Abstract

The food market is experiencing a period of deep tensions between farmers, food companies, and retailers across the world. This is particularly true in Italy, a Mediterranean country with a strong agricultural tradition and a great interest in the food market. The largest market weight in terms of food retail in Italy is held by national chains linked to the cooperative movement (Coop and Conad) that has promised to ensure more collaborative and less imbalanced relationships between producers and distributors, along with a stronger connection to the territory and socially responsible corporate management. The Coop is currently the biggest cooperative in Italy. Its increasing power in the Italian food retail system has caused it to behave like an oligopoly that has exploited its proximity to left-wing parties to obtain an advantageous position in some markets (ex: Emilia, Liguria, etc.). Equally alarming is a growing financialization which has led to the bankruptcy of CoopCa and Coop Operaie of Trieste, affecting approximately 20,000 investors. The recent crisis in food retail is redirecting firms’ strategies and producing new forms of food distribution such as Alternative Food Networks that are trying to restore the mission and values of the old consumer cooperatives.

1. Introduction

The neoliberal turn was defined as an experiment (Bowman et al. 2014) in which “the richest economic actors strengthened their privilege after a period of decline in profits” (Salento 2014, p. 4). However, several scholars have pointed out that liberalization policies, to enhance promarket commitment, have instead generated more inefficiency, value extraction, social disaffection, and conflict, as demonstrated by the recent wave of populism and anti-European intolerance (Streeck 2016; Arcidiacono and Palidda 2015).

Moreover, the recent crisis of 2008 has shown that market liberalization has been a mistake not only in terms of content but also in terms of methods. It has often been a top-down policy, resulting from a process of convergence towards a Liberal Market Model (Hall and Soskice 2001) that has weakened the functions of direction and control by the State and delegitimized the relevance of crucial national stakeholders such as citizens and communities. This has conferred poor value on the wealth of practices and cultures embedded in local contexts.

As stated by the Foundational Economy Collective (2018), the well-being of citizens depends on their consumption of essential goods and services defined as “foundational” (water, food, energy, health care, etc.). Foundational goods depend on an infrastructure and delivery systems of networks and branches that are neither created nor renewed automatically. “Since World War II, ‘the economy’ has been managed (by fiscal or monetary policy) for growth of gross domestic product (GDP) with welfare primarily distributed through individual consumption based on wages. And, since the late 1970s there has also been a presupposition in favor of competition and markets through structural reform which aims to make labour markets more flexible and introduces large scale privatization and outsourcing. In all of this, foundational services and the infrastructures that enables them to be provided are subordinate” (ibid., p. 2). Neoliberalism has primarily extracted value from these foundational sectors, producing imbalances and inequalities in the value chain. Applying a Polanyian conceptualization, it has also produced a progressive dis-embeddedness of companies from their social context. The recurrent crises produced by this model reinforce the need to rethink this “foundational economy” and relaunch a form of “everyday capital” (Barbera et al. 2016). This is based on the valorization of new emerging experiences that aim to restore the crucial value of these goods and services through the direct commitment of users/producers.

As observed by Bowman et al. (2014), the food market, its access and distribution are emblematic of the process described. The food market is currently characterized by deep global tensions between farmers, food companies, and retailers across the world (i.e., demographic growth, concentration of power and unfairness within the supply chain, financialization of agricultural commodities, imbalances generated by the mass production of food in terms of health and environmental impact, and so on.). Moreover, retailers represent one of the most controversial actors in the modern food supply chain (Dobson 2005; Dobson and Inderst 2007). At the same time, the food market is strongly dependent on cultures, strategies, and relations among local actors and stakeholders. Therefore, food accessibility and distribution are a “laboratorial” field for bottom-up initiatives of social innovation and civil economy (Zamagni 1999; Loconto 2014; Arcidiacono and Maestripieri 2018) that aim to restore the “foundational value” of the food market.

Consequently, many observers (Lorendahl 1996; Tregear and Cooper 2016; Fonte and Cucco 2017; Gonzalez 2017) have underlined the relevance of the food cooperative model as a people- and place-centered business strategy capable of mobilizing social capital and wielding a considerable impact in terms of advocacy and political influence. Globally, especially in countries such as the USA, UK, and Italy, grocery food cooperatives have proved to be an alternative and viable business model (Curl 2009; Nadeau 2012) providing the foundation for organic foods movements. Cooperatives can be considered the most advanced form of what Webb and Webb (1902) called “industrial democracy”. In such a model, workers are heavily involved in the destiny of the company through a system of collaborative governance.

The history of this model dates back further than capitalism, yet until now it has played only a residual role within the market. The relevance of experience among food cooperatives is also re-emerging after the recent crisis as the most reliable form of economic governance with respect to global and strongly financialized capitalistic food retailers. The cooperative model is now considered to represent the best practice of company governance, exhibiting positive effects in terms of value creation and distribution (Scholz and Schneider 2016). Food cooperatives provide the most powerful example (also in terms of market share) of the substantial impact cooperatives can have (Nadeau 2012). At the same time, food retail cooperatives, since the 1980s, have increasingly mimicked supermarkets in terms of their business strategy (Rothschild and Whitt 1986; Barbera et al. 2018), preferring scaling-up strategies to concrete membership participation and commitment so that they can counter the increasing competition from discount warehouses and noncooperative natural food stores (Zitcer 2015).

According to the World Co-operative Monitor (Euricse 2017), there are 2379 cooperatives, 1449 of which are in Europe and 28% are located in the food industry. This is particularly true in Italy, a Mediterranean country with a strong agricultural tradition and a great interest in the food market, as well as a long tradition of cooperative movements. The Italian Coop is now the largest cooperative in modern retail and records the largest revenue with 13.5 billion euros (12th in the European ranking of Cooperatives Europe). The role played by the Italian cooperative model in food retail is a clear success in economic terms, yet it comprises both light and shadow, which is often underestimated in public and academic debate on the relevance (and limits) of cooperation.

The purpose of this article is to review the evolution of the Italian cooperative movement through a case study approach, focusing on the food distribution industry, a field historically relevant to the history of cooperation. It will therefore highlight stages in the transformation of the largest food retail cooperative in Italy, COOP, and recent changes that have caused it to redefine its objectives and principles of action. In the following section, the objectives of the analysis and the method used will be illustrated in detail. This will be followed by consideration of how financialization processes and the acquisition of a dominant position in some markets have removed the cooperative movement from its founding values. Subsequent sections will then explore the possible experiences that are reviving the principles of cooperation in the food distribution sector. Finally, a concluding paragraph will consider further research paths and policy implications.

