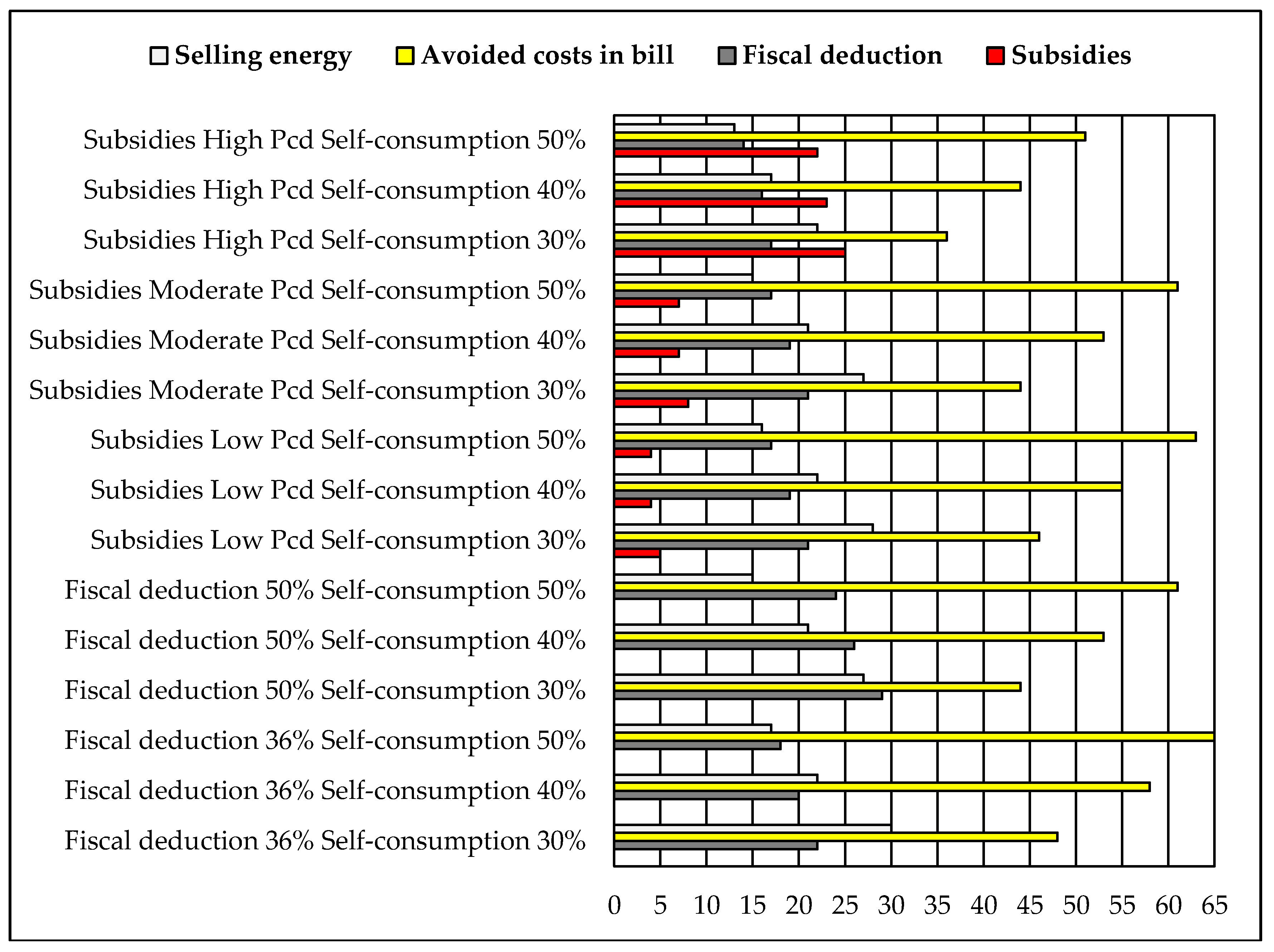

The profitability is characterized by several items. An analysis of their percentage distribution can be useful to define the relevance of these variables. Obviously, the distribution depends by typology of case study—

Figure 5.

A consumer pays to use electricity and when a PV system is installed, the investor (consumer) becomes also a producer of energy (also called prosumer). For this motive, the purchase of energy is not more necessary (relatively to the share of self-consumption) and avoided cost of bills can be interpreted as a revenue. In all case studies, this represent the aim item of discounted cash inflow. It varies from 36% in scenarios Subsidies High PCD and Self-consumption 30% to 65% in scenarios Fiscal deduction 36% and Self-consumption 50%.

The selling of energy to the grid has a percentage weight basically greater than fiscal deduction. This is not verified only in scenarios in which the consumer reaches a share of self-consumption equal to 50%. The fiscal deduction permits to reduce the taxable income and it is applied following by the investment in PV system. In this way, there is a reduction of taxable costs and this item can be interpreted as a revenue.