2. Objectives and Method

The focus of this article is on analyzing the rise and development of the cooperative system in the food retail market in Italy and then assessing its socioeconomic impact, providing evidence for the limits of this cooperative venture. Adopting the “foundational economy approach” (Bowman et al. 2014; Barbera et al. 2016), the analysis will demonstrate how, despite the great “fertility” of the cooperative model and the fairness of their original values and principles, the transformation of food retail cooperatives in Italy was influenced by the convergence process of liberalization, leading to value-extractive strategies from organizations such as the COOP. Three main dimensions are therefore analyzed:

- -

- the peculiar history of Italian coops, mainly in the food retail industry;

- -

- the transformation of its role within the market: concentration and financialization;1

- -

- relations with its constituency and suppliers as a crucial field of transformation.

The analysis is based on the following data:

- -

- secondary data on the evolution of the large retail system and the food market in Italy, collected by business organizations (i.e., Federdistribuzione; ISMEA) or public institutions such as the Ministry of Economic Development, from 1996 to 2018. These will describe the contextual peculiarity of the COOP’s role in the Italian retail market;

- -

- official documents and reports by the Authority for Market Competition (2012) and several consumer associations (i.e., Federconsumatori and Adusbef). This will help examine the principal issue connected with the COOP’s financialization and the exercising of buyer power towards farmers and suppliers;

- -

- published interviews with entrepreneurs, managers of the large retail system, or members of the cooperative movement in Italy in the main Italian newspapers (Corriere, Il Sole 24 ore, Il Fatto Quotidiano, etc.) between 2010 and 2018. This will clarify the reasons for this transformation from the point of view of insiders.

The empirical material was thus analyzed to reconstruct the evolution of the Italian cooperative model within the large retail sector, focusing on the discrepancy between the coop’s founding principles and the role they actually played in the Italian national food retail market. A case study approach is employed to explore the phenomenon in the context in which it is generated and reproduced (Yin 2003). This type of approach does not necessarily require an analysis on the field as it is based above all on the use of different types of data through the triangulation of different data sources (Denzin 1978). Choosing this approach is justifiable because the factors and variables that comprise the topic under investigation are multiple and interconnected (historical, political, and economic).

3. The Rise and Evolution of Italian Cooperatives in the Food Retail System

The history of the cooperative movement is linked to the access to food and its distribution. The first cooperative organizations, born around the mid-1800s in England, presented themselves as an instrument to defend workers and their families from the negative effects of the industrial revolution. The pioneers of Rochdale were workers in a small textile company that gave birth to the first consumer cooperative. These were based on specific principles that the entire cooperative movement would later develop around the world: free accession (an “open door” policy); democratic control of members (“one head, one vote”); return cap on capital; political and religious neutrality; the development of cooperation education.

In Italy, the history of cooperation closely followed the experience of Rochdale with the creation of the Society of Workers of Turin, the country’s first industrial city. This is where the “Providence Store” was founded in 1854 with the intention of ameliorating the effects of the crisis within the agricultural industry and the consequent rise in food prices. The Turin experience expanded in 1856 with the establishment of the Artistica Vetraria di Altare, a working cooperative with the dual purpose of addressing the increasing risks of industrial unemployment and guaranteeing workers access to basic needs. The first experiences of the coop were enshrined within the limits of a process of industrial modernization that strengthened some of the dynamics of social inequality to which the cooperative action tried to respond, representing an alternative to private shops and guaranteeing savings as a result of overcoming intermediary wholesalers. Adherence to the principles of Rochdale was grounded in the affirmation of a working-class culture and industrial claims that saw mutual aid and solidarity as the only way to overcome the asymmetries of power between workers and owners. The aim was not to become instruments subordinated to the logic of the market but to build a concrete alternative.

The first cooperative experiences in Italy gained the support of both liberals and republicans. From the beginning, cooperation was considered an instrument for the nonconflictual insertion of the subordinate classes into economic development; it was thus a useful tool of social organization in the recently united Italian State. Other interesting initiatives at that time originated in Florence, thanks to the activity of some enlightened members of the nobility and bourgeois who, in 1863, established the Cooperative Society of Consumption for the People and, again, two years later in Como, where the first Italian cooperative was born with a statute that explicitly referred to the principles of Rochdale. In 1893, the cooperative movement in Italy had developed into the constitution of the National League of Cooperatives and Mutuals.

In 1919, the first crisis of the Italian cooperative movement occurred when it unveiled its peculiar and profound political “partisanism”: the splitting of Catholic-inspired cooperation from the National League of Cooperatives and the foundation of a parallel Catholic Confederation of Italian Cooperatives. The division between red coops (close to the Communist party) and white coops (close to the Christian Democrats) was purely ideological and shifted the cooperative movement from a position of economic rivalry to one of political and institutional competition. Vella (2010) states that “in comparison with other European countries, the Italian cooperative experience is unique, specific, and singular, since there is no similarity with other experiences, especially referring to its structural and managerial diversification and its widespread presence in all sectors of economic activity” (ibid., p. 110), but the cooperative movement in Italy distinguishes itself for having “never been neutral, a-political and a-religious (as envisaged by the International Cooperative Alliance among the principles of cooperation) […] its second characteristic is its rootedness in the national territory and its strong link with the local public administrations” (p. 95).

The years of fascism represented the only slowdown in the increasingly active political role of the cooperatives. Mussolini himself viewed the cooperative movement with suspicion and tried to subordinate them to the direct control of the Ministry of the National Economy. Only with postwar reconstruction did the cooperatives regain their autonomy and experience a new phase of expansion in all sectors, especially in commercial distribution.

The large food retail sector became one of the focal points for the expansion of the Italian cooperative movement and, due to its relatively easy scalability, was perhaps one of its greatest successes. The new distribution model was developed in a society with a strong agricultural-peasant tradition, in which many families were dependent on self-production for their food consumption. It was a society with a very low per capita income and in which “only 7.4% of Italian homes in 1951 possessed the elementary combination of electricity, drinking water and sanitation” (Ginsborg 1989, p. 283). The food retail system enhanced productivity and food safety all around the country and its expansion was associated with several socioeconomic narratives and “promises”, such as improving the efficiency of the supply chain and providing more benefits for consumers in terms of variety, healthiness, and prices. However, the retail system encountered severe resistance from local shops and suppliers which slowed down its expansion in Italy compared to the rest of Europe. The first representatives of a large retail food sector were developed in Europe in the second half of the nineteenth century, such as the English Sainsbury (1869) and the German Telgelmann (1867). In Italy they arrived in 1957 when, in Milan, Supermercati Italiani opened the first supermarket to be funded by the American tycoon Nelson Rockefeller.

In most Mediterranean countries, with Italy at the forefront, the conflict between large and small distributors was extremely harsh and mediated mainly by public regulators. Traditional shops found support from local political representatives who, for reasons of social consensus, imposed strict regulatory limits on the expansion of large-scale food retailers. For instance, the framework law on trade n. 426/71 subordinated new supermarket openings to the stipulations of regional/municipal development plans, setting rigid product tables and regulating opening hours in a highly structured manner. The centrality of local administrators within a system granting space and opportunities for the large retail system inevitably ended up encouraging those business groups that could count on establishing greater territorial roots, while maintaining a certain degree of strength for small neighborhood stores over time. For instance, in the retail sector Italy was the country with the largest density of small shops (one for every sixty inhabitants) until the 1970s. However, the economic crisis in 1973 revealed the fragility of the Italian growth model while the public debt increased, driven also by the political consensus needs of the ruling class. The subject of liberalization, which has long been underresearched in Italy, “exploded” at the end of that decade. The deregulation processes that took place all around the European continent marked a new course for economic policy against the backdrop of the failure of Mitterand’s socialist government in France and the English Labour Party under James Callaghan. The real acceleration, however, only took place in the 1990s, following the burgeoning process of European unification which required the elimination of any preferential treatment for companies with public participation. Through the Treaty of Maastricht (‘92) and Amsterdam (‘97), the foundations for a “new economic constitution” were laid down. The 1990s were a fundamental turning point for Italy, for the establishment of the first independent administrative authorities, and for the launch of several important reforms designed to move the Italian model towards greater “market freedom” (Trigilia and Burroni 2009): from the reform of the financial system (1990–1998) to corporate governance systems (1998–2004).

Therefore, following the 1992/1993 crisis, the Ministry of Industry and Commerce began to introduce important reforms into the retail sector that led to a reduction of 8% of traditional stores (as many as 70,000 stores were closed). Local administrations began to look with renewed interest at the ability of large-scale retail companies to absorb young workers from declining industrial sectors. They also sought to revitalize business opportunities for local agricultural producers, generating at the same time real estate value around the emerging shopping centers. This added to municipal budgets that were under pressure from the declining allocation of national resources.

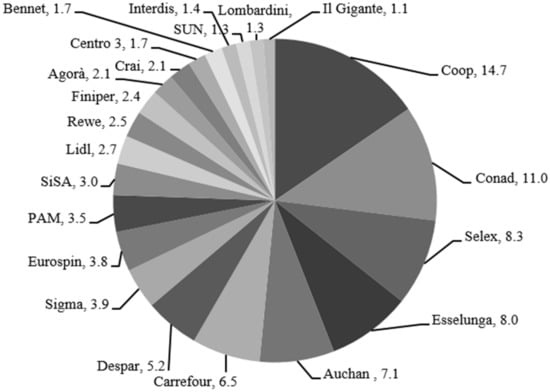

However, the centrality of local government remained unaltered in the trade sector, affecting the fragmentation of the market with dozens of operators active in the national context (Figure 1). Comparing the values of the C3 index with the major European countries, it is notable that in Italy the three largest chains held only 34% of the market, compared to 61% for the three largest chains in the English and German markets or 53–54% for the French and Spanish markets. It should also be noted that the largest share of the national market was in the hands of the so-called DO (organized distribution) (57.1% of the large retail market) rather than large national or global operators of large distribution (41.5% of the market). DO consists of local entrepreneurs who combined a plurality of small shops under one single label. The remaining share of 1.3% was occupied by so-called independent operators. This is an Italian peculiarity that favors the logic of transformation and efficiency for distribution systems on a national scale, while at the same time protecting the relationship with local business entrepreneurs. In this sense, the cooperative system best embodied this particular political choice, legitimizing its hegemonic role under large-scale cooperative brands such as Coop (14.7%) and Conad (11%). The cooperative movement was strong in Italy due to its privileged and direct relationship with the territory and the political support of local administrations, particularly those governed by the center-left. By promising a more equal and collaborative relationship with the supply chain and placing the territories at the center in line with socially responsible managerial logic, it encountered less resistance in its rise in the Italian regions.

Figure 1.

Market share of large food retailers in Italy (%). Source: Author’s calculations on data AGCM—Autorità Garante Concorrenza e Mercato (2012).