Literature analysis underlined as subsidies played a key-role in the economic evaluation of PV plants. In this context their weight is marginal, when is hypothesized a low value of PCD (about 4–5%) or a moderate value of PCD (about 7–8%). Instead, they have a weight of about 22–25%, when the reduction of carbon dioxide assumes a value of 70 € per ton of CO2.

4.3. Alternative Scenarios

NPV are obtained according to the assumptions of a set of input variables. In order to give solidity to results obtained, a sensitivity on the critical variables is conducted. In this way, a variance of the expected NPV could occur and this analysis defines the variations of this index (

Sommerfeldt and Madani 2017).

Some variables are already changed in baseline case studies and for this motive the same approach is repeated in this analysis.

Section 4.1 has defined as NPV varies in function of the share of self-consumption, the rate of fiscal deduction and the value of carbon dioxide (subsidies).

electricity purchase price.

Section 4.2 has defined that this cost, having a sign negative, can be interpreted as a revenue. The variable is decreased (

Table 4) and increased (

Table 5) of 0.02 cent€/kWh.

electricity sales price. The consumer can sell to the grid the share of energy not self-consumed. The variable is decreased (

Table 6) and increased (

Table 7) of 0.015 cent€/kWh.

unitary investment cost. A significant decrease of investment costs has characterised the PV market. This is caused by political choices (e.g., subsidies) that have favoured a consistent amount of installed PV systems. The variable is increased (

Table 8) and decreased (

Table 9) of 200 €/kW.

average annual insolation. Italy presents several insolation levels due to its geographical conformation varying from 1350 kWh/m

2 × year (northern region—

Table 10) to 1600 kWh/m

2 × year (southern region—

Table 11).

The profitability is verified in one-hundred and three case studies in alternative scenarios. In particular, NPV is always positive in two scenarios. The first when is applied a value of tr equal to 1600 kWh/m2 × year and the second is verified with a Cinv,unit equal to 1700 €/kW. Instead, the unprofitability is obtained in seventeen case studies: fourteen when the share of self-consumption is equal to 30% (six in combination with Fiscal Deduction 36% and four with both Fiscal Deduction 50% and Subsidies Low PCD) and three with a wself,c equal to 40% (in combination with Fiscal Deduction 36%).

This work does not assign a probability value to single case studies. However, the solar irradiation calculated in baseline scenario is subject to variation when is considered a territory situated in a northern or southern region. NPV varies from −365 €/kW to 1011 €/kW in the North of Italy, it ranges from 9 €/kW to 1702 €/kW in the South of Italy.

Italian PV market is mature and consequently, the variation of investment costs is not expected. However, the difference of costs can be proposed by several firms in order to expand their market share. NPV ranges from −378 €/kW to 1157 €/kW when is considered an increase of costs in comparison to baseline scenario, while it varies from 22 €/kW to 1557 €/kW in the opposite situation.

Regarding electricity sales price, a possible variation can be assumed when is applied a Net Metering Scheme, in which the price of electricity is increased above market value. The development of decentralized energy systems aims to obtain that single units must be self-sufficient in terms of energy and consequently, all advantages must be destined to the share of self-consumption. NPV varies from −330 €/kW to 1253 €/kW with a ps equal to 4 cent€/kWh and it ranges from −26 €/kW to 1461 €/kW with a ps equal to 7 cent€/kWh.

The energy bill is composed by several components and its value depends by time bands. Currently, there is an increase of energy bill in Italy. For this motive, there is a concrete opportunity that scenario presented in

Table 5 can be real. NPV varies from −46 €/kW to 1576 €/kW. While, in the opposition situation (p

c equal to 17 cent€/kWh) it ranges from −309 €/kW to 1137 €/kW.

Finally, alternative values RECD can of be analysed. In

Section 3.1, energetic mix is calculated at net of renewables and imports and RECD is equal to 685 gCO

2eq/kWh. However, PV plant can be compared with an energy portfolio in which also renewables and imports are considered. Initially, the distribution of energy sources is evaluated for 2017 (

ENEA 2018): PEM

GAS = 36.5%, PEM

OIL = 34%, PEM

COAL = 6%, PEM

RES = 19% (percentage in energy mix of renewables) and PEM

IMP = 4.5% (percentage in energy mix of imports). In particular, renewables can be subdivided in hydroelectric (HYD), PV, biomass (BIO), wind (WIN) and geothermal (GEO). Their distribution is calculated according to values of GSE (Gestore Servizi Energetici) regarding electricity sector in 2016: PEM