In a country characterized by a “regionalized” model of Mediterranean capitalism (Trigilia and Burroni 2009), with strong territorial differences in terms of economic and social structures, the devolution reform (firstly with the Bassanini Law—L. 59/1997, then the Constitutional reform 3/2001) increased the power and discretionary decision-making of municipal and regional administrations in the field of commerce and distribution. Therefore, it is necessary to look at internal territorial differences to understand the evolution of the large retail system in Italy. A more specific analysis (of the Autorità Garante Concorrenza e Mercato (AGCM 2012) highlighted a form of “distributive federalism” in which some brands built “territorial lordships” in specific regional areas (Table 1). Within some local areas, specific brands would therefore act as an oligopoly in markets that were more concentrated than the national data would suggest: for example, in regions such as Tuscany and Emilia Romagna, Liguria, the C3 index measured between 70% and 80% of the market, and the first national distributor, Coop, held a share of between 40% and 50%. It is also apparent that the strength of cooperative distribution companies was greater in the “red”, socialist-dominated regions. Certainly, in light of regulatory evolution in the trade sector, the rooting and proximity networks of the cooperative movement in the red regions explains the dominant role of COOP in some territories. However, complaints from competitors have highlighted the “sticky” aspect of this proximity, which resulted in a series of abuses of its dominant position, sanctioned only recently by the Antitrust Authority. Such “vicious proximity” between public administrations of the center-left parties and the cooperative movement clearly emerges through the public denunciation of Bernardo Caprotti, the founder of one of the biggest Italian retail chains, Esselunga, and one of Coop’s biggest competitors. The latter published a pamphlet in 2007 with the title “Falce e Carrello (Scythe and Cart)” (Caprotti 2007) in which he made an accusation against the cooperatives as well as the clientelist and particularistic system that made their hegemony possible in specific regions, excluding any other possible competitor such as Esselunga. The accusation of Caprotti, documented in the book, reports a series of cases in which Esselunga has been denied authorization to open stores in Emilia, Tuscany, and Liguria, where the Coop has historically had a stronger influence. Some of these accusations were considered insufficiently proven but, nevertheless, the Anti-Trust Authority, recently expressed itself in favor and published a provision dated 28 June 2012 that recognizes how “the Coop Italia has implemented a unified strategy, continued and repeated from 2001 to 2009, the effects of which still remain today. In particular, the company has systematically interposed the competitor’s attempts to start up new food stores, in areas potentially suitable for commercial settlements and already in its availability [....] Also intervening instrumentally in the administrative procedures underway initiated by Esselunga to obtain the necessary authorizations [....] Moreover, by preventing an efficient competitor from accessing the market, Coop Estense has caused damage to consumers in terms of higher prices and/or minor choice” (provision A437). The expanding strategy of the Coop, which was increasingly aggressive and detrimental to the principles of fair competition, is only one striking example of a “genetic mutation” (Frau 2010) of the foundational principles of cooperativism, such as social responsibility and political neutrality, in the Italian food retail system. Strong political contiguity enabled Coop to grow in some territories; however, this growth has been generated by an alteration of the rules of competition, taking advantage of the social capital historically developed in red contexts.

Table 1.

Indicators of large retail by region.

4. The Mutation of the Cooperative Food Retail Sector between Financialization and Buyer Power

Since the creation of large partnerships and a consortium of cooperatives, the cooperative model began to adopt a more vertical governance structure compared to the horizontal model that characterized the first experiences of cooperation. In the case of the Coop, this process accelerated at the beginning of the 1980s, when small- and medium-sized cooperative companies implemented a merger process that led to the birth of what were defined as the 7 sisters of the large cooperative distribution (Coop Estense, Coop Liguria, Unicoop Firenze, Unicoop Tirreno, Coop Adriatica, Coop Lombardia, and Novacoop). In 2015, this process culminated in a further merger between the three largest cooperatives, Coop Estense, Coop Adriatica and Coop Consumatori Nord-Est, giving rise to what came to be known as the Coop Alliance. This new alliance began a further process of expansion of the Coop brand in the national territory, no longer through the creation of new cooperatives, but by acting as an Ipercoop spa, a clear example of a shift in strategy and a progressive departure from the principles (organizational and ethical) of the cooperative model.

Frau (2010), the former director of Novacoop, wrote that: “What is the secret of the success of the Coop? The explanation is very simple. In order to be able to hover high in the sky, they are forced to free themselves of what is considered a heavy “bond” (the mutualistic purpose) that prevents and strongly limits the flight (development and growth), sacrificing the founding values and its own DNA, that is, the mutual exchange in favor of its members, to marry tout court the logic of the capitalist market and profit, without renouncing to their own and exclusive legislative and tax advantages of the cooperatives” (p. 50). In other words, the cooperative sector strategically used the fiscal advantages of its cooperative status while de facto operating as a regular business driven by shareholder value. Immediately after World War II, the Italian cooperatives shifted away from a productivist model and a ‘competitive market’ paradigm (Fonte and Cucco 2017). The most recent process of merging the local COOPs is related to this shift: on the one hand, it was a necessary strategy to defend against the growing competition from low-cost global brands arriving on Italian territory such as LIDL; on the other hand, it represented a financial strategy that supported investment and growth objectives. In this scenario, the relationship with the constituency and with the territories loosens and appears increasingly weak. The reason for this is because the historical and social conditions that supported the origins of the cooperative movement have largely changed. Italy is now a rich country, with an increasingly demanding and price-oriented consumer market facing a globalized world. Moreover, there is also the mutation of the political base of the cooperative movement, mainly on the Italian left and in Christian democratic parties. Fonte and Cucco (2017) argue that the ideology and politics of the former cooperative movement were based on a holistic vision of a fairer society with a specific social base in the productive class (farmers, workers, and so on). The forces of the leftist parties began to transform profoundly after the “historical compromise” (1976–1978) that forced the Communist Party to form a government of national solidarity with the Catholics. The decline of the PCI (Partito Comunista Italiano) culminated in 1991 with its dissolution and was followed by the limited success of the “Rifondazione Comunista” of Bertinotti and of the DS (Left Democrats). These parties gradually abandoned their base of reference to become a political elite representing the intellectual and bourgeoisie class of the country, attracted at first by the reformist experience of social democracy and then by the hypothesis of Blair’s “third way”. The Christian Democratic Party was then destroyed by the biggest Italian case of political corruption, called “Tangentopoli”, in 1992. These political deflagrations played a crucial role in the transformation of the cooperative movement because it re-oriented their strategy towards finding new political/economic sponsors, Moreover, the depletion of the ideological opposition that had led them to separate in the 1920s had largely been exhausted with the dissolution of the parties of reference, from which they merged into very fluid political formations and a more hybrid identity. Just before the cooperative merger, the leader of Confcooperative Paschetta declared in a recent interview for one of the most important national newspapers (La Repubblica), that “These barriers, which may have prevented dialogue between us in the past, have now fallen for years. Talking about different political colors is now anachronistic”. This decline in “ideological barriers” had thus given way to an economic-strategic merger aimed at increasing their market strength. Regionally, Legacoop was historically very strong in terms of large distribution; Confcooperative, however, could count on a substantial presence in the agricultural sector and cooperative credit.

The process of merging and expansion has fractured the traditional connection between the territory, the members, and the Coop, and thus created an obstacle to concrete and active participation. By statute, the members are called every three years for the election of local committees, now reduced to bodies without any power, who work with the cooperative, especially on initiatives to collect new members. Becoming a member is considered by most coop members a commercial affiliation, a membership that exists through a fidelity card related to a customer relationship program. This meant that the relationship between members was based more on instrumental and commercial market reasons (to acquire free shopping packages or discounts) than a concrete affiliation and adherence to the cooperation principles. Awareness of mutualistic purposes and the active participation of members during meetings is low and has been increasingly sterilized by these transformation processes. Frau (2010) clearly highlights the disproportionate relationship between members and participating members: at the 2009 budget assemblies, Coop Adriatica registered 11,000 participating members out of a total of 1,014,000 members, or approximately 1.1%; Coop Estense registered 7200 participating members out of a total of 583,204, (1.2% of the total); Coop Consumatori Nord Est registered 7000 members out of a total of 541,177 (‘1.3%); Novacoop registered 7974 members out of 599,223. (1.3%) and Coop Liguria registered 3104 members out of a total of 481,457 (0.7%).

Despite the decline in active participation among its members, the economic strength of Coop continues to lie in the social loan tool, created to collect economic resources from members to use for mutualistic and solidaristic purposes based on the support of its constituency. However, the Coop started to use the social loans to self-finance its expansive strategies and its financial activities. Through this tool, the Coop obtains tax advantages (an interest tax of 12.5% compared to that normally applied to bank deposits of 27%). Consequently, Coop is able to act like a bank, despite the law prohibiting this, and it rakes liquidity for speculative operations without being subjected to the same controls as other official banking operators. In 2014, the Coop had invested €12.2 billion (Amorosi 2016): €3.1 billion in government bonds; €2.4 billion in bonds, €2.1 billion in holdings (in Unipol, Mps, and Carige), €1.5 billion in noninvestment securities, and €2 billion in liquidity. Coop has a shareholding for €2.2 billion and a net worth of €6 billion, similar to a merchant bank like Mediobanca. Moreover, in all cooperatives, the total amount of social loans collected could not exceed three times the net assets, but in Coop Adriatica (the most important in the cooperative scenario) the ratio is 2.36 times higher. Although violation of this rule should lead to expulsion from the cooperative world, nobody has acted against the Coop.

In the last few years, cases where Coops that have been forced to close down operations due to losses created by the speculative activities of managers are numerous and distributed throughout the national territory:

- Reggio Emilia (Orion, Coopsette, Unieco, total amount lost €25.5 million)

- Reggiolo (Coop Muratori, maximum amount skipped: €30 million lost)

- Trieste (Coop Operaie crac involved deposits of more than €102 million lost)

- Milan (Unacoop, interested savings of €16 million lost)

- Varese (New Cooperative, €7 million lost)

- Rome (Depot-Locomotives, €1.5 million lost)

- Piacenza (Indacoo, €2.8 million lost)

- Fidenza (Di Vittorio, €12.5 million lost, proposed 25% reimbursement)

- Udine (CoopCa, which ran about forty supermarkets in Carnia, closed its doors and €27 million was lost).

The European Commission, at the request of the Italian Federation of Large Retailers (Federdistribuzione 2016) and Italian consumer associations such as Adusbef, had become interested in the peculiar situation surrounding Coops which was implementing strategies and behaviors that strayed far from cooperative objectives and continued to enjoy a tax advantage regime that could be characterized as unlawful “state aid” according to EU treaties.

Considering also the relationship with the supplier and the territory, which has been a central element of the business strategy of cooperatives since their inception, it is important to address the buyer power issue. The practice of slotting fees2 or trade spending contributions,3 rather than increasing the efficiency of the supply chain, has led to a deterioration of relations with producers/suppliers and negative welfare effects on consumers. Suppliers are forced to increase the prices charged to other buyers to amortize the reduction of its margins with the buyer equipped with the most buyer power (waterbed effect) (Dobson and Inderst 2007). Larger suppliers with superior bargaining power can almost cancel these contributions by downloading them onto smaller ones, also with the intention of keeping them out of the market. In turn, rising incoming costs will lead to higher prices for consumers, shifting the distributor’s profit from the end-market to the supply negotiation phase. The sale of slotting fees or other types of contribution could represent a very profitable business for large retailers, even more than final consumer sales. The European Central Bank (2011) conducted a study on 6 European countries, including Italy, that confirms how a higher level of concentration in the purchases of big retailers has yielded a positive dynamic in final prices. The analysis therefore excluded how the concentration of contractual power in the hands of large retailers had not recently produced any positive effects on final prices for consumers. However, it indicates an appropriation of value by the distributors. On this issue, the Italian Antitrust Agency (AGCM) launched a survey in 2012 of a representative sample of 471 food firms. It found that in 67% of cases distributors had asked producers to change the economic agreements defined in earlier negotiations (rarely in written form), in many cases (almost 40%) with a retroactive effect. In cases of refusal, 74% of respondents claimed to have suffered consequences in the form of cancellation from a supplier list or a deterioration in the buying conditions for future supplies. Moreover, suppliers must contribute to services that are not wholly realized or are clearly accountable in almost a third of cases. Such unfair practices are particularly burdensome for smaller suppliers; i.e., those who have revenues of less than 10 million euros, serve a limited number of chains (between 1 and 3), and do not have market leading products.

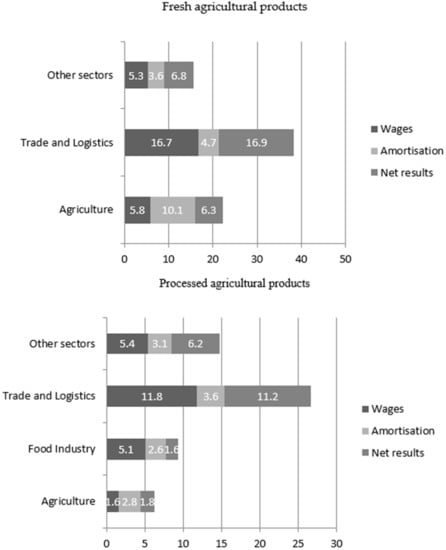

According to the Italian Institute for Agricultural Market (ISMEA 2018), in the Italian value chain of agricultural products the most vulnerable actors in the supply chain are producers(see Figure 2): out of every 100 euros spent by the consumer on purchasing fresh agricultural products, only 22 remain as added value to producers who must cover depreciation and pay the salaries, yielding a net profit of 6 euros, with the remaining 17 euros in the hands of commerce, distribution, and transport businesses. In the case of processed food, the net income is equally compressed, amounting to only 1.6 euros for farmers, while the net remuneration for commerce, distribution, and transport entrepreneurs remains at 11 euros.