HYD = 39%, PEM

PV = 21%, PEM

BIO = 18%, PEM

WIN = 16% and PEM

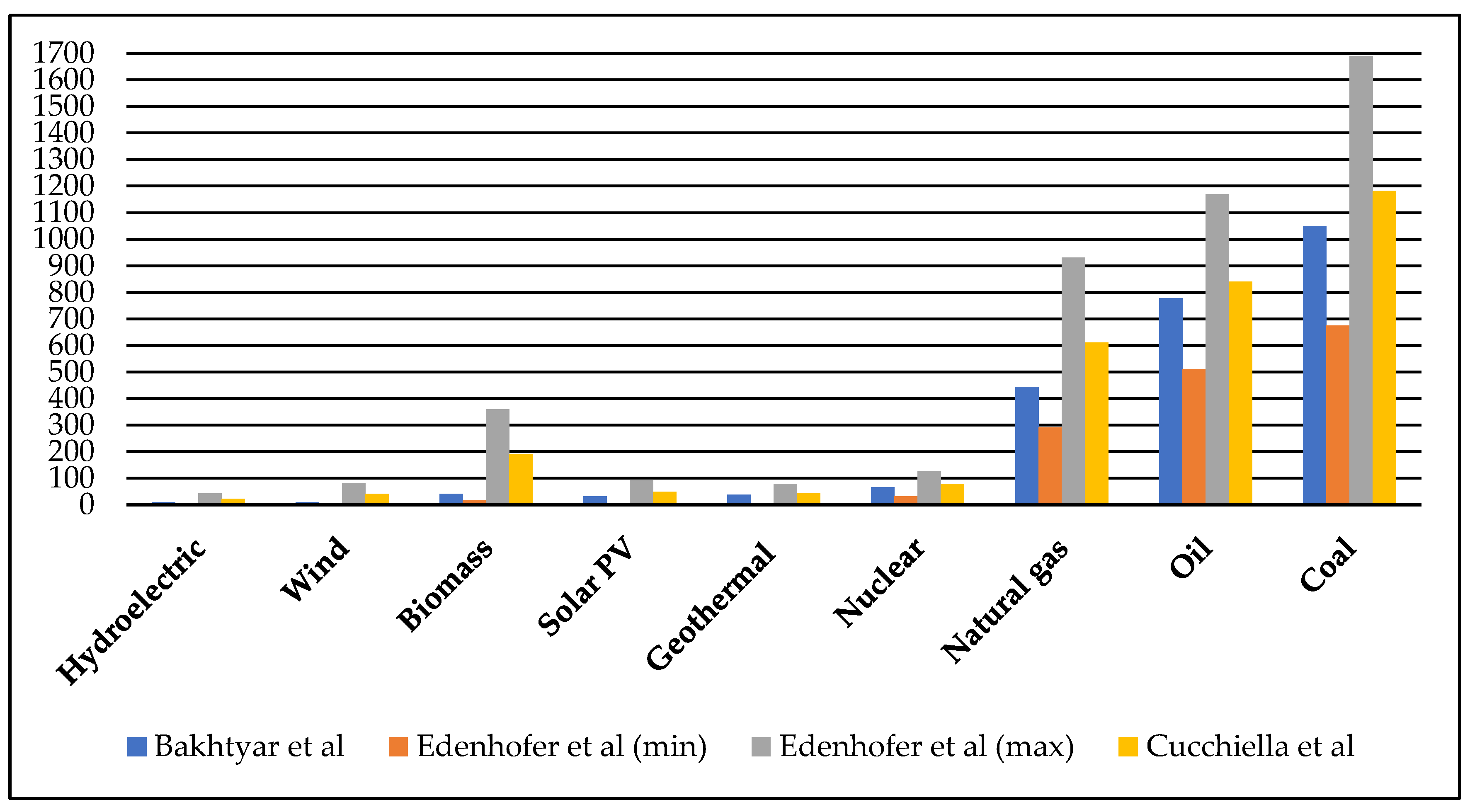

GEO = 6%. The values of emissions are chosen as average values of

Figure 3: ECD

HYD = 19 gCO

2eq/kWh, ECD

PV = 42 gCO

2eq/kWh, ECD

BIO = 152 gCO

2eq/kWh, ECD

WIN = 34 gCO

2eq/kWh and ECD

GEO = 41 gCO

2eq/kWh. For the value of imports is considered the average among oil, carbon and gas (ECD

IMP = 847 gCO

2eq/kWh)—Equation (16).

According to Equations (13)–(15), the following step is the transformation of environmental benefits in economic terms. The unitary value of subsidies changes in function of the value of P

CD—Equations (17)–(19).

The variation of NPV in alternative scenarios in which RECD is assumed equal to 562 gCO

2eq/kWh is proposed in

Table 12. Obviously, both scenarios Fiscal Deduction 36% and Fiscal Deduction 50% are not modified by this change.