Figure 2.

Breakdown of added value of agriculture, food industry, and other sectors, net of contributions and taxes (EUR-for every 100 euros spent by each household) Source: Italian Institute for Agricultural Market (ISMEA) elaboration on ISTAT (Istituto Italiano di Statistica) and Eurostat data.

These outcomes are the results of a double-down online auction of the supply system that has been adopted by every big retail chain, including Coop. According to this system, the distributor sends an e-mail to all suppliers asking them at what price they are willing to sell their products. The supplier can then make an offer. Once the distributor collects all the offers, he raises his request to the supplier again but places the lowest bid collected during the first round as a new starting point in terms of price. Even the Coop adheres to this system, as demonstrated by the complaint of Fortunato Peron, managing director of Celox, a pear producer who, after 20 years as a supplier to Coop Italia, protested against what he considered an excessive discount request and subsequently lost his contract. Peron, which had Coop as its sole buyer and pears as its core business, decided to turn to the AGCM which later acknowledged the “abuse of a dominant position” and sentenced Coop Italia to a fine of 49,000 euros4. Peron’s complaint was endorsed by five other suppliers. Despite the overall number of suppliers exceeding 3000, similar examples provide evidence of the way in which Coop’s purchase strategy does not respect the cooperative ideality of a balanced and fruitful relationship with the economic actors of the territory.

5. Reconfiguring and Restoring Trust in Food Cooperativism?

The critical issues in the value chains for food are a global problem (FAO 2013; EU Parliament 2015) and Italy, despite the privileged role of cooperative companies, is no exception. This has led to a profound rethinking of the logic of production, distribution, and consumption of food that, in recent years, has favored the establishment of several alternative ways of arranging food accessibility and distribution. These initiatives, widely implemented in various countries, represent an attempt to redesign a new food supply chain based on “re-localization” and “re-socialization” of the food market (Murdoch et al. 2000; Canfora 2016). Forno and Graziano (2014) have more recently defined them as Sustainable Community Movement Organizations (SCMOs), a real social movement with the ability to mobilize citizens primarily via their purchasing power. A growing awareness (“coscentization”) of the food value chain has fostered new economic initiatives based on the (co) management of production, distribution, and consumption of food as a common good (Lyson 2005). The relevance of these has also grown in significance in Italy where initiatives of cooperativism (latu sensu) have been relaunched to support better functioning of the food value chain.

The first relevant example are SPGs (Solidarity Purchasing Groups). These were first developed in Fidenza in 1995 and aimed to promote new relationships between consumers and producers through the bottom-up organization of consumers, who operate mainly at an informal level to meet local producers directly and who purchase food products wholesale based on solidarity and ethical concerns. In each SPG, consumers and producers make choices according to specific values and ethics; i.e., the sustainability of production, respect for local traditions, or compliance with labor standards (etc.). SPGs have several characteristics that are typically attributed to social innovations (Moulaert et al. 2009; Mulgan 2012): the “novelty” of the proposed model and an explanation of changes in the food supply chain, both in terms of the scale of openness that characterize the system, or its embeddedness within the local environment. Processes are based on giving voice to actors (e.g., consumers) who would otherwise be powerless relative to major economic actors such as corporations or mass retailers. The benefits of this rapid decision-making and feedback cycle are that the group saves money and more easily determines the ethos of larger producers while defending local producers. The local relevance of SPGs is crucial as a strategy to ensure better value for money by releasing the content for household consumption. This stimulates the community and promotes mutual solidarity, reiterating the value of economic forms based on reciprocity and collaborative schemes. The largest number of SPGs are concentrated in northern regions, especially where the Coop brand maintains a solid presence. This seems to have generated a knock-on effect of the values of mutuality and solidarity that today are expressed through this alternative channel, which seems to have much in common with the historical cooperative movement even if it is characterized by an organizational model of micro dimensions (an average SPG collects 10/15 families in most cases) and informal organization (most SPGs refuse to have a formal structure and prefer to act as a group of peers without any formal regulation or hierarchy). However, this new form of organisation has a very different constituency and principles compared to the earlier cooperatives. They mainly originate from outside the agricultural or productive sectors and are therefore less associated with working class issues and are more the expression of a bourgeois service class. This is a class who are highly educated, work in the tertiary sector, and whose reasons are not strictly economic but are enriched with postmaterialist dimensions, such as attention to the environment, human rights, working conditions, animal welfare, and the enhancement of local food producers.

Another innovative experience on offer is that provided by the food-sharing platforms that have emerged all around the word, and in Italy are represented by ifoodshare.org scambiacibo.it; bringthefood.org; breading.it, and kalulu.it. These sites are focused on the idea of enabling peer experiences where the goal is to guarantee access to food for everyone, thus avoiding waste. This experience is based on the paradigm of the “circular economy” but does not exclude solidarity purposes. Unlike SPGs, they are more often used for profit initiatives. These companies are thus very different from cooperativism and mainly exploit the process of technological innovation as a strategy for the disintermediation and enhancement of peer exchange.

Other interesting initiatives are projects such as Local2you. This is the result of a collaboration between three social cooperatives (Pictor15, Fraternity, and Noah’s Ark), active in the Bologna area in the employment of disadvantaged people, and who are engaged in the home delivery of high-quality agricultural products from local producers. This service is also associated with a distribution service and a catering business active in the Emilian territory (Estravagario and Vetro). Local2you collaborates for deliveries with several farmers’ markets and has relations with the SPGs of the region. This indicates the growth of an increasingly collaborative and integrated model between different reconfigurations of a value chain in the food sector. It should be noted that, in this case, like the first cooperatives, the relationship with the territory and its tradition of activation and participation still plays a crucial role: it is not by chance that this experience has developed into a traditional “red region” where the cooperative model remains strong and embedded.

In conclusion, the food sector is an arena of continuous experimentation that today is involved mainly in the disintermediation of large distributors redesigning supply chain relationships. Although not explicitly, these have important elements in common with cooperativism and may also involve collaboration and synergy with the cooperative movement, as in the case of Local2you. However, regarding the benefits of adopting a cooperative model, there is currently insufficient analysis, especially in terms of socioeconomic impact and sustainability over time.

6. Concluding Remarks

Food retail has proven to be a “special observatory” for the transformation and convergence towards the neoliberal model that seems to have overwhelmed the cooperative model. However, despite its long tradition, food cooperativism is not immune to this convergence and the Italian case displays the same “shades of grey” as the crisis of food cooperativism in Anglo-Saxon contexts (Zitcer 2015). In recent years, these shades have become even darker, configuring a “great transformation” of food cooperativism that has undermined its ethical roots: from production to financialization, from fair prices to financial interest, from profit to rent, from solidarity to value extraction, from accumulation to greed, and from solidarity to exclusion.

In the early 1900s, cooperativism had been the bearer of a great innovation in Italy thanks to a bottom-up mobilization. This enabled consumers to guarantee a system of access to quality food that guaranteed high standards, not only for products but also for the employment of the workers involved in the entire supply chain. Over time, this cooperative system has developed a strategy of mimicking the other large distributors (Barbera et al. 2018). The COOP chain is an example of this and has become one of the most important food cooperatives in the country, developing a process of agglomeration and fusion that has strengthened its economic action in the territory. However, at the same time, it has bureaucratized and sterilized the active participation of its members. In turn, this growth process was based on the strong politicization of the cooperative movement in Italy which generated, in some privileged markets within the so-called “red regions”, a form of hegemony which had negative consequences both for consumers and for providers. Finally, the financialization process represented the failure of many Italian cooperative experiences, causing substantial economic damage to the members involved who had put their trust in this alternative model.

However, the moral and ethical crisis of the Italian food coop has generated what we could call a “double movement”, in the Polanyan sense. New coops have attempted to re-embed the cooperative experience in the local socioeconomic context, trying also to exploit the opportunities that arose from the digital transformation. These coops have tried to reactivate participation, including the high moral density of new social movements linked to food consumption and production (alternative food networks, neorural movements, collaborative economy entrepreneurs, and so on) with an open model of governance that includes different types of membership, formal and informal, individual or collective, that Gonzalez (2017) has recently renamed “Open Multistakeholder Cooperatives” (p. 278), or “Community Cooperatives” (Majee and Hoyt 2011; Mori 2014) These are cases that, although working only in specific market niches, represent important attempts to constitute a new and more equitable food supply chain, recovering the founding principles and objectives of the first food cooperatives. The wealth of new experimentations that are developing, not only in Italy, are important signs of a phenomenon that deserves to be explored further by social scientists through an intense multidisciplinary research program that can provide an account of their impact and long-term sustainability. In this sense, the foundational economy approach seems to be fruitful, not only in analytical terms but also in the elaboration of new policies that recognize the “foundational value” for the food distribution industry.

Funding

This research received no external funding.

Conflicts of Interest

The author declares no conflict of interest.

References

- AGCM. 2012. Indagine Conoscitiva Sul Settore Della GDO–IC43. Roma: AGCM. [Google Scholar]

- Amorosi, Antonio. 2016. Coop Connection. Milano: Chiarelettere. [Google Scholar]

- Arcidiacono, Davide, and Lara Maestripieri. 2018. Solidarity Purchasing Groups as social innovators: an analysis of alternative food networks in Italy. Revista Española de Sociología. forthcoming. [Google Scholar]

- Arcidiacono, Davide, and Rita Palidda. 2015. Liberalizzazioni e regolazione pubblica dell’economia tra isomorfismo e resilienza: Il caso italiano. Sociologia del Lavoro 139: 107–22. [Google Scholar] [CrossRef]

- Barbera, Filippo, Joselle Dagnes, and Angelo Salento, eds. 2016. Il Capitale Quotidiano. Roma: Donzelli. [Google Scholar]

- Barbera, Filippo, Joselle Dagnes, and Roberto Di Monaco. 2018. Mimetic Quality: Consumer Quality Conventions and Strategic Mimicry in Food Distribution. International Journal of Sociology of Agriculture and Food 24: 253–73. [Google Scholar]

- Bowman, Andrew, Ismail Ertürk, Julie Froud, Sukhdev Johal, John Law, Mick Moran, and Karel Williams. 2014. The End of the Experiment? From Competition to the Foundational Economy. Manchester: Manchester University Press. [Google Scholar]

- Canfora, Irene. 2016. Is the short food supply chain an efficient solution for sustainability in food market? Agriculture and Agricultural Science Procedia 8: 402–7. [Google Scholar] [CrossRef]

- Caprotti, Bernardo. 2007. Falce e Carrello. Le Mani Sulla Spesa Degli Italiani. Venezia: Marsilio Editore. [Google Scholar]

- Curl, John. 2009. For All the People: Uncovering the Hidden History of Cooperation, Cooperative Movements, and Communalism in America. Oakland: PM Press. [Google Scholar]

- Denzin, Norman. 1978. Sociological Methods. New York: McGraw-Hill. [Google Scholar]

- Dobson, Paul. 2005. Exploiting Buyer Power: Lessons from the British Grocery Trade. Antitrust Law Journal 72: 529–62. [Google Scholar]

- Dobson, Paul, and Roman Inderst. 2007. Differential Buyer Power and the Waterbed Effect: Do strong Buyers Benefit or Harm Consumers? European Competition Law Review 28: 393–400. [Google Scholar]

- EU Parliament. 2015. Unfair Trading Practices in the Business-to-Business Food Supply Chain. Bruxelles: EU Parliament. [Google Scholar]

- Euricse. 2017. World Cooperative Monitor. Exploring the co-Operative Economy. Available online: www.monitor.coop (accessed on 21 February 2018).

- European Central Bank. 2011. Structural Features of Distributive Trades and their Impact on Prices in the Euro Area. Occasional Paper Series, n. 128/2011; Bruxelles: Task Force of the Monetary Policy Committee of the European System of Central Banks. [Google Scholar]

- Food and Agriculture Organisation of the United Nations (FAO). 2013. Sustainability Assessment of Food and Agriculture Systems (SAFA). Available online: http://www.fao.org/nr/sustainability/sustainability-assessments-safa/en/ (accessed on 21 February 2018).

- Federdistribuzione. 2016. La mappa del Sistema Distributivo in Italia. Available online: www.federdistribuzione.it (accessed on 15 December 2017).