The profitability is confirmed in several scenarios (only scenario Subsidies Low PCD and Self-consumption 30% has a negative NPV). The index varies from 181 €/kW to 1200 €/kW. The presence of renewable in an energy mix determines a reduction of carbon dioxide linked to this portfolio. In fact, a reduction of RECD is verified and it is equal to 123 gCO2eq/kWh. This determines a reduction of value of SUBPV and consequently, also NPV is characterized by a reduction. It varies from about 20 €/kW (Self-consumption 30%) to 160 €/kW (Self-consumption 50%).

4.4. Discussions and Policy Implications

The transition towards a low carbon society requires to evaluate the relationship between the CE models and the use of REs. The CE framework is characterized by requirements to measure. One of them is increasing share of renewable and recyclable resources.

The reduction of GHG emissions is possible thanks to the use of less raw materials and more sustainable sourcing (

Elia et al. 2017). Recycling and recovery of materials as indium, silicon and silver can be obtained by PV waste favouring the application of CE model (

Brenner and Adamovic 2017). However, a sustainable RE technology requires that the all parts of the product lifecycle can be optimized. The analysis from cradle to growth is conducted (

Charles et al. 2016). The recovery of PV modules is typically characterized by unprofitability (

Choi and Fthenakis 2014).

CE model aims to favour the development of REs and economic opportunities take the front seat (

Kopnina 2017). This work follows this approach. In fact, PV investment is characterized by a low risk and results obtained define that the profitability can reach interesting values.

PV systems are able not only to favour the decarbonisation of society, but also to reduce geopolitical risks. In fact, when a country increases the internally energy produced there is also a decrease in external energy required. Consumers can increase their profits in a significant way and this is possible through the harmonization between demanded and produced energy. At the same time, consumers are responsible actors towards targets to reach.

Energy firms move from centralised to decentralised power and new business models emerge in which people provide the energy for their homes and commercial premises. At the same time, emissions constraints for manufacturing of products represent another motivation to develop REs.

Subsidies cannot be seen as a perpetual assistance, but in this new proposal consumers sell the amount of CO2eq avoided using a PV system instead to use electricity by fossil fuels.

The Paris Agreement is a crucial step to reduce the decarbonisation of society. A mix of renewable resources, energy efficiency, an appropriate waste management and material efficiency strategies represent initiatives to implement. In this way, renewable economy and circular economy moves towards the same direction.

5. Conclusions

Renewables represent the main actor in a transition towards a society low-carbon. PV source plays a key-role, in fact its growth has assumed significant values in the last years globally. However, consumers are also investors and a project is implemented only if economic conditions are verified.

Currently, a subsidized fiscal rate of 50% (instead of 36%) is applied to the Italian context. This measure has not produced a consistent increase of the power installed. A new proposal is defined in this work, in which when a consumer reduces carbon dioxide emission levels has right to receive an economic contribution. This is paid by operators that emit a level of pollutants greater than the value allowed (carbon price defined by a real market). In addition, this incentive is given to the energy produced by a PV plant for all its lifetime (20 years). The subsidy is assumed fixed according to the FIT scheme.

Literature review has underlined as a consistent quantity of emissions is not covered by a carbon price and this value is below 10 €/tCO2eq. However, several authors have highlighted as carbon price must have a greater value in order to tackle climate change.

The reduction of carbon dioxide is calculated according to values reported in literature. Italy moves towards a reduction of use of both oil and carbon, at the same time there is an increase of natural gas. The share of RE tends to be stable. The reduction of emissions is assumed equal to 685 gCO2eq/kWh and the market value of EU ETS is characterised by an increase of about 13 €/tCO2eq considering July 2017–July 2018 as interval period.

The fiscal deduction with a rate of 50% produces more profits for consumers in comparison to a subsidy determined by the price of CO2eq when this value is lower than 18.50 €/tCO2eq. Among this value and one proposed by market there is a difference of only 1 €/tCO2eq. Consequently, this choice can be applied in a real context.

This analysis follows the values reported by report of the High-Level Commission on Carbon Prices. Applying a price of carbon dioxide equal to 35 €/tCO2eq. NPV varies from 260 €/kW to 919 €/kW and DPBT can be equal to 5–6 years. When, instead, is applied a price of carbon dioxide equal to 70 €/tCO2eq, NPV ranges from 698 €/kW to 1357 €/kW and DPBT varies from 3 years to 6 years.

Profits obtained are probably not relevant, but consumer can opt towards this choice for the following aspects: (i) investment costs are low, (ii) reduces the costs of energy bill and can also obtained profits and (iii) contributes to tackle the climate change. The harmonization between demanded and produced energy increases the economic performance. Alternative scenarios give solidity to results obtained.

A new development of residential PV applications is able to increase the sustainability of a country and the quantitative analysis proposed in this work demonstrates as PV source contributes to the CE models.