- Fligstein, Neil. 1990. The Transformation of Corporate Control. Cambridge: Harvard University Press. [Google Scholar]

- Fonte, Maria, and Ivan Cucco. 2017. Cooperatives and alternative food networks in Italy. The long road towards a social economy in agriculture. Journal of Rural Studies 53: 291–302. [Google Scholar] [CrossRef]

- Forno, Francesca, and Paolo Graziano. 2014. Sustainable Community Movement Organizations. Journal of Consumer Culture 14: 139–57. [Google Scholar] [CrossRef]

- Foundational Economy Collective. 2018. Foundational Economy. The Infrastructure of Everyday Life. Manchester: MUP. [Google Scholar]

- Frau, Mario. 2010. La Coop non sei tu. La Mutazione Genetica Delle Coop: Dal Solidarismo alle Scalate Bancarie. Roma: Editori Riuniti. [Google Scholar]

- Ginsborg, Paul. 1989. Storia d’Italia dal Dopoguerra ad Oggi-Società e Politica 1943–1988. Torino: Einaudi. [Google Scholar]

- Gonzalez, Raquel. 2017. Going back to go forwards? From multi-stakeholder cooperatives toOpen Cooperatives in food and farming. Journal of Rural Studies 53: 278–90. [Google Scholar] [CrossRef]

- Hall, Peter, and David Soskice. 2001. Varieties of Capitalism: The Institutional Foundations of Comparative Advantage. New York: Oxford University Press. [Google Scholar]

- ISMEA. 2018. Rapporto Annuale–Outlook sull’agro-Alimentare Italiano. Available online: www.ismea.it (accessed on 1 October 2018).

- Lapavitsas, Costas. 2013. Profiting Without Producing. How Finance Exploits Us All. London: Verso. [Google Scholar]

- Loconto, Allison Marie. 2014. Institutionalising Social Innovation: An Exploration of Boundaries. Paper presented at EASST Annual Conference: Situating Solidarities: Social Challenges for Science and Technology Studies, Toruń, Poland, September 17–19. [Google Scholar]

- Lorendahl, Bengt. 1996. New cooperatives and local development: A study of six cases in Jamtland, Sweden. Journal of Rural Studies 12: 143–50. [Google Scholar] [CrossRef]

- Lyson, Thomas. 2005. Civic Agriculture and Community Problem Solving. Culture & Agriculture 27: 92–98. [Google Scholar]

- Majee, Wilson, and Ann Hoyt. 2011. Cooperatives and Community Development: A Perspective on the Use of Cooperatives in Development. Journal of Community Practice 19: 48–61. [Google Scholar] [CrossRef]

- Mori, Pier Angelo. 2014. Community and cooperation: the evolution of cooperatives to-wards new models of citizens’ democratic participation in public services provision. Annals of Public and Cooperative Economy 85: 327–52. [Google Scholar] [CrossRef]

- Moulaert, Frank, Diana MacCallaum, Jean Hillier, and Serena Vicari. 2009. Social Innovation and Territorial Development. Bulrlington: Ashgate. [Google Scholar]

- Mulgan, Geoff. 2012. The Theoretical Foundations of Social Innovation. In Social Innovation Blurring Boundaries to Reconfigure Markets. Edited by Alex Nicholls and Alex Murdock. London: Palgrave, pp. 33–65. [Google Scholar]

- Murdoch, Jonathan, Terry Marsden, and Jo Banks. 2000. Quality, nature and embeddedness: Some theoretical considerations in the context of the food sector. Economic Geography 76: 107–25. [Google Scholar] [CrossRef]

- Nadeau, Emile. 2012. The Cooperative Solution. Madison: Inxpress. [Google Scholar]

- Rothschild, Joyce, and Allen Whitt. 1986. The Cooperative Workplace: Potentials and Dilemmas of Organisational Democracy and Participation. Cambridge: Cambridge University Press. [Google Scholar]

- Salento, Angelo. 2014. The Neo-Liberal Experiment in Italy. False Promises and Social Disappointments. CRESC Working Paper Series; Working Paper No. 137. Manchester. Available online: http://hummedia.manchester.ac.uk/institutes/cresc/workingpapers/wp137.pdf (accessed on 8 June 2017).

- Scholz, Trebor, and Nathan Schneider. 2016. Ours to Hack and to Own. New York: OR Books. [Google Scholar]

- Streeck, Wolfgang. 2016. How Will Capitalism End? Essays on a Failing System. London: Verso Books. [Google Scholar]

- Tregear, Angela, and Sarah Cooper. 2016. Embeddedness, social capital and learning in rural areas: The case of producer cooperatives. Journal of Rural Studies 44: 101–10. [Google Scholar] [CrossRef]

- Trigilia, Carlo, and Luigi Burroni. 2009. Italy: Rise, decline and restructuring of a regionalized capitalism. Economy and Society 38: 630–53. [Google Scholar] [CrossRef]

- Vella, Maria. 2010. Oltre il Motivo del Profitto. Storia, Economia, Gestione e Finanza Delle Imprese Cooperative Italiane. Santarcangelo di Romagna: Maggioli. [Google Scholar]

- Webb, Beatrice, and Sidney Webb. 1902. Industrial Democracy. New York: Longmans. [Google Scholar]

- Yin, Robert K. 2003. Case Study Research: Design and Methods. Thousand Oaks: Sage. [Google Scholar]

- Zamagni, Stefano. 1999. Social Paradoxes of Growth and Civil Economy. In Economic Theory and Social Justice. Edited by Giancarlo Gandolfo and Ferruccio Marzano. London: Palgrave, pp. 212–50. [Google Scholar]

- Zitcer, Andrew. 2015. Food Co-ops and the Paradox of Exclusivity. Antipode 47: 812–28. [Google Scholar] [CrossRef]

| 1 | We refer to the term financialization in the meaning of Fligstein (1990) and Lapavitsas (2013) of strategy of production of wealth more through financial instruments and operations instead of relying mainly on productive activity. |

| 2 | This is a fee charged to suppliers or producers by retailers in order to have their product placed on specific shelves. |

| 3 | These are costs requested by the retailers to suppliers to realize services to increase demand for products through special pricing, display fixtures, demonstrations, value-added bonuses, and so on. |

| 4 | The fine is evidently ridiculous compared to the COOP gains and damages to the supplier, who was forced to close his company. |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